Equilibrium Pricing and Power Design in Hybrid Supply Chains: A Stackelberg Game Approach

Abstract

1. Introduction

2. Literature Review

2.1. Power Structure Research in Supply Chains

2.2. Service Sensitivity and Hybrid Supply Chain

2.3. Literature Comments

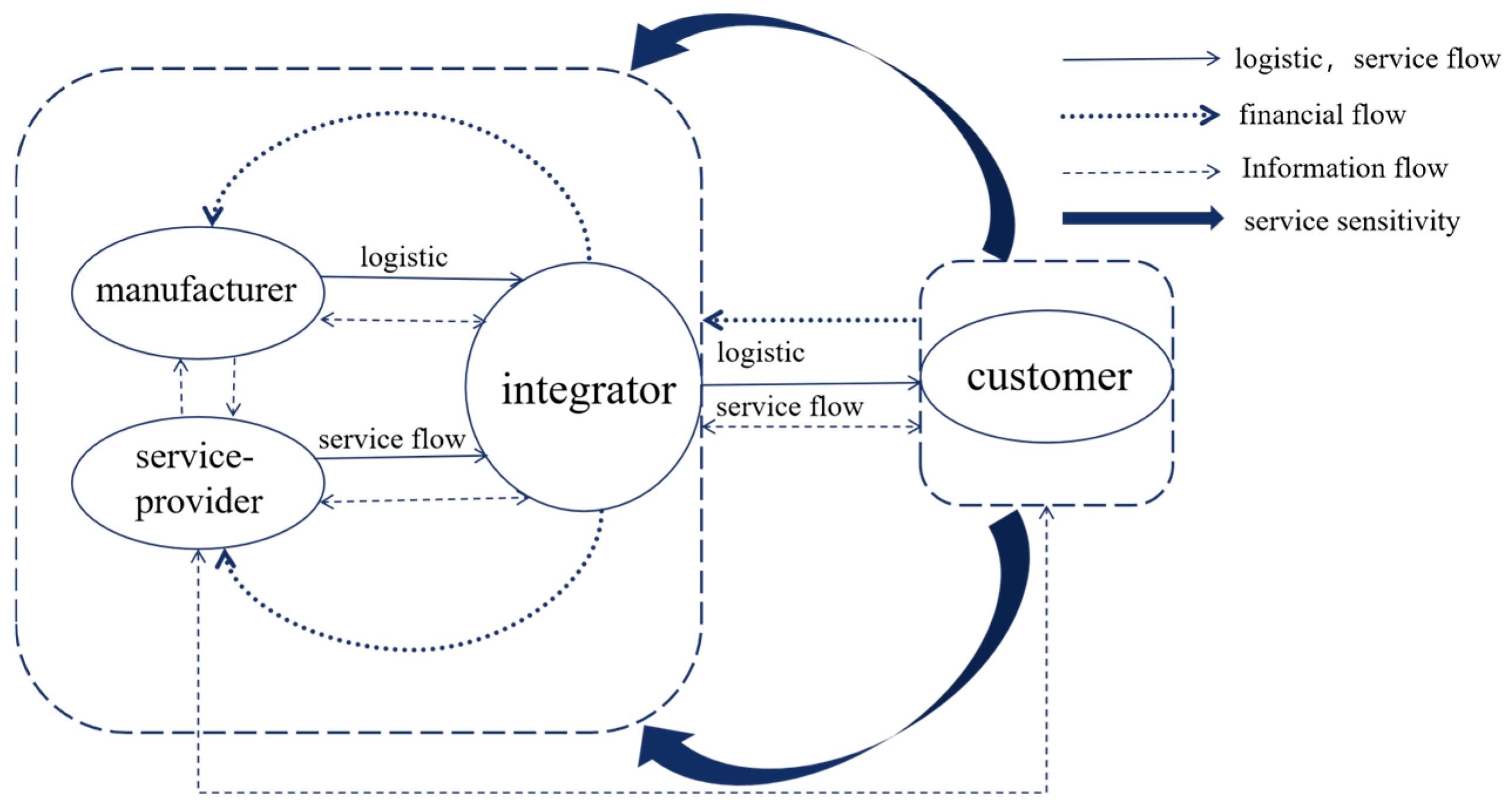

3. Problem Description and Assumption

3.1. Problem Description

3.2. Assumptions

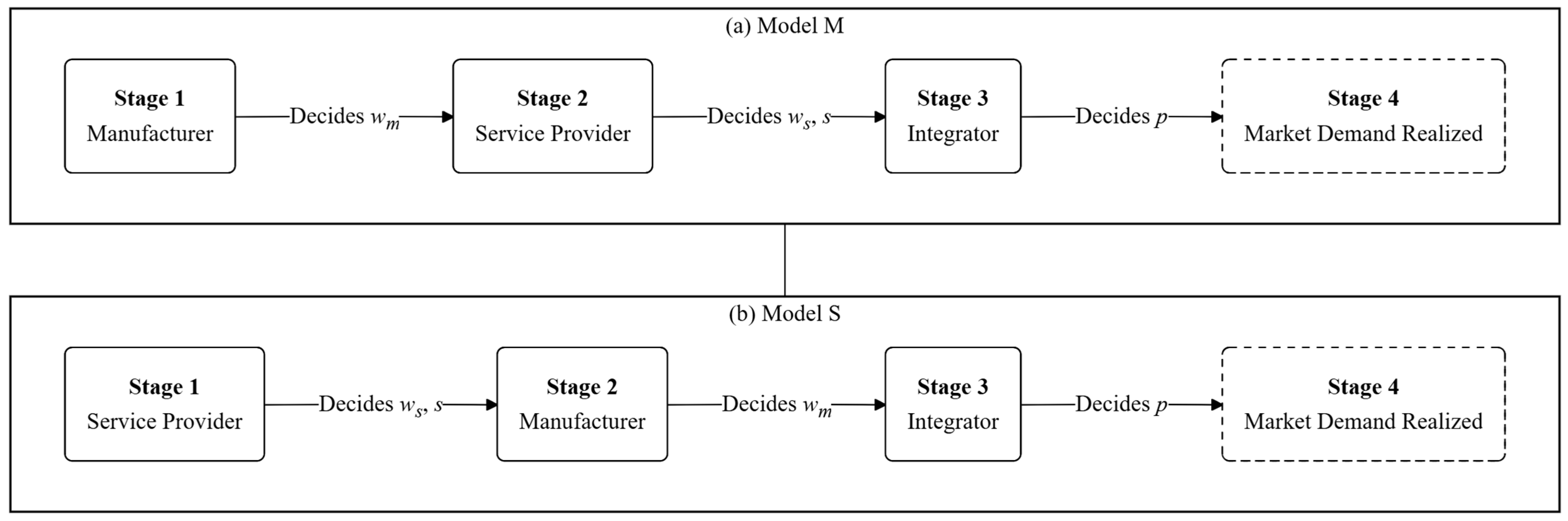

4. Model Formulation and Equilibrium Analysis

4.1. Model M-Manufacturer Dominant Power Structure

4.2. Model S-Service Provider Dominant Power Structure

4.3. Comparison of Equilibrium Solutions

4.4. Comparison and Analysis of Models

- (1)

- ; ;

- (2)

- ;

- (1)

- , .

- (2)

- , .

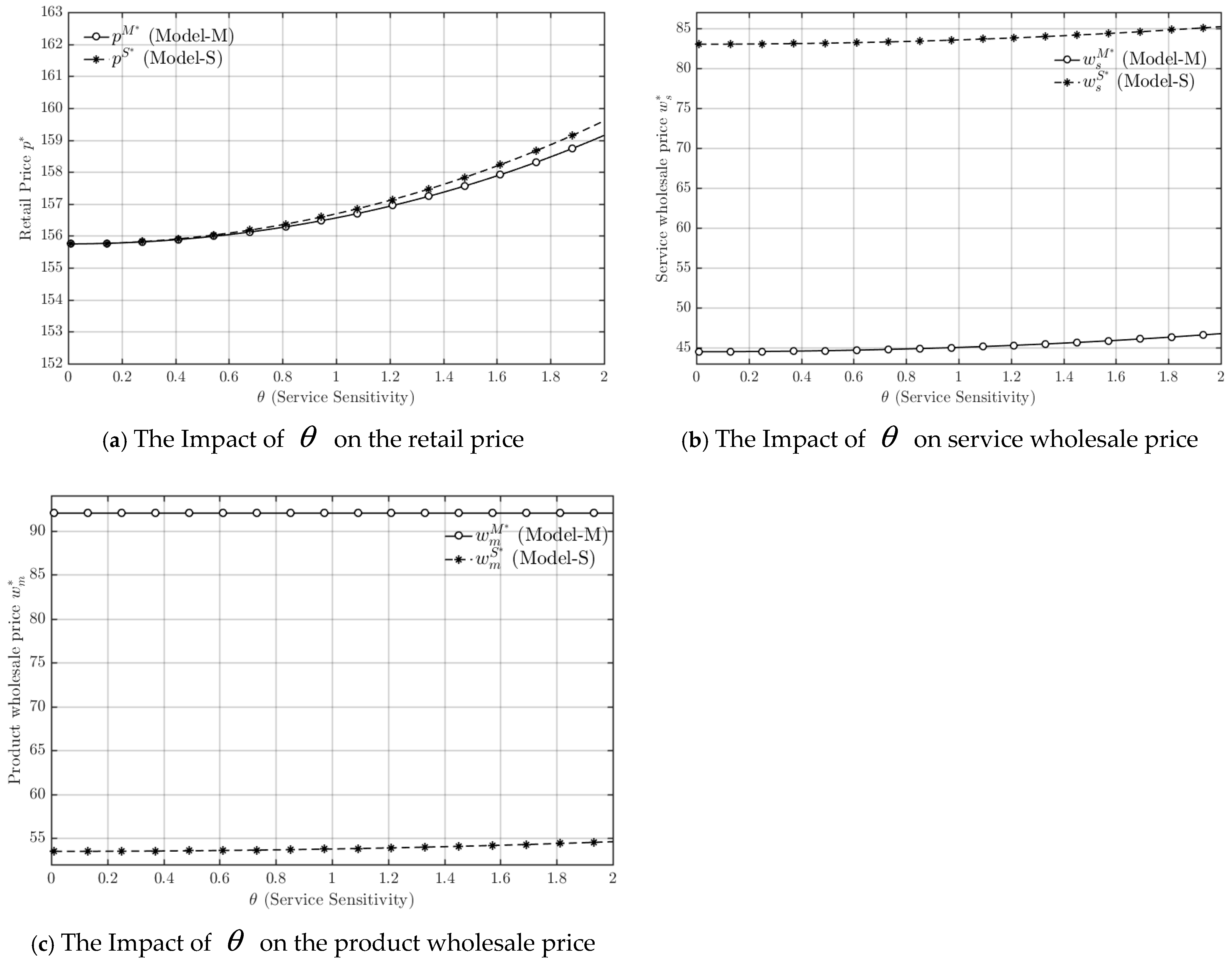

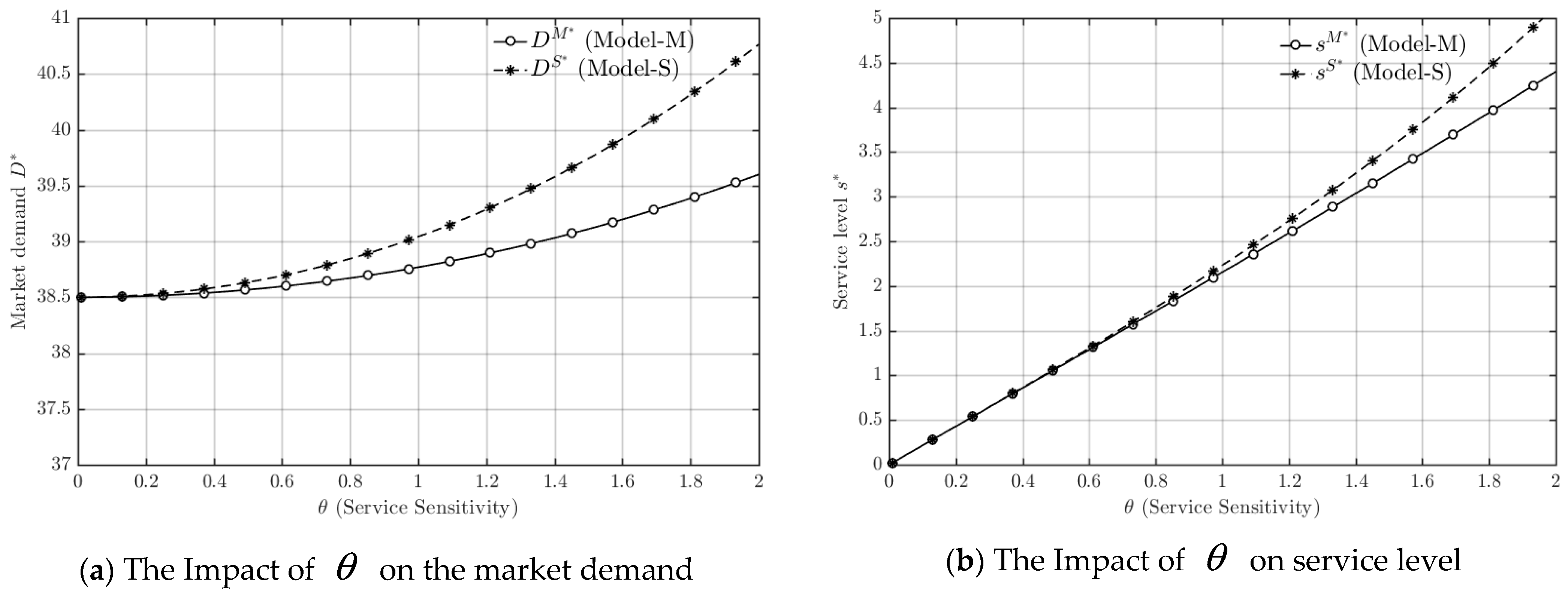

5. Numerical Simulation and Analysis

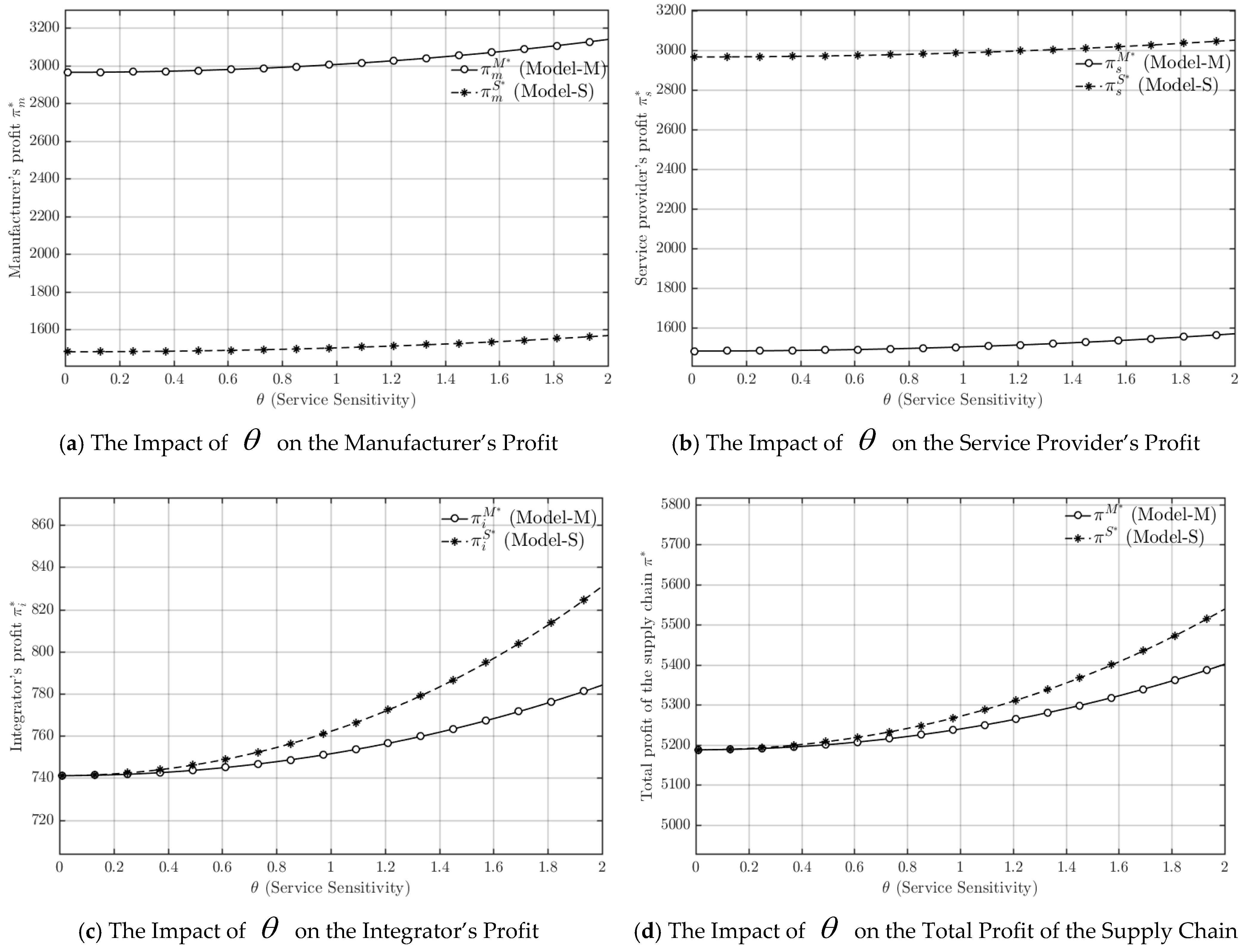

5.1. Effects of Service Sensitivity

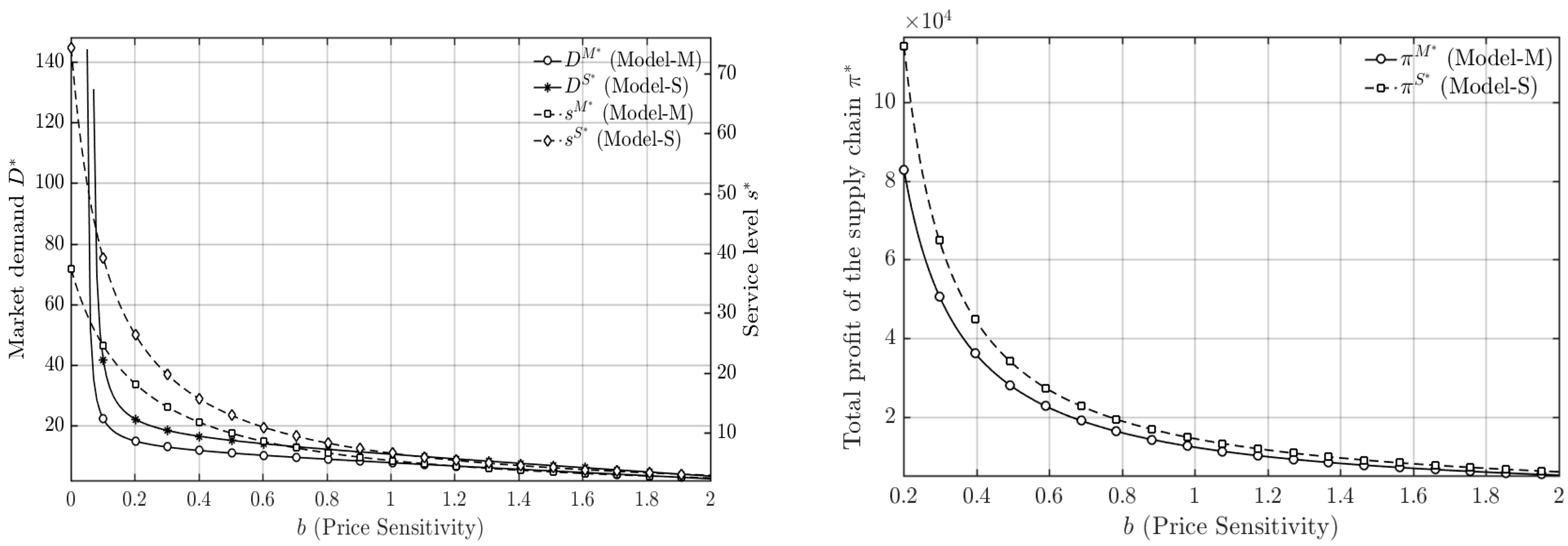

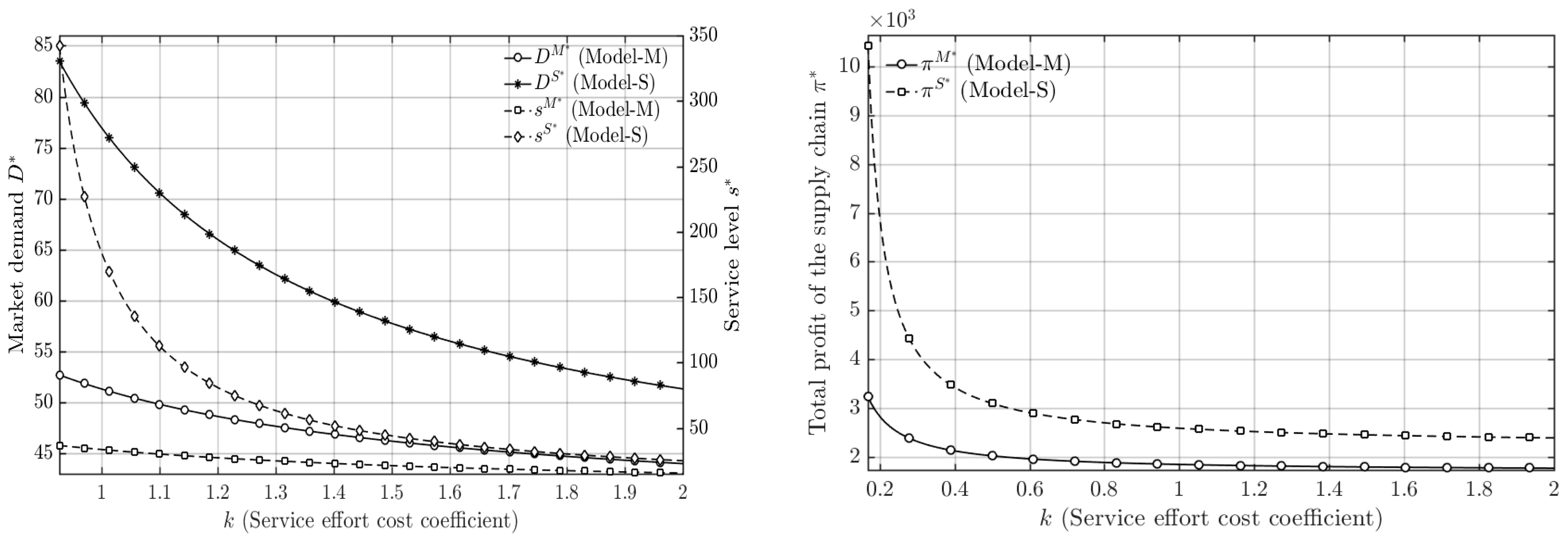

5.2. Robustness Analysis

6. Conclusion and Discussion

6.1. Main Conclusions

6.2. Research Limitations and Future Research Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Model M

- Step1: Compute the first-order partial derivative of with respect to and set it to zero.

- .

- Step2: Substitute the above into , then compute the first-order derivatives with respect to and respectively and set them to zero.

- , By solving the above two equations simultaneously, we obtain: , Substitute this result into . We obtain: .

- Step3: Substitute equations and into , then compute the first-order derivative with respect to and set it to zero. We obtain: , Then, compute the first-order derivative with respect to and set it to zero: . Substitute into equations respectively to obtain the optimal equilibrium solutions. □

Appendix B. Model S

- Step1: Compute the first-order derivative of with respect to and set it to zero. .

- Step2: Substitute the above into , then compute the first-order derivative with respect to and set it to zero, , Substitute into , we get: .

- Step3: Substitute equation into , then compute the first-order derivatives with respect to and respectively and set them to zero. And by solving the above two equations simultaneously, we obtain: , . Substitute into equations respectively to obtain the optimal equilibrium solutions. □

References

- Lin, J.; Miao, R.; Jiang, Z.; Wang, L. Service-Oriented Manufacturing: The Development Trend of Chinese Manufacturing Industry. In Advanced Manufacturing Systems; PTS 1–3. 2nd International Conference on Manufacturing Science and Engineering; Trans Tech Publications Ltd.: Stafa-Zurich, Switzerland, 2011; pp. 388–392. [Google Scholar]

- Gao, N.; Zhao, S.; Zhang, X. Research on the Service-Oriented Manufacturing Model. In Proceedings of the IEEE International Conference on Industrial Engineering and Engineering Management, Hong Kong, China, 8–11 December 2009; IEEE: New York, NY, USA, 2009; Volume 1–4, pp. 2431–2434. [Google Scholar]

- Kretschmer, T.; Leiponen, A.; Schilling, M.; Vasudeva, G. Platform ecosystems as meta-organisations: Implications for platform strategies. Strateg. Manag. J. 2022, 43, 405–424. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Jiang, X. The impact of power structure on the retail service supply chain with an O2O mixed channel. J. Oper. Res. Soc. 2016, 67, 294–301. [Google Scholar] [CrossRef]

- Zhai, Y.; Bu, C.; Zhou, P. Effects of channel power structures on pricing and service provision decisions in a supply chain: A perspective of demand disruptions. Comput. Ind. Eng. 2022, 173, 108715. [Google Scholar] [CrossRef]

- Yang, Z.; Zheng, Y.; Li, J.; Zhu, S.X.; Yang, C. Delivery service for a service-oriented manufacturing supply chain with procurement and delivery time decisions. Int. J. Prod. Res. 2024, 62, 7581–7597. [Google Scholar] [CrossRef]

- Cao, B.; Zhang, Q.; Cao, M. Optimizing Hybrid-Channel Supply Chains with Promotional Effort and Differential Product Quality: A Game-Theoretic Analysis. Mathematics 2022, 10, 1798. [Google Scholar] [CrossRef]

- Wan, N.; Fan, J. Pricing and platform coupon decisions of a hybrid channel supply chain under different power structures. Rairo-Oper. Res. 2025, 59, 427–460. [Google Scholar] [CrossRef]

- Wan, N.; Fan, J. Platform service decision and selling mode selection under different power structures. Ind. Manag. Data Syst. 2024, 124, 1991–2020. [Google Scholar] [CrossRef]

- Bian, J.; Lai, K.K.; Hua, Z. Service outsourcing under different supply chain power structures. Ann. Oper. Res. 2017, 248, 123–142. [Google Scholar] [CrossRef]

- Ma, J.; Yi, T.; Liu, C. Studying the Complexity of Multichannel Supply Chain with Different Power Structures Under Carbon Subsidy Policy. Int. J. Bifurc. Chaos 2021, 31, 2150166. [Google Scholar] [CrossRef]

- Choi, T.-M.; Wallace, S.W.; Wang, Y. Risk management and coordination in service supply chains: Information, logistics and outsourcing. J. Oper. Res. Soc. 2016, 67, 159–164. [Google Scholar] [CrossRef]

- Wang, K.Z.; Jiang, Z.B.; Lin, W.J.; Xie, W.M. Study on the Hybrid Supply Chain Management of Service-oriented Manufacturing. Soft Sci. 2013, 27, 93–95, 100. [Google Scholar]

- Xu, Y.; Wang, L.; Wang, W.; Chen, H.; Meng, X. The promotion of digital transformation for supply chain diversification in service-oriented manufacturing paradigm. Int. J. Logist. Res. Appl. 2024, 27, 2261–2284. [Google Scholar] [CrossRef]

- Zuo, F.J.; Zhang, Z.F.; Fan, B.B. Research on coordination of service-oriented manufacturing hybrid supply chain. Mod. Manuf. Eng. 2019, 460, 43–49. [Google Scholar]

- Zhang, Y.; Gao, Z.; Huang, M.; Jiang, S.; Yin, M.; Fang, S.-C. Multi-period distribution network design with boundedly rational customers for the service-oriented manufacturing supply chain: A 4PL perspective. Int. J. Prod. Res. 2024, 62, 7412–7431. [Google Scholar] [CrossRef]

- Zhang, J. What is the role of product services in the dual-channel closed-loop supply chain? Rairo-Oper. Res. 2024, 58, 3637–3658. [Google Scholar] [CrossRef]

- Chung, H.; Ahn, D.-Y.; Yoo, W.S. Equilibrium supply chain structures in the presence of asymmetric manufacturer capabilities in service efficacy and provision. J. Oper. Res. Soc. 2022, 73, 394–416. [Google Scholar] [CrossRef]

- Chen, Y.; Wu, M. Pricing Decisions in Dual-Channel Supply Chains Considering the Offline Channel Preference and Service Level. Mathematics 2024, 12, 2468. [Google Scholar] [CrossRef]

- Wang, S.; Hu, Z. Logistics Service Supply Chain Decision-Making Analysis Considering Impact of Environment and Service Level. Pol. J. Environ. Stud. 2022, 31, 5285–5297. [Google Scholar] [CrossRef]

- Roy, B.; Das, S. Multi-channel price and service level competition with the impact of coordination contracts. IMA J. Manag. Math. 2025, 36, 451–474. [Google Scholar] [CrossRef]

- Yang, H.; Zhao, S.; Peng, J. Optimal Retail Price and Service Level in a Dual-Channel Supply Chain with Reference Price Effect. J. Ind. Manag. Optim. 2023, 19, 3883–3912. [Google Scholar] [CrossRef]

- Hong, Z.; Guo, X. Green product supply chain contracts considering environmental responsibilities. Omega 2019, 83, 155–166. [Google Scholar] [CrossRef]

| Notation | Meaning |

|---|---|

| Base market demand | |

| Price sensitivity | |

| Service effort cost coefficient | |

| Service sensitivity | |

| Cost of the manufacturer’s production | |

| Cost of service provider services | |

| Product wholesale price | |

| Service wholesale price | |

| Retail price | |

| service level | |

| Market demand | |

| Manufacturer’s profit | |

| Service provider’s profit | |

| Integrator’s profit | |

| The Total Profit of the Supply Chain |

| Variable | Model M | Model S |

|---|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, B.; Yu, X. Equilibrium Pricing and Power Design in Hybrid Supply Chains: A Stackelberg Game Approach. Mathematics 2025, 13, 3939. https://doi.org/10.3390/math13243939

Yang B, Yu X. Equilibrium Pricing and Power Design in Hybrid Supply Chains: A Stackelberg Game Approach. Mathematics. 2025; 13(24):3939. https://doi.org/10.3390/math13243939

Chicago/Turabian StyleYang, Bingyan, and Xiaomo Yu. 2025. "Equilibrium Pricing and Power Design in Hybrid Supply Chains: A Stackelberg Game Approach" Mathematics 13, no. 24: 3939. https://doi.org/10.3390/math13243939

APA StyleYang, B., & Yu, X. (2025). Equilibrium Pricing and Power Design in Hybrid Supply Chains: A Stackelberg Game Approach. Mathematics, 13(24), 3939. https://doi.org/10.3390/math13243939