1. Introduction

The increase in extreme events such as floods, inundations, landslides, earthquakes, and the spread of infectious agents that affect humans, animals and vegetation [

1] that have occurred in the last decades on a global scale, combined with the limited adaptive capacities and poor resilience of territories, have made environmental protection and safeguard issues increasingly central to international debate. Built environments, especially cities where most of the global population is concentrated, have proven to be fragile in relation to such events and incapable of providing responses capable of preserving the properties and the population, highlighting the urgency of a strong change in using natural resources. This has caused the need to develop management tools capable of addressing the challenges imposed by the modifications underway. To this end, specific urban governance measures have been introduced, aimed at sustainable governance, optimal use of local resources through the safeguard and mitigation of the negative effects of critical events on social, economic, and environmental systems, and reducing fragility in emergency processing. Since the 1960s and 1970s, awareness of the value of the environment and its intrinsic vulnerability has increased, accentuated by the uncontrolled and disorganized growth that began after the Second World War. The process of urbanization and the increase in intensity and severity of extreme events have caused an increase in the extent of damage to territories, communities, and global economies, making it inevitable to recognize the profound climate transformations, eliminating any form of skepticism regarding the need to intervene with preventive and proactive measures aimed at countering the consequences and developing greater resilience [

2]. This push toward more conscious and sustainable land management policies derives from various internationally significant programs, among which the 2030 Agenda for Sustainable Development, developed by the United Nations, is the most important. This Agenda identifies 17 Sustainable Development Goals (SDGs) that are fundamental for addressing the current environmental, social, and economic crises. In particular, the 17th goal aims to strengthen the means of implementation and to revitalize the Global Partnership for Sustainable Development. According to the 2030 Agenda, this objective can be achieved through multi-stakeholder partnerships and the mobilization of substantial resources from a variety of sources, and with the effective use of financing. Indeed, engaging different sectors and actors to work together in an integrated and coordinated manner—by pooling financial resources, knowledge, and technical expertise—represents a vital vehicle for supporting the achievement of the SDGs [

3]. The integration of resources other than public ones, at the basis of numerous international programs, also derives from the scarcity of government funds to be allocated to interventions to secure the territory, which has made the involvement of private capital essential. In particular, the private subjects are attracted not only by interesting profitability opportunities, but also by the desire to invest in the field of sustainable and responsible investment. These investments are based on specific programs that integrate Environmental, Social, and Governance (ESG) criteria into decision-making processes. Among these, the United Nations Environment—Finance Initiative (UNEP FI) Responsible Property Investment Program is one of the most important, and it addresses a range of challenges in the field of sustainable real estate [

4]. To this target, the development of sustainable finance plays a fundamental role, as it allows for catalyzing public and private resources to ensure transparency and integrity while supporting environmental and social sectors—two dimensions that are deeply interconnected. In particular, the strong interdependence among these spheres implies that the achievement of objectives in one domain inherently depends on the fulfillment of objectives in the other. This highlights the increasing importance of social investment within the sustainable finance agenda: in particular, social bonds are introduced as a promising financial tool that enables investors to support projects with positive social impacts while achieving financial returns, distinguishing them from philanthropy. They enhance project transparency and accountability and can help mitigate the social risks of a disorderly transition to a low-carbon economy. In addition to these approaches, blended finance (combining public and private capital) represents a valid strategy to de-risk and incentivize private investment in social sectors’ sustainable finance, as it allows for catalyzing different resources to achieve the UN SDGs, especially in low- and middle-income countries (LMICs). In this context, social bonds are viable tools to attract private investors as they offer an efficient market-based mechanism with positive social impact and financial returns [

5]. These financial instruments are an essential part of the sustainable finance ecosystem, allowing governments, corporations, or local authorities to pursue resilient transformation projects for local territories capable of coping with environmental crisis dynamics. More specifically, this trend toward investments able to respond in an adaptive way to ongoing climate changes has generated the need to integrate environmental factors into decision-making processes, due to the severity of their impacts. However, the optimistic push toward these types of investments risks triggering the phenomenon of greenwashing. While green finance is widely recognized as a major means to promote sustainable development and environmental goals, its implementation does not necessarily correlate with a measurable reduction in pollution levels. The need to enhance corporate ESG performance, due to the global focus on the environment and on sustainable strategies, leads to the spreading of green bonds, as they significantly help offset the negative effects of policy uncertainty by demonstrating a firm’s commitment to green development. Nonetheless, merging evidence raises important concerns about the credibility and integrity of such instruments. In particular, the study by Ge et al. (2024) [

6] highlights that the issuance of green bonds does not necessarily lead to significant ESG performance differentiation among firms with varying levels of pollution or degrees of political connectivity. This lack of distinction suggests the presence of greenwashing, that is, green bonds, while beneficial, may sometimes be used for “reputational” purposes without substantive improvements.

3. Environmental Risks

As highlighted in the previous paragraph, the increasing impact of extreme events on the economy in general, and on real estate investments in particular, requires a more in-depth analysis of the environmental risk concept and its quantification. This section aims to provide a general framework of environmental risk, offering a definition that includes its main components and the approaches used for its quantification, with particular attention to natural and anthropogenic phenomena that influence the safety of the territory and of investments. The Italian Department of Civil Protection describes environmental risk as “primarily associated with the production, management, and distribution of goods, services, or products from industrial processes which, in the event of an accident, may have effects on the population, animals, and the territory” [

7]. This definition focuses on anthropogenic risks, while giving less relevance to natural factors, which are also crucial for a territory’s safety.

The Italian institute for environmental protection, ISPRA (Istituto Superiore per la Protezione e la Ricerca Ambientale) [

8], adopts a broader approach, framing environmental risk in relation to two distinct categories: (i) environmental crisis: a situation in which an expected or ongoing event can lead to potentially dangerous situations for the environment that require measures for the prevention and/or mitigation of the risk; (ii) environmental emergency: a dangerous situation for the immediate integrity of environmental matrices that requires exceptional and urgent interventions to be managed and brought back to normal conditions. Risk is therefore understood as the probability of the occurrence of critical events that may cause harmful impacts on various territorial contexts. In particular, the ISPRA document entitled “Environmental Risk” [

9] distinguishes between natural and anthropogenic risk—that is, between risks arising from human activities considered potentially damaging (for example, due to the production of polluting substances), and natural risks that are dangerous to the different geographical areas.

The reciprocal nature of the interactions between natural events and human activities is also emphasized: in numerous crisis scenarios, hybrid causes are identified. For instance, land consumption and soil sealing carried out in response to urban growth lead to a reduction in the land’s water absorption capacity, thereby increasing the severity of flood damage caused by heavy rainfall. ISPRA distinguishes between triggering factors of endogenous origin—deriving from internal processes such as volcanic and tectonic activity—and the phenomena of exogenous origin, which act on the Earth’s external surface (even extreme meteorological events).

To quantify this risk (

R), the formula in Equation (1) is applied:

where

P is the hazard,

V is the vulnerability, and

E is the exposed value. The hazard is defined as the probability that a given event will occur with a specific intensity in a given area and in a given time interval. Vulnerability refers to the propensity of human works and environmental assets to suffer damage following the occurrence of a specific catastrophic event. Exposure represents the value of all elements at risk (human lives, infrastructures, and historical, architectural, cultural, and environmental assets) within the exposed area [

10]. In order to have a greater understanding of the environmental risk concept, it is useful to examine the different identified typologies, classifying, as previously mentioned, the endogenous and exogenous risks. In

Table 1, the illustrated categorization is shown.

The definition of environmental risk outlined above identifies different types of phenomena whose effects represent risks for territorial systems. Given the potentially destructive nature of such events, the need to define a comprehensive and organic system for the assessment and management of associated risks, in order to preserve human life, territorial components, and cultural and architectural heritage assets, is evident. Among the tools developed to support sustainability objectives, several specific European directives that specifically address major environmental risk issues can be identified. For example, for the evaluation and management of flood risks, Directive 2007/60/EC [

12] of the European Parliament has been enacted. This directive provides for cooperation among Member States and the involved Administrations through the development of specific flood hazard and risk maps for each hydrographic district or management unit. This directive is part of a fundamental European regulatory framework for the coordinated and large-scale management of environmental risks at the international level. The development of this type of legislative device represents a crucial step toward achieving the objective of reducing negative impacts on human health, the environment, cultural heritage, and economic activities within the European community. The definition of risk levels established by these regulations allows the identification of integrated risk management and prevention strategies that are standardized at an international level. Within the European regulatory framework for the management and assessment of environmental risks, EU Regulation No. 2088/2019 [

13] plays a central role. In particular, it requires financial market participants and financial advisors to provide, with full transparency, specific information on the approach procedures used to integrate sustainability (and therefore, also environmental) risks and considerations on negative impacts, on sustainability in financial assessments, and on investment returns. This regulation thus promotes a more risk-aware approach that actively involves the private sector in large-scale interventions. Specifically, the increasing role of private actors in territorial transformation and development processes aimed at securing urban spaces and the built environment is recognized. Indeed, given the limitations of dealing with critical events exclusively with public resources, the private sector plays an increasingly key role.

This role is also determined by the growing awareness of the impacts of extreme events, which represent a risk factor for real estate investments. The occurrence of critical phenomena significantly affects the value of assets and their attractiveness for investors and financial institutions. In light of these considerations, the need to develop a new approach to risk assessment that takes environmental issues into account is attested.

In recent years, numerous studies on the issue of environmental risk assessment, mitigation, prevention, and management have been carried out. Zhengtang (2011) [

14] recognizes the urgency to develop effective catastrophe modeling through stochastic optimization, which provides a framework for integrating decisions into disaster models, aimed at improving the ability to deal with critical phenomena. Neumayer et al. (2014) [

15] highlight the link between investment in risk prevention and mitigation, which is typical of countries where there is a high number of critical events, and the reduction in economic losses, particularly where the focus is on predicting the occurrence of harmful events and the vulnerability of the territory. This approach is focused on different environmental risk components (seismic, water, flood, etc.) and on the corresponding benchmark parameters to quantify the intensity of the phenomena. In fact, the objective is to determine the level of risk by estimating the probability that pre-defined physical parameters exceed specific pre-set levels of danger. For seismic events, attention is often paid, for example, to Peak Ground Acceleration (PGA), which represents the maximum acceleration on the ground during an earthquake, determining the impact of the event in relation to the topological and stratigraphic characteristics of the soil. The practical application of these approaches clashes with the limited availability of probabilistic data concerning the occurrence of extreme events, as well as with the lack of in-depth knowledge of the territory in its natural and anthropogenic components. In the study by Grossi et al. (2005) [

16], the authors highlight several issues related to the development of models for the quantification of natural hazards: the scarcity of data, especially those dating back to periods much earlier than the analysis date, is identified as one of the main obstacles to the construction of accurate probabilistic forecasting models. Another limitation affecting the reliable measurement of damage is related to the specificity of the response and the degree of damage compared to the building’s structural properties, intended use, and other characteristics.

The difficulties in determining losses following disasters are also highlighted in the work of Kron et al. (2012) [

17]; indeed, the study points out how it is rarely possible to identify the causes of individual damage by distinguishing between several events. The authors also demonstrate the need to account for socio-economic changes—such as inflation, population growth, and asset values increase—when comparing losses over time within the same area. A further critical issue in the evaluation of environmental risks lies in calculating the effects of interactions among individual risk factors: the mutual influence among risk components leads to a high complexity in comprehensive estimation methodologies. For instance, mitigation measures adopted for one type of risk may increase vulnerability to another; moreover, certain events may trigger secondary phenomena, generating a cascade effect.

The need to analyze the different environmental risk components collides with the lack of homogeneity of scale at which they are mapped: Tocchi et al. (2023) highlight that for flood risk the interested areas are much less extensive than the surfaces involved in seismic phenomena, making geographical harmonization necessary to ensure an effective global assessment [

18]. These limits require an interdisciplinary approach that can incorporate multiple expertise, especially if consideration of not only natural disasters but also technological and health-related ones is carried out. The model developed by Righi is based on the recognition of the connection between human health, climate, and environment in a One-Health perspective. In fact, for the estimation of risk, the use of quantitative indicators, forecasting models, and physical and social vulnerability curves, which incorporate, for example, through surveys, the perception of risk by citizens and local stakeholders, is proposed [

19].

Similarly to what has been described by Righi (2012) [

19], the research by Marin et al. (2017) [

20] points out the importance of focusing on socio-economic aspects. Specifically, their work aims to provide a series of methodologies suitable for obtaining a complete and detailed list of the exposure of economic activities to natural disasters. The proposed assessments take into account the different socio-economic variables, such as population density, employment rate, business turnover, and capital stock, considered as forms of direct and indirect socio-economic exposure to natural catastrophes. In line with the observations carried out by Righi et al. (2012) [

19], the study of de Ruiter et al. (2020) [

21] underlines the need to identify methodologies capable of effectively managing the overlapping of multiple risk components, overcoming the limits of traditional methods of Disaster Risk Reduction (DRR). In particular, the Afghan territory, in which the economic Average Annual Losses (AALs) caused specifically by critical seismic and flood events are measured, is analyzed. Similarly, Wang et al. (2021) [

22] analyze the environmental risk, examining the seismic and flood components, to carry out assessments on the China–Indochinese Peninsula economic corridor, focusing on the estimation of the exposure of existing and planned railway infrastructures to critical events. Specifically, the study aims at the determination of the Expected Annual Damage (EAD is the Expected Annual Damage expressed in dollars) with respect to different return periods (100 years for floods and 475 years for earthquakes) used to weight the flood and seismic risk components. Moreover, the article by Rehman et al. (2019) [

23] highlights the importance of obtaining tools and strategies for the prevention of environmental disaster risks by analyzing different social, technical, institutional, cultural, infrastructural, and environmental factors influencing floods in the Pakistani context. In addition, Chen et al. (2011) [

24] propose a multi-criteria analysis for Environmental Risk Assessment (ERA) with the purpose of preventing or eliminating damages and losses caused by critical events in international airport projects: the criteria proposed in the analysis consider social, technical, economic, environmental, and political factors (STEEP) used in the Network Analytical Process.

De Ruiter et al. (2017) [

25] conducted a literature review on quantitative vulnerability indicators comparing studies on seismic risk and flood risk; in light of the obtained results, the authors recognize the validity of a differentiated assessment of the two types of events: for flood risk, the use of physical vulnerability curves and building occupancy models based on the time of day is proposed, whereas, for the management of seismic events, the use of social vulnerability indicators is suggested.

The cited studies attest the absence of a consolidated organic and integrated assessment system in which the different components of environmental risk can coherently converge, in order to quantify it. Kron (2012) [

17] tries to overcome this limit by translating damages into monetary terms. In particular, losses are classified into two categories, namely insured and total losses. The data relating to the former (i.e. insured losses) are considered reliable, since they correspond to the actual compensation paid. The assessment of total losses leads to a further categorization into direct, indirect and secondary or consequential losses: the direct ones are immediately visible and quantifiable (loss of homes, household goods, vehicles, etc.). Their calculation is based on replacement and repair costs. Indirect losses include increased transportation costs due to damage to infrastructure, job losses, and loss of rental income. Two examples of indirect losses are business interruption (BI), which is the loss of income due to the activity interruption, and contingent business interruption (CBI), which occurs when activity is stopped due to damage to suppliers or the recipient company. The latter, consequential (or secondary losses), instead concern the economic impact assessed in the form of reduced tax revenues, lower economic output, reduced GDP or weakening of the currency.

In light of the conclusions and outputs of the analyzed studies and considering the objective of the present research to propose an integrated risk assessment approach as a combination of aspects (seismic, hydrogeological, and linked to the pollution of contaminated sites), for each of these components, the most widespread assessment methodologies are identified. The aim of this analysis is to overcome the limitations and gaps highlighted in the reference scientific literature for the integration of risk factors in a univocal evaluation framework.

The following sections examine the current approaches to quantifying risk components with the purpose of identifying comparable assessment metrics; specifically, the present work is focused on three components of environmental risk, namely seismic, hydrogeological, and pollution risks. These aspects are not always directly appreciated by the real estate market and should implicitly flow into the risk premium factor.

3.1. Seismic Risk Assessment

The seismic risk assessment is based on a complex regulatory framework that incorporates European directives through various legislative tools such as Ministerial Decree No. 58 (28/02/2017) [

26], which introduces the “Guidelines for the classification of seismic risk of buildings”. These guidelines serve as a fundamental reference for the study and analysis of seismic events by defining the seismic performance of the building in terms of Expected Annual Loss (EAL) and structural collapse capacity. The seismic risk class is determined as the minimum (the lower) of the two classes derived from the building’s safety index at the ultimate limit state and the one associated with the EAL. The guidelines focus on two fundamental points: human life safety and EAL. The research by O’Reilly (2018) [

27] proposes a pushover analysis useful for identifying the performance levels with respect to the limit states explained by the Italian code for different building typologies.

The limit states are qualitatively defined in the technical standards for construction NTC 2008 [

28] through four damage levels:

Operational Limit State (SLO)

Damage Control Limit State (SLD)

Life Safety Limit State (SLV)

Collapse Prevention Limit State (SLC)

Ministerial Decree No. 58/2017 [

26], by introducing the EAL metric, integrates the economic loss into the assessment of vulnerability to seismic events. EAL represents a metric of a building’s global performance in terms of expected annual economic losses due to earthquake-induced damage, accounting for various sources of uncertainty [

29]. From its mathematical definition—Equation (2)—it is evident that EAL provides a measure of seismic vulnerability by simultaneously considering economic factors and structural performance across different limit states, i.e., the earthquake intensity relative to its frequency:

where

(

Intensity Measure) represents the seismic intensity metric, and

(

Total Loss) denotes the total economic loss due to damage. EAL thus expresses structural efficiency in relation to economic losses and different seismic intensities and return periods (

) over the nominal lifespan of the building. Specifically, this efficiency is expressed as a function of the average annual exceedance frequency of seismic events, indicated as

, and the associated repair costs (

). The graphical representation of the EAL integral is obtained by plotting the points (

,

), corresponding to each limit state: the resulting curve describes the economic loss for each damage level (

Figure 1).

Repair costs are expressed as a percentage of the total reconstruction cost, which is treated as a threshold value beyond which repair of single damages is deemed inefficient. Cardone et al. (2017) [

30] highlight that in several evaluation models, such as the one developed by the Federal Emergency Management Agency (FEMA P-58), this threshold—based on empirical data and simulated scenarios—is set at a reduced percentage of the total reconstruction cost (approximately 40%). The Ministerial Decree of 2 July 1981 [

31], issued pursuant to Law No. 219/1981 enacted following the Irpinia–Lucania earthquake, introduced the concept of economic convenience limit, setting this threshold at 80% of the replacement cost—implicitly assuming that beyond this value, demolition and reconstruction are more cost-effective than repair. This threshold is significantly higher than the reference levels typically adopted in international contexts, such as the U.S. (40–60%) or Canada (20–40%).

The %RC values used in expected loss assessments can be compared, as carried out by Cosenza et al. (2018) [

32], with actual repair costs observed during the monitoring of the reconstruction of private residential buildings located outside the historical center and damaged in the 2009 L’Aquila earthquake. Key sources of data for this analysis include the White Book on L’Aquila’s reconstruction, drawn by ReLUIS and authored by Dolce and Manfredi (2015) [

33], as well as the studies by Di Ludovico et al. (2017) [

34]. Similarly, the research by O’Reilly (2018) [

27] estimates reconstruction costs for Italian school buildings damaged in the 2012 Emilia–Romagna earthquake, calculating typical reconstruction costs per square meter and including demolition and debris removal expenses.

Several challenges in the annual losses calculation, including the complexity of its computation, the need for advanced technical–scientific expertise, and the scarcity of data on the repair costs of both structural and non-structural building components, limit the practical application of the EAL metric [

32]. To address this complexity, the 2017 guidelines offer a simplified approach for seismic risk classification and the identification of retrofitting interventions. This is particularly useful when limited information is available regarding the geometry and structural details of the buildings. O’Reilly’s analysis shows that EAL values obtained using the simplified method are generally higher than those from the more rigorous traditional approach; this discrepancy is attributed to approximations and the increased weighting of repair costs in the simplified method [

27]. As noted by the authors, this method defines expected loss ratios as percentages of the replacement cost for each limit state, without accounting for the actual condition of the building. On the other hand, the simplified approach determines comparable results to the rigorous method when focusing on performance improvements from seismic strengthening or retrofitting interventions.

In addition to the EAL, the guidelines also prescribe the calculation of the Life Safety Index (ISV) to assess the safety level of a building. This is defined as the ratio between the Peak Ground Acceleration (PGA) corresponding to the Life Safety Limit State (PGASLV) of the assessed building and the planned/design PGA established by current regulations, based on the return period defined for the given building type.

Cardone et al. (2017) [

30] point out that the use of EAL alone does not fully capture all aspects of seismic vulnerability scenarios, due to (i) the failure to consider cumulative effects from widespread but minor damage, and (ii) the underestimation of severe damage concentrated in limited areas of a building. An evident limitation of this approach concerns the use of intervention thresholds based solely on reconstruction cost, without considering the property’s market value—as a private owner would—or the socio-economic implications of such costs, as would be relevant to a public subject. For these reasons, and to ensure greater consistency with the hydrological and environmental pollution risk assessments discussed in subsequent sections, this study adopts a monetary-based EAL representation, replacing %RC with reconstruction costs expressed in monetary terms.

3.2. Hydrogeological Risk Assessment

Hydrogeological phenomena have garnered increasing attention due to the growing occurrence of destructive effects in recent years, often caused by the exceedance of critical rainfall thresholds along the slopes, of hydrometric levels of the watercourses within secondary hydrographic networks, and of rainwater drainage and disposal capacity [

35].

As discussed in the previous sections, such events play a key role in public policies for sustainable land management, as well as in the private real estate investment sector. Financial institutions, investors, and businesses are increasingly involved in shaping territorial transformation strategies, with a growing emphasis on resilient investment models.

The Italian territory is considered particularly prone to these hazards. The Department of Civil Protection classifies it as fragile [

36], due to its geological and geomorphological characteristics, which lead to extremely rapid onset of violent phenomena such as mudflows, flash floods, overbank floods, and river flooding. Contributing anthropogenic factors include increased population density, urban expansion, abandonment of mountainous lands, illegal construction, ongoing deforestation, environmentally unsound agricultural practices, and lack of maintenance of slopes and waterways.

The primary preventive and predictive measures against hydrogeological hazards are based on risk level assessment systems for various reference geographical areas. For instance, certain regulatory texts—such as the Technical Implementation Norms of the Basin Plan (Hydrogeological Structure Subsection)—require hydrological and hydraulic compatibility studies to evaluate impacts on upstream and downstream hydraulic regimes as part of hydrogeological risk zoning [

37].

The 2021 ISPRA Report is among the most recent legislative reference tools for risk assessment. This report updates and integrates the methodologies of 2016 to comply with European standards, introducing a modified risk mapping system known as

mosaicatura [

34]. The adopted approach involves differentiated mapping of various types of hydrogeological phenomena, including landslides, avalanches, coastal erosion, and flooding.

Regarding flood risk, the delineation of flood-prone areas across the national territory is based on the probability scenarios defined in Article 6 of the Floods Directive 2007/60/EC [

12]. In Italy, the classification of these areas is governed by Legislative Decree No. 49/2010, which transposes and implements the European directive by categorizing areas according to flood probability: high probability events with return periods between 20 and 50 years (HPH), medium probability events with return periods between 100 and 200 years (MPH), and low probability or extreme events with return periods exceeding 200 years (LPH).

A similar approach is applied to landslide risk mapping, where areas are delineated according to hazard levels: very high (P4), high (P3), medium (P2), low (P1), and Areas of Attention (AA). Hazard levels are determined based on various factors, particularly historical data from the Italian Landslide Inventory (IFFI), which informs the spatial distribution and recurrence of landslide events. Additionally, landslide susceptibility models, which assess slope stability in relation to terrain morphology and hydrology, are essential. These geostatistical analyses correlate landslide occurrences with environmental factors such as topography, geology, and rainfall patterns.

Further integration with erosion maps and geotechnical data enhances slope stability prediction. The use of geospatial databases and landslide susceptibility indices enables more accurate hazard level classification. Landslide indices represent the ratio between the area affected by landslides and the total area analyzed.

Hazard mapping is then compared with mosaicatura of the population density and household density data—derived from the 15th ISTAT Census (2011)—as well as with maps showing the density of buildings, business units, cultural heritage assets, and structural aggregates. The representation of the density spatial correlation is used to assess risk levels for each category—for example, determining the population at risk, i.e., the residents in landslide-prone areas exposed to threats such as death, injury, missing persons, or evacuation.

The risk maps presented in the ISPRA 2021 Report [

35] serve as qualitative tools for measuring risk levels, taking into account the exposed population, surface area affected, at-risk infrastructure (number of buildings, roads, and bridges), and land use.

However, these tools do not quantify damage in monetary terms, unlike the seismic risk assessment methodology outlined in Ministerial Decree No. 58/2017 [

26], which uses the EAL metric to estimate anticipated economic loss. To bridge this gap, the Expected Annual Damage (EAD) metric has been introduced as a method of economic assessment of hydrogeological damage. Similar to seismic risk assessment, the EAD captures direct physical damages (e.g., to buildings and infrastructure), converting them into monetary terms based on reconstruction cost estimates.

Bilskie et al. (2021) [

38] attempt to go beyond this approach by considering the spatial distribution of social risk—not limited to property damage, but also accounting for displaced individuals and those requiring shelter.

Mathematically, EAD is defined by Equation (3):

where

is the return period of the

i-th flood event, and

represents the associated economic loss, calculated as the product of the damage ratio—obtained from the vulnerability curve—and the reconstruction cost [

39].

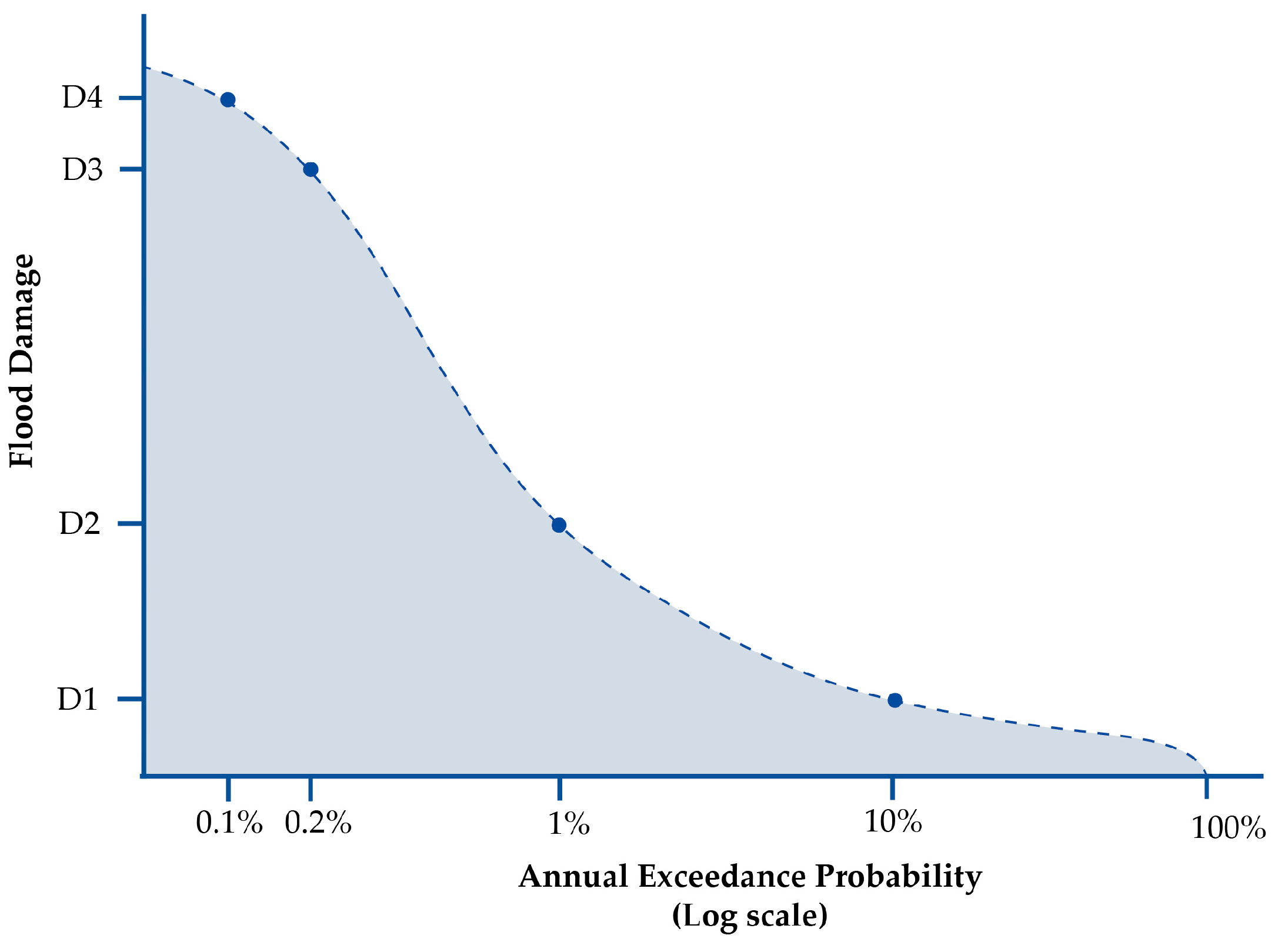

The EAD is graphically represented by the damage probability curve (see

Figure 2), which associates different damage levels with their Annual Exceedance Probability (AEP), that is, the probability to overcome pre-established thresholds [

40] that can be evaluated based on water depth levels [

41]. The Expected Annual Damage corresponds to the area under this curve (i.e., the integral). The graph reveals that higher-impact floods have lower probabilities of occurrence compared to lower-impact events.

The study by Wang et al. (2021) exemplifies the application of the EAD for total risk estimation, combining exposure, vulnerability, and the probability of event occurrence across various return periods. Vulnerability is modeled through a curve or matrix that describes the relationship between damage rates and hazard intensity [

22]. Wang’s work aims to estimate total risk by combining the probability of both floods and earthquakes with their associated loss rates, employing the probability integration model proposed by de Moel and Aerts (2011) and Alfieri et al. (2017) [

41,

42].

Similarly, Tocchi et al. (2023) [

18] propose a multi-hazard analysis of seismic and flood risks in the Veneto region of Italy, focusing on the monetary quantification of expected damages for both hazards. This is achieved through risk maps and damage curves, which enable a harmonized comparison of EAL for floods and earthquakes in alignment with Italian regulatory standards.

The research by Zhou et al. (2023) [

39] focuses on flood risk assessment for infrastructure networks in China, applying the global hydrological model PCR-GLOBWB, which utilizes a global flood hazard map developed by Ward et al. (2013) [

43]. This model enhances dynamic water flow modeling to generate high-resolution flood hazard maps (30″ × 30″), depicting floodwater depths. As in previous studies, the risk assessment relies on vulnerability curves and flood scenarios categorized by water depth classes and relative return periods.

3.3. Pollution Risk Assessment

The final component of environmental risk analyzed in the present study concerns pollution, particularly the relationship between the presence of contaminated sites and the real estate market. A polluted site can significantly compromise the environmental quality of an urban area, negatively affecting residents’ perceptions of safety and overall well-being. Facilities such as industrial plants, landfills, or incinerators are frequently perceived as threats to public health due to their potential to pollute the air, water, and soil. Exposure to such anthropogenic environmental risks fosters a sense of insecurity that inevitably influences collective attitudes and behaviors [

44].

One of the main consequences of perceived environmental risk is the shift in housing preferences as the perceived environmental degradation leads urban residents to prefer areas considered healthier, thereby influencing choice processes [

45]. Trends in the residential real estate market—particularly in terms of transaction volumes and property values—are often used as proxy variables to evaluate the impacts of pollution-related projects. These market dynamics can serve as a means to monetize the externalities, whether positive or negative, generated by interventions affecting perceived environmental quality. Environmental pollution causes a loss of communities’ well-being, and this loss can be quantified monetarily by estimating the Willingness to Pay (WTP), which is the maximum amount individuals are willing to pay to restore a safe level of perceived environmental quality, or the Willingness to Accept (WTA), which is the minimum amount individuals would accept as compensation for the loss in well-being [

46]. Both WTP and WTA, which are obtained through revealed preference or stated preference techniques [

47], are frequently implemented in Cost–Benefit Analyses (CBAs) to monetize the effects of a project on the population.

Revealed preference techniques allow for the estimation of the monetary value of an intangible good by using a related market good as a proxy [

48]. The most widely used preference method for evaluating environmental interventions is the Hedonic Price Method (HPM), which analyzes real estate market dynamics—specifically, property values—as proxies for environmental disamenities or amenities. The goal of this approach is to estimate the implicit cost of pollution, based on the assumption that individuals, when purchasing property, consider not only the intrinsic features of the asset but also the characteristics of the surrounding urban context—where pollution is perceived as a detractor of contextual quality [

49].

The HPM is applied to determine the weight of all attributes—both intrinsic and extrinsic—in the formation of a property’s market price, thereby allowing for the assessment of the implicit value of environmental disamenities [

50]. Numerous applications of the method can be found in the literature, often showing a clear relationship between proximity to polluted sites and property values: as the distance from a pollutant source decreases, property prices also are reduced. This suggests that closeness to an environmental contamination source is perceived as a health risk by the community [

51,

52,

53].

The monetization of intangible benefits can also be achieved by measuring community WTP through stated preference techniques, among which the most commonly used is the Contingent Valuation (CV). CV involves the development of a questionnaire simulating a hypothetical market in which the good under evaluation can be traded [

54,

55]. Efficiently structuring the survey questions is crucial, as respondents must be provided with all relevant information regarding the hypothetical scenario in a clear, logical, and plausible manner.

In accordance with the objectives of this paper, the proposal to estimate the monetary equivalent of environmental pollution by combining CV and HPM methodologies is carried out. Specifically, to determine an annual equivalent value, the CV questionnaire will focus on annual rent, and the dependent variable analyzed through the HPM will also be annual rent. In this way—similar to the assessments conducted for seismic and hydrogeological risks—it will be possible to calculate the Monetized Annual Pollution (MAP).

If estimates about overall environmental pollution monetization are available, or if the analysis concerns investments that do not immediately yield rental income (as in the case of new developments), the annual equivalent can be derived either by dividing the total estimate by the asset’s economic lifespan or by applying an appropriate capitalization rate based on the reference market.

4. Methodological Approach

Within financial investments, the risk premium represents the risk–return trade-off (risk–opportunity) of a given investment. It is defined as the difference between the expected returns of the initiative and those of a risk-free investment—generally represented by government bonds issued by countries with stable economies. The risk premium thus reflects an increment in expected returns offered to the investor as compensation for bearing risk. Given the inherent uncertainty that an investment may fail to achieve its projected outcomes, the risk premium is expected to compensate for potential invested capital losses and/or the failure to realize anticipated and prefixed profits.

With the financialization of the real estate market, investment-related risk in this sector has increasingly been evaluated using methodologies drawn from stock markets [

56]. Specifically, the risk premium associated with real estate investments is determined by considering various components such as financial leverage [

57,

58], the inflation rate [

59,

60], and the Book-to-Market Ratio (B/M), which measures the ratio between a firm’s market value and its carrying value [

61,

62], as well as the Small Minus Big (SMB) and High Minus Low (HML) factors, which capture the size and value effects of the investment assets [

63]. These risk factors are commonly derived through regression-based approaches applied to historical time series of risk premiums, which are used as proxies for overall investment risk [

64].

The use of historical series in risk premium estimation is based on two key assumptions: (i) the dataset of past events is sufficiently representative of future scenarios (i.e., that historical trends are applicable to present and future market conditions), and (ii) in the past, the market has assessed the risk accurately, assigning a corresponding expected return increment (i.e., the risk premium). However, the growing incidence of extreme events and the occurrence of speculative bubbles—including those affecting the real estate market—have highlighted (i) the limitations of purely financial approaches in risk assessment, (ii) the unreliability of historical data, and (iii) a frequent mismatch between perceived risk (and hence the associated premium risk) and actual risk [

63].

Alongside traditional financial components incorporated into the determination of the risk premium, it is proposed to include an environmental risk component (

), defined as the sum of seismic risk (

), hydrogeological risk (

), and pollution risk (

), as expressed in Equation (4):

The expression of Equation (4) is valid under the assumption of independence of the underlying events contributing to each of the three environmental risk components. Interpreting risk using a logic analogous to the Return on Equity (ROE)—defined as the ratio of annual income and invested equity—Equation (4) can be reformulated as Equation (5):

where

is the market value of the property at the time of investment [

64],

is the investment horizon, and

with

are coefficients reflecting the evolution over time of the costs associated with EAL, EAD, and MAP, and the real estate market trends. Specifically,

implies that intervention costs are assumed to grow in line with property values;

indicates that property values are expected to increase in a more sustainable manner than intervention costs; and

indicates the opposite.

For simplification purposes, by assuming

, where

is the expected inflation rate, Equation (5) can be rewritten as Equation (6):

This formulation enables the risk measure to be normalized (i.e., without dimension) with respect to the total investment value, under the assumption that environmental risk is at least equal to the ratio of the average annual monetary amounts required to remediate damages from the considered events and the invested equity. The resulting percentage quantifies the environmental risk component, which should be integrated into the overall risk premium that is more commonly perceived as more probable in the real estate investment volatility valuation process, to be considered for the potential occurrence of seismic events, floods, and pollution-related hazards.

5. Discussion

In light of the inadequacy of traditional methodologies for assessing the damages associated with extreme events, the need to develop a more effective integrated approach for investment risk evaluation has become increasingly urgent. In particular, including environmental components into the overall investment risk assessment ensures higher alignment with the current needs driven by the intensified impacts of the climate crisis. Further evidence of the growing focus on environmental aspects is reflected in the increased number of regulatory initiatives aimed at mitigating the hazards of such events. Indeed, the failure to adequately account for environmental dimensions jeopardizes not only the general security of territories but also undermines the resilience and long-term profitability of investments, prompting key actors within the real estate sector to recognize the critical importance of incorporating environmental risk into strategic frameworks. Despite the presence of numerous studies in the recent academic literature, exploring risks associated with seismic, hydrogeological, and pollution-related events, the absence of a unified evaluation approach remains a significant gap. Through a review of the existing literature, the main methodologies used to translate risks into quantifiable terms, such as EAL, EAD, and the newly introduced MAP, have been identified, along with the major challenges in developing a unified system for the measurement of different risk components.

This integrated approach enables a comprehensive, inflation-adjusted assessment of extreme events’ impacts on the real estate market, allowing the quantification of the components that collectively define environmental risk.

However, significant limitations persist, such as the predictive accuracy of the models used to estimate the occurrence and impact of seismic and hydrogeological events, as well as the associated restoration costs. For instance, landslides are the result of complex geological processes, for which it is difficult to develop reliable predictive models based on standardized quantitative parameters. Moreover, while seismic intensity is relatively consistent and uniform across a given area, it still depends on a limited number of factors, such as topographical conditions (e.g., flat versus hilly terrain) and subsurface composition (e.g., soil stratigraphy and quality). In the hydrogeological context, consolidated datasets on structural damage and reconstruction costs are largely lacking. Flood impacts also vary significantly across affected zones—even neighboring ones—depending on specific characteristics of the area, such as soil permeability, land use typologies, carried out activities, and the maintenance state of water containment systems.

With reference to pollution-related risk, generally, this is treated as a “static” component, without considering return periods of the events, and it is also based on market perceptions captured through a purpose-built survey. Another critical issue of the proposed framework concerns the need for the evaluator to have a deep understanding of both the context and the asset under analysis and, thus, of the costs required to implement the approach. These costs are justified only in the case of high market value and when investors are strongly committed to allocating the necessary resources to complete the investment. Otherwise, such costs may become unsustainable “abort costs”.

To simplify the proposed methodology, the environmental risk components are assumed to be independent and are thus aggregated additively. However, in practice, these events are often interrelated: for example, seismic events can trigger hydrological anomalies [

65], and both floods and earthquakes may compromise the structural integrity of industrial sites, potentially leading to pollution events. Furthermore, the proposed approach does not account for damage to personal goods (e.g., furnishings, vehicles), nor does it consider broader economic disruptions (e.g., halted production, interrupted mobility), or damage to human health and social systems.

6. Conclusions and Further Insights

The intensification of extreme events, such as earthquakes, floods, and landslides, together with the increasing spread of pathogens and the growing awareness of the connection between health and pollution, has resulted in significant impacts on territorial systems, making it essential to recognize ongoing climate transformations. These events have highlighted the inherent vulnerabilities of territories and the ineffectiveness of traditional policies, prompting public entities to involve the private sector in order to obtain the large capital required for urban risk mitigation and adaptation. As a consequence, awareness regarding the influence of environmental factors on both public and private real estate investments has grown. This has encouraged institutional investors, credit institutions, private investors, and enterprises to pursue more sustainable and resilient development strategies. In this context, it becomes necessary to integrate various environmental components into the overall investment risk assessment, thereby enhancing investor consciousness and promoting greater transparency within the real estate sector. In addition, consolidated evaluation models focus on various risk factors, such as position, intended use, size, yield, volatility, dynamism and stability of the reference market [

66], underestimating increasingly crucial role of environmental risks. Within this framework, European states have sought to identify possible pathways for assessing risks associated with extreme events. In particular, a number of regulatory tools have been introduced to mitigate and counteract the adverse effects of such events. Among these, Regulation (EU) No. 2088/2019 is a significant reference: Article 2 defines sustainability risk as “an environmental, social or governance event or condition that, if it occurs, could cause a high actual or potential negative impact on the value of the investment” [

13]. This definition explicitly incorporates Environmental, Social, and Governance (ESG) components, thus broadening the traditional risk concept and introducing different declinations.

A review of the literature on environmental risk reveals several widely adopted methodologies for assessing the damages associated with seismic, hydrogeological, and pollution-related events. Damages resulting from the first two phenomena are ordinarily monetized through two analogous approaches that lead to the estimation of EAL and EAD, while the third is measured with a new metric named MAP. This is calculated using two methods: one approach relies on stated preferences via CV, whereas the other is based on revealed preferences through the HPM. The results obtained (EAL, EAD, and MAP) are related to the real estate market, accounting for its expected variation over time due to inflation and the rising costs of remediation following environmental events. Ultimately, this process allows the quantification of the seismic, hydrogeological, and pollution-related risk components that collectively define environmental risk.

The predictive accuracy of models remains constrained by the complexity and variability of the phenomena analyzed, coupled with the lack of consolidated datasets for structural damage and reconstruction costs. Furthermore, pollution-related risk assessments are based on market perceptions rather than historical data, and the practical application of the framework entails significant costs, which are sustainable mainly for high-value assets. Moreover, for simplification purposes, the proposed approach assumes the independence of environmental risk components, aggregating them additively, even if, in practice, these events are often interrelated. Additionally, the model does not account for damage to personal goods, broader economic disruptions, or impacts on human health and social systems.

Despite these limitations—which suggest several insights for future research—the proposed contribution represents an innovative approach for the definition and measurement of environmental risk that starts from consolidated methodologies for each risk component and harmonizes them into a cohesive structure. This integrated approach offers critical support to both public and private decision-makers in the real estate market by improving the accuracy of investment vulnerability assessments. By taking into account the direct impact of extreme events on investment returns and the high costs associated with repairing damage to buildings, the use of quantitative tools for risk evaluation and management would significantly enhance both resilience and economic–financial stability.

Note: The current study has been developed within the current research P.R.I.N. Project 2022: “INSPIRE—Improving Nature-Smart Policies through Innovative Resilient Evaluations”, Grant number: 2022J7RWNF.