Econometric Analysis of Climate Change

A topical collection in Econometrics (ISSN 2225-1146).

Submission Status:

Closed

|

Viewed by 91273

Share This Topical Collection

Editors

Prof. Dr. Claudio Morana

Prof. Dr. Claudio Morana

Prof. Dr. Claudio Morana

Prof. Dr. Claudio Morana

E-Mail

Website

Collection Editor

Dipartimento di Economia, Metodi Quantitativi e Strategie di Impresa, University of Milano- Bicocca, 20126 Milano, MI, Italy

Interests: linear and nonlinear large-scale time series models; macro, financial, and climate change econometrics; the microfinance interface and boom–bust macro-financial cycles

Special Issues, Collections and Topics in MDPI journals

Prof. Dr. J. Isaac Miller

Prof. Dr. J. Isaac Miller

Prof. Dr. J. Isaac Miller

Prof. Dr. J. Isaac Miller

E-Mail

Website

Collection Editor

Department of Economics, University of Missouri, Columbia, MO 65211, USA

Interests: econometrics; time series; energy; climate

Topical Collection Information

Dear Colleagues,

This Topical Collection aims to promote an interdisciplinary approach to the detection and attribution of climate change; the cross-fertilization between climate science, economics, and econometrics; and econometric estimates of climate impacts and policy evaluation. We solicit the submission of papers whose novelty stems from the development and introduction of new econometric models of climate change, and we invite papers using econometric methods to analyze climate data, as well as economic, financial, and econometric studies of climate impacts. We particularly welcome submissions in the field of climatology highlighting interesting statistical challenges to which econometric methods can contribute.

Prof. Dr. Claudio Morana

Prof. Dr. J. Isaac Miller

Collection Editors

Manuscript Submission Information

Manuscripts should be submitted online at www.mdpi.com by registering and logging in to this website. Once you are registered, click here to go to the submission form. Manuscripts can be submitted until the deadline. All papers will be peer-reviewed. Accepted papers will be published continuously in the journal (as soon as accepted) and will be listed together on the Special Issue website. Research articles and review articles, as well as short communications, are invited. For planned papers, a title and short abstract (about 100 words) can be sent to the Editorial Office for announcement on the website.

Submitted manuscripts should not have been published previously, nor be under consideration for publication elsewhere (except conference proceedings papers). All manuscripts are thoroughly refereed through a single-blind peer-review process. A guide for authors and other relevant information for the submission of manuscripts is available on the Instructions for Authors page. Econometrics is an international, peer-reviewed, open access, quarterly journal published by MDPI.

Please visit the

Instructions for Authors page before submitting a manuscript.

There are no article processing charges (APCs) for publication in this Special Issue. Submitted papers should be well formatted and use proper English. Authors may use MDPI's

English editing service prior to publication or during author revisions.

Keywords

- econometrics

- climate change

- environmental, economic, and financial implications of climate change

Published Papers (14 papers)

Open AccessEditor’s ChoiceArticle

Is Climate Change Time-Reversible?

by

Francesco Giancaterini, Alain Hecq and Claudio Morana

Cited by 3 | Viewed by 5603

Abstract

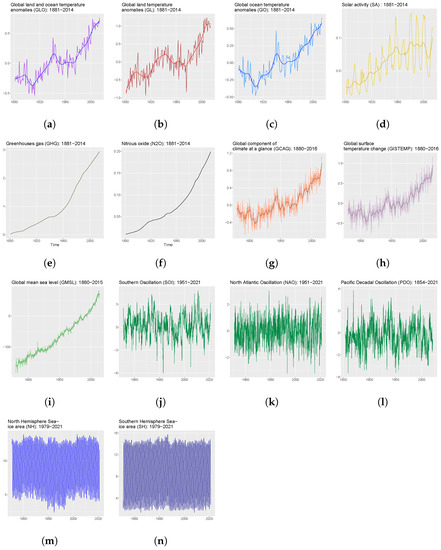

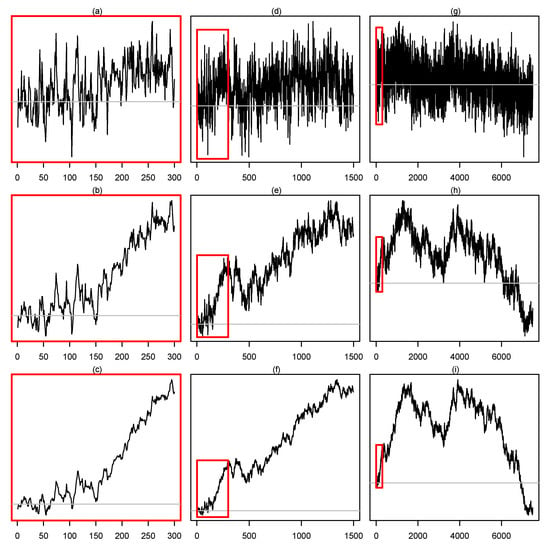

This paper proposes strategies to detect time reversibility in stationary stochastic processes by using the properties of mixed causal and noncausal models. It shows that they can also be used for non-stationary processes when the trend component is computed with the Hodrick–Prescott filter

[...] Read more.

This paper proposes strategies to detect time reversibility in stationary stochastic processes by using the properties of mixed causal and noncausal models. It shows that they can also be used for non-stationary processes when the trend component is computed with the Hodrick–Prescott filter rendering a time-reversible closed-form solution. This paper also links the concept of an environmental tipping point to the statistical property of time irreversibility and assesses fourteen climate indicators. We find evidence of time irreversibility in greenhouse gas emissions, global temperature, global sea levels, sea ice area, and some natural oscillation indices. While not conclusive, our findings urge the implementation of correction policies to avoid the worst consequences of climate change and not miss the opportunity window, which might still be available, despite closing quickly.

Full article

►▼

Show Figures

Open AccessArticle

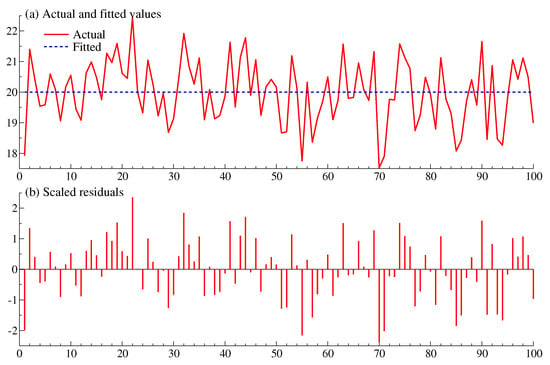

Detecting and Quantifying Structural Breaks in Climate

by

Neil R. Ericsson, Mohammed H. I. Dore and Hassan Butt

Cited by 6 | Viewed by 4580

Abstract

Structural breaks have attracted considerable attention recently, especially in light of the financial crisis, Great Recession, the COVID-19 pandemic, and war. While structural breaks pose significant econometric challenges, machine learning provides an incisive tool for detecting and quantifying breaks. The current paper presents

[...] Read more.

Structural breaks have attracted considerable attention recently, especially in light of the financial crisis, Great Recession, the COVID-19 pandemic, and war. While structural breaks pose significant econometric challenges, machine learning provides an incisive tool for detecting and quantifying breaks. The current paper presents a unified framework for analyzing breaks; and it implements that framework to test for and quantify changes in precipitation in Mauritania over 1919–1997. These tests detect a decline of one third in mean rainfall, starting around 1970. Because water is a scarce resource in Mauritania, this decline—with adverse consequences on food production—has potential economic and policy consequences.

Full article

►▼

Show Figures

Open AccessEditor’s ChoiceArticle

Green Bonds for the Transition to a Low-Carbon Economy

by

Andreas Lichtenberger, Joao Paulo Braga and Willi Semmler

Cited by 34 | Viewed by 11588

Abstract

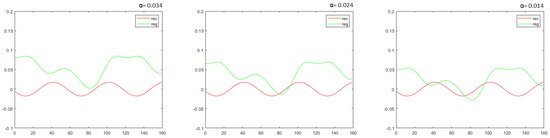

The green bond market is emerging as an impactful financing mechanism in climate change mitigation efforts. The effectiveness of the financial market for this transition to a low-carbon economy depends on attracting investors and removing financial market roadblocks. This paper investigates the differential

[...] Read more.

The green bond market is emerging as an impactful financing mechanism in climate change mitigation efforts. The effectiveness of the financial market for this transition to a low-carbon economy depends on attracting investors and removing financial market roadblocks. This paper investigates the differential bond performance of green vs non-green bonds with (1) a dynamic portfolio model that integrates negative as well as positive externality effects and via (2) econometric analyses of aggregate green bond and corporate energy time-series indices; as well as a cross-sectional set of individual bonds issued between 1 January 2017, and 1 October 2020. The asset pricing model demonstrates that, in the long-run, the positive externalities of green bonds benefit the economy through positive social returns. We use a deterministic and a stochastic version of the dynamic portfolio approach to obtain model-driven results and evaluate those through our empirical evidence using harmonic estimations. The econometric analysis of this study focuses on volatility and the risk–return performance (Sharpe ratio) of green and non-green bonds, and extends recent econometric studies that focused on yield differentials of green and non-green bonds. A modified Sharpe ratio analysis, cross-sectional methods, harmonic estimations, bond pairing estimations, as well as regression tree methodology, indicate that green bonds tend to show lower volatility and deliver superior Sharpe ratios (while the evidence for green premia is mixed). As a result, green bond investment can protect investors and portfolios from oil price and business cycle fluctuations, and stabilize portfolio returns and volatility. Policymakers are encouraged to make use of the financial benefits of green instruments and increase the financial flows towards sustainable economic activities to accelerate a low-carbon transition.

Full article

►▼

Show Figures

Open AccessArticle

Robust Estimation and Forecasting of Climate Change Using Score-Driven Ice-Age Models

by

Szabolcs Blazsek and Alvaro Escribano

Cited by 7 | Viewed by 4076

Abstract

We use data on the following climate variables for the period of the last 798 thousand years: global ice volume (

), atmospheric carbon dioxide level (

), and Antarctic land surface temperature (

).

[...] Read more.

We use data on the following climate variables for the period of the last 798 thousand years: global ice volume (

), atmospheric carbon dioxide level (

), and Antarctic land surface temperature (

). Those variables are cyclical and are driven by the following strongly exogenous orbital variables: eccentricity of the Earth’s orbit, obliquity, and precession of the equinox. We introduce score-driven ice-age models which use robust filters of the conditional mean and variance, generalizing the updating mechanism and solving the misspecification of a recent climate–econometric model (benchmark ice-age model). The score-driven models control for omitted exogenous variables and extreme events, using more general dynamic structures and heteroskedasticity. We find that the score-driven models improve the performance of the benchmark ice-age model. We provide out-of-sample forecasts of the climate variables for the last 100 thousand years. We show that during the last 10–15 thousand years of the forecasting period, for which humanity influenced the Earth’s climate, (i) the forecasts of

are above the observed

, (ii) the forecasts of

level are below the observed

, and (iii) the forecasts of

are below the observed

. The forecasts for the benchmark ice-age model are reinforced by the score-driven models.

Full article

►▼

Show Figures

Open AccessArticle

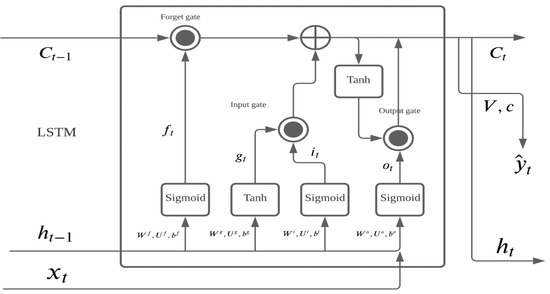

Climate Finance: Mapping Air Pollution and Finance Market in Time Series

by

Zheng Fang, Jianying Xie, Ruiming Peng and Sheng Wang

Cited by 24 | Viewed by 6124

Abstract

Climate finance is growing popular in addressing challenges of climate change because it controls the funding and resources to emission entities and promotes green manufacturing. In this study, we determined that PM

, PM

, SO

, NO

,

[...] Read more.

Climate finance is growing popular in addressing challenges of climate change because it controls the funding and resources to emission entities and promotes green manufacturing. In this study, we determined that PM

, PM

, SO

, NO

, CO, and O

are the target pollutant in the atmosphere and we use a deep neural network to enhance the regression analysis in order to investigate the relationship between air pollution and stock prices of the targeted manufacturer. We also conduct time series analysis based on air pollution and heavy industry manufacturing in China, as the country is facing serious air pollution problems. Our study uses Convolutional-Long Short Term Memory in 2 Dimension (ConvLSTM2D) to extract the features from air pollution and enhance the time series regression in the financial market. The main contribution in our paper is discovering a feature term that impacts the stock price in the financial market, particularly for the companies that are highly impacted by the local environment. We offer a higher accurate model than the traditional time series in the stock price prediction by considering the environmental factor. The experimental results suggest that there is a negative linear relationship between air pollution and the stock market, which demonstrates that air pollution has a negative effect on the financial market. It promotes the manufacturer’s improving their emission recycling and encourages them to invest in green manufacture—otherwise, the drop in stock price will impact the company funding process.

Full article

►▼

Show Figures

Open AccessArticle

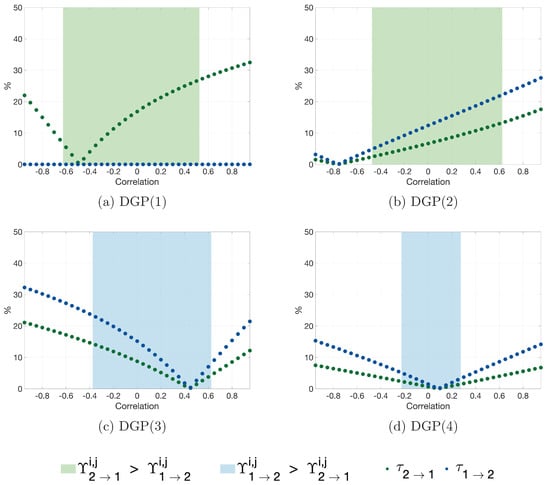

On Spurious Causality, CO2, and Global Temperature

by

Philippe Goulet Coulombe and Maximilian Göbel

Cited by 8 | Viewed by 7189

Abstract

Stips et al. (2016) use information flows (Liang (2008, 2014)) to establish causality from various forcings to global temperature. We show that the formulas being used hinge on a simplifying assumption that is nearly always rejected by the data. We propose the well-known

[...] Read more.

Stips et al. (2016) use information flows (Liang (2008, 2014)) to establish causality from various forcings to global temperature. We show that the formulas being used hinge on a simplifying assumption that is nearly always rejected by the data. We propose the well-known forecast error variance decomposition based on a Vector Autoregression as an adequate measure of information flow, and find that most results in Stips et al. (2016) cannot be corroborated. Then, we discuss which modeling choices (e.g., the choice of CO

series and assumptions about simultaneous relationships) may help in extracting credible estimates of causal flows and the transient climate response simply by looking at the joint dynamics of two climatic time series.

Full article

►▼

Show Figures

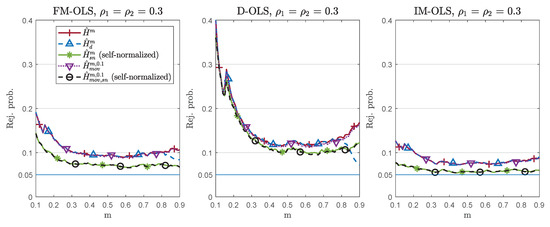

Open AccessFeature PaperArticle

Monitoring Cointegrating Polynomial Regressions: Theory and Application to the Environmental Kuznets Curves for Carbon and Sulfur Dioxide Emissions

by

Fabian Knorre, Martin Wagner and Maximilian Grupe

Cited by 3 | Viewed by 4293

Abstract

This paper develops residual-based monitoring procedures for cointegrating polynomial regressions (CPRs), i.e., regression models including deterministic variables and integrated processes, as well as integer powers, of integrated processes as regressors. The regressors are allowed to be endogenous, and the stationary errors are allowed

[...] Read more.

This paper develops residual-based monitoring procedures for cointegrating polynomial regressions (CPRs), i.e., regression models including deterministic variables and integrated processes, as well as integer powers, of integrated processes as regressors. The regressors are allowed to be endogenous, and the stationary errors are allowed to be serially correlated. We consider five variants of monitoring statistics and develop the results for three modified least squares estimators for the parameters of the CPRs. The simulations show that using the combination of self-normalization and a moving window leads to the best performance. We use the developed monitoring statistics to assess the structural stability of environmental Kuznets curves (EKCs) for both CO

and SO

emissions for twelve industrialized countries since the first oil price shock.

Full article

►▼

Show Figures

Open AccessArticle

Temperature Anomalies, Long Memory, and Aggregation

by

J. Eduardo Vera-Valdés

Cited by 10 | Viewed by 4826

Abstract

Econometric studies for global heating have typically used regional or global temperature averages to study its long memory properties. One typical explanation behind the long memory properties of temperature averages is cross-sectional aggregation. Nonetheless, formal analysis regarding the effect that aggregation has on

[...] Read more.

Econometric studies for global heating have typically used regional or global temperature averages to study its long memory properties. One typical explanation behind the long memory properties of temperature averages is cross-sectional aggregation. Nonetheless, formal analysis regarding the effect that aggregation has on the long memory dynamics of temperature data has been missing. Thus, this paper studies the long memory properties of individual grid temperatures and compares them against the long memory dynamics of global and regional averages. Our results show that the long memory parameters in individual grid observations are smaller than those from regional averages. Global and regional long memory estimates are greatly affected by temperature measurements at the Tropics, where the data is less reliable. Thus, this paper supports the notion that aggregation may be exacerbating the long memory estimated in regional and global temperature data. The results are robust to the bandwidth parameter, limit for station radius of influence, and sampling frequency.

Full article

►▼

Show Figures

Open AccessArticle

Nonlinear Cointegrating Regression of the Earth’s Surface Mean Temperature Anomalies on Total Radiative Forcing

by

Kyungsik Nam

Cited by 2 | Viewed by 4309

Abstract

This study proposes a nonlinear cointegrating regression model based on the well-known energy balance climate model. Specifically, I investigate the nonlinear cointegrating regression of the mean of temperature anomaly distributions on total radiative forcing using estimated spatial distributions of temperature anomalies for the

[...] Read more.

This study proposes a nonlinear cointegrating regression model based on the well-known energy balance climate model. Specifically, I investigate the nonlinear cointegrating regression of the mean of temperature anomaly distributions on total radiative forcing using estimated spatial distributions of temperature anomalies for the Globe, Northern Hemisphere, and Southern Hemisphere. Further, I provide two types of nonlinear response functions that map the total radiative forcing level to mean temperature anomalies. The proposed statistical model provides a climatological implication that spatially heterogenous warming effects play a significant role in identifying nonlinear climate sensitivity. Cointegration and specification tests are provided that support the existence of nonlinear effects of total radiative forcing.

Full article

►▼

Show Figures

Open AccessFeature PaperArticle

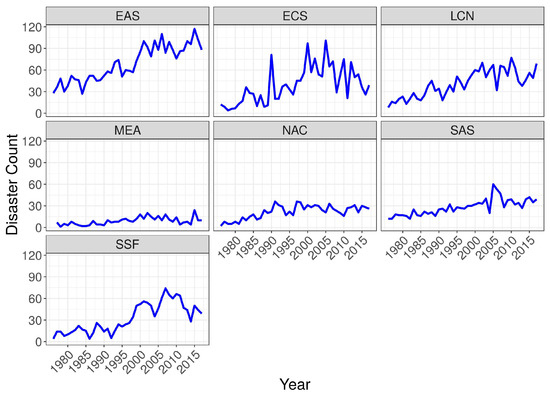

Climate Disaster Risks—Empirics and a Multi-Phase Dynamic Model

by

Stefan Mittnik, Willi Semmler and Alexander Haider

Cited by 17 | Viewed by 6050

Abstract

Recent research in financial economics has shown that rare large disasters have the potential to disrupt financial sectors via the destruction of capital stocks and jumps in risk premia. These disruptions often entail negative feedback effects on the macroeconomy. Research on disaster risks

[...] Read more.

Recent research in financial economics has shown that rare large disasters have the potential to disrupt financial sectors via the destruction of capital stocks and jumps in risk premia. These disruptions often entail negative feedback effects on the macroeconomy. Research on disaster risks has also actively been pursued in the macroeconomic models of climate change. Our paper uses insights from the former work to study disaster risks in the macroeconomics of climate change and to spell out policy needs. Empirically, the link between carbon dioxide emission and the frequency of climate related disaster is investigated using a panel data approach. The modeling part then uses a multi-phase dynamic macro model to explore the effects of rare large disasters resulting in capital losses and rising risk premia. Our proposed multi-phase dynamic model, incorporating climate-related disaster shocks and their aftermath as a distressed phase, is suitable for studying mitigation and adaptation policies as well as recovery policies.

Full article

►▼

Show Figures

Open AccessFeature PaperArticle

Dynamic Panel Modeling of Climate Change

by

Peter C. B. Phillips

Cited by 4 | Viewed by 6430

Abstract

We discuss some conceptual and practical issues that arise from the presence of global energy balance effects on station level adjustment mechanisms in dynamic panel regressions with climate data. The paper provides asymptotic analyses, observational data computations, and Monte Carlo simulations to assess

[...] Read more.

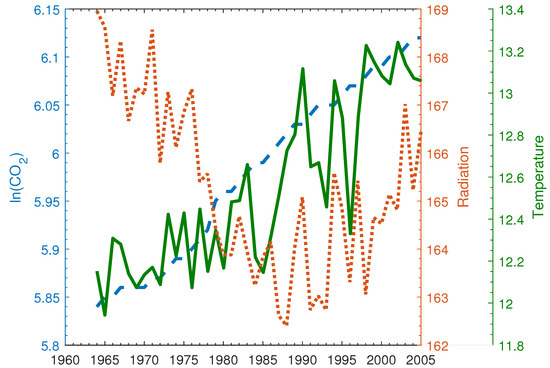

We discuss some conceptual and practical issues that arise from the presence of global energy balance effects on station level adjustment mechanisms in dynamic panel regressions with climate data. The paper provides asymptotic analyses, observational data computations, and Monte Carlo simulations to assess the use of various estimation methodologies, including standard dynamic panel regression and cointegration techniques that have been used in earlier research. The findings reveal massive bias in system GMM estimation of the dynamic panel regression parameters, which arise from fixed effect heterogeneity across individual station level observations. Difference GMM and Within Group (WG) estimation have little bias and WG estimation is recommended for practical implementation of dynamic panel regression with highly disaggregated climate data. Intriguingly, from an econometric perspective and importantly for global policy analysis, it is shown that in this model despite the substantial differences between the estimates of the regression model parameters, estimates of global transient climate sensitivity (of temperature to a doubling of atmospheric CO

) are robust to the estimation method employed and to the specific nature of the trending mechanism in global temperature, radiation, and CO

Full article

►▼

Show Figures

Open AccessFeature PaperArticle

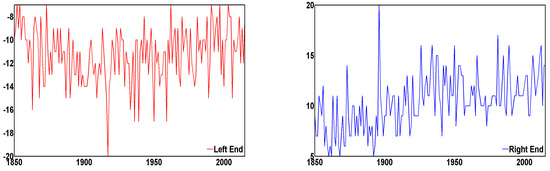

Frequency-Domain Evidence for Climate Change

by

Manveer Kaur Mangat and Erhard Reschenhofer

Cited by 8 | Viewed by 4553

Abstract

The goal of this paper is to search for conclusive evidence against the stationarity of the global air surface temperature, which is one of the most important indicators of climate change. For this purpose, possible long-range dependencies are investigated in the frequency-domain. Since

[...] Read more.

The goal of this paper is to search for conclusive evidence against the stationarity of the global air surface temperature, which is one of the most important indicators of climate change. For this purpose, possible long-range dependencies are investigated in the frequency-domain. Since conventional tests of hypotheses about the memory parameter, which measures the degree of long-range dependence, are typically based on asymptotic arguments and are therefore of limited practical value in case of small or medium sample sizes, we employ a new small-sample test as well as a related estimator for the memory parameter. To safeguard against false positive findings, simulation studies are carried out to examine the suitability of the employed methods and hemispheric datasets are used to check the robustness of the empirical findings against low-frequency natural variability caused by oceanic cycles. Overall, our frequency-domain analysis provides strong evidence of non-stationarity, which is consistent with previous results obtained in the time domain with models allowing for stochastic or deterministic trends.

Full article

►▼

Show Figures

Open AccessArticle

Tornado Occurrences in the United States: A Spatio-Temporal Point Process Approach

by

Fernanda Valente and Márcio Laurini

Cited by 12 | Viewed by 6831

Abstract

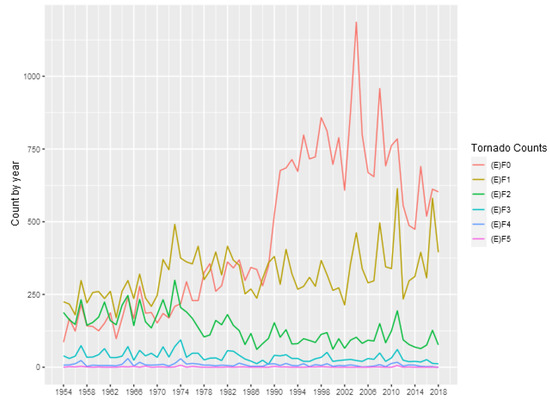

In this paper, we analyze the tornado occurrences in the Unites States. To perform inference procedures for the spatio-temporal point process we adopt a dynamic representation of Log-Gaussian Cox Process. This representation is based on the decomposition of intensity function in components of

[...] Read more.

In this paper, we analyze the tornado occurrences in the Unites States. To perform inference procedures for the spatio-temporal point process we adopt a dynamic representation of Log-Gaussian Cox Process. This representation is based on the decomposition of intensity function in components of trend, cycles, and spatial effects. In this model, spatial effects are also represented by a dynamic functional structure, which allows analyzing the possible changes in the spatio-temporal distribution of the occurrence of tornadoes due to possible changes in climate patterns. The model was estimated using Bayesian inference through the Integrated Nested Laplace Approximations. We use data from the Storm Prediction Center’s Severe Weather Database between 1954 and 2018, and the results provided evidence, from new perspectives, that trends in annual tornado occurrences in the United States have remained relatively constant, supporting previously reported findings.

Full article

►▼

Show Figures

Open AccessEditor’s ChoiceArticle

Forecast Accuracy Matters for Hurricane Damage

by

Andrew B. Martinez

Cited by 25 | Viewed by 9006

Abstract

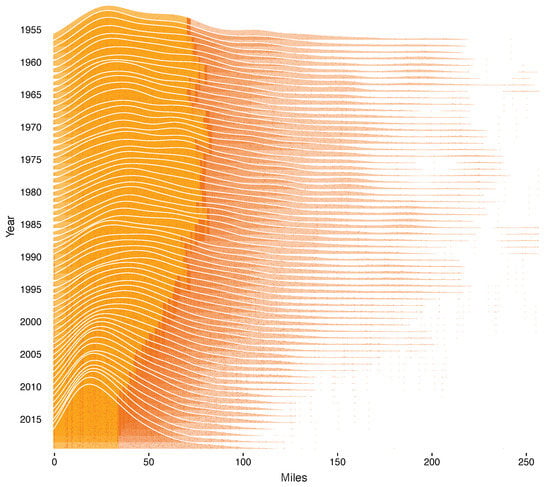

I analyze damage from hurricane strikes on the United States since 1955. Using machine learning methods to select the most important drivers for damage, I show that large errors in a hurricane’s predicted landfall location result in higher damage. This relationship holds across

[...] Read more.

I analyze damage from hurricane strikes on the United States since 1955. Using machine learning methods to select the most important drivers for damage, I show that large errors in a hurricane’s predicted landfall location result in higher damage. This relationship holds across a wide range of model specifications and when controlling for ex-ante uncertainty and potential endogeneity. Using a counterfactual exercise I find that the cumulative reduction in damage from forecast improvements since 1970 is about $82 billion, which exceeds the U.S. government’s spending on the forecasts and private willingness to pay for them.

Full article

►▼

Show Figures