- Article

Binance USD Delisting and Stablecoins Repercussions: A Local Projections Approach

- Papa Ousseynou Diop and

- Julien Chevallier

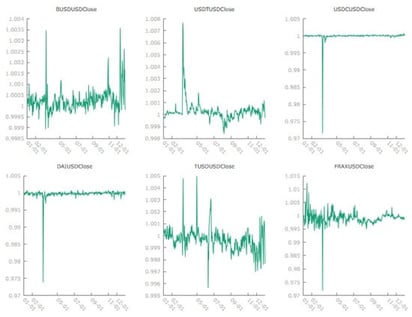

The delisting of Binance USD (BUSD) constitutes a major regulatory intervention in the stablecoin market and provides a unique opportunity to examine how targeted regulation affects liquidity allocation, market concentration, and short-run systemic risk in crypto-asset markets. Using daily data for 2023 and a linear and nonlinear Local Projections event-study framework, this paper analyzes the dynamic market responses to the BUSD delisting across major stablecoins and cryptocurrencies. The results show that liquidity displaced from BUSD is reallocated primarily toward USDT and USDC, leading to a measurable increase in stablecoin market concentration, while decentralized and algorithmic stablecoins absorb only a limited share of the shock. At the same time, Bitcoin and Ethereum experience temporary liquidity contractions followed by a relatively rapid recovery, suggesting conditional resilience of core crypto-assets. Overall, the findings document how a regulatory-induced exit of a major stablecoin reshapes short-run market dynamics and concentration patterns, highlighting potential trade-offs between regulatory enforcement and market structure. The paper contributes to the literature by providing the first empirical analysis of the BUSD delisting and by illustrating the usefulness of Local Projections for studying regulatory shocks in cryptocurrency markets.

16 January 2026