Abstract

In the contemporary context, characterized by the paramount importance of sustainability, both governments and companies, particularly multinational enterprises (MNEs), play an important role in fostering and overseeing the transformative processes necessary to establish a robust accounting framework for natural capital. The objective of this paper is twofold: firstly, to conduct a comprehensive review of the existing body of literature on this subject and to highlight the importance of avoiding intangible liabilities in MNE from bad practices based on Natural Capital bad practices, and secondly, to outline prospective directions for further research in this domain. To achieve these objectives, we pose two fundamental research questions: (1) What is the current state of knowledge regarding the intangible liabilities and accounting practices of MNEs concerning Natural Capital? (2) How can future research in the field of Natural Capital Accounting be oriented to assist MNEs in accounting for their interactions with Natural Capital? A mixed-method approach is used to address these inquiries. Initially, we substantiate the intrinsic connection between MNEs and the natural environment, utilizing bibliometric techniques to identify the primary themes and areas of focus in the realm of natural capital accounting. Subsequently, we employ in-depth analysis and logical reasoning to propose potential avenues for future research. Additionally, we present a comprehensive model designed to guide forthcoming research endeavors in the domain of natural capital accounting. Among the salient findings derived from our model analysis, it is evident that the inclusion of other environmental factors, such as ecosystem services and biodiversity, should be integral to the overall framework of natural capital accounting. Furthermore, the incorporation of such accounting practices into the day-to-day operations of companies is essential to preserving the natural capital and the reputation of the firms.

1. Introduction

Natural resources as raw materials have been unquestionably linked to international business, to FDI, and therefore to multinational corporations. Some of the world’s largest corporations have been important investors in the extractive industry and play a key role in the mining of metals and in the extraction of oil and gas. The need for investing in a low-carbon economy (UNCTAD 2010) and the role of Transnational Corporations in Agricultural Production and Development (UNCTAD 2007) has been recognized. Also, UNCTAD (2020) discussed how the forces driving investment change as raw materials progress up the “value chain” to become finished products. In summary, the need for improvements in corporate responsibility (ESG, environmental, social, and governance) has been recognized (UNCTAD 2009).

Institutional development in the global economy is needed to measure and preserve the social and economic value of natural capital. Several steps have been taken to reduce negative externalities in recent decades. The lack of standards and the relatively poor institutional development of certain countries have created situations with high social and environmental costs. If we go back to the history of MNE operation with natural resources, we find examples of intangible liabilities, defined as negative externalities due to bad practices, corporate irresponsibility, natural disasters, and lack of national institutional development to address the social and economic value of natural resources and the environment. For instance, in the extractive industries sector, we can mention the environmental and social degradation caused by oil spills, such as Shell in the Niger Delta, Chevron-Texaco in Ecuador, ExxonMobil and Petrobras in Chad and Cameroon (UNCTAD 2010), and BP in the Gulf of Mexico, to cite some well-known examples.

Numerous international initiatives have been developed in recent years to promote the concept of sustainable business development. In this context, since 2013, when the 7th Environment Action Program defined natural capital as “biodiversity, including ecosystems that provide essential goods and services, from fertile land and multifunctional forests to productive land and sea, from good quality drinking water and clean air to pollution and climate regulation and protection from natural disasters”, measuring natural capital became a challenge to ensure smart, sustainable, and inclusive growth, leading to a better understanding of the relationship between economy, society, and environment.

Institutions influence firms’ strategies through regulatory, normative, and cognitive channels (Scott 1995, 2005). In other words, institutional factors affect MNE strategy (Ruijs et al. 2019). The strategic decisions of MNE reflect the institutional environment of their countries (Chen et al. 2009). The company as an institution, as well as its specific norms and values, which guide decision-making, constitute institutional ownership advantages that can be transferred to subsidiaries in host countries and influence institutional development in those countries (Hall and Soskice 2001). Therefore, MNE policies and practices are expanding through the value chain (Peng et al. 2008).

The term sustainability encompasses all three dimensions: economic, environmental, and social. Since sustainability performance at the subsidiary level can be globally integrated into the MNE, the adaptation of social and environmental programs to local demands is influenced by the institutional and economic model of the home country, which, in fact, is a determining factor in the overall strategy of the MNE.

Natural capital accounting (NCA) provides a systematic framework for MNEs to define appropriate policies on an informed basis and to measure the natural assets and services of a particular site or ecosystem. The principles of NCA have been recognized by the UN, with the publication of its System of Environmental Economic Accounting (SEEA) in 2021. Its approach has significantly influenced national policy making, leading to the development of NCA frameworks by world powers such as the United States, European Union, and United Kingdom. Essentially, NCA is a means of incorporating nature-related risks and opportunities into financial considerations. It allows nature-related impacts and dependencies to be reflected in monetary balance sheets and profit and loss accounts.

The aim of this paper is to analyze and review the published works on Natural Capital Accounting and to propose future milestones for this line of research. For the elaboration of the roadmap for future research, it has been considered that most of the literature has been published in recent years, noting that, during the early periods, the literature was scarce, even years in which there has been no publication at all, focusing in recent years on natural capital, ecosystem services, biodiversity, valuation of natural capital and natural capital accounting itself. A mixed methodology is applied. A bibliometric technique is used to identify the main topics studied in NCA. Subsequently, an in-depth analysis and logical reasoning are applied to propose a model and future lines of research.

Following the United Nations (2021, SEEA), a review article is “a study that analyzes and synthesizes an existing body of literature by identifying, challenging, and advancing the building blocks of a theory through an examination of a previous body (or several bodies) of work”. This paper presents future avenues for research on how to improve natural capital accounting, including all the milestones mentioned above (ecosystem services, biodiversity, natural capital valuation), and incorporating the reasons why we believe future research should be directed towards achieving these milestones.

To achieve these objectives, the second section analyzes the importance of natural capital accounting for the firm; the third section analyzes the literature reviews that have been carried out on this topic. A bibliometric technique known as co-word analysis is used to identify the main topics studied in this line of research. Based on these results, a proposal for the orientation/direction of future research on digital human resources is presented in the fourth section. Finally, the last section presents the conclusions, contributions, limitations, and future lines of research.

2. Why Is NCA Necessary for MNE?

2.1. Background to the Relationship between MNE and Natural Capital as a Source of Intangible Liabilities

Explaining the relationship between MNE and Natural Capital as sources of intangible liabilities needs to start from defining what intangible assets are; at least from an accounting point of view, they are related.

Two main sources of intangibles1 have been considered as relevant determinant factors of Multinational Enterprises (MNE) strategies. On the one hand, the Liabilities of Foreignness associated with operating in a foreign country is based on managing differences (distances) between countries of origin and the country of destination of FDI, which brings cultural and physical distance. It includes six dimensions: (1) education, (2) industrial development, (3) language, (4) degree of democracy, (5) political, ideology, and religion, and (6) institutional distance as research agendas in International Business (IB) (Haji and Ghazali 2018; Hofstede 1980; Kogut and Singh 1988). On the other hand, we face intangible assets (ownership advantages) based on knowledge, as the main sources of the economic capital of MNEs and its competitive advantages (House et al. 2004; Dow and Karunaratna 2006; Dunning 1988).

Thinking on these two types of intangible liabilities, we wonder: are there any types of intangible liabilities related to Natural Capital and MNEs activities? If so, are we missing an important concept and research area in international business about how to account for it? To answer these questions, we make the following considerations. A MNE is competitive if it is able and knows how to produce, commercialize, distribute, and sell goods and services in the market either cheaper or differentiated by nature and quality characteristics from those made by competitors (selling to the same market target). Competitiveness is based on a firm’s specific knowledge and capabilities that are incorporated into physical and intangible assets. These types of assets, together with another of a generic type, constitute what can be called Economic Capital of the firm. By nature, those assets can be of a technological character (that allows the manufacture or production of goods and services), commercial (for distribution and selling), and managerial (designing and implementing strategies, assigning resources, coordinating, and controlling). Physical specific assets can be found in all three types of economic capital we have mentioned and, therefore, establish relations with Natural Capital. The relationship between the MNE and Natural Capital nowadays makes it possible, due to its singularity, to consider another kind of intangible asset, the reputation of the firm.

In our understanding, we believe that reputation can be conceptualized as an intangible asset. Reputation is based on public recognition or perception of the quality of activities of the firm by both internal and external stakeholders of the organization (Dunning 2000). However, even if perceptions logically differ between individual stakeholders, they could be understood as a collective perception (Cantwell et al. 2010; Rindova et al. 2005; Bromley 1993). Favorable collective perception may be a source of economic rent, and then there are incentives for firms to maintain and invest in their reputations (Bromley 2000; Dollinger et al. 1997).

Reputation contributes to generating the goodwill of the firm, and a negative reputation may contribute to creating bad will and may also lead to generating intangible liabilities. A positive reputation increases the likelihood that stakeholders will be favorable in contracting with a recognized firm (Connelly et al. 2011; Musteen et al. 2013). Within this argument, not behaving reliably or honestly can have immediate and long-term consequences, as a decrease in a positive reputation may affect the future actions of other players toward a firm. If the “present value of future income exceeds the short-term profit” of dishonesty, firms will be honest and invest in their reputations.

When there is a loss of reputation, companies make large investments to recover it, which probably increases risks and financial needs. Therefore, the emergence of intangible liabilities based on the bad praxis of MNE in relation to the Natural Capital may have economic consequences that directly affect the value of the company (Herrera Rodriguez and Ordóñez-Castaño 2020). Therefore, it is possible to assume that a firm may develop intangible liabilities based on damage to the natural environment, which may imply monetary payments to third parties either at a specific time or as a future cash outflow because of applying bad practices, following wrong policies on a continuous basis or due to events as results of concrete activities. Also, no anticipated negative events or hidden implicit contracts may result in potential intangible liabilities that, in the future, may need to become explicit. When intangible liability is related to a bad reputation and less competitiveness, it also has consequences in a reduction of the equity value for shareholders.

When hidden liabilities emerge and contingencies are recorded to support future payments to third parties (fines, compensations, v.gr.), a loss of value of intangible assets can be expected throughout a loss of reputation. Loss of value of specific assets can be interpreted as a loss of a firm’s competitiveness. The decrease in asset value cannot only be reflected in the decrease in the equity of the firm, but it can also be reflected in its liabilities, increasing them at the time that these losses are accompanied by payment obligations to third parties. This fact is also expected to be correlated to a loss of a firm’s reputation.

Under the proposed conceptual approach, we consider that the possibility for the firm to record natural capital accounting can mitigate the intangible liabilities of a firm.

2.2. Natural Capital Accounting as a Reflection of Sustainable MNE Development

The use of the concept of natural capital is a crucial element in productive structures within the value chain that creates wealth and value in both companies and countries. A large part of the decisions taken related to the adoption of the 2030 Agenda are very sensitive to the valuation of natural resources and their scarcity, although they do not always have adequate scientific justification (Statistics South Africa 2020). To avoid this lack of information, the System of Environmental and Economic Accounting Central Framework was published in 2014 (UNEP-WCMC 2014).

To achieve sustainable development, accounting systems must consider the basis for sustainable growth provided by ecosystems and their services (Barton et al. 2017), considering biodiversity as a key factor both for functioning and resilience and for their capacity to provide ecosystem services. However, human activities that result in overexploitation, pollution, land-use changes, and climate change, for example, can decrease the resilience of natural ecosystems (Bertness et al. 2015). Moreover, ecosystem functioning, and the future provision of ecosystem services may be threatened by the current rate of biodiversity loss. In this sense, biodiversity accounting allows trends in ecosystem and species diversity (and the benefits they provide) to be compared with economic and social activity in a spatially explicit way to answer key policy questions (European Union 2015). Establishing linkages between biodiversity and the economy provides an important opportunity to integrate biodiversity into a wider range of decision-making contexts (e.g., sectoral and development policies) (European Union 2016).

For all of the above, natural capital accounting (NCA) can help companies avoid intangible liabilities, helping to assess, understand, manage, and act in relation to nature (NCC 2016). The adoption of NCA by companies is at an early stage but is progressing towards a common framework promoted mainly by the Natural Capital Coalition (NCC 2017) and by the International Integrated Reporting Council (Post et al. 2020). These two initiatives aim to provide information on the performance and impact of companies on natural capital.

The need to provide recurring information by companies regarding their interaction with natural capital is supported by three key points (Barker 2019):

- Legal. The legal requirements included in the EU 2022/2464 Sustainability Reporting Directive (EU 2022) make it mandatory to include information regarding environmental aspects in the description of policies, results, and related risks. These must be incorporated into management reports. Among this information, it is necessary to include “details of the current and foreseeable impacts of the companies’ operations on the environment and, where applicable, the use of renewable and/or non-renewable energy, greenhouse gases, emissions, water use and air pollution”.

- Economic. The legitimacy (and reputation) of a company as perceived by society can be linked to the way it reports, as well as to the assumption of public commitments. A good environmental communication policy can lead to a greater and/or better social perception of the company that applies it.

- Corporate. This approach considers that the regulatory and coercive framework coupled with market forces explains only part of corporate behavior. Institutional theory defines generally accepted social constructs, including appropriate environmental behavior. A company will be constrained by it to be accepted.

It is necessary to account for both the impacts and dependencies of natural capital to determine potentially significant risks and opportunities. Knowing the state of research development in this area is crucial to determining where research in this field should go.

3. Materials, Methods, and Results

The Scopus database was used, and searches were performed in the fields Title, Keywords, and Abstract. The query performed on 10 May 2023 was (TITLE-ABS-KEY (“Accounting” and “natural capital” or “ecosystem services” or “biodiversity”). The search returned 136 documents. The keywords (399) were filtered, so that plurals and singulars of the same words were automatically grouped, and words were also automatically grouped by common synonyms, leaving a total of 393 words or groups of words. We used the Scopus Database instead of the WOS Database because, due to the low number of journals referred to the topic, the number in Scopus (136) was higher than in WOS (112). Table 1 summarizes the data research.

Table 1.

Data Search.

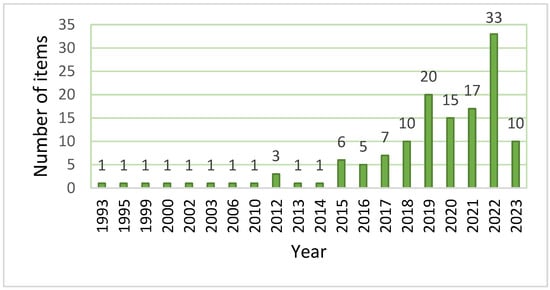

The study started in 1993 because it was the year when the first paper was published. Although research on natural capital accounting began more than 30 years ago, and as Figure 1, shows, most of the articles were published in the last 4 years. Until 2014, contributions were sporadic, and it was not until a year later, coinciding with the signing of the UNFCCC (2018), that scientific production increased considerably, an even greater increase from 2018, the year in which the European Green Pact was enacted, whose objective was to place the EU on the path towards an ecological transition that culminates in reaching climate neutrality by 2050. In that sense, 2022 was the year with the highest scientific output to date, although 2023 is likely to follow the same trend, given that this study only covers articles published up to the date of the consultation. These data show the growing interest in NCA in the literature.

Figure 1.

Documents by Year. Source: Own elaboration.

To identify the different topics addressed in the literature on NCA, a co-word analysis was used in conjunction with the SciMat program (Cobo et al. 2012). The analysis criteria were as follows: unit of analysis: words (authorRole=true, sourceRole=true, addedRole=true); network type, co-occurrence (2); normalization measure, equivalence index (2); clustering algorithm, single centers; maximum cluster size, 12; minimum cluster size, 3; evolution measure, inclusion index; overlap measure, Jaccard index.

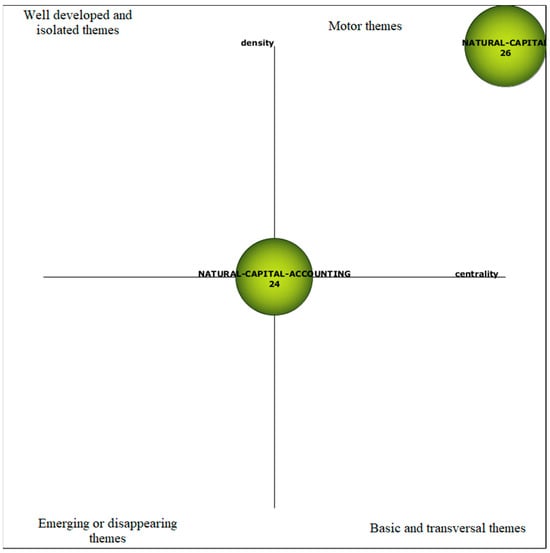

Callon et al. (1991) proposed the classification of each thematic network into one of the following groups: well-developed and isolated themes (upper left quadrant), emerging or disappearing themes (lower left quadrant), basic and transversal themes (lower right quadrant), and driving themes (upper right quadrant), considering centrality and density measures and thus creating a strategic diagram.

Two approaches were carried out and are presented below: first, an analysis without word clustering and then a new analysis with word clustering by topic.

3.1. Bibliometric Analysis of AQL without Word Clustering

In the first analysis, all words were considered, excluding plurals and misspellings. The following figure shows the results for the entire 1993–2023 period without word groups, where “Capital-natural” is a driving theme and “Capital-natural-accounting” is a recurring theme that can be included in all four themes.

Once the bibliometric analysis was carried out, we analyzed the most cited articles, which means articles that have been cited more than 10 times. In these articles, we analyzed the aim of the paper, the main conclusions, and the proposed future research in order to obtain information to build our model of lines of future research.

Our conclusions after analyzing the articles shown in Figure 2 and Figure 3 are that the most common subject is natural capital future research is that it should revolve around economic and social assessments, building on existing economic impact assessment approaches and extending this approach to other types of ecosystems. In this sense, it should include more detailed models that support decision-making that incorporate the implications of moving from screening to the implementation of results, including how to measure and monitor the effect of different actions. Extending SEEA improvements and implementing rules that allow the evaluation of whether the accountability between companies and governments is following these institutional changes can allow information to be analyzed more effectively and translated into policy and management responses. Table 2 summarizes and analyzes the main authors, citations and papers belonging to cluster network for natural capital in all period 1993–2023 without word groups to explore the proposed future research in these articles.

Figure 2.

Strategic diagram for all periods 1993–2023 without word grouping. Source: Own elaboration. From Scimat.

Figure 3.

Cluster network for natural capital in all periods 1993–2023 without groups. Source: Own elaboration based on Scimat.

Table 2.

Main authors, citations, and papers belonging to cluster network for natural capital in all periods 1993–2023 without word groups.

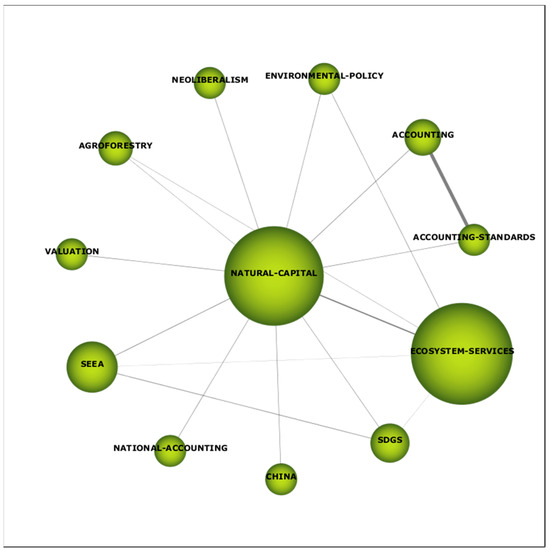

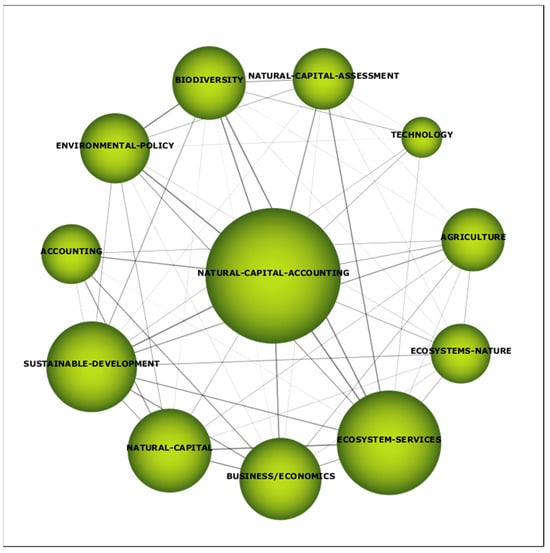

Once this analysis was completed, clusters for the two topics were prepared. Figure 4 shows the cluster for “Natural Capital Accounting” and we can see a star-shaped network characterized by the presence of keywords correlated with the cluster theme. The main themes are clearly ecosystem services correlated with environmental policy. Different natural capital accounting systems also appear, such as SEEA and SDGS. Other accounting terminology is also observed in the network. However, despite the importance detected in the literature review, biodiversity does not appear as part of the network of published articles on natural capital.

Figure 4.

Cluster Network for natural capital accounting for all periods 1993–2023 without clusters. Source: Own elaboration through Scimat.

After analyzing the articles shown in Table 3 related to Natural Capital Accounting, we conclude that the two most cited papers focus on the need to identify the type of distribution function of the relationship between biodiversity and ecosystem conditions/services and how to extend it beyond case studies to multiple situations.

Table 3.

Main authors, citations, and papers belonging to cluster network for natural capital accounting in all periods 1993–2023 without word groups.

The clustering “natural capital accounting” appears for all periods in 1993–2023, and without clustering words, many keywords appear. The keywords “SEEA” and “sustainable development” are strongly correlated with each other, as well as with “environmental accounting”. We note the appearance of biodiversity at the core of this analysis.

3.2. Bibliometric Analysis of AQL without Word Clustering

Subsequently, due to the scarcity of topics originating from the analysis performed without grouping, the same analysis was carried out considering the groupings shown in Table 4.

Table 4.

Thematic groups and words of the groups.

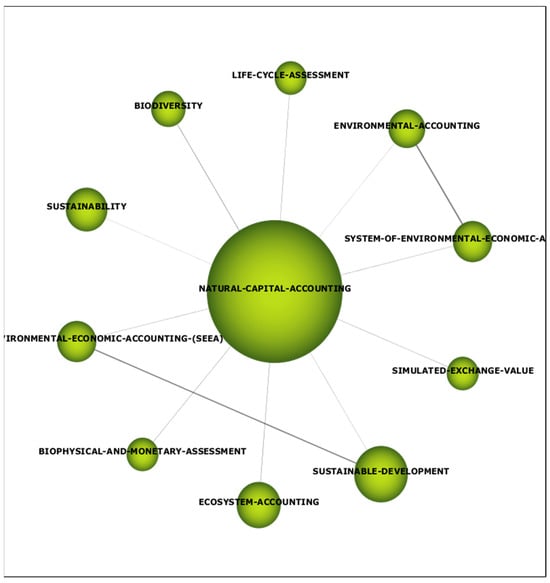

Following Callon et al. (1991) and in order to identify the knowledge structure of the topic studied, the results of the co-word analysis are presented. Figure 5 presents the strategic diagram obtained from this analysis using word groups for the period (1993–2023), including the number of documents in which each topic is addressed, represented by the size of the circle.

Figure 5.

Strategic diagram for all periods 1993–2023 with word clusters. Source: Own Elaboration.

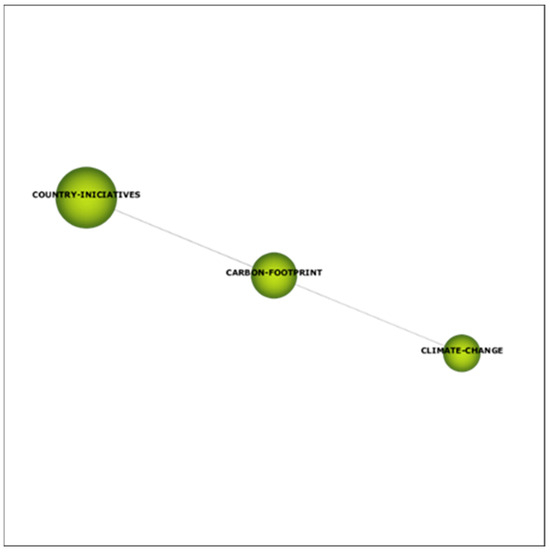

For the entire period analyzed (1993–2023) with word groups, the driving theme, as Figure 6 shows, is “Natural-capital-accounting”, while the theme “carbon footprint”, as Figure 7 shows, is positioned as the basic theme and driving theme.

Figure 6.

Cluster Network “Natural-capital-accounting” in all periods (1993–2023) with word groups. Source: Own elaboration. SciMat Results.

Figure 7.

Cluster Network for “Carbon Footprint” in all periods (1993–2023) with word groups. Source: SciMat Results. Own elaboration.

The authors’ analysis shows more than ten papers cited more than 10 times and fewer than 10 references in this cluster. The most cited papers belong to this cluster based on Natural Capital Accounting after grouping words, as shown in Table 5. In all of these papers, the authors analyzed how to approach Natural Capital Accounting from a macroeconomic perspective more than from a microeconomic one, which means the low research developed regarding MNE and Natural Capital Accounting.

Table 5.

Main authors, papers, and times cited to cluster network for natural capital accounting.

Analyzing the articles, we find that the authors emphasize the importance of advancing the understanding and application of natural capital accounting (NCA) for comprehensive sustainability assessment. The described framework, while serving in some cases as a foundation for national and regional ecological flow and services accounting, is acknowledged as requiring supplementation with social indicators to holistically measure progress toward sustainability, accounting for people’s quality of life. The identification of research needs is underscored, particularly in developing analytical methods and valuation approaches that integrate ecosystem services concepts into various policies. Although articles include specific cases, the need for additional research is evident, exploring common dynamics for all contexts. Key features of natural systems, such as non-linearities, irreversibilities, multifunctionality, adaptability, and resilience, are highlighted as critical considerations in NC accounting. In this approach, future research is urged to develop conceptual models and decision-making tools, ensuring consistency in asset valuation and supporting sustainable practices. Additionally, ongoing research should explore the core features of ecosystems, aiming to maintain fundamental functionalities for future generations. Lastly, the suggested theoretical framework is proposed for application in contrasting results across economies with significant recent growth, underlining the universality and adaptability of the approach in diverse contexts.

When analyzing the “Natural-capital-accounting” sub-network (Figure 7), it contains a wide network of terms that correlate with each other, with the most notable relationships being those related to sustainable development, ecosystem services, and the business economics of natural capital. It also shows how important collaborative work in the environment is for the improvement of natural capital accounting, which is shown through the connections between the terms “environmental policy”, “sustainable development”, and “biodiversity”, which will be the pillars of the model developed.

After analyzing the articles shown in Table 6 related to Carbon Footprint, we conclude that the main future lines of research, according to these authors, should go beyond EQS and focus specifically on ecosystem accounting. They stress the need for comprehensive research and testing of ecosystem assessment, spatial integration, measurement, and valuation of ecosystem services. In addition, it calls for defining ecosystem degradation and its allocation to economic units. The need to develop indicators related to biodiversity, regulation, and maintenance of ecosystem services is identified in the context of the Natural Capital Investment Framework (NCIF). The development of interrelationships between indicators is considered crucial to address the issues of resource efficiency and depletion. The authors stress the importance of future research to provide guidance on the application of natural capital indicators to ensure consistency and comparability across countries for which pilot testing of the NCIF is recommended to understand its usefulness in different governance contexts. Considering global sustainability efforts, future lines of inquiry abound on the imperative need to combine the adoption of new NCA standards with unprecedented public spending on economic recovery to drive sustainable development. Future research must have a multidisciplinary effort, involving collaboration between individuals and institutions, to promote the integration, trust, and use of NCAs in decision-making processes.

Table 6.

Main authors, citations, and papers belonging to cluster network for carbon footprint in all periods 1993–2023 with word groups.

The “Carbon footprint” network (Figure 8) for all periods in 1993–2023, shows that the most important keywords in the group are “national initiatives” and “climate change”. The keywords are strongly correlated with carbon footprint. The cluster of words “country initiatives” includes a list of countries and regions using different approaches to combat climate change and reduce carbon emissions. The “carbon footprint” network has gained prominence in recent years due to the enormous growth in the number of environmental policies that have taken place in the last 10 years.

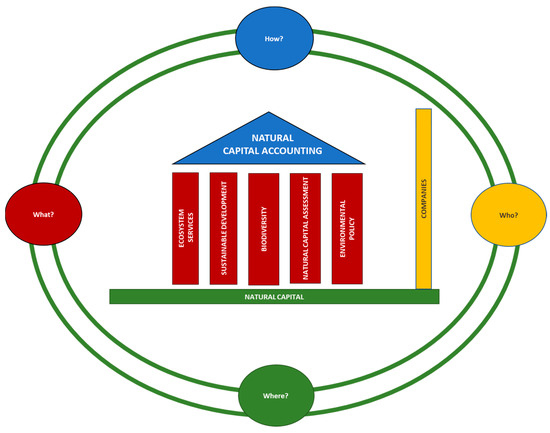

Figure 8.

Research Avenues Model for NCA. Source: Own elaboration.

4. Discussion

Based on the previous analysis, which shows us the absence of decisive results in the bibliometric analysis carried out shows that this is still a young line of research that needs to be further developed in different areas.

We develop a model to define, based on the most valuable characteristics (the what, the where, the who, the how), the main avenues of research in NCA.

The pillar underpinning our model, “what”, is the companies’ own need to define their relationship with natural capital, as shown in Section 2 of this article.

The cross-cutting issue, “the who”, indicates that it is the company that is the driver of change; of course, it is the one that has the capacity to introduce in its information collection, analysis, and valuation practices the necessary procedure for natural capital accounting and, therefore, the one that is able to assimilate the change driven by government agendas towards a zero carbon economy.

The ceiling of the model is “the how”. The implementation of all the changes we are obliged to make will only be possible through the implementation and improvement of 5 items in the daily processes of companies: firstly, the relationship with ecosystem services and sustainable development, secondly, the relationship with biodiversity, followed by environmental policies, and finally, the valuation of natural capital, to be able to achieve the accounting of this asset.

Therefore, to answer the research question posed, “How to orient/direct future research on natural capital accounting?”, the line of research to be addressed is established for each thematic group of the analysis, according to the results obtained in the model, as well as the research question to be posed.

As a development of the model and after analyzing all results, Table 7 summarizes our proposal of lines of future research.

Table 7.

Lines of Future Research based on the Research Avenues Model.

5. Conclusions

The main contribution of this paper is to point out the low degree of development of research in the topic of Natural Capital Accounting at the microeconomic level and the need for it to record and avoid intangible liabilities in all the Natural Capital Scope.

The paper analyzes the relationship among Intangible Liabilities, Natural Capital, and Reputation for MNE and the need to study this topic to record the impact of MNE in Natural Capital, as a new or not deeply studied concept in International Business research. We identify the sources of this implicit intangible liability coming from the Natural Capital that it may be related to the competitiveness of the firm. We also argue the correlation expected between the behavior of the firm regarding natural capital and the specific and singular intangible assets such as Reputation.

This paper also contributes to determining the relevance of firms’ reputations and their connection to natural capital accounting to avoid intangible liabilities. An efficient record of natural capital will be reflected in the value of the firm and in another singular and important intangible asset: its reputation. In this respect, a loss or gain in reputation should be correlated to the competitiveness of the firm. A reduction in the reputation might be due to bad practices, bad decisions, and bad relationships between the firm and natural capital that may lead to intangible liabilities with the obligation of future payments to third parties. Thus, the depreciation of intangible assets such as natural capital has an influence on a reduction of equity value, and in certain cases due to contingencies, intangible liabilities may possibly emerge.

Based on this, NCA research is essential in a world where natural resources are becoming increasingly scarce. Traditional accounting does not adequately reflect the degradation and depletion of these resources, which underestimates the associated risks and threats. Natural Capital Accounting provides critical information for business decision-making and policies that promote sustainability. MNEs can use this information to assess the environmental impact of their operations and design strategies to minimize that impact across both their subsidiaries and their supply chain.

In summary, Natural Capital Accounting research presents an important field of inquiry and is central to addressing contemporary environmental, economic, and social challenges.

Author Contributions

Conceptualization, M.-J.G.-L. and F.P.-H.; data curation, M.-J.G.-L.; investigation, M.-J.G.-L. and F.P.-H.; methodology, M.-J.G.-L.; project administration, M.-J.G.-L.; resources, M.-J.G.-L. and F.P.-H.; supervision, M.-J.G.-L.; validation, M.-J.G.-L. and F.P.-H.; writing—original draft, M.-J.G.-L.; writing—review and editing, M.-J.G.-L. and F.P.-H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

Note

| 1 | We only cite some of the main representatives authors on these topics. |

References

- Barker, Richard. 2019. Corporate Natural Capital Accounting. Oxford Review of Economic Policy 35: 68–87. [Google Scholar] [CrossRef]

- Barton, David N., Rob Dunford, Erik Gomez-Baggethun, Paula A. Harrison, Sander Jacobs, Eszter Kelemen, Berta Martin-Lopez, P. Antunes, R. Aszalos, O. Badea, and et al. 2017. Integrated Valuation of Ecosystem Services. Guidelines and Experiences. OpenNESS. Available online: http://hdl.handle.net/10138/232667 (accessed on 23 January 2024).

- Bertness, Mark D., Caitlin P. Brisson, and Sinead M. Crotty. 2015. Indirect human impacts turn off reciprocal feedback and decrease ecosystem resilience. Oecologia 178: 231–37. [Google Scholar] [CrossRef]

- Boehnert, Joanna. 2016. The Green Economy: Reconceptualizing the Natural Commons as Natural Capital. Environmental Communication 10: 395–417. [Google Scholar] [CrossRef]

- Bromley, Dennis Basil. 1993. Reputation, Image and Impression Management. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Bromley, Dennis Basil. 2000. Psychological aspects of corporate identity, image, and reputation. Corporate Reputation Review 3: 240–52. [Google Scholar] [CrossRef]

- Callon, Michel, Jean Pierre Courtial, and Francoise Laville. 1991. Co-word analysis as a tool for describing the network of interactions between basic and technological research: The case of polymer chemistry. Scientometrics 22: 155–205. [Google Scholar] [CrossRef]

- Cantwell, John, John H. Dunning, and Sarianna M. Lundan. 2010. An evolutionary approach to understanding international business activity: The co-evolution of MNEs and the institutional environment. Journal of International Business Studies 41: 567–86. [Google Scholar] [CrossRef]

- Chen, Shun-Hsing, Hui-Hua Wang, and King-Jang Yang. 2009. Establishment and application of performance measure indicators for universities. The TQM Journal 21: 220–35. [Google Scholar] [CrossRef]

- Cobo, M. J., A. G. López-Herrera, E. Herrera-Viedma, and F. Herrera. 2012. SciMAT: A new computational tool for scientific map analysis. Journal of the American Society for Information Science and Technology 63: 1609–30. [Google Scholar] [CrossRef]

- Connelly, Brian L., S. Trevis Certo, R. Duane Ireland, and Christopher R. Reutzel. 2011. Signaling theory: A review and assessment. Journal of Management 37: 39–67. [Google Scholar] [CrossRef]

- Dollinger, Marc J., Peggy A. Golden, and Todd Saxton. 1997. The effect of reputation on the decision to joint venture. Strategic Management Journal 18: 127–40. [Google Scholar] [CrossRef]

- Dow, Douglas, and Amal Karunaratna. 2006. Developing a Multidimensional Instrument to Measure Psychic Distance Stimuli. Journal of International Business Studies 37: 575–77. [Google Scholar] [CrossRef]

- Dunning, John H. 1988. The Eclectic Paradigm of International Production: A Restatement and some Possible Extensions. Journal of International Business Studies 19: 1–31. [Google Scholar] [CrossRef]

- Dunning, John H. 2000. The eclectic paradigm as an envelope for economic and business theories of MNE activity. International Business Review 9: 163–90. [Google Scholar] [CrossRef]

- EU. 2022. Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 Amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as Regards Corporate Sustainability Reporting (Text with EEA Relevance). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32022L2464 (accessed on 23 January 2024).

- European Union. 2015. Knowledge Innovation Project (KIP) on Accounting for Natural Capital and Ecosystem Services—Scoping Paper. Exploratory Paper. Torino: EU. [Google Scholar]

- European Union. 2016. Report on Phase 1 of the Knowledge Innovation Project on an Integrated Accounting System for Natural Capital and Ecosystem Services in the EU (KIP-INCA Phase 1 Report). Copenhagen: European Environment Agency. [Google Scholar]

- Fairbrass, Alison, Georgina Mace, Paul Ekins, and Ben Milligan. 2020. The Natural Capital Indicator Framework (ncif) For Improved National Natural Capital Reporting. Ecosystem Services 46: 101198. [Google Scholar] [CrossRef]

- Farrell, Catherine A., Lisa Coleman, Daniel Norton, Mary Kelly-Quinn, Stephen Kinsella, Carl Obst, Mark Eigenraam, C. O’donoghue, I. Sheehy, F. Smith, and et al. 2022. Applying Ecosystem Accounting to Develop a Risk Register for Peatlands and Inform Restoration Targets at Catchment Scale: A Case Study from The European Region. Restoration Ecology 30: e13632. [Google Scholar] [CrossRef]

- Fletcher, Robert, Wolfram H. Dressler, Zachary R. Anderson, and Bram Büscher. 2019. Natural Capital Must Be Defended: Green Growth as Neoliberal Biopolitics. Journal of Peasant Studies 46: 1068–95. [Google Scholar] [CrossRef]

- Haji, Abdifatah Ahmed, and Nazli Anum Mohd Ghazali. 2018. The role of intangible assets and liabilities in firm performance: Empirical evidence. Journal of Applied Accounting Research 19: 42–59. [Google Scholar] [CrossRef]

- Hall, Peter A., and David Soskice. 2001. Varieties of Capitalisms. Oxford: Oxford University Press. [Google Scholar]

- Herrera Rodriguez, Edila Eudemia, and Iván Andrés Ordóñez-Castaño. 2020. Disclosure of intangible liabilities: Comparative study of the banking sectors in Panama and Colombia. Journal of Applied Accounting Research 21: 635–56. [Google Scholar] [CrossRef]

- Hofstede, G. 1980. Cultural Consequences: International Differences in Work Related Values. Beverly Hills: Sage Publications. [Google Scholar]

- House, Robert J., Paul J. Hanges, Mansour Javidan, Peter W. Dorfman, and Vipin Gupta, eds. 2004. Culture, Leadership and Organizations: The GLOBE Study of 62 Societies. Thousand Oaks: Sage Publications. [Google Scholar]

- Islam, Moinul, and Shunsuke Managi. 2019. Green Growth and Pro-environmental Behavior: Sustainable Resource Management Using Natural Capital Accounting in India. Resources, Conservation and Recycling 145: 126–38. [Google Scholar] [CrossRef]

- Judd, Adrian, and Jemma-Anne Lonsdale. 2021. Applying Systems Thinking: The Ecosystem Approach and Natural Capital Approach Convergent or Divergent Concepts in Marine Management? Marine Policy 129: 104517. [Google Scholar] [CrossRef]

- Kjaer, Louise, Niels Høst-Madsen, Jannick Schmidt, and Tim McAloone. 2015. Application of Environmental Input-output Analysis for Corporate and Product Environmental Footprints-learnings From Three Cases. Sustainability 7: 11438–61. [Google Scholar] [CrossRef]

- Kogut, Bruce, and Harbir Singh. 1988. The Effect of National Culture on the Choice of Entry Mode. Journal of International Business Studies 19: 411–32. [Google Scholar] [CrossRef]

- Kotsiras, Konstantinos, Ioannis P. Kokkoris, Arne Strid, and Panayotis Dimopoulos. 2020. Integrating Plant Diversity Data into Mapping and Assessment of Ecosystem and Their Services (maes) Implementation in Greece: Woodland and Forest Pilot. Forests 11: 956. [Google Scholar] [CrossRef]

- Lai, Tin-Yu, Jani Salminen, Jukka-Pekka Jäppinen, Saija Koljonen, Laura Mononen, Emmi Nieminen, Petteri Vihervaara, and Soile Oinonen. 2018. Bridging the Gap Between Ecosystem Service Indicators and Ecosystem Accounting in Finland. Ecological Modelling 377: 51–65. [Google Scholar] [CrossRef]

- Li, Penghui, Ruqian Zhang, Hong Wei, and Liping Xu. 2022. Assessment of Physical Quantity and Value of Natural Capital in China Since The 21st Century Based on A Modified Ecological Footprint Model. Science of the Total Environment 806: 150676. [Google Scholar] [CrossRef] [PubMed]

- Mace, Georgina M. 2019. The Ecology of Natural Capital Accounting. Oxford Review of Economic Policy 35: 54–67. [Google Scholar] [CrossRef]

- Marais, Zara E., Thomas P. Baker, Anthony P. O’Grady, Jacqueline R. England, Dugald Tinch, and Mark A. Hunt. 2019. A Natural Capital Approach to Agroforestry Decision-making at the Farm Scale. Forests 10: 980. [Google Scholar] [CrossRef]

- Musteen, Martina, Lawrence Rhyne, and Congcong Zheng. 2013. Asset or constraint: Corporate reputation and MNCs’ involvement in the least developed countries. Journal of World Business 48: 321–28. [Google Scholar] [CrossRef]

- NCC. 2016. Natural Capital Protocol. Available online: www.naturalcapitalcoalition.org/protocol (accessed on 23 January 2024).

- NCC. 2017. Natural Capital Protocol Framework. Available online: https://capitalscoalition.org/wp-content/uploads/2021/07/NCC_Framework.pdf (accessed on 23 January 2024).

- Obst, Carl Gordon. 2015. Reflections on Natural Capital Accounting at The National Level: Advances in The System of Environmental-economic Accounting. Sustainability Accounting, Management and Policy Journal 6: 315–39. [Google Scholar] [CrossRef]

- Peng, Mike W., Denis Y. L. Wang, and Yi Jiang. 2008. An Institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies 39: 920–36. [Google Scholar] [CrossRef]

- Post, Corinne, Riikka Sarala, Caroline Gatrell, and John E. Prescott. 2020. Advancing theory with review articles. Journal of Management Studies 57: 351–76. [Google Scholar] [CrossRef]

- Rindova, Violina P., Ian O. Williamson, Antoaneta P. Petkova, and Joy Marie Sever. 2005. Being good or being known: An empirical examination of the dimensions, antecedents, and consequences of organizational reputation. Academy of Management Journal 48: 1033–49. [Google Scholar] [CrossRef]

- Ruijs, Arjan, Michael Vardon, Steve Bass, and Sofia Ahlroth. 2019. Natural Capital Accounting for Better Policy. Ambio 48: 714–25. [Google Scholar] [CrossRef] [PubMed]

- Schaefer, Mark, Erica Goldman, Ann M. Bartuska, Ariana Sutton-Grier, and Jane Lubchenco. 2015. Nature as Capital: Advancing and Incorporating Ecosystem Services in United States Federal Policies and Programs. Proceedings of the National Academy of Sciences of the United States of America 112: 7383–89. [Google Scholar] [CrossRef] [PubMed]

- Scott, W. Richard. 1995. Institutions and Organizations. Ideas, Interest and Identities. Newcastle upon Tyne: Sage. [Google Scholar]

- Soctt, W. Richard. 2005. Institutional Theory: Contributing to a Theoretical Research Program. In Great Minds in Management. Oxford: Oxford University Press. [Google Scholar]

- Stage, J., and C. Uwera. 2018. Prospects for Establishing Environmental Satellite Accounts in A Developing Country: The Case of Rwanda. Journal of Cleaner Production 200: 219–30. [Google Scholar] [CrossRef]

- Statistics South Africa. 2020. Terrestrial and Terrestrial Ecosystem Accounts, 1990 to 2014. Pretoria: Statistics South Africa. [Google Scholar]

- UNCTAD. 2007. World Investment Report 2007. Transnational Corporations, Extractive Industries and Development. New York and Geneva: UNCTAD. [Google Scholar]

- UNCTAD. 2009. World Investment Report 2009. Transnational Corporations, Agricultural Production and Development. New York and Geneva: UNCTAD. [Google Scholar]

- UNCTAD. 2010. World Investment Report 2010. Investing in a Low-Carbon Economy. New York and Geneva: UNCTAD. [Google Scholar]

- UNCTAD. 2020. SDG Investment Trends Monitor (Issue 2). New York and Geneva: UNCTAD. [Google Scholar]

- UNEP-WCMC. 2014. Annual Report. Report on Achievements for the Year 2014. Nairobi: UNEP. [Google Scholar]

- UNFCCC. 2018. The Paris Agreement. Publication. Bonn: UNFCCC. [Google Scholar]

- United Nations. 2021. System of Environmental Economic Accounting SEEA. New York: United Nations. [Google Scholar]

- Vardon, Michael, Juan-Pablo Castaneda, Michael Nagy, and Sjoerd Schenau. 2018. How the System of Environmental-economic Accounting Can Improve Environmental Information Systems and Data Quality for Decision Making. Environmental Science and Policy 89: 83–92. [Google Scholar] [CrossRef]

- Vardon, Michael, Heather Keith, Carl Obst, and David Lindenmayer. 2019. Putting Biodiversity into The National Accounts: Creating a New Paradigm for Economic Decisions. Ambio 48: 726–31. [Google Scholar] [CrossRef]

- Vardon, M., P. Lucas, S. Bass, M. Agarwala, A. M. Bassi, D. Coyle, A. Dvarskas, C. A. Farrell, O. Greenfield, S. King, and et al. 2023. From COVID-19 To Green Recovery with Natural Capital Accounting. Ambio 52: 15–29. [Google Scholar] [CrossRef]

- Wackernagel, Mathis, Larry Onisto, Patricia Bello, Alejandro Callejas Linares, Ina Susana López Falfán, Jesus Méndez García, Ana Isabel Suárez Guerrero, and Ma. Guadalupe Suárez Guerrero. 1999. National Natural Capital Accounting with The Ecological Footprint Concept. Ecological Economics 29: 375–90. [Google Scholar] [CrossRef]

- Wu, J., K. Li, and Y. Zhao. 2020. The Use of Land Natural Capital in The Guanzhong Region Based on A Revised Three-dimensional Ecological Footprint Model. Progress in Geography 39: 1345–55. [Google Scholar] [CrossRef]

- Yamaguchi, Rintaro, and Shunsuke Managi. 2019. Backward- and Forward-looking Shadow Prices in Inclusive Wealth Accounting: An Example of Renewable Energy Capital. Ecological Economics 156: 337–49. [Google Scholar] [CrossRef]

- Zhang, H., D.-L. Zhu, and Y. Zhang. 2022. Natural Capital Accounting of Cultivated Land Based on Three-dimensional Ecological Footprint Model—A Case Study of The Beijing-tianjin-hebei Region. Frontiers in Environmental Science 10: 1060527. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).