Journal Description

Games

Games

is a scholarly, peer-reviewed, open access journal of studies on game theory and its applications published bimonthly online by MDPI.

- Open Access— free for readers, with article processing charges (APC) paid by authors or their institutions.

- High Visibility: indexed within Scopus, ESCI (Web of Science), MathSciNet, zbMATH, RePEc, EconLit, EconBiz, and other databases.

- Rapid Publication: manuscripts are peer-reviewed and a first decision is provided to authors approximately 35.8 days after submission; acceptance to publication is undertaken in 6.7 days (median values for papers published in this journal in the second half of 2025).

- Recognition of Reviewers: reviewers who provide timely, thorough peer-review reports receive vouchers entitling them to a discount on the APC of their next publication in any MDPI journal, in appreciation of the work done.

Impact Factor:

0.5 (2024)

Latest Articles

Quadratic Programming Approach for Nash Equilibrium Computation in Multiplayer Imperfect-Information Games

Games 2026, 17(1), 9; https://doi.org/10.3390/g17010009 - 3 Feb 2026

Abstract

There has been significant recent progress in algorithms for approximation of Nash equilibrium in large two-player zero-sum imperfect-information games and exact computation of Nash equilibrium in multiplayer normal-form games. While counterfactual regret minimization and fictitious play are scalable to large games and have

[...] Read more.

There has been significant recent progress in algorithms for approximation of Nash equilibrium in large two-player zero-sum imperfect-information games and exact computation of Nash equilibrium in multiplayer normal-form games. While counterfactual regret minimization and fictitious play are scalable to large games and have convergence guarantees in two-player zero-sum games, they do not guarantee convergence to Nash equilibrium in multiplayer games. We present an approach for exact computation of Nash equilibrium in multiplayer imperfect-information games that solves a quadratically-constrained program based on a nonlinear complementarity problem formulation from the sequence-form game representation. This approach capitalizes on recent advances for solving nonconvex quadratic programs. Our algorithm is able to quickly solve three-player Kuhn poker after removal of dominated actions. Of the available algorithms in the Gambit software suite, only the logit quantal response approach is successfully able to solve the game; however, the approach takes longer than our algorithm and also involves a degree of approximation. Our formulation also leads to a new approach for computing Nash equilibrium in multiplayer normal-form games which we demonstrate to outperform a previous quadratically-constrained program formulation.

Full article

(This article belongs to the Special Issue New Advances in Computational Game Theory and Its Applications)

Open AccessArticle

Exclusionary Contracts and Incentives to Innovate

by

Simen Aardal Ulsaker

Games 2026, 17(1), 8; https://doi.org/10.3390/g17010008 - 3 Feb 2026

Abstract

►▼

Show Figures

This paper develops a game-theoretic model to study how exclusionary contracts affect firms’ incentives to invest in innovation. Several symmetric sellers compete to supply an identical product to a set of buyers, and each seller can invest in R&D to develop a higher-quality

[...] Read more.

This paper develops a game-theoretic model to study how exclusionary contracts affect firms’ incentives to invest in innovation. Several symmetric sellers compete to supply an identical product to a set of buyers, and each seller can invest in R&D to develop a higher-quality version of the product. Prior to choosing their R&D investments, sellers may offer exclusionary contracts to buyers. In equilibrium, all buyers sign an exclusionary contract with the same seller, which eliminates rival sellers’ incentives to invest in R&D and concentrates innovative effort in a single firm. Banning exclusionary contracts increases the aggregate probability of innovation and the joint surplus of buyers and sellers only when the R&D technology exhibits sufficiently strong diseconomies of scale.

Full article

Figure 1

Open AccessFeature PaperArticle

Communication and Standoff

by

Catherine Hafer

Games 2026, 17(1), 7; https://doi.org/10.3390/g17010007 - 2 Feb 2026

Abstract

This paper examines the potential for pre-play communication to shorten the duration of two-player incomplete-information wars of attrition. If players’ types constitute costlessly verifiable information, then all types of players disclose their types, resulting in the war of attrition having duration zero. However,

[...] Read more.

This paper examines the potential for pre-play communication to shorten the duration of two-player incomplete-information wars of attrition. If players’ types constitute costlessly verifiable information, then all types of players disclose their types, resulting in the war of attrition having duration zero. However, if type constitutes unverifiable information, the results are less sanguine. Pre-play cheap-talk communication has no effect on the play of the subsequent war of attrition. Mediated cheap-talk communication is no better: No institution that relies on players’ cheap-talk reports can systematically allocate the prize to the player who values it more highly at a lower resource cost than is entailed in equilibrium play of the war of attrition. Costly signaling in the form of burning money can effectively supplant the war of attrition as a means of allocating the prize, but it requires the same expected equilibrium resource expenditures, with the same expected distribution across types, as does the war of attrition. Thus, in spite of players’ unanimous preference for a system in which types are made known, and in spite of their disclosing type in equilibrium when type is verifiable, they nonetheless expend resources to credibly communicate their types when type is not verifiable, and the resources expended are, on average, equivalent to those expended in a war of attrition.

Full article

(This article belongs to the Special Issue Conflict and Communication: Applications of Game Theory to Political Economy)

Open AccessArticle

Monetary Policy Committees, Independence, and Influence

by

Esteban Colla-De-Robertis

Games 2026, 17(1), 6; https://doi.org/10.3390/g17010006 - 16 Jan 2026

Abstract

►▼

Show Figures

We develop a model of monetary policy committee decision-making, building on the framework of games played through agents (GPTA). Interest groups seek to influence policy by offering action-contingent contracts to committee members. The resulting equilibrium admits a simple characterization and shows how institutional

[...] Read more.

We develop a model of monetary policy committee decision-making, building on the framework of games played through agents (GPTA). Interest groups seek to influence policy by offering action-contingent contracts to committee members. The resulting equilibrium admits a simple characterization and shows how institutional features—such as committee size—shape the extent of external influence. When political pressure pushes for expansive and inflationary policy, larger committees can enhance de facto independence by diluting this influence. We also show that when anti-inflationary pressures dominate, an appropriate choice of committee size can replicate the preference shift towards more conservativeness familiar from delegation frameworks, even when it is not feasible to appoint a conservative central banker in a systematic way.

Full article

Figure 1

Open AccessArticle

On Collusion Sustainability and the Elasticity of Substitution

by

Marc Escrihuela-Villar

Games 2026, 17(1), 5; https://doi.org/10.3390/g17010005 - 14 Jan 2026

Abstract

We analyze the relationship between collusion sustainability in an infinitely repeated game using trigger strategies and the elasticity of substitution. To this end, we adopt a demand function with constant elasticity of substitution between the differentiated goods. Since our model exhibits a one-to-one

[...] Read more.

We analyze the relationship between collusion sustainability in an infinitely repeated game using trigger strategies and the elasticity of substitution. To this end, we adopt a demand function with constant elasticity of substitution between the differentiated goods. Since our model exhibits a one-to-one relationship between the elasticity of substitution and demand price elasticity, we demonstrate that a larger elasticity decreases the sustainability of collusion. Intuitively, a more elastic demand function causes the increase in deviation profits to compensate for the increase in collusive profits, making collusion less easily sustained. This result holds regardless of whether firms compete in quantities or prices.

Full article

(This article belongs to the Section Applied Game Theory)

►▼

Show Figures

Figure 1

Open AccessArticle

Fair Division of Indivisible Items: Envy-Freeness vs. Efficiency Revisited

by

Steven J. Brams, D. Marc Kilgour and Christian Klamler

Games 2026, 17(1), 4; https://doi.org/10.3390/g17010004 - 14 Jan 2026

Abstract

We study conflicts between envy-based fairness and efficiency for allocating indivisible items under additive utilities. We formalize several small, transparent instances showing that standard envy-freeness (EF) or its relaxations EFX and EFX0—i.e., envy-freeness up to any item, where EFX restricts attention

[...] Read more.

We study conflicts between envy-based fairness and efficiency for allocating indivisible items under additive utilities. We formalize several small, transparent instances showing that standard envy-freeness (EF) or its relaxations EFX and EFX0—i.e., envy-freeness up to any item, where EFX restricts attention to positively valued items and EFX0 allows removing zero-valued items as well—can conflict with Pareto-optimality (PO), maximin (MM), or maximum Nash welfare (MNW). Normatively, we argue that envy-freeness (even as EFX or EFX0) is not a panacea for allocating indivisible items and should be weighed against efficiency and welfare criteria.

Full article

(This article belongs to the Section Algorithmic and Computational Game Theory)

Open AccessArticle

Randomized Algorithms and Neural Networks for Communication-Free Multiagent Singleton Set Cover

by

Guanchu He, Colton Hill, Joshua H. Seaton and Philip N. Brown

Games 2026, 17(1), 3; https://doi.org/10.3390/g17010003 - 12 Jan 2026

Abstract

This paper considers how a system designer can program a team of autonomous agents to coordinate with one another such that each agent selects (or covers) an individual resource with the goal that all agents collectively cover the maximum number of resources. Specifically,

[...] Read more.

This paper considers how a system designer can program a team of autonomous agents to coordinate with one another such that each agent selects (or covers) an individual resource with the goal that all agents collectively cover the maximum number of resources. Specifically, we study how agents can formulate strategies without information about other agents’ actions so that system-level performance remains robust in the presence of communication failures. First, we use an algorithmic approach to study the scenario in which all agents lose the ability to communicate with one another, have a symmetric set of resources to choose from, and select actions independently according to a probability distribution over the resources. We show that the distribution that maximizes the expected system-level objective under this approach can be computed by solving a convex optimization problem, and we introduce a novel polynomial-time heuristic based on subset selection. Further, both of the methods are guaranteed to be within

(This article belongs to the Section Algorithmic and Computational Game Theory)

►▼

Show Figures

Figure 1

Open AccessArticle

All-Pay Auctions with Different Forfeits

by

Benjamin Kang and James Unwin

Games 2026, 17(1), 2; https://doi.org/10.3390/g17010002 - 9 Jan 2026

Abstract

In an auction, each party bids a certain amount, and the one who bids the highest is the winner. Interestingly, auctions can also be used as models for other real-world systems. In an all-pay auction all parties must pay a forfeit for bidding.

[...] Read more.

In an auction, each party bids a certain amount, and the one who bids the highest is the winner. Interestingly, auctions can also be used as models for other real-world systems. In an all-pay auction all parties must pay a forfeit for bidding. In the most commonly studied all-pay auction, parties forfeit their entire bid, and this has been considered as a model for expenditure on political campaigns. Here, we consider a number of alternative forfeits that might be used as models for different real-world competitions, such as preparing bids for defense or infrastructure contracts.

Full article

(This article belongs to the Special Issue Game-Theoretical Analysis of the Division of Labor and Trade Conflict)

Open AccessFeature PaperArticle

Endowment Inequality in Common Pool Resource Games: An Experimental Analysis

by

Garrett Milam and Andrew Monaco

Games 2026, 17(1), 1; https://doi.org/10.3390/g17010001 - 4 Jan 2026

Abstract

This work addresses whether heterogeneity in player endowments influences investment decisions in common pool resource (CPR) games, shedding light on the relationship between inequality and economic decision making. We explore two theoretical avenues from behavioral economics—linear other-regarding preferences and inequity aversion—and examine the

[...] Read more.

This work addresses whether heterogeneity in player endowments influences investment decisions in common pool resource (CPR) games, shedding light on the relationship between inequality and economic decision making. We explore two theoretical avenues from behavioral economics—linear other-regarding preferences and inequity aversion—and examine the predictions of each with a laboratory experiment. Our experimental results roundly reject the majority of these explanations: in treatments with endowment inequality, high endowment individuals invest more in the common pool resource than low endowment individuals. We discuss these results in the context of the literature on psychological entitlement and positional preferences.

Full article

(This article belongs to the Section Behavioral and Experimental Game Theory)

►▼

Show Figures

Figure 1

Open AccessArticle

A Dichotomous Analysis of Unemployment Benefits

by

Xingwei Hu

Games 2025, 16(6), 66; https://doi.org/10.3390/g16060066 - 10 Dec 2025

Abstract

This paper introduces a novel framework for designing fair and sustainable unemployment benefits, grounded in cooperative game theory and real-time fiscal policy. The labor market is modeled as a coalitional game, where a random subset of participants is employed, generating stochastic economic output.

[...] Read more.

This paper introduces a novel framework for designing fair and sustainable unemployment benefits, grounded in cooperative game theory and real-time fiscal policy. The labor market is modeled as a coalitional game, where a random subset of participants is employed, generating stochastic economic output. To ensure fairness, we adopt equal employment opportunity as a normative benchmark and propose a dichotomous valuation rule that assigns value to both employed and unemployed participants. Within a continuous-time, balanced budget framework, we derive a closed-form payroll tax rate that is fair, debt-free, and asymptotically risk-free. This tax rule is robust across alternative objectives and promotes employment, productivity, and equality of outcome. The framework naturally extends to other domains involving random bipartitions and shared payoffs, such as voting rights, health insurance, road tolling, and feature selection in machine learning. Our approach offers a transparent, theoretically grounded policy tool for reducing poverty and economic inequality while maintaining fiscal discipline.

Full article

(This article belongs to the Section Cooperative Game Theory and Bargaining)

►▼

Show Figures

Figure 1

Open AccessArticle

The Effect of Foreign Influence on Conflict and Social Identity in Ethnically Diverse Societies

by

Esther Hauk

Games 2025, 16(6), 65; https://doi.org/10.3390/g16060065 - 9 Dec 2025

Abstract

This paper develops a formal model to analyze how foreign interventions—via resource transfers towards mobilization, technological upgrades of the mobilization technology, and various forms of conditional aid—reshape identity choices and conflict dynamics in divided societies. After a foreign intervention occurred, individuals simultaneously decided

[...] Read more.

This paper develops a formal model to analyze how foreign interventions—via resource transfers towards mobilization, technological upgrades of the mobilization technology, and various forms of conditional aid—reshape identity choices and conflict dynamics in divided societies. After a foreign intervention occurred, individuals simultaneously decided how many resources to allocate to conflict and whether to identify as ethnic or national. The utility derived from identity decreases with the perceived social distance from the chosen group and increases with the group’s status. Foreign interventions can modify identity choices by affecting perceived social distance or group status. Our results reveal that inclusive aid and material support for mobilization are likely to induce national identification. Conversely, exclusive or ethnically targeted aid and technological upgrades of mobilization technology are likely to result in ethnic identification. We show that for all types of interventions analyzed, conflict mobilization is lower and the intervened nation’s material payoff is higher when individuals identify nationally than ethnically.

Full article

Open AccessArticle

Decisions in the Basketball Endgame: A Downside of the Three-Point Revolution

by

Luka Secilmis, Teo Secilmis, Simon Jantschgi and Heinrich H. Nax

Games 2025, 16(6), 64; https://doi.org/10.3390/g16060064 - 8 Dec 2025

Abstract

Von Neumann’s minimax theorem defines optimal strategic unpredictability in zero-sum games. Empirical evidence from professional sports has been interpreted as positive behavioral evidence for minimax. In this article, we analyze the strategic optimality of offensive plays in the basketball endgame when a team

[...] Read more.

Von Neumann’s minimax theorem defines optimal strategic unpredictability in zero-sum games. Empirical evidence from professional sports has been interpreted as positive behavioral evidence for minimax. In this article, we analyze the strategic optimality of offensive plays in the basketball endgame when a team has a final possession and trails by no more than a single basket. This final moment of the game most closely approximates the simultaneous-move conditions of a game where minimax theory applies. Using comprehensive NBA data from 2010 to 2025, we test for equality of success rates across shooter types (star vs. non-stars) and shot selection (two-point vs. three-point). Our analysis reveals systematic violations of minimax play that have intensified with basketball’s shift to three-pointers and higher expected points. In the final decisive moment of the game, we find that teams systematically overuse three-point shots even though the two-point attempt yields higher field goal percentages. In addition, teams over-rely on star players for the final shot; non-star two-point shots have been the top-performing endgame option in 2022–2025.

Full article

(This article belongs to the Special Issue Game Theory, Sports and Athletes’ Behavior Under Pressure)

►▼

Show Figures

Figure 1

Open AccessArticle

Moral Emotions and Beliefs Influence Charitable Giving

by

Garret Ridinger and Anne Carpenter

Games 2025, 16(6), 63; https://doi.org/10.3390/g16060063 - 5 Dec 2025

Abstract

►▼

Show Figures

This paper studies the influence of moral emotions and beliefs on understanding charitable giving. While specific moral emotions such as empathy, guilt, and shame have been associated with prosocial behavior, how they impact giving behavior may depend on beliefs about the giving of

[...] Read more.

This paper studies the influence of moral emotions and beliefs on understanding charitable giving. While specific moral emotions such as empathy, guilt, and shame have been associated with prosocial behavior, how they impact giving behavior may depend on beliefs about the giving of others. Using a laboratory experiment, individuals participated in a dictator game with charity and completed measures of beliefs, empathy, guilt, and shame. Results show that while individual variation in empathy, guilt, and shame is important in explaining charitable giving, these effects depend crucially on individual beliefs.

Full article

Figure 1

Open AccessArticle

Behavioural Signatures of Wise Negotiators: An Experimental Approach Using an Investment Game

by

Prarthana Saikia and Ankita Sharma

Games 2025, 16(6), 62; https://doi.org/10.3390/g16060062 - 1 Dec 2025

Abstract

Wisdom in negotiation is increasingly vital in managing conflicts, yet its behavioural expression remains underexplored. This study explores the behavioural signatures of individuals nominated as wise negotiators within an organisational context. There were 48 participants recruited as wise negotiators from a larger pool

[...] Read more.

Wisdom in negotiation is increasingly vital in managing conflicts, yet its behavioural expression remains underexplored. This study explores the behavioural signatures of individuals nominated as wise negotiators within an organisational context. There were 48 participants recruited as wise negotiators from a larger pool of 313 participants. There were three manipulations used: archetypes (personality), reciprocity style, and emotionality, resulting in a 4X3X2 design (24 conditions). Participants were also asked to fill out various wisdom related questionnaires. Each participant had to go through 24 conditions separately before playing an investment game each time. For the analysis purpose, three-way repeated ANOVA and three-way repeated ANCOVA were used. The results revealed that there was a difference in how wise negotiators negotiate differently with different archetypes (p < 0.01), reciprocity (p < 0.01) and emotional situations (p < 0.01). Additionally, there were also interaction effects of archetypes, reciprocity and emotional situations (p < 0.05). Notably, when wisdom variables were statistically controlled, these differences became nonsignificant. A supplementary 2 × 2 design explored gender interactions, showing that outcomes differed by opponents’ gender but not by the gender of the wise negotiator. This finding highlights the role of wisdom traits in strategic negotiation and has implications for training and selection in a high-stakes negotiation context.

Full article

(This article belongs to the Section Behavioral and Experimental Game Theory)

►▼

Show Figures

Figure 1

Open AccessFeature PaperArticle

On SEIR Epidemic Dynamics with Pro- and Anti-Vaccination Strategies: An Evolutionary Game Theory Approach

by

Karam Allali

Games 2025, 16(6), 61; https://doi.org/10.3390/g16060061 - 19 Nov 2025

Abstract

►▼

Show Figures

We investigate a susceptible–exposed–infected–recovered

We investigate a susceptible–exposed–infected–recovered

Figure 1

Open AccessFeature PaperArticle

Minimax Under Pressure: The Case of Tennis

by

Ben Depoorter, Simon Jantschgi, Ivan Lendl, Miha Mlakar and Heinrich H. Nax

Games 2025, 16(6), 60; https://doi.org/10.3390/g16060060 - 18 Nov 2025

Cited by 1

Abstract

A series of articles has tested von Neumann’s minimax theory against behavioral evidence based on field data from professional sports. The evidence has been viewed and collectively cited as positive evidence that elite athletes in their familiar sports contexts mix well and behave

[...] Read more.

A series of articles has tested von Neumann’s minimax theory against behavioral evidence based on field data from professional sports. The evidence has been viewed and collectively cited as positive evidence that elite athletes in their familiar sports contexts mix well and behave in line with minimax. In this paper, based on open state-of-the-art tennis data and analytics, we shall uncover new and significant evidence against minimax at the very top of the game, where previously, such results had not been obtained. The kinds of behavioral deviations from minimax that we find become apparent, because we enrich the test strategy to take into account whether or not players face ‘pressure’ situations like break points and other decisive points. Our paper highlights that the prior literature’s failure to reject minimax does not constitute positive behavioral evidence, as some of that literature argued, because it is not robust to data aggregations and separations that are psychologically natural given the relevant real-world context. In this case, this means separating serves into the serve types that players actually consider and separating situations by pressure levels, which leads to clear and sound rejection of minimax.

Full article

(This article belongs to the Special Issue Game Theory, Sports and Athletes’ Behavior Under Pressure)

Open AccessArticle

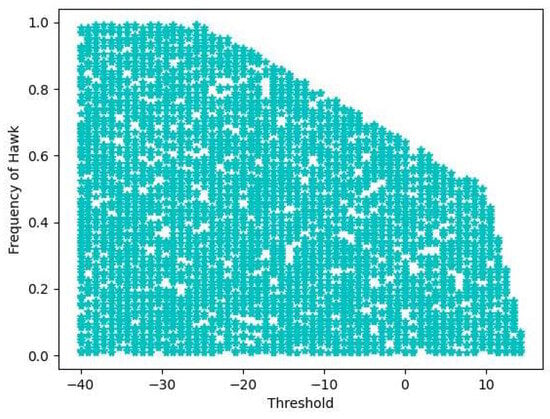

Linear Programming for Computing Equilibria Under Truncation Selection and Designing Defensive Strategies Against Malicious Opponents

by

Zhuoer Zhang and Bryce Morsky

Games 2025, 16(6), 59; https://doi.org/10.3390/g16060059 - 12 Nov 2025

Abstract

Linear programming and polyhedral representation conversion methods have been widely applied to game theory to compute equilibria. Here, we introduce new applications of these methods to two game-theoretic scenarios in which players aim to secure sufficiently large payoffs rather than maximum payoffs. The

[...] Read more.

Linear programming and polyhedral representation conversion methods have been widely applied to game theory to compute equilibria. Here, we introduce new applications of these methods to two game-theoretic scenarios in which players aim to secure sufficiently large payoffs rather than maximum payoffs. The first scenario concerns truncation selection, a variant of the replicator equation in evolutionary game theory where players with fitnesses above a threshold survive and reproduce while the remainder are culled. We use linear programming to find the sets of equilibria of this dynamical system and show how they change as the threshold varies. The second scenario considers opponents who are not fully rational but display partial malice: they require a minimum guaranteed payoff before acting to minimize their opponent’s payoff. For such cases, we show how generalized maximin procedures can be computed with linear programming to yield improved defensive strategies against such players beyond the classical maximin approach. For both scenarios, we provide detailed computational procedures and illustrate the results with numerical examples.

Full article

(This article belongs to the Section Non-Cooperative Game Theory)

►▼

Show Figures

Figure 1

Open AccessFeature PaperArticle

Provision of Public Goods via Unilateral but Mutually Conditional Commitments—Mechanism, Equilibria, and Learning

by

Jobst Heitzig

Games 2025, 16(6), 58; https://doi.org/10.3390/g16060058 - 5 Nov 2025

Abstract

We propose a one-shot, non-cooperative mechanism that implements the core in a large class of public goods games. Players simultaneously choose conditional commitment functions, which are binding unilateral commitments that condition a player’s contribution on the contributions of others. We prove that the

[...] Read more.

We propose a one-shot, non-cooperative mechanism that implements the core in a large class of public goods games. Players simultaneously choose conditional commitment functions, which are binding unilateral commitments that condition a player’s contribution on the contributions of others. We prove that the set of strong Nash equilibrium outcomes of this mechanism coincides exactly with the core of the underlying cooperative game. We further show that these core outcomes can be found via simple individual learning dynamics.

Full article

(This article belongs to the Section Non-Cooperative Game Theory)

►▼

Show Figures

Figure 1

Open AccessArticle

The Bateson Game: A Model of Strategic Ambiguity, Frame Uncertainty, and Pathological Learning

by

Kevin Fathi

Games 2025, 16(6), 57; https://doi.org/10.3390/g16060057 - 3 Nov 2025

Abstract

►▼

Show Figures

This paper introduces the Bateson Game, a signaling game in which ambiguity over the governing rules of interaction (interpretive frames), rather than asymmetry of information about player types, drives strategic outcomes. We formalize the communication paradox of the “double bind” by defining a

[...] Read more.

This paper introduces the Bateson Game, a signaling game in which ambiguity over the governing rules of interaction (interpretive frames), rather than asymmetry of information about player types, drives strategic outcomes. We formalize the communication paradox of the “double bind” by defining a class of games where a Receiver acts under uncertainty about the operative frame, while the Sender possesses private information about the true frame, benefits from manipulation, and penalizes attempts at meta-communication (clarification). We prove that the game’s core axioms preclude the existence of a separating Perfect Bayesian Equilibrium. More significantly, we show that under boundedly rational learning dynamics, the Receiver’s beliefs can become locked into one of two pathological states, depending on the structure of the Sender’s incentives. If the Sender’s incentives are cyclical, the system enters a persistent oscillatory state (an “ambiguity trap”). If the Sender’s incentives align with reinforcing a specific belief or if the Sender has a dominant strategy, the system settles into a stable equilibrium (a “certainty trap”), characterized by stable beliefs dictated by the Sender. We present a computational analysis contrasting these outcomes, demonstrating empirically how different parametrizations lead to either trap. The Bateson Game provides a novel game-theoretic foundation for analyzing phenomena such as deceptive AI alignment and institutional gaslighting, demonstrating how ambiguity can be weaponized to create durable, exploitative strategic environments.

Full article

Figure 1

Open AccessFeature PaperArticle

Integrating Strategic Properties with Social Perspectives: A Bipartite Classification of Two-by-Two Games

by

Shacked Avrashi, Lior Givon and Ilan Fischer

Games 2025, 16(6), 56; https://doi.org/10.3390/g16060056 - 22 Oct 2025

Abstract

Classifying games according to their strategic properties provides meaningful insights into the motivations driving the interacting parties, suggests possible future trajectories, and in some cases also points to potential interventions aiming to influence the interactions’ outcomes. Here, we present a new classification that

[...] Read more.

Classifying games according to their strategic properties provides meaningful insights into the motivations driving the interacting parties, suggests possible future trajectories, and in some cases also points to potential interventions aiming to influence the interactions’ outcomes. Here, we present a new classification that merges two perspectives: (i) a revised version of Rapoport and Guyer’s taxonomy, which extends beyond the original 78 games they describe by classifying all two-by-two games according to fundamental strategic properties, and (ii) a novel classification grounded in the theory of subjective expected relative similarity, which addresses not only the games’ payoffs but also the players’ strategic perceptions of their opponents. While Rapoport and Guyer’s original taxonomy classifies only strictly-ordinal games, the revised classification addresses all two-by-two games. It comprises eleven categories that are further grouped into five super-categories that focus on the game’s expected outcome and its strategic stability. The second, similarity-based, classification comprises four main categories, specifying whether players’ perceptions of their opponents have the potential to influence strategic decision-making. The merged classification comprises 14 game types, offering a holistic account of the strategic interaction, the players’ underlying motivations, and the expected outcome. It combines the fixed strategic properties with the variable social aspects of the interaction. Moreover, the novel classification points to the potential of social interventions that may influence the game’s outcome by altering strategic similarity perceptions. Therefore, the present work is relevant for both theoretical and experimental research, providing insights into actual choices expected inside and outside of the laboratory.

Full article

(This article belongs to the Section Algorithmic and Computational Game Theory)

►▼

Show Figures

Figure 1

Highly Accessed Articles

Latest Books

E-Mail Alert

News

Topics

Special Issues

Special Issue in

Games

Conflict and Communication: Applications of Game Theory to Political Economy

Guest Editors: Dimitri Landa, Le Bihan PatrickDeadline: 28 February 2026

Special Issue in

Games

Game Theory in Economics: Recent Advances in Spatial Competition

Guest Editor: Stefano ColomboDeadline: 28 February 2026

Special Issue in

Games

Game Theory and Competition Policy

Guest Editor: Heiko GerlachDeadline: 28 February 2026

Special Issue in

Games

Selected Papers from The 1st International Electronic Conference on Games (IECGA2025)

Guest Editor: Kjell HauskenDeadline: 28 February 2026