Abstract

Government bonds are one of the safest and most attractive instruments in the investment portfolio for private investors and investment funds. Although bonds are perceived as an alternative to bank deposits, a number of macroeconomic factors influence their yield. The goal of the research is to investigate the relationship between macroeconomic factors and the yield of government bonds. We use regression models on a dataset of 22 countries with post-industrial economics for ten years. The main criteria for selecting countries are membership in the Organization for Economic Cooperation and Development and inclusion in the Top-25 countries on the competitiveness index. The results revealed a negative association between the yield of government bonds and gold. Moreover, we indicate a positive association between the yield of government bonds and the following indicators—inflation, oil prices, and GDP per capita. In the case of the influence of population savings and the uncertainty index, we obtain inconclusive results. The study contributes to ongoing research in the field of financial management with respect to investigating determinants of the yield of government bonds.

1. Introduction

For many years government bonds have been considered the most attractive investment portfolio tools (Tjandrasa et al. 2020). According to the traditional term structural models (Liu et al. 2009), the yield of government bonds is determined by three main factors: interest rate, default risk, and loss in the event of default. Nevertheless, a number of studies (Collin-Dufresn et al. 2001) have shown that indicated factors do not fully explain the yield of government bonds. That is why additional research is required. In the framework of this study, we reveal the existing gap from positions of macro factors. Thus, the main goal of the study is to examine the association between macro factors and the yield of government bonds.

We use a dataset of 22 countries with post-industrial economics in the period from 2010 to 2020. The selection for the countries is based on two main criteria—their membership in the Organization for Economic Co-operation and Development (OECD) and their rating in the Top-25 countries in the competitiveness index (The World Bank 2020). The choice of the countries is explained by the following aspect. These criteria ensure the existence of a developed stock market in the country. Moreover, it allows investigation of countries with great experience in financing their deficits due to expansive fiscal policy during near-zero interest rates. Moreover, in our panel data, we try to avoid a huge number of compromises, which in the future will have to be eliminated either by deleting observations for this year or by imposing restrictions. The presence of many emissions will be because one of the factors, for example, inflation, can have a much stronger impact on undeveloped and part of developing countries than on developed ones and thereby distort the importance of other factors. That is why our research is restricted to 22 countries.

We examine the association between macro factors and the yield of government bonds. Specifically, we focus on regression models. We take the yield of 10-year government bonds as the dependent variable. We analyse the influence of the following macro factors on the yield of government bonds. These are inflation rate, gold and oil prices, GDP per capita, population saving, uncertainty index, exchange rate, and foreign direct investments.

The result shows a significant number of macro factors, that influence the yield of government bonds. It reveals the negative association between the gold price and the yield of government bonds. Contrarily, the result reveals that the changes in the inflation rate, oil price, and GDP per capita bear the same direction as changes in the yield of government bonds. We obtain inconclusive results in relation to population savings and uncertainty index. The research also proves the insignificant influence of exchange rate and foreign direct investments on the yield of government bonds.

Our main motivation for conducting this research is to identify macroeconomic factors that may affect the potential earnings of both an ordinary private investor and the profitability of investment funds that decide to invest their funds in government bonds of countries with post-industrial economics. Moreover, our literature review revealed the gap concerning the modern analysis of the determinants of the yield of government bonds in developed countries (Kurniasih and Restika 2015; Nkwede et al. 2016; Pratiwi and Mustafa 2021). Most current research is focused on the analysis of developing countries. Our research fulfils the revealed gap.

This research contributes to the studies in financial management with respect to investigating the determinants of the yield of government bonds. The suggested regression model allows predicting the changes in the yield of government bonds depending on fluctuations of macro factors. It can be useful to investors in the construction of their portfolios. Moreover, according to the knowledge of the authors, it is one of the first studies analysing the influence of the uncertainty index on the yield of government bonds.

2. Theoretical and Empirical Background of Research

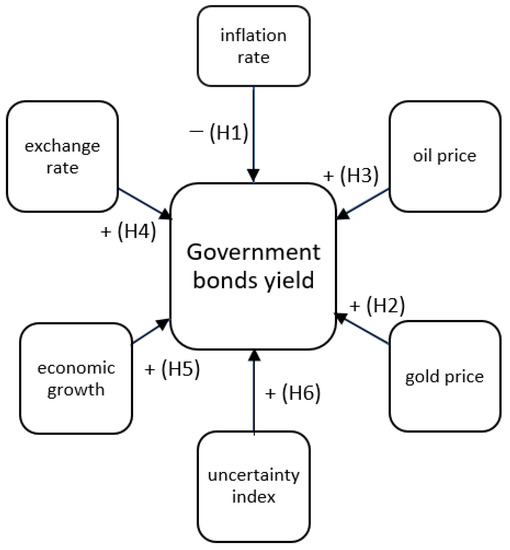

Numerous studies have attempted to explain the association between macro factors and different types of bonds. Nevertheless, there is no consensus on what and how the factors affect the yield of government bonds. From a theoretical perspective, we base our research on the concept of financial management. The yield of bonds consists of a risk-free interest rate, and a yield spread that represents a premium for the various risks to each type of security (Ferreira et al. 2020). We identify the risks by analysing the influence of macro factors on the yield of government bonds. The conceptual model of research is presented in Figure 1.

Figure 1.

The conceptual model of research.

The inflation rate can influence the yield of government bonds. In the case of Thai bonds, Paisarn (2012) revealed the negative significant influence of the inflation rate on the yield of government bonds. Siahaan and Panahatan (2019) proved the earlier mentioned results by analysing the Indonesian government bonds. Moreover, Permanasari and Kurniasih (2021) focusing on the other historical period in the case of the Indonesian government bonds, revealed that inflation does not affect the government bond yield. Contrarily, Kurniasih and Restika (2015) based on the regression analysis concluded the opposite view: the inflation rate and the yield of bonds have a positive relation.

Due to the high level of the inflation rate, coupon payments of bonds depreciate. This leads to the yield of bonds being insufficient to cover the inflation rate. Accounting for the relatively low yield of the government bonds (Sibbertsen et al. 2014), we suppose the following hypothesis:

Hypothesis 1 (H1).

The growth of the inflation rate has a negative effect on the yield of the government bond.

The changes in the price of resources can also significantly impact the yield of government bonds. Mostly, the impact may depend on the economy of a certain country and its status (importer or exporter) concerning certain resources. Pratama Dhony and his research group (2019) revealed a positive significant relationship between the gold price and the yield of the bond. At the same time, researchers did not find an influence of oil price on the bonds’ yield in Indonesia. Aretz et al. (2010) suggest the previous results in the part of gold price. Muharam (2013) contrarily found a positive association between oil price and bond yield. Based on the literature review, we propose the following hypotheses:

Hypothesis 2 (H2).

The growth of the gold price has a positive effect on the yield of the government bond.

Hypothesis 3 (H3).

The growth of the oil price has a positive effect on the yield of the government bond.

There is also no consensus regarding the exchange rate. In a number of studies, Blanka Francová (2017, 2018) revealed that exchange rate risk is positively associated with bond price and accordingly its return. Yusuf and Prasetyo (2019) came to the same conclusions. Nevertheless, Varirahartia and Marsoem (2022) highlighted that the exchange rate does not have a significant impact on the yield of Indonesian government bonds. Most international transactions are carried out in dollars, and it is possible to suggest that the weakening or strengthening of the domestic currency will affect the yield of government bonds. That is why we suggest the following hypothesis:

Hypothesis 4 (H4).

The growth of the exchange rate has a positive effect on the yield of the government bond.

Vanja Piljak (2013) identified that domestic macroeconomic factors have a higher level of influence on government bond yields than global ones. In the framework of research, the author focused mainly on domestic monetary policy stance and business cycle patterns. Nkwede and his research group (2016) also paid attention to the economic development of the country. Moreover, researchers mentioned the relevance of the set of indicators, including savings, and foreign direct investments, in relation to bond yield. The importance of the economic development of the country is also proven by Chinese scientists (Huang et al. 2019). The authors concluded that the growth of GDP and the business activity index led to the decrease of risk for bonds and accordingly a decrease in their yield. Pratiwi and Mustafa (2021) in their recent research revealed that gross domestic product does not affect the yield of 10-year government bonds in Indonesia.

In the framework of the current research, we analyse economic growth from the positions of three indicators. They are GDP per capita, saving of population, and foreign direct investments. We propose that these indicators are associated with business activity and the general development of the country. We propose the following hypothesis:

Hypothesis 5 (H5).

The economic growth of the country has a positive effect on the yield of the government bond.

The uncertainty index reflects the level of society at which they assess the risk due to an uncertain or ambiguous situation. Hites Ahir and his research group (Ahir et al. 2022) claim that the uncertainty index is growing worldwide. The reason for this is such major shocks as the Gulf War, the Euro debt crisis, the Brexit vote, and the COVID-19 pandemic. Avom et al. (2020) provided evidence that uncertainty directly reduces direct investments. To the same conclusions came Ho and Gan (2021). To the knowledge of the authors, there is no research focusing on the analysis of the association between the uncertainty index and the yield of government bonds. The growth of the uncertainty index reflects accordingly the growth of risks. That is why we test the following hypothesis:

Hypothesis 6 (H6).

The growth of the uncertainty index has a positive effect on the yield of the government bond.

3. Materials and Methods

In this study, we use regression models to analyse the association between macroeconomic factors and the yield of government bonds. Regression analysis is the most suitable tool for the following aspects. It allows simultaneous analysis of the influence of a large number of factors on one dependent variable. Moreover, the use of the regression model is a common tool in a number of studies, aimed at the analysis of the yield of securities, including bonds (Dhony et al. 2019; Huang et al. 2019; Liu et al. 2009).

The original dataset is collected based on databases by the Federal Reserve Bank of St. Louis and Macrotrends1. The study considers 22 countries, that are included in the Top-25 countries in the competitiveness index and members of OECD. The analysis period is from 2010 to 2020.

The descriptive statistics of the collected dataset are presented in Table 1.

Table 1.

The descriptive statistics of the dataset.

In the framework of research, the dependent variable is the yield of government bonds. This study is based on a panel dataset of annual changes in government bond yield of developed countries. Panel data represent the most suitable tool for sample analysis with cross-sectional and time-series data. Our multiple linear regression model is built for analysis to determine the main macro factors affecting the yield of government bonds. In this case, the multiple regression analysis is the most suitable approach for the following aspects. It would enable the investigation of the impact of multiple explanatory variables on the yield of government bonds at the same time. Moreover, it is a common tool in several similar studies (Aretz et al. 2010; Nkwede et al. 2016; Huang et al. 2019). Furthermore, authors have developed models with fixed and random effects along with multiple linear regression. The models failed the Hausman test in the case of fixed effects and the Breusch–Pagan test in the case of random effects. This highlighted the preference for the multiple linear regression model.

The content of the model is set out in the equation, which is presented below:

Yield10Y = β0 + β1 × Inflation + β2 × Oil − β3 × Gold + β4 × Exchangerate + β5 × GDPPerCapita + β6 × WUIABS − β7 × WUIChange − β8 × Savings + β9 × FDI + ε

Based on the equation presented above, we create four different types of regression models. The first one includes all explanatory variables, the second—the amount of population savings, foreign direct investments, and uncertainty index; the third—the inflation rate, GDP per capita, and exchange rate, and the last—oil and gold prices.

As we have many explanatory variables and are more interested in the variables that would explain the greatest portion of the variance in the yield of government bonds, we perform a backward elimination. We eliminate the variable step-by-step with the lowest p-value until all the explanatory variables in the model become statistically significant at p < 0.05. In all the estimations, we control for heteroscedasticity and report robust standard errors for each coefficient estimate.

4. Results

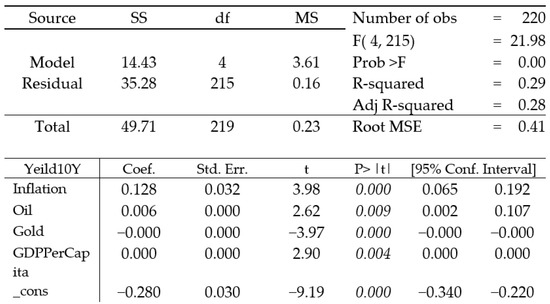

The results of the regression analysis are shown in Table 2.

Table 2.

The final view of regression models.

The final view of the model, which includes the influence of all significant macroeconomic factors, is the following:

Yeild10Y= −0.280 + 0.12 Inflation + 0.006Oil − 0.0006Gold + 0.00003GDPPerCapita

Figure 2 also provides the confidence intervals for the regression parameters in the case of including whole analysed explanatory variables.

Figure 2.

The results of multiple linear regression for the 1st model, including whole analysed macro factors.

Below, we also include the results of the diagnostic of the final model. Firstly, we calculate the variance inflation factor (VIF) to test for multicollinearity. The higher value of VIF (above five) indicates the existence of collinearity of the variables, included in the model. In Table 3, the calculations of VIF and tolerance are presented.

Table 3.

The variance inflation factor.

As the value of VIF is lower than five, there is no strong multicollinearity between included in the model variables. Moreover, we examine the normality of the residual distribution with the Shapiro–Wilk W test (see Figure 3).

Figure 3.

The results of Shapiro–Wilk W test.

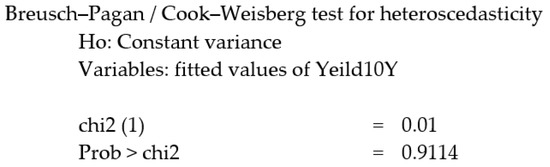

In the analysed case the p-value exceeds 5%, indicating that the residuals are normally distributed. The next step of the diagnostic is the checking for homoscedasticity of residuals. One of the main assumptions of multiple linear regression is the homoscedasticity of the variance of the residuals. If the variance of the residuals is non-constant, then the variance of the residuals is heteroscedastic. In the case of heteroscedasticity, the value of the output variable depends not only on the change in the input variable but also on the relative value of this change. The presence of heteroscedasticity of random errors leads to the inefficiency of estimates obtained using the least-squares method. The result of the Breusch–Pagan test is presented in Figure 4.

Figure 4.

The results of Breusch–Pagan test.

The p-value is higher than 0.05. This allows accepting that the distribution of residuals is homogeneous. The results of the tests are recognized for the high quality of the presented model.

Contrary to the expectations (H1), we find that the growth of the inflation rate has a positive effect on the yield of government bonds for both models. The 1%—change in the differences in the inflation rate led to 12.8–14.3% changes in the differences in the yield of government bonds.

We observe the strongest support for (H2) and (H3). The changes in the price of resources can significantly impact the yield of government bonds. The obtained results prove the relevance of such factors in the case of gold and oil. The 1%- change in the differences in the oil price led to 0.6–1.3% changes in the differences in yields of government bonds. The 1%- change in the differences in the gold price has less influence on the changes in the differences in yields of government bonds. Nevertheless, such influence is statistically significant.

We do not find support for H4. According to the results of regression analysis, the growth of the exchange rate is recognized as statistically insignificant in relation to the yield of government bonds.

In the case of H5, we obtain inconclusive results. On one side, we find a positive association between GDP per capita and the yield of government bonds. Moreover, we observe the positive influence of the amount of savings of the population on the yield of government bonds. On another side, foreign direct investments seem to be statistically insignificant in relation to the yield of government bonds.

For H6, in the general regression analysis, we do not find a significant influence of the uncertainty index on the yield of government bonds. Nevertheless, the results of the second model have recognized it as a statistically important factor. The 1%- change in the differences in the uncertainty index led to 48.1% changes in the differences in the yield of government bonds.

Regression models show that the ones we have built are suitable for describing 22 countries at the same time and for each country separately, and the results will not differ much because the analysed countries are highly developed and have stable economies.

Our paper provides additional evidence in determining the relevance of macro factors in relation to the yield of government bonds. Regarding the inflation rate, we support the results obtained by Permanasari and Kurniasih (2021). The growth of interest rate has a positive effect on the yield of government bonds. This can be explained by the following aspect. The volatility of the inflation rate has an impact on investments in securities because the growth of the inflation rate is associated with the growth of risk of securities (including government bonds) and accordingly their yield (Nurfauziah and Setyarini 2004).

We also expand on the results of previous research concerning the price of resources (Aretz et al. 2010; Muharam 2013; Dhony et al. 2019). The prices of oil and gold have a positive association with the yield of government bonds. This highlights the dependence of analysed countries on resources, mainly gold and oil.

We reveal contrary results in relation to the exchange rate in comparison with previous literature (Francová 2017, 2018; Yusuf and Prasetyo 2019). The exchange rate has no impact on the yield of government bonds. The results can be explained by the features of the dataset. We are focused on the annual data. According to Syarif et al. (2021), the exchange rate has a short-term influence, and the regression analysis on the level of annual data can ignore this aspect. That is why future studies will be based on another level of analysis that can support or reject the current research.

Our paper provides inconclusive results concerning economic growth. We find that GDP per capita and savings of the population have a generally positive association with the yield of government bonds. The results expand on the previous research (Piljak 2013; Nkwede et al. 2016; Huang et al. 2019). Nevertheless, the results do not reveal the significant influence of foreign direct investments. In the framework of research, we focus mainly on the developed countries with post-industrial economies. The analysed countries may not depend on investing from outside and often act as such investors in emerging economies.

According to the uncertainty index, we obtain interesting results. In the general model, the factor is recognized as statistically insignificant. However, the analysis of the uncertainty index separately from other factors shows its relevance in attitude towards the yield of government bonds. To the knowledge of the authors, there is no previous research focused on the association between the uncertainty index and the yield of government bonds. Future research can continue and expand on the current research for the countries with developing economies.

5. Conclusions and Discussion

Our paper provides an expansion of the theories of financial management with respect to revealing the determinants of the yield of government bonds. The suggested regression models explain associations between macro factors and the yield of government bonds in developed countries. Most current research is focused on the analysis of developing countries. We expand on the existing studies with positions of analysing the countries with post-industrial economics. Moreover, according to the knowledge of the authors, this is one of the first studies, focusing on the influence of the uncertainty index on the yield of government bonds. The results may be useful to different types of investors in the process of their construction of portfolios.

The results reported above are subject to several limitations. First, the analysis is restricted to 22 countries, that are included in the Top-25 countries in the competitiveness index and members of OECD. The analysis period is from 2010 to 2020. Most of the analysed countries are developed countries with post-industrial economies. Second, our dataset is focused on the annual data. It may ignore the short-term influence of factors on the yield of government bonds. Moreover, it ignores the influence of one-off events. Third, the research is focused on government bonds. The focus on other types of bonds may also be interesting, especially in the case of analysis of the influence of the uncertainty index on the bond yield. Fourth, the study ignores the effect of time delay, because this analysis suggests a different approach to building a regression model. Finally, the analysis of factors on government bonds is restricted by simple multiple linear models. Further studies may consider more sophisticated nonlinear models (Giudici et al. 2020), which extend classical linear correlation models into a network-based approach.

Despite the above-mentioned limitations, our results are beneficial to regulators and investors concerning control and change predictions in the yield of government bonds depending on the changes in macro factors.

Author Contributions

E.K.: Conceptualization, investigation, writing—original draft, writing—review and editing, project administration. M.K.: methodology, software, writing—original draft, formal analysis. All authors have read and agreed to the published version of the manuscript.

Funding

The research is partially funded by the Ministry of Science and Higher Education of the Russian Federation under the strategic academic leadership program ‘Priority 2030’ (Agreement 075-15-2021-1333 dated 30.09.2021).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | https://fred.stlouisfed.org/ (accessed on 1 Octorber 2021); https://www.macrotrends.net/ (accessed on 1 Octorber 2021). |

References

- Ahir, Hites, Nicholas Bloom, and Davide Furceri. 2022. The World Uncertainty Index. No. w29763. National Bureau of Economic Research. Available online: https://www.nber.org/papers/w29763 (accessed on 31 March 2022).

- Aretz, Kevin, Söhnke M. Bartram, and Peter F. Pope. 2010. Macroeconomic risks and characteristic-based factor models. Journal of Banking & Finance 34: 1383–99. [Google Scholar]

- Avom, Désiré, Henri Njangang, and Larissa Nawo. 2020. World economic policy uncertainty and foreign direct investment. Economics Bulletin 40: 1457–64. [Google Scholar]

- Collin-Dufresn, Pierre, Robert S. Goldstein, and J. Spencer Martin. 2001. The determinants of credit spread changes. The Journal of Finance 56: 2177–207. [Google Scholar] [CrossRef]

- Dhony, Pratama, Hartoyo Sri, and Maulana Tubagus Nur Ahmad. 2019. Effect of bond characteristics and macroeconomic factors on the return of corporate bonds in the sector of property, real estate and building construction. Russian Journal of Agricultural and Socio-Economic Sciences 87: 99–103. [Google Scholar]

- Ferreira, Marcio Lorencini, Michele Nascimento Jucá, and Ricardo Goulart Serra. 2020. The Effect of Ownership Structure on the Yield Spread of Corporate Bonds. Theoretical Economics Letters 10: 926. [Google Scholar] [CrossRef]

- Francová, Blanka. 2017. Valuation of government bonds: The exchange rate is an important aspect. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis 65: 1911–16. [Google Scholar] [CrossRef]

- Francová, Blanka. 2018. An Analysis of the Impact of Selected Factors on the Bond Market. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis 66: 1451–58. [Google Scholar] [CrossRef]

- Giudici, Paolo, Peter Sarlin, and Alessandro Spelta. 2020. The interconnected nature of financial systems: Direct and common exposures. Journal of Banking & Finance 112: 105149. [Google Scholar]

- Ho, Linh Tu, and Christopher Gan. 2021. Foreign direct investment and world pandemic uncertainty index: Do health pandemics matter? Journal of Risk and Financial Management 14: 107. [Google Scholar] [CrossRef]

- Huang, Jiemin, Kai Chang, and Yixiang Tian. 2019. Analysis of Macroeconomic Factors Affecting the Corporate Bond Yield Spread. Engineering Letters 27: 1–11. [Google Scholar]

- Kurniasih, Augustina, and Yulia Restika. 2015. The influence of macroeconomic indicators and foreign ownership on government bond yields: A case of Indonesia. Mediterranean Journal of Social Sciences 6: 34–34. [Google Scholar] [CrossRef]

- Liu, Sheen, Jian Shi, Junbo Wang, and Chunchi Wu. 2009. The determinants of corporate bond yields. The Quarterly Review of Economics and Finance 49: 85–109. [Google Scholar] [CrossRef]

- Muharam, Harjum. 2013. Government Bond Yield Volatility and It’s Determinants: The Case of Indonesia Government Bond. Paper presented at the First International Conference on Finance and Banking Faculty of Economics and Business Diponegoro University-Indonesia Financial Management Association (IFMA), Bali, Indonesia, December 11–12; pp. 1–25. [Google Scholar]

- Nkwede, Friday E., Lenard C. Uguru, and Louis C. Nkwegu. 2016. Corporate bond market development in Nigeria: Does macroeconomic factors matter? Arabian Journal of Business and Management Review (Oman Chapter) 6: 25. [Google Scholar] [CrossRef][Green Version]

- Nurfauziah, Nurfauziah, and Adistien Fatma Setyarini. 2004. Analisis Faktor-faktor yang Mempengaruhi Yield Obligasi Perusahaan (Studi Kasus pada Industri Perbankan dan Industri Finansial). Jurnal Siasat Bisnis 2: 241–56. [Google Scholar] [CrossRef]

- Paisarn, Wilaiporn. 2012. The Determinants of Thailand Bond Yield Spreads. Available online: https://ssrn.com/abstract=2136979 (accessed on 1 October 2021).

- Permanasari, Intan, and Augustina Kurniasih. 2021. Factors Affecting the Yield of Indonesia Government Bonds 10 Years. European Journal of Business and Management Research 6: 243–48. [Google Scholar] [CrossRef]

- Piljak, Vanja. 2013. Bond markets co-movement dynamics and macroeconomic factors: Evidence from emerging and frontier markets. Emerging Markets Review 17: 29–43. [Google Scholar] [CrossRef]

- Pratiwi, Chyntia Juliana, and Matrodji H. Mustafa. 2021. The analysis the effect of macroeconomic factors on Indonesia 10-year government bond yield. Dinasti International Journal of Digital Business Management 2: 471–81. [Google Scholar] [CrossRef]

- Siahaan, Antonius, and Julius Peter Panahatan. 2019. Analysis of impact of yield, interest rates, US Fed rates, and inflation on price on government bonds in Indonesia. Emerging Markets: Business and Management Studies Journal 6: 59–74. [Google Scholar]

- Sibbertsen, Philipp, Christoph Wegener, and Tobias Basse. 2014. Testing for a break in the persistence in yield spreads of EMU government bonds. Journal of Banking & Finance 41: 109–18. [Google Scholar]

- Syarif, Muh, Aini Indrijawatic, Pasrun Adamd, and La Ode Saidie. 2021. The Causal Relationship between Exchange Rates and Bond Yield in Indonesia. Iranian Economic Review 25: 167–78. [Google Scholar]

- The World Bank. 2020. Global Competitiveness Index. Available online: https://databank.worldbank.org/metadataglossary/africa-development-indicators/series/GCI.INDEX.XQ (accessed on 1 October 2021).

- Tjandrasa, Benny Budiawan, Siagian Hotlan, and Jie Ferry. 2020. The macroeconomic factors affecting government bond yield in Indonesia, Malaysia, Thailand, and the Philippines. Investment Management and Financial Innovations 17: 111–21. [Google Scholar] [CrossRef]

- Varirahartia, Ditha, and Bambang Santoso Marsoem. 2022. Effect of Bonds Maturity Date, Interest Rates, Inflation, Exchange Rates and Foreign Exchange Reserves on Yield To Maturity of Government Bonds 2014–20. Journal Health Sains 3: 373–87. [Google Scholar] [CrossRef]

- Yusuf, Achlanudin, and Ahmad Danu Prasetyo. 2019. The effect of inflation, US bond yield, and exchange rate on Indonesia bond yield. Jurnal Perspektif Pembiayaan Dan Pembangunan Daerah 6: 649–56. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).