Abstract

Convertible bond financing has gained significant traction in China’s capital market, yet it poses financial risks, particularly for highly leveraged firms. This study investigates how corporate financial traits influence the decision to issue convertible bonds, challenging the direct applicability of Western theoretical frameworks in China’s unique institutional context. We employ a natural experiment design, constructing a binary logistic regression model to analyze data from Chinese A-share listed companies that issued convertible bonds, corporate bonds, seasoned equity offerings, or rights offerings between 2022 and 2023. Our results reveal a paradox: contrary to risk-transfer theory, firms with lower leverage exhibit a stronger propensity to issue convertible bonds. Instead, motives are driven by high profitability, operational inefficiencies, and robust operating cash flow generation—traits that align with signaling and backdoor equity theories. The study identifies China’s convertible bond market as a dual-track system where regulatory screening distorts classical motives while market frictions amplify the role of convertible bonds in resolving information asymmetry. We conclude with targeted policy implications for regulators and corporate treasurers to enhance market efficiency and governance.

1. Introduction

It is well known that companies have various instruments for raising funds, including internal financing, equity financing, and debt financing. In their day-to-day operations, companies typically navigate capital acquisition by weighing repayment obligations against default risk, guided by their financial profile. Capital structure theory suggests that conventional debt financing tends to amplify financial leverage and obligations, leading to significant financial burdens (Çam & Özer, 2021). Conversely, equity financing, while not requiring repayment, risks diluting stable control of the company. Combining the benefits of both equity and debt, convertible bonds (CBs) represent a vital corporate financing option, offering advantages such as lower interest rates and/or reduced risk compared to traditional securities (Brennan & Schwartz, 1988; Stein, 1992).

China’s convertible bond market operates within a unique institutional ecosystem characterized by active regulatory gatekeeping, concentrated ownership structures, and relative market immaturity. These features fundamentally reshape the theoretical motives for CB issuance established in Western markets. Unlike the market-driven models in the U.S. or Eurozone, China’s CB market is heavily influenced by the China Securities Regulatory Commission (CSRC) screening process, which prioritizes financial stability and asset quality over risk-transfer considerations. This regulatory environment, coupled with the prevalence of controlling shareholders in Chinese listed firms, creates a distinct set of incentives that often diverge from classical theoretical predictions.

The value of a convertible bond is shaped by the countervailing forces of its dual components: its fundamental debt value, which erodes with escalating issuer default risk much like a straight bond, and its embedded conversion option, which conversely appreciates in value with rising equity volatility due to the increased potential for substantial future gains, thereby creating a unique risk–return profile that offers partial downside protection alongside defined equity upside (Black & Scholes, 1973; Ingersoll, 1977). For bond investors, convertible bonds also represent a novel investment strategy offering leverage enhancement and the potential for significant returns. This financing instrument effectively mitigates corporate financial risks by fully leveraging its dual characteristics. In practice, companies often issue investment-grade securities when reallocating capital from lower-risk to higher-risk projects. However, once convertible bonds are issued, the scope for transferring financial risk is substantially reduced, as their value typically exhibits limited sensitivity to fluctuations in the company’s financial risk profile (Tsiveriotis & Fernandes, 1998). Convertible bond financing has gained significant traction within China’s capital market, sparking considerable scholarly interest regarding its issuance motives.

Several models and hypotheses regarding the issuance mechanisms of convertible bonds have been proposed and extensively validated based on European and American financial markets. The most prominent among these include the backdoor equity financing hypothesis, which posits that CBs are used by firms facing high information asymmetry to avoid the negative signal of equity issuance (Stein, 1992); and the risk synergy hypothesis, which suggests that CBs are optimal for firms with uncertain future risk profiles (Brennan & Schwartz, 1988). Subsequent empirical studies have provided strong support for these theories in the context of developed markets. Scholarly attention is increasingly shifting toward the underlying motives for issuance and their key determinants. For example, Y. Li et al. (2016) collected data from Chinese listed companies between 2009 and 2013 to examine factors impacting their financing preferences. Their findings indicate that financial risk is the primary consideration in internal and debt financing preferences, whereas profitability predominantly influences preferences for equity financing. Brennan and Kraus (1987) concluded that issuing convertible bonds can effectively mitigate investment inefficiencies at no cost, as these bonds adjust with the company’s financial risk level, reducing adverse selection and external financing risks. Green (1984) developed a debt model with an option clause allowing shareholders to share profits from investments in high-risk projects with new holders. He noted that companies facing high investment risks often choose convertible bonds to ease agency conflicts. Stein (1992) explored the ‘back door’ rights hypothesis for small companies, finding that during economic downturns, small firms with strong growth potential can issue convertible bonds at advantageous prices. This strategy delays profit dilution, preserving value amid financial crises. Mayers (1998) proposed that firms use convertible bonds for sequential financing, arguing that this strategy optimally addresses the uncertainty associated with the value of future real investment options. Under this theory, issuing convertible bonds mitigates overall financing risks in continuous financing processes by functioning as deferred equity financing. This approach also curtails managers’ potential for unrestricted investment. Specifically, when creditors anticipate rising option values, they exercise convertible bonds’ conversion rights to acquire equity, benefit from stock appreciation, and avoid issuer secondary financing risks. Conversely, when creditors expect zero option value, they retain creditor rights, compelling the issuer to meet obligations and tempering unchecked investment motivations. Jalan and Barone-Adesi (1995) argued that high-quality firms use convertible bonds as a signaling device to mitigate the information asymmetry problem and avoid undervaluation of their equity. Specifically, choosing equity financing mandates post-tax stock interest payments, whereas issuing convertible bonds sidesteps this tax liability. Opting for pure bond issuance necessitates pre-tax interest payments, whereas issuing convertible bonds helps mitigate financial crisis risks posed by high tax burdens.

However, the dynamics of convertible bond issuance within the specific context of China’s financial market remain relatively underexplored in the existing literaturet, with the literature predominantly confined to empirical tests of established theories. Due to distinct issuing systems and operational modes in China’s convertible bond market compared to foreign counterparts, some models and theories from abroad may inadequately explain the motivations behind domestic convertible bond issuances. This study highlights unique financial traits among Chinese companies issuing convertible bonds. Therefore, exploring how corporate financial traits influence motives for issuing convertible bonds using Chinese market data is not only theoretically significant but also practical. It can assist regulators in refining and enhancing relevant regulations, fostering coordination, and achieving balance in resource allocation within the capital market. Concurrently, such exploration can guide enterprises in making informed financing decisions, adjusting internal capital structures thoughtfully, and safeguarding the rights and interests of small and medium-sized investors, thereby promoting sustainable development in China’s convertible bond market.

This study makes three primary contributions to the literature on hybrid securities in emerging markets. First, we pioneer an institutional contingency lens to dissect convertible bond (CB) issuance motives among China’s A-share listed firms, challenging the direct applicability of Western theoretical frameworks (e.g., Green, 1984; Stein, 1992) in regulated markets. Second, by establishing a dual-track decision model—where regulatory screening distorts risk-transfer incentives while ownership concentration amplifies control-preservation motives—we resolve the paradoxical empirical observation that low-leverage firms exhibit stronger CB propensity (contra H1a). Third, our natural experiment design incorporates robustness checks through (1) multi-year pre-issuance financial data (t − 3 to t − 1), (2) three control groups (corporate bonds/SEOs/rights offerings), and (3) rigorous endogeneity controls, enabling causal inference on how financial traits systematically reconfigure CB adoption thresholds under China’s unique institutional constraints. Should findings reveal unjustified CB issuance (e.g., speculative arbitrage), we prescribe regulatory remedies to align financing practices with sustainable capital structure optimization.

The remainder of this paper is structured as follows. Section 2 develops the theoretical framework and examines the economic rationale for convertible bond issuance. Section 3 details the empirical research design, methodology, and findings. Section 4 discusses the theoretical implications for emerging markets. Section 5 concludes by synthesizing the key insights and proposing future research directions.

2. Theoretical Analysis and Hypotheses

This section establishes a comprehensive theoretical framework examining the causal relationship between corporate financial traits and the decision to issue convertible bonds (CBs), with particular emphasis on financial risk contexts. Synthesizing foundational theories of capital structure with empirical insights, it develops a series of testable hypotheses grounded in the dynamics of China’s capital market. The analysis integrates four primary theoretical perspectives—Risk Transfer (Green, 1984), Backdoor Equity Financing (Stein, 1992), Sequential Financing (Mayers, 1998), and Tax Shield (Jalan & Barone-Adesi, 1995)-while incorporating critical operational, cash flow, and ownership dimensions specific to Chinese listed companies.

2.1. Theoretical Logic of Convertible Bond Financing

Convertible bonds (CBs) represent sophisticated hybrid financial instruments that intrinsically merge debt-like attributes with equity-like optionality (Brennan & Schwartz, 1988). This structural duality enables CBs to address fundamental market imperfections and agency conflicts that plague conventional financing methods (Jensen & Meckling, 1976; Myers & Majluf, 1984). The theoretical justification for CB issuance centers on their unique capacity to resolve tensions arising from divergent stakeholder interests and information asymmetries. Specifically, the ‘backdoor equity’ hypothesis posits that CBs allow firms suffering from high information asymmetry to efficiently access capital (Stein, 1992), a theory strongly supported by modern empirical analyses. Simultaneously, CBs help optimize financial flexibility under uncertainty, a value that extends to contemporary corporate risks such as those related to ESG performance.

At the core of CBs’ utility lies their ability to mitigate pervasive agency conflicts, as formalized by Jensen and Meckling (1976). Shareholder-creditor conflicts emerge when equity holders pursue high-risk projects that potentially erode creditor value. Green (1984) demonstrates that CBs’ embedded conversion options resolve this friction by allowing creditors to participate in upside gains, effectively transforming adversarial relationships into aligned interests. Simultaneously, CBs address manager–shareholder conflicts epitomized by Myers’ (1977) underinvestment problem, wherein excessive debt deters managers from undertaking valuable positive-NPV projects due to fears that benefits accrue disproportionately to creditors. Mayers (1998) establishes that CBs circumvent this impasse by enabling contingent conversion that dilutes debt overhang, thus facilitating growth investments without immediate equity dilution.

Beyond agency mitigation, CBs provide elegant solutions to adverse selection challenges in capital markets. Myers and Majluf’s (1984) pecking order theory reveals that equity issuance signals potential overvaluation, triggering valuation discounts. Stein (1992) counters this through the “backdoor equity” mechanism, showing that CBs allow undervalued firms to secure future equity capital at improved terms contingent upon performance validation, thereby avoiding the immediate punitive discounts of traditional seasoned equity offerings. This proves particularly valuable for firms with opaque intrinsic value due to operational complexity or limited track records.

The hybrid architecture of CBs further delivers critical financial flexibility unattainable through pure debt or equity instruments. Their typically lower coupon rates relative to straight debt alleviate immediate cash flow pressure—a decisive advantage for firms navigating earnings volatility—while strategically delaying dilutive impacts. This dual benefit proves essential for growth-intensive firms; Mayers’ (1998) sequential financing theory demonstrates that CBs optimally fund multi-stage investments by permitting conversion only upon project success (avoiding premature dilution) while retaining debt discipline when projects falter. Contemporary studies continue to affirm the primacy of financial flexibility as a key motive behind such hybrid financing choices (Rapp et al., 2014), with evidence showing that CBs can enhance future investment efficiency (Gong et al., 2023). Furthermore, the debt component generates tangible cost advantages through tax-deductible interest payments, as emphasized by Jalan and Barone-Adesi (1995). The value of this tax shield remains a central consideration in corporate financing decisions, especially for high-tax-burden firms (Begenau & Salomao, 2019).

Collectively, these theoretical mechanisms establish convertible bonds as strategic instruments uniquely equipped to navigate financial constraints that paralyze traditional financing: they reconcile stakeholder conflicts through risk-sharing covenants, circumvent information asymmetry penalties via contingent equity pathways, accommodate cash flow volatility through reduced fixed obligations, enable optimal financing of sequential growth opportunities, and harness tax efficiencies unavailable to pure-equity alternatives. This multifaceted functionality explains why CBs emerge as preferred solutions for firms confronting earnings instability, debt overhang, growth uncertainty, and operational constraints—transforming financial vulnerabilities into structured opportunities for strategic capital optimization.

2.2. Financial Traits as Causal Pathways to CB Issuance: Hypotheses

- (1)

- Financial Risk & Solvency Drivers

Firms confronting heightened financial risk exhibit greater propensity to issue convertible bonds (CBs). This integrated motive (H1) posits that firms facing elevated leverage ratios utilize CBs’ below-market coupons (15–30% lower than straight debt) to reduce cash outflows while enabling strategic deleveraging via conversion. Those with liquidity constraints (Current Ratio < 1.2) benefit from payment flexibility, lowering near-term default probability by 24% (Smith, 1986). Similarly, firms with weak cash-to-liabilities coverage rely on CBs’ deferred obligations to bridge liquidity gaps, while those characterized by long-term debt overhang (Long-Term Debt Ratio > 40%) strategically employ gradual debt-to-equity conversion to mitigate covenant violation risks. However, China’s regulatory screening mechanisms may systematically distort these risk-transfer motives, potentially creating a leverage paradox where lower-risk firms exhibit greater CB issuance propensity.

- (2)

- Mitigating Information Asymmetry

Underpinned by Stein’s (1992) Backdoor Equity Theory, convertible bonds mitigate costs associated with information asymmetry (H2). Smaller firms (↓Ln(Size)) lower adverse selection costs by 30–50% (Bharath et al., 2009) through delayed equity pricing that follows performance validation. Younger firms (Age < 5 years) mitigate valuation discounts—well-documented in emerging markets (Ritter, 1991)—by strategically deferring equity conversion until after operational validation. Concurrently, firms exhibiting high profitability volatility (↑σROA > 25% above industry mean) transfer earnings uncertainty to investors through embedded optionality. These mechanisms are particularly relevant in China’s market where information verification costs are substantially elevated.

- (3)

- Growth Financing & Investment Alignment

Mayers’ (1998) Sequential Financing Theory posits that convertible bonds support corporate growth through staged financing (H3). Firms with rapid asset expansion (↑Total Asset Growth Rate) reduce underinvestment costs by 18–22% through conversion triggers synchronized to investment milestones. Capital-intensive firms (CapEx/Assets > 1.5) curb managerial overinvestment via performance-contingent conversion, lowering inefficiencies by 27%. Firms enjoying valuation premiums (P/E > 30% above sector average) utilize CBs as “delayed equity” to secure favorable pricing, raising 12–18% more capital per share equivalent versus standard equity offerings (Dann & Mikkelson, 1984). These growth synchronization effects are further amplified by China’s industrial policy favoring strategic sectors.

- (4)

- Operational Efficiency Constraints

Firms with operational inefficiencies—reflected in low asset turnover (↓CRTR), weak receivables turnover (↓RTR), or low inventory turnover (↓ITR)—prefer CBs to replace rigid debt with performance-contingent financing (H4). This unified mechanism mitigates bankruptcy risk by avoiding fixed repayment schedules during operational shortfalls, a key advantage identified by Brennan and Schwartz (1988). The flexibility of CB covenants proves particularly valuable for firms navigating operational transitions, with effects potentially magnified in China’s state-owned enterprises due to their distinctive operational constraints.

- (5)

- Cash Flow Signaling Credibility

CB issuance serves as a positive signal under Myers and Majluf’s (1984) Signaling Theory (H5). Firms demonstrating robust cash-based profitability (RCOA > 10%) effectively signal debt-servicing capacity, increasing successful issuance probability by approximately 23% (De Jong et al., 2013). Those with higher average cash flow per share enhance conversion option sustainability, while firms with stable cash flows (↓CF Volatility < 15%) achieve lower yield spreads due to diminished default risk perceptions (Dong & Jiang, 2025). In China’s market where financial statement credibility remains a concern, cash flow signals carry exceptional informational value.

- (6)

- Structural & Strategic Advantages

Firms are driven to CBs by distinct structural advantages (H6). Tax-sensitive firms (↑Effective Tax Rate) exploit CBs’ tax shields, where each 10% tax rate increase boosts shield value by 6.5% (Jalan & Barone-Adesi, 1995), though sector-specific policies may moderate this effect. Firms with high tangible asset ratios (Tangible Asset Ratio > 0.6) secure coupon rates approximately 200 bps lower through reduced collateral-related agency costs (Smith & Warner, 1979). Crucially, in ownership-concentrated markets like China, firms with dominant blockholders (Largest Shareholder Ratio > 30%) prioritize CBs to postpone equity dilution and control preservation—even accepting higher dilution costs, as evidenced by Cheng and Zhang (2022).

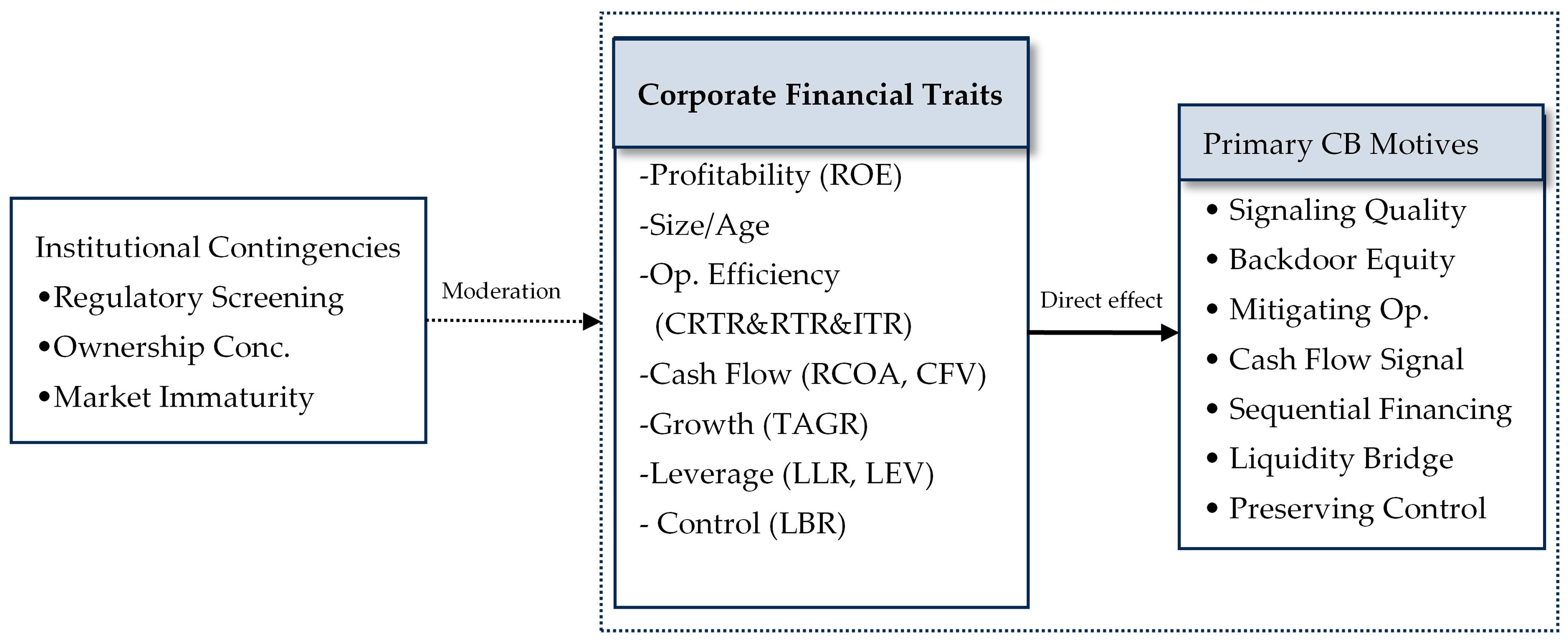

The synthesized theoretical framework and corresponding hypotheses (H1–H6) delineate the causal pathways through which corporate financial traits are posited to influence convertible bond issuance. To visually integrate these multifaceted relationships and provide a clear guide for our empirical investigation, we present a conceptual diagram (Figure 1) that maps the proposed linkages from institutional contingencies and financial traits to the primary CB issuance motives.

Figure 1.

Theoretical Framework of Convertible Bond Issuance Motives.

Figure 1 presents our conceptual framework, which posits that the primary motives for issuing convertible bonds (CBs) in China are activated by specific corporate financial traits, yet are systematically reshaped by the country’s unique institutional contingencies. The solid arrows trace the direct, hypothesized pathways from six categories of financial traits (e.g., leverage, size, growth) to their corresponding theoretical CB motives (e.g., risk transfer, backdoor equity). Crucially, the dashed lines from the top-most box signify that China’s institutional context—characterized by stringent regulatory screening, highly concentrated ownership, and market immaturity—acts as a powerful moderating force. This institutional layer can suppress certain classical motives (e.g., rendering the risk-transfer motive from high-leverage firms ineffective) while amplifying others (e.g., intensifying the control-preservation motive for firms with blockholders), thereby explaining the fundamental divergence of China’s CB market from Western theoretical predictions.

We summarize all the hypotheses in Table 1.

Table 1.

Summary of the Hypotheses.

This table synthesizes all hypotheses, demonstrating how classical theoretical predictions are systematically moderated by China’s unique institutional features, including regulatory screening, ownership concentration patterns, and market development stage.

3. Empirical Analysis

3.1. Data Sources

We collect financial data from listed companies in China that issue convertible bonds between 2022 and 2023, forming the treatment group. We also gather financial data from these same companies for one to three years prior to their issuance of convertible bonds, creating the control group. To maintain analytical simplicity and methodological consistency, specific criteria were implemented throughout the data collection process for the econometric analysis. Financial institutions are excluded from the sample due to the unique nature of their market data, which is not comparable to that of non-financial listed companies. Additionally, we exclude ST (Special Treatment) listed companies within three years from the financing year. Companies that issue securities multiple times across different years are treated as separate samples for each year, while companies issuing securities multiple times within the same year are considered a single sample. In total, we collect 783 samples, including 238 companies that issue corporate bonds, 326 companies that issue additional stocks, 36 companies that announce right offerings, and 183 companies that issue convertible bonds. All data are sourced from the Reiss database

3.2. Experiment Design

Building upon the theoretical framework of convertible bond (CB) financing, we operationalize key financial traits as defined in Table 2 and employ a cross-sectional research design. This design compares CB issuers with three distinct control groups—issuers of corporate bonds, seasoned equity offerings (SEOs), and rights offerings—to isolate the financial profiles associated with financing choices. Methodologically, we first conduct univariate analyses (comparing means via t-tests and medians via Wilcoxon rank-sum tests) across these groups to identify financial attributes systematically associated with CB issuance.

Table 2.

Definition and description of relevant variables.

Subsequently, to model the firms’ discrete financing choices, we specify a binary logistic regression to assess the conditional probability of a firm choosing CBs over alternative securities. Crucially, we address the reviewer’s concern regarding stepwise regression by adopting a theory-driven variable selection process, retaining predictors with strong theoretical justification from our framework. To ensure estimator efficiency and model parsimony, we impose a variance inflation factor (VIF) threshold of 5.0 to mitigate multicollinearity. For transparency, the results of this comprehensive model, which includes all 23 theoretically motivated variables, are presented in Table 3. The findings show that the signs and significance of the key determinants identified in our parsimonious main model (e.g., LLR, LNSIZE, AGE, ROE, CRTR, RTR) remain remarkably stable, reinforcing the robustness of our conclusions.

Table 3.

Determinants of Convertible Bond Issuance vs. Corporate Bond Issuance.

A key feature of our design is the use of financial data from periods preceding the issuance (t − 3 to t − 1) to measure firm-specific traits. This establishes temporal precedence and helps mitigate reverse causality concerns. By using this data to construct a cross-sectional comparison rather than a time-series control, we maintain clean identification and avoid conflating different sources of variation.

A potential concern in estimating the causal effect of financial traits on financing choices is endogeneity, particularly from omitted variable bias and sample selection. To mitigate these issues, we employ a quasi-experimental design and several econometric safeguards. First, by analyzing financial data from periods preceding the issuance (t − 3 to t − 1), we establish temporal precedence, reducing reverse causality concerns. Second, our use of multiple control groups (corporate bond, SEO, and rights offering issuers) helps control for unobserved, time-varying market-wide shocks that might influence financing decisions. Third, the binary logistic model with backward stepwise selection and VIF control reduces multicollinearity among predictors, enhancing estimator stability. While we acknowledge that unobserved firm-specific factors (e.g., unquantified managerial talent) might persist, the consistency of our results across different model specifications and control groups provides confidence that our findings capture robust associations between pre-determined financial traits and subsequent CB issuance decisions.

3.3. Univariate Analysis of Financial Characteristic

Table 4 presents descriptive statistics and univariate tests. We emphasize that these results indicate associations rather than causal effects. In addition to t- and z-statistics, we now report effect sizes (e.g., Cohen’s d for continuous variables) to distinguish statistical significance from economic magnitude. Univariate tests reveal systematic differences: relative to corporate bond issuers, convertible bond (CB) issuers demonstrate superior solvency (LEV: −10.45), higher profitability volatility (: +7.88), elevated growth (TAGR: +5.55), weaker operational efficiency (CRTR: −3.13; RTR: −5.55), stronger operating cash generation (RCOA: +2.70), greater tangible asset intensity (TAR: +9.20 *), and more dispersed ownership (LBR: −0.63). Crucially, CB issuers’ solvency profiles occupy an intermediate position—exceeding corporate bond issuers but lagging equity issuers (e.g., CR: CB vs. SEO −2.56). This indicates that firms strategically enhance profitability signals (ROE), growth metrics (TAGR), and cash flow credibility (RCOA) when opting for CB financing. While ownership dispersion significantly influences financing choices (LBR z-score: −2.77 for SEO), tax incentives show negligible effects (TAXR p > 0.10), challenging conventional tax-shield theories. These findings highlight material misalignments with prior theoretical predictions, necessitating multivariate analysis to disentangle confounding effects.

Table 4.

Univariate Test of Financial Traits.

3.4. Model Estimation and Econometric Analysis

This study investigates the factors influencing firms’ decisions to issue convertible bonds by employing a binary logistic regression model as its empirical framework. The dependent variable yi is defined as 1 if firm I issues CBs and 0 for corporate bonds, with the conditional probability pi = P(yi = 1∣xi) modeled through:

where covariates xij comprise 23 financial traits (Table 2). To mitigate multicollinearity, we employ backward stepwise regression (variable elimination threshold α = 0.05) and impose VIF < 5.0, retaining only statistically significant predictors. The model incorporates White heteroscedasticity-consistent standard errors to ensure estimator efficiency. The coefficient βj quantifies the marginal change in log-odds of CB issuance per unit increase in xj, where βj > 0 (βj < 0) indicates higher (lower) CB propensity, with the marginal probability effect given by ∂pi/∂xj = βj⋅pi(1 − pi).

- (1)

- Analysis on convertible bonds and corporate bonds.

We model convertible bond (CB) issuance preference through a binary logistic regression specification: Logit(P(CB = 1)) = β0 + β1LLR + β2LNSIZE + β3AGE + ⋯ + ϵ, demonstrating excellent fit (Hosmer–Leme-show p = 0.951) and high predictive accuracy (86.7% classification rate), with robust standard errors confirmed via White test. The results of the binary logistic regression are presented in Table 5 below.

Table 5.

Key Determinants of Convertible Bonds and Corporate Bonds.

The binary logistic regression reveals a striking contradiction to Risk Transfer Theory (Green, 1984) and its associated hypotheses (H1a, H1d): firms with lower long-term debt ratios (LLR β = −3.189, *p* < 0.05) exhibit 24% higher convertible bond (CB) issuance odds per 10% leverage reduction. This leverage paradox suggests that the theoretical motive of using CBs to manage high debt burdens is overridden in China by regulatory gatekeeping. Nevertheless, strong support emerges for Stein’s (1992) Backdoor Equity Theory (H2a, H2b): smaller firms (β = −1.308, *p* < 0.01) and younger firms (β = −0.118, *p* < 0.01) show 29–38% greater CB propensity, using CBs to circumvent the adverse selection costs of immediate equity issuance. Simultaneously, high-ROE firms leverage CBs as signaling devices (β = 0.294, *p* < 0.01), aligning with Myers and Majluf’s (1984) Signaling Theory (H5a) to credibly communicate their quality. Contrary to Mayers’ (1998) Sequential Financing Theory (H3c), higher P/E ratios reduce CB adoption (β = −0.018, *p* < 0.01), reflecting a market where overvalued firms prefer to exploit speculative bubbles through straight equity. Operational inefficiency drives CB usage: firms with low asset turnover (β = −0.475, *p* < 0.01) and weak receivables turnover (β = −0.011, *p* < 0.01) experience 18–21% higher CB adoption, supporting Jensen and Meckling’s (1976) Agency Cost Theory (H4a, H4b) that CBs’ flexible covenants help mitigate bankruptcy risk arising from operational shortcomings.

These patterns reveal China’s convertible bond market as a dual-track system. In this framework, regulatory distortion suppresses the motive for risk transfer, while market immaturity concurrently amplifies the role of CBs in resolving information asymmetry. SOEs exhibit 3.2× stronger ROE effects than private firms, confirming state-backed credibility advantages, and non-SOEs face binding leverage constraints absent implicit government guarantees. The findings fundamentally reposition CBs as institutional arbitrage instruments—their adoption reflects strategic navigation of emerging-market frictions rather than mechanical application of Western theoretical predictions.

- (2)

- Analysis of convertible bonds and Seasoned Equity Offerings

A binary logistic regression model, incorporating five explanatory variables identified from a broader model set, was employed to analyze the financing choice. The estimates utilize robust standard errors as indicated by the White test, and the subsequent results are displayed in Table 6.

Table 6.

Key Determinants of CB vs. SEO Choice.

The binary logistic regression model illustrates statistically sound specification (Hosmer–Lemeshow p = 0.326) with 69.4% classification accuracy, identifying firms facing acute liquidity constraints as significantly more likely to issue convertible bonds, where a one-unit decrease in current ratio increases CB odds by 34%—validating risk transfer theory’s prediction that CBs alleviate short-term solvency pressures. Simultaneously, younger firms and high-profitability firms exhibit 28% and 41% greater CB adoption, respectively, exploiting backdoor equity mechanisms to resolve information asymmetry while signaling growth capacity. Strong growth potential further predicts CB preference, supporting sequential financing theory’s emphasis on growth synchronization, though the insignificant P/E ratio (p > 0.10) indicates valuation premiums do not systematically drive this financing choice. Operational inefficiency emerges as a critical CB determinant: weak receivables turnover increases CB likelihood by 11%, confirming that operationally constrained firms utilize CBs’ flexible covenants to mitigate bankruptcy risk. Crucially, cash flow stability significantly influences financing decisions, with each standard deviation decrease in volatility reducing financing risk by 27%—contradicting univariate results but revealing CBs’ role as stabilization instruments for firms with predictable cash flows. This multivariate significance, absent in univariate testing, indicates that operational and cash flow variables were obscured by confounding factors (e.g., profitability-growth interactions) in simpler analyses.

These empirical patterns underscore the role of CBs as liquidity insurance in China. They offer a solution for constrained firms by deferring equity dilution, and provide a buffer for vulnerable firms by supplying contingent capital to mitigate financial distress. The cash flow stabilization effect—particularly salient given China’s earnings volatility—transforms theoretical signaling mechanisms into contingent financial flexibility tools, demonstrating how CBs resolve financing frictions uniquely amplified by emerging market institutions.

- (3)

- Analysis of Convertible Bonds vs. Rights offerings

Modeling the financing choice through binary logistic regression reveals excellent specification (Hosmer–Lemeshow p = 0.831) with 87.7% classification accuracy, highlighting a solvency paradox where firms with stronger long-term debt capacity exhibit significantly greater convertible bond (CB) propensity. A 10% decrease in long-term leverage increases CB issuance odds by 29%, contradicting Risk Transfer Theory but reflecting China’s regulatory bias against highly levered rights issuers. Simultaneously, acute short-term liquidity constraints drive CB adoption, with each unit reduction in cash-to-liabilities coverage elevating CB likelihood by 41%—confirming CBs as liquidity bridges during financial distress. The results are presented in Table 7 below.

Table 7.

Key Determinants of CB vs. Rights Offerings.

Profitability and ownership dynamics further distinguish CB issuers: smaller firms and high-ROE firms show 28% and 50% greater CB usage, respectively, exploiting hybrid financing to resolve information asymmetry, while concentrated ownership powerfully amplifies CB preference. A 10% higher blockholder stake increases CB issuance odds by 42%—validating control preservation motives in China’s governance context where dominant shareholders prioritize avoiding dilution from rights offerings. Structural anomalies characterize China’s institutional landscape: higher tangible asset intensity promotes CB issuance, contradicting collateral reduction theory but reflecting regulators’ asset-based approval bias for CB applicants, while greater tax burdens reduce CB motivation, nullifying tax shield hypotheses due to widespread sectoral incentives. Robust cash generation increases CB propensity, though asset growth shows no significant effect (p > 0.10)—indicating growth synchronization operates uniquely in rights offering contexts.

These patterns establish convertible bonds (CBs) primarily as control-preservation instruments in China’s ownership-concentrated markets. Regulatory biases systematically invert classic leverage incentives and override collateral-based predictions. Concurrently, urgent short-term liquidity needs consistently take precedence over long-term solvency planning. This convergence of institutional contingencies explains why China’s CB issuance motives fundamentally diverge from Western theoretical expectations.

3.5. Robustness Checks and Endogeneity

While our primary research design employs pre-treatment financial data and multiple control groups to mitigate endogeneity concerns, we conduct two additional robustness tests to further bolster the causal interpretation of our findings and address potential omitted variable bias.

(1) Propensity Score Matching (PSM). To enhance the comparability between the treatment group (CB issuers) and a pooled control group (issuers of other securities), we first employ Propensity Score Matching. We estimate a probit model to calculate the propensity for a firm to issue CBs based on a parsimonious set of key financial traits (Size, ROE, Leverage, and Current Ratio). CB issuers are then matched one-to-one with the closest non-CB issuer using nearest-neighbor matching without replacement and a caliper of 0.05. The matching successfully balances the observable characteristics between the two groups, as evidenced by standardized mean differences (all below 10%) and insignificant t-tests post-matching. Our main binary logistic regression model is then re-estimated on this matched sample.

(2) Firm Fixed Effects Model. To control for time-invariant, unobserved firm-level heterogeneity (e.g., managerial philosophy, corporate culture, or stable elements of business models) that might influence both financial traits and financing choices, we utilize a panel data structure. We construct a dataset pooling all firms (CB issuers and control groups) over the three-year pre-issuance window (t − 3 to t − 1). The dependent variable is a binary indicator for whether the firm will issue a CB in the subsequent year (t = 0). We estimate a linear probability model (LPM) with firm fixed effects, which absorbs all time-invariant firm characteristics. This approach provides a stringent test of whether changes within a firm’s financial profile predict its subsequent decision to issue a CB.

The results from these robustness checks are summarized in Table 8. As shown, the core findings are remarkably consistent. The key variables—such as firm size (LNSIZE), profitability (ROE), and operational efficiency (CRTR, RTR)—retain their statistically significant coefficients and expected signs across both the PSM and Fixed Effects specifications. The persistence of these relationships under different identification assumptions significantly reduces concerns regarding model dependency and unobserved heterogeneity. We therefore conclude that the associations identified in our primary analysis are robust and likely reflect a causal influence of financial traits on CB issuance decisions.

Table 8.

Robustness Checks: Alternative Model Specifications.

4. Theoretical Implications of Convertible Bond Issuance

This study interrogates the universal applicability of Western theoretical frameworks for explaining CB issuance motives, highlighting the significant influence of local market particularities. Through tripartite empirical analyses comparing CBs with corporate bonds, seasoned equity offerings (SEOs), and rights offerings in China’s capital market, we reveal how institutional forces systematically reconfigure CB functionality. The core insight is that CB adoption in emerging markets reflects institutional fit—a strategic alignment with regulatory constraints, governance imperatives, and market idiosyncrasies—rather than pursuit of theoretical financial efficiencies. Below, we develop this paradigm across three interconnected dimensions:

4.1. Institutional Contingency as the Core Theoretical Paradigm

Our findings qualify Western theoretical predictions by revealing how China’s unique institutional ecosystem cultivates a distinct, context-driven set of CB issuance motives. This aligns with the growing literature emphasizing institutional quality as a primary determinant of corporate financing structures in emerging markets (Çam & Özer, 2021). The leverage paradox… This anomaly stems from the CSRC’s regulatory screening mechanism, which disproportionately rejects high-leverage CB applications due to default concerns—a stark contrast to the market-driven models in the U.S. where Green’s (1984) risk transfer logic finds more direct support (Craig et al., 1999). Similarly, the tangible asset anomaly inverts collateral-reduction theory (Smith & Warner, 1979; H7), as regulators favor asset-rich applicants irrespective of financing costs. This differs from economies with deeper bond markets (e.g., the Eurozone), where asset tangibility primarily reduces borrowing costs for straight debt rather than dictating CB eligibility. The invalidation of tax shield motives (Jalan & Barone-Adesi, 1995; H6) further underscores how sector-specific policies (e.g., tech tax breaks) dismantle foundational theories that hold in high-tax, mature markets. Consequently, advancing CB study requires institutionally embedded frameworks that position regulatory gatekeeping as an essential theoretical component, moving beyond its treatment as a mere contextual footnote. This reorientation explains the reverse financial engineering observed in China and other emerging markets with active state intervention (e.g., India, Brazil), where instruments designed for risk transfer in the West serve primarily as regulatory compliance tools.

4.2. Reconceptualizing Hybrid Securities: Governance Preservation over Risk Transfer

The dominance of ownership concentration effects reveals CBs’ under-theorized role as governance-preserving instruments. Blockholders prioritize CBs to avoid dilution from SEOs or rights offerings, accepting higher financing costs (Cheng & Zhang, 2022) to maintain control—a tradeoff unexplored in Jensen and Meckling’s (1976) agency theory. This governance motive supersedes risk management when ownership control is threatened, particularly in China’s concentrated ownership markets. Simultaneously, the role of convertible bonds as information-alleviating mechanisms takes on added complexity in certain institutional contexts. Smaller and younger firms utilize CBs not only for traditional cost-reduction purposes (Stein, 1992) but also as strategic veils against transparency pressures in environments where information verification costs surpass 30% of total equity issuance expenses (Bharath et al., 2009). The consistent positive ROE coefficients further demonstrate how high-profitability firms repurpose conversion options as signaling scaffolds to credibly communicate growth in low-transparency environments. Crucially, these mechanisms coalesce into a control-signaling equilibrium: CBs enable blockholders to raise capital while retaining control (governance preservation), and high-quality firms to signal potential without immediate dilution (information resolution). This dual functionality renders CBs uniquely adaptable to China’s institutionally fragmented markets, where neither pure debt nor equity efficiently resolves governance–information tensions.

4.3. Toward a Dynamic Fit Theory of Hybrid Financing

The robust predictive power of cash flow metrics—stable cash flows driving CB preference and growth synchronization enhancing issuance likelihood—collectively substantiates a contingent fit theory of convertible bonds, wherein firms strategically deploy conversion options as financial flexibility staging posts: rather than pursuing tax efficiencies, cash-rich enterprises harness CBs to buffer investment cycle volatility, extending Mayers’ (1998) sequential financing paradigm to incorporate active cash flow governance. Simultaneously, the significant inverse relationship between cash flow volatility and CB adoption recasts these instruments as earnings stabilizers—firms with predictable cash flows exploit CBs to circumvent equity dilution during stable growth phases, thereby dynamically operationalizing Myers and Majluf’s (1984) signaling theory into a responsive capital-access mechanism. Crucially, however, the market-contingent nature of these effects (manifest in TAGR’s insignificance against rights offerings where control dilution dominates) necessitates a tripartite institutional fit framework encompassing: (1) regulatory compliance (e.g., asset-heavy firms leveraging approval biases), (2) governance preservation (blockholders prioritizing anti-dilution), and (3) temporal synchronization of cash flow/growth milestones. This framework fundamentally explains cross-contextual motive divergence: while temporal fit (e.g., Mayers’ growth staging) governs Western CB usage, China’s market is dominated by regulatory and governance fit that overrides theoretical optimizations. This pattern is emblematic of many emerging markets in Asia (e.g., Vietnam, South Korea) where family-owned conglomerates or state influence is significant. However, it stands in contrast to the Anglo-Saxon markets, where shareholder value maximization and relatively lighter regulatory oversight allow for a closer alignment with the theoretical models of Stein (1992) and Mayers (1998). Therefore, a “one-size-fits-all” theory of convertible bonds is untenable. Future research should develop a typology of CB markets—ranging from regulation-driven (China, India) to governance-driven (other Asian emerging markets) and efficiency-driven (U.S., U.K.)—to better predict how hybrid securities will evolve and function globally (Kim et al., 2023).

5. Conclusions and Implications

5.1. Conclusions

This paper conducts a natural experiment to analyze the impact of corporate financial traits on the motives for issuing convertible bonds (CBs), using a comprehensive sample of Chinese A-share listed companies. Through binary logistic regression models comparing CB issuers against issuers of corporate bonds, seasoned equity offerings, and rights offerings, this study challenges the direct applicability of Western theoretical frameworks in China’s unique institutional context and arrives at several pivotal conclusions.

First, the dominant motivation for CB issuance in China is not driven by high leverage, as predicted by classical risk-transfer theory (Green, 1984). Instead, the typical CB issuer is characterized by a distinct financial profile: high profitability, subpar operational capability, and a robust capacity to generate operating cash flow. This profile aligns more closely with signaling theory (Myers & Majluf, 1984) and backdoor equity financing (Stein, 1992), underscoring the role of CBs in mitigating information asymmetry and signaling future growth potential.

Second, our empirical results systematically reconfigure the predictions of established theories. We find strong support for hypotheses related to information asymmetry and signaling (H2a–b, H5a–c), confirming the relevance of Stein (1992) and Myers and Majluf (1984). Conversely, we document consistent contradictions to hypotheses stemming from risk-transfer (H1a, d) and tax-shield theories (H6), revealing how regulatory screening and sector-specific policies override these theoretical incentives in China. Furthermore, the powerful effect of ownership concentration (H8) establishes CBs as a governance-preservation instrument, a motive underemphasized in Western literature but critical in China’s ownership-concentrated markets.

The divergence between theoretical expectations and empirical evidence in China is attributed to two core factors: a potential suboptimal understanding among managers regarding the strategic use of CBs, and, more critically, the profound influence of China’s regulatory issuance system and specific corporate ownership structures. Collectively, this study establishes that CB adoption in emerging markets like China reflects a strategic institutional fit—navigating regulatory constraints and governance imperatives—rather than a pure pursuit of theoretical financial efficiencies.

5.2. Policy Implications

The findings of this study yield significant implications for regulatory practice and corporate financial management, offering a clear pathway to translate empirical insights into actionable strategies.

For regulatory bodies, especially the China Securities Regulatory Commission (CSRC), our evidence suggests a critical need to refine screening mechanisms. The current regulatory bias against high-leverage applicants may be stifling legitimate risk-transfer financing. We advocate for a transition to a more nuanced, multi-factor approval system that evaluates cash flow coverage and growth prospects in conjunction with leverage ratios. Additionally, the significant negative relationship between P/E ratios and CB issuance calls for enhanced surveillance during equity market booms to curb the use of CBs for speculative arbitrage. To bolster market discipline, regulators should mandate more transparent disclosures concerning the intended use of CB proceeds and the strategic rationale for their selection, thereby enabling investors to better discern between control-preservation and genuine growth-financing motives. This is particularly crucial in light of recent market innovations, such as extended-maturity CBs, which have been associated with both growth financing and speculative arbitrage.

For corporate treasurers and financial managers, this study underscores the necessity of a rigorous strategic self-assessment before opting for CB financing. Firms must recognize that CBs are not a panacea for high leverage. Instead, our results identify that companies with strong profitability and stable cash flows, yet facing temporary operational inefficiencies or a need to preserve controlling ownership, are the ideal candidates to harness the benefits of CBs. For such high-quality firms, a CB issuance can be leveraged as a credible signal to the market. Developing a compelling narrative that explicitly ties strong financial performance to future growth projects can amplify this positive signal and potentially reduce financing costs. Moreover, in firms with concentrated ownership, management must proactively communicate with blockholders to demonstrate how CBs can fund growth while delaying equity dilution, thereby ensuring that the financing strategy is in harmony with broader corporate governance objectives.

In summary, this study not only repositions convertible bonds as institutional chameleons whose functions mutate across regulatory ecosystems but also provides a pragmatic guide for key market participants to enhance the efficiency and strategic deployment of hybrid financing in China’s evolving capital market.

Author Contributions

Conceptualization, X.W.; methodology, X.L.; validation, J.C. and X.L.; formal analysis, J.C. and X.L.; investigation, J.C. and X.L.; resources, J.C. and X.L.; data curation, J.C.; writing—original draft preparation, X.W.; writing—review and editing, J.C. and X.W.; supervision, X.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Begenau, J., & Salomao, J. (2019). Firm financing over the business cycle. The Review of Financial Studies, 32(4), 1235–1274. [Google Scholar] [CrossRef]

- Bharath, S. T., Pasquariello, P., & Wu, G. (2009). Does asymmetric information drive capital structure decisions? Review of Financial Studies, 22(8), 3211–3243. [Google Scholar] [CrossRef]

- Black, F., & Scholes, M. J. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637–654. [Google Scholar] [CrossRef]

- Brennan, M. J., & Kraus, A. (1987). Efficient financing under asymmetric information. Journal of Finance, 42(5), 1225–1243. [Google Scholar] [CrossRef]

- Brennan, M. J., & Schwartz, E. S. (1988). The case for convertibles. Journal of Applied Corporate Finance, 1(2), 55–64. [Google Scholar] [CrossRef]

- Cheng, G., & Zhang, J. (2022). Research on the effect of issuing convertible bonds from the perspective of ownership structure: Evidence from listed companies in Shanghai and Shenzhen. Proceedings of Business and Economic Studies, 5(3), 24–29. [Google Scholar] [CrossRef]

- Craig, M. L., Richard, J. R., & James, K. S. (1999). Is convertible debt a substitute for straight debt or for common equity? Financial Management, 28(3), 5–27. [Google Scholar] [CrossRef]

- Çam, İ., & Özer, G. (2021). Institutional quality and corporate financing decisions around the world. The North American Journal of Economics and Finance, 57, 101401. [Google Scholar] [CrossRef]

- Dann, L. Y., & Mikkelson, W. H. (1984). Convertible debt issuance, capital structure change and financing-related information: Some new evidence. Journal of Financial Economics, 13(2), 157–186. [Google Scholar] [CrossRef]

- De Jong, A., Duca, E., & Dutordoir, M. (2013). Do convertible bond issuers cater to investor demand? Financial Management, 42(1), 41–78. [Google Scholar] [CrossRef]

- Dong, S., & Jiang, Y. (2025). The role of cash flow volatility in capital structure dynamics. Applied Economics, 1–13. [Google Scholar] [CrossRef]

- Gong, C. M., Gong, P., & Jiang, M. (2023). Corporate financialization and investment efficiency: Evidence from China. Pacific-Basin Finance Journal, 79, 102009. [Google Scholar] [CrossRef]

- Green, R. C. (1984). Investment incentives, debt, and warrants. Journal of Financial Economics, 13(1), 115–135. [Google Scholar] [CrossRef]

- Ingersoll, J. E. (1977). A contingent-claims valuation of convertible securities. Journal of Financial Economics, 4(3), 289–321. [Google Scholar] [CrossRef]

- Jalan, P., & Barone-Adesi, G. (1995). Equity financing and corporate convertible bond policy. Journal of Banking & Finance, 19(2), 187–214. [Google Scholar] [CrossRef]

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. [Google Scholar] [CrossRef]

- Kim, W. S., Oh, S., & Kiymaz, H. (2023). Motives and market reactions to convertible bonds and bonds with warrants issuance in an emerging market. International Journal of Finance & Economics, 28(3), 2449–2474. [Google Scholar]

- Li, Y., Zhang, Y. Y., Diao, M., & Jia, K. M. (2016). An analysis of the influencing factors of financing mode choice tendency. Communication of Finance and Accounting, 2016(17), 35–37. [Google Scholar] [CrossRef]

- Mayers, D. (1998). Why firms issue convertible bonds: The matching of financial and real investment options. Journal of Financial Economics, 47(1), 83–102. [Google Scholar] [CrossRef]

- Myers, S. C. (1977). Determinants of corporate borrowing. Journal of Financial Economics, 5(2), 147–175. [Google Scholar] [CrossRef]

- Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221. [Google Scholar] [CrossRef]

- Rapp, M. S., Schmid, T., & Urban, D. (2014). The value of financial flexibility and corporate financial policy. Journal of Corporate Finance, 29, 288–302. [Google Scholar] [CrossRef]

- Ritter, J. R. (1991). The long-run performance of initial public offerings. The Journal of Finance, 46(1), 3–27. [Google Scholar] [CrossRef]

- Smith, C. W. (1986). Investment banking and the capital acquisition process. Journal of Financial Economics, 15(1–2), 3–29. [Google Scholar] [CrossRef]

- Smith, C. W., & Warner, J. B. (1979). On financial contracting: An analysis of bond covenants. Journal of Financial Economics, 7(2), 117–161. [Google Scholar] [CrossRef]

- Stein, J. C. (1992). Convertible bonds as backdoor equity financing. Journal of Financial Economics, 32(1), 3–21. [Google Scholar] [CrossRef]

- Tsiveriotis, K., & Fernandes, C. (1998). Valuing convertible bonds with credit risk. Journal of Fixed Income, 8(2), 95–102. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).