Abstract

The vulnerability of the global financial system to systemic risk-related adverse events has become more evident in recent years, as shown by the 2008 financial crisis and the global pandemic. This study examines systemic risk and its contributing factors using network analysis to understand how contagion occurs. To achieve this, a bibliometric analysis was conducted using a cluster analysis of publications from 2020 to 2025. The bibliometric analysis covered 1642 papers related to systemic risk and financial transmission networks. The CiteSpace software was used to identify seven thematic clusters. The results show the relevance of topological analysis in explaining the connection between institutions and the spread of risk. There is also a clear tradition in the literature of applying the DY spillover index, which captures the temporal dynamics of systemic connectivity. Multilayer networks stand out as a trend in recent studies, as they have the potential to represent different types of relationships simultaneously between nodes. Finally, the literature pays attention to systemic connectivity problems during crises, which can amplify volatility and generate forced asset sales, highlighting the need to use advanced VAR-type models to anticipate risk transmission and guide macroprudential management.

1. Introduction

Recent international events, such as the subprime crisis and the pandemic, have raised concerns about the stability of the global financial system. It has become evident that the financial system is vulnerable and that this vulnerability could have significant repercussions on the real economy. Shang et al. (2024) point out that banking system fragility threatens the industry, hinders sustainable economic development, and can lead to crises.

Sun (2023) suggests that the global crisis has demonstrated the complexity of the financial structure of modern economies, which constitutes a source of systemic risk with severe potential consequences for the financial system through feedback effects and contagion mechanisms. During the crisis, organizations such as the Bank for International Settlements (BIS) and the International Monetary Fund (IMF) warned that systemic risk could severely impact the real economy. In this sense, financial regulators prioritized addressing it (Bian et al. 2020).

Systemic risk can be understood, according to Schwarcz (2008), as the possibility that an economic shock, such as the failure of a market or institution, will trigger, either through panic or other means, a chain reaction of market or institutional collapse, or a succession of significant losses for financial institutions. The result is an increase in the cost of capital or a reduction in its availability, often evidenced by substantial volatility in financial market prices. According to Hurd (2016), this definition captures the essence of systemic risk and recognizes the fact that a systemic crisis can also cause damage outside the network.

Caccioli et al. (2018) argue that the financial system is a complex network of banks, hedge funds, and other financial institutions connected by visible and invisible links. These agents continuously buy and sell financial assets within a global network of institutions, facilitating the circulation of capital and financing the business sector, households, and the state.

However, this set of interconnections also induces systemic risk, which Caccioli et al. (2018) define as “the occurrence of a collapse of the financial system” (p. 82). For example, during the crisis, European banks’ exposure to U.S. securitized assets resulted in a 50% loss in capitalization (Markose et al. 2021). This demonstrates how global financial interconnection can lead to instability in the financial system and systemic risk.

Some studies have mapped financial networks to quantify the risk of systemic collapse. These networks constitute complex systems of interdependent institutions that can generate systemic risk (Jackson and Pernoud 2021). Eisenberg-Noe was the first to model interbank networks to study defaults and cascading failures (Banerjee et al. 2025). Since then, research incorporating network metrics and contagion models has demonstrated the usefulness of measuring and predicting systemic risk (Jackson and Pernoud 2021).

This is evident in situations such as the collapse of Lehman Brothers in 2008 and the bailout of AIG, which show how feedback in interconnected networks amplifies systemic shocks (Teply and Klinger 2019). In this context, network theory provides a rigorous analytical framework for studying systemic risk and financial interconnections (Gao 2022).

The collapse of Lehman Brothers in 2008 and the need for a bailout of American International Group (AIG) demonstrate how feedback in interconnected networks can amplify the impact on the financial system. The undesirable effects of systemic risk, interconnection, and shock propagation have attracted considerable research interest from academics (Teply and Klinger 2019).

These studies are important because financial system stability is crucial for the functioning of the real economy and, in general, for the well-being of society. However, strengthening the stability of modern financial systems requires an understanding of the structural conditions that can trigger their collapse. Given the complexity of systemic risk, network theory has been employed to study it and to understand the intricate connections between components of the financial system (Gao 2022).

There are some bibliometric studies on systemic risk in the literature. Pacelli et al. (2025) analyze 583 papers that highlight the effects of climate risks on financial stability, while Nica et al. (2024) cover 1022 papers and show a trend toward advanced statistical models and emerging technologies. Su et al. (2024) studied 2071 papers and emphasized the need to evaluate the methods used and the potential of new computational tools. For their part, Bai et al. (2020), considering the COVID-19 crisis as a reference point, develop a bibliometric analysis of 1025 papers, which integrates previous findings to conceptually define c and map its fragmentation according to financial subdisciplines and the empirical methods used.

Other studies have characterized the evolution of the literature on systemic risk and its emerging fields of discussion through a literature review approach. For example, Ellis et al. (2022) analyze 4859 abstracts and provide a descriptive synthesis of the main indices and measures of systemic risk and financial contagion, with a focus on their regulatory implications. For their part, Silva et al. (2017) examine and conclude that the literature emphasizes phenomena such as “too big to fail” and the effects of interconnectivity and contagion on the spread of financial crises.

However, to the best of our knowledge, this study is the first effort to integrate into a single framework the dominant theoretical currents in the approach to systemic risk, the main quantitative approaches applied, and the use of network analysis. Based on this, the current state of research on systemic risk and how the network approach contributes to its understanding is examined. To this end, a bibliometric analysis is developed using CiteSpace software, which identifies patterns of scientific production, dynamics of collaboration between authors and institutions, and thematic structures associated with this field of study.

Based on the above, this paper aims to analyze the current state of research on systemic risk and how network analysis contributes to addressing this phenomenon. To this end, the main theoretical currents that have guided the study of financial systemic risk will be identified, highlighting their conceptual approaches and key debates in the literature. In addition, the applicability of network theory will be analyzed to map the interconnection between financial institutions, detect critical risk nodes, and assess the propagation of systemic shocks.

Finally, the main established and emerging empirical methods for systemic risk analysis will be described, including statistical and econometric models and techniques based on network analysis. We conduct a bibliometric analysis using academic network mapping to identify patterns of scientific production, collaboration between authors and institutions, and thematic structures surrounding the study of systemic risk.

Through this analysis, we aim to illuminate the potential of network analysis in modeling systemic risk and establish a framework that will facilitate future research in this field. This paper aims to apply network theory to understand the intricate relationships within the financial system and navigate the complexities of systemic risk.

This paper is organized as follows. We begin with the first section, which establishes the theoretical basis by providing context on systemic risk and developing the conceptual dimensions that facilitate a better understanding of the phenomenon. Then, in the second section, we describe the methodological aspects of the bibliometric analysis, which is based on scientific mapping. We continue with the third section, which presents the results, which are based on the characterization of the analyzed literature and the identified knowledge networks. In the fourth section, we discuss the results considering the proposed theoretical framework. Finally, we conclude by including the implications and possible future lines of research.

This paper also makes practical contributions. By mapping academic output related to the application of network theory in the study of systemic risk, we gain a solid understanding of the dominant approaches to analyzing the stability of financial systems. Decision-makers can use this information to develop risk analysis and management models that facilitate the early detection of systemic risk events. Public policymakers will be able to identify elements that enable the detection of the causes and mechanisms of systemic risk diffusion. This could contribute to the design of more effective regulations and macroprudential policies that strengthen system supervision.

2. Theoretical Foundation

2.1. Systemic Risk

Following the crisis of 1929, caused by exaggerated expectations of the performance of the US economy, the Subprime Crisis of 2008 became a benchmark event for analyzing the stability of the global financial system. It has led to the development of an extensive body of literature on systemic risk analysis. According to Polat (2019), this crisis emerged in the subprime mortgage market in the United States and has shown how contagious effects can quickly spread to the rest of the world. According to the author, the catastrophic events of this crisis are still being felt more than a decade later, highlighting the continued fragility of the global economy. Therefore, there are clear reasons to delve deeper into the analysis of contagion in financial crises and states of financial instability (Polat 2019).

Banerjee and Feinstein (2019) note that the global financial crisis of 2007–2009 highlighted the need to investigate and understand how failures and losses propagate through the financial system. The authors express concern about how difficulties at one bank can endanger the financial health of the entire system, a risk that is amplified in an era of globalization and close connections. However, Petrone and Latora (2018) argue that “the stability of the financial system cannot be assessed by focusing exclusively on each bank or financial institution” (p. 1). Therefore, a rigorous analysis of global financial network structures is required to understand contagion mechanisms. Landaberry et al. (2021) point out that the increasing complexity of connections in the financial system makes it one of the main sources of amplification and propagation of risk impacts. This situation became evident in the worst possible way during the global financial crisis that followed the collapse of Lehman Brothers.

Leventides et al. (2019) argue that the U.S. mortgage crisis and the European sovereign debt crisis of 2009 revealed weaknesses in financial institutions worldwide. These crises highlighted the key role of financial interconnectedness in transmitting problems throughout the system. These weaknesses have become apparent in other global crises, such as the economic turmoil associated with the recent pandemic (Abduraimova and Nahai-Williamson 2021). While financial connections can efficiently distribute risk and generate benefits through diversification, they can also lead to contagious episodes of default following a financial shock (Leventides et al. 2019). This demonstrates the trade-off between the benefits of diversification and the amplification of negative effects due to entities’ exposure to the same risky assets and their leverage.

In general, systemic risk in financial markets is defined as the risk that a significant portion of the financial system will be unable to provide credit and will collapse (Bian et al. 2020). Markose et al. (2021) argue that systemic risk is related to the disruption of financial service flows due to the deterioration of the financial system, which has the potential to negatively impact the real economy.

Silva et al. (2018) agree with this definition, describing systemic risk as the disruption of financial services caused by the deterioration of the financial system, which can have major consequences for the real sector. This risk can manifest as bank runs or liquidity spirals. Furthermore, systemic risk is associated with contagion, which begins with the failure of a financial institution and spreads throughout the financial system and potentially reaches the real economy (Bian et al. 2020).

Hurd (2016) discusses the risk categories proposed by Duffie and Singleton. These include market risk, credit risk, liquidity risk, operational risk, and systemic risk. Systemic risk is defined as the risk of illiquidity across the entire market or the risk of chain defaults. While the other risk categories are not systemic risk, they are included when they have implications for the entire market. Bian et al. (2020) take a similar approach, defining systemic risk as a state of loss or stress in the financial system that includes credit and liquidity risk. They systematically analyze the contagion mechanism.

2.2. Systemic Risk Taxonomy

According to Neveu (2018), there are multiple taxonomies of systemic risk; however, De Bandt identifies some relevant categories

- Narrow: Affecting one or a few institutions, with adverse effects on others.

- Broad: Shocks that simultaneously impact many institutions.

- Strong: Lead to the failure of entities that were solvent before the event.

- Contagion: A combination of a strong and narrow event.

Likewise, horizontal events, which are limited to the financial system, are distinguished from vertical events, which generate spillovers on the real economy. Jackson and Pernoud (2021) propose another classification:

- Contagion through direct externalities: Occurs when the difficulties of one entity affect others due to their financial connections. For example, defaults or forced sales of assets.

- Feedback effects and self-fulfilling prophecies: These are induced by beliefs and incentives, such as massive withdrawals in response to the perception of a bank’s insolvency.

According to Chen et al. (2023), these feedback effects can be interpreted as dynamics in which an initial shock triggers responses in the market, which then return to the point of origin, amplifying the initial disturbance and thus closing a feedback loop.

2.3. Systemic Risk Measurement

As the phenomenon of systemic risk has attracted more attention from academics, different approaches have been developed to empirically address this risk. According to Zedda and Cannas (2020), the initial approach focused on identifying financial institutions whose default could trigger a wave of defaults across the entire system—a phenomenon known as “too big to fail.” Other academics and professionals refer to these institutions as Systemically Important Financial Institutions (SIFIs). This approach has now evolved to quantify the systemic risk contribution (Zedda and Cannas 2020).

Wang et al. (2022) identified two approaches to addressing systemic risk in the academic literature, which are described below.

- Conditional risk: Measures how much additional risk the financial system assumes if one or more key institutions encounter financial difficulties. For example, SRISK measures how much an institution could lose if the market enters a crisis, connecting concepts such as “too big to fail” and “too interconnected to fail.”

- Network theory: It analyzes how financial institutions are interconnected and how problems at one entity can spread to others. It measures the intensity of causal relationships and the effect of one entity’s volatility on others. In addition, it identifies who emits and receives risk in the event of extreme contagion.

Other models and approaches frequently used in systemic risk analysis are also recognized, such as:

- CoVaR approach: Measures the tail dependence of bank asset returns.

- Expected Systemic Risk: Measures a bank’s tendency to be undercapitalized if the entire system is undercapitalized.

- SRISK: A measure of a financial institution’s capital shortfall conditional on a severe market downturn. It is a measure based on size, leverage, and credit risk.

- Put Option Portfolio: Analyzes how the assets in the portfolio are correlated with each other. Based on the above, the probability of banks defaulting simultaneously is estimated. The present value of the expected loss is interpreted as a put option on the bank’s assets to calculate the value and volatility of the expected loss.

- Interbank Network Analysis: This is one of the methods that has been used to investigate the emergence of systemic risk through connections between banks. In this network structure, each node represents a bank, and the connections between banks are represented by edges (Leventides et al. 2019).

Table 1 shows some models for quantifying systemic risk, which are frequently mentioned in the literature.

Table 1.

Models for quantifying systemic risk that are frequently mentioned in the literature.

Of these approaches, network analysis is notable because it models both the position of a banking institution within the system and the structure of the system itself. Interbank connections are complex and include assets, portfolio returns, and overlapping portfolios. This implies that banks may invest in the same assets, so if one bank suffers losses in its investment portfolio, the other bank may also suffer losses. According to Leventides et al. (2019), portfolio correlation can cause forced sales in the market during periods of crisis. This, in turn, generates fear in interbank lending, making banks reluctant to extend credit and causing a lack of liquidity in the market.

Neveu (2018) points out that network modeling is not a universal solution, but it is very helpful for identifying sources of contagion. However, one must consider the need to analyze network layers and acceleration mechanisms. Bian et al. (2020) point out that, while traditional models study the banking sector’s credit network, they do not comprehensively consider financial correlations between companies and banks. This can lead to an underestimation of systemic risk. In short, network theory is an important contribution to the analysis of systemic risk; however, further contributions are needed to better capture the system’s complexity, allowing the results of studies to inform policies and regulations on the subject.

2.4. Impact of Systemic Risk

Network analysis provides insight into how interbank connections amplify risk. This approach is relevant for addressing interconnections in areas such as the interbank market, where funding links become a key transmission channel. One issue that requires careful consideration is the potential impact of systemic risk on interbank market dynamics and, consequently, their valuation.

According to Piccotti (2017), contagion risk is not diversifiable and affects stock risk premiums. Therefore, investors demand higher returns on securities with high covariance to contagious intermediaries to offset the effects of systemic risk. Additionally, financial contagion leads to greater illiquidity in the interbank system, affecting stock prices. Piccotti (2017) states that a sufficiently severe decline in liquidity can lead to market freezes or forced sales. This situation can be exacerbated by high levels of leverage among financial intermediaries.

Due to the potential impact of systemic risk on interbank markets, regulators may consider implementing policies to mitigate its adverse effects. One option is to increase liquidity requirements, but this would come at the cost of efficiency. This is because an increase in liquidity requirements discourages the holding of illiquid assets (Aldasoro et al. 2017), which can negatively impact profitability. On the other hand, an increase in capital requirements could be considered, although the potential negative effect on interbank credit demand, with its corresponding effect on interest rates.

The results of the empirical study by Choi et al. (2020) support the idea that systemic risk is incorporated into asset pricing; therefore, the risk premiums observed in the stock market reflect this additional exposure, beyond what is explained by traditional valuation models such as Fama and French’s. For his part, Chen et al. (2024) analyzes the behavior of the extreme illiquidity premium during the Subprime Crisis and observes that during this period, this premium increases, in line with higher liquidity costs in the corporate bond market. Thus, policymakers must consider the balance between stability and efficiency when establishing prudential requirements for the financial system.

2.5. Systemic Risk Control

Caccioli et al. (2018) note that more research is needed to improve our understanding of the complexity of financial networks and reduce systemic risk. Some research has shown significant progress by providing useful insights into the conditions that can lead to systemic events. However, conflicting theories and empirical evidence exist in several areas of systemic risk studies, particularly regarding policy recommendations (Neveu 2018).

Aldasoro et al. (2017) discuss the possibility of increasing either liquidity or capital requirements to control systemic risk. This would result in lower exposure to interbank markets. However, this strategy has its limits. Excessive regulatory burdens can make requirements nearly binding, increasing the likelihood of forced sales after large-scale shocks. In other words, if regulatory requirements become too high, financial institutions may have difficulty complying with them, which can negatively impact system efficiency (Aldasoro et al. 2017). Even if a significant shock to the financial system occurs, some institutions may be unable to deal with the contingency because this type of regulation negatively affects financial flexibility and hinders access to liquidity.

The literature offers conflicting perspectives on the capital and liquidity requirements necessary for managing systemic risk. Neveu (2018) argues that increasing capital requirements for banks causes supervised financial institutions to transfer credit risk to unsupervised insurers, thereby increasing systemic risk. Additionally, many empirical studies are based on the erroneous assumption that historical data can predict systemic risk and that the market acts as a portfolio. According to Neveu (2018), this approach only provides regulators with information about the minimum potential risk the system would face.

Topological analysis is not just a formality, since connections between banks strongly influence contagion risk, system resilience, and the potential of regulatory policies. Aldasoro et al. (2017) provide evidence that macroprudential policies can mitigate this risk, albeit at a cost in terms of efficiency and investment. Meanwhile, Neveu (2018) suggests that regulators should incorporate the topological dimension as a central part of policy, beyond standard quantitative norms. To that extent, the topological approach makes a key contribution to systemic risk analysis, as it allows for an understanding of the system through cross-exposures and dependency networks. Therefore, the network approach goes beyond traditional policy based on capital requirements, liquidity, and leverage levels.

On the other hand, Pichler et al. (2021) demonstrated that network reorganization can provide greater financial stability without the need for additional capital, i.e., without additional costs for banks and regulators. According to the authors, although regulating the network is more challenging than simply setting leverage ratios, their results show that adopting a network perspective can efficiently reduce systemic risk. Furthermore, Leventides et al. (2019) show that network heterogeneity plays an important role in its stability. Thus, an interbank network composed of banks of different sizes will be better able to withstand a random shock and make contagion less likely. Other studies show that the outcome of a systemic event depends largely on the underlying network and the propagation of the shock (Ramadiah et al. 2019).

Battiston and Martinez-Jaramillo (2018) argue that the network approach can help achieve more effective regulation. However, Silva et al. (2018) point out that decisions considered appropriate by the financial regulator to improve system stability do not always induce desirable global properties. For example, if the regulator creates incentives for participating agents to alter the network topology, the resulting structure could be riskier than the current one. This could occur because decisions that are safe locally do not necessarily lead to a stable global system (Silva et al. 2018). According to the authors, studies combining network topology and systemic risk raise questions that remain unanswered in the literature.

In line with the above, studies on systemic risk have advanced significantly, particularly following the 2008 financial crisis and the global pandemic. Two main approaches to addressing this phenomenon have been identified in general. The first approach quantifies conditional losses, allowing us to observe how an institution can impact the financial system when facing difficulties. The second approach consists of analyzing the interconnection of financial institutions and modeling how adverse events spread through contagion channels. This latter approach is promising because it allows us to understand how financial institutions are connected and how problems can spread. Rather than analyzing institutions in isolation, this approach maps relationships and contagion flows in the system. This approach has evolved to analyze more complex networks that consider multiple types of links, study different types of institutions, and capture nonlinear relationships.

3. Materials and Methods

This descriptive-analytical study takes a quantitative approach based on bibliometric analysis. The study aims to analyze the current state of research on systemic risk and how network analysis contributes to addressing this phenomenon. A bibliometric analysis helps characterize academic productivity and the cognitive structures shaping the field of systemic risk research. This study seeks to quantify and visualize patterns, trends, and cognitive structures within a specific domain of knowledge (Ninkov et al. 2021; Donthu et al. 2021; Hoang 2025). In this sense, its value lies in mapping the conceptual evolution of the field and revealing the theoretical and methodological milestones that have driven progress in the study of systemic risk.

Mapping is carried out, focusing on the analysis of scientific and thematic networks by exploring the relationships between knowledge nodes, their structure, and evolution. Through structural and temporal indicators, the connections between nodes, the cohesion of clusters, and the emergence of new lines of research are examined, providing a comprehensive view of the cognitive organization and evolution of the field under analysis.

Data collection was carried out using Thomson Reuters’ Web of Science (WoS) database (Echchakoui 2020). CiteSpace is software used for processing, visualizing, and interpreting bibliometric data. It helps map intellectual collaboration networks, co-citation references, concurrent keywords, timeline clusters, and emblematic papers (Maia et al. 2019). In this study, the tool was applied to: build reference and co-authorship networks; detect thematic clusters; analyze centrality; and detect influential nodes in the knowledge network.

The following inclusion and exclusion criteria were defined for the development of this bibliometric study:

- Papers published between 2020 and 2025 were selected to capture recent developments in this field and developments associated with systemic risk analysis. This criterion may generate bias by omitting historical background or seminal works; however, it allows for a focus on the most recent research, which is useful for identifying emerging trends in the conceptual structure and models applicable to systemic risk. Result: 3428 papers.

- Scientific papers published in English and not retracted, in the fields of economics, business finance, administration, computer science, information systems, operations research, management sciences, and business. This criterion may introduce bias by omitting conceptual contributions in peripheral areas of research. However, it allows the analysis to focus on the conceptual structure of systemic risk within its disciplinary core. Result: 1643 papers.

- Literature reviews were excluded to avoid analytical redundancies and ensure that the bibliometric mapping focuses exclusively on original studies that contribute directly to the empirical or theoretical development of the field. Focusing on original papers allows for the collection of higher-quality data (Wan Mustapa et al. 2025), which helps to facilitate the identification of advances and trends in primary research, avoiding biases derived from high citation rates (Öztürk et al. 2024) and the synthetic nature of review papers.

- This criterion may generate bias by underrepresenting literature produced in other languages and limiting the scope to works that have not been reviewed in greater depth; however, it improves the comparability of results and avoids problems in bibliometric analysis arising from terminological dispersion across multiple languages. Only one review was identified. Result: 1642 papers.

A significant number of papers were obtained for review, which can be explained by the comprehensiveness of the search strategy, which allowed for the comprehensive capture of relevant literature in the field, including terminological variations, synonyms, and keyword combinations that reflect different approaches and perspectives on the topic. In addition, a manual review of the database was conducted to ensure that the studies included in the corpus were aligned with the object of analysis.

Since the study was based exclusively on Web of Science (WoS) records, no duplicate studies were identified. Likewise, the integrity of the metadata was verified, and no papers were found lacking a title or abstract, which are essential elements for the correct identification and labeling of clusters in bibliometric analysis. To ensure the completeness of the collection of relevant literature, the search equation was designed by combining two main conceptual categories, linked together by Boolean operators. This strategy enabled the retrieval of works on both the phenomenon of systemic risk and financial contagion, as well as its approach from the perspective of networks and interconnections.

Additionally, truncation and lemmatization operators were applied to capture the different terminological variations present in the records, minimizing the risk of omissions due to differences in singular/plural forms, suffixes, or derived terminology. In this way, the search strategy ensures breadth, relevance, and replicability, facilitating a complete mapping of the field under study.

To perform the query on the database, the following search equation (Table 2) is applied, addressing the two main categories of analysis in this work: systemic risk and networks.

Table 2.

Search equation.

After completing the screening process based on inclusion and exclusion criteria, the resulting database is processed in CiteSpace software. This software is used to generate figures and tables that facilitate the exploration of academic networks. The bibliometric analysis was performed using CiteSpace 6.3.R1 (64-bit), employing co-citation of references as the unit of analysis. Time slicing was set for the period January 2020–December 2025 (1 year per slice). Nodes were selected using the Top 50 criterion (the 50 most cited/occurring items per slice) to maintain a comparable sample per interval.

An analysis of the resulting maps is then conducted and complemented by a descriptive review of the most cited papers in the identified clusters. To understand the main avenues of research that are consolidated and under construction and that contribute to the development of the field of systemic risk analysis and contagion networks, an exploration of the thematic content of each cluster will be carried out.

The main metrics used to identify clusters and characterize and analyze the publications that comprise them are:

- Intermediation Centrality: CiteSpace uses intermediation centrality to measure importance in the network, as this metric reflects the control strength and bridging effect of a node (Yan and Du 2025).

- Modularity: This measures how the network can be divided into relatively independent blocks or modules. The coefficient takes values between 0 and 1; the closer to 1, the greater the modularity and, therefore, the clarity in the formation of clusters in the network (Chen et al. 2010).

- Silhouette Coefficient: This is useful for evaluating the internal coherence and separation between the identified clusters. Its values range from −1 to 1, where a value close to 1 indicates a well-defined assignment and a clear separation between groups. In general, values above 0.7 are considered indicative of high clustering quality, which facilitates the tasks of interpreting, aggregating, and labeling clusters (Chen et al. 2010).

- Coverage (Cov): Represents the proportion of references cited by a specific paper relative to the total number of references that make up a cluster. This value allows us to analyze the degree of representativeness or contribution of each paper in the cluster and its contribution to the thematic construction of the group (Chen 2014).

- Burst: Burst detection determines whether the number of references to a particular citation has increased dramatically in a short period of time (Chen et al. 2010). In other words, it reports a sudden and significant increase in citations that may indicate intense and concentrated attention from the academic community toward that work and the emergence of emerging or frontier topics.

- Sigma: This is used to measure the novelty of nodes and combines their importance in the network structure and their temporal variability. According to Yan and Du (2025), papers with high sigma values tend to be innovative and crucial.

Cluster labeling was performed manually by reviewing the content of the papers with the highest coverage and centrality (titles, abstracts, and, when necessary, full texts) to assign a synthetic label that summarized the dominant theme of each group. As a robust check, these manual labels were compared with the automatic labels generated by CiteSpace (LLR and LSI algorithms) to verify the consistency between sources of characterization. Conceptual consistency was observed between the manual and automatic labels.

The structural soundness of the bibliometric map was evaluated using network metrics. The modularity coefficient Q reports a value of 0.6664, indicating a clear division into thematic subgroups. The weighted average silhouette S = 0.8642 reflects high internal cohesion of the clusters (the elements of each cluster are, on average, more like each other than to other clusters). These quantitative results support the thematic validity of the groupings obtained and the consistency of the manual labeling process.

A high value of the largest connected component (Largest CCs) = 84% is observed, indicating that most references are connected by the chain of relationships, which means that a good proportion of the corpus is part of the same thematic block.

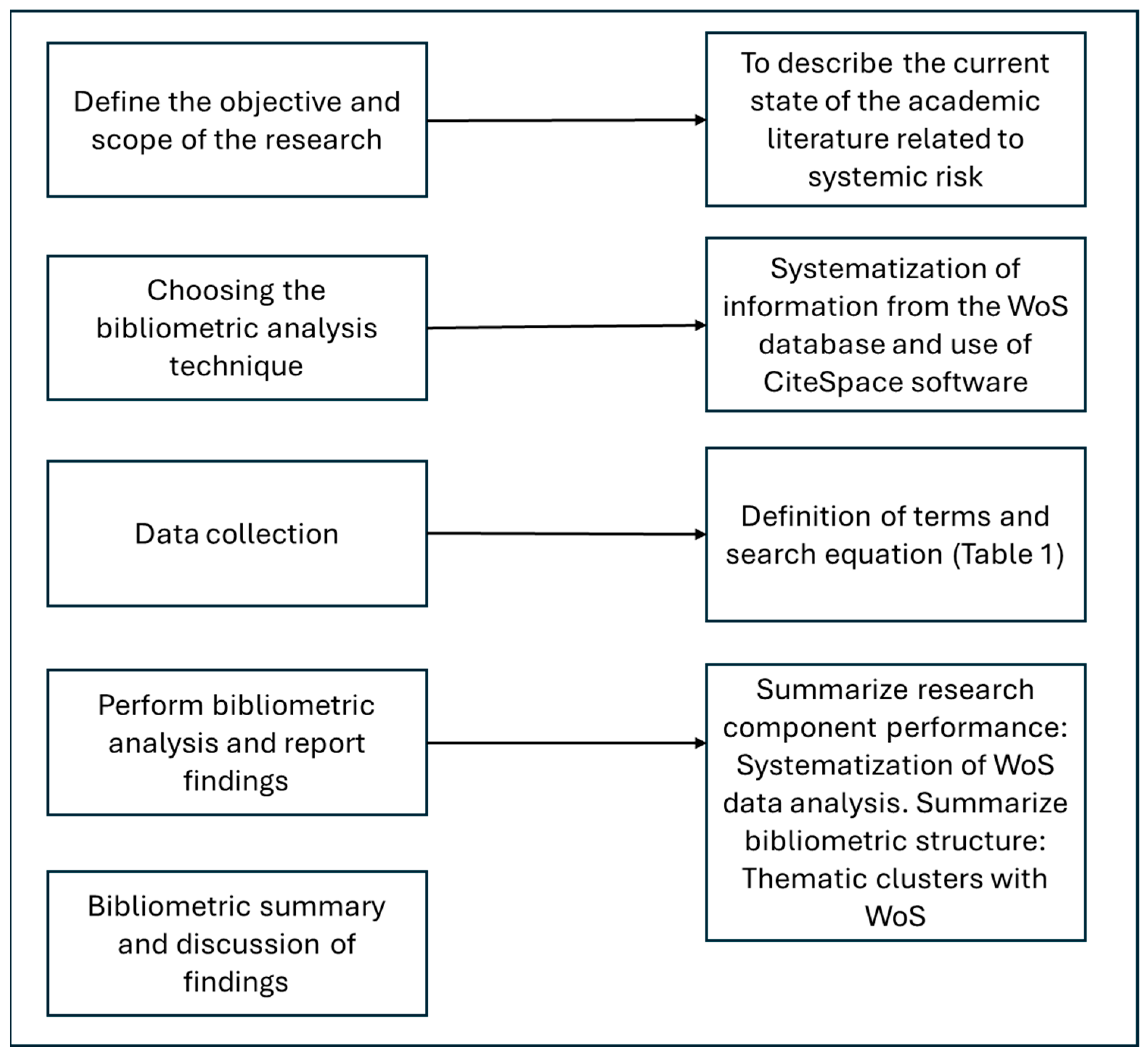

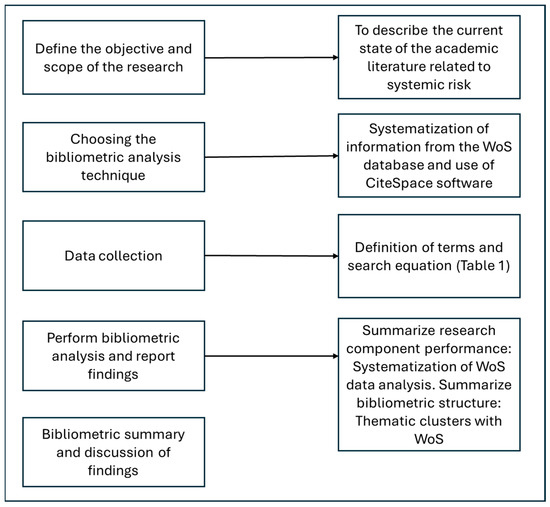

This bibliometric study was conducted in a structured manner using a protocol that included consultation, purification, systematization, and presentation of the bibliometric analysis results. For the present study, we took the protocol proposed by Donthu et al. (2021) as a reference. They systematized some recommendations for carrying out this analysis in a logical order (Figure 1).

Figure 1.

Bibliometric analysis protocol. Note. Based on Donthu et al. (2021).

The procedure shown in the figure is briefly described below:

- Define the objective and scope of the research: The research questions and categories of analysis were specified, based on which the search equation was constructed.

- Choice of bibliometric analysis technique: Web of Science (WoS) was selected for its broad and curated coverage, recognized for providing high-quality peer-reviewed papers and widely used in the literature (Khan et al. 2022). CiteSpace was used as an analysis tool to map the conceptual structure and evolutionary dynamics of a scientific field.

- Data collection: The search equation defined in Table 2 was applied, verifying duplicates and metadata completeness to ensure the quality of the records.

- Development of bibliometric analysis and reporting of findings: This included the systematization of WoS results, cluster algorithm testing, manual cluster labeling, and content characterization to identify the conceptual structure.

- Bibliometric synthesis and discussion of findings: The results were integrated with the theoretical and empirical literature on systemic risk, highlighting models, approaches, and the application of network analysis.

This procedural framework is usually used for studies of this nature in various management fields (Farooq 2024; Forliano et al. 2021; Nobanee et al. 2021).

To assess the consistency of results over time, the records were divided into two periods: pandemic (2020–2022) and post-pandemic (2023–2025). Although a thematic evolution can be observed, highlighting the emergence of new approaches such as multilayer networks, the results confirm the robustness and persistence of structural clusters associated with systemic risk. Topics such as systemic crisis, financial networks, and market contagion remain stable cores, showing that, despite recent methodological advances, the corpus maintains an epistemological coherence centered on interconnectivity and risk propagation.

4. Results

The results of the bibliometric analysis, which identify the main thematic clusters in the field of study, are presented below. Bibliometric mapping analyzes connections between papers based on links within clusters. These links tend to be stronger and are augmented by terms commonly used in titles, abstracts, and descriptors in the bibliometric context (Chen 2006). Each cluster is described in terms of authors with the greatest centrality and thematic coverage, allowing us to trace the predominant lines of research. Similarly, we analyze the most influential papers within each cluster and their conceptual contributions.

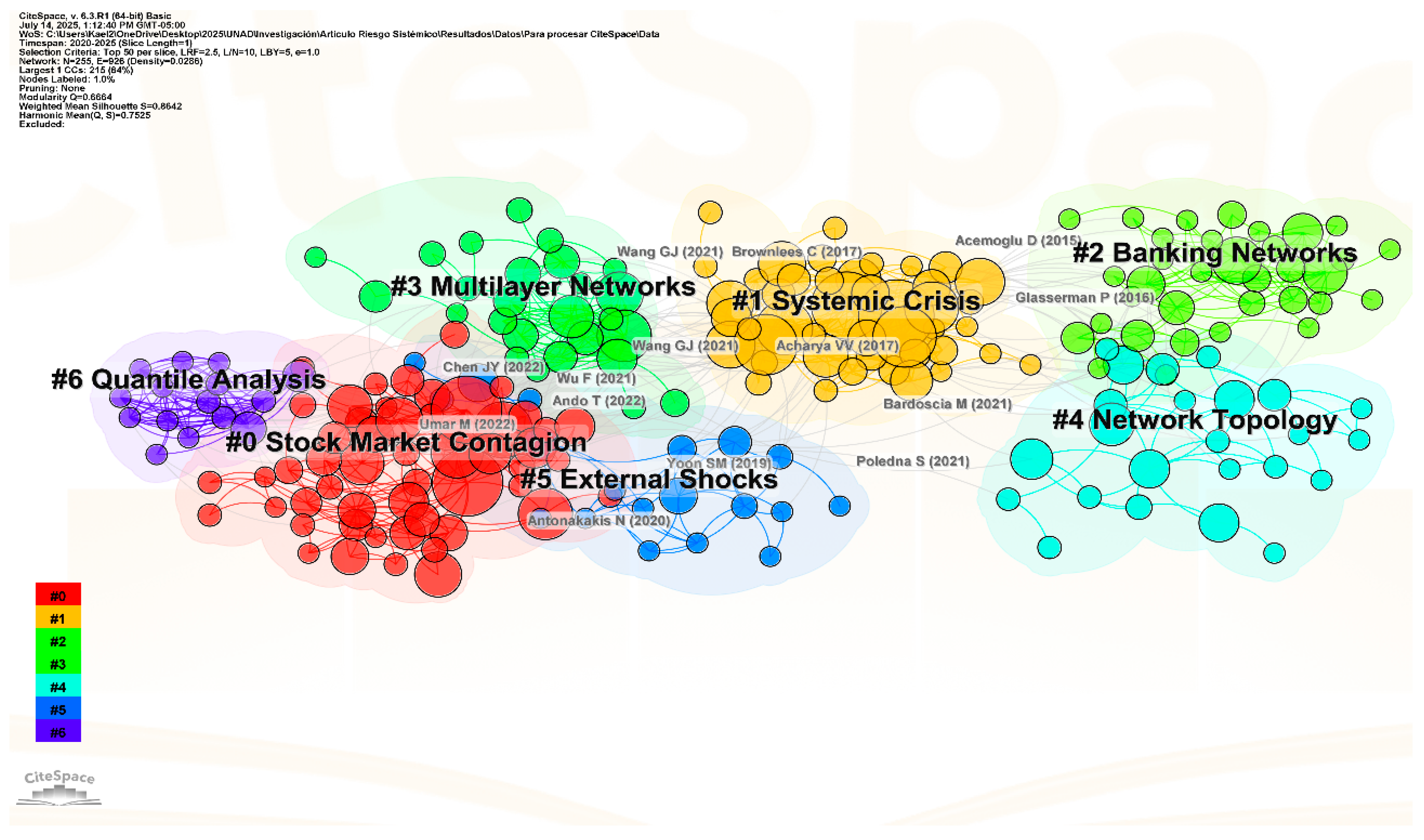

The CiteSpace software identified seven thematic clusters, showing that discussion in this domain is grouped around objects of study such as markets and financial institutions, and applicable methodologies for risk analysis, such as multilayer networks or quantile regression models. Figure 2 shows the output of the CiteSpace software, where seven thematic clusters are identified, numbered from #0 to #6.

Figure 2.

Thematic Clusters on Systemic Risk. Note: Clusters extracted using the CiteSpace clustering algorithm.

Although the software automatically assigns labels based on the titles of the publications, in this case, manual assignment was chosen, based on a systematic reading of the papers that are representative of each cluster. In this way, representative tags will be available, aligned with the objectives of the reviewed papers and the methodologies used to carry out the analysis.

Manual labeling allows contextual nuances and emerging terms that are conceptually relevant to the debate to be captured. For labeling purposes, the studies included in each group were thoroughly reviewed to ensure that the names of each group reflected the thematic intent and conceptual consistency of the linked studies.

The thematic clusters identified considering the conceptual framework on systemic risk are described below.

- Stock Market Contagion: Capturing the independence between assets or sectors to analyze the spread of price shocks or volatility. In this case, the nodes are financial assets, the links are statistical relationships, and the type of contagion is generally indirect, for example, the amplification of volatility.

- Systemic crisis: Understand how an adverse event can affect the entire financial system. The propagation, amplification, and consequences of shocks in interconnected networks associated with systemic macroeconomic, market, or microeconomic problems are analyzed.

- Banking Networks: Evaluate the spread of losses and failures among interconnected banks. In this case, the nodes are banks, the links are financial exposures such as loans or shared trends in financial assets. Unlike stock markets, interbank networks tend to show greater temporary stability, as they operate under more structured and regulated relationships, leading to lower volatility (Ahelegbey et al. 2021).

- Multilayer Networks: Modeling the dynamics of complex financial systems where there are different types of relationships between nodes (Wang et al. 2021). For example, one layer could be volatility, and another layer could be extreme risk.

- Network Topology: Analyze the effect of the structure and shape of the network of connections between financial institutions (Das et al. 2022). This allows us to address the speed and scale of systemic risk propagation by studying propagation routes, system resilience or fragility, systemic nodes, and macro-prudential policies.

- External Shocks: Examine how events originating outside the financial industry or the domestic market affect the system. These shocks may originate from geopolitical events, such as the Russia-Ukraine war, from the sustainability of the system, such as the debt crisis due to exposure to sovereign bonds, or even from health issues, such as the global pandemic.

- Quantile Analysis: This statistical technique allows you to estimate the relationship between variables based not only on averages, but also on the different quantile points of the endogenous variable distribution.

Figure 2 also shows a notable overlap between topics such as contagion in stock markets, external shocks, and quantile analysis. This overlap is explained by the fact that studies based on quantile analysis are used to capture the heterogeneity of contagion and diversification effects under different market conditions, showing that assets can simultaneously participate in multiple risk transmission channels and that various exposures can be affected by external shocks.

After identifying the thematic categories, the cluster exploration option is applied using the CiteSpace software. According to the coverage index (Cov), the five most representative papers for each thematic cluster are identified (Table 3). Coverage indicates the total number of papers in a cluster that cite the analyzed paper. Table 3 shows the results of systematizing these papers, which are ranked by coverage and considered relevant for characterizing the clusters.

Table 3.

Characterization of thematic categories of clusters and papers identified.

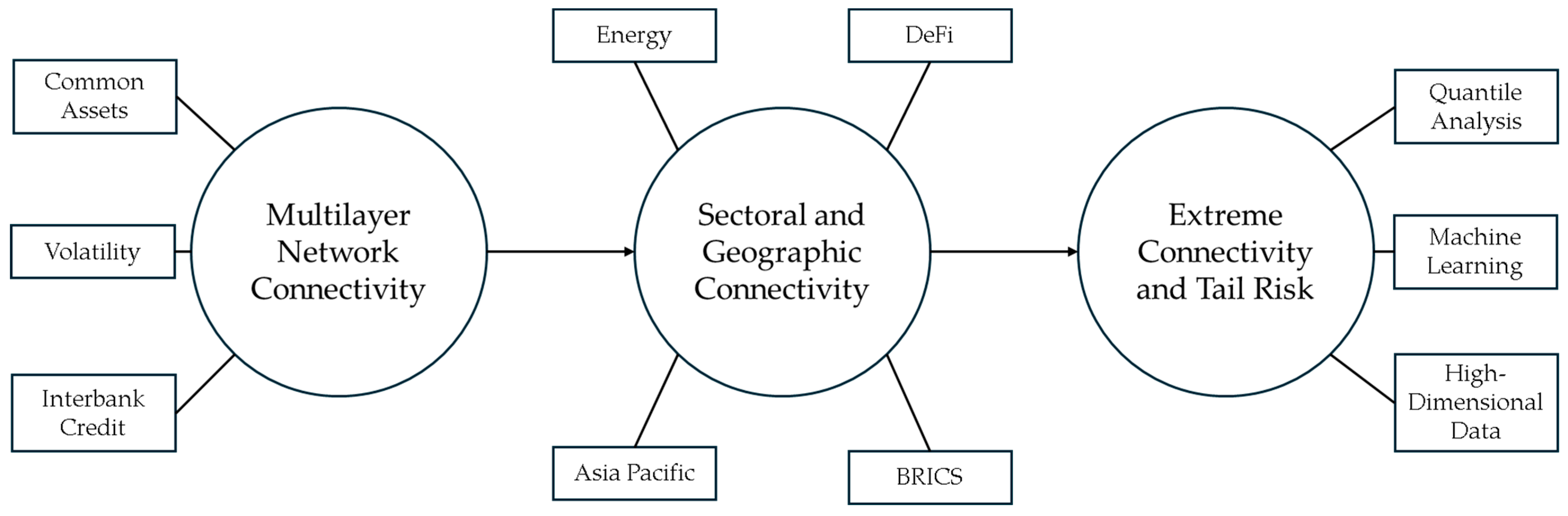

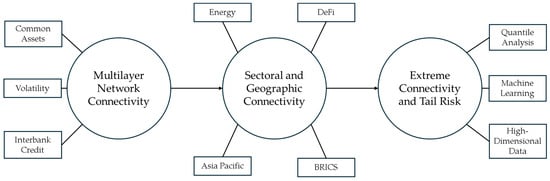

A review of the objectives of the reviewed papers allows us to identify three key research avenues that characterize this field of study. These broad lines of research are described below, emerging as key trends for advancing the study of risk propagation dynamics in complex financial systems.

- Connectivity in multilayer networks: The trend toward addressing complex networks by analyzing multilayer connections, which allows for capturing diverse sources of contagion, identifying hidden vulnerabilities, and assessing the compound effects of shocks.

- Sectoral and geographic connectivity: The trend toward analyzing connectivity between specific sectors, regions, or industries. For example, the banking, energy, oil, or manufacturing sectors. Fianu et al. (2022) apply Bayesian graphical autoregressive vector models (BG-VARX) and Bayesian structural equations with external variables (BG-SEMX), which allow for the representation of interdependence between electricity zones, thereby enabling the identification of vulnerable zones or risk transmitters within the market.

- Extreme connectivity and tail risk: The trend toward applying quantile analysis to study volatility and assess extreme connectivity, market sentiments and fears, and their impact on the network. This approach can be valuable for analyzing public and investor sentiment, which can be influenced by market performance during crises like COVID-19 (Ahelegbey et al. 2022).

Figure 3 shows a logical sequence of research to respond to the growing complexity of the field of systemic risk analysis. It starts with a multilayer network connectivity analysis, which can be used to examine interactions between common assets, volatility, and interbank exposures. This analysis can then be extended to sectoral and geographical connectivity, incorporating aspects such as regional heterogeneity, key markets such as the Asia Pacific and the BRICS, and sectors that have received greater attention, such as energy and decentralized finance (DeFi). Finally, the focus is on extreme connectivity and tail risk analysis, which can be enhanced with the use of advanced tools such as quantile analysis, machine learning, and high-dimensional data to capture extreme events and anticipate risks under stress conditions.

Figure 3.

Diagram of Research Pathways in Systemic Risk.

The literature review also allows us to identify some frequently used methodological approaches in studies on systemic risk and contagion networks. These approaches are recognized as a trend in recent studies due to their ability to capture complex dynamics of financial interconnectedness and assess the potential for shock propagation. Table 4 shows the primary analytical models identified in the reviewed sample papers.

Table 4.

Models for Systemic Risk Analysis.

In the characterization of models applicable to systemic risk analysis, the prevalence of multivariate time series techniques is clear, particularly the vector autoregression (VAR) model. These models allow for a rigorous analysis of the dynamic and multidirectional relationships of different endogenous variables and can be explored to analyze temporal causality in the Granger sense. They contribute to the analysis of lagged effects, which is important in the study of financial contagion, as an institution does not always have an immediate impact on the system. The Forecast Error Variance Decomposition (FEVD) can be used to measure total connectivity, net connectivity per institution, and the DY Spillover Index.

A centrality analysis identifies some central publications that are referenced in the sample under analysis. Citation frequency, the betweenness centrality index, and the degree centrality provided by CiteSpace are used to analyze this centrality. This allows us to identify highly influential authors in this field, where it is evident that their contribution is related to the statistical foundation and methodology for developing empirical analysis. For example, Demirer et al. (2017) provide conceptual and technical foundations for the development of the LASSO model, which facilitates the analysis of the topology of financial networks based on multidimensional causality analysis. Ando et al. (2018) developed a study in which they applied vector autoregression with quantile regression and demonstrated that the model can capture the credit risk transmission that is hidden in models that use conventional conditional mean estimators.

Gang Jing Wang makes some contributions to the analysis of systemic risk and the interconnectedness of financial networks through a network approach, using techniques for extreme risk analysis. For example, in Wang et al. (2021), the authors explore multi-layer networks and evaluate different types of spillover between financial institutions based on the mean, volatility, and extreme risk layers. Wang et al. (2018) analyze extreme market situations where systemic risk manifests, for which they apply the TENET approach, using quantile regression and the construction of an interdependence network, using CoVaR. Wang et al. (2017) perform tail-wise Granger causality tests to construct a specific extreme risk network and evaluate the risks in the banking, insurance, real estate, and financial services sectors.

The other papers identified in Table 4 as highly central demonstrate the applicability of the identified models, which are influential in this field. Chen et al. (2022) apply a quantile VAR model to analyze dynamic connectivity and tail spillover in energy, metals, and carbon markets. Brunetti et al. (2015) compare networks constructed from correlations between stock returns and actual bank loan transactions. Bouri et al. (2021) use TVP-VAR to study changes in global asset connectivity in the face of the COVID-19 crisis. Cao et al. (2021) developed a multi-layer network structure to simultaneously analyze debt ratios and equity trends in financial institutions. Yi et al. (2018) use the DY Spillover Index and LASSO-VAR to explore the connectivity of 52 cryptocurrencies.

Table 5 shows the Sigma and Burst indicators, which, beyond measuring impact, allow us to analyze the level of innovation of the work and the level of attention it receives over time. The works by Ando et al. (2022), Demirer et al. (2017), and Wang et al. (2018) present high Burst and Sigma values, which indicate that they have received sudden attention in the literature and represent a novel and influential contribution within their field; this can be explained by their contributions to modeling the phenomenon, related to the QVAR, LASSO-VAR, and TENET models, respectively.

Table 5.

Analysis of High Impact Publications.

Below are three relevant and innovative contributions, selected based on the Sigma and Burst indicators:

- Demirer et al. (2017): They make an innovative contribution by introducing the LASSO approach applied to high-dimensional VAR models, which overcomes the traditional limitations of global bank network estimates. This is because this model allows VAR to be estimated in high-dimensional environments, where the parameters can exceed the number of observations, and can be useful for estimating global banking connectivity networks, maintaining parsimony, and avoiding overfitting.

- Ando et al. (2022): Their methodological contribution consists of extending the connectivity framework of Diebold and Yilmaz (2009, 2014), based on estimates of conditional means from a VAR, towards a quantile formulation capable of capturing the structural heterogeneity of the network under different magnitudes of shocks. This allows us to address the assumption that the topology of the financial system is established in the face of shocks of varying intensity by modeling the variation in connectivity across the conditional distribution of shocks, from the mildest to the most extreme.

- Wang et al. (2018): Make a significant contribution to the measurement of systemic risk by empirically operationalizing the TENET (Tail-Event driven NETwork) model proposed by Härdle et al. (2016). Their contribution lies in the possibility of articulating the network structure with dependence on the distribution tails to overcome the limitations of linear contagion models. This articulation allows us to see beyond the average relationships between nodes, addressing how interconnections intensify in periods of financial stress, which can reveal propagation patterns that traditional models do not capture.

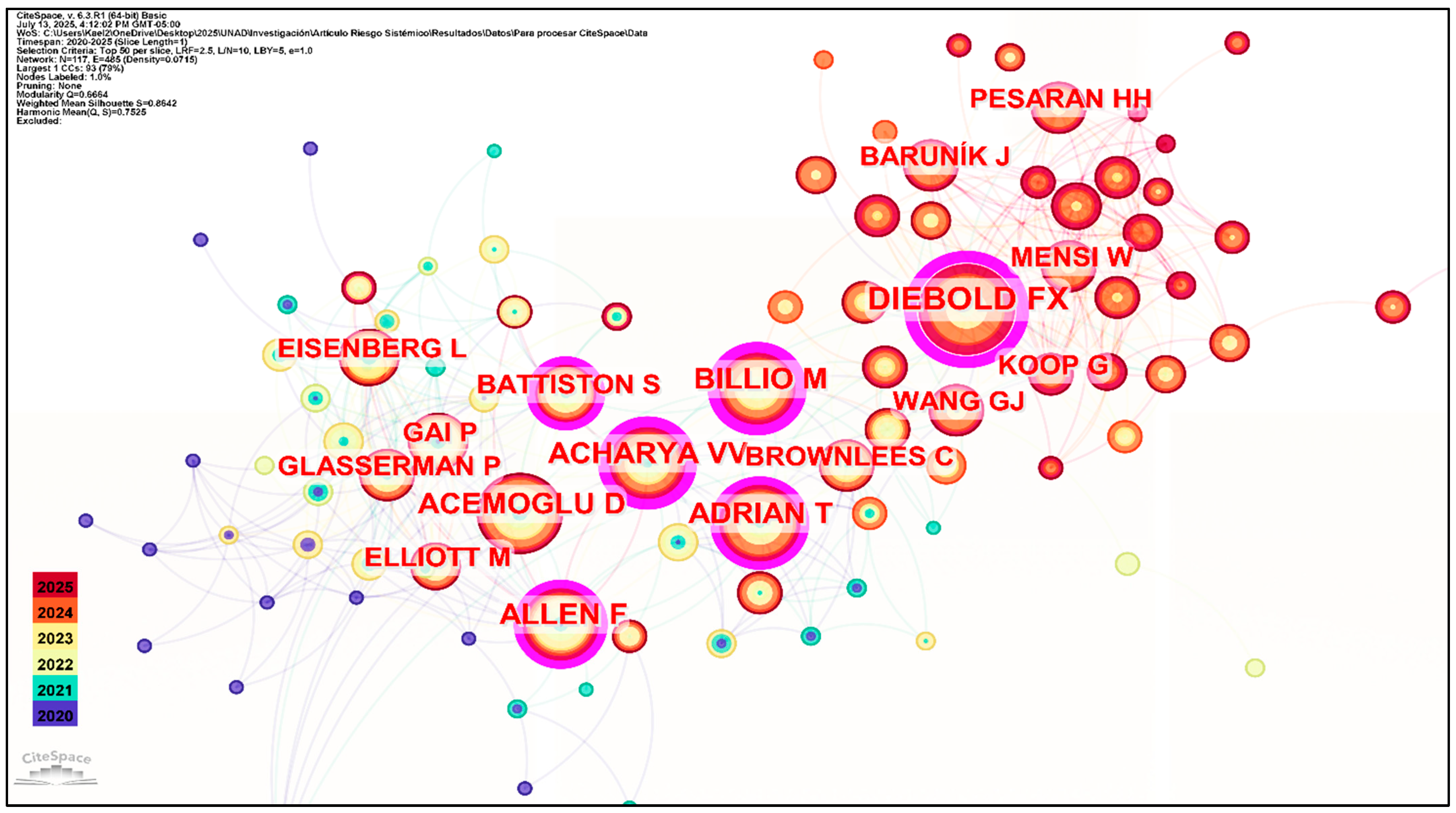

An analysis of co-authorship was proposed to identify influential theoretical figures in the different scientific cooperation networks. Unlike co-citation networks, this analysis explores direct collaboration between authors, which can reveal the configuration of networks based on institutional, geographic, and thematic affinity. This analysis can be used to identify cooperation networks that promote the development of research in this field.

Figure 4 identifies authors with high network centrality based on node size. The network highlights the betweenness centrality of Francis X. Diebold, whose theoretical and conceptual contributions constitute a key pillar in the development of the literature on systemic risk. The authors highlight that their model introduces a simple and robust way of measuring the connectivity between economic variables through variance decomposition and contributes to integrating traditional econometric methodologies with modern approaches such as network analysis and Big Data (Diebold and Yilmaz 2023). Their contributions remain relevant, as evidenced by the time ring surrounding their node, their central position in the co-authorship network, and the high density of their connections. These elements reflect their participation in key projects in the field and suggest that their research agenda continues to exert significant influence on the evolution of the subject area.

Figure 4.

Co-authorship Network. Note: History of a ring tree with nodes defined by degree centrality.

In this regard, some emerging studies allow us to identify clusters that could be consolidated as avenues for future research. For example, contagion analysis can be applied to specific markets, such as commodity markets, to examine how shocks affect the interconnection between participants (Naeem et al. 2025). Likewise, the study of multilayer networks is consolidating itself as an alternative for capturing the complex dynamics of volatility transmission in markets such as foreign exchange, in different economies worldwide (Wang et al. 2022). External shock analysis allows us to observe how phenomena such as the pandemic or the war in Ukraine can intensify connectivity between assets in sectors like energy (Su et al. 2024).

Finally, the usefulness of quantile connectivity analysis has been demonstrated in studying the interaction between traditional assets and tokens (Yousaf et al. 2023). These studies reflect a trend toward the use of advanced methodologies to model connectivity under stress conditions, integrating multilayer networks and considering emerging phenomena that amplify systemic exposure.

5. Discussion

This study conducts a bibliometric analysis of systemic risk based on cluster exploration using CiteSpace, which identified relevant thematic subfields in this area. The application of the tool shows that topological network analysis is a central topic of discussion, as it allows for an understanding of the interconnection structure between financial institutions and the dynamics of risk propagation. Classic measures of centrality and clustering are commonly used in contagion network analysis. Consequently, topological analysis is consolidated as an essential axis for mapping systemic vulnerabilities and anticipating financial contagion in contexts of global interconnection.

The primary objective of this study is to identify the main theoretical currents that have guided research on systemic financial risk. Analysis of the citation structure and the most recurrent references within the academic corpus allows us to recognize four theoretical traditions that have become established as the dominant axes in the development of this field of study:

- Volatility networks and spillovers: Notable work in this field includes that of Diebold and Yilmaz (2012, 2014, 2023), who developed a method that integrates financial network theory and VAR models to analyze the transmission of volatility shocks and conceptualize systemic risk as a dynamic contagion phenomenon. This tradition is dominated by empirical studies on volatility spillovers, financial contagion, and macroprudential risk.

- Dynamic correlations and temporal dependence: This tradition integrates classical time series theory with conditional heteroscedasticity models (GARCH and its extensions) and nonlinear tests of dependence and causality focused on the tails of the distribution. Its objective is to capture how conditional volatility and higher-order dependence transmit risk over time. For example, Hong et al. (2009) propose tests that allow many lags to be incorporated using kernel weights, mitigating the loss of degrees of freedom and preserving power compared to alternatives with lagged effects. In addition, it offers robustness against conditional heteroscedasticity and facilitates the detection of nonlinear dynamic dependencies and long-term memory.

- Complex Networks and Topological Analysis: This tradition is inspired by complex network theory and financial topology. It focuses on the structure of the system, which includes nodes (institutions) and links (debt relationships, exposure, and correlation). Billio et al. (2012) demonstrate, through principal component analysis and Granger causality networks, that connectivity increases systemic vulnerability, while Elliott et al. (2014) explain the financial cascades that arise when failures are transmitted through contractual links.

- Bayesian Approach and Dynamic Inference: Extends traditional VAR models toward a dynamic Bayesian approach, which allows for capturing the temporal and nonlinear evolution of interdependencies between financial variables. This framework enables real-time analysis of systemic risk dynamics, incorporating macroeconomic information and conditional volatility. Among the techniques used is TVP-VAR, which estimates parameters that vary over time and allows for updated Bayesian predictions. According to Antonakakis and Gabauer (2017), this methodology has advantages over the moving window VAR proposed by Diebold and Yilmaz (2014), adjusting more quickly to economic shocks and offering greater flexibility in the face of structural changes in financial connectivity.

The second objective of this study is to analyze the applicability of network theory to analyze the interaction between financial institutions. Cluster analysis identifies multilayer networks as a relevant node, showing how research has evolved from traditional single-layer network approaches to more complex structures. Unlike conventional connectivity, which analyzes system interactions in a single layer and does not distinguish between different types of simultaneous relationships, multilayer networks allow for the modeling of multiple layers of links between nodes, capturing heterogeneous and complex interactions.

Empirically, the papers reviewed show that directed and weighted networks allow for the analysis of transmission asymmetries and the detection of risk-generating and risk-transmitting nodes. Meanwhile, multilayer networks emerge as a suitable approach for modeling simultaneous relationships and cross-interdependencies. Findings from recent studies confirm that multilayer networks constitute a methodological frontier in systemic risk analysis, offering different levels of information that facilitate the identification of contagion-emitting and contagion-receiving nodes, as well as the modeling of complex financial interdependencies.

One of the most analyzed events in the literature studied is the recent crisis related to the global pandemic, which is explained by the observation window proposed for this research. Studies agree that this episode intensified market connectivity and amplified direct contagion channels, increasing systemic exposure (Leventides et al. 2019). In addition, the crisis highlighted the structural vulnerabilities of the international financial system (Abduraimova and Nahai-Williamson 2021).

In this context, volatility constitutes a fundamental layer of analysis, as it acts as a predictive indicator that allows us to anticipate the accumulation of tensions in the markets and, thus, facilitate the design of early responses before these tensions translate into widespread defaults or liquidity crises.

Multilayer network analysis highlights the importance of volatility (Dai et al. 2023a, 2023b; Zhou et al. 2025), as it acts as a key channel for the transmission of expectations and panic among financial agents. This reflects the fact that abrupt changes in market sentiment can amplify systemic risk. In this regard, Leventides et al. (2019) find a high correlation between asset portfolios during periods of crisis, which can increase price volatility. This is explained by the fact that increased uncertainty provokes fear in the markets, which can lead a significant group of investors to adopt similar behaviors, such as selling assets perceived as risky.

This coordinated movement generates a dynamic of forced sales that pressures price and amplifies asset volatility, even for those that were not correlated before the crisis. The results of Wang et al. (2022) support this idea, as they observe how, during the stock market crisis in China, the connectivity of the system reached its peak, along with a vertiginous increase in the risk of volatility.

The results presented above coincide with findings from previous studies that highlight the volatility layer in systemic risk analysis. Furthermore, the literature on volatility emphasizes the fact that large shocks contain abundant information and recognizes that episodes of strong variations concentrate the most relevant signal on systemic risk (Ando et al. 2022). Volatility, therefore, not only measures uncertainty about asset values, but can also act as a factor that modulates the relevance of the financial network topology in the propagation of systemic risk (Battiston and Martinez-Jaramillo 2018).

Consequently, asset volatility can modify the exposure of each institution (Caccioli et al. 2018), amplifying or attenuating contagion mechanisms within the network. This fact reinforces the idea of incorporating multilayer models into systemic risk analysis that capture both structural heterogeneity and the uncertainty inherent in market dynamics.

To analyze volatility dynamics, recent approaches such as that proposed by Ahelegbey and Giudici (2022), who developed the Network Volatility Index (NetVIX), can be incorporated. This indicator integrates average market volatility with the degree of interconnection between markets, allowing us to capture price instability and how that instability spreads through the financial network.

The third objective of the study is to describe emerging empirical methods for systemic risk analysis. From an econometric perspective, the prevalence of vector autoregressive (VAR) models is observed. One of the most influential studies in this field is by Diebold and Yilmaz (2009), who developed the DY Spillover Index, which is widely used to quantify spillovers but requires arbitrarily selecting the size of the moving window and may discard observations, making it less flexible in the face of structural changes.

Some empirical innovations have helped to address the limitations of classical models. For example, TVP-VAR allows us to address problems related to the definition of the moving window size, the loss of observations, and outliers (Antonakakis and Gabauer 2017). For its part, QVAR (Ando et al. 2018) extends the decomposition of variance to conditional quantiles and allows asymmetric effects that are not seen in the analysis of the mean to be captured. Finally, LASSO VAR helps to regularize coefficients to avoid overfitting in high-dimensional systems (Greenwood-Nimmo et al. 2019), which can be useful when there are many variables.

A comparative analysis of the clusters reveals significant differences in methodological rigor. The cluster focused on contagion in financial markets predominantly uses conventional methodologies to characterize systemic episodes. The systemic crisis cluster is characterized by an empirical approach focused on historical episodes, where the analysis of multilayer networks and financial connectivity allows for the detection of early signs of crisis. In the banking networks, network topology, and multilayer networks cluster, there is a shift toward more structured analytical models, with a particular emphasis on topology metrics and the use of simulation techniques, which strengthens the ability to identify and characterize financial contagion channels.

In the clusters related to external shocks and quantile analysis, there has been a qualitative leap in terms of rigor, with the incorporation of advanced econometric techniques such as QVAR, Elastic Net VAR, and machine learning algorithms that capture nonlinearities and extreme effects and assess systemic risk in conditions of high volatility. In particular, the external shocks cluster addresses macroeconomic and geopolitical factors using VAR methodologies and spillover models to analyze the phenomenon based on exogenous assumptions.

Unlike previous bibliometric studies, which have focused mainly on quantifying scientific output, identifying influential authors, and mapping general research trends (e.g., Nica et al. 2024), this study provides a detailed overview of the predominant and emerging methodological approaches.

The application of CiteSpace software has made it possible to measure the conceptual structure, based on which different theoretical currents have been identified, and econometric methodologies have been characterized. Although Pacelli et al. (2025) highlight networks for understanding the interconnection of financial institutions, they do not systematically explore thematic clusters and the conceptual representation of the field of research on systemic risk.

For their part, Su et al. (2024) identify the prevalence of GARCH and VAR models in the analysis of financial contagion, but our study complements these findings by highlighting the importance of mapping multilayer networks, risk-transmitting and risk-receiving nodes, and the evolution of empirical work toward advanced econometric techniques.

The results of this bibliometric study have important implications for actors in the financial system and public policymakers. First, multilayer models such as those used by Xiang and Borjigin (2024), Wang et al. (2021), and Cerqueti et al. (2021) can be used to design warning systems that detect the spread of risks across different layers of the financial system.

Topological analysis for the detection of risk-emitting nodes and vulnerable sectors, as seen in Dai et al. (2023a, 2023b), Arreola Hernandez et al. (2020), and Choi et al. (2020), can help regulators prioritize supervision and adjust the intensity of regulatory intervention in times of crisis. In addition, Naeem et al. (2025) proposal to analyze tail risk exposure using quantile analysis techniques allows policymakers and regulators to identify and manage extreme risks at different percentiles of the return distribution.

The findings of this bibliometric analysis have shown a clear evolution in the study of systemic risk and contagion networks. Future research could delve deeper into concepts such as resilience, structural redundancy, and system fragility from a complex systems perspective, incorporating developments in network theory. At the methodological level, there is a growing trend toward developing advanced VAR-type econometric models; therefore, subsequent work could delve deeper into this line by incorporating models with regularization, based on elastic networks (Xiang and Borjigin 2024), spectral decomposition techniques, and dynamic clustering.

At the practical level, the findings show a growing trend toward the analysis of sectoral and geographic connectivity, which constitutes an incentive for regulators to adopt a surveillance approach based on network analysis. In this way, they will be able to monitor propagation channels and anticipate potential sources of vulnerability based on the sectors or regions where the financial network is located.

In general terms, integrating bibliometric findings with network analysis and emerging methodologies for systemic risk analysis can guide decision-makers in identifying the underlying causes of contagion and designing regulations that are tailored to the context in which systemic shocks occur and, at the same time, enables the implementation of macroprudential policies and adaptive supervisory systems that strengthen the resilience of the financial system in the face of future crises.

However, despite the ability of bibliometric techniques to map trends and knowledge structures, their limitations must be recognized, such as those associated with decisions related to parameter definition or coverage threshold, which can affect the reproducibility of results. Furthermore, representations based on co-citation networks may underestimate the relevance of interdisciplinary or emerging contributions.

It is important to note that there is no standard approach for assessing the quality of the interpretation of thematic clusters or their conceptual representativeness in complex fields such as financial systemic risk.

This study presents some limitations that must be considered when interpreting the results. First, it should be noted that the characteristics of a bibliometric analysis entail inherent restrictions in the screening and selection process of the analyzed papers. Although inclusion and exclusion criteria were applied, the risk of coverage bias persists, considering, among other things, that the papers analyzed were selected exclusively from the WoS database.

The use of CiteSpace software also imposes methodological limitations, as the analysis is based on metadata such as titles, abstracts, and keywords. Although an effort was made to describe the content of the relevant publications in the sample, the approach does not allow for an in-depth assessment of the context, as this requires a thorough qualitative content analysis to address the various nuances. To address this situation, subsequent reviews could focus on specific risk events or specific markets such as emerging economies or cryptocurrencies.

6. Conclusions

The objective of this study was to analyze the current state of research on systemic risk and the contribution of network analysis to understanding contagion mechanisms. At the contextual level, some studies focus on analyzing financial interconnected networks that can drive the propagation of losses and the escalation of bank failures. Other studies analyze the propagation of shocks in financial markets, highlighting the role of crises—such as pandemics, geopolitical conflicts, or sectoral collapses—and how these can be amplified through linkages and compromise the stability of the financial system. At the theoretical and methodological level, a set of studies is identified that emphasize models that improve the understanding of the dynamic and causal relationships between financial variables, highlighting the use of VAR models and their extensions such as TVP-VAR, QVAR, and LASSO-VAR.

This study shows that trends in addressing the phenomenon are based on rigorous econometric methodologies and a greater emphasis on network theory to understand the interconnectedness of financial institutions. It concludes that, to adequately address systemic risk, it is crucial to characterize the existing connections in global financial networks, identify the centrality of institutions considered “too big to fail,” and assess the potential impact of systemic escalation by analyzing contagion mechanisms. In this context, multilayer networks represent a significant advance in understanding the phenomenon, as they allow for the integration of different dimensions of interconnectedness, providing a comprehensive view of the fragility of the financial system and potential risk propagation routes.

Based on the results obtained and emerging themes in the literature on financial contagion, it is possible to outline specific actions in terms of regulation and investment portfolio management, aimed at strengthening systemic risk management and mitigating adverse economic impacts. These include actions to:

- Encourage the integration of advanced quantitative tools such as QVAR or TVP-VAR to measure and monitor risk connectivity between assets and markets.

- Dynamically adjust the weighting of assets within investment portfolios, considering the connectivity between markets and their exposure to events such as pandemics or geopolitical conflicts.

- Develop supervisory frameworks that incorporate multi-layered networks to capture the complex dynamic transmission of risks between markets.

- Strengthen the transparency of financial markets, considering phenomena such as shadow banking and the rapid development of the crypto-asset market, to identify potential contagion and facilitate early intervention.

- Establish early warning systems based on social media information and investor sentiment, which allow for the anticipation of events such as short squeezes, especially in high-risk assets such as digital tokens.

- Adapt regulations and strategies to minimize spillover risks in energy, carbon, and agricultural markets, considering external shocks such as pandemics, conflicts, and the energy transition.

This study has some limitations. First, the choice of the WoS database represents a methodological restriction. Although the database is characterized by rigorous indexing and contains a significant portion of relevant, high-quality academic output, its coverage is selective and may exclude impactful studies from other databases such as Scopus or SSRN. This poses a risk that certain contributions in the emerging literature may not have been considered, limiting the comprehensiveness of the findings.

On the other hand, the exclusive use of CiteSpace software for processing and visualizing information limits the scope of the study to the data processing capacity of the software. Although the tool effectively identifies thematic clusters, the results are conditioned by the clustering algorithm and the configuration parameters chosen by the researchers.

This bibliometric analysis is theoretically relevant in that it establishes a theoretical foundation for understanding the phenomenon of systemic risk and for methodological alternatives for its measurement and analysis. These findings can be leveraged in future research, as they facilitate the identification of prominent theoretical approaches in the field and the analytical frameworks used in the development of empirical studies.

Three main avenues for further study are identified: (i) the study of multilayer network connectivity to capture the different financial contagion channels; (ii) the analysis of sectoral and geographic connectivity to understand the heterogeneity of systemic risk; and (iii) the approach to extreme connectivity and tail risk, which can be especially useful for anticipating significant events under stress conditions. These avenues are linked to the identified thematic clusters. For example, the study of contagion in financial markets and the crisis is linked to sectoral and geographical connectivity.

The analysis of banking networks and network topology can be approached from the perspective of multilayer network analysis. Finally, attention to external shocks and quantile analysis is associated with the approach of extreme connectivity and tail risk.

Author Contributions

Conceptualization, J.S.R.R., J.C.A.-P. and J.E.C.N.; methodology, J.S.R.R., J.C.A.-P. and J.E.C.N.; software, J.S.R.R., J.C.A.-P. and J.E.C.N.; validation, J.S.R.R., J.C.A.-P. and J.E.C.N.; formal analysis, J.S.R.R., J.C.A.-P. and J.E.C.N.; investigation, J.S.R.R., J.C.A.-P. and J.E.C.N.; resources, J.S.R.R., J.C.A.-P. and J.E.C.N.; data curation, J.S.R.R., J.C.A.-P. and J.E.C.N.; writing—original draft preparation, J.S.R.R., J.C.A.-P. and J.E.C.N.; writing—review and editing, J.S.R.R., J.C.A.-P. and J.E.C.N.; visualization, J.S.R.R., J.C.A.-P. and J.E.C.N.; supervision, J.S.R.R., J.C.A.-P. and J.E.C.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The database used in this study is available at Web of Science https://www.webofscience.com/ (accessed on 22 June 2025).

Acknowledgments

The authors thank the Universidad Nacional Abierta y a Distancia—UNAD.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| IMF | International Monetary Fund |

| BIS | Bank for International Settlements |

| AIG | American International Group |

| SIFI | Systemically Important Financial Institutions |

| WoS | Web of Science |

| TENET | Tail-Event-Driven Network |

| SAR | Spatial Autoregression |

| DY | Spillover Index |

| VAR | Vector Autoregression |

| TVP-VAR | Time-Varying Parameter Vector Autoregression |

| QVAR | Quantile Vector Autoregression |

| CoVar | Conditional Value at Risk |

| QFVAR | Quantile Factor Vector Autoregression |

| SRISK | Systemic Risk Measure |

| PCQ | Partial Cross Quantogram |

| EDB | Exposed-Distressed-Bankrupter |

| FEVD | Forecast Error Variance Decomposition |

References