Enhancing Power-to-Hydrogen Flexibility Through Optimal Bidding in Nordic Energy Activation Market with Wind Integration

Abstract

1. Introduction

- (i)

- Development of a Mixed Integer Linear Programming (MILP) model that integrates the technical constraints of a PtH facility while enabling its optimal participation in the Nordic mFRR market.

- (ii)

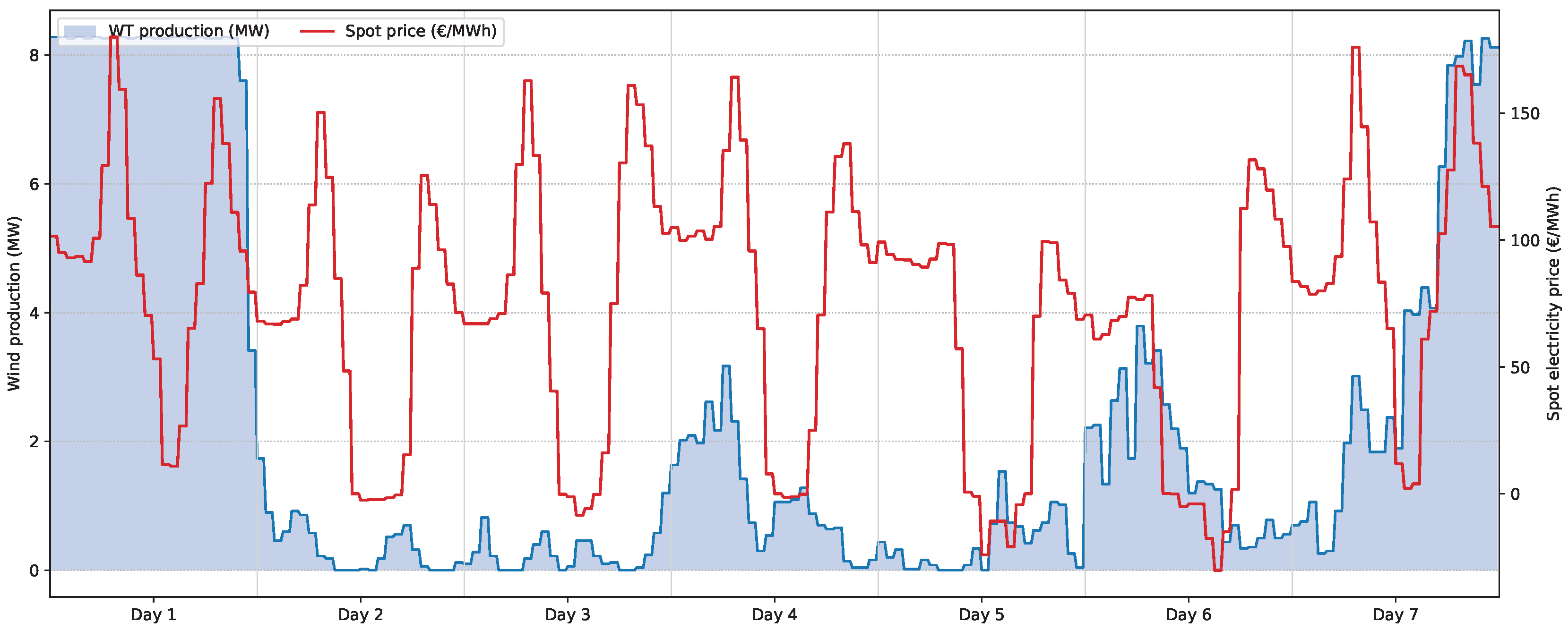

- Evaluation of the economic performance of a 6 MW PtH facility located at the Port of Hirtshals, Denmark, under two power supply scenarios: electricity sourced from the grid and electricity procured through a PPA with nearby WTs.

- (iii)

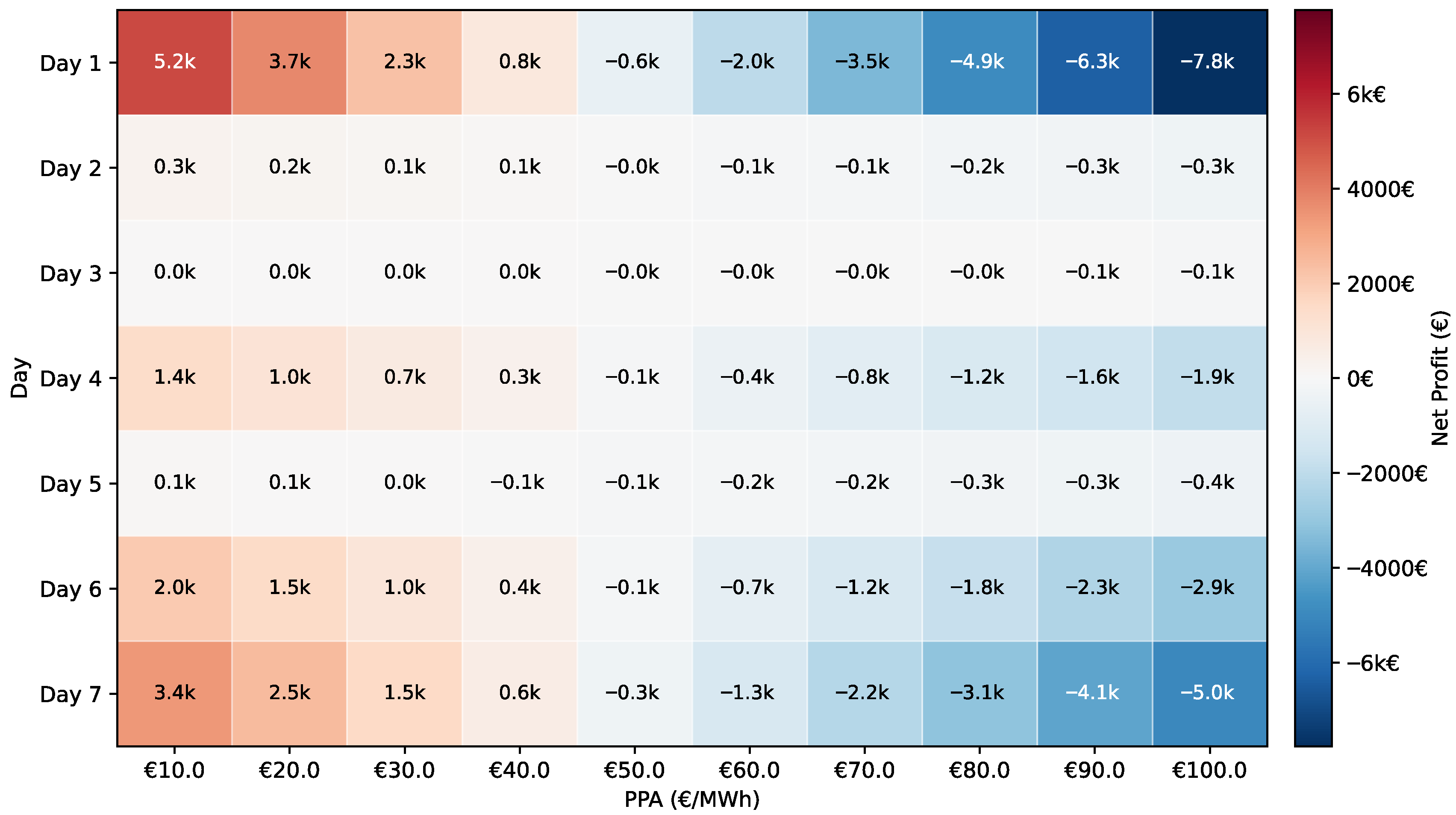

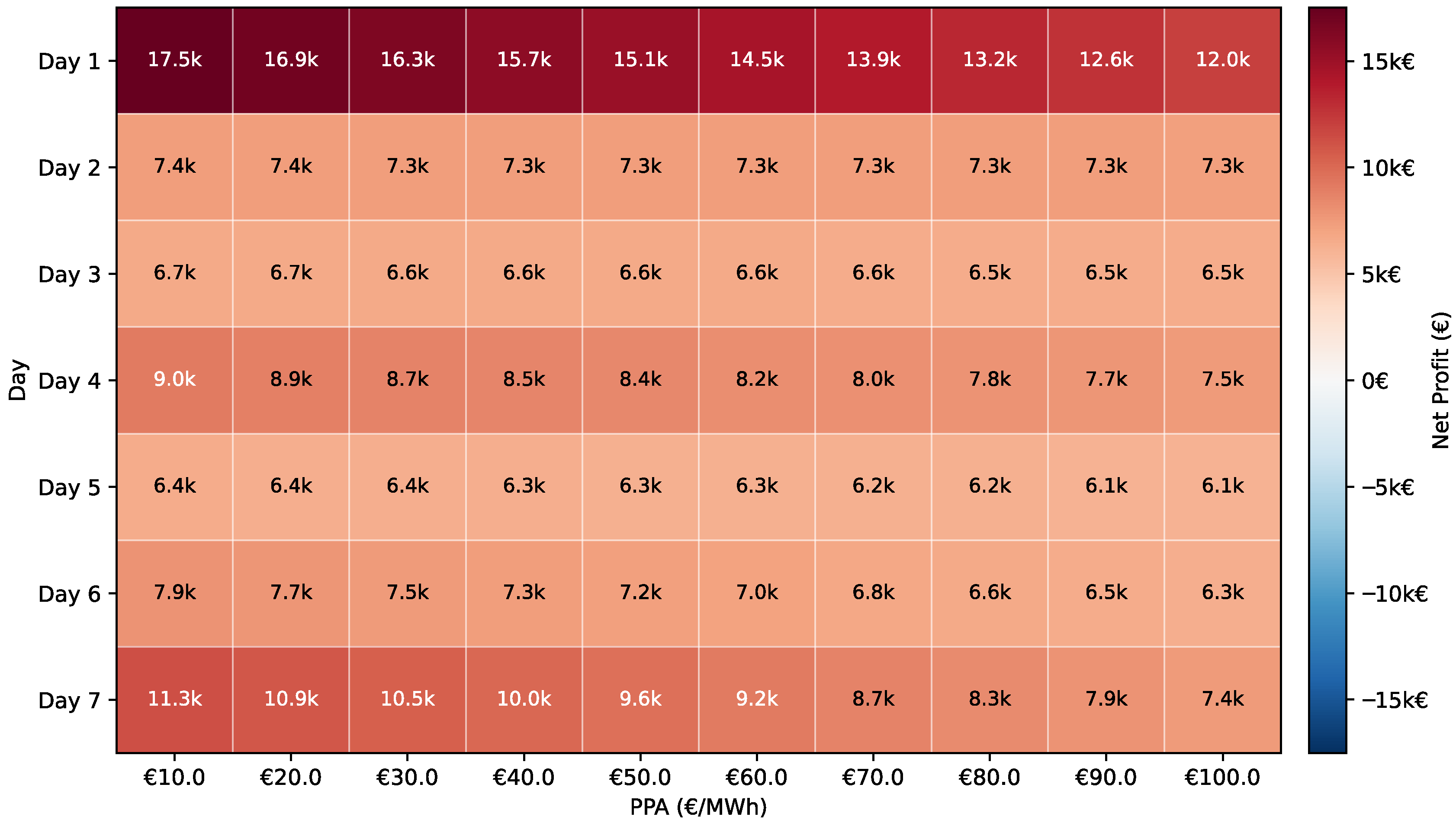

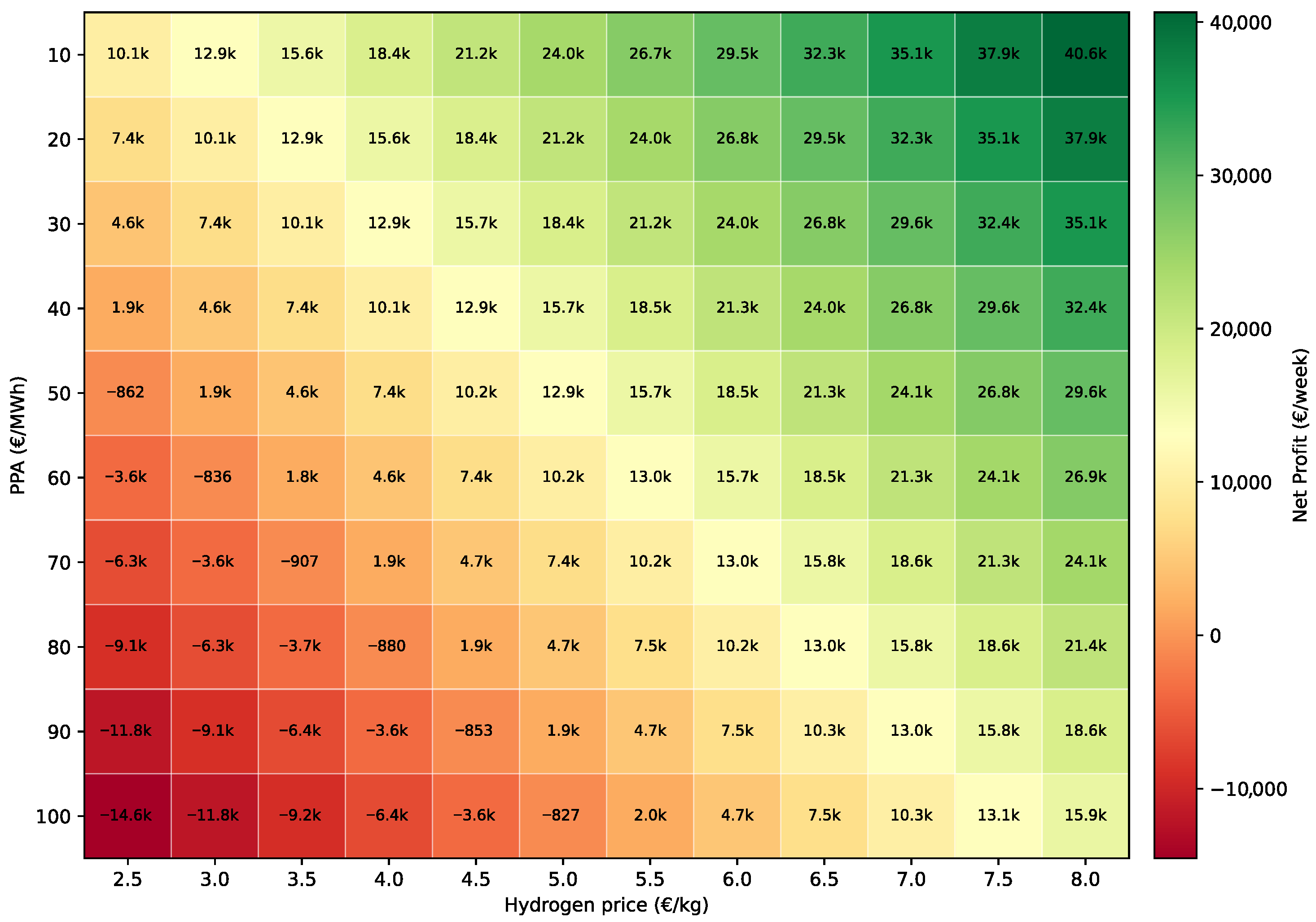

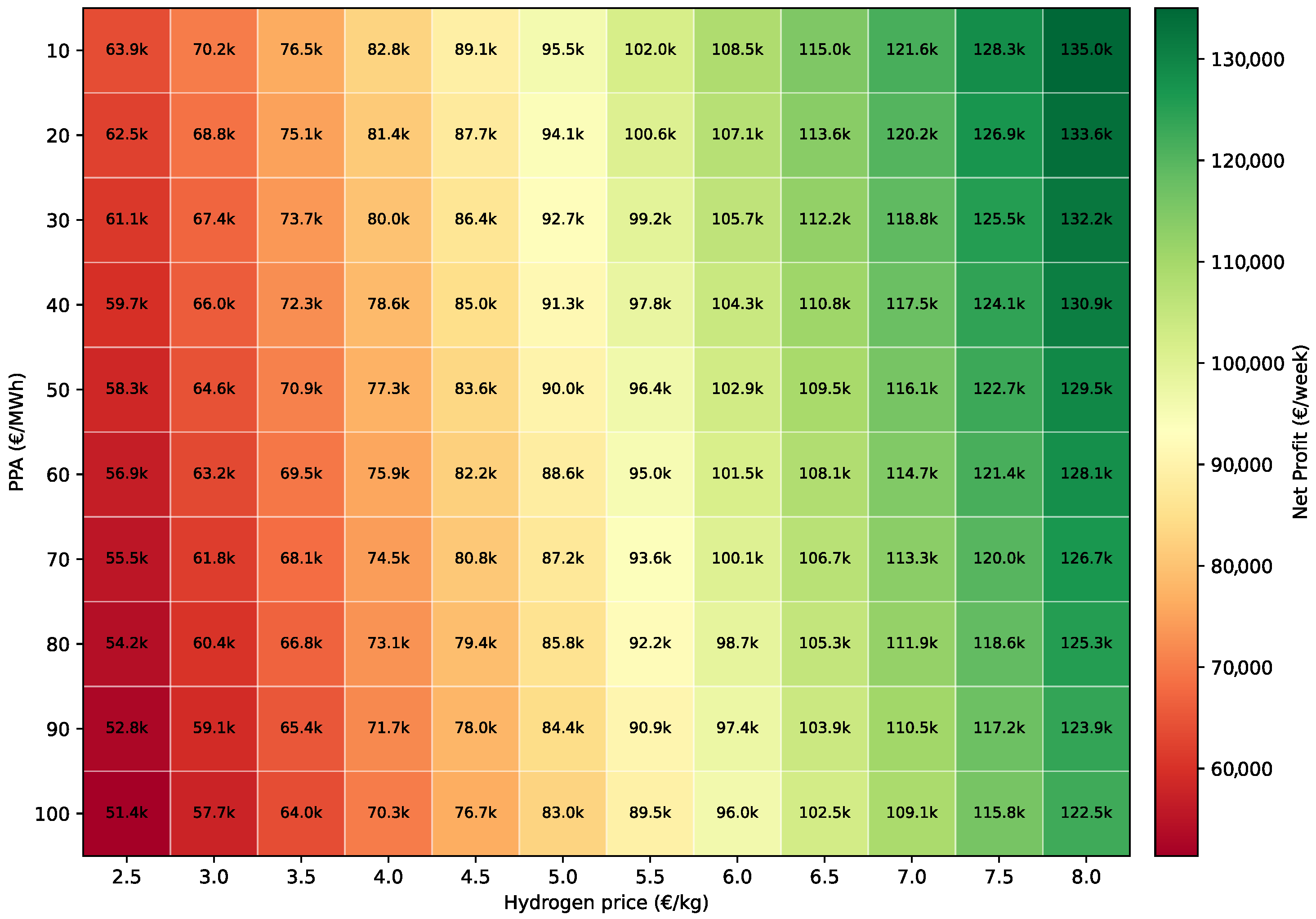

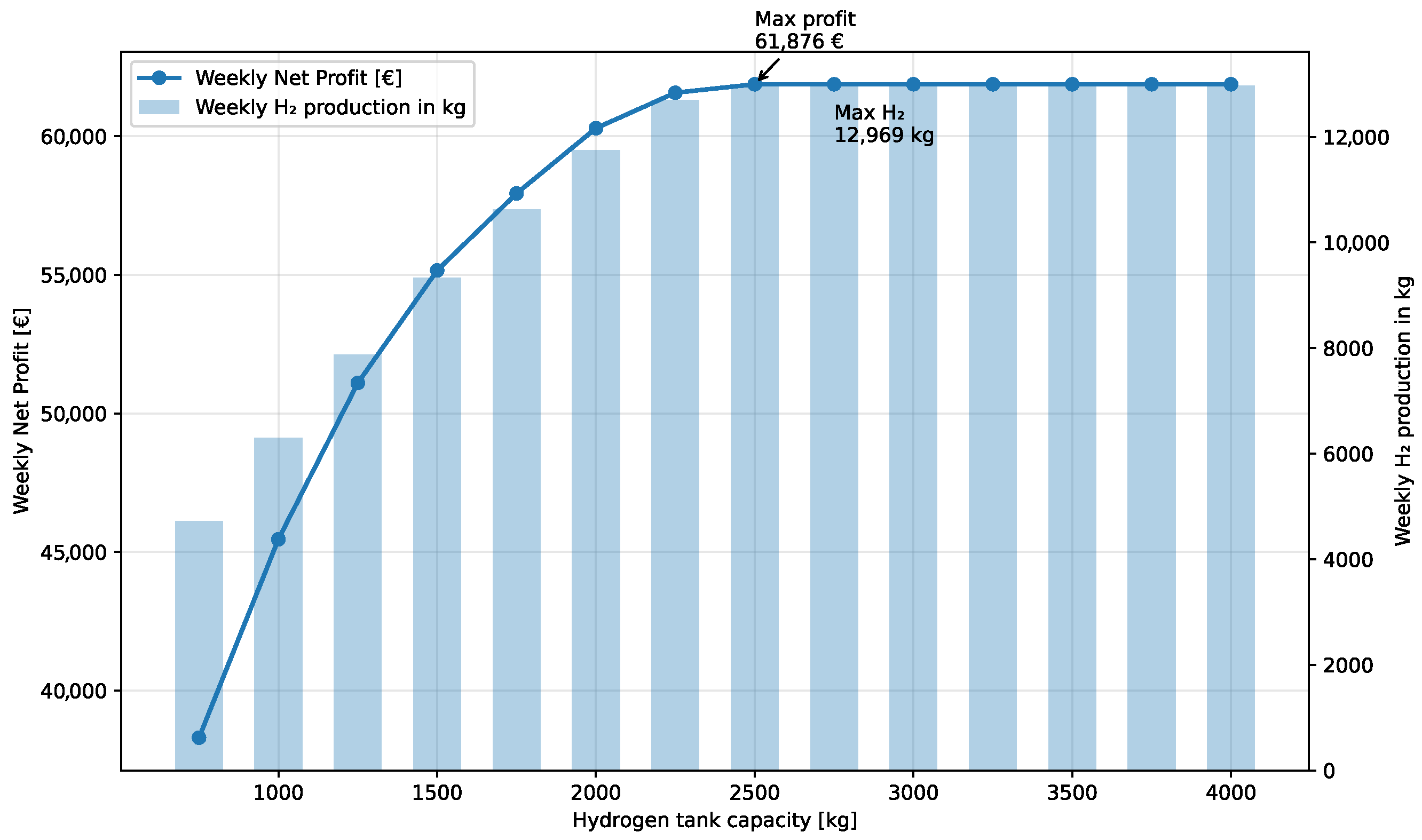

- Execution of sensitivity analyses on key parameters influencing profitability, including PPA pricing, hydrogen price, and hydrogen storage tank capacity.

2. Methodology of Research

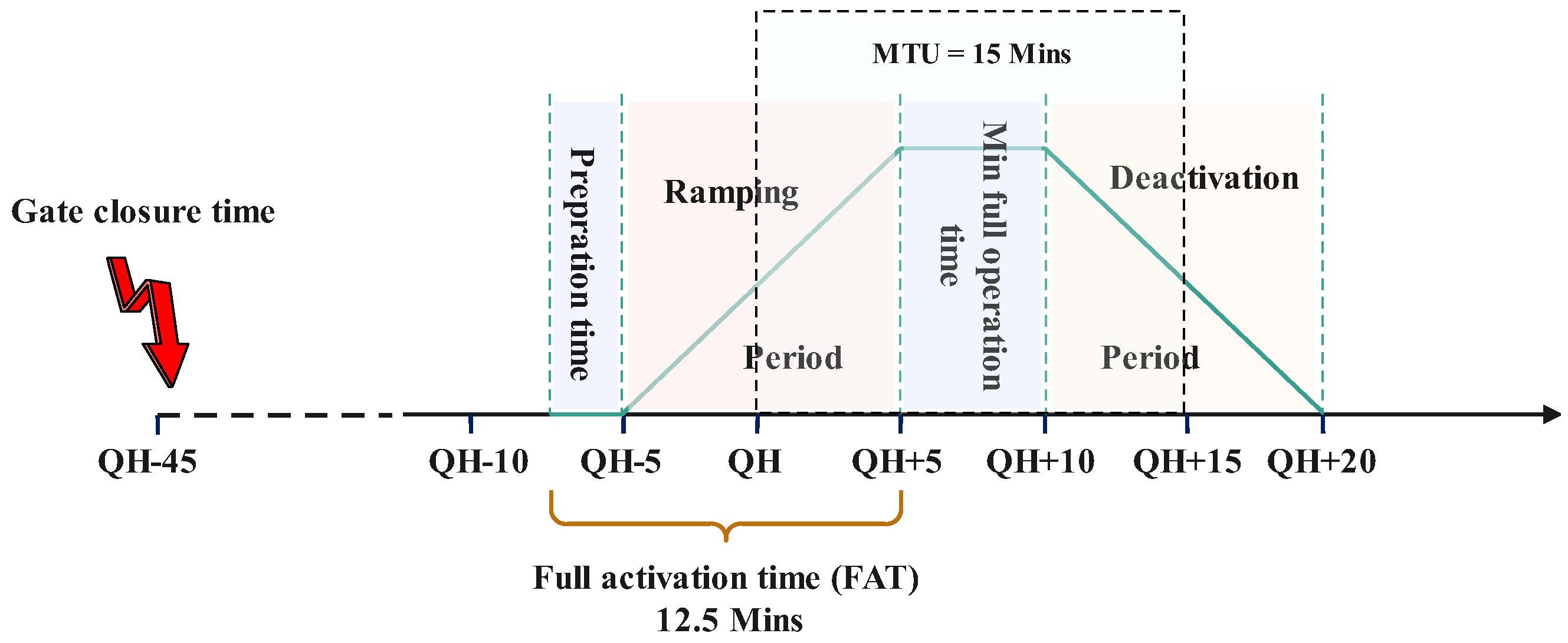

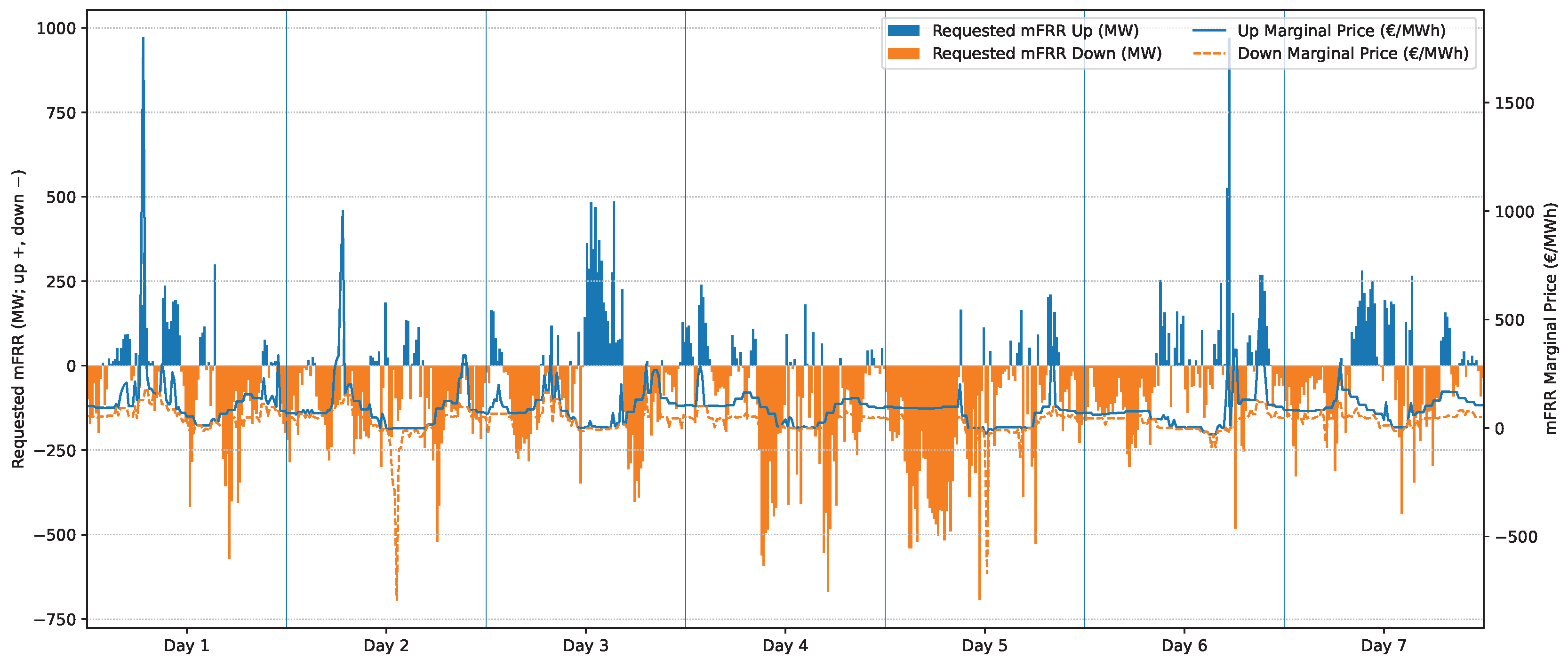

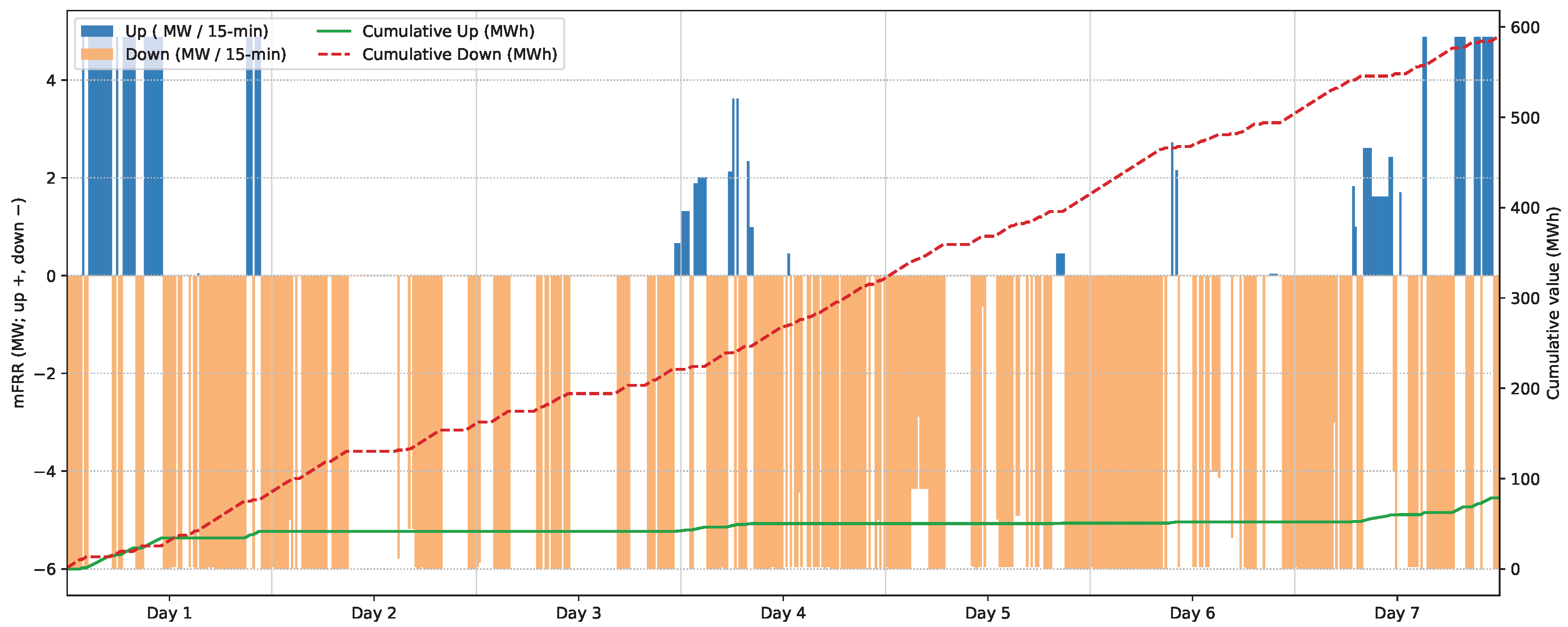

2.1. Nordic mFRR Energy Activation Market (EAM)

2.2. Mathematical Model

- ⋄

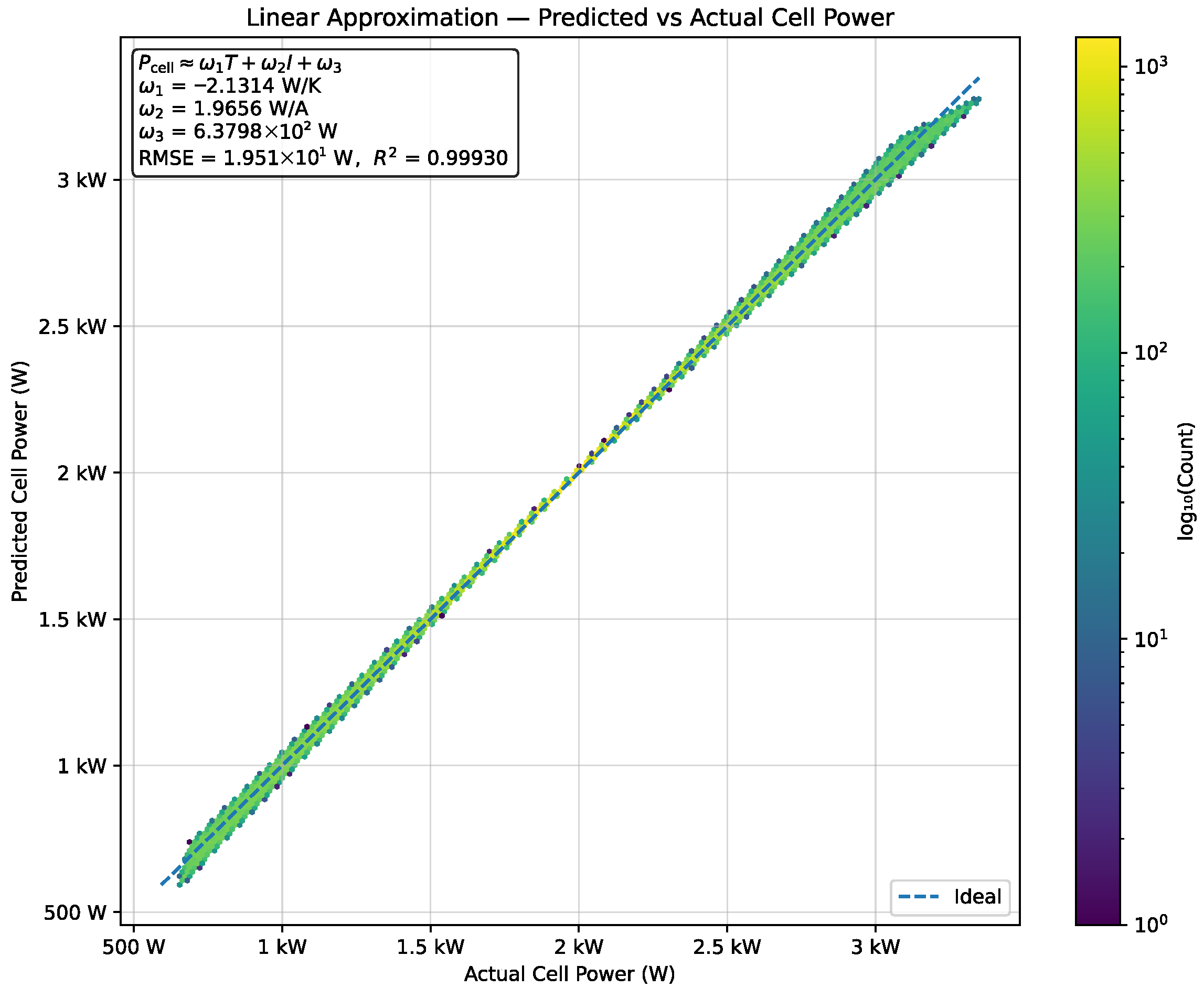

- Electrolyzer performance is represented by a linearized power–current–temperature relation and is enforced only in the online state; however, start/stop and thermal dynamics are addressed.

- ⋄

- The hydrogen storage tank is modeled as a zero-dimensional mass balance with negligible charge/discharge losses, consistent with compressed-gas storage efficiencies around 99% reported in [7].

- ⋄

- Temperature is assumed to be regulated by the balance-of-plant thermal system.

- ⋄

- Compressor power follows an equivalent adiabatic (theoretically) formulation with a constant efficiency parameter [32].

- ⋄

- Market participation is modeled with perfect foresight of mFRR activation prices and power generation of WT.

3. Case Study and Simulation

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kraftnät, S. Balancing Market Outlook 2030. Technical Report, Svenska Kraftnät, Tech. Rep., 2024. [Online]. Available online: https://www.svk.se (accessed on 18 September 2025).

- NBM. Confirmation of mFRR EAM Go Live March 4th 2025. 2025. Available online: https://nordicbalancingmodel.net/confirmation-of-mfrr-eam-go-live-march-4th-2025/?utm_source=chatgpt.com (accessed on 20 August 2025).

- Buttler, A.; Spliethoff, H. Current status of water electrolysis for energy storage, grid balancing and sector coupling via power-to-gas and power-to-liquids: A review. Renew. Sustain. Energy Rev. 2018, 82, 2440–2454. [Google Scholar] [CrossRef]

- Virji, M.; Randolf, G.; Ewan, M.; Rocheleau, R. Analyses of hydrogen energy system as a grid management tool for the Hawaiian Isles. Int. J. Hydrogen Energy 2020, 45, 8052–8066. [Google Scholar] [CrossRef]

- Schiebahn, S.; Grube, T.; Robinius, M.; Tietze, V.; Kumar, B.; Stolten, D. Power to gas: Technological overview, systems analysis and economic assessment for a case study in Germany. Int. J. Hydrogen Energy 2015, 40, 4285–4294. [Google Scholar] [CrossRef]

- Götz, M.; Lefebvre, J.; Mörs, F.; Koch, A.M.; Graf, F.; Bajohr, S.; Reimert, R.; Kolb, T. Renewable Power-to-Gas: A technological and economic review. Renew. Energy 2016, 85, 1371–1390. [Google Scholar] [CrossRef]

- Wulf, C.; Zapp, P.; Schreiber, A. Review of power-to-X demonstration projects in Europe. Front. Energy Res. 2020, 8, 191. [Google Scholar] [CrossRef]

- Guinot, B.; Montignac, F.; Champel, B.; Vannucci, D. Profitability of an electrolysis based hydrogen production plant providing grid balancing services. Int. J. Hydrogen Energy 2015, 40, 8778–8787. [Google Scholar] [CrossRef]

- Glenk, G.; Reichelstein, S. Economics of converting renewable power to hydrogen. Nat. Energy 2019, 4, 216–222. [Google Scholar] [CrossRef]

- Zheng, Y.; Huang, C.; You, S.; Zong, Y. Economic evaluation of a power-to-hydrogen system providing frequency regulation reserves: A case study of Denmark. Int. J. Hydrogen Energy 2023, 48, 26046–26057. [Google Scholar] [CrossRef]

- Saretta, M.; Raheli, E.; Kazempour, J. Electrolyzer Scheduling for Nordic FCR Services. In Proceedings of the 2023 IEEE International Conference on Communications, Control, and Computing Technologies for Smart Grids, SmartGridComm 2023, Glasgow, UK, 31 October–3 November 2023. [Google Scholar] [CrossRef]

- Lomholt, C.N.; Klausen, N.M. Techno-Economical Evaluation of the Integration of Electrolysers to Provide Dynamic Frequency Response in a Large-Scale Renewable Power System. 2023. Available online: https://backend.orbit.dtu.dk/ws/portalfiles/portal/375176376/M-0609_-_Carl_Nikolaj_Lomholt_Nilas_M_ller_Klausen.pdf (accessed on 18 September 2025).

- Phan, L.V.; Nguyen-Dinh, N.P.; Nguyen, K.M.; Nguyen-Duc, T. Advanced frequency control schemes and technical analysis for large-scale PEM and Alkaline electrolyzer plants in renewable-based power systems. Int. J. Hydrogen Energy 2024, 89, 1354–1367. [Google Scholar] [CrossRef]

- Nski, J.S.; Milewski, J.; Ryś, P.R.; Paczucha, J.; Kłos, M. Grid Frequency Fluctuation Compensation by Using Electrolysis: Literature Survey. Energies 2025, 18, 4376. [Google Scholar] [CrossRef]

- Riofrio, J.; You, S.; Weckesser, T. Power-to-X (PtX) integration in modern power systems: Exploring grid code compliance and technical requirements in Denmark and the United Kingdom. IET Conf. Proc. 2023, 2023, 5–14. [Google Scholar] [CrossRef]

- Ghaemi, S.; Li, X.; Mulder, M. Economic feasibility of green hydrogen in providing flexibility to medium-voltage distribution grids in the presence of local-heat systems. Appl. Energy 2023, 331, 120408. [Google Scholar] [CrossRef]

- Ghaemi, S.; Anvari-Moghaddam, A. Maximizing Value in Power-to-Hydrogen Plants Within Eco-Industrial Clusters Through Internal Heat Market. In Proceedings of the 2024 20th International Conference on the European Energy Market (EEM), Istanbul, Turkey, 10–12 June 2024; pp. 1–7. [Google Scholar] [CrossRef]

- Yu, Q.; Hao, Y.; Ali, K.; Hua, Q.; Sun, L. Techno-economic analysis of hydrogen pipeline network in China based on levelized cost of transportation. Energy Convers. Manag. 2024, 301, 118025. [Google Scholar] [CrossRef]

- Haggi, H.; Sun, W.; Fenton, J.M.; Brooker, P. Proactive Rolling-Horizon-Based Scheduling of Hydrogen Systems for Resilient Power Grids. IEEE Trans. Ind. Appl. 2022, 58, 1737–1746. [Google Scholar] [CrossRef]

- Pingkuo, L.; Junqing, G. Comparative analysis on the development potential of green hydrogen industry in China, the United States and the European Union. Int. J. Hydrogen Energy 2024, 84, 700–717. [Google Scholar] [CrossRef]

- Zenith, F.; Flote, M.N.; Santos-Mugica, M.; Duncan, C.S.; Mariani, V.; Marcantonini, C. Value of green hydrogen when curtailed to provide grid balancing services. Int. J. Hydrogen Energy 2022, 47, 35541–35552. [Google Scholar] [CrossRef]

- Xiao, P.; Hu, W.; Xu, X.; Liu, W.; Huang, Q.; Chen, Z. Optimal operation of a wind-electrolytic hydrogen storage system in the electricity/hydrogen markets. Int. J. Hydrogen Energy 2020, 45, 24412–24423. [Google Scholar] [CrossRef]

- Verstraten, P.; Wevers, M.; Raja, A. The Effects of PPAs on the Electricity Market TNO Public TNO Public Title TNO Public Report Text TNO Public Number of Pages 22 (excl. Front and Back Cover) Number of Appendices 0. 2024. Available online: https://publications.tno.nl/publication/34642473/pHWx3P/TNO-2024-R10051.pdf (accessed on 18 September 2025).

- Gonzalez-Aparicio, I.; Vitulli, A.; Krishna-Swamy, S.; Hernandez-Serna, R.; Jansen, N.; Verstraten, P. TNO Whitepaper Offshore Wind Business Feasibility in a Flexible and Electrified Dutch Energy Market by 2030. 2022. Available online: https://publications.tno.nl/publication/34640203/tMlTI0/TNO-2022-offshorewind.pdf (accessed on 18 September 2025).

- Schrotenboer, A.H.; Veenstra, A.A.; uit het Broek, M.A.; Ursavas, E. A Green Hydrogen Energy System: Optimal control strategies for integrated hydrogen storage and power generation with wind energy. Renew. Sustain. Energy Rev. 2022, 168, 112744. [Google Scholar] [CrossRef]

- Urs, R.R.; Sadiq, M.; Mayyas, A.; Mezher, T. Unlocking the Power of Negative Electricity Prices: Grid Connected Hydrogen Production. In Proceedings of the 2024 2nd Power Electronics and Power System Conference, PEPSC 2024, Singapore, 6–9 November 2024; pp. 58–63. [Google Scholar] [CrossRef]

- Ziegler, L.; Schulze, A.; Henning, M.; Steinsultz, N.; Christian, P.; Shaikh, R.A.; Kumar, Y.P.S.; Islam, S.M.M.; Abbott, D. Techno-economic Analysis of Optimal Grid-Connected Renewable Electricity and Hydrogen-to-Power Dispatch. J. Physics Conf. Ser. 2024, 2689, 12013. [Google Scholar] [CrossRef]

- Şahin, M.E. An overview of different water electrolyzer types for hydrogen production. Energies 2024, 17, 4944. [Google Scholar] [CrossRef]

- Khasawneh, H.J.; Maaitah, R.A.; AlShdaifat, A. Green hydrogen in Jordan: Stakeholder perspectives on technological, infrastructure, and economic barriers. Energies 2025, 18, 3929. [Google Scholar] [CrossRef]

- García-Valverde, R.; Espinosa, N.; Urbina, A. Simple PEM water electrolyser model and experimental validation. Int. J. Hydrogen Energy 2012, 37, 1927–1938. [Google Scholar] [CrossRef]

- Ulleberg, Ø. Modeling of advanced alkaline electrolyzers: A system simulation approach. Int. J. Hydrogen Energy 2003, 28, 21–33. [Google Scholar] [CrossRef]

- Li, C.H.; Zhu, X.J.; Cao, G.Y.; Sui, S.; Hu, M.R. Dynamic modeling and sizing optimization of stand-alone photovoltaic power systems using hybrid energy storage technology. Renew. Energy 2009, 34, 815–826. [Google Scholar] [CrossRef]

- Energinet. ENERGI Data Service. 2025. Available online: https://www.energidataservice.dk/tso-electricity/ImbalancePrice (accessed on 15 September 2025).

| Item | Value |

|---|---|

| Electrolyzer capacity | 6 MW |

| Electrolyzer ramping | 20% of capacity per second |

| Hydrogen tank size | 4 ton |

| Min level of hyrogen tank | 0.4 ton |

| Rated power of compressor | 1.5 MW |

| Mechanical efficiency | 0.75 |

| Inlet pressure of compressor | 30 bar |

| Outlet pressure of compressor | 200 bar |

| Adiabatic efficient coefficient | 1.4 |

| Item | Value |

|---|---|

| Number of cell | 1900 |

| Cell area | 0.37 |

| Thermal neutral voltage | 1.473 v |

| Heat capacity | 62,500 J |

| Thermal resistance | 0.167 |

| Normal working temperature | 90 |

| Ohmic ressistive parameter | 8.05 |

| Ohmic ressistive parameter | |

| Overvoltage parameter | −1.002 |

| Overvoltage parameter | 8.424 |

| Overvoltage parameter | 247.3 |

| Min permissible operating current | 1000 A |

| Max permissible operating current | 4500 A |

| Faraday constant | 96,485.3 |

| Day | Connected to Grid | Connected to WTs | ||

|---|---|---|---|---|

| Number | With EAM | Without EAM | With EAM | Without EAM |

| 1 | 11,998.66 | 278.02 | 15,688.80 | 845.14 |

| 2 | 12,667.24 | 1314.58 | 7334.36 | 64.37 |

| 3 | 11,200.68 | 1158.09 | 6624.62 | 6.92 |

| 4 | 8274.57 | 976.87 | 8529.67 | 304.17 |

| 5 | 9634.94 | 1976.11 | 6326,62 | −53.75 |

| 6 | 10,578.06 | 2188.73 | 7347.04 | 407.40 |

| 7 | 7987.55 | 466.06 | 10,024.50 | 595.72 |

| Total weekly profit | 72,341.72 | 8358.49 | 61,875.65 | 2170.00 |

| Total production | 16.08 | 5.02 | 12.96 | 6.88 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ghaemi, S.; Aihloor Subramanyam, S.; Golmohamadi, H.; Anvari-Moghaddam, A.; Bak-Jensen, B. Enhancing Power-to-Hydrogen Flexibility Through Optimal Bidding in Nordic Energy Activation Market with Wind Integration. Energies 2025, 18, 5734. https://doi.org/10.3390/en18215734

Ghaemi S, Aihloor Subramanyam S, Golmohamadi H, Anvari-Moghaddam A, Bak-Jensen B. Enhancing Power-to-Hydrogen Flexibility Through Optimal Bidding in Nordic Energy Activation Market with Wind Integration. Energies. 2025; 18(21):5734. https://doi.org/10.3390/en18215734

Chicago/Turabian StyleGhaemi, Sina, Sreelatha Aihloor Subramanyam, Hessam Golmohamadi, Amjad Anvari-Moghaddam, and Birgitte Bak-Jensen. 2025. "Enhancing Power-to-Hydrogen Flexibility Through Optimal Bidding in Nordic Energy Activation Market with Wind Integration" Energies 18, no. 21: 5734. https://doi.org/10.3390/en18215734

APA StyleGhaemi, S., Aihloor Subramanyam, S., Golmohamadi, H., Anvari-Moghaddam, A., & Bak-Jensen, B. (2025). Enhancing Power-to-Hydrogen Flexibility Through Optimal Bidding in Nordic Energy Activation Market with Wind Integration. Energies, 18(21), 5734. https://doi.org/10.3390/en18215734