Abstract

Despite widespread recognition of the potential of cork oak forests and the cork industry to generate societal value, few comprehensive efforts have been made to quantify this value. This paper seeks to analyze and monetarily assess the overall value that the Catalan cork industry creates for society. To achieve this, it applies Integrated Social Value (ISV) analysis, a social accounting model that evaluates both the economic and social value generated by an organization for its stakeholders. Additionally, it incorporates the valuation of ecosystem services to provide a more holistic perspective. The magnitudes of the performed value estimations show that the environmental value of the analyzed Catalan cork companies is at least as high as the socioeconomic value. This study makes two key contributions. First, it extends the application of the ISV model to an entire industry—comprising interconnected companies operating within the same business sphere—while addressing specific challenges in the value calculation. Second, it integrates ISV analysis with the existing framework for valuing ecosystem services, thereby capturing the environmental value of the natural resources on which the industry relies.

1. Introduction

The value of economic sectors is primarily evaluated based on their monetary outputs and fiscal impacts [1]. In contrast, natural ecosystems are frequently appraised through the prism of intrinsic or non-market values, such as biodiversity, aesthetic significance, and cultural identity, often disconnected from their potential contributions to economic activity and societal well-being [2,3]. This dichotomy—between the economic valuation of business sectors and the moral or ecological valuation of nature—has contributed to a fragmented understanding of how different industries contribute to sustainable development. While recent advances in natural capital accounting attempt to bridge this gap [4,5], most industries continue to be analyzed through narrowly defined economic parameters, overlooking their broader ecological dependencies and social contributions.

This is also the case for the cork industry, which has a long-standing tradition in some Spanish regions such as Catalonia. Beyond the economic value created by the cork industry, the ecosystems formed by the cork oak (Quercus suber) forests also generate ecosystem services that are essential for society, such as food production, water retention, soil conservation, or carbon storage [6]. In addition, cork extraction can be regarded as a sustainable process because it is obtained from the outer bark of cork oak without damaging the tree or affecting biodiversity [7]. Despite widespread recognition of the potential of cork oak forests and the cork industry to generate societal value, few comprehensive efforts have been made to quantify this value.

In this paper, we seek to address this gap and attempt to analyze the overall value that the Catalan cork industry creates for society. To achieve this, we assess the socioeconomic value of a sample of Catalan cork companies by applying Integrated Social Value (ISV) analysis, a social accounting model that evaluates both the economic and social value generated by an organization for its stakeholders [8], and that has been applied mainly to single organizations [9]. We complement this approach with an assessment of the environmental value of the cork companies’ embeddedness in ecological systems. Specifically, we use the value transfer method [10] to account for the provision, regulation, and cultural services of the cork oak forest ecosystems, which form the basis for the cork value chain.

Our study demonstrates the feasibility of combining ISV with ecosystem service (ES) valuation for assessing the value of the Catalan cork companies. The magnitudes of the performed value estimations show that the environmental value is at least as high as the socioeconomic value, and that the main stakeholder benefiting from the Catalan cork business activity is the environment and, indirectly, society.

Our study makes two key contributions. First, it aims to extend the application of the ISV model to an entire industry—comprising interconnected companies operating within the same business sphere—while addressing specific challenges in the value calculation. Second, it integrates ISV analysis with the existing framework for valuing ES, thereby capturing the environmental value of the natural resources on which the industry relies.

Our paper is structured as follows. The next section introduces the conceptual framework and presents the approach used for the socioeconomic and environmental value assessments. The subsequent section describes the specific methods applied for analyzing the case study of the Catalan cork companies and the steps followed to estimate the socioeconomic and environmental value generated by Catalan cork businesses. Thereupon, the results of the estimation are presented. The final section discusses the results and draws the conclusions.

2. Conceptual Framework

2.1. Socioeconomic Value Assessment

Socioeconomic assessment of industries generally focuses on analyzing selected indicators of economic and social impacts, such as GDP contribution, employment, or tax revenue. Studies that assess the impacts of entire sectors often use methods that measure direct, indirect, and induced economic effects at the regional level, such as input–output analysis and multiplier effects [11]. However, while such studies allow for estimating the value created for the whole regional economy, they do not differentiate the distribution of the value added among different agents or stakeholders [12].

Social accounting can be considered a more suitable approach to assess the value generated for organizations’ communities of interest or stakeholders [13]. Social accounting is thus not only linked to the wider field of social impact measurement or social impact assessment [14] but also focuses on the preparation and publication of an account about an organization’s stakeholder interactions and adheres to generally accepted accounting principles [9].

A social accounting methodology that considers the social value created for all the organization’s stakeholders holistically is Integrated Social Value (ISV) analysis. The methodology of ISV analysis, developed by [8], is based on the perspective of stakeholder theory [15]. In line with other broad value approaches [16,17,18], it employs a more comprehensive conception of value than the conventional shareholder value. On the one hand, it considers the value created by an organization for all its stakeholders, and, on the other hand, it includes positive and negative impacts that do not have a market value.

ISV is made up of the social value created by economic activity—captured by financial accounting indicators—and the social value that the organization creates specifically for its various stakeholders through non-market relationships [8]. The calculation of this specific social value or non-market value combines qualitative and quantitative analysis. The qualitative analysis aims to identify the value that is perceived by the organization’s stakeholders by actively involving them in the research, and the quantitative analysis centers on quantifying this perceived value by developing indicators and financial proxies to monetize it.

Although ISV analysis is a relatively new method, it has been empirically applied to more than 90 organizations of different sizes and industries, both profit and non-profit [9]. ISV analysis has been applied specifically to universities [19], museums [20], food markets [21], fishermen’s guilds [22], and hotels [23], among others. The monetization of the value created by organizations for their stakeholders makes it possible to measure very different socioeconomic impacts in the same unit, which not only facilitates understanding and communication to a broad audience, but also allows aggregating the data and relating it to other financial measures [24]. The resulting information enables managers and policy makers to assess whether the socioeconomic value creation and distribution are aligned with the stated purpose of an organization.

So far, ISV analysis has been applied mainly to single organizations and has focused on disentangling the most relevant variables of non-market social value creation [9]. Some recent attempts have applied this approach to large samples of companies located in science and technology parks [25,26], but they have not addressed specific challenges associated with industry-wide analyses, such as adjustments for inter-company transactions and the distribution of value at the regional level.

2.2. Environmental Value Assessment

Companies, by carrying out their economic activities in certain locations, rely on steady supplies of different natural resources (e.g., raw materials, energy, water), while also impacting key elements of the natural environment such as air, water, and soil. Collectively, the natural resources that provide essential benefits to businesses and society are often referred to as “natural capital”, which includes both tangible “goods” such as timber and mineral deposits as well as “services” (such as absorption of rain water by soil, storage of floodwater by wetlands, storage of carbon in forests, and dilution and assimilation of wastes by rivers), often referred to as “ecosystem services” [27].

Ecosystem services (ESs) thus refer to the contribution of ecosystems to society [28,29] and are commonly defined as “the benefits people obtain from ecosystems” [30]. It is generally agreed that ESs can be classified into four broad categories: provisioning, regulating, cultural, and supporting services [30]. Provisioning services refer to the material and energy contributions generated by or in an ecosystem and directly used by people (e.g., food, fresh water, timber, fiber). Regulating services are related to the capacity of ecosystems to regulate ecosystem processes (e.g., climate regulation, disease control, water purification). Cultural services are related to non-material benefits people obtain from ecosystems through physical and intellectual interactions or spiritual and symbolic interactions (e.g., recreation, aesthetic enjoyment, spiritual fulfillment). Supporting services—which in more recent frameworks are no longer considered as a separate category—are necessary to produce all other services (e.g., nutrient cycling, soil formation, photosynthesis).

ESs occur at a range of spatial (and temporal) scales, from the short-term site level, such as recreational activities, to the long-term global level, such as climate regulation through carbon sequestration [31]. The scale at which the ecosystem service is supplied (local, regional, or global) determines which stakeholders may benefit from it. Provisioning services provide tangible goods that are usually private benefits for the local landowner and for the customer/user of the goods and services. Cultural services tend to benefit different stakeholders in the region (e.g., visitors, researchers), whereas essential regulation and maintenance services are enjoyed by society at larger regional or global scales.

Although there is no commonly accepted methodology for ES assessment, the commonly followed steps are 1. identification of relevant ESs, 2. measuring of these ESs in physical terms, and 3. qualitative, quantitative, and/or monetary valuation of these ESs [4]. Monetary ES valuation assigns economic value to the benefits humans derive from the diverse ESs and makes the value of nature visible to inform decision-making, especially in contexts where ESs are undervalued or ignored in market transactions and policy [28,32].

There are different valuation techniques used to assess ESs’ impact on well-being in monetary terms, which will be appropriate depending on the application and data available (e.g., prices paid for goods and services traded in markets, damage costs avoided contingent valuation, choice experiment), and the employed technique influences the results of the valuation [33]. Since conducting original valuation research is expensive and time-consuming, a common practice is to use value transfer or benefit transfer. Value transfer consists of valuing an ES in one context based on valuation evidence determined in another context, while making specific adjustments to account for differences between the two contexts, e.g., adjust for foreign exchange rates, adjust for inflation, and/or adjust for Purchasing Power Parity (PPP) [10].

Monetary ES valuation has been applied in diverse contexts, ranging from local land-use decisions to national accounting and international policy frameworks. Assigning a value to an ES provides a relevant tool for policy makers and conservationists to evaluate management impacts and make a cost–benefit analysis of potential policies [34]. But ES valuation can also be useful to account for businesses’ impact on society: the supply of ESs generated by ecosystems under control by companies can be regarded as a positive externality, while their degradation can be interpreted as a negative externality [27]. There are increasing initiatives that propose monetary ES valuation to assess environmental dependencies, inform risk management, support sustainability strategies, and guide investment decisions [35,36]. However, there is a lack of empirical studies on ES valuation practices by companies and their integration with social and financial accounting practices.

3. Material and Methods

3.1. Case Study: The Catalan Cork Industry and the Sample Selection

The cork industry has a long-standing tradition in Catalonia. The extraction of cork and its transformation into products date back to the second half of the 18th century, and in its early stages, the industry was mainly dedicated to producing wine and champagne cork stoppers for export to France. Over the years, the Catalan cork sector expanded and industrialized, driven by the growth of the local wine and cava industries and by increasing internationalization [37]. Today, Catalonia’s cork products—including wine and champagne stoppers, construction materials for insulation, flooring, and wall coverings—are exported to international markets and enhance the region’s global trade profile [7].

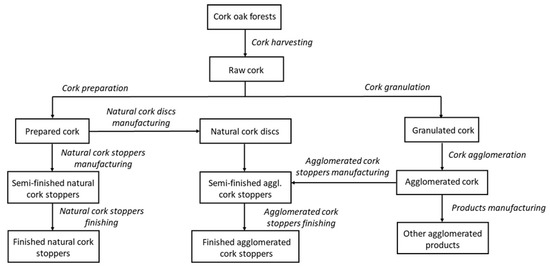

The Catalan cork industry is primarily located in the northeast of Catalonia, between the Costa Brava and the Catalan Pyrenees. At the time of this study, it was composed of 30 small and medium-sized enterprises [38]. These companies operate at different stages of the cork product value chain: cork harvesting, cork preparation, cork granulation, production of natural cork stoppers, natural cork discs, agglomerated cork stoppers, and other agglomerated products. The harvested cork is processed by the industry and undergoes various treatments depending on its quality and the final products to be manufactured [39]. The primary objective of industrial cork production is to produce natural cork products, which have higher economic value. Agglomerated cork products are typically made from the by-products of natural cork manufacturing or from lower-quality cork material. Figure 1 presents a schematic flow chart of the processes carried out by the Catalan cork industry.

Figure 1.

Processes of the Catalan cork industry (for the sake of simplicity, the flow chart does not show the flows of by-products or waste of the processes that can potentially feed other processes).

As input data for our study, we required a set of company accounting data along with additional information regarding their purchases and sales of cork products. Due to the difficulty of collecting accounting data directly from Catalan cork companies, we opted to base our assessment on secondary data, in line with previous studies [25,26], and utilized the SABI (Iberian Balance Sheet Analysis System) database. Additionally, we contacted all known companies through the Catalan Cork Institute Foundation in March 2023 to request specific information necessary for the socioeconomic and environmental value assessments.

Our final sample consists of 11 companies for which we were able to obtain all required financial data for the year 2021 (i.e., the most recent accounting year available at the time) and which also agreed to complete an Excel sheet containing the following information for the most recent representative year: (a) whether they had any supplier or customer relationships with other Catalan cork companies, and the percentage of annual purchases and sales represented by these relationships; (b) the geographic distribution of purchases and sales—within Catalonia, the rest of Spain, and internationally; (c) the type and quantity of processed cork (cork input); and (d) the percentage distribution of the cork oak forest origin (i.e., the source of cork supply) across Catalonia, the rest of Spain, and the rest of the world.

Table 1 provides an overview of the cork processing activities carried out by the sampled companies, along with their size, as measured by the number of employees and annual turnover. The table also includes data on the broader industry, excluding three small businesses (self-employed entrepreneurs) for which data were unavailable in the SABI database.

Table 1.

Characteristics of cork companies’ sample.

In 2021, the companies in our sample employed a total of 350 people and generated a combined turnover of EUR 108 million, representing 72% of the total employment and 78% of the total turnover of the industry. As shown in Table 1, the sample slightly underrepresents small companies and overrepresents larger businesses. However, it presents a more balanced representation of the various cork processing stages.

To assess the environmental value of the forest-based cork businesses, we calculate the equivalent area of cork oak forest used by our sample of cork companies (all cork is harvested from natural forests) and estimate its average value using secondary data from a previous study [40], i.e., by applying a value transfer method.

3.2. Socioeconomic Value Assessment

First, we assess the socioeconomic value created through the economic activity of the cork companies, following the methodology of ISV analysis. We focus specifically on the so-called market-based social value, or socioeconomic value (SEV). SEV reflects the creation and distribution of wealth by an organization to its stakeholders through market mechanisms (i.e., sale of products/services and remuneration of production factors) [9] and is calculated according to the guidelines provided by [8].

SEV can be divided into direct and indirect SEV components [8]. Direct socioeconomic value (D-SEV) refers to the value added that an organization generates and distributes among the various stakeholders essential for its operation. Thus, D-SEV includes value distributed to employees (net wages), shareholders (economic result), public administrations (social security contributions, income tax, VAT, and other taxes), financial entities (financial expenses and revenues), and the value retained within the organization itself (depreciation). Indirect socioeconomic value (I-SEV) accounts for value generated by first-tier suppliers of goods and services, proportionate to the organization’s purchases. Additionally, if the organization sells products and/or services, it creates value for its customers, which can be measured by turnover—since, in a market economy, the price paid reflects the minimum value perceived by the customer. In summary, SEV represents the socioeconomic value created and distributed among six primary stakeholder groups with whom the organization maintains market relationships: employees, shareholders, public administrations, financial entities, suppliers, and customers.

We used the SABI database to extract the accounting data needed for SEV calculation [8] for the year 2021: net turnover, value added, personnel costs, number of employees, financial expenses, financial revenues, corporate taxation, economic result, and depreciation. As in the study by [25] on the SEV calculation of science and technology parks, these secondary accounting data were used to approximate the value created for each of the six stakeholder groups (see Table 2).

Table 2.

Socioeconomic value calculation (adapted from [25]).

For certain stakeholders (i.e., customers, shareholders, and the company itself), SEV corresponds directly to specific accounting items: for customers, SEV is equivalent to company sales; for shareholders, it is the company’s net operating result; and for the company itself, it is the value of depreciation. The SEV generated for financial entities is calculated by adding both financial revenues and financial expenses as absolute values, since both types of flows generate value for the financial system. For suppliers, we apply a proxy developed by [25], which estimates the value created to be 43% of the purchase volume (i.e., that suppliers generate an average of EUR 0.43 in value added for every EUR 1.0 in sales to the company). This is accounted for as value created for the supplier, although a part of the supplier’s value added goes to the public administrations. As SABI does not provide direct data on consumption of goods and materials for the companies in the sample, purchase volume was estimated by subtracting company value added from turnover. The SEV for public administrations is composed of five elements: the company’s VAT, VAT induced through supplier transactions, employer and employee social security contributions, employees’ income taxes, and other taxes (e.g., corporate taxation). As shown in Table 2, the total SEV for public administrations equals the sum of these components. Finally, the SEV generated for employees corresponds to net wages, calculated as personnel costs minus the social security contributions paid by both employer and employees, as well as income tax.

However, the Catalan cork companies maintain business relationships among themselves, i.e., some act as suppliers to others, which could lead to double counting in the SEV calculation. The specific information collected directly from the sample companies enabled us to identify and exclude intra-industry transactions, thereby adjusting their turnover and purchase figures accordingly (the adjustment and calculation are made with percentages referring to the mass of the purchase/sale (the only information available) and referring to the main cork products bought or sold (not by-products)).

3.3. Environmental Value Assessment

Second, we assess the environmental value generated by the forest-based cork businesses, applying the approach of ES valuation. The first step involved estimating the cork oak forest area required to supply the Catalan cork companies. This estimation was based on data provided by the sample companies regarding the type and quantity of processed cork (cork input). For companies that harvest or handle raw cork, we used the reported quantities directly. For other companies, we calculated the equivalent amount of raw cork using conversion rates derived from the cork industry’s quality assurance system, SYSTECODE [41]. To estimate the equivalent hectares of cork oak forest, we assumed an average raw cork productivity (annualized average of a harvesting period) of 100 kg/ha year for Catalonia [42] and 150 kg/ha year for other producing regions globally [43].

The second step was the monetary valuation of the ESs provided by cork oak forests. For this, we relied on a prior study commissioned by the Catalan Cork Institute Foundation, which assessed the economic value of ESs provided by cork oak forests in Catalonia, based on primary data from five cork oak estates located in the province of Girona [40]. We updated the economic values from that study to reflect 2021 price levels, using national consumer price index data from the World Bank [44]. Table 3 presents the resulting figures disaggregated by ES, along with the valuation techniques used in the original study. Importantly, we excluded the provisioning value of cork from our ES valuation, as it was already incorporated in the SEV assessment.

Table 3.

Valuation details of cork oak forests’ ecosystem services (updated values from [40]).

Among the ESs considered, the regulation service of habitat maintenance—which includes biological control, refuge provision, and genetic resource conservation—represented nearly half of the total ESs value (EUR 2,261.90/ha year). The study of [40] derives the valuation from baseline estimates of ES values for different land and marine cover types along the Catalan coast [45], extrapolated to the specific ecological context of cork oak forests. Habitat maintenance is particularly significant in these landscapes, as cork oak systems support some of the highest levels of biodiversity in southwestern Europe and northwestern Africa [46].

The third and final step of the environmental value calculation involved determining the attribution of ESs value from cork oak forests, that is, deciding how to allocate the benefits of these services among the various outputs produced by the forest system. As shown in the provisioning services listed in Table 3, cork oak forests yield several marketable products beyond raw cork, such as wood, honey, and animal pasture. These additional outputs contribute to the overall economic viability of cork oak landscapes and can constitute a significant share of the total economic returns, particularly in multifunctional systems such as cork oak woodlands.

A commonly used method for allocating environmental benefits among multiple forest outputs is through economic allocation factors, based on the relative revenue generated by each product [47]. According to the ES valuation study conducted by [40], and considering only those provisioning services that have commercial exploitation (as indicated by asterisks in Table 3), raw cork accounts for approximately 49% of the total revenue from the forest. This figure is consistent with findings from a recent study on Portuguese cork producers managing cork oak woodlands (montados), which reported that cork typically contributes around 50% of total farm income [48]. Given the alignment between these two sources, we adopted an attribution factor of 50% to apportion the environmental value of ESs to the cork-related activities of Catalan cork companies.

4. Results

4.1. Socioeconomic Value

Table 4 shows the results obtained for the value calculations of the SEV created and distributed to the six main stakeholder groups that maintain market relations with the Catalan cork companies. The table shows the SEV calculation for the entire sample of eleven cork companies, both in absolute values and percentages.

Table 4.

Socioeconomic value (SEV) creation and distribution of Catalan cork companies (year 2021).

As can be seen from the values in Table 4, most of the value created is transferred to customers and suppliers, which together account for 81% of the total SEV. The data collected from the companies on the breakdown of their sales and purchases in different geographical areas allow us to estimate the value distribution in Catalonia, the rest of Spain, and the rest of the world. Catalan cork companies source to a greater extent from the rest of the world (69%) than from Spain (14%) or Catalonia (17%). Similarly, customers are located mostly abroad (56%)—mainly in Portugal, France, Italy, and the United States—and to a lesser extent in Spain (29%) and Catalonia (15%). Of the remaining value transfers to stakeholders, the SEV for employees and the SEV retained in the companies occur entirely within Catalonia, while no specific information is available on the geographical distribution of SEV for public administrations, shareholders, and financial entities. In conclusion, 68% of the value created by the Catalan cork companies is distributed outside the region of Catalonia.

In addition to the absolute values of SEV, we can calculate the relative value of SEV per turnover and per employee. If we relate the total SEV (EUR 170,428,754) to the total turnover of the 11 cork companies, excluding their intra-industry transactions (EUR 103,238,383), we obtain an SEV per turnover of EUR 1.65. If we relate the total SEV (EUR 170,428,754) to the total number of employees of the 11 cork companies (350 people), we obtain an SEV per employee of EUR 479,707.

The obtained ratios of SEV per turnover and SEV per employee could be used to extrapolate these results to the entire Catalan cork sector (EUR 138 million of turnover and 485 employees in the year 2021). However, these SEV ratios and the distribution of the socioeconomic value to the different stakeholders may be influenced by factors such as company size and type of business activity. Table 5 shows the mean, minimum, maximum, and median values of value distribution and SEV ratios for the sample companies. Whereas the value distribution figures vary between 1% and 22% without a recognizable pattern, the SEV per turnover ratio appears to be fairly stable, ranging between EUR 1.51 and 1.90.

Table 5.

SEV distribution and ratios in Catalan cork companies (year 2021).

If we extrapolate the SEV calculation to the entire Catalan cork sector by multiplying the SEV/turnover ratio from Table 4 with the total industry turnover (EUR 138 million), we obtain an amount (EUR 227 million) that closely aligns with the result of a calculation based on the financial data available for 27 out of the 30 cork companies (EUR 225 million). This latter calculation includes some adjustments, such as extrapolating missing data using the average industry variation from previous years and applying adjustment factors to data from companies with business activities unrelated to cork or located outside Catalonia, based on the estimated share of their cork-related turnover within Catalonia. If we further adjust the turnover (and purchase) data to account for inter-company transactions using the same adjustment factor applied to the sample companies, we obtain an extrapolated value of EUR 217 million.

4.2. Environmental Value

The environmental value creation of Catalan cork companies in the year 2021 results from multiplying the equivalent cork oak forest area (209,410 ha) by the valuation proxy for cork oak forests’ ESs (Table 3) and the attribution factor of 50%. Table 6 shows the result obtained for the calculated environmental value for the entire sample of eleven cork companies and its breakdown into different geographical areas, as the value refers to cork oak forests located in Catalonia, other Spanish regions, and other countries such as Portugal, Italy, and France. It should be noted that most of this value is created outside the territory of Catalonia.

Table 6.

Estimated environmental value (year 2021).

Since the value calculation result relies heavily on a single monetary proxy and is significantly influenced by the average raw cork production figures used as well as the attribution factor, we undertook a sensitivity analysis by increasing or decreasing the input values by 50% (see Table 7).

Table 7.

Sensitivity analysis of the effects of cork production yield and attribution on estimated environmental value.

The results of the sensitivity analysis show an inverse relationship between cork yield and environmental value because lower yields require larger forest areas to produce the same amount of cork, and the valued ESs are proportional to forest area. However, a lower cork production yield may also influence the extent of delivered ESs, for example, by decreasing carbon sequestration per hectare or by increasing the biodiversity supported by the habitats. The relationship between cork production yield and the delivery of ESs is non-linear and context-dependent, and generally follows a bell-shaped curve, with maximum benefits at intermediate productivity levels [46]. Regarding the attribution of environmental value to the cork industry, the observed relationship in the sensitivity analysis is much simpler: environmental value varies directly in proportion to changes in the attribution factor, i.e., the percentage of cork in the overall income generated by cork oak forests. Finally, the sensitivity analysis suggests a possible range from a low estimate of EUR 162,338,564 to a high estimate of EUR 1,461,047,075.

If we extrapolate the environmental value calculation (base case with average raw cork production and a 50% attribution factor) to the entire Catalan cork sector using the sector’s 2021 cork input quantity and composition [49], we obtain an estimate of EUR 669 million.

5. Discussion and Conclusions

Our study attempts to analyze and monetize the overall value created for society by the Catalan cork industry. On the one hand, we calculate the socioeconomic value generated through the economic activity of a sample of Catalan cork companies, following the methodology of ISV analysis. Specifically, we estimate the SEV, the socioeconomic value created and distributed to the six main stakeholder groups that maintain market relations with Catalan cork companies (employees, shareholders, public administrations, financial entities, suppliers, and customers). In extending the ISV model to an entire industry, we have addressed some specific challenges in value calculation beyond simple data aggregation. In contrast to previous studies [25,26], we collected primary data directly from companies, which allowed us to account for inter-company transactions—and thus avoid double counting—as well as assess the territorial distribution of value. The result obtained for our sample’s SEV in the year 2021 is EUR 170 million. This means that, on average, every EUR 1.0 of revenue by the Catalan cork companies creates EUR 1.65 of SEV for all their stakeholders.

It is difficult to compare the SEV results with those of other industries due to the limited number of existing studies in this area. However, the SEV per company and SEV per employee ratios fall within the range of average company values observed in four different territories (the three provinces of the Basque Autonomous Community and one region in Sweden) in the study by [25]. Regarding the distribution of value among stakeholders, Catalan cork companies show a proportionally higher distribution to customers (61%) and suppliers (20%) and a lower distribution to public administrations (8%). More recent data from companies located in European science and technology parks confirm this observation [26].

Although our initial aim was to calculate the SEV of the entire Catalan cork industry, we faced the problem of not having all the necessary secondary data updated to the required level. Our decision to focus on a smaller sample of 11 companies, for which we were able to obtain all the required financial information, has ensured the robustness of the calculation results. The subsequent extrapolation and comparison with the estimate made for the whole Catalan cork sector show that the SEV/turnover ratio may be a reliable indicator—at least in the context of the analyzed sector.

On the other hand, our study calculates the environmental value of the forest-based cork industry, following the approach of ES valuation. After determining the equivalent cork oak forest area used by Catalan cork companies in the year 2021 (209,410 ha), its ES value is estimated by assigning a valuation proxy derived from a previous study and by attributing this value to the Catalan cork companies according to the average contribution of cork to forestry income. The result obtained for the estimation ranges between a low estimate of EUR 162 million and a high estimate of EUR 1461 million. Cork oak forests’ ESs create benefits for different stakeholders at the local, regional, and global scales, including essential regulation and maintenance services (such as climate regulation and habitat maintenance) that are enjoyed by society as a whole. Nevertheless, the cork industry—like all industries—also has associated negative environmental impacts (e.g., through energy and water consumption, waste generation, and emissions from processing and transport), which are not considered in the present study. Beyond the recurrent assertion that the cork industry’s CO2 balance is positive because cork oak forests absorb and store more CO2 than is released during the production and use of cork products (e.g., [39]), it has not been possible to find more detailed data on these negative environmental impacts that could have been included in the analysis of the companies in this study.

The environmental value calculation is complex because it refers to ecosystems in different locations. The valuation proxies used are within the range found in the literature on forest ESs, where regulation and maintenance services are commonly valued higher than provisioning and cultural ones [33]. However, the value of regulation and maintenance services is generally difficult to assess because the benefit that people derive from these services (which are not privately owned or traded) frequently cannot be directly observed or measured. In addition, the ability to transfer values from one context to another depends on the specific ES: some ESs, such as carbon sequestration, are provided at a global scale and their benefits are easily transferable; by contrast, values of local-scale services, such as hydrological regulation, may have little transferability. Although ES assessments conducted for specific cork oak forests [50,51,52] determined lower values, they are less comprehensive, i.e., they consider fewer ESs than the study we used for the value transfer [40]. In the absence of more detailed information on the site-specific parameters of the cork oak sites outside of Catalonia, the present calculated value can be considered a first reasonable estimate that indicates that the environmental value of Catalan cork companies is at least equal to their socioeconomic value. The results of this study also highlight that the main stakeholder benefiting from the Catalan cork industry is the environment and, indirectly, society.

The integration of the ES valuation framework with ISV analysis has revealed that both approaches, despite having different disciplinary roots, rely on similar principles. Both are frameworks aimed at capturing market and especially non-market value of organizations/ecosystems and estimating their utility through monetary proxies. Although ES valuation generally focuses on ecological benefits to society, often with a biophysical foundation, it also includes non-material benefits such as recreational activities and tourism, scientific and educational activities, or cultural identity and landscape [40,52]. The latter aspects are often those that make up the non-market social value element of ISV, i.e., the social value that companies create for their various stakeholders through non-market relationships. In this sense, ES valuation not only complements the market-based social value or socioeconomic value of organizations with a value estimate of their positive environmental footprint but also with elements of their positive social footprint. Although often conducted as an expert-driven assessment, ES valuation increasingly involves the perceptions and preferences of stakeholders [53], and in this way resembles the approach followed by the non-market social value dimension of ISV.

Our findings contribute to the evolving discourse on social and environmental accounting by applying the ISV model to an entire industrial ecosystem rather than a single organization. Unlike other socioeconomic impact assessment methods that estimate the economic impulse created by institutions’ expenditure on regional economies (e.g., input–output analysis or multiplier effect approaches), the ISV calculation allows for assessing the benefits experienced by the stakeholders impacted by the business activity. Combined with ES valuation, the approach can also capture the benefits experienced by stakeholders from nature.

Our study demonstrates the feasibility of combining ISV with ES valuation for assessing the value of the Catalan cork industry. This approach can be applied to evaluate the societal benefits of other traditional nature-based industries, such as food production and construction, or nature-based solutions (NBSs). From a policy perspective, the results highlight the need to incorporate non-market values into regional development strategies, particularly in rural and forest-dependent areas. The cork industry in Catalonia exemplifies how traditional sectors can promote GDP contribution, employment, or tax revenue and simultaneously support biodiversity, carbon sequestration, landscape preservation, and cultural heritage.

Future research should aim to refine the SEV calculation to improve its robustness and comparability across different industrial contexts, and to complement the SEV calculation with the estimation of the non-market social value that goes beyond the benefits created by cork oak forests, such as training for employees, work–life balance initiatives, or collaborations in social projects. Furthermore, future studies should incorporate the industry’s operational negative environmental impacts, specifically the CO2 emissions that occur along the value chain and that should be subtracted from cork oak carbon sequestration at the forest stage. In general terms, research could explore more deeply the incorporation of ES valuation into social value frameworks and analyze alternative approaches to capture cultural ecosystem services, relational values, and non-material benefits that are often underrepresented in monetary valuation.

Author Contributions

Conceptualization, S.A. and A.H.; methodology, S.A.; formal analysis, S.A.; investigation, S.A., A.H. and E.V.; writing—original draft preparation, S.A.; writing—review and editing, A.H. and E.V.; project administration, A.H. and E.V. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Catalan Cork Institute Foundation through a grant awarded to promote the circular economy by the Waste Agency of Catalonia (ARC027/20).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Acknowledgments

The authors thank Roberto D. Ponce Oliva for his constructive and helpful comments on an earlier version of the manuscript.

Conflicts of Interest

This research was funded by the Catalan Cork Institute Foundation, which participated in data collection and manuscript review but did not influence the study design, methodological decisions, data analysis, or the interpretation of the reported research results.

Abbreviations

The following abbreviations are used in this manuscript:

| D-SEV | Direct socioeconomic value |

| ESs | Ecosystem services |

| GDP | Gross domestic product |

| Ha | Hectare |

| I-SEV | Indirect socioeconomic value |

| ISV | Integrated Social Value |

| M | Million |

| NBSs | Nature-based solutions |

| PPP | Purchasing Power Parity |

| SABI | Iberian Balance Sheet Analysis System |

| SEV | Socioeconomic value |

| VAT | Value-added tax |

References

- Stiglitz, J.E.; Sen, A.; Fitoussi, J.-P. Report by the Commission on the Measurement of Economic Performance and Social Progress; Commission on the Measurement of Economic Performance and Social Progress: Paris, France, 2009. [Google Scholar]

- Bateman, I.J.; Mace, G.M.; Fezzi, C.; Atkinson, G.; Turner, R.K. Economic Analysis for Ecosystem Service Assessments. Environ. Resour. Econ. 2011, 48, 177–218. [Google Scholar] [CrossRef]

- Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES). Global Assessment Report on Biodiversity and Ecosystem Services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services; Díaz, S., Settele, J., Brondízio, E.S., Ngo, H.T., Eds.; IPBES Secretariat: Bonn, Germany, 2019. [Google Scholar]

- TEEB. The Economics of Ecosystems and Biodiversity: Mainstreaming the Economics of Nature: A Synthesis of the Approach, Conclusions and Recommendations of TEEB; United Nations Environment Programme: Geneva, Switzerland, 2010. [Google Scholar]

- Dasgupta, P. The Economics of Biodiversity: The Dasgupta Review; HM Treasury: London, UK, 2021. [Google Scholar]

- Quinto-Canas, R.; Cano-Ortiz, A.; Raposo, M.; Piñar Fuentes, J.C.; Cano, E.; Barbosa, N.; Pinto Gomes, C.J. Cork Oak Vegetation Series of Southwestern Iberian Peninsula: Diversity and Ecosystem Services. In New Metropolitan Perspectives. NMP 2020. Smart Innovation, Systems and Technologies; Bevilacqua, C., Calabrò, F., Della Spina, L., Eds.; Springer: Cham, Switzerland, 2021; Volume 178, pp. 267–282. [Google Scholar] [CrossRef]

- Sierra-Pérez, J.; Boschmonart-Rives, J.; Gabarrell, X. Production and trade analysis in the Iberian cork sector: Economic characterization of a forest industry. Resour. Conserv. Recycl. 2015, 98, 55–66. [Google Scholar] [CrossRef]

- Retolaza, J.L.; San-Jose, L.; Ruiz-Roqueñi, M. Social Accounting for Sustainability: Monetizing the Social Value; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Retolaza, J.L.; San-Jose, L. Understanding social accounting based on evidence. SAGE Open 2021, 11, 21582440211003865. [Google Scholar] [CrossRef]

- Johnston, R.J.; Rolfe, J.; Rosenberger, R.S.; Brouwer, R. Benefit Transfer of Environmental and Resource Values: A Guide for Researchers and Practitioners; Springer: Berlin/Heidelberg, Germany, 2015. [Google Scholar] [CrossRef]

- Prochazkova, P.T.; Noskova, M. An application of input-output analysis to social enterprises: A case of the Czech Republic. J. Entrep. Emerg. Econ. 2020, 12, 495–522. [Google Scholar] [CrossRef]

- Ayuso, S.; Sánchez, P.; Retolaza, J.L.; Figueras-Maz, M. Social value analysis: The case of Pompeu Fabra University. Sustain. Account. Manag. Policy J. 2020, 11, 233–252. [Google Scholar] [CrossRef]

- Richmond, B.J.; Mook, L.; Jack, Q. Social accounting for nonprofits: Two models. Nonprofit Manag. Leadersh. 2003, 13, 308–324. [Google Scholar] [CrossRef]

- Corvo, L.; Pastore, L.; Manti, A.; Iannaci, D. Mapping social impact assessment models: A literature overview for a future research agenda. Sustainability 2021, 13, 4750. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone: Oxford, UK, 1997. [Google Scholar]

- Emerson, J.; Bonini, S.; Brehm, K. The Blended Value Map: Tracking the Intersects and Opportunities of Economic, Social and Environmental Value Creation; William and Flora Hewlett Foundation: Menlo Park, CA, USA, 2003. [Google Scholar]

- Porter, M.E.; Kramer, M.R. Creating shared value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Arimany-Serrat, N.; Tarrats-Pons, E. Integrated Social Value at Universities: A Guarantee for Public Subsidies. Sustainability 2021, 13, 5975. [Google Scholar] [CrossRef]

- San-Jose, L.; Garcia-Merino, J.D.; Retolaza, J.L. Social value in the orange economy: Social accounting applied to museums. Mus. Manag. Curatorship 2023, 38, 231–253. [Google Scholar] [CrossRef]

- Guzmán-Pérez, B.; Pérez-Monteverde, M.V.; Mendoza-Jiménez, J.; Román-Cervantes, C. Social Value and Urban Sustainability in Food Markets. Front. Psychol. 2021, 12, 689390. [Google Scholar] [CrossRef] [PubMed]

- Mendoza Jiménez, J.; Guzmán Pérez, B.; Pérez Monteverde, M.V.; Román Cervantes, C. The Contribution of the Fishermen’s Guilds and the Agrarian Transformation Societies to the Sustainable Development Goals: The Case of the Canary Islands. Sustainability 2020, 12, 5635. [Google Scholar] [CrossRef]

- Guzmán-Pérez, B.; Mendoza-Jiménez, J.; Pérez-Monteverde, M.V. Measuring the social sustainability of hotels: A case study from the Canary Islands. Int. J. Contemp. Hosp. Manag. 2023, 35, 512–532. [Google Scholar] [CrossRef]

- Ayuso, S.; Carbonell, X.; Serradell, L. Assessing universities’ social sustainability: Accounting for stakeholder value. Int. J. Sustain. High. Educ. 2021, 23, 443–457. [Google Scholar] [CrossRef]

- Blázquez, V.; Aguado, R.; Retolaza, J.L. Science and technology parks: Measuring their contribution to society through social accounting. CIRIEC-España Rev. Econ. Pública Soc. Coop. 2020, 100, 277–306. [Google Scholar] [CrossRef]

- Blazquez, V.; Biffi, A.; Aguado, R. The social value of science and technology parks: A European perspective. Technol. Anal. Strateg. Manag. 2023, 37, 798–809. [Google Scholar] [CrossRef]

- Mohr, J.; Thissen, C. Measuring and disclosing corporate valuations of impacts and dependencies on nature. Calif. Manag. Rev. 2022, 65, 91–118. [Google Scholar] [CrossRef]

- Costanza, R.; d’Arge, R.; de Groot, R.; Faber, S.; Grasso, M.; Hannon, B.; Limburg, K.; Naeem, S.; O’Neill, R.V.; Paruelo, J.; et al. The value of the world’s ecosystem services and natural capital. Nature 1997, 387, 253–260. [Google Scholar] [CrossRef]

- Daily, G.C. Nature’s Services: Societal Dependence on Natural Ecosystems; Island Press: Washington, DC, USA, 1997. [Google Scholar]

- Millennium Ecosystem Assessment. Ecosystems and Human Well-Being: Biodiversity Synthesis; World Resources Institute: Washington, DC, USA, 2005. [Google Scholar]

- Hein, L.; van Koppen, K.; de Groot, R.S.; van Ierland, E.C. Spatial scales, stakeholders and the valuation of ecosystem services. Ecol. Econ. 2006, 57, 209–228. [Google Scholar] [CrossRef]

- Costanza, R.; de Groot, R.; Sutton, P.; van der Ploeg, S.; Anderson, S.J.; Kubiszewski, I.; Farber, S.; Turner, R.K. Changes in the global value of ecosystem services. Glob. Environ. Change 2014, 26, 152–158. [Google Scholar] [CrossRef]

- Grammatikopoulou, I.; Vačkářová, D. The value of forest ecosystem services: A meta-analysis at the European scale and application to national ecosystem accounting. Ecosyst. Serv. 2021, 48, 101262. [Google Scholar] [CrossRef]

- Liu, S.; Costanza, R.; Farber, S.; Troy, A. Valuing ecosystem services. Ann. N. Y. Acad. Sci. 2010, 1185, 54–78. [Google Scholar] [CrossRef]

- Transparent Project. Standardized Natural Capital Management Accounting: A Methodology Promoting the Integration of Nature in Business Decision Making; Value Balancing Alliance, Capitals Coalition, World Business Council for Sustainable Development: Brussels, Belgium, 2023. [Google Scholar]

- Value Balancing Alliance. Available online: https://www.value-balancing.com (accessed on 5 June 2025).

- Megía, T.; Martín, D. El Clúster Català del Suro; Generalitat de Catalunya; Departament d’Innovació, Universitats i Empresa/Observatori de Prospectiva Industrial: Barcelona, Spain, 2009. [Google Scholar]

- Mascort, M. (Association of Cork Entrepreneurs of Catalonia AECORK, Palafrugell, Spain). Personal communication, 2022.

- Rives, J.; Fernandez-Rodriguez, I.; Rieradevall, J.; Gabarrell, X. Integrated environmental analysis of the main cork products in southern Europe (Catalonia—Spain). J. Clean. Prod. 2013, 51, 289–298. [Google Scholar] [CrossRef]

- Gabinet d’Estudis Econòmics. El valor de los Servicios Ambientales de los Alcornocales en Cataluña; Gabinet d’Estudis Econòmics UPC: Barcelona, Spain, 2013; Available online: https://icsuro.com/wp-content/uploads/2023/11/2013-Valor-servicios-ambientales-alcornocales-en-Cat.pdf (accessed on 5 June 2025).

- CELIEGE (European Cork Confederation). International Code of Cork Stopper Practices (Version 7.1); CELIEGE: Santa Maria de Lamas, Portugal, 2020. [Google Scholar]

- Boschmonart Rives, J. La Fixació de CO2 de la Sureda a Catalunya. Informe Expert per a l’Institut Català del Suro; Inèdit: Barcelona, Spain, 2016; unpublished work. [Google Scholar]

- Demertzi, M.; Paulo, J.A.; Arroja, L.; Dias, A.C. A carbon footprint simulation model for the cork oak sector. Sci. Total Environ. 2016, 566–567, 499–511. [Google Scholar] [CrossRef] [PubMed]

- World Bank Group. World Development Indicators. Updated 19 September 2023. Available online: https://data.worldbank.org/indicator/FP.CPI.TOTL?end=2022&start=2010 (accessed on 20 September 2023).

- Brenner, J.; Jiménez, J.A.; Sardá, R.; Garola, A. An Assessment of the Non-Market Value of the Ecosystem Services Provided by the Catalan Coastal Zone, Spain. Ocean Coast. Manag. 2010, 53, 27–38. [Google Scholar] [CrossRef]

- Bugalho, M.; Caldeira, M.; Pereira, J.; Aronson, J.; Pausas, J. Mediterranean Cork Oak Savannas Require Human Use to Sustain Biodiversity and Ecosystem Services. Front. Ecol. Environ. 2011, 9, 278. [Google Scholar] [CrossRef]

- Croezen, H.; Bijleveld, M.; Sevenster, M. Natural Cork Bottle Stoppers: A Stopper on CO2 Emissions? CE Delft: Delft, The Netherlands, 2013. [Google Scholar]

- Sørensen, I.H.; Torralba, M.; Quintas-Soriano, C.; Muñoz-Rojas, J.; Plieninger, T. Linking cork to cork oak landscapes: Mapping the value chain of cork production in Portugal. Front. Sustain. Food Syst. 2021, 5, 787045. [Google Scholar] [CrossRef]

- Verdum, M. (Catalan Cork Institute Foundation, Palafrugell, Spain). Personal communication, 2023.

- Corona, P.; Quatrini, V.; Schirru, M.; Dettori, S.; Puletti, N. Towards the Economic Valuation of Ecosystem Production from Cork Oak Forests in Sardinia (Italy). iForest 2018, 11, 660–667. [Google Scholar] [CrossRef]

- La Riccia, L.; Assumma, V.; Bottero, M.C.; Dell’Anna, F.; Voghera, A. A Contingent Valuation-Based Method to Valuate Ecosystem Services for a Proactive Planning and Management of Cork Oak Forests in Sardinia (Italy). Sustainability 2023, 15, 7986. [Google Scholar] [CrossRef]

- Amorim. Corticeira Amorim Sustainability; Amorim: Mozelos, Portugal, 2020; Available online: https://www.amorim.com/xms/files/Investidores/Kit_Investidor/Amorim_Sustainability_2020.pdf (accessed on 5 June 2025).

- do Rosário, I.T.; Rebelo, R.; Caser, U.; Vasconcelos, L.; Santos-Reis, M. Valuation of Ecosystem Services by Stakeholders Operating at Different Levels: Insights from the Portuguese Cultural Montado Landscape. Reg. Environ. Change 2019, 19, 2173–2185. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).