Abstract

Social trust is a fundamental element in the evolution of digital finance, significantly influencing its development. This study presents an innovative exploration of the role and internal mechanisms of social trust in digital finance, utilizing using provincial panel data from 27 provinces in China spanning the period from 2012 to 2021. By focusing on trust as a core element, the study enriches the research framework on digital finance development, revealing that beyond traditional factors such as technology and the economy, social and psychological factors also affect digital finance growth. These findings provide new perspectives on understanding digital finance development. The study elucidates the complex substitution and interdependence between formal and informal institutions, offering valuable insights for optimizing institutional frameworks to promote digital finance. It also uncovers significant regional heterogeneity in the influence of social trust on digital finance, and social trust primarily enhances the depth and digitization of digital finance, while its effect on the breadth of digital finance is statistically insignificant. These insights serve as a valuable reference for policymakers aiming to ensure the sustainable expansion of the digital finance sector.

1. Introduction

From both theoretical and global development experience perspectives, the advancement of financial markets is a crucial driver of a country’s high-quality economic development. Digital finance, which integrates the Internet and finance, leverages data as a key production factor to expand financial inclusion and enhance the efficiency of serving the real economy (Q. Xu et al., 2024; Ding et al., 2023). Consequently, promoting the development of digital finance has become a focal point for scholars, who are increasingly interested in the potential of this growing field.

Existing literature has examined the factors influencing the development of digital finance through the establishment of digital financial ecosystems, the construction of economic infrastructure, and the optimization of regulatory systems, all within the realm of formal institutions. However, informal institutional factors have often been neglected. Socio-economic order is upheld by both formal and informal institutions (Sitkin & Roth, 1993). Formal systems regulate behavior primarily through supervision and enforcement (North, 1990), whereas informal institutions influence behavior through ideologies, including values, ethical norms, and moral beliefs (Rousseau et al., 1998). These informal institutional factors shape decision-making space and significantly affect market behavior, playing an important role in the development of a market economy.

Social trust, which is a key component of the informal institution, forms the moral foundation that supports the functioning of a market economy. It regulates market behavior, compensates for contractual incompleteness, and influences the decision-making of market participants, thereby affecting the development of digital finance. Especially in an era of digitalisation, the growth of the digital financial market is constrained by several factors, including policy regulation and the digital divide. Trust is a pivotal aspect of relationships between financial service providers and consumers. Therefore, examining the role of trust in the evolution of digital finance and understanding its underlying mechanisms can provide valuable insights for the functioning of this field.

At the same time, formal institutions are crucial for the sound development of financial markets. They also play a key role in shaping societal trust. The institutional environment provides the macro backdrop for the embedding of social trust, and its sophistication may significantly influence the effectiveness of trust mechanisms. Specifically, there are two potential interaction patterns between formal institutions and social trust. The first is the “substitution effect.” In an environment with strong laws and effective regulations, a clear framework of rules and efficient contract enforcement may partially replace the need for trust-dependent informal governance, thereby reducing the marginal contribution of social trust, leading to a partial substitution of its role. The second is the “complementary effect,” where social trust and formal institutions enhance each other. A robust institutional framework can increase systemic credibility, thereby strengthening the role of social trust in encouraging participation in digital finance. Furthermore, a high level of social trust can lower institutional operating costs and reduce transaction frictions. Clarifying which of these effects predominates, and revealing their complex interplay in the development of digital finance, will provide crucial theoretical grounding for the construction of a policy framework in which “hard institutions” and “soft capital” can work together effectively.

In a large-scale transition economy such as China’s, the development of digital finance has been significant both in terms of its scale and its speed (Li & Zhang, 2024). The provinces within China show considerable differences in their institutional environments, levels of social trust, and advancements in digital finance. This diverse regional ecosystem provides a valuable “natural experiment” for examining the complex interplay between institutional and cultural factors. Such a unique national context provides a great opportunity to deepen our understanding of the many different aspects of the development of the digital financial market.

This study focuses on the Chinese context and aims to systematically examine the effects and mechanisms through which social trust affects the development of digital finance, as well as the conditions that influence these effects. It is important to recognise that the impact of trust on digital finance is neither consistent nor uniform, its effects can vary significantly depending on factors such as business types, regional characteristics, and developmental stages. For instance, although social trust can enhance the allocation of resources and increase the scope of services, it can also have complex effects on income distribution due to technological and social factors, such as the digital divide and algorithmic bias. Based on this understanding, the study explores three core questions: Firstly, given its status as a key informal institution, does social trust have significantly different impacts on various dimensions of digital finance? Secondly, does social trust have different effects on digital finance development in different regions? Thirdly, how does the impact of social trust change as digital finance evolves through its developmental stages? An in-depth analysis of these questions will contribute to the development of a more systematic and explanatory theoretical framework for digital finance. Additionally, it will provide empirical evidence to help formulate differentiated and targeted regional development policies.

The main contributions are as follows: (1) This study innovatively analyzes the factors influencing digital finance development from the perspective of informal institutions, offering new insights into understanding the multifaceted nature of digital finance evolution. (2) This study clarifies the complex relationship between social trust and formal institutions, aiding policymakers in better understanding how to promote the healthy development of digital finance by optimizing the institutional environment. It also reveals that as the benefits of technological advancements become more widespread, the importance of “soft power” factors, such as social culture, will increasingly come to the fore. (3) This study analyses the impact of trust on the development of digital finance across three sub-dimensions. It finds that trust does not significantly increase the coverage breadth. This empirical result suggests that the current trust-driven model for digital finance development may be inherently limited in its ability to achieve inclusivity. It provides direction for the government to guide the sustainable development of the digital finance industry.

2. Research Analysis and Hypothesis

The role of digital finance in economic development is becoming increasingly significant, as digital financial development can generate economic benefits and stimulate growth (Murinde et al., 2022; Kapoor, 2014; K. Dong et al., 2022). Research on the factors influencing the development of digital finance is, however, limited and mainly focuses on the following areas: (1) technological factors, such as technological advantages and the widespread Internet access (Syed et al., 2021; Schindler, 2017), play a crucial role; (2) financial ecosystems, including economic development (Sun et al., 2018), financial talent availability (Yao & Shi, 2017), and financial literacy (Yang & Zeng, 2022), are important influences; 3) the institutional environment, which includes regulatory frameworks (R. D. Chen et al., 2019), policy regulation (Barth et al., 2013), and judicial service assurances (Zhang & Qiao, 2023), also shapes digital financial development. Most existing research has emphasized formal institutional factors, while informal institutional elements have received limited exploration.

Informal institutions consist of socially shared systems of norms and beliefs that regulate behavior through invisible constraints (North, 1990). They guide people’s choices and help maintain social order. Digital finance is still in the early stages of development, with formal institutional arrangements not fully established. As a result, informal institutions are essential for creating mutually understood and accepted institutional frameworks, which will promote the growth of digital finance.

Social trust, as a core element of informal institutions, inevitably affects the growth of digital finance. Arrow (1972) argued that trust is a fundamental prerequisite for transactions, whether in commercial trade (Guiso et al., 2009), bond issuance (Brockman et al., 2020), or equity investment (Georgarakos & Pasini, 2011). This is largely due to the various frictions inherent in financial transactions, such as information asymmetry, incomplete contracts, and the potential for opportunistic behavior. These factors can hinder transactions or even make them impossible, thereby obstructing financial development. The more complex a financial instrument, the greater the reliance on trust. Additionally, digital finance is still evolving, and as a result, its legal and regulatory frameworks are not fully established. Compared to traditional financial and non-financial contracts, digital finance shows a stronger reliance on “trust” (Guiso et al., 2004). The regulatory and institutional gaps that emerge during the development of digital finance highlight the need to address these issues through social trust.

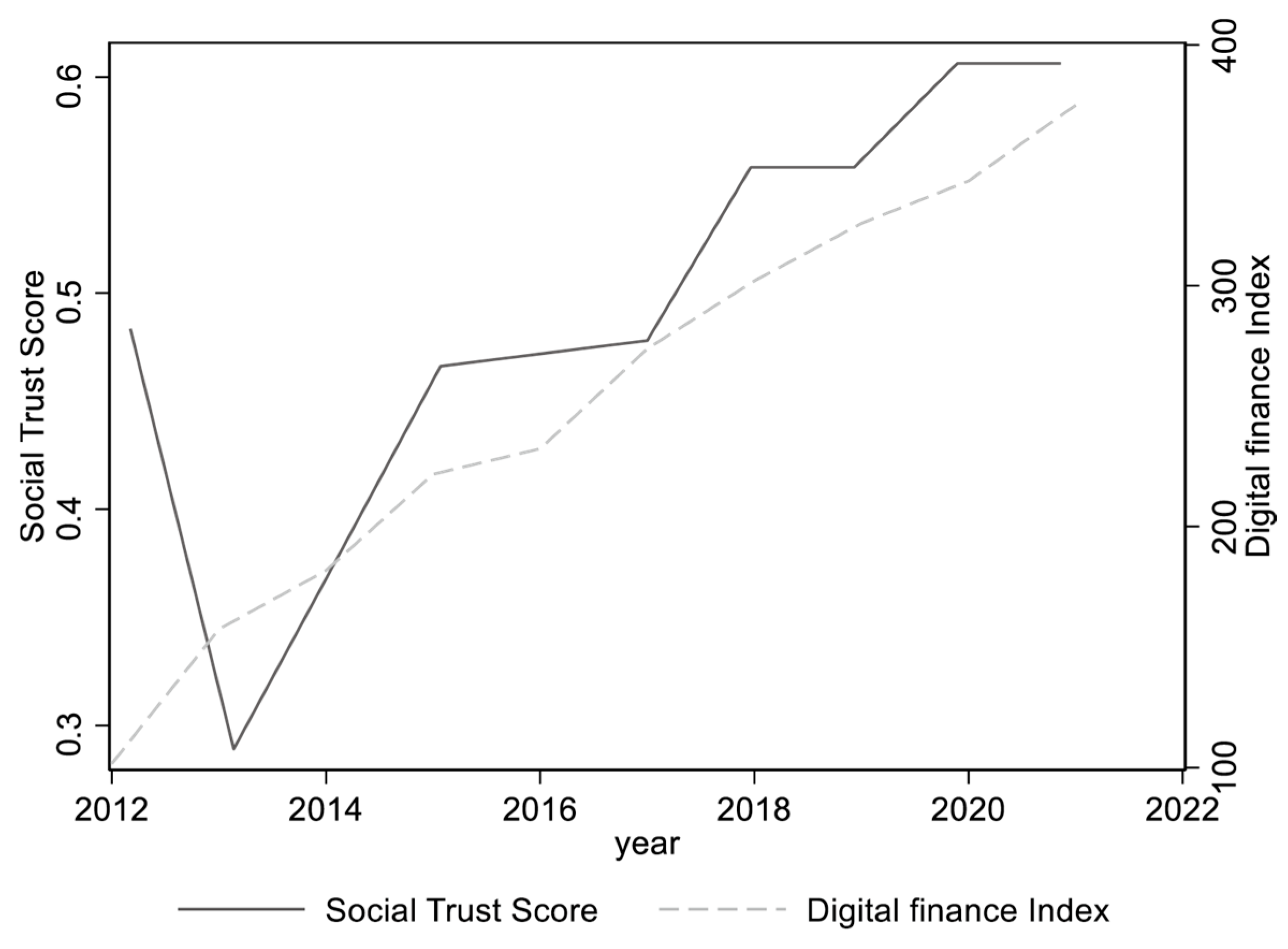

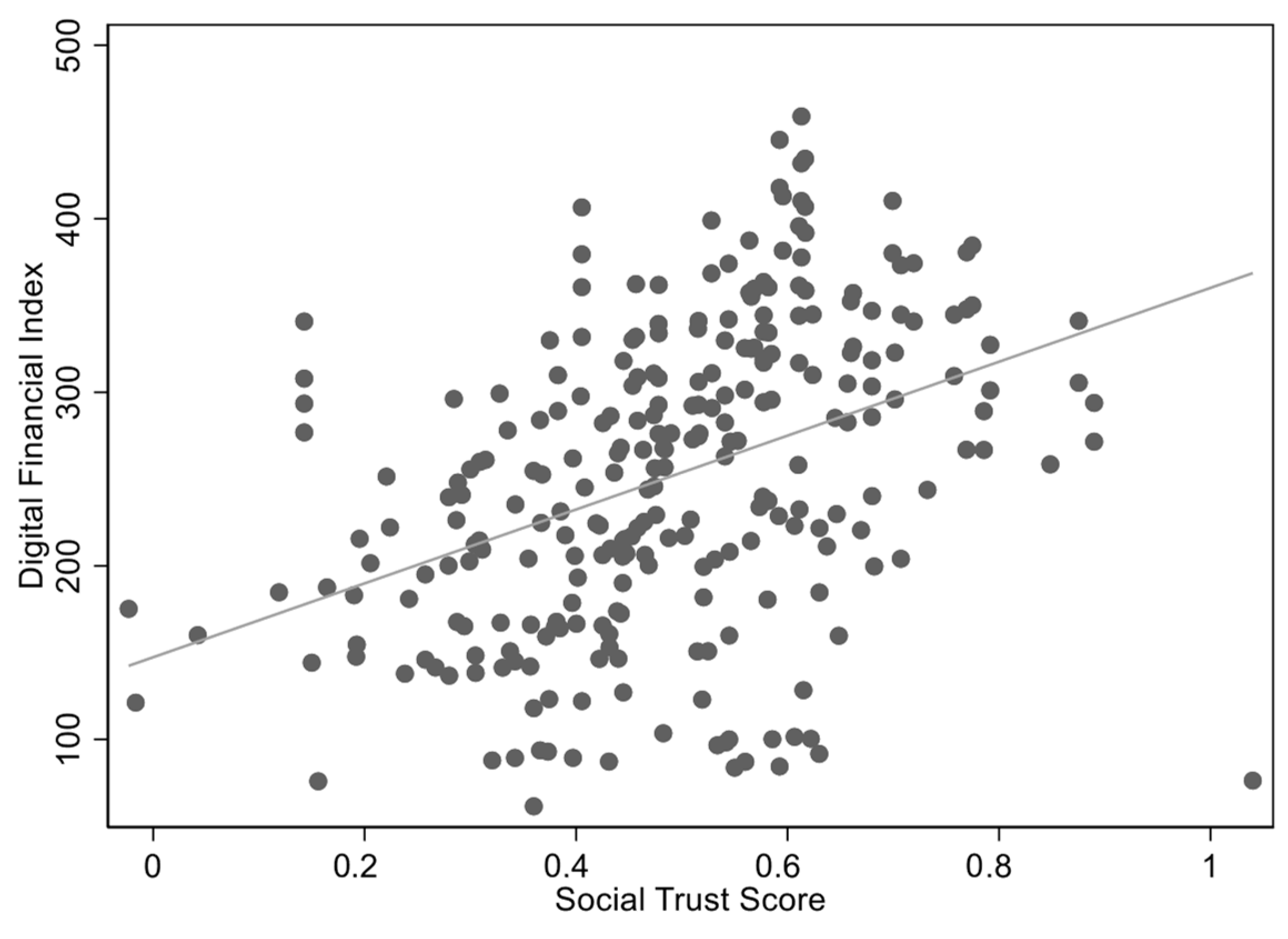

Figure 1 and Figure 2 display the trend data for social trust and the development of digital finance, respectively. Figure 1 shows that, over time, both social trust and digital finance development generally follow an upward trend, except in 2012. In Figure 1, the left Y-axis represents the annual average social trust score (on a scale of −1 to 1), while the right Y-axis shows the annual average digital financial development index (dimensionless). Figure 2 further illustrates the relationship between these two variables, indicating that as social trust increases, digital finance tends to grow as well. Overall, the data suggest that social trust positively influences the development of digital finance. Each province’s social trust score (on a scale from −1 to 1) is represented by the X-axis in Figure 2, while the Y-axis shows the province’s digital finance development index (dimensionless).

Figure 1.

Social trust and digital finance trends.

Figure 2.

Scatterplot of social trust and digital finance.

Specifically, from a risk perception perspective, on the one hand, trust establishes an internal constraint mechanism that creates soft constraints through regulatory frameworks and ethical norms (Peng, 1999). This helps guide the public towards a better understanding of behavioral standards in financial market participation, mitigates market risks, and facilitates the growth of digital finance. On the other hand, digital financial transactions increase spatial distance, customers lack a sense of personal control, which in turn increases concerns about financial security, and social trust helps alleviate these concerns, contributing positively to the growth of digital finance.

From a transaction cost perspective. The growth of digital finance has increased the potential for financial innovation, resulting in a wide range of financial products, services, and distribution channels. However, this expansion has also heightened information asymmetry, which raises decision-making costs for market participants. Social trust effectively mitigates these costs by facilitating information sharing and improving access to relevant data (Frost, 2020). Additionally, social trust can help overcome barriers to the spread of new financial models in weak social networks, accelerating the diffusion of information (Granovetter, 1973). This, in turn, further reduces transaction costs and supports the growth of digital finance.

In theory, social trust arises from market interactions, where individuals respond positively to favorable information and negatively to unfavorable information, though negative responses often outweigh positive ones. Given the current imperfections in the digital financial regulatory framework, which suffer from regulatory lag and loopholes, any scandal in the digital finance sector will have a much greater amplified impact. The healthy development of digital finance may be hindered by this.

A significant achievement of digital financial development has been its role in advancing inclusive finance (Huang et al., 2018). The primary beneficiaries of inclusive financial services are small and micro enterprises, which, due to limited access to information, are more reliant on trust in their decision-making processes. At present, digital finance is steadily developing, with no negative incidents recorded, and the negative impact of social trust thus remains limited. Therefore, we propose the hypothesis:

Hypothesis 1.

Social trust positively influences the development of digital finance.

Institutions are essential foundations for building trust, and they have become direct objects of trust themselves. Several scholars have argued that institutions and trust act as substitutes, where stringent formal control systems might inhibit trust (Sitkin & Roth, 1993; Mayear et al., 1995). However, the relationship between formal and informal systems is a complex one. For instance, while the formal system establishes a normative framework, it cannot cover all scenarios and therefore needs to be complemented by informal systems; informal systems cannot entirely replace formal institutional relationships in maintaining social order. It indicates that this substitutive relationship has its limitations.

This study acknowledges that institutions and trust (informal institutions) are interdependent, complementary, and mutually transformative. Social trust, as a fundamental component of informal systems, closely interacts with formal institutions and is a fundamental condition for the successful conclusion of financial contracts. Through its soft constraint function, trust compensates for the rigidity and lack of adaptability inherent in formal financial contracts. Aghion et al. (2010) demonstrated that trust and formal institutions can reinforce and complement each other, working together to enhance market efficiency and stability. Therefore, we can infer that a transparent, fair, and predictable institutional environment can further enhance social trust, collectively promoting the development of digital financial markets. We propose the hypothesis:

Hypothesis 2.

The formal institutional environment enhances the positive effects of social trust on the development of digital finance.

The evolution of digital finance is shaped by demand and supply, with social trust significantly impacting its development through key channels in both areas.

From a demand-side perspective, the widespread adoption of digital finance relies on effective market demand. As levels of social trust rise, individuals are more willing to engage in economic cooperation, which creates greater opportunities for employment and entrepreneurship (Butler et al., 2016). This, in turn, directly contributes to household income growth.

As income levels rise, demand increases for more efficient and convenient financial services, such as mobile payments and digital credit. These services not only satisfy financial needs but also further stimulate the growth of the digital finance market. Therefore, social trust plays a positive role in fostering digital finance development, primarily through increased household income. We propose the hypothesis:

Hypothesis 3.

Social trust promotes the development of digital finance by enhancing household income.

From a supply-side perspective, digital finance involves the deep integration of digital technologies within the financial sector. This development relies on a mature internet ecosystem. In a highly trusted social environment, people are more likely to share information, communicate, and conduct transactions online. Social trust improves the authenticity and reliability of information on internet platforms, reducing transaction risks and costs, thereby fostering the growth of the internet.

The development of the internet provides both technical support and market opportunities for digital finance. On one hand, the early adoption of internet technology in the financial sector has led to the creation of new financial products and services, such as online lending and intelligent investment advisors, thereby enriching the offerings available in financial markets. On the other hand, the massive user base cultivated during the internet’s proliferation, coupled with digital lifestyle habits and the platform economy ecosystem, has provided a natural gateway and context for the rapid penetration of digital financial services. Thus, social trust, through the key pathway of “promoting internet development,” has laid a solid technological foundation and market environment for supply-side innovation in digital finance. We propose the following hypothesis:

Hypothesis 4.

Social trust enhances digital finance development by promoting internet growth.

3. Data and Estimation Strategy

3.1. Data Sources and Data Integration

The digital finance data utilized in this study is obtained from Peking University’s Digital Inclusive Finance Index. The social trust data is sourced from the Chinese General Social Survey (H. P. Xu et al., 2023). Additional data is collected from various resources, including the Cathay Pacific database, the seventh national census, the EPS database, the China Judicial Civilization Index Report, the Fan Gang Marketization Index, and annual government work reports.

The Chinese General Social Survey (CGSS) is China’s first national academic survey programme to be conducted continuously and comprehensively. Since the latest CGSS data on social trust is from 2021, the study period is limited to 2012 to 2021. Furthermore, data for Tibet, Xinjiang, Hainan, and Jiangxi are excluded from the analysis due to significant gaps in social trust data for these provinces. Table 1 summarizes the main variables utilized in this study.

Table 1.

Descriptive statistics.

This study uses provincial-level panel data from China from 2012 to 2021. In terms of variable selection, the social trust variable originates from micro-level survey data, while the other variables are derived from provincial-level panel data. As the research question focuses on provincial digital finance development, the explanatory variables must possess corresponding regional characteristics. To achieve this, we apply the well-known academic method developed by Stephen and Philip (1997), which involves aggregating individual trust data from the CGSS to create provincial-level social trust indicators.

Social trust is an inherently regional public good and informal institution. Its level is influenced by long-term factors, such as historical traditions, cultural backgrounds, and social norms that are specific to a region. This trust is shared among all members of that region. Consequently, aggregating individual-level trust data into regional-level indicators is a common and valid approach for examining the effects of macro variables like culture and institutions. Furthermore, the CGSS data used in this study is a nationally representative survey sample, whose authority and scientific rigour ensure the validity of the constructed trust indicators.

3.2. Model Specification

In order to examine the impact of social trust on digital finance, this study uses the following basic econometric model:

In Equation (1), denotes the province and denotes the year. represents the degree of digital financial development in province i in year t, while represents the degree of social trust in province in year . includes the control variables at the provincial level, such as the economic development level, government intervention, government investment in science and technology, the tertiary industry’s share of GDP, social security and employment expenditures, and the government’s digital focus. Here, represents province fixed effects, represents year fixed effects, is a random perturbation term, and , , are model estimation parameters.

This study employs a two-way fixed effects model. This is used to assess the impact of social trust on the development of digital finance. It incorporates provincial fixed effects to account for province-specific characteristics that remain constant over time, such as geographical conditions and historical cultural traditions, which influence digital finance development. Additionally, year fixed effects are included to control for national trends and macroeconomic shocks, like national policies and technological innovations. This framework enables us to clearly identify the net effect of changes in social trust on digital finance development, effectively addressing endogeneity issues that may arise from neglecting provincial characteristics and common temporal trends.

3.3. Variable Description

Digital Finance. This study utilizes the fourth issue of the digital financial inclusion indicators provided by Peking University’s Digital Finance Research Center. It focuses on three specific sub-indicators for further analysis: the breadth of digital finance refers to the penetration rate and accessibility of digital financial accounts; the depth of digital finance indicates the actual frequency and scale of using digital financial services, which encompasses specific operations such as payments, credit, wealth management, and insurance; the degree of digitization reflects the extent of fintech support and the convenience of these services.

Social Trust. To measure social trust, we follow established methods (W. Dong et al., 2018; X. Chen & Wan, 2020) using data from the CGSS. The following questions are asked of the participants: “In general, do you agree that the majority of people in this society can be trusted?” Participants respond to questions on a scale from “Strongly Disagree” to “Strongly Agree”, and the system assigns them scores of −2, −1, 0, 1, or 2, respectively. We calculate average scores for different provinces, with higher scores indicating greater levels of social trust. Social trust data from CGSS are available for the years 2012, 2013, 2015, 2017, 2018, and 2021. Given the relatively stable nature of social trust (Ang et al., 2015), missing data are interpolated as follows: 2014 data are the mean of 2013 and 2015; 2016 data are the mean of 2015 and 2017; 2019 data are assumed to be the same as 2018; and 2020 data adopt the 2021 value. For robustness checks, this study also uses the blood donation rate per 1000 population in 2014 as an alternative proxy for social trust.

Control Variables. The model controls for six factors: economic development (per capita GDP, in log form), government intervention (general budget expenditures, in log form), government investment in science and technology (log of science and technology expenditures), the tertiary industry’s share of GDP, social security and employment expenditures, and the government’s digital focus. Government Digital Concerns is obtained by aggregating the vocabulary of government reports on digital concerns from various government websites.

4. Empirical Analysis

4.1. Basic Results

The estimates of the impact of social trust on digital finance, which are consistent across the models, are presented in Table 2. In Column (1), the coefficient for social trust is significantly positive at the 1% level. This indicates that social trust plays a significant role in the development of digital finance, supporting Hypothesis 1. Column (2) shows the results after control variables have been included, and Column (3) shows the results after accounting for control variables, as well as province and year fixed effects. In all models, the coefficient for social trust remains significantly positive.

Table 2.

Baseline regressions.

Regarding the development of China’s digital financial market, the positive impact of social trust on digital finance outweighs its negative effects. This positive impact can be observed in several key areas: First, trust helps reduce transaction costs, expand business opportunities, and encourage innovation within the digital finance sector. Second, it helps to maintain order in the financial markets, thereby enhancing the security and stability of digital finance. Third, trust can encourage closer integration between digital finance and the real economy.

4.2. Robustness Checks

To ensure the robustness of these results, this section performs additional robustness tests. It addresses endogeneity estimation, applies systematic GMM estimation, replaces explanatory variable indicators, adds control variable indicators, winsorizes, and lags explanatory variables by one period.

4.2.1. IV-2SLS

To address endogeneity in the model, a two-stage instrumental variable approach is adopted. The chosen instrumental variables are the percentage of party members and the percentage of ethnic minorities in each province. Party members represent the vanguard of society, guided by principles that emphasize “serving the people” and integrity. Regions with a high proportion of party members indicate that more individuals are engaging in trustworthy behavior within formal institutional frameworks. This, in turn, has a positive impact on society as a whole, reinforcing trust in both institutions and strangers. As the ruling party, the actions and understanding of party members in implementing policies help create a stable and predictable social environment, which forms the basis for high social trust. Therefore, the number of party members is positively correlated with social trust. Regarding exclusivity constraints, the influence of the proportion of party members on the development of digital finance primarily occurs through the cultivation of high-trust social norms. These social norms are formed via a supportive cultural atmosphere. This atmosphere is cultivated through informal institutional channels. There are no other direct pathways of influence. This satisfies the exclusivity requirement for instrumental variables, making the proportion of party members in each province a suitable choice for an instrumental variable.

Additionally, ethnic minorities tend to exhibit stronger internal cohesion and greater distrust of external entities. As a result, provinces with high populations of ethnic minorities generally have lower social trust. The proportion of ethnic minorities can influence the development of digital finance only by shaping the cultural environment of “general social trust,” lacking other economic or policy pathways. Therefore, the proportion of ethnic minorities is also a suitable instrumental variable.

The F-statistic for the instrumental variable test significantly exceeds the empirical threshold of 10, confirming the validity of these instrumental variables. As shown in Table 3 of Column (1), the estimated coefficient for the proportion of party members is positive and significant, and the second-stage results for social trust are also significantly positive, confirming the initial conclusions with party membership as an instrumental variable. Column (2) presents the results using the percentage of ethnic minorities as an instrumental variable, where the core variable coefficients remain significantly positive, validating the robustness of the earlier model.

Table 3.

IV approach.

4.2.2. System GMM

To address potential endogeneity issues, To address potential endogeneity issues, the baseline regression model includes the dependent variable (digital finance) lagged by one period as an explanatory variable. The GMM system method effectively addresses measurement errors by treating lagged terms as instrumental variables. Combining level and difference equations and utilising lagged terms in this way mitigates estimation biases arising from statistical reporting errors in financial development indicators. The estimated results are shown in Table 4, indicating robust results.

Table 4.

Robustness checks.

4.2.3. Replacing Explanatory Variables

To avoid the measurement method of the core explanatory variable, “social trust”, influencing the estimation results, this study involved a robustness test. The blood donation rate per thousand people in each province was used as a proxy for social trust, in line with the traditional methodology for social capital research by Wu et al. (2014). Voluntary blood donation is a quintessentially altruistic act. People participate without expecting direct material rewards, which reflects their trust in the blood collection system and their commitment to the wider community. Consequently, regional blood donation rates can be used to gauge trust levels, specifically trust in strangers, serving as a valid and objective proxy for social trust. Given that the dataset includes blood donation rates for 2014, the model is estimated with only province fixed effects. The regression results are consistent with those of the baseline model.

4.2.4. Add Control Variables

To further address the issue of omitted variables, two additional control variables are introduced: the sense of social fairness and the sense of social participation. These variables, drawn from the CGSS, are processed similarly to the social trust indicators. The regression results confirm that the findings remain robust.

4.2.5. Sample Extreme Value

The explanatory and dependent variables are winsorized at the 1% level to mitigate the problem of outliers. The regression results indicate that the coefficients of the explanatory variables remain positive and significant, suggesting the robustness of the findings.

4.2.6. Explanatory Variables Lagged by 1 Period

To account for the possibility that social trust may take time to impact digital finance and to further prevent endogeneity, the social trust variable lagged by 1 period (L.trust) is reintroduced into the regression model. The results presented in Table 4 show that the coefficient on L.trust remains positive and statistically significant, indicating a continuing influence of social trust on digital finance development.

5. The Role of the Formal Institutional Environment

The above study demonstrates that social trust, as an informal system, beneficially impacts the advancement of digital finance. Generally, informal institutions complement formal institutions, with the informal system assuming a more prominent role only when the formal system is also present. To further explore how the formal institutional environment enhances the effect of social trust on the development of digital finance, this study employs the interaction term method, commonly used in mathematical research, to test this hypothesis. Specifically, the formal institutional environment and its interaction with social trust are incorporated into the foundation of Equation (1), leading to the following model:

In Equation (2), represents the formal institutional environment, while denotes the estimated coefficient of the interaction term between social trust and the formal institutional environment variable.

This study utilizes formal institutional environment indicators expressed in terms of marketization and the regional institutional environment. First, marketization indicators are derived from the Fan Gang Marketization Index, with the provincial marketization ranking used to evaluate the marketization environment. The analysis focuses on the top third, the top two-thirds, and the entire sample. Two dummy variables are defined: lnen1, which equals 1 for provinces ranked in the top one-third by marketization, and 0 otherwise; and lnen2, which equals 1 for provinces ranked in the top two-thirds, and 0 otherwise. Lnen is used as the continuous marketization variable. Second, the regional institutional environment is represented by the development of intermediary organizations and the legal institutional environment, consistent with the approach used for marketization indicators.

The empirical results are shown in Table 5. The results in Columns (1) and (2) show that the coefficients of the interaction terms are significantly positive for provinces in the top third of formal institutional environment rankings, indicating that both the regional institutional environment and marketization amplify the role of social trust in promoting digital finance. Similarly, Columns (3) and (4) show significantly positive coefficients for the interaction terms in the top two-thirds of provinces. Columns (5) and (6) present results for the full sample, where the interaction terms remain significantly positive. These findings indicate that the formal institutional environment enhances the role of social trust in fostering digital finance development, indicating that trust and the informal system are complementary rather than substitutes. This conclusion supports Hypothesis 2.

Table 5.

Estimated effects of the impact of the formal system environment.

A well-functioning institutional environment is crucial to ensuring that trust can effectively operate within the digital financial market. At the same time, trust can compensate for shortcomings in the formal institutional environment, promoting market self-regulation. The combined development of both trust and formal institutions can enhance the efficiency and security of financial services. This study reveals that, rather than merely “substituting” for it, formal institutions exert a “reinforcing effect” on social trust. This suggests that in emerging fields such as digital finance, which rely heavily on impersonal transactions, formal institutions and informal norms may exhibit profound synergistic relationships. While the specific manifestations of “social trust” and “institutions” differ across nations, the logic of their interaction is a universal theoretical question. The synergistic effects revealed in this study offer a new analytical perspective for understanding the complex interplay between institutions and culture across different contexts.

6. Further Analysis

6.1. Mechanism

Social trust has a positive impact on economic activities. When social trust is low, increasing it enhances individuals’ profitability opportunities, raising income levels (Butler et al., 2016). Given that China is currently characterized by a relatively low level of trust, an increase in social trust will lead to an improvement in residents’ income levels. Increased income motivates individuals to engage in financial activities, thereby facilitating the development of digital finance.

Moreover, a greater willingness among residents to accept new things and participate in internet-based activities is indicated by a higher level of social trust. Since extensive Internet usage is fundamental to the development of digital finance, social trust indirectly contributes to this development by encouraging Internet engagement.

Therefore, social trust can promote digital finance not only directly but also through two mechanisms: increasing residents’ income and enhancing Internet development. To verify the existence of these mechanisms, the following models are constructed:

In these equations, represents the income level of residents and the degree of Internet development in each province. The income level of residents is measured by the average salary of residents in each province, while the degree of Internet development is indicated by the percentage of employees in computer services and software in each province.

The results of the mechanism test for income levels are shown in columns (1) to (3) of Table 6. The regression coefficients for the relevant variables are all significantly positive, indicating that social trust fosters social inclusiveness, which leads to increased resident income. Rising income levels are crucial for the development of digital finance.

Table 6.

Mechanisms: population income level and the level of Internet development.

The results of the mechanism test for the Internet development are shown in Columns (1), (4), and (5) of Table 6. The regression coefficients for the relevant variables are significantly positive, indicating that social trust enhances Internet development, which in turn fosters the growth of digital finance.

6.2. Heterogeneity Tests

6.2.1. Digital Financial Structures

This study analyzes the impact of social trust on the development of digital finance by analyzing three dimensions of digital financial structures: digital financial breadth (CB), digital financial depth (UD), and degree of digitization (DL). These serve as dependent variables in the regression models to better understand how social trust influences different aspects of digital finance.

The regression results, presented in columns (1)–(3) of Table 7, show that while social trust positively impacts all dimensions, the coefficient for digital financial breadth is not statistically significant. This suggests that social trust does not significantly affect digital financial breadth, though it does have a notably positive impact on digital financial depth and digitization.

Table 7.

Heterogeneity checks: digital financial structures and local heterogeneity.

Social trust does not significantly influence the breadth of digital finance adoption. This may be attributed to uneven technological development, which results in trust factors having limited impact in certain regions or among specific groups. For example, in areas where the adoption of digital technology is slow, individuals are more focused on the accessibility of financial services rather than on trust.

Social trust has a significantly positive impact on the depth of digital financial usage. This influence primarily promotes user engagement and participation in complex digital financial services rather than merely increasing the user base. The underlying mechanism lies in the fact that compared to basic payment functions, the deep application of digital finance (such as online credit, insurance, and wealth management) typically involves more severe information asymmetry, more complex risk structures, and higher uncertainty in contract execution. In this context, social trust acts as an informal institutional mechanism that effectively reduces perceived risks for both parties involved in transactions and strengthens users’ reliance on digital financial platforms. This trust drives the evolution of digital financial services from basic functions to more advanced applications.

Social trust has a significantly positive impact on the levels of digitalisation. It facilitates the advancement of digital technologies and drives the development of financial infrastructure toward more intelligent and efficient systems. The degree of digitalization reflects how extensively cutting-edge technologies such as artificial intelligence, blockchain, and cloud computing are integrated into financial operations. However, the progression of digitalization encounters several challenges, including technological uncertainty, system compatibility, and data security concerns. This study finds that social trust creates a “safe space” for technology adoption, accelerating the digital transformation of core systems.

In our analysis of social trust and digital finance across three dimensions, we discovered significant differences in their impacts. Trust plays a key role in enhancing the depth of digital finance usage and, to a lesser extent, in driving digitalization levels. However, its influence on expanding the breadth of coverage is less significant. The current trust-based model for digital finance development may have limitations when it comes to achieving financial inclusion. Specifically, as social trust fails to effectively expand the reach of digital finance, the benefits tend to primarily go to groups that are already financially stable or have higher digital literacy. This is often reflected in an increased “usage depth” of complex financial products. This leaves marginalised and low-income groups, who are underserved by traditional financial systems, out of the equation, thereby exacerbating the “digital divide” and income inequality. Ultimately, this development model struggles to achieve its original goal of promoting inclusive growth and may also reinforce structural inequalities, posing potential challenges to balanced social development.

6.2.2. Regional Heterogeneity

Given substantial regional variations in social capital and financial development across China, these differences impact the development of digital finance. To explore this, the study divides China into eastern, central, and western regions. It then creates dummy variables for each region. The study incorporates interaction terms between these regional dummies and social trust into the regression model.

The results in columns (4)–(6) of Table 7 show that the interaction term for the eastern region is positive, suggesting that social trust has a stronger effect on digital finance in this region. In the central region, the interaction term is not significant, indicating that regional factors do not play a significant role in enhancing the impact of social trust on digital finance. In the western region, the interaction term is significantly negative, indicating that regional factors weaken the influence of social trust on digital finance development.

In general, regions with more developed economies tend to have more developed traditional finance, better formal institutional environments, and a more pronounced positive effect of trust on the development of digital finance. The continuation of the leveraging of strengths in trust-building by developed regions is recommended for the facilitation of the healthy development of digital finance. Furthermore, cross-regional and cross-industry collaboration and knowledge transfer should be enhanced in order to collectively develop a more robust trust framework for digital finance. The more mature formal institutions and more developed market environment in eastern regions provide ideal conditions for social trust to exert a synergistic enhancement effect. This further validates our core argument regarding institutional complexity.

6.3. Quantile Regression

To further analyse the impact of social trust on digital finance, this study uses a panel quantile regression model to evaluate its varying effects at different levels of digital finance. As shown in Table 8, the results reveal that the social trust coefficient rises from the 20th to the 80th quantile of digital finance. This suggests that social trust plays an increasingly significant role in promoting digital finance as it advances.

Table 8.

Quantile regression results.

In regions with higher levels of digital finance, more advanced internet infrastructure allows social trust to play a stronger role in the informal system, thereby driving the development of digital finance. Conversely, in regions where digital finance is less developed, social trust has a comparatively weaker effect on its promotion. This suggests that as digital finance develops further and technological dividends become more widespread, the importance of “soft power” factors such as social culture will increase.

7. Conclusions and Policy Implications

As a form of social capital, social trust has important implications for economic development. This study examines the effect of social trust on the growth of digital finance, considering the role of both formal institutional environments and informal institutions. The empirical findings indicate that social trust positively influences digital finance. Furthermore, it was observed that the formal institutional environment reinforces the positive effect of social trust on digital finance, suggesting that formal and informal institutional factors are complementary rather than substitutes (Sitkin & Roth, 1993; Mayear et al., 1995). A favorable institutional environment, coupled with the establishment of trust, is essential for fostering the growth of digital finance. Although the manifestations of social trust vary across cultures, the question of how informal norms interact with formal rules is universal in the social sciences. The conclusions drawn in this study therefore have significant theoretical implications and analogical value for other emerging economies undergoing digital transformation and institutional development.

This study further demonstrates that social trust promotes the development of digital finance via two key mechanisms: (1) by increasing residents’ income levels and (2) by enhancing Internet development. In terms of the sub-dimensions of digital finance, trust primarily influences the depth of digital finance and the degree of digitization. In terms of regional heterogeneity, social trust has a more significant impact on digital finance in the eastern region, where regional factors strengthen its effect. However, in the central region, these regional factors are insignificant, while in the western region, they tend to weaken the role of social trust in promoting digital finance. The quantile regression results suggest that the impact of social trust on digital finance increases as the level of digital finance grows.

Using provincial-level panel data from China, this study provides systematic empirical evidence of the relationship between social trust and the development of digital finance. It should be noted that the findings are specific to China’s particular socioeconomic transition and cultural context. The connotations, dimensions and interaction patterns between social trust and formal institutions can differ significantly between political systems and cultural contexts. Therefore, the direct international applicability of this study’s findings is limited. Nevertheless, this study aims to shed light on the broader theoretical question of how informal and formal institutions interact to influence emerging financial sectors, by conducting an in-depth analysis of China as a prototypical “case”. As a large economy with significant internal variation, China’s diversity in terms of social trust, institutional environments, and digital finance development offers a valuable “natural experiment” for examining this issue. This study theoretically illuminates the “institutional synergy effect” and its operational mechanisms, revealing potential intrinsic connections and path dependencies among variables. These mechanisms have significant implications and analogical value for understanding other emerging economies that are currently undergoing digital transformation.

Based on these conclusions, the following policy recommendations are made in this study. Firstly, the importance of social trust is emphasised. The development of digital finance should prioritise establishing a robust trust system. The interaction between social trust and the formal institutional system in shaping digital financial growth must be recognised. When designing rules for digital financial platforms, legal frameworks, social norms, and public expectations must all be considered. This integration will enhance users’ sense of belonging and trust in digital finance.

Secondly, policies that support the development of digital finance should be tailored to different categories. For instance, inclusive digital payments should be strongly encouraged, whereas digital lending and similar services require more rigorous compliance and consumer protection oversight. At the same time, policies should prioritise fostering digital inclusion through education and technical assistance to prevent vulnerable groups from being marginalised and mitigate wealth polarisation trends.

Thirdly, we must promote development in the central and western regions and increase the importance of social trust in encouraging digital financial growth in these areas. Cooperation with eastern regions and other countries should be intensified to foster a favourable policy environment, thereby boosting social trust and promoting the further development of digital finance in central and western regions.

Author Contributions

Conceptualization, F.Z. and B.H.; methodology, F.Z. and B.H.; software, F.Z.; validation, F.Z. and B.H.; formal analysis, F.Z. and B.H.; investigation, F.Z. and B.H.; resources, F.Z. and B.H.; data curation, F.Z. and B.H.; writing—original draft preparation, F.Z. and B.H.; writing—review and editing, F.Z. and B.H.; visualization, F.Z.; supervision, F.Z. and B.H.; project administration, F.Z. and B.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original data presented in the study are openly available in Chinese General Social Survey at http://cgss.ruc.edu.cn/ (accessed on 15 October 2024), and in Peking University’s Digital Inclusive Finance Index at https://idf.pku.edu.cn/ (accessed on 15 October 2024).

Conflicts of Interest

Author Fan Zeng has been employed by the company Guangzhou Rural Commercial Bank Co., Ltd. The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest. And the authors declare no conflicts of interest.

References

- Aghion, P., Algan, Y., Cahuc, P., & Shleifer. (2010). Regulation and distrust. The Quarterly Journal of Economics, 125, 1015–1049. [Google Scholar] [CrossRef]

- Ang, J. S., Cheng, Y. M., & Wu, C. P. (2015). Trust, investment, and business contracting. Journal of Financial and Quantitative Analysis, 50(3), 569–595. [Google Scholar] [CrossRef]

- Arrow, K. J. (1972). Gifts and exchanges. Philosophy and Public Affairs, 1(4), 343–362. [Google Scholar]

- Barth, J. R., Lin, C., Ma, Y., Seade, J., & Song, F. M. (2013). Do bank regulation, supervision and monitoring enhance or impede bank efficiency? Journal of Banking & Finance, 37, 2879–2892. [Google Scholar] [CrossRef]

- Brockman, P., Ghoul, S. E., Guedhami, O., & Zheng, Y. (2020). Does social trust affect international contracting? Evidence from foreign bond covenants. Journal of International Business Studies, 53, 1011–1044. [Google Scholar] [CrossRef]

- Butler, J. V., Giuliano, P., & Guiso, L. (2016). The right amount of trust. Journal of the European Economic Association, 14, 1155–1180. [Google Scholar] [CrossRef]

- Chen, R. D., Lin, B., & He, C. Y. (2019). Internet finance characteristics, internet finance investor sentiment and the return of internet financial products. Economic Research Journal, 54, 78–93. (In Chinese). [Google Scholar]

- Chen, X., & Wan, P. (2020). Social trust and corporate social responsibility: Evidence from China. Corporate Social Responsibility and Environmental Management, 27(2), 485–500. [Google Scholar] [CrossRef]

- Ding, Q., Huang, J. B., & Chen, J. Y. (2023). Does digital finance matter for corporate green investment? Evidence from heavily polluting industries in China. Energy Economics, 117, 106476. [Google Scholar] [CrossRef]

- Dong, K., Taghizadeh-Hesary, F., & Zhao, J. (2022). How inclusive financial development eradicates energy poverty in China? The role of technological innovation. Energy Economics, 109, 106007. [Google Scholar] [CrossRef]

- Dong, W., Han, H., Ke, Y., & Chan, K. C. (2018). Social trust and corporate misconduct: Evidence from China. Journal of Business Ethics, 151(2), 539–562. [Google Scholar] [CrossRef]

- Frost, J. (2020). The economic forces driving fintech adoption across countries. SSRN Electronic Journal, 838(II), 70–89. [Google Scholar] [CrossRef]

- Georgarakos, D., & Pasini, G. (2011). Trust, sociability, and stock market participation. Review of Finance, 15, 693–725. [Google Scholar] [CrossRef]

- Granovetter, M. (1973). The strength of weak ties. American Journal of Sociology, 1, 347–367. [Google Scholar] [CrossRef]

- Guiso, L., Sapienza, P., & Zingales, L. (2004). The role of social capital in financial development. American Economic Review, 94, 526–556. [Google Scholar] [CrossRef]

- Guiso, L., Sapienza, P., & Zingales, L. (2009). Cultural biases in economic exchange. Quarterly Journal of Economics, 124(3), 1095–1131. [Google Scholar] [CrossRef]

- Huang, Y. P., Wang, M., & Fu, Q. Z. (2018). Reconstructing China’s rural finance through digital technologies. International Economic Review, 3, 106–124. (In Chinese). [Google Scholar]

- Kapoor, A. (2014). Financial inclusion and the future of the Indian economy. Futures, 56, 35–42. [Google Scholar] [CrossRef]

- Li, Q., & Zhang, X. (2024). Digital finance development in China: A scientometric review. Heliyon, 10(16), e36107. [Google Scholar] [CrossRef]

- Mayear, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational trust. Academy of Management Review, 20(3), 709–734. [Google Scholar] [CrossRef]

- Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the fintech revolution on the future of banking: Opportunities and risks. International Review of Financial Analysis, 81, 102103. [Google Scholar] [CrossRef]

- North, D. C. (1990). Institutions, institutional change, and economic performance. Cambridge University Press. [Google Scholar]

- Peng, S. Q. (1999). Mechanisms of trust building: Relational operations and rule of law. Sociological Studies, 2, 55–68. (In Chinese) [Google Scholar] [CrossRef]

- Rousseau, D. M., Sitkin, S. B., Burt, R. S., & Camerer, C. (1998). Not so different after all: A cross-discipline view of trust. Academy of Management Review, 23(3), 393–404. [Google Scholar] [CrossRef]

- Schindler, J. (2017). FinTech and financial innovation: Drivers and depth. Finance & Economics Discussion. [Google Scholar] [CrossRef]

- Sitkin, S. B., & Roth, N. L. (1993). Explaining the limited effectiveness of legalistic “remedies” for trust/distrust. Organization Science, 4(3), 367–392. [Google Scholar] [CrossRef]

- Stephen, K., & Philip, K. (1997). Does social capital have an economic payoff? A cross-country investigation. The Quarterly Journal of Economics, 112(4), 1251–1288. [Google Scholar] [CrossRef]

- Sun, Y. J., Yang, H. P., & Lin, C. (2018). “Internet plus” and the variance of financial structure—An empirical analysis based on provincial panel data. Journal of Industrial Technology and Economy, 37(6), 84–91. (In Chinese). [Google Scholar]

- Syed, A., Ahmed, F., Muhammad, A. K., & Trinidad Segovia, J. E. (2021). Assessing the role of digital finance on shadow economy and financial instability: An empirical analysis of selected south Asian countries. Mathematics, 9(23), 3018. [Google Scholar] [CrossRef]

- Wu, W., Firth, M., & Rui, O. M. (2014). Trust and the provision of trade credit. Journal of Banking & Finance, 39, 146–159. [Google Scholar] [CrossRef]

- Xu, H. P., Zhang, C. Q., & Huang, Y. W. (2023). Social trust, social capital, and subjective well-being of rural residents: Micro-empirical evidence based on the Chinese General Social Survey (CGSS). Humanities and Social Sciences Communications, 10, 49. [Google Scholar] [CrossRef]

- Xu, Q., Zhong, M. R., & Dong, Y. (2024). Digital finance and rural revitalization: Empirical test and mechanism discussion. Technological Forecasting and Social Change, 201, 123248. [Google Scholar] [CrossRef]

- Yang, C. L., & Zeng, P. (2022). The impact of financial literacy on farmers’ entrepreneurship—Based on the mediating effect of digital financial participation. Financial Economy, 9, 37–55. (In Chinese). [Google Scholar]

- Yao, Y. J., & Shi, D. Y. (2017). Exploring regional differences in development of internet finance: Perspectives of path dependence and government interference. Journal of Financial Research, 5, 127–142. (In Chinese). [Google Scholar]

- Zhang, C. S., & Qiao, X. (2023). Research on judicial services for safeguarding the development of digital economy in the financial sector. Tianjin Legal Science, 39, 5–16. (In Chinese). [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).