Journal Description

Journal of Risk and Financial Management

Journal of Risk and Financial Management

is an international, peer-reviewed, open access journal on risk and financial management, published monthly online by MDPI.

- Open Access— free for readers, with article processing charges (APC) paid by authors or their institutions.

- High Visibility: indexed within Scopus, EconBiz, EconLit, RePEc, and other databases.

- Journal Rank: CiteScore - Q1 (Business, Management and Accounting (miscellaneous))

- Rapid Publication: manuscripts are peer-reviewed and a first decision is provided to authors approximately 20.5 days after submission; acceptance to publication is undertaken in 4.6 days (median values for papers published in this journal in the first half of 2025).

- Recognition of Reviewers: reviewers who provide timely, thorough peer-review reports receive vouchers entitling them to a discount on the APC of their next publication in any MDPI journal, in appreciation of the work done.

Latest Articles

Modeling Volatility of the Bahraini Stock Index: An Empirical Analysis

J. Risk Financial Manag. 2025, 18(12), 700; https://doi.org/10.3390/jrfm18120700 - 8 Dec 2025

Abstract

This study investigates the volatility dynamics of the Bahrain All Share Index (BAX) between 2010 and 2025, a period marked by COVID-19 and regional geopolitical shocks. Using ARMA (1,1) to model returns and four GARCH-family models (ARCH, GARCH, EGARCH, GJR-GARCH) to capture volatility,

[...] Read more.

This study investigates the volatility dynamics of the Bahrain All Share Index (BAX) between 2010 and 2025, a period marked by COVID-19 and regional geopolitical shocks. Using ARMA (1,1) to model returns and four GARCH-family models (ARCH, GARCH, EGARCH, GJR-GARCH) to capture volatility, we provide new evidence from a bank-based frontier market that has received limited empirical attention. The results reveal that returns are stationary and exhibit volatility clustering. Among the competing models, EGARCH (1,1) provides the best fit—exhibiting the lowest AIC and SIC values and the highest log-likelihood—revealing a significant leverage effect whereby negative shocks generate stronger volatility than positive shocks. This asymmetric volatility pattern contradicts earlier findings for Bahrain but aligns with theoretical expectations for bank-based financial systems. The findings carry implications for investors in terms of portfolio risk management, derivative pricing, and asset allocation. They also have important implications for regulators and policymakers, suggesting that counter-cyclical buffers and interest rate adjustments could be applied to stabilize the market in anticipation of negative shocks. These insights enrich the scarce literature on volatility in small frontier markets and contribute to a more nuanced understanding of the volatility dynamics in the MENA region.

Full article

(This article belongs to the Special Issue Risk Management in Capital Markets)

►

Show Figures

Open AccessArticle

Does Alignment with the IIRF Influence Capital Markets? Evidence from South Africa and the UK

by

Mbalenhle Khatlisi and Tafirei Mashamba

J. Risk Financial Manag. 2025, 18(12), 699; https://doi.org/10.3390/jrfm18120699 - 8 Dec 2025

Abstract

This study examines whether integrated reports that are more closely aligned with the International Integrated Reporting Framework (IIRF) are differently associated with firm value compared to those less aligned. Using panel estimated generalised least squares and other robust estimations, the analysis covers the

[...] Read more.

This study examines whether integrated reports that are more closely aligned with the International Integrated Reporting Framework (IIRF) are differently associated with firm value compared to those less aligned. Using panel estimated generalised least squares and other robust estimations, the analysis covers the Top 100 firms listed on South Africa’s Johannesburg Stock Exchange and the United Kingdom’s London Stock Exchange from 2011 to 2018. South Africa presents a mandatory integrated reporting (IR) setting, while the UK adopts a voluntary approach, offering a natural comparative context. An IR quality index was constructed to measure the degree of alignment with the IIRF, and market value of equity and Tobin’s Q are used as proxies for firm value. The results show no evidence of capital market differentiation in South Africa between more and less IIRF-aligned reports. In contrast, UK capital markets may differentiate, with less-aligned reports showing a significant negative association with firm value. These findings suggest that low-quality integrated reports may undermine firm value in voluntary IR settings.

Full article

(This article belongs to the Section Financial Markets)

Open AccessArticle

Can Corporate Governance Structures Reduce Fraudulent Financial Reporting in the Banking Sector? Insights from the Fraud Hexagon Framework

by

Imang Dapit Pamungkas, Melati Oktafiyani, Prasada Agra Swatyayana, Rahma Kurniawati, Annisa Amelia Putri and Mohamed Abdulwahb Ali Alfared

J. Risk Financial Manag. 2025, 18(12), 698; https://doi.org/10.3390/jrfm18120698 - 5 Dec 2025

Abstract

This study investigates the determinants of Fraudulent Financial Reporting (FFR) in the banking sector from 2021 to 2024 by integrating the Fraud Hexagon framework within a risk and financial management perspective. Using panel data comprising 140 bank-year observations (35 banks over four years),

[...] Read more.

This study investigates the determinants of Fraudulent Financial Reporting (FFR) in the banking sector from 2021 to 2024 by integrating the Fraud Hexagon framework within a risk and financial management perspective. Using panel data comprising 140 bank-year observations (35 banks over four years), the research applies an empirical analysis to examine six key elements—pressure, opportunity, rationalization, capability, arrogance, and collusion—that shape fraud risk behavior in financial institutions. The results indicate that leverage does not significantly influence fraud incentives, suggesting that financial pressure alone is insufficient to drive fraudulent reporting without weak governance structures. In contrast, factors related to ineffective monitoring, auditor switching, and director change show varying effects on FFR. The findings also reveal that CEO image does not reflect arrogance, which has no significant effect on FFR, and political connections of entities do not automatically reduce fraud risk unless supported by strong and independent governance mechanisms. The study underscores the crucial moderating role of the audit committee in enhancing financial reporting integrity. From a policy perspective, the research provides strategic insights for regulators and supervisory bodies such as the Financial Services Authority (OJK) to strengthen governance frameworks, enforce stricter disclosure requirements, and integrate fraud risk management practices into corporate oversight. Overall, this study contributes to the financial governance literature by demonstrating how effective risk management and governance alignment can reduce fraudulent reporting and improve the sustainability of the banking sector.

Full article

(This article belongs to the Special Issue Research on Corporate Governance and Financial Reporting)

►▼

Show Figures

Figure 1

Open AccessSystematic Review

ESG Signals, Investor Psychology and Corporate Financial Policy: A Bibliometric Study

by

Ngoc Phu Tran, Ariful Hoque and Thi Le

J. Risk Financial Manag. 2025, 18(12), 697; https://doi.org/10.3390/jrfm18120697 - 4 Dec 2025

Abstract

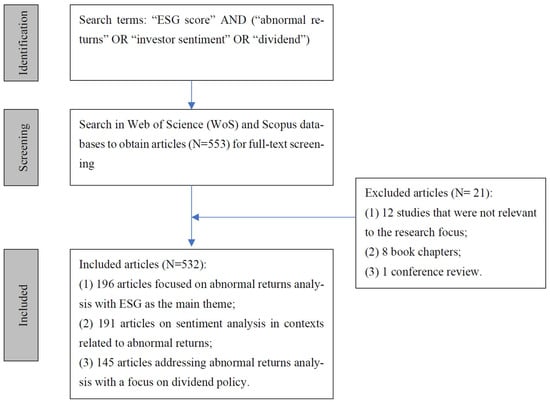

This study undertakes a systematic literature review combined with bibliometric analysis to examine how abnormal returns are studied in relation to environmental, social, and governance (ESG) factors, investor sentiment, and dividend policy. Using RStudio version 2025.09.0+387 and VOSviewer version 1.6.20, we conduct a

[...] Read more.

This study undertakes a systematic literature review combined with bibliometric analysis to examine how abnormal returns are studied in relation to environmental, social, and governance (ESG) factors, investor sentiment, and dividend policy. Using RStudio version 2025.09.0+387 and VOSviewer version 1.6.20, we conduct a bibliometric study that integrates performance analysis, science mapping, and network analysis. The dataset consists of 532 publications published between 2000 and 2025 and indexed in the Web of Science and Scopus databases. Our results show that scholarly work on abnormal returns is organised around three main thematic areas. First, investor sentiment is closely linked with event study applications, behavioural finance explanations, and sentiment analysis, which underscores the importance of psychological influences in understanding market anomalies. Second, prior studies on dividend policy continue to rely heavily on event study designs to evaluate how markets react to dividend announcements. Third, investor sentiment and dividend policy are connected through their common focus on abnormal returns, which operate as a central conceptual link between these strands of literature. Although interest in behavioural and policy-related determinants of abnormal returns has grown over time, work that explicitly incorporates ESG considerations remains relatively marginal. This peripheral position points to an important gap, suggesting that the dynamic relationships among ESG performance, investor sentiment, dividend decisions, and abnormal returns are still not fully explored. The contribution of this study lies in bringing these elements together by mapping research on event studies while treating ESG performance as a potential market signal that may shape both investor sentiment and corporate financial policy.

Full article

(This article belongs to the Special Issue Behaviour in Financial Decision-Making)

►▼

Show Figures

Figure 1

Open AccessArticle

From Fintech to Financial Stability: The Role of ESG, Basel III Liquidity Ratios, and Default Risk in European Banking

by

Minh Nhat Linh Nguyen and Phuong Thao Do

J. Risk Financial Manag. 2025, 18(12), 696; https://doi.org/10.3390/jrfm18120696 - 4 Dec 2025

Abstract

Our study examines the relationship between fintech adoption and liquidity management in European banking, investigating how digital transformation influences Basel III liquidity compliance and default risk. Using a sample of 45 European banks from the STOXX 600 index over 2019–2024, we employ textual

[...] Read more.

Our study examines the relationship between fintech adoption and liquidity management in European banking, investigating how digital transformation influences Basel III liquidity compliance and default risk. Using a sample of 45 European banks from the STOXX 600 index over 2019–2024, we employ textual analysis of annual reports to construct a fintech adoption index and examine its effects on liquidity coverage ratio (LCR) and net stable funding ratio (NSFR). Our findings demonstrate that fintech adoption significantly enhances banks’ liquidity management capabilities. However, ESG performance moderates this relationship, with higher ESG commitments weakening the positive fintech-liquidity association, suggesting resource allocation conflicts between sustainability and technological investments. Through mediation analysis, we find that liquidity management partially mediates the fintech-default risk relationship, revealing complex trade-offs where fintech-driven liquidity improvements may increase default risk through alternative channels. Robustness tests using lagged variables, propensity score matching, alterative proxies, and size-based subsamples confirm our findings. Notably, smaller banks derive substantially greater liquidity benefits from fintech adoption compared to larger institutions. Our results provide the first comprehensive analysis of how digital transformation affects regulatory liquidity compliance in European markets, offering important implications for bank management and regulatory oversight in the post-Basel III era.

Full article

(This article belongs to the Special Issue Market Liquidity, Fintech Innovation, and Risk Management Practices)

►▼

Show Figures

Figure 1

Open AccessArticle

Non-Linear Dynamics of ESG Integration and Credit Default Swap on Bank Profitability: Evidence from the Bank in Turkiye

by

Muhammed Veysel Kaya and Şeyda Yıldız Ertuğrul

J. Risk Financial Manag. 2025, 18(12), 695; https://doi.org/10.3390/jrfm18120695 - 4 Dec 2025

Abstract

This paper investigates the effect of Environmental, Social and Governance (ESG) scores and Credit Default Swap (CDS) spreads on the profitability of Halkbank, one of the biggest state-owned banks in Türkiye, an emerging economy. To this end, we employ Non-linear Autoregressive Distributed Lag

[...] Read more.

This paper investigates the effect of Environmental, Social and Governance (ESG) scores and Credit Default Swap (CDS) spreads on the profitability of Halkbank, one of the biggest state-owned banks in Türkiye, an emerging economy. To this end, we employ Non-linear Autoregressive Distributed Lag (NARDL) and Markov Switching Regression (MSR) methods, taking into account non-linear market risks, using Halkbank’s quarterly data consisting of 63 observations for the period 2009Q1–2024Q3. Moreover, to prevent multicollinearity, we aggregate banking-specific and macroeconomic indicators into a single composite index using Principal Component Analysis (PCA). Our MSR findings suggest that ESG scores and CDS spreads negatively affect bank profitability and that these effects are particularly pronounced during periods of high market volatility. Similarly, NARDL findings suggest that ESG scores have asymmetric effects on bank performance, with both positive and negative changes in ESG performance having a negative impact on profitability, and moreover, negative changes have a more negative impact on profitability. This means that the bank’s sustainability initiatives may be costly and negatively affect profitability in the short run, but these effects will be more negative if initiatives deteriorate. Our findings emphasize the need for banks to adopt a gradual ESG approach that enables them to increase their capacity without compromising financial stability and for regulatory structures to have a flexible and sophisticated risk management framework capable of rapidly adapting to different market conditions. Therefore, our study provides valuable insights to sector managers and policymakers regarding the financial implications of sustainability approaches.

Full article

(This article belongs to the Special Issue Emerging Issues in Economics, Finance and Business—2nd Edition)

Open AccessArticle

Investigating the Dynamic Connection Between Gold and Stock Markets During Crises

by

Konstantina Pendaraki and Magdalini Charda

J. Risk Financial Manag. 2025, 18(12), 694; https://doi.org/10.3390/jrfm18120694 - 4 Dec 2025

Abstract

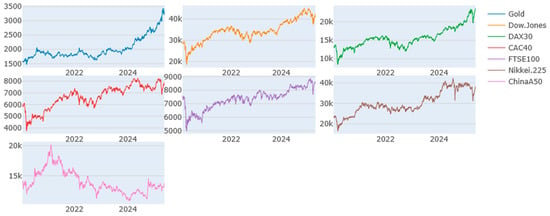

This paper examines the dynamic interactions between national stock indexes of global significance and gold, a prominent safe-haven asset, during the two most recent crises (the conflict between Russia and Ukraine and COVID-19). Daily data and the sophisticated Time-Varying Parameter Vector Autoregressive (TVP-VAR)

[...] Read more.

This paper examines the dynamic interactions between national stock indexes of global significance and gold, a prominent safe-haven asset, during the two most recent crises (the conflict between Russia and Ukraine and COVID-19). Daily data and the sophisticated Time-Varying Parameter Vector Autoregressive (TVP-VAR) approach are used to estimate how the dynamic relationship changes throughout the course of the crisis. According to research, gold is a net recipient of causal impacts from stock indices; this is particularly evident in the early phases of COVID-19 but considerably diminishes as the conflict progresses. Furthermore, it is discovered that the US and European stock indexes have a far greater impact on gold than the Asian indices. They have an impact on the Nikkei225 index as well. In general, gold works well as a crisis buffer, and this is especially evident in the context of COVID-19. This is especially useful for shielding investors’ portfolios from poor performance during crises.

Full article

(This article belongs to the Special Issue Financial Assets as Profit-Makers in Inflationary Periods, 2nd Edition)

►▼

Show Figures

Figure 1

Open AccessArticle

External Financing and Stock Returns: Korean Evidence

by

Su Jeong Lee and Jinsung Hwang

J. Risk Financial Manag. 2025, 18(12), 693; https://doi.org/10.3390/jrfm18120693 - 4 Dec 2025

Abstract

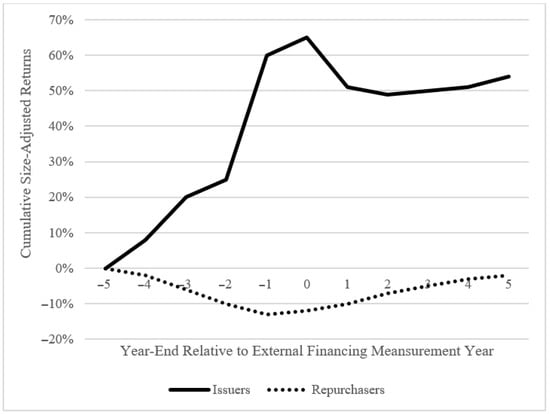

This study examines whether the external financing anomaly exists in an emerging-market setting. Using data on Korean listed firms from 1994 to 2023, we find that firms with higher net external financing subsequently earn significantly lower stock returns, consistent with behavioral misvaluation and

[...] Read more.

This study examines whether the external financing anomaly exists in an emerging-market setting. Using data on Korean listed firms from 1994 to 2023, we find that firms with higher net external financing subsequently earn significantly lower stock returns, consistent with behavioral misvaluation and market-timing explanations. A hedge portfolio long in net repurchasers and short in net issuers delivers an average annual return of about 12 percent. Decomposing financing flows show that both equity and debt issuance predict lower future returns, and further separating debt into bonds and loans reveals a stronger negative return association for bond-financed firms, consistent with greater sentiment sensitivity in market-based financing. We also document subsequent declines in operating performance, indicating that external financing aligns with temporary overvaluation rather than growth opportunities. Overall, our findings extend evidence on the external financing anomaly to an emerging market and provide further support for the behavioral interpretation of corporate financing decisions.

Full article

(This article belongs to the Special Issue Behavioral Finance and Financial Management)

►▼

Show Figures

Figure 1

Open AccessArticle

Policy Framework to Improve MSME Competitiveness and Financial Performance with Indonesia’s Asta Cita Vision Goals

by

Lenny Leorina Evinita, Jaqueline Elisabeth Margaretha Tangkau, Pricilia Joice Pesak and Suham Cahyono

J. Risk Financial Manag. 2025, 18(12), 692; https://doi.org/10.3390/jrfm18120692 - 4 Dec 2025

Abstract

Micro, small, and medium enterprises (MSMEs) are recognized as the cornerstone of Indonesia’s economy, especially in the agriculture, fisheries, and tourism sectors. Given Asta Cita’s ambitious vision for the country, which emphasizes inclusive and sustainable development, MSMEs are under increasing pressure to improve

[...] Read more.

Micro, small, and medium enterprises (MSMEs) are recognized as the cornerstone of Indonesia’s economy, especially in the agriculture, fisheries, and tourism sectors. Given Asta Cita’s ambitious vision for the country, which emphasizes inclusive and sustainable development, MSMEs are under increasing pressure to improve their competitiveness and financial performance. This research aims to develop and empirically evaluate a comprehensive policy framework that identifies digitalization, sustainable development, and innovation as the primary catalysts for MSME progress, with government support as a mediating variable, grounded in dynamic capabilities and institutional theories. A quantitative methodology was used to collect primary data from 435 MSME respondents in North Sulawesi, which was then analyzed using Partial Least Squares Structural Equation Modeling (PLS-SEM). The findings show that digitalization, sustainable practices, and innovation have a substantial, positive impact on the financial performance of MSMEs. However, government support cannot mediate the influence of digitalization, sustainable development, and innovation on improving economic performance. This shows that internal organizational competencies are more important than external interventions in achieving financial success. The results of this study underscore the need for MSMEs to prioritize technology integration, incorporate sustainability into their business frameworks, and continue innovating to maintain resilience and competitiveness.

Full article

(This article belongs to the Special Issue Fintech, Digital Finance, and Socio-Cultural Factors)

►▼

Show Figures

Figure 1

Open AccessArticle

False Stability? How Greenwashing Shapes Firm Risk in the Short and Long Run

by

Rahma Mirza, Tanvir Bhuiyan and Ariful Hoque

J. Risk Financial Manag. 2025, 18(12), 691; https://doi.org/10.3390/jrfm18120691 - 3 Dec 2025

Abstract

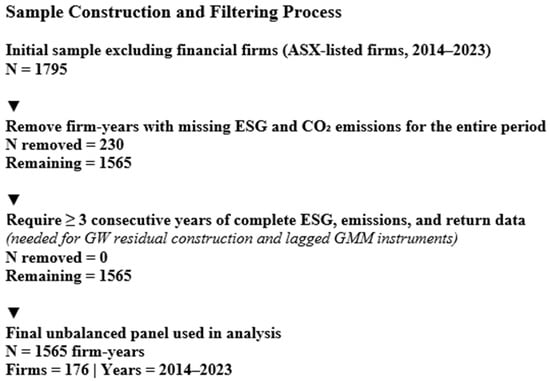

This study examines the relationship between greenwashing and firm risk among listed Australian firms from 2014 to 2023. We construct a firm-level greenwashing score as the residual based on regressions of composite ESG on Scope 1–2 CO2 emissions; positive residuals indicate overstated

[...] Read more.

This study examines the relationship between greenwashing and firm risk among listed Australian firms from 2014 to 2023. We construct a firm-level greenwashing score as the residual based on regressions of composite ESG on Scope 1–2 CO2 emissions; positive residuals indicate overstated sustainability relative to emissions. Using realized volatility as a measure of firm risk and applying the Generalized Method of Moments (GMM) regression framework, we uncover three key findings. First, contemporaneous greenwashing significantly lowers volatility, which is consistent with legitimacy and signalling theory, as overstated ESG credentials create a temporary perception of stability. Second, the risk-reducing effect is strongest with a one-period lag, likely reflecting delayed ESG and emissions reporting cycles and investor reaction times. Third, by the two-period lag, the effect reduces in magnitude, suggesting that markets eventually recognize the misalignment between ESG claims and environmental performance. Robustness checks with the E-pillar confirm these dynamics. Additional tests excluding the COVID-19 period (2020 and 2021) reveal that the risk-mitigating effects of greenwashing are even stronger during normal market conditions, implying that pandemic-related volatility may have muted the signalling power of ESG narratives. While firm fundamentals (e.g., book-to-market) explain part of risk variation, greenwashing-driven effects are economically meaningful yet short-lived. The findings underscore that greenwashing offers only temporary risk mitigation; as transparency improves and regulatory enforcement strengthens, firms relying on inflated ESG narratives face diminishing benefits and potential long-term risk penalties.

Full article

(This article belongs to the Special Issue Emerging Trends and Innovations in Corporate Finance and Governance)

►▼

Show Figures

Figure 1

Open AccessArticle

Determinants and Transmission Channels of Financial Cycle Synchronization in EU Member States

by

Matei-Nicolae Kubinschi, Robert-Adrian Grecu and Nicoleta Sîrbu

J. Risk Financial Manag. 2025, 18(12), 690; https://doi.org/10.3390/jrfm18120690 - 3 Dec 2025

Abstract

This paper investigates the determinants and transmission channels underlying the synchronization between financial and business cycles across European Union (EU) member states. For the empirical approach, we combine frequency-domain filtering techniques with spillover index analysis to track cross-country macro-financial interlinkages. We measure financial

[...] Read more.

This paper investigates the determinants and transmission channels underlying the synchronization between financial and business cycles across European Union (EU) member states. For the empirical approach, we combine frequency-domain filtering techniques with spillover index analysis to track cross-country macro-financial interlinkages. We measure financial cycle correlations and spillovers in terms of common exposures to trade linkages, overlapping systemic risk episodes, and bilateral financial claims. An important finding is that financial and business cycles tend to move together, largely due to shared macro-financial conditions and systemic stress episodes. While the data reveal strong co-movement between these cycles, the analysis does not imply a specific direction of causality. In particular, it remains possible that shifts in financial conditions can amplify or even precede business-cycle fluctuations, as seen during major crises. The focus of this study is, therefore, on the interdependence and synchronization of these cycles rather than on causal sequencing. The analysis combines complementary filtering and variance-decomposition methods to quantify the interdependencies shaping EU financial stability, providing a basis for enhanced macroprudential policy coordination. The policy implications for macroprudential authorities entail taking into account cross-border effects and spillovers when implementing instruments for taming the financial cycle.

Full article

(This article belongs to the Special Issue Business, Finance, and Economic Development)

Open AccessSystematic Review

Green Bond Pricing: A Comprehensive Review of the Empirical Literature

by

Lewis Liu and Yanqi Hu

J. Risk Financial Manag. 2025, 18(12), 689; https://doi.org/10.3390/jrfm18120689 - 3 Dec 2025

Abstract

As green finance grows, green bonds have become an essential tool for funding sustainable projects. While many studies explore whether green bonds exhibit a “green premium,” existing literature reviews often lack depth, timeliness, and consistent methodology. This paper addresses these gaps by systematically

[...] Read more.

As green finance grows, green bonds have become an essential tool for funding sustainable projects. While many studies explore whether green bonds exhibit a “green premium,” existing literature reviews often lack depth, timeliness, and consistent methodology. This paper addresses these gaps by systematically reviewing 70 empirical studies on green premiums published up to 2025, making it the most comprehensive review to date. We organize the literature by region (Global, U.S., Europe, Asia Pacific), market segment, premium dimension, data source, and estimation method, offering a structured framework to analyze diverse findings. Our analysis reveals a consistent negative green premium of −12.44 bps on average across most markets, with European and Asian markets showing higher yield spreads than the U.S. Studies using more recent data report smaller premiums, and larger bond issues tend to have lower premiums. Despite variations in methods and data sources, the overall results are consistent. This paper provides an updated overview of green premium research and offers key insights for investors, issuers, and policymakers on green finance pricing and investment strategies.

Full article

(This article belongs to the Special Issue Green Finance and Corporate Strategy: Challenges and Opportunities)

►▼

Show Figures

Figure 1

Open AccessArticle

Investigating the Relationship Between ESG Disclosure Performance and Audit Fees in the Presence of Institutional Ownership: Evidence from Malaysian Listed Firms

by

Yenyen Yip

J. Risk Financial Manag. 2025, 18(12), 688; https://doi.org/10.3390/jrfm18120688 - 3 Dec 2025

Abstract

Based on the Malaysian market, this study investigates the connection between ESG (environmental, social, and governance) disclosure performance and audit fees and examines whether institutional ownership moderates this relationship. The sample of this study comprises 323 firm-year observations collected from 49 Malaysian publicly

[...] Read more.

Based on the Malaysian market, this study investigates the connection between ESG (environmental, social, and governance) disclosure performance and audit fees and examines whether institutional ownership moderates this relationship. The sample of this study comprises 323 firm-year observations collected from 49 Malaysian publicly listed companies covering 2012 to 2020. Panel data regression is employed to test the hypotheses. The findings indicate a significant positive relationship between ESG disclosure performance and audit fees, suggesting that auditors perceive ESG reporting as increasing audit complexity and risk. Further, institutional ownership strengthens this positive relationship, indicating that sophisticated investors’ monitoring roles lead to more thorough auditing of ESG disclosures. Our primary contribution is resolving mixed findings in prior literature by identifying institutional ownership as a key moderating variable. The findings offer critical insights for Malaysian regulators in designing the ESG verification framework and help companies and investors better understand audit cost drivers. This study highlights the real-world impact of institutional shareholders on corporate governance and raises market awareness of how auditors respond to sustainability disclosures.

Full article

(This article belongs to the Special Issue Emerging Technology, Corporate Governance Disclosure and Corporate Social Responsibility)

Open AccessArticle

Portfolio Diversification with Non-Conventional Assets: A Comparative Analysis of Bitcoin, FinTech, and Green Bonds Across Global Markets

by

Vaibhav Aggarwal, Sudhi Sharma, Parul Bhatia, Indira Bhardwaj, Reepu Na and Shashank Sharma

J. Risk Financial Manag. 2025, 18(12), 687; https://doi.org/10.3390/jrfm18120687 - 2 Dec 2025

Abstract

This study examines the diversification and hedging potential of non-conventional assets like cryptocurrency (Bitcoin), FinTech equities (FINXs), and green bonds (QGREENs) against traditional equity benchmarks, namely the MSCI World and MSCI Emerging Markets indices using daily data from 2016 to 2021. Employing Time-Varying

[...] Read more.

This study examines the diversification and hedging potential of non-conventional assets like cryptocurrency (Bitcoin), FinTech equities (FINXs), and green bonds (QGREENs) against traditional equity benchmarks, namely the MSCI World and MSCI Emerging Markets indices using daily data from 2016 to 2021. Employing Time-Varying Parameter Vector Autoregression (TVP-VAR), network connectedness analysis, and the Minimum Connectedness Portfolio (MCoP) approach, the study uncovers dynamic interdependencies among these markets. The results reveal that Bitcoin consistently acts as a net receiver of shocks, providing strong diversification benefits during crisis periods, such as the COVID-19 pandemic. FinTech assets show moderate resilience, while green bonds primarily serve as shock transmitters with limited hedging ability. Optimal portfolio weights indicate the highest allocation to Bitcoin, followed by FinTech and green assets, supporting their inclusion in diversified portfolios. Overall, the findings underscore Bitcoin’s superior risk-mitigating role and highlight the strategic importance of digital assets in achieving portfolio stability and sustainability in volatile global markets.

Full article

(This article belongs to the Special Issue Advancing Research in International Finance)

►▼

Show Figures

Figure 1

Open AccessArticle

The Determinants of Limited Household Participation in Risky Financial Markets: Evidence from China Using Explainable Machine Learning

by

Yingtan Mu, Boyang Fu and Qiuming Hu

J. Risk Financial Manag. 2025, 18(12), 686; https://doi.org/10.3390/jrfm18120686 - 2 Dec 2025

Abstract

This study takes the limited household participation in risky financial markets as its point of departure. Drawing on microdata from the 2019 China Household Finance Survey (CHFS), we construct a multidimensional analytical framework using machine learning methods. The results indicate that this limitation

[...] Read more.

This study takes the limited household participation in risky financial markets as its point of departure. Drawing on microdata from the 2019 China Household Finance Survey (CHFS), we construct a multidimensional analytical framework using machine learning methods. The results indicate that this limitation arises from the interplay of multiple dimensions, with significant nonlinear relationships observed between these factors and household investment behavior. Insufficient development of key driving factors constitutes the main barrier to participation in risky financial markets. Feature interaction analysis reveals a “reversal effect” in how urban–rural disparities, economic attention, income level, and social engagement shape participation behavior. Educational attainment and financial literacy act as “threshold conditions” that enable economic attention to translate into actual investment decisions. The heterogeneity analysis further shows that households at different life-cycle stages as well as across urban–rural settings exhibit distinct participation patterns. These findings provide data-driven insights that can inform policies to promote financial inclusion, enhance investor education, and strengthen household risk management practices.

Full article

(This article belongs to the Section Financial Markets)

►▼

Show Figures

Figure 1

Open AccessArticle

Deep Learning and Transformer Architectures for Volatility Forecasting: Evidence from U.S. Equity Indices

by

Gergana Taneva-Angelova and Dimitar Granchev

J. Risk Financial Manag. 2025, 18(12), 685; https://doi.org/10.3390/jrfm18120685 - 2 Dec 2025

Abstract

Volatility forecasting plays a crucial role in financial markets, portfolio management, and risk control. Classical econometric models such as GARCH, ARIMA, and HAR-RV are widely used but face limitations in capturing the nonlinear and regime-dependent dynamics of financial volatility. This study compares traditional

[...] Read more.

Volatility forecasting plays a crucial role in financial markets, portfolio management, and risk control. Classical econometric models such as GARCH, ARIMA, and HAR-RV are widely used but face limitations in capturing the nonlinear and regime-dependent dynamics of financial volatility. This study compares traditional econometric models (HAR-RV, ARIMA, GARCH) with deep learning (DL) architectures (LSTM, CNN-LSTM, PatchTST-lite, and Vanilla Transformer) in forecasting realized variance (RV) for major U.S. equity indices (S&P 500, NASDAQ 100, and the Dow Jones Industrial Average) over the period 2000–2025. RV is used as the dependent variable because it is a standard model-free proxy for market volatility. Forecast accuracy is evaluated across forecast horizons of h = 1, 5, 22 days using QLIKE, RMSE, and MAE, along with Diebold–Mariano (DM) significance tests and overfitting diagnostics. Results show that Transformer-based models achieve the lowest errors and strongest generalization, particularly at short horizons and during volatile periods. Overall, the findings highlight the growing advantage of AI-driven models in delivering stable and economically meaningful volatility forecasts, supporting more effective portfolio allocation and risk management—especially in environments marked by rapid market shifts and structural breaks.

Full article

(This article belongs to the Special Issue Quantitative Methods for Financial Derivatives and Markets)

►▼

Show Figures

Figure 1

Open AccessArticle

Does ESG Index Recognition Improve Firm Performance? Evidence from Thailand’s ESG100 Using Staggered Difference-in-Differences

by

Nuthawut Sabsombat, Wiparat Suralai and Phichayada Donsomjitr

J. Risk Financial Manag. 2025, 18(12), 684; https://doi.org/10.3390/jrfm18120684 - 2 Dec 2025

Abstract

In the context of rising investor interest in Environmental, Social, and Governance (ESG) benchmarks, this study examines whether first-time inclusion in Thailand’s ESG100 index improves firm performance. Performance is measured along three dimensions: accounting (return on assets, return on equity), market valuation (Tobin’s

[...] Read more.

In the context of rising investor interest in Environmental, Social, and Governance (ESG) benchmarks, this study examines whether first-time inclusion in Thailand’s ESG100 index improves firm performance. Performance is measured along three dimensions: accounting (return on assets, return on equity), market valuation (Tobin’s Q, market-to-book ratio), and payout policy (dividend ratio, dividend yield). Using a rigorous staggered Difference-in-Differences (DiD) framework—incorporating both traditional DiD and modern estimators by Callaway and Sant’Anna and Sun and Abraham—alongside propensity score matching to address treatment timing and selection bias, this methodology ensures robust identification. Results indicate that ESG100 inclusion does not improve short-term accounting or market performance, with robustness tests indicating slight declines. However, firms newly included in ESG100 significantly increase dividend payouts. We also find that firm size moderates these effects: large firms experience improvements in ROA and ROE, while smaller firms show limited or negative responses. In contrast, market valuation and payout responses do not vary by firm size. These findings refine stakeholder and agency theories in an emerging-market context by showing that ESG recognition influences cash distribution policies more than accounting metrics or market prices. By differentiating these effects, this paper contributes to theory and practice around ESG adoption in emerging economies and discusses implications for corporate ESG strategy and policy in the Asia-Pacific region.

Full article

(This article belongs to the Section Sustainability and Finance)

►▼

Show Figures

Figure 1

Open AccessArticle

Environmental Auditing, Public Finance, and Risk: Evidence from Moldova and Bulgaria

by

Luminita Diaconu, Biser Krastev, Elena Georgieva and Radosveta Krasteva-Hristova

J. Risk Financial Manag. 2025, 18(12), 683; https://doi.org/10.3390/jrfm18120683 - 2 Dec 2025

Abstract

The recent expansion of sustainability studies has reshaped corporate governance and public oversight with direct implications for financial exposure and risk management. In particular, environmental auditing generates decision-useful signals on environmental liabilities, remediation and compliance costs, and budgetary/fiscal risks that affect both corporate

[...] Read more.

The recent expansion of sustainability studies has reshaped corporate governance and public oversight with direct implications for financial exposure and risk management. In particular, environmental auditing generates decision-useful signals on environmental liabilities, remediation and compliance costs, and budgetary/fiscal risks that affect both corporate financing conditions (e.g., cost of capital) and public finance resilience. This study conducts a comparative examination of environmental auditing practices in Moldova and Bulgaria over 2020–2025, asking how audit mandates, coverage, and disclosure practices inform banks, insurers, investors, and budget holders. Using documents from national legal databases and supervisory portals, we apply descriptive content analysis across structural, substantive, and procedural dimensions, with special attention to financial-risk channels (contingent liabilities, sanction risk, value-for-money and procurement risks). We find that Bulgaria exhibits stronger institutional implementation capacity, while Moldova shows legislative innovation; in both cases, stronger transparency, public participation, and digital audit analytics are needed to quantify fiscal and enterprise-level ESG risks. Overall, this paper positions environmental auditing as a governance lever linking sustainability oversight to finance- and risk-related outcomes, aligning with focus on sustainable finance, ESG disclosure, and governance.

Full article

(This article belongs to the Special Issue Sustainable Finance and Corporate Responsibility)

►▼

Show Figures

Figure 1

Open AccessArticle

Influence of FinTech Paylater, Financial Well Being, Behavioral Finance, and Digital Financial Literacy on MSME Sustainability in South Sumatera

by

Endah Dewi Purnamasari, Leriza Desitama Anggraini and Faradillah

J. Risk Financial Manag. 2025, 18(12), 682; https://doi.org/10.3390/jrfm18120682 - 2 Dec 2025

Abstract

This study examines the influence of FinTech Paylater, Financial Well Being (FW), Behavioral Finance (BF), and Digital Financial Literacy (DFL) on the sustainability of Micro, Small, and Medium Enterprises (MSMEs) in South Sumatera, Indonesia. Using a quantitative explanatory design, data from 563 MSME

[...] Read more.

This study examines the influence of FinTech Paylater, Financial Well Being (FW), Behavioral Finance (BF), and Digital Financial Literacy (DFL) on the sustainability of Micro, Small, and Medium Enterprises (MSMEs) in South Sumatera, Indonesia. Using a quantitative explanatory design, data from 563 MSME owners were collected through a structured questionnaire and analyzed using Structural Equation Modeling–Partial Least Squares (SEM–PLS). The results show that FinTech Paylater, FW, BF, and DFL have positive and significant effects on MSME sustainability, with DFL emerging as the strongest predictor. Paylater services support sustainability by improving liquidity and access to short-term financing, while FW enhances financial stability and resilience. BF shapes financial decision-making through behavioral control and risk awareness. The integrated model explains 61% of the variance in MSME sustainability and demonstrates that digital capability and psychological factors jointly determine whether FinTech is used productively or consumptively. The findings provide theoretical contributions to the literature on FinTech and MSME sustainability and offer practical implications for policymakers and FinTech providers in designing targeted Digital Financial Literacy programs and responsible Paylater schemes for MSMEs in emerging economies.

Full article

(This article belongs to the Special Issue The Role of Financial Literacy in Modern Finance)

►▼

Show Figures

Figure 1

Open AccessArticle

Regime-Switching Affine Term Structure Models with Jumps: Evidence from South African Bond Yields

by

Malefane Molibeli and Gary van Vuuren

J. Risk Financial Manag. 2025, 18(12), 681; https://doi.org/10.3390/jrfm18120681 - 1 Dec 2025

Abstract

We present a unified framework for modelling the term structure of interest rates using affine term structure models (ATSMs) with jumps and regime switches. The novelty lies in combining affine jump diffusion models with regime switching dynamics within a unified framework, allowing for

[...] Read more.

We present a unified framework for modelling the term structure of interest rates using affine term structure models (ATSMs) with jumps and regime switches. The novelty lies in combining affine jump diffusion models with regime switching dynamics within a unified framework, allowing for state-dependent jump behaviour while preserving analytical tractability. This integration enables the model to simultaneously capture nonlinear market regimes and discontinuous movements in interest rates—features that traditional affine models or regime switching models alone cannot jointly represent. Estimation is carried out using the Unscented Kalman Filter (UKF) with the belief that it is capable of handling nonlinearity and therefore should estimate the non-Gaussian dynamics well. The yield curve fit demonstrates that both models fit our data well. RMSEs show that the regime switching affine jump diffusion (RS-AJD) model outperforms the affine jump diffusion (AJD) in-sample.

Full article

(This article belongs to the Special Issue Modelling for Positive Change: Economics and Finance)

►▼

Show Figures

Figure 1

Highly Accessed Articles

Latest Books

E-Mail Alert

News

Topics

Topic in

Clean Technol., Economies, FinTech, JRFM, Sustainability

Green Technology Innovation and Economic Growth

Topic Editors: David (Xuefeng) Shao, Miaomiao Tao, Selena ShengDeadline: 31 December 2025

Topic in

Economies, IJFS, JRFM, Risks, Sustainability

Insurance and Risk Management Advances in the 4A Era—AI, Aging, Abruptions, and Adoptions

Topic Editors: Xiaojun Shi, Lingyan Suo, Feng Gao, Baorui DuDeadline: 30 May 2026

Topic in

Economies, JRFM, Risks, Sustainability

The Future of Global Finance and Business: Trends, Policies and Market Evolution

Topic Editors: John Malindretos, Giuliana Andreopoulos, Eleftherios I. Thalassinos, Ana Cristina SiqueiraDeadline: 31 July 2026

Topic in

Economies, IJFS, Sustainability, Businesses, JRFM

Sustainable and Green Finance

Topic Editors: Otilia Manta, Maria PalazzoDeadline: 31 October 2026

Conferences

Special Issues

Special Issue in

JRFM

AI Investing and Portfolio Management

Guest Editors: Hsiu-lang Chen, Linh NguyenDeadline: 12 December 2025

Special Issue in

JRFM

Finance and Accounting in Times of Global Uncertainty: ESG, SDGs, and Digital Disruption

Guest Editors: Enkeleda Lulaj, Antonio Mínguez-VeraDeadline: 30 December 2025

Special Issue in

JRFM

Selected Papers from the 1st International Online Conference on Risk and Financial Management

Guest Editor: Thanasis StengosDeadline: 31 December 2025

Special Issue in

JRFM

Artificial Intelligence (AI) in Finance and Economy

Guest Editors: Ahmet Faruk Aysan, Dursun Delen, Hasan Dinçer, Selim ZaimDeadline: 31 December 2025

Topical Collections

Topical Collection in

JRFM

Quantitative Advances and Risks in Asian Financial Markets

Collection Editors: Svetlozar (Zari) Rachev, Shigeyuki Hamori, Yasushi Hamao, Shuangzhe Liu, Ali Jaffri