Solar Energy Resource and Power Generation in Morocco: Current Situation, Potential, and Future Perspective

Abstract

1. Introduction

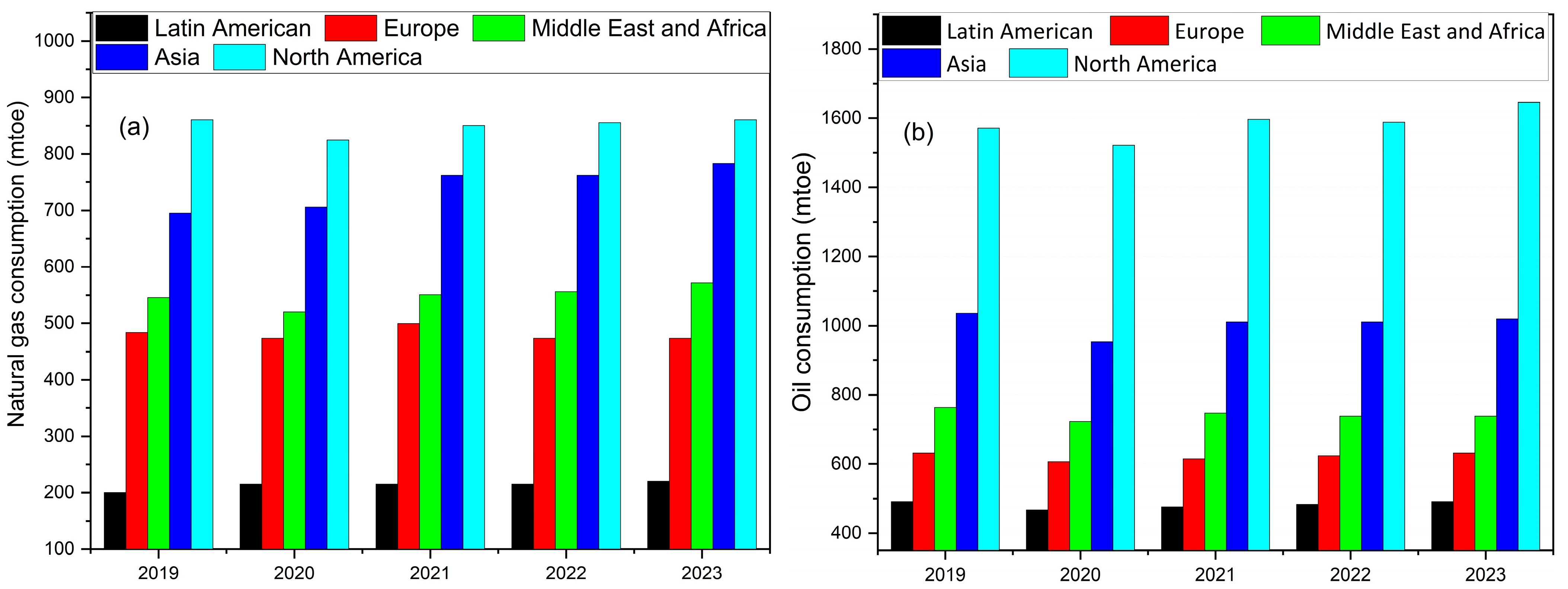

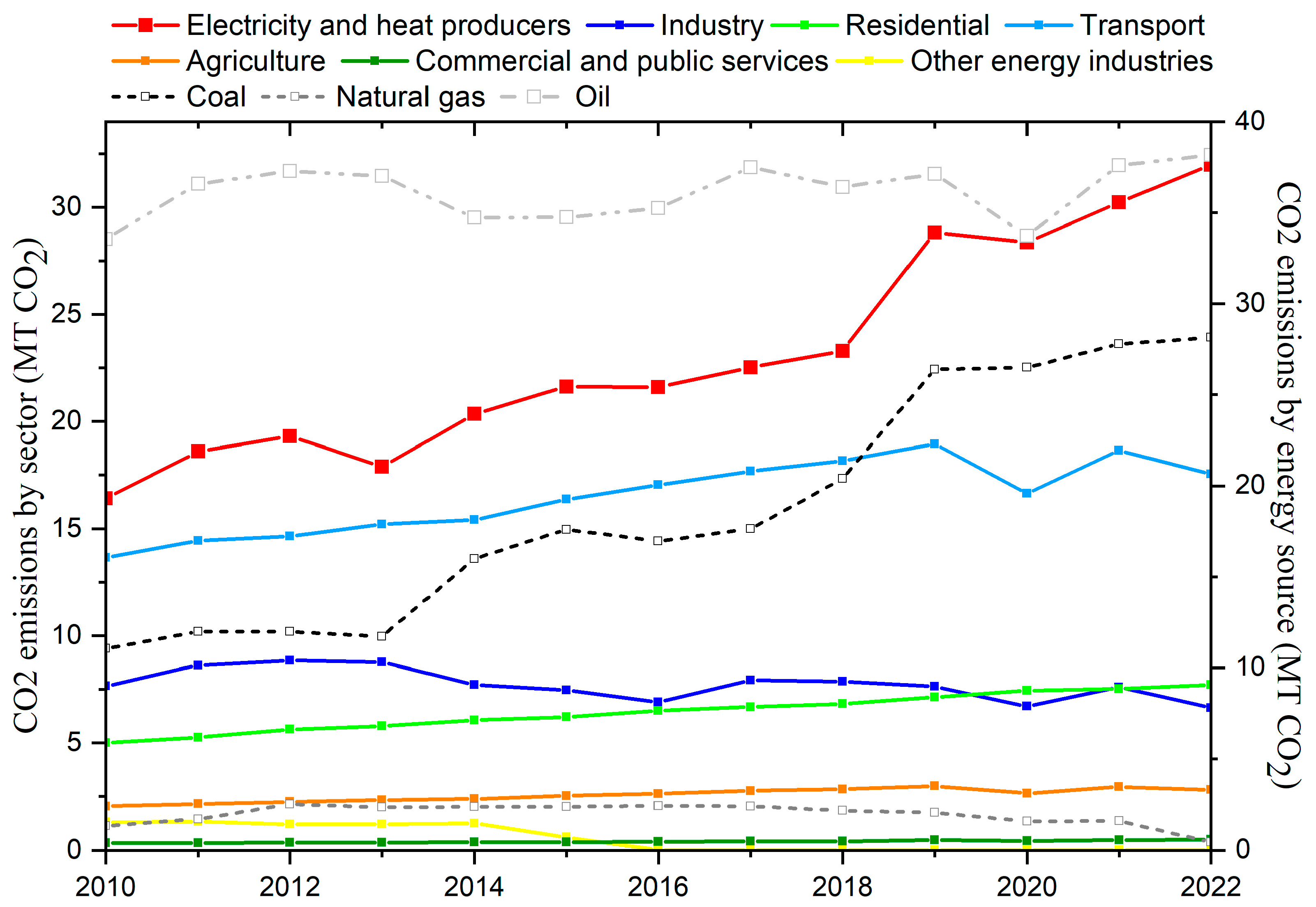

2. Overview of Morocco’s Energy Landscape

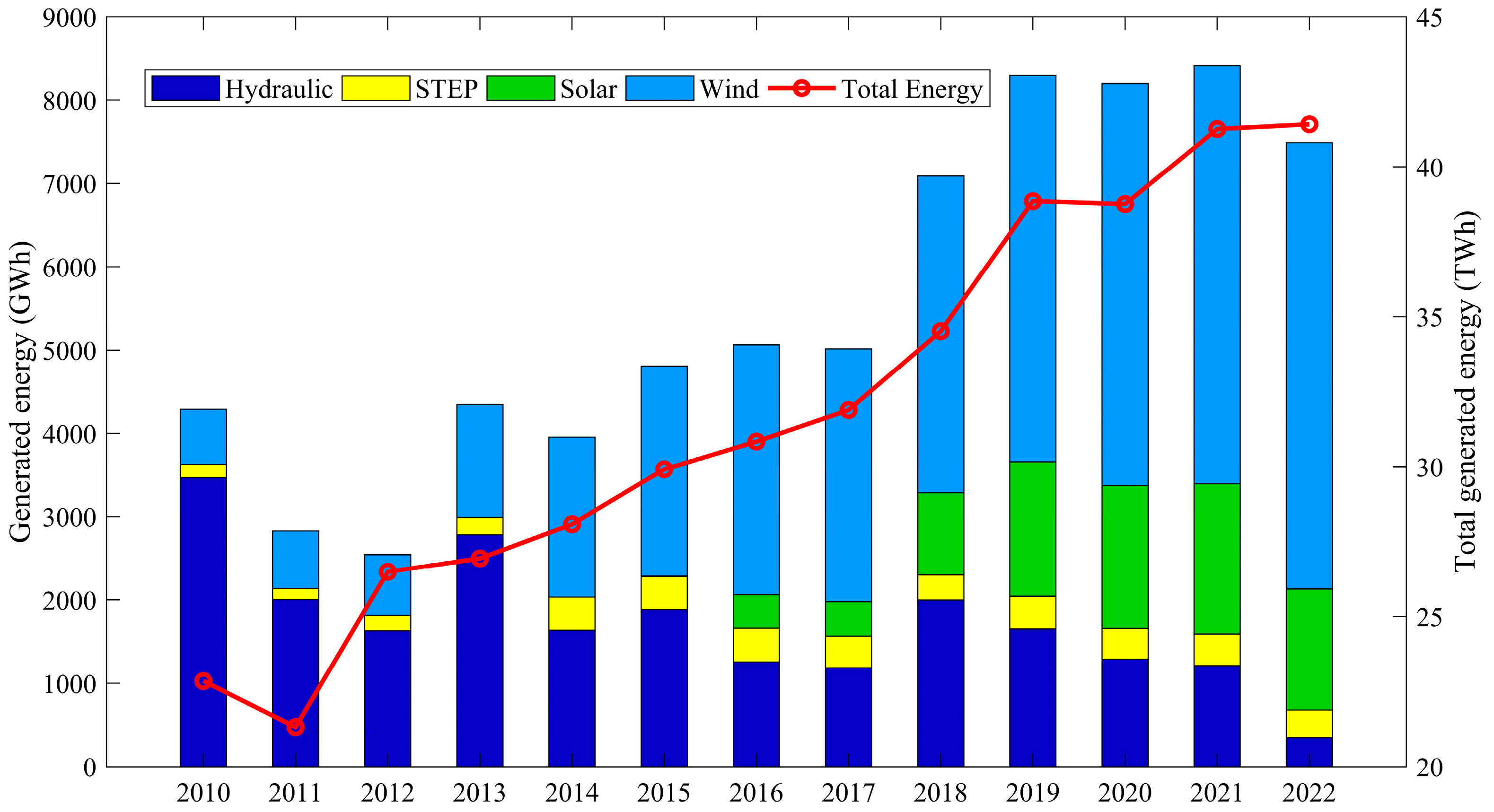

2.1. Moroccan Energy Sector in Numbers

2.2. Moroccan Energy Strategy

2.3. Moroccan Green Hydrogen Strategy

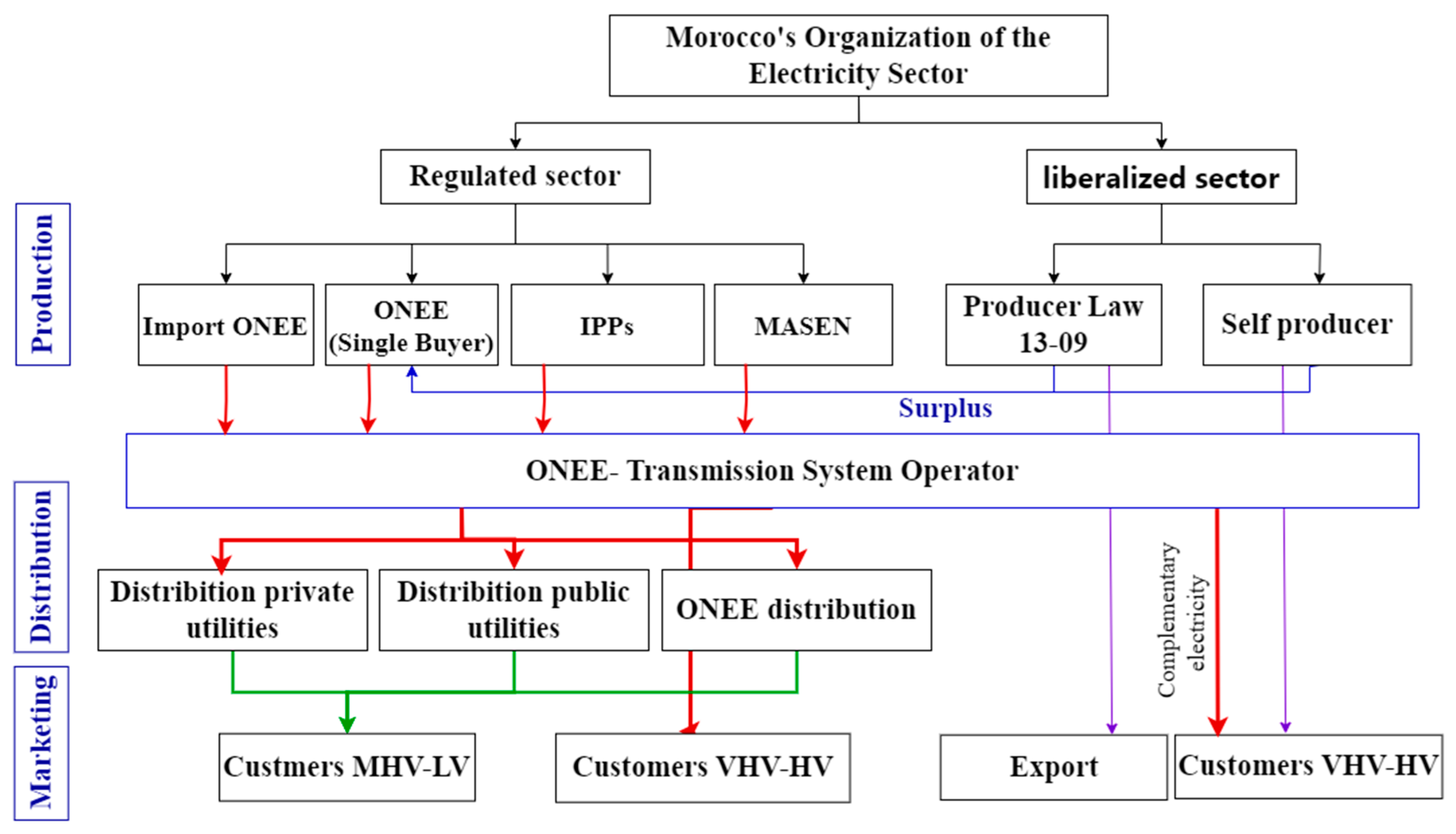

2.4. Electricity Sector Organization

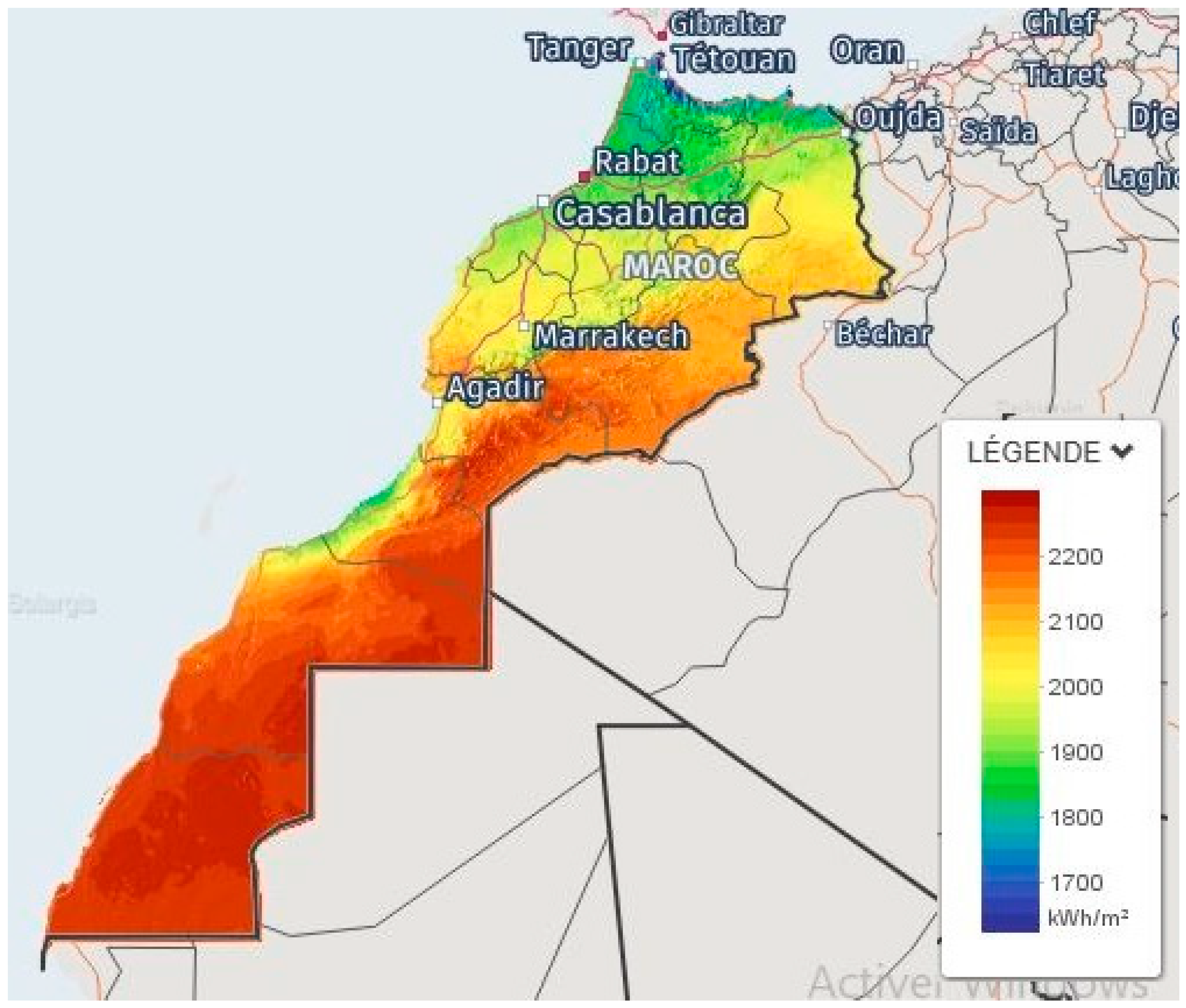

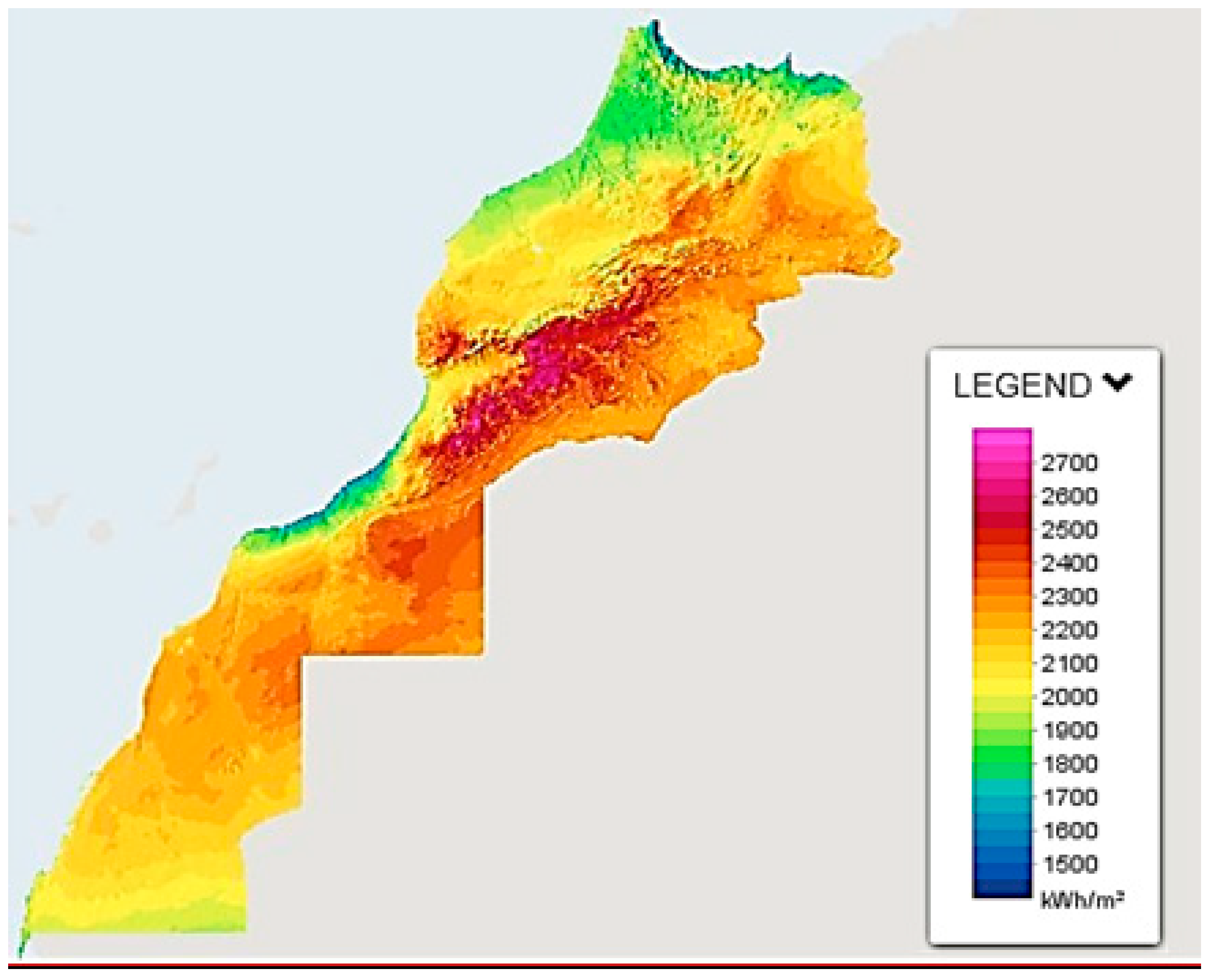

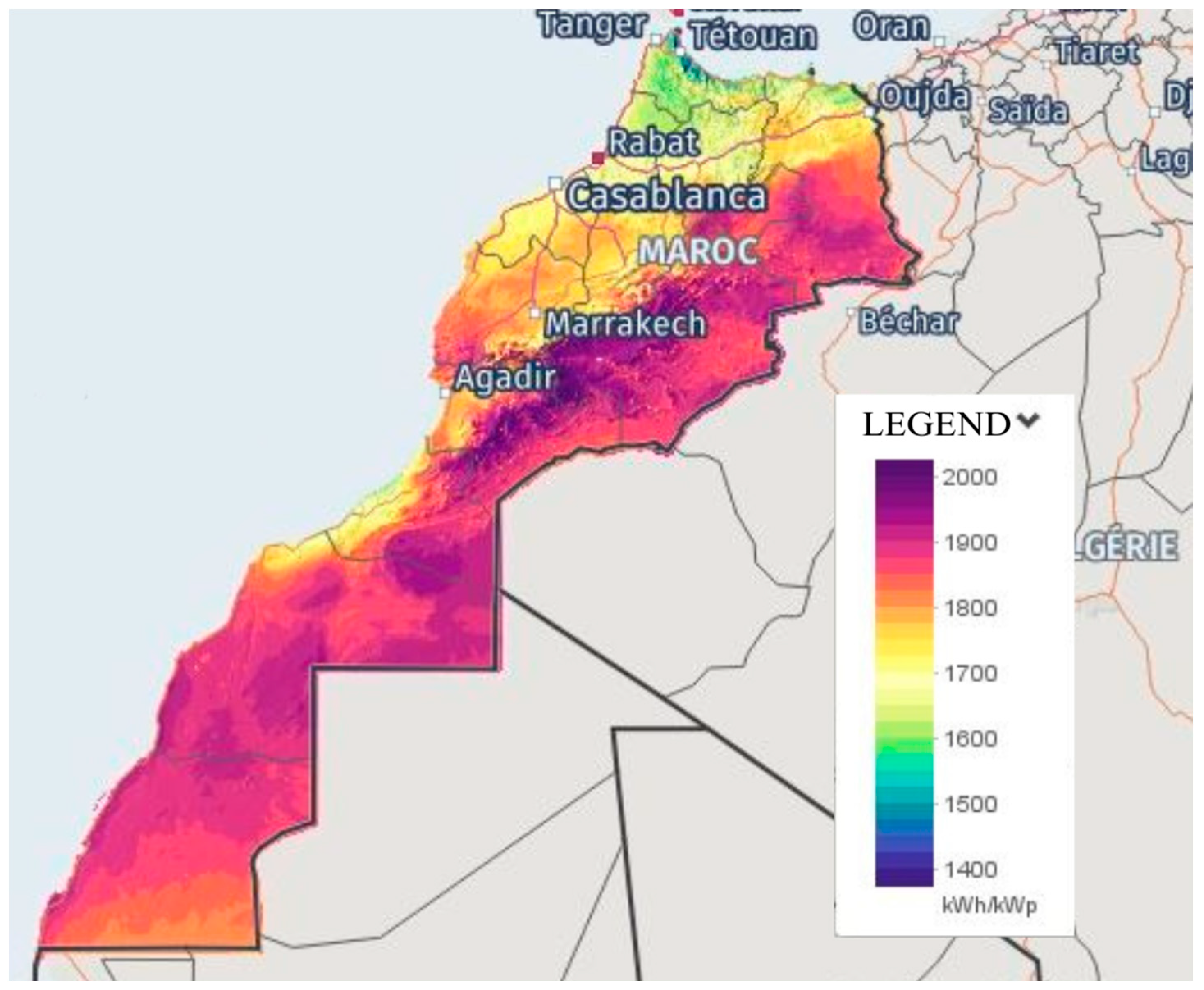

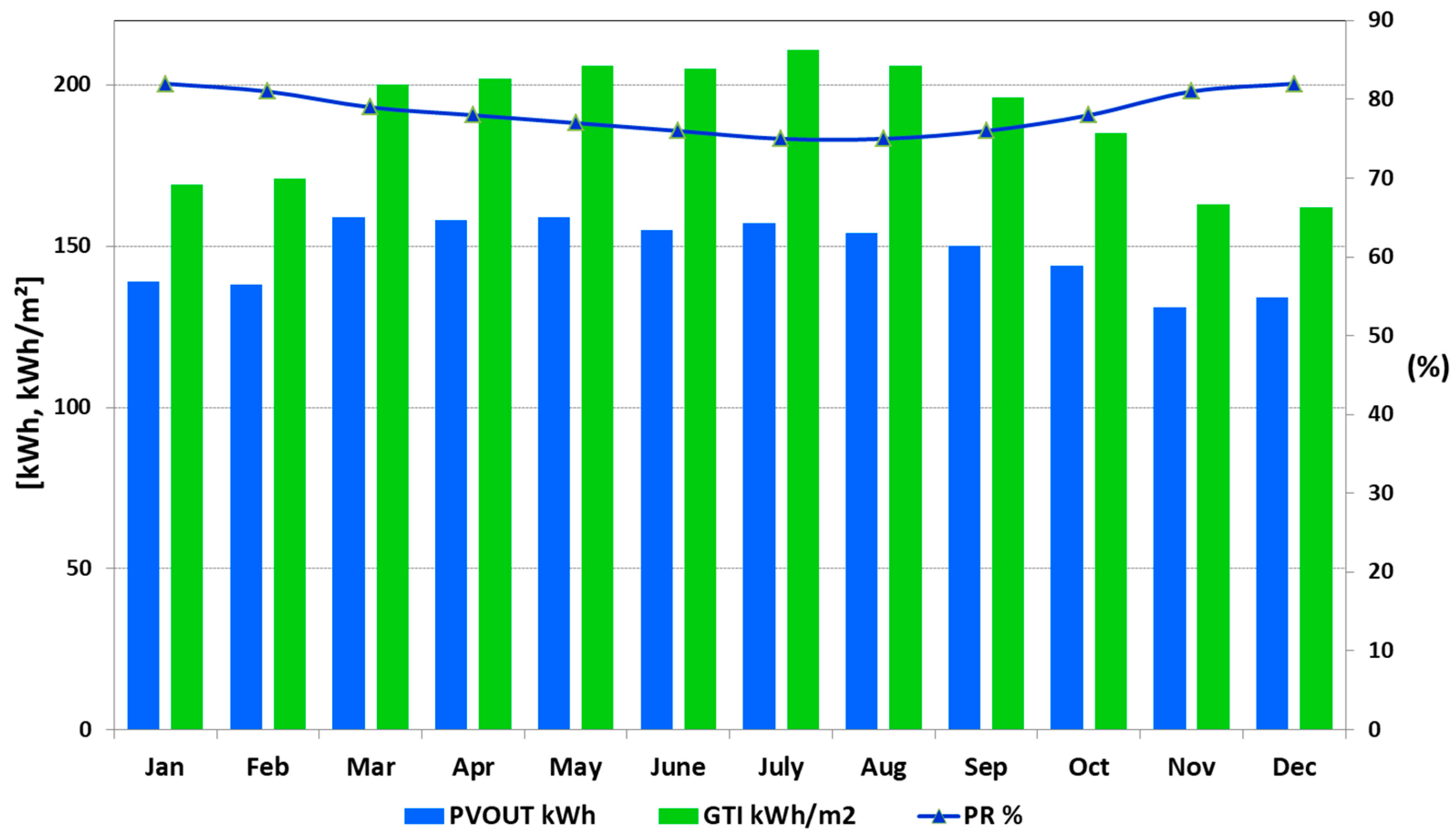

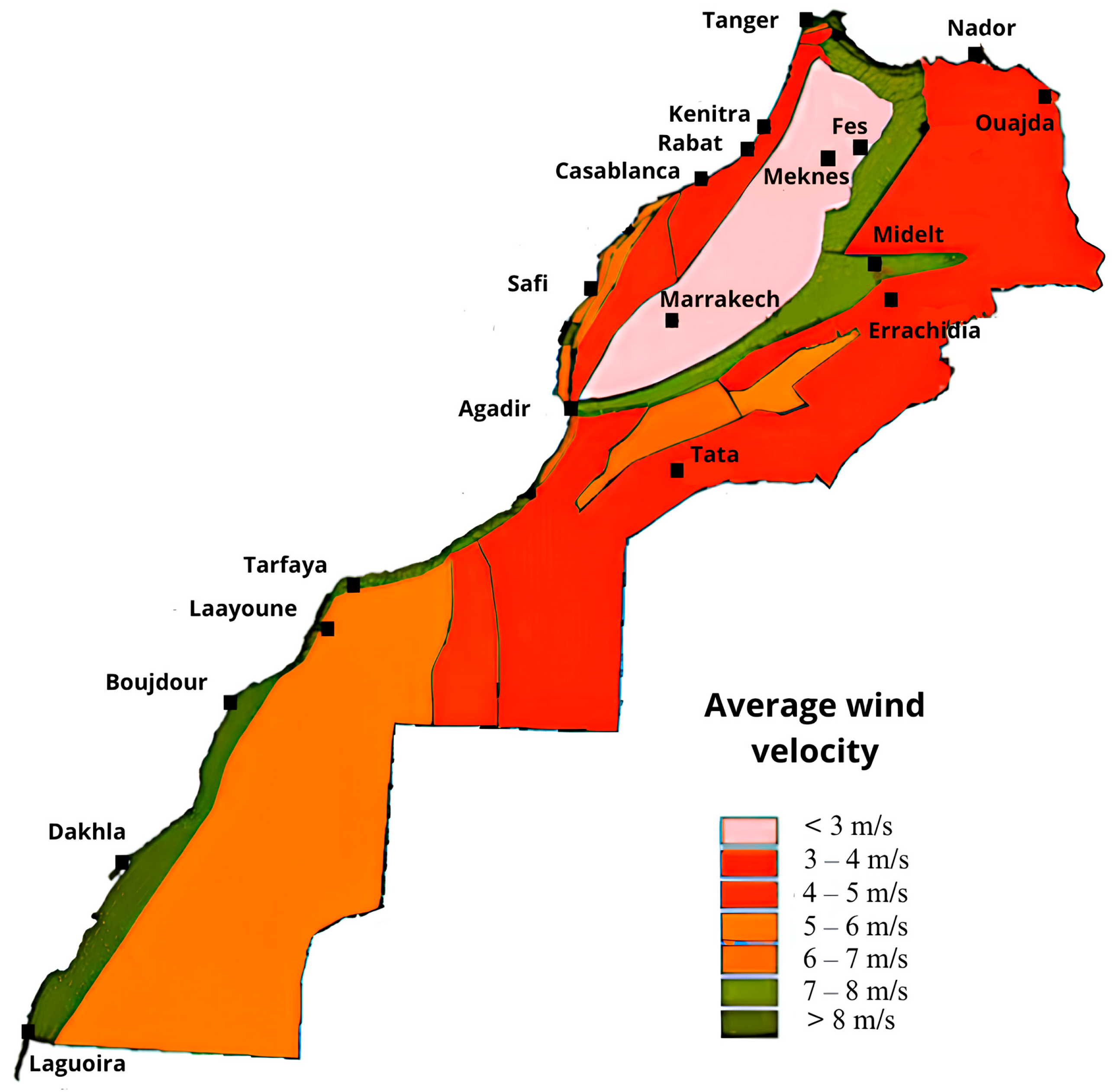

3. Solar Resources Potential in Morocco

4. Current State of Solar Energy in Morocco

4.1. Policies and Regulations

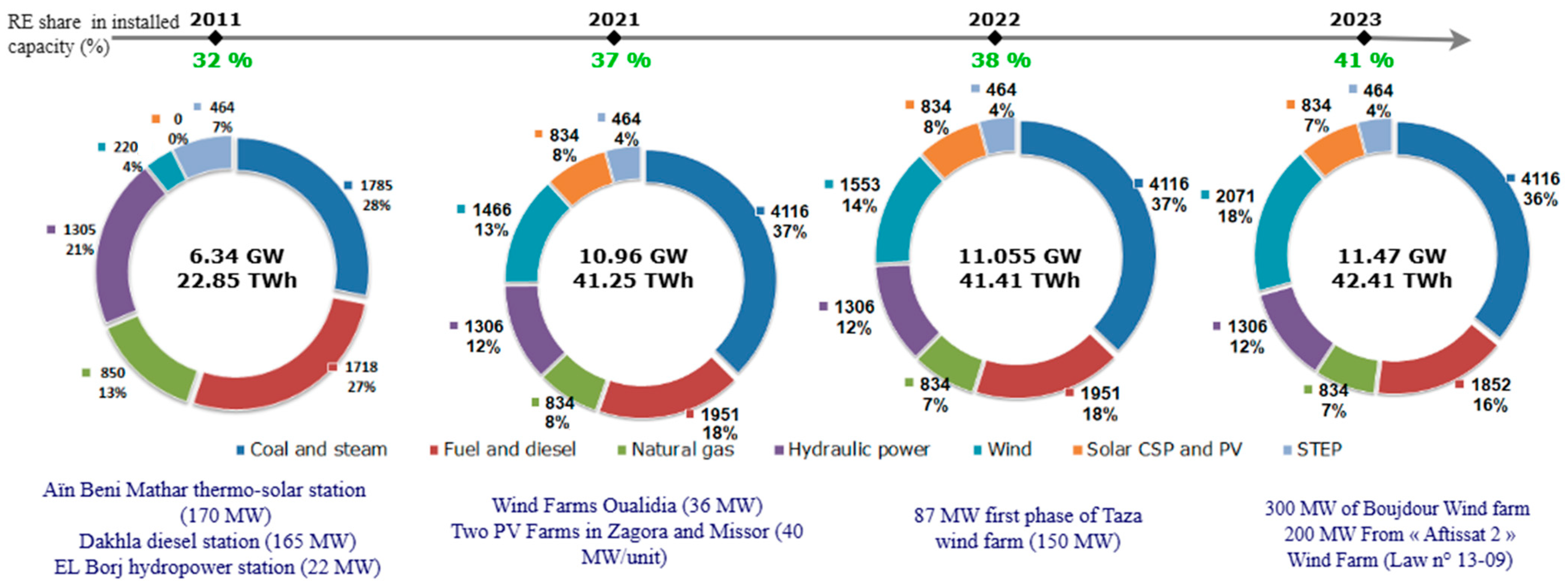

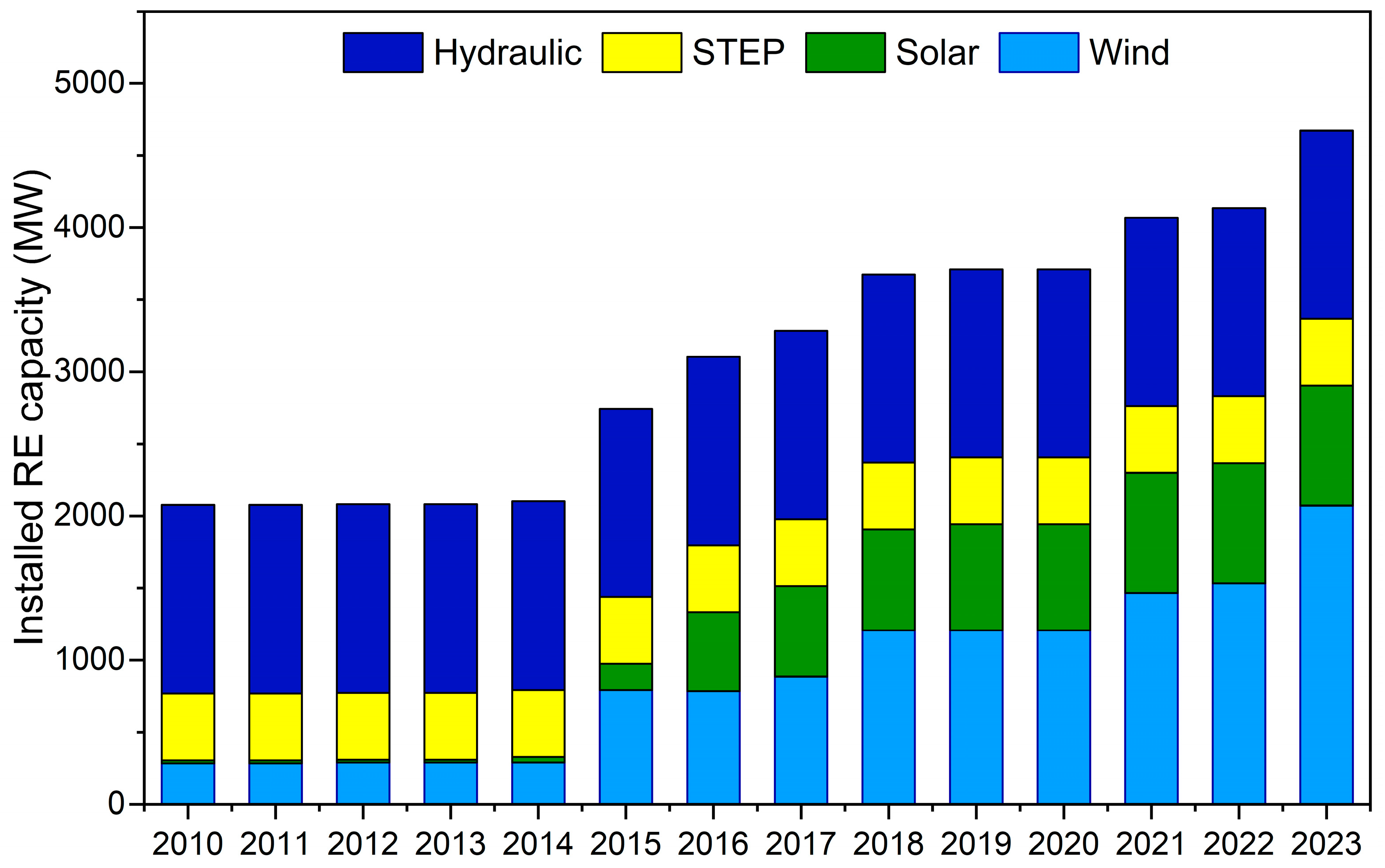

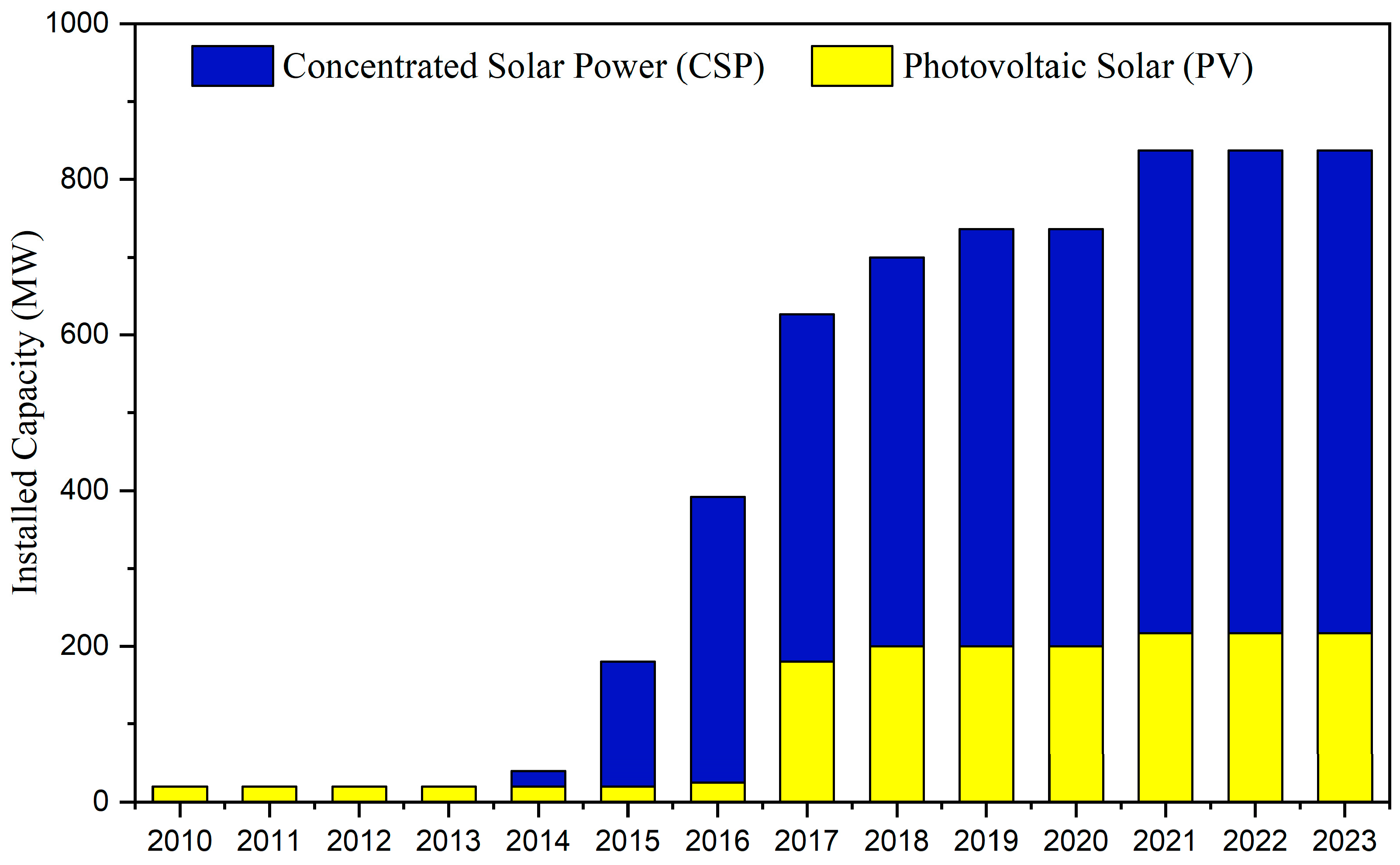

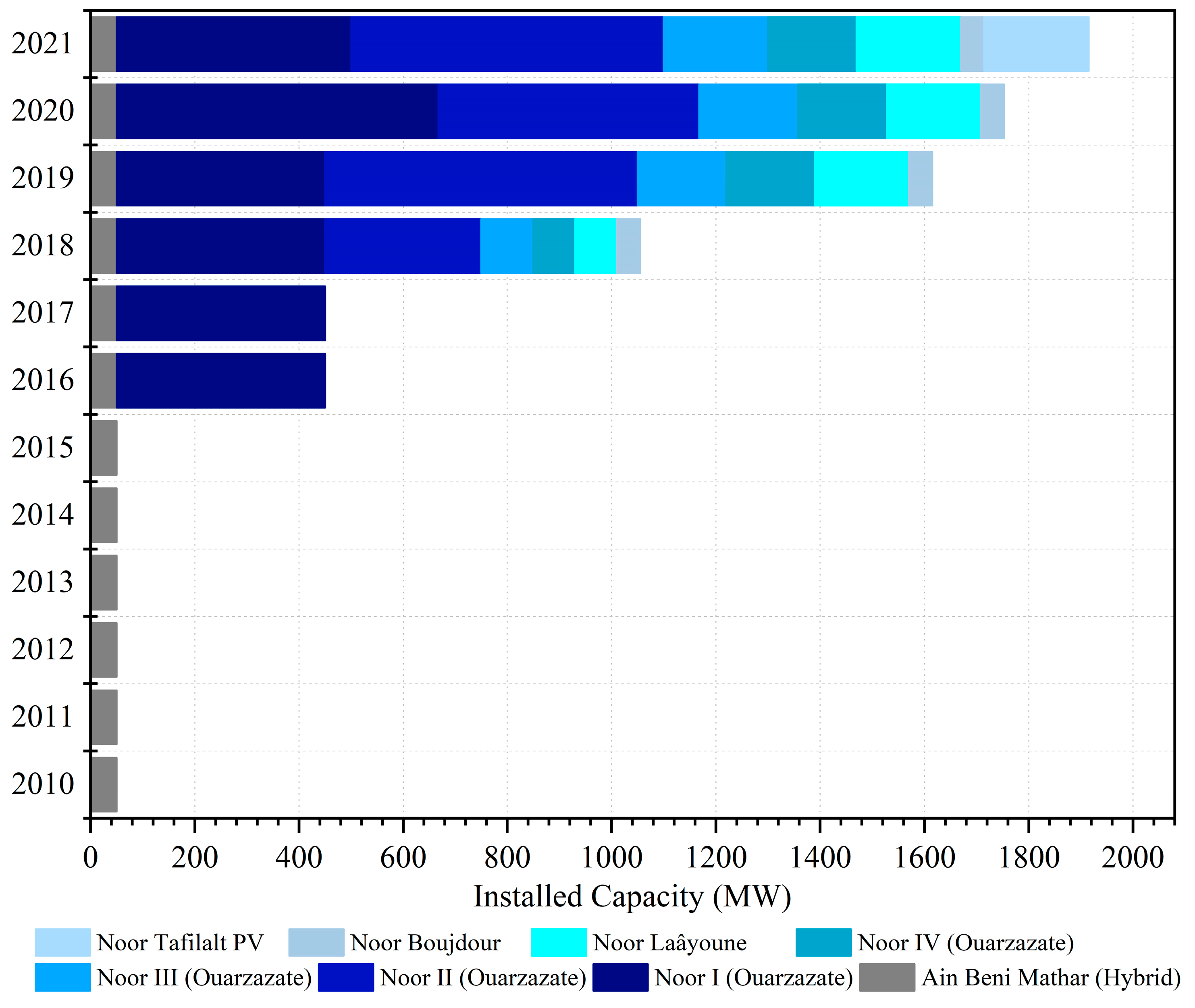

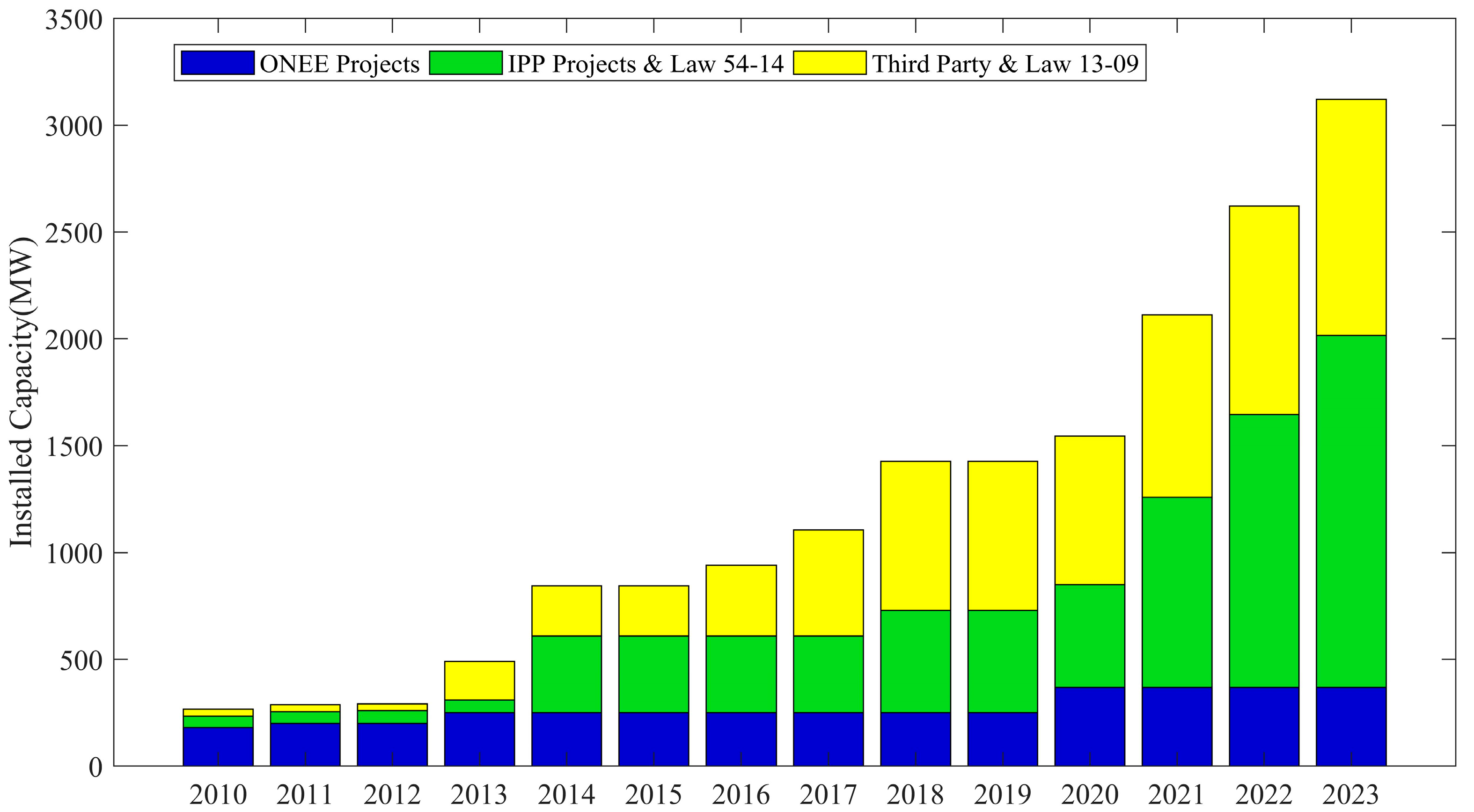

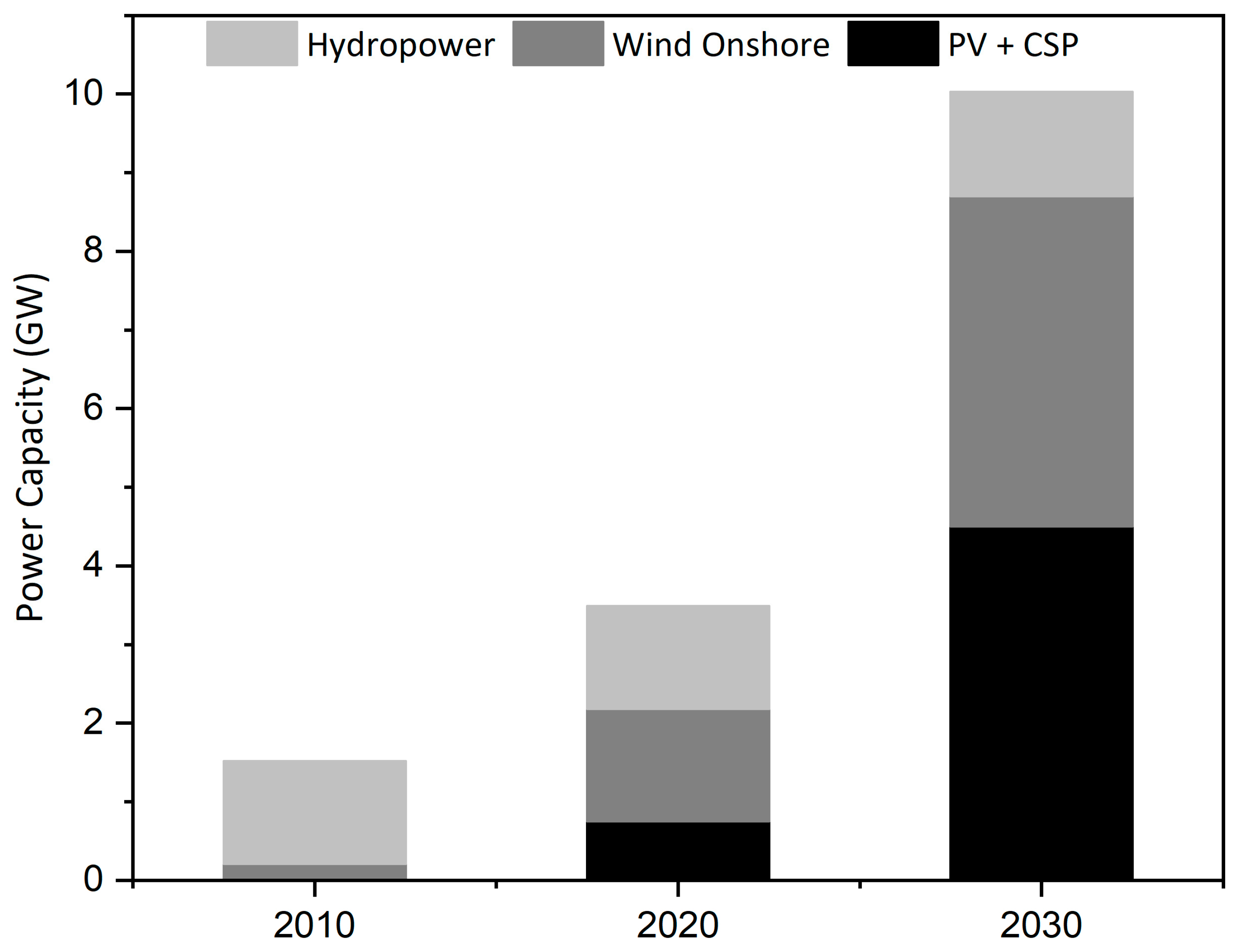

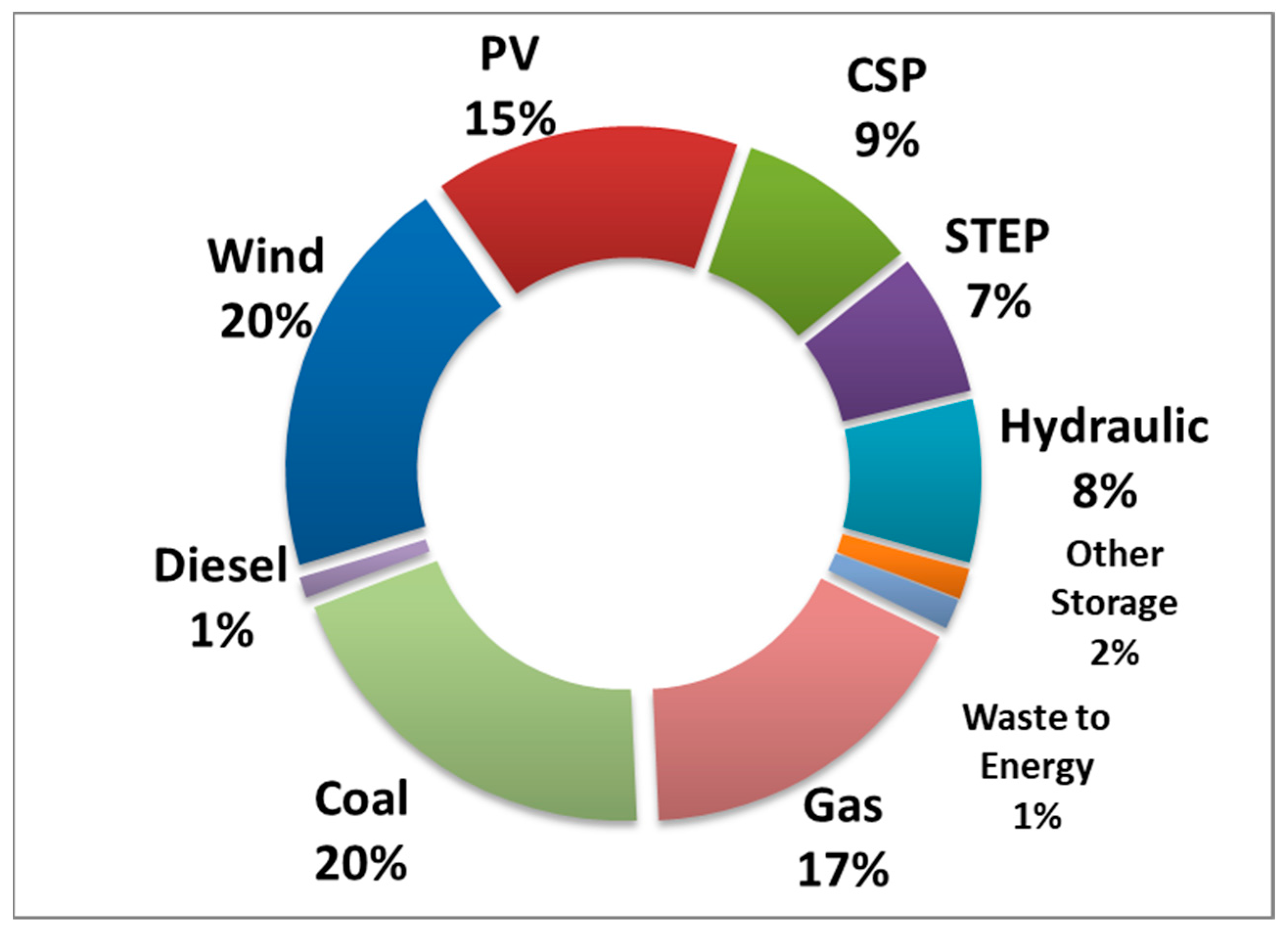

4.2. Installed Capacity

- RE will account for 52% of total installed electrical capacity before 2030, and 70% by 2040.

- By 2030, solar, wind, and hydro power are expected to account for 20%, 20%, and 12%, respectively, in the energy mix. Accordingly, 10 GW of RE must be added between 2018 and 2030, 4560 MW of solar, 4200 MW of wind, and 1330 MW of hydro power [36], including those to be carried by the private sector within the framework of Law 13-09.

- Investment: USD 9 billion for solar projects.

- Reduction in greenhouse gas emissions by 42% in 2030.

- Creation of an industrial base for solar technologies.

- Promotion of capacity building and applied research in PV and CSP technologies (particularly parabolic trough and solar tower) and related disciplines.

- Small PV plant in Tit Mellil: 46 kW.

- Small PV plant in Ouarzazate: 120 kW.

- PV plant in Assa: 800 kW.

- PV plant in Kénitra: 2 MW.

4.3. Investment and Funding

- -

- MORSEFF, a financing line for energy-efficiency and RE projects, which allows Moroccan companies to access loans (or leasing) for the acquisition of equipment or the realization of major sustainable energy projects of up to EUR 4.5 million in finance, an investment subsidy of 10% of the credit, and a free energy audit for the evaluation, implementation, and verification of the project. MORSEFF’s services are accessible locally thanks to distribution through partner banks such as Banque Populaire with Eco Energy Invest credit, BMCE with Cap Énergie, or Maghrebail with Energy Lease. For example, a loan of MAD 75 million was granted to Moroccan companies to improve their energy efficiency, thanks to the BMCE and BCP banks.

- -

- Standard credits from local banks such as BMCI’s Green Credit or Attijariwafa Bank’s Effinergie.

- -

- Imtiaz-Croissance aims to strengthen the support system for SMEs, VSEs, and auto-entrepreneurs. It targets SMEs operating in industry and activities integrated into industry that meet the following criteria. (i) Turnover in the last financial year between MAD 10 million and MAD 200 million. (ii) Having a development project promoting growth, creation of added value, and creation of jobs likely to accelerate the change in scale and emergence of new business models.

- -

- The Moussanada program aims to support 700 companies per year in the process of modernization and improvement of their productivity to (i) strengthen their competitiveness in terms of reducing costs and lead times and improving quality; (ii) improve their performance and productivity; and (iii) support them to access new markets.

- -

- FODEP aims to encourage industries to invest in depollution or save resources and introduce an environmental dimension into their activities to deal with the regulatory framework in preparation for the globalization of trade.

- -

- The Small Business Support (SBS) program was launched by the European Bank for Reconstruction and Development (EBRD) and financed by a grant from the European Union and other donors to support Moroccan SMEs through appropriate advice and international industrial expertise coupled with grant mechanisms.

- -

- The establishment of energy performance contracts with an Energy Service Company (ESCO), which allows the financing of investment and maintenance costs, and the guarantee of savings. An explanatory brochure of a typical green electricity supply and energy-efficiency improvement project can be downloaded.

- -

- Companies can also finance their green energy projects through funds dedicated to improving the competitiveness of companies in general as part of Morocco SME programs, for example.

4.4. Challenges and Barriers

5. Future Outlook of Solar Energy in Morocco

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. Main Actors Involved in the Development of the Energy Sector in Morocco

- Ministry for Energy Transition and Sustainable Development (MTEDD), Rabat, Morocco, Site Web: www.mem.gov.ma

- Direction Générale des Collectivités Territoriales (Directorate-General for Local Authorities), Rabat, Morocco, Site Web: https://www.collectivites-territoriales.gov.ma/

- Moroccan Agency for Energy Efficiency (AMEE),Rabat, Morocco, Site Web: http://www.amee.ma/index.php/en/ (Accessed on: 5 August 2024).

- Office National de l’électricité et de l’Eau Potable (Water Branch/Electricity Branch), Morocco, Site Web: http://www.one.org.ma

- National Office for Hydrocarbons and Mines (ONHYM), Rabat, Morocco, Site Web: https://www.onhym.com/en

- ANRE—l’Autorité Nationale de Régulation de l’Électricité, Rabat, Morocco, Site Web: https://anre.ma/en/

- Moroccan National Agency for Sustainable Energy (MASEN), Rabat, Morocco, Site Web: http://www.masen.ma/fr/masen/ (Accessed on: 5 August 2024).

- National Inventory Commission (CNI), a Moroccan government agency responsible for overseeing the preparation and updating of Morocco’s national greenhouse gas inventory. CC National Data | 4C Maroc. https://www.4c.ma/donnees-nationales-cc?lang=en (accessed on: 5 August 2024)

- Moroccan Energy Observatory (OME), a Moroccan government agency responsible for collecting, analyzing, and disseminating data on Morocco’s energy sector. Mise en service du Portail de l’Observatoire Marocain de l’Energie (mem.gov.ma). https://www.mem.gov.ma/Pages/actualite.aspx?act=25 (accessed on 5 August 2024)

- Moroccan Agency for Nuclear and Radiological Safety and Security (AMSSNur), https://www.iaea.org/newscenter/news/moroccan-agency-for-nuclear-and-radiological-safety-and-security-designated-as-first-iaea-collaborating-centre-in-the-field-of-nuclear-security-in-africa (accessed on: 5 August 2024)

- National Centre for Nuclear Energy, Science, and Technology (CNESTEN), Rabat, Morocco, Site Web: https://www.cnesten.org.ma/

- Energy Investment Company (SIE), Rabat, Morocco, Site Web: https://www.siem.ma/. It offers consultancy services and assists in project development (energy efficiency, RE) through several actions such as identification of needs, choice of appropriate technologies, financing options, project implementation arrangements, and assessment of project profitability.

- Société Chérifienne des Pétroles (SCP), Morocco.

- Institute for Research in Solar Energy and New Energies (IRESEN), for research and innovation, Rabat, Morocco, Site Web: http://www.iresen.org/. The missions of IRESEN include the development and financing of nationwide research projects (fundraising agency) and the development of international collaborations in the sector of solar energy and new energies. Since its creation, IRESEN has financed hundreds of projects and established other research instances (e.g., Green Energy Park, Green and Smart Building Institute) in Morocco and Africa.

- Rabat School of Mines National (‘École nationale supérieure des mines de Rabat—ENSMR), Morocco, site web: https://www.enim.ac.ma/.

- Moroccan Institute for Standardization (IMANOR), Rabat, Morocco, site web: https://www.imanor.gov.ma/.

- Public Testing and Research Laboratory (LPEE), Morocco, site web: http://www.lpee.ma/en.

- Economic, Social, and Environmental Council (CESE), Rabat, Morocco, site web: https://www.cese.ma/en/.

- 4C Morocco (Platform for dialogue and capacity building on climate issues).

- Concessionary electricity producers. Since 1994, private companies have been authorized to produce electricity solely to meet ONEE’s needs. They are connected to ONEE through long-term power-purchase agreements (PPAs). At present, the concessionary electricity producers are Jorf Lasfar Energy Company, JLEC (2080 MW); Compagnie Éolienne du Détroit, CED (54 MW); Société Energie Électrique de Tahaddart, EET (384 MW); Tarfaya Energy Company, TEC (300 MW); and SAFI Energy Company, SAFIEC (1386 MW).

- Auto-producers. Self-generators may produce electrical energy in one of the following cases, mainly for their own use, and the surplus is sold exclusively to ONEE: the generating capacity to be installed by the producer must not exceed 50 MW; the generating capacity must exceed 300 MW, with a right of access to the national electricity grid to ensure transmission of the electrical energy.

- Société d’Investissement Énergétique (SIE), Rabat, Morocco, site web: https://www.siem.ma/.

- SIE, founded in 2009, is the government’s financial arm for achieving the planned energy mix. The organization develops projects in the energy sector with the help of partners, investors, and developers. SIE has a capacity of MAD 1 billion (around EUR 100 million) available through the Fonds de Développement de l’Électrification (FDE). A quarter of their capacity is allocated to energy efficiency and three quarters to RE.

References

- Saidi, K.; Ben Mbarek, M. Nuclear energy, renewable energy, CO2 emissions, and economic growth for nine developed countries: Evidence from panel Granger causality tests. Prog. Nucl. Energy 2016, 88, 364–374. [Google Scholar] [CrossRef]

- IEA. Coal 2023—Analysis and Forcast to 2026; International Energy Agency: Paris, France, 2023; pp. 1–170. Available online: https://www.iea.org/news/global-coal-demand-expected-to-decline-in-coming-years (accessed on 15 July 2024).

- Idowu, S.O.; Schmidpeter, R.; Capaldi, N.; Zu, L.; Del Baldo, M.; Abreu, R. (Eds.) CO2-Emissions. In Encyclopedia of Sustainable Management; Springer: Cham, Switzerland, 2023; p. 600. [Google Scholar] [CrossRef]

- Berahab, P.R. Tendances et Perspectives Energétiques à l’Horizon 2023: Survivre à la Crise Énergétique tout en Construisant un Avenir Plus Vert; Policy Center for the New South: Salé, Moroco, 2023; Available online: https://www.policycenter.ma/sites/default/files/2023-01/PB_04_23%28RimBerahab%29.pdf (accessed on 2 June 2024).

- Sorooshian, S. The sustainable development goals of the United Nations: A comparative midterm research review. J. Clean. Prod. 2024, 453, 142272. [Google Scholar] [CrossRef]

- IRENA. A World Energy Transitions Outlook Brief Tracking COP28 Outcomes Tripling Renewable Power Capacity by 2030; International Renewable Energy Agency: Abu Dhabi, Dubai, 2024; Available online: https://www.irena.org/Publications/2024/Mar/Tracking-COP28-outcomes-Tripling-renewable-power-capacity-by-2030 (accessed on 2 June 2024).

- Zeid, A.A. Le Maroc, un Champion Africain en Matière des Energies Renouvelables (Amani Abou Zeid). 2023. Available online: https://www.mapnews.ma/fr/actualites/economie/le-maroc-un-champion-africain-en-matière-des-énergies-renouvelables-amani-abou (accessed on 5 June 2024).

- ANRE. Rapport Annuel 2022 Anre. 2022. Available online: https://anre.ma/wp-content/uploads/2023/12/FR-RA_ANRE-2022-PLANCHE-DV.pdf (accessed on 23 June 2024).

- Saidi, H. Développement Renewable Energy in Morocco in the Era of the New Development Model. Afr. J. Bus. Financ. 2022, 1, 155–171. [Google Scholar]

- Mohamed, D.B. Énergies Renouvelables: Le Maroc, un Leader aux Portes de l’Europe. 2023. Available online: https://forbesafrique.com/energies-renouvelables-le-maroc-un-leader-aux-portes-de-leurope/ (accessed on 15 July 2024).

- Šimelytė, A. Promotion of renewable energy in morocco. In Energy Transformation Towards Sustainability; Elsevier: Amsterdam, The Netherlands, 2019; pp. 249–287. [Google Scholar] [CrossRef]

- Azeroual, M.; EL Makrini, A.; EL Moussaoui, H. Renewable Energy Potential and Available Capacity for Wind and Solar Power in Morocco Towards 2030. J. Eng. Sci. Technol. Rev. 2018, 11, 189–198. [Google Scholar] [CrossRef]

- Vidican, G. The emergence of a solar energy innovation system in Morocco: A governance perspective. Innov. Dev. 2015, 5, 225–240. [Google Scholar] [CrossRef]

- Nakach, I.; Mouhat, O.; Shamass, R.; el Mennaouiy, F. Review of strategies for sustainable energy in Morocco. Polityka Energetyczna–Energy Policy J. 2023, 26, 65–104. [Google Scholar] [CrossRef]

- Boulakhbar, M.; Lebrouhi, B.; Kousksou, T.; Smouh, S.; Jamil, A.; Maaroufi, M.; Zazi, M. Towards a large-scale integration of renewable energies in Morocco. J. Energy Storage 2020, 32, 101806. [Google Scholar] [CrossRef]

- Kettani, M.; De Lavergne, J.D.; Sanin, M.E. Hub Solaire Énergie solaire au Maroc: Vers un leadership régional ? Rev. l’Energie 2021, 659, 37–61. [Google Scholar]

- International Trade Administration. ECommerce|International Trade Administration. Trade.Gov. 2020. Available online: https://www.trade.gov/knowledge-product/philippines-ecommerce (accessed on 10 July 2024).

- Bennouna, A. Maroc—2023 Verra Sans Doute Une Petite Baisse des Emissions de Gaz à Effet de Serre Besoins en Energie Primaire et Emissions de ges Associées; EcoAct: Paris, France, 2023; pp. 9–11. [Google Scholar] [CrossRef]

- Bennouna, A. Energie au Maroc, Quoi de Neuf en 2022? EcoAct: Paris, France, 2022; pp. 2–7. [Google Scholar] [CrossRef]

- Bennouna, A. The State of Energy in Morocco; Regional Programme Energy Security and Climate Change Middle East and North Africa; Konrad-Adenauer-Stiftung e.V.: Sankt Augustin bei Bonn, Germany, 2023; pp. 1–31. [Google Scholar]

- Haut Commissariat au Plan. Morocco in Figures. Haut-Comissariat au Plan. 2020. Volume 4, No. 1, pp.1–9. Available online: https://www.hcp.ma/downloads/?tag=Le+Maroc+en+chiffres (accessed on 23 June 2024).

- Adeola, A.O.; Akingboye, A.S.; Ore, O.T.; Oluwajana, O.A.; Adewole, A.H.; Olawade, D.B.; Ogunyele, A.C. Crude oil exploration in Africa: Socio-economic implications, environmental impacts, and mitigation strategies. Environ. Syst. Decis. 2022, 42, 26–50. [Google Scholar] [CrossRef]

- IEA. Electricity Market Report; International Energy Agency: Paris, France, 2020. [Google Scholar] [CrossRef]

- ANRE. 2021|1. Rev. Alyoda 2021. [Google Scholar] [CrossRef]

- PAGE. La Transition du Maroc Vers une Economie Verte: Etat des Lieux et Inventaire. 2022. Available online: https://www.undp.org/fr/morocco/publications/la-transition-du-maroc-vers-une-economie-verte-etat-des-lieux-et-inventaire (accessed on 15 June 2024).

- ONEE. Bilan Electrique Marocain 2023. 2023. Available online: http://www.one.org.ma/ (accessed on 15 June 2024).

- Romani, Z.; Draoui, A.; Allard, F. Metamodeling the heating and cooling energy needs and simultaneous building envelope optimization for low energy building design in Morocco. Energy Build. 2015, 102, 139–148. [Google Scholar] [CrossRef]

- PEED. Support de SenSibiliSation Sur l’Efficacité Energétique dans les Bâtiments au Maroc. 2019. Available online: https://www.peeb.build/imglib/downloads/PEEB_efficacite-energetique-dans-les-batiments-au-maroc_support-de-sensibilation.pdf.pdf (accessed on 15 July 2024).

- Laaroussi, A. The Energy Transition in Morocco. In Renewable Energy and Sustainable Buildings; Springer: Cham, Switzerland, 2022. [Google Scholar] [CrossRef]

- Burck, J.; Uhlich, T.; Bals, C.; Höhne, N.; Nascimento, L.; Kumar, C.H.; Bosse, J.; Riebandt, M.; Pradipta, G. 2024 CCPI Climate Change Performance Index 2024. Available online: https://www.legambiente.it/wp-content/uploads/2023/12/CCPI_-2024.pdf (accessed on 18 June 2024).

- Van Eynde, F. Flanders Investment & Trade Market Survey. 2018. p. 71. Available online: https://www.flandersinvestmentandtrade.com/export/sites/trade/files/market_studies/Australia-FoodandBeverageIndustry2019.pdf (accessed on 19 June 2024).

- Alhamwi, A.; Kleinhans, D.; Weitemeyer, S.; Vogt, T. Moroccan National Energy Strategy reviewed from a meteorological perspective. Energy Strat. Rev. 2015, 6, 39–47. [Google Scholar] [CrossRef]

- Roadmap Green Hydrogen. Feuille de Route: Hydrogène Vert. 2021. p. 93. Available online: https://www.mem.gov.ma/Lists/Lst_rapports/Attachments/36/Feuillederoutedehydrogènevert.pdf (accessed on 23 July 2024).

- Bahou, S. Techno-economic assessment of a hydrogen refuelling station powered by an on-grid photovoltaic solar system: A case study in Morocco. Int. J. Hydrogen Energy 2023, 48, 23363–23372. [Google Scholar] [CrossRef]

- Caillard, A.; Yeganyan, R.; Cannone, C.; Plazas-Niño, F.; Howells, M. A Critical Analysis of Morocco’s Green Hydrogen Roadmap: A Modelling Approach to Assess Country Readiness from the Energy Trilemma Perspective. Climate 2024, 12, 61. [Google Scholar] [CrossRef]

- IEA. Energy Policies Beyound IEA Countries; International Energy Agency: Paris France, 2019; p. 221. Available online: https://www.connaissancedesenergies.org/sites/default/files/pdf-actualites/Energy_Policies_beyond_IEA_Contries_Morocco.pdf (accessed on 23 June 2024).

- El Gharras, A.; Menichetti, E. Morocco and Its Quest to Become a Regional Driver for Sustainable Energy; MENARA Future Notes, No. 15; Istituto Affari Internazionali: Roma, Italy, 2018. [Google Scholar] [CrossRef]

- Mohamed, C. Gisements Solaires et Eoliens au Maroc: Estimation et Evaluation par Intelligence Artificielle et Systèmes d’Information Géographique. Ph.D. Thesis, Université Moulay Ismail, Meknes, Morocco, 2022. Available online: https://www.researchgate.net/publication/362314063_Gisements_solaires_et_eoliens_au_Maroc_estimation_et_evaluation_par_intelligence_artificielle_et_systemes_d’information_geographique/citations (accessed on 23 June 2024).

- Lever et Coucher du Soleil au Maroc. Available online: https://www.donneesmondiales.com/afrique/maroc/coucher-soleil.php#:~:text=Enjuin%2Clesoleilbrille,57sur9%3A57heures (accessed on 11 July 2024).

- Hidane, S.; HarBa, A.; Benhamdan, J.; Mokhtari, F.Z.; Allam, M.E. Industries des Énergies Renouvelables—Région Casa Settat. 2023. Available online: www.amee.ma (accessed on 2 June 2024).

- Bouhal, T.; Agrouaz, Y.; Kousksou, T.; Allouhi, A.; El Rhafiki, T.; Jamil, A.; Bakkas, M. Technical feasibility of a sustainable Concentrated Solar Power in Morocco through an energy analysis. Renew. Sustain. Energy Rev. 2018, 81, 1087–1095. [Google Scholar] [CrossRef]

- El Alami, K.; Asbik, M.; Boualou, R.; Ouchani, F.-Z.; Agalit, H.; Bennouna, E.G.; Rachidi, S. A critical overview of the suitability of natural Moroccan rocks for high temperature thermal energy storage applications: Towards an effective dispatching of concentrated solar power plants. J. Energy Storage 2022, 50, 104295. [Google Scholar] [CrossRef]

- Masen.ma. Atlas de la Ressource Solaire au Maroc (masen.ma). Available online: https://solaratlas.masen.ma/map?c=29.61167:-9.074707:5&s=31.625815:-7.989137&m=masen:pvout (accessed on 15 July 2024).

- Kousksou, T.; Allouhi, A.; Belattar, M.; Jamil, A.; El Rhafiki, T.; Zeraouli, Y. Morocco’s strategy for energy security and low-carbon growth. Energy 2015, 84, 98–105. [Google Scholar] [CrossRef]

- Haidi, T.; Cheddadi, B.; El Mariami, F.; El Idrissi, Z.; Tarrak, A. Wind energy development in Morocco: Evolution and impacts. Int. J. Electr. Comput. Eng. 2021, 11, 2811–2819. [Google Scholar] [CrossRef]

- Global Photovoltaic Power Potential by Country|Data Catalog n.d. Available online: https://datacatalog.worldbank.org/search/dataset/0038379 (accessed on 15 July 2024).

- Usman, Z.; Amegroud, T. Lessons from Power Sector Reforms the Case of Morocco. World Bank Policy Research Working Paper, 8969. 2019. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3434149 (accessed on 15 July 2024).

- IRENA. Renewable Generation Costs in 2022; International Renewable Energy Agency: Abu Dhabi, Dubai, 2022. [Google Scholar]

- IRENA. Renewable Capacity Statistiques 2023; International Renewable Energy Agency: Abu Dhabi, Dubai, 2023; Available online: www.irena.org/publications (accessed on 5 August 2024).

- IRENA. Renewable Power Generation Costs in 2020; International Renewable Energy Agency: Abu Dhabi, Dubai, 2020. [Google Scholar]

- IEA. World Energy Outlook 2023; International Energy Agency: Paris, France, 2023; pp. 23–28. Available online: www.iea.org (accessed on 5 August 2024).

- Mrabti, T.; Loudiyi, K.; Darhmaoui, H.; Kassmi, K.; El Moussaoui, A.; Mansouri, S.; Vazquez, M.A.; Diaz, e.V. Implantation et fonctionnement de la première installation photovoltaïque à haute concentration ‘CPV’ au Maroc. J. Renew. Energ. 2012, 15, 351–356. [Google Scholar] [CrossRef]

- Barhdadi, A.; Benazzouz, A.; Fabrizio, B.; Verdilio, D. Implementation of high concentration photovoltaic grid connected power plant for training, research, innovation and solar electricity production. J. Phys. Conf. Ser. 2015, 605, 012042. [Google Scholar] [CrossRef]

- Masen. Plan d’Acquisition de Terrain. no. Pat 1. 2016, pp. 1–18. Available online: https://www.masen.ma/sites/default/files/documents_rapport/13.pdf (accessed on 22 June 2024).

- MEMEE. Contribution Déterminée au Niveau National-Actualisée; Ministère l’Energie des Mines l’Eau l’Environnement du Maroc: Rabat, Morocco, 2021; p. 36.

- Chakib, B.; Tarik, S.; Stoelting, M.P.; Soufi, I. Developpement Des Energies Solaire et Eolienne Au Maroc Enseignements et Perspectives; Royal Institute for Strategic Studies: Rabat, Morocco, 2020; pp. 1–232. Available online: https://www.ires.ma/sites/default/files/docs_publications/DEVELOPPEMENT_DES_ENERGIES_SOLAIRE__0.pdf (accessed on 5 August 2024).

- Yaneva, M. Overview—Morocco to Add 4 GW of Wind, Solar Capacity by 2020. 2017. Available online: https://renewablesnow.com/news/overview-morocco-to-add-4-gw-of-wind-solar-capacity-by-2020-555087/ (accessed on 14 July 2024).

- Vidican, G.; Böhning, M.; Burger, G.; Regueira, E.d.S.; Müller, S. Achieving Inclusive Competitiveness in the Emerging Solar Energy Sector in Morocco; German Development Institute: Bonn, Germany, 2013; Volume 79, Available online: https://www.idos-research.de/studies/article/achieving-inclusive-competitiveness-in-the-emerging-solar-energy-sector-in-morocco/ (accessed on 23 June 2024).

- Mergoul, K.; Laarabi, B.; Barhdadi, A. Solar water pumping applications in Morocco: State of the art. In Proceedings of the 2018 6th International Renewable and Sustainable Energy Conference (IRSEC), Rabat, Morocco, 5–8 December 2018. [Google Scholar] [CrossRef]

- men.gov.ma. Renewable Energy-Solar. Available online: https://www.mem.gov.ma/Pages/secteur.aspx?e=2&prj=3 (accessed on 20 June 2024).

- Barradi, T. Un Aperçu de la Situation de l’Efficacité Énergétique des Ménages au Maroc; Heinrich-Böll-Stiftung: Rabat, Morocco, 2019; pp. 10–11. Available online: http://www.abhatoo.net.ma/maalama-textuelle/developpement-economique-et-social/developpement-economique/energie-et-mines/energie-et-mines-generalites/un-apercu-de-la-situation-de-l-efficacite-energetique-des-menages-au-maroc (accessed on 29 July 2024).

- Gargab, F.Z.; Allouhi, A.; Kousksou, T.; El-Houari, H.; Jamil, A.; Benbassou, A. A New Project for a Much More Diverse Moroccan Strategic Version: The Generalization of Solar Water Heater. Inventions 2021, 6, 2. [Google Scholar] [CrossRef]

- Benoit-Ivan, W. Morocco: In the Suburbs of Rabat, a Factory Will Manufacture Solar Water Heaters; AFRIK 21: Roubaix, France, 2023; Available online: https://www.afrik21.africa/en/morocco-in-the-suburbs-of-rabat-a-factory-will-manufacture-solar-water-heaters/ (accessed on 1 August 2024).

- Vedie, P.H. Les Energies Renouvelables au Maroc: Un Chantier de Règne; Ideas: Minneapolis, MN, USA, 2020; pp. 1–10. [Google Scholar]

- men.gov.ma. Hydroelectricity. Available online: https://www.mem.gov.ma/Pages/secteur.aspx?e=2&prj=2 (accessed on 23 June 2024).

- International Renewable Energy Agency (IRENA). Country Indicators and SDGs: Vanuatu; International Renewable Energy Agency: Abu Dhabi, Dubai, 2022; pp. 1–4. [Google Scholar]

- Veysel, K. Investment Opportunities in Morocco’s Energy Sector. 2024. Available online: https://www.netzerocircle.org/articles/investment-opportunities-in-moroccos-energy-sector (accessed on 15 July 2024).

- Zafar, S. Renewable Energy in Morocco. 2022. Available online: https://www.ecomena.org/renewable-energy-in-morocco/ (accessed on 1 August 2024).

- Bennis, L. La finance verte au Maroc: Enjeux et perspectives à l’ère du changement climatique Green finance in Morocco: Challenges and perspectives in the era of climate change. Rev. Française d’Economie Gest. 2023, 4, 29–61. [Google Scholar]

- AMEE. Guide des Programmes de Financement et d’Appui Pour. 2021. Available online: https://www.amee.ma/sites/default/files/inline-files/GuidedesProgrammesdeFinancementetD%27appuipourlesEntreprisesMarocaines.pdf (accessed on 18 July 2024).

- Wael, M.; Khaled, B.; Dahmani, M. Overcoming Barriers to Energy Transition in the MENA Region: New Institutional Dynamics. Preprints 2024, 2024021440. [Google Scholar] [CrossRef]

- Smouh, S.; Gargab, F.Z.; Ouhammou, B.; Mana, A.A.; Saadani, R.; Jamil, A. A New Approach to Energy Transition in Morocco for Low Carbon and Sustainable Industry (Case of Textile Sector). Energies 2022, 15, 3693. [Google Scholar] [CrossRef]

- IRENA. Renewable Power: Sharply Falling Generation Costs; International Renewable Energy Agency: Abu Dhabi, Dubai, 2016; pp. 15–18. [Google Scholar]

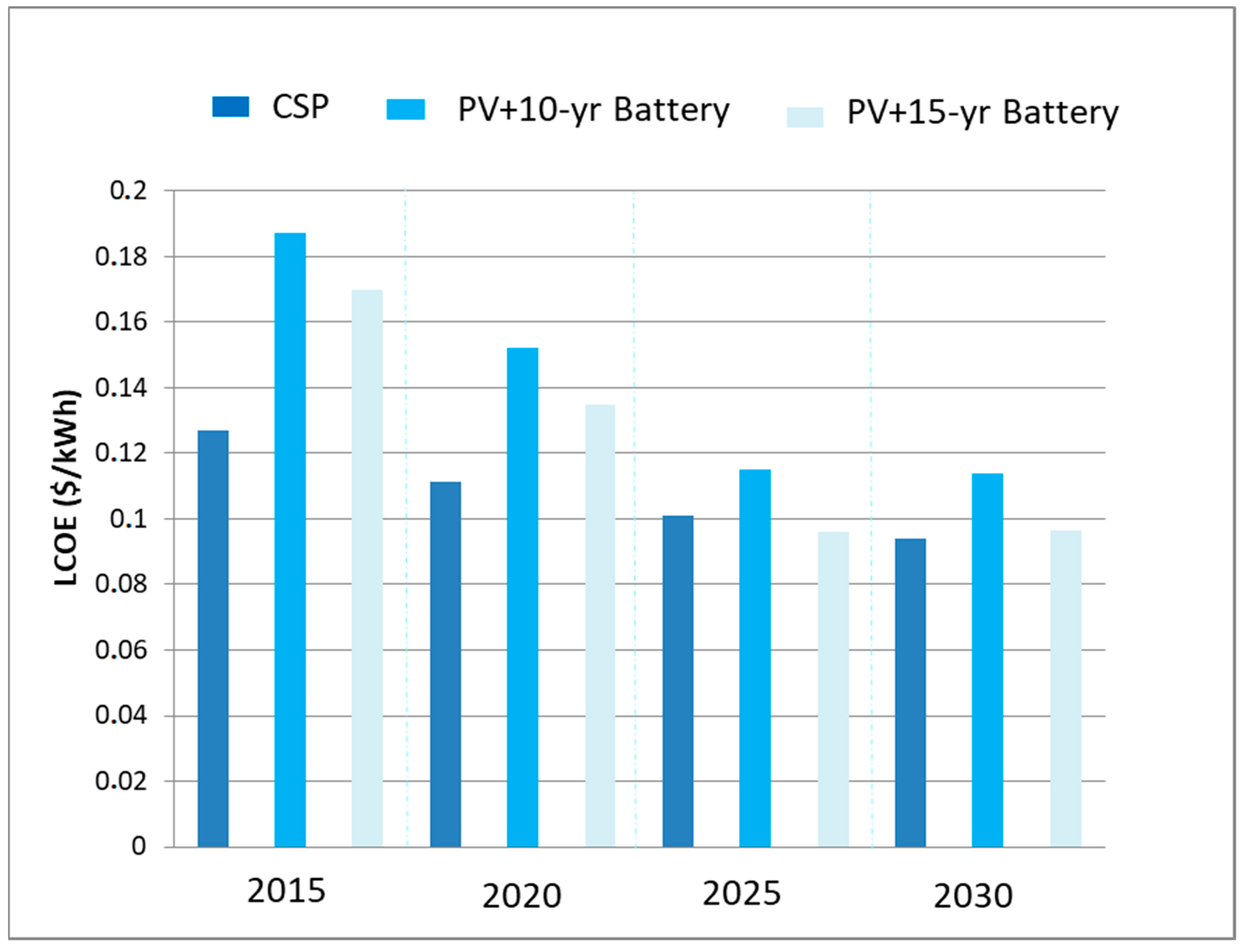

- Feldman, D.; Margolis, R.; Denholm, P. Exploring the Potential Competitiveness of Utility-Scale Photovoltaics Plus Batteries with Concentrating Solar Power, 2015–2030; U.S. Department of Energy: Washington, DC, USA, 2016; pp. 1–31.

- El Hafdaoui, H.; Khallaayoun, A.; Ouazzani, K. Long-term low carbon strategy of Morocco: A review of future scenarios and energy measures. Results Eng. 2024, 21, 101724. [Google Scholar] [CrossRef]

- Heuzebroc, J. Pénurie d’Eau: Le Maroc Tire le Signal d’Alarme. Available online: https://www.nationalgeographic.fr/environnement/penurie-deau-le-maroc-tire-le-signal-dalarme (accessed on 2 August 2024).

- Quel Avenir de l’Eau Au Maroc ?; Rapport De Synthese Des Travaux De La Journee Scientifique Du 17 Mars 2022; Royal Institute for Strategic Studies (IRES): Rabat, Мorocco. 2022. Available online: https://www.ires.ma/sites/default/files/docs_publications/Avenir_de_leau_au_Maroc-Rapport_de_synthese.pdf (accessed on 2 August 2024).

- Kettani, M.; Bandelier, P. Techno-economic assessment of solar energy coupling with large-scale desalination plant: The case of Morocco. Desalination 2020, 494, 114627. [Google Scholar] [CrossRef]

| Law | Main Points |

|---|---|

| Law 13-09 relating to RE. Promulgated by Dahir (Royal Decree) 1-10-16, dated on 26 Safar AH 1431, corresponding to 11 February 2010 (B.O. No. 5822 of 18 March 2010) |

|

| Decree 2-10-578 of 7 Jumada I, 1432 (11 April 2011), adopted in the application of Law 13-09 on RE |

|

| Law 57-09 (14 January 2010) |

|

| Law 37-16, modifying and completing Law 57-09, creating MASEN |

|

| Law 16-09 (13 January 2010) and its amended Law 39-16 (25 August 2016). |

|

| Law 47-09 on energy efficiency (29 September 2011) |

|

| Law 48-15 relative to regulation of the electricity sector (24 May 2015) |

|

| Law 58-15 amending and supplementing Law 13-09 relating to RE (published in Official Bulletin 6436 of 4 February 2016) |

|

| “Dahir” (Royal Decree) 1-16-60 of 17 Shaaban 1437 (24 May 2016) |

|

| Order 927-20 of Official Bulletin 6870 (2 April 2020) |

|

| Act 40-19 supplementing and amending Act 13-09 on RE sources and Act 48-15 on regulation of the electricity sector |

|

| Law 82.21 on the auto production of electrical energy (December 2022) |

|

| By-Law 3851-21, published in January 2022 |

|

| By-Law 2138-22, published in September 2022 |

|

| Project Name | Installed Capacity/Annual Production/LCOE | Location | Technology/ Storage Technology | CO2 Avoided TCO2/Year | Project Framework | Investment Cost (Million MAD) | Planned Start-Up Date |

|---|---|---|---|---|---|---|---|

| Ain Beni Mathar | 20 MW/55 GWh/yr/2.4 MAD/kWh | Beni Mathar | ISCC + parabolic trough | - | ONEE | - | 2018 |

| Noor Ouarzazate I | 160 MW/618 GWh/yr/1.62 MAD/kWh | Ouarzazate | CSP (parabolic trough) 3 h of storage molten salt with two tanks | 280,000 | Managed by MASEN, and the construction, operation, and maintenance have been awarded to the consortium led by ACWA Power | 7000 | 2016 |

| Noor Ouarzazate II | 200 MW/ 600 GWh/yr 1.36 MAD/kWh | Ouarzazate | parabolic trough + dry cooling 7 h of storage molten salt with two tanks | 300,000 | 9218 | 2018 | |

| Noor Ouarzazate III | 150 MW/ 500 GWh/yr 1.42 MAD/kWh | Ouarzazate | CSP power tower + dry cooling 7 h of storage molten salt with two tanks | 222,000 | 7180 | 2018 | |

| Noor Ouarzazate IV | 72 MW/120 GWh/yr 0.46 MAD/kWh | Ouarzazate | polycrystalline PV with tracking - | 86,539 | 775 | 2018 | |

| Noor Laayoune I | 85 MW/200 GWh/yr 0.46 MAD/kWh | Laayoune | polycrystalline PV with tracking | 104,300 | 968 | 2018 | |

| Noor Boujdour I | 20 MW/45 GWh/yr 0.46 MAD/kWh | Boujdour | polycrystalline PV with tracking | 23,855 | 302 | 2018 | |

| Noor Boujdour II | 350 MW | polycrystalline PV | - | - | Will be operational by 2027) | ||

| Noor Tafilalt | 120 MW/220 GWh/yr | Erfoud | polycrystalline PV | 102,045 | ONEE, developed within the concessional and contractual framework | 1200 | Late 2020 |

| Missour | 2021 | ||||||

| Zagora | 2021 | ||||||

| Noor Midelt I | 800 MW ≈0.68 MAD/kWh | Midelt | hybrid system CSP parabolic trough (300 MW)/PV (500 MW) 5 h of storage | 675,360 | Consortium EDF/MASDAR(EAU)/Green of Africa (Morocco) | 7572 | Planned for 2024 |

| Noor Midelt II | 400 to 800 MW | - | Plan on the horizon for 2030 | ||||

| Noor Atlas | 200 MW distributed over eight power plants of 30 to 40 MW. 320 GWh/yr. | Boudnib, Bouanane, Outat El Haj, Enjil, Ain Beni Mathar, Tata, and Tan Tan. | polycrystalline PV | 204,090 | ONEE, developed within the concessional and contractual framework | 2000 | Constructed in 2021 Planned for 2024 |

| Solar Program Noor PV II | 750 MW (distributed over seven power plants) | Ain Beni Mathar, El Hajeb, Bajaad, Sidi Bennour, Kalaa Sraghna, Taroudant, Guersif | polycrystalline PV | - | 400 MW will be developed within the framework of Law 13-09 | - | From 2023 |

| Solar Energy Power Plant: Sub-Projects |

|---|

| Solar photovoltaic plant (10 MW): “Maroc Photovoltaïque” |

| Solar photovoltaic plant (30 MW): “Green Power Morocco” |

| Photovoltaic solar power plant in self-production (1 MW): “Golden Logistics” |

| Photovoltaic solar power plant in self-production (1 MW): “OCP Holding” |

| Photovoltaic solar power plant in self-production (1 MW) |

| Photovoltaic solar power plant in self-production (1.69 MW): “Safran Nacelles” |

| Photovoltaic solar power plant in self-production (2.5 MW): “Nexans Maroc” |

| Photovoltaic solar power plant in self-production (18 MW) |

| Financial barriers |

|

| Technological and Industrial barriers |

|

| Political barriers |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Benbba, R.; Barhdadi, M.; Ficarella, A.; Manente, G.; Romano, M.P.; El Hachemi, N.; Barhdadi, A.; Al-Salaymeh, A.; Outzourhit, A. Solar Energy Resource and Power Generation in Morocco: Current Situation, Potential, and Future Perspective. Resources 2024, 13, 140. https://doi.org/10.3390/resources13100140

Benbba R, Barhdadi M, Ficarella A, Manente G, Romano MP, El Hachemi N, Barhdadi A, Al-Salaymeh A, Outzourhit A. Solar Energy Resource and Power Generation in Morocco: Current Situation, Potential, and Future Perspective. Resources. 2024; 13(10):140. https://doi.org/10.3390/resources13100140

Chicago/Turabian StyleBenbba, Rania, Majd Barhdadi, Antonio Ficarella, Giovanni Manente, Maria Pia Romano, Nizar El Hachemi, Abdelfettah Barhdadi, Ahmed Al-Salaymeh, and Abdelkader Outzourhit. 2024. "Solar Energy Resource and Power Generation in Morocco: Current Situation, Potential, and Future Perspective" Resources 13, no. 10: 140. https://doi.org/10.3390/resources13100140

APA StyleBenbba, R., Barhdadi, M., Ficarella, A., Manente, G., Romano, M. P., El Hachemi, N., Barhdadi, A., Al-Salaymeh, A., & Outzourhit, A. (2024). Solar Energy Resource and Power Generation in Morocco: Current Situation, Potential, and Future Perspective. Resources, 13(10), 140. https://doi.org/10.3390/resources13100140