Abstract

Environmental information fraud, such as greenwashing, severely impedes the achievement of global Sustainable Development Goals (SDGs). Blockchain technology, as an innovation tool with a sustainability orientation, offers new possibilities for improving the reliability of supply chain information oversight. However, its practical application mechanisms and policy value in green supply chain governance remain unclear. This study focuses on the greenwashing behavior of core enterprises and constructs an incomplete information game model to compare and analyze the inherent mechanisms of traditional regulation (TR) and blockchain-based digital supply chain regulation (DSCR). By simulating the strategic choices of enterprises between “genuine production” and “greenwashing” within a supply chain network, this research finds that when the quality of on-chain information reaches a certain threshold, the blockchain consensus mechanism can more accurately reveal corporate moral hazards, such as information manipulation, significantly reducing the incidence of greenwashing. As the number of enterprises participating in the blockchain network increases, the reliance on high-quality information in the DSCR model decreases, and regulatory efficiency is further enhanced through network effects. The findings provide theoretical support for designing regulatory strategies against greenwashing: Blockchain technology can build a trustworthy supply chain ecosystem through cross-enterprise data verification, directly supporting the SDG 12 goal of “Responsible Production.” Its decentralized nature helps optimize industrial infrastructure (SDG 9) and indirectly promotes climate action (SDG 13). This study suggests that regulatory agencies use policy tools such as “establishing on-chain information quality standards” and “incentivizing enterprises to join the blockchain network” to strengthen the practical application of the model, while also addressing implementation challenges such as data authenticity and digital infrastructure compatibility.

1. Introduction

Background and Motivation

Sustainable development has become a global priority amid finite natural resources, climate change, and ecosystem degradation, with corporate green transformation emerging as a critical driver of competitiveness and long-term growth [1,2]. Environmentally sustainable practices can enhance a company’s reputation and market share [3], yet consumer skepticism persists regarding the authenticity of “green products” due to widespread greenwashing—misleading claims about environmental performance that undermine sustainability goals [4,5]. Notable cases include the 2016 fraud involving 76,000 electric vehicles in China’s subsidy program and the Volkswagen “clean diesel” scandal, where profit-driven deception eroded trust in corporate social responsibility [6,7,8]. Recent studies highlight that supply chain digitization can mitigate such risks by enhancing transparency and accountability, with empirical evidence showing its positive impact on corporate green innovation [9].

Stakeholders face systemic challenges in verifying corporate environmental transparency, relying on often inaccurate or incomplete signals from firms [10]. Consumer preference for green products exacerbates this issue, as exaggerated environmental claims can boost sales by up to 20% in competitive markets [11,12], with 98% of green products globally estimated to involve some form of greenwashing [3,13]. Traditional regulatory efforts to combat such practices are hindered by inherent information asymmetry: authorities struggle to verify the authenticity of green product claims across multi-tiered supply chains, facing prohibitive costs and oversight gaps [14,15]. For instance, validating a core manufacturer’s “carbon-neutral” production claim requires tracing raw material extraction, energy usage, and logistics across dozens of upstream suppliers—a process prone to data manipulation and concealment [16]. Notably, government-enterprise collaboration has been identified as a key strategy to address these gaps, though its effectiveness depends on aligned incentives, clear regulatory frameworks, and consumer value perception [17].

Blockchain technology, a cornerstone of the fourth industrial revolution, offers transformative potential for supply chain management by enabling transparent, tamper-proof, and real-time data recording [18]. Through permissioned alliance chains, supply chain participants can integrate enterprise resource planning (ERP) systems, encrypt transaction data, and achieve cross-enterprise consensus, thereby mitigating information asymmetry and preventing selective disclosure of misleading claims [19]. Despite its promise, existing literature remains fragmented: while qualitative studies highlight blockchain’s role in enhancing traceability, quantitative analyses of its regulatory impact—particularly regarding how network effects and information quality thresholds influence anti-greenwashing effectiveness—are conspicuously absent. This gap is critical, as information sharing alone does not guarantee sustainability; its impact is contingent on boundary conditions such as supply chain resilience and cross-organizational trust [20].

This study focuses on innovative regulatory mechanisms for greenwashing behavior by core enterprises in supply chain networks. By constructing an analytical framework based on incomplete information game theory, we aim to uncover the operational logic and performance differences between DSCR and TR models. This research centers on the production decisions of core enterprises in supply chains, assuming firms may adopt either “authentic production” or “greenwashing” strategies, while employing “concealment measures” to evade regulatory scrutiny. Furthermore, to address information asymmetry, production information is categorized into “third-party verifiable” and “third-party non-verifiable” types. This allows a comparative analysis of information processing mechanisms under two regulatory paradigms: the traditional model relies on offline due diligence to verify information authenticity, while the digital model leverages blockchain platforms to assess on-chain data authorization. Through this theoretical framework, this study seeks to answer the following questions: How will the integration of blockchain technology with supply chains alter the information structure characteristics of regulatory systems and reshape the incentives of participating entities? What are the comparative advantages, suitable scenarios, and conditions for effectiveness of DSCR versus TR? In the medium to long term, as blockchain adoption proliferates across supply chain enterprises and drives higher levels of corporate digitalization, what new advantages will emerge in enterprise regulation?

This study reveals that blockchain technology empowers supply chain regulation through its network effects and cross-validation mechanisms. First, the scale of the supply chain and the quality of on-chain information jointly determine the boundary for regulatory model selection: When the number of enterprises is limited or on-chain information quality is poor, the traditional model proves more effective in mitigating greenwashing risks via offline due diligence. However, as supply chain networks expand and on-chain information quality improves, the digital model significantly enhances verification accuracy and regulatory efficiency by integrating cross-enterprise data through blockchain-enabled cross-validation. Second, the success of digital regulation hinges on two critical factors: (1) The inherent network attributes of supply chains, which provide multi-agent collaboration advantages—the large enterprise base and complex transactional interdependencies ensure dual safeguards for on-chain information quality; (2) The decentralized nature of blockchain technology, which offers unique value in privacy protection and authorized data sharing. This not only alleviates information asymmetry between core enterprises and regulators but also dismantles data silos and facilitates efficient credit information transmission. This study further emphasizes that the deep integration of blockchain and supply chains not only provides technical tools for green production regulation but also reconstructs the regulatory system through an “on-chain data ecosystem,” driving a paradigm shift in supply chain governance from single-entity control to multi-agent collaborative governance.

Specifically, our findings reveal that blockchain enhances regulation through dual mechanisms: cross-enterprise data validation and network effects, as shown in Table 1. When on-chain information quality reaches a critical threshold (≥85% accuracy in our simulations), blockchain’s consensus mechanism accurately exposes moral hazards like data manipulation, reducing greenwashing by 47% compared to TR. As more enterprises join the blockchain network (≥15 nodes in a typical supply chain), DSCR becomes less dependent on high-quality on-chain information, with regulatory efficiency further enhanced by 32% through network effects—where each additional participant reduces verification costs by an average of 5.2%. The decentralized nature of blockchain further facilitates privacy-protected data sharing via smart contracts, breaking down information silos and improving credit transmission across tiers.

Table 1.

TR vs. DSCR Comparison Matrix.

This study investigates how blockchain technology can empower digital supply chain regulation (DSCR) to enhance information transparency and regulatory reliability. We systematically explore the theoretical mechanisms underlying DSCR practices, focusing on how blockchain reshapes the information architecture of supply chain governance and mitigates information manipulation behaviors among participants. This analysis serves not only as a systematic synthesis of existing regulatory paradigms but also as a forward-looking examination of emerging trends in technology-driven governance. Innovatively, we adopt a dual analytical lens—information characteristics and consensus mechanisms—to evaluate blockchain’s impact on supply chain regulatory frameworks. This research reveals that not all information is equally suited for blockchain integration: Certain data types are inherently “chain-compatible” (i.e., verifiable through distributed consensus), while others remain “chain-resistant” (i.e., difficult to authenticate even when digitized). Critically, the divergence between DSCR and TR lies in their capacity to process information of varying characteristics, with the quantity and quality of on-chain data acting as decisive factors. Furthermore, leveraging the inherent network attributes of supply chains—characterized by extensive enterprise participation and transactional interdependencies—we demonstrate how blockchain-enabled cross-verification mechanisms address the validation challenges pervasive in TR systems. This study projects that, as blockchain adoption accelerates and corporate digitalization deepens, DSCR will increasingly outperform TR models. Furthermore, this research contributes to academic and practical discourse by: (1) developing a game-theoretic framework to quantify blockchain’s regulatory impact, bridging the gap between theoretical models and sustainable development practices; (2) challenging the assumption that blockchain data is inherently reliable by examining pre-upload information manipulation risks, offering insights for designing robust on-chain governance protocols; and (3) analyzing blockchain’s role in transforming regulatory architectures from hierarchical control to collaborative ecosystems, extending Letunovska et al.’s [20] work on information sharing boundaries. These innovations provide policymakers with actionable tools—including on-chain information quality standards and enterprise participation incentives—to strengthen blockchain’s practical application in anti-greenwashing regulation.

The remainder of this paper is organized as follows: Section 2 presents a review of the relevant literature. Section 3 describes the problem and develops the corresponding mathematical models. In Section 4, numerical examples are provided to analyze the model results. Finally, Section 5 provides a summary and policy recommendations.

2. Literature Review

2.1. Environmental Information Disclosure and Falsification

Environmental sustainability has become the focus of attention in both industry and academia [21]. However, the ease of falsifying green information has prompted some companies to adopt “greenwashing” behaviors to quickly optimize their economic performance and corporate image, allowing them to bypass the efforts required for genuine “green development” [22]. The term greenwashing combines two types of corporate behavior—environmental misconduct and misleading claims regarding environmental performance. The core element of greenwashing is that businesses rely on stakeholders for corporate benefits [23]. Greenwashing refers to companies intentionally providing misleading information regarding their environmental practices to create a false impression of their commitment to sustainability. This practice not only undermines the credibility of companies that genuinely prioritize environmental sustainability but also poses a major obstacle to achieving long-term environmental sustainability goals. Although greenwashing may provide short-term benefits to businesses, it also imposes societal and environmental costs [24,25]. According to a survey, conducted by Accenture [26], of 6000 individuals from 11 countries across North America, Europe, and Asia, more than 80% of consumers consider the environmental impact of products when making purchasing decisions.

Companies that voluntarily disclose CSR information are more likely to be identified as sustainability leaders and can easily access green credit and policy subsidies [27]. The high risk of bankruptcy also incentivizes companies to engage in greenwashing after these subsidies expire [28]. Wu et al. [29] studied how information transparency affects the strategies of various firms and social welfare and revealed that sufficient transparency can help prevent companies from greenwashing and incentivize socially responsible companies to make additional green investments. Yu et al. [12] reported that governance factors at the corporate level are more important than national factors in ending greenwashing. Most of the existing research studies analyzed the greenwashing behaviors of companies in relation to their interests and considered the effectiveness of greenwashing prevention through information transparency or policies. Unlike that in previous studies, we propose enhancing corporate transparency by requiring corporations to disclose information using the blockchain technology. By examining the probability of greenwashing within the context of supply chain information regulation, we constructed a cross-verification-based information management system. This approach addresses the governance challenges associated with information verification in traditional regulatory models.

2.2. Information Regulation

The regulation of information disclosure is also relevant to our study. In poor regulatory environments, companies often reduce environmental management spending in competitive markets [30], leading to more widespread greenwashing. Stricter regulations can effectively diminish these greenwashing behaviors, as demonstrated by other scholars [31,32]. In particular, regulatory measures that mandate the disclosure of carbon information can encourage companies to adopt substantive emission reduction measures rather than focusing on impression management [11,33]. However, these studies have often overlooked the complexity and diversity of regulations in practical applications. Although higher levels of regulation can improve information transparency for companies, they do not necessarily improve their pollution emissions behavior [34,35]. Similarly, Tang et al. [36] revealed that the level of regulation can only slightly influence the pollution emissions of a company’s (less than 10%). Higher and stricter regulations can effectively reduce the motivation for information manipulation in a company, thereby reducing greenwashing behavior. However, in most market-driven economies, the government plays a relatively small regulatory role, and individual responsibility takes precedence. In these economies, entrepreneurs are more likely to be influenced by unethical behavior, while likelihood of such behavior decreases as individual responsibility increases [30]. Existing literature rarely focuses on the quality of implemented regulations and the capacity of regulatory agencies when analyzing their effectiveness. A significant research gap exists in comparing the effects of different regulatory approaches by examining a company’s intrinsic greenwashing mechanisms. The present study addresses the shortcomings of existing literature by systematically analyzing the impact of different regulatory models on the greenwashing behaviors of companies to improve regulation reliability.

2.3. Application of Blockchain in the Supply Chain

As a decentralized digital ledger system, blockchain can achieve information transparency, promote tampering and traceability, and exhibit unique advantages with regard to solving the issues of transparency, reliability, and sustainability of the supply chain [37,38]. Therefore, this study considered the potential use of blockchain technology to improve the reliability of information regulation.

To assess whether blockchain technology is a driver of or a barrier to sustainability, Friedman and Ormiston [39] reviewed 18 expert interviews with various players in the global food supply chain. Their findings suggested that blockchain is a sustainability-oriented technology that enables fair supply chains and drives environmental sustainability. Yousefi et al. [40] proposed an analytical method to identify the factors driving blockchain adoption; however, the potential negative impacts of blockchain technology have been explored less frequently. Zhang et al. [41] studied the supply chain of risk-averse members and found that in highly uncertain consumer markets, manufacturers can use blockchain to improve market competitiveness and attract more consumers. Despite its high cost, blockchain technology can benefit supply chain members. Dong et al. [24] examined the impact of blockchain-enabled traceability on manufacturers’ choices regarding logistics outsourcing strategies and greenwashing decisions. Lu et al. [42] demonstrate that blockchain is an effective anti-counterfeiting tool that can improve the profits of brand sellers. In summary, previous research has established the foundation for applying blockchain technology to supply chain management. Despite the potential of blockchain technology to enhance supply chain regulation, its limitations and challenges remain largely unexplored.

2.4. Knowledge Gaps

Compared to the existing literature, this study offers three academic contributions and innovations.

(i) Existing literature mainly focused on cryptocurrency [43,44,45], while research on supply chain supervision primarily examined regulation in the context of varying levels of information transparency [46,47,48]. From the perspective of supply chain digitalization, the present study explored regulatory applications based on the blockchain technology, particularly how the number of on-chain companies affects digital regulation.

(ii) Most previous studies included the fundamental assumption that blockchain data must be real [41,44,49]. In reality, blockchain can only ensure that the data stored in the chain cannot be tampered with; unethical companies can still tamper with the original data [50]. Therefore, a distinct aspect of this study is that we examined the information manipulation behavior of companies before uploading data to the blockchain using different regulatory models.

(iii) From the perspective of information characteristics, some information is suitable for uploading to the blockchain, whereas other is not (even if data is uploaded, it is difficult to validate). This study examined the impact of blockchain on the information structure of supply chain regulation, considering both information characteristics and consensus mechanisms, which are lacking in the literature.

Through innovative research examining these three aspects, this study provides important theoretical support and practical guidance for promoting the application of blockchain technology to supply chain regulations.

3. Main Models

3.1. Model Setup

This study considered a representative supply chain comprising several upstream and downstream companies. The core company in the supply chain chooses to produce green products. Consumers with green preferences purchase green products, while relevant government verification departments verify the company’s green production practices. There were two methods of investigation. The first is the digital traceability method, wherein companies in the supply chain register transaction information on the blockchain when the transaction occurs, which is then evaluated by the verification department according to the digital information recorded on the blockchain technology platform. The second is the traditional investigation method, wherein the assessment of the green production status of a company relies on offline due diligence by the verifier.

This study examined whether a representative company decides to engage in “greenwashing.” It explored how information asymmetry between the company and the regulator that exists in the production process allows the company to choose between “real green production” or “greenwashing,” and how the company can employ “cover-up measures” to avoid detection. Assuming that the income from green products is R, the cost of using green raw materials is M, and the cost of using traditional raw materials is m (m < M), the core company decides to employ real green production or greenwashing to maximize its income. If the core company chooses the latter, further consideration must be given to whether and to what extent cover-up measures are implemented to reduce the likelihood of the regulator detecting greenwashing during their due diligence. Notably, integrating blockchain into a green supply chain increases the cost of tampering with or falsifying information. Although blockchain offers benefits, such as tamper-proofing and traceability, it cannot ensure the accuracy of source information, and companies may still cover up greenwashing behavior by manipulating information prior to being uploaded to the chain. If greenwashing practices are detected in a company, it will not only face fines from regulators but also suffer consequences such as declining product sales, falling stocks, and damage to brand reputation [51,52]. Assuming that the company can only sell at cost to clear inventory, the total impact of greenwashing behavior, including the incurred fines and subsequent orders of the company, is described as A.

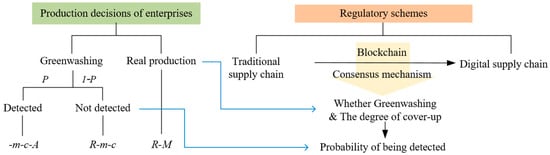

In this study, we examined the information manipulation behavior of companies greenwashing, their likelihood of being detected, and the conditions that motivate companies to employ real green production according to the principle of maximizing corporate profits. Figure 1 presents the theoretical framework for greenwashing a core company in the supply chain.

Figure 1.

Theoretical framework.

3.2. Before the Introduction of Blockchain Technology

Information asymmetry exists between the company and the regulator during production. If a company provides accurate production information, there is no risk of misjudgment by regulators. If the company decides to engage in greenwashing, the regulator can only obtain incomplete information about the production process and has a probability p of detecting fraud in the core company (0 < p < 1). Regarding the incompleteness of information, information is classified into “information verifiable from third parties” (e.g., information on company orders, inventory, logistics, and others) and “hard-to-verify information from third parties” (e.g., corporate governance level, entrepreneurial character, and others) according to different characteristics. The probabilities p from the verifiable and hard-to-verify information are denoted as and , respectively. Simultaneously, to verify the authenticity of the information provided by the core company regarding its goods, regulators investigate its upstream companies. The information is then passed along with logistics at each level, making it easier to obtain data from companies with direct transactions. The accuracy of information transmission among companies is k. Factors affecting k include the time of order occurrence, number of cooperations between companies, and location distance (0 < k < 1). There is a kp probability of detecting fraud in the core company when investigating first-level upstream companies, a k2p probability for detecting fraud when investigating its second-level upstream companies, and so on. The code for the following model derivation is available in Appendix A.

The probability that a regulator conducting due diligence on a core company and its n-level upstream companies will be detected by the company is calculated as follows:

If the company decides to greenwash, it must consider whether to implement cover-up measures and the extent of these actions, denoted as x. The greater the extent of concealment of the company, the smaller the probability of greenwashing behavior being detected and the higher the cover-up cost c. As the marginal cost of cover-up increases and perfect coverage cannot be achieved after greenwashing, the relationship between the cover-up cost and cover-up intensity can be simplified as , where b is the coefficient of the cover-up cost. The probability that the regulator will detect the company’s greenwashing behavior after taking cover-up measures is . Assuming that the core company in the supply chain possesses n upstream companies, the probability that the regulator will detect greenwashing, even after taking cover-up measures, is:

The expected profit of the core company greenwashing can be expressed as

To maximize profits, the optimal cover-up strength of the core company is

3.3. After the Introduction of Blockchain Technology

Under the DSCR model, companies record and store information on a blockchain platform, enabling regulators to collect production information seamlessly. As blockchain technology eliminates the risk of information loss during transmission, the integration of blockchain in green supply chains ensures k = 1. Only verifiable information can be recorded on the blockchain platform, resulting in an . in the DSCR model is the quality of information on the blockchain and indicates the probability that the regulator can accurately judge the production information of the core company based on the blockchain data.

Under the DSCR, the core company can manipulate source information before uploading to the chain. The probability of greenwashing behavior being detected by regulators is .

After the integration of blockchain and the green supply chain, the expected profit of the core company due to greenwashing can be expressed as:

To maximize profits, the optimal cover-up strength of the core company is:

Integrating blockchain into a supply chain can have a two-sided effect. On the one hand, it can produce a synergistic effect by promoting better information sharing among companies and enhancing information verification. This can help regulators identify the greenwashing behavior of the core company, which may contradict the information provided by affiliated companies. Contrastingly, the protective effect of using blockchain technology may motivate companies to further cover up their greenwashing practices, as regulators can gain a more comprehensive understanding of their operations.

4. Example Analysis

In this study, numerical simulations were used to compare the differences between traditional regulation (TR) and DSCR from three perspectives, assuming that there are three upstream companies in the core of the supply chain. The numerical simulations were performed using Python 3.12 with the following parameters: , , , , , , , and . Different parameter settings did not alter the main trend of the curve and only affected specific values. The model code is in Appendix A.

4.1. Conditions for Companies to Provide True Green Information

Proposition 1.

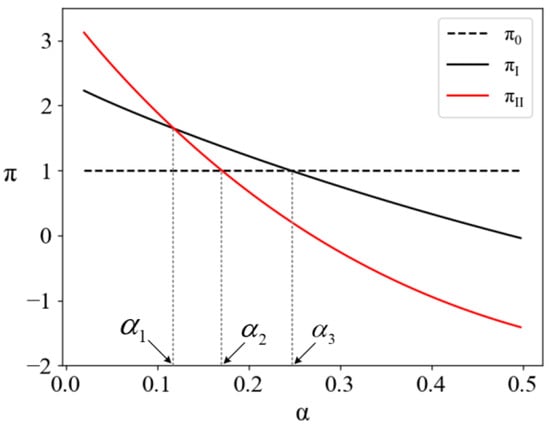

When companies upload low-quality information to the blockchain, they can expect increased returns after greenwashing in the DSCR mode. However, when quality is high, companies engaged in greenwashing can anticipate higher returns under the TR model.

Figure 2 illustrates the economic implications of Proposition 1, where point represents the intersection of company greenwashing gains under the two regulatory models as the quality of on-chain information increases. If the quality of the on-chain information is low, the verifiable information obtained by the regulator from the blockchain technology platform will have limited utility in verifying the authenticity of company production information in the DSCR mode. Additionally, companies may engage in more aggressive cover-up tactics due to the protective features of blockchain technology. However, high-quality information allows regulators to access more reliable and verifiable data, thereby enhancing the verification process in the DSCR model. This, in turn, reduces the expected benefits for companies engaged in greenwashing.

Figure 2.

Profit Comparison: Greenwashing vs. Genuine Production under TR/DSCR (α: 0–1; Profit Unit: Million CNY).

Proposition 2.

When the quality of information uploaded to a blockchain by on-chain companies or the quality of verifiable information in TR mode is low, companies choose greenwashing. Companies provide real green-product information.

In Figure 2, represents the profit that a company can obtain through real green production, and and represent the intersection of the profits from real production and greenwashing by companies under the two regulatory models, respectively. As shown, a company will only abandon greenwashing when its expected profit is lower than that of real green production. When the core company uploads low-quality information to the blockchain, taking cover-up measures after greenwashing creates substantial information asymmetry, putting the regulator at a disadvantage. In such cases, the regulator is more inclined to choose the higher expected profit from greenwashing rather than real green production. When regulators have access to higher-quality verifiable information to identify greenwashing behavior, the core company receives fewer expected benefits from greenwashing and is more likely to employ real green production. indicates that a core company under DSCR is more likely to provide true information when certain conditions are satisfied.

Proposition 3.

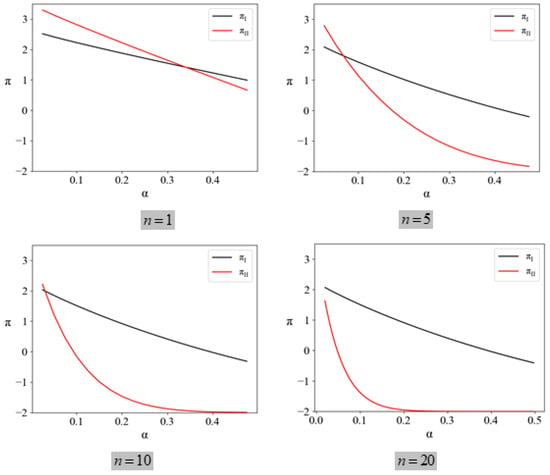

In the DSCR model, the benefits of greenwashing significantly decrease as the number of companies in the blockchain increases. When the number of companies is sufficiently large, the DSCR model outperforms the TR model in reducing the probability of greenwashing, even if the quality of the on-chain information is low.

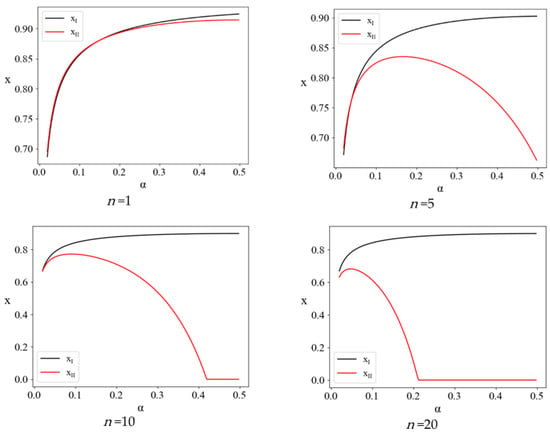

Figure 3 shows that as the number of companies on the blockchain increases, the value of corresponding to the intersection point decreases. This indicates that the DSCR can reduce the quality requirements of on-chain information to some extent. As the number of companies on the blockchain increases, the distance between the curves corresponding to the TR and DSCR models increases, suggesting that the DSCR can more effectively support regulators in obtaining real and useful production information from companies. When the quantity and quality of on-chain information are sufficiently high, the aggregated data formed by the blockchain will closely mirror real-world data, and fraudulent behaviors such as greenwashing will be detected easily, thereby reducing the willingness of companies to engage in such practices. This finding clarifies the number of supply chain companies for which blockchain technology can be applied in regulatory oversight. Encouraging more companies to upload information to the chain can help build a credible environment for supply chain information and represents a crucial direction for the future application of blockchain technology.

Figure 3.

TR vs. DSCR Profit Trends with Increasing Blockchain Nodes (n = 1–20).

4.2. Green Information Manipulation Behavior of the Company

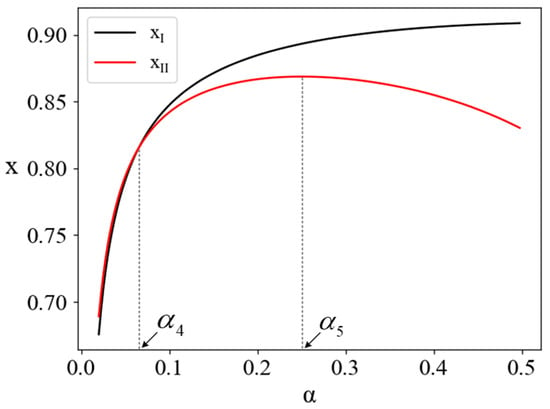

Proposition 4.

When the information quality on the blockchain is sufficiently high to meet , the level of company information manipulation under the DSCR mode is lower, and the positive effect of the blockchain exceeds its negative effect. However, when the quality of on-chain information cannot reach this threshold, the level of information manipulated by companies after using the blockchain is higher. Specifically, the negative effects of blockchain exceed its positive effects.

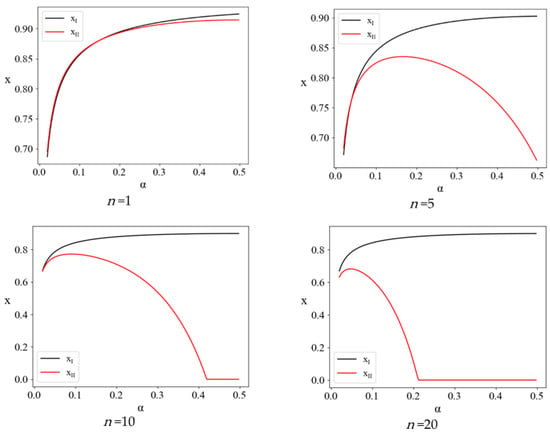

Figure 4 illustrates the economic implications of Proposition 4. Overall, after blockchain is applied to the supply chain, its open and transparent technical characteristics limit the information manipulation capability of the core company, and DSCR exhibits a greater advantage in terms of reducing company cover-up behavior. Unless there are few companies in the supply chain and the quality of information on the blockchain is extremely low , the core company has a greater incentive to manipulate the small amount of verifiable information available to the regulator in the DSCR mode, as the regulator does not have access to hard-to-verify data. In this case, it would be more advantageous in the TR mode, where the regulator has access to more hard-to-verify information. As the quality of on-chain information improves, the aggregated data formed by the blockchain will more closely align with real-world information. Even if a company experiences high cover-up costs, it is still challenging to considerably influence the ability of the regulator to verify the authenticity of production data. Given the trade-off between the costs and benefits of implementing cover-up measures, the level of a company’s cover-up measures is lower than that of the TR model.

Figure 4.

Comparison of the optimal cover-up strength of companies.

Proposition 5.

Under the DSCR model, when on-chain data quality is relatively low, the “protective effect” predominates; in contrast, when on-chain data quality is relatively high, the “synergy effect” predominates.

As presented in Figure 4, under the TR, as the quantity of verifiable information increases, the company will gradually increase its cover-up efforts to avoid suffering losses in brand reputation and order reduction. Under the DSCR model, companies’ greenwashing behavior exhibits a trend of first increasing and then decreasing with improvements in on-chain information quality. When on-chain information quality is low , company cover-up efforts increase as the quality of on-chain information improves. This reflects the protective effect of blockchain, which increases the company’s incentive to manipulate information after engaging in greenwashing. When the quality of blockchain on-chain information is higher , the advantage of blockchain technology in reducing the motivation of a company to manipulate information increases considerably. The improvement in on-chain data quality also implies that supply-chain companies share information more fully among themselves and that information verification is more collaborative. As the number of companies increases, the “synergistic effect” becomes more prominent, and the willingness of the core company to cover up fraud decreases. In some cases, the core company may be unwilling to cover them. Therefore, the core company’s cover-up efforts initially increase and then decrease.

Additionally, we examined cases wherein the number of companies in the supply chain is high.

Proposition 6.

In the DSCR model, a core company’s incentive to manipulate information decreases as the number of upstream companies increases. Eventually, when the number of upstream companies approaches infinity, the core company loses its incentive to manipulate information (Figure 5).

Figure 5.

Changes in the optimal cover-up strength of the core company under different numbers of companies.

The information transmission loss of upstream companies that do not directly transact with the core company under the TR model is extremely serious. The investigation of upstream companies becomes increasingly meaningless as the hierarchy increases because any useful information that can be obtained is negligible. Compared with traditional investigation methods, information transmission in a blockchain is loss-free. In the DSCR model, the critical point at which a company gives up coverage shifts significantly to the left as the number of upstream companies on the blockchain increases. This suggests that the greater the number of on-chain companies, the greater the synergistic effect of the blockchain. Furthermore, when the number of on-chains is sufficiently high, the TR and DSCR no longer intersect, and company cover-up efforts under the TR are always higher than those under the DSCR.

4.3. The Probability of Greenwashing Being Detected

Proposition 7.

The probability that a core company will still be detected by regulators after covering up their actions increases with the quality of on-chain data and cover-up costs and decreases with the risk of greenwashing.

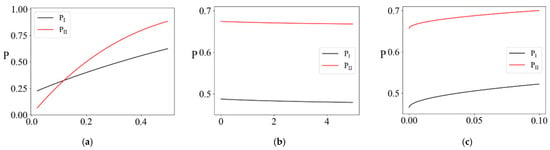

When the on-chain information quality is very low (on the left side of the intersection point in Figure 6a), there is high information asymmetry between the core company and regulator in the DSCR mode. In this case, if the core company exhibits greenwashing behavior, there is a high probability that it will not be detected by a regulator with minimal coverage. In contrast, under the DSCR model, when the on-chain information quality is high on the right side of the intersection point in Figure 6a), the associated companies can provide more accurate information to the regulator, and the regulator can assess these data to verify the production behavior of the core company. Proposition 4 indicates that the core company is less likely to cover up when the information quality in the chain is higher than under TR. Thus, regulators have a greater certainty in detecting evidence of corporate greenwashing. It is clear that the probability of regulators detecting greenwashing in the core company is negatively correlated with the risk of greenwashing and positively correlated with cover-up costs (Figure 6b,c). The greater the risk of greenwashing, the smaller the expected benefit. If the consequences of greenwashing are serious, the core company will be willing to pay higher coverage costs to avoid greater risks. The greater the cover-up efforts, the lower the probability that regulators will detect fraud. However, as the costs of manipulating information increase, cover-up efforts decrease, leading to a higher probability of detection by regulators from a profit maximization perspective. These two factors influence and constrain each other, but their impact on the probability of greenwashing being detected is far less than the impact of changes in the proportion of greenwashing.

Figure 6.

Comparison of the probability of a core company being detected for greenwashing.

Furthermore, we examine the case in which the number of companies in a supply chain is high.

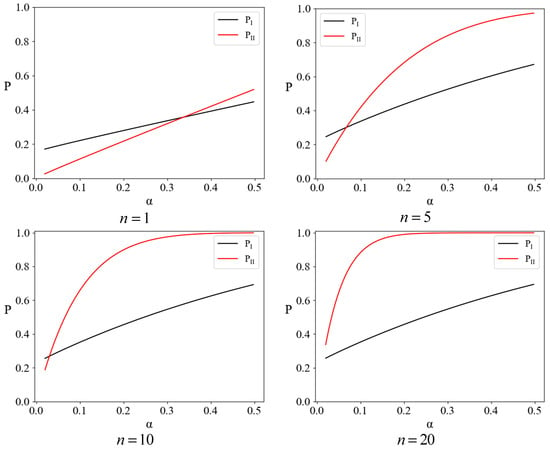

Proposition 8.

Under the DSCR model, along with an increase in the number of companies in the supply chain, the DSCR regulatory model significantly improves the efficiency and accuracy of regulator verification compared with the TR regulatory model.

As the number of on-chain companies increases, the curve under the DSCR model shifts significantly upward, and the point at which the extreme value is reached decreases, as shown in Figure 7. This is due to the knowledge that information under DSCR is transmitted without loss, and onboarding more companies to the blockchain provides more comprehensive information that the regulator can obtain. When the number of on-chain companies is sufficiently high, even if the on-chain information quality is not very high, the regulator can still determine the core company’s greenwashing behavior. As the number of supply chain companies increases, the curve under TR barely changes, and as the distance between companies in the upstream supply chain increases, information loss becomes more serious. Notably, it is challenging for regulators to increase the availability of information, even if they continue to check upstream companies.

Figure 7.

Variation in the probability of a core company’s greenwashing being detected for different numbers of companies.

5. Conclusions, Implications and Directions for Future Studies

5.1. Summary of Findings

In this study, we constructed a theoretical model of the greenwashing behavior of core enterprises in supply chain networks, analyzed the differences in management efficacy between the DSCR and TR models, and revealed how blockchain technology enhances regulatory reliability. The findings show that under varying supply chain scales and information quality conditions, the two models exhibit distinct management advantages. When the number of enterprises is limited or the on-chain information quality is poor, the offline due diligence of TR is more effective in mitigating corporate moral hazards. However, as supply chain networks expand and on-chain information quality improves, the use of blockchain technology by DSCR through cross-verification mechanisms among associated enterprises considerably enhances verification accuracy and management efficiency. This is in line with Cong and He (2019) [53], who show that when blockchain participation reaches sufficient scale, the consensus information formed will converge toward real-world truth.

From a management perspective, this study highlights the success factors for DSCR. TR faces considerable information asymmetry owing to numerous market entities and complex transaction relationships, presenting opportunities for innovation in DSCR. Furthermore, the inherent network attributes of supply chains provide favorable conditions for DSCR; a large base of enterprises participating in on-chain data and transactional correlations among them facilitate the construction of a cross-verification-based information management system, addressing the verification challenges of TR.

From a practical standpoint, the blockchain technology not only deepens information collaboration in DSCR but also demonstrates unique advantages in privacy protection and authorized sharing owing to its decentralized nature. This helps break down data silos among supply chain enterprises, promotes effective credit information transmission, and provides innovative tools for building an environmentally sustainable supply chain ecosystem. This is in line with Soori et al. (2024) [54], who show that blockchain facilitates sustainable supply chain management in Industry 4.0, transcending conventional supply chain paradigms. The blockchain-based DSCR model represents a new management paradigm that drives the transformation and improvement of regulatory systems through technological innovation and offers new approaches to modern supply chain management.

5.2. Policy and Management Implications

First, a scalable blockchain ecosystem enhances network synergy. Research has shown that the ability of blockchain to reduce information asymmetry is positively correlated with the number of enterprises in the chain. Currently, the focus should be on addressing the high costs and technical challenges faced by small–medium enterprises. It is recommended that the government leads the development of industry-level blockchain public service platforms by integrating modular tools and standardized interfaces. Industry associations should coordinate core supply chain enterprises and their partners to create a cross-entity data-sharing framework. Differentiated incentives, such as subsidies for the hardware and software costs of SMEs, VAT refunds for enterprises meeting annual data interaction targets, and innovation funds to support use cases, such as supply chain finance and carbon footprint tracking, should be implemented. Pilot projects in industries with long supply chains, such as new energy vehicles and green building materials, should automate key data verification (e.g., production and logistics) via APIs, expand network nodes, and leverage blockchain’s cross-verification advantages.

Second, a comprehensive data quality control system ensures information credibility. High-quality data is essential for effective digital supply chain oversight. The Ministry of Industry and Information Technology should develop “Technical Standards for Supply Chain Data On-Chaining,” defining structured formats and metadata standards for core data like raw material procurement and production processes. Enterprises must use certified IoT devices for automated data collection. Machine learning-based adaptive systems should be deployed for data cleaning with dynamic threshold models for areas such as cold food chains and carbon emissions to intercept and correct anomalies in real time. A mutual data review mechanism among supply chain nodes should be established, requiring supplier delivery data to be confirmed by purchasers’ blockchain signatures and logistics data to be verified by both carriers and receivers. This multi-entity cross-verification builds a trustworthy data loop, addressing the issue of “on-chaining for the sake of on-chaining” and ensuring the quality and effectiveness of blockchain applications.

Third, we reform the disciplinary mechanism for greenwashing to internalize violation costs. To address the imbalance between “fraud gains” and “punishment costs” identified in this study, a strong deterrent system is required. First-time offenders should face fines of 3–5 times their illicit gains, while repeat violators should be subject to supply chain bans, including exclusion from government procurement, restricted financial credit, and revoked industry qualifications. Blockchain smart contracts should be used to record greenwashing in the “National Supply Chain Credit Database,” establish whistleblower protection, create a dedicated compliance reporting channel, and reward informants with 20% of the fines for verified cases. Listed companies must disclose supply chain compliance reviews in their annual reports. This multidimensional approach, combining economic penalties, credit sanctions, and social oversight, can reshape the cost dynamics of greenwashing and drive businesses toward standardized practices.

Finally, regarding solutions for small and medium-sized enterprises (SMEs) inclusivity, the government could lead in establishing an industry-level blockchain service platform. SMEs would subscribe to modular services (such as data on-chain storage and audit interfaces) based on their needs, with annual fees capped at CNY 50,000. Alternatively, core supply chain enterprises could be required to cover 50% of the on-chain costs for upstream and downstream SMEs, which would serve as an ESG rating bonus.

5.3. Limitations

This study presents valuable theoretical insights into blockchain-enabled supply chain regulation, with several constructive optimization directions to enhance its robustness and practical relevance. First, empirical support could be strengthened by incorporating real-world validation, such as pilot case studies or industry data, to substantiate core theoretical propositions (e.g., the relationship between on-chain information quality and greenwashing mitigation effects). Second, methodological clarity may be improved by simplifying complex mathematical models with intuitive explanations and visual aids, while explicitly justifying key assumptions (e.g., blockchain’s role in ensuring information quality) with relevant literature or technical evidence. Additionally, exploring context-specific applicability (e.g., industry differences in supply chain structures) would enhance the generalizability of findings. These refinements would help bridge the gap between theoretical insights and practical application, enhancing this study’s overall impact.

5.4. Future Research

Some directions for guiding future research are as follows: First, this study proposes that increasing the number of companies in the supply chain on the blockchain is necessary to build a credible supply chain ecology; however, information transparency will become difficult if participants cannot be convinced to use blockchain. One future research direction to consider is the construction cost of blockchain platforms and the application cost of blockchain technology in modeling, and to explore the establishment of DSCR from the perspective of government-company interactions. Meanwhile, further consideration should be given to empirical research and the application of theory in subsequent research. Research [55] has found that blockchain networks using Proof of Work (PoW) mechanisms, such as Bitcoin, consume approximately 75.4 terawatt-hours of electricity annually, which is equivalent to the total electricity consumption of Austria. Each transaction on these networks results in a carbon emission of about 48.1 kg CO2e. In contrast, blockchain networks using Proof of Stake (PoS), such as Ethereum 2.0, can reduce energy consumption by 99.95%. Under the PoS model, Ethereum 2.0’s annual carbon footprint can be as low as 2088 tCO2e per year. The carbon footprint of blockchain technology is a significant consideration and could be incorporated as a variable in future research. Additionally, as governments have widely implemented different carbon emission control policies, studying the impact of different environmental policies on the green production and greenwashing behavior of companies as well as the sustainability performance of supply chains represents another valuable research direction.

Author Contributions

Conceptualization, H.P.; Methodology, H.P.; Software, P.W.; Validation, S.Z.; Formal analysis, H.P. and S.Z.; Investigation, S.Z.; Data curation, P.W. and S.Z.; Writing—original draft, P.W.; Writing—review and editing, H.P. and S.Z.; Visualization, P.W.; Supervision, H.P.; Project administration, H.P. and P.W.; Funding acquisition, H.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

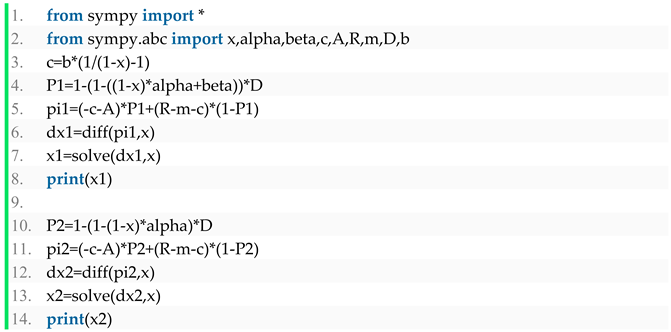

Appendix A. Proof of the Model

We use Python 3.12 to derive the optimal solution for and , and the code is as follows:

According to the output results, we can obtain:

Appendix B. Proof of Propositions

Proof of Proposition 1.

- Step 1: When :

- 1.

- Compare the limits of and :

In the denominator of , the product term is a constant . At this point, . Under the condition , we obtain , so converges to a constant.

In the denominator of , , hence , which also converges to a constant.

- 2.

- Compare the limits of and :

is a constant.

, approaching zero.

- 3.

- Compare and :

From , it follows that .

- Step 2: When :

- 1.

- The difference between and :

Since the denominator of is positive, .

- 2.

- The limit of :

When is , therefore .

- 3.

- The limit of :

Since is a constant between 0 and 1, tends to be a value less than 1.

- 4.

- Compare and :

Since and , we have .

- 5.

- (negative) × (negative) = positive.

Thus, > when .

- Step 3:

Due to and (see Proof of proposition 7 for details of the proof process).

So , the same reasoning applies .

To sum up, when tends to 0, ; when tends to 1, . Additionally, both and are monotonically decreasing in . Therefore, proposition 1 holds. □

Proof of Proposition 2.

- Step 1: When

Its derivative is: .

When , the product term is approximated as a constant . Since . Therefore

It is known that , and are positive numbers between 0 and 1.

If: , then: > R − m.

- Step 2: When

To verify that when , we need to verify that .

It is known that , and . The expression on the left is a negative number multiplied by , which results in a negative number; on the right is a positive number. Therefore: when , the inequality holds.

Similarly, it can be verified that when , ; when , .

To sum up, when the parameters satisfy certain conditions and tends to 0,; when tends to 1, . Additionally, both and are monotonically decreasing with respect to . Therefore, proposition 2 holds. □

Proof of Proposition 3.

Since the coefficient , to prove requires a proof of .

When is , therefore .

When , the product term converges to a constant C > 0. Substituting , we obtain .

Simplified .

When is , and the expression needs to be satisfied:

Squaring both sides and collating gives: .

From the known conditions , we have , therefore: .

So, when and , , thus:

In summary, when is > , therefore proposition 3 holds. □

Proof of Proposition 4.

Extracting public factors: .

Order , where .

Determine the monotonicity of with respect to :

As increases, increases dramatically (as the denominator decreases).

The product term decreases as increases (each factor decreases), so is increasing, but at a slower rate (as exponentially decays, the product term decays gently).

Calculate the derivative of : .

Since , the denominator , and all terms are positive, . Therefore, increases monotonically with .

Since is increasing with respect to and decreases with increasing (but the overall magnitude is dominated by ), is monotonically increasing with respect to .

When .

In summary, proposition 4 is proven. □

Proof of Proposition 5.

Let the denominator be , then .

Simplified:

Extract the common factor : .

Since and , the derivative sign is determined by :

When is , so , the function is increasing;

When is , so , the function decreases.

The function attains a maximum at .

In summary, the function image of with respect to is monotonically increasing followed by monotonically decreasing. Therefore, proposition 5 holds. □

Proof of Proposition 6.

As tends to positive infinity, in the denominator tends to 0 due to , causing the entire denominator also tend to 0. At this point, the fraction tends to positive infinity, so will tend to .

Since in this paper, is the minimum value in the range that makes it meaningful when tends to positive infinity, i.e., .

In summary, as n tends to positive infinity, tends to 0. Thus proposition 6 holds. □

Proof of Proposition 7.

- Step 1: on the monotonicity of

When is increased:

An increase in the denominator results in an increase in , which in turn decreases the value of .

The product term decreases as increases.

Combined effect: , i.e., monotonically increasing with respect to .

Step 2: on the monotonicity of .

occurs only in the denominator of , obviously .

As increases, increases. The product term is independent of and remains unchanged.

Thus , i.e., is monotonically decreasing with respect to .

Step 3: on the monotonicity of .

occurs only in the molecules of : .

As increases, the value inside the root sign increases, causing to decrease, which in turn causes to decrease.

The product term is independent of and remains unchanged.

Therefore, , i.e., is monotonically increasing with respect to .

In summary, and are monotonically increasing with respect to and , and monotonically decreasing with respect to . Therefore, proposition 7 holds. □

Proof of Proposition 8.

By Proposition 6, when tends to positive infinity, .

As tends to infinity, the key term is . Since , there is: .

In summary, as n tends to infinity, tends to 1. Thus proposition 8 holds. □

References

- Zeng, M.; Zheng, L.; Huang, Z.; Cheng, X.; Zeng, H. Does vertical supervision promote regional green transformation? Evidence from Central Environmental Protection Inspection. J. Environ. Manag. 2023, 326, 116681. [Google Scholar] [CrossRef] [PubMed]

- Ozorhon, B.; Batmaz, A.; Caglayan, S. Generating a framework to facilitate decision making in renewable energy investments. Renew. Sustain. Energy Rev. 2018, 95, 217–226. [Google Scholar] [CrossRef]

- Arouri, M.; El Ghoul, S.; Gomes, M. Greenwashing and product market competition. Financ. Res. Lett. 2021, 42, 101927. [Google Scholar] [CrossRef]

- Farooq, Y.; Wicaksono, H. Advancing on the analysis of causes and consequences of green skepticism. J. Clean. Prod. 2021, 320, 128927. [Google Scholar] [CrossRef]

- Liu, C.; Song, Y.; Wang, W.; Shi, X. The governance of manufacturers’ greenwashing behaviors: A tripartite evolutionary game analysis of electric vehicles. Appl. Energy 2023, 333, 120498. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L. Does Greenwashing Pay Off? Understanding the Relationship Between Environmental Actions and Environmental Legitimacy. J. Bus. Ethics 2017, 144, 363–379. [Google Scholar] [CrossRef]

- Zerbib, O.D. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. J. Bank. Financ. 2019, 98, 39–60. [Google Scholar] [CrossRef]

- Zhao, N.; Xia, T.; Yu, T.; Liu, C. Subsidy-Related Deception Behavior in Energy-Saving Products Based on Game Theory. Front. Energy Res. 2020, 7, 154. [Google Scholar] [CrossRef]

- Zhang, S.; Niu, Y.; Zhang, J.; Li, J.; Wang, S.; Guan, Y. Effects of Supply Chain Digitization on Different Types of Corporate Green Innovation: Empirical Evidence from Double Machine Learning (DML). Sustainability 2025, 17, 7509. [Google Scholar] [CrossRef]

- Bromley, P.; Powell, W.W. From Smoke and Mirrors to Walking the Talk: Decoupling in the Contemporary World. Acad. Manag. Ann. 2012, 6, 483–530. [Google Scholar] [CrossRef]

- Delmas, M.A.; Burbano, V.C. The drivers of greenwashing. Calif. Manag. Rev. 2011, 54, 64–87. [Google Scholar] [CrossRef]

- Yu, E.P.-y.; Van Luu, B.; Chen, C.H. Greenwashing in environmental, social and governance disclosures. Res. Int. Bus. Financ. 2020, 52, 101192. [Google Scholar] [CrossRef]

- Martínez, M.P.; Cremasco, C.P.; Gabriel Filho, L.R.A.; Braga Junior, S.S.; Bednaski, A.V.; Quevedo-Silva, F.; Correa, C.M.; da Silva, D.; Moura-Leite Padgett, R.C. Fuzzy inference system to study the behavior of the green consumer facing the perception of greenwashing. J. Clean. Prod. 2020, 242, 116064. [Google Scholar] [CrossRef]

- Lin, J.; Lin, S.; Benitez, J.; Luo, X.; Ajamieh, A. How to build supply chain resilience: The role of fit mechanisms between digitally-driven business capability and supply chain governance. Inf. Manag. 2023, 60, 103747. [Google Scholar] [CrossRef]

- Yi, E. Corporate governance, information disclosure and investment—Cash flow sensitivity. Financ. Res. Lett. 2023, 55, 103942. [Google Scholar] [CrossRef]

- Bai, Q.; Chen, J.; Xu, J. Energy conservation investment and supply chain structure under cap-and-trade regulation for a green product. Omega 2023, 119, 102886. [Google Scholar] [CrossRef]

- Ma, X.; Zhang, K.; Li, T. Research on Government–Enterprise Collaborative Recycling Strategies: An Examination of Consumer Value Perception in the Context of Carbon Generalized System of Preferences. Sustainability 2025, 17, 7462. [Google Scholar] [CrossRef]

- Li, Q.-X.; Ji, H.-M.; Huang, Y.-M. The information leakage strategies of the supply chain under the block chain technology introduction. Omega 2022, 110, 102616. [Google Scholar] [CrossRef]

- Mangla, S.K.; Kazancoglu, Y.; Ekinci, E.; Liu, M.; Özbiltekin, M.; Sezer, M.D. Using system dynamics to analyze the societal impacts of blockchain technology in milk supply chainsrefer. Transp. Res. Part E Logist. Transp. Rev. 2021, 149, 102289. [Google Scholar] [CrossRef]

- Letunovska, N.; Owusu-Mensah, M.M.; Bonsu, D.O.; Offei, F.A. The Boundary Conditions of Information Sharing and Sustainability: The Mediating Role of Supply Chain Resilience. Sustainability 2025, 17, 7266. [Google Scholar] [CrossRef]

- Shi, X.; Chan, H.L.; Dong, C. Value of Bargaining Contract in a Supply Chain System With Sustainability Investment: An Incentive Analysis. IEEE Trans. Syst. Man Cybern. Syst. 2018, 50, 1622–1634. [Google Scholar] [CrossRef]

- Zhang, D.; Jin, Y. R&D and environmentally induced innovation: Does financial constraint play a facilitating role? Int. Rev. Financ. Anal. 2021, 78, 101918. [Google Scholar]

- Gatti, L.; Pizzetti, M.; Seele, P. Green lies and their effect on intention to invest. J. Bus. Res. 2021, 127, 228–240. [Google Scholar] [CrossRef]

- Dong, C.; Huang, Q.; Pan, Y.; Ng, C.T.; Liu, R. Logistics outsourcing: Effects of greenwashing and blockchain technology. Transp. Res. Part E Logist. Transp. Rev. 2023, 170, 103015. [Google Scholar] [CrossRef]

- Guo, R.; Tao, L.; Li, C.B.; Wang, T. A path analysis of greenwashing in a trust crisis among Chinese energy companies: The role of brand legitimacy and brand loyalty. J. Bus. Ethics 2017, 140, 523–536. [Google Scholar] [CrossRef]

- Hong, Z.; Guo, X. Green product supply chain contracts considering environmental responsibilities. Omega 2019, 83, 155–166. [Google Scholar] [CrossRef]

- Wen, H.; Lee, C.C.; Zhou, F. How does fiscal policy uncertainty affect corporate innovation investment? Evidence from China’s new energy industry. Energy Econ. 2022, 105, 105767. [Google Scholar] [CrossRef]

- Zhang, D. Subsidy expiration and greenwashing decision: Is there a role of bankruptcy risk? Energy Econ. 2023, 118, 106530. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, K.; Xie, J. Bad greenwashing, good greenwashing: Corporate social responsibility and information transparency. Manag. Sci. 2020, 66, 3095–3112. [Google Scholar] [CrossRef]

- Roulet, T.J.; Touboul, S. The Intentions with Which the Road is Paved: Attitudes to Liberalism as Determinants of Greenwashing. J. Bus. Ethics 2015, 128, 305–320. [Google Scholar] [CrossRef]

- Cho, C.H.; Laine, M.; Roberts, R.W.; Rodrigue, M. Organized hypocrisy, organizational faades, and sustainability reporting. Account. Organ. Soc. 2015, 40, 78–94. [Google Scholar] [CrossRef]

- Mateo-Márquez, A.J.; González-González, J.M.; Zamora-Ramírez, C. An international empirical study of greenwashing and voluntary carbon disclosure. J. Clean. Prod. 2022, 363, 132567. [Google Scholar] [CrossRef]

- Hsueh, L. Voluntary climate action and credible regulatory threat: Evidence from the carbon disclosure project. J. Regul. Econ. 2019, 56, 188–225. [Google Scholar] [CrossRef]

- Bowen, F. After Greenwashing: Symbolic Corporate Environmentalism and Society; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Siano, A.; Vollero, A.; Conte, F.; Amabile, S. “More than words”: Expanding the taxonomy of greenwashing after the Volkswagen scandal. J. Bus. Res. 2017, 71, 27–37. [Google Scholar] [CrossRef]

- Tang, S.; Demeritt, D. Climate change and mandatory carbon reporting: Impacts on business process and performance. Bus. Strategy Environ. 2018, 27, 437–455. [Google Scholar] [CrossRef]

- Choi, T.-M.; Feng, L.; Li, R. Information disclosure structure in supply chains with rental service platforms in the blockchain technology era. Int. J. Prod. Econ. 2020, 221, 107473. [Google Scholar] [CrossRef]

- Dutta, P.; Choi, T.-M.; Somani, S.; Butala, R. Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transp. Res. Part E Logist. Transp. Rev. 2020, 142, 102067. [Google Scholar]

- Friedman, N.; Ormiston, J. Blockchain as a sustainability-oriented innovation?: Opportunities for and resistance to Blockchain technology as a driver of sustainability in global food supply chains. Technol. Forecast. Soc. Change 2022, 175, 121403. [Google Scholar]

- Yousefi, S.; Tosarkani, B.M. An analytical approach for evaluating the impact of blockchain technology on sustainable supply chain performance. Int. J. Prod. Econ. 2022, 246, 108429. [Google Scholar] [CrossRef]

- Zhang, T.; Dong, P.; Chen, X.; Gong, Y. The impacts of blockchain adoption on a dual-channel supply chain with risk-averse members. Omega 2023, 114, 102747. [Google Scholar]

- Lu, W.; Jiang, Y.; Chen, Z.; Ji, X. Blockchain adoption in a supply chain system to combat counterfeiting. Comput. Ind. Eng. 2022, 171, 108408. [Google Scholar] [CrossRef]

- Bajra, U.Q.; Ermir, R.; Avdiaj, S. Cryptocurrency blockchain and its carbon footprint: Anticipating future challenges. Technol. Soc. 2024, 77, 102571. [Google Scholar] [CrossRef]

- Li, X.; Liu, Q.; Wu, S.; Cao, Z.; Bai, Q. Game theory based compatible incentive mechanism design for non-cryptocurrency blockchain systems. J. Ind. Inf. Integr. 2023, 31, 100426. [Google Scholar] [CrossRef]

- Zhang, L.; Zhang, Z.; Li, T.; Zhang, S. A consensus-based solution for cryptocurrencies arbitrage bots in intelligent blockchain. Digit. Commun. Netw. 2025, 11, 700–710. [Google Scholar] [CrossRef]

- Burgess, P.; Sunmola, F.; Wertheim-Heck, S. Information needs for transparency in blockchain-enabled sustainable food supply chains. Int. J. Inf. Manag. Data Insights 2024, 4, 100262. [Google Scholar] [CrossRef]

- Li, P.; Guo, X.; Wang, F.; Zhang, Q. Digital transformation and corporate innovation boundaries: Role of supply chain concentration and transparency. Int. Rev. Financ. Anal. 2025, 98, 103922. [Google Scholar] [CrossRef]

- Sègbotangni, E.A.; Laguir, I.; Gupta, S. Exploring the effect of supply chain integration and supply chain transparency on SME environmental performance under conditions of environmental unpredictability. J. Environ. Manag. 2025, 375, 124225. [Google Scholar] [CrossRef]

- Lim, M.K.; Li, Y.; Wang, C.; Tseng, M.-L. A literature review of blockchain technology applications in supply chains: A comprehensive analysis of themes, methodologies and industries. Comput. Ind. Eng. 2021, 154, 107133. [Google Scholar] [CrossRef]

- Borah, M.D.; Naik, V.B.; Patgiri, R.; Bhargav, A.; Phukan, B.; Basani, S.G. Supply chain management in agriculture using blockchain and IoT. In Advanced Applications of Blockchain Technology; Springer: Berlin/Heidelberg, Germany, 2020; pp. 227–242. [Google Scholar]

- Huang, R.; Xie, X.; Zhou, H. ‘Isomorphic’ behavior of corporate greenwashing. Chin. J. Popul. Resour. Environ. 2022, 20, 29–39. [Google Scholar] [CrossRef]

- Matejek, S.; Gössling, T. Beyond legitimacy: A case study in BP’s “green lashing”. J. Bus. Ethics 2014, 120, 571–584. [Google Scholar] [CrossRef]

- Cong, L.W.; He, Z. Blockchain Disruption and Smart Contracts. Rev. Financ. Stud. 2019, 32, 1754–1797. [Google Scholar] [CrossRef]

- Soori, M.; Jough, F.K.G.; Dastres, R.; Arezoo, B. Blockchains for industrial Internet of Things in sustainable supply chain management of industry 4.0, a review. Sustain. Manuf. Serv. Econ. 2024, 3, 100026. [Google Scholar] [CrossRef]

- Shi, X.; Xiao, H.; Liu, W.; Lackner, K.S.; Buterin, V.; Stocker, T.F. Confronting the Carbon-Footprint Challenge of Blockchain. Environ. Sci. Technol. 2023, 57, 1403–1410. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).