Abstract

Financial inclusion should be shared with university students so that they link access to and use of financial products and services to low costs, without discrimination or inequality, to achieve the Sustainable Development Goals. This study aims to map the literature on the relationship between financial inclusion and undergraduate students within a contextual approach. The mapping was conducted through a scoping review, utilizing keyword pairwise searches, which we referred to as contextual constellations, as an emergent method. The search was conducted on the Web of Science and Scopus databases. The range of publications found ranges from 1973 to July 2024. The contextual analysis considered the following keywords: financial inclusion, undergraduate students, financial literacy, financial well-being, experiment, behavior, sustainable development goals, social and solidarity economy, decision, and innovation. The relationships were analyzed using VOSviewer software, version 1.6.20. The findings found the main articles that have contributed to knowledge about the relationship between financial inclusion and undergraduate students from the proposed context. Therefore, the research gaps in the relationship between financial inclusion and undergraduate students were identified. This research also offers the potential to conduct a mapping from a contextual perspective, identifying strong and weak relationships between research topics and keywords of interest.

1. Introduction

Inclusion has been identified as a route of action that leads to complex patterns among individuals or groups, enabling them to achieve a status of acceptance within a social system that values diversity and tolerance (Luhmann, 1994). However, when we focus on the acceptance status referring to a financial system, Jungo et al. (2023) mention that financial inclusion (FI) is related to financial products and services through relatively low costs and without any discrimination, which reduces inequality. Furthermore, financial inclusion has also been linked to Sustainable Development through its positive effect on fulfilling the Objectives established in the 2030 Agenda (Arner et al., 2020), specifically in poverty reduction and global alliances for the fulfillment of commitments for Sustainable Development.

Additionally, it is reasonable to expect that, by considering educational aspects within the study of financial inclusion, individuals pursuing university studies may have access to a higher level of financial inclusion due to their knowledge of the subject. However, research conducted by León-Cuanalo et al. (2022) identified that traditional banking financial services have not been formally included in a sample of university students with studies in economics and administration in Mexico, despite having access points available in their population, which could indicate a financial inclusion problem. On the other hand, Cassimon et al. (2022) say that specialized products require an understanding of specific terms for their use or application and are usually more associated with individuals with formal employment and advanced educational backgrounds.

This study examines various factors that can provide context for how students (St) make financial decisions, and how they could enhance the level of financial inclusion. For instance, Choowan et al. (2025) published that financial literacy and behavior positively affect financial well-being. Financial literacy (FL) has been addressed in a multidimensional manner, where the skills required to develop conscious financial decision-making, based on identifying the returns, risks, and costs of financial products and services, are studied. At the same time, Financial Well-being (FWB) determines life satisfaction, whereas income and wealth can predict Subjective Well-being (Choung et al., 2023). In this work, we relate financial well-being as a future financial goal that can be achieved through adequate financial literacy and increased financial inclusion. However, evidence in scientific literature shows that the relationship between financial inclusion and financial well-being has not been widely considered in the existing literature (Bashir & Qureshi, 2023).

In addition, understanding students’ behavioral relations regarding financial inclusion is crucial, as behavior (Beh) is another area of interest within the research. Studies have already linked financial literacy with behavior in the experimental field, as financial resilience results from good financial planning behavior (Epstein & Klerman, 2016; Yeo et al., 2023). However, more specific studies on financial inclusion and behavior are expected to be found. Based on the previous point, one area of interest for future behavioral research is experimentation (Exp), which allows us to show mixed findings, although they may not always be statistically significant (Epstein & Klerman, 2016). In finance and behavioral economics, there has been a growing trend toward developing field and laboratory experiments in decision-making models (Kumar et al., 2022).

Financial inclusion has a crucial connection with achieving the Sustainable Development Goals (SDG) (Arner et al., 2020), and it is essential to identify other publications that have focused on this connection. Specifically, there is evidence from studies on the impact of financial inclusion on a sustainable future (Ghosh, 2024) or its relevance to women’s empowerment as part of reducing the gender gap (Esmaeilpour Moghadam & Karami, 2023).

The social impact that can be achieved through financial inclusion, and alternatives oriented to creating social savings groups have a beneficial social and financial impact on their members. In the area of the social solidarity economy (SSE), some organizations, such as credit unions (Álvarez-Gamboa et al., 2023; Escobar & Grubbauer, 2021) have financial inclusion processes that consider adding value with a high social impact in generally rural locations. Thus, Álvarez-Gamboa et al. (2023) point out that, when comparing commercial banks and cooperative organizations, such as credit unions, cooperative organizations have shown a higher loan rate proportional to their assets and lower volatility in profitability, unlike commercial banks.

Financial inclusion enables individuals and businesses to access a range of financial products and services (Demirgüç-Kunt & Klapper, 2013; Rastogi et al., 2023) to make informed decisions regarding payment, savings, credit, or insurance transactions, which must be presented responsibly and sustainably. This need for banking services and products extends even further when discussing modernization through innovation (Inn). We refer to the combination of financial services with digitalization, also known as Financial Technologies (Mirza et al., 2023). Fintech could be a sign of commercial banking’s interest in expanding its impact on financial inclusion, with a focus on sustainability and its stakeholders (Campanella et al., 2022; Kocornik-Mina et al., 2021), as well as building competitive and global financial markets with low transaction costs (Gálvez-Sánchez et al., 2021). However, some studies (Pavlovskaya & Eletto, 2021) suggest that the formal financial system lacks genuine interest in providing access to financial instruments for lower-income individuals. These lacks would force low-income individuals to make better decisions (Dec) when accessing financial mechanisms in traditional and digital banking or to seek solutions in social mechanisms not based on profitability but on principles designed to serve specific communities, such as a social currency.

In this assumption, undergraduate students are considered the best candidates for achieving a higher level of financial inclusion, given their advanced educational backgrounds and, in some cases, access to formal employment and digital media. Therefore, this study aims to conduct a scoping review of the relationship between financial inclusion and undergraduate students through a contextual framework based on keyword pairwise searches, which we refer to as contextual constellations as an emerging method.

Although there are literature reviews on financial inclusion (Gálvez-Sánchez et al., 2021), financial literacy (Vijay Kumar & Senthil Kumar, 2023), and financial well-being (Bashir & Qureshi, 2023), the relationship between financial inclusion and undergraduate students has not yet been explored. For this reason, the following research questions are posed to guide this work:

- How many scientific journal publications exist on the relationship between financial inclusion and undergraduate students?

- How have financial literacy and financial well-being been studied concerning financial inclusion?

- What main concepts have been studied regarding the relationship between financial inclusion and undergraduate students?

- What aspects of the relationship between financial inclusion and undergraduate students have been studied in our context of interest?

This review is structured as follows: Section 1 presents a brief introduction to the interest context on the relationship between financial inclusion and undergraduate students. Section 2 exposes the requirements employed in this research to develop the scoping review. Section 3 proposes an emerging method called Contextual Constellation to systematize the process of reviewing the literature by quadrants of paired keywords. Section 4 presents the results of mapping the literature to address the research questions. Section 5 discusses the findings and the usefulness of the Contextual Constellations, proposing a research agenda for future studies. Finally, Section 6 concludes with suggestions to abord the research gaps funded.

2. Materials and Methods

A scope review is a type of study that focuses on the relatively rapid mapping of relevant literature in a field of interest. Essentially, a scope review aims to identify key concepts, primary sources, types of evidence, and research gaps that support an area of interest by systematically searching, selecting, and synthesizing existing knowledge (Arksey & O’Malley, 2005; Gómez, 2023). Scoping reviews are also related to the development of maps (not always systematic) that quickly examine the nature of a research area or to planning a systematic literature review (Gough et al., 2012). Therefore, a scoping review can serve as an exploratory study when a research topic is being reviewed for the first time (Arksey & O’Malley, 2005; Gough et al., 2012; Orduña-Malea & Costas, 2021).

One component that can accompany a literature review is mapping. In describing the research field, the focus or scope of the description can vary with the scope of the mapping, but it generally forms part of the synthesis and interpretation process. According to Gough et al. (2012), maps have three primary purposes: (1) to describe the nature of a research field, (2) to provide a basis for conducting a synthesis, and (3) to interpret the findings of a synthesis. For mapping, software such as VOSviewer is handy, as it allows the development and visualization of maps by analyzing bibliometric networks (Jan van Eck & Waltman, 2023). Version 1.6.20 of VOSviewer was used in this study.

The design for this scoping review was conducted in accordance with PRISMA-ScR (Tricco et al., 2018). This scoping review examines scientific literature through mapping, a process that involves compiling publication data based on keywords related to a specific area to create a coded database for analysis (Arksey & O’Malley, 2005). The potential of mapping lies in its ability to help address a topic from a contextual perspective (Liu et al., 2024). The final protocol was registered prospectively on the Open Science Framework https://osf.io/xa958/ (accessed on 8 September 2025).

2.1. Expanding the Context Approach

The primary reference to develop a scoping review is shown by Arksey and O’Malley (2005), who proposed five stages to do a scoping review: (1) identifying the research questions, (2) identifying the relevant studies, (3) study selection, (4) charting the data, (5) collating, summarizing, and reporting the results.

On the other hand, systematic mapping provides a comprehensive review of the existing literature. This allows for a broader perspective on an emerging topic and is often very useful when there is a lack of consensus regarding an approach (Liu et al., 2024). The systematic mapping developed by Liu et al. (2024) considers four steps for its development: (1) Exploration and preliminary work, (2) Strategy design, (3) Search execution, and (4) Coding and analysis. This article proposes an emerging method called Contextual Constellations, which follows similar steps but considers a contextual area of interest to narrow the search. This method is recommended when there are many publications or the research approach is interdisciplinary.

This emerging method is based on the work of Liu et al. (2024) regarding the description of the systematic mapping process, and on the work of Koutsos et al. (2019), which develops a clear description of scientific rigor in the process of systematic literature review. Although the intention is not to conduct a search as in-depth as systematic literature reviews, its elements help us follow a protocol suitable for a scoping review, where the results are classified and categorized based on the strength of the evidence, considering the frequency and coverage of the sample selected articles both geographically and thematically. Table A1 in the Appendix A shows this comparison.

2.2. Comparison of Methods for Literature Review

A comparison was made to identify the most common types of literature reviews and propose an expansion toward a contextual approach through systematic mapping with contextual constellations. The work of Koutsos et al. (2019) and López-Cortes et al. (2022) López-Cortes et al. (2022), who previously compared types of literature reviews, served as a reference, as shown in Table 1.

Table 1.

Comparison of methods for literature review and emergent method.

Contextual constellations, such as systematic literature reviews, cannot completely eliminate problems of subjectivity (Koutsos et al., 2019), but at least they allow one to follow step by step with documented support, which is available for verification by anyone. This method uses the PRISMA ScR to standardize the procedure and to ensure transparency in the review process; the reproducibility of the method and its coverage correspond to a systematic mapping combined with a scope review.

3. Contextual Constellations

A map analysis helps synthesize a subset of studies within the broader literature (Gough et al., 2012). Contextual constellations enable this synthesis by creating subsets of studies based on the selected research context.

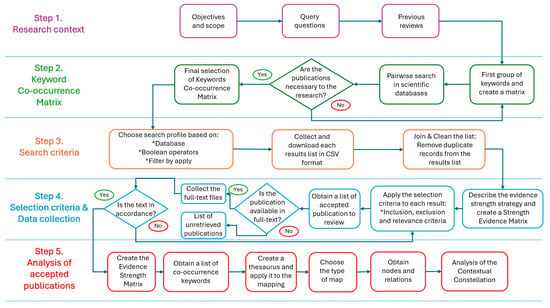

We propose a new method based on matrices to organize information searches with a mapping in five steps: (1) Research context, (2) Keyword co-occurrence matrix, (3) Search criteria, (4) Data collection and selection criteria, (5) Analysis of the database of accepted publications. The steps are shown in Figure 1.

Figure 1.

Steps to Develop Mapping with Contextual Constellations.

3.1. Research Process

The five-step process for developing contextual constellations and using the VOSviewer to visualize and analyze contextual maps is presented in the following sections.

3.1.1. Research Context

This scoping review used the Population, Concept, Context, (PCC) approach, considering the Population (P) of studies on the relationship between financial inclusion and undergraduate students, including all the selected keywords such as financial inclusion, students, financial literacy, financial well-being, experiments, decisions, behavior, Sustainable Development Goals, Social and Solidarity Economy, and innovation. We analyze Concept (C) regarding research on financial decision-making among undergraduate students to achieve financial inclusion and select the specific keywords that pertain to that decision-making process, such as financial inclusion, students, financial literacy, and financial well-being. For the reasons stated above, we also delve into a Context (C) that may significantly impact student decision-making, such as experiments, decisions, behavior, Sustainable Development Goals, Social and Solidarity Economy, and innovation, which are considered keywords that act as contextual terms. These criteria will be used to map studies, as shown in Table 2.

Table 2.

Population, Concept, and Context Framework.

3.1.2. Keywords Co-Occurrence Matrix

We suggest choosing four or six keywords, at most ten, to contextualize the research in any study. This research examines the relationship between students and financial inclusion, and it was selected ten items to construct a Keywords Co-occurrence Matrix.

All the selected articles are contained in a universal set (), and each element () is an article with at least a previously selected keyword.

where

Also, all selected articles include other non-selected keywords, and these are considered in a complement set ().

Then,

Therefore, the aim of this study is to concentrate on the Population () set and its subsets and intersections. Each selected keyword is a subset that includes at least one publication with such keyword.

Also, I can denote that

In turn, each selected keyword is part of a subset according to the framework PCC, where the Concept () set and Context () set are subsets of the Population () set.

An element is a publication. The union of the publications is the set of elements for which each element belongs to at least one of these sets. It is denoted by:

Thus:

Therefore, in constructing the Keyword Co-occurrence Matrix, we will obtain a matrix that captures the intersections among the subsets of the selected keywords.

Therefore:

And, for example:

3.1.3. Search Criteria

The type of publication is limited to articles and reviews. The search was conducted over an open period, with no limitation on the years of consultation. The range of publications found ranges from 1973 to July 2024. The predominant language of the publications was English, but this feature was not selected as a filter in the search engines. Therefore, the publication sample included articles in Russian, Portuguese, Spanish, and Chinese, with English. Scientific databases used were Web of Science and Scopus. The search was conducted between 19 March and 11 July 2024.

The ten keywords selected above were used, and paired keyword searches were performed using the Boolean operator “AND” and quotation marks for compound words to obtain the exact term. All publication search rounds were conducted with two initial filters. The first filter involved applying a pairwise keyword search using the Boolean operator “AND” in the “TOPIC” field for Web of Science and the “ARTICLE TITLE, ABSTRACT, KEYWORDS” field for Scopus.

The second filter consisted of selecting only the “ARTICLE” and “REVIEW ARTICLE” classifications in the “DOCUMENT TYPES” field in both Web of Science and Scopus. However, when the searches returned results of more than 1000 publications, a third filter was applied, which consisted of including three additional search terms with Boolean operators in the ABSTRACT field: AND “Financial inclusion” OR “Financial literacy” OR “Financial Well-Being.” If the results remained above 1000 publications, that sample was considered without further filtering, as shown in Table 3.

Table 3.

Search strategy.

Each paired keyword search was retrieved as a list in CSV format. Duplicate records were eliminated manually by merging the lists in Excel and applying the Delete Duplicates function. It should be noted, however, that the manual process was exhaustive because, when combining the Web of Science and Scopus lists, the two databases use different IDs and abbreviations, complicating duplicate elimination. It is also worth noting that some publications list only the author’s first name and sometimes the initial or final of the surname, making identification difficult. At the end, a clean list of results was obtained.

3.1.4. Data Collection and Selection Criteria

GRADE Working Group (2024); Koutsos et al. (2019) note that several systems of assessing the strength of evidence are hierarchical, with evidence from systematic reviews, meta-analyses, and experiments given first, followed by evidence from observational studies or expert opinions.

In this study, a less strict criterion than in the systematic review was followed to a scoping review, and the relevance criteria with a 5-point Likert scale was used to assign the strength of evidence of the articles, with five being the most relevant article and one the least relevant, where the type of evidence is classified into five groups, both, strength and type of evidence is according to Table 4.

Table 4.

Parameter of strength of evidence.

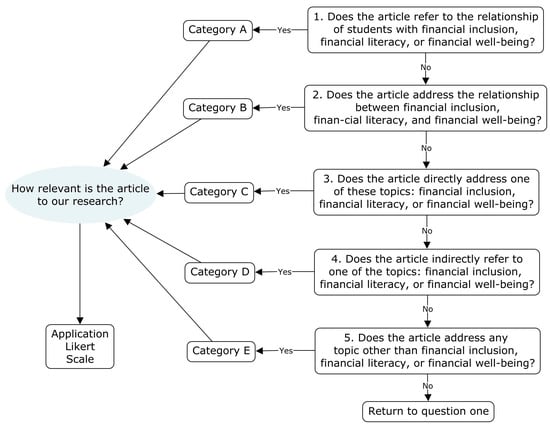

In this stage, the titles, abstracts, and keywords of each article listed in the Excel database are reviewed. To classify and evaluate the articles according to this strategy, the importance and complexity of the research question in each article are considered. This process identifies the strength of the evidence, resulting in a list of publications accepted and suitable for the study. Five query questions were established to classify the articles into five categories. The flowchart of this classification process is shown in Figure 2.

Figure 2.

Query questions.

It was chosen to rate the relevance of the publications based on the question: How relevant is the article to our research? The answer is obtained using a parameter of the strength of evidence.

The reviewers agree to assess each publication according to the parameters for the strength of the evidence. It was estimated that the valuable publications for our purpose are category A, with values [5, 4, 3, and 2], which, to a greater or lesser extent, cover the terms financial inclusion, financial literacy, and financial well-being related to students. The publications in category B are included only with values [5, 4, and 3] because the topics of financial inclusion, financial literacy, and financial well-being are explored in contexts that involve financial decisions or behaviors. The specific publications of category C whose values are [5 and 4] are considered because they provide findings in their area as reviews about financial inclusion, financial literacy, financial well-being, or with any contextual keywords. The publications in category D, whose only value is [5], are considered because they have the research context and have a strong relationship among the contextual keywords. Finally, all publications in category E are not considered because they are far from the aim of this research.

Once the available full-text publications have been identified, the list of accepted and retrieved publications is updated. This information can be used to create mappings; summaries of publications related to the topic. Two reviewers jointly developed this data graphing process to determine which variable to extract. The independent reviewers agree to adhere to the parameters for the strength of evidence in classifying and evaluating each article, to ensure objectivity and reduce subjectivity. In case of disagreement, a third member of the research team may serve as an additional independent reviewer to resolve it. The process is summarized in a PRISMA statement (Haddaway et al., 2022; Moher et al., 2010) to underline the final selection of publications. All selection criteria used in this method are summarized in Table 5.

Table 5.

Selection criteria.

3.1.5. Analysis of Accepted Publications

Systematic mapping requires a considerable volume of publications to assess their potential more effectively. In this work, we propose a new method that enables us to start from a population of publications of interest and observe them either globally or by sampling in quadrants of interest. Overall, it is possible to view a map of each category or by each set.

3.2. Software Use

The results obtained are mapped using the free software VOSviewer version 1.6.20 to identify the formation of clusters in the publications, and the contextual constellations that guide our research. VOSviewer is an application that displays maps of relationships that connect publications through nodes such as authors and keywords (Jan van Eck & Waltman, 2023).

The application can use CVS formats in Excel to read search results from Scopus and TXT formats for search results from the Web of Science. Therefore, it was decided to unify the data obtained from the Scopus and Web of Science searches using a single CSV format. To better interpret the data in VOSviewer, thesauri were used to unify terms that had the same meaning or were very similar but were generally written differently. These thesauri can be requested as Supplementary Materials. Finally, bibliometric analysis, systematic mapping, and descriptive statistics can be used to evaluate trends among search results in scientific databases.

3.2.1. Mapping Instructions

It is recommended to divide the use of VOSviewer into two stages: the first, when mapping for the first time; and the second, when obtaining contextual constellations for analysis. In the first stage, the objective is to identify the general overview of keyword associations recognized by VOSviewer and to build thesauri to prevent the map visualization from including repeated or similar terms that could scatter attention.

The second stage consists of applying the thesauri in VOSviewer to create contextual constellations according to a specific map type that helps us understand the relationships between publications and their scope. The process of using VOSviewer is described in Table 6.

Table 6.

The process of the use of VOSviewer.

3.2.2. Types of Mapping

Regardless of whether the searches were performed in pairs using Boolean operators, the results often yield articles that only include one of the selected keywords. Therefore, it is necessary to structure the sets of publications based on their intersections. To explain the use of intersections, the types of mapping achieved with the Contextual Constellations proposal are presented below, based on their intersections.

- (a)

- Type I: General Mapping

This type of map involves importing the complete database of retrieved publications and mapping all selected keywords using VOSviewer. The sets representing this mapping are grouped into the Universal () set, as in Equation (1).

Therefore, the general mapping involves all elements recognized by VOSviewer’s capabilities; that is, it is recommended that the threshold of keywords selected for mapping be limited to a maximum of 1000 elements to ensure the effectiveness of the contextual constellation map general visualization ().

Therefore:

- (b)

- Type II: Keyword Selection Mapping

This type of map involves entering the complete database of retrieved publications and mapping only some of the keywords used in the keyword co-occurrence matrix that guides the search. The main reason for this is the specific search for the relationship between the Concept () subset, which aligns with the research’s primary objective.

- (c)

- Type III: Component Mapping

It consists of identifying the intersections of the keywords of interest, filtering the list of publications retrieved from a sample with a new list containing only the publications that match those intersections, and mapping the result.

- (d)

- Type IV: Components Merging Mapping

This type of map is similar to the previous process: the intersections of the words of interest are summed, duplicate posts are removed to create a new list that groups the merged quadrants of interest, and the result is mapped.

- (e)

- Type V. Mapping of Detected Publications in a Contextual Constellation

When a mapping is generated by keyword selection, clusters form around those keywords. However, the detected publications for this type of map include additional keywords beyond the selected one. Therefore, a new subset of related publications is created in the keyword selection map and remapped to identify all the keywords included in those publications. This allows for analysis of how the keywords of interest have been studied in relation to the contexts in which they were addressed, and these contexts can also be mapped.

Then,

- (e)

- Graphs obtained from the mappings

One advantage of using VOSviewer is that it provides information about keywords as nodes, relationships as links, and the link strength for each keyword. This allows you to graph keyword frequencies and compare the number of publications that have used them.

4. Results

Implementing the method proposed here, the results are presented in two sections: first, in the same order as the five steps suggested, and second, in relation to the research questions.

4.1. Emergent Method

4.1.1. Research Context Found

This paper undertook a comprehensive mapping as a scoping review. However, only four first-hand literature reviews on financial inclusion were found before this paper. Table 7 shows the main contributions of these reviews.

Table 7.

Previous literature review.

4.1.2. Developed Matrix of Keyword Co-Occurrence

Matrices were used to organize the search sequences following the pairwise keyword search procedure. A total of 84 publication listings and two pairwise search matrices were obtained, yielding 4975 publications for Web of Science, and 7412 publications for Scopus: generating a total of 12,387 publications for both databases. These matrices can be requested as Supplementary Materials. These results were consolidated into a single sample by eliminating duplicate publications, yielding 5463 articles and reviews.

4.1.3. Applied Search Criteria

This study utilized the Web of Science and Scopus databases, which generate similar lists based on the search patterns employed, allowing for the standardization of the results in a single list. After applying the strength of evidence matrix criteria, the sample of articles was reduced to 1538 accepted articles.

4.1.4. Selection Criteria and Data Collection

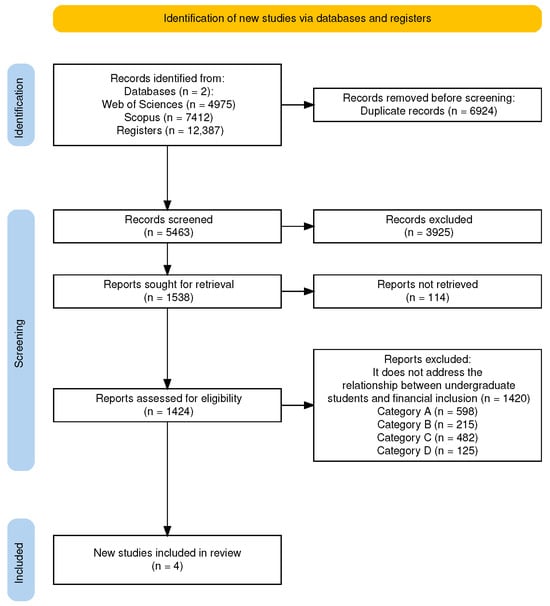

According to the above, 1538 publications were accepted (28% of the initial population), where 114 were discarded because the full-text article could not be retrieved. The available database comprised 1424 publications, but 1420 do not address the relationship between undergraduate students and financial inclusion. Finally, only four articles represent our central mapping database (0.28% of the accepted database). The result of this search process is shown in Figure 3.

Figure 3.

Statement PRISMA (Haddaway et al., 2022).

4.1.5. Analysis of the Database Obtained

The results obtained after classifying the 1424 retrieved publications are distributed into five categories, with category E being completely excluded from the research. The results for each category are shown in Table 8.

Table 8.

Strength of Evidence Matrix.

After this classification, it is possible to analyze the information from different angles, such as an overall view, by intersections, by combining intersections, or by the strength of the links assigned by VOSviewer.

4.2. Research Questions

4.2.1. Relationship Between Financial Inclusion and Undergraduate Students

By conducting keyword pairwise searches, it was possible to construct a results matrix that includes the final publications containing the selected keywords and that are pairwise matched within a publication. Referring to the question: Q1. How many publications in scientific journals exist on the relationship between financial inclusion and undergraduate students? And it can refer to intersection ( ∩ ), which includes the number of publications in which the keywords “Undergraduate Students” and “Financial Inclusion” coincide. There are four publications that exactly match the term, but VOSviewer identifies one additional publication that also research the relationship between undergraduate students and financial inclusion. These publications have been summarized in Table 9, which presents research specifically studying the relationship between financial inclusion and students from 2015 to 2022.

Table 9.

Result of the intersection of and .

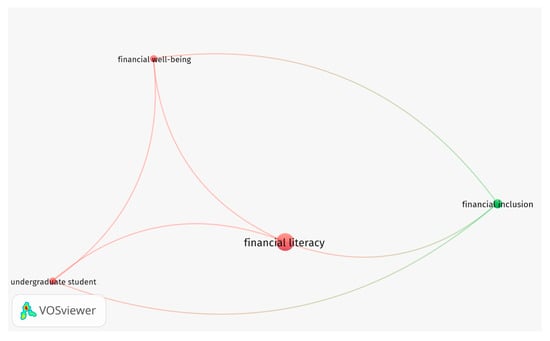

At this point, it was identified among the selected accepted publications (N = 1424). A contextual constellation was funded by selecting only the four keywords from the total number of retrieved publications. This constellation shows only two clusters, red and green, where financial inclusion is the only green node that begins to be integrated with the red nodes: financial literacy, financial well-being, and undergraduate students, as is shown in Figure 4.

Figure 4.

Contextual constellation of 4 keywords. In the network map, the color differentiates each group.

4.2.2. Financial Inclusion, Financial Literacy, and Financial Well-Being

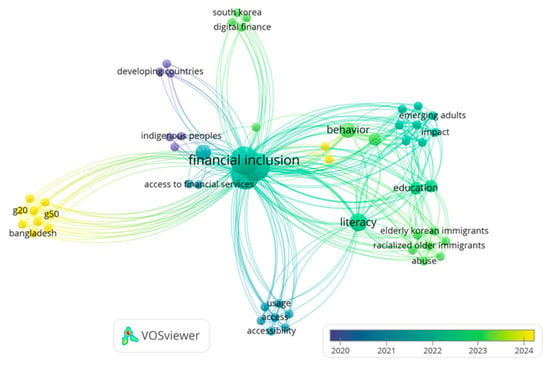

The co-occurrence maps formed at the intersection of publications that match the keywords “Financial Inclusion,” “Financial Literacy,” and “Financial Well-being” are analyzed to answer the question: Q2. How have financial literacy and financial well-being been studied concerning financial inclusion?

From a population of 1424 selected publications, a sample of 190 publications consisting of the sum of the intersections ( ∩ ), ( ∩ ), and ( ∩ ), removing duplicates, but considering only the intersection ( ∩ ∩ ), the sample only finds ten publications that include these three keywords. Through a contextual constellation, it can answer the question by studying the relations in the overlay map, because in this sample, the first approach, which involves joining FI, FL, and FWB, is in the work of (Buckland et al., 2020) in their study about promoting the financial well-being of indigenous peoples in Canada. This subset considers a link strength major by keywords such as literacy, behavior, education, financial capability, and knowledge. Therefore, the contextual constellation also can show this interception in recent research in 2024, which is focused on the interaction of the vulnerable population of India with digital financial literacy (Kamble et al., 2024), and about the poverty alleviation in China (Zhang et al., 2025). The search is performed with VOSviewer, and the results can be analyzed with a contextual constellation as shown in Figure 5.

Figure 5.

Contextual Constellation of subset ( ∩ ∩ ).

4.2.3. Concepts Around the Relationship FI-St

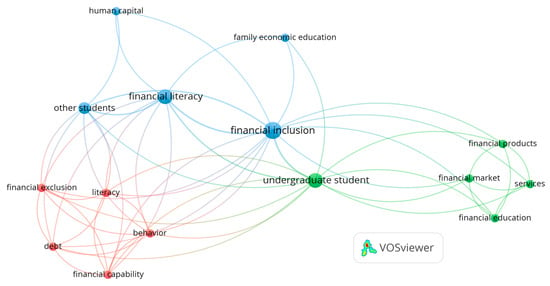

In this sense, the six found publications that address the topic of the relationship between financial inclusion and undergraduate students can help observers understand the contexts of interest of their research. A contextual constellation was constructed to identify areas of interest by analyzing the keywords used in each of these publications. This answer is based on the question: Q3. What main concepts have been studied regarding the relationship between financial inclusion and undergraduate students?

Within our co-occurrence matrix, subset (FI ∩ St) is identified, which is the intersection of “financial inclusion” and “students.” A thesaurus is applied to create two nodes that group the keywords into “undergraduate students” when their degree can be identified and “other students” when they are not specifically undergraduate students. The contextualization of subset (FI ∩ St) is shown in Figure 6.

Figure 6.

Contextual constellation of subset (FI ∩ St). In the network map, the color differentiates each group.

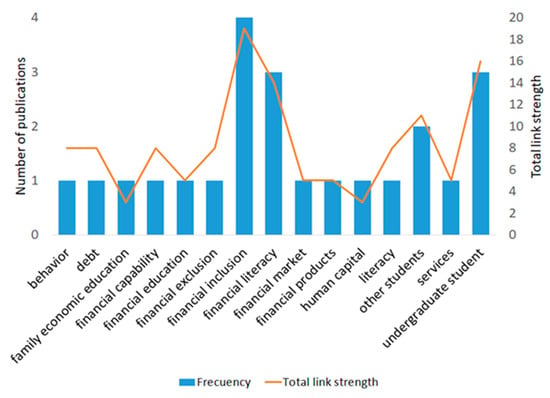

Thus, Cluster 1 shows a relationship between financial exclusion, debt, literacy, financial capability, and behavior. Cluster 2 shows that financial inclusion is more closely associated with financial literacy, family economic education, human capital, and other students. Meanwhile, in Cluster 3, we identify the terms undergraduate students, financial products, financial markets, services, and financial education.

Given the interest in this subset, it is understandable that the terms with the highest frequency and link strength in the publications are financial inclusion, financial literacy, undergraduate students, and other students. The remaining publications have the same frequency, as only four publications are included in the map. However, it is noted that the terms behavior, debt, and financial capability have the strongest link strength compared to the rest. In contrast, family economic education and human capital have the lowest link strength, as shown in Figure 7.

Figure 7.

Context of subset (FI ∩ St).

4.2.4. Contextual Relationship Between Financial Inclusion and Undergraduate Students

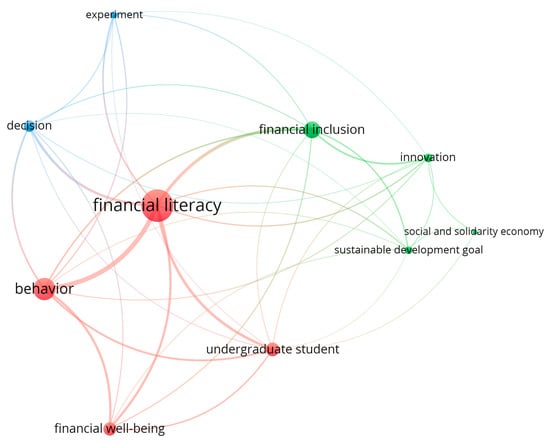

In this paper, we have focused our interest on exploring the context of the relationship between financial inclusion and undergraduate students in specific areas that could represent a new stream of research. Therefore, we have selected ten keywords that provide context for the areas of interest in this research. These keywords, in turn, represent the population of 1424 selected publications. We use them to answer the question: Q4. What aspects of the relationship between financial inclusion and undergraduate students have been studied in our context of interest?

A co-occurrence map was created from the entire population of accepted publications (N = 1424). During the mapping process with VOSviewer, only the 10 contextual keywords of interest were selected. VOSviewer displays the contextual constellation of a network map, showing the clusters that form these keywords to identify their most substantial relationships. Three clusters were identified in the network map. Cluster 1 encompasses financial literacy, behavior, and financial well-being among undergraduate students. Cluster 2 encompasses financial inclusion, innovation, the Sustainable Development Goals, and the social and solidarity economy. It is worth noting that, in the proposed context, financial inclusion shifts its focus from undergraduate students to innovation, as illustrated in Figure 8.

Figure 8.

Network-type contextual constellation of 10 keywords. In the network map, the color differentiates each group.

Due to this contextual constellations’ procedure, specific groupings can be observed in the proposed context of keywords, showing the strengths and weaknesses among their connections, which guide us on the currents and gaps of research. Therefore, the study identifies the most influential publications on the relationship between financial inclusion and university students under the proposed contextual scheme. It is necessary to say that the filter was conducted in Excel using a conditions formula to identify which publication considers the most number of selected keywords, and the result was five publications, as recognized in Table 10.

Table 10.

Publications covering the highest number of chosen keywords.

It should be noted that the frequency of the publications containing any of the ten selected keywords was used. This data is provided by Vosviewer when obtaining the listings before mapping. Finally, inconsistencies were found in some results: the publication with the most keyword matches addresses gamification as part of controlling behavioral biases among investors in the stock market (Şenol & Onay, 2023). While the topic covers experimental and behavioral aspects, it falls outside the field of students and financial inclusion, but it fits the context in which these issues are being studied.

5. Discussion

Financial inclusion can represent access to financial instruments that enable better management of private property and a higher standard of living, where understanding the use and management of these instruments facilitates informed financial decision-making. In this context, students can play a relevant role in the social inclusion of their surrounding circles. Students, primarily undergraduate students, can play a crucial role as agents of social inclusion in emerging financial trends, particularly in innovation.

Therefore, it is relevant to identify the characteristics surrounding the relationship between financial inclusion and undergraduate students. For this reason, in the following sections, we will discuss the main findings of this work.

5.1. Previous Reviews

Regarding the most relevant results found through four literature reviews conducted before our work, we identified that the research focus was primarily on understanding the impact of financial inclusion on its inception and penetration, as well as the obstacles and barriers to achieving inclusion (Ghosh, 2024). Other studies focus on analyzing the effect of financial inclusion initiatives on the economy and how this inclusion has impacted the development process in countries (Pranajaya et al., 2024). On the other hand, some studies have chosen to evaluate progress in customer service-oriented services and offerings operationally (Tay et al., 2022). However, although financial inclusion has been closely linked to financial literacy, it is evident that financial inclusion alone still has many challenges to overcome. When it was studied, the main topics centered on digitalization, economic development, demographic and geographic factors, and financial literacy (Suryavanshi et al., 2024).

Regarding methods for studying that have developed comprehensive bibliometric analysis and mapping in a similar way to this study, there is one that utilizes the software SciMAT, version 1.1.04 and VOSviewer, version 1.6.19 which analyzes the information using four quadrants ased solely on the publication index in the Web of Science Database (El Bied et al., 2024).

5.2. Discussion of the Findings

In this study, we contribute to literature in two ways. First, we examine the contextual relationship between financial inclusion and undergraduate students in our areas of interest. Second, we merge mapping with a matrix of pairs of keywords to search for information, identifying contextual constellations and evaluating the publications with more influence in the contextual analysis.

In this scoping review, it was possible to cover a wide range of articles that, to varying degrees, provide relevant data for our objective. However, considering publications that specifically addressed the relationship between undergraduate students and financial inclusion, five were found, and only four articles are available in full text. Three of these articles directly address the relationship between financial inclusion and undergraduate students in Mexico, Indonesia, and the United States (León-Cuanalo et al., 2022; Rahmawati et al., 2019; Williams & Oumlil, 2015). In contrast, one article focuses on workers pursuing higher-level professional or technical studies, equivalent to university studies in Peru (Ferrada & Montaña, 2022). Finally, one article could not be retrieved because it was not open-access (Febriana & Damayanti, 2017) and was therefore excluded from our sample. Furthermore, exploring the potential of using VOSviewer, the relationships yielded by the mapping of the subset (FI ∩ St) were reviewed to discover that the first results matched our findings of publications in Excel, but added two more publications with information of interest to the study.

The initial findings indicate a growing body of publications on financial literacy, and the relationship between university students and financial inclusion is beginning to attract interest in this context. However, the work on this subject is relatively recent.

The publications identified in the subset (FI ∩ St) have addressed this relationship from the measurement of financial literacy and inclusion indices, the influence of schooling on these indices, financial socialization as part of family influence on financial decision-making, and the proposal of educational models.

5.3. Research Gaps

Exploring the knowledge gap between financial inclusion and undergraduate students reveals a recent surge in interest in financial inclusion within the scientific field. According to databases such as Scopus, the most recent publications about “financial inclusion” date back to 1998, and in our sample of accepted publications, the oldest article is from 2014. Compared to the term “financial literacy,” it has been appearing in Scopus since 1992, and in our sample of publications, it has appeared since 2004. This sample suggests that the time horizons of publications on both terms are similar. However, the interest and depth with which the topic has been addressed are undoubtedly more inclined toward financial literacy. This scoping review confirms a strong relationship between financial literacy, financial well-being, and the behavior of undergraduate students. In contrast, financial inclusion has recently been integrated.

5.4. Approach to Contextual Constellations

In this paper, it proposes using contextual constellations to analyze the relationships between keywords and the research in the publications from which they originate. In the mapping, the contextual constellation of ten keywords provided information about the relationship between our research’s specific topics of interest. It identified three clusters. The first group is closely related to “financial literacy”, “financial well-being”, and “behavior” among “undergraduate students”. In the second cluster, “financial inclusion” is linked to the nodes of “innovation”, “sustainable development goals”, and “social solidarity economy”. The third group comprises the terms “experiment” and “decision,” which shows the research gap between financial inclusion and undergraduate students in the proposed context.

According to the contextual constellation of the subset (FI ∩ St), the main concepts that have already been studied alongside the relationship between undergraduate students and financial inclusion are financial literacy, other students, family economic education, human capital, financial exclusion, behavior, debt, literacy, financial capacity, financial education, financial market, services, and financial products. This focus reiterates the need to bridge the gap in understanding the relationship between financial inclusion and undergraduate students, particularly in relation to innovation, the SDGs, experiments, and the social and solidarity economy. On this last point, a significant knowledge gap is recognized because the social and solidarity economy focuses on a sector of the economy that generally diverges from traditional financial products and services, and inclusion itself is one of its key objectives. Therefore, financial inclusion should provide new financial models with a collective vision. Thus, contextual constellations can serve as a standardized method based on the PRISMA ScR. Therefore, the procedure can ensure transparency and reproducibility in the review process, embedded in a systematic mapping combined with a scope review.

5.5. Use of VOSviewer

While several options exist for creating bibliographic maps, VOSviewer version 1.6.20 offers advantages such as its almost intuitive use and the convenience of being a desktop application that does not require installation in the operating system’s root directory. It also has online access, but the ability to download node and link lists was only tested in the desktop version. Furthermore, it is highly recommended that first-time users of VOSviewer follow the instructions in Table 6 and note each option selected to ensure they consistently obtain the same map, which can vary significantly depending on the thresholds selected.

5.6. Strengths and Limitations

The scoping review developed in this study had strengths in its method, as it employed a systematic search of publications in scientific databases through the use of a matrix of keywords, allowing for replication of the steps and selection process, and verification of its consistency. Therefore, this method enables us to analyze different segments of the information through subsets of interest relationships and keywords and visualize them with maps. The procedure is similar to using a telescope, which, with a particular inclination and focus, makes it possible to see the same constellation, and in the case of keywords, it is possible to see the same contextual constellation follow the same steps.

However, this study also had limitations in exploiting the potential of the VOS Viewer software, because there is incompatibility in the code format of the merged lists in Excel from the Web of Science and Scopus databases and the CSV format, which prevented the generation of comprehensive maps due to inconsistencies in bibliometric analysis approach, overall in type of analysis with bibliographic coupling by organizations, and analysis with co-citation with references or sources.

5.7. Future Research

The information obtained in this study will deepen the investigation of this field through a systematic literature review on the relationship between financial inclusion and undergraduate students. Furthermore, we can explore individual future lines of research, between them: (1) the relationship between financial inclusion, financial literacy, and financial well-being, regarding to students to enhance the sustainable development goals, (2) the relationship between financial inclusion, students’ behavior and decisions though experiments, and finally (3) the relationship between financial inclusion and students regarding to the social and solidarity economy through new financial mechanisms or innovations that will increase access to financial services and products, specifically for those who may be financially excluded from conventional financial mechanisms.

6. Conclusions

Through the results obtained from the mapping and contextual analyses, the study can identify research gaps in the exploration, within the context of interest raised here, of the relationships between financial inclusion and its most relevant contextual keywords. Although there is evidence that existing publications regarding financial inclusion and undergraduate students are still scarce, there is also a tendency to incorporate the field of study that has emerged around financial literacy, like a force of gravity that attracts new elements to the field. In this case, financial inclusion is more likely to be approached through the study of undergraduate students’ behaviors, focusing on financial literacy and financial well-being, which confirms the importance of these two terms in our research.

Finally, this scoping review addresses the research gaps in the relationship between financial inclusion and undergraduate students, adopting a contextually specific approach based on ten key terms. However, its most novel contribution is the introduction of a new method of mapping contextual analysis using matrices to perform keyword searches by pairs and systematically cover a field of interest targeted in specific research called Contextual Constellations, which is a standardized method based on the PRISMA ScR, with a procedure that can ensure the transparency and reproducibility, embedded in a systematic mapping combined with a scope review. This study provides researchers with a new tool to identify areas of influence by sets and subsets, research gaps, and potential future lines of inquiry.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/jrfm19010023/s1 Table S1: Thesaurus used in VOSviewer; Table S2: Accepted publications; Table S3: PRISMA ScP Checklist; Figure S1: Keyword co-occurrence matrix for Web of Science database; Figure S2: Keyword co-occurrence matrix for Scopus database; Document S1 Protocol ScR 12SEP25.

Author Contributions

Conceptualization, A.F.-V., I.A.R.-G. and M.d.R.P.-S.; methodology, A.F.-V., I.A.R.-G. and M.d.R.P.-S.; software, A.F.-V. and J.M.C.; validation, I.A.R.-G., D.D.d.L. and M.d.R.P.-S.; formal analysis, A.F.-V. and M.d.R.P.-S.; investigation, A.F.-V., I.A.R.-G. and A.Z.; resources, I.A.R.-G. and A.Z.; data curation, A.F.-V., D.D.d.L. and J.M.C.; writing—original draft preparation, A.F.-V., I.A.R.-G. and M.d.R.P.-S.; writing—review and editing, I.A.R.-G., D.D.d.L., M.d.R.P.-S. and A.Z.; visualization, I.A.R.-G., D.D.d.L. and J.M.C.; supervision, I.A.R.-G. and M.d.R.P.-S.; project administration, I.A.R.-G.; funding acquisition, I.A.R.-G. and A.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Instituto Politécnico Nacional, through research project SIP20250693.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Acknowledgments

The authors the thank the Instituto Politécnico Nacional for its support through research development incentives (EDI) and research projects SIP20253714 and SIP20254778. Alicia Flores thanks the National Polytechnic Institute for the paid leave granted for postgraduate studies.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| FI | Financial Inclusion |

| FL | Financial Literacy |

| FWB | Financial Well-Being |

| St | Students |

| Exp | Experiment |

| Beh | Behavior |

| SDG | Sustainable Development Goals |

| SSE | Social and Solidarity Economy |

| Dec | Decision |

| Inn | Innovation |

Appendix A

Table A1 compares the proposed method in this study based on the methods provided by Liu et al. (2024) and Koutsos et al. (2019) with the aim of identifying that most of the steps of aforementioned authors have been implicitly considered in our method.

Table A1.

Comparison of methods for literature review taken as the basis of the new proposal.

Table A1.

Comparison of methods for literature review taken as the basis of the new proposal.

| Systematic Literature Review (Koutsos et al., 2019) | Systematic Mapping (Liu et al., 2024) | Contextual Constellations (This Study) |

|---|---|---|

| 1. Scoping 1.1 Review protocol 1.2 Few relevant studies 1.3 Previous systematic reviews | 1. Exploration and preliminary work 1.1 Establish research aim 1.2 Ensure research scope 1.3 Definition of research question | 1. Research context 1.1 Objectives and scope 1.2 Query questions 1.3 Previous reviews |

| 2. Planning 2.1 Search strategy | 2. Search strategy 2.1 Identifying keywords | 2. Keyword co-occurrence Matrix 2.1 First group of keywords 2.2 Pairwise search in databases 2.3 Keyword co-occurrence Matrix |

| 2.2 Eligibility criteria 2.3 Strength of evidence 3. Identification/Search 3.1 Implementation of the pre-defined search strategy 3.2 Examination of resulted articles 3.3 Make changes to the search strategy if needed 3.4 Performing additional searches 3.5 Search for additional sources for identifying articles 3.6 Manually selection sources for identifying articles 4. Screening 4.1 Export of citations as the resulting studies of the search queries. 4.2 Import the exported citation into a citation manager 4.3 Remove of duplicates 4.4 Update article information | 2.2 Selecting databases 2.3 Defining search string strategy 3. Research execution 3.1 Conducting search with inclusion criteria 3.2 Obtain a list of papers 3.3 Remove duplicates 3.4 (a) Screening of papers 3.4 (b) Removing inconsistent paper with exclusion criteria | 3. Search criteria 3.1 Choose search profile 3.2 Collect and download the list of results 3.3 Join and clean the list of the result to remove duplicates |

| 4.5 Thorough examination of the selected articles 5. Eligibility/Assessment 5.1 Setting inclusion and exclusion criteria 5.2 Defining the strategy for the strength of evidence 5.3 Assessing articles based on their strength of evidence | 4. Coding and analysis 4.1 (a) Conducting classification scheme | 4. Selection criteria and data collection 4.1 Describe the evidence strength strategy 4.2 Establish and apply relevance, inclusion and exclusion criteria 4.3 Obtain a list of accepted publications 4.4 Collect a list of accepted in full-text |

| 5.4 Assessing the types of bias that may exist 5.5 Reading in depth the selected full-text of the articles 6. Presentation/Interpretation 6.1 Synopsis of the systematic review finding 6.2 Study of the heterogeneity of the studies included 6.3 Presentation of the results 6.4 Interpretation of the findings 6.5 Discussion on the generalization of the conclusions 6.6 Limitations of the systematic review 6.7 Recommendations for further research | 4.1 (b) Data extraction and mapping | 5. Analysis of accepted publications 5.1 Create the Evidence Strength Strategy 5.2 Obtain a list of co-occurrence keywords 5.3 Create thesaurus 5.4 Choose the type of map 5.5 Obtain nodes and relations Analysis of the contextual constellations |

References

- Abramova, I., Nedilska, L., Kurovska, N., Kovalchuk, O., & Poplavskyi, P. (2023). Modern state and post-war prospects of financial inclusion in ukraine considering the eu experience. Financial and Credit Activity: Problems of Theory and Practice, 6(53), 318–333. [Google Scholar] [CrossRef]

- Arksey, H., & O’Malley, L. (2005). Scoping studies: Towards a methodological framework. International Journal of Social Research Methodology: Theory and Practice, 8(1), 19–32. [Google Scholar] [CrossRef]

- Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2020). Sustainability, FinTech and financial inclusion. European Business Organization Law Review, 21(1), 7–35. [Google Scholar] [CrossRef]

- Álvarez-Gamboa, J., Cabrera-Barona, P., & Jácome-Estrella, H. (2023). Territorial inequalities in financial inclusion: A comparative study between private banks and credit unions. Socio-Economic Planning Sciences, 87, 101561. [Google Scholar] [CrossRef]

- Bashir, I., & Qureshi, I. H. (2023). Examining theories, mediators and moderators in financial well-being literature: A systematic review and future research agenda. Qualitative Research in Organizations and Management: An International Journal, 18(4), 265–290. [Google Scholar] [CrossRef]

- Bates, S., Clapton, J., & Coren, E. (2007). Systematic maps to support the evidence base in social care. Evidence and Policy, 3(4), 539–551. [Google Scholar] [CrossRef]

- Buckland, J., Daniels, C., & Godinho, V. (2020). Does Australia have an advantage in promoting financial well-being and what might Canada and other countries learn? Canadian Journal of Urban Research, 29(1), 39–54. [Google Scholar] [CrossRef]

- Campanella, F., Serino, L., & Crisci, A. (2022). Governing Fintech for sustainable development: Evidence from Italian banking system. Qualitative Research in Financial Markets, 15(4), 557–571. [Google Scholar] [CrossRef]

- Cassimon, S., Maravalle, A., Pandiella, A. G., & Turroques, L. (2022). Determinants of and barriers to people’s financial inclusion in Mexico. In OECD economics department (OECD Economics Department Working Papers No. 1728). OECD. [Google Scholar] [CrossRef]

- Choowan, P., Daovisan, H., & Suwanwong, C. (2025). Effects of financial literacy and financial behavior on financial well-being: Meta-analytical review of experimental studies. International Journal of Financial Studies, 13(1), 1. [Google Scholar] [CrossRef]

- Choung, Y., Chatterjee, S., & Pak, T. Y. (2023). Digital financial literacy and financial well-being. Finance Research Letters, 58, 104438. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A., & Klapper, L. (2013). Measuring financial inclusion: Explaining variation in use of financial services across and within countries. Brookings Papers on Economic Activity, 2013(1), 279–340. [Google Scholar] [CrossRef]

- El Bied, S., Ros Mcdonnell, L., de-la-Fuente-Aragón, M. V., & Ros Mcdonnell, D. (2024). A comprehensive bibliometric analysis of real estate research trends. International Journal of Financial Studies, 12(3), 95. [Google Scholar] [CrossRef]

- Epstein, D., & Klerman, J. A. (2016). On the “When” of social experiments: The tension between program refinement and abandonment. New Directions for Evaluation, 2016(152), 33–45. [Google Scholar] [CrossRef]

- Escobar, L., & Grubbauer, M. (2021). Housing microfinance, saving and credit cooperatives, and community development in low-income settings in Mexico. Community Development Journal, 56(1), 141–160. [Google Scholar] [CrossRef]

- Esmaeilpour Moghadam, H., & Karami, A. (2023). Financial inclusion through FinTech and women’s financial empowerment. International Journal of Social Economics, 50(8), 1038–1059. [Google Scholar] [CrossRef]

- Febriana, R. N., & Damayanti, S. M. (2017). The relationship between demographic factors towards financial literacy and financial inclusion among financially educated student in Institut Teknologi Bandung. Advanced Science Letters, 23(8), 7204–7206. [Google Scholar] [CrossRef]

- Ferrada, L. M., & Montaña, V. (2022). Inclusion and financial literacy: The case of higher education student workers in Los Lagos, Chile. Estudios Gerenciales, 38(163), 211–221. [Google Scholar] [CrossRef]

- Gálvez-Sánchez, F. J., Lara-Rubio, J., Verdú-Jóver, A. J., & Meseguer-Sánchez, V. (2021). Research advances on financial inclusion: A bibliometric analysis. Sustainability, 13(6), 3156. [Google Scholar] [CrossRef]

- Ghosh, M. (2024). Financial inclusion studies bibliometric analysis: Projecting a sustainable future. Sustainable Futures, 7, 100160. [Google Scholar] [CrossRef]

- Gough, D., Thomas, J., & Oliver, S. (2012). Clarifying differences between review designs and methods. Systematic Reviews, 1(1), 28. [Google Scholar] [CrossRef] [PubMed]

- Gómez, W. (2023). Assessing PrEP messaging and communication: A review of the qualitative literature. Current Opinion in Psychology, 51, 101586. [Google Scholar] [CrossRef]

- GRADE Working Group. (2024). Education and debate. BMJ, 328, 1–8. [Google Scholar]

- Ha, D., Le, P., & Nguyen, D. K. (2025). Financial inclusion and fintech: A state-of-the-art systematic literature review. Financial Innovation, 11(69), 2–42. [Google Scholar] [CrossRef]

- Haddaway, N. R., Page, M. J., Pritchard, C. C., & McGuinness, L. A. (2022). PRISMA2020: An R package and Shiny app for producing PRISMA 2020-compliant flow diagrams, with interactivity for optimised digital transparency and Open Synthesis. Campbell Systematic Reviews, 18(2), e1230. [Google Scholar] [CrossRef] [PubMed]

- Jan van Eck, N., & Waltman, L. (2023). VOSviewer manual. Available online: https://www.vosviewer.com/ (accessed on 23 December 2025).

- Jungo, J., Madaleno, M., & Botelho, A. (2023). Financial literacy, financial innovation, and financial inclusion as mitigating factors of the adverse effect of corruption on banking stability indicators. Journal of the Knowledge Economy, 15(2), 8842–8873. [Google Scholar] [CrossRef]

- Kamble, P. A., Mehta, A., & Rani, N. (2024). Financial inclusion and digital financial literacy: Do they matter for financial well-being? Social Indicators Research, 171(3), 777–807. [Google Scholar] [CrossRef]

- Kocornik-Mina, A., Bastida-Vialcanet, R., & Eguigurenhuerta, M. (2021). Social impact of value-based banking: Best practises and a continuity framework. Sustainability, 13(14), 7681. [Google Scholar] [CrossRef]

- Koutsos, T. M., Menexes, G. C., & Dordas, C. A. (2019). An efficient framework for conducting systematic literature reviews in agricultural sciences. Science of the Total Environment, 682, 106–117. [Google Scholar] [CrossRef] [PubMed]

- Kumar, S., Rao, S., Goyal, K., & Goyal, N. (2022). Journal of behavioral and experimental finance: A bibliometric overview. Journal of Behavioral and Experimental Finance, 34, 100652. [Google Scholar] [CrossRef]

- León-Cuanalo, G., Hernández-Rivera, A., & Haro-Álvarez, G. (2022). Financial Inclusion in Bachelor Students in Mexico, 2017–2018. Revista Mexicana de Economia y Finanzas Nueva Epoca, 17(1), e716. [Google Scholar] [CrossRef]

- Liu, Q., Chan, K. C., & Chimhundu, R. (2024). Fintech research: Systematic mapping, classification, and future directions. Financial Innovation, 10(1), 24. [Google Scholar] [CrossRef]

- López-Cortes, O. D., Betancourt-Nuñez, A., Bernal-Orozco, M. F., & Vizmanos, B. (2022). Scoping review: Una nueva forma de síntesis de la evidencia. Investigación en Educación Media, 11(44), 98–104. [Google Scholar] [CrossRef]

- Luhmann, N. (1994). Inclusión-exclusión. Acta Sociológica, 12, 11–39. [Google Scholar]

- Malkina, M. Y., & Rogachev, D. Y. (2019). Influence of Personal Characteristics on the Financial Behavior of Youth. Journal of Institutional Studies, 11(3), 135–152. [Google Scholar] [CrossRef]

- Mirza, N., Umar, M., Afzal, A., & Firdousi, S. F. (2023). The role of fintech in promoting green finance, and profitability: Evidence from the banking sector in the euro zone. Economic Analysis and Policy, 78, 33–40. [Google Scholar] [CrossRef]

- Moher, D., Liberati, A., Tetzlaff, J., & Altman, D. G. (2010). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. International Journal of Surgery, 8(5), 336–341. [Google Scholar] [CrossRef]

- Nogueira Silva, B., Viera Silva, W., Pereira de Macêdo, A. F., de Almeida Levino, N., Dalazen, L. L., Kaczam, F., & Pereira da Veiga, C. (2023). A systematic review on social currency: A one-decade perspective. Journal of Financial Services Marketing, 29(2), 636–652. [Google Scholar] [CrossRef]

- Orduña-Malea, E., & Costas, R. (2021). Link-based approach to study scientific software usage: The case of VOSviewer. Scientometrics, 126(9), 8153–8186. [Google Scholar] [CrossRef]

- Pavlovskaya, M., & Eletto, R. (2021). Credit unions, class, race, and place in New York City. Geoforum, 127, 335–348. [Google Scholar] [CrossRef]

- Pranajaya, E., Alexandri, M. B., Chan, A., & Hermanto, B. (2024). Examining the influence of financial inclusion on investment decision: A bibliometric review. Heliyon, 10(3), e25779. [Google Scholar] [CrossRef] [PubMed]

- Rahmawati, S. A., Narmaditya, B. S., Wibowo, A., Wulandari, D., Hardinto, P., Prayintno, P., & Utomo, S. H. (2019). Family economy education, financial literacy and financial inclusion among university students in Indonesia. International Journal of Scientific & Technoilogy Research, 8(12), 1291–1294. [Google Scholar]

- Rastogi, S., Singh, K., & Kanoujiya, J. (2023). Do countries capture their inclusive growth, sustainability, and poverty correctly? A study on statistical performance indicators defined by World Bank. Social Responsibility Journal, 19(10), 1935–1951. [Google Scholar] [CrossRef]

- Respati, D. K., Widyastuti, U., Nuryati, T., Musyaffi, A. M., Handayani, B. D., & Ali, N. R. (2023). How do students’ digital financial literacy and financial confidence influence their financial behavior and financial well-being? Nurture, 17(2), 40–50. [Google Scholar] [CrossRef]

- Suryavanshi, U., Chaudhry, R., Arora, M., & Mittal, A. (2024). Mapping the evolution of financial inclusion: A retrospective overview using bibliometric analysis. Global Knowledge, Memory and Communication. [Google Scholar] [CrossRef]

- Şenol, D., & Onay, C. (2023). Impact of gamification on mitigating behavioral biases of investors. Journal of Behavioral and Experimental Finance, 37, 100772. [Google Scholar] [CrossRef]

- Tay, L. Y., Tai, H. T., & Tan, G. S. (2022). Digital financial inclusion: A gateway to sustainable development. Heliyon, 8(6), e09766. [Google Scholar] [CrossRef]

- Tricco, A. C., Lillie, E., Zarin, W., O’Brien, K. K., Colquhoun, H., Levac, D., Moher, D., Peters, M. D. J., Horsley, T., Weeks, L., Hempel, S., Akl, E. A., Chang, C., McGowan, J., Stewart, L., Hartling, L., Aldcroft, A., Wilson, M. G., Garritty, C., … Straus, S. E. (2018). PRISMA extension for scoping reviews (PRISMA-ScR): Checklist and explanation. Annals of Internal Medicine, 169(7), 467–473. [Google Scholar] [CrossRef]

- Vijay Kumar, V. M., & Senthil Kumar, J. P. (2023). Insights on financial literacy: A bibliometric analysis. Managerial Finance, 49(7), 1169–1201. [Google Scholar] [CrossRef]

- Wang, Y., Wang, Z., Liu, G., Wang, Z., Wang, Q., Yan, Y., Wang, J., Zhu, Y., Gao, W., Kan, X., Zhang, Z., Jia, L., & Pang, X. (2022). Application of serious games in health care: Scoping review and bibliometric analysis. Frontier in Public Health, 10, 896974. [Google Scholar] [CrossRef]

- Williams, A. J., & Oumlil, B. (2015). College student financial capability: A framework for public policy, research and managerial action for financial exclusion prevention. International Journal of Bank Marketing, 33(5), 637–653. [Google Scholar] [CrossRef]

- Xiao, J. J., Huang, J., Goyal, K., & Kumar, S. (2022). Financial capability: A systematic conceptual review, extension and synthesis. International Journal of Bank Marketing, 40(7), 1680–1717. [Google Scholar] [CrossRef]

- Yeo, K. H. K., Lim, W. M., & Yii, K. J. (2023). Financial planning behaviour: A systematic literature review and new theory development. Journal of Financial Services Marketing, 29(3), 979–1001. [Google Scholar] [CrossRef]

- Zhang, Y., Tadesse, A., & Huang, J. (2025). How to improve the efficiency of financial inclusion for poverty alleviation in China? An empirical analysis. Journal of Poverty, 29(5), 437–455. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.