Abstract

Numerous researchers acknowledge that the occupational pension protects employees. However, in China, the total cost of occupational pensions is shared between employees and employers, representing a significant financial commitment. This study aimed to explore the effect of the occupational pension on corporate social responsibility (CSR) and organizational resilience. Drawing on insights from cost-stickiness and resource-based theories, we developed a model that elucidated the influence of occupational pensions on firms’ approaches to CSR within the context of COVID-19 and how this, in turn, impacted organizational resilience. This study categorized CSR into strategic and responsive activities, employing the concept of cost stickiness as a framework. We analyzed a sample of 34,145 observations from Chinese A-share listed companies spanning the period 2010–2023 to examine the influence of occupational pension adjustments on CSR strategies. The findings of this study revealed that the cost pressure associated with contributions to occupational pensions prompted firms to decrease their engagement in responsive CSR activities while enhancing their strategic CSR initiatives. Furthermore, it was observed that strategic CSR contributed to improved organizational resilience, whereas responsive CSR did not exhibit the same effect. The relationship between occupational pension contributions and CSR was found to be significantly and negatively moderated by factors such as the minimum wage and population aging. Conversely, the relationship between CSR and organizational resilience was significantly and positively moderated by digital transformation and marketing capabilities.

1. Introduction

The occupational pension is a crucial labor protection system in many countries. In 1984, China introduced an enterprise pension system to partially provide retirement benefits to enterprise workers (Zheng et al. 2023). The occupational pension system became mandatory nationwide in 2011 with the introduction of the Social Security Law in 2010 (Shan and Park 2023). Under the Social Security Law, both employers and employees are responsible for paying basic occupational pension premiums (Wang and Huang 2023). As society grows, pension premiums continue to increase, and so the cost to businesses continues to rise (Hu et al. 2023; Wang et al. 2023a, 2023b). These cost shocks have affected enterprise behavior and investment decisions in various ways, such as increasing tax avoidance (Campbell et al. 2021), reducing outward investment (Duckett 2020), inhibiting innovation (Gao et al. 2023), and influencing strategic corporate decisions (Agarwal et al. 2020; Wahyudi et al. 2020).

The observation that investing in occupational pensions can detract from a firm’s ability to fund CSR initiatives is rooted in the inherent limitation of organizational resources, a foundational principle of resource-based theory (Yang et al. 2022). This theory elucidates how a limited pool of organizational resources necessitates careful allocation. Thus, when a significant portion is earmarked for occupational pensions, it naturally constrains the availability of resources for other ventures, most notably CSR efforts (Yang et al. 2022). Occupational pensions, in this scenario, emerge as competitors against CSR and other operational activities for the scarce resources of the organization. This competition underscores the pivotal challenge of resource allocation—how to distribute limited resources effectively across various organizational needs. As allocations towards pensions increase, with other operations held steady, the proportion of resources dedicated to CSR correspondingly diminishes, underscoring the delicate equilibrium required in managing organizational resources.

Will firms cut or maintain their corporate social responsibility (CSR) investments amid rising pension premiums? Theoretical analyses of the possible mechanisms involved still leave the answer uncertain. CSR refers to the activities of enterprises that incorporate social and environmental issues into their operations and interactions with stakeholders (Van Marrewijk 2003). According to Porter and Kramer’s 2006 framework for CSR decision-making, CSR can be divided into two categories: responsive and strategic (Porter and Kramer 2006; Kang 2016). Responsive CSR aims to improve short-term stakeholder relationships and is often viewed as a symbolic impression management activity (Porter and Kramer 2006), or short-term investment separate from the organization’s core business (Bansal et al. 2015; Muller and Kräussl 2011). Strategic CSR is an investment with limited short-term returns and requires long-term planning, significant resource investment, and major organizational restructuring (Bansal et al. 2015; Habib and Hasan 2016; Kang 2016).

When firms face cost shocks, they must weigh the costs of adjusting CSR, including economic losses (Ibrahim et al. 2022) and social, contractual, or psychological costs (Costa and Habib 2023), as well as the loss of intangible assets such as reputational capital (Ibrahim et al. 2022). This understanding is based on cost stickiness theory (Habib and Hasan 2016; Venieris et al. 2015). Cost stickiness theory suggests that certain costs are sticky and increase more with a firm’s business volume rather than decrease when business volume falls asymmetrically (Anderson et al. 2003; Venieris et al. 2015). Several studies have shown that CSR is a long-term investment with limited short-term returns (Habib and Hasan 2019; Kang 2016). The value-creating effect of CSR can only be realized through sustained investment (Habib and Hasan 2016). If firms respond to the labor cost shock of rising occupational pension costs by reducing CSR expenses or adjusting CSR inputs, they will also face higher adjustment costs, which may force them to abandon CSR altogether (Habib and Hasan 2016; Kang 2016; Venieris et al. 2015).

Besides exploring the mechanisms of firms’ adjustment to CSR based on the cost stickiness theory, this study also introduces the resource base theory to illustrate how CSR affects organizational resilience. Organizational resilience has emerged as a critical factor in ensuring sustainable business operations, environmental adaptability, and quality development (Kantur and Say 2015). Organizational resilience indicates how well firms cope with and adapt to turbulent environments (Guo et al. 2020; Jiang et al. 2019). However, few studies have analyzed the impact of CSR from the perspective of organizational resilience (Torres and Augusto 2021). Resource-based theory was first proposed by Wernerfelt (1984), who argued that scarce resources acquired by firms can help them improve their competitiveness and performance (Wernerfelt 1984). Studies have shown that corporate investment in social responsibility leads to more effective advice and greater acquisition of scarce resources for stakeholders (Freeman et al. 2021). This study applied resource-based theory to analyze the impact of CSR on organizational resilience from the perspective of resource acquisition, as well as applying insights drawn from stakeholder theory and signaling theory in the analysis.

Additionally, we assessed the moderating role of the macro-social development level. According to China’s fifth national census (2000), the proportion of the population aged 65 years and above at that time was approximately 7%, making China an aging country (Bai and Lei 2020). As the number and proportion of the aging population increase, the dwindling labor supply poses a long-term threat to business development (Clemens 2021; Jarzebski et al. 2021). Similar to the occupational pension, the minimum wage system plays a role in safeguarding the basic living standards of those on low incomes and in improving income distribution. However, a significant increase in the minimum wage can also result in a labor cost shock (Clemens 2021).

The moderating role of a firm’s strategic level was also assessed. Digital transformation is driving Chinese enterprises to upgrade to artificial intelligence and informatization, which is likely to significantly improve productivity through the efficient transmission of information and optimal allocation of resources (Li et al. 2023a). This study considered marketing capability as an important indicator for improving enterprise efficiency in acquiring resources (Mishra and Modi 2016).

Current research has focused primarily on the positive effects of occupational pensions on society and the labor force, while neglecting its cost to firms. Our study is inspired by the observation that the potential negative effects of pensions on firms have not received adequate attention in existing research. Furthermore, this investigation incorporates the cost stickiness and resource-based theories, which have seldom been applied in previous analyses exploring the nexus between pensions and CSR.

In order to fill these gaps, our empirical investigation, which involved Chinese A-share listed firms from 2010 to 2023, aimed to reveal the relationship between occupational pension, CSR, and organizational resilience. Our theoretical contributions are multifaceted. Firstly, through the lenses of cost stickiness and resource-based theory, we delineate the theoretical mechanisms by which pensions influence CSR. Secondly, we dissect the distinction between strategic CSR and responsive CSR, employing cost stickiness theory as our analytical framework. Thirdly, drawing upon stakeholder theory and theories related to organizational resilience, we elucidate the divergent impacts of these two types of CSR on organizational resilience. Lastly, we introduce moderating variables such as minimum wage, population aging, marketing capability, and digital transformation to facilitate a more nuanced analysis. The exploration of these moderating effects significantly augments the depth of our theoretical investigation.

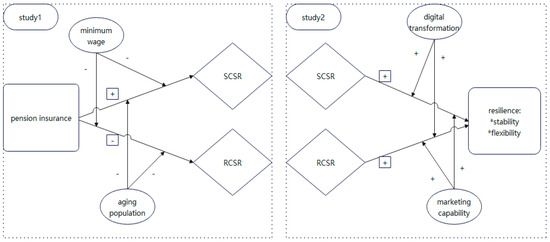

The findings of this study are intended to aid policymakers in comprehending and evaluating the extent of the impact of the occupational pension system in China. Additionally, they can help inform corporate managers in relation to more effective strategic decision-making when faced with labor cost shocks. Figure 1 illustrates the theoretical framework of the study.

Figure 1.

A process model for our proposed framework.

Description: Study one showed that occupational pension increased strategic CSR and decreased responsive CSR. Study two showed that strategic and responsive CSR increased organizational resilience.

2. Theory and Hypothesis Development

2.1. Occupational Pension, Strategic and Responsive CSR

There is a significant contrast between strategic and responsive CSR strategies in terms of cost stickiness (Habib and Hasan 2016). Strategic CSR integrates social responsibility with corporate strategies, resources, capabilities, processes, business models, and stakeholder interactions (Porter and Kramer 2006). This approach requires long-term planning, significant investments in resources, and major organizational restructuring, particularly in areas such as product and customer responsibilities (Bansal et al. 2015). Therefore, the cost of maintaining strategic CSR activities is significant. Consequently, cutting strategic CSR in response to labor cost shocks from pension premiums can lead to economic losses, social costs, contractual or psychological costs, and losses of intangible assets, such as reputational capital (Chen et al. 2023; Habib and Hasan 2016; Venieris et al. 2015).

Responsive CSR aims to improve stakeholder relations and meet stakeholder demands in the short term, aligned with established norms, expectations, and practices to build legitimacy and gain resource support (Porter and Kramer 2006). Some have viewed responsive CSR as a token impression management activity, or a short-term investment separate from the organization’s core business (Bansal et al. 2015; Muller and Kräussl 2011). In China, responsive CSR includes exercising community responsibility through charitable donations, and environmental responsibility through environmental protection inputs (Tao and Song 2020). According to the overinvestment hypothesis of agency theory, charitable giving may be viewed as agency behavior that reflects management self-interest. CEOs may be inclined to over-invest in charitable giving, which can negatively affect the interests of shareholders and the overall value of the firm. This overinvestment can even become a significant economic burden, constraining firm growth (Barnea and Rubin 2010; Friedman 1970). Responsive CSR is a reversible short-term investment that requires fewer resources, incurs lower adjustment costs, and is less susceptible to stickiness. Therefore, we argue that firms can quickly adjust or reduce responsive CSRs when faced with labor cost shocks from pensions (Buslei et al. 2023; Wang et al. 2023b).

Based on the above analysis, we formulated the following hypotheses:

Hypothesis 1a:

Due to high cost stickiness, firms will maintain strategic CSR when facing labor cost shocks from occupational pensions.

Hypothesis 1b:

Due to low cost stickiness, firms will cut responsive CSR when facing labor cost shocks from occupational pensions.

2.2. Strategic and Responsive CSR and Organizational Resilience

Meyer (1982) coined the term ‘organizational resilience’ to describe an organization’s ability to respond to disturbances and restore previous order (Meyer 1982). Scholars have summarized the concept of organizational resilience in terms of ability or process. Organizational resilience refers to the dynamic and flexible ability of an organization to combine prediction, stability maintenance, survival, endurance, adaptation, learning, and developmental abilities (Carvalho and Areal 2016; Ma et al. 2018).

Previous studies have shown the complexity of the factors that influence organizational resilience (Andersson et al. 2019). This study primarily examined the mechanisms of organizational resilience from three perspectives: individual, organizational, and environmental. Individual factors influencing resilience include knowledge acquisition, skill training, and ability improvement (Williams et al. 2017). In addition, creativity (Manfield and Newey 2017), employee psychological capital (Linnenluecke 2017), and leadership (de Oliveira Teixeira and Werther 2013) are important factors. At the organizational level, the factors with the greatest influence include managing organizational relationships (Kahn et al. 2018) and transferring information within an organization (Bustinza et al. 2019). According to Kahn et al. (2018), based on intergroup relationship theory, when a department is under external pressure, neighboring departments may use approaches such as assistance, adaptation, and integration to enhance the resilience of the department (Gao and Gao 2023; Jin et al. 2024; Liu et al. 2021).

Effective communication and engagement with stakeholders can improve a firm’s ability to adapt to environmental changes and reduce negative impacts (DesJardine et al. 2019; Kahn et al. 2018). By improving communication and contact with stakeholders, firms that actively engage in social responsibility activities can enhance their ability to adapt to environmental changes and reduce negative impacts caused by such changes (DesJardine et al. 2021). However, few studies have examined the factors influencing firms’ organizational resilience during crises, particularly during the COVID-19 pandemic. Furthermore, in the Chinese context, it is necessary to enhance the exploration of socially responsible investments to improve organizational resilience (Lu et al. 2022; Sajko et al. 2021).

2.2.1. The Impact of Strategic CSR on Organizational Resilience

Strategic CSR focuses on stakeholders, such as employees, consumers, and suppliers, who are closely linked to a firm’s development, competition, and strategic changes (Pollman 2019). For example, employee responsibility can foster loyalty, solidarity, and a positive corporate culture, which can help firms withstand shocks and overcome challenges (Crane and Matten 2020; Fukuda and Ouchida 2020; Pollman 2019). By fulfilling product and consumer responsibilities, firms can develop high-quality products, build an excellent brand image, maintain and attract high-quality customers, and enhance their overall social image (Huang et al. 2020; Porter and Kramer 2006).

According to resource-based theory, firms can improve their competitiveness and prevent crises by integrating resources (Yang et al. 2022). Following understandings derived from resource-based theory and stakeholder theory, firms can effectively strengthen the connection between themselves and strategic stakeholders such as employees, consumers, and suppliers by enhancing their strategic CSR, which will enable them to acquire scarce strategic resources more readily (Yang et al. 2022). Specifically, investing in CSR strengthens the connections between firms and strategic stakeholders, which will enable such firms to obtain scarce resources that are closely related to their core business, thus strengthening their defensive capabilities in the face of crises and enhancing their stability and flexibility (DesJardine et al. 2019; Sajko et al. 2021; Wieczorek-Kosmala 2022).

The transmission mechanism of market signals was severely comprised during the COVID-19 pandemic, leading to increased information asymmetry and opacity (Li et al. 2022; Polyzos et al. 2021). According to signaling theory, firms can use CSR investments to communicate their stable and positive states to stakeholders, which is likely to increase stakeholder support and investment confidence in such firms, as well as enhance the ability of firms to withstand changes in the external environment (Bebchuk and Fried 2003; DesJardine et al. 2021; Fama 1980; Li et al. 2022; Polyzos et al. 2021). Following understandings derived from signal and stakeholder theories, firms can release strategic CSR-related information to dispel stakeholder doubts and strengthen connections among employees, consumers, suppliers, and other stakeholders (DesJardine et al. 2021; Li et al. 2022).

Based on the above analysis, we proposed the following hypothesis:

Hypothesis 2a:

Strategic CSR improves organizational resilience.

2.2.2. The Impact of Responsive CSR on Organizational Resilience

According to stakeholder theory, governments and communities are important for CSR as responsive stakeholders (Porter and Kramer 2006). Exercising environmental responsibility is mandatory in China (Elhendy et al. 2006; Porter and Kramer 2006). However, this has not been consistently applied in relation to enterprises’ core business and strategic objectives, because environmental responsibility has a shorter investment cycle and is more reversible than strategic CSR (Elhendy et al. 2006; Guo et al. 2020; Porter and Kramer 2006). Community responsibility refers to the responsibilities and tasks that enterprises should undertake to maintain public safety and to help realize the public interests of community residents (Zhang et al. 2016). In China, autonomous organizations such as neighborhood and village committees are the main bodies that guarantee community safety and deal with emergency affairs. Community responsibility is mostly guaranteed and implemented through meeting state-enforced obligations, whereas enterprises invest in community responsibility to respond to policies and systems and meet legitimacy needs (Zhang et al. 2016). However, investment in community responsibility requires a focus away from the core business of enterprises and does not enhance their operational capacity, improve their performance level, or help them recover (Al-Mamun and Seamer 2021; Zhang et al. 2016). Based on understandings derived from resource-based and stakeholder theories, responsive CSR can meet the needs of responsive stakeholders, such as the government and community, but it is difficult to obtain scarce resources related to the core business of enterprises from the government and community. Therefore, allocating resources to exercise responsive CSR may be considered wasteful, and overinvestment in this area may hinder business recovery in the post-pandemic era (DesJardine et al. 2021; Sajko et al. 2021; Wieczorek-Kosmala 2022).

According to signaling theory, responsive CSR satisfies the needs of responsive stakeholders, such as governments and communities; improves information transparency between governments, communities, and firms; and, to some extent, strengthens government and community support for firms (Chen et al. 2022). However, government and community support for firms tends to emerge only after a long period of time. For example, it takes considerable time for supportive policies to be introduced. In addition, policies introduced by the government have a strong macro-regulatory function, making it difficult to influence the internal structure and resource allocation of firms (Ketter 2022; Sharma et al. 2021; Wieczorek-Kosmala 2022). In summary, responsive CSR makes it difficult to effectively promote a firm’s organizational resilience and can even impede it. Therefore, this study argues that responsive CSR does not enhance, and can even undermine, a firm’s organizational resilience.

Based on the above analysis, we proposed the following hypothesis:

Hypothesis 2b:

Responsive CSR weakens organizational resilience.

2.3. The Moderating Role of Minimum Wage

Increases in the minimum wage create an incentive effect according to the efficiency wage theory, which postulates a positive relationship between a worker’s income and his or her efficiency, and that higher wages increase productivity due to increased effort at work and motivation (especially for low-skilled workers) to upgrade and train (Clemens 2021; Kong et al. 2020; Starr 2019). However, minimum wages trigger negative effects when the increases exceed certain thresholds (Akee et al. 2019; Fieseler et al. 2019; Pancieri et al. 2022). According to the relevant provisions of the Labor Contract Law, firms are required to pay compensation for the dismissal of employees, the amount of which is directly linked to the minimum wage standard (Akee et al. 2019). Minimum wages reduce the cost of employee advocacy, increase the cost of dismissal, and increase job stability. Firms cannot easily fire even poorly performing employees, which dampens the motivation of others (Akee et al. 2019; Cooper et al. 2018; Li et al. 2023b). To some extent, the minimum wage increases the cost burden for firms.

Based on the above analysis, we proposed the following hypothesis:

Hypothesis 3a:

Higher minimum-wage levels exacerbate decreases in responsive CSR related to occupational pension.

Hypothesis 3b:

Higher minimum-wage levels mitigate increases in strategic CSR related to occupational pension.

2.4. The Moderating Role of Population Aging

The impact of population ageing on the world economy has been thoroughly analyzed in the existing literature (Nadkarni and Prügl 2021). However, in contrast, the process of population ageing in China is complex. This is because population ageing in China is taking place in the context of “ageing before wealth” (Zhang and He 2022). Economic growth has been crucial in strengthening resources for old age, but China is now facing downward pressure on its economy (Zhang and He 2022). With its population aging faster than middle-income countries can normally sustain, China’s per capita income level has yet to reach the world’s high level (Ren et al. 2023). The challenge lies in how to provide the country with resources for old age (Ren et al. 2023). Population aging has disrupted China’s labor market and increased recruitment costs for companies (Ding and Ran 2021; Maestas et al. 2023). At the same time, the aging population has also increased the cost of pension contributions, thus significantly increasing the operating costs of enterprises (Ding and Ran 2021; Maestas et al. 2023).

Based on the above analysis, we proposed the following hypothesis:

Hypothesis 4a:

Higher population-aging levels exacerbate decreases in responsive CSR related to occupational pension.

Hypothesis 4b:

Higher population-aging levels mitigate increases in strategic CSR related to occupational pension.

2.5. The Moderating Role of Digital Transformation

The digital economy has generated new business models in areas such as the internet (Russell 2013), big data (Watts and Feltus 2017), cloud computing (Wu et al. 2019), artificial intelligence (Barta and Görcsi 2021), and the Internet of Things (IoT) (Gao et al. 2021). These technologies have become increasingly integrated into various sectors of the economy and society, playing an important role in creating employment, stimulating consumption, and driving investment (Pandey and Pal 2020).

The COVID-19 pandemic has further highlighted the importance of network effects and new business models in the digital economy, topics which have attracted widespread academic attention (Pandey and Pal 2020). The impact of digital transformation extends beyond the macroeconomic and production spheres, with significant effects on the internal and external environments of firms, providing a strong impetus for high-quality development, transformation, and upgrading (Watts and Feltus 2017; Wei et al. 2019). Digitally transformed firms have fewer barriers to information transfer (Lanzolla et al. 2020; Moi and Cabiddu 2021). In addition, digital transformation makes it easier for firms to fully absorb resources (Chen and Zhang 2021; Feyen et al. 2021).

Based on the above analysis, we proposed the following hypothesis:

Hypothesis 5a:

Digital transformation mitigates decreases in responsive CSR related to the occupational pension.

Hypothesis 5b:

Digital transformation exacerbates increases in strategic CSR related to the occupational pension.

2.6. The Moderating Role of Marketing Capability

Marketing capabilities can play a moderating role in terms of facilitating transformation of a firm’s resources into products (Mishra and Modi 2016). Specifically, the impact of marketing capabilities on firm resilience can be categorized into two aspects. First, based on signaling and stakeholder theories, high marketing capability provides more convenient signaling channels for firms, which improves the efficiency of information transmission (Mishra and Modi 2016). Therefore, enterprises with high marketing capabilities can appropriately signal social responsibility to stakeholders (Mishra and Modi 2016).

Second, based on resource base theory and stakeholder theory, marketing capability refers to a firm’s ability to understand the preferences and needs of stakeholders, such as employees, consumers, products, communities, and the environment. A high marketing capability can increase the efficiency of resource transformation (Xiong and Bharadwaj 2013). CSR investment enables firms to obtain scarce resources, and firms with high marketing capabilities can increase the effectiveness of socially responsible investments. Marketing capabilities enhance the impact of CSR and make it easier for firms to transform socially responsible resources into output and value, thereby increasing their resilience to risks (Mishra and Modi 2016; Morgan 2012).

In summary, this study argues that marketing capabilities facilitate the transformation of strategic CSR investments into organizational resilience by improving the efficiency of information and resource transformation. Although responsive CSR focuses on stakeholders not involved with a firm’s core business, marketing capabilities allow for this to some extent by improving the efficiency of information and resource transformations. Thus, marketing capabilities mitigate the damaging or inhibiting effects of responsive CSR on organizational resilience.

Based on the above analysis, we proposed the following hypothesis:

Hypothesis 6a:

Marketing capability promotes the transformation of strategic CSR into organizational resilience in firms.

Hypothesis 6b:

Marketing capability mitigates the inhibitory effect of responsive CSR on organizational resilience in firms.

3. Methodology

Our main study is divided into two parts: study one examines the effect of occupational pension on CSR, and study two examines the effect of CSR on organizational resilience.

3.1. Sample

Our sample consists of data from 2010 to 2023 for a sample of listed companies in China. The final sample consists of 34,145 observations. All continuous variables were logged in this study. To minimize the effect of outliers, all continuous variables are winnowed at the 1% and 99% levels.

3.2. Measures

Occupational pension is defined and measured as follows: Based on previous studies (Shan and Park 2023; Zheng et al. 2023), we use the amount of occupational pension (LnPensions) in the annual reports of listed companies. We use the DID enacted by the 2010 Social Security Law to measure robustness. In the treatment of the policy variable (Treat), we use the average occupational pension expenditure as the benchmark, assigning a value of one to firms that exceed this average, and a value of zero to those that are below or equal to the average. This is because firms with higher levels of occupational pension expenditure are more likely to be affected by the Social Insurance Law. Thus, firms above the average are considered to be more susceptible to influence (Treat = 1), while those below are considered less susceptible (Treat = 0). In the treatment of the policy time variable (Time), this study assigns a value of one to the years following the enactment of the Social Insurance Law and a value of zero to the years prior to its enactment. We assign a value of one to the year of the Social Security Law’s enactment and subsequent years (year ≥ 2011), and a value of zero to the years before its enactment. We define Treat*Time as the impact of the Social Security Law on firms (DID), to test the robustness of the relationship between occupational pensions and corporate social responsibility.

Strategic and responsive CSR are defined and measured as follows: Learning from previous methods, strategic CSR (LnSCSR) is the sum of employee responsibility, consumer responsibility, and product responsibility (LnSCSR = ln(employee responsibility+consumer responsibility+product responsibility)), while responsive CSR (LnRCSR) is the sum of environmental responsibility and community responsibility (LnRCSR = ln(environmental responsibility+community responsibility)) (Porter and Kramer 2006, 2011). This part of the data in the benchmark regression comes from the social responsibility report of listed firms disclosed by Hexun.com (Gu et al. 2022; Nwagbara and Reid 2013; Porter and Kramer 2006).

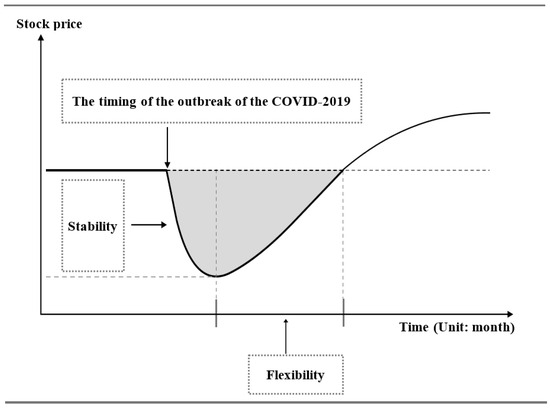

Organizational resilience is defined and measured as follows: We categorize resilience into stability and flexibility, as outlined by DesJardine et al. (DesJardine et al. 2019; Sajko et al. 2021). LnStability refers to the maximum loss in stock price. To make the final result more accurate and objective, we use the relative value of the maximum loss. To illustrate this conclusion, this study introduces the reverse coding method of Fan et al. (2001), to measure stability. LnFlexibility refers to the time taken for stock price to recover from the lowest point to 30% of the initial efficiency level, as measured using the reverse coding method (Fan et al. 2001). Data are from the Wind database. It is worth noting that the COVID-19 pandemic in this study serves as the triggering event for measuring resilience. In robustness checks, we employ the growth rate of profits and the volatility of stock prices to measure resilience from a different perspective.

This study is based on the most fundamental principles of resilience in physics, as well as the perspective of resilience applied in management, economics, and ecology, viewing resilience as an inherent capability or trait of enterprises, stored within the organization. Moreover, resilience, being an unobservable capacity, is considered a latent variable that can only be indirectly reflected through the performance of the enterprise. Therefore, prior research suggests that the characteristics of resilience exhibited by enterprises must be triggered by external disturbances. Consequently, this study measures resilience based on the significant external disruption caused by the COVID-19 pandemic (2020–2023). In robustness checks, we modify the measurement method of resilience. We utilize the growth rate of operating income and the volatility of stock prices to measure organizational resilience from a different perspective, distinguishing it from stability and flexibility through two additional dimensions: the level of growth, and the level of volatility.

We clearly represent the measurement dimensions of resilience in Figure 2.

Figure 2.

Measurement of resilience.

Aging population is defined and measured as follows: One of the moderating variables of this paper is the degree of aging (LnAging). Referring to previous studies, this paper uses the percentage of the population over 65 years old in each city from China Statistical Yearbook data to measure this variable (Bellino et al. 2020; Hu et al. 2020).

Minimum wage is defined and measured as follows: Minimum wage is one of the moderating variables in this paper (LnMiwage). Referring to previous studies, this paper uses data from official government websites, such as the provincial human resources and social security departments. It manually organizes the data of minimum wage standards in local areas (Du and Wang 2020).

Digital transformation is defined and measured as follows: The dependent variable of this paper is the degree of digitalization (LnDigitaltrans). Concerning previous studies, this paper adopts the Digital Transformation Index of Chinese Listed Companies, jointly published by the National Finance Team of Guangdong Institute of Finance and the Editorial Board of Research in Financial Economics, to measure the degree of digital transformation (LnDigitaltrans) (Liu et al. 2022a; Wang et al. 2023b). The larger the value of the digital indicator, the higher the enterprise’s degree of digital transformation.

Marketing capability is defined and measured as follows: The moderating variable in this paper is marketing capability (LnCmkt). In this paper, the stochastic frontier model (SFA) is used to measure marketing capability. The stochastic frontier production function reflects the functional relationship between the input mix and the maximum output under the specific technical conditions and given combination of production factors (Mishra and Modi 2016).

Building on previous research, this study employs the Stochastic Frontier Analysis (SFA) method to estimate marketing capabilities, describing the “input-output” relationship (Mishra and Modi 2016). Specifically, the SFA is used to calculate how much marketing-related output can be obtained from resources related to corporate inputs and marketing activities. The input indicators include sales expenses, accounts receivable, management expenses, intangible assets maintenance costs, and customer relationship maintenance costs (measured by the product of sales revenue lagged by two periods). The output indicator is sales income. Both input and output variables are presented in the descriptive statistics in Table 1. We propose the following Equation (1) or Equation (2):

Table 1.

Descriptive statistics.

Within this framework, represents the model-specific unobserved error term; is the non-negative inefficiency term, indicating the distance of firm’s sales from the sales frontier. The inefficiency term is first subjected to an exponential transformation, followed by a logarithmic transformation (), thus obtaining the value of the firm’s marketing capability (in fact, LnCmkt = ).

After comparing and testing for goodness of fit, we found that Equation (1) has an Akaike Information Criterion (AIC) of 58,760.28 and a Bayesian Information Criterion (BIC) of 58,820.14; Equation (2) has an AIC of 33,642.16 and a BIC of 33,719.12. Previous research indicates (Tsionas 2002) that models with lower AIC and BIC values have a higher goodness of fit. Therefore, upon comparison, we select Equation (2), which has the lower values of both AIC and BIC.

Controls are defined and measured as follows: Referring to previous studies (DesJardine et al. 2019; Sajko et al. 2021), to control for the influence of other factors, this study chose enterprise size (LnSize), asset-liability ratio (LnLev), return on assets (LnROA), cash flows (LnCashflow), shareholding concentration (LnTop5), age of business (LnListAge), and growth capacity (LnRevenue) as the control variables. The data were obtained from the CSMAR (China Economic and Financial Research Database) database. It is worth noting that all variables with an uppercase “L” have been subjected to logarithmic transformation.

3.3. Methods

Based on previous research (Ibrahim et al. 2022; Wang et al. 2023b), in study one, we utilized panel data and, according to the Hausman test results (Prob > chi2 = 0.0000), we concluded that employing a fixed effects model regression for both individual and time-specific effects is appropriate. In study two, drawing upon the work of DesJardine et al. (2019) and Sajko et al. (2021), and considering the mixed-structure nature of the data, adopting an OLS (ordinary least squares) regression model is deemed suitable.

4. Results

4.1. Descriptive Statistics

Table 1 shows descriptive statistics of variables.

4.2. Correlation Analysis

This study examined the correlation coefficients between any two variables to assess the presence of overly strong correlations. It is evident from Table 2 that the absolute values of the correlation coefficients among key variables are all less than 0.7, thus eliminating the concern of strong correlations and severe multicollinearity, enabling further regression analysis (Ali et al. 2009).

Table 2.

Correlation coefficient matrix. Control variables are not reported in this table.

4.3. Study One: Impact of Occupational Pension on CSRs

In Table 3, the coefficient of LnPensions in Model (1) is significantly positive, indicating that firms’ occupational pension expenditures are positively related to strategic CSR, which verifies Hypothesis 1a. In Model (2), the coefficient of LnPensions is significantly negative, indicating that firms’ occupational pension expenditures are negatively related to responsive CSR, which verifies Hypothesis 1b. From the regression results of Models 1 and 2, it can be seen that firms do not adjust all types of CSR downward in response to the cost of occupational pension expenditures, but selectively increase strategic CSR and decrease responsive CSR. This conclusion aligns with the cost stickiness theory cited in this study (Habib and Hasan 2016a; Venieris et al. 2015). Based on our results, we confirm that the cost stickiness of strategic CSR is higher and not easily reduced. In contrast, the cost stickiness of responsive CSR is lower and more easily reduced.

Table 3.

Study one: The impact of pensions on strategic and responsive CSR.

In Table 3, the coefficients of the control variables selected based on previous research (DesJardine et al. 2019; Sajko et al. 2021) also provide certain insights for the study, albeit limited. In Model 1, besides the coefficient of LnPensions on LnSCSR being significantly positive, the coefficients for LnSize, LnROA, and LnTop5 are also significantly positive. This indicates that company size, return on assets, and concentration of equity positively affect strategic CSR. This may be because larger companies, those with higher returns on assets, and those with more concentrated equity place greater emphasis on maintaining corporate strategy. Additionally, these companies usually have a long-term perspective. The coefficients for LnLev and LnListAge are significantly negative, suggesting that leverage and company age negatively affect strategic CSR. This could be due to companies with higher leverage struggling to maintain investments in strategic resources. Companies that have been operating longer may have entered a phase of development fatigue. The coefficients for LnCashflow and LnRevenue are not significant, indicating that cash flow and profit have minimal impact on strategic CSR. However, it is important to note that these are structural explanations produced during the multivariate regression process with multiple variables, rather than individual interpretations of control variables on LnPensions.

Furthermore, in Table 3, Model (2), besides the coefficient of LnPensions on LnRCSR being significantly negative, the coefficients for LnSize, LnROA, and LnListAge are also significantly negative. This suggests that company size, return on assets, and company age negatively affect responsive CSR. This may be because larger companies, those with higher returns, and those that have been operating longer recognize more profoundly that overinvestment in responsive CSR can incur costs without bringing additional benefits to the company. Therefore, they reduce responsive CSR when facing pressure. The coefficients for LnCashflow, LnRevenue, and LnTop5 are significantly positive, indicating that cash flow, profit, and concentration of equity positively affect responsive CSR. This might be because companies with higher cash flow, greater profit growth, and higher concentration of equity believe that responsive CSR can bring non-core business cash flows and profits. The coefficient for LnLev is not significant, suggesting that leverage has a minimal impact on responsive CSR. Similarly, it is worth noting that these are structural explanations produced during the multivariate regression process with multiple variables.

In addition, we divided all the samples equally into three groups based on firm size: small, medium, and large firms. Then, we conducted the tests, and generated the results shown in Table 4. We found that the significant negative effect of occupational pensions on RCSR is present in large-scale firms. Although the effect of occupational pensions on SCSR is not significant in the three groups, they all show a positive effect. The above results basically support our conclusion.

Table 4.

Heterogeneity test for small, medium, and large firms for study one.

4.4. Study Two: Impact of CSRs on Organizational Resilience

In Table 5, the coefficients of LnSCSR are significantly positive in both Model (1) and Model (3), indicating that strategic CSR increases organizational resilience, verifying Hypothesis 2a. This result confirms our proposed viewpoint that strategic CSR investments facilitate engagement with stakeholders related to the core business, reduce information asymmetry, and thereby effectively acquire core, scarce resources that influence organizational strategy. In Model (2) and Model (4), the coefficients of LnRCSR are significantly negative, indicating that responsive CSR decreases organizational resilience, verifying Hypothesis 2b. From the above regression results, it is clear that strategic CSR increases resilience and responsive CSR does not. This result confirms our proposed viewpoint that responsive CSR investments decrease engagement with stakeholders related to the core business. This prevents the company from effectively acquiring core, scarce resources that influence organizational strategy, ultimately failing to enhance resilience. Our findings further validate the resource-based view, signaling theory, and stakeholder theory (Yang et al. 2022; Li et al. 2022).

Table 5.

Study two: the impact of CSR on organizational resilience.

In addition, we divided all the samples equally into three groups based on firm size: small, medium, and large firms. Then, we conducted the test and generated the results shown in Table 6. We found that the significant positive effect of SCSR on stability is concentrated in small and large-scale firms, and the significant positive effect of SCSR on flexibility is concentrated in medium and large-scale firms. The significant negative effect of RCSR on stability is concentrated in large-scale firms. The effect of RCSR on flexibility is not significant in all three types of firms, but all of them show negative correlation. All of these findings generally support our conclusions.

Table 6.

Heterogeneity test for small, medium, and large firms for study two.

4.5. Robustness Tests

4.5.1. DID Tests for the Relationship between Occupational Pension and CSRs

In this study, the difference-in-difference model is used for the robustness test (Etinzock and Kollamparambil 2019). The difference-in-difference model can effectively solve the problem of endogeneity among variables (Shen et al. 2020). The difference-in-difference method is often used in policy evaluation models (Encina 2013). Therefore, we constructed a difference-in-difference model to evaluate occupational pension policy.

In Table 7, the coefficient of DID in Model (1) is significantly positive, indicating that the enactment of the Social Security Act positively affected strategic CSR, verifying Hypothesis 1a. The coefficient of DID in Model (2) is significantly negative, indicating that the enactment of the Social Security Act negatively affected responsive CSR, verifying Hypothesis 1b. The regression results of both Models (1) and (2) indicate that the results of Hypotheses 1a and 1b are robust.

Table 7.

Robust test for the relationship between occupational pension and CSRs.

4.5.2. Adding Industry-Controlled Regressions for Study One and Study Two

In this section, we incorporated industry controls into the regression and concluded that, as shown in Table 8, Model (1), LnPensions positively affects LnSCSR, consistent with the initial regression results, supporting Hypothesis 1a. In Model (2), LnPensions negatively affects LnRCSR, supporting Hypothesis 1b.

Table 8.

Robust test for pensions on CSRs (adding industry_fixed effect).

Similarly, Table 9, Models (1) and (2) indicate that both LnSCSR and LnRCSR contribute to LnStability, which slightly deviates from our proposed hypothesis. However, the significance of the LnSCSR coefficient (***) is higher than that of LnRCSR (**). In fact, this result suggests that strategic CSR is more capable of enhancing the stability aspect of organizational resilience than responsive CSR, which is essentially in line with our core perspective. In Models (3) and (4), LnSCSR significantly enhances LnFlexibility, while LnRCSR does not show significance. This indicates that strategic CSR enhances the flexibility aspect of organizational resilience, whereas responsive CSR does not. Overall, the above results essentially affirm the robustness of the original conclusion.

Table 9.

Robust test for CSRs on organizational resilience (adding industry_fixed effect).

4.5.3. Changing the Measurement of the Dependent Variable for the Relationship between CSRs and Organizational Resilience

We replaced the measure of organizational resilience with a robustness test. Specifically, we replaced stability and flexibility with the degree of income growth and volatility of the firm’s stock value (Ortiz-de-Mandojana and Bansal 2016). In Table 10, the coefficients of LnSCSR are shown to be significantly positive in Model (1) and significantly negative in Model (3). This indicates that strategic CSR will increase organizational resilience, verifying Hypothesis 2a. The coefficients of LnRCSR are all significantly negative in Model (2), and the coefficients of LnRCSR are all significantly positive in Model (4), verifying Hypothesis 2b. From the above regression results, it can be seen that strategic CSR increases resilience, whereas responsive CSR does not. This proves that the original results are robust. This result differentiates the dimensions of organizational resilience from another measurement perspective: revenue growth and stock price volatility (Ortiz-de-Mandojana and Bansal 2016). Our findings indicate that strategic CSR enhances revenue growth and reduces stock price volatility. Responsive CSR decreases revenue growth and increases stock price volatility. This essentially confirms our viewpoint: strategic CSR enhances organizational resilience, while responsive CSR does not.

Table 10.

Robustness test for CSRs on organizational resilience.

4.5.4. Cointegration and Causality Tests for Dynamic Panel Data

Our investigation commences with Section 4.5.3, where we engage in conducting cointegration tests on the dynamic panel data. Initially, addressing the unbalanced nature of our panel data, we meticulously convert it into a balanced panel structure. Following this, we diligently execute unit root tests for each independent and dependent variable independently. Concluding our analytical process, we undertake cointegration tests to scrutinize the interconnections between all independent and dependent variables, covering six distinct relationships, thereby guaranteeing a detailed and exhaustive examination.

Upon converting the unbalanced panel data into a balanced structure, we conducted unit root tests on both the independent and dependent variables. The rationale behind these unit root tests was to ascertain the stationarity of our time series (Levin et al. 2002). A non-stationary time series, marked by the presence of a unit root, implies that the statistical properties of the dataset, such as its mean and variance, may evolve over time, potentially skewing analysis and forecasting efforts (Levin et al. 2002). Moreover, the outcomes of these unit root tests are crucial for detecting any instances of spurious regression, a phenomenon in which the perceived relationship between variables is actually driven by random trends within the time series, rather than a genuine economic connection (Levin et al. 2002). In Table 11, we present the unit root test findings for each key variable. It becomes evident that the p-values for the Levin-Lin-Chu (LLC) test applied to LnSCSR, LnRCSR, LnPensions, LnGrowth, and LnVolatility are all below the threshold of 0.01. This indicates the absence of unit roots for these variables, confirming them as stationary series.

Table 11.

Unit root test.

Building on this foundation, we proceeded to perform cointegration tests on the relationships among the primary variables (Torruam and Abur 2014). The objective of these cointegration tests was to detect and measure the presence of enduring stable relationships within our panel data. The outcomes of these tests are presented in Table 12, detailing the results for each principal variable. Notably, the p-values for the Modified Phillips-Perron t, Phillips-Perron t, and Augmented Dickey-Fuller t tests concerning the variable relationships all fall below the 1% threshold. This clearly indicates the existence of long-term stable relationships among these variables, signifying cointegration.

Table 12.

Pedroni cointegration test.

Following the completion of the unit root and cointegration tests detailed previously, we advanced our analysis by conducting causality tests on the dynamic panel data. To comprehensively assess causality, we employed three distinct testing methodologies. Initially, we utilized the instrumental variables approach for this purpose. Subsequently, we applied the systematic Generalized Method of Moments (GMM) as our second method of analysis. Lastly, we explored the causal relationships among the six sets of variables of interest through the Granger causality test, providing a thorough examination of the causality within our dataset.

Endogeneity issues, arising from omitted variables, simultaneity bias, or measurement errors, pose significant challenges in establishing causal relationships (Semadeni et al. 2014). The instrumental variables approach stands out as an effective method for addressing these challenges, primarily focusing on elucidating the causal dynamics between variables beyond mere associations. This approach is instrumental in isolating and estimating the genuine causal effects among variables, thereby circumventing the pitfalls of reverse causation through leveraging exogenous variations in the dependent variable.

Identifying suitable instrumental variables, however, is a nuanced process that hinges on satisfying two critical criteria (Semadeni et al. 2014). Firstly, there must be a demonstrable correlation between the instrumental variables and the endogenous explanatory variables. Secondly, the instrumental variable should not exert a direct influence on the dependent variable, except indirectly via the endogenous explanatory variable. Essentially, this implies that the instrumental variable is not correlated with the model’s error term, safeguarding against the risk of it being deemed valid due to its correlation with variables directly affecting the dependent variable. This careful selection ensures the integrity of the causal inference drawn from the analysis.

Adhering to the aforementioned criteria, we opted for social insurance as the instrumental variable for pension insurance, attributed to its strong correlation with occupational pensions insurance and its indirect influence on CSR (Jumaniyazov and Xaydarov 2023). This choice is predicated on the rationale that social insurance, while closely associated with occupational pensions insurance, does not have a direct impact on CSR. Similarly, we selected administrative costs as the instrumental variable for strategic CSR (SCSR), given its significant correlation with SCSR and negligible direct effect on resilience (Zhang et al. 2023). From a stakeholder viewpoint, both administrative costs and SCSR share a substantial connection with the stakeholders of the firm’s primary operations. Furthermore, we identified selling expenses as the instrumental variable for responsive CSR (RCSR), considering its strong correlation with RCSR, but limited direct influence on resilience (Duan et al. 2023). Viewed through a stakeholder lens, selling expenses and RCSR are closely related to stakeholders in the firm’s ancillary business activities.

The test outcomes from utilizing the instrumental variable approach are documented in Table 13, where we observe a pronounced correlation between the instrumental variables and the potentially endogenous independent variables. Importantly, our findings lend preliminary support to the initial results derived from study one and study two, reinforcing the validity of our methodological approach.

Table 13.

Instrumental variables approach.

Following the initial analyses, we proceeded with the System Generalized Method of Moments (System GMM) test (Roodman 2009). System GMM serves as a robust estimation technique for dynamic panel data models, and is especially suited for panels with a short time dimension, as is the case in our study. Dynamic panel data models often incorporate lagged dependent variables as predictors, and the adoption of System GMM is motivated by several key factors. Firstly, akin to the instrumental variables approach, it effectively addresses endogeneity issues. Secondly, System GMM is adept at mitigating biases arising from measurement errors and omitted variables by leveraging the inherent dynamic structure of the variables as instrumental variables. Thirdly, it tackles the challenge of over-identification by offering tests for over-identification constraints, thereby assisting researchers in assessing the appropriateness of their chosen instrumental variables and ensuring the reliability of estimations.

In our analysis, we also employed the individual quantities of social insurance and administrative and selling expenses alongside the first and second lags of these three variables as instrumental variables to conduct the System GMM test across the six relationships (Roodman 2009). The outcomes of this analysis are documented in Table 14. The Hansen test chi-square values, being all greater than 0.1, lead us to accept the null hypothesis that the instrumental variables are exogenous and valid. Furthermore, the probabilities associated with the Arellano-Bond AR(1) test statistic are all below 0.1, whereas those for the AR(2) test statistic exceed 0.1, indicating no presence of second-order autocorrelation and supporting the null hypothesis. Collectively, the insights from Table 14 affirm that the System GMM results are in concordance with our original findings, reinforcing the strength of our analytical approach.

Table 14.

System GMM test.

4.5.5. Tests for Mediating Effects

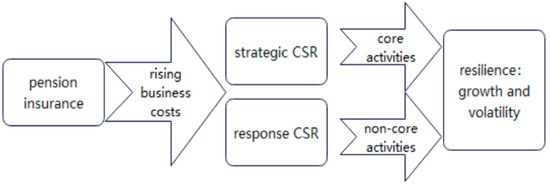

Given the observed influence of pensions on both strategic CSR (SCSR) and responsive CSR (RCSR), and their respective impacts on resilience, it appears logical to postulate that SCSR and RCSR could act as mediating variables, potentially allowing for the integration of studies one and two into a unified analysis (see Figure 3). However, variations in data structure pose constraints on this hypothesis, relegating such explorations to the realm of robustness tests.

Figure 3.

Theoretical mechanism of the mediating effects.

We performed a mediated effects analysis using this specific dataset, with the findings detailed in Table 15 and Table 16. The outcomes in Table 15 reveal that the absolute magnitudes of the LnPensions coefficients in Model (3) are reduced compared to that in Model (2). Likewise, the absolute magnitudes of the LnPensions coefficients in Model (5) are diminished relative to Model (4). This pattern indicates that occupational pensions contribute to bolstering organizational resilience via SCSR. In a similar vein, Table 16 demonstrates that occupational pensions diminish organizational resilience through RCSR, corroborating our initial hypothesis.

Table 15.

Mediating effects of SCSR for occupational pensions and resilience.

Table 16.

Mediating effects of RCSR for occupational pensions and resilience.

Subsequently, we executed Granger causality tests for the relationships encompassed by the six hypotheses (Lopez and Weber 2017), with the outcomes detailed in Table 17. We observed that the p_Value_HPJ for all tested relationships falls below the 1% threshold, leading to a rejection of the initial hypotheses. This outcome underscores the presence of causality within the relationships we examined, affirming the robustness of our original findings.

Table 17.

Granger causality test.

5. Further Studies

The Moderating Effects Tests

Further research has been conducted to explore the moderating role of the relationship between occupational pension, CSR and organizational resilience.

As shown in Table 18, Models (1) and (3), the coefficient of Lmiwage*Lpensions is significantly negative, indicating that the minimum wage system mitigates the positive correlation between Lpensions and SCSR and exacerbates the negative correlation between Lpensions and RCSR, thus proving Hypotheses 3a and 3b. In Models (2) and (4), the coefficient of Laging* is significantly negative, indicating that population aging mitigates the positive correlation between LnPensions and SCSR and exacerbates the negative correlation between LnPensions and RCSR, proving Hypotheses 4a and 4b.

Table 18.

The moderating roles of minimum wage or aging population.

As shown in Table 19, in Models (1), (2), (5), and (6), the coefficients of LnDigitaltrans*LnSCSR and LnDigitaltrans*LnRCSR are significantly positive, indicating that digital transformation exacerbates the positive correlation between SCSR and organizational resilience, and digital Ttransformation mitigates the negative correlation between RCSR and organizational resilience, proving Hypotheses 5a and 5b. In Models (3), (4), (7), and (8), the coefficients of LnCmkt*LnSCSR and LnCmkt*LnRCSR are significantly positive, indicating that marketing capability facilitates the positive correlation between LnSCSR and organizational resilience and indicating that marketing capability mitigates the negative correlation between LnRCSR and organizational resilience, proving Hypotheses 6a and 6b.

Table 19.

The moderating roles of digital transformation or marketing capability.

6. Conclusions and Discussions

The main purpose of our study is to investigate the impact of occupational pension on CSR, as well as the impact of CSR on organizational resilience. The findings of this study suggest that depending on the cost stickiness of CSR, occupational pension induces A-share listed companies to reduce responsive CSR investments and increase strategic CSR under the cost stickiness effect of occupational pension premiums. Moreover, strategic CSR increases organizational resilience and responsive responsibility decreases organizational resilience. In addition, this study explores the moderating effects of population aging, minimum wage, digital transformation, and marketing capabilities on the above relationships.

6.1. Main Conclusions

First, the study’s main findings are as follows: occupational pension reduces reactive CSR and increases strategic CSR investment based on the cost stickiness theory. The cost stickiness of strategic CSR is high. A-share listed companies are reluctant to pay high adjustment costs under the cost pressure of paying for occupational pensions. Instead, they increase strategic CSR to obtain additional benefits. The cost stickiness of responsive CSR is low, so under the cost pressure of paying for occupational pensions, enterprises are willing to pay lower adjustment costs to reduce the costs caused by responsive CSR investment.

Second, different CSR inputs have varying effects on organizational resilience. Strategic CSR inputs promote the formation of organizational resilience, while responsive CSR inputs inhibit it. As a long-term corporate investment, strategic CSR aims to strengthen the core business of an A-share listed company and create an intersection of interests between the company and its strategic stakeholders. This increases the stability and flexibility of the company and promotes the formation of organizational resilience. On the other hand, responsive CSR may prioritize short-term benefits, which can hinder efforts to improve the core business of the enterprise, negatively impact its stability and flexibility, and impede the development of organizational resilience.

Third, the minimum wage moderates the relationship between occupational pension and CSR. Our research shows that the minimum wage and occupational pension share similarities. Both are forms of labor protection that increase the burden on firms. The cost effect of the minimum wage is similar to the effect of firms’ contributions to occupational pensions. Therefore, we conclude that the minimum wage worsens the negative relationship between the occupational pension and responsive CSR. The study shows that the minimum wage negatively moderates the positive correlation between occupational pensions and strategic CSR. Additionally, the study finds that population aging has a moderating effect on the relationship between occupational pension and CSR. Population aging shocks the labor market and increases the cost of hiring employees for firms, which in turn increases the burden on companies. Therefore, population aging exacerbates the negative relationship between occupational pension and responsive CSR. Furthermore, population aging mitigates the positive relationship between the occupational pension and strategic CSR.

Fourth, our study shows that digital transformation moderates the relationship between CSR and organizational resilience. It enables firms to access information quickly and accelerates their efficiency in absorbing resources, facilitating the transformation of strategic CSR into organizational resilience. Additionally, digital transformation mitigates the reduction of organizational resilience related to responsive CSR. Marketing capabilities moderate the relationship between CSR and organizational resilience. Our study shows that marketing capabilities help deliver intra-firm messages to stakeholders more effectively. Additionally, firms with higher marketing capabilities accelerate stakeholder support for the firm, which facilitates the transformation of strategic CSR into organizational resilience. Similarly, companies with greater marketing capabilities can reduce the negative impact of responsive CSR on organizational resilience.

6.2. Theoretical Contributions

First, to clarify the controversy surrounding the motivation of Chinese A-share listed companies to fulfill their CSR from the integrated perspective of the cost stickiness theory, this study categorizes CSR into responsive and strategic, based on the cost stickiness theory (Porter and Kramer 2006), and examines how the dynamic balance between the responsive and strategic institutional fit is achieved in the process of CSR fulfillment (Porter and Kramer 2006). The study’s findings offer a theoretical framework for why companies adopt CSR, enriching the application of cost stickiness theory and stakeholder theory.

Second, this study contributes to the existing literature on enhancing organizational resilience processes from a CSR perspective, based on the context of COVID-19. Previous literature has primarily focused on the capability view of organizational resilience, which emphasizes resilience as an organizational characteristic (DesJardine et al. 2019; Do et al. 2022; Hillmann and Guenther 2021; Sajko et al. 2021). This study examines the relationship between CSR and organizational resilience from the perspectives of stakeholder theory, resource-based theory, and signaling theory. The findings indicate that strategic CSR enhances organizational resilience, while responsive CSR inhibits organizational resilience. This study explains how to enhance organizational resilience in the context of COVID-19. It expands research understanding of CSR and organizational resilience and enriches the application of stakeholder theory, resource-based theory, and signaling theory.

Finally, this study offers a unique contribution to the marketing literature by considering the moderating role of marketing capabilities in the relationship between CSR and organizational resilience. The incorporation of marketing capabilities into a model of the relationship between CSR investments and organizational resilience sheds further light on the boundary mechanisms of the impact of CSR on organizational resilience. Compared to previous studies (Mishra and Modi 2016), this study analyzed the moderating effect of marketing capabilities on the relationship between CSR and organizational resilience. The findings suggest that firms with higher marketing capabilities contribute more to organizational resilience through strategic CSR. Additionally, it was found that responsive CSR had a weaker inhibitory effect on organizational resilience for firms with higher levels of marketing capabilities. Firms with high levels of marketing capability can effectively correct the degree of deviation between responsive CSR and the firm’s core business. This study enriches and expands the explanatory scope of stakeholder theory, resource base theory, and signaling theory from the perspective of marketing capability.

6.3. Management Implications

The study’s findings aid policy makers in comprehending and evaluating the precise effects and extent of influence of the occupational pension system. Additionally, the study’s results assist A-share listed companies’ managers in determining the direction of optimization for CSR investment strategies when confronted with labor cost shocks, and in enhancing the organization’s risk-resistant capability while fulfilling social responsibility practices. In times of peace, managers should be prepared for potential risks, predict changes in the external environment, proactively adapt to market fluctuations, continuously acquire high-quality resources, and make timely adjustments to their corporate development strategies to improve the organizational resilience of their enterprises.

First, A-share listed companies should increase their investment in strategic CSR, such as product responsibility and consumer responsibility. Strengthening customer relationship management can effectively improve the organizational resilience of enterprises and promote high-quality development and sustainable operation (Ntounis et al. 2022; Wieczorek-Kosmala 2022). Simultaneously, improving awareness of product innovation and avoiding product homogenization are also important for enhancing the organizational resilience of enterprises (Liu et al. 2022b). In the process of business practice, enterprises should accelerate digital transformation and upgrading to improve the efficiency of scarce resource acquisition and information transfer.

Secondly, A-share listed companies should invest in responsive CSR moderately. This is because overinvestment in responsive CSR, after satisfying the conditions of legitimacy and consistency, can divert resources from a firm’s core business, which is not conducive to organizational resilience and sustainable operations (Barnea and Rubin 2010; Friedman 1970). Companies should evaluate and measure their investment in responsive CSR in a timely manner and manage it appropriately to maintain a balance between strategic and responsive CSR.

Thirdly, improving marketing capabilities can enhance the brand image of A-share listed companies, promote resource transformation and information transfer efficiency, and improve the quality of corporate development (Mishra and Modi 2016). Marketing competence helps firms fulfill the process of strategic CSR, improve their organizational resilience, and avoid the consumption and destruction of firms’ strategic resources due to overinvestment in responsive CSR.

7. Limitations and Future Research

This study navigates through several procedural and theoretical challenges that merit attention. Firstly, our CSR analysis leans on a solitary data source: the Hexun.com database. Despite its esteemed reputation for quality and utility within the academic community, it might not encapsulate the full spectrum of innovative CSR metrics. Secondly, the scope of our study and the breadth of data necessitate further assessment of heterogeneity within the sampled population. Thirdly, while our focus on A-share listed companies guarantees data integrity, it potentially harbors a bias in sample selection. Moreover, the observed low R2 values in certain models signal a call for refinement in our model selection process, underscoring significant domains for future inquiry and rigorous investigation. Finally, globalization is also an important cause of rising labor costs, especially in multi-country, multi-region studies, which are not taken into account in this study.

Looking ahead, future research endeavors could amplify and diversify the contributions of this study in several pivotal ways. Firstly, beyond the reliance on secondary data, forthcoming studies could pioneer custom CSR indicators employing methodologies such as data mining or surveys. This approach promises to rejuvenate the measurement of research variables, bolstering the study’s objectivity and analytical rigor. Secondly, the integration of case studies and the acquisition of firsthand data via interviews could unveil nuanced perspectives on the evolution of pension insurance and CSR investments. Thirdly, broadening the research horizon to include the unlisted corporate sector would augment the theoretical landscape, rendering the conclusions more universally relevant and pragmatically grounded. Fourthly, undertaking a comparative analysis of pension insurance policies within China and abroad could offer multi-level insights, thereby expanding the study’s scope and depth. These strategies are poised to reinforce the groundwork established by this investigation, propelling the discourse around CSR and its wider ramifications forward.

Author Contributions

Conceptualization, H.W. and T.Z.; methodology, H.W., T.Z. and X.W.; software, H.W. and X.W.; validation, H.W., T.Z. and X.W.; formal analysis, H.W. and T.Z.; investigation, H.W.; resources, X.W.; data curation, H.W. and X.W.; writing—original draft preparation, H.W.; writing—review and editing, H.W.; visualization, T.Z. and J.Z.; supervision, H.W. and J.Z.; project administration, H.W. and J.Z.; funding acquisition, T.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This study is supported by the Research Project of Macao Polytechnic University (RP/ESCHS-03/2020).

Data Availability Statement

The data that support the findings of this study are available from Hexun Evaluation of Corporate Social Responsibility Reports of A-share Listed Companies, China Stock Market and Accounting Research da-tabase (CSMAR), and the annual financial statements of listed companies. However restrictions apply to the availability of these data, which were used under license for the current study, and so they are not publicly available. Data are however available from the authors upon reasonable request and with the permission of Beijing Hexun Online Information Consulting Service Company Limited (Hexun Evaluation of Corporate Social Responsibility Reports of A-share Listed Companies), Shenzhen CSMAR Data Technology Company Limited (CSMAR), listed on the official website of the year (annual financial statements of listed companies).

Acknowledgments

The authors are grateful to all research staff that contributed to the data collection required for this study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Agarwal, Sumit, Jessica Pan, and Wenlan Qian. 2020. Age of decision: Pension savings withdrawal and consumption and debt response. Management Science 66: 43–69. [Google Scholar] [CrossRef]

- Akee, Randall, Liqiu Zhao, and Zhong Zhao. 2019. Unintended consequences of China’s new labor contract law on unemployment and welfare loss of the workers. China Economic Review 53: 87–105. [Google Scholar] [CrossRef]

- Ali, Muhammad Amjad, Nausherwan Nobel Nawab, Amjad Abbas, M. Zulkiffal, and M. Sajjad. 2009. Evaluation of selection criteria in Cicer arietinum L. using correlation coefficients and path analysis. Australian Journal of Crop Science 3: 65. [Google Scholar]

- Al-Mamun, Abdullah, and Michael Seamer. Board of director attributes and CSR engagement in emerging economy firms: Evidence from across Asia. Emerging Markets Review 46: 100749. [CrossRef]

- Anderson, Mark C., Rajiv D. Banker, and Surya N. Janakiraman. 2003. Are Selling, General, and Administrative Costs “Sticky”? Journal of Accounting Research 41: 47–63. [Google Scholar] [CrossRef]

- Andersson, Thomas, Mikael Cäker, Stefan Tengblad, and Mikael Wickelgren. 2019. Building traits for organizational resilience through balancing organizational structures. Scandinavian Journal of Management 35: 36–45. [Google Scholar] [CrossRef]

- Bai, Chen, and Xiaoyan Lei. 2020. New trends in population aging and challenges for China’s sustainable development. China Economic Journal 13: 3–23. [Google Scholar] [CrossRef]

- Bansal, Pratima, Guoliang F. Jiang, and Jae C. Jung. 2015. Managing Responsibly in Tough Economic Times: Strategic and Tactical CSR During the 2008–2009 Global Recession. Long Range Planning 48: 69–79. [Google Scholar] [CrossRef]

- Barnea, Amir, and Amir Rubin. 2010. Corporate Social Responsibility as a Conflict Between Shareholders. Journal of Business Ethics 97: 71–86. [Google Scholar] [CrossRef]

- Barta, Gergő, and Gergely Görcsi. 2021. Risk management considerations for artificial intelligence business applications. International Journal of Economics and Business Research 21: 87–106. [Google Scholar] [CrossRef]

- Bebchuk, Lucian Arye, and Jesse M. Fried. 2003. Executive compensation as an agency problem. Journal of Economic Perspectives 17: 71–92. [Google Scholar] [CrossRef]

- Bellino, Stefania, Ornella Punzo, Maria Cristina Rota, Martina Del Manso, Alberto Mateo Urdiales, Xanthi Andrianou, Massimo Fabiani, Stefano Boros, Fenicia Vescio, Flavia Riccardo, and et al. 2020. COVID-19 disease severity risk factors for pediatric patients in Italy. Pediatrics 146: e2020009399. [Google Scholar]

- Buslei, Hermann, Johannes Geyer, and Peter Haan. 2023. Midijob reform: Increased redistribution in pension insurance-noticeable costs, relief not well targeted. DIW Weekly Report 13: 63–70. [Google Scholar]

- Bustinza, Oscar F., Ferran Vendrell-Herrero, MªNieves Perez-Arostegui, and Glenn Parry. 2019. Technological capabilities, resilience capabilities and organizational effectiveness. The International Journal of Human Resource Management 30: 1370–92. [Google Scholar] [CrossRef]

- Campbell, John L., Nathan C. Goldman, and Bin Li. 2021. Do financing constraints lead to incremental tax planning? Evidence from the Pension Protection Act of 2006. Contemporary Accounting Research 38: 1961–99. [Google Scholar] [CrossRef]

- Carvalho, Ana, and Nelson Areal. 2016. Great places to work®: Resilience in times of crisis. Human Resource Management 55: 479–98. [Google Scholar] [CrossRef]

- Chen, Chun-Da, Ching-Hui Joan Su, and Ming-Hsiang Chen. 2022. Are ESG-committed hotels financially resilient to the COVID-19 pandemic? An autoregressive jump intensity trend model. Tourism Management 93: 104581. [Google Scholar] [CrossRef] [PubMed]

- Chen, Shengqi, and Hong Zhang. 2021. Does digital finance promote manufacturing servitization: Micro evidence from China. International Review of Economics & Finance 76: 856–69. [Google Scholar]

- Chen, Yian, Li Guiping, and Wenjing Gao. 2023. Is pension insurance a barrier to entrepreneurship? New evidence from China. Economic Research-Ekonomska Istraživanja 36: 2155207. [Google Scholar] [CrossRef]

- Clemens, Jeffrey. 2021. How do firms respond to minimum wage increases? understanding the relevance of non-employment margins. Journal of Economic Perspectives 35: 51–72. [Google Scholar] [CrossRef]

- Cooper, Russell, Guan Gong, and Ping Yan. 2018. Costly labour adjustment: General equilibrium effects of China’s employment regulations and financial reforms. The Economic Journal 128: 1879–922. [Google Scholar] [CrossRef]

- Costa, Mabel D., and Ahsan Habib. 2023. Cost stickiness and firm value. Journal of Management Control 34: 235–73. [Google Scholar] [CrossRef]

- Crane, Andrew, and Dirk Matten. 2020. COVID-19 and the Future of CSR Research. Journal of Management Studies 58: 280–84. [Google Scholar] [CrossRef]