Digital Payments Trust in Latin America and the Caribbean

Abstract

1. Introduction

2. Literature Review and Development of Hypothesis

2.1. Theoretical Framework

2.2. Trust in the Financial System and Usage of Digital Payments

2.3. Trust in the Financial System, Usage of Digital Payments, and User’s Income Level

3. Research Methodology

3.1. Data

3.2. Methodology

4. Results

5. Discussion of Results

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviation

| LAC | Latin American and Caribbean |

References

- Acemoglu, D., & Johnson, S. (2023). Power and progress: Our thousand-year struggle over technology and prosperity. PublicAffairs. [Google Scholar]

- Acemoglu, D., & Robinson, J. A. (2012). Why nations fail: The origins of power, prosperity, and poverty. Crown Business. [Google Scholar]

- Acemoglu, D., & Robinson, J. A. (2019). The narrow corridor: States, societies, and the fate of liberty. Penguin Press. [Google Scholar]

- Adel, N. (2024). The impact of digital literacy and technology adoption on financial inclusion in Africa, Asia, and Latin America. Heliyon, 10(24), e40951. [Google Scholar] [CrossRef]

- Ahmed, S., Ahmed, R., Ashrafi, D. M., Ahmed, E., & Annamalah, S. (2024). Building trust in cybernetic payment network: Insights from an emerging economy. Journal of Open Innovation: Technology, Market, and Complexity, 10(3), 100331. [Google Scholar] [CrossRef]

- Albastaki, T., Hamdan, A., Albastaki, Y., & Bakir, A. (2024). Factors affecting e-payment acceptance by customers: An empirical study in the Kingdom of Bahrain. Competitiveness Review, 34(1), 107–124. [Google Scholar] [CrossRef]

- Amboage, G. B., Monteiro, G. F. d. A., & Bortoluzzo, A. B. (2024). Technological adoption: The case of PIX in Brazil. Innovation and Management Review, 21(3), 198–211. [Google Scholar] [CrossRef]

- Arango-Arango, C. A., & Suárez-Ariza, N. F. (2017). Factors impeding the use of electronic payment instruments in emerging economies: The case of Colombia. Journal of Payments Strategy & Systems, 10(4), 363–382. [Google Scholar]

- Arvidsson, N. (2019). Building a cashless society. Springer. [Google Scholar] [CrossRef]

- Aurazo, J., & Vega, M. (2021). Why people use digital payments: Evidence from micro data in Peru. Latin American Journal of Central Banking, 2(4), 100044. [Google Scholar] [CrossRef]

- Bailey, A. A., Bonifield, C. M., Arias, A., & Villegas, J. (2022). Mobile payment adoption in Latin America. Journal of Services Marketing, 36(8), 1058–1075. [Google Scholar] [CrossRef]

- Bijlsma, M., van der Cruijsen, C., & Koldijk, J. (2022). Determinants of trust in banks’ payment services during COVID: An exploration using daily data. Economist, 170(2), 231–256. [Google Scholar] [CrossRef]

- Bold, C., Porteous, D., & Rotman, S. (2012). Social cash transfers and financial inclusion: Evidence from four countries. Focus Note No. 77. Consultative Group to Assist the Poor (CGAP). [Google Scholar]

- Bortot, F. (2003). Frozen savings and depressed development in Argentina. Savings and Development, 27(2), 161–202. [Google Scholar]

- Broekhoff, M. C., van der Cruijsen, C., & de Haan, J. (2024). Towards financial inclusion: Trust in banks’ payment services among groups at risk. Economic Analysis and Policy, 82, 104–123. [Google Scholar] [CrossRef]

- Chandra, S., Srivastava, S. C., & Theng, Y.-L. (2010). Evaluating the role of trust in consumer adoption of mobile payment systems: An empirical analysis. Communications of the Association for Information Systems, 27(1), 29. [Google Scholar] [CrossRef]

- Chang, C. C., & Hung, J. S. (2018). The effects of service recovery and relational selling behavior on trust, satisfaction, and loyalty. International Journal of Bank Marketing, 36(7), 1437–1454. [Google Scholar] [CrossRef]

- Chatterjee, A. (2020). Financial inclusion, information and communication technology diffusion, and economic growth: A panel data analysis. Information Technology for Development, 26(3), 1734770. [Google Scholar] [CrossRef]

- Chiang, C. W., Anderson, C., Flores-Saviaga, C., Arenas, E., Colin, F., Romero, M., Rivera-Loaiza, C., Chavez, N. E., & Savage, S. (2017, November 8–10). Understanding interface design and mobile money perceptions in Latin America. CLIHC ‘17: Proceedings of the 8th Latin American Conference on Human-Computer Interaction, ACM International Conference Proceeding Series, Antigua Guatemala, Guatemala. [Google Scholar] [CrossRef]

- Demir, A., Pesqué-Cela, V., Altunbas, Y., & Murinde, V. (2022). Fintech, financial inclusion and income inequality: A quantile regression approach. The European Journal of Finance, 28(1), 86–107. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A., Klapper, L., Singer, D., & Ansar, S. (2022). The global findex database 2021: Financial inclusion, digital payments, and resilience in the age of COVID-19. World Bank Publications. [Google Scholar] [CrossRef]

- Dinh, D. V. (2024). Digital economy and the electronic payment behavior: An empirical analysis. Transnational Corporations Review, 16(4), 200078. [Google Scholar] [CrossRef]

- Duane, A., O’Reilly, P., & Andreev, P. (2014). Realising M-Payments: Modelling consumers’ willingness to M-pay using Smart Phones. Behaviour & Information Technology, 33(4), 318–334. [Google Scholar] [CrossRef]

- Fungáčová, Z., Hasan, I., & Weill, L. (2019). Trust in banks. Journal of Economic Behavior & Organization, 157, 452–476. [Google Scholar] [CrossRef]

- Galiani, S., Gertler, P., & Ahumada, C. N. (2020). NBER working paper series trust and saving in financial institutions by the poor. Available online: http://www.nber.org/papers/w26809 (accessed on 15 March 2025).

- Gulyas, O., & Kiss, G. (2023). Impact of cyber-attacks on the financial institutions. Procedia Computer Science, 219, 84–90. [Google Scholar] [CrossRef]

- Heyert, A., & Weill, L. (2024). Trust in banks and financial inclusion: Micro-level evidence from 28 countries. Economic Systems, 49, 101248. [Google Scholar] [CrossRef]

- Huang, Z., Wang, L., & Yu, W. (2025). Financial development, electronic payments, and residents’ consumption: Evidence from rural China. Finance Research Letters, 71, 106455. [Google Scholar] [CrossRef]

- Humairoh, H., Annas, M., Wiwaha, A., Duha, T., & Endri, E. (2025). Digitalization of the payment systems: Evidence from Indonesia. Quality—Access to Success, 26(205), 245–253. [Google Scholar] [CrossRef]

- Keefer, P., & Scartascini, C. (2022). Trust: The key to social cohesion and growth in Latin America and the Caribbean. Inter-American Development Bank. [Google Scholar] [CrossRef]

- Koh, B. S. K., Mitchell, O. S., & Fong, J. H. (2021). Trust and retirement preparedness: Evidence from Singapore. The Journal of the Economics of Ageing, 18, 100283. [Google Scholar] [CrossRef]

- Koomson, I., Koomson, P., & Abdul-Mumuni, A. (2023). Trust in banks, financial inclusion and the mediating role of borrower discouragement. International Review of Economics & Finance, 88, 1418–1431. [Google Scholar] [CrossRef]

- Lab, I., & Forum, W. E. (2022). Accelerating digital payments in Latin America and the Caribbean. Inter American Development Bank. [Google Scholar] [CrossRef]

- Latinobarometro. (2023). Banco de datos-corporación latinobarómetro 2023. Available online: https://www.fundacioncarolina.es/wp-content/uploads/2023/11/Latinobarometro_Informe_2023.pdf (accessed on 20 March 2025).

- Lee, C. C., Chen, P. F., & Chu, P. J. (2023). Green recovery through financial inclusion of mobile payment: A study of low- and middle-income Asian countries. Economic Analysis and Policy, 77, 729–747. [Google Scholar] [CrossRef]

- Liu, Z., Ben, S., & Zhang, R. (2019). Factors affecting consumers’ mobile payment behavior: A meta-analysis. Electronic Commerce Research, 19(3), 575–601. [Google Scholar] [CrossRef]

- López-Concepción, A., Gil-Lacruz, A., Saz-Gil, I., & Bazán-Monasterio, V. (2023). Social wezll-being for a sustainable future: The influence of trust in big business and banks on perceptions of technological development from a life satisfaction perspective in Latin America. Sustainability, 15(1), 628. [Google Scholar] [CrossRef]

- Mayer, C. (2008). Trust in financial markets. European Financial Management, 14(4), 617–632. [Google Scholar] [CrossRef]

- Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational trust. Academy of Management Review, 20(3), 709–734. [Google Scholar] [CrossRef]

- McAndrews, J. J. (2020). The case for cash. Latin American Journal of Central Banking, 1(1–4), 100004. [Google Scholar] [CrossRef]

- Mehrotra, R., Somville, V., & Vandewalle, L. (2021). Increasing trust in bankers to enhance savings: Experimental evidence from India. Economic Development and Cultural Change, 69(2), 623–644. [Google Scholar] [CrossRef]

- Melvin, M. (2003). A stock market boom during a financial crisis? ADRs and capital outflows in Argentina. Economics Letters, 81(1), 129–136. [Google Scholar] [CrossRef]

- Ngugi, B., Pelowski, M., & Ogembo, J. G. (2010). M-pesa: A case study of the critical early adopters’ role in the rapid adoption of mobile money banking in Kenya. The Electronic Journal of Information Systems in Developing Countries, 43(1), 1–16. [Google Scholar] [CrossRef]

- Oney, E., Oksuzoglu Guven, G., & Hussain Rizvi, W. (2017). The determinants of electronic payment systems usage from consumers’ perspective. Economic REsEaRch-Ekonomska IstRaživanja, 30(1), 394–415. [Google Scholar] [CrossRef]

- Ozili, P. K. (2024). Digital financial inclusion research and developments around the world. In Reference module in social sciences. Elsevier. [Google Scholar] [CrossRef]

- Park, N. Y. (2020). Trust and trusting behavior in financial institutions: Evidence from South Korea. International Review of Economics & Finance, 67, 408–419. [Google Scholar] [CrossRef]

- Parra Saiani, P., Ivaldi, E., Ciacci, A., & Di Stefano, L. (2021). Broken trust. Confidence gaps and distrust in latin america. Social Indicators Research, 173, 269–281. [Google Scholar] [CrossRef]

- Png, I. P. L., & Tan, C. H. Y. (2020). Privacy, trust in banks, and use of cash. Macroeconomic Review, 19(1), 109–116. Available online: https://ssrn.com/abstract=3526531 (accessed on 18 March 2025). [CrossRef]

- Rabinovich, J., & Pérez Artica, R. (2023). Cash holdings and corporate financialization: Evidence from listed Latin American firms. Competition and Change, 27(3–4), 635–655. [Google Scholar] [CrossRef]

- Ramayanti, R., Rachmawati, N. A., Azhar, Z., & Nik Azman, N. H. (2024). Exploring intention and actual use in digital payments: A systematic review and roadmap for future research. Computers in Human Behavior Reports, 13, 100348. [Google Scholar] [CrossRef]

- Sahi, A. M., Khalid, H., Abbas, A. F., & Khatib, S. F. A. (2021). The evolving research of customer adoption of digital payment: Learning from content and statistical analysis of the literature. Journal of Open Innovation: Technology, Market, and Complexity, 7(4), 230. [Google Scholar] [CrossRef]

- Setor, T. K., Senyo, P. K., & Addo, A. (2021). Do digital payment transactions reduce corruption? Evidence from developing countries. Telematics and Informatics, 60, 101577. [Google Scholar] [CrossRef]

- Shim, S., Serido, J., & Tang, C. (2013). After the global financial crash: Individual factors differentiating young adult consumers’ trust in banks and financial institutions. Journal of Retailing and Consumer Services, 20(1), 26–33. [Google Scholar] [CrossRef]

- Shree, S., Pratap, B., Saroy, R., & Dhal, S. (2021). Digital payments and consumer experience in India: A survey based empirical study. Journal of Banking and Financial Technology, 5, 1–20. [Google Scholar] [CrossRef]

- Singh, S. K., & Bhattacharya, K. (2017). Does easy availability of cash affect corruption? Evidence from a panel of countries. Economic Systems, 41(2), 236–247. [Google Scholar] [CrossRef]

- Teach Children to Save|American Bankers Association. (2025). About teach children to save. Available online: https://www.aba.com/advocacy/community-programs/teach-children-save (accessed on 6 March 2025).

- Tian, S., Zhao, B., & Olivares, R. O. (2023). Cybersecurity risks and central banks’ sentiment on central bank digital currency: Evidence from global cyberattacks. Finance Research Letters, 53, 103609. [Google Scholar] [CrossRef]

- Urban, C., Schmeiser, M., Collins, J. M., & Brown, A. (2020). The effects of high school personal financial education policies on financial behavior. Economics of Education Review, 78, 101786. [Google Scholar] [CrossRef]

- van der Cruijsen, C., de Haan, J., & Roerink, R. (2023). Trust in financial institutions: A survey. Journal of Economic Surveys, 37(4), 1214–1254. [Google Scholar] [CrossRef]

- Wong, T. L., Lau, W. Y., & Yip, T. M. (2020). Cashless payments and economic growth: Evidence from selected OECD countries. Journal of Central Banking Theory and Practice, 9(3), 189–213. [Google Scholar] [CrossRef]

- Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. MIT Press. [Google Scholar]

- World Bank. (2023). Mobile cellular subscriptions (per 100 people) [Data set]. World Development Indicators. Available online: https://databank.worldbank.org/metadataglossary/millennium-development-goals/series/IT.CEL.SETS.P2 (accessed on 9 February 2025).

- Xin, H., Techatassanasoontorn, A. A., & Tan, F. B. (2015). Antecedents of consumer trust in mobile payment adoption. Journal of Computer Information Systems, 55(4), 1–10. [Google Scholar] [CrossRef]

- Yang, Q., Liu, Y., & Yang, L. (2022). Commercial gentrification in China and its distribution, development, and correlates: The case of Chengdu. Frontiers in Environmental Science, 10, 992092. [Google Scholar] [CrossRef]

- Zhang, B., & Zhou, P. (2021). Financial development and economic growth in a microfounded small open economy model. North American Journal of Economics and Finance, 58, 101544. [Google Scholar] [CrossRef]

- Zhou, T. (2011). The effect of initial trust on user adoption of mobile payment. Information Development, 27(4), 290–300. [Google Scholar] [CrossRef]

- Zhu, A. Y. F. (2019). School financial education and parental financial socialization: Findings from a sample of Hong Kong adolescents. Children and Youth Services Review, 107, 104532. [Google Scholar] [CrossRef]

| Variables | Variables Description | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Dependent Variable | |||||

| Likelihood of using electronic payments | 1 = Usese electronic payments, 0 = does not use electronic payments | 55.4% | 0.497 | 0 | 1 |

| Independent Variable | |||||

| Financial system confidence | 1 = Has confidence in banks, 0 = has no confidence in banks | 80.9% | 0.393 | 0 | 1 |

| Control Variables | |||||

| Age | |||||

| Age up to 23 years | 1 = Up to 23 years old, 0 = other age | 15.8% | 0.365 | 0 | 1 |

| Age 24 to 30 years | 1 = Between 24 to 30 years old, 0 = other age | 16.8% | 0.374 | 0 | 1 |

| Age from 30 to 40 years old | 1 = Between 30 to 40 years old, 0 = other age | 20.3% | 0.402 | 0 | 1 |

| Age from 40 to 60 years old | 1 = Between 40 to 60 years old, 0 = other age | 31.1% | 0.463 | 0 | 1 |

| Age over 60 years | 1 = You are over 60 years old, 0 = other age | 16.0% | 0.367 | 0 | 1 |

| Gender | 1 = female, 0 = male | 52.5% | 0.499 | 0 | 1 |

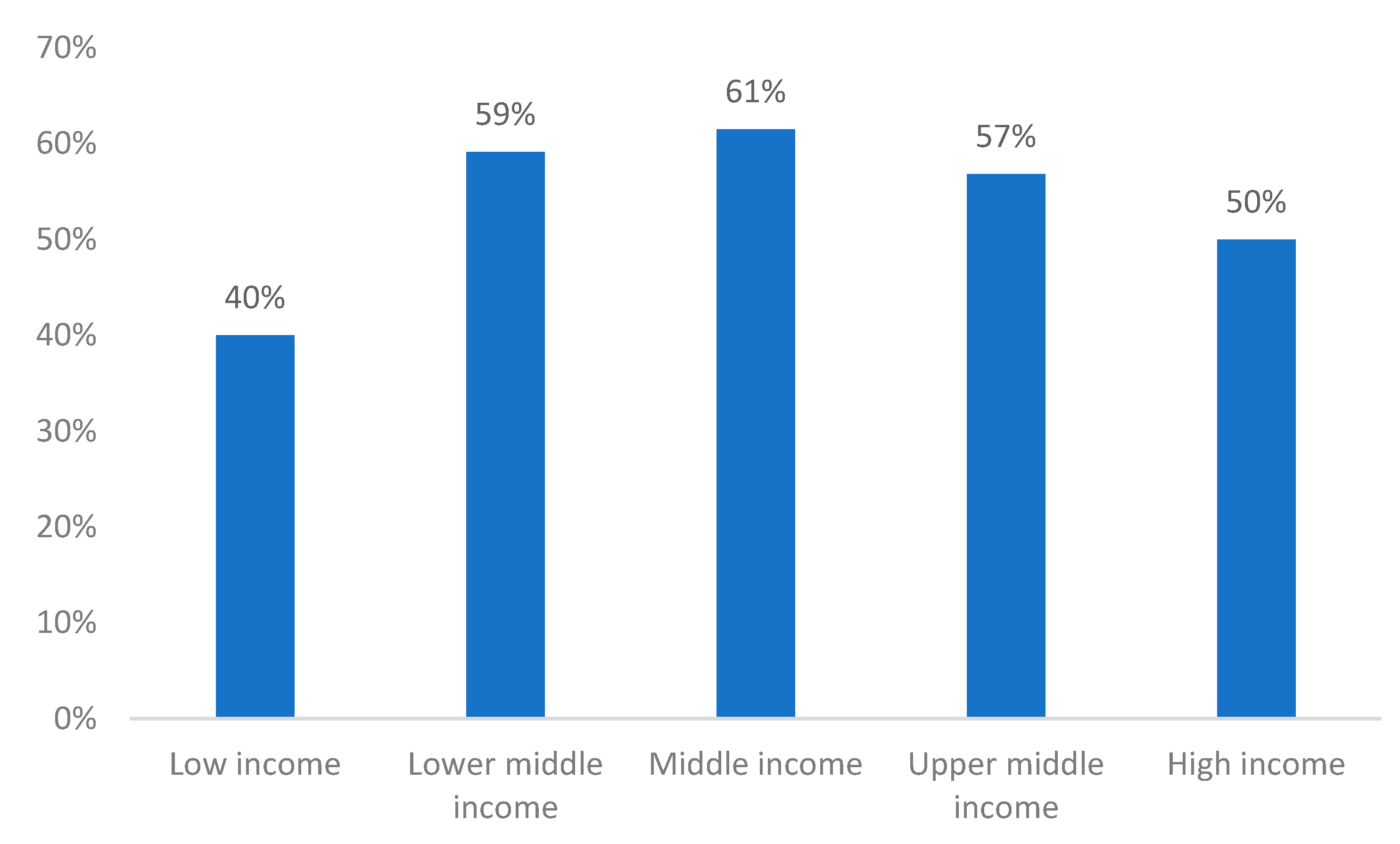

| Income level | |||||

| High income (Q5) | 1 = High income, 0 = other income | 3.0% | 0.172 | 0 | 1 |

| Upper-middle income (Q4) | 1 = Upper-middle income, 0 = other income | 7.1% | 0.256 | 0 | 1 |

| Middle income (Q3) | 1 = Has average income, 0 = other income | 40.8% | 0.491 | 0 | 1 |

| Lower-middle Income (Q2) | 1 = Has lower-middle income, 0 = other income | 28.2% | 0.450 | 0 | 1 |

| Low income (Q1) | 1 = Has low income, 0 = other income | 18.2% | 0.386 | 0 | 1 |

| Education | 1 = Studied up to secondary school, 0 = other | 41.8% | 0.493 | 0 | 1 |

| Employment status | 1 = Worked the previous week, 0 = did not work | 63.8% | 0.481 | 0 | 1 |

| Area | 1 = Lives in rural areas, 0 = lives in urban areas | 5.3% | 0.225 | 0 | 1 |

| Has a mobile phone | 1 = Has a cell phone, 0 = has no cell phone | 90.3% | 0.296 | 0 | 1 |

| N | 19,205 |

| Electronic Payments Use | |

|---|---|

| Odds Ratios | |

| Confidence in the financial system | 1.624 *** |

| (−11.36) | |

| Age | |

| Up to 23 years old | 1.574 *** |

| (−8.72) | |

| Age between 24 to 30 | 1.590 *** |

| (−9.25) | |

| Age between 30 to 40 | 1.484 *** |

| (−8.37) | |

| Age 60 or older | 0.569 *** |

| (−10.52) | |

| Gender (women = 1) | 0.872 *** |

| (−4.00) | |

| Income level | |

| High income | 1.928 *** |

| (−6.65) | |

| Upper-middle income | 2.329 *** |

| (−11.89) | |

| Middle income | 2.344 *** |

| (−18.61) | |

| Lower-middle income | 1.935 *** |

| (−13.68) | |

| Education (Secondary or less = 1) | 0.894 ** |

| (−3.18) | |

| Employment status (Works = 1) | 1.415 *** |

| −9.23 | |

| Area (Rural = 1) | 0.646 *** |

| (−5.87) | |

| Has a cell phone | 1.844 *** |

| (−10.32) | |

| Country control | Yes |

| N | 19,205 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Low Income | Lower-Middle Income | Middle Income | Upper-Middle Income | High Income | |

| Confidence in the financial system | 1.657 *** | 1.703 *** | 1.499 *** | 1.454 * | 2.406 *** |

| (−5.53) | (−6.63) | (−5.6) | (−2.17) | (−3.6) | |

| Age | |||||

| Up to 23 years old | 1.510 ** | 1.464 *** | 1.663 *** | 2.689 *** | 0.901 |

| (−3.01) | (−3.79) | (−6.38) | (−5.17) | (−0.37) | |

| Age between 24 to 30 | 1.482 ** | 1.789 *** | 1.466 *** | 2.955 *** | 0.896 |

| (−3.16) | (−6.09) | (−4.91) | (−5.52) | (−0.38) | |

| Age between 30 to 40 | 1.633 *** | 1.503 *** | 1.375 *** | 1.738 ** | 1.833 * |

| (−4.48) | (−4.62) | (−4.23) | (−2.97) | (−2.15) | |

| Age 60 or older | 0.683 ** | 0.514 *** | 0.534 *** | 0.693 | 0.754 |

| (−3.22) | (−6.50) | (−7.12) | (−1.81) | (−0.93) | |

| Gender (women = 1) | 0.843 * | 0.874 * | 0.885 * | 0.927 | 0.705 |

| (−2.06) | (−2.06) | (−2.29) | (−0.59) | (−1.75) | |

| Education (Secondary or less = 1) | 1.286 ** | 0.981 | 0.758 *** | 0.614 *** | 1.233 |

| (−2.91) | (−0.30) | (−5.11) | (−3.52) | −0.95 | |

| Employment status (Works = 1) | 1.408 *** | 1.548 *** | 1.367 *** | 1.447 ** | 1.335 |

| (−3.83) | (−5.98) | −5.29 | −2.6 | −1.35 | |

| Area (Rural = 1) | 0.618 ** | 0.845 | 0.515 *** | 0.948 | 0.935 |

| (−2.90) | (−1.14) | (−5.66) | (−0.18) | (−0.16) | |

| Has a cell phone | 1.753 *** | 1.876 *** | 1.932 *** | 1.417 | 1.38 |

| (−4.79) | (−5.35) | (−6.21) | (−1.63) | (−1.17) | |

| Country control | Yes | Yes | Yes | Yes | Yes |

| N | 3489 | 5414 | 7828 | 1357 | 581 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rubio, J.; Tulcanaza-Prieto, A.B. Digital Payments Trust in Latin America and the Caribbean. Economies 2025, 13, 140. https://doi.org/10.3390/economies13050140

Rubio J, Tulcanaza-Prieto AB. Digital Payments Trust in Latin America and the Caribbean. Economies. 2025; 13(5):140. https://doi.org/10.3390/economies13050140

Chicago/Turabian StyleRubio, Jeniffer, and Ana Belén Tulcanaza-Prieto. 2025. "Digital Payments Trust in Latin America and the Caribbean" Economies 13, no. 5: 140. https://doi.org/10.3390/economies13050140

APA StyleRubio, J., & Tulcanaza-Prieto, A. B. (2025). Digital Payments Trust in Latin America and the Caribbean. Economies, 13(5), 140. https://doi.org/10.3390/economies13050140