Abstract

Shifting urban land from planned to marketed allocation is an essential aspect of China’s economic market reform. However, its impact on carbon emissions has not been directly examined. Using prefecture-level urban panel data from 1997 to 2017, we empirically test the effect and mechanism of land transfer marketization (LTM) on carbon emissions. The results show that the LTM can significantly reduce urban CO2 emissions. Specifically, a unit increase in the degree of LTM can decrease total urban CO2 emissions by 3% and carbon intensity by 2.4%. The main transmission mechanism is attributed to three effects of land transfer: (1) Structural effect. LTM increases the supply of commercial service land and reduces that of industrial land, thereby reducing the total urban carbon emissions. (2) Resource allocation effect. LMT will screen out efficient enterprises and promote the reduction of carbon emissions. (3) Financing effect. By enhancing the ability of governments and businesses to finance, LTM can facilitate the introduction of green industries and improve the research of low-carbon technologies of enterprises, thus reducing carbon emissions. The above conclusions have passed a series of robustness tests. They also show that the impacts of the LMT are heterogeneous and stronger in the Centre and West in cities with lower economic development levels and larger populations. This study validates the efficacy and underlying mechanism of LTM in significantly reducing urban carbon emissions. Consequently, it offers a framework for the formulation of policies aimed at reducing urban carbon emissions through land market reform.

JEL Classification:

O13; Q01

1. Introduction

Climate statistics indicate that the global average temperature has been increasing rapidly in recent decades compared to historical data. This has had numerous adverse effects on human survival, development, and biological diversity. Data released by the International Energy Agency shows that global energy-related carbon dioxide emissions reached more than 36.8 billion tons in 2022, which increased 321 million tons from the previous year. Scientific research indicates that incremental carbon emissions are the direct contributor to global warming, the greenhouse effect, and extreme weather [,]. These problems caused by increasing carbon emissions can directly harm people’s health and quality of life. Controlling carbon emissions and mitigating the climate crisis are thus central to advancing global sustainable development. Sustainable development aims to achieve synergistic progress in economic growth, ecological conservation, and social welfare. Environmental challenges triggered by excessive carbon emissions have become a critical bottleneck constraining the realization of sustainable development goals—not only threatening ecosystem stability but also undermining social sustainability by impacting agricultural production and public health. Therefore, reducing carbon emissions has become a major issue that needs to be addressed by all countries around the world. According to relevant research data, in 2022, global CO2 emissions reached 36.8 billion tons, with China accounting for approximately 12.1 billion tons of carbon emissions. In 2007, China surpassed the United States to become the largest emitter of CO2 in the world. Tyfield et al. [] argue that the key to global efforts to address climate change hinges upon China’s ability to balance economic development with reducing carbon emissions. Therefore, under the global consensus on combating climate change and practicing low-carbon development, China has proposed the “dual-carbon” goal, continuously advancing urban carbon emission reductions. This represents not only a significant commitment to tackling global climate challenges but also a crucial initiative aligned with core elements of the United Nations Sustainable Development Goals, such as “climate action” and “sustainable cities and communities.” It provides directional guidance for Chinese cities exploring sustainable pathways that harmonize economic development with ecological conservation.

The reform of land transfer marketization (LTM) is the most significant policy influencing the allocation of urban land resources in China, directly impacting the high-quality development of urban economies []. Following market-oriented reforms, China’s urban land supply shifted from government-led negotiated transfers or free allocations to open market-based transfers through bidding, auction, and listing (collectively termed “Bidding-Auction-Listing”). In this market-driven process, government departments set a reserve price, with the final transaction price determined by market forces. This mechanism facilitates land allocation toward high-efficiency uses. In the context of “dual carbon”, the carbon emission effect of land use has become a focal point of academic attention. Scholars have investigated the impact of land use on carbon emissions from a range of multidimensional perspectives, including land use pattern [], land structure [], and land supply [,]. According to the impact of LTM on land resource allocating, the existing literature has also investigated the effect of LTM on carbon emissions. Chen et al. [] found that non-market land grants (such as agreement transfer) increase carbon emissions. Liu et al. [] based on Chinese provincial-level panel data, find that LTM exerts a marked and stable inhibitory effect on carbon emissions. Xu et al. [] based on a panel data model found that the development of land marketization in China has a significant inverse suppression effect on carbon emission. Yang and Wu [] also found a significant negative correlation between the level of land marketization and the carbon emission effect of land use, based on a systematic GMM model. Therefore, transforming land use and management practices to enhance the level of LTM aligns with the requirements for developing a low-carbon economy []. The aforementioned studies offer valuable references and insights that can be utilized to gain a deeper understanding of the impact of land grant marketization on carbon emissions, as well as the mechanisms through which this impact is transmitted. However, on the other hand, the theoretical frameworks of the above studies are all limited to the provincial level, lacking the support of prefecture-level city data. In light of the above, this study seeks to address the following issues: firstly, using China’s 1997–2017 city-level panel data, we construct a double fixed-effects model and a mediated-effects model with the aim of exploring the relationship between LTM and urban carbon emissions. It clarifies the impact effects between the two, providing empirical support for cities to advance low-carbon development through optimized land policies. The second objective is to investigate the transmission mechanism of land transfer marketization on carbon emission reduction from the perspectives of structural effect, resource allocation effect and financing effect. This will enable the identification of the key focus point of the carbon emission reduction path. This exploration directly addresses the carbon reduction mechanism through the market-based allocation of land resources in urban sustainable development. It can help cities optimize the allocation of land resources while reducing carbon emissions, achieving the sustainable development synergy of economic benefits and ecological benefits.

This article’s potential academic implications include: (1) Providing quantitative evidence for the effect of LMT on urban CO2 emissions and offering policy support for cities advancing sustainable development through land market reforms. No studies, to our knowledge, have analyzed the direct influence of LTM on carbon emissions in Chinese cities. (2) Examining the impact mechanism of land marketization on carbon emissions from three perspectives: structural effect, resource allocation effect, and financing effect. It clarifies the specific paths through which land policies contribute to urban sustainable development, providing more targeted regulatory directions for policy makers. (3) From the perspective of land resource allocation, enriches the literature research on land resource allocation and urban carbon emissions, and provides policy suggestions for promoting urban low-carbon development and achieving “economic-ecological-social” coordinated sustainability. The rest of this article is structured as follows. The second section is institutional background. The third section is the research hypothesis. The fourth section describes the model and data. The fifth section presents an empirical analysis. The sixth section provides further analysis. The final section is conclusions and policy recommendations.

2. Institutional Background

China’s urban land allocation has gone through marketization over several decades. Since 1949, China has developed a dual system where the state owns urban land and collectives own rural land. All urban land is allocated by the government without compensation during the planned economy. However, after the reform and opening up, land transactions became increasingly market-oriented. The Land Administration Law enacted in 1986 legalized the granting of land use rights in return for compensation. As a result, urban commercial construction land changed from being allocated without compensation to being transferred with compensation gradually. The 1988 Constitutional Amendment stipulates the separation of the right to use land from the right to own it and that land transfer is to be ceded under the law. The Land Administration Law further stipulates that construction units should obtain land use rights through land transfer. Land transfer was mainly performed through agreements during this period. In May 2002, the “Regulations on the Transfer of State-owned Land Use Rights through Bidding, Auction and Listing” issued by the central government stipulates that all types of commercial lands, such as commercial, tourism, entertainment, and commercial residential land, must be sold through bidding, auction, or listing. With the market-oriented reform of commercial and residential land completed, the Central Government also promulgated the Circular of the State Council on Relevant Issues Concerning the Strengthening of Land Regulation and Control in August 2006. This notice stipulated that industrial land also must be sold through market-based approaches. Since then, urban commercial land in China has completed the transformation from gratuitous allocation and agreement transfer to open market transfer. This has brought important implications for urban economic activities and resource allocation.

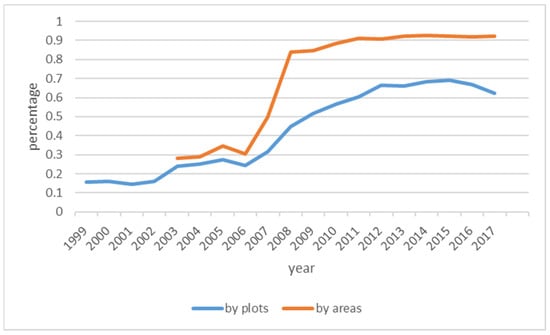

Following the implementation of the market-based reform of land disposal in 2001, the market-based level of urban land disposal has exhibited a notable increase (see Figure 1). In terms of the number of cases transferred by auction as a percentage of the total number of cases transferred, the proportion of cases transferred by auction increased from 15.48% to 62.22% between 1999 and 2017. Similarly, in terms of the area transferred by auction as a percentage of the total area transferred, the proportion of cases transferred by auction rose from 27.98% to 92.40% between 2003 and 2017.

Figure 1.

The level of urban LTM from 1999 to 2017. Data source: Statistical Yearbook of China’s Land and Resources 2000–2018.

China’s distinctive land system serves as an efficacious instrument for local governments to exert control over economic development. On the one hand, local governments exercise exclusive control over the primary land market. By leveraging its authority over land, the government seeks to stimulate investment and accelerate economic growth by increasing the availability of land during periods of economic decline, at prices that may be below market value. Conversely, land also serves as a significant conduit for capital formation. For instance, the revenue generated from land premiums reached 34.889 billion yuan in 1996, but by 2010, it had grown exponentially to 301.093 billion yuan. Concurrently, land-based financing has facilitated the expeditious accumulation of capital essential for economic advancement. From 2003 to 2015, the volume of land mortgages in 84 pivotal cities across the country increased from RMB 580 billion to RMB 113,300 billion. In accordance with China’s distinctive ‘land for development’ model, land has emerged as a pivotal driver of economic expansion [].

Nevertheless, the non-market-oriented method of land allocation(such as agreement transfer) allows for significant rent-seeking opportunities due to the lack of transparency and openness in land supply, which can lead to corruption []. This ultimately results in the inefficiency of land utilization. Transparency and openness in land supply do not directly eliminate corruption. Instead, they systematically constrain the institutional space for rent-seeking by breaking information monopolies, limiting discretionary power, and establishing price benchmarks, ultimately achieving a corruption-suppressing effect. Concurrently, local governments, pursuing the objective of economic growth, encourage investment through the lenient policy of land granting, thereby attracting a considerable number of polluting and high-energy-consuming enterprises. Furthermore, driven by economic growth targets, local governments attract a significant number of polluting and energy-consuming enterprises through loose land transfer policies, resulting in a substantial amount of energy consumption and pollution emissions. The implementation of an open, fair and just market allocation mechanism can effectively circumvent the potential for detrimental competition and rent-seeking corruption that may arise in the process of land transfer. A review of the literature reveals that market-based allocation of land resources can enhance the utilization efficiency of diverse land types [,,]. Nevertheless, the influence of market-based land allocation on carbon emissions remains underexplored. LTM has the potential to enhance energy efficiency through the optimization of industrial structures and technological advancement []. Given the intrinsic relationship between energy use efficiency and carbon emissions, it can be reasonably assumed that an increase in energy efficiency will result in a corresponding reduction in carbon emissions. In light of the aforementioned evidence, this paper proceeds to investigate and elucidate the potential impact of LTM on urban carbon emissions.

3. Theoretical Analysis and Research Hypotheses

3.1. LTM and CO2 Emissions

In the wake of reforms to fiscal decentralization and the tax-sharing system, it has become a common practice for local governments to foster local economic growth and achieve rapid industrialization through the provision of low-cost industrial land and high-cost commercial land. This not only results in the waste of land resources, but the structure of economic development with high energy consumption and high pollution also presents a significant challenge to environmental governance. Market-based land allocation achieves optimization of industrial layout by adjusting the structure of land supply, and the upgrading of the industrial structure is one of the effective measures to reduce carbon emissions []. Secondly, LTM will also have a positive impact on the allocation efficiency of land resources [], which is referred to as the resource allocation effect. Thirdly, LTM will also result in an increase in land grant and land mortgage financing, an improvement in the financing capacity of the government and enterprises, and a promotion of the expansion of financing scale. This will, in turn, facilitate the reduction of carbon emissions in terms of policy subsidies and technological innovation. In light of the aforementioned evidence, we propose the following hypothesis 1:

H1:

LTM can reduce urban carbon emissions.

For further elaboration, this paper constructs a production function including the energy sector based on the Cobb–Douglas production function.

where Y, T, L, K, E, respectively, represent economic output, land use efficiency, labour, capital, and energy consumption.

Assuming the carbon emission conversion factor for energy consumption is constant, the carbon emission efficiency of a department is calculated by multiplying energy consumption by the carbon emission conversion factor to determine carbon dioxide emissions:

Among these, CE and δ represent carbon emission efficiency and carbon emission conversion factor, respectively.

Assuming land utilization efficiency is a function of the level of LTM:

represents the level of LTM. If market-based land allocation can effectively enhance land use efficiency, then T and µ will exhibit a positive correlation.

From this we obtain the expression for the city’s carbon emission efficiency:

From the above equation, it can be concluded that the greater LTM () and the higher the land use efficiency (T), the higher the carbon emission efficiency of a single sector, and thus the lower the carbon emissions.

Next, this paper continues to extend the model to a two-sector model. The economy consists of low-carbon emission sector 1 and high-carbon emission sector 2, i.e., . Combining Equation (4), we get , then

Define IS as the industrial structure of a city. Assuming regional LTM affects industrial structure upgrading, and that IS is a function of the degree of LTM, then

Therefore, the carbon emission efficiency of the city is:

Due to , it can be seen that the higher the degree of LTM (), the more rationalised the industrial structure (IS), the higher the efficiency of carbon emissions, and thus the more carbon emissions can be reduced, which is conducive to urban carbon emission reduction.

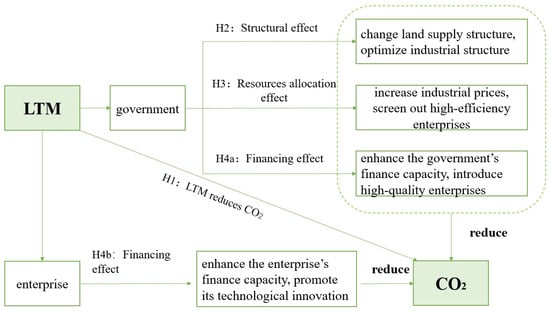

Next, this paper analyses the transmission mechanism of LTM affecting urban carbon emissions in terms of structural effect, resource allocation effect and financing effect.

3.2. The Influencing Mechanism

Before examining the specific transmission mechanisms, it is important to clarify that marketization does not equate to automatic carbon reduction but rather establishes a screening mechanism through institutional design. The core function of market-based land allocation, providing land through competitive methods such as bidding, auctions, or public listing, is to replace the inefficient logic of administrative allocation with price signals. For example, when industrial land is allocated through negotiated agreements, local governments often attract high-energy-consuming enterprises such as traditional steel mills with low prices, leading to inefficient land use and high emissions. Under market-based allocation, however, enterprises must pay prices reflecting land’s true value. High-energy-consuming enterprises exit the competition due to cost constraints, while low-carbon technology enterprises such as new energy equipment manufacturers secure land rights by leveraging higher marginal land productivity. This process does not occur automatically but rather represents an indirect screening of corporate carbon intensity through the price mechanism.

3.2.1. Structural Effect

Industrial structure upgrading refers to the systematic optimization of the proportional relationships, technological levels, value-added levels, and resource allocation methods among industries during economic development, transitioning from low to high and from crude to refined. At its core, it represents the evolution of economic activities from low-efficiency, low-value-added, high-consumption industries toward high-efficiency, high-value-added, low-consumption industries, ultimately enhancing the quality and sustainability of economic growth. This can be understood through two dimensions: First, the optimization of inter-industry structure centers on the dynamic adjustment of the proportion of the three sectors, with primary representing agriculture, secondary representing industry, and tertiary representing services. This progressive shift from agriculture to industry to services represents the most tangible manifestation of industrial upgrading, reflecting the transfer of resources from low-output to high-output industries. Second, intra-industry structural optimization focuses on enhancing technological sophistication and value-added within the same sector, representing the deeper dimension of industrial upgrading. Compared to business and services, industrial production processes are associated with higher carbon emissions. Research indicates that expanding industrial land supply areas by local governments results in increasing industrial energy carbon emissions []. Conversely, converting secondary land to tertiary land can reduce carbon emissions from an energy consumption perspective [,]. In summary, a higher proportion of land allocated to industry leads to increasing urban carbon emissions. In contrast, the proportion of land transferred to commercial services increased while urban carbon emissions decreased. Under “land for development”, the local economic development model, land has become the engine driving growth, and local governments often attract investment at low or even negative land prices []. However, the effectiveness of land supply improves with the increasing level of land marketization []. Studies also found that the allocation of industrial storage land in Chinese cities was high from 1999 to 2003. However, the supply of industrial storage land began to decline after 2003, the land transfer was mainly for residential and commercial services from 2009 to 2016 [], from which it can be indicated that the supply structure of urban land in China has changed from industrial land to residential and commercial land in the process of land marketization. Due to the differences in carbon emissions among different land uses, residential and commercial land may result in lower total carbon emissions compared to industrial land. Therefore, this article proposes Hypothesis 2:

H2:

LTM changes the urban land supply structure, leading to a decrease in the supply of industrial land and an increase in the supply of commercial service land. Carbon emissions from services are lower than those from the industry sector, leading to an overall decrease in carbon emissions.

3.2.2. Resource Allocation Effect

Since local governments are the monopolists of the primary land market, land becomes a powerful policy tool for them to participate in resource allocation. LTM is a process that allocates land resources through market and price mechanisms, which exists with implications for the efficiency of land resource allocation. Enhancing the degree of LTM can more effectively leverage land price signals to guide the efficient allocation of production factors, thereby improving resource allocation efficiency []. Studies have found that allocation transactions lead to extensive use of land resources, while the transfer transaction method helps to improve the intensive use of land []. Meanwhile, the greater the amount of non-public market transfer (negotiated transfer) of land in a city, the less efficient the allocation of resources among its industrial enterprises []. This suggests that land elements have not been effectively allocated to high-productivity enterprises. Due to the limited nature of urban land, the transfer of land through open competition to the highest bidder is necessary for efficient allocation. Based on data from the Statistical Yearbook of China’s Land and Resources over the years, the average price of land transferred for sale in cities nationwide increased from 1.1331 million yuan/hectare in 1999 to 22.514 million yuan/hectare in 2017, representing a nearly 19-fold increase. The market-driven screening of enterprises operates not through simple profit maximization but through comprehensive cost analysis. A company’s land bidding capability depends not only on short-term profits but is more constrained by its full lifecycle costs. High-quality enterprises with advanced technology or high production efficiency are more likely to purchase land at higher prices. Therefore, these high-quality enterprises acquire land and expand production. Highly efficient enterprises often possess greater motivation and capability to adopt advanced clean technologies. For instance, Baowu Steel Group reduced carbon emissions per ton of steel by 30% while increasing production capacity by 12% through the promotion of hydrogen-enriched carbon-cycle blast furnace technology. CATL’s new lithium battery production line achieved synergistic efficiency and low-carbon outcomes by optimizing processes, lowering energy consumption per unit by 28% and raising product yield to 99.5%. This confirms that high-efficiency enterprises, with their advanced technological research and development capabilities and more efficient production methods, can reduce urban carbon emissions. Therefore, highly efficient enterprises acquire land to expand their production. Due to their advanced technological research capabilities and more efficient production methods, this will reduce the carbon emissions of the city. Existing studies have confirmed that the increase in land marketization optimizes the industrial structure [], which in turn promotes the reduction in urban carbon emissions. Consequently, Hypothesis 3 is proposed:

H3:

LTM can screen out efficient enterprises through the resource allocation effect of “the highest price wins” in the market, thereby reducing carbon emissions.

3.2.3. Financing Effect

Another prominent mechanism that LTM affects carbon emissions is the financing effect. Land is the best collateral and has a good financing function. Land transfer can enhance borrowers’ financial position by increasing income and pledging assets, thereby easing credit restrictions []. LTM will lead to an increase in land-transferring revenues and land mortgage financing, resulting in the expansion of the financing scale []. Therefore, LTM can lead to higher land prices, thereby easing financing constraints through the collateral effect and improved capital structure, which further enhances the ability of governments and enterprises to finance.

Land-transferring prices impact the financing capacity of local governments. The increase in land prices has enabled local governments to generate more revenue by selling land, while also improving their ability to finance land mortgages. This enhanced financing capacity can provide the government with more investment options, making them more likely to introduce emerging green industries. These emerging industries have lower carbon emissions because of their environmentally friendly production methods and advanced technology. Meanwhile, the government’s use of fiscal expenditure to subsidize and reward enterprises for technological transformation and innovation will also increase. Under the incentive effect of these measures, those original inefficient enterprises that consume too much energy and because of high pollution can actively improve their production methods and continue to carry out technological innovation to reduce carbon emissions.

Land-transferring prices also impact the financing ability of enterprises. If the price of land increases, the collateral value of the enterprise’s land and property will also increase accordingly, thus easing the financing constraints of the enterprise. Schumpeter’s innovation theory posits the essential role of financial availability in technological innovation, while financing constraints can hinder enterprises’ innovation activities []. Rising land prices have increased the value of the land assets owned by enterprises, then enterprises can increase their input in R&D so that the production technology level becomes higher. This improves energy efficiency and decreases total CO2 emissions caused in the production process. Accordingly, this paper proposes Hypothesis 4a,b:

H4a:

LTM can enhance the government’s financing ability through the financing effect. It can encourage the government to introduce emerging green industries and carry out technological transformations of high-carbon enterprises to reduce carbon emissions.

H4b:

LTM can improve the financing ability of enterprises through the financing effect, which motivates them to undertake R&D in green technology, ultimately leading to the reduction of carbon emissions.

The specific impact mechanisms are shown in Figure 2.

Figure 2.

Mechanisms of LTM’s effect on CO2.

4. Research Design

In this section, this article sets up an econometric model to empirically analyze the effects and mechanisms of LTM on urban CO2 emissions.

4.1. Model

4.1.1. Static Panel Model

The model constructed to examine the impact of LTM on CO2 emissions is as follows:

lnco2 is the total CO2 emissions of the city i. r_squre represents the level of LTM. Xi represents a series of control variables affecting carbon emissions at the city level. γi and θi are fixed effects, respectively, at the level of city and year. εi is the random error term. In the above estimation formula, the coefficient concerned in this paper is α1. If the regression coefficient α1 is below 0, it means that LTM reduces urban carbon emissions.

4.1.2. Mechanism Testing Models

In order to test the existence of the three mechanisms of action, on the basis of constructing the relevant regression equations, this paper adopts the stepwise regression method to test the mechanism of influence by using the mediated effect model [,]. After introducing the mediating variable , the mechanism test model is constructed as follows:

4.2. Variables and Data

(1) Dependent variable (lnco2). Urban carbon emissions. Indicator 1: Total CO2 emission, which is estimated by Chen et al. [] for Chinese cities during 1997–2017. Indicator 2: carbon emission intensity. It is calculated by dividing total carbon emission by the city’s GDP. Furthermore, the proportion of GDP contributed by prefecture-level cities to the provincial GDP to decompose the total CO2 emissions of provinces into each prefecture-level city is used as a robust estimation variable of urban carbon emissions.

(2) The key explanatory variable (LTM). The level of LTM. Two main methods are used in the current literature research to measure the level of LTM: the proportion method and the weight method [,,]. The former index is calculated as a percentage of the land transferred by bidding, auction, or listing, while the latter index uses land supply ways and price weighting to calculate. The calculation formula is where Zi represents the way of land transaction in the urban primary land market. fi represents the price weight of the transaction way, whose calculation is benchmarked against the trading land price of bidding, auction, or listing. The proportion method is divided into the supply proportion method and the transfer proportion method. The supply proportion method includes non-operational construction lands for public, education, infrastructure, and other uses []. Considering this paper focuses on examining the impact of urban carbon emissions, the transfer ratio method is more suitable to explain the research problem. This index can be calculated either by area or by spot of cases. According to Xu et al. [], this paper constructs 8 indicators to measure the level of LTM, which are listed in Table 1. Specifically, the proportion of the land areas of bidding, auction, or listing to land transfer is taken as the benchmark indicator of LTM. Other algorithm indicators are used for robustness tests.

Table 1.

Variable definitions.

(3) Control variables. (1) Economic development level. This paper uses the gross regional product to measure. (2) Urban built-up area. (3) Popularity density. (4) Infrastructure, whose measurement adopts urban road area per capita. (5) Industrial structure. The share of secondary sector output in RGDP is used to measure. (6) Fixed-asset investment. (7) Scientific and technological level. This paper directly used the science and technology expenditure of each city to measure it. (8) Foreign direct investment. This paper uses the number of foreign direct investment contract projects to measure. (9) Whether to provide heating. Specifically, the value is 1 for cities with heating in winter and 0 for cities without heating. (10) Whether to implement low-carbon pilot policies. The value of prefecture-level cities that implemented the pilot policy in the sample period is 1, if not is 0.

(4) Mechanism variables. The variables used in the mechanism analysis of this paper include commercial service land transfer area, industrial land transfer area, industrial land average price, total land supply transaction price, and industrial capital stock.

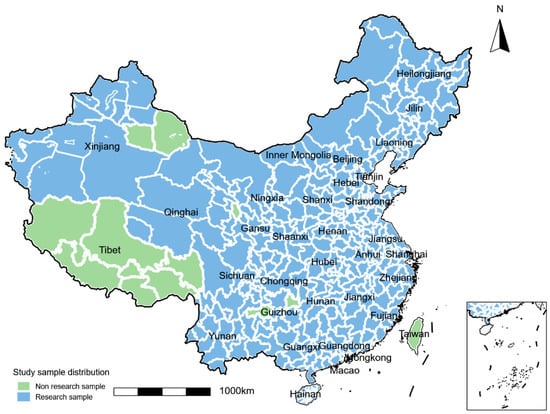

(5) Data source. The research samples consist of prefecture-level cities and municipalities across the country, with the city scope encompassing the whole city. The sample excludes the Tibet Autonomous Region and Hong Kong, Macao, and Taiwan due to the lack of relevant economic data. Figure 3 shows the geographical locations of the study samples. Land transfer data comes from the China Land and Resources Statistical Yearbook, and city-level economic data is obtained from the China City Statistical Yearbook over the years. Table 1 and Table 2 provide the definitions of variables and simple statistical descriptions.

Figure 3.

Sample geographic location map.

Table 2.

Descriptive statistics.

5. Results and Discussion

5.1. Baseline Regression Results

This section analyses LTM’s effect on urban carbon emissions. According to the baseline model constructed in Equation (1), based on the 1997–2017 city panel data, fixed effects, and control variables are added sequentially. The results are presented in Table 3, which reports the total impact of LTM on urban carbon emissions, and Table 4, which reports the impact of LTM on urban carbon emission intensity. In Table 3, columns (1) and (3) control the city-fixed and year-fixed effects, while columns (2) and (4) further add control variables. According to column (2), Table 3, the coefficient of r_squre is estimated to −0.022 and statistically significant, indicating that urban CO2 emissions will decrease significantly along with the increasing degree of LTM. One standard unit increase in LTM level means that urban carbon emissions decrease by approximately 2.2%. Also, the regression results for other control variables are as expected. Additionally, LTM may also have lagging effects. This is because there will be a construction period of two or three years after the land is sold, and the current urban carbon emissions will be influenced by the LTM levels in the lagging period. Therefore, the indicators of LTM in the model include the values of the current three lagging periods, whose regression results are presented in columns (3) and (4) of Table 3. Observing column (4), the coefficient indicates that one standard unit increase in the LTM level leads to a decline of approximately 3.0% in urban carbon emissions. The coefficient of LTM remains notably negative even when lagged for three periods. It indicates that the LTM significantly reduces urban carbon emissions not only in the current period but also in the three lagging periods. Furthermore, columns (1) and (2) of Table 4 reveal that increasing the degree of LTM remarkably reduces the carbon emission intensity of cities. An increase in one standard unit in the LTM will decrease the urban CO2 emission intensity by 2.4%.

Table 3.

Carbon emission baseline regression.

Table 4.

Carbon intensity baseline regression.

5.2. Robustness Test

(1) Replace the explained variable

This section describes the method used to calculate the CO2 emissions of each prefecture-level city. The total CO2 emissions of the provinces are decomposed according to the share of the city in the GDP of the provinces. The regression is then performed by replacing the dependent variable, and the results are reported in Table 5. It shows that LTM still notably reduces urban carbon emissions, which confirms the reliability of the previous conclusions.

Table 5.

Robustness test.

(2) Replace core explanatory variables

Adopt different LTM indicators. The effect of LTM on urban carbon emissions may also vary depending on the marketization measurement indicators. Excluding the benchmark indicator, this section takes the remaining seven indicators as explanatory variables for robustness testing and reports the results in Table 6 and Table 7, respectively, using the proportional method and the weighted method. The results indicate that almost all indicators are notably negative, both in the current and lagged periods. Although the regression coefficients of r_splot and r1 in the current period do not pass the significance test, they are statistically significant in the lagged period. The above test illustrates that the LTM is notably reducing urban CO2 emissions, conforming to the reliability of baseline regression results.

Table 6.

Robustness test of the proportional index.

Table 7.

Robustness test of the weighted index.

(3) Instrumental variables method

This study employs the interaction term between terrain undulation and urban economic growth targets as an instrumental variable to examine the endogeneity issue between LTM and urban carbon emissions. The regression results are presented in Table 8. The instrumental variable exerts a positive effect on LTM. After adding the instrumental variable, the significant negative correlation between LTM and carbon emissions remains positive, validating the reliability of the baseline findings.

Table 8.

Instrumental variable method.

5.3. Mechanism Test

5.3.1. Structural Effect Test

To test this mechanism, indicators of commercial service land and industrial land are used to conduct mechanism tests, whose results are presented in Table 9. What is evident from columns (1) and (3) in Table 9 is that LTM significantly increases the area of land transferred for commercial and service, while reducing that for industrial. From the comparison with the baseline results in Table 3, column (4), it can be observed that the impact of LMT on CO2 emissions decreases after the indicators of intermediary variables are added to Table 9. Therefore, lnland_sf and lnland_gy are partial intermediate variables. Additionally, Table 9’s column (2) regression coefficient indicates that urban carbon emissions increase by approximately 0.5% when the transferred area of commercial service land increases by 1 unit. Similarly, column (4) shows that each unit of land transferred to industry increases carbon emissions by about 1.1%. In summary, LTM changes the land supply structure of cities, which is manifested in decreasing the share of industrial land and increasing that of commercial service land. This leads to a decrease in the total CO2 emissions of cities, as the service industry typically emits less carbon than the industrial sector. As a result, Hypothesis 1 has been tested.

Table 9.

Structural effect.

5.3.2. Resource Allocation Effect Test

In comparison to inefficient enterprises, efficient ones produce fewer carbon emissions. However, with the increasing number and scale of corporations, the city’s total carbon emissions will continue to rise. Therefore, unlike the comparison of total carbon emissions among different functional lands in the section on structural effect, this section does not involve inefficient enterprises in the regression analysis to compare with high-efficiency enterprises and observe the difference in carbon emissions between them. Instead, it directly replaces total CO2 emissions with carbon emission intensity as the dependent variable to conduct the next mechanism test. The mechanism test for financing effect also adopts the same approach.

As previously mentioned, LTM may eliminate efficient enterprises through the resource allocation effect of price competition to reduce CO2. To verify this mechanism, the average price of industrial land transfer is used as a proxy variable to perform the regression. Column (1) of Table 10 shows that LTM has notably increased the price of industrial land. Meanwhile, column (2) of Table 4 indicates that LTM notably decreases the carbon emission intensity of cities. Compared to column (2) of Table 10, the addition of the lnavg_price changes LTM’s effect on reducing carbon emission intensity from significant to insignificant. However, the estimated coefficient of lnavg_price remains significant at the level of 10%. It proves that LTM contributes to a reduction in carbon emissions due to the resource allocation effect of increasing industrial land transfer prices. Therefore, Hypothesis 2 is tested.

Table 10.

Resource allocation effect.

5.3.3. Financing Effect Test

(1) Government financing

To analyze how LTM impacts government financing, we measured land financing using total land supply revenue. In Table 11, column (1) shows that LTM notably increased total land supply revenue. Comparison with the carbon intensity baseline result in Table 4’s column (2) shows that the regression coefficient of LTM on carbon intensity becomes insignificant when the total land supply revenue is added to column (2) of Table 11. However, the total land supply revenue is significant at the 5% level. Thus, LTM reduces carbon emissions through the financing effect of increasing government land transfer revenue. Therefore, Hypothesis 3 is confirmed.

Table 11.

Government financing effect.

(2) Enterprise financing

To inspect the effect of LTM on enterprise financing, we measure enterprise financing using industrial capital stock. The empirical result in column (1) of Table 12 indicates a significant increase in industrial capital stock due to LTM. Comparison with the baseline carbon intensity regression in column (2) of Table 4 shows that the regression coefficient of LTM on carbon intensity becomes insignificant after the addition of industrial capital stock in column (2), Table 12. In conclusion, it has been demonstrated that LTM can inhibit urban carbon emissions by increasing the industrial capital stock and enhancing the financing effect of enterprises. As a result, Hypothesis 4 has been tested.

Table 12.

Enterprise financing effect.

6. Further Discussion

China’s vast territory results in significant regional differences and imbalanced economic development. Therefore, this paper discusses the effect of LTM on CO2 emissions reduction in cities with different regions, economic development levels, and population sizes through heterogeneity analysis.

6.1. Regional Heterogeneity

This section begins by dividing samples into three groups according to East, Centre, and West. This is done to compare the impact of LTM on urban carbon emissions in the three economic regions, with the results shown in Table 13. The results in columns (1)~(3) correspond to the influence results of sample cities in the East, Centre, and West, respectively. The results illustrate that the inhibitory effect of LTM on urban CO2 emissions is most pronounced in the West, followed by the Centre. However, it is insignificant for the East. Possible reasons for the relatively weak impact of urban carbon emissions in the East with a higher development level include a higher degree of marketization of factor allocation, a relatively perfect institutional environment, and a smaller impact of land marketization allocation. However, the economic development of the Centre and West is inferior to that of the East. Additionally, the degree of marketization of factor allocation in these regions is relatively low, and the relevant institutional environment requires improvement. Therefore, LTM has a greater impact and can better promote the reduction in urban carbon emissions.

Table 13.

Regional heterogeneity.

6.2. Urban Economic Development Heterogeneity

This section begins by dividing samples into two groups based on urban GDP. The top 50% of urban GDP represents cities with higher development levels, while the bottom 50% represents cities with lower development levels, with the regression results presented in Table 14. LTM in higher-development cities does not significantly affect carbon emissions. However, in lower-development cities, LTM can significantly reduce the total CO2 emissions. This may be due to the better institutional environment in highly developed cities, which renders the impact of the marketization of land transfer insignificant. However, in cities with lower economic development levels, their institutional environment needs improvement. Therefore, the effect of LTM on the suppression of urban carbon emissions is more significant in these cities. This finding also corresponds to the analysis of regional heterogeneity.

Table 14.

Economic development heterogeneity.

6.3. Population Size Heterogeneity

According to Zheng et al. [], densely populated cities lead to more compact activities, resulting in reduced transportation needs and lower urban carbon emissions. Therefore, LTM’s impact on carbon emissions may vary across cities with different demographic sizes. Next, samples are categorized based on population size: with a cut-off of one million, below (excluding one million) is considered a small city, and vice versa for a large city. Table 15, column (1) shows the result for small cities. The influence of the coefficients of LTM in the current and lagged periods fail to be significant. Column (2) presents the result for large cities, where the coefficient of the independent variables is negative. The above results indicate that LTM in small cities has no notable impact on carbon emissions, and there is no lag effect. However, in large cities, the higher the level of LTM, the more significantly the city’s carbon emissions can be reduced, with significant effects in both the current and lagged periods. The possible reason for this variation is that the implementation of land market reform policies differs between large and small cities.

Table 15.

Population size heterogeneity.

7. Conclusions and Recommendations

7.1. Conclusions

The reform of urban land transfer towards a market-oriented approach is a significant institutional change that has a profound impact on activities related to urban carbon emissions. However, existing literature on this issue is insufficient. Using the urban panel data over the 1997–2017 period, this paper aims to examine the impact and mechanism of LTM on urban CO2 emissions. The results are presented below: ① LTM has a significant inhibitory effect on urban CO2 emissions. Specifically, each standard unit increase in the level of LTM can reduce the total CO2 emissions of cities by 3% and carbon intensity by 2.4%. This suggests that LTM has promoted the reduction of carbon emissions and the sustainability of the urban economy in favor of the environment. ② LTM’s impact on urban CO2 emissions is significantly heterogeneous among cities. For cities in the East, cities with higher development levels, and cities with small population sizes cities, LTM exerts no significant impact on CO2 emissions. Vice versa, LTM can not only significantly decrease the current CO2 emissions but also inhibit future urban CO2 emissions. ③ The LTM policy will inhibit urban carbon emissions through three mechanisms: structural effect, resource allocation effect, and financing effect, all of which have significant mediating effects.

This study provides city-level empirical evidence on the carbon emission reduction effects of land transfer marketization in China, contributing to the growing literature on urban land policy and environmental sustainability. Our findings demonstrate that LTM significantly reduces urban carbon emissions through three key transmission mechanisms: structural effects, resource allocation effects, and financing effects. These results extend previous provincial-level analyses (Liu et al., 2022; Xu et al., 2013) [,] by revealing more nuanced influencing mechanisms at the city scale. The negative relationship between LTM and carbon emissions aligns with Yang and Wu (2019) [], challenging earlier concerns that market-oriented land allocation might prioritize economic growth over environmental protection (Chen et al., 2019) []. Our identification of multiple transmission mechanisms advances theoretical understanding by demonstrating that LTM operates not merely as an administrative tool but as a comprehensive policy instrument driving urban sustainable transformation.

7.2. Policy Recommendations

The research conclusions of this paper propose a land resource allocation system perspective to reduce urban carbon emissions, enriching low-carbon research. Additionally, it has practical reference value and policy implications in evaluating and optimizing the land transfer policy. Therefore, some policy suggestions are put forward below:

(1) China should continue to perfect the land transfer policy towards marketization and improve the level of land marketization. This research has shown that improving the LTM level can notably reduce the total urban CO2 emissions, which confirms the effectiveness of China’s land resource allocation towards marketization. In addition, it also reveals that the effects are heterogeneous in cities with different regions and populations. Therefore, the characteristics of different cities should be taken into account to implement matching policy programmers, adopt differentiated measures, summarize typical cases and promote exemplary experiences.

(2) Actively use land policy instruments to promote green growth. The mechanism test finds that LTM can contribute to China’s urban carbon emission reduction by changing the structure of land supply and optimizing land allocation. Therefore, China should promote green development through land structure adjustment, namely, increasing the transfer of commercial land, reducing the transfer of industrial land and allocating industrial land to more green enterprises. Through a series of measures to stimulate the enthusiasm of enterprises to innovate and promote green development, such as formulating green technology guidelines, establishing special funds for the research and manufacture of related technologies and industrial equipment to reduce CO2 emissions. Additionally, it is necessary to promote industry energy conservation and emission reduction and facilitate the horizontal adaptation and vertical integration of industry market policies. Promote the reform of local fiscal and taxation systems, reduce undue intervention by local governments in land supply and land financing, defuse land financing risks and play the role of markets in allocating resources in land use more effectively.

(3) For other countries, referring to the case of China, policymakers can actively explore new modes to balance spatial land use and promote green development. Combined with the actual situation of each country, give full play to the structural, resource allocation and financing effects of land resources, and make good use of land policy tools, so as to promote the transformation and upgrading of regional industries, guide the green innovation of enterprises, and achieve regional green development.

7.3. Research Shortcomings and Prospects

Despite this study having made some contributions, it still has several limitations. These limitations point out the directions for future research. First, data constraints prevented full exploration of micro-level mechanisms linking LTM to firm and household behavior, and future firm-level or household-level analyses could provide deeper insights into behavioral mechanisms. Second, our focus on carbon emissions captures only one dimension of environmental sustainability, and future research should adopt more comprehensive frameworks evaluating broader impacts on air quality, water resources, and ecosystem services. Third, the analysis primarily focuses on Chinese cities, and comparative research examining land market reforms across different institutional contexts could enhance generalizability. Finally, longitudinal studies tracking cities over extended periods could reveal whether the carbon reduction benefits represent temporary adjustments or sustainable long-term shifts in urban development trajectories.

Author Contributions

S.X. provided conceptualization, data curation, methodology, investigation, formal analysis, funding acquisition, and writing—review. D.J. provided data curation, investigation, formal analysis and original draft writing. Y.W. provided theoretical model, data curation, investigation and formal analysis. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Social Science Fund of China (22BJL052) and the Fundamental Research Funds for the Central Universities (B250207067).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be made available upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abid, N.; Ahmad, F.; Aftab, J.; Razzaq, A. A blessing or a burden? Assessing the impact of Climate Change Mitigation efforts in Europe using Quantile Regression Models. Energy Policy 2023, 178, 113589. [Google Scholar] [CrossRef]

- Owjimehr, S.; Samadi, A.H. Energy transition determinants in the European Union: Threshold effects. Environ. Sci. Pollut. Res. 2022, 30, 22159–22175. [Google Scholar] [CrossRef]

- Tyfield, D.; Ely, A.; Geall, S. Low Carbon Innovation in China: From Overlooked Opportunities and Challenges to Transitions in Power Relations and Practices. Sustain. Dev. 2015, 23, 206–216. [Google Scholar] [CrossRef]

- Yan, Z.; Yang, Z. How the Marketization of Land Transfer under the Constraint of Dual Goals Affects the High-Quality Development of Urban Economy: Empirical Evidence from 278 Prefecture-Level Cities in China. Sustainability 2022, 14, 14707. [Google Scholar] [CrossRef]

- Mao, X.; Lin, J.; Meng, J. The impact of construction land growth on carbon emissions in China. China Popul. Resour. Environ. 2011, 21, 34–40. [Google Scholar]

- Xia, C.; Zhang, J.; Zhao, J.; Xue, F.; Li, Q.; Fang, K.; Shao, Z.; Zhang, J.; Li, S.; Zhou, J. Exploring potential of urban land-use management on carbon emissions—A case of Hangzhou, China. Ecol. Indic. 2023, 146, 109902. [Google Scholar] [CrossRef]

- Qu, F.; Lu, N.; Feng, S. Effects of land use change on carbon emissions. China Popul. Resour. Environ. 2011, 21, 76–83. [Google Scholar]

- Deng, S.; Zhang, L. Urban land supply strategies and carbon emissions in China: From the perspective of land-based fiscal revenue and land-based investment. Humanit. Soc. Sci. Commun. 2025, 12, 1519. [Google Scholar] [CrossRef]

- Chen, Q.; Ma, X.; Shi, X.; Zhou, X.; Lan, J. Does industrial land supply Behavior Affect industrial energy carbon emissions?—Three dimensional analysis based on supply scale, mode and price. China Popul. Resour. Environ. 2019, 29, 57–67. [Google Scholar]

- Liu, X.; Xu, H.; Zhang, M. Carbon emission effect and transmission mechanism of land transfer marketization: Based on the perspective of industrial structure. China Popul. Resour. Environ. 2022, 32, 12–21. [Google Scholar]

- Xu, H.; Guo, Y.; Chen, Z. The relationship between land market development, urban land intensification and carbon emissions—An empirical analysis based on inter-provincial panel data in China. China Land Sci. 2013, 27, 26–29. [Google Scholar] [CrossRef]

- Yang, H.; Wu, Q. Study on the effect of carbon emission from land use based on systematic GMM panel model—A case study of inter-provincial panel data in China. Chin. J. Soil Sci. 2019, 50, 541–549. [Google Scholar] [CrossRef]

- Zhu, D.; Lin, R. On Low Carbon Economy and Transformation of Land Use. China Land Sci. 2010, 24, 3–6. [Google Scholar] [CrossRef]

- Liu, S.; Xiong, X.; Zhang, Y.; Guo, G. Land system and Chinese development model. China Ind. Econ. 2022, 1, 34–53. [Google Scholar] [CrossRef]

- Cai, H.; Henderson, J.V.; Zhang, Q. China’s land market auctions: Evidence of corruption? RAND J. Econ. 2013, 44, 488–521. [Google Scholar] [CrossRef] [PubMed]

- Wang, J. Mechanism analysis of land transfer to improve urban land use efficiency. Real Estate World 2023, 17, 24–26. [Google Scholar]

- Ding, C. Land policy reform in China: Assessment and prospects. Land Use Policy 2003, 20, 109–120. [Google Scholar] [CrossRef]

- Du, J.; Thill, J.-C.; Peiser, R.B.; Feng, C. Urban land market and land-use changes in post-reform China: A case study of Beijing. Landsc. Urban Plan. 2014, 124, 118–128. [Google Scholar] [CrossRef]

- Yang, Y.; Xue, R.; Zhang, X.; Cheng, Y.; Shan, Y. Can the marketization of urban land transfer improve energy efficiency? J. Environ. Manag. 2023, 329, 117126. [Google Scholar] [CrossRef]

- Brännlund, R.; Lundgren, T.; Marklund, P.-O. Carbon intensity in production and the effects of climate policy—Evidence from Swedish industry. Energy Policy 2014, 67, 844–857. [Google Scholar] [CrossRef]

- Li, L.; Huang, P.; Ma, G. Land resource misallocation and productivity difference of industrial enterprises in China. Manag. World 2016, 8, 86–96. [Google Scholar] [CrossRef]

- Li, L.; Bao, H.X.H.; Robinson, G.M. The return of state control and its impact on land market efficiency in urban China. Land Use Policy 2020, 99, 104878. [Google Scholar] [CrossRef]

- Zhong, W.; Zheng, M. How the Marketization of Land Transfer Affects High-Quality Economic Development: Empirical Evidence from 284 Prefecture-Level Cities in China. Sustainability 2022, 14, 12639. [Google Scholar] [CrossRef]

- Wang, K.; Xiong, Z.; Gao, W. Study on the trading mode of Industrial land use right and the elasticity of enterprise land factor output in development zone. China Land Sci. 2013, 27, 4–9. [Google Scholar] [CrossRef]

- Yang, J.; Liu, C.; Liu, K. Land marketization and industrial restructuring in China. Land Use Policy 2023, 131, 106737. [Google Scholar] [CrossRef]

- Chen, C.; Liu, B.; Wang, Z. Can land transfer relax credit constraints? Evidence from China. Econ. Model. 2023, 122, 106248. [Google Scholar] [CrossRef]

- Qin, Y.; Zhu, H.; Zhu, R. Changes in the distribution of land prices in urban China during 2007–2012. Reg. Sci. Urban Econ. 2016, 57, 77–90. [Google Scholar] [CrossRef]

- Aghion, P.; Askenazy, P.; Berman, N.; Cette, G.; Eymard, L. Credit Constraints and the Cyclicality of R&D Investment: Evidence from France. J. Eur. Econ. Assoc. 2012, 10, 1001–1024. [Google Scholar] [CrossRef]

- Wen, Z.; Ye, B. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Chen, J.; Gao, M.; Cheng, S.; Hou, W.; Song, M.; Liu, X.; Liu, Y.; Shan, Y. County-level CO2 emissions and sequestration in China during 1997–2017. Sci. Data 2020, 7, 391. [Google Scholar] [CrossRef] [PubMed]

- Qian, Z.; Mou, Y. The level of land marketization in China: Measurement and analysis. Manag. World 2012, 7, 67–75. [Google Scholar] [CrossRef]

- Xu, S.; Chen, J.; Zhao, G. How does Marketization of land Transfer Promote economic Growth. China Ind. Econ. 2018, 3, 44–61. [Google Scholar] [CrossRef]

- Liu, T.; Cao, G.; Yan, Y.; Wang, R.Y. Urban land marketization in China: Central policy, local initiative, and market mechanism. Land Use Policy 2016, 57, 265–276. [Google Scholar] [CrossRef]

- Zheng, S.; Wang, R.; Glaeser, E.L.; Kahn, M.E. The greenness of China: Household carbon dioxide emissions and urban development. J. Econ. Geogr. 2011, 11, 761–792. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).