Abstract

The digital transformation of the shipping industry presents both strategic opportunities and cost challenges. This study employs a Cournot duopoly model to analyze how digital technology adoption affects freight pricing, market demand, and profit dynamics under varying cost structures. Methodologically, we integrate operational efficiency and carbon reduction effects into a competitive framework—a novel approach that reveals a tripartite prisoner’s dilemma in technology adoption, a phenomenon seldom explored in shipping literature. Our findings indicate that digitalization can lower freight rates when implementation costs are low, but may lead to price increases under high-cost conditions. Strategic asymmetries often result in winner-takes-all outcomes, while bilateral adoption may erode collective profits. For practitioners, this study offers a dynamic decision-making framework to help shipping firms align digital investments with cost-benefit realities and sustainability goals, thereby avoiding suboptimal competitive equilibria.

Keywords:

digital technology; shipping industry; carbon intensity reduction; cost-benefit optimization MSC:

91-10

1. Introduction

1.1. Background and Motivation

Against the backdrop of sustained growth in global trade and accelerated progress towards the ‘double carbon’ goal, the shipping industry, as the primary carrier of international trade, faces dual challenges: intensified market competition and strengthened environmental regulations. In recent years, carbon dioxide emissions from the shipping industry have been on the rise. In response, the International Maritime Organization (IMO) has established a clear objective: by 2030, the carbon intensity of international shipping must be reduced by at least 40% compared to the average level in 2008, with net-zero greenhouse gas emissions targeted around 2050. Concurrently, countries and regions are actively exploring and promoting the use of clean energy, enhancing energy efficiency, and implementing digital technologies to reduce carbon emissions, thereby facilitating a green and low-carbon transition in shipping [1]. These initiatives are essential not only for combating global climate change but also for ensuring the long-term sustainability of the shipping industry.

Digital technologies in the shipping industry have significantly enhanced energy efficiency and resource utilization by integrating diverse data sources and intelligent systems. The primary contribution of these technologies lies in optimizing ship sailing paths, minimizing idle rates, and precisely regulating equipment energy consumption, thereby facilitating efficient collaboration between ports and cargo owners. The digital platform can collect and analyze ship operational parameters in real-time, providing shipowners with a reliable basis for decision-making and minimizing unnecessary detours and waiting times. Overall, this technological integration effectively reduces carbon emissions in the shipping industry, resulting in the reduction of millions of tons of carbon dioxide emissions annually and offering crucial support for the low-carbon transformation of the sector [2]. For instance, route optimization through intelligent systems allows ships to circumvent adverse weather conditions and congested areas during voyages, thereby enhancing voyage efficiency and decreasing fuel consumption (Table 1).

Shipping companies encounter numerous operational management challenges in implementing digital technology, underscoring the urgent need to investigate cost strategies associated with such technologies. Initially, the high investment required for digital technology encompasses expenses related to equipment acquisition, installation, commissioning, and system integration, thereby imposing significant financial burdens on small and medium-sized shipping companies [3]. For instance, an advanced intelligent monitoring system for ships may necessitate an investment of millions of RMB, which represents a considerable expense for SMEs with limited capital resources. Furthermore, the operational and maintenance costs of digital technology must not be overlooked, as skilled technicians are essential for its operation and upkeep, consequently escalating labor costs [4]. Additionally, the rapid pace of technological advancement necessitates continuous investments in upgrades to maintain effective emission reduction capabilities. As artificial intelligence and big data technologies evolve, firms are required to regularly update their software and hardware to ensure the relevance and applicability of their technological solutions. These financial challenges not only hinder the adoption of digital technologies by shipping companies but also complicate their long-term operational cost strategies. Thus, conducting a comprehensive study on optimizing the cost strategy of digital technology holds significant theoretical and practical implications for shipping companies aiming to achieve sustainable development while adhering to environmental regulatory requirements.

In the long run, digital technology can significantly reduce operating costs by optimizing route planning and enhancing ship energy efficiency. Specifically, advanced digital route optimization algorithms enable shipping companies to accurately plan optimal routes based on multidimensional information, including real-time weather data, ocean currents, and ship performance parameters, thereby effectively reducing fuel consumption and sailing time. In terms of market competition, the adoption of digital technology enables shipping companies to attract quality customer resources by shortening delivery cycles and increasing service frequency.

Table 1.

Milestone Events for Digital Sustainable Development in the Shipping Industry.

Table 1.

Milestone Events for Digital Sustainable Development in the Shipping Industry.

| Time | Event |

|---|---|

| November 2021 | SMASH, the Dutch smart shipping platform, has released a smart shipping roadmap, proposing 5 application scenarios and 10 R&D areas, and defining a clear vision for the development of smart shipping in the Netherlands by 2030 [5]. |

| November 2023 | ZeroNorth has invested heavily in the fuel sector with the acquisitions of Clearlynx, Prosmar Bunkering and BTS to help drive the digitization of the entire shipping fuel value chain to accelerate the decarbonization of the industry [6]. |

| March 2024 | Container shipping line Hapag-Lloyd uses Ankeri’s digital infrastructure system to collect and manage fleet data, improving its ability to optimize ship performance, reduce emissions and advance sustainability initiatives [7]. |

| March 2024 | Nabai employs robotic hull cleaning and intelligent attached seabed management services to efficiently remove attached seabed and fouling layers, reducing the resistance of ship navigation, and in turn reducing fuel consumption and carbon emissions [8]. |

| February 2025 | PG Ship Management cooperated with SDARI to use the “DOSS-CO2 Carbon Emission Management” service to monitor, analyze, and evaluate the fleet-wide carbon emissions, energy efficiency, and other important indicators from the source of data entry [9]. |

1.2. Research Questions and Major Findings

Given the significant impact of digital technology applications on cost and operational decisions within the green shipping industry, a Cournot model has been developed to describe the competitive framework between two shipping companies. This framework is explored through a matrix of four strategic scenarios. Overall, three critical issues arise:

Q1: How does digital technology influence freight pricing, market demand, and profitability for shipping companies?

Q2: How should shipping companies select their technology strategy—traditional or digital—to maximize profits under varying cost conditions?

Q3: In what ways do technological asymmetries shape the competitive landscape of the market? Is there a Pareto-optimal equilibrium, or does a Prisoner’s Dilemma exist?

In order to address the research questions, this study employs the Cournot model for analysis and conducts a quantitative investigation utilizing price and profit functions. Specifically, the focus is on the impact of digital technology on competition within the shipping market, revealing a significant influence on freight pricing, market demand, and the profitability of shipping companies. When the costs associated with digital technology are low, firms can mitigate these expenses through efficiency gains, allowing them to reduce freight rates and enhance competitiveness. Conversely, if the costs are high, freight rates may increase. Furthermore, digital technologies can improve customer utility and broaden market demand. Under varying cost conditions, companies must select appropriate technological strategies to maximize profits, taking into account both operational and installation costs. While digital technology presents clear advantages, elevated costs may result in diminished profits, whereas traditional technology can achieve Pareto optimality under specific circumstances.

Technological asymmetries significantly impact the competitive landscape. The unilateral adoption of digital technology may enable the technologically superior party to capture market share, resulting in a ‘winner-takes-all’ situation; however, it may also provoke retaliatory price reductions or instigate a technology race. Conversely, simultaneous adoption of digital technology by both parties could lead to lower total profits than in a unilateral scenario, while mutual reliance on traditional technology may exacerbate resource wastage, corresponding to the three equilibriums of the Prisoner’s Dilemma.

While it may seem intuitive that firms lower prices when technology costs are low and raise them when costs are high, this study extends beyond such basic economic intuition by formally modeling the strategic interdependence and asymmetric outcomes in digital technology adoption. Unlike prior studies that focus solely on operational efficiency or environmental benefits of digitalization [10], this paper integrates efficiency gains and carbon reduction effects into a Cournot duopoly framework, revealing how digital adoption reshapes competitive equilibria and profit distribution under varying cost structures.

Moreover, while existing literature has highlighted the role of digital platforms in enhancing logistics coordination [11] or improving energy efficiency [12], this study uncovers a tripartite prisoner’s dilemma in technology adoption—a phenomenon not previously articulated in the shipping context [13]. By identifying the conditions under which unilateral digitalization leads to winner-takes-all outcomes and bilateral adoption erodes collective profits, this research provides a dynamic strategic framework that helps firms avoid suboptimal equilibria and align digital investments with sustainability goals.

This paper is divided into seven parts. Section 1 serves as the introduction, detailing the background, core issues, and motivations of the study. It highlights the costs and competitive challenges associated with the application of digital technology in the shipping industry and outlines the research objectives and innovative value. Section 2 comprises a literature review that systematically examines the research progress in the fields of digital technology, shipping operation management, and carbon emission reduction. It identifies the shortcomings of existing research and clarifies the theoretical orientation of this study. Section 3 focuses on model construction, utilizing Cournot duopoly competition framework to introduce the efficiency and environmental protection attributes of digital technology. It establishes a strategy matrix containing four scenarios (TT/TD/DT/DD) and derives the equilibrium freight, demand, and profit functions. Section 4 analyzes the value of digital technology, quantitatively revealing the mechanisms through which digital technology impacts pricing, market demand, and profit via propositions and inferences. It also explores the competitive effects and dilemmas under conditions of technological asymmetry. Section 5 discusses optimal and equilibrium strategies, integrating cost constraints and market demand sensitivity to propose a dynamic technology path selection framework. It analyzes Pareto optimality and the Prisoner’s Dilemma across different scenarios while providing strategic recommendations for enterprises. Section 6 confirms through numerical analysis that digital adoption can only enhance profitability when unit operating costs and installation costs are low. Under high costs, traditional strategies have proven to be more profitable, validating the model’s prediction of a prisoner’s dilemma in technology investment. Finally, Section 7 concludes with a summary of the research findings and practical insights, addresses the limitations of the model, and suggests future research directions, such as multi-subject games and policy dynamics analysis. Subsequent chapters will progressively develop the theoretical derivation and empirical analysis to provide systematic support for shipping enterprises in formulating digital transformation strategies.

2. Literature Review

2.1. Digital Technology for Shipping Companies

The shipping industry’s attitude towards digital technologies is predominantly positive, particularly among industry leaders and large enterprises, which have adopted these technologies to enhance competitiveness and address industry challenges. However, some firms remain cautious about digital transformation, primarily due to concerns regarding technological risks, cost investments, and reliance on traditional operating models. The COVID-19 outbreak acted as a catalyst for the industry’s digital transformation, resulting in a 94% disruption rate in global supply chains. This situation compelled shipping companies to utilize digital tools to maintain operational continuity, thereby accelerating the digitalization process across the industry [14]. In this context, Tijan et al. [10] employed the TOE (Technology-Organization-Environment) theoretical framework to conduct an in-depth analysis of the drivers of digital transformation in the shipping industry through regional case studies. Their findings illustrate how technological advancements, organizational readiness, and environmental pressures can synergistically foster innovation in business models, significantly enhancing operational efficiency and competitiveness. Nonetheless, digital transformation is not instantaneous and is often obstructed by resistance to change among individuals and organizational inertia. To tackle these challenges, Raza et al. [15] developed a digital maturity assessment framework specifically for the liner shipping industry, which systematically identifies barriers to transformation and outlines implementation pathways, emphasizing the crucial role of industry-specific factors in the digital transformation process.

With the rapid development of digital technology, the digitalization of international logistics has significantly accelerated, leading to a deep integration of digital applications across all aspects of the supply chain. The digital transformation of the shipping industry is characterized by four major trends: the popularization of digital services, the development of digital ecosystems, the integration of service content, and the convergence of online and offline platforms [16]. In this context, Chávez et al. [11] combine digital servitization with principles of the circular economy to propose a sustainable business model framework that examines how digital innovation can enhance value creation and promote environmental sustainability. Furthermore, the container shipping industry has demonstrated robust adaptive capacity amid global economic turmoil, with its digital transformation practices showing that fostering digital resilience during crises enables shipping companies to navigate uncertainties more effectively and achieve sustainable development [17]. Nevertheless, the container shipping market continues to face challenges from intense competition and fluctuating profitability.

However, while the existing literature provides valuable qualitative insights into the drivers, barriers, and trajectories of digitalization, it remains predominantly descriptive and lacks a formal analytical framework to quantify the strategic competition that arises when firms choose between traditional and digital technologies. Prior studies have not sufficiently addressed how the cost of digital adoption and the resulting competitive asymmetries directly determine freight pricing, market share, and profit distribution in a duopolistic market, which is the critical gap our study aims to fill.

2.2. Operations Management in Shipping Companies

The shipping industry, as the primary mode of transportation for global trade, faces numerous challenges, including intense market competition, significant overcapacity, declining freight rates, and increasingly stringent environmental protection requirements. Shipping companies exhibit a high degree of overlap in their business areas and route layouts, resulting in exceptionally fierce market competition. Consequently, operational efficiency has become a critical factor for shipping companies seeking to enhance their competitiveness and profitability in this brutal environment [18]. Chen et al. [19] emphasize that improving operational efficiency is not only a fundamental strategy for shipping companies to withstand market pressures but also an essential choice for achieving sustainable development.

Among the major factors affecting shipping efficiency, port congestion and energy consumption are particularly prominent. Wang et al. [20] proposed an innovative congestion management system that systematically evaluates congestion at the organizational level, providing a practical solution to alleviate bottlenecks in ports. Concurrently, optimizing energy consumption has become a key focus in the industry. Although the existing Energy Efficiency Design Index (EEDI) offers a regulatory framework, its limitations have led the industry to seek more advanced digital tools. Barreiro et al. [12] emphasize that operational efficiency can be significantly enhanced by integrating digital systems to optimize ship routes and improve feedback mechanisms throughout a ship’s life cycle. Furthermore, enhancements in energy efficiency not only contribute to operational effectiveness but also represent a transitional phase in the shipping industry’s shift toward greener practices. Innovative technologies, such as alternative fuels, smart ship technologies, and wind-assisted propulsion systems, have shown significant promise in reducing carbon emissions and pollution. The International Maritime Organization’s (IMO) emissions reduction targets, along with the promotion of supportive policies by various countries, underscore the urgency of this green transition [1].

In the aftermath of the epidemic era, the global economic recovery has resulted in a significant increase in oil demand. Concurrently, production cuts by OPEC and its allies have intensified market supply constraints, leading to rising fuel prices. Wang et al. [21] present a comprehensive analysis of the effects of investment in blockchain technology on bunker costs, operational efficiency, and market competitiveness. They construct cost-benefit models, competition models, and bunker price volatility models to support their findings. The study indicates that blockchain technology can effectively reduce fuel consumption, optimize sourcing strategies, and enhance supply chain transparency, thereby improving shipping companies’ ability to manage fuel price fluctuations. Additionally, the high costs associated with alternative fuels, such as liquefied natural gas (LNG), have driven the industry to seek more effective cost optimization strategies. He et al. [22] offer a systematic approach for shipping companies to minimize their operating costs by developing a mathematical optimization model that incorporates route planning, sailing speed adjustments, and fuel refueling strategies. Their empirical analysis demonstrates that by optimizing routes, speeds, and fueling strategies, shipping companies can significantly lower LNG fuel-related operating costs and enhance overall efficiency.

A key limitation of this stream of research is its frequent treatment of operational efficiency and environmental performance as isolated, internal optimization problems. These studies often fail to model the strategic interdependencies in which one firm’s efficiency gain forces a reaction from its competitor, thereby reshaping the competitive equilibrium of the entire market. Our research bridges this gap by explicitly modeling how efficiency gains and emission reductions are translated into competitive actions and reactions within a duopoly.

2.3. Carbon Emission Reduction in Shipping Companies

In recent years, the global issue of climate change has intensified, with the carbon emissions from the shipping industry accounting for approximately 3% of the global total. This has garnered significant attention from the international community regarding carbon emission reduction [23]. As a central component of the shipping industry, research on carbon emission reduction among shipping companies has emerged as a prominent focus in both academia and industry. However, current measures for reducing carbon emissions exhibit several limitations. Firstly, from an economic perspective, shipping companies encounter challenges such as high investment costs for emission reductions and extended payback periods, which may diminish their motivation to pursue emissions reductions or even prompt evasive actions [24]. Zhu et al. [13] investigated the optimal allocation of carbon emission quotas within the shipping industry by developing a two-layer multi-objective model. They proposed that shipping companies could enhance their carbon emissions management by optimizing shipping routes, improving fuel efficiency, adopting low-carbon technologies, and engaging in carbon trading [24]. Secondly, in terms of international cooperation, shipping companies are influenced by the formation, operation, and dissolution of shipping alliances. Xiao et al. [25] examined the effects of antitrust exemptions and shipping alliances on the performance of shipping companies. Their findings indicate that shipping companies can optimize alliance structures, strengthen intra-alliance cooperation, enhance operational efficiency, and respond proactively to policy changes to improve their performance. In terms of policy, the variation in emission reduction strategies across countries complicates the ability of shipping companies to coordinate their efforts on an international scale. For instance, the potential repercussions of the European Union’s unilateral decision to incorporate shipping into its Emissions Trading System (ETS) have sparked controversy regarding its impact on the global shipping industry and its legitimacy. Mao et al. [26] argue that domestic legislation should be enhanced to integrate shipping into national carbon emissions trading systems and that an incentive mechanism should be established. They also advocate for shipping companies to improve their performance by optimizing their energy structures, accelerating the green transition, engaging in international cooperation, and actively participating in carbon emissions trading systems to meet carbon reduction targets [27].

Shipping companies play a crucial role in reducing emissions in the maritime sector. Meng et al. [28] analyzed the emission reduction decisions of shipping companies under varying intensities of environmental regulation by constructing a dynamic game model. Their study revealed that environmental regulations significantly influence the emission reduction behaviors of shipping companies, and there exists a mutual reinforcement effect among the emission reduction decisions of these companies. Additionally, the high pollution and noise generated by traditional auxiliary engines during ship docking, along with the high costs and compatibility challenges associated with the implementation of shore power technology, have led researchers to advocate for the expansion and optimization of shore power facilities to mitigate carbon emissions from ships while in port. By combining the NSGA-III algorithm with the TOPSIS method, studies have demonstrated that increasing shore power capacity significantly reduces pollutant emissions. Furthermore, enhancing the speed of shore power connections further decreases both ship waiting time and pollutant emissions [29]. These findings suggest that shipping companies can effectively lower carbon emissions through multidimensional strategies and technological innovations. Future research should continue to investigate the synergistic effects of policy coordination, technology application, and international cooperation to foster the sustainable development of the shipping industry.

While game-theoretic models have been applied to shipping, they typically address cooperation or macro-level policy compliance. Our model distinguishes itself by integrating carbon emission reduction directly into the core of non-cooperative, firm-level competition. We do not treat emission reduction merely as a cost or a collaborative goal, but model it as a strategic variable that, combined with digital efficiency gains, can be leveraged for competitive advantage. This integrated approach to modeling the joint strategic decisions on digitalization and decarbonization under cost constraints represents a novel contribution not found in prior models.

3. Model

The Cournot model is a classic oligopolistic competition model used to describe the behavior of enterprises in the market as they maximize profits by adjusting output. In analyzing competition in the shipping market, we adopted the Cournot model to explore the competitive dynamics between two shipping companies (). Each of these companies has distinct characteristics regarding transportation efficiency and emission reduction capacity, while other conditions are assumed to be consistent. The pricing of freight per unit () is a comprehensive consideration process, jointly influenced by multiple factors, including total market size, individual and competitor market demand, transportation time, and carbon emissions. The price function is as follows:

The total market size serves as the benchmark parameter, with a sufficiently large scale to ensure that market demand remains positive under any circumstances. Demand in the shipping market is typically constrained by macroeconomic factors and industry capacity. A large-scale market can prevent demand from becoming negative in extreme situations, such as price wars, thereby enhancing the model’s practicality. Additionally, the market demand of competitors indirectly affects freight rates through a specific influence coefficient . Furthermore, the level of transportation efficiency, as directly reflected by transportation time , and the amount of carbon emissions have both a direct and significant impact on freight rate levels. Shortening transportation time can enhance customer utility, enabling enterprises to either reduce freight charges or improve competitiveness through differentiated services. The reduction of carbon emissions aligns with the trend of green logistics, potentially enhancing market demand through policy subsidies or customer preferences, and even supporting premium strategies. The influence of transportation time and carbon emissions is measured by their respective sensitivity coefficients (). If the transportation time sensitivity coefficient () is relatively high, enterprises can significantly reduce freight charges through technological upgrades. Conversely, if the carbon emission sensitivity coefficient () is substantial, investments in environmental protection will yield greater market returns. The magnitude of the sensitivity coefficient reflects the cost-effectiveness of technological investments. The transportation time sensitivity coefficient and the carbon emission sensitivity coefficient exert a direct and notable influence on freight rate levels. To guarantee the real-world relevance of the model parameters, this study has calibrated these two crucial coefficients based on existing research: the transportation time sensitivity coefficient = 0.3 reflects the typical valuation range of shipping customers for transportation efficiency [10], whereas the carbon emission sensitivity coefficient = 0.2 indicates the market’s willingness to pay for carbon reduction under the current regulatory framework [13]. Such calibration ensures the alignment between the model’s conclusions and real-world market behavior.

In the face of the innovation brought by digital technology, shipping companies are presented with a significant opportunity for transformation and upgrading. With the assistance of digital technology, these companies can markedly enhance transportation efficiency and effectively reduce carbon emissions, that is will be reduced to (), will be reduced to (). Automated loading and unloading equipment, along with ship Internet of Things sensors, can monitor the status of goods and mechanical properties in real time, thereby minimizing human operational delays and improving port turnover efficiency [30]. Furthermore, a decentralized information-sharing platform reduces paperwork and coordination time within the supply chain, accelerating the customs clearance process for goods. This digital platform also supports the dynamic scheduling of mixed energy sources, such as LNG and hydrogen fuel, thereby decreasing reliance on traditional heavy oil [31]. However, it is important to note that technological innovation is often accompanied by increased costs. Unit operating costs and installation expenses represent significant obstacles for shipping companies in adopting new technologies. For the clarity of the strategic analysis, we assume that the unit operating cost and the installation cost associated with digital technology are symmetric and identical for both competing firms. Consequently, shipping companies must carefully weigh the advantages and disadvantages of both traditional and digital technologies. The parameters involved in the model and their meanings are outlined in Table 2.

Table 2.

Symbol Legend.

To comprehensively analyze the competitive landscape, we constructed a strategy matrix encompassing two distinct technologies and conducted an in-depth examination of the competitive behaviors exhibited by the two shipping companies across four different scenarios. We denote traditional technologies and digital technologies using the letters “T” and “D”, respectively. For clarity, superscripts such as , , or are included to indicate the specific technologies employed by the two shipping companies in each scenario. The profit functions of the two shipping companies across the four scenarios are presented in Table 3.

Table 3.

Profit of two shipping companies in each scenario.

It is important to note that our model employs linear demand and cost functions with constant sensitivity coefficients for transportation time and carbon emissions. While this assumption of linearity is a standard and necessary simplification for deriving tractable equilibria in initial game-theoretic models [21], we acknowledge that it may not capture potential nonlinearities in customer behavior or policy incentives. However, this parsimonious setup successfully serves our core objective: to provide a foundational analytical framework that clearly reveals the strategic interactions and critical cost thresholds in digital technology adoption. Exploring nonlinear functional forms and dynamic sensitivity coefficients presents a valuable and promising direction for future research.

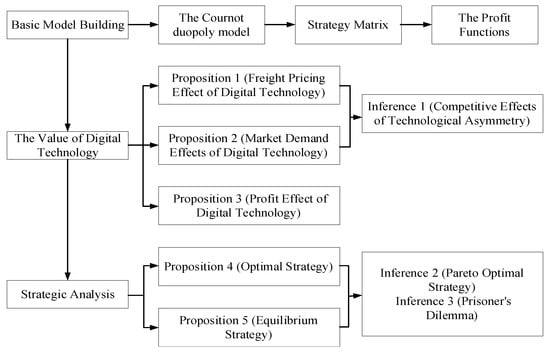

By solving the maximization problem of the profit function, we obtained the equilibrium market demand, equilibrium freight charges, and equilibrium profits of the two companies across various scenarios. These research findings not only enhance our understanding of the complexities of competition in the shipping market but also offer valuable insights for shipping companies to develop competitive strategies. The research framework is shown in Figure 1.

Figure 1.

The Research Framework.

4. The Value of Digital Technology

4.1. Proposition 1 (Freight Pricing Effect of Digital Technology)

- (1)

- When , ;

- (2)

- When , .

Proposition 1 offers a comprehensive analysis of the impact of digital technology on freight pricing within the competitive shipping market. It specifically indicates that, under certain conditions, the adoption of digital technology can lead to varying trends in freight pricing among shipping companies. When digital technology significantly enhances transportation efficiency and reduces carbon emissions, and the market responds positively to these advancements, freight pricing is likely to decrease. Conversely, if the costs associated with implementing digital technology are high and the market response is relatively indifferent, freight pricing may increase. The relationship between cost savings generated by digital technology and fluctuations in market demand is a critical factor in determining the rise or fall of freight pricing. When digital technology effectively reduces transportation costs while significantly increasing market demand, shipping companies are inclined to lower freight rates to attract a larger customer base. Conversely, if the costs associated with implementing technology are high and market demand growth is limited, companies may raise freight rates to maintain their profit levels.

When shipping companies decide to adopt digital technology, they must conduct a comprehensive evaluation of its impacts, including improvements in transportation efficiency, reductions in carbon emissions, and cost savings. This assessment enables the company to predict trends in freight pricing more accurately and to develop appropriate pricing strategies. In light of the implementation of digital technology, shipping companies must also adopt flexible pricing strategies that closely align with fluctuations in market demand. Strengthening market research and understanding customer needs is crucial, as it helps the company gauge customer acceptance of digital technology and freight pricing. This, in turn, provides robust data support for formulating more effective competitive strategies. Ningbo-Zhoushan Port’s digital transformation exemplifies digital technology’s dual pricing impact. As the world’s busiest cargo port for 16 years, its “2 + 1” smart terminal project cut costs through automation, enabling competitive freight rates [32]. Meanwhile, innovations like the “Four-Port Linkage” platform and “China-Europe Express” service created premium service options, validating digital tech’s role in both cost reduction and value-added service creation.

4.2. Proposition 2 (Market Demand Effects of Digital Technology)

- (1)

- When , ;

- (2)

- When , .

Proposition 2 illustrates the profound impact of digital technology on the market demand for shipping companies. Digital technology enhances the customer experience by improving transportation efficiency and reducing transit times, effectively attracting market demand. Additionally, by aligning with the trend of green logistics, it helps shape a positive environmental image for enterprises, appealing to customer segments that prioritize environmental protection. However, if the costs associated with implementing digital technology are excessively high, companies may need to raise shipping prices to cover these additional expenses, potentially dampening market demand. Furthermore, improper implementation of technology or low market acceptance can also negatively impact demand. Shipping companies must thoroughly understand the significant potential of digital technology in enhancing market demand and actively invest in the research, development, and application of related technologies.

In implementing digital technology, enterprises should prioritize cost control to ensure the economic benefits of these applications. Regularly assessing the return on investment (ROI) associated with digital technology is essential for facilitating timely strategic investments. Furthermore, shipping companies should closely monitor market dynamics and shifts in customer demand to ensure that the application of digital technology aligns with market needs. By enhancing market research and collecting customer feedback, companies can continuously optimize their digital technology application strategies to adapt to the ever-evolving market landscape. Additionally, enterprises should identify potential risks and challenges associated with the application of digital technology and develop targeted strategies to address them. Establishing a flexible market response mechanism is crucial for enabling quick strategic adjustments in response to changing market demands, thereby maintaining the company’s competitive advantage. A typical case is the use of domestically produced green methanol for ship bunkering at Shanghai’s Yangshan Port [33]. This goes beyond fuel transition to become a digitally coordinated operation. The port’s digital management system precisely schedules bunkering processes while digitally verifying the green methanol’s origin and carbon footprint. It provides shippers with strong environmental awareness a verifiable pathway to reduce supply chain emissions, directly stimulating market demand, attracting new customer segments, and consolidating competitive advantages for early adopters in the green shipping market.

4.3. Inference 1 (Competitive Effects of Technological Asymmetry)

When , the technologically advanced side creates a “winner takes all” phenomenon.

Inference 1 emphasizes that in the competitive shipping market, a company with significant advantages in digital technology can capture a larger market share and achieve higher profits. The benefits of digital technology greatly enhance transportation efficiency and reduce carbon emissions for shipping companies, thereby improving their competitiveness. This technological advantage attracts more customers, which, in turn, enables the company to secure an even greater market share. Consequently, the profits of technologically advanced companies will be substantially higher than those of their less advanced counterparts. This disparity arises because technologically superior companies can offer more efficient and environmentally friendly transportation services, attracting more customers and commanding higher freight rates. The advantages of digital technology can create significant market barriers, hindering other shipping companies from entering the market or expanding their market share. This occurs because technologically advanced firms have established strong customer bases and brand identities, making it challenging for new entrants or competitors to overcome these advantages in a short timeframe.

Shipping companies must fully recognize the importance of digital technology and increase their investments in research and development of related technologies. This strategy will enable companies to gain a technological edge and secure a favorable position in the market. In addition to increasing investments in research and development, shipping companies should prioritize technological innovation and upgrades. By pursuing advancements in technology, these companies can secure a leading position in the industry while continuously enhancing transportation efficiency and reducing carbon emissions. Although the benefits of digital technology may result in a ‘winner-takes-all’ phenomenon, shipping companies can address this challenge by fostering a cooperative and mutually beneficial ecosystem. For example, companies can form strategic partnerships with other shipping firms and logistics service providers to collaboratively promote the application and integration of digital technology, thereby facilitating resource sharing and achieving mutually advantageous outcomes.

4.4. Proposition 3 (Profit Effect of Digital Technology)

- (1)

- When , , .

- (2)

- When ,

- (3)

- When , , ;

- (4)

- When , , .

Proposition 3 highlights the significant impact of digital technology on profitability within the competitive shipping market. The adoption of digital technology often necessitates a substantial initial investment, which includes costs related to technology acquisition, system integration, employee training, and other associated expenses. These investment outlays can directly affect the profit margins of shipping companies. If the investment is excessively high, the company may face challenges in achieving short-term profitability. Digital technology can significantly enhance transportation efficiency and reduce carbon emissions, thereby lowering operating costs for shipping companies and boosting their competitiveness in the market. Improved transportation efficiency decreases transit times, delays, and waiting periods, which, in turn, increases customer satisfaction and loyalty. Aligning with the current global trend toward sustainability and low carbon emissions not only enhances a company’s environmental image but also elevates its brand value. The application of digital technology can profoundly influence market demand. As consumers increasingly seek environmentally friendly and efficient transportation services, shipping companies that offer digital and intelligent solutions are more likely to capture market share and foster customer loyalty. Consequently, this can positively impact the company’s profitability.

Before adopting digital technology, shipping companies must conduct a thorough evaluation of their return on investment (ROI). This assessment should encompass factors such as the cost-effectiveness of the technology, shifts in market demand, and competitors’ strategies. Through comprehensive evaluation and strategic planning, companies can ensure that the implementation of digital technology yields the anticipated economic benefits. To maximize the value derived from digital technology, shipping companies should focus on its integration into their business operations. This integration involves embedding digital technology within the company’s operational processes to achieve digitization, intelligence, and automation of business functions. By optimizing these processes and enhancing operational efficiency, companies can reduce costs and improve customer satisfaction. Given the ever-evolving nature of market demand, shipping companies must remain vigilant and adaptable in their strategies. This adaptability should encompass transportation services, pricing strategies, and marketing approaches that respond to fluctuations in market demand. By flexibly adjusting to market changes, companies can better meet customer needs and enhance their competitiveness. The complete mathematical derivations, including the step-by-step proofs for propositions and the explicit expression for the critical threshold F, are provided in the Appendix A, Appendix B, Appendix C, Appendix D, Appendix E, Appendix F, Appendix G, Appendix H and Appendix I to ensure reproducibility.

5. Optimal and Equilibrium Strategies

5.1. Proposition 4 (Optimal Strategy)

- (1)

- When and , the optimal strategy is the unilateral application strategy (TD/DT);

- (2)

- When or , the optimal strategy is for both parties to adopt the traditional technology (TT).

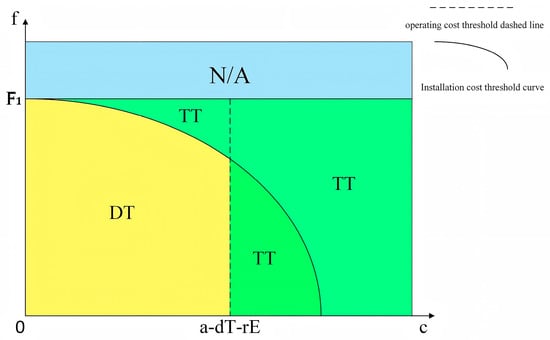

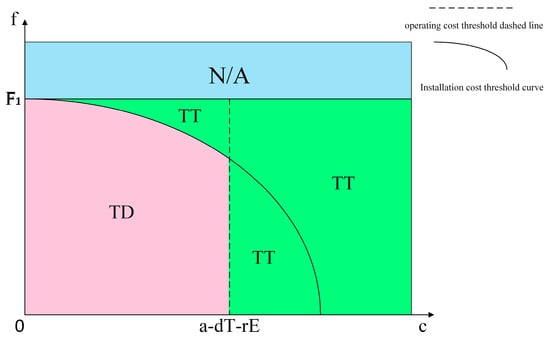

Proposition 4 outlines an optimal strategy for leveraging digital technology in competition within the shipping market. Under certain market conditions, the selection of a digital technology strategy exhibits notable game-theoretic characteristics and path dependence. When the cost-benefit ratio of technology is substantial and market demand is favorable, the proactive unilateral adoption of technology can establish competitive barriers. Conversely, when the economic advantages of technology are limited or market acceptance is low, a conservative technology strategy may emerge as the preferred solution for risk aversion. As illustrated in Figure 2 and Figure 3, in a market environment where digital technology offers significant cost advantages, shipping companies that are early adopters of advanced technology can develop differentiated competitiveness through enhanced transportation efficiency and optimized carbon emissions. This technical potential can be converted into customer preference, resulting in a ‘Matthew effect’ in market share. At this juncture, the traditional service model of technology laggards may face the risk of customer attrition, potentially triggering a systematic restructuring of competitive positions. In scenarios characterized by high digital costs and uncertain market demand responses, maintaining traditional technologies can serve as a robust strategy. This approach allows shipping companies to mitigate unnecessary investment risks and to wait for market trends to clarify before making strategic decisions.

Figure 2.

The Optimal Strategy of Company 1.

Figure 3.

The Optimal Strategy of Company 2.

In light of the significant uncertainties surrounding the application of digital technologies, shipping enterprises should establish a strategic evaluation framework for their implementation. This framework should include the following components: first, the development of a three-dimensional decision-making model for technology adoption that comprehensively considers the cost-benefit coefficient, market competition dynamics, and the technology maturity curve. Second, it is essential to enhance the elasticity of technology iteration mechanisms, allowing for flexible adjustments in the degree of application through a modular technology architecture. Third, companies should focus on cultivating the ability to guide market demand and maximize market response benefits through customer education and the demonstration effects of technology. Additionally, it is imperative to strengthen collaborative innovation within the industrial chain to mitigate systemic risks associated with technology application, facilitated by a port and shipping data-sharing platform and the establishment of a green shipping alliance. Proposition 4 identifies the strategy profile that maximizes aggregate industry profit. It provides a benchmark for what would be desirable from an industry-wide perspective.

5.2. Proposition 5 (Equilibrium Strategy)

- (1)

- When and , the equilibrium strategy is the unilateral application strategy (TD/DT);

- (2)

- When or , the equilibrium strategy is for both parties to adopt traditional technology (TT).

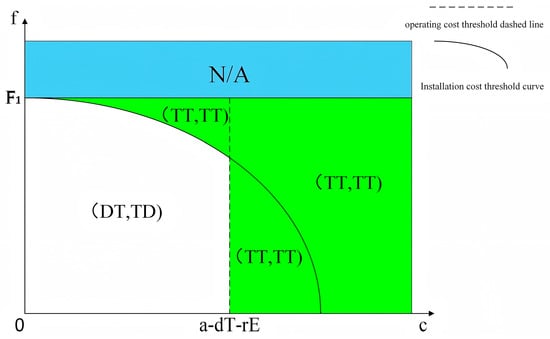

Proposition 5 emphasizes the equilibrium strategy in shipping market competition, particularly focusing on how two shipping companies should choose their technology application strategies to attain market equilibrium under specific conditions. When digital technology proves to be cost-effective and market demand is responsive, companies are more inclined to adopt new technologies to bolster their competitiveness. This tendency enhances their ability to capture market share and attract customer preference, culminating in a unilateral adoption of digital technology. In this context, one company may embrace digital technology while the other adheres to traditional methods, ultimately resulting in a balanced strategic approach. Conversely, when the cost-effectiveness of digital technology is unclear or market demand for it is weak, shipping companies tend to retain traditional technologies to mitigate unnecessary investment risks. In such scenarios, both parties adopt traditional technologies as an equilibrium strategy, as illustrated in Figure 4.

Figure 4.

The Equilibrium Strategy.

Shipping companies must accurately assess the evolving trends of market demand when formulating their strategies. Conducting market research and analysis to understand customer acceptance of digital technology and their demand preferences is essential for making informed strategic decisions. Before implementing digital technologies, shipping companies should conduct a thorough assessment of the associated risks and benefits. Factors such as technology maturity, cost inputs, and market demand must be considered to ensure the economic viability and feasibility of technology adoption. In response to the changing market environment and technological development trends, shipping companies should develop flexible competitive strategies. Based on market demand and technology application, they should timely adjust their transportation services, pricing strategies, and marketing methods to align with market competition needs. Additionally, enhancing communication and collaboration with partners is crucial for jointly promoting the application and development of digital technology, thereby achieving mutual benefits and win-win outcomes. Proposition 5 describes the stable outcome of strategic competition, where firms act independently to maximize their own profits.

5.3. Inference 2 (Pareto Optimal Strategy)

When and , the TT scenario is Pareto optimal.

Inference 2 suggests that when the cost-effectiveness of digital technology is not significantly greater than that of traditional technology, and the market demand response to digital technology is relatively neutral, both shipping companies adopting traditional technology (TT scenario) constitutes a Pareto optimal strategy. Under the conditions specified in Inference 2, the costs associated with digitization are higher, and the benefits may not adequately compensate for these expenses. Therefore, from an economic perspective, it may be more prudent to retain traditional technologies. Furthermore, the relatively neutral response of market demand to digital technology indicates that consumers or customers have not yet demonstrated a strong preference or demand for digital technology. This further diminishes the urgency and necessity of adopting digital technologies. The market reaches a relatively stable equilibrium state when both parties maintain traditional technology. In this state, any party altering its strategy (such as adopting digital technology) may encounter uncertain risks and costs without guaranteeing a clear competitive advantage or profit enhancement.

Consequently, shipping companies should exercise caution when considering digital technology and conduct a comprehensive evaluation of both the cost-effectiveness of the technology and the evolving trends in market demand. In situations where conditions are not favorable, maintaining traditional technologies may be a more prudent strategy. Although Inference 2 indicates that traditional technologies are optimal under specific circumstances, shipping companies must remain cognizant of the fact that market conditions and technological trends are in a state of constant flux. Consequently, these companies need to exhibit flexibility and be prepared to adapt their strategies to evolving circumstances. While upholding traditional technologies, shipping companies should also actively seek collaborative opportunities with other enterprises or institutions to jointly foster technological innovation and facilitate industrial upgrading. By engaging in collaborative innovation, the risks and costs incurred by a single enterprise can be mitigated, while simultaneously accelerating the diffusion and application of technology.

5.4. Inference 3 (Prisoner’s Dilemma)

When and , both parties fall into three dilemmas:

- (1)

- Unilateral Application Dilemma (TD/DT): One party suffers profit loss while the other benefits;

- (2)

- Dilemma of Simultaneous Application (DD): Total profit is lower than that in the unilateral scenario;

- (3)

- Non-application Dilemma (TT): Overall market inefficiency, low total profit.

Inference 3 identifies three potential dilemmas in shipping market competition: TD/DT, DD, and TT. When one shipping company adopts digital technology while another continues to utilize traditional methods, the company embracing the new technology may risk losing profits due to higher technology costs. Conversely, companies that retain legacy technologies may lose market share by failing to match their competitors’ service levels. When two shipping companies adopt digital technology simultaneously, the total profit may be lower than that achieved through unilateral application of digital technology, primarily due to excessive technology investments and intensified market competition. Additionally, the two companies may engage in detrimental practices such as price wars, further eroding profits. If both shipping companies maintain traditional technologies, the overall market may become inefficient, failing to meet consumer demand for efficient and environmentally friendly transportation services. This inefficiency can lead to reduced market demand, subsequently affecting the profit levels of both companies. Therefore, shipping companies should avoid blindly following trends or making uninformed investments when deciding whether to adopt digital technology.

Companies should comprehensively evaluate their resource endowments, technical capabilities, and market environments to formulate reasonable technology application strategies. To circumvent the dilemma of simultaneous adoption, shipping companies can strengthen collaboration and pursue mutually beneficial outcomes. By sharing technological achievements, optimizing resource allocation, and collaborating in market development, shipping companies can reduce the costs associated with technology application while enhancing overall market efficiency. It is essential for these companies to closely monitor shifts in customer demand and market trends, adjusting their technology application strategies accordingly. By providing efficient and environmentally friendly transportation services that align with customer needs, shipping companies can gain market share and build customer trust. In anticipation of potential challenges, shipping companies should develop flexible strategies to address these issues. This involves establishing risk early warning mechanisms, creating contingency plans, and strengthening internal management to effectively navigate market volatility and risk challenges. The alignment between optimal and equilibrium strategies is not guaranteed. When unit operating costs is moderately low and installation expenses are moderate, a Prisoner’s Dilemma occurs. In this region, The Nash Equilibrium is for both firms to adopt digital technology (DD), as adoption becomes a dominant strategy for each. However, the resulting profits in this DD equilibrium are lower for both firms compared to the coordinated asymmetric (TD/DT) outcome or sometimes even the TT outcome. Here, the decentralized equilibrium (DD) is Pareto inefficient, diverging from the optimal outcomes. This creates the classic dilemma where individual rationality leads to a collectively inferior result.

6. Numerical Analysis

To further validate the theoretical findings and illustrate the impact of digital technology adoption on the profits of shipping companies under varying cost conditions, we conduct a numerical analysis based on the Cournot duopoly model established in Section 3. The analysis focuses on the effects of unit operating cost and installation cost on the profits of both companies under four strategic scenarios.

Drawing on Chen et al. [19]’s research on the competitive structure of the shipping market, we set the market size parameter = 100 and the demand impact coefficient = 0.8. Based on Barreiro et al. [12]’s study on operational efficiency, we assume the transportation time sensitivity coefficient = 0.3, reflecting the degree of importance customers attach to transportation efficiency. Using the benchmark data from Wang et al. [20]’s research on port congestion, the transportation time for traditional technology is = 10, and digitalization can reduce transportation time by approximately 40% [3]. Therefore, the transportation time for digital technology is = 6. According to Tadros et al. [1]’s analysis of the IMO’s emission reduction goals and environmental regulation trends, the carbon emission sensitivity coefficient is = 0.2. The carbon emissions for traditional technology are = 8, and digitalization can reduce carbon emissions by approximately 50% [4]. Hence, the carbon emissions for digital technology are = 4. The range of unit operating cost is 0–20, and the range of installation cost is 0–500 [15].

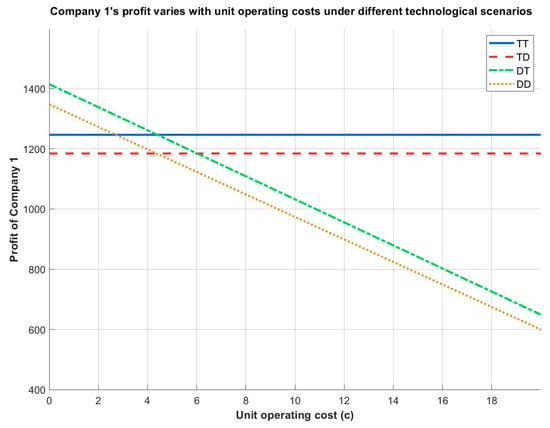

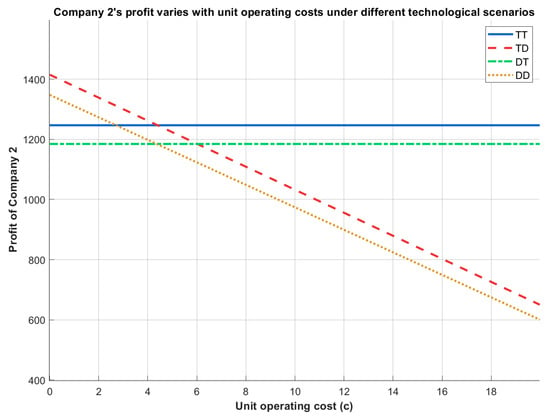

We first examine how the unit operating cost influences the profits of Companies 1 and 2 under the four strategic scenarios (Figure 5 and Figure 6).

Figure 5.

Company 1’s profit varies with unit operating costs under different technological scenarios.

Figure 6.

Company 2’s profit varies with unit operating costs under different technological scenarios.

The reversal of profit rankings for both companies as increases underscores the dual role of operational costs in shaping digital strategy effectiveness. Digital technologies offer clear advantages in low-cost environments, but their benefits can be completely offset or even reversed under high operational costs, making traditional technologies a more robust choice. This supports Proposition 3 regarding the profit effect of digital technology and Inference 3 concerning the prisoner’s dilemma in technology adoption.

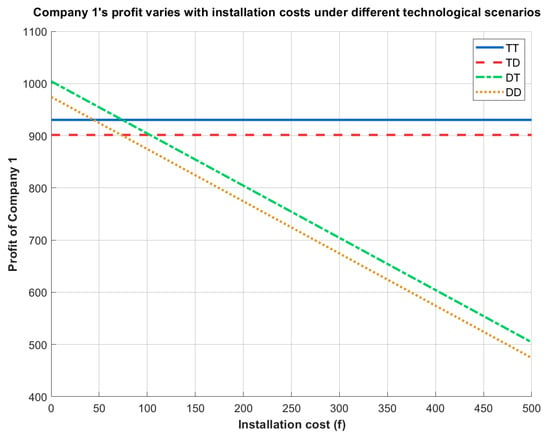

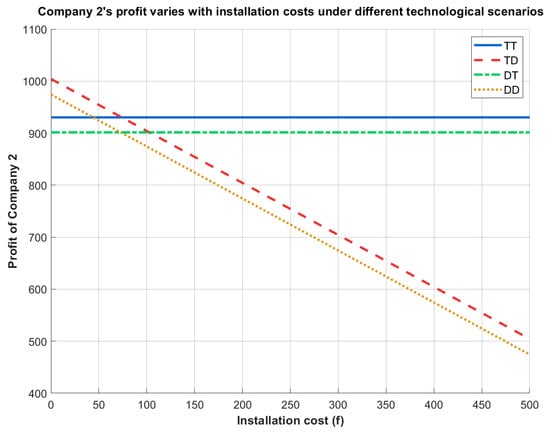

Next, we analyze the effect of the installation cost on the profits of both companies (Figure 7 and Figure 8).

Figure 7.

Company 1’s profit varies with installation costs under different technological scenarios.

Figure 8.

Company 2’s profit varies with installation costs under different technological scenarios.

The profit dynamics under varying installation costs reinforce the critical role of cost thresholds in digital technology adoption. Both figures demonstrate that low installation costs favor digital scenarios, particularly those involving unilateral adoption by one party, which can generate cross-firm benefits. However, as installation costs increase, traditional technology consistently emerges as the most stable and profitable strategy for both companies. The bilateral digital scenario is highly vulnerable to rising installation costs, transitioning from a competitive strategy under low costs to the worst-performing option under high costs.

These numerical results emphasize the importance of cost-conscious digital strategy formulation and the potential risks of technology adoption without proper cost assessment.

7. Conclusions

This study constructed a Cournot duopoly model to analyze the strategic implications of digital technology adoption in the shipping industry, incorporating dimensions of freight pricing, carbon emissions, and transportation efficiency. Our analysis provides definitive answers to the three research questions posed at the outset.

Regarding Q1, our findings reveal a dual and cost-contingent effect. Digital technology’s impact on freight pricing is not monotonic. When the efficiency gains outweigh the implementation costs, firms can strategically lower freight rates to gain market share. Conversely, prohibitively high technology costs compel firms to raise prices to preserve profitability. For market demand, digitalization generally exerts a positive influence by enhancing customer utility through faster and greener services. However, this positive effect can be negated if the associated cost pressures lead to significant price increases. Finally, the effect on profitability is critically dependent on the competitive context. While a technological firm can achieve superior profits, simultaneous adoption can trigger intense competition that erodes industry-wide profits, creating a potential prisoner’s dilemma.

Regarding Q2, our model provides a clear decision-making framework. The optimal strategy is dictated by the interplay of unit operating cost and installation cost. When these costs are low, a unilateral digital strategy is optimal, allowing the adopter to capture a ‘winner-takes-all’ advantage. Under conditions of moderate costs, the Nash equilibrium may push both firms toward mutual digital adoption, even though this can be collectively suboptimal. When costs are high, the most stable and prudent strategy for both firms is to mutually adhere to traditional technologies. Therefore, managers must base their adoption decisions on a rigorous, dynamic assessment of their cost structures relative to the market.

Regarding Q3, our analysis confirms that technological asymmetry fundamentally reshapes competition, often leading to a “winner-takes-all” outcome favoring the digital leader. More importantly, we identify a tripartite prisoner’s dilemma as a pervasive feature of this landscape, which manifests in three forms: first, an Unilateral Application Dilemma arises where one firm’s gain directly translates to the other’s loss; second, a Dilemma of Simultaneous Application occurs where mutual adoption triggers intense competition, driving collective profits below what a coordinated asymmetric outcome could achieve; and finally, a Non-application Dilemma emerges, locking the entire industry into a state of systemic inefficiency. A Pareto-optimal equilibrium is achievable only under specific conditions, typically when both firms wisely forego digital investment in high-cost environments, thereby avoiding destructive competition.

The digitalization and decarbonization transformation of the shipping industry faces strategic pitfalls, including the “prisoner’s dilemma,” requiring coordinated efforts from regulators and industry stakeholders. To address profit gaps caused by high installation costs, targeted financial incentives such as digitalization investment subsidies, tax credits, and green technology special funds should be implemented to reduce barriers to corporate transformation. Meanwhile, when moderate installation costs are accompanied by “winner-takes-all” risks that hinder collective action, mandatory industry-wide data-sharing platforms and green shipping corridors should be promoted. These measures, supported by special regulatory frameworks and collective digital infrastructure investment, will foster collaborative ecosystems, balance competition and cooperation, and drive the industry toward efficient and sustainable equilibrium development.

The identification of a prisoner’s dilemma in digital adoption adds a new dimension to the literature on shipping sustainability [28], highlighting how individual rationality can lead to collective inefficiency. This insight challenges the prevailing optimism toward digital collaboration and calls for coordinated policy and alliance-based governance to overcome adoption barriers. In sum, this research transcends the descriptive level of “what digital technology does” to explain how and under what conditions it reshapes market structures and firm behaviors, thereby offering a theoretically grounded and strategically actionable framework for both scholars and practitioners in the shipping industry.

This study constructs a model based on the assumptions of static market parameters and the homogenization of enterprise capabilities. Future research could incorporate factors such as random demand fluctuations, heterogeneous technology adoption cycles, and various regulatory scenarios, including non-linear customer sensitivity to emissions and transit time. In the context of digital technologies continuously reshaping the competitiveness of the shipping industry, this study provides enterprises with a strategic framework to balance technological innovation and market agility: they should not only carefully assess technological risks but also respond flexibly to industry changes with dynamic strategies.

Author Contributions

M.W. is tasked with building models, calculating propositions and inferences, and drafting the conclusions while integrating all components effectively. S.Z. (Shibo Zhang) and X.Z. contribute by generating graphs, analyzing the results, and assisting with calculations. Y.W. is responsible for the introduction and literature review of the article, conducting a thorough search of the relevant literature to assess the current state of research in the field. S.Z. (Shengying Zhao) contribute by editing, supervision, and funding acquisition. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by research project of Liaoning Provincial Department of Education Basic Scientific Research (LJ112410158013); Science and Technology Innovation Think Tank Project of Liaoning Provincial Association for Science and Technology (LNKX2025QN39); Dalian Academy of Social Sciences Project (2024dlsky137); Dalian Federation of Social Sciences Project (2024dlskzd186); Special funds for basic scientific research business expenses of undergraduate colleges and universities in Liaoning Province (500924203074); Innovation and Entrepreneurship Training Program for College Students (X202410158048); Digital Engine-Chaining the Blue Ocean: An Analysis of High-quality Development Path of Marine Fishery Supply Chain in Liaoning Province (X202510158038).

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Appendix A

The price functions of Company 1 and Company 2 are as follows:

In scenario TD, the profit functions of the two shipping companies are represented as and , resulting in . The equilibrium market demand for the two shipping companies can be attained by maximizing their respective profits. The first-order conditions necessary for maximizing the profits of the shipping companies are given by and . Consequently, we derive the following results:

From this, the equilibrium freight rate and equilibrium profit can be obtained:

In a similar manner, we can derive the equilibrium market demand, equilibrium freight rates, and equilibrium profits for scenario TT.

Additionally, we can determine the equilibrium market demand, equilibrium freight charges, and equilibrium profits for scenario DT.

Finally, we will analyze the equilibrium market demand, equilibrium freight charges, and equilibrium profits for scenario DD.

Appendix B. Proof of Proposition 1

If shipping companies adopt digital technology, their equilibrium freight rates are influenced by cost factor c. First, we define the price functions under traditional technology (TT) and digital technology (DD). The freight function for scenario TT, in which both parties utilize traditional technology, is as follows: . Conversely, the freight function for scenario DD, where both parties adopt digital technology is: . The profit function for enterprise in scenario TT is represented as: . The equilibrium yield for scenario TT is derived from the first-order condition :. Similarly, the profit function for enterprise in scenario DD is: . The equilibrium yield for scenario DD is obtained from the first-order condition : . By substituting the price functions, we can determine the equilibrium freight rates. The equilibrium freight rate for scenario TT is , while the equilibrium freight rate for scenario DD is . By comparing the values of and , we can derive the necessary conclusions. The critical condition is . When , , the freight charges for digital enterprises decrease; conversely, when , , the high cost compels the company to increase the freight charges.

Appendix C. Proof of Proposition 2

The equilibrium yield of scenario TT is , while the equilibrium yield of scenario DD is . By comparing the magnitudes of these yields, we can draw the following conclusion: When , , digital technology significantly enhances market demand by reducing transportation time and carbon emissions. At this juncture, the cost advantage is adequate to offset the technological investments, enabling enterprises to expand their market share. Conversely, when , , the high technical costs compel enterprises to curtail production to maintain profitability, leading to a decline in market demand.

Appendix D. Proof of Inference 1

From Proposition 1 and Proposition 2, it is evident that when only one party adopts digital technology, the party with the technological advantage captures the market through reduced transportation time and carbon emissions (). Furthermore, this party can mitigate costs and lower freight charges through enhanced efficiency (), resulting in a ‘winner-takes-all’ phenomenon, with the threshold condition being established as proof.

Appendix E. Proof of Proposition 3

When both parties adopt traditional technologies, the profit of the enterprise is: . Substituting into the equilibrium output gives: . When both parties adopt digital technology, the profit of the enterprise is , and substituting it into the equilibrium output gives: . Compare the profit difference between scenario DD and TT. The expression of the profit difference is: . When , , ; When , the profit difference between scenario DD and TT is given by: , we set the profit difference to zero to solve for the critical fixed cost . If , ,; If , , .

Appendix F. Proof of Proposition 4

Scenario TT (both parties adopt traditional technologies), the equilibrium profit of enterprise is . Scenario TD/DT (Unilateral application of digital technology), suppose enterprise adopts traditional technology (T) and enterprise adopts digital technology (D), that is, scenario TD, the equilibrium profit of enterprise is , and the equilibrium profit of enterprise is . Scenario DD (Both parties adopt digital technology), the equilibrium profit of enterprise : . When and the fixed cost , the profit of scenario DD is . However, since enterprise j adopts digital technology in scenario TD, its profit is higher. In the TD scenario, the profit of enterprises (traditional technology) may be lower than that in the TT scenario, but the profit of enterprises (digital technology) is significantly higher than that in the TT scenario. Since the strategic goal is to maximize individual profits, enterprise j has the motivation to unilaterally adopt digital technologies, while enterprise cannot obtain higher profits by following, eventually forming a unilateral application equilibrium (TD/DT). When , according to Propositions 1 and 2, the operating cost of digital technology is too high, resulting in an increase in freight charges and a decrease in demand. The profit of scenario DD: Enterprises will suffer losses if they adopt digital technologies. It is better for both parties to maintain traditional technologies (TT). When , even if , the high fixed costs offset the technological advantages, causing , enterprises to choose traditional technologies (TT) to avoid losses.

Appendix G. Proof of Proposition 5

In the Cournot model, the determination of the equilibrium strategy depends on the Nash equilibrium, that is, each enterprise selects the optimal response strategy when its opponent’s strategy is given. The following are the definitions of the profit functions for four scenarios: Scenario TT (both parties are traditional technologies), the equilibrium profit of enterprise is . Scenario TD/DT (Unilateral Digital Technology), when enterprise adopts traditional technology (T) and enterprise adopts digital technology (D), , . When enterprise adopts digital technology (D) and enterprise adopts traditional technology (T), , . Scenario DD (both parties are digital technologies), the equilibrium profit of enterprise is . When and the fixed cost , the profit of scenario DD is . However, if the rival enterprise adopts traditional technology (T), the digital enterprise can obtain higher profits through unilateral application (TD/DT): . At this point, the Nash equilibrium is: If enterprise selects D, the optimal response of enterprise is T; If enterprise selects T, the optimal response of enterprise is D. The two sides were unable to coordinate to form a symmetrical equilibrium, and eventually a unilateral application equilibrium (TD/DT) was formed. When , the profit of scenario DD is lower than TT: . Both sides choose T as the only equilibrium strategy to avoid losses. When , even if , the high fixed costs offset the technological advantages, , enterprises maintain traditional technologies (TT) to avoid losses.

Appendix H. Proof of Inference 2

When and , unilateral digitalization (TD/DT), taking scenario TD as an example, the profit of Company 1 is impaired (), and the profit of Company 2 increases (), which is not the Pareto optimal strategy. If both parties choose digitalization (DD), the total profit is lower than that of the unilateral scenario. When and , , maintaining the traditional technique (TT) as the only feasible strategy, so the TT scenario is Pareto optimal.

Appendix I. Proof of Inference 3

When and , unilateral digitalization (TD/DT), taking scenario TD as an example, one party suffers a loss in profit, , one party gains, which is a unilateral application predicament. If both parties choose digitalization (DD), the total profit is lower than that of the unilateral scenario, which is the predicament of simultaneous application. If all enterprises do not adopt digital technologies, the overall market efficiency will be low, which is manifested as: , the total profit is far lower than that of unilateral or bilateral digital scenarios, which is the non-application predicament.

References

- Tadros, M.; Ventura, M.; Soares, C.G. Review of current regulations, available technologies, and future trends in the green shipping industry. Ocean Eng. 2023, 280, 114670. [Google Scholar] [CrossRef]

- Hoang, A.T.; Foley, A.M.; Nižetić, S.; Huang, Z.; Ong, H.C.; Ölçer, A.I.; Pham, V.V.; Nguyen, X.P. Energy-related approach for reduction of CO2 emissions: A critical strategy on the port-to-ship pathway. J. Clean. Prod. 2022, 355, 131772. [Google Scholar] [CrossRef]

- Jian, L.; Guo, J.; Ma, H. Research on the impact of digital innovation driving the high-quality development of the shipping industry. Sustainability 2022, 14, 4648. [Google Scholar] [CrossRef]

- Wagner, N.; Wiśnicki, B. The importance of emerging technologies to the increasing of corporate sustainability in shipping companies. Sustainability 2022, 14, 2475. [Google Scholar] [CrossRef]

- Xue, J.H. Analysis of the Digital Transformation Policy of The Global Shipping Industry: Taking Singapore, United Kingdom, the Netherlands and Germany as Examples. Available online: https://www.istis.sh.cn/cms/news/article/98/27399 (accessed on 29 January 2023).

- eWorldship. From the Perspective of Maritime Digital Technology Companies, How Can the Shipping Industry Meet the Test of Decarbonization? Available online: https://www.eworldship.com/html/2023/ship_inside_and_outside_1128/198432.html (accessed on 29 January 2023).

- Xinde Marine News. Hapag-Lloyd Continues to Apply Digital Technologies to Help Decarbonize Its Fleet. Available online: https://www.xindemarinenews.com/topic/yazaishuiguanli/53464.html (accessed on 29 January 2023).

- Neptune Robotics. Homepage of Neptune Robotics. Available online: https://neptune-robotics.com/ (accessed on 29 January 2023).

- Xinde Marine News. DNV Joins Hands with SDARI and PG to Create a Digital Carbon Emissions Management Model and Build a New Era of Shipping Emissions Reduction. Available online: https://www.xindemarinenews.com/topic/yazaishuiguanli/58569.html (accessed on 29 January 2023).

- Tijan, E.; Jović, M.; Aksentijević, S.; Pucihar, A. Digital transformation in the maritime transport sector. Technol. Forecast. Soc. Chang. 2021, 170, 120879. [Google Scholar] [CrossRef]

- Chávez, C.A.G.; Brynolf, S.; Despeisse, M.; Johansson, B.; Rönnbäck, A.Ö.; Rösler, J.; Stahre, J. Advancing sustainability through digital servitization: An exploratory study in the maritime shipping industry. J. Clean. Prod. 2024, 436, 140401. [Google Scholar] [CrossRef]

- Barreiro, J.; Zaragoza, S.; Diaz-Casas, V. Review of ship energy efficiency. Ocean Eng. 2022, 257, 111594. [Google Scholar] [CrossRef]

- Zhu, M.; Shen, S.; Shi, W. Carbon emission allowance allocation based on a bi-level multi-objective model in maritime shipping. Ocean Coast. Manag. 2023, 241, 106665. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Khan, Z.; Wood, G.; Knight, G. COVID-19 and digitalization: The great acceleration. J. Bus. Res. 2021, 136, 602–611. [Google Scholar] [CrossRef]

- Raza, Z.; Woxenius, J.; Vural, C.A.; Lind, M. Digital transformation of maritime logistics: Exploring trends in the liner shipping segment. Comput. Ind. 2023, 145, 103811. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, X.; Xu, L.; Xu, J. Trends of digitalization, intelligence and greening of global shipping industry based on CiteSpace knowledge graph. Ocean Coast. Manag. 2024, 255, 107206. [Google Scholar] [CrossRef]

- Gao, X.; Kong, Y.; Cheng, L. Strategies and mechanisms for building digital resilience of container shipping platform in crisis situations: A network orchestration perspective. Ocean Coast. Manag. 2023, 246, 106887. [Google Scholar] [CrossRef]

- Wu, J.; Liu, J.; Li, N. The evasion strategy options for competitive ocean carriers under the EU ETS. Transp. Res. Part E Logist. Transp. Rev. 2024, 183, 103439. [Google Scholar] [CrossRef]

- Chen, J.; Ye, J.; Zhuang, C.; Qin, Q.; Shu, Y. Liner shipping alliance management: Overview and future research directions. Ocean Coast. Manag. 2022, 219, 106039. [Google Scholar] [CrossRef]

- Wang, Z.; Wu, X.; Lo, K.L.; Mi, J.J. Assessing the management efficiency of shipping company from a congestion perspective: A case study of Hapag-Lloyd. Ocean Coast. Manag. 2021, 209, 105617. [Google Scholar] [CrossRef]

- Wang, H.; Wang, C.; Li, M.; Xie, Y. Blockchain technology investment strategy for shipping companies under competition. Ocean Coast. Manag. 2023, 243, 106696. [Google Scholar] [CrossRef]

- He, P.; Jin, J.G.; Pan, W.; Chen, J. Route, speed, and bunkering optimization for LNG-fueled tramp ship with alternative bunkering ports. Ocean Eng. 2024, 305, 117957. [Google Scholar] [CrossRef]