Abstract

This study examines the key factors influencing online banking adoption in India in the post-COVID-19 period. Building on the Technology Acceptance Model (TAM), the research integrates traditional factors—perceived ease of use (PEOU), accessibility (ABS), and reliability of the banking system (RBS)—with a novel construct, perceived environmental, social, and governance performance of banks (PESGB). Data were collected through a structured questionnaire administered to Indian banking customers, and the proposed model was tested using covariance-based structural equation modeling (CB-SEM). The results demonstrate that PEOU, ABS, and PESGB significantly and positively influence customers’ intention to adopt online banking, whereas RBS does not show a significant effect. These findings suggest that in the post-pandemic era, customers prioritize usability, accessibility, and sustainability over traditional concerns of reliability. The study contributes to the extension of TAM by incorporating ESG considerations and offers practical implications for banks to enhance digital adoption by promoting user-friendly services and aligning digital transformation strategies with sustainability commitments.

1. Introduction

1.1. Background and Context of Online Banking in India

In today’s world, a key marketing strategy is the effective use of web-based technology to enhance business operations. Banks are striving to expand their range of services in order to retain customers. However, many banks are facing challenges in developing strategies that minimize costs, are easily accessible, and reduce the time taken to deliver services to their customers (Keskar & Pandey, 2018). The COVID-19 pandemic has further challenged traditional banking strategies. In India, people’s preference has shifted towards contactless or online transactions instead of cash exchanges due to the pandemic (Verma & Tanwar, 2022). Environmental, social, and governance (ESG) factors have increasingly become important in financial management strategies aimed at enhancing business performance on a global scale (Dicuonzo et al., 2024). The growth of financial technology is contributing to improved ESG performance among banks. Recent studies suggest that ESG considerations can impact bank profitability, and the ongoing COVID-19 pandemic may influence this relationship (Yuen et al., 2022). The adoption and integration of ESG principles within the financial sector, including banking, have been significantly influenced by advancements in financial technology (El Khoury et al., 2023; Galeone et al., 2024).

Information technology (IT) tools have significantly enhanced the speed and quality of service delivery within the global banking sector, particularly through the expansion of online banking. In India, the economic liberalization of the 1990s played a pivotal role in fostering the development of web-based banking services (Smriti & Kumar, 2021). Online banking allows users to access their bank accounts and conduct financial transactions electronically using computers, tablets, mobile phones, and other digital devices. By integrating traditional banking functions with internet technologies, online banking has gained widespread acceptance across both developed and developing countries (Chawla & Joshi, 2018; Chen & Barnes, 2007). Nevertheless, several challenges hinder its broader adoption, including limited technological literacy among users (Amsaveni & Kanagarathinam, 2017), low levels of awareness (Akhter et al., 2018), cybersecurity concerns, and inadequate digital infrastructure (Felix, 2014). Despite these obstacles, online and mobile banking usage is projected to grow substantially between 2020 and 2024, with Asia leading this expansion. In 2020, approximately 1.9 billion individuals worldwide utilized online banking services—a number expected to increase to 2.5 billion by 2024 (Norrestad, 2022). In support of this trend, the Indian government continues to promote the integration of digital banking into citizens’ daily financial practices.

Access to banking services played a crucial role in sustaining individuals’ socioeconomic resilience during the COVID-19 pandemic (Al Nawayseh, 2020). In response to the growing demand for digital solutions, both public and private sector banks in India have actively promoted and expanded their online banking platforms. The Indian banking sector has witnessed the emergence of innovative concepts such as payments banks and small finance banks, further accelerating digital financial inclusion. Notably, India’s Immediate Payment Service (IMPS) has contributed to the advancement of digital payment systems, influencing the adoption of similar services in 25 other countries. According to data revealed by the India Brand Equity Foundation in 2021, the total assets of the Indian banking industry—including public, private, and foreign banks—reached USD 2.52 trillion in 2020. Furthermore, total banking sector credit expanded at a compound annual growth rate (CAGR) of 3.57%, reaching USD 1698.97 billion in the same year. As per the Reserve Bank of India’s Annual Report (2022–2023), over 113.94 billion online banking transactions were conducted in India, amounting to a total transaction value of INR 2086.84 trillion. To enhance customer outreach and deliver consistent, high-quality experiences, banks are increasingly leveraging digital technologies. The COVID-19 crisis has significantly accelerated the adoption of such technologies across the globe (Al Nawayseh, 2020; Khatun et al., 2021).

1.2. Research Gap and Objectives

Despite the growing body of research on online banking adoption, several gaps remain. First, while prior studies have examined traditional determinants such as perceived ease of use, usefulness, trust, and security (Davis, 1989; Singh & Srivastava, 2020; Stewart & Jürjens, 2018), little is known about the role of environmental, social, and governance (ESG) practices in influencing digital banking adoption. This omission is critical because, in the post-pandemic era, customers increasingly evaluate banks not only on efficiency and reliability but also on their sustainability commitments (Yuen et al., 2022; Koh et al., 2022).

Second, many studies have treated reliability and security as interchangeable, although they represent distinct constructs. Reliability reflects consistent service availability, while security concerns the protection of data and transactions. Moreover, accessibility—the ease with which customers navigate and complete online banking transactions—has often been overlooked despite its central role in shaping user satisfaction (Martins et al., 2010; Aboobucker & Bao, 2018). In developing economies such as India, accessibility may even outweigh reliability or security as a driver of adoption.

Third, most existing studies focus on developed economies or pre-pandemic contexts (Chen & Barnes, 2007; Chawla & Joshi, 2018). India presents a unique case due to rapid digitalization, large-scale financial inclusion initiatives, and significant socio-economic diversity. While the COVID-19 pandemic accelerated digital adoption, few empirical studies have examined how consumer priorities in India have shifted toward usability, accessibility, and sustainability, often overriding traditional concerns about risk (Al Nawayseh, 2020; Ghani et al., 2022).

To address these gaps, this study extends the Technology Acceptance Model (TAM) by integrating Perceived ESG of Banks with traditional determinants such as Perceived Ease of Use, Reliability of the Banking System, and Accessibility of the Banking System. The primary objective is to empirically investigate how these factors influence customers’ intention to adopt online banking in India during and after the COVID-19 pandemic. In doing so, this study advances theoretical understanding by incorporating sustainability into technology adoption models and offers practical insights for banks aiming to align digital transformation with evolving consumer expectations.

2. Literature Review

The COVID-19 pandemic has significantly shaped the direction of scientific research, with over 80% of related publications emerging from the health sciences (Daragmeh et al., 2021; Ruiz-Real et al., 2020). Nevertheless, the crisis has also stimulated substantial growth in technological and social science research domains. This study contributes to the literature on technology adoption and technological efficiency within the banking sector. The rapid advancement of information technology (IT) is increasingly recognized as a driving force behind the transformation of traditional service delivery into digital platforms. In recent years, many businesses have restructured their operations to offer services independent of geographical and temporal constraints.

Online banking, as a digitally enabled business model, exemplifies this shift. It allows banks and customers to exchange information and perform financial transactions electronically, eliminating the need for physical interaction. Customers are no longer required to visit bank branches to access services, and banks can facilitate transactions without face-to-face engagement (Ghani et al., 2022). This technological evolution has become integral to enhancing service efficiency and accessibility in the post-pandemic digital economy.

Advancements in online banking have significantly enhanced financial inclusion, particularly for vulnerable populations in emerging economies (Ghani et al., 2022; Puriwat & Tripopsakul, 2021). Online banking offers considerable advantages to both financial institutions and customers by enabling the promotion and delivery of services in a faster, more cost-effective, and globally accessible manner (Khan & Alhumoudi, 2022). With the widespread use of smartphones, customers can now perform a wide range of banking transactions remotely by following digital banking instructions provided by their financial institutions. Online banking has become a strategic tool for banks to attract and retain customers, increasingly positioning itself as a competitive alternative to traditional banking services.

In 2012, India ranked third globally in terms of internet penetration, accounting for 5.7% of the world’s internet users, following China (22.4%) and the United States (10.2%). The research paradigm of this study is grounded in well-established theoretical frameworks and empirical evidence from prior literature. It explores the challenges and opportunities associated with online banking adoption in India, emphasizing the critical role of government policy from both consumer and financial institution perspectives (Deshpande & Hiremath, 2022). Furthermore, the evolution of retail electronic payments and the expanding range of digital financial services—spearheaded by the National Payments Corporation of India (NPCI)—has significantly influenced digital banking trends. According to data from the Financial Services Ministry of India (2024), the total volume of digital transactions across retail and wholesale payment platforms more than doubled between fiscal years 2020–2021 and 2022–2023, reaching approximately 113.9 billion transactions with a total value exceeding INR 2000 trillion (roughly USD 24.14 trillion).

2.1. Perceived ESG of Banks and Online Banking Acceptance

Perceived ESG of banks (PESGB) refers to customers’ assessment of a bank’s environmental, social, and governance practices, and how these practices influence trust, reputation, and the acceptance of banking services (Koh et al., 2022). A growing body of research highlights that ESG performance serves as a critical indicator of financial distress and institutional stability within the banking sector (Chiaramonte et al., 2021; Harymawan et al., 2021). Active engagement in ESG practices helps financial institutions mitigate downside risk (Hoepner et al., 2023), while weak ESG profiles are associated with increased tail risk (Ilhan et al., 2021). To strengthen their reputation and enhance customer trust, banks have increasingly integrated sustainability into their core strategies.

Although banks may not directly contribute to environmental degradation, their indirect impact—through paper consumption, energy usage, and operational practices—can be significant (Korzeb & Samaniego-Medina, 2019). A key approach to promoting sustainable banking involves fostering customer acceptance of IT-enabled banking services (Burhanudin et al., 2021). In alignment with the Reserve Bank of India’s policy (2010), the expansion of digital banking is viewed as beneficial not only for financial performance but also for environmental sustainability, offering opportunities for cost reduction and enhanced operational efficiency (Taneja & Ali, 2021).

From the perspective of ethical consumer behavior, customers are increasingly integrating sustainability considerations into their financial decision-making processes. The functional and environmental attributes of green online banking play a critical role in influencing user adoption behaviors (Lekakos et al., 2014). With the rising level of environmental awareness, consumer preferences are shifting toward banking services that offer not only fast access, reliability, and security but also a demonstrable commitment to ESG principles. Given the well-documented predictive capacity of ESG ratings in reflecting a bank’s financial health and reputational resilience, it is reasonable to infer that consumers increasingly consider a bank’s ESG profile as a key factor in their decision to adopt online banking services. Accordingly, the following research hypothesis is proposed:

Hypothesis 1.

Perceived ESG of banks (PESGB) positively influences consumers’ intention to adopt online banking services (OBA).

2.2. Perceived Ease of Use and Online Banking Acceptance

Davis (1989) proposed the Technology Acceptance Model (TAM), which states that users are more likely to adopt a new technology when they perceive it to be easy to use. In the context of online banking, if customers find the system intuitive and simple to navigate, their likelihood of adoption increases. Empirical studies have consistently demonstrated a positive relationship between perceived ease of use (PEOU) and users’ intention to adopt online banking services (Carranza et al., 2021). PEOU reflects an individual’s confidence in using a particular technology without requiring significant effort. The more user-friendly the technology, the more likely users are to engage with it (Carranza et al., 2021; Ali et al., 2021).

Technological readiness plays a pivotal role in facilitating the adoption of digital financial services. When firms demonstrate a high level of technological preparedness, they reduce user uncertainty and enable smoother transitions to digital platforms. In contrast, underdeveloped or inefficient technological infrastructures can heighten perceived risks and act as barriers to adoption. In the context of online banking, features that enhance usability—such as intuitive user interfaces, seamless navigation, and 24/7 accessibility—significantly contribute to customer satisfaction by offering convenience and flexibility that traditional banking channels often lack (Jebarajakirthy & Shankar, 2021). However, if users perceive online banking as overly complex or difficult to navigate, their likelihood of adoption decreases markedly (Mostafa, 2020). Given the influential role of perceived ease of use in shaping user attitudes, satisfaction, and behavioral intention within digital banking environments, the following hypothesis is proposed:

Hypothesis 2.

Perceived ease of use (PEOU) positively influences customers’ intention to adopt online banking services (OBA).

2.3. Reliability of the Banking System and Online Banking Acceptance

The reliability of the banking system (RBS) plays a critical role in fostering and maintaining strong relationships between customers and financial service providers. Perceived reliability serves as a key proxy for trust, which is closely linked to security in the context of online banking. Customers expect seamless and secure access to digital banking services without concerns over data breaches, fraud, or other vulnerabilities. When systems are perceived as reliable, the attractiveness and adoption of online banking increase. Thus, enhancing user confidence in website security, payment processing, and data protection is essential for encouraging online banking usage.

Customers consistently demand that banking websites be both secure and trustworthy, ensuring the protection of both the information they access and the sensitive data they provide (Alkhaibari et al., 2023). However, security and safety concerns remain major barriers to the widespread adoption of online banking. Several studies have emphasized that website security significantly influences customer attitudes toward digital banking (Sinha & Mukherjee, 2016). In the Indian context, a positive relationship has been found among website security, trust in digital technologies, and customer satisfaction (Kumar et al., 2018). As online banking inherently involves the sharing of personal and financial data, even minor doubts about system integrity can discourage adoption. Previous research highlights that website security concerns, data privacy issues, cyber threats, and fear of financial loss are among the main deterrents to adopting FinTech services such as online banking (Stewart & Jürjens, 2018). Customers’ risk perceptions can be mitigated through strong assurances of trust, privacy, and information security (Roy et al., 2017). In emerging economies, where cybersecurity infrastructure may be less robust, these concerns are even more pronounced. Consequently, trust in system reliability becomes a decisive factor in online banking adoption.

While the construct of RBS was included to capture aspects of customer trust, some of the measurement items (e.g., concerns about advertisements, contextual practicality during the pandemic, and green banking features) do not fully align with the conventional definitions of reliability or security. As such, RBS in this study should be interpreted as reflecting peripheral dimensions of customer experience rather than strict technical reliability. The construct is therefore exploratory in nature, and its inclusion highlights the need for future research to adopt more precise and validated measures of system reliability and security.

Hypothesis 3.

Perceived reliability of the banking system (RBS) positively influences customers’ intention to adopt online banking services (OBA).

2.4. Accessibility of the Banking System and Online Banking Acceptance

Accessibility refers to a user’s ability to physically access an information source, navigate its interface, and effectively retrieve relevant content. In the context of online banking, the accessibility of the banking system (ABS) is a critical factor influencing customer adoption. Previous studies have identified various accessibility challenges across banking websites—for example, significant issues were reported in Portuguese banks (Martins et al., 2010) and across financial institutions in Pakistan (Nouman, 2012). An assessment of 49 public- and private-sector bank websites in India, benchmarked against the Web Content Accessibility Guidelines (WCAG), revealed widespread accessibility violations (Kaur & Dani, 2014).

Website layout and interface design have also been shown to significantly impact user satisfaction (Aboobucker & Bao, 2018). Accessibility not only enhances service efficiency but also encourages online banking usage by simplifying digital interactions (Jiang et al., 2013). Furthermore, users’ prior experience and contextual factors influence their perceptions of website accessibility. In developing countries like India, enhanced website accessibility and simplified user interfaces are especially vital for encouraging online banking adoption.

Hypothesis 4.

The accessibility of the online banking system (ABS) positively influences customers’ intention to adopt online banking (OBA).

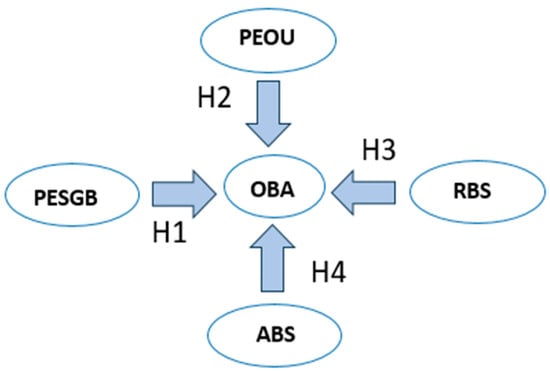

Figure 1 presents the conceptual framework underlying this study, illustrating the hypothesized relationships among key constructs that influence the adoption of online banking. The proposed research model integrates various theoretical and empirical insights to explain how factors such as accessibility, usability, reliability, security, and perceived ESG practices affect customers’ behavioral intentions. Each of these dimensions is grounded in relevant literature and serves as the basis for developing the study’s hypotheses. The subsequent subsections provide a detailed rationale for each hypothesized relationship, drawing on prior empirical findings and theoretical perspectives to substantiate the proposed linkages within the model.

Figure 1.

Research Model of Factors Influencing Online Banking Adoption.

3. Methodology and Analysis Result

3.1. Data Collection

To test the proposed research model and hypotheses concerning the adoption of online banking, a structured survey was conducted in India after the COVID-19 pandemic. The data collection approach was adapted from methodologies used in prior studies (Khan & Alhumoudi, 2022). Primary data were obtained through an online questionnaire administered via Google Forms, utilizing a random sampling technique. The survey was disseminated between January 2023 and April 2023 via email and social media platforms, including WhatsApp, Facebook, and Messenger. Potential respondents were invited to participate regardless of their demographic background or geographic location within India. The survey link was disseminated broadly through email and social media platforms without imposing restrictions on specific user groups. Individuals who accessed the link and satisfied the basic criterion of prior online banking experience were automatically included in the sample. No quotas or stratified procedures were applied, thereby ensuring that all invited individuals had an equal probability of participation. A final screening process was conducted to retain only those respondents with actual online banking experience in the dataset.

To operationalize randomness, the survey link was distributed widely and without restriction across multiple digital channels (email, WhatsApp, Facebook, Messenger) so that any individual with online banking experience had an equal probability of participation. The absence of quotas or stratified restrictions reduced the risk of systematic selection, thereby aligning the process with simple random sampling principles. To further mitigate sampling bias, the survey was intentionally circulated to diverse networks covering different geographic regions and demographic groups in India. Although digital dissemination may inherently overrepresent more digitally literate users, this was addressed by including multiple channels of distribution and by screening only for prior online banking experience, which ensured relevance and minimized self-selection bias. These measures strengthen the validity of the sample and reduce threats to representativeness, while still acknowledging the practical limitations of online survey-based random sampling.

A total of 201 responses were received. However, 45 participants indicated that they had never used online banking services. Consequently, the final sample comprised 156 respondents with online banking experience. While the sample size is relatively small compared to the Indian population, this limitation may be attributed to respondents’ heightened concerns about sharing banking-related information on digital platforms. The prevalence of phishing and scam attempts has fostered a general mistrust of online communications, which likely contributed to the low response rate, particularly via email outreach. Nevertheless, this study addresses a critical issue: the reluctance of many bank customers to adopt online banking despite their regular engagement with conventional banking services. All participants were assured anonymity and took part voluntarily. The questionnaire was designed to capture respondents’ perceptions, attitudes, and intentions regarding the acceptance and use of Internet banking.

The demographic characteristics of the respondents encompassed gender, age group, educational qualification, occupation, type of bank affiliation, and banking experience. The sample consisted of approximately 63.68% male and 36.32% female participants. The largest proportion of respondents (42.29%) belonged to the 30–40 age group, whereas only 4.48% were aged above 55 years. In terms of educational background, a significant share (53.73%) held a postgraduate degree or higher, while 10.95% had qualifications below the undergraduate (college diploma) level. With respect to bank affiliation, 60.70% of respondents were associated with public sector banks. Furthermore, 30.85% of participants reported having more than seven years of experience as bank customers.

3.2. Survey Instrument

Based on the literature review, an online survey was designed and conducted to achieve the objectives of this study. To improve transparency and replicability, we have revised the methodology section to include greater detail on the questionnaire design. The survey consisted of two parts: (1) demographic information (e.g., gender, age, education, occupation, type of bank, and banking experience), and (2) construct measurement items. All items were measured on a 5-point Likert scale (1 = strongly disagree to 5 = strongly agree).

The questionnaire was developed based on established theories and prior empirical research, ensuring the relevance and validity of the measurement items. The study focused on five latent constructs: Perceived Ease of Use (PEOU), Reliability of the Banking System (RBS), Accessibility of the Banking System (ABS), Perceived Environmental, Social, and Governance performance of banks (PESGB), and Online Banking Adoption (OBA). As latent constructs cannot be measured directly, they were operationalized through multiple observed (measured) variables, each representing specific indicators derived from questionnaire responses (Sikdar et al., 2015). By providing these sample items and referencing validated sources, we clarify how respondents were guided to interpret and rate ESG-related attributes. These items reflect both functional (website/environmental features) and ethical (CSR, governance) aspects of ESG, enabling us to operationalize PESGB as a multidimensional construct that influences online banking adoption.

Initially, 25 observed variables were used to represent the five constructs. However, through zero-order Confirmatory Factor Analysis (CFA), two items exhibited weak factor loadings and were excluded from the final model. As a result, the refined measurement model retained 23 observed (measure) variables that demonstrated adequate loadings on their respective constructs, as presented in Table 1. These constructs were confirmed to be significant factors influencing the adoption of online banking in the Indian context. To ensure measurement accuracy and explanatory power, the final model captured the cumulative variance explained by the selected constructs. All measurement items were adapted to align with the study’s objectives and contextual relevance.

Table 1.

Questionnaire Items.

3.3. Data Analysis Techniques

In this study, we employed Structural Equation Modeling (SEM) using AMOS to analyze the relationships among the proposed constructs. The decision to use SEM rather than PLS-SEM was guided by both the theoretical orientation and the data characteristics of our research. SEM is a robust multivariate analytical technique that was employed to validate the measurement and structural models. Specifically, the study adopted a covariance-based SEM (CB-SEM) approach (Gefen et al., 2011) to simultaneously assess the relationships among latent constructs and account for measurement errors. Data analysis was performed using SPSS 20 and AMOS 23.0. The reliability and validity of the constructs were rigorously evaluated, and the structural model was used to estimate path coefficients and assess their statistical significance.

Our model extends the Technology Acceptance Model (TAM) by incorporating the novel construct of Perceived ESG of Banks (PESGB). Since our primary objective was theory confirmation—to examine whether ESG considerations significantly influence online banking adoption—SEM using AMOS was deemed the most appropriate analytical approach. This method enables a rigorous evaluation of measurement validity (both convergent and discriminant), overall model fit indices, and the causal relationships among latent constructs. By contrast, PLS-SEM is more suited to prediction-oriented or exploratory studies, whereas our research sought to confirm and validate theoretically grounded linkages.

Furthermore, our sample size (n = 156) and measurement characteristics satisfied the recommended criteria for SEM. The Kaiser–Meyer–Olkin (KMO) value of 0.883 demonstrated meritorious sampling adequacy, while Cronbach’s Alpha coefficients exceeding 0.70 across all constructs indicated strong reliability. To address concerns of common method bias (CMB), we adopted both procedural and statistical safeguards. Procedurally, we guaranteed respondent anonymity, used clear and neutral wording, and distributed construct items across different sections of the questionnaire to minimize priming effects. Statistically, we conducted Harman’s single-factor test, which revealed that the first factor accounted for only 28.6% of the variance—well below the 50% threshold—indicating that CMB was not a serious concern in this dataset. We also examined variance inflation factor (VIF) values, all of which were below 3.3, further confirming that neither multicollinearity nor CMB posed significant threats to the integrity of our findings.

4. Result

4.1. Measurement Model Analysis

A fundamental component of Structural Equation Modeling (SEM) is the measurement model, which assesses the extent to which observed (manifest) variables accurately reflect their corresponding latent constructs. To evaluate the validity of the measurement model, several tests were conducted, including assessments of reliability, convergent validity, and discriminant validity. Before structural model estimation, the measurement model’s reliability and validity were examined to ensure a satisfactory model fit. Internal consistency was assessed using Cronbach’s Alpha (CA), Composite Reliability (CR), and standardized factor loadings. The model exhibited strong internal consistency, with a Cronbach’s Alpha of 0.9018 and a Kaiser–Meyer–Olkin (KMO) measure of sampling adequacy of 0.883. A KMO value exceeding 0.80 is regarded as meritorious, indicating that the data is highly suitable for factor analysis (Kaiser, 1974).

A widely accepted threshold for factor loadings is 0.50 or higher, which is generally regarded as indicative of strong construct validity, as supported by established guidelines in psychometric and SEM literature (Hair et al., 2010). Following the confirmation of data normality and internal consistency, the measurement model underwent empirical validation. The results demonstrated that all constructs exhibited adequate and acceptable validity under established standards (Table 2). In terms of reliability, Cronbach’s Alpha (CA) values for all constructs exceeded the commonly accepted threshold of 0.70 (Hair et al., 2010), indicating strong internal consistency. Specifically, CA values were consistently above 0.70, reflecting satisfactory to high reliability across the scale. Additionally, the critical ratio (C.R.) values for all measurement items ranged from 4.422 to 8.350, indicating that the factor loadings were statistically significant at p < 0.01. These findings confirm that the observed variables reliably represent their corresponding latent constructs.

Table 2.

Model Estimates, Factor-Loading, and Reliability.

Although Table 3 reports some Average Variance Extracted (AVE) values slightly below the recommended threshold of 0.50, prior SEM literature suggests that convergent validity can still be considered adequate when Composite Reliability (CR) exceeds 0.70, as this demonstrates that the constructs capture sufficient variance relative to error (Fornell & Larcker, 1981; Hair et al., 2010). In this study, all constructs satisfied the CR requirement, supporting convergent validity despite marginally lower AVE values. Importantly, the CR value of 1.250 originally reported for the Reliability of the Banking System (RBS) was identified as a typographical error. The corrected CR value for RBS is 0.825, which falls well within the accepted range of 0.70–0.95. This correction ensures that all constructs meet the recommended criteria for both convergent validity and composite reliability, thereby strengthening the robustness of the measurement model.

Table 3.

AVE, CR, and correlations.

In our study, multiple Likert-type items were aggregated into latent constructs, which are widely treated as continuous variables in behavioral, social, and management research (Carifio & Perla, 2008; Norman, 2010). Under these conditions, the use of Pearson correlation is appropriate, as the summed or averaged Likert scores approximate interval-level data and more closely satisfy the assumptions of parametric analysis than individual ordinal items. Moreover, employing Pearson correlation ensures that our results remain directly comparable with prior literature and enhances the interpretability and practical relevance of the findings for both academic and practitioner audiences.

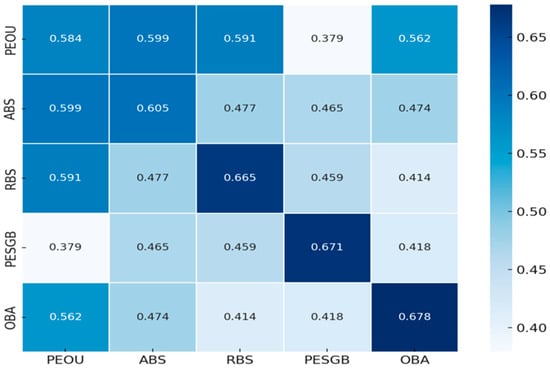

Figure 2 presents the Pearson correlation matrix, illustrating the strength and direction of relationships among the five key constructs: Perceived Ease of Use (PEOU), Accessibility (ABS), Reliability of Banking System (RBS), Perceived ESG of Banks (PESGB), and Online Banking Adoption (OBA). All correlation coefficients are positive, indicating that as one variable increases, the others tend to increase as well. This suggests a consistent pattern of mutually reinforcing relationships among the constructs, reinforcing the theoretical structure of the extended Technology Acceptance Model (TAM) proposed in this study.

Figure 2.

Pearson Correlation Matrix.

The strongest observed correlation is between PESGB and OBA (r = 0.678). This highlights the crucial role that perceptions of a bank’s ESG performance play in encouraging the adoption of digital banking services. In today’s sustainability-driven landscape, customers may be more likely to engage with banks that demonstrate strong environmental, social, and governance values. Similarly, the second strongest relationship is between PEOU and ABS (r = 0.599), which suggests that when online banking systems are perceived as easy to use, users also tend to find them more accessible. These two dimensions appear to reinforce each other, emphasizing the importance of user-centered design.

On the other end, the weakest correlation is between PEOU and PESGB (r = 0.379), indicating that while ESG perception contributes to digital banking adoption, it is not strongly linked to ease of use perceptions. This may reflect users’ tendency to evaluate ESG factors and usability through different cognitive pathways—one aligned with ethical or social concerns, and the other with practical and functional aspects. Overall, the correlation matrix validates the internal consistency of the model and suggests several avenues for further investigation, particularly the synergistic effects of ESG perception and system usability on user behavior in the context of digital banking.

Following the confirmation of the reliability and validity of individual constructs and the overall measurement model, the study proceeded to evaluate the model’s overall fitness. The goodness-of-fit of the measurement model was assessed using a range of standard indices, as reported in Table 4. These include the Goodness-of-Fit Index (GFI), Adjusted Goodness-of-Fit Index (AGFI), Comparative Fit Index (CFI), Incremental Fit Index (IFI), and Root Mean Square Error of Approximation (RMSEA). All indices met their respective cut-off criteria, indicating a satisfactory model fit (Hair et al., 2010). Specifically, the model yielded the following values: CMIN/df = 1.936 (p = 0.000), CFI = 0.864, GFI = 0.805, AGFI = 0.800, RMSEA = 0.078, and IFI = 0.867, which collectively demonstrate acceptable fit under established guidelines (Fornell & Larcker, 1981). These results affirm the validity and appropriateness of the overall measurement model in capturing bank customers’ adoption of online banking services during the pandemic.

Table 4.

Model Fit.

4.2. Structural Model Analysis

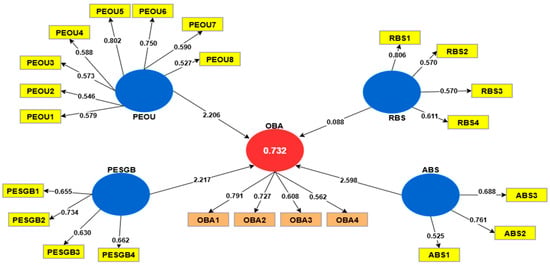

Upon completing the validity, reliability, and goodness-of-fit assessments, the structural model was employed to test the four research hypotheses concerning the adoption of online banking in India during the study period. The model parameters were estimated using Structural Equation Modeling (SEM), and the fully standardized path coefficients were obtained through the maximum likelihood estimation method in AMOS (Figure 3). The structural model demonstrated an acceptable fit, with all fit indices falling within recommended thresholds, thus validating the overall model adequacy. The relationships between online banking adoption (OBA) and the proposed predictors—Perceived ESG of Banks (PESGB), Perceived Ease of Use (PEOU), Accessibility of the Banking System (ABS), and Reliability of the Banking System (RBS)—were evaluated based on their standardized path coefficients (β) and significance levels (Table 5). These coefficients reflect the strength and direction of the hypothesized effects, and should be both substantial and theoretically consistent.

Figure 3.

Structural Model Analysis.

Table 5.

The Result of Hypotheses.

Among the four hypothesized paths, three were found to be statistically significant: PESGB → OBA (β = 2.217, p < 0.001), PEOU → OBA (β = 2.206, p < 0.001), and ABS → OBA (β = 2.598, p = 0.000), thereby supporting Hypotheses H1, H2, and H4. These findings suggest that customers’ perceptions of ESG practices, ease of use, and accessibility are critical factors influencing their intention to adopt online banking services. In contrast, the path from RBS to OBA (β = 0.088, p = 0.757) was not statistically significant, indicating that Hypothesis H3 is not supported. This finding should be interpreted with caution. As noted earlier, the measurement items for RBS did not capture the core aspects of reliability and security emphasized in the broader literature. Instead, they reflected contextual perceptions during the pandemic and green banking considerations. Consequently, the non-significant relationship may reflect limitations in construct validity rather than a definitive absence of influence. Future research should refine the operationalization of RBS by employing validated measures that more accurately capture reliability and security in online banking. Overall, the findings suggest that the key drivers of online banking usage in India—especially during and following the COVID-19 pandemic—include the convenience of access, rapid money transfers, and the ability to conduct essential transactions such as online shopping and medical procurement.

4.3. Discussion

Owing to the rapid advancement of financial technology, customers now have more diversified and convenient access to financial services than ever before. In particular, the Government of India has actively promoted digital financial transactions through initiatives such as Digital India (2022). To address the research objectives, this study extends the Technology Acceptance Model (TAM) by incorporating Perceived Ease of Use (PEOU), Reliability of the Banking System (RBS), Accessibility of the Banking System (ABS), and a novel construct—Perceived ESG of Banks (PESGB)—to investigate their influence on customers’ adoption of online banking in India. Structural Equation Modeling (SEM) was employed to evaluate the proposed hypotheses.

The empirical findings indicate that Perceived Ease of Use (PEOU) has a significant and positive effect on customers’ intention to adopt online banking, aligning with previous research (Carranza et al., 2021). Similarly, Sepasgozar et al. (2020) emphasized that both perceived ease of use and perceived usefulness directly shape users’ attitudes toward technology adoption, particularly in the context of Iranian banks. Numerous studies have highlighted the critical role of PEOU in facilitating technology acceptance (Chauhan et al., 2019), with its relevance especially pronounced in the Indian banking sector. The ability to perform financial transactions at any time and from any location has substantially enhanced customers’ willingness to engage with online banking platforms. Although perceived usefulness has often been identified as a stronger determinant of adoption than ease of use among Indian users, the influence of PEOU remains significant (Sudarsono et al., 2020).

The COVID-19 pandemic further accelerated this shift, profoundly altering consumer behavior and increasing dependence on digital financial services. In Indonesia, a marked surge in online banking adoption was observed following the pandemic, a trend similarly reflected in Malaysia, where perceived usefulness strongly influenced customers’ engagement with digital banking services (Ghani et al., 2022).

Traditionally, customers have expressed concerns regarding the security and privacy of online banking. Trust in website integrity, secure transaction processes, and robust data protection mechanisms is considered essential for mitigating perceived risks. However, the findings of the present study reveal that the Reliability of the Banking System (RBS) does not have a significant influence on customers’ adoption of online banking in India, which diverges from the results of earlier studies (Singh & Srivastava, 2020). This suggests that perceived risk may no longer play a decisive role in shaping online banking behavior. Recent research indicates that during periods of crisis, such as the COVID-19 pandemic, security concerns were often outweighed by the urgency of functionality and service accessibility (Al Nawayseh, 2020). In particular, consumers prioritized ease of access and service efficiency over potential security threats, especially under conditions requiring social distancing and heightened dependence on digital financial services.

Consistent with previous research (Aboobucker & Bao, 2018), the present study confirms that Accessibility of the Banking System (ABS) exerts a significant positive influence on customers’ acceptance of online banking. Historically, barriers such as limited digital infrastructure, low digital literacy, and lack of awareness have impeded the widespread use of online banking in India (Burhanudin et al., 2021). However, the growing penetration of personal digital devices—such as smartphones, tablets, and laptops—has substantially enhanced customers’ ability to engage with banking services remotely. To further facilitate adoption, banks must prioritize the development of seamless and user-friendly platforms, ensuring that digital interfaces are intuitive, responsive, and supported by clear and accessible content. Eliminating technical and informational barriers is essential for improving user experience and encouraging broader participation in digital banking services.

Moreover, financial technology—including online banking—has begun to play a critical role in advancing environmental and social responsibility. Environmental, Social, and Governance (ESG) factors are gaining prominence as integral components of digital transformation strategies in the banking sector. Prior studies have demonstrated that ESG scores are reliable indicators of financial stability and institutional resilience, particularly during periods of crisis (Harymawan et al., 2021). A strong ESG performance not only signals a bank’s commitment to sustainable and ethical practices but also enhances its operational efficiency and corporate reputation through digital innovation.

Yuen et al. (2022) found that banks with higher ESG ratings were more successful in attracting ethically minded investors and clients during the COVID-19 pandemic, underscoring the growing relevance of ESG in customer decision-making. While direct empirical studies examining the impact of Perceived ESG of Banks (PESGB) on online banking adoption remain limited, existing evidence suggests that customers are increasingly influenced by a bank’s environmental and social initiatives (Taneja & Ali, 2021). This heightened awareness supports the expansion of IT-driven green banking practices, as consumers become more inclined to engage with institutions that align with their sustainability values.

This study provides the first empirical evidence that perceived ESG performance significantly influences the adoption of online banking in India. This finding underscores the rising importance of environmental and social consciousness in shaping customer perceptions, preferences, and behavioral intentions. ESG initiatives not only advance long-term sustainability objectives but also serve as strategic drivers of digital engagement and customer trust. Al Amosh and Khatib (2022) further emphasized the positive relationship between ESG performance and financial outcomes, observing that banks with strong ESG commitments tend to experience higher website traffic and enhanced customer loyalty. These insights suggest that integrating ESG principles into digital banking strategies can yield both reputational and economic benefits.

5. Conclusions

5.1. Theoretical Contributions

This study enhances the theory by incorporating Environmental, Social, and Governance (ESG) factors into the Technology Acceptance Model (TAM). It demonstrates that growing environmental and social awareness influences the adoption of digital banking. Customers are increasingly prioritizing eco-friendly practices, such as opting for digital statements, embracing paperless services, and supporting green banking innovations. This trend signifies a broader commitment to sustainability-driven consumption, establishing ESG not only as an important reputational factor but also as a key driver of technology acceptance.

The findings suggest that customers who are more informed and concerned about their banks’ ESG performance are significantly more inclined to adopt online banking. This has important implications for banks striving to align their operational strategies with sustainability goals. Financial institutions can further enhance ESG integration by adopting centralized ESG data systems to improve reporting accuracy and facilitate strategic decision-making (Yadav et al., 2024). Such measures allow banks to track ESG performance holistically and ensure alignment with broader sustainability objectives.

Furthermore, financial technology—particularly online banking—has emerged as a critical enabler in addressing contemporary environmental and social challenges. Although banks may not directly produce greenhouse gas emissions, they contribute indirectly through financing and lending activities that support carbon-intensive industries (Galletta et al., 2022). The advancement and integration of digital financial technologies offer significant potential to mitigate environmental impact by reducing the reliance on paper-based processes, promoting energy-efficient operations, and facilitating low-carbon financial services. Moreover, such innovations can strengthen ESG-oriented practices, enabling banks to align more closely with sustainability goals and drive responsible investment and operational strategies.

With younger generations becoming increasingly comfortable with digital tools, the post-pandemic period presents a timely opportunity for the Indian banking sector to accelerate modernization and promote digital transformation. In conclusion, despite persistent challenges, the future of online banking in India remains promising. As customer behavior evolves and sustainability gains traction, banks that proactively adapt to technological advancements and shifting customer expectations will be best positioned for long-term success and resilience in a competitive financial ecosystem.

5.2. Management Implications

The rapid integration of digital technology into both professional and everyday life in India—supported by government initiatives to expand digital transactions—has accelerated the adoption of online banking. This study offers practical insights for banks, policymakers, and educators regarding the key factors influencing customer acceptance of online banking services during and after the COVID-19 pandemic. The findings underscore the importance of developing robust, user-friendly, and accessible digital platforms, as PEOU and ABS emerged as significant drivers of adoption. To strengthen trust and promote broader usage, banks should provide clear multi-channel guidance and self-learning resources on safe and effective e-banking practices, equip staff with targeted technical training to support customers and enhance confidence, and design systems that are intuitive, seamless, and responsive to user needs.

The study also highlights the growing role of Environmental, Social, and Governance (ESG) concerns in influencing customer behavior. Banks that integrate and promote ESG initiatives—such as digital statements, green banking services, and transparent sustainability practices—can strengthen reputation and customer loyalty. Finally, while system reliability was not a significant predictor of adoption in this study, cybersecurity remains essential. Strong data protection, redundant safety mechanisms, and transparent risk management are critical to maintaining customer trust. In conclusion, banks that align digital transformation with usability, accessibility, and ESG values—while maintaining strong security—will be better positioned to enhance customer satisfaction, expand financial inclusion, and remain competitive in the evolving financial ecosystem.

5.3. Limitations and Future Research

This study seeks to identify the key drivers of online banking adoption and its perceived utility during and after the COVID-19 pandemic in a developing economy such as India. While the study offers meaningful contributions to the understanding of financial technology acceptance, it is not without limitations.

First, the most significant limitation lies in the relatively small sample size of bank customers surveyed, which is insufficient when compared to the vast banking population in India. This limitation affects the generalizability of the findings. Future studies should aim to include a larger and more diverse sample to enhance the external validity of the results (Amsaveni & Kanagarathinam, 2017). Another limitation concerns the construct of RBS. Although included in the analysis, the measurement items did not fully capture the multidimensionality of reliability and security. Future studies should refine this construct with validated indicators that distinguish between service reliability, accessibility, and security to avoid construct misspecification and enhance theoretical robustness.

Second, the geographical distribution of respondents is skewed, with a majority drawn from the North-East region of India. Given the country’s vast socio-economic diversity, this regional concentration may limit the representativeness of the findings. As socioeconomic, infrastructural, and digital literacy conditions vary widely across different regions, further research should explore regional differences to draw more comprehensive conclusions (Sikdar et al., 2015).

Furthermore, while this study identifies valuable trends in online banking adoption, the representativeness of the findings is constrained by the regional concentration of the sample and the absence of direct comparison with national banking usage statistics. Although participants were drawn from diverse demographic groups, the lack of benchmarking against official datasets from the Reserve Bank of India or national surveys limits the ability to generalize results to the wider Indian banking population. Future research should incorporate stratified or quota-based sampling aligned with national-level usage statistics to enhance external validity and provide a more comprehensive picture of adoption patterns across India’s socio-economic and geographic spectrum.

Third, demographic factors such as gender, age, education level, occupation, and banking experience were not explicitly analyzed in this study. Prior research suggests that these characteristics can significantly influence online banking behavior (Burhanudin et al., 2021). Hence, future research should examine how demographic variables mediate or moderate the adoption of online banking services. Moreover, it is equally important to identify the type of device used—such as smartphones, laptops, personal computers, or tablets—as these may influence user experience and adoption rates.

Online banking plays a critical role in enhancing the operational efficiency and service quality of financial institutions, particularly within the banking sector. Unlike traditional offline banking, online banking eliminates the need for physical paperwork and enables banks to offer a broader range of financial services. This digital shift not only reduces operating costs but also contributes to improved ESG (Environmental, Social, and Governance) performance. However, the findings of this study reveal that approximately 22% of respondents had never utilized online banking services, despite being regular users of banking facilities. This indicates a significant limitation in the reach and inclusivity of digital banking in India.

While online banking provides customers with round-the-clock access to financial services, it also serves as a strategic platform for banks to gather insights into customer preferences and deliver more tailored services. To address the existing adoption gap, banking institutions must prioritize the development of online platforms that are user-friendly, flexible, personalized, and accessible. Although our study incorporated a construct labeled as Reliability of the Banking System (RBS), we recognize that some of the measurement items may not have fully captured the multidimensionality of reliability and security. Future research should develop more refined instruments that distinguish between reliability, accessibility, and security to better reflect their unique contributions to online banking adoption.

Author Contributions

Conceptualization, C.-W.L. and S.B.; Methodology, S.B.; Software, S.B.; Validation, S.B. and P.-H.C.; Formal analysis, P.-H.C.; Investigation, F.-Y.L.; Resources, P.-H.C.; Data Curation, F.-Y.L.; Writing—original draft preparation, S.B.; Writing—review and editing, C.-W.L.; Supervision, C.-W.L.; Funding Acquisition, C.-W.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki and approved by the Institutional Review Board of Chung Yuan Christian University (No. 2025500112, 15 March 2025).

Informed Consent Statement

All participants provided informed consent prior to their involvement in this study. Consent has also been obtained from the volunteers for the publication of this paper.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Acknowledgments

We would like to thank all participants in this study.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Aboobucker, I., & Bao, Y. (2018). What obstruct customer acceptance of Internet banking? Security and privacy, risk, trust, and website usability, and the role of moderators. The Journal of High Technology Management Research, 29, 109–123. [Google Scholar] [CrossRef]

- Akhter, M., Baabdullah, A., Dutta, S., Kumar, V., & Dwivedi, Y. K. (2018). Consumer adoption of mobile banking services: An empirical examination of factors according to adoption stages. Journal of Retailing and Consumer Services, 43, 54–67. [Google Scholar] [CrossRef]

- Al Amosh, H., & Khatib, S. F. (2022). Websites visits and financial performance for GCC banks: The moderating role of environmental, social and governance performance. Global Business Review, 13, 09721509221109576. [Google Scholar] [CrossRef]

- Ali, Q., Parveen, S., Yaacob, H., & Zaini, Z. (2021). Cardless banking system in Malaysia: An extended TAM. Risks, 9, 41. [Google Scholar] [CrossRef]

- Alkhaibari, M., Albarq, A. N., Elrayah, M., Moustafa, M. A., Ghaleb, M., & Abbas, A. (2023). The impact of e-banking service quality on the sustainable customer satisfaction: Evidence from the Saudi Arabia commercial banking sector. International Journal of Data and Network Science, 7, 1153–1164. [Google Scholar] [CrossRef]

- Al Nawayseh, M. K. (2020). Fintech in COVID-19 and beyond: What factors are affecting customers’ choice of fintech applications? Journal of Open Innovation: Technology, Market, and Complexity, 6, 153. [Google Scholar] [CrossRef]

- Al-Sharafi, M. A., Arshah, R. A., Herzallah, F. A., & Alajmi, Q. (2017). The effect of perceived ease of use and usefulness on customers intention to use online banking services: The mediating role of perceived trust. International Journal of Innovative Computing, 7, 9–14. [Google Scholar]

- Amsaveni, T., & Kanagarathinam, M. (2017). A study on consumer awareness of e-banking services in public sector banks in Coimbatore. International Journal of Advance Research and Innovative Ideas in Education, 3, 908–916. [Google Scholar]

- Bătae, O. M., Dragomir, V. D., & Feleagă, L. (2020). Environmental, social, governance (ESG), and financial performance of European banks. Journal of Accounting and Management Information Systems, 19, 480–501. [Google Scholar] [CrossRef]

- Burhanudin, B., Ronny, R., & Sihotang, E. T. (2021). Consumer guilt and green banking services. International Journal of Consumer Studies, 45, 38–53. [Google Scholar] [CrossRef]

- Carifio, J., & Perla, R. (2008). Inciting striving speech (i.e., BS) and imperfect dialogical exchanges is exactly what is needed in Higher Education today. Journal of Social Sciences, 4, 68–74. [Google Scholar] [CrossRef]

- Carranza, R., Díaz, E., Sánchez-Camacho, C., & Martín-Consuegra, D. (2021). E-banking adoption: An opportunity for customer value co-creation. Frontiers in Psychology, 11, 621248. [Google Scholar] [CrossRef] [PubMed]

- Chauhan, V., Yadav, R., & Choudhary, V. (2019). Analyzing the impact of consumer innovativeness, and perceived risk in Internet banking adoption: A study of Indian consumers. International Journal of Bank Marketing, 37, 323–339. [Google Scholar] [CrossRef]

- Chawla, D., & Joshi, H. (2018). The moderating effect of demographic variables on mobile banking adoption: An empirical investigation. Global Business Review, 19(3_suppl), S90–S113. [Google Scholar] [CrossRef]

- Chen, Y. H., & Barnes, S. (2007). Initial trust and online buyer behavior. Industrial Management & Data Systems, 107, 21–36. [Google Scholar]

- Chiaramonte, L., Dreassi, A., Girardone, C., & Piserà, S. (2021). Do ESG strategies enhance bank stability during financial turmoil? Evidence from Europe. The European Journal of Finance, 28, 1173–1211. [Google Scholar] [CrossRef]

- Daragmeh, A., Sági, J., & Zéman, Z. (2021). Continuous Intention to use E-wallet in the context of the COVID-19 pandemic: Integrating the Health Belief Model (HBM) and Technology Continuous Theory (TCT). Journal of Open Innovation: Technology, Market, and Complexity, 7, 132. [Google Scholar] [CrossRef]

- Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13, 319–339. [Google Scholar] [CrossRef]

- Deshpande, S. A., & Hiremath, B. M. (2022). E banking in India challenges and opportunities. International Journal of Creative Research Thoughts, 10, b588–b591. [Google Scholar]

- Dicuonzo, G., Palmaccio, M., & Shini, M. (2024). ESG, governance variables and Fintech: An empirical analysis. Research in International Business and Finance, 69, 102205. [Google Scholar] [CrossRef]

- El Khoury, R., Nasrallah, N., Hussainey, K., & Assaf, R. (2023). Spillover analysis across FinTech, ESG, and renewable energy indices before and during the Russia–Ukraine war: International evidence. Journal of International Financial Management & Accounting, 34, 279–317. [Google Scholar]

- Felix, P. (2014). Prospects and challenges of electronic banking in Ghana: The case of Zenith Bank, Sunyani. International Journal of Advances in Management, Economics and Entrepreneurship, 1, 6–14. [Google Scholar]

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18, 39–50. [Google Scholar] [CrossRef]

- Galeone, G., Ranaldo, S., & Fusco, A. (2024). ESG and FinTech: Are they connected? Research in International Business and Finance, 69, 102225. [Google Scholar] [CrossRef]

- Galletta, S., Mazzù, S., & Naciti, V. (2022). A bibliometric analysis of ESG performance in the banking industry: From the current status to future directions. Research in International Business and Finance, 62, 101684. [Google Scholar] [CrossRef]

- Gefen, D., Rigdon, E. E., & Straub, D. (2011). Editor’s comments: An update and extension to SEM guidelines for administrative and social science research. MIS Quarterly, 35, iii–xiv. [Google Scholar] [CrossRef]

- Ghani, E. K., Ali, M. M., Mus, M. N. R., & Omonov, A. A. (2022). The effect of perceived usefulness, reliability, and COVID-19 pandemic on digital banking effectiveness: Analysis using technology acceptance model. Sustainability, 14, 11248. [Google Scholar] [CrossRef]

- Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis (7th ed.). Pearson. [Google Scholar]

- Harymawan, I., Putra, F. K. G., Fianto, B. A., & Ismail, W. A. W. (2021). Financially distressed firms: Environmental, social, and governance reporting in Indonesia. Sustainability, 13, 10156. [Google Scholar] [CrossRef]

- Hoepner, A. G. F., Oikonomou, I., Sautner, Z., Starks, L. T., & Zhou, X. (2023). ESG shareholder engagement and downside risk. European Corporate Governance Institute-Finance Working Paper No. 671/2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2874252 (accessed on 15 January 2024).

- Ilhan, E., Sautner, Z., & Vilkov, G. (2021). Carbon tail risk. The Review of Financial Studies, 34, 1540–1571. [Google Scholar] [CrossRef]

- Jebarajakirthy, C., & Shankar, A. (2021). Impact of online convenience on mobile banking adoption intention: A moderated mediation approach. Journal of Retailing and Consumer Services, 58, 102323. [Google Scholar] [CrossRef]

- Jiang, L., Yang, Z., & Jun, M. (2013). Measuring consumer perceptions of online shopping convenience. Journal of Service Management, 24, 191–214. [Google Scholar] [CrossRef]

- Kaiser, H. F. (1974). An index of factorial simplicity. Psychometrika, 39, 31–36. [Google Scholar] [CrossRef]

- Kaur, A., & Dani, D. (2014). Banking websites in India: An accessibility evaluation. CSI Transactions on ICT, 2, 23–34. [Google Scholar] [CrossRef]

- Keskar, M. Y., & Pandey, N. (2018). Internet banking: A review (2002–2016). Journal of Internet Commerce, 17, 310–323. [Google Scholar] [CrossRef]

- Khan, M. A., & Alhumoudi, H. A. (2022). Performance of E-banking and the mediating effect of customer satisfaction: A structural equation model approach. Sustainability, 14, 7224. [Google Scholar] [CrossRef]

- Khatun, M. N., Mitra, S., & Sarker, M. N. I. (2021). Mobile banking during COVID-19 pandemic in Bangladesh: A novel mechanism to change and accelerate people’s financial access. Green Finance, 3, 253–267. [Google Scholar] [CrossRef]

- Koh, H. K., Burnasheva, R., & Suh, Y. G. (2022). Perceived ESG (environmental, social, governance) and consumers’ responses: The mediating role of brand credibility, Brand Image, and perceived quality. Sustainability, 14, 4515. [Google Scholar] [CrossRef]

- Korzeb, Z., & Samaniego-Medina, R. (2019). Sustainability performance: A comparative analysis in the polish banking sector. Sustainability, 11, 653. [Google Scholar] [CrossRef]

- Kumar, A., Adlakaha, A., & Mukherjee, K. (2018). The effect of perceived security, and grievance redressal on continuance intention to use M-wallets in a developing country. International Journal of Bank Marketing, 36, 1170–1189. [Google Scholar] [CrossRef]

- Lekakos, G., Vlachos, P., & Koritos, C. (2014). Green is good but is usability better? Consumer reactions to environmental initiatives in e-banking services. Ethics and Information Technology, 16, 103–117. [Google Scholar] [CrossRef]

- Martins, J., Gonçalves, R., Mamede, H., Pereira, J., & Martins, M. (2010, November 25–26). Web accessibility 2.0—Web accessibility status of the banks with activities in Portugal. DSAI2010—3rd International Conference on Software Development for Enhancing Accessibility and Fighting Info-Exclusion 2010, Oxford, UK. [Google Scholar]

- Mostafa, R. B. (2020). Mobile banking service quality: A new avenue for customer value co-creation. International Journal of Bank Marketing, 38, 1107–1132. [Google Scholar] [CrossRef]

- Norman, G. (2010). Likert scales, levels of measurement and the “laws” of statistics. Advances in Health Sciences Education, 15, 625–632. [Google Scholar] [CrossRef] [PubMed]

- Norrestad, F. (2022). Internet banking users worldwide in 2020 with forecasts to 2024, by region. Available online: https://www.statista.com/statistics/1228757/online-banking-users-worldwide (accessed on 11 December 2023).

- Nouman, N. (2012). Website content accessibility of banks websites in Pakistan using WCAG 2.0. ARPN Journal of Systems and Software, 2, 23–26. [Google Scholar]

- Puriwat, W., & Tripopsakul, S. (2021). Explaining an adoption and continuance intention to use contactless payment technologies: During the COVID-19 pandemic. Emerging Science Journal, 5, 85–95. [Google Scholar] [CrossRef]

- Roy, S. K., Balaji, M. S., Kesharwani, A., & Sekhon, H. (2017). Predicting Internet banking adoption in India: A perceived risk perspective. Journal of Strategic Marketing, 25, 418–438. [Google Scholar] [CrossRef]

- Ruiz-Real, J. L., Nievas-Soriano, B. J., & Uribe-Toril, J. (2020). Has Covid19 gone viral? An overview of research by subject area. Health Education & Behavior, 47, 861–869. [Google Scholar]

- Sepasgozar, F. M. E., Ramzani, U., Ebrahimzadeh, S., Sargolzae, S., & Sepasgozar, S. (2020). Technology acceptance in e-Governance: A case of a finance organization. Journal of Risk and Financial Management, 13, 138. [Google Scholar] [CrossRef]

- Shkolnyk, I., Kozmenko, S., Kozmenko, O., Orlov, V., & Shukairi, F. (2021). Modeling of the financial system’s stability on the example of Ukraine. Equilibrium Quarterly Journal of Economics and Economic Policy, 16, 377–411. [Google Scholar] [CrossRef]

- Sikdar, P., Kumar, A., & Makkad, M. (2015). Internet banking adoption: A factor validation and satisfaction causation study in the context of Indian banking customers. International Journal of Bank Marketing, 33, 760–785. [Google Scholar] [CrossRef]

- Singh, S., & Srivastava, R. K. (2020). Understanding the intention to use mobile banking by existing online banking customers: An empirical study. Journal of Financial Services Marketing, 25, 86–96. [Google Scholar] [CrossRef]

- Sinha, I., & Mukherjee, S. (2016). Acceptance of technology, related factors in use of off branch e-banking: An Indian case study. The Journal of High Technology Management Research, 27, 88–100. [Google Scholar] [CrossRef]

- Smriti, A., & Kumar, R. (2021). Present status of E-banking in India: Challenges and opportunities. The International Journal of Creative Research Thoughts, 9, a556–a561. [Google Scholar]

- Stewart, H., & Jürjens, J. (2018). Data security and consumer trust in FinTech innovation in Germany. Information and Computer Security, 26, 109–128. [Google Scholar] [CrossRef]

- Sudarsono, H., Nugrohowati, R. N. I., & Tumewang, Y. K. (2020). The effect of Covid-19 pandemic on the adoption of internet banking in Indonesia: Islamic bank and conventional bank. The Journal of Asian Finance, Economics and Business, 7, 789–800. [Google Scholar] [CrossRef]

- Taneja, S., & Ali, L. (2021). Determinants of customers intentions towards environmentally sustainable banking: Testing the structural model. Journal of Retailing and Consumer Services, 59, 102418. [Google Scholar] [CrossRef]

- Verma, P. K., & Tanwar, A. (2022). Impact of COVID-19 on e-banking in India. Shodhsamhita, 8, 21–33. [Google Scholar]

- Yadav, R. A., Premalatha, K. P., & Patil, S. (2024). Advancing sustainable banking and financial inclusion in India through ESG integration in technological disruptions. Community Practitioner, 20, 260–272. [Google Scholar]

- Yoon, C. (2010). Antecedents of customer satisfaction with online banking in China: The effects of experience. Computers in Human Behavior, 26, 1296–1304. [Google Scholar] [CrossRef]

- Yuen, M. K., Ngo, T., Le, T. D., & Ho, T. H. (2022). The environment, social and governance (ESG) activities and profitability under COVID-19: Evidence from the global banking sector. Journal of Economics and Development, 24, 345–364. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).