Does Industrial Structure Upgrading Promote China’s Outward Foreign Direct Investment (OFDI) in ASEAN Countries? Evidence from Provincial Panels

Abstract

1. Introduction

2. Literature Review

3. Research Design

3.1. Data Source

3.2. Variable Description

3.2.1. Dependent Variable

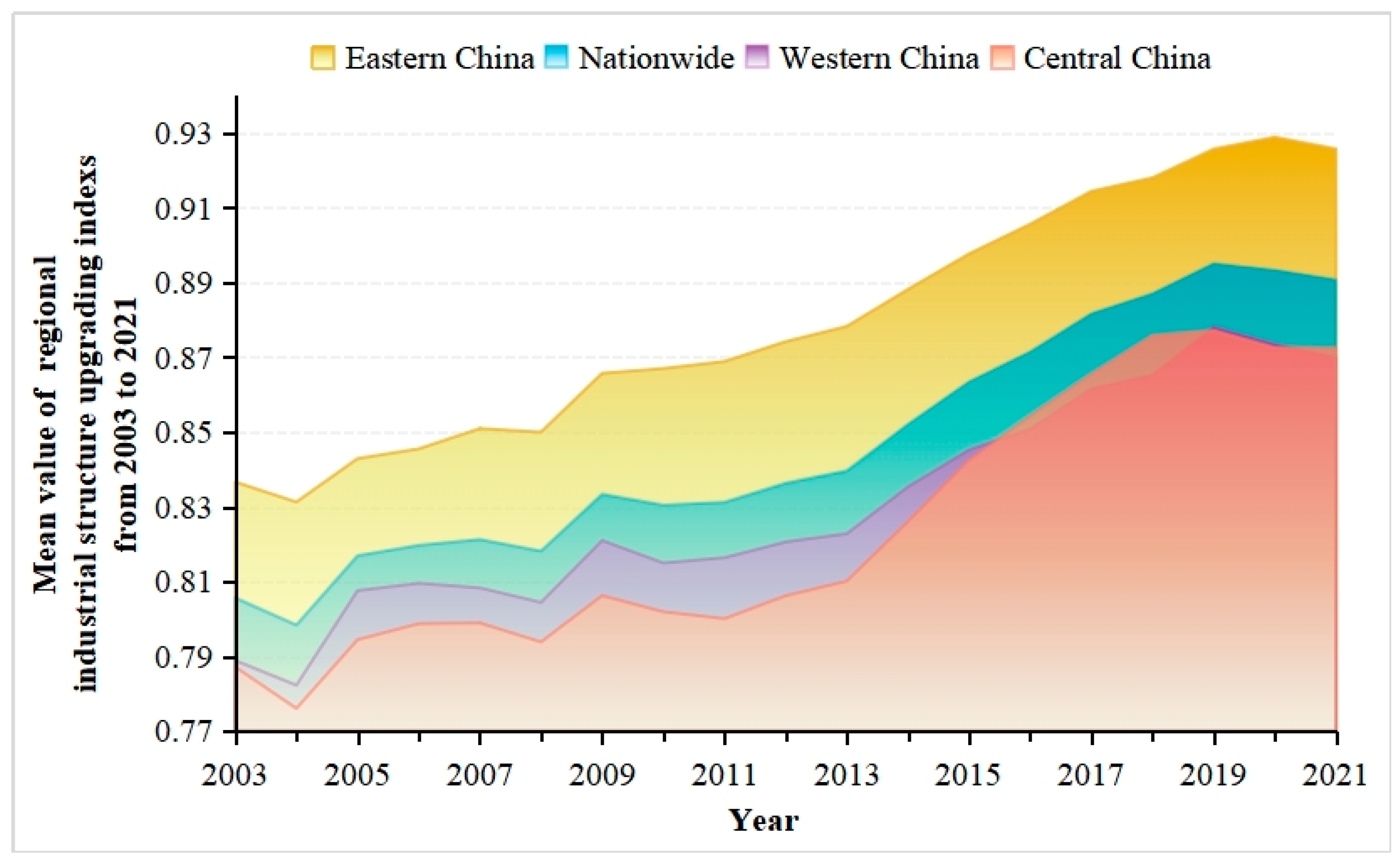

3.2.2. Independent Variables

3.2.3. Control Variables

3.3. Model Settings and Methodology

3.4. Preliminary Tests

4. Empirical Analysis

4.1. Baseline Regression

4.2. Robustness Tests

4.2.1. Add Relevant Control Variables

4.2.2. Remove Interfering Samples

4.3. Endogeneity Test

4.4. Heterogeneity Analysis

4.4.1. Regional Heterogeneity in the Home Country

4.4.2. Heterogeneity of Income Levels in Host Countries

4.5. Mechanism Analysis

5. Conclusions

5.1. Key Findings

5.2. Significance and Inspiration

5.2.1. Theoretical and Practical Significance

5.2.2. Policy Implications

5.3. Limitations and Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | The data structure is organized by Province-Year-Host Country, with the “Host Country” referring to the 10 ASEAN member nations: Brunei, Cambodia, Indonesia, Laos, Malaysia, the Philippines, Singapore, Thailand, Myanmar, and Vietnam. The host country fixed effect used in the model refers to a corresponding ASEAN country that receives inflows of OFDI from a China province in that year. Additionally, not all provinces were involved in investment activities targeting all ASEAN member countries every year during the survey period. |

| 2 | The World Bank divides the world’s economies into four income groups: High-income, upper middle-income, lower middle-income, and low-income countries. This classification system is designed to reflect a country’s level of development. In the latest classification standards released by the World Bank in 2024, ASEAN countries are classified as follows: Singapore and Brunei are upper middle-income countries, Indonesia, Malaysia, and Thailand are upper middle-income countries, and Cambodia, Laos, Myanmar, the Philippines, and Vietnam are low middle-income countries. |

References

- Amighini, Alessia, Claudio Cozza, Roberta Rabellotti, and Marco Sanfilippo. 2014. Investigating Chinese Outward Foreign Direct Investments: How Can Firm-level Data Help? China & World Economy 22: 44–63. [Google Scholar] [CrossRef]

- Barcenilla, Sara, Gregorio Gimenez, and Carmen López-Pueyo. 2019. Differences in Total Factor Productivity Growth in the European Union: The role of Human Capital by Income Level. Prague Economic Papers 28: 70–85. [Google Scholar] [CrossRef]

- Barrios, Salvador, Holger Görg, and Eric Strobl. 2005. Foreign direct investment, competition and industrial development in the host country. European Economic Review 49: 1761–84. [Google Scholar] [CrossRef]

- Bayar, Ylmaz, Rita Remeikienė, and Ligita Gasparėnienė. 2020. Intellectual property rights, R&D expenditures, and high-tech exports in the EU transition economies. Journal of International Studies. [Szczecin]: Centre of Sociological Research (CSR) 13: 143–54. [Google Scholar] [CrossRef]

- Blyde, Juan, and Danielken Molina. 2015. Logistic infrastructure and the international location of fragmented production. Journal of International Economics 95: 319–32. [Google Scholar] [CrossRef]

- Buchanan, Bonnie G., Quan V. Le, and Meenakshi Rishi. 2012. Foreign direct investment and institutional quality: Some empirical evidence. International Review of Financial Analysis 21: 81–89. [Google Scholar] [CrossRef]

- Cao, Hui, and Paul Folan. 2012. Product life cycle: The evolution of a paradigm and literature review from 1950–2009. Production Planning & Control 23: 641–62. [Google Scholar] [CrossRef]

- Chang, Shun-Chiao. 2014. The determinants and motivations of China’s outward foreign direct investment: A spatial gravity model approach. Global Economic Review 43: 244–68. [Google Scholar] [CrossRef]

- Chen, Feiqiong, Huiqian Liu, and Yuhao Ge. 2020a. Overseas M&A integration, innovation networks and home-country industrial technology innovation: Case studies from China. Asian Journal of Technology Innovation 29: 304–23. [Google Scholar] [CrossRef]

- Chen, Jianxun, Wu Zhan, Zhaodi Tong, and Vikas Kumar. 2020b. The effect of inward FDI on outward FDI over time in China: A contingent and dynamic perspective. International Business Review 29: 101734. [Google Scholar] [CrossRef]

- Chen, Yufeng, Mingxin Chen, and Lulu Tian. 2023. What determines China’s energy OFDI: Economic, geographical, institutional, and cultural distance? Energy Strategy Reviews 47: 101084. [Google Scholar] [CrossRef]

- Child, John, David Faulkner, and Robert Pitkethly. 2000. Foreign direct investment in the UK 1985–1994: The impact on domestic management practice. Journal of Management Studies 37: 141–66. [Google Scholar] [CrossRef]

- Cho, Jaeyoung, and Jangwoo Lee. 2020. Speed of FDI expansions and the survival of Korean SMEs: The moderating role of ownership structure. Asian Business & Management 19: 184–212. [Google Scholar] [CrossRef]

- Correia, Sergio. 2016. A Feasible Estimator for Linear Models with Multi-Way Fixed Effects. Available online: http://scorreia.com/research/hdfe.pdf (accessed on 1 August 2024).

- Costinot, Arnaud. 2009. An elementary theory of comparative advantage. Econometrica 77: 1165–92. [Google Scholar] [CrossRef]

- Desbordes, Rodolphe, and Shang-Jin Wei. 2017. Foreign direct investment and external financing conditions: Evidence from normal and crisis times. The Scandinavian Journal of Economics 119: 1129–66. [Google Scholar] [CrossRef]

- Do, Quy-Toan, Andrei A. Levchenko, and Claudio Raddatz. 2016. Comparative advantage, international trade, and fertility. Journal of Development Economics 119: 48–66. [Google Scholar] [CrossRef]

- Dong, Yan, Jinhuan Tian, and Qiang Wen. 2022. Environmental regulation and outward foreign direct investment: Evidence from China. China Economic Review 76: 101877. [Google Scholar] [CrossRef]

- Du, Kerui, Yuanyuan Cheng, and Xin Yao. 2021. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Economics 98: 105247. [Google Scholar] [CrossRef]

- Duan, Wenjing, Shujin Zhu, and Mingyong Lai. 2020. The impact of COVID-19 on China’s trade and outward FDI and related countermeasures. Journal of Chinese Economic and Business Studies 18: 355–64. [Google Scholar] [CrossRef]

- Eskandar, Hoda, and Hadi Hadadi. 2022. Effect of Short-term Financial Constraints on SMEs, Investment Decisions. Iranian Journal of Finance 6: 120–34. [Google Scholar] [CrossRef]

- Falk, Martin. 2016. A gravity model of foreign direct investment in the hospitality industry. Tourism Management 55: 225–37. [Google Scholar] [CrossRef]

- Feng, Ling, and Lulan Ge. 2022. China’s OFDI and the economic growth: From the perspective of natural resource. International Studies of Economics 17: 311–33. [Google Scholar] [CrossRef]

- Gong, Min, Yidi Zeng, and Fan Zhang. 2023. New infrastructure, optimization of resource allocation and upgrading of industrial structure. Finance Research Letters 54: 103754. [Google Scholar] [CrossRef]

- Guan, Jian Cheng, Richard C. M. Yam, Chiu Kam Mok, and Ning Ma. 2006. A study of the relationship between competitiveness and technological innovation capability based on DEA models. European Journal of Operational Research 170: 971–86. [Google Scholar] [CrossRef]

- Hiley, Mark. 1999. The dynamics of changing comparative advantage in the Asia-Pacific region. Journal of the Asia Pacific Economy 4: 446–67. [Google Scholar] [CrossRef]

- Huang, Wanhua. 2021. Research on the Impact of Investment Efficiency of China’s Commercial Economy on Industrial Structure Adjustment Based on Cloud Computing. IEEE Sensors Journal 21: 25525–31. [Google Scholar] [CrossRef]

- Jiang, Mingrui, Sumei Luo, and Guangyou Zhou. 2020. Financial development, OFDI spillovers and upgrading of industrial structure. Technological Forecasting and Social Change 155: 119974. [Google Scholar] [CrossRef]

- Jiao, Yong, Gaofei Wang, Chengyou Li, and Jia Pan. 2024. Digital inclusive finance, factor flow and industrial structure upgrading: Evidence from the yellow river basin. Finance Research Letters 62: 105141. [Google Scholar] [CrossRef]

- Li, Bowen, Fangxin Jiang, Hongjie Xia, and Jiawei Pan. 2022. Under the Background of Ai Application, Research on the Impact of Science and Technology Innovation and Industrial Structure Upgrading on the Sustainable and High-Quality Development of Regional Economies. Sustainability 14: 11331. [Google Scholar] [CrossRef]

- Li, Fengchun, and Siying Wu. 2023. Impacts of Home Country’s Institutional Environment on Ofdi Dual Margin. International Review of Economics & Finance 87: 54–67. [Google Scholar] [CrossRef]

- Li, Xing, Wei Zhou, and Jiani Hou. 2021. Research on the impact of OFDI on the home country’s global value chain upgrading. International Review of Financial Analysis 77: 101862. [Google Scholar] [CrossRef]

- Liao, Hongwei, Liangping Yang, Shuanping Dai, and Ari Van Assche. 2021. Outward FDI, industrial structure upgrading and domestic employment: Empirical evidence from the Chinese economy and the belt and road initiative. Journal of Asian Economics 74: 101303. [Google Scholar] [CrossRef]

- Lin, Justin Yifu, and Yan Wang. 2012. China’s integration with the world: Development as a process of learning and industrial upgrading. China Economic Policy Review 1: 1250001. [Google Scholar] [CrossRef]

- Ling, Junjie, and Shuai Li. 2021. Correlation and Comparative Advantage of Global Value Chain of China’s Manufacturing and Service Industries—Empirical Research Based on ADB Database. Academic Journal of Business & Management 3: 68–73. [Google Scholar] [CrossRef]

- Lipsey, Robert E., Robert C. Feenstra, Carl H. Hahn, and George N. Hatsopoulos. 1999. The role of foreign direct investment in international capital flows. In International Capital Flows. Chicago: University of Chicago Press, pp. 307–62. [Google Scholar]

- Liu, Wei, Zhihui Zhao, Zhao Wen, and Shixiong Cheng. 2022. Environmental regulation and OFDI: Evidence from Chinese listed firms. Economic Analysis and Policy 75: 191–208. [Google Scholar] [CrossRef]

- Liu, Xiaohui, and Chenggang Wang. 2003. Does foreign direct investment facilitate technological progress?: Evidence from Chinese industries. Research Policy 32: 945–53. [Google Scholar] [CrossRef]

- Liu, Yanfeng, Xue Li, Xiaonan Zhu, Min-Kyu Lee, and Po-Lin Lai. 2023. The theoretical systems of OFDI location determinants in global north and global south economies. Humanities and Social Sciences Communications 10: 1–13. [Google Scholar] [CrossRef]

- Liu, Yishuang, Wei Liu, Xiaoling Zhang, Hanmin Dong, Zhihui Zhao, and Zhan Zhang. 2024. Domestic environmental impacts of OFDI: City-level evidence from China. International Review of Economics & Finance 89: 391–409. [Google Scholar] [CrossRef]

- Ma, Yan. 2015. The product cycle hypothesis: The role of quality upgrading and market size. International Review of Economics & Finance 39: 326–36. [Google Scholar] [CrossRef]

- Matsuyama, Kiminori. 2014. Institution-induced productivity differences and patterns of international capital flows. Journal of the European Economic Association 12: 1–24. [Google Scholar] [CrossRef]

- McCaig, Brian, and Nina Pavcnik. 2018. Export Markets and Labor Allocation in a Low-Income Country. American Economic Review 108: 1899–941. [Google Scholar] [CrossRef]

- Qiao, Penghua, Mengli Lv, and Yuping Zeng. 2020. R&D intensity, domestic institutional environment, and SMEs’ OFDI in emerging markets. Management International Review 60: 939–73. [Google Scholar] [CrossRef]

- Rasiah, Rajah. 2004. Infrastructure, resident patents and income levels in developing Asia. Science, Technology and Society 9: 103–27. [Google Scholar] [CrossRef]

- Rasiah, Rajah. 2011. Epilogue: Implications from industrializing East Asia’s innovation and learning experiences. Asia Pacific Business Review 17: 257–62. [Google Scholar] [CrossRef]

- Saha, Sadhon, Md Nazmus Sadekin, and Sanjoy Kumar Saha. 2022. Effects of institutional quality on foreign direct investment inflow in lower-middle income countries. Heliyon 8: e10828. [Google Scholar] [CrossRef] [PubMed]

- Santos, Eleonora. 2023. FDI and Firm Productivity: A Comprehensive Review of Macroeconomic and Microeconomic Models. Economies 11: 164. [Google Scholar] [CrossRef]

- Shahriar, Saleh, Sokvibol Kea, and Lu Qian. 2020. Determinants of China’s outward foreign direct investment in the Belt & Road economies: A gravity model approach. International Journal of Emerging Markets 15: 427–45. [Google Scholar] [CrossRef]

- Su, Yi, and Qi-ming Fan. 2022. Renewable energy technology innovation, industrial structure upgrading and green development from the perspective of China’s provinces. Technological Forecasting and Social Change 180: 121727. [Google Scholar] [CrossRef]

- Tang, Decai, Jiannan Li, Ziqian Zhao, Valentina Boamah, and David D. Lansana. 2023. The influence of industrial structure transformation on urban resilience based on 110 prefecture-level cities in the Yangtze River. Sustainable Cities and Society 96: 104621. [Google Scholar] [CrossRef]

- Tang, Qingqing, Flora F. Gu, En Xie, and Zhan Wu. 2020. Exploratory and exploitative OFDI from emerging markets: Impacts on firm performance. International Business Review 29: 101661. [Google Scholar] [CrossRef]

- Tkachuk, Hanna. 2023. Confectionery Enterprises’ Competitiveness in the Domestic Market of Ukraine and their Export Potential: An Analytical Overview and Top-10 Rating. Economic Affairs 68: 963–69. [Google Scholar] [CrossRef]

- Tong, Yee-Siong. 2021. China’s outbound investment in asean economies in three periods: Changing patterns and trends. The Singapore Economic Review 66: 105–42. [Google Scholar] [CrossRef]

- Wang, Qi. 2004. The effect of foreign direct investment on the industrial structure adjustment of investing countries and its transmission mechanism. Journal of International Trade, 73–77. (In Chinese). [Google Scholar] [CrossRef]

- Wang, Tai-Yue, and Shih-Chien Chien. 2007. The influences of technology development on economic performance—The example of ASEAN countries. Technovation 27: 471–88. [Google Scholar] [CrossRef]

- Wang, Yongqin, Julan Du, and Kai Wang. 2015. The Determinants of Location Choices of China’s ODI: Institutions, Taxation and Resources. Front. Econ. China 10: 540–65. [Google Scholar] [CrossRef]

- Wu, Ning, and ZuanKuo Liu. 2021. Higher education development, technological innovation and industrial structure upgrade. Technological Forecasting and Social Change 162: 120400. [Google Scholar] [CrossRef]

- Xu, Yingzhi, Ruijie Zhang, and Wenyuan Sun. 2021. Green technology innovation, factor market distortion and industrial structure upgrading. R&D Management 33: 75–86. (In Chinese) [Google Scholar] [CrossRef]

- Yang, Jiao-Hui, Wei Wang, Kai-Li Wang, and Chung-Ying Yeh. 2018. Capital intensity, natural resources, and institutional risk preferences in Chinese outward foreign direct investment. International Review of Economics & Finance 55: 259–72. [Google Scholar] [CrossRef]

- Yang, Lu, and Haibo Zhang. 2023. Environmental regulations and outward foreign direct investment—Empirical evidence from Chinese enterprises. Environmental Science and Pollution Research 30: 1072–84. [Google Scholar] [CrossRef]

- You, Jianmin, and Wei Zhang. 2022. How heterogeneous technological progress promotes industrial structure upgrading and industrial carbon efficiency? Evidence from China’s industries. Energy 247: 123386. [Google Scholar] [CrossRef]

- Yu, Xiao, and Peng Wang. 2021. Economic effects analysis of environmental regulation policy in the process of industrial structure upgrading: Evidence from Chinese provincial panel data. Science of the Total Environment 753: 142004. [Google Scholar] [CrossRef]

- Zhang, Nathan, Kevin Canini, Sean Silva, and Maya Gupta. 2021. Fast linear interpolation. ACM Journal on Emerging Technologies in Computing Systems (JETC) 17: 1–15. [Google Scholar] [CrossRef]

- Zhang, Yijun, Yi Song, and Han Zou. 2022. Non-linear effects of heterogeneous environmental regulations on industrial relocation: Do compliance costs work? Journal of Environmental Management 323: 116188. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Yongmin, Zhenbang Zhang, Hanglin Jin, Wenjun Tu, and Yingnan Liu. 2024. Innovation and OFDI along the Belt and Road. Technological Forecasting and Social Change 200: 123136. [Google Scholar] [CrossRef]

- Zhao, Jiazhang, and Longfei Guo. 2018. Effect of OFDI on home country’s industrial structure upgrading: Based on Chinese provincial panel data. Regional Economic Review, 76–83. (In Chinese) [Google Scholar] [CrossRef]

- Zhao, Jinjing, and Jongchul Lee. 2021. The Belt and Road Initiative, Asian infrastructure investment bank, and the role of enterprise heterogeneity in China’s outward foreign direct investment. Post-Communist Economies 33: 379–401. [Google Scholar] [CrossRef]

- Zhao, Jinjing, Jie Pan, Xiangwei Xie, and Miao Su. 2024. Green outward foreign direct investment and host country environmental effects: The home country’s carbon emission reduction system is crucial. Energy 290: 130182. [Google Scholar] [CrossRef]

- Zhao, Xi. 2023. Study on the Effect of Venture Capital on Regional Industrial Structure Upgrade. Academic Journal of Business & Management 5: 122–26. [Google Scholar] [CrossRef]

- Zheng, Xiyue, Fusheng Wang, Shiyu Liu, Han Wang, and Dongchao Zhang. 2024. Outward foreign direct investment, dynamic capabilities and radical innovation performance: Empirical evidence from Chinese high-tech companies. Chinese Management Studies 18: 921–53. [Google Scholar] [CrossRef]

- Zhu, Bangzhu, Mengfan Zhang, Yanhua Zhou, Ping Wang, Jichuan Sheng, Kaijian He, Yi-Ming Wei, and Rui Xie. 2019. Exploring the effect of industrial structure adjustment on interprovincial green development efficiency in China: A novel integrated approach. Energy Policy 134: 110946. [Google Scholar] [CrossRef]

- Zhu, Weiwei, Yaqin Zhu, Huaping Lin, and Yu Yu. 2021. Technology progress bias, industrial structure adjustment, and regional industrial economic growth motivation—Research on regional industrial transformation and upgrading based on the effect of learning by doing. Technological Forecasting and Social Change 170: 120928. [Google Scholar] [CrossRef]

- Zhu, Xiangmei, Bin Zhang, and Hui Yuan. 2022. Digital economy, industrial structure upgrading and green total factor productivity—Evidence in textile and apparel industry from China. PLoS ONE 17: e0277259. [Google Scholar] [CrossRef]

| Variables | Obs | Mean | S.D. | Min | Max |

|---|---|---|---|---|---|

| LOFDI | 507 | 4.105 | 1.981 | −1.609 | 9.521 |

| LStr | 507 | 0.908 | 0.075 | 0.764 | 1.042 |

| LFDI | 507 | −3.738 | 0.637 | −7.131 | −2.502 |

| LER | 507 | −1.731 | 0.890 | −4.768 | 0.511 |

| IQ | 507 | −0.011 | 0.797 | −1.752 | 1.651 |

| LTec | 507 | 2.940 | 1.366 | −2.390 | 4.205 |

| LRes | 507 | 2.360 | 1.305 | −2.521 | 4.566 |

| Variables | Description | Measurement | Source |

|---|---|---|---|

| LOFDI | Outward foreign direct investment flow | The natural logarithm of annual OFDI flows from provinces in China to ASEAN countries | fDi Markets |

| LStr | Provincial industrial structure upgrading index | The natural logarithm of assigning and weighting the proportion of added value of three industries to GDP | China Statistical Yearbook National Bureau of Statistics |

| LFDI | Provincial scale of foreign direct investment | Calculation of the natural logarithm of the share of FDI in regional GDP | China Statistical Yearbook National Bureau of Statistics |

| LER | Provincial environmental regulation intensity | Natural logarithm of the amount of completed investment in industrial pollution control as a percentage of the value-added component of the secondary sector | China Statistical Yearbook National Bureau of Statistics |

| IQ | Institutional quality | Average of six sub-scores (voice and accountability, political stability, government effectiveness, regulatory quality, rule of law, and control of corruption) | World Governance Indicators (WGI) database |

| LTec | The technological level of the host country | The natural logarithm of high-tech exports as a percentage of manufacturing exports | World Bank |

| LRes | Abundance of natural resources in the host country | The natural logarithm of the sum of fuel exports (% of commodity exports) and ore and metal exports (% of commodity exports) | World Bank |

| LOFDI | LStr | LFDI | LER | IQ | LTec | LRes | |

|---|---|---|---|---|---|---|---|

| LOFDI | 1 | ||||||

| LStr | 0.113 ** | 1 | |||||

| LFDI | −0.055 | 0.372 *** | 1 | ||||

| LER | 0.117 *** | −0.405 *** | −0.047 | 1 | |||

| IQ | −0.112 ** | 0.0620 | 0.002 | −0.081 * | 1 | ||

| LTec | −0.094 ** | 0.008 | 0.022 | −0.034 | 0.574 *** | 1 | |

| LRes | 0.075 * | −0.050 | 0.016 | 0.075 * | 0.194 *** | 0.272 *** | 1 |

| Variable | VIF | 1/VIF |

|---|---|---|

| LTec | 1.560 | 0.643 |

| IQ | 1.510 | 0.662 |

| LStr | 1.410 | 0.708 |

| LER | 1.230 | 0.816 |

| LFDI | 1.180 | 0.847 |

| LRes | 1.090 | 0.915 |

| Mean | VIF | 1.330 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| LStr | 2.996 *** | 3.034 ** | 6.826 *** | 6.327 *** | 6.413 *** |

| (0.928) | (1.101) | (1.412) | (1.589) | (1.578) | |

| LFDI | −0.442 ** | −0.396 ** | −0.377 ** | ||

| (0.136) | (0.145) | (0.127) | |||

| LER | 0.439 ** | 0.505 ** | 0.478 ** | ||

| (0.136) | (0.159) | (0.158) | |||

| IQ | −0.244 | −0.280 * | −2.039 ** | ||

| (0.139) | (0.131) | (0.804) | |||

| LTec | −0.088 | −0.084 | −0.306 | ||

| (0.094) | (0.095) | (0.175) | |||

| LRes | 0.168 * | 0.208 * | −0.109 | ||

| (0.087) | (0.096) | (0.186) | |||

| _cons | 1.385 | 1.350 | −3.126 * | −2.491 | −1.163 |

| (0.891) | (1.044) | (1.501) | (1.705) | (1.850) | |

| Year FE | No | Yes | No | Yes | Yes |

| HC FE | No | Yes | No | No | Yes |

| Cluster | Yes | Yes | Yes | Yes | Yes |

| N | 507 | 507 | 507 | 507 | 507 |

| R2 | 0.013 | 0.117 | 0.085 | 0.134 | 0.174 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| LStr | 6.172 *** | 5.670 *** | 7.239 *** |

| (1.558) | (1.453) | (1.467) | |

| LPES | −0.078 | ||

| (0.158) | |||

| LHES | 0.192 | ||

| (1.050) | |||

| LDis | −2.790 | ||

| (1.882) | |||

| LInfra | 0.123 * | ||

| (0.067) | |||

| LTra | 0.211 * | ||

| (0.102) | |||

| _cons | 65.382 | −0.196 | −2.522 |

| (54.619) | (2.214) | (1.553) | |

| Control | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| HC FE | Yes | Yes | Yes |

| Cluster | Yes | Yes | Yes |

| N | 507 | 483 | 461 |

| R2 | 0.177 | 0.156 | 0.189 |

| Variables | (1) First Stage | (2) Second Stage |

|---|---|---|

| LStr | 5.776 *** | |

| (1.411) | ||

| IV1 | 0.170 *** | |

| (0.014) | ||

| IV2 | −0.070 *** | |

| (0.020) | ||

| LM Statistic | 8.674 | |

| (0.013) | ||

| Cragg-Donald Wald F | 694.278 | |

| Hansen J statistic | 0.956 | |

| (0.328) | ||

| Control | Yes | Yes |

| Year FE | Yes | Yes |

| HC FE | Yes | Yes |

| Cluster | Yes | Yes |

| N | 507 | 507 |

| R2 | 0.851 | 0.174 |

| Variables | (1) Eastern Region | (2) Central Region | (3) Western Region |

|---|---|---|---|

| LStr | 9.423 *** | −10.420 | −44.003 |

| (2.693) | (18.541) | (29.275) | |

| _cons | −5.270 | 16.228 | 44.039 * |

| (3.588) | (15.266) | (23.633) | |

| Control | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| HC FE | Yes | Yes | Yes |

| Cluster | Yes | Yes | Yes |

| N | 404 | 55 | 48 |

| R2 | 0.202 | 0.745 | 0.647 |

| Variables | (1) High Income | (2) Upper Middle Income | (3) Lower Middle Income |

|---|---|---|---|

| LStr | 13.690 *** | 4.414 | 5.788 ** |

| (0.158) | (2.588) | (1.530) | |

| _cons | 73.619 ** | −8.077 | −0.975 |

| (1.994) | (8.739) | (1.893) | |

| Control | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| HC FE | Yes | Yes | Yes |

| Cluster | Yes | Yes | Yes |

| N | 87 | 226 | 194 |

| R2 | 0.537 | 0.286 | 0.206 |

| Variables | (1) Eastern Region | (2) Central Region | (3) Western Region |

|---|---|---|---|

| LStr | 18.086 *** | −6.989 | −43.388 |

| (3.716) | (11.943) | (24.694) | |

| LnStr × RD | −1.005 * | −2.659 ** | −0.056 |

| (0.457) | (0.997) | (1.554) | |

| _cons | −12.877 *** | 14.943 | 43.542 * |

| (3.524) | (9.077) | (20.087) | |

| Control | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| HC FE | Yes | Yes | Yes |

| Cluster | Yes | Yes | Yes |

| N | 404 | 55 | 48 |

| R2 | 0.207 | 0.771 | 0.647 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, A.; Zhao, J.; Su, Z.; Su, M. Does Industrial Structure Upgrading Promote China’s Outward Foreign Direct Investment (OFDI) in ASEAN Countries? Evidence from Provincial Panels. Economies 2024, 12, 228. https://doi.org/10.3390/economies12090228

Li A, Zhao J, Su Z, Su M. Does Industrial Structure Upgrading Promote China’s Outward Foreign Direct Investment (OFDI) in ASEAN Countries? Evidence from Provincial Panels. Economies. 2024; 12(9):228. https://doi.org/10.3390/economies12090228

Chicago/Turabian StyleLi, Ai, Jinjing Zhao, Zhenqing Su, and Miao Su. 2024. "Does Industrial Structure Upgrading Promote China’s Outward Foreign Direct Investment (OFDI) in ASEAN Countries? Evidence from Provincial Panels" Economies 12, no. 9: 228. https://doi.org/10.3390/economies12090228

APA StyleLi, A., Zhao, J., Su, Z., & Su, M. (2024). Does Industrial Structure Upgrading Promote China’s Outward Foreign Direct Investment (OFDI) in ASEAN Countries? Evidence from Provincial Panels. Economies, 12(9), 228. https://doi.org/10.3390/economies12090228