Abstract

Against the backdrop of rapidly growing distributed photovoltaics (DPVs) and mounting pressure on conventional frequency-regulation (FR) resources, this study proposes a day-ahead–intraday two-stage optimal scheduling strategy for aggregators of DPV + advanced energy storage participating in a joint energy–FR market. In the day-ahead stage (hourly resolution), a multi-aggregator-independent offering model is formulated that explicitly accounts for PV curtailment costs and storage operating/lifecycle costs. Subject to constraints on buy–sell transactions, PV output, storage charging/discharging power and state of charge (SOC), FR capacity, and power balance, the model co-optimizes energy and FR-capacity offers to maximize profit. In the intraday stage (15 min resolution), bidding deviation penalties are introduced, and a rolling optimization is employed to jointly adjust energy and FR dispatch/offers, reconfigure storage SOC in real time, reduce deviations from day-ahead schedules, and enhance economic performance. A three-aggregator case study indicates that, with deviation penalties considered, regulation-command tracking remains at a high level and PV utilization remains very high, while clearing costs decline and system frequency-response capability improves. The results demonstrate the proposed strategy’s implementability, economic efficiency, and scalability, enabling high-quality participation in ancillary services and promoting high-quality renewable integration under high-penetration distributed scenarios.

1. Introduction

Under China’s “Dual-Carbon” strategy (carbon peaking and carbon neutrality) and the requirements for building a new-type power system, clean energy is penetrating the grid at an accelerated pace, with distributed photovoltaics expanding particularly rapidly. With the rapid development of distributed photovoltaics, the instability of photovoltaic output has become a major challenge in power grid scheduling. The fluctuations in PV output not only impact the stability of the power system but also increase the complexity of the frequency regulation market. Traditional frequency regulation equipment, such as coal-fired units, faces limitations in efficiency and response time when dealing with PV fluctuations. In contrast, energy storage systems, with their fast response and flexible regulation capabilities, can effectively compensate for these shortcomings and become a key resource for stabilizing grid frequency []. Meanwhile, traditional FR providers such as coal-fired generating units face declining regulation performance and increasing marginal FR costs, highlighting the urgency of developing a new portfolio of flexible resources to ensure frequency-stable operation []. Owing to fast start–stop capability, rapid response, and strong bidirectional regulation, energy storage is progressively becoming a key FR support resource []. In DPV scenarios in particular, aggregating an energy storage system with PV and coordinating them through communications-based control can both smooth PV fluctuations and provide high-quality FR services to the grid []. PV–storage coordination thus offers high-precision, time-sensitive FR and is poised to constitute an essential component of ancillary services in high-renewables systems [].

In recent years, extensive research has been conducted on joint PV–storage frequency regulation. On the control side, proposed methods include state-of-charge partition control [], virtual synchronous generator schemes [], and priority-based scheduling strategies [] to optimize PV–storage power allocation and frequency-response performance. On the system-modeling side, the literature has developed real-time control models for PV–storage participation in automatic generation control command tracking [] and examined storage response characteristics, lifecycle degradation, and their impacts on FR performance []. In addition, studies have investigated participation strategies for storage aggregations in ancillary-service markets, including FR capacity bidding, market performance evaluation, and revenue-allocation mechanisms [].

Despite these advances, three key challenges remain in modeling the market behavior of FR resources. First, many day-ahead bidding models focus solely on profit maximization and do not explicitly incorporate PV curtailment losses and ESS operating/degradation costs, leading to a disconnect between economic planning and physical feasibility []. Second, the intraday stage is often simplified as rule-based control without a mechanism to coordinate dispatch and revenue, limiting aggregators’ ability to flexibly address operational deviations []. Third, the lack of bidding mechanisms that effectively coordinate resource sharing and revenue allocation among multiple aggregators tends to cause system-level imbalances in resource utilization and inequitable returns []. In parallel, an encryption-based coordinated kilowatt–megawatt trading framework achieves privacy-preserving bidding and settlement and strengthens multi-party coordination, offering relevant implications for DPV–storage aggregators [].

To address the above issues, this paper focuses on the participation of distributed photovoltaics + advanced energy storage aggregators in system frequency regulation and proposes a two-stage day-ahead–intraday optimal scheduling framework. In the day-ahead stage (hourly resolution), we formulate a multi-aggregator-independent offer model that explicitly accounts for PV curtailment costs and storage operating/degradation costs. The model integrates PV output forecasts and storage characteristics, constrains each aggregator’s dispatchable energy, and co-optimizes joint energy and FR-capacity offers to maximize profit.

In the intraday phase, with a 15 min time resolution, the focus is on addressing frequency deviations and power imbalances during operation. Aggregators employ a rolling optimization bidding strategy aimed at maximizing their revenue, thereby reducing deviations between energy and frequency regulation bids. By dynamically optimizing the state of charge of energy storage and considering deviation penalties, aggregators are able to achieve maximum profitability. This mechanism ensures the efficient allocation of resources, enhances the overall system’s frequency regulation response and economic performance, and minimizes system volatility and uncertainty while ensuring the operational safety of each aggregator. The strategy is self-incentivizing, fair, and scalable, and it effectively improves the quality of coordinated frequency regulation and overall operational efficiency in scenarios with multiple participating aggregators.

2. Operational and Market Mechanisms for Aggregated Distributed PV with Advanced Energy Storage in Frequency Regulation

2.1. Hierarchical Control Architecture

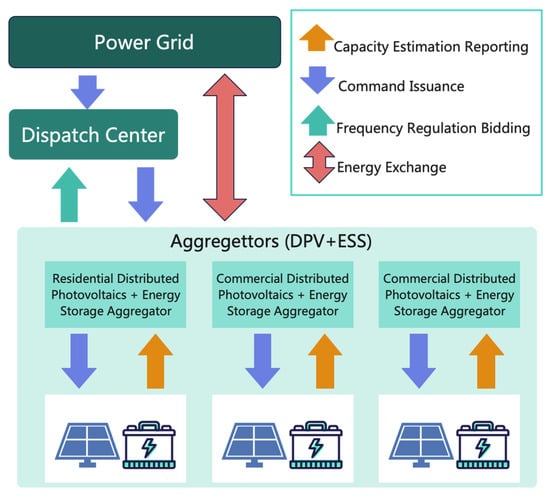

In the day-ahead bidding and clearing phase, aggregators are required to estimate and report their energy market and frequency regulation market bid information for each time period on the operational day based on the capabilities of the distributed photovoltaics and energy storage systems. As shown in Figure 1, The dispatch center clears the day-ahead energy and frequency regulation markets based on the bids submitted by all aggregators, determining the market clearing price and the awarded quantity for each DPV and ESS aggregator. Subsequently, each aggregator reallocates the frequency regulation capacity of the distributed PV and ESS within its aggregation range.

Figure 1.

Distribution Network Layer-Virtual Power Plant Layer-Component Layer Control Architecture.

The Distributed Photovoltaics + Advanced Energy Storage aggregator needs to achieve continuous and precise control, with intraday and real-time control being especially critical. Power distribution based on the power margin consistency principle enables more rational utilization of the regulation capacity of each unit, thereby improving the overall accuracy and response speed of the regulation. In the settlement phase, the dispatch center calculates the frequency regulation mileage and performance metrics for each time period based on the aggregator’s energy baseline and response to AGC commands. These calculations determine the aggregator’s energy market revenue and frequency regulation market revenue.

The frequency regulation market adopts a performance-based revenue mechanism, where the settlement price in the frequency regulation market is the sum of the price for the capacity component and the price for the performance component. The higher the performance metric, the better the frequency regulation services provided, which also translates to higher revenue for the frequency regulation resources. Aggregators primarily consist of three components: distributed photovoltaic generation systems, energy storage devices, and communication systems.

2.2. Trading Method for Distributed Photovoltaics + Advanced Energy Storage Aggregators in the Energy-Frequency Regulation Market

The first stage is the day-ahead market bidding optimization phase. Distributed Photovoltaics + Advanced Energy Storage aggregators, based on the day-ahead 24 h photovoltaic output forecast and the predicted electricity prices for the energy-frequency regulation market, submit their bidding output for each time period of the next day before the day-ahead market closes. During the decision-making process for the bidding strategy in this phase, special attention is given to the coupling relationship between the day-ahead market, PV curtailment, and energy storage operating losses. After the dispatch center completes centralized optimization and clearing of the energy market and pre-clearing of the frequency regulation market, the Distributed Photovoltaics + Advanced Energy Storage aggregator signs a day-ahead energy market transaction contract with the dispatch center.

The second stage is the intraday-real-time market rolling optimization bidding phase. Distributed Photovoltaics + Advanced Energy Storage aggregators adjust their day-ahead bids based on the latest photovoltaic output forecast from the PV plant and real-time market electricity prices. Every 15 min, they submit new bids for the energy-frequency regulation market, revising their frequency regulation market bidding output. Each time, they formulate a bidding strategy for the subsequent 4 h (16 time periods) and use the optimized results of the first period in the current rolling window. This process progressively reduces the deviation from the day-ahead bidding plan. In the intraday-real-time phase, the aggregator optimizes with the objective of maximizing its own revenue and minimizing the tracking error of frequency regulation instructions. Aggregators can achieve a response to the energy-frequency regulation commands by optimizing their bidding strategies and appropriately utilizing energy storage capacity, while ensuring that their own load requirements are met.

3. Day-Ahead Optimization Control Decomposition Strategy and Intraday-Real-Time Precision Control Strategy for Distributed Photovoltaics + Advanced Energy Storage Aggregators Considering Frequency Regulation Services

3.1. Day-Ahead Optimization Control Decomposition Strategy

In the day-ahead stage, the declared electricity purchase and sale quantities of distributed photovoltaic (PV) and advanced energy storage aggregators in the energy market are directly confirmed as the market-cleared quantities. To ensure PV consumption efficiency, a PV declaration deviation penalty mechanism is incorporated into the model. Aggregators synergistically optimize the declaration schemes for energy purchase/sale and frequency regulation (FR) capacity by integrating PV output forecasts and the charging-discharging characteristics of energy storage. On the premise of maximizing their own profits, aggregators determine the day-ahead bidding capacities for participating in the energy market and FR ancillary service market in each time period.

For day-ahead market clearing, the total clearing cost of intraday transactions is taken as the optimization objective to minimize, and clearing calculations are only performed on the day-ahead FR capacity declared by each aggregator, thereby generating the day-ahead FR cleared results.

In the intraday stage, aggregators take the day-ahead FR cleared results and the declared electricity purchase/sale quantities as the basis. To improve their compliance capabilities, an additional deviation penalty mechanism is introduced. Through a rolling optimization approach, aggregators solve for the intraday bidding capacities that maximize profits in each time period. Owing to the higher time resolution (15 min) of intraday rolling optimization and the significantly improved accuracy of PV output forecasts (as the time approaches actual operation), the optimized bidding capacities for energy purchase/sale and FR obtained in this stage are directly adopted as the operational control strategies for actual execution.

3.1.1. Objective Function

3.1.2. Constraints

Aggregator’s Buy-Sell Power Constraints:

Photovoltaic Output Constraints:

Energy Storage Charging and Discharging Power Constraints:

Frequency Regulation Capacity Constraints:

Power Balance Constraints:

where is a binary (0–1) indicator of the buying/selling status of aggregator in period ( = 1 indicates buying/import, = 0 indicates selling/export); and denote the maximum admissible buying (import) and selling (export) power, respectively; , represent the charging and discharging power of the energy storage for aggregator , during time period t; represent the charging and discharging efficiency of the energy storage; and represent the charging and discharging efficiency of the energy storage; and represent the lower and upper limits of the state of charge of the energy storage for aggregator ; represents the SOC of aggregator at time ; and represent the SOC at the start and end times of the aggregator ’s operation; is the minimum frequency regulation capacity required by the market; is the state variable indicating aggregator ’s participation in frequency regulation; and represents a large number.

3.2. Intraday-Real-Time Precision Control Strategy

Based on the ultra-short-term forecasting data of distributed photovoltaics and advanced energy storage, as well as the aggregator’s day-ahead awarded capacity, a real-time bidding deviation penalty mechanism is introduced. The objective is to maximize the joint aggregator’s revenue from participation in the real-time energy market and frequency regulation ancillary services market. This mechanism determines the real-time bidding capacity for the distributed PV + advanced energy storage aggregator in both the energy market and frequency regulation market for each time period.

3.2.1. Intraday-Real-Time Coordinated Bidding Strategy for Distributed Photovoltaics + Advanced Energy Storage

Due to the intermittency and volatility of photovoltaic output, there is a deviation between the actual output and the day-ahead forecast, which affects the stability of the system operation. In this paper, a bidding deviation penalty mechanism is introduced to incentivize improvements in day-ahead forecast accuracy. The bidding deviation penalty costs include energy market deviation penalties and frequency regulation market deviation penalties. To reduce the deviation penalty, PV can participate in frequency regulation by reducing output; however, its frequency regulation performance still lags behind traditional units such as coal-fired power plants due to the uncertainty of PV output. Moreover, the output deviation results in an inability to accurately meet the day-ahead bidding capacity, causing certain deviation penalties. Energy storage can shift energy, ensuring continuous and stable generation, and has flexible regulation characteristics compared to conventional coal-fired units. Therefore, the joint participation of distributed photovoltaics and energy storage aggregators in the energy-frequency regulation ancillary services market not only reduces the bidding deviation caused by PV output uncertainty but also allows the use of curtailed energy to gain certain revenues through energy storage.

3.2.2. Objective Function

3.2.3. Constraints

Photovoltaic Output Constraints:

Energy Storage Charging and Discharging Power Constraints:

Frequency Regulation Capacity Constraints:

Power Balance Constraints:

The day-ahead bidding is formulated as an MILP using standard big-M on/off coupling to link binary and continuous variables, and is solved in MATLAB R2024b via YALMIP with Gurobi. A representative 24-step instance contains 72 binary and ~216 continuous variables. The intraday rolling (96 steps) adopts the same MILP structure, with each solution window having a decision size about four times that of the day-ahead case.

4. Case Study Analysis

This case study focuses on the intraday/day-ahead market participation strategies of three distributed photovoltaic-energy storage (PV-ESS) aggregators. Each aggregator is equipped with independent photovoltaic modules and an energy storage system (ESS). The key ESS-related parameters of each aggregator are listed in Table 1, and the PV outputs are given in Table 2.The core operating parameters and market pricing mechanism are as follows: The electricity price adopts a time-of-use (TOU) pricing model. In the energy market, the electricity purchase price is ¥0.31/kW (RMB 0.31 per kW) during 00:00–06:00 and 17:00–24:00, ¥1.07/kW (RMB 1.07 per kW) during 07:00–10:00 and 16:00, and ¥0.64/kW (RMB 0.64 per kW) during 11:00–15:00. The electricity sales price is set synchronously on a time-of-use basis, with corresponding rates of ¥0.16/kW, ¥0.53/kW, and ¥0.32/kW for the aforementioned time periods, respectively.

Table 1.

Key ESS Parameters per Aggregator.

Table 2.

Photovoltaic Output of Each Aggregator.

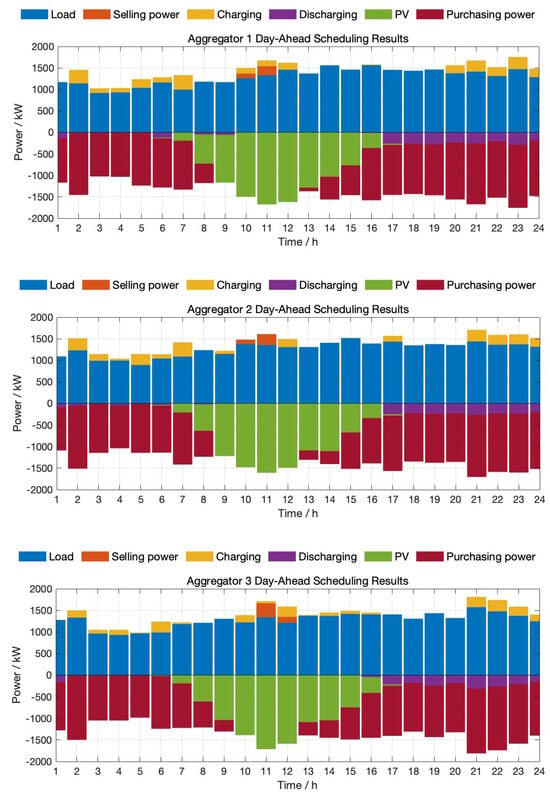

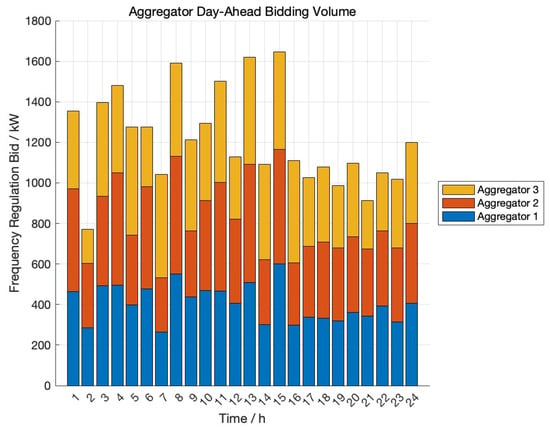

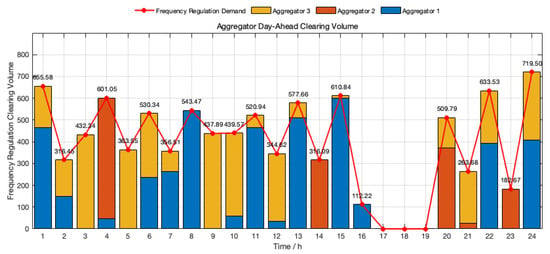

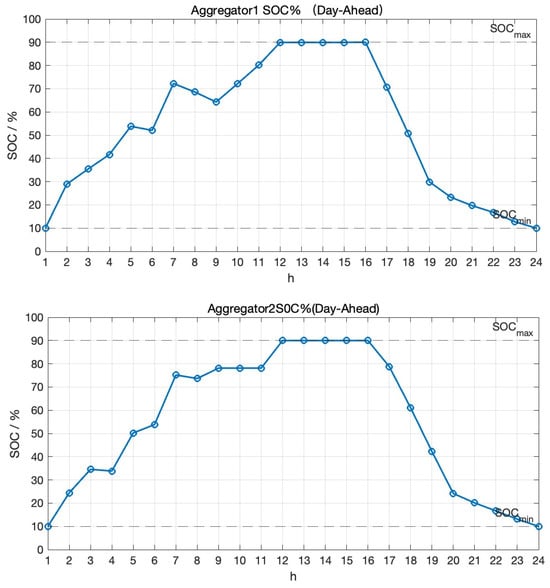

Consider three distributed PV–storage aggregators that operate independently while jointly participating in the energy market and frequency-regulation ancillary services. Each aggregator, aiming to maximize profit based on its day-ahead energy and FR capabilities, makes rational use of storage: the overall planning for participation in the energy market is shown in Figure 2, the day-ahead bidding strategies for the FR market are shown in Figure 3, and the corresponding day-ahead clearing results are shown in Figure 4. Based on day-ahead energy and FR requirements, the dispatching organization schedules each aggregator’s energy and FR provision across time periods to minimize total clearing costs. To ensure full utilization of storage, the state-of-charge trajectories of each aggregator are presented in Figure 5.

Figure 2.

Aggregators’ Day−Ahead Energy Scheduling Diagram.

Figure 3.

Day-Ahead Bidding Strategy for the Frequency-Regulation Market.

Figure 4.

Day-Ahead Clearing Results for Frequency Regulation Capacity.

Figure 5.

Day-Ahead Planned SOC Trajectories of Aggregators’ Energy Storage.

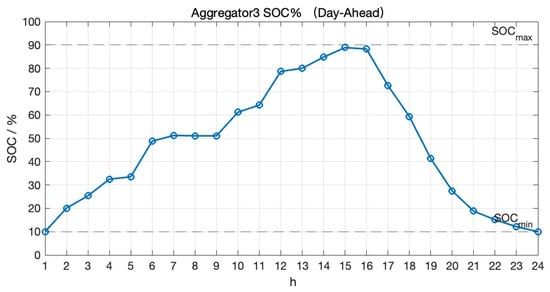

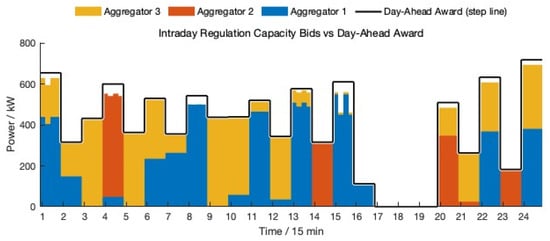

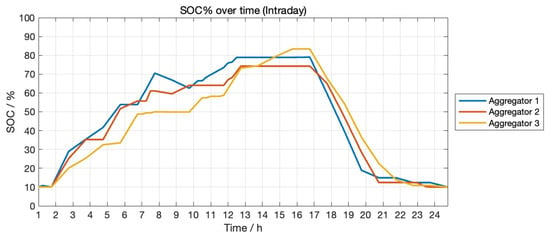

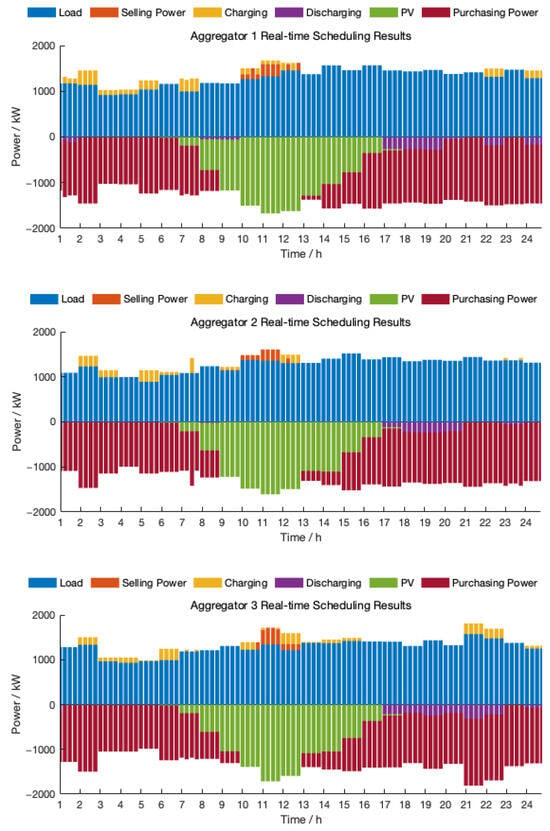

Given that the day-ahead market has been cleared, aggregators must incorporate deviation penalties relative to their day-ahead awards when submitting intraday bids in the energy and frequency-regulation markets. Accounting for PV output uncertainty and day-ahead–intraday forecast errors, and conditional on the day-ahead awards, each aggregator maximizes intraday total revenue via a rolling optimization bidding strategy that jointly plans energy and frequency-regulation offers, with the frequency-regulation offer capacity for each awarded interval dynamically revised on a 15 min timescale (see Figure 6). To enhance availability and mitigate deviation risk, the state of charge of storage is configured in a synchronized rolling manner, with its evolution shown in Figure 7; the intraday coordinated planning results for the energy market are reported in Figure 8.

Figure 6.

Intraday Bidding Strategy for the Frequency-Regulation Market.

Figure 7.

Intraday SOC Trajectories of Aggregators’ Energy Storage.

Figure 8.

Aggregators’ Intraday Energy Scheduling Diagram.

Subject to penalties on frequency-regulation and energy deviations, the aggregators achieved regulation-command tracking accuracies of 94.48%, 94.62%, and 100.00%, and PV utilization (non-curtailment) rates of 99.44%, 99.44%, and 99.99%, respectively, thereby validating that the proposed dynamic interaction strategy enables high-quality integration of renewables while providing ancillary services and ensures safe, stable operation for each aggregator.

5. Conclusions and Outlook

5.1. Conclusions

This paper investigates the coordinated participation strategy of distributed PV-storage aggregators in joint energy and frequency regulation markets under high-renewable-penetration scenarios. Focusing on the challenges of photovoltaic output volatility, insufficient frequency regulation capacity, and market coordination among multiple entities, this study proposes a two-stage optimal scheduling framework integrating day-ahead planning and intraday rolling optimization.

- (1)

- In the day-ahead stage, a multi-aggregator independent offering model is developed. The model explicitly considers PV curtailment costs, storage operation and degradation costs, and energy-frequency regulation coupling constraints. By jointly optimizing energy and frequency regulation capacity bids, the framework achieves an economically efficient allocation of flexible resources while ensuring physical feasibility.

- (2)

- In the intraday stage, a rolling optimization strategy with deviation penalties is introduced. By dynamically updating PV forecasts, market prices, and state of charge trajectories, aggregators can effectively reduce deviations from day-ahead plans, enhance regulation-command tracking accuracy, and improve real-time economic performance.

- (3)

- A three-aggregator case study demonstrates that the proposed strategy significantly improves regulation-command tracking performance and PV utilization rates compared to baseline scheduling schemes. It ensures reliable frequency regulation services and reduces system clearing costs, thereby validating the strategy’s effectiveness, scalability, and engineering applicability.

In summary, the proposed day-ahead–intraday coordinated scheduling strategy provides a comprehensive and economically efficient framework for distributed PV-storage aggregators to participate in energy and ancillary service markets. It supports high-quality renewable integration while enhancing the system’s frequency regulation capability, offering theoretical and practical insights for future distributed resource aggregation and market operation mechanisms.

5.2. Outlook

Although this study provides a systematic and practical framework for PV-storage aggregators, several avenues merit further exploration:

- (1)

- Algorithmic enhancement and uncertainty modeling: Future work can incorporate advanced forecasting techniques and robust or stochastic optimization methods to address uncertainties in PV output, market prices, and regulation signals, further improving the accuracy and adaptability of the proposed model.

- (2)

- Multi-market and multi-service coordination: Beyond energy and frequency regulation markets, future research can explore coordinated participation in carbon trading, capacity markets, and demand response programs, thereby maximizing overall economic benefits.

- (3)

- Engineering deployment and scalability: Considering real-world implementation constraints, future studies may investigate lightweight or distributed computation methods to support edge-node deployment. Pilot demonstrations could verify the model’s adaptability under diverse grid and market environments, promoting the transformation of theoretical strategies into practical applications.

These research directions will help to further improve the flexibility, robustness, and economic efficiency of distributed PV-storage aggregator participation strategies in future power systems.

Author Contributions

Conceptualization, X.Y., Y.D. and Z.Y.; methodology, X.Y., Y.D., Z.Y., L.G. and S.W.; validation, Y.D., S.W. and Q.A.; formal analysis, X.Y. and S.W.; investigation, L.G. and S.W.; resources, Z.Y. and Q.A.; data curation, X.Y. and Q.A.; writing—original draft preparation, S.W., Q.A. and A.L.; writing—review and editing, X.Y., Y.D. and L.G.; visualization, Q.A. and A.L.; supervision, Q.A.; project administration, Q.A.; funding acquisition, X.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research is financially supported by the Science and Technology Project of State Grid Corporation of China (520940240036).

Data Availability Statement

The data can be obtained from the paper.

Conflicts of Interest

Y.D., Z.Y., L.G. and S.W. were employed by the State Grid Shanghai Electric Power Research Institute. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- Ma, X.; Ma, Q.; Li, X.; Su, B.; Chen, L.; Zhang, Y.; Li, W. Discussion on framework of frequency regulation and control systems for northwest new power system. Electr. Power Autom. Equip. 2025, 45, 217–224. [Google Scholar]

- Wang, Y.Y.; Liu, H.H.; Si, J.C.; Song, S.H.; Cai, Y.B. Analysis on the strategies of energy storage stations participating in the electricity energy-regulation joint market. Shandong Electr. Power 2024, 51, 55–66. [Google Scholar]

- Qian, G.; Meng, J.; Zhu, H.; Ding, Q.; Chen, X. Capacity Planning and Operation Strategy of New PV-Storage Power Station Based on Frequency Modulation Service. Electr. Power 2023, 56, 132–138. [Google Scholar]

- Tostado-Véliz, M.; Liang, Y.; Hasanien, H.M.; Turky, R.A.; Martínez-Moreno, J.; Jurado, F. Robust Optimal Coordination of Active Distribution Networks and Energy Communities with High Penetration of Renewables. Renew. Energy 2023, 218, 119286. [Google Scholar] [CrossRef]

- Ma, Y.; Hu, Z.; Song, Y. Hour-Ahead Optimization Strategy for Shared Energy Storage of Renewable Energy Power Stations to Provide Frequency Regulation Service. IEEE Trans. Sustain. Energy 2022, 13, 2331–2342. [Google Scholar] [CrossRef]

- Lin, A.; Ke, Q.; Jiang, Y. Market mechanism design of independent energy storage participating in frequency modulation auxiliary service market. Electr. Power Autom. Equip. 2022, 42, 26–34. [Google Scholar]

- Chen, Y.; Strunz, K.; Wang, X.; Wang, L.; Wang, K.; Li, P.; Xu, J.; Huang, S.; Xia, Y.; Xu, J.; et al. Guest Editorial: Models, Methods, and Platforms for Electromagnetic Transient Simulation of Modern Power Systems with High Penetration Power Electronic Integration. IET Renew. Power Gener. 2022, 17, 1–5. [Google Scholar] [CrossRef]

- Hu, Z.; Xia, R.; Wu, L.; Liu, H. Joint Operation Optimization of Wind-Storage Union With Energy Storage Participating Frequency Regulation. Power Syst. Technol. 2016, 40, 2251–2257. [Google Scholar]

- Yang, Y.G.; Lu, Q.Y.; Wu, S.X.; Wang, Z.; Xia, T. Coordinated Primary Frequency Control for Virtual Power Plant Based on Distributed Subgradient-Projection Method. In Proceedings of the 2019 IEEE Innovative Smart Grid Technologies–Asia (ISGT Asia), Chengdu, China, 21–24 May 2019. [Google Scholar]

- Fang, Y.; Zhao, S.; Du, E.; Li, S.; Li, Z. Coordinated Operation of Concentrating Solar Power Plant and Wind Farm for Frequency Regulation. J. Mod. Power Syst. Clean Energy 2021, 9, 751–759. [Google Scholar] [CrossRef]

- Qin, W.; Li, X.; Jing, X.; Zhu, Z.; Lu, R.; Han, X. Multi-Temporal Optimization of Virtual Power Plant in Energy-Frequency Regulation Market under Uncertainties. J. Mod. Power Syst. Clean Energy 2025, 13, 675–687. [Google Scholar] [CrossRef]

- Guan, L.; Huang, G.; Wu, F.; Liu, S.; Zheng, X.; Wu, L.; Li, Y.; Chang, J.; Peng, X. Research on Power Dispatching and Marketization Mechanism for High-Proportion Distributed Photovoltaic. Zhejiang Electr. Power 2022, 41, 10–16. [Google Scholar]

- Zhang, J.; Li, X.; Tan, Q.; Zhong, Z.; Zhao, Q. Multi-time Scale Robust Optimization for Integrated Multi-Energy System Considering the Internal Coupling Relationship of Photovoltaic Battery Swapping-Charging-storage Station. J. Energy Storage 2025, 109, 115109. [Google Scholar] [CrossRef]

- Shuai, X.; Wang, X.; Wang, Z.; Guo, H.; Ma, Z. Cooperative Operation for Multiple Integrated Energy Systems Considering Wind Power Consumption by Nash Bargaining Convention. J. Xi’an Jiaotong Univ. 2022, 56, 187–196. [Google Scholar]

- Lin, J.; Qiu, J.; Zhang, C.; Lu, X.; Tao, Y.; An, S. An Encryption-Based Coordinated Kilowatt and Negawatt Energy Trading Framework. IEEE Internet Things J. 2025, 12, 48962–48977. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).