Abstract

This study examined South Africa’s economic growth rate from 1980 to 2022 through an econometric analysis of fiscal and monetary policies. The study sought to investigate the relationships between the economy’s growth rate and various fiscal and monetary policy variables, taking into account different economic approaches such as Keynesian, monetarist, and Wagner’s perspectives. The methodology used consisted of data preparation, multiple unit root tests, Autoregressive Distributed Lag (ARDL) cointegration analysis, diagnostic tests, and pairwise Granger causality analysis. The empirical analysis found a long-term cointegration among the economic growth rate, government debt, expenditure, and revenue in fiscal policy, though government debt and expenditure were not statistically significant. Contrary to economic theory, increased government revenue had a negative correlation with economic growth. There was no long-term relationship found between the economic growth rate and monetary policy variables such as the official exchange rate, inflation rate, real interest rates, and M3 money supply. Pairwise Granger causality tests revealed a one-way relationship between government spending and economic growth, providing support to the Keynesian approach to fiscal policy. This study also discovered evidence that economic growth Granger-causes inflation, implying that economic growth may have predictive power for inflation, consistent with the demand-pull inflation hypothesis. However, no direct predictive relationships were found between the selected monetary policy variables and economic growth, supporting the long-run theory of monetary neutrality. This study suggests evaluating spending, managing inflation, implementing reforms, closing infrastructure gaps, encouraging investment, and ensuring fiscal sustainability.

1. Introduction

A delicate balance between fiscal and monetary policies has shaped South Africa’s economic trajectory, with significant implications for the country’s performance (Du Plessis et al. 2007). These policies are critical in addressing key economic indicators such as inflation, fiscal spending, unemployment rates, and economic expansion. However, policymakers face the challenge of striking the right balance between promoting economic growth and managing inflationary dynamics (Debrun and Kapoor 2010). In an interconnected global economy, fiscal and monetary policies implemented in one country can have far-reaching consequences for other economies (Cui et al. 2019). South Africa, as an emerging market economy, faces numerous challenges that necessitate a diversified response from macroeconomic policymakers. High unemployment rates, inequality of wealth, and structural constraints hinder economic growth (Mago 2019). To address these challenges and maintain economic stability, the National Treasury and the South African Reserve Bank (SARB) have implemented distinct fiscal and monetary policy measures.

The ongoing debate among economists about the relative effectiveness of monetary and fiscal policies in influencing economic activity emphasises this study’s relevance. While Keynesians advocate for government intervention and stress the importance of fiscal policy in stimulating demand during economic downturns (Tcherneva 2011), nonetheless, Laidler (1990) contends that, despite its impact on monetary policy, the monetarist debate failed to establish a long-term theoretical foundation for monetary economics. As a result, Laidler (1990) noted that there is a misalignment between academic research and policy implementation.

South Africa’s economic landscape faces a complex set of challenges, including uncertain global economic conditions, persistently relatively high core inflation, and domestic constraints such as infrastructure limitations and energy shortages (Coger 2000). Despite significant efforts to regulate monetary policy and reduce inflationary pressures, the economy continues to face challenges such as slowing growth, rising current account deficits, and volatile financial markets (Miyajima 2021). The approach to analyse South Africa’s economic growth should be viewed in light of more comprehensive macroeconomic models, such as the medium-sized open economy DSGE model (i.e., dynamic stochastic general equilibrium) created by Du Plessis and others in 2014 (Du Plessis et al. 2014). The model of Du Plessis et al. (2014) provides a comprehensive view of the South African economy, taking into account factors such as sticky prices, consumer habit formation, and capital adjustment costs. In contrast, our study employs a more targeted econometric approach to determine the impacts of specific fiscal and monetary policy variables on economic growth. The authors will use the chosen methodology to test the relevance of Keynesian, monetarist, and Wagner theories to South Africa’s growth experience.

While the applied approach may not capture all of the complex interactions modelled in the DSGE framework, it does offer a complementary viewpoint by emphasising long-term relationships and causality between key policy variables and economic growth rates. The findings of this study can be interpreted as providing empirical evidence that can be used to refine or validate aspects of more comprehensive models such as those of Du Plessis et al. (2014), particularly the role of government spending and monetary policy in promoting economic growth. Thus, by positioning the current research within this broader framework, the authors acknowledge the complexities of the South African economy while remaining focused on testing specific economic theories. This approach enables us to contribute to the ongoing debate about the efficiency of various policy approaches in the South African context, potentially informing both future policy decisions and more complex modelling efforts.

Therefore, this study looks at South Africa’s economic growth rate from 1980 to 2022 using an econometric analysis of fiscal and monetary policies. This research uses data preparation, unit root testing, Autoregressive Distributed Lag (ARDL) cointegration analysis, diagnostic tests, and pairwise Granger causality analysis to provide insights into the relationship between economic growth rate and various policy variables. This research seeks to answer a critical question by examining the interaction of domestic and global factors influencing South Africa’s economic performance: How can South Africa effectively navigate these complex challenges in order to promote a robust and inclusive economic growth rate while maintaining price stability and fiscal sustainability? Our research concentrated on analysing monetary policy instruments, the effectiveness of fiscal policy, and the overarching goal of these policies in promoting sustainable growth and development.

2. Literature Review

This section of the study will look into existing economic theories and previous empirical studies on fiscal and monetary policy-associated macroeconomic variables, as well as growth in the economy.

2.1. Existing Theoretical Economic Framework

The classical school of economics, advocated by Adam Smith and David Ricardo during the late 18th and early 19th centuries, provided the basis for contemporary economic thinking (Herzog 2014). The hypothesis highlighted the influence of unrestricted markets and introduced ideas such as the “invisible hand” and comparative advantage (Smith 1776). Nevertheless, this methodology has faced criticism due to its reliance on the assumptions of perfect competition and information, which frequently do not align with real-world situations (Nenovsky 2011). During the same period, Wagner (1893) formulated Wagner’s law, which declares a direct and positive correlation between economic growth and increased public spending (Afzal and Abbas 2009).

John Maynard Keynes formulated his influential theory in 1936 as a response to the Great Depression (Backhouse 2015). His theory advocated for government intervention in order to effectively control aggregate demand (Keynes 1936). Keynesian economics has played a significant role in influencing fiscal policy, but it has been criticised for its potential to result in government failure and inflation (Blinder 1988). In the mid-20th century, monetarism emerged as a dominant economic theory, advocated by Milton Friedman around the 1950s (Jones 1983). It emphasised the importance of regulating the money supply, according to Olson (1984), as a crucial tool for economic control. This methodological approach has had an impact on monetary policy in many countries but has faced criticism for oversimplifying the sophisticated economic connections that exist in the economy (Borner 1979).

The neoclassical synthesis, advocated by economists such as Paul Samuelson and John Hicks during the late 20th century, aimed to reconcile the divergent viewpoints of classical and Keynesian economics (Samuelson 1954; Hicks 1937). This approach has had a significant impact on both fiscal and monetary policy, but it may not completely hold the refinements of either school (Boianovsky 2004). Arthur Laffer, in the 1970s, popularised the concept of supply-side economics, which highlighted that reducing taxes can encourage growth in the economy (Bender 1984). Although the Laffer curve theory holds significant influence in fiscal policy discussions, it has faced criticism for potentially worsening the inequality gap in a society (Mirowski 1982).

By the 1980s, according to Palley (1996), new Keynesian economics, real business cycle theory, and endogenous growth theory has emerged. New Keynesian economists integrated the concepts of inflexible prices and imperfect competition into their models (Crotty 1996). The real business cycle theory, promoted by Finn Kydland and Edward Prescott, highlighted the significance of technological shocks in propelling economic fluctuations (Tabellini 2005). Romer (1986) and Lucas (1988) advocated the concept of endogenous growth theory, emphasising the crucial role of human capital and research and development (R&D) in driving sustained economic growth over time. Additionally, according to Barro (1989), the Ricardian equivalence hypothesis also emerged, which suggests that government debt has a negligible effect on both overall demand and economic growth.

In the 1990s, there was a rise in the prominence of new institutional economics, led by scholars such as Douglass North (1990) and Oliver Williamson (2000). They emphasised the importance of institutions in influencing economic outcomes (Guerdjikova 2007). Additionally, Barro (1990) contributed to the discussion by emphasising the significance of government spending and robust public institutions as key drivers of long-term economic growth. This institutional aspect, according to Posner (2010), strengthens the previous focus on the accumulation of capital and progress in technology. This approach has been especially pertinent in conversations amongst economists about growth in the economy, but it encounters difficulties in measuring institutional elements (Tilman 2008). Modern monetary theory (MMT), according to Nesiba (2013), suggests that sovereign currency issuers are not limited by revenue when it comes to their spending. This controversial theory has significant implications for both fiscal and monetary policy, but it is criticised for its potential to cause inflation risks (Palley 2014). Ecological economics, pioneered by scholars such as Herman Daly (1991) and Robert Costanza (1996), considers the economy as a part of the ecological system and questions the dominant beliefs about economic growth. This approach is specifically applicable to discussions regarding sustainable development (Luks 1998).

Therefore, one could argue that while each of these economic theories mentioned above has made significant contributions towards our understanding of growth and development in the economy, they are not without limitations and criticisms. Thus, the ongoing development and improvement of economic theories demonstrate the complex and evolving nature of the world’s economic systems, as well as the difficulties in understanding their dynamics in real time.

2.2. Previous Empirical Studies Relevant to This Study

Researchers have long been interested in understanding how fiscal and monetary policies affect economic growth. The present discussion looked at empirical studies that investigated the effects of these two distinct policies (associated variables) on economic growth in various countries and regions. Table 1, Table 2 and Table 3 provide a brief summary of empirical studies examining the effects of fiscal policy variables on economic growth. Similarly, Table 4, Table 5, Table 6 and Table 7 provide a brief summary of empirical studies examining the effects of monetary policy variables on economic growth.

Recent empirical research has attempted to test these theories in a variety of contexts. Du Plessis et al. (2014) formulated a medium-sized open economy DSGE model for South Africa, providing a comprehensive framework for analysing macroeconomic dynamics in the country. As a result, the model outperformed private sector economists’ inflationary predictions. Arestis et al. (2021) studied the relationship between government expenditure and output in Turkey. Their findings emphasise the importance of taking into account the specific nature of government spending when assessing its impact on growth.

In the context of monetary policy, Friedman and Schwartz (1963) found that pro-cyclical money supply movements led output by two-quarters. They concluded that changes in the money stock cause output fluctuations, and they gave a verbal explanation of how money and the business cycle might be linked. However, studies such as that of Belongia and Ireland (2016) have revisited Friedman and Schwartz’s seminal work, offering new perspectives on the relationship between money and output.

2.2.1. Effects of Associated Fiscal Policy Variables on Economic Growth

Table 1.

A brief summary of empirical studies on government expenditure and economic growth.

Table 1.

A brief summary of empirical studies on government expenditure and economic growth.

| Author(s) | Country/Region | Key Findings of the Study |

|---|---|---|

| Arestis et al. (2021) | Turkey | The study supports the Keynesian view, based on economically significant government expenditures, rather than Wagner’s law. Empirical findings indicated that government expenditures on defence, economic affairs, education, health, housing and community amenities, and social protection positively affect output through Keynesian fiscal multiplier and investment-accelerator mechanisms. |

| Iwegbunam and Robinson (2018) | South Africa | The Keynesian theory was confirmed, while Wagner’s theory was rejected. |

| Mlilo and Netshikulwe (2017) | South Africa | Discovered supporting evidence for the Keynesian theory, but no evidence was found for Wagner’s law. |

| Permana and Wika (2014) | Indonesia | Confirmed the validity of Wagner’s theory. |

| Sedrakyan and Varela-Candamio (2019) | Armenia and Spain | Accepted Keynesian theory for short-term economic conditions and Wagner’s law for long-term economic trends. |

Table 2.

A brief summary of empirical studies on government revenue and economic growth.

Table 2.

A brief summary of empirical studies on government revenue and economic growth.

| Author(s) | Country/Region | Key Findings of the Study |

|---|---|---|

| Ayana et al. (2023) | Sub-Saharan Africa | The initial impact of government revenue on growth is negative, but growth is subsequently enhanced through interaction with institutional integrity. |

| Moyo et al. (2021) | South Africa | There is a significant and direct correlation between tax revenue and economic growth. |

| Nguyen and Darsono (2022) | Asian countries | Inadequate governance resulted in a decline in government revenue. |

| Roşoiu (2015) | Romania | The government revenue has a positive impact on the gross domestic product (GDP). |

Table 3.

A brief summary of empirical studies on government debt and economic growth.

Table 3.

A brief summary of empirical studies on government debt and economic growth.

| Author(s) | Country/Region | Key Findings of the Study |

|---|---|---|

| Hassan et al. (2023) | Kenya | External debt has a small positive impact, while domestic debt has a small negative impact. |

| Kithinji (2020) | Kenya | The composition of public debt and government spending has a substantial impact on economic growth. |

| Mothibi and Mncayi-Makhanya (2019) | South Africa | Negative relationship between government debt and economic growth. |

| Saungweme and Odhiambo (2020) | South Africa | Foreign debt exerts a detrimental influence on the economy over an extended period, while domestic debt yields favourable effects in the short term. |

2.2.2. Effects of Associated Monetary Policy Variables on Economic Growth

Table 4.

A brief summary of empirical research on inflation and economic growth.

Table 4.

A brief summary of empirical research on inflation and economic growth.

| Author(s) | Country/Region | Key Findings of the Study |

|---|---|---|

| Anochiwa and Maduka (2015) | Nigeria | Long-term relationship between inflation and economic growth; thus, recommended inflation rate below 10%. |

| Bittencourt et al. (2015) | SADC member states | Economies were negatively impacted by the increasing inflation rates. |

| Khoza et al. (2016) | South Africa | Optimal economic growth can be achieved by maintaining a recommended inflation rate of 5.3%. |

| Mbulawa (2015) | Botswana | An inflation rate of 3–6% is suggested as a means to promote economic growth. |

Table 5.

A brief summary of empirical research on exchange rates and economic growth.

Table 5.

A brief summary of empirical research on exchange rates and economic growth.

| Author(s) | Country/Region | Key Findings of the Study |

|---|---|---|

| Ashour and Yong (2018) | Developing countries | A fixed exchange regime is associated with a higher rate of economic growth. |

| Ehikioya (2019) | Nigeria | Continual fluctuations in exchange rates have a detrimental effect on the growth of the economy. |

| Muzekenyi et al. (2019) | South Africa | Real exchange rates have a detrimental effect on economic growth in both the short and long term. |

| Patel and Mah (2018) | South Africa | There is a strong negative correlation between real exchange rates and economic growth. |

Table 6.

A brief summary of empirical research on real interest rates and economic growth.

Table 6.

A brief summary of empirical research on real interest rates and economic growth.

| Author(s) | Country/Region | Key Findings of the Study |

|---|---|---|

| Matemilola et al. (2015) | South Africa | There is a significant negative correlation between interest rates and long-term economic growth. |

| Nyasha and Odhiambo (2015) | South Africa | Interest rate reforms have a positive impact on economic growth in both the short and long term. |

| Sari et al. (2022) | Indonesia | Interest rates exert a negative impact on economic growth. |

| Shaukat et al. (2019) | Transitional economies | Suggested lowering interest rates as a means to stimulate economic growth. |

Table 7.

A brief summary of empirical research on money supply and economic growth.

Table 7.

A brief summary of empirical research on money supply and economic growth.

| Author(s) | Country/Region | Key Findings of the Study |

|---|---|---|

| Buthelezi (2023) | South Africa | In high economic scenarios, an increase in the money supply results in a decrease in GDP. |

| Chaitip et al. (2015) | ASEAN Economic Community | Long-term relationship between money supply and economic growth. |

| Dingela and Khobai (2017) | South Africa | There is a robust and direct positive relationship between the amount of money in circulation and the rate of economic growth. |

| Matres and Le (2021) | 217 countries | Initially, a negative correlation between the growth of the money supply and economic growth. However, this relationship changes to a positive correlation in a subsequent year. |

2.3. Other Viewpoints on Economic Growth and Governmental Policy Measures

2.3.1. The Relationship between Debt and Economic Growth

The research conducted by Reinhart and Rogoff (2010) has had a significant impact on current discussions regarding the correlation between government debt and economic growth. In their seminal paper “Growth in a Time of Debt”, the authors contend that countries with government debt-to-GDP ratios surpassing 90% tend to experience significantly decreased rates of economic growth. Although there has been some disagreement about their approach, their research has emphasised the possible dangers of elevated levels of government debt to the long-term growth of the economy.

2.3.2. The Concept of Cumulative Causation and Its Impact on Economic Development

Myrdal (1957) and Kaldor (1970) formulated theories on cumulative causation that have significant relevance for comprehending the process of economic growth in developing nations such as South Africa. Myrdal’s theory highlights the significance of initial advantages or disadvantages in a region, which can result in self-perpetuating cycles of growth or decline. This viewpoint is especially essential when examining the regional discrepancies within South Africa. Kaldor’s growth laws centre on the manufacturing sector as a catalyst for economic expansion, highlighting the significance of economies of scale and the value of growth driven by exports. This framework has the potential to offer valuable insights into the strategies employed by South Africa to promote industrial development.

2.3.3. The Washington Consensus and Systematic Restructuring

The Washington Consensus, a term coined by John Williamson in 1989, denotes a collection of policy recommendations frequently advocated to developing nations by institutions such as the International Monetary Fund (IMF) and the World Bank (Martin 2009). These policies generally encompass fiscal restraint, trade liberalisation, privatisation, and deregulation. The International Monetary Fund’s structural adjustment programs, which are founded on these principles, have had a significant impact on shaping economic policies in numerous developing nations, including South Africa (Hooper 2002). Nevertheless, these programs have faced criticism for potentially worsening inequality and disregarding the unique circumstances of individual countries (Marangos 2008).

2.3.4. Different Approaches to Development

The experiences of East Asian economies—specifically South Korea and, more recently, China—provide different viewpoints on the government’s role in economic development. The concept of the developmental state, as explained by authors such as So and Amsden (2002) and Wade (1992), underscores the capacity of strategic government intervention to foster industrialisation and growth in the economy. These supplementary viewpoints offer crucial context for comprehending the complicated interconnections among fiscal policy, monetary policy, and economic growth in South Africa. They emphasise the importance of taking into account various factors beyond conventional macroeconomic indicators, such as institutional quality, historical legacies, and global economic structures. By integrating various theoretical frameworks and empirical evidence, our analysis of South Africa’s economic growth can be placed within wider discussions regarding development economics and the efficacy of policies in emerging market situations.

3. Methodology

This section of this study describes how the authors conducted a comprehensive econometric analysis to investigate the impact of fiscal and monetary policies on economic growth in South Africa. The methodology consisted of several steps, including data preparation, unit root testing, cointegration analysis, model estimation, diagnostic testing, and Granger causality analysis. As a result, the following sections outline the step-by-step methodology used in this study.

3.1. Data Preparation

This study used annual time-series data for South Africa from the SARB and World Bank (World Bank development indicators) from 1980 to 2022 for macroeconomic variables related to fiscal and monetary policy and economic growth. The empirical analysis used government expenditure, revenue, and debt as fiscal policy proxies, while using the inflation rate, real interest rate, official exchange rate, broad money supply (M3), and GDP annual growth rate as economic growth rate proxies. Thus, comparable to the work of Monamodi (2019), this study examined secondary data, tested relationships, and made sound econometric predictions using quantitative analysis and time series.

3.2. Model Specification

This study used the Autoregressive Distributed Lag (ARDL) model. Based on the research of Pesaran et al. (2001), Narayan (2005) modified the model. This study model was chosen after several studies. Du Plessis et al. (2007) examined South Africa’s fiscal and monetary policies’ cyclicality since democracy. In another study, Noman and Khudri (2015) examined how monetary and fiscal policies affect Bangladesh’s economy. Based on historical data, the authors used the ARDL model to predict and analyse variable linkages. For the purposes of this paper, the variable relationship analysis that we conducted treated the two policies separately in order to align with the traditional economic theories discussed in this paper; thus, the fiscal and monetary policy models were specified as follows:

Fiscal policy model:

GDP_growth = f(GE, GR, GD)

Monetary policy model:

where GDP_growth is the proxy that is employed to measure the economic growth rate (as annual GDP growth rate), GE is government spending, GR is government revenue, GD is government debt, IF is inflation rate, M is the M3 money supply, IR is the interest rate, and ER is the exchange rate. Additionally, the following Table 8 presents an overview of the macroeconomic variables analysed in the study.

GDP_growth = f(IF, ER, MS, IR)

Therefore, the regression model is specified as follows:

In order to mitigate the issue of heteroskedasticity, the aforementioned equation is transformed into a logarithmic format (Khobai and Le Roux 2017). Consequently, the linear equation of the natural logarithm yields the following expression:

where

Table 8.

Description of macroeconomic variables of the study.

Table 8.

Description of macroeconomic variables of the study.

| Variable | Description of the Variable | Measurement | Data Source * |

|---|---|---|---|

| lnGDP_growth_growth | Logarithm of gross domestic product growth rate | (% annual growth rate) | WB |

| lnGE | Logarithm of government expenditure | (% of GDP) | SARB |

| lnGR | Logarithm of government revenue | (% of GDP) | SARB |

| lnGD | Logarithm of government debt | (% of GDP) | SARB |

| lnIF | Logarithm of inflation (average consumer prices) | (% change) | WB |

| lnER | Logarithm of official exchange rate | (Ratio) | WB |

| lnMS | Logarithm of broad money supply (M3) | (% of GDP) | WB |

| lnIR | Logarithm of real interest rate | (%) | WB |

* Notes: data were sourced from the World Bank development indicators (WB) and South African Reserve Bank (SARB).

3.3. Empirical Estimation Technique

This study examined how fiscal and monetary policies affect economic growth in South Africa by examining the relationships between Equations (5)–(8). Using a time-series technique to investigate long-run cointegration among the variables, the ARDL model was employed. The ARDL model was selected because it is robust to misspecification, accommodates variables with different orders of integration, and captures short- and long-term relationships in time-series data (Pesaran et al. 2001). It is important to note that while the ARDL model offers several advantages, it also has limitations, and the model may be subject to omitted-variable bias or misspecification. Thus, these qualities made it the ideal model for empirical analysis in this study. Then, we examined macroeconomic variable causal relationships using pairwise Granger causality.

3.3.1. Unit Root Testing (ADF, PP, and KPSS)

One of the fundamental assumptions in time-series analysis is stationarity, which refers to a series of statistical properties remaining constant over time (Hoffmann 1987). Non-stationarity can produce misleading regression results and invalid statistical inferences. As a result, it is critical to check for the presence of unit roots (non-stationarity) in time-series data.

This study employed three widely used unit root tests: the Augmented Dickey–Fuller (ADF) test (Dickey and Fuller 1979), the Phillips–Perron (PP) test (Phillips and Perron 1988), and the Kwiatkowski–Phillips–Schmidt–Shin (KPSS) stationarity test (Kwiatkowski et al. 1992). The ADF and PP tests compare the null hypothesis of a unit root (non-stationarity) to the alternative hypothesis of stationarity. These tests are performed on each variable at levels and first differences, with either an intercept or an intercept and trend. The optimal lag length for the ADF test is calculated using information criteria such as the Akaike Information Criterion (AIC). The KPSS test, on the other hand, compares the null hypothesis of stationarity to the alternative hypothesis of unit root. This test is used in conjunction with the ADF and PP tests to provide additional information about the variables’ stationarity. The results of these unit root tests guide the appropriate transformations (i.e., differencing or detrending) needed to achieve stationarity before proceeding with further econometric analyses.

3.3.2. ARDL Model as a Method of Cointegration

This study confirmed the order of integration of the variables through unit root testing before employing the ARDL model to investigate the presence of long-run equilibrium relationships (cointegration) among the variables. The ARDL model has been noted as a significant technique introduced by Pesaran et al. (2001) that could be applied regardless of whether the variables were integrated of order zero, I(0), or integrated of order one, I(1). However, it is essential to note that none of the variables were integrated of an order higher than one, I(2), as this would have violated the assumptions of the ARDL approach (Pesaran et al. 2001).

Fiscal policy on economic growth:

Monetary policy on economic growth:

where the difference operator, denoted by the symbol Δ in this instance, indicates how a variable changes over time. When all independent variables are held constant, the intercept term represents the baseline value of the dependent variable. The effects of the explanatory variables on the dependent variable are represented by the coefficients β and λ, which align to the regression coefficients.

Consequently, the following is a description of the error correction term model:

Fiscal policy:

Monetary policy:

where is the difference operator, is the intercept, are the regression coefficients, is the error correction term, and is the white noise error term.

The third step involved evaluating the long-run variable relationships by estimating the unrestricted error correction model (ECM) with the ARDL bounds test. The ARDL bounds test uses the Wald test, represented by the F-statistic, to determine whether or not cointegration exists. That is, the F-statistic has been used to test the cointegration hypothesis for its existence (Dritsakis 2011). The null hypothesis for both fiscal and monetary policy, which suggests the absence of cointegration, is represented as follows:

Alternatively, cointegration amongst the variables may exist, according to the following hypothesis:

As a result, the authors used the critical value sets to draw conclusions about the outcomes of the cointegration analysis. That is, Pesaran et al. (2001) introduced two critical value sets for the bound testing framework. The upper-bound and lower-bound critical values are included in these sets. These crucial values function as standards for assessing macroeconomic theories. In particular, the null hypothesis of no cointegration is rejected when testing it if the computed F-statistic is greater than the upper-bound critical value. Conversely, the null hypothesis of no cointegration cannot be ruled out if the calculated F-statistic is less than the lower-bound critical value. In cases when the calculated F-statistic lies between the lower- and upper-bound critical values, the findings are ambiguous and do not offer a definitive conclusion regarding the null hypothesis (Pesaran et al. 2001).

3.3.3. Diagnostic Testing of Fiscal and Monetary Policy Models

Several diagnostic tests are performed to verify the estimated ARDL models as highlighted in Table 9. These tests are necessary to evaluate the classical linear regression model’s assumptions and identify possible weaknesses that could affect the analysis’s conclusions.

Table 9.

Types of diagnostic tests employed in this study.

In addition, this study uses variance inflation factors (VIFs) to assess the level of multicollinearity within the models, as well as graphical diagnostic tools like the cumulative sum of recursive residuals (CUSUM) and CUSUM of squares (CUSUMQ) tests to evaluate the model coefficients’ stability over time. Thus, these tests are critical for determining the consistency of the regression parameters and detecting potential structural breaks or parameter instability (Deng and Perron 2008).

3.3.4. Pairwise Granger Causality Test of Fiscal and Monetary Policy Models

The study examined fiscal and monetary policy variables’ effects on economic growth using the pairwise Granger causality test (Granger 1969). This test was based on the idea that if a variable X caused another variable Y, past X values should help predict future Y values (Hoffmann 1987). Pairwise Granger causality testing has been selected since Thabane and Lebina (2016) showed its superior performance across datasets of various sizes, including small and large samples. This robust causality test was preferred over others due to its adaptability to sample sizes. Fiscal and monetary policy models were tested separately for pairwise Granger causality. The test conducted a bivariate regression model for each model (fiscal and monetary policy), estimating the relationship between GDP_growth and one independent variable. Hence, it is crucial to acknowledge that the Granger causality tests possess certain limitations. They demonstrate the ability to make predictions within the statistical framework being used, rather than establishing absolute causation. According to Edoumiekumo (2010), these tests are most valuable when they are supported by clear theoretical foundations. In addition, bivariate Granger causality tests may not fully capture the complicated nature of economic relationships.

3.4. The Rationale behind Not Using Multivariate Analyses

This study primarily utilised bivariate analysis techniques, specifically the Autoregressive Distributed Lag (ARDL) model and pairwise Granger causality tests. Although these methods offer valuable insights, it is crucial to consider the reasons for not using multivariate analysis techniques (as shown in Table 10 below) and how this decision may be connected to the conflicting results that have been observed.

Table 10.

Rationale for not using multivariate analyses.

4. Results and Discussion

4.1. Statistical Description and Correlation Analysis

4.1.1. Descriptive Statistics

The assessment below in Table 11 provides a summary of South Africa’s economic performance between 1980 and 2022, focusing on key macroeconomic indicators.

Table 11.

Descriptive statistics of various macroeconomic variables.

South Africa’s GDP growth rate averaged 2.10%, with significant fluctuations (SD = 2.53%), indicating gradual economic expansion (Mlilo and Netshikulwe 2017). The government’s debt-to-GDP ratio was consistently high, averaging 36.87% and peaking at 70.90%, raising questions about debt sustainability (Mothibi and Mncayi-Makhanya 2019). Government spending remained consistent, averaging 21.11% of GDP_growth (SD = 1.82%), while revenue averaged 24.25% (SD = 2.90%), indicating a stable financial environment. The official exchange rate fluctuated significantly (mean = 6.80, SD = 4.63), potentially affecting trade and investment (Muzekenyi et al. 2019). Real interest rates fluctuated moderately (mean = 4.08%, SD = 3.94%), potentially stimulating economic growth (Matemilola et al. 2015). Inflation rates were relatively high (mean = 8.50%, SD = 4.61%), which could affect household purchasing power and economic stability. The M3 money supply-to-GDP ratio increased consistently (mean = 56.33%, SD = 10.36%), indicating the potential for economic stimulation as well as inflationary pressures (Dingela and Khobai 2017).

4.1.2. Correlation Analysis

The correlation analysis in Table 12 below reveals a complex web of relationships between South Africa’s macroeconomic variables.

Table 12.

Correlation analysis for selected variables.

As a result, the findings show a strong positive relationship between government spending and debt. Furthermore, there were positive correlations between government revenue and spending, as well as between official exchange rates and government spending and revenue. The money supply (M3) as a percentage of GDP has a positive correlation with government revenue and official exchange rates. In contrast, negative correlations were found between GDP_growth and government debt, GDP_growth and inflation, and government debt and inflation. Interestingly, government spending and M3 money supply have a negative correlation with inflation. The relationship between GDP_growth and government spending and revenue appears to be weak and unstable.

4.2. Unit Root and Stationarity Tests

Table 13 below shows the probability value (p-value) results of three different unit root tests: Augmented Dickey–Fuller (ADF), Phillips–Perron (PP), and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) stationarity tests recorded at 5% statistical difference. These tests are used to determine whether a time-series variable is stationary or non-stationary, which is an important factor in time-series analysis and modelling.

Table 13.

Unit root test (ADF, PP, and KPSS) results.

The ADF test results show that GDP_growth and interest rates (IRs) are stationary at levels, whereas other variables such as government debt (GD), government expenditure (GE), and exchange rates (ER) become stationary after initial differencing. The PP test confirms these findings, with most variables being non-stationary at levels but stationary after initial differentiation. This is consistent with common findings from economic and financial time-series data (Hoffmann 1987). The KPSS test offers an additional viewpoint, confirming non-stationarity at levels for variables such as GDP_growth, GD, inflation (IF), and money supply (MS). However, it shows that GE and government revenue (GR) are stable at their current levels. Most variables become stationary after the first differencing, with the exception of IF, which remains non-stationary.

These findings emphasise the importance of differencing variables in econometric modelling to avoid false regression results. The majority of variables are integrated of order one, I(1), which means that they become stationary after the first differencing. The consistency between the three tests strengthens the overall conclusion. However, there are some discrepancies, such as the KPSS test, which shows GDP_growth as non-stationary at levels, whereas the ADF and PP tests show stationarity. These differences highlight the importance of using multiple tests to ensure reliable results in time-series analysis.

4.3. The Estimation of the ARDL Model

4.3.1. Empirical Analysis of Fiscal Policy Model

The ARDL bounds test was used to identify long-term relationships between fiscal policy variables. The F-statistic (15.13923), as shown in Table 14 below, exceeded the upper-bound critical value at 1% significance, indicating a cointegrated long-run relationship between variables (Pesaran et al. 2001).

Table 14.

Fiscal policy model cointegration bounds F-test results (ARDL: 1,2,1,1).

Additionally, the long-run estimates in Table 15 indicate that government debt and spending had a negative but statistically insignificant impact on GDP_growth. Government revenue had a statistically significant negative effect, with each 1% increase resulting in a 1.59% decrease in economic growth. This contradicts the widely held belief that increased government revenue boosts economic growth.

Table 15.

Fiscal policy model—long-run estimated ARDL results (1,2,1,1).

The diagnostic test results in Table 16 reveal the model’s strengths and weaknesses. While there was no autocorrelation, serial correlation, or ARCH effect, and the model was properly specified, it did not meet the normality assumption, thus potentially jeopardising its reliability.

Table 16.

Diagnostic test results of fiscal policy model.

The variance inflation factors (VIFs) assessment results in Table 17 reveal significant multicollinearity among variables, which could lead to unstable coefficient estimates (Gujarati and Porter 2009).

Table 17.

Variance inflation factors.

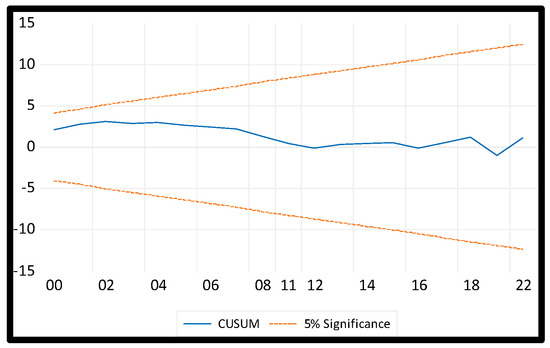

The CUSUM (cumulative sum of recursive residuals) test was conducted as shown in Figure 1 below to detect changes or instability in a model’s parameters between 1980 and 2022. As a result, Figure 1 shows the CUSUM statistic for the study’s fiscal policy model, which is still within the 5% critical bounds. Thus, there is no evidence of parameter instability or structural breaks in the model, implying that the model’s parameters have remained stable and consistent over the assessment period (from 1980 to 2022).

Figure 1.

CUSUM test (CUSUM): fiscal policy model.

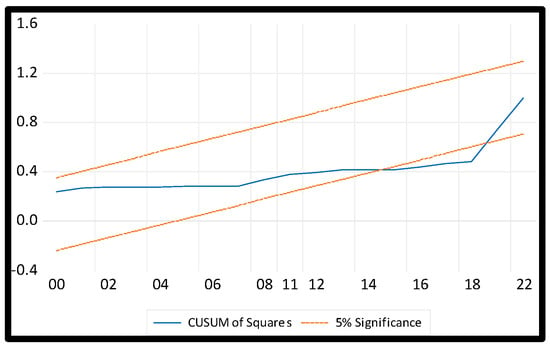

However, the CUSUM of squares (CUSUMQ) test in Figure 2 reveals that the time series experienced structural breakdowns, resulting in instability for a brief period between 2015 and 2019. Thus, the blue line deviates by 5% from the critical boundary line. However, the model regains stability, as evidenced by the blue line returning to the critical boundary of 5%. This deviation can be attributed to South Africa’s fiscal policy between 2015 and 2019, which aimed to reduce budget deficits through spending cuts and tax increases, but these efforts were hampered by slow economic growth (National Treasury 2019). That is, during this time, the VAT rate was raised from 14% to 15% in 2018, and the government announced plans to restructure agencies to reduce costs. However, rising debt levels persisted as macroeconomic policymakers struggled to implement fiscal consolidation measures.

Figure 2.

CUSUM of squares test (CUSUMQ): fiscal policy model.

4.3.2. Empirical Analysis of Monetary Policy Model

As shown in Table 18 below, the monetary policy model’s F-bounds test yielded 1.949471, below the lower-bound critical value at all significance levels. This indicated no long-term cointegration between the dependent variable and explanatory variables.

Table 18.

Monetary policy cointegration F-bounds test results (ARDL: 1,0,0,0,0).

The short-run estimates in Table 19 reveal that no coefficients were statistically significant at the 5% level. The R-squared value (0.23) and negative adjusted R-squared (−0.043410) suggested a poor model fit. The F-statistic (0.841906), with a p-value of 0.54, indicated that the independent variables had no significant effect on economic growth in the short run.

Table 19.

Monetary policy short-run estimates on economic growth (ARDL: 1,0,0,0,0).

The diagnostic tests results of the monetary policy model, as shown in Table 20, revealed no serial correlation, no heteroskedasticity, and an adequate functional form. However, the residuals did not have a normal distribution.

Table 20.

Diagnostic test results of monetary policy model.

Additionally, the monetary policy model’s VIFs, as outlined in Table 21, did not exceed 10, indicating that multicollinearity was not a significant issue (Gujarati and Porter 2009).

Table 21.

Monetary policy variance inflation factors.

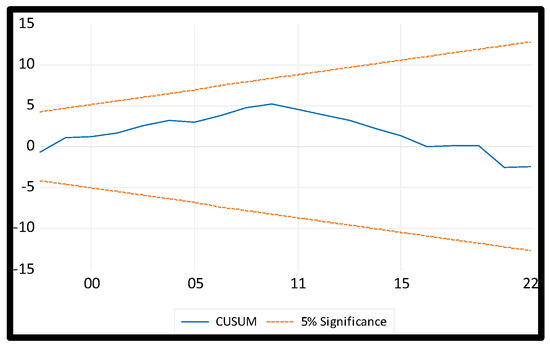

Furthermore, the CUSUM and CUSUMQ tests were used to assess the stability of the parameters in the monetary policy model by looking at how macroeconomic variables related to monetary policy affect economic growth. As a result, Figure 3 above shows the CUSUM test, which compares the cumulative sum of recursive residuals to a critical threshold at a significance level of 5%. As a result, the results show that the total sum is still within the critical threshold limit, indicating that the model’s parameters are consistent over the sample period.

Figure 3.

CUSUM test (CUSUM): monetary policy model.

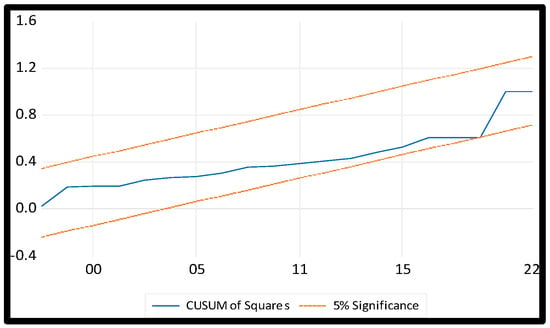

Also, Turner (2010) argues that the CUSUMQ test is particularly effective at detecting sudden fluctuations in parameters. Thus, the CUSUMQ plot in Figure 4 confirms the stability of the monetary policy model parameters by showing that the cumulative sum of squared residuals remains within the critical bounds, which is consistent with the CUSUM test results above, both of which are within the 5% significance level.

Figure 4.

CUSUM of squares test (CUSUMQ): monetary policy model.

5. Pairwise Granger Causality Test

5.1. Fiscal Policy Model Results

The pairwise Granger causality test for the fiscal policy model, as shown in Table 22, revealed that government expenditure (lnGE) has a causal relationship with economic growth (lnGDP_growth) at a 5% significance level (p-value = 0.0053). This suggests that changes in government expenditure can predict future fluctuations in economic growth, aligning with Keynesian economic theory (Gottesman et al. 2005). However, the reverse causality was not observed. The test found no causal relationship between government debt (lnGD) or government revenue (lnGR) and economic growth. The absence of causality between government debt and growth supports the Ricardian equivalence hypothesis. The findings regarding government revenue may align with the Laffer curve theory, which suggests that tax rates beyond a certain threshold can hinder economic activity. When examining the first differences of the variables, no Granger causality was observed among any of the selected variables.

Table 22.

Pairwise Granger causality test—fiscal policy model.

5.2. Monetary Policy Model Results

Table 23 outlines that the exchange rate (lnER) does not cause economic growth in the monetary policy model. This finding supports Friedman’s (1953) theory that nominal exchange rate changes have limited long-term effects on real economic factors. The 1972 Lucas proposal of monetary neutrality is also supported. That is, the test found no causal relationship between economic growth and inflation, interest, or M3 money supply. However, it appears that economic growth Granger-causes inflation, supporting the demand-pull inflation theory. The absence of Granger causality from interest rates and money supply to growth supports the theory of monetary neutrality. The first differences of monetary policy variables show no Granger causality between economic growth and monetary policy variables.

Table 23.

Pairwise Granger causality test—monetary policy model.

6. Conclusions and Policy Recommendations

This study found no conclusive evidence that increased government spending leads to higher economic growth in South Africa, but a causal relationship was established using pairwise Granger causality analysis, which is consistent with Keynesian theory: an inverse relationship between government revenue and economic growth was discovered, contradicting conventional economic theory and implying potential inefficiencies in the tax system. Monetary policy variables had no long-term relationship with economic growth, supporting the idea of monetary neutrality. The lack of pairwise Granger causality between monetary variables and economic growth provides evidence of their limited long-term impact using the time-series data presented in this study.

Our policy recommendations include the following:

- Evaluating the effectiveness of government expenditures and the impact of taxes on economic activity.

- Maintaining price stability and managing inflation, with minimal long-term impact on growth.

- Implementing macroeconomic policies and structural reforms to address infrastructure gaps and skill inconsistencies.

- Fostering private sector investment and growth through fiscal sustainability and effective debt management, even though the current study did not find evidence to suggest a direct link between government debt and economic growth.

7. Limitations and Suggestion for Future Research

This study provides insight into fiscal and monetary policies’ effects on South African economic growth, but it has limitations. The SARB and World Bank development indicators may have measurement errors. Alternative or primary data sources could be investigated in future research. Model misspecification or omitted-variable bias may occur with the ARDL model and pairwise Granger causality tests. Future studies could consider different model specifications or variables. This study assumed parameter stability, but structural breaks or regime shifts may affect macroeconomic variable relationships. Regime-switching models and structural break tests could be used in future research. Interdependencies and spillover effects between fiscal and monetary policies were not examined, suggesting further research.

Possible Implications due to Conflicting Results Observed

The decision to employ bivariate analysis instead of multivariate analysis could be a factor in the contradictory findings that were observed (as highlighted in Table 24), especially in relation to the correlation analysis and Granger causality tests. These conflicts may arise due to the following factors:

Table 24.

Rationale behind conflicting results.

Author Contributions

Conceptualization, L.M.; methodology, L.M.; software, L.M.; validation, L.M.; formal analysis, L.M.; investigation, L.M.; resources, L.M.; data curation, L.M.; writing—original draft preparation, L.M.; writing—review and editing, L.M.; visualization, L.M.; supervision, S.M. (Sakhile Mpungose) and S.M. (Simiso Msomi); project administration, L.M.; funding acquisition, S.M. (Sakhile Mpungose) and S.M. (Simiso Msomi). All authors have read and agreed to the published version of the manuscript.

Funding

The [APC (1800 CHF)] was funded by the College of Law & Management Studies, School Of Accounting, Economics & Finance, University of KwaZulu-Natal, Durban, 3629, South Africa.

Informed Consent Statement

Not applicable.

Data Availability Statement

Secondary data for the variables of this study were sourced from the South African Reserve Bank (SARB) and World Bank Online databases. However, data can be made available upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Afzal, Muhammad, and Qaiser Abbas. 2009. Wagners Law in Pakistan: Another Look. Journal of Economics and International Finance 2: 12–19. [Google Scholar]

- Anochiwa, Lasbrey, and Anne Maduka. 2015. Inflation and Economic Growth in Nigeria: Empirical Evidence? Journal of Economics and Sustainable Development 6: 113–21. [Google Scholar]

- Arestis, Philip, Hüseyin Şen, and Ayşe Kaya. 2021. On the Linkage between Government Expenditure and output: Empirics of the Keynesian View versus Wagner’s Law. Economic Change and Restructuring 54: 265–303. [Google Scholar] [CrossRef]

- Ashour, Majidah, and Chen Chen Yong. 2018. The impact of exchange rate regimes on economic growth: Empirical study of a set of developing countries during the period 1974–2006. The Journal of International Trade & Economic Development 27: 74–90. [Google Scholar] [CrossRef]

- Ayana, Isubalew Daba, Wondaferahu Mulugeta Demissie, and Atnafu Gebremeskel Sore. 2023. Effect of government revenue on economic growth of sub-Saharan Africa: Does institutional quality matter? PLoS ONE 18: e0293847. [Google Scholar] [CrossRef] [PubMed]

- Backhouse, Roger Edward. 2015. Samuelson, Keynes and the Search for a General Theory of Economics. Italian Economic Journal 1: 139–53. [Google Scholar] [CrossRef][Green Version]

- Barro, Robert Joseph. 1989. The Ricardian Approach to Budget Deficits. Journal of Economic Perspectives 3: 37–54. [Google Scholar] [CrossRef]

- Barro, Robert Joseph. 1990. Government Spending in a Simple Model of Endogeneous Growth. Journal of Political Economy 98: S103–S125. [Google Scholar] [CrossRef]

- Belongia, Micheal, and Peter Ireland. 2016. The Evolution of U.S. Monetary policy: 2000–2007. Journal of Economic Dynamics and Control 73: 78–93. [Google Scholar] [CrossRef]

- Bender, Bruce. 1984. An Analysis of the Laffer Curve. Economic Inquiry 22: 414–20. [Google Scholar] [CrossRef]

- Bittencourt, Manoel, Reneé van Eyden, and Monaheng Seleteng. 2015. Inflation and Economic Growth: Evidence from the Southern African Development Community. South African Journal of Economics 83: 411–24. [Google Scholar] [CrossRef]

- Blinder, Alan Stuart. 1988. The Fall and Rise of Keynesian Economics. Economic Record 64: 278–94. [Google Scholar] [CrossRef]

- Boianovsky, Mauro. 2004. The IS-LM Model and the Liquidity Trap Concept: From Hicks to Krugman. History of Political Economy 36: 92–126. [Google Scholar] [CrossRef]

- Borner, Silvio. 1979. Who Has the Right Policy Perspective, the OECD or Its Monetarist Critics? Kyklos 32: 285–306. [Google Scholar] [CrossRef]

- Breusch, Trevor Stanley. 1978. Testing for Autocorrelation in Dynamic Linear Models. Australian Economic Papers 17: 334–55. [Google Scholar] [CrossRef]

- Buthelezi, Eugene Msizi. 2023. Impact of Money Supply in Different States of Inflation and Economic Growth in South Africa. Economies 11: 64. [Google Scholar] [CrossRef]

- Chaitip, Prasert, Kanchana Chokethaworn, Chukiat Chaiboonsri, and Monekeo Khounkhalax. 2015. Money Supply Influencing on Economic Growth-wide Phenomena of AEC Open Region. Procedia Economics and Finance 24: 108–15. [Google Scholar] [CrossRef]

- Coger, Dalvan Moe. 2000. South Africa’s Future: From Crisis to Prosperity, and: Fault Lines: Journeys into the New South Africa, and: South Africa in Transition: The Misunderstood Miracle, and: A Concise History of South Africa, and: South Africa: A Narrative History (review). Africa Today 47: 182–87. [Google Scholar] [CrossRef]

- Costanza, Robert. 1996. The Impact of Ecological Economics. Ecological Economics 19: 1–2. [Google Scholar] [CrossRef]

- Crotty, James Robert. 1996. Is New Keynesian Investment Theory Really ‘Keynesian’? Reflections on Fazzari and Variato. Journal of Post Keynesian Economics 18: 333–57. [Google Scholar] [CrossRef]

- Cui, Ruomeng, Jun Li, and Dennis Zhang. 2019. Reducing Discrimination with Reviews in the Sharing Economy: Evidence from Field Experiments on Airbnb. Management Science 66: 1071–94. [Google Scholar] [CrossRef]

- Daly, Herman Edward. 1991. Towards an Environmental Macroeconomics. Land Economics 67: 255. [Google Scholar] [CrossRef]

- Debrun, Xavier, and Radhicka Kapoor. 2010. Fiscal Policy and Macroeconomic Stability: Automatic Stabilizers Work, Always and Everywhere. IMF Working Papers 10: 1. [Google Scholar] [CrossRef]

- Deng, Ai, and Pierre Perron. 2008. A non-local perspective on the power properties of the CUSUM and CUSUM of squares tests for structural change. Journal of Econometrics 142: 212–40. [Google Scholar] [CrossRef]

- Dickey, David Alan, and Wayne Arthur Fuller. 1979. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar] [CrossRef]

- Dingela, Siyasanga, and Hlalefang Khobai. 2017. Dynamic Impact of Money Supply on Economic Growth in South Africa. An ARDL Approach. Available online: https://mpra.ub.uni-muenchen.de/82539// (accessed on 20 July 2024).

- Dritsakis, Nikolaos. 2011. Demand for Money in Hungary: An ARDL Approach. Review of Economics & Finance 1: 1–16. [Google Scholar]

- Du Plessis, Stan, Ben Smit, and Federico Sturzenegger. 2007. The Cyclicality Of Monetary And Fiscal Policy In South Africa Since 1994. The South African Journal of Economics 75: 391–411. [Google Scholar] [CrossRef]

- Du Plessis, Stan, Ben Smit, and Rudi Steinbach. 2014. A Medium-Sized Open Economy DSGE Model of South Africa, South African Reserve Bank Working Paper Series, WP/14/04. Available online: https://www.resbank.co.za/content/dam/sarb/publications/working-papers/2014/6319/WP1404.pdf (accessed on 17 July 2024).

- Edoumiekumo, Samuel. 2010. Foreign direct investment and economic growth in Nigeria: A granger causality test. Journal of Research in National Development 7. [Google Scholar] [CrossRef]

- Ehikioya, Benjamin Ighodalo. 2019. The impact of exchange rate volatility on the Nigerian economic growth: An empirical investigation. Journal of Economics and Management 37: 45–68. [Google Scholar] [CrossRef]

- Engle, Robert. 1982. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 50: 987–1007. Available online: https://econpapers.repec.org/RePEc:ecm:emetrp:v:50:y:1982:i:4:p:987-1007 (accessed on 5 August 2019). [CrossRef]

- Friedman, Milton. 1953. Economic Advice and Political Limitations: Rejoinder. The Review of Economics and Statistics 35: 252. [Google Scholar] [CrossRef]

- Friedman, Milton, and Anna Jacobson Schwartz. 1963. Money and Business Cycles. The Review of Economics and Statistics 45: 32–64. [Google Scholar] [CrossRef]

- Godfrey, Leslie George. 1978. Testing for Higher Order Serial Correlation in Regression Equations when the Regressors Include Lagged Dependent Variables. Econometrica 46: 1303. [Google Scholar] [CrossRef]

- Gottesman, Aron, Lall Ramrattan, and Michael Szenberg. 2005. Samuelson’s economics: The continuing legacy. The Quarterly Journal of Austrian Economics 8: 95–104. [Google Scholar] [CrossRef]

- Granger, Clive William John. 1969. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 37: 424–38. [Google Scholar] [CrossRef]

- Guerdjikova, Ani. 2007. The New Institutional Economics of Markets. Journal of Institutional and Theoretical Economics 163: 517. [Google Scholar] [CrossRef]

- Gujarati, Damodar, and Dawn Cheree Porter. 2009. Basic Econometrics, 5th ed. New York: McGraw Hill Inc. [Google Scholar]

- Hassan, Mohamedamin Ahmed, Benedicto Onkoba Ongeri, and David Katuta Ndolo. 2023. The Effect of National Public Debt on Economic Growth in Kenya. European Scientific Journal 19: 79. [Google Scholar] [CrossRef]

- Herzog, Lisa. 2014. Adam Smith on Markets and Justice. Philosophy Compass 9: 864–75. [Google Scholar] [CrossRef]

- Hicks, John Richard. 1937. Mr. Keynes and the ‘Classics’; A Suggested Interpretation. Econometrica 5: 147. [Google Scholar] [CrossRef]

- Hoffmann, Rodolfo. 1987. Damodar Gujarati. Basic Econometrics. McGraw-Hill, 1978. Brazilian Review of Econometrics 7: 83. [Google Scholar] [CrossRef]

- Hooper, Vincent James. 2002. The Washington Consensus and Emerging Economies. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Iwegbunam, Ifeoma Anthonia, and Zurika Robinson. 2018. Revisiting Wagner’s Law in the South African Economy. Acta Universitatis Danubius. Œconomica 15: 16. Available online: http://journals.univ-danubius.ro/index.php/oeconomica/article/view/5294/5212 (accessed on 24 July 2024).

- Jarque, Carlos Manuel, and Anil Kumar Bera. 1987. A Test for Normality of Observations and Regression Residuals. International Statistical Review/Revue Internationale de Statistique 55: 163. [Google Scholar] [CrossRef]

- Jones, Evan. 1983. Monetarism in Practice. The Australian Quarterly 55: 433. [Google Scholar] [CrossRef]

- Kaldor, Nicholas. 1970. The Case for Regional Policies. Scottish Journal of Political Economy 27: 234–63. [Google Scholar] [CrossRef]

- Keynes, John Maynard. 1936. The General Theory of Employment, Interest and Money. Political Science Quarterly 51: 600. [Google Scholar] [CrossRef]

- Khobai, Hlalefang, and Pierre Le Roux. 2017. The Relationship between Energy Consumption, Economic Growth and Carbon Dioxide Emission: The Case of South Africa. International Journal of Energy Economics and Policy 7: 102–9. Available online: https://www.econjournals.com/index.php/ijeep/article/view/4361 (accessed on 12 June 2024).

- Khoza, Keorapetse, Relebogile Thebe, and Andrew Phiri. 2016. Nonlinear impact of inflation on economic growth in South Africa: A smooth transition regression analysis. International Journal of Sustainable Economy 8: 277–93. [Google Scholar]

- Kithinji, Angela Mucece. 2020. The Influence of Public Debt on Economic Growth in Kenyan Government. International Journal of Business Management and Economic Review 3: 120–25. [Google Scholar] [CrossRef]

- Kwiatkowski, Denis, Peter Charles Bonest Phillips, Peter Schmidt, and Yongcheol Shin. 1992. Testing the null hypothesis of stationarity against the alternative of a unit root. Journal of Econometrics 54: 159–78. [Google Scholar] [CrossRef]

- Laidler, David. 1990. The Legacy of the Monetarist Controversy. Northampton: Edward Elgar Publishing, vol. 72, pp. 394–409. [Google Scholar] [CrossRef]

- Lucas, Robert Emerson. 1988. On the Mechanics of Economic Development. Journal of Monetary Economics 22: 3–42. [Google Scholar] [CrossRef]

- Luks, Fred. 1998. The rhetorics of ecological economics. Ecological Economics 26: 139–49. [Google Scholar] [CrossRef]

- Mago, Stephen. 2019. Urban Youth Unemployment in South Africa: Socio-Economic and Political Problems. Commonwealth Youth and Development 16. [Google Scholar] [CrossRef]

- Marangos, John. 2008. The Evolution of the Anti-Washington Consensus Debate: From ‘Post-Washington Consensus’ to ‘After the Washington Consensus’. Competition & Change 12: 227–44. [Google Scholar] [CrossRef]

- Martin, William. 2009. South Africa’s Subimperial Futures: Washington Consensus, Bandung Consensus, or Peoples’ Consensus? African Sociological Review / Revue Africaine De Sociologie 12: 122–32. [Google Scholar] [CrossRef]

- Matemilola, Bolaji Tunde, Amin Noordin Bany-Ariffin, and Fatima Etudaiye Muhtar. 2015. The impact of monetary policy on bank lending rate in South Africa. Borsa Istanbul Review 15: 53–59. [Google Scholar] [CrossRef]

- Matres, Javier de Oña García, and Tuan Viet Le. 2021. The Impact of Money Supply on the Economy: A Panel Study on Selected Countries. Journal of Economic Science Research 4. [Google Scholar] [CrossRef]

- Mbulawa, Strike. 2015. Effect of Macroeconomic Variables on Economic Growth in Botswana. Journal of Economics and Sustainable Development 6: 68–77. [Google Scholar]

- Mirowski, Philip. 1982. What’s Wrong with the Laffer Curve? Journal of Economic Issues 16: 815–28. [Google Scholar] [CrossRef]

- Miyajima, Ken. 2021. Monetary Policy, Inflation, and Distributional Impact: South Africa’s Case. IMF Working Papers 78: 1. [Google Scholar] [CrossRef]

- Mlilo, Mthokozisi, and Matamela Netshikulwe. 2017. Re-testing Wagner’s Law: Structural breaks and disaggregated data for South Africa. Journal of Economics and Behavioral Studies 9: 49. [Google Scholar] [CrossRef]

- Monamodi, Nkosinathi. 2019. The Impact of Fiscal and Monetary Policy on Economic Growth in Southern African Custom Union (SACU) Member Economies between 1980 and 2017: A Panel ARDL Approach. SSRN Electronic Journal 15: 86–102. [Google Scholar] [CrossRef]

- Mothibi, Lerato, and Precious Mncayi-Makhanya. 2019. Investigating The Key Drivers of Government Debt in South Africa: A Post-Apartheid Analysis. International Journal of eBusiness and eGovernment Studies 11: 16–33. [Google Scholar] [CrossRef]

- Moyo, Delani, Ahmed Samour, and Turgut Tursoy. 2021. The Nexus Between Taxation, Government Expenditure and Economic Growth in South Africa. A fresh evidence from combined cointegration test. Studies of Applied Economics 39: 2–115. [Google Scholar] [CrossRef]

- Muzekenyi, Mike, Jethro Zuwarimwe, Beata Kilonzo, and Daniel Nheta. 2019. An Assessment of The Role of Real Exchange Rate On Economic Growth In South Africa. Journal Of Contemporary Management 16: 140–59. [Google Scholar] [CrossRef]

- Myrdal, Gunnar. 1957. Economic Theory and Underdeveloped Regions. London: Duckworth. [Google Scholar]

- Narayan, Paresh Kumar. 2005. The saving and investment nexus for China: Evidence from cointegration tests. Applied Economics 37: 1979–90. [Google Scholar] [CrossRef]

- National Treasury. 2019. Economic Transformation, Inclusive Growth, and Competitiveness: Towards an Economic Strategy for South Africa, Economic Policy; Pretoria: National Treasury.

- Nenovsky, Nikolay. 2011. Criticisms of Classical Political Economy. Menger, Austrian economics and the German Historical School. The European Journal of the History of Economic Thought 18: 290–93. [Google Scholar] [CrossRef]

- Nesiba, Reynold. 2013. Do Institutionalists and post-Keynesians share a common approach to Modern Monetary Theory (MMT)? European Journal of Economics and Economic Policies: Intervention 10: 44–60. [Google Scholar] [CrossRef]

- Nguyen, Hoa Thi, and Susilo Nur Aji Cokro Darsono. 2022. The Impacts of Tax Revenue and Investment on the Economic Growth in Southeast Asian Countries. Journal of Accounting and Investment 23: 128–46. [Google Scholar] [CrossRef]

- Noman, Shoayeb, and Mohsan Khudri. 2015. The Effects of Monetary and Fiscal Policies on Economic Growth in Bangladesh. ELK Asia Pacific Journal of Finance and Risk Management 6: 21–34. [Google Scholar] [CrossRef]

- North, Douglass Cecil. 1990. Institutions, Institutional Change and Economic Performance. The Economic Journal 101: 1587. [Google Scholar] [CrossRef]

- Nyasha, Sheilla, and Nicholas Mbaya Odhiambo. 2015. The Impact of Banks and Stock Market Development on Economic Growth in South Africa: An ARDL-bounds Testing Approach. Contemporary Economics 9: 93–108. [Google Scholar] [CrossRef]

- Olson, Mancur. 1984. Beyond Keynesianism and Monetarism. Economic Inquiry 22: 297–322. [Google Scholar] [CrossRef]

- Palley, Thomas. 1996. Growth Theory in a Keynesian Mode: Some Keynesian Foundations for New Endogenous Growth Theory. Journal of Post Keynesian Economics 19: 113–35. [Google Scholar] [CrossRef]

- Palley, Thomas. 2014. Money, Fiscal Policy, and Interest Rates: A Critique of Modern Monetary Theory. Review of Political Economy 27: 1–23. [Google Scholar] [CrossRef]

- Patel, Deeviya, and Gisele Mah. 2018. Relationship between Real Exchange Rate and Economic Growth: The case of South Africa. Journal of Economics and Behavioral Studies 10: 146–58. [Google Scholar] [CrossRef]

- Permana, Yudistira Hendra, and Gek Sintha Mas Jasmin Wika. 2014. Testing the Existence of Wagner Law and Government Expenditure Volatility in Indonesia Post-Reformation Era. Journal of Economics and Sustainable Development 5: 130–39. [Google Scholar] [CrossRef]

- Pesaran, Mohammad Hashem, Yongcheol Shin, and Richard Jay Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Phillips, Peter Charles Bonest, and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Posner, Richard Allen. 2010. From the new institutional economics to organization economics: With applications to corporate governance, government agencies, and legal institutions. Journal of Institutional Economics 6: 1–37. [Google Scholar] [CrossRef]

- Ramsey, James Bernard. 1969. Tests for Specification Errors in Classical Linear Least-Squares Regression Analysis. Journal of the Royal Statistical Society. Series B (Methodological) 31: 350–71. Available online: https://www.jstor.org/stable/2984219 (accessed on 11 July 2024). [CrossRef]

- Reinhart, Carmen, and Kenneth Rogoff. 2010. Growth in a Time of Debt. National Bureau of Economic Research 100: WP15639. Available online: https://econpapers.repec.org/paper/nbrnberwo/15639.htm (accessed on 24 July 2024).

- Romer, Paul Michael. 1986. Increasing Returns and long-run Growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef]

- Roşoiu, Iulia. 2015. The Impact of the Government Revenues and Expenditures on the Economic Growth. Procedia Economics and Finance 32: 526–33. [Google Scholar] [CrossRef]

- Samuelson, Paul Anthony. 1954. The Pure Theory of Public Expenditure. The Review of Economics and Statistics 36: 387–89. [Google Scholar] [CrossRef]

- Sari, Wuri Nur Indah, Eni Setyowati, Sherlyna Mandassari Putri, and Sitti Retno Faridatussalam. 2022. Analysis of the Effect of Interest Rates, Exchange Rate Inflation and Foreign Investment (PMA) on Economic Growth in Indonesia in 1986–2020. Available online: www.atlantis-press.com (accessed on 11 July 2024). [CrossRef]

- Saungweme, Talknice, and Nicholas Mbaya Odhiambo. 2020. Relative Impact of Domestic and Foreign Public Debt on Economic Growth in South Africa. Journal of Applied Social Science 15: 132–50. [Google Scholar] [CrossRef]

- Sedrakyan, Gohar Samvel, and Laura Varela-Candamio. 2019. Wagner’s law vs. Keynes’ hypothesis in very different countries (Armenia and Spain). Journal of Policy Modeling 41: 747–62. [Google Scholar] [CrossRef]

- Shaukat, Badiea, Qigui Zhu, and Muhammad Ijaz Khan. 2019. Real interest rate and economic growth: A statistical exploration for transitory economies. Physica A: Statistical Mechanics and Its Applications 534: 122193. [Google Scholar] [CrossRef]

- Smith, Adam. 1776. An Inquiry into the Nature and Causes of the Wealth of Nations. Readings in Economic Sociology 1: 6–17. [Google Scholar] [CrossRef]

- So, Alvin, and Alice Hoffenberg Amsden. 2002. The Rise of ‘The Rest’: Challenges to the West from Late-Industrializing Economies. Contemporary Sociology 31: 457. [Google Scholar] [CrossRef]

- Tabellini, Guido. 2005. Finn Kydland and Edward Prescott’s Contribution to the Theory of Macroeconomic Policy. Scandinavian Journal of Economics 107: 203–16. [Google Scholar] [CrossRef]

- Tcherneva, Pavlina. 2011. Fiscal Policy Effectiveness: Lessons from the Great Recession. Levy Economics Institute Working Paper No. 649. Available online: https://ssrn.com/abstract=1760135 (accessed on 14 July 2024).

- Thabane, Kanono, and Sello Lebina. 2016. Economic Growth and Government Spending Nexus: Empirical Evidence from Lesotho. African Journal of Economic Review 4: 86–100. Available online: https://econpapers.repec.org/RePEc:ags:afjecr:264386 (accessed on 24 July 2024).

- Tilman, Rick. 2008. Institutional Economics as Social Criticism and Political Philosophy. Journal of Economic Issues 42: 289–302. [Google Scholar] [CrossRef]

- Turner, Paul. 2010. Power properties of the CUSUM and CUSUMSQ tests for parameter instability. Applied Economics Letters 17: 1049–53. [Google Scholar] [CrossRef]

- Wade, Robert. 1992. East Asia’s Economic Success: Conflicting Perspectives, Partial Insights, Shaky Evidence. World Politics 44: 270–320. [Google Scholar] [CrossRef]

- Wagner, Adolph. 1893. Grundlegung der politischen Okonomie, 3rd ed. Leipzig: CF Winter’sche Verlagshandlung. [Google Scholar]

- Williamson, Oliver Eaton. 2000. The New Institutional Economics: Taking Stock, Looking Ahead. Journal of Economic Literature 38: 595–613. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).