Abstract

The real estate sector is steadily moving towards zero-emission buildings, driven by EU policies to achieve near-zero energy (NZEB) buildings by 2050. In Italy, more than 70% of residential buildings fall into the lower energy classes, and this mainly affects low-income households. As a result, the decarbonisation of the real estate sector presents both technical and socio-economic obstacles. Building on these premises, this study introduces the Retrofit Optimization Problem (ROP), a methodological framework adapted from the Multidimensional Knapsack Problem (MdKP). This method is used in this study to conduct a qualitative analysis of accessibility to retrofit between different socio-economic groups, integrating constraints to simulate restructuring capacity based on different incomes. The results show significant disparities: although many retrofit strategies can meet regulatory energy performance targets, only a small number are financially sustainable for low-income households. In addition, interventions with the greatest environmental impact remain inaccessible to vulnerable groups. These preliminary results highlight important equity issues in the energy transition, indicating the need for specific and income-sensitive policies to prevent decarbonisation efforts from exacerbating social inequalities or increasing the risk of assets being stranded in the housing market.

1. Introduction

The real estate industry plays a pivotal role in the battle against climate change, contributing to over one-third of global carbon emissions. The sector faces increasing pressure to pursue decarbonisation, which has become a top priority. Research from the Carbon Risk Real Estate Monitor and the Global Real Estate Sustainability Benchmark indicates that buildings account for 37% of global carbon emissions, and only 15% of international real estate assets align with the 1.5 °C target set by the Paris Agreement [1]. This reality emphasises the urgent need to raise ambitions and effectuate comprehensive decarbonisation across the entire sector. At the European level, the percentage of energetically inefficient buildings is, on average, around 75% [2]. In Italy, the problem is even more severe: approximately 60% of residential buildings—more than 12 million, for over 31 million residential units—were constructed before 1976, when energy efficiency regulations were either minimal or non-existent [3,4]. Additionally, over 70.4% of these buildings fall into the lowest energy performance classes (“E”, “F”, and “G”), and only 11% are characterized by a higher class than “B” (“A1”–“A4”), highlighting the urgent need for upgrades to meet modern efficiency standards.

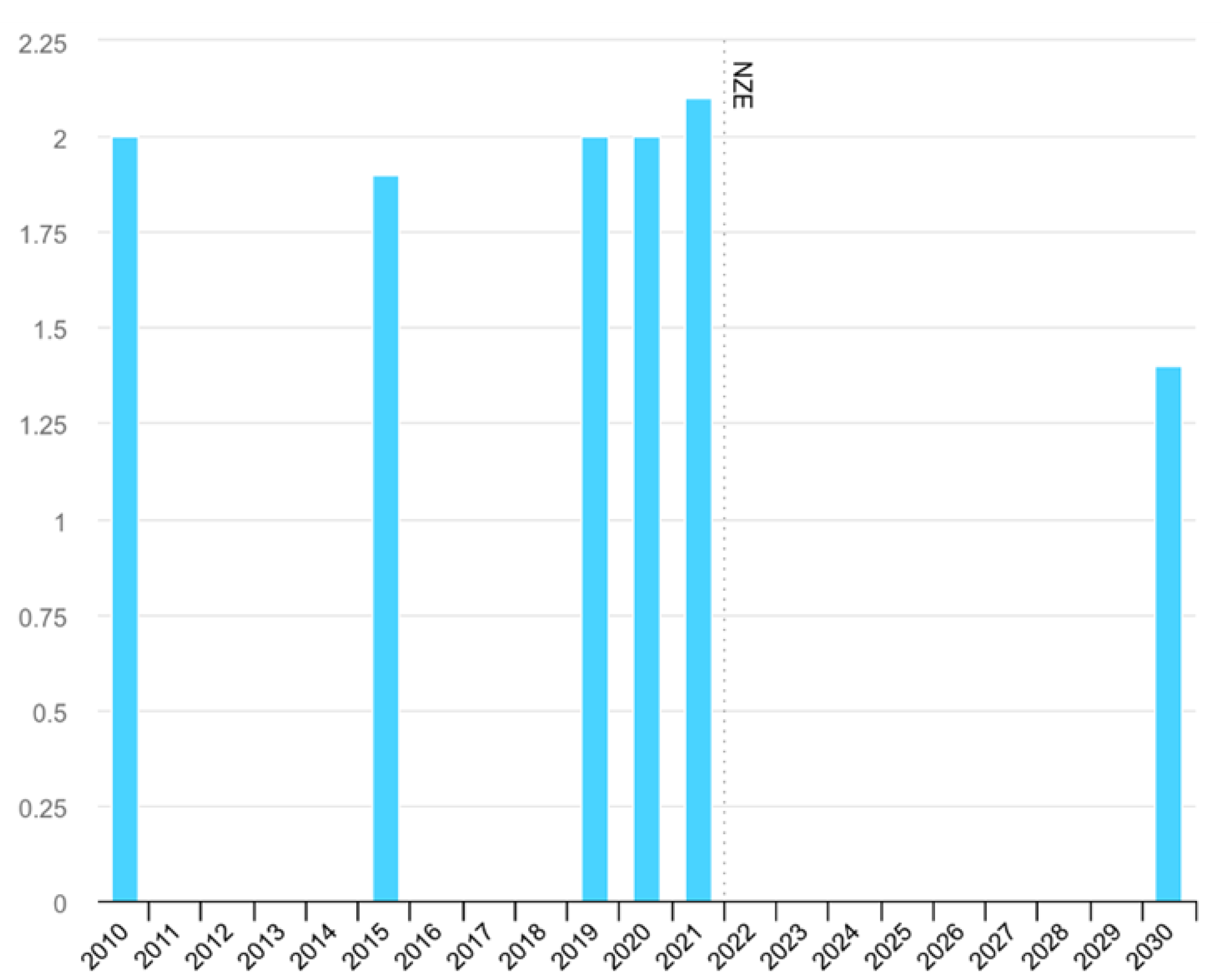

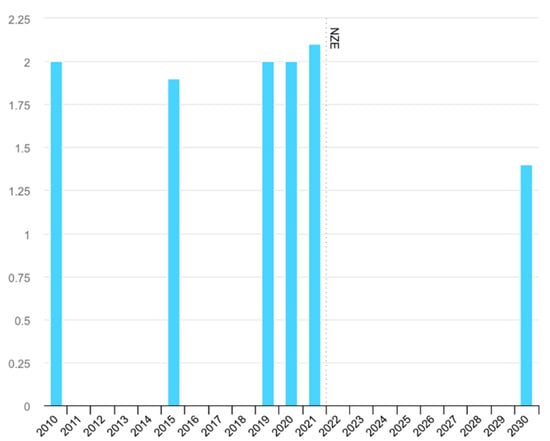

The transition to a more sustainable real estate sector is driven by regulations that mandate increasingly stringent energy targets. In this regard, the European Union promulgated a law, the European “Green Homes” Directive (EPBD—Energy Performance of Buildings Directive). Published as Directive (EU) 2024/1275 in the Official Journal of the European Union on 8 May 2024, it represents a cornerstone of the EU’s efforts to combat climate change. This directive, part of the Fit for 55 reform package, aims to progressively reduce CO2 emissions from the European building stock and achieve complete decarbonisation by 2050. Its approach involves large-scale renovations and substantial improvements in energy efficiency across the construction sector. The importance of these measures is underscored by the graph shown in Figure 1, which depicts CO2 direct emissions from residential building operations in the Net Zero Emissions (NZE) scenario from 2010 to 2030.

Figure 1.

CO2 direct emissions from the operation of residential buildings in the Net Zero Scenario, 2010–2030. Source: IEA (2020)—https://www.iea.org/data-and-statistics/charts/co2-emissions-from-the-operation-of-buildings-in-the-net-zero-scenario-2010-2030 (accessed on 18 April 2025).

The graph illustrates that a significant decline in emissions post-2022 reflects the anticipated impact of stricter energy efficiency measures, renewable energy adoption, and policy interventions aligned with net-zero goals. The dotted line labelled “NZE” marks the critical point where building operations must align with net-zero targets, emphasizing the urgency of action.

Key measures outlined in the directive include the following targets for Italy and all EU member states:

- New private buildings: Starting in 2030, all newly constructed private buildings must meet zero-emission standards, and public buildings must adhere to this requirement by 2028;

- Residential buildings: By 2030, residential buildings must achieve an average 16% reduction in energy consumption, with a target of 20–22% by 2035;

- Non-residential buildings: Energy consumption should be reduced by 16% by 2030 and 26% by 2033.

By implementing this directive, the EU aims to align its building sector with the commitments of the Paris Agreement and the European Green Deal, fostering a sustainable and energy-efficient future.

While the EPBD introduces ambitious goals for energy efficiency, it does not impose specific penalties for property owners who fail to meet these requirements within the stipulated timeframes. Additionally, there are no explicit restrictions on selling or renting properties that do not comply with current standards. Nonetheless, the lack of formal penalties does not insulate these properties from market forces. Implementing stricter energy efficiency regulations has diminished market interest in non-compliant properties. Those unable to conform to these new requirements are seeing a pronounced drop in interest from potential buyers or renters. With awareness growing regarding the environmental and economic impacts of high energy consumption, many potential occupants are now favouring sustainable properties that incur lower operational costs. This shift has been exacerbated by external factors such as the COVID-19 pandemic, the conflict in Ukraine, and, as a result, rising energy prices, all of which have heightened focus on energy-efficient buildings. At the same time, increasing environmental consciousness and the importance of Environmental, Social, and Governance (ESG) criteria drive the demand for properties that meet sustainability benchmarks. One of the main consequences of the content described is that buildings that do not adhere to contemporary energy efficiency standards are increasingly at risk of becoming economically obsolete. Specifically, non-compliant properties, which tend to be more expensive to manage due to inefficiencies, are gradually losing their appeal and risk becoming “stranded assets”. Generally, a stranded asset is an investment that loses value prematurely due to regulatory, market, or environmental changes. Several key factors can drive the risk of stranded assets in the real estate sector. First, regulatory pressures are increasing as energy efficiency standards become stricter, putting non-compliant buildings at risk of losing marketability and asset value. Market preferences are also shifting, with tenants and buyers favouring certified green buildings, marginalizing less efficient properties. Moreover, financial risks play a role; stranded assets may encounter difficulties securing financing as banks adopt stricter ESG criteria for real estate investments [5,6,7,8,9,10,11,12,13]. Climate change-related risks further exacerbate this issue. Buildings reliant on fossil fuels face higher exposure to depreciation due to both transitional and physical climate risks. Extreme weather events—such as floods, wildfires, and landslides—pose significant threats to asset resilience and long-term value [14,15,16]. Finally, technological and market evolutions, such as the decreasing costs of clean energy technologies (e.g., solar photovoltaics and heat pumps), further diminish the attractiveness of inefficient buildings.

The financial implications of stranded asset risk are very high, affecting property owners, lenders, and institutional investors who hold real estate portfolios. Transitioning to zero-emission buildings may require significant investments to enhance energy efficiency or to adopt alternative heating systems. Such modifications could result in financial losses for institutions, as they may have to write off loans and investments associated with these properties. This risk could be particularly pronounced if the transition is not executed smoothly or without a clear strategy.

In addition to regulatory and market influences, an often-overlooked aspect of the energy transition is the socioeconomic gap in retrofit affordability. Even when incentives exist, households in lower income brackets encounter significant obstacles in obtaining energy-efficient improvements. This challenge is intensified by income-neutral public policies such as the “Ecobonus” and “Superbonus” 110%. Although these policies are generous, they mainly benefit higher-income groups. This happens for two reasons: financially, these groups have the resources to make the initial investment required for these projects, and culturally, they are better equipped to navigate the complex procedures involved [17,18]. As a result, most energy retrofit efforts have taken place in affluent households, leaving out the most vulnerable populations.

Future retrofit policies should adopt an income-sensitive strategy to mitigate social inequalities and prevent stranded assets in economically vulnerable regions. Several nations have already begun in this direction by offering income-sensitive incentive programs. In the United States, for instance, the Weatherization Assistance Program (WAP) delivers free energy efficiency upgrades for low-income households, which include insulation, HVAC replacements, and air sealing [19]. In Germany, the KfW (Kreditanstalt für Wiederaufbau) development bank provides grants and low-interest loans via its BEG (Bundesförderung für effiziente Gebäude) initiative, which adjusts financial support according to income levels and the extent of renovation [19]. Similarly, in the Netherlands, the government provides “Energy Savings Loans” and local initiatives like “Energiebespaarlening”, which deliver tailored financing for energy retrofits, focusing on households in vulnerable neighbourhoods [20]. These global examples show that properly calibrated, income-sensitive support systems enhance equity and boost the overall effectiveness of national decarbonisation efforts. Integrating these principles into Italian policy design would be vital for inclusive and meaningful energy transition planning.

2. Aim

This study aimed to introduce and preliminarily validate a methodological framework—the Retrofit Optimization Problem (ROP)—designed to align building decarbonisation goals for the worst-performing buildings, typically rated E, F, or G on the EPC scale, with household financial capabilities. By adapting the Multidimensional Knapsack Problem (MdKP), the ROP integrates income-sensitive budget constraints, minimum EPC class improvement requirements, and environmental considerations into a unified decision-making framework, aiming to balance economic affordability and decarbonisation goals.

While a complete operational application of the ROP is deferred to future work, this study applied its foundational logics to qualitatively assess retrofit affordability and environmental impact across different income groups in Italy. Specifically, this work aimed to:

- Diagnose how financial barriers exclude low-income households from effective retrofit solutions;

- Evaluate the trade-offs between regulatory compliance and environmental efficiency;

- Highlight the limitations of previous incentive frameworks in achieving equitable decarbonisation;

- Lay the groundwork for the future quantitative development of income-sensitive, policy-supporting optimization tools, demonstrating that without targeted policy reforms, lower-income households are systematically excluded from achieving meaningful energy performance improvements, exacerbating social inequalities and increasing the risk of widespread stranded assets in the residential sector.

Through this preliminary analysis, this study provides critical early insights into the structural inequities of retrofit accessibility and their implications for climate policy effectiveness, social justice, and the real estate market.

The remainder of the paper is organized as follows. Section 3 reviews the literature on stranded asset risk in the building sector, the economic and behavioural barriers to retrofit adoption, and the integration of energy justice principles and income-sensitive constraints into energy retrofit modelling. It concludes with an overview of existing optimization approaches and their limitations in addressing socioeconomic disparities. Section 4 outlines the characteristics of the Italian residential building stock and income distribution and introduces the proposed optimization framework based on a multidimensional knapsack formulation. Section 5 presents the key qualitative and quantitative results, identifying which retrofit interventions are financially viable across income groups and evaluating their environmental effectiveness. Section 6 summarizes the study’s main contributions, discusses methodological limitations, and proposes future research directions.

3. Literature Review

3.1. Stranded Assets and Regulatory Risk in the Building Sector

The concept of stranded assets has been explored extensively in the literature, particularly concerning the risks posed by environmental and climate regulations. According to Caldecott et al. (2013), Curtin et al. (2019), and Caldecott et al. (2021) [21,22,23], stranded assets can be broadly categorized into three types: (a) stranded resources, referring to unexploited fossil fuel reserves or unused natural capital such as forests and agricultural land; (b) stranded capital, which includes physical production assets that may rapidly depreciate or require costly conversion due to regulatory or market shifts; and (c) stranded paper, denoting the financial implications of asset devaluation on balance sheets, particularly within the portfolios of banks and institutional investors.

This categorization provides a helpful framework for understanding how decarbonisation policies may trigger asset value loss across various sectors. Building on this, Daumas (2024) defines stranded assets in the context of the low-carbon transition as “assets whose profit expectations will be drastically reduced as the economy decarbonizes” [24]. He highlights the structural barriers, such as high reallocation and transaction costs, that prevent these assets from being easily repurposed or liquidated. Focusing specifically on the built environment, Muldoon-Smith and Greenhalgh (2019) extend the concept to the real estate sector, arguing that climate change mitigation policies can render certain property types obsolete, underperforming, or economically unviable. In their view, buildings that fail to meet emerging environmental standards risk becoming functionally or financially stranded within a market increasingly governed by energy performance and sustainability criteria [25].

The recent adoption of the Energy Performance of Buildings Directive (EPBD) 2024/1275, as part of the European Green Deal, establishes binding obligations for upgrading building stock. Failure to comply may render properties non-compliant with national energy codes, further exacerbating the stranded asset risk and pressuring owners towards timely and cost-effective renovation.

3.2. Economic Barriers to Energy Retrofit Adoption

Despite the recognized benefits of energy efficiency, the adoption of retrofit measures among private homeowners remains notably low. Empirical studies have identified several economic barriers contributing to this reluctance. One primary obstacle is the high upfront cost associated with energy-efficient renovations. Fernandez-Luzuriaga et al. (2022) examined Spanish households’ willingness to invest in thermal insulation [26]. They found that substantial initial expenses deter homeowners from undertaking such projects, especially when future energy savings are uncertain. Similarly, Adan and Fuerst (2015) observed that homeowners often perceive energy efficiency improvements as economically unattractive due to long payback periods and difficulty assessing returns on investments [27]. Their UK housing market data analysis suggested that voluntary uptake remains limited without strong policy incentives or financing mechanisms, particularly among middle- and low-income households. Additionally, the perceived uncertainty regarding energy savings plays a significant role in decision-making. Bakaloglou and Belaïd (2022) highlighted that homeowners often hesitate to invest in energy renovations due to doubts about the actual performance and reliability of the improvements, leading to postponed or abandoned projects [28]. The effectiveness of financial incentives also influences retrofit adoption. Broberg et al. (2019) investigated the impact of Energy Performance Certificates (EPCs) in Sweden and found no significant overall effect on energy efficiency investments [29]. However, they observed that certain heating system-related measures did experience positive treatment effects, suggesting that while EPCs raise awareness, they may not sufficiently motivate broader investment without complementary incentives. Moreover, the design and accessibility of subsidy programs can affect their success. Giraudet et al. (2021) analysed French home heating policies and noted that, although various subsidies exist, their cost-effectiveness and distributional impacts vary [30]. Without careful design, such policies may inadvertently favour higher-income households, leaving lower-income groups unable to afford even the minimum required investments. Petitet et al. (2017) further emphasize that financial support mechanisms can sometimes lead to market distortions and inefficiencies when not aligned with actual investment barriers or do not account for household heterogeneity [31]. Their study, focusing on European energy transition policies, warns against the unintended consequences of poorly calibrated support schemes, which may reduce policy effectiveness and fairness across socio-economic groups. Further reinforcing this perspective, Petkov et al. (2021) examined the dynamic interplay between public policies and retrofit decision-making in the real estate sector [32]. Their research highlights that retrofit investments are not driven solely by individual cost–benefit analyses but are also shaped by the perceived credibility, stability, and clarity of regulatory frameworks. The authors argue that fragmented or short-term policies may fail to mobilize investment. In contrast, well-designed, long-term strategies that signal commitment and reduce regulatory uncertainty can significantly enhance homeowner confidence and accelerate decarbonisation efforts. In addition to economic and policy-related barriers, behavioural and informational factors remain significant obstacles. Liu et al. (2021) conducted an integrative review of homeowners’ retrofit behaviours and identified a complex interplay of psychological, social, and cognitive variables influencing decision-making [33]. Their findings indicate that low awareness, fear of risk, insufficient technical knowledge, and minimal motivation frequently lead to inaction, despite favourable economic conditions or incentives. This underscores the necessity for financial and regulatory backing and behaviourally informed interventions that tackle the non-monetary factors influencing renovation choices.

From the literature analysis, economic barriers such as high upfront costs, uncertainty about energy savings, and inadequately targeted or unstable financial incentives, combined with behavioural and informational limitations, significantly hinder the widespread adoption of energy retrofits among private homeowners. Addressing these challenges requires comprehensive policies that provide financial support, build trust in regulatory and technical outcomes, and ensure equitable and psychologically attuned access across different household profiles.

3.3. Energy Justice and Affordability Constraints in Retrofit Modelling

Recent studies increasingly highlight the importance of embedding energy justice and affordability concerns into the design and modelling of retrofit policies. The concept of energy justice, which includes recognition, procedural, and distributive justice, has become central to evaluating how retrofit programs affect different social groups [34]. Specifically, fuel poverty and energy vulnerability linked to income mainly impact households in older, inefficient buildings, which often hinders their involvement in substantial energy renovations [35].

Numerous empirical studies indicate that existing subsidy systems benefit higher-income households, worsening current inequalities. For example, a survey by D’Agostino et al. (2017) at the European level revealed that retrofit programs across EU Member States frequently lacked appropriate targeting mechanisms, leading to uneven adoption and restricted access for low-income households. The authors emphasize the need for customized policies and financial tools to prevent regressive effects and guarantee fair participation in the energy transition [36]. Similarly, retrofit programs in Canada and the UK have struggled to reach low-income groups due to design features that assume up-front liquidity or tax liability—conditions not met by the most vulnerable [37,38].

This concern is further reinforced by a study of a white certificate program implemented in Victoria, Australia, between 2009 and 2017, which analysed the spatial and socioeconomic distribution of energy-efficiency certificate generation [39]. The findings revealed that areas with lower economic resources and higher proportions of rented dwellings had significantly lower retrofit activity, despite facing higher levels of energy stress. This suggests that utilitarian, market-based subsidy approaches may be regressive, inadvertently reinforcing existing energy inequalities. The authors contend that retrofit poverty reflects distributional injustice, signifying unequal chances to enhance energy performance. They advocate for policies more effectively catering to vulnerable communities’ unique requirements and structural challenges.

Researchers are increasingly advocating for equity-focused retrofit models that consider technical feasibility and economic and social factors to overcome these limitations. Recent studies have incorporated income-sensitive constraints into optimization frameworks to evaluate who can truly afford various levels of energy improvement [40]. These models function as diagnostic and prescriptive tools, guiding public policy formulation by pinpointing the population segments excluded by flat-rate incentives or tax credit systems [41].

3.4. Optimization Models for Retrofit Planning: From Data-Driven Simulation to Multi-Objective and Regulatory-Constrained Frameworks

Recent advancements in building energy retrofit research have increasingly focused on integrating optimization techniques, contextual analysis, and machine learning to improve planning and decision-making processes. Seyedzadeh and Pour Rahimian (2021) highlighted the potential of multi-objective optimization in developing data-driven models for predicting energy performance in non-domestic buildings, while their previous work also emphasized the need to balance multiple conflicting goals, such as cost, energy savings, and CO2 reduction [42]. In a related study, Seyedzadeh et al. (2021) proposed a model that integrates machine learning with multi-objective optimization to improve the prediction of energy loads in buildings, offering a robust tool for early-stage retrofit decision-making [43]. Similarly, Seyedzadeh et al. (2020) demonstrated the usefulness of data-driven modelling in estimating energy performance in renovation scenarios [27]. These techniques help generate scenario-based assessments that are more resilient to uncertainty and local variability. Building on this, Tavakolan et al. (2022) developed a parallel simulation-based optimization framework to evaluate retrofit strategies in the Iranian building stock, highlighting the significance of region-specific energy models [44]. These contributions reflect a trend towards context-sensitive and computation-driven models that adapt to local building characteristics and climatic conditions.

In parallel with optimization, the environmental implications of retrofit strategies—particularly regarding embodied energy and carbon emissions—have received increasing attention. Almeida et al. (2023) assessed how different weights attributed to operational and embodied carbon influence retrofit prioritization in Mediterranean climates, underlining the need for lifecycle-based retrofit decision frameworks [45]. Similarly, Altan and Mohelnikova (2009) investigated the carbon reduction potential of renovated buildings, providing empirical validation of policy assumptions around energy savings and environmental performance [46].

Recent studies have also started to integrate occupant behaviour and social dynamics into retrofit planning. Monzón-Chavarrías et al. (2021) explored how behavioural changes during the COVID-19 lockdown affected residential energy use in Barcelona, advocating for retrofit approaches incorporating occupancy patterns and adaptive use of space. These insights call for retrofit models that are technically sound and responsive to lifestyle dynamics and temporal variations in building use [47,48].

Parallel to these data- and behaviour-driven developments, many studies have emphasized multi-objective and environmentally constrained models, which aim to balance energy efficiency, cost-effectiveness, and environmental impact. For example, He and Wang (2024) introduced a multi-objective quantum genetic algorithm for optimizing public building envelope designs, effectively balancing energy consumption and investment costs [49]. Similarly, Ferrara et al. (2019) developed the EDeSSOpt framework, which optimizes energy demand and supply to achieve cost-effective designs in multi-family buildings [50].

A key conceptual shift has emerged in the literature, moving from narrowly defined cost-optimal approaches towards holistic, multi-objective frameworks. Vilà and Sánchez (2023) reviewed this evolution comprehensively, arguing that deep renovation strategies must go beyond purely economic assessments [51]. They propose a methodological transition incorporating environmental, comfort, and social dimensions, aiming for sustainable renovation models that reflect the complexity of real-world decision-making. In this context, Fan and Xia (2018a) developed a multi-objective optimization model that incorporates sustainability targets, including economic cost, energy consumption, and environmental impact [52]. In a complementary study, Fan and Xia (2018b) proposed a model that directly integrates EPC compliance constraints into the optimization process, using notch test data to represent real-world building performance accurately [53]. This approach significantly advances the alignment between simulated retrofit strategies and actual regulatory thresholds, bridging the gap between technical feasibility and policy compliance. Camporeale et al. (2017) further contributed by applying a multi-objective optimization model to a housing block retrofit project in Seville, balancing energy savings, indoor thermal comfort, and cost-efficiency [54]. Their case-based approach underscores the importance of context-specific constraints, such as Mediterranean climate conditions and architectural typologies, in determining the success of renovation strategies. Additionally, Ferreira et al. (2014) offered a critical comparison between cost-optimal renovation strategies and net-zero energy building (NZEB) targets, highlighting that although NZEB approaches lead to higher performance, they also introduce significantly greater investment needs, raising concerns around economic viability and payback periods [55]. Their analysis underlines the importance of incorporating technical ambition and financial feasibility into multi-objective retrofit planning.

Penna et al. (2015) contributed significantly to this discourse by formulating a multi-objective optimization model for evaluating energy efficiency measures in existing buildings [56]. Their approach considered three core objectives: reducing energy consumption, minimizing CO2 emissions, and improving thermal comfort. By comparing alternative configurations of envelope and HVAC interventions, they demonstrated how a model-based selection process can lead to balanced and efficient retrofit decisions under multiple constraints. Their findings support the importance of integrated design methodologies to identify the trade-offs among technical, economic, and environmental performance.

However, many existing models operate within idealized or non-regulated contexts, lacking integration of normative energy performance thresholds and mandatory intervention protocols. Addressing this gap, Ferrantelli and Kurnitski (2022) evaluated various Energy Performance Certificate (EPC) classification methods, providing insights into how minimum energy performance standards influence renovation rates and associated costs [57]. Furthermore, Araújo et al. (2023) combined machine learning techniques with multi-objective optimization, utilizing EPC data to predict energy needs and propose optimal retrofit solutions, thereby enhancing decision-support systems in regulated environments [58].

Scenario-based approaches have gained traction from an implementation perspective to represent realistic and gradual retrofit pathways. In this context, Malevolti et al. (2024) presented a case study on the energy renovation of a residential building, comparing multiple intervention scenarios in terms of cost, CO2 emissions, and energy savings [59]. Similarly, Vainio and Nippala (2023) developed a long-term renovation roadmap for Finland through 2050, evaluating the decarbonisation potential of various strategies. Their work emphasizes the critical role of strategic policy alignment with low-carbon objectives [60]. It highlights the importance of regulatory planning in ensuring the feasibility and effectiveness of multi-decade renovation programs.

Moreover, the adaptability of retrofit models to financial constraints remains underexplored. A report by Legambiente and the Kyoto Club showing that renovating buildings can reduce CO emissions by up to 75% compared to building new buildings. Paper highlights importance of considering embedded and operational carbon in the life cycle of buildings [61]. Yang and Jradi (2025) also proposed an adaptive grey-box modelling approach for evaluating retrofit strategies, utilizing simplified energy models that can adjust to varying financial and environmental constraints [62]. Notably, Polychroni and Androutsopoulos (2020) explored innovative financing schemes to address upfront investment barriers, showing how tailored financial instruments, such as green loans or third-party investment models, can support the practical implementation of technically optimal but capital-intensive retrofits [63].

As energy retrofit modelling advances—incorporating optimization methods, regulatory requirements, and environmental goals—there is still a significant gap in addressing socioeconomic realities. Few models consider the interplay of household income, regulatory performance goals, and emission reduction targets. This underscores the necessity for innovative frameworks that ensure technical strength while reflecting the systemic inequalities affecting access to energy efficiency improvements.

4. Materials and Methods

This section thoroughly outlines the methodological approach taken in this study. Section 4.1 focuses on the socioeconomic context and income-related affordability constraints affecting retrofit adoption. Meanwhile, Section 4.2 describes the mathematical formulation and operational framework of the Retrofit Optimization Problem (ROP), which merges technical and economic elements with income-sensitive policy considerations.

4.1. Socioeconomic Barriers to Retrofit Adoption: Insights from Italian Household Income Data

Economic obstacles like steep initial costs and inconsistent policies impede retrofit adoption, while socioeconomic disparities intensify the challenges in accessing retrofitting solutions. Recent empirical research indicates that lower-income households face significant barriers to energy transition participation.

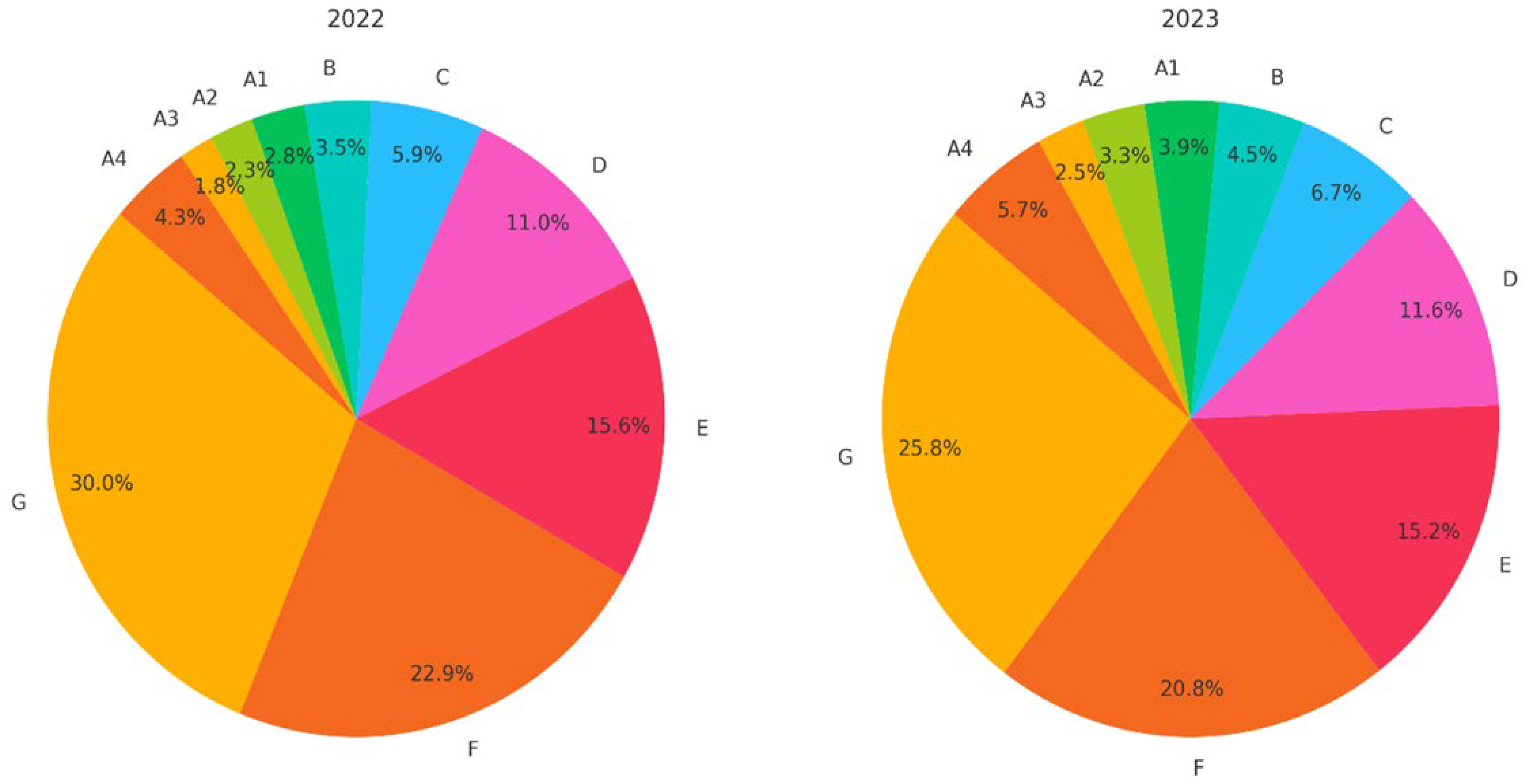

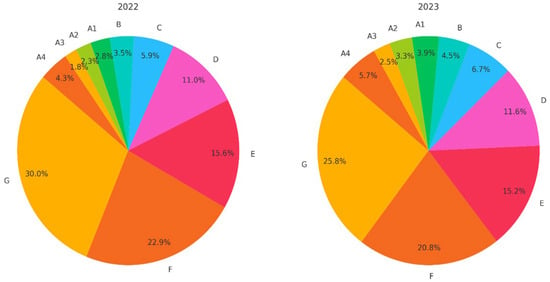

This financial barrier is strongly associated with Italy’s building stock’s poor energy performance. As shown in the 2023 Annual Report on Energy Efficiency by ENEA [63], more than 70% of Italian buildings fall into the lowest energy classes—E, F, and G—with a minimal share (approximately 11%) reaching classes B or higher. This confirms the significant scale of non-compliant buildings and the urgent need for systemic intervention strategies. Figure 2 shows a breakdown by EPC class for 2022 and 2023.

Figure 2.

Distribution of EPCs issued in 2022 (n = 1,083,755) and in 2023 (n = 1,195,713) and subjected to a verification process by energy class (sources: Regions and Autonomous Provinces and ENEA [64]).

To understand the significant barriers encountered by lower-income households, we compared the average costs of an energy retrofit in Italy with the average annual income of Italian households in 2024 over 10 years. The reasoning behind our approach is outlined below.

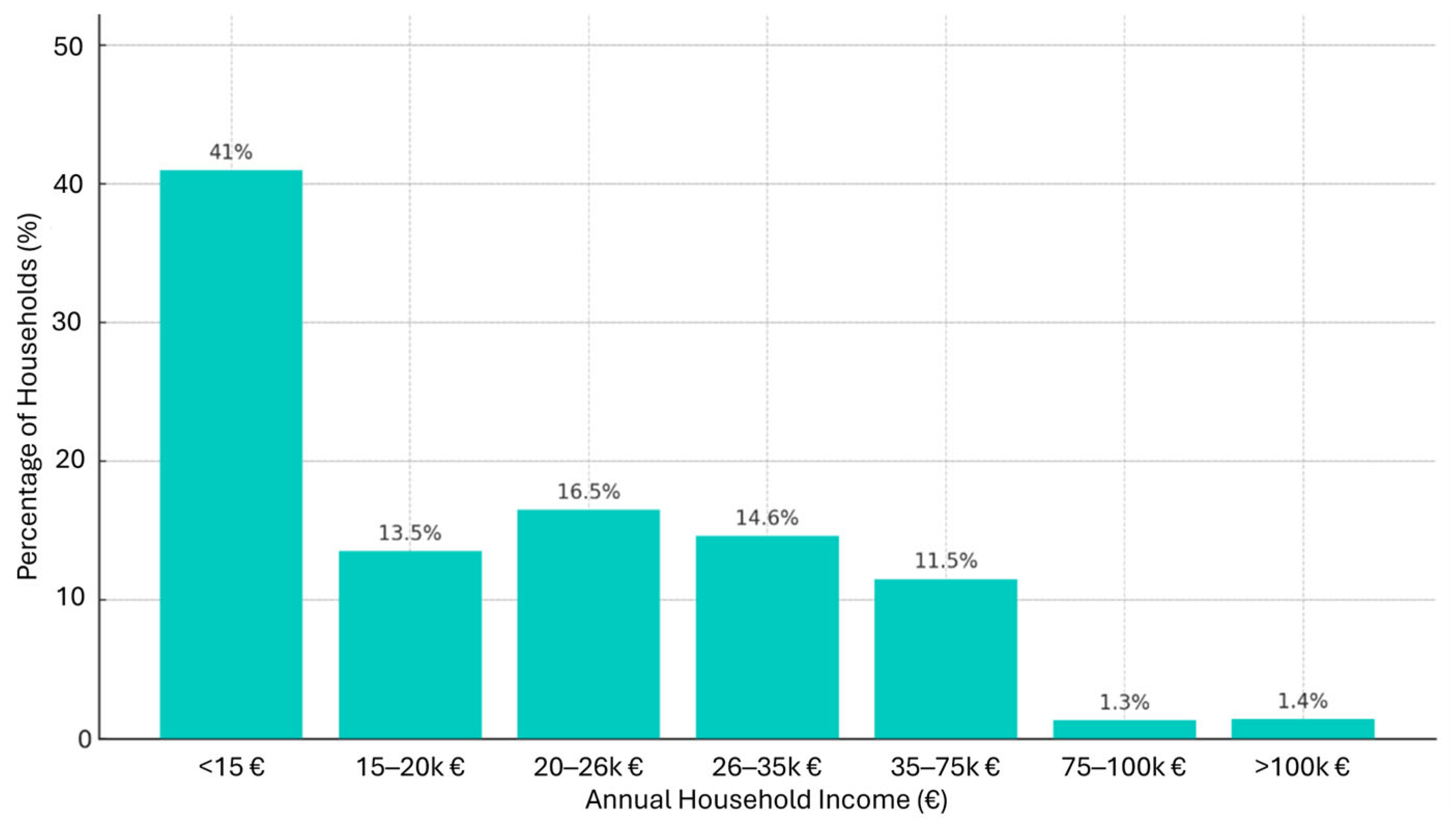

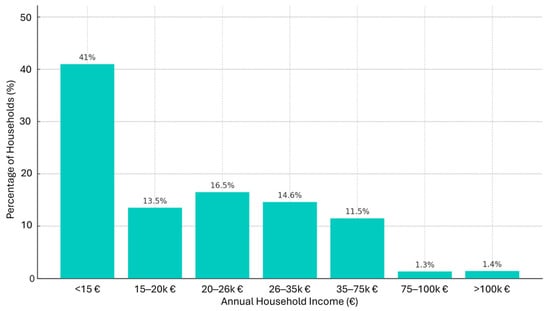

According to the latest ISTAT data, the average area of a dwelling in Italy is about 100 m2 [65]. Regarding the dwelling size, according to a study conducted by Codacons, the average cost for an energy retrofit in Italy generally varies between €35,000 and €60,000 per dwelling [66]. Taking an average between the two values provided by Codacons’ estimates, the average expenditure for an energy retrofit in Italy would be about €47,500. However, their income strongly influences the expenditure that an individual is willing to bear for retrofit interventions. ISTAT data updated to 2024, reports that the average annual income of Italian households in that year was €35,995 [65]. However, according to the Revenue Agency, tax deductions for building renovation are generally spread over 10 years, which suggests that many households plan work over this medium–long period [67]. Extending the average annual income of Italian households in 2024 over 10 years, you get a financial availability of about €359,950. The €47,500 previously defined as an average expenditure for a retrofit intervention in Italy represents 13.2% of this 10-year average income. According to ISTAT 2023/2024 data, Italian households are categorized into seven distinct income brackets, as shown in Table 1, with the percentage breakdown associated with each bracket in Figure 3.

Table 1.

Income brackets for Italian households (source: ISTAT 2023/2024).

Figure 3.

Percentage distribution of Italian households by income bracket (source: ISTAT 2023/2024).

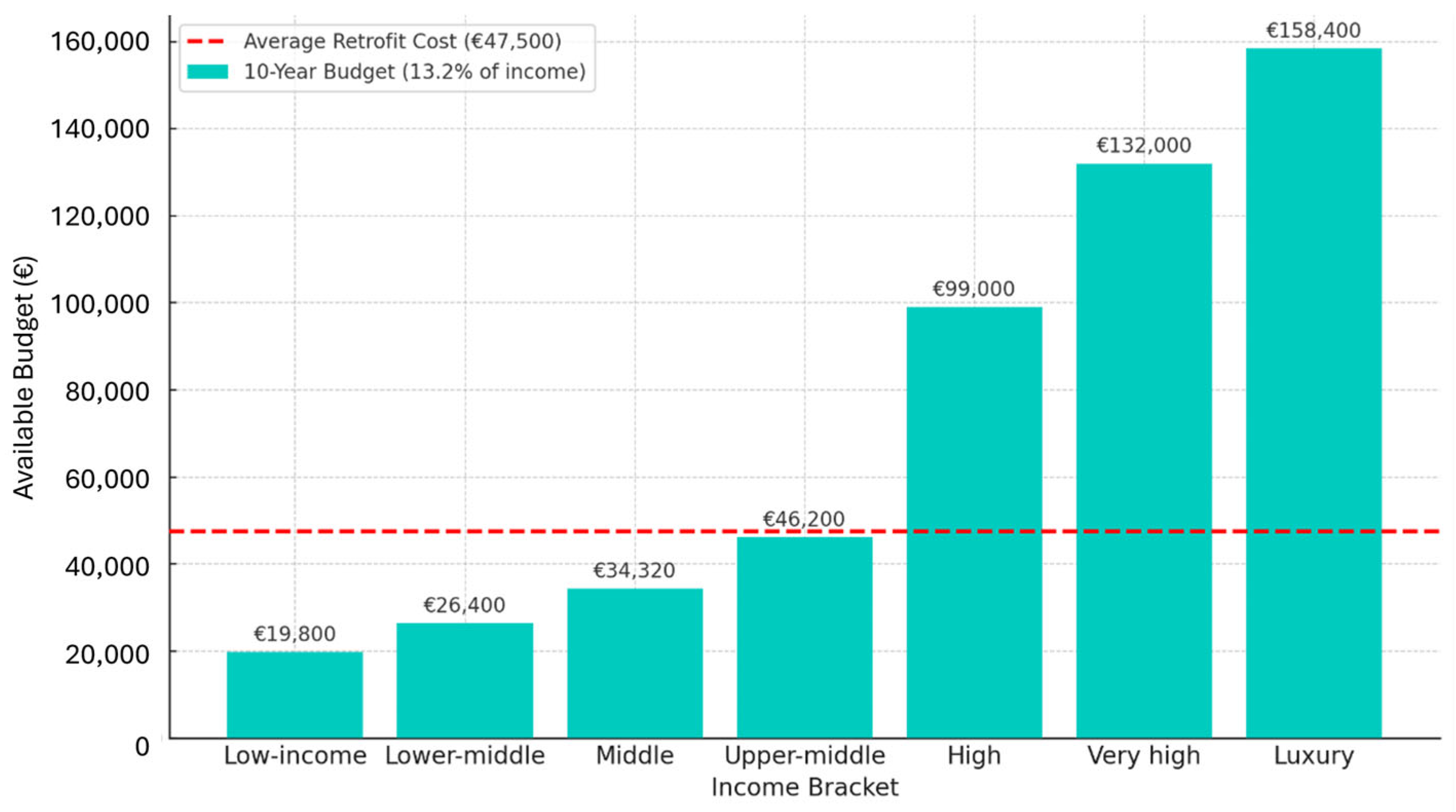

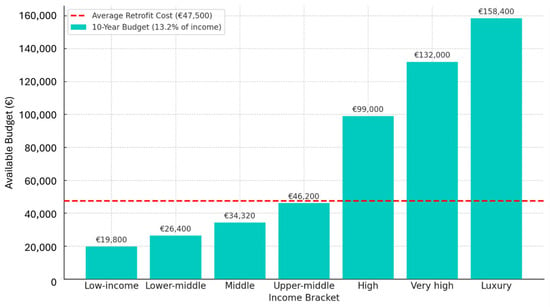

Therefore, the 13.2% previously obtained for each income range can be applied to estimate the euros that Italians tend to invest on average for retrofit interventions (the highest value of each range was considered in the calculation). Figure 4 shows the abovementioned tendency and compares these data with the average retrofit costs.

Figure 4.

Estimated 10-year retrofit budgets by income bracket compared to the average retrofit cost in Italy (€47,500).

The chart visually juxtaposes the average cost of a comprehensive energy retrofit (€47,500, indicated by the red dashed line) with the available 10-year investment capacity for each income bracket. An early noticeable affordability gap appears: only upper-middle and higher income households can meet or surpass this threshold without outside help.

In particular:

- Low income households (with a budget of €19,800) and lower-middle income households (€26,400) fall significantly below the affordability threshold, making energy retrofits entirely out of reach without subsidies.

- Middle income households (€34,320) also remain below the average cost, although they are closer to the margin, indicating that partial retrofits might be accessible.

- The upper-middle income group is nearly at parity (€46,200), suggesting some feasibility depending on household priorities.

- Only the high income, very high, and luxury brackets have surplus financial capacity.

This finding is further reinforced by the Bank of Italy [68], which confirms the existence of a direct correlation between income levels and energy efficiency:

“There is a strong correlation between household income and the energy efficiency of their homes. Lower-income families often reside in buildings with poorer energy performance due to their inability to afford the high renovation costs.”

This statement validates the modelling approach used in this study and illuminates the critical need for socially targeted retrofit policies.

4.2. Methodological Framework

4.2.1. Theoretical Foundation: The Knapsack Problem (KP) and the Multidimensional Knapsack Problem (MdKP)

The 0-1 Knapsack Problem (0-1 KP) is among the most researched combinatorial optimization problems and is categorized within classic NP problems [69]. This classic optimization problem aims to select a combination of items from a set with a specific weight and value to maximize the total value while ensuring that the total weight does not exceed a predefined capacity constraint. This problem is named after the analogy of a knapsack or backpack, which can only hold a certain amount of weight, and the goal is to pack it with the most valuable items possible. Additionally, KPs have gained considerable traction owing to their relevance in numerous real-world applications [70], which encompass investment decisions, cargo loading issues [71], energy minimization [72,73], resource al-location [74,75] computer memory management [76], project portfolio selection [77,78], adaptive multimedia systems [79], housing challenges [80], cutting-stock problems [81], and a plethora of other contexts [69,82,83].

Formally, the 0-1 KP can be specified using an Integer Linear Programming (ILP) model with a set of binary decision variables defined for using the following objective function:

where is a non-negative profit value of item (with ), is equal to 1 if item j is included in the subset of the selected items and equal to 0 otherwise, is a non-negative weight of item (with ), and is the “knapsack” capacity.

Expression (2) guarantees the satisfaction of the capacity constraint, and variable definitions are provided in (3).

The origins of the Knapsack Problem can be traced back to the early 20th century, with early formulations appearing in the mathematical literature. However, it gained prominence in computer science and operations research due to its relevance in various practical applications. The problem has since been studied extensively, leading to the development of numerous solution algorithms, theoretical advancements, and variants. Among these, notable examples include the bounded knapsack problem (BKP), unbounded knapsack problem (UKP), multidimensional knapsack problem (MdKP), multiple knapsack problem (MKP), quadratic knapsack problem (QKP), set-union knapsack problem (SUKP), randomised time-varying knapsack problem (RTVKP), quadratic multiple knapsack problem (QMKP), multiple-choice multidimensional knapsack problem (MMKP), and discounted knapsack problem (DKP) [84,85,86,87,88,89].

In particular, the multidimensional knapsack problem (MdKP) is a well-known combinatorial optimization problem that extends the classic 0-1 Knapsack Problem by incorporating multiple resource constraints.

Given a knapsack having different resources with capacities () and items having profits () and weight for the -th capacity (; ), the MdKP consists of determining a subset of items such that its total -th weight does not exceed the -th capacity (), and its total profit is a maximum. The MdKP can be defined by the following Integer Linear Programming (ILP):

Each item consumes an amount from each resource . The goal is to select a subset of items with maximum total profit, see (4); chosen items must not exceed resource capacities, see (5). The 0-1 decision variable indicates the selected items [90,91].

Rationale for Choosing MdKP over Other Optimization Techniques

The adoption of the Multidimensional Knapsack Problem (MdKP) as the methodological foundation of this study is driven by its structural suitability and practical relevance to the issue at hand. Unlike other multi-objective optimization methods, such as Pareto-based evolutionary algorithms, goal programming, or fuzzy logic models, the MdKP offers a discrete and transparent framework that is particularly effective for representing decision-making under multiple simultaneous constraints. This characteristic makes it well-suited for modelling energy retrofit planning, where decision-makers must select combinations of mutually exclusive interventions while considering financial, environmental, and regulatory constraints. The MdKP effectively models “yes-or-no” decisions across various resource dimensions, such as budget, emissions, and performance criteria. This straightforward formulation resonates with the real-life challenges faced by households. Additionally, compared to more intricate heuristic or stochastic methods, the MdKP offers superior clarity and replicability, both essential attributes for developing policy-focused tools. Its clear structure aids in identifying viable retrofit combinations across various income levels, facilitating equity-oriented policy assessments. Such transparency in modelling is crucial in environments focused on enhancing performance and uncovering systemic inequalities in access to energy transition opportunities.

The proposed model, the Retrofit Optimization Problem (ROP), builds on the MdKP and is formally introduced in the following paragraph. The ROP reconfigures the classic MdKP structure to function as a technical optimization tool and as a diagnostic instrument for identifying income-based barriers to decarbonisation.

4.2.2. The Retrofit Optimization Problem (ROP): From Technical Tool to Socioeconomic Diagnostic

The selection of retrofit interventions is a multi-objective decision-making process where stakeholders must weigh economic feasibility, operational savings, and environmental impact. The goal is to minimize total costs, which include initial investment, ongoing operational expenses, and environmental costs associated with CO2 emissions. Property owners and decision-makers must carefully evaluate which combination of interventions provides the most significant cost savings while ensuring compliance with regulatory requirements on energy efficiency and CO2 emissions reduction. The decision-making process begins with assessing the building’s initial conditions, where energy performance is analysed to determine the current inefficiencies. Furthermore, regulatory requirements—like those set forth by the Energy Performance of Buildings Directive (EPBD)—must be examined to guarantee that retrofit interventions meet legally mandated efficiency standards. Notably, the EPBD does not specify a minimum number of energy class upgrades. This study set a minimum target of two EPC class improvements, which is in line with the eligibility criteria of the Italian “Superbonus” scheme. This scheme mandates at least a two-class enhancement or achieving the top energy class possible. The reasons for this selection are twofold: it reflects the existing national policy precedent and ensures a significant level of retrofit ambition that is technically viable and financially justified within a decarbonisation framework.

Once the building’s performance baseline is established, various retrofit interventions are evaluated based on installation costs, expected operational savings, and effects on CO2 emissions. Given the complexity of budget constraints and environmental goals, using an optimization approach to identify the best combination of interventions becomes essential. This approach aims to minimize the total cost of the retrofit strategy, accounting for both the initial investment required and the long-term financial impact of energy consumption and CO2 emissions.

Originally conceived as a model to minimize investment, operational, and emissions-related costs while ensuring compliance with energy performance regulations, the ROP has evolved into a critical instrument for equity-oriented policy design. Its novelty is integrating income-sensitive constraints, transforming the knapsack from a generic optimization container into a structural inequality simulator. It simulates which retrofit paths are realistically achievable per income group under current policy conditions.

The key factors influencing the feasibility and desirability of a given retrofit intervention are the following:

- Investment Cost. This term represents the initial investment required for each retrofit intervention. Since retrofit measures often involve significant upfront expenditures, this cost must be minimized to ensure a budget’s financial feasibility;

- Operational Cost. Even after implementation, a building continues to incur recurring operational expenses related to energy consumption. These costs, which include electricity, heating, and maintenance, must be minimized to ensure that the selected interventions provide long-term economic benefits;

- Emissions Cost. Given the increasing emphasis on carbon pricing and emission regulations, buildings with higher CO2 emissions could face economic disadvantages due to carbon taxes, market penalties, or decreased property valuation. This term penalizes retrofit solutions that fail to significantly reduce emissions, ensuring that selected interventions align with climate policy objectives;

- Household income. Many households, particularly those in lower-income brackets, experience considerable liquidity constraints and limited credit access. They must allocate their scarce resources according to their needs. Based on this observation, the model positions income as a key structural variable, aligning the optimization process with social justice considerations. It incorporates affordability thresholds for each income bracket, thus transforming a traditional economic efficiency tool into a distributional one.

Given the multiple constraints and trade-offs involved in the decision-making process, a formal optimization model is necessary to determine the most cost-effective combination of interventions systematically.

Selecting optimal retrofit interventions for inefficient buildings can be modelled as an MdKP. The primary objective is to reduce the total costs of retrofit interventions and expenses related to operations and CO2 emissions by considering the owners’ available budget and adhering to all EPBD regulations regarding improvements in energy efficiency and CO2 emissions reduction. In this context, the knapsack represents the available resources, such as the investment budget and energy performance thresholds. At the same time, the items are the possible retrofit actions, each characterized by cost, simulated energy savings, and CO2 reduction. Unlike classic MdKP formulations, the objective of the Retrofit Optimization Problem (ROP) is not to maximize profit but to minimize total retrofit investment costs while ensuring that the energy efficiency improvements and emission reductions are sufficient to achieve at least a two-class EPC upgrade, if financially feasible. If this goal cannot be met, the model automatically assigns the highest reachable class based on simulation-driven post-retrofit performance estimates. This represents valuable insights for policies aimed at understanding the limits of each income bracket in pursuing decarbonisation goals. Substantially, rather than prescribing “the best” intervention mix, the ROP reveals what is mathematically and socially feasible, and for whom. It exposes the inequitable opportunity structure within the retrofit landscape under current incentive frameworks. In doing so, it informs income-targeted policy instruments, helping policymakers assess how many and which segments of the population would be excluded from meeting EU climate targets without structural support.

To capture the affordability dimension and account for socioeconomic disparities in retrofit adoption, the model introduces a novel constraint: the retrofit budget for each household is not assumed to be a fixed or universal value but rather derived from the income-based capacity to invest, informed by empirical data on Italian household incomes. Specifically, as analysed in Section 4.1, households are segmented into seven standardized income brackets, each associated with a maximum 10-year retrofit budget calculated as 13.2% of the upper income threshold for that bracket.

Each intervention i contributes across multiple resource dimensions:

- Investment cost ;

- Operational cost savings ;

- CO2 reduction cost .

These parameters are derived through building-specific simulations rather than being assumed a priori, enhancing the model’s realism and technical accuracy.

The multidimensional “capacity” of the knapsack is therefore defined by the following:

- The maximum budget ;

- The minimum energy savings required to reach each EPC class.

The optimization process identifies the combination of interventions that best fit these multidimensional constraints, either reaching the regulatory target or providing the best achievable outcome under limited resources.

Table 2 presents a comparative analysis illustrating the structural differences between the classic Multidimensional Knapsack Problem (MdKP) and our Retrofit Optimization Problem (ROP).

Table 2.

Multidimensional Knapsack Problem (MdKP) vs. Retrofit Optimization Problem (ROP).

In each Knapsack Problem variant, the objective function is typically formulated as a maximization problem, where the goal is to maximize a given benefit while respecting the constraints. However, our ROP is inherently structured as a minimization problem, where we aim to reduce investment, operations, and CO2 emission costs.

To align with the knapsack formulation, we transform our minimization problem into a maximization problem by applying the transformation

The key elements of the ROP clustering in decision variables, objective function, and constraints are reported below.

Decision Variables

Let:

- : total number of retrofit interventions considered.

- : total number of energy classes defined by EPC standards (e.g., G to A).

We define the following decision variables:

- : binary decision variable equal to 1 if intervention is selected, and 0 otherwise, for all .

- : binary decision variable equal to 1 if energy class is assigned to the building after retrofit, and 0 otherwise, for all , with classes ordered from worst (e.g., G) to best (e.g., A). Each energy class j corresponds to a threshold for maximum allowable energy use (kWh/m2/year) based on national EPC standards (e.g., D.M. 26 June 2015 for Italy).

Objective Function

This is designed to minimize the total cost of the selected interventions while optionally incorporating energy and CO2 savings as follows:

where is a binary decision variable (1 if intervention is selected, 0 otherwise), is the upfront investment cost of intervention i, is the annual savings in operational costs due to energy efficiency improvements, is the annual savings in CO2 emission costs due to energy efficiency improvements, is the time horizon for cost savings evaluation, is the discount rate to account for the time value of money, and are coefficients weighting for investment cost, operational, and emissions costs, respectively.

Constraints

- Budget constraint (income-sensitive). This constraint ensures that the total cost of the selected retrofit interventions does not exceed the maximum available investment budget. It represents the percentage of the 10-year projected income that can be allocated to retrofit expenditures. This approach enables the model to simulate homeowners’ affordability limits in each income segment.The maximum budget for each income bracket is assessed and reported in Section 4.1.

- Energy savings threshold constraint (for energy class upgrade). This constraint ensures that the cumulative energy savings from the selected interventions are sufficient to meet the performance threshold required for the targeted EPC energy class. It enforces compliance with energy efficiency standards.where is the baseline energy consumption of the building before retrofit interventions, expressed in kWh/m2/year; is the binary decision variable previously defined; denotes the fractional energy saving (expressed as a share of the baseline consumption) associated with intervention . It is defined as , and thus lies in the interval [0, 1]; is the maximum allowable post-retrofit energy consumption threshold (kWh/m2/year) corresponding to the desired EPC energy class as defined by national standards; is the total number of retrofit interventions under consideration.

- Class selection constraint. This constraint restricts the model to assigning exactly one post-retrofit energy class to the building. It ensures consistency in the classification output and avoids ambiguity in energy performance evaluation.

- Class assignment based on performance. This conditional logic defines the assignment of the energy class based on simulated energy performance. A class is assigned only if the total post-retrofit consumption meets or improves upon its predefined threshold. This approach allows flexibility and realism by avoiding predefined intervention–class relationships.in the total post-retrofit energy consumption of the building, measured in kWh/m2/year. It is computed as the result of the contribution to energy performance improvement of the selected retrofit interventions; is the maximum allowable energy consumption for energy class , as defined by national EPC standards (e.g., D.M. 26 June 2015 in Italy). Each energy class corresponds to a unique upper-bound threshold on annual energy use per square meter.

- Fallback mechanism (conditional selection rule, embedded in the class assignment logic). This mechanism enhances the model’s robustness by consistently providing a feasible solution, even when economic constraints prevent meeting the original energy class target. It reflects real-world limitations and supports decision-making under uncertainty. Suppose the performance threshold required for the target class (e.g., a two-class improvement) is not achievable within the available budget. In that case, the model automatically assigns the highest reachable class based on actual performance outcomes and resource constraints. Importantly, this mechanism provides valuable insights by realistically estimating the energy class attainable for different income groups under budget restrictions. It thus supports a more socially informed evaluation of retrofit strategies and highlights systemic inequities in achieving decarbonisation targets.

5. Results

In this section, we report a qualitative assessment to explore the affordability of retrofit interventions across various income groups, utilizing a standardized set of the most common energy renovation measures and their combinations for a 100 m2 apartment. The proposed interventions encompass boiler replacement, heat pump installation, window replacement, and a photovoltaic system set at 6 kilowatts, which is designed to meet the average annual electricity demands of a typical Italian household. Additionally, thermal insulation is included. These primary measures were analysed in pairs, triples, and full packages to create a realistic decision-making environment for homeowners.

Each intervention was evaluated for its average cost and potential impact on improving the Energy Performance Certificate (EPC) class. Furthermore, each measure was assessed concerning all income brackets capable of affording it, based on a ten-year investment capacity of 13.2% of the highest limit within each income class. This resulted in a matrix representation that accurately identifies each eligible income bracket.

Table 3 presents the outcomes of this assessment.

Table 3.

Average costs, EPC class improvements, and affordability mapping of individual and combined retrofit interventions across Italian income brackets.

It is essential to acknowledge and emphasize a methodological constraint in evaluating the EPC class enhancements presented in Table 4. The gains in EPC class resulting from combined retrofit interventions were calculated by adding the improvements from individual measures. However, this method likely results in an overestimation of the total potential improvement. In reality, the final EPC classification of a building is not a straightforward sum of isolated measure effects; it is instead shaped by the overall performance of the building system after all retrofits have been made. Different interventions may address the same inefficiencies or exhibit diminishing returns, especially when combining insulation and heat pump installation measures. As a result, their total effect on energy performance may not be entirely additive, as noted in the EU Commission’s document titled “Cost-optimal levels of energy performance requirements”. Consequently, the EPC class improvements presented for the combinations of interventions should be seen as indicative rather than definitive. They suggest a theoretical maximum based on the aggregation of individual contributions, rather than as results from whole-building energy modelling simulations.

Table 4.

Estimated CO2 emissions avoided per square meter for common retrofit interventions.

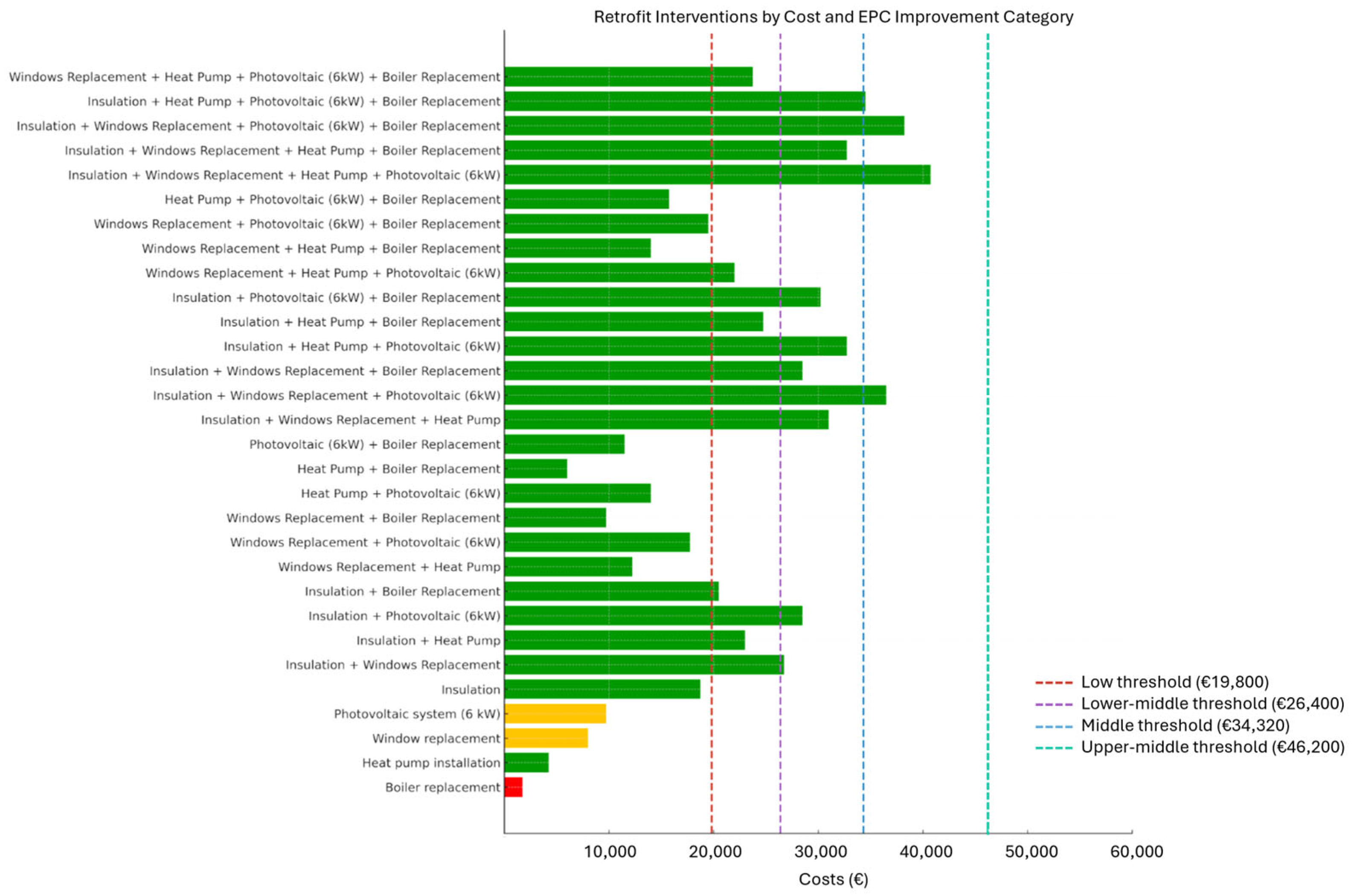

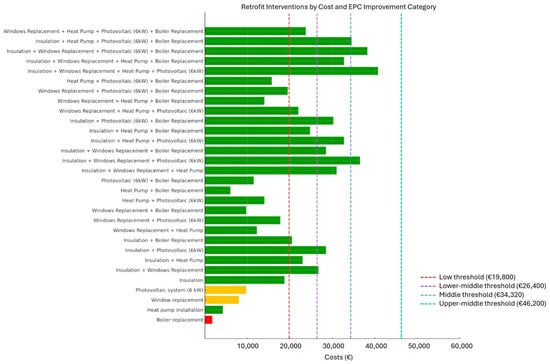

Figure 5 compares the average costs of individual and combined retrofit interventions with the income-based investment thresholds to better visualize the affordability constraints across income groups. It highlights which solutions are realistically accessible and which exceed each bracket’s economic capacity.

Figure 5.

Average costs of individual and combined retrofit interventions compared to income-based affordability thresholds.

The figure illustrates the gap between retrofit costs and household affordability for different income levels. Dashed vertical lines indicate the maximum investment capacity over ten years for each income bracket, determined by 13.2% of the upper income limit. While some interventions can successfully achieve the targeted two-class EPC improvement (represented by the green bars), very few are financially accessible to the lowest-income brackets. Notably:

- Low-income families can only afford a narrow range of interventions, as most options exceed their financial capacity.

- While boiler replacement is financially accessible, it does not adequately meet regulatory requirements (highlighted in red).

- Middle-income groups can begin to choose from more extensive solutions, especially those that integrate insulation with windows, heat pumps, or photovoltaic systems. This highlights a significant equity disparity.

Only 14 types of retrofit interventions, or their combinations, are accessible to lower-income brackets, which represent 41% of Italian households. Of these 14 options, three do not lead to the minimum improvement in energy performance certificate (EPC) class by two classes. Consequently, only 11 solutions can effectively enhance building energy performance, accounting for 37% of the evaluated options. However, whether these budget-compatible interventions are also the most environmentally efficient is questionable. Our optimization model emphasizes the need to reduce CO2 emissions and costs. From the perspective of the decarbonisation goals of the EPBD for the real estate sector, it should not overlook the CO2 emissions avoided that are associated with each intervention. Consequently, the limited selection of budget-friendly choices might lead to less favourable environmental results.

As seen from Figure 5, the economically eligible measures for households in the lowest income group mainly concern the replacement of boilers or fixtures. However, they are among the least efficient in terms of environmental benefits. In fact, according to the Carbon Avoided Retrofit Estimator (CARE) [95], a digital tool developed by Architecture 2030 to assess the environmental impact of building rehabilitation concerning new construction that combines each retrofit intervention with a specific environmental advantage in terms of reducing carbon emissions, the replacement of fixtures results in an average reduction of 30–80 kg CO2/m2. This reduction is lower than other retrofit measures, such as thermal insulation (50–100 kg CO2/m2) or installation of photovoltaic (150–300 kg CO2/m2). The only other intervention that generates such a low reduction in CO2 emissions is precisely the replacement of the boiler. In this respect, the AICS toolkit, developed by ENEA and the Italian Agency for Development Cooperation, allows the calculation of the avoided emissions with the replacement of heating installations [96]. The toolkit indicates that the reduction of emissions is influenced by several factors, such as the type of boiler being replaced, the new technology implemented, and the energy efficiency of the building. On average, the data show that substituting a diesel boiler with a heat pump saves 50–70 kg CO2 per square meter while replacing a conventional condensing boiler yields 20–30 kg CO2 per square meter. Table 4 presents the CO2 emissions avoided due to the primary retrofit intervention.

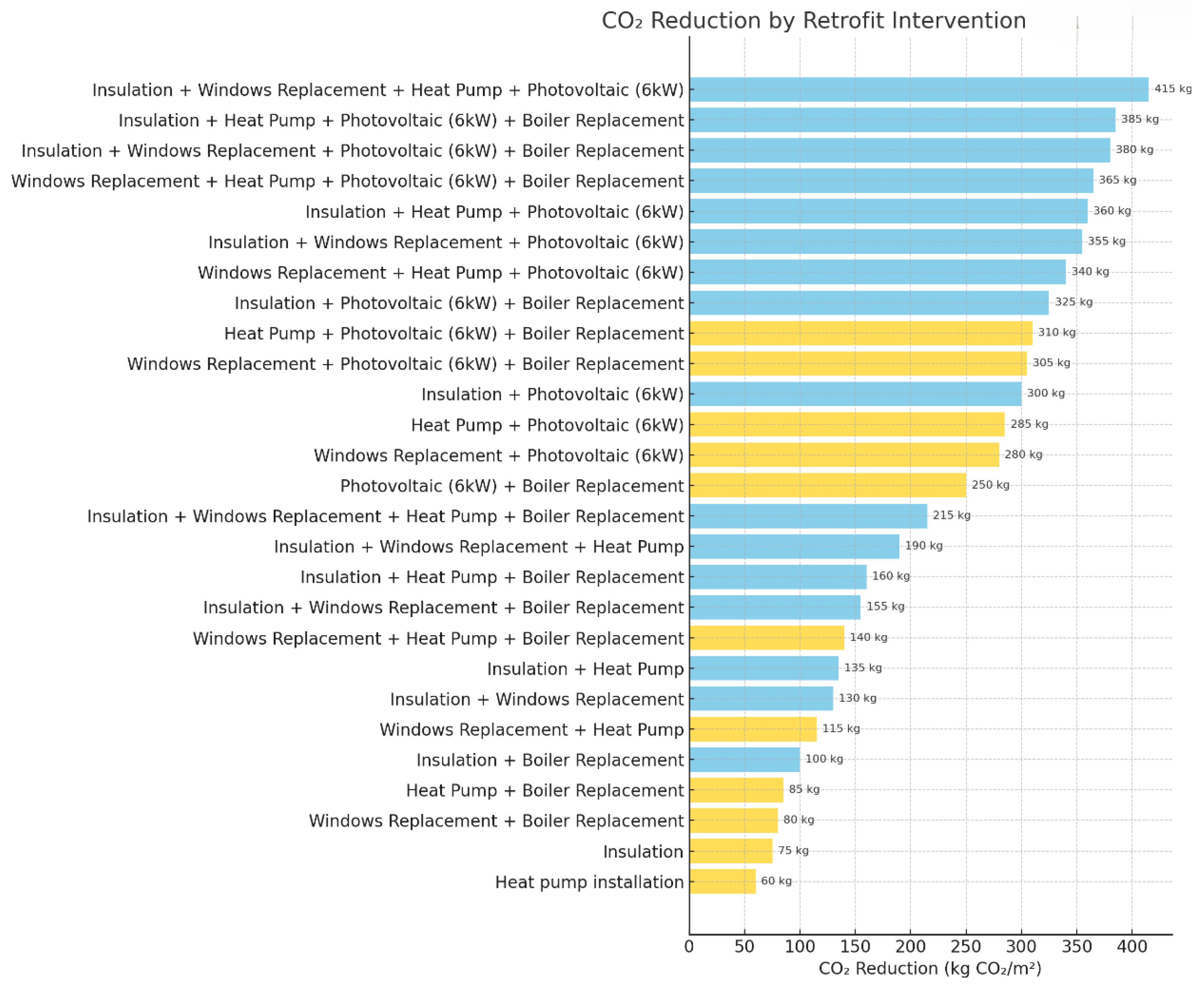

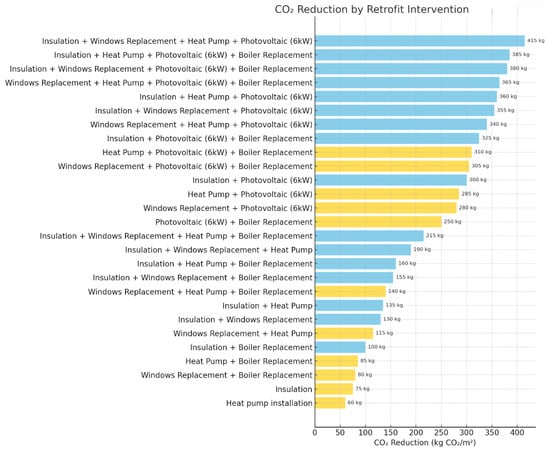

Based on the average values of CO2 emissions avoided reported in Table 4, Figure 6 illustrates the estimated carbon reductions associated with each retrofit intervention or combination thereof, excluding those that do not meet the minimum threshold of a two-class EPC improvement.

Figure 6.

Estimated CO2 emissions avoided (kg/m2) by retrofit intervention or combination thereof.

In addition to assessing the EPC class enhancements, it is essential to recognize that the reported CO2 reductions for combined interventions may be inflated, as they are derived from simply adding the average emissions avoided by individual measures. In practical applications, the carbon savings from various interventions typically do not add up due to overlapping effects, diminishing returns, and system interactions. Therefore, these figures should be viewed as theoretical maximums rather than exact cumulative savings. A more thorough assessment would necessitate a dynamic simulation of whole-building performance after retrofitting.

Figure 6 highlights the estimated carbon dioxide (CO2) emissions avoided per square meter for each retrofit intervention or combination thereof. The bars are colour-coded to distinguish interventions that are financially accessible to low-income households (in yellow) from those that are not (in light blue). The values annotated alongside each bar represent the estimated CO2 reduction. The graph indicates that the most effective environmental interventions, offering the highest CO2 reductions, are largely unaffordable for the lowest income group. This scenario highlights equity issues in decarbonisation efforts, revealing that households in the lowest income tier may only have access to a limited range of retrofit interventions with reduced environmental advantages.

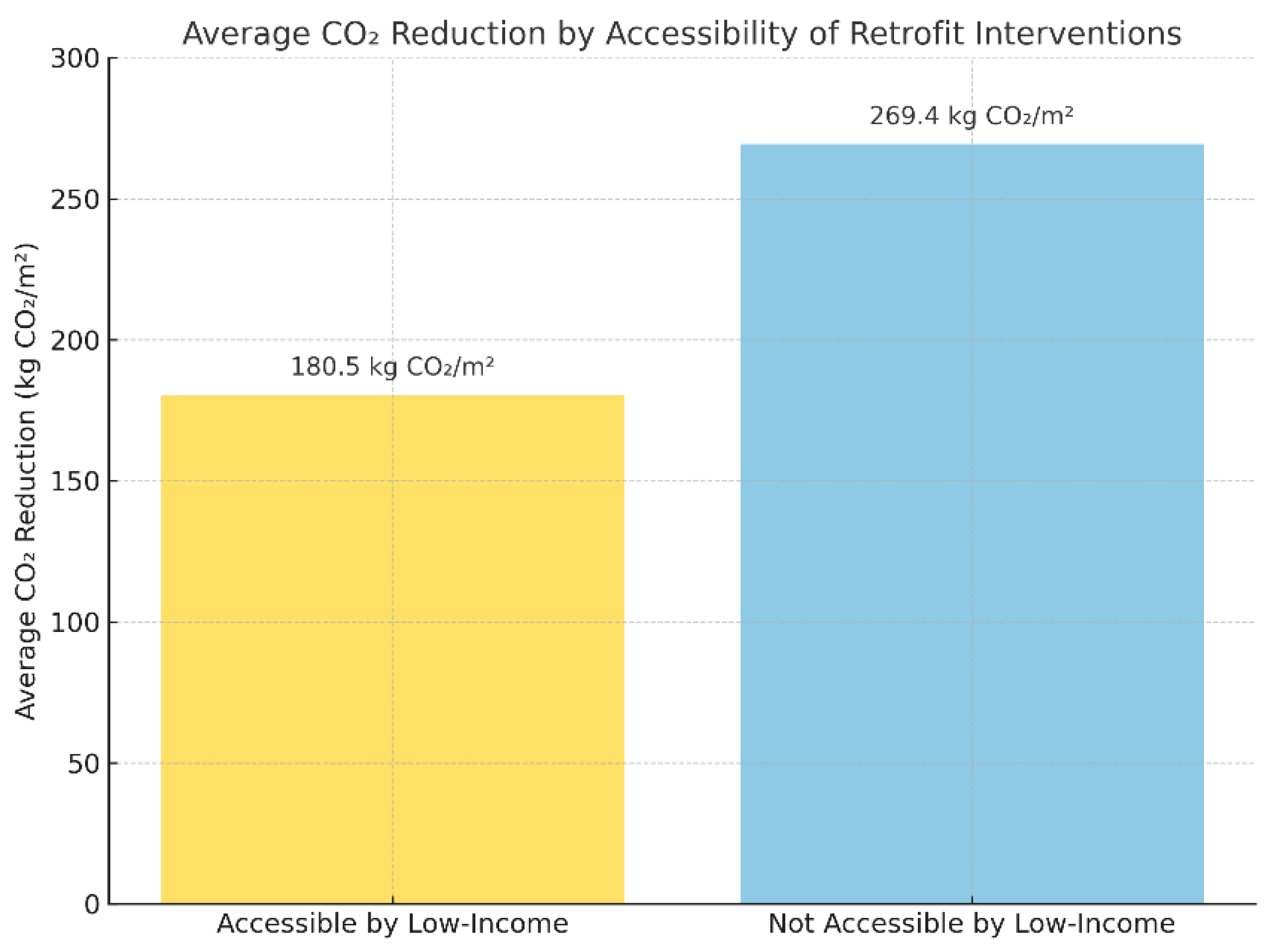

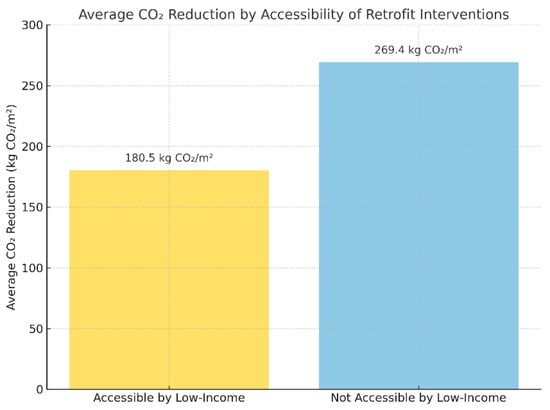

Figure 7 illustrates the average CO2 reduction (kg CO2/m2) associated with retrofit interventions categorized by their accessibility to low-income households. The results show a substantial gap in environmental efficiency between accessible and inaccessible interventions. While accessible retrofits offer an average reduction of 180.5 kg CO2/m2, non-accessible interventions achieve a much higher average of 269.4 kg CO2/m2. The chart highlights the disparity in environmental impact between the two groups, with most high-impact solutions being unaffordable for the most vulnerable populations. It indicates that non-accessible solutions yield, on average, a 49% greater CO2 reduction than those lower-income groups can afford. This insight again underscores a significant equity issue: lower-income households are systematically excluded from the most effective renovation options, highlighting the need for dedicated financial assistance to ensure equitable participation in decarbonisation initiatives.

Figure 7.

Average CO2 emissions avoided (kg CO2/m2) by retrofit interventions, disaggregated by financial accessibility for low-income households.

Although these analyses are purely qualitative and do not focus on specific real-world case studies, they clearly and compellingly represent the structural limitations embedded in current retrofit frameworks. By simulating a realistic decision-making environment constrained by income-based affordability thresholds, the study highlights the mismatch between regulatory energy performance targets and the financial capacities of different socioeconomic groups. These findings establish a solid basis for future quantitative and case-based validations, while also offering valuable evidence to inform the creation of more equitable, income-sensitive policy tools, ensuring that the energy transition does not neglect anyone. The goal is also to raise awareness of Italy’s challenges in the decarbonisation transition. This concern arises because 41% of Italian households belong to the low-income bracket, and over 70% of Italian buildings are classified in the lowest energy categories—E, F, and G—where the most vulnerable populations typically reside.

6. Discussion and Conclusions

This study introduces a new methodological framework, the Retrofit Optimization Problem (ROP), to align decarbonisation objectives with socioeconomic limitations in the Italian residential sector. The ROP modifies a multidimensional knapsack model to incorporate technical and environmental factors and income-sensitive constraints that reflect the investment capabilities of households from various income levels. This approach serves a dual purpose: it identifies the most effective retrofit strategies within specified constraints and reveals the structural inequalities restricting access to these strategies. The ROP does more than enhance technical performance; it highlights a core issue in retrofit policymaking: overlooking many people in meaningful decarbonisation efforts. The outcomes of a qualitative analysis, which reflects on the key factors involved in the ROP structure, indicate that, although numerous retrofit options fulfil regulatory objectives, such as achieving a two-class EPC enhancement, only a limited number are financially feasible for low-income households. More alarmingly, the solutions with the most significant environmental benefits, capable of attaining the highest reductions in CO2, remain mostly out of reach for low-income families, who often reside in energy-inefficient apartments. While claiming to be comprehensive, the analysis of various retrofit intervention combinations revealed that the average emissions reduction from feasible interventions by low-income families is 49% lower than that of inaccessible interventions. Policymakers cannot overlook this outcome as it underscores a critical equity challenge in the energy transition.

A recent report from the Parliamentary Budget Office (UPB) revealed that Italy’s main public incentive programs for energy retrofits, the “Ecobonus” and “Superbonus”, have shown a significantly regressive effect [97]. These schemes favour higher-income households disproportionately while not adequately serving those who need assistance the most. As a result, these mechanisms fall short of supporting an inclusive energy transition, particularly in a country where a significant share of the population is classified as low-income. In addition, a substantial part of the Italian building stock falls into the lower energy performance categories (“E”, “F” and “G”), further increasing the economic burden on vulnerable households already living in non-standard buildings. Policies that ignore income disparities limit participation in national decarbonisation targets. The results obtained are therefore intended to help policy-makers focus on the needs of families, helping those with lower incomes to benefit from coupled retrofit interventions that they would not be able to achieve without subsidies, in order to effectively pursue the decarbonisation objectives of the construction sector, to improve the provision of thermal comfort and to reduce the economic expenses of needy families. This research underscores the need for income-sensitive policies considering households’ varying capacities to invest in energy efficiency upgrades. Climate goals will remain unattainable without targeted support, leading also to significant economic problems. A vast segment of the residential market risks becoming stranded assets, a concern thoroughly discussed in the literature and reflected in market trends. Properties with poor energy ratings face declining value as regulatory demands tighten and market preferences shift toward sustainable, high-efficiency housing.

The ROP framework proposed in this work became a useful diagnostic and predictive tool for shaping future policies. It serves multiple strategic functions:

- Descriptive: maps the affordability boundaries of retrofits across income brackets.

- Normative: exposes equity gaps and stranded asset risks from a socio-environmental perspective.

- Prescriptive: could help simulate the redistributive impact of different policy subsidies scenarios.

- Critical: Challenges the universality of flat-rate incentives (e.g., Superbonus) for their regressive outcomes.

Additionally, it is crucial to note that although the ROP framework is conceptually outlined in this study, it has yet to be fully operationalised or utilised in practical simulations. The analysis presented is based on the core principles of the ROP, including affordability constraints, goals for class improvement, and multidimensional decision criteria; however, it maintains a qualitative approach. The evaluation targeted average costs and potential enhancements in the EPC class linked to standard retrofit interventions, omitting real building stock data, specific climate conditions, or comprehensive thermal performance metrics necessary for precise energy reclassification. Therefore, although the ROP establishes the methodological groundwork, this work mainly functions as a proof of concept rather than a practical application model. Future studies could convert the ROP into a comprehensive quantitative optimization framework, including building-specific simulations. In particular, future studies could consider how the application of the ROP changes for different types of building, as the variations of the latter can change the combinations of intervention of retrofit adopted. In condominiums, the complexity of adopting an intervention increases due to the need to obtain the consent of owners, the management of common spaces and the need to plan works that may involve different housing units; in an autonomous house, the decision and management of works are simpler and more customizable, allowing more specific and targeted interventions to improve energy efficiency. In addition, energy profiles could be more detailed and modelled as user behaviour and climate zone change, since the latter has a significant impact on the choice and effectiveness of retrofit interventions, the choice of materials, technologies and the need for certain works. The climate zone therefore determines whether a specific intervention is optimal or not, and how much energy savings can be achieved. Improving this accuracy in the model could optimize forecasting and policy decisions. In summary, this study’s initial findings indicate that reaching climate neutrality in the building sector involves more than just regulatory commitment; it necessitates socially informed policies that encompass financial, technical, and equity aspects. Although the ROP framework is still in its early conceptual stage, it provides a hopeful direction for modelling, understanding, and eventually connecting environmental goals with social realities.

Author Contributions

Conceptualization, D.T., M.D.S., A.B. and F.P.D.G.; Methodology, D.T., F.S., M.D.S., A.B. and F.P.D.G.; Validation, D.T., F.S., M.D.S. and F.P.D.G.; Formal analysis, D.T. and M.D.S.; Investigation, D.T., M.D.S. and A.B.; Resources, F.S.; Data curation, D.T. and A.B.; Writing—original draft, D.T., A.B. and F.P.D.G.; Writing—review and editing, D.T. and A.B.; Visualization, D.T., F.S., M.D.S., A.B. and F.P.D.G.; Supervision, D.T., F.S. and M.D.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Dataset available on request from the authors.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Masson-Delmotte, V.; Zhai, P.; Portner, H.O.; Roberts, D.; Skea, J.; Shukla, P.R.; Pirani, A.; Moufouma-Okia, W.; Péan, C.; Pidcock, R.; et al. Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C Above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; World Meteorological Organization: Geneva, Switzerland, 2018. [Google Scholar]

- ENEA. Rapporto Annuale Efficienza Energetica 2023; ENEA: Roma, Italy, 2023. [Google Scholar]

- Morano, P.; Tajani, F.; Di Liddo, F.; Guarnaccia, C. The Value of the Energy Retrofit in the Italian Housing Market: Two Case-Studies Compared. WSEAS Trans. Bus. Econ. 2018, 15, 249–258. [Google Scholar]

- Law No. 373. Norme per il Contenimento del Consumo Energetico per Usi Termici Negli Edifici, 30 March 1976.

- Aich, S.; Thakur, A.; Nanda, D.; Tripathy, S.; Kim, H.-C. Factors Affecting ESG towards Impact on Investment: A Structural Approach. Sustainability 2021, 13, 10868. [Google Scholar] [CrossRef]

- Cadamuro Morgante, F.; Gholamzadehmir, M.; Sdino, L.; Rosasco, P. How to Invest in the “Market of Sustainability”: Evaluating the Impacts of a Real Estate Investment across ESG Criteria [Investire Nel “Mercato Sostenibile”: Valutare Gli Impatti Di Un Investimento Immobiliare Attraverso i Criteri ESG]. Valori E Valutazioni 2023, 33, 65–84. [Google Scholar] [CrossRef]

- McCabe, J. ESG and Real Estate. Ph.D. Thesis, The University of Texas at Austin, Austin, TX, USA, 2023. [Google Scholar]

- Nanda, A. ESG in Real Estate Investment: Issues for the Future. In The Palgrave Encyclopedia of Urban and Regional Futures; Brears, R.C., Ed.; Springer International Publishing: Cham, Switzerland, 2022; pp. 513–517. ISBN 978-3-030-87744-6. [Google Scholar]

- Robinson, S.; McIntosh, M.G. A Literature Review of Environmental, Social, and Governance (ESG) in Commercial Real Estate. J. Real Estate Lit. 2022, 30, 54–67. [Google Scholar] [CrossRef]

- Del Giudice, V.; De Paola, P.; Morano, P.; Tajani, F.; Del Giudice, F.P.; Anelli, D. Depreciation of Residential Buildings and Maintenance Strategies in Urban Multicultural Contexts. In Values, Cities and Migrations: Real Estate Market and Social System in a Multicultural City; Napoli, G., Mondini, G., Oppio, A., Rosato, P., Barbaro, S., Eds.; Green Energy and Technology; Springer International Publishing: Cham, Switzerland, 2023; pp. 217–232. ISBN 978-3-031-16925-0. [Google Scholar]

- De Paola, P.; Previtera, S.; Manganelli, B.; Forte, F.; Del Giudice, F.P. Interpreting Housing Prices with a Multidisciplinary Approach Based on Nature-Inspired Algorithms and Quantum Computing. Buildings 2023, 13, 1603. [Google Scholar] [CrossRef]

- Forte, F.; Del Giudice, V.; De Paola, P.; Del Giudice, F.P. Cultural Heritage and Seismic Disasters: Assessment Methods and Damage Types. In Appraisal and Valuation; Morano, P., Oppio, A., Rosato, P., Sdino, L., Tajani, F., Eds.; Green Energy and Technology; Springer International Publishing: Cham, Switzerland, 2021; pp. 163–175. ISBN 978-3-030-49578-7. [Google Scholar]

- Del Giudice, V.; De Paola, P.; Morano, P.; Tajani, F.; Del Giudice, F.P. A Multidimensional Evaluation Approach for the Natural Parks Design. Appl. Sci. 2021, 11, 1767. [Google Scholar] [CrossRef]

- Del Giudice, V.; Salvo, F.; De Paola, P.; Del Giudice, F.P.; Tavano, D. Ex-Ante Flooding Damages’ Monetary Valuation Model for Productive and Environmental Resources. Water 2024, 16, 665. [Google Scholar] [CrossRef]

- Massimo, D.E.; Del Giudice, V.; Musolino, M.; De Paola, P.; Del Giudice, F.P. A Bio Ecological Prototype Green Building Toward Solution of Energy Crisis. In International Symposium: New Metropolitan Perspectives; Calabrò, F., Della Spina, L., Piñeira Mantiñán, M.J., Eds.; Lecture Notes in Networks and Systems; Springer International Publishing: Cham, Switzerland, 2022; Volume 482, pp. 713–724. ISBN 978-3-031-06824-9. [Google Scholar]

- Massimo, D.E.; Del Giudice, V.; Musolino, M.; De Paola, P.; Del Giudice, F.P. Green Building to Overcome Climate Change: The Support of Energy Simulation Programs in Gis Environment. In International Symposium: New Metropolitan Perspectives; Calabrò, F., Della Spina, L., Piñeira Mantiñán, M.J., Eds.; Lecture Notes in Networks and Systems; Springer International Publishing: Cham, Switzerland, 2022; Volume 482, pp. 725–734. ISBN 978-3-031-06824-9. [Google Scholar]

- Moore, T.; Nicholls, L.; Strengers, Y.; Maller, C.; Horne, R. Benefits and Challenges of Energy Efficient Social Housing. Energy Procedia 2017, 121, 300–307. [Google Scholar] [CrossRef]

- Grazini, C. Energy Poverty as Capacity Deprivation: A Study of Social Housing Using the Partially Ordered Set. Socio-Econ. Plan. Sci. 2024, 92, 101843. [Google Scholar] [CrossRef]

- Weatherization Assistance Program. Available online: https://www.energy.gov/scep/wap/weatherization-assistance-program (accessed on 16 May 2025).