Abstract

This study undertakes a systematic literature review combined with bibliometric analysis to examine how abnormal returns are studied in relation to environmental, social, and governance (ESG) factors, investor sentiment, and dividend policy. Using RStudio version 2025.09.0+387 and VOSviewer version 1.6.20, we conduct a bibliometric study that integrates performance analysis, science mapping, and network analysis. The dataset consists of 532 publications published between 2000 and 2025 and indexed in the Web of Science and Scopus databases. Our results show that scholarly work on abnormal returns is organised around three main thematic areas. First, investor sentiment is closely linked with event study applications, behavioural finance explanations, and sentiment analysis, which underscores the importance of psychological influences in understanding market anomalies. Second, prior studies on dividend policy continue to rely heavily on event study designs to evaluate how markets react to dividend announcements. Third, investor sentiment and dividend policy are connected through their common focus on abnormal returns, which operate as a central conceptual link between these strands of literature. Although interest in behavioural and policy-related determinants of abnormal returns has grown over time, work that explicitly incorporates ESG considerations remains relatively marginal. This peripheral position points to an important gap, suggesting that the dynamic relationships among ESG performance, investor sentiment, dividend decisions, and abnormal returns are still not fully explored. The contribution of this study lies in bringing these elements together by mapping research on event studies while treating ESG performance as a potential market signal that may shape both investor sentiment and corporate financial policy.

1. Introduction

Beginning in the early 2000s, environmental, social, and governance (ESG) has gradually shifted from a mainly values-driven or socially responsible niche into a widely recognised cornerstone of sustainable finance (Ho et al., 2024; Soysa et al., 2024). During this transition, global ESG assets have expanded rapidly, with projections suggesting that they will surpass 30 trillion US dollars by 2023 (Rasmussen, 2025). At the same time, although many studies report that stronger ESG profiles are associated with a lower cost of capital and higher firm value, the evidence regarding their influence on stock returns, and particularly on abnormal returns, remains mixed and inconclusive (Banerjee et al., 2025).

Previous bibliometric studies have charted the development of ESG research mainly by documenting publication volumes, leading outlets, and general performance indicators (Mukhtar et al., 2025). These contributions are useful for understanding how the field has expanded over time, yet they pay limited attention to abnormal returns and seldom consider the mediating or moderating roles of investor sentiment and dividend policy (A. Khan et al., 2022). More recent event-based studies suggest that ESG-related shocks can trigger abnormal returns and that these effects are often channelled through shifts in investor sentiment. However, the potential influence of dividend signalling and payout policy on this relationship has received very little systematic scrutiny (Yang et al., 2025).

This oversight mirrors a broader separation between research streams in ESG, behavioural finance, and corporate finance. Our study undertakes a comprehensive bibliometric analysis located at the intersection of ESG, investor sentiment, dividend policy and abnormal returns to reduce this fragmentation. By mapping temporal trends, identifying influential authors and journals, and examining thematic clusters and keyword co-occurrence patterns, the study aims to uncover underexplored connections. Particular attention is given to the possibility that dividend policy acts as a moderator in the link between ESG performance, sentiment, and abnormal returns, thereby contributing to a more integrated theoretical framework and offering practical guidance for investors and policymakers who confront ESG-driven market dynamics.

The analysis is organised around five research questions:

- What are the main trends in the literature that examines ESG in relation to abnormal returns?

- Which authors, institutions, and journals emerge as the most prominent and influential contributors to this field?

- Which individual studies appear to have shaped the direction of research most strongly?

- What major thematic areas and clusters can be identified within the existing body of work?

- What specific avenues seem most promising for advancing future research on the interaction between ESG, investor sentiment, dividend policy, and abnormal returns?

Our findings indicate that the literature on abnormal returns is organised around three main thematic clusters. The first cluster centres on investor sentiment and shows a close association with event studies, behavioural finance and sentiment analysis. Previous studies emphasise the role of psychological influences in generating market anomalies and often rely on textual analysis and other unconventional sources of information, including news flows, online discussions, and social media activity, to infer investor behaviour. The second cluster is anchored in research on dividend policy and is closely linked to themes such as signalling, market reactions and stock returns. This stream builds on classical theories of information asymmetry and signalling, in which dividend decisions convey information about firm fundamentals and are evaluated through the stock price response. Empirical studies in this area continue to rely heavily on event study designs in order to measure how markets respond to dividend announcements and revisions. The third cluster reflects the way investor sentiment and dividend policy intersect through their shared connection with abnormal returns, which act as the main conceptual bridge between these domains. Although prior academic interest in behavioural and policy-related determinants of abnormal returns has grown steadily, ESG-related topics occupy only a marginal position within the observed networks. This peripheral status points to a substantive gap and suggests that the interaction between ESG performance, investor sentiment and dividend policy has so far received limited attention in the academic discourse.

This study makes three closely related contributions to the behavioural finance literature. First, our results point to a substantive gap in existing work, namely, the limited integration of ESG considerations with investor sentiment and dividend policy in explaining abnormal returns. By drawing attention to this neglected intersection, the study lays the groundwork for a line of inquiry that connects sustainable finance with behavioural perspectives on investor decision making and with corporate payout decisions. Second, the bibliometric mapping in this study shows that investor sentiment and dividend policy have both emerged as important frameworks for understanding abnormal returns, yet they have largely developed on separate tracks. The study adds a conceptual contribution by suggesting an integrated view in which these two mechanisms, one behavioural and the other institutional, are treated as jointly relevant. In particular, the results point to the value of examining their possible roles as mediating or moderating channels between ESG performance and abnormal returns. Third, by bringing together these distinct but related thematic domains, this paper outlines a concrete empirical agenda that asks how ESG factors affect abnormal returns through the combined influence of investor sentiment and dividend policy. This perspective has practical relevance for investors, corporate managers and regulators because it clarifies how sustainability performance may feed into firm valuation in markets where informational frictions and behavioural biases shape the pricing of financial assets.

2. Methods

2.1. Study Design

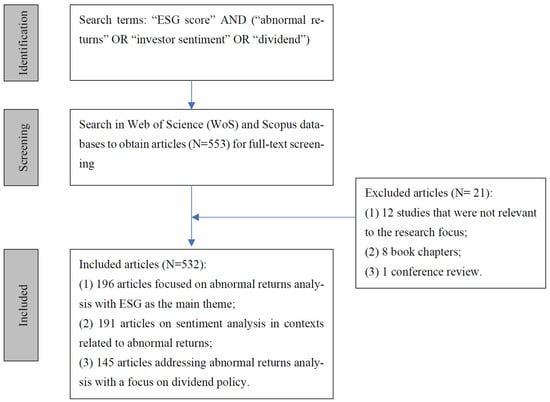

We follow the Preferred Reporting Items for Systematic Reviews and Meta Analyses PRISMA framework as the guiding protocol for identifying, selecting and critically examining the relevant studies in this review, as illustrated in Figure 1 (Moher et al., 2010). Bibliometric analysis is subsequently employed to conduct a structured examination of interconnected publications, using indicators such as publication counts and citation frequencies as proxies for scholarly productivity and influence (Carlsson et al., 2017). Beyond quantifying research output, this approach also helps to reveal the underlying intellectual structure of the field, including its dominant themes and emerging lines of inquiry.

Figure 1.

PRISMA diagram.

In this study, R Studio is used as the main environment for data handling and performance analysis following recent guidance on bibliometric workflows in finance and management research (Aria & Cuccurullo, 2017; Donthu et al., 2021). Within R Studio we rely on the Bibliometrix package to import and merge records from Web of Science and Scopus, remove duplicates, harmonise fields such as authors, sources, and countries, and compute standard indicators including annual publication and citation counts, h index values for authors and sources, and productivity and impact rankings for countries and institutions, in line with previous studies (Donthu et al., 2021; Paul & Criado, 2020). Bibliometrix is also used to construct adjacency matrices for co-citation, co-authorship, bibliographic coupling, and keyword co-occurrence, which are then exported to VOSviewer for network visualisation.

VOSviewer is used for science mapping and graphical representation of the networks in accordance with the procedures described by Van Eck and Waltman (2010). We construct distinct maps to analyse co-citation relationships among authors and sources, co-authorship at the author and country levels, bibliographic coupling among documents, and co-occurrence of author keywords. These procedures represent standard techniques in contemporary bibliometric research in finance and related disciplines (Abhilash et al., 2023; Rani et al., 2025). We apply fractional counting, set minimum thresholds for inclusion in the maps, such as a minimum number of documents or citations, and use the default VOSviewer layout and clustering algorithms based on modularity optimisation as recommended by Van Eck and Waltman (2010). In each map, the size of a node reflects its importance according to the chosen bibliometric measure, for example, the number of documents in which it appears or the number of citations it receives. The strength of the links represents the degree of association between two units, colours distinguish the main clusters, and label size and spacing are adjusted manually to improve readability without modifying the underlying network structure.

2.2. Data Selection

We draw on previous review studies dealing with ESG changes, investor sentiment, dividend policy and stock market performance to develop and refine the set of search terms used in this study (Alburaythin et al., 2025; Galema & Gerritsen, 2025; Wang, 2024; Zhou et al., 2024). These keywords are used to search the Web of Science (WoS) and Scopus databases. In each database, we use a combination of four concept groups that capture ESG score, investor sentiment, dividend and abnormal returns. The search terms are applied to titles, abstracts and author keywords. Within each block, we use the operator OR, and across blocks, the operator AND. Documents are included if they met the following criteria: (1) classified as journal articles or conference papers; (2) written in English; and (3) published between 2000 and 2025. Applying these criteria yielded 553 documents.

In this study, the data screening process was conducted by domain experts with advanced training in data science and extensive experience in ESG-based stock market prediction. Accordingly, 21 articles are excluded from our dataset, including: (1) 12 studies that were not relevant to the research focus, (2) 8 book chapters, and (3) 1 conference review. As a result, a total of 532 articles were retained for data analysis, comprising: 196 articles focused on abnormal returns analysis with ESG as the main theme; 191 articles on sentiment analysis in contexts related to abnormal returns, and 145 articles addressing abnormal returns analysis with a focus on dividend policy. Since our review is framed within the field of Finance, we excluded 12 records that belonged to Computer science and Psychology. By including them, the bibliometric mapping’s focus would be diluted and patterns unique to capital markets research on ESG scores, investor sentiment, dividends, and abnormal returns would be obscured. In addition, this study considers only peer-reviewed journal articles indexed in Web of Science and Scopus and excludes book chapters and conference papers. Large citation databases were originally designed around journals, and the coverage and citation data for books and chapters remain clearly less complete and less consistent than for journal articles, which can bias citation-based indicators and network measures (Moed, 2005). Comparative assessments of Web of Science and Scopus indicate that book chapters represent only a small and unevenly covered portion of the indexed material, which in turn raises concerns about the reliability of citation-based analyses for these documents (Martínez-Vázquez et al., 2021; Delgado-Quiros & Ortega, 2025). In addition, prior research also advises that authors adopt clear inclusion criteria and rely on a homogeneous corpus of publications, most commonly journal articles, since these share comparable peer review standards, citation practices and metadata structures (Ozturk et al., 2024). Many recent bibliometric applications, therefore, restrict their samples to journal articles to obtain consistent and comparable indicators (Churruca et al., 2019).

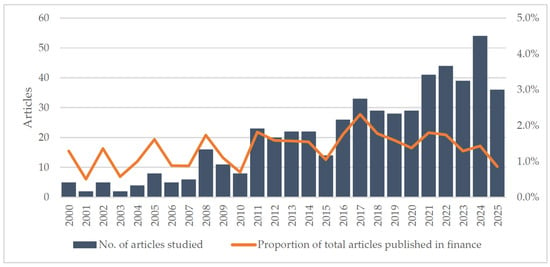

Figure 2 illustrates the number of articles included by year, reflecting the growing scholarly interest in the application of ESG, investor sentiment, and dividend policy in stock market research.

Figure 2.

Annual distribution of the 532 articles included in this study.

The trend depicted in Figure 2 demonstrates a clear and consistent growth in scholarly attention toward the intersection of ESG, investor sentiment, dividend policy, and abnormal returns over the past two decades. From 2000 to 2008, research output on this topic was relatively modest, with fewer than 10 published articles per year, which indicates that academic interest was still at an early stage. Around 2010, the pattern changes, as annual publications begin to exceed 20 articles, suggesting a growing recognition of environmental, social, and governance factors as potentially important drivers of financial performance and investment anomalies. The number of studies continues to rise and reaches a local peak in 2017. From 2020 onward, the expansion becomes much more pronounced, culminating in more than 50 articles in 2024. This sharp increase is consistent with the broader surge in global attention to sustainable finance, the introduction of major regulatory initiatives such as the European Union taxonomy, and proposals for enhanced ESG-related disclosure by the United States Securities and Exchange Commission, and the wider availability of ESG and sentiment data for empirical analysis. The proportion of these studies relative to all finance articles indexed in the same databases in each year fluctuates around one to two percent in the 2000–2010 period, which indicates that the topic was still a niche within the wider finance literature. From 2010 onward, both the absolute number of publications and their share in finance increase, with local peaks around 2011 and 2017 when the proportion reaches close to three percent. Our results suggest that the expansion of research on ESG, sentiment, and dividends is not only a byproduct of the general growth of finance journals. Instead, it appears to reflect the emergence of richer ESG and news-based datasets, greater depth and liquidity in financial markets that allow event study designs, and stronger institutional and regulatory attention to sustainable finance. Overall, Figure 2 shows that the field has moved from a peripheral niche to a visible and recurrent theme within contemporary finance research.

3. Results and Discussion

3.1. Performance Analysis

Table 1 reports the authors who contribute most actively to the literature on ESG and abnormal returns. Pandey DK and Zhang Z each appear in six publications, although Pandey displays a higher fractionalised frequency (2.17 compared with 1.83), which suggests a stronger involvement in leading or coordinating roles. Other prominent contributors include Kumari V, Wang Y and Zhang W. The repeated appearance of surnames such as Zhang and Wang hints at the presence of research groups or institutional hubs with a sustained focus on ESG or behavioural finance themes. Additional authors, including Li Z, Liu Y, Wang C, Zhang C and Al Shattarat WK, also feature regularly in the corpus and provide important supporting contributions to the development of this field. Together, these findings highlight both the individuals driving the field and the collaborative networks sustaining its growth.

Table 1.

Most published authors.

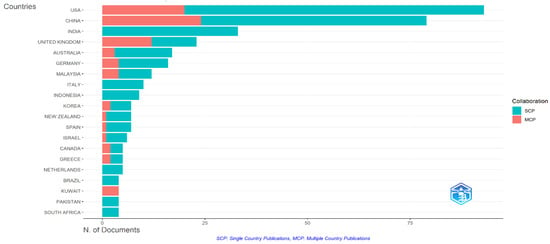

Figure 3 illustrates the global distribution of research output, distinguishing between Single Country Publications (SCP) and Multiple Country Publications (MCP) on the studied topic. The United States leads with the highest output, driven largely by SCPs, reflecting its robust datasets, financial markets, and institutional support. China follows, also dominated by SCPs, signalling growing domestic research capacity. India ranks third but stands out for its high SCP share, reflecting reliance on international collaboration and global expertise. Other notable contributors include the UK, Australia, Germany, and Malaysia, with European countries generally showing a more balanced SCP–MCP mix. Emerging players such as Indonesia, Korea, and Spain contribute modestly, while countries like Kuwait, Pakistan, and South Africa remain nascent in this domain.

Figure 3.

Most productive countries.

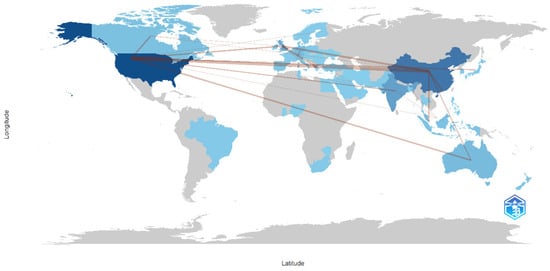

Figure 4 provides a complementary global view of research productivity and collaboration on the topic studied. The United States emerges as the central hub of international co-authorship, with extensive ties across Europe, Asia, and Oceania. China and India also display strong transnational connections, particularly within the Asia-Pacific, while countries such as Australia, Malaysia, and Germany act as regional nodes. By contrast, Africa, South America, and parts of Eastern Europe remain underrepresented, underscoring the need for broader inclusion to strengthen global diversity in ESG-finance research.

Figure 4.

Country scientific production and collaboration map.

Table 2 further illustrates the intellectual structure of the field. Edmans et al. (2007) is the most cited study (TC = 630), marking early recognition of sentiment’s role in abnormal returns. Liu et al. (2020) achieve the highest annual citation rate (87.00), reflecting the impact of pandemic-driven sentiment shocks. Other highly cited works, such as Price et al. (2012) and Joseph et al. (2011), emphasise the predictive power of textual tone and online search behaviour. ESG-specific studies (Drobetz et al., 2004) reveal growing attention to governance and sustainability dimensions, while methodological innovations showcase the application of deep learning and machine learning to financial sentiment. However, dividend policy remains largely absent among these core studies, highlighting a critical research gap.

Table 2.

Most cited articles.

3.2. Keyword Analysis

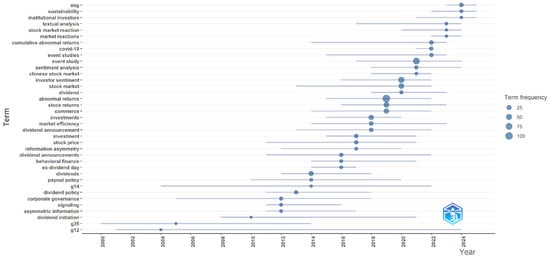

Figure 5 tracks the chronological development of research themes. Each bubble represents the central tendency of the publication year for a given term. Specifically, we compute the average publication year across all articles in which the term appears and use this value for the horizontal position of the bubble. The size of the bubble is proportional to the total frequency of the term in the corpus, so larger bubbles indicate terms that appear more often. The horizontal line associated with each term spans from the first year in which the term occurs in our dataset to the last year in which it appears and therefore summarises the active period of that research theme. In the early phase (2000–2010), studies were rooted in classical finance, focusing on dividend policy, signalling, and information asymmetry. Between 2010 and 2015, attention shifted toward market efficiency and corporate event reactions. From 2015 to 2020, the literature expanded into behavioural finance, with investor sentiment, event studies, and textual analysis gaining prominence. Most recently (2020–2025), focus has turned to ESG, COVID-19, institutional investors, and abnormal returns, reflecting global shocks and sustainability imperatives. Overall, the progression highlights a shift from traditional finance to interdisciplinary approaches that integrate behavioural insights, machine learning, and ESG concerns.

Figure 5.

Trend topics.

3.3. Network Analysis

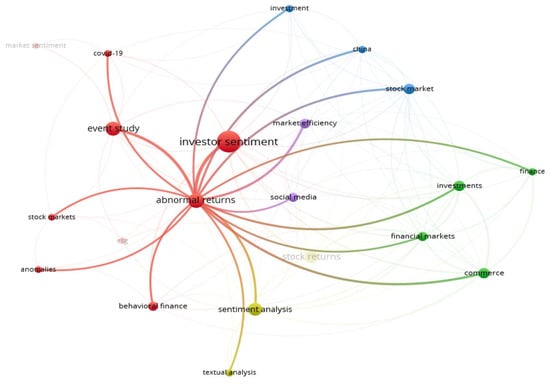

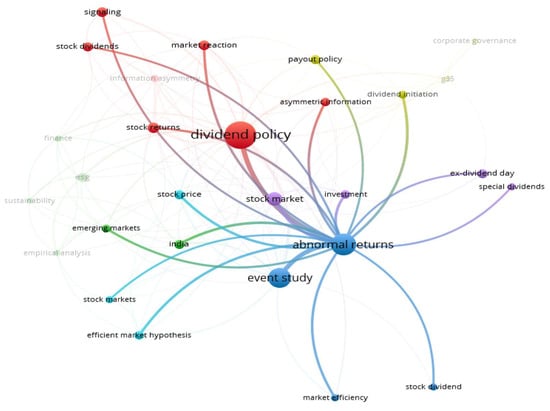

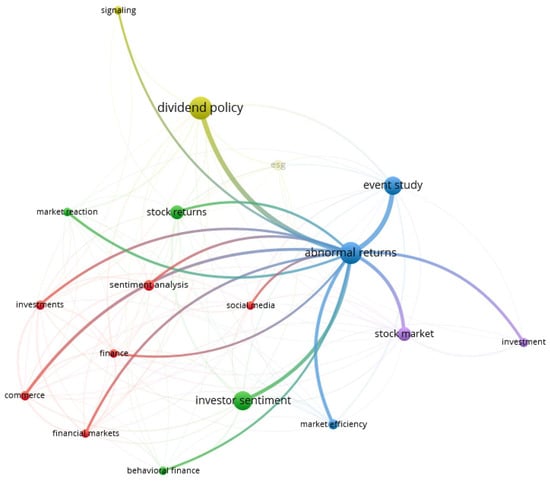

Author keyword co-occurrence analysis is applied to assess the strength of associations among keywords in the dataset, helping to reveal thematic linkages and identify emerging research frontiers (Mukhtar et al., 2025). To ensure clarity and avoid visual clutter, only keywords occurring more than five times are included. The networks are generated and visualised using VOSviewer, with the results presented in Figure 6, Figure 7 and Figure 8.

Figure 6.

The relationship among ESG, investor sentiment and abnormal returns.

Figure 7.

The relationship among ESG, dividend policy and abnormal returns.

Figure 8.

The relationship among ESG, investor sentiment, dividend policy and abnormal returns.

As shown in Figure 6, the keyword co-occurrence analysis provides valuable insights into the thematic structure of the existing literature on the relationship between ESG factors and abnormal returns, particularly considering the roles of investor sentiment. The terms abnormal returns and investor sentiment emerge as the most central and strongly interconnected nodes. This highlights the dominant role that investor sentiment plays in explaining deviations from expected returns, reinforcing its relevance in both traditional and emerging asset pricing models.

Several distinct thematic clusters are evident in the network. The red cluster, containing keywords such as event study, behavioural finance, anomalies, COVID-19, and stock markets, suggests that a significant portion of the literature is grounded in behavioural finance theory. These studies often utilise event study methodology to examine how investor sentiment, particularly during crises like the COVID-19 pandemic, leads to abnormal return patterns due to irrational market behaviour and sentiment-driven overreaction. The yellow cluster, featuring sentiment analysis, textual analysis, and behavioural finance, points to the methodological evolution of the field. Researchers are increasingly employing natural language processing (NLP) and machine learning techniques to extract sentiment from textual data sources such as news articles, social media posts, and financial disclosures. This trend demonstrates a growing interest in using alternative data to quantify investor sentiment and its impact on return anomalies. In the green cluster, terms such as finance, investments, financial markets, and commerce reflect a more traditional finance-oriented perspective. These keywords suggest that sentiment-driven abnormal returns are being studied across various markets and instruments, implying that investor psychology influences broader investment decisions. Simultaneously, the blue cluster, which includes keywords such as China, stock market, and investment, reveals a geographical and market-specific focus, with emerging markets, particularly China, frequently analysed due to their unique investor behaviour and sentiment dynamics. The purple cluster consists of market efficiency, social media, and related terms, indicating a growing body of work that challenges the Efficient Market Hypothesis (EMH). The link between social media and market outcomes suggests that non-traditional sources of information are now considered significant drivers of price movements and investor behaviour, thereby contributing to abnormal returns.

Interestingly, while the keyword ESG appears in Figure 6, it occupies a peripheral position with weak linkages to the main themes. This indicates that the integration of ESG considerations into the abnormal returns and investor sentiment literature remains underexplored. The limited visibility of ESG-related keywords highlights a notable gap in the literature. This underlines the potential for further investigation into how ESG performance may shape investor sentiment and, consequently, influence abnormal returns. Moreover, the interaction between ESG and abnormal returns remains largely unaddressed, suggesting fertile ground for future research.

We further examine the relationship between ESG, dividend policy and abnormal returns in Figure 7. This network further enriches the bibliometric analysis by highlighting the scholarly discourse surrounding dividend policy and its connection to abnormal returns. The central placement and strong linkage of dividend policy and abnormal returns suggest a significant research focus on how various aspects of dividend decision making influence market reactions and excess returns. At the centre of this map, dividend policy appears as a highly interconnected term, closely associated with abnormal returns, stock returns, market reaction, and signalling. This configuration suggests that the dividend policy literature is deeply rooted in signalling theory and information asymmetry. The strong co-occurrence of signalling and market reaction supports the view that dividend announcements often act as signals of firm value, influencing investor perception and leading to abnormal price reactions. The cluster surrounding abnormal returns, represented in blue, retains connections with traditional financial concepts such as event study, market efficiency, stock dividend, and stock price. This implies that event study methodology continues to be the dominant empirical approach for examining the effects of dividend-related events, such as dividend initiation, ex-dividend day, or special dividends, on abnormal returns. In Figure 7, geographic and market-specific attention is evident. The green cluster includes keywords such as emerging markets, India, and empirical analysis, suggesting a growing interest in how dividend policy influences stock price reactions in non-Western or developing economies. These studies may reflect contextual differences in investor behaviour, regulatory environments, and capital market structures.

Interestingly, the appearance of ESG and sustainability in the green cluster indicates a nascent intersection between sustainable finance and dividend policy. However, the weak linkage between these terms and the core concepts (dividend policy, abnormal returns) suggests that the mediating or moderating effects of dividend policy in ESG performance-related market reactions remain underdeveloped in the current literature. This confirms the gap identified in the previous map and reinforces the need for integrated research exploring how ESG strategies affect dividend signalling and the resulting abnormal returns.

The yellow cluster highlights terms such as corporate governance, payout policy, and dividend initiation, indicating a strand of literature concerned with how internal governance structures influence dividend decisions and their signalling effects. Governance mechanisms likely play a critical role in shaping dividend credibility, especially in firms where information asymmetry is high. These governance-dividend dynamics could also interact with ESG strategies, presenting a promising direction for future research.

As illustrated in Figure 8, the integrated keyword co-occurrence network provides a comprehensive perspective on the intellectual landscape connecting abnormal returns, investor sentiment, dividend policy and ESG. The central position of abnormal returns once again highlights its status as the focal theme across the literature, serving as a bridge that links investor behaviour, firm policy decisions, and market outcomes.

The green cluster, anchored by investor sentiment, demonstrates a dense web of connections with keywords such as behavioural finance, sentiment analysis, financial markets, and social media. This pattern emphasises the growing interest in behavioural approaches to financial anomalies, where investor emotions and cognitive biases, often measured through computational techniques such as sentiment analysis, play a key role in explaining abnormal market movements. The link to finance and commerce further illustrates the broad application of sentiment in understanding pricing inefficiencies across asset classes and industries. Importantly, the connection between investor sentiment and abnormal returns suggests that sentiment functions not merely as an explanatory variable, but also potentially as a mediating or moderating mechanism through which other factors, such as ESG or dividend policies, exert their influence on firm performance and valuation.

The yellow cluster revolving around dividend policy is prominently connected to signalling, stock returns, and market reaction. These associations reaffirm classical financial theories, particularly the signalling hypothesis, which posits that dividend announcements convey information about a firm’s future prospects, influencing investor reactions and resulting in abnormal returns. The strong link to abnormal returns indicates that dividend-related market responses continue to be a vibrant area of research, often explored through event study methodology (as reflected in the blue cluster). Interestingly, dividend policy is also linked, albeit weakly, to ESG, indicating a nascent area of inquiry where sustainability and governance considerations intersect with traditional corporate finance decisions. This represents a compelling research frontier: whether firms with strong ESG profiles adopt distinctive dividend strategies, and how such strategies may influence investor perception and market outcomes.

The blue and purple clusters consolidate keywords related to methodological approaches, including event study, stock market, market efficiency, and investment. These terms highlight the empirical rigour commonly applied in studies of abnormal returns, particularly when analysing market responses to earnings announcements, dividend declarations, or sentiment shocks. The continued reliance on event study methodology reinforces its utility in quantifying short-term return deviations attributable to specific information events.

This integrated map reveals a robust and interconnected body of literature where investor sentiment and dividend policy are central to understanding abnormal returns. However, despite the strong behavioural and policy-related linkages, the role of ESG remains underdeveloped, with only minor and peripheral representation in the network. This observation is consistent with earlier maps and further supports the rationale for further study.

3.4. ESG and Abnormal Returns

Table 3 presents a synthesis of recent empirical studies, offering additional context to the bibliometric findings by identifying recurring themes and methodological patterns in the investigation of the relationship between ESG factors and abnormal returns. Across multiple markets and time periods, researchers have predominantly employed event study methodologies (Galema & Gerritsen, 2025), panel data techniques (Berg et al., 2024), and factor models such as the Fama-French three-factor model (Z. H. Chen et al., 2024) to estimate abnormal returns around ESG-related events or disclosures.

Table 3.

ESG and abnormal returns in previous studies.

A recurrent finding across studies is the asymmetric investor response to ESG signals. Specifically, negative ESG news or downgrades tends to elicit stronger and more statistically significant abnormal returns than positive ESG announcements (Serafeim & Yoon, 2023). This pattern supports the notion of a “negativity bias” in investor sentiment, where downside risks are priced more aggressively due to reputational, regulatory, or fiduciary concerns. These dynamics reinforce the behavioural finance explanation of abnormal returns and align with the increasing bibliometric focus on investor sentiment as a mediating mechanism. Studies that examine ESG and broader corporate social responsibility news report that negative events generate statistically significant negative abnormal returns, whereas positive events often elicit weak or insignificant price reactions. Kruger (2015) shows that markets penalise firms for negative responsibility-related events much more than they reward positive ones, which he interprets as evidence that downside risks dominate in investors’ assessment of ESG information. Capelle-Blancard and Petit (2019) document a similar asymmetry using a large sample of ESG news and find that firms lose value following negative ESG coverage while they gain little on average from positive announcements. This empirical regularity is consistent with the negativity bias identified in behavioural psychology, where negative information is found to carry greater weight than equally intense positive information in judgement and decision making (Rozin & Royzman, 2001). In a financial context this bias implies that investors price potential reputational, regulatory, and litigation losses more aggressively than corresponding upside opportunities, so that adverse ESG news and rating downgrades tend to generate stronger abnormal return responses than upgrades. Evidence on the time profile of ESG valuation effects further underscores the role of short horizon sentiment and market context. Do and Kim (2020) analyse changes in ESG ratings for Korean listed firms and find that rating improvements are associated with significant positive abnormal returns around the disclosure date, but these effects decay quickly and turn negative several years after the announcement. They interpret this pattern as indicating that investors initially treat ESG upgrades as a favourable signal, yet do not consistently view ESG activities as supporting long-term firm value. Taken together with event studies on ESG news, these results suggest that the impact of ESG information on prices is shaped by investor horizons, market development, and disclosure quality, rather than by ESG scores alone.

3.5. Investor Sentiment and Abnormal Returns

Table 4 together with the related studies sheds further light on the role of sentiment in financial markets. Abnormal returns are systematically associated with sentiment induced mispricing that does not vanish immediately because investors face limits to arbitrage and do not fully offset irrational trading (Alburaythin et al., 2025). Wang (2024) shows that the influence of sentiment is not constant over time, with particularly strong effects at intraday horizons. Zhou et al. (2024) report that investors in smaller capitalisation stocks in China tend to overreact more strongly during periods of low sentiment, while I. Pandey and Guillemette (2024) demonstrate that trading in United States meme stocks is driven in large part by social media activity, especially among investors with lower levels of financial literacy. Ding et al. (2023) build a sentiment index based on technical trading rules and show that it has predictive power for both momentum and subsequent reversals, generating sizable abnormal returns. Prior studies reinforce the central position of investor sentiment in asset pricing and in the persistence of inefficiencies across different markets and time horizons. These findings point to both cultural and structural heterogeneity in the way sentiment is transmitted into prices (Wang, 2024; I. Pandey & Guillemette, 2024). In addition, they offer concrete tools for practice, for instance the design of sentiment sensitive portfolios (Zhou et al., 2024) and the use of predictive sentiment indices derived from trading rules (Ding et al., 2023). The fact that mispricing persists across such varied contexts underlines the importance of behavioural biases and limits to arbitrage, while at the same time providing investors with exploitable signals when navigating sentiment driven anomalies.

Table 4.

Investor sentiment and abnormal returns in previous studies.

3.6. Dividend Policy and Abnormal Returns

Table 5 synthesises empirical evidence on the relationship between dividend policy and abnormal returns (ARs) across international markets, with most studies employing event study designs complemented by econometric techniques. In the UK, Hasan and Al-Najjar (2025) found that dividend increases generally yield positive ARs, though timing had little effect, challenging the Efficient Market Hypothesis (EMH) and pointing to persistent behavioural influences. In China, Sun and Wen (2023) demonstrated, using the DGTW_CAR3 metric, that firms in the top decile of ARs substantially outperformed those in the bottom decile, with qualitative disclosures, sentiment, and institutional trading shaping return dynamics.

Table 5.

Dividend policy and abnormal returns in previous studies.

In the Indian market, D. K. Pandey et al. (2022) report significantly positive abnormal returns around dividend announcements and ex-bonus dates. However, the strength of this effect weakens when firms repeatedly increase dividends in a nonlinear pattern, which they interpret as evidence that broader macroeconomic or epidemiological conditions may moderate the impact of dividend news. Evidence from other markets points in a similar direction. In the United States, Asem and Alam (2021) find that ex dividend price drops are systematically smaller than the dividend amounts, generating positive excess abnormal returns, while Chowdhury and Sonaer (2016) show that tax considerations are an important determinant of abnormal returns around special dividend payments. In Thailand, Suwanna (2012) documents significantly positive cumulative abnormal returns after dividend announcements, which reinforces the view that dividends convey value-relevant information. Taken together, these studies indicate that the signalling role of dividends persists across a range of institutional and market settings.

The broader body of evidence indicates that changes in dividends, particularly increases, are often followed by positive abnormal returns. This pattern raises questions for the strict form of the Efficient Market Hypothesis and suggests that investor sentiment, institutional trading behaviour and qualitative disclosures all play an important part in shaping market reactions. External influences such as prevailing macroeconomic conditions, as documented for example by D. K. Pandey et al. (2022), and tax-related considerations, as shown by Chowdhury and Sonaer (2016), add further layers of complexity. Taken together, these findings point toward the need for multifactorial approaches in order to capture the full dynamics of market behaviour around dividend announcements rather than relying on any single explanatory channel. M. Khan (2019) develops composite governance and ESG measures that concentrate on financially material issues at the industry level and shows that these material ESG scores have greater predictive power for stock returns than standard aggregate ratings. Follow-up analyses indicate that the abnormal returns associated with changes in material ESG scores become small once profitability and investment factors are taken into account, which implies that at least part of the apparent ESG alpha reflects underlying fundamentals rather than pure mispricing. This line of evidence supports the view that the valuation consequences of ESG disclosures depend on whether the information is financially material and on the way it interacts with other signals of firm quality, including dividend policy. From this perspective, dividend payouts and indicators of financial materiality operate as moderating influences that shape how investors incorporate ESG information into expectations about future cash flows and discount rates. They also help explain why abnormal returns around ESG-related events tend to be asymmetric and context-dependent rather than uniform across firms and markets.

This study reveals a research field anchored around abnormal returns, with investor sentiment and dividend policy as central explanatory mechanisms. Investor sentiment emerges as both a driver and mediator of return anomalies, with methodological advances in NLP and machine learning expanding the toolkit for measuring its effects. Dividend policy continues to serve as a critical signal of firm value, producing systematic abnormal returns across global markets despite contextual variations. However, ESG remains only weakly integrated into this discourse, positioned peripherally in the intellectual maps and empirical studies. This fragmentation highlights an important research gap: the need to examine how ESG performance interacts with dividend policies and investor sentiment in shaping abnormal returns. Addressing this gap would not only enrich theoretical integration across behavioural finance, corporate governance, and sustainable finance but also provide investors and policymakers with practical insights into how ESG-driven strategies influence market outcomes in an era of heightened sustainability concerns.

4. Conclusions and Implications

This study uses bibliometric analysis to investigate the intellectual structure and thematic evolution of the literature on abnormal returns, with particular attention to the roles of investor sentiment and dividend policy and their possible interaction with ESG factors. The analysis relies on keyword co-occurrence networks that reveal distinct yet interconnected clusters and, in doing so, clarify the main research streams and the areas where coverage remains incomplete. The results highlight the central position of investor sentiment in explaining abnormal returns and reflect the growing influence of behavioural finance theories in this field. Frequent co-occurrence of terms such as event study, investor sentiment and abnormal returns indicates that researchers increasingly employ textual data and machine learning methods to quantify investor mood and cognitive biases. At the same time, ESG-related terms appear only at the margins of these networks, suggesting that sustainability considerations are not yet fully embedded in this behavioural perspective.

Dividend policy emerges as a second dominant explanatory theme for abnormal returns. Here, the clusters are closely associated with concepts such as signalling, market reaction, stock dividends, and dividend initiation, which reflect a strong grounding in classical theories of information asymmetry and signalling. Event study designs remain the main empirical tool for assessing how markets respond to dividend announcements and for evaluating pricing efficiency around these events. Although ESG and sustainability-related keywords do appear within these clusters, their connections to the core dividend and market reaction themes are weak, which indicates that the interaction between ESG performance and dividend signalling has attracted limited systematic attention.

The conceptual mapping also reveals a point of convergence where abnormal returns are jointly linked to investor sentiment and dividend policy. This intersection shows that behaviourally driven and policy-oriented strands of the literature are not entirely separate. Instead, sentiment and payout decisions can be viewed as parallel mechanisms through which firms influence investor behaviour and market outcomes. Nevertheless, ESG considerations remain conceptually peripheral across the networks. Sustainability issues have not yet been fully integrated into the central discourse on abnormal returns, despite their growing relevance for investment practice and corporate strategy. Overall, the findings describe a mature but segmented body of research. Considerable progress has been made in understanding how investor sentiment and dividend policy shape abnormal returns, yet the limited incorporation of ESG factors points to a significant gap that future work needs to address.

Our study contributes to the literature by pinpointing this underexplored intersection and by outlining a concrete research agenda that examines how ESG performance influences abnormal returns through the mediating or moderating roles of investor sentiment and dividend policy. This perspective has the potential to connect behavioural finance, corporate governance and sustainable investing in a single analytical framework and to promote a more comprehensive explanation of return anomalies in a financial environment that is evolving rapidly toward sustainability-related objectives. At the same time, our bibliometric evidence shows that current research on abnormal returns is dominated by behavioural explanations centred on investor sentiment, while ESG considerations remain only weakly integrated into this framework. By revealing the detailed cluster structure of the field, our analysis makes it possible to move beyond a descriptive account of separate strands of work and to propose a more integrated agenda that links sustainable finance with theories of sentiment, signalling, and information processing in financial markets.

Author Contributions

Conceptualization, A.H., T.L. and N.P.T.; methodology, A.H., T.L. and N.P.T.; software, N.P.T.; validation, A.H., T.L. and N.P.T.; formal analysis, A.H., T.L. and N.P.T.; investigation, A.H., T.L. and N.P.T.; re-sources, A.H., T.L. and N.P.T.; data curation, A.H., T.L. and N.P.T.; writing—original draft preparation, N.P.T.; writing—review and editing, A.H. and T.L.; visualization, A.H., T.L. and N.P.T.; supervision, A.H. and T.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available upon reasonable request.

Conflicts of Interest

The authors state that there are no potential financial or personal conflicts of interest relevant to this study.

References

- Abhilash, A., Shenoy, S. S., & Shetty, D. K. (2023). Overview of corporate governance research in India: A bibliometric analysis. Cogent Business & Management, 10(1), e2182361. [Google Scholar] [CrossRef]

- Alburaythin, Y., Fifield, S. G., & Paramati, S. (2025). Interaction between investor sentiment, limits to arbitrage and the returns of stock market anomalies: Evidence from the UK stock market. The European Journal of Finance, 31(1), 76–98. [Google Scholar] [CrossRef]

- Arayssi, M., Dah, M., & Jizi, M. (2016). Women on boards, sustainability reporting and firm performance. Sustainability Accounting, Management and Policy Journal, 7(3), 376–401. [Google Scholar] [CrossRef]

- Aria, M., & Cuccurullo, C. (2017). Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. [Google Scholar] [CrossRef]

- Asem, E., & Alam, S. (2021). The abnormal return associated with consecutive dividend increases. The European Journal of Finance, 27(3), 222–238. [Google Scholar] [CrossRef]

- Banerjee, S., Aggarwal, D., & Sengupta, P. (2025). Do stock markets care about ESG and sentiments? Impact of ESG and investors’ sentiment on share price prediction using machine learning. Annals of Operations Research, 1–40. [Google Scholar] [CrossRef]

- Berg, F., Heeb, F., & Kölbel, J. (2024). The economic impact of ESG ratings (SAFE Working Paper, No. 439). Leibniz Institute for Financial Research SAFE.

- Capelle-Blancard, G., & Petit, A. (2019). Every little helps? ESG news and stock market reaction. Journal of Business Ethics, 157(2), 543–565. [Google Scholar] [CrossRef]

- Carlsson, H., Larsson, S., Svensson, L., & Åström, F. (2017). Consumer credit behavior in the digital context: A bibliometric analysis and literature review. Journal of Financial Counseling and Planning, 28(1), 76–94. [Google Scholar] [CrossRef]

- Chen, C. P., & Liu, Y. S. (2018). The impacts of investor sentiment and price uncertainty on the effects of open-market share repurchase announcements. Applied Economics Letters, 25(11), 730–733. [Google Scholar] [CrossRef]

- Chen, Z. H., Kang, J., Koedijk, K. G., Gao, X., & Gu, Z. (2024). Short-term market reactions to ESG ratings disclosures: An event study in the Chinese Stock Market. Journal of Behavioral and Experimental Finance, 43, e100975. [Google Scholar] [CrossRef]

- Chowdhury, J., & Sonaer, G. (2016). Ex-dividend day abnormal returns for special dividends. Journal of Economics and Finance, 40(4), 631–652. [Google Scholar] [CrossRef]

- Churruca, K., Pomare, C., Ellis, L. A., Long, J. C., & Braithwaite, J. (2019). The influence of complexity: A bibliometric analysis of complexity science in healthcare. BMJ Open, 9(3), e027308. [Google Scholar] [CrossRef] [PubMed]

- Dasilas, A., & Leventis, S. (2011). Stock market reaction to dividend announcements: Evidence from the Greek stock market. International Review of Economics & Finance, 20(2), 302–311. [Google Scholar]

- Day, M. Y., & Lee, C. C. (2016, August 18–21). Deep learning for financial sentiment analysis on finance news providers. 2016 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining (ASONAM) (pp. 1127–1134), San Francisco, CA, USA. [Google Scholar]

- Delgado-Quiros, L., & Ortega, J. L. (2025). Citation counts and inclusion of references in seven free-access scholarly databases: A comparative analysis. Journal of Informetrics, 19(1), e101618. [Google Scholar] [CrossRef]

- Ding, W., Mazouz, K., Ap Gwilym, O., & Wang, Q. (2023). Technical analysis as a sentiment barometer and the cross-section of stock returns. Quantitative Finance, 23(11), 1617–1636. [Google Scholar] [CrossRef]

- Do, Y., & Kim, S. (2020). Do higher-rated or enhancing ESG of firms enhance their long–term sustainability? Evidence from market returns in Korea. Sustainability, 12(7), e2664. [Google Scholar] [CrossRef]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Drobetz, W., Schillhofer, A., & Zimmermann, H. (2004). Corporate governance and expected stock returns: Evidence from Germany. European Financial Management, 10(2), 267–293. [Google Scholar] [CrossRef]

- Edmans, A., Garcia, D., & Norli, Ø. (2007). Sports sentiment and stock returns. The Journal of Finance, 62(4), 1967–1998. [Google Scholar] [CrossRef]

- Galema, R., & Gerritsen, D. (2025). ESG rating changes and stock returns. Journal of International Money and Finance, 154, e103309. [Google Scholar] [CrossRef]

- Gluck, M., Hubel, B., & Scholz, H. (2021). ESG rating events and stock market reactions. Available online: https://ssrn.com/abstract=3803254 (accessed on 1 December 2025).

- Green, T. C., & Hwang, B. H. (2012). Initial public offerings as lotteries: Skewness preference and first-day returns. Management Science, 58(2), 432–444. [Google Scholar] [CrossRef]

- Han, Y., Yang, K., & Zhou, G. (2013). A new anomaly: The cross-sectional profitability of technical analysis. Journal of Financial and Quantitative Analysis, 48(5), 1433–1461. [Google Scholar] [CrossRef]

- Hasan, F., & Al-Najjar, B. (2025). Calendar anomalies and dividend announcements effects on the stock markets returns. Review of Quantitative Finance and Accounting, 64(2), 829–859. [Google Scholar] [CrossRef]

- Ho, L., Nguyen, V. H., & Dang, T. L. (2024). ESG and firm performance: Do stakeholder engagement, financial constraints and religiosity matter? Journal of Asian Business and Economic Studies, 31(4), 263–276. [Google Scholar] [CrossRef]

- Joseph, K., Wintoki, M. B., & Zhang, Z. (2011). Forecasting abnormal stock returns and trading volume using investor sentiment: Evidence from online search. International Journal of Forecasting, 27(4), 1116–1127. [Google Scholar] [CrossRef]

- Khan, A., Goodell, J. W., Hassan, M. K., & Paltrinieri, A. (2022). A bibliometric review of finance bibliometric papers. Finance Research Letters, 47, e102520. [Google Scholar] [CrossRef]

- Khan, M. (2019). Corporate governance, ESG, and stock returns around the world. Financial Analysts Journal, 75(4), 103–123. [Google Scholar] [CrossRef]

- Kruger, P. (2015). Corporate goodness and shareholder wealth. Journal of Financial Economics, 115(2), 304–329. [Google Scholar] [CrossRef]

- Liu, H., Manzoor, A., Wang, C., Zhang, L., & Manzoor, Z. (2020). The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health, 17(8), e2800. [Google Scholar] [CrossRef]

- Martínez-Vázquez, R. M., Milán-García, J., & de Pablo Valenciano, J. (2021). Challenges of the blue economy: Evidence and research trends. Environmental Sciences Europe, 33(1), e61. [Google Scholar] [CrossRef]

- Moed, H. F. (2005). Citation analysis in research evaluation. Springer. [Google Scholar]

- Moher, D., Liberati, A., Tetzlaff, J., Altman, D. G., & Prisma Group. (2010). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. International Journal of Surgery, 8(5), 336–341. [Google Scholar] [CrossRef]

- Mukhtar, B., Shad, M. K., Ali, K., Woon, L. F., & Waqas, A. (2025). Systematic literature review and retrospective bibliometric analysis on ESG research. International Journal of Productivity and Performance Management, 74(4), 1365–1399. [Google Scholar] [CrossRef]

- Ozturk, O., Kocaman, R., & Kanbach, D. K. (2024). How to design bibliometric research: An overview and a framework proposal. Review of Managerial Science, 18(11), 3333–3361. [Google Scholar] [CrossRef]

- Pandey, D. K., & Kumari, V. (2021). Event study on the reaction of the developed and emerging stock markets to the 2019-nCoV outbreak. International Review of Economics & Finance, 71, 467–483. [Google Scholar]

- Pandey, D. K., Kumari, V., & Tiwari, B. K. (2022). Impacts of corporate announcements on stock returns during the global pandemic: Evidence from the Indian stock market. Asian Journal of Accounting Research, 7(2), 208–226. [Google Scholar] [CrossRef]

- Pandey, I., & Guillemette, M. (2024). Social media, investment knowledge, and meme stock trading. Journal of Behavioral Finance, 26, 1–17. [Google Scholar] [CrossRef]

- Paul, J., & Criado, A. R. (2020). The art of writing literature review: What do we know and what do we need to know? International Business Review, 29(4), e101717. [Google Scholar] [CrossRef]

- Price, S. M., Doran, J. S., Peterson, D. R., & Bliss, B. A. (2012). Earnings conference calls and stock returns: The incremental informativeness of textual tone. Journal of Banking & Finance, 36(4), 992–1011. [Google Scholar] [CrossRef]

- Rani, R., Vasishta, P., Singla, A., & Tanwar, N. (2025). Mapping ESG and CSR literature: A bibliometric study of research trends and emerging themes. International Journal of Law and Management. ahead-of-print. [Google Scholar] [CrossRef]

- Rasmussen, T. (2025). Environmental, social, and governance (ESG) reporting in the US: How to prepare and communicate evolving requirements (The Berkeley-Haas Case Series). University of California, Berkeley, Haas School of Business. [Google Scholar]

- Rozin, P., & Royzman, E. B. (2001). Negativity bias, negativity dominance, and contagion. Personality and Social Psychology Review, 5(4), 296–320. [Google Scholar] [CrossRef]

- Serafeim, G., & Yoon, A. (2023). Stock price reactions to ESG news: The role of ESG ratings and disagreement. Review of Accounting Studies, 28(3), 1500–1530. [Google Scholar] [CrossRef]

- Sheel, A., & Zhong, Y. (2005). Cash dividend announcements and abnormal returns in the lodging and restaurant sectors: An empirical examination. The Journal of Hospitality Financial Management, 13(1), 49–58. [Google Scholar] [CrossRef]

- Soysa, R. N. K., Pallegedara, A., Kumara, A. S., Jayasena, D. M., & Samaranayake, M. K. S. M. (2024). Construction of a sustainability reporting score index integrating sustainable development goals (SDGs), The case of Sri Lankan listed firms. Journal of Asian Business and Economic Studies, 31(3), 190–202. [Google Scholar] [CrossRef]

- Sun, P. W., & Wen, Z. (2023). Stock return predictability of the cumulative abnormal returns around the earnings announcement date: Evidence from China. International Review of Finance, 23(1), 58–86. [Google Scholar] [CrossRef]

- Suwanna, T. (2012). Impacts of dividend announcement on stock return. Procedia-Social and Behavioral Sciences, 40, 721–725. [Google Scholar] [CrossRef]

- Tsukioka, Y., Yanagi, J., & Takada, T. (2018). Investor sentiment extracted from internet stock message boards and IPO puzzles. International Review of Economics & Finance, 56, 205–217. [Google Scholar] [CrossRef]

- Van Eck, N., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538. [Google Scholar] [CrossRef]

- Wang, W. (2024). Investor sentiment and stock market returns: A story of night and day. The European Journal of Finance, 30(13), 1437–1469. [Google Scholar] [CrossRef]

- Yang, H., Tang, F., Hu, F., & Yao, D. (2025). Corporate ESG performance and abnormal cash dividends. International Review of Financial Analysis, 102, e104082. [Google Scholar] [CrossRef]

- Zghal, I., Hamad, S. B., Eleuch, H., & Nobanee, H. (2020). The effect of market sentiment and information asymmetry on option pricing. The North American Journal of Economics and Finance, 54, e101235. [Google Scholar] [CrossRef]

- Zhou, J., Liu, W. Q., & Li, J. Y. (2024). Can Investor Sentiment Explain the Abnormal Returns of Volatility-Managed Portfolio Strategy? Evidence from the Chinese Stock Market. Emerging Markets Finance and Trade, 60(13), 2907–2937. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).