Abstract

The main objective of this paper is to examine the factors influencing investor intention to adopt robo-advisory services in Saudi Arabia, with a particular focus on sustainability and platform interface quality (PIQ) within a socio-technical framework. Drawing on the Diffusion of Innovation (DOI), Technology Acceptance Model (TAM), Value-Based Adoption Model (VAM), and Trust theory, the research integrates constructs such as Knowledge about Robo-Advisors (KRA), PIQ, Green Perceived Value (GPV), and Perceived Trust (PT). Data were collected through a structured questionnaire targeting financially active individuals, with 387 valid responses analyzed using Partial Least Squares Structural Equation Modelling (PLS-SEM). The findings reveal that KRA significantly influences Intention to Use Robo-Advisors (IURA) both directly and indirectly, through GPV and Relative Advantage (RA), with only marginal support observed for Perceived Usefulness (PU). PIQ strongly influences perceived ease of use (PEOU) and PU, contributing to IURA, while PT significantly moderates the effects of KRA and PIQ. Multi-group analysis (MGA) further highlights heterogeneity across age, education, and investment groups, underscoring the contextual nature of adoption. The study highlights the critical role of PT, PIQ, and GPV alignment in investor decision-making when engaging with robo-advisory platforms. It offers theoretical contributions by extending traditional adoption models through the inclusion of green value and interface quality, and practical implications for FinTech developers and policymakers aiming to build inclusive, trustworthy, and environmentally aligned robo-advisory platforms.

1. Introduction

In recent years, financial technology (FinTech) has significantly reshaped the global financial landscape by introducing automated, data-driven solutions that enhance efficiency, accessibility, and personalization in financial services [1,2]. Among these innovations, robo-advisory platforms have emerged as a prominent tool, delivering algorithm-based investment management with minimal human intervention [3,4]. These platforms offer low-cost, user-friendly, and scalable solutions for portfolio construction, rebalancing, and financial planning, thus democratizing access to wealth management services traditionally reserved for affluent clients [5,6]. Globally, the adoption of robo-advisors continues to rise, particularly among tech-savvy, cost-sensitive, and environmentally conscious investors seeking efficient yet sustainable investment solutions [7,8].

Worldwide, robo-advisory assets under management are projected to reach about US$1.8 trillion in 2024, reflecting the rapid global diffusion of algorithm-driven investment platforms [9]. Projections for 2025 suggest this figure may rise to nearly US$2.06 trillion, underscoring the momentum of continued expansion [10]. Empirical evidence from recent international studies further indicates that robo-advisor usage, coupled with growing Environmental, Social, and Governance (ESG) awareness, enhances PU and ease of use, with PT playing a moderating role in shaping behavioral intention within sustainable investment contexts [11]. Comparative research across markets identifies common adoption drivers such as platform usability and perceived benefits, which consistently influence investor willingness to adopt robo-advisory services [12]. Systematic reviews extend these insights, consolidating evidence around behavioral trust, performance outcomes, and algorithm modeling as central themes in robo-advisory research [13]. Additionally, advances in interface and user-experience design, particularly features that enhance user control, have been shown to improve perceived safety and encourage adoption in AI-enabled advisory settings [14]. At the same time, ESG-personalized robo-advice is democratizing access to sustainable investments for retail investors, reinforcing the salience of green value in shaping adoption decisions [11].

Saudi Arabia has rapidly embraced this FinTech revolution, aligning its transformation with Vision 2030’s strategic objectives to diversify the economy, foster financial inclusion, and promote digital innovation [15,16]. Government-backed initiatives, such as FinTech Saudi and regulatory sandboxes introduced by the Saudi Arabian Monetary Authority (SAMA) and Capital Market Authority (CMA), have cultivated a thriving ecosystem for FinTech start-ups and robo-advisory services [17,18]. Platforms like Sarwa, Derayah Smart, and Abyan now offer Sharia-compliant, AI-enabled investment solutions tailored to a growing base of retail investors [19,20]. Despite this promising momentum, robo-advisor adoption remains nascent, constrained by limited user trust, digital literacy gaps, and the absence of localized behavioral models reflecting Saudi investors’ unique risk preferences and sustainability expectations [21,22].

Existing global literature on robo-advisory services has predominantly emphasized constructs such as PU, ease of use, and trust [5,23]. However, variables such as PIQ, prior user knowledge, and GPV, particularly in the domain of sustainable digital finance, have received comparatively limited attention [24,25,26]. Moreover, most studies conceptualize trust solely as a direct predictor of adoption, overlooking its potential moderating role in amplifying or weakening the influence of antecedents like usability and awareness [21,27]. While the notion of GPV has been well established in consumer behavior literature, its application to FinTech—especially in the context of robo-advisory adoption—remains underdeveloped, despite growing investor demand for ESG-aligned platforms [28,29]. Importantly, although international evidence highlights usability, sustainability, and trust as pivotal adoption drivers, these dimensions remain underexplored in Saudi Arabia. Prior Saudi-focused studies often adopt a broad FinTech perspective, without distinguishing the unique usability and trust dynamics that characterize algorithm-driven advisory services [30,31].

To address these critical gaps, the current study proposes and tests a novel research model that integrates constructs from the DOI theory, TAM, VAM, and trust literature. The model incorporates underexplored predictors such as GPV, KRA, and PIQ. It further introduces PT as a moderator, offering a more nuanced understanding of how trust shapes the strength of relationships between knowledge, interface design, and adoption intention. By capturing both sustainability-oriented and usability-focused investor motivations, this study provides a socio-technical perspective on robo-advisor adoption in a high-growth emerging market.

The empirical investigation employs a quantitative, survey-based research design, targeting active and potential investors in Saudi Arabia. Data were collected using a structured questionnaire and analyzed using PLS-SEM, a robust technique suitable for testing complex models with multiple mediators and moderators. This methodological approach allows for the validation of both direct and indirect pathways influencing investor intention, while accounting for the contextual factors unique to the Saudi FinTech environment.

This study contributes to theory by advancing the literature on digital finance adoption through a multi-theoretical framework that captures the intersection of technological innovation, behavioral trust, and environmental consciousness. It introduces GPV and interface quality as pivotal yet underutilized constructs in robo-advisory research and reframes trust not just as a prerequisite but as a moderator shaping the efficacy of other adoption drivers. Practically, the findings will offer valuable insights to FinTech developers, policymakers, and financial institutions in designing user-centric, trust-enhancing, and sustainability-aligned robo-advisory platforms tailored to regional investor profiles.

In sum, this research responds to an urgent need for localized, theory-driven, and empirically validated models that can guide the future of robo-advisory adoption in Saudi Arabia and comparable emerging economies. It bridges critical knowledge gaps by linking socio-technical design features with sustainability perceptions and trust dynamics, thereby aligning technological innovation with the Kingdom’s broader financial transformation agenda.

2. Literature Review

2.1. FinTech and Robo-Advisory Landscape in Saudi Arabia

The FinTech ecosystem in Saudi Arabia has witnessed transformative growth, aligning with the goals of Vision 2030 to diversify the economy and promote financial inclusion [15]. FinTech is reshaping the traditional banking landscape by introducing innovative, user-centric digital financial services [1,32]. In particular, the integration of mobile payments, peer-to-peer lending, and robo-advisory platforms has contributed significantly to expanding access to financial products and services, especially among the underbanked populations [33].

At the broader regional level, the FinTech sector across the Gulf Cooperation Council (GCC) and Middle East and North Africa (MENA) regions has shown substantial momentum, driven by socio-demographic shifts, regulatory modernization, and the integration of behavioral finance into digital financial services [34,35]. In the GCC, countries like Saudi Arabia, UAE, and Bahrain are spearheading FinTech innovation by aligning FinTech adoption with investor Behaviour and market efficiency objectives. Research highlights that the fusion of FinTech with behavioral finance principles is mitigating cognitive biases, enhancing portfolio diversification, and improving investor trust in digital platforms [34]. Similarly, in the MENA region, FinTech has been a catalyst for economic transformation, particularly through its role in expanding financial inclusion and digitizing payment systems. The region’s young, tech-savvy population, high smartphone penetration, and evolving digital ecosystems have created fertile ground for the uptake of financial technologies [35,36]. However, despite this growth, fragmented regulatory environments and disparities in financial infrastructure continue to pose challenges. This highlights the need for cross-national comparative studies and region-specific policy strategies to further harmonize and scale the FinTech ecosystem in the MENA and GCC context.

Government support, regulatory reforms, and the establishment of the FinTech Saudi initiative have played a pivotal role in nurturing a thriving digital finance ecosystem [17]. The SAMA and the CMA have provided regulatory sandboxes to foster innovation while mitigating systemic risks [18]. This proactive approach has enabled FinTech start-ups and incumbent financial institutions to collaborate and deploy scalable digital financial solutions [37].

Within the broader FinTech landscape, robo-advisory services have emerged as a critical development, offering algorithm-driven investment management with minimal human intervention [3]. These platforms cater to a growing segment of digitally literate investors who seek low-cost, transparent, and automated investment solutions [7]. As noted by [21], robo-advisors in Saudi Arabia are gaining traction due to their ability to reduce biases in financial decision-making and improve access to diversified portfolios.

Robo-advisory services in Saudi Arabia are gaining prominence as scalable, cost-effective, and Sharia-compliant wealth management solutions. Regulated by the CMA, licensing for robo-advisors began in 2019, with platforms like Sarwa and Derayah Smart marking early entrants into the market [19]. Today, Saudi robo-advisors such as Malaa, Tamra Capital, Drahim, Vault Wealth, Abyan, Derayah Smart, and Sarwa offer low minimum investment thresholds (as little as SAR 50), competitive fee structures, and portfolios aligned with Islamic finance principles, thus catering to a diverse investor base [20].

According to Statista, assets under management in the Kingdom’s wealth management sector are expected to reach US$206.18 billion in 2025, with financial advisory services comprising the majority at US$200.88 billion. Although the market anticipates a modest contraction at a Compound Annual Growth Rate (CAGR) of –1.18%, it will still retain a significant size of US$196.61 billion by 2029 [38].

FintechSaudi’s 2021 report highlights robo-advisors as being crucial for reaching underserved and digital-native segments, stressing the need for improved trust, awareness, and user experience design [39]. Further, the 2023 Annual FinTech Report documents a 74% increase in FinTech companies over the previous year, attributing part of this growth to robo-advisory platforms supported by regulatory sandboxes and proactive investor education [16]. CMA’s 2023 report reinforces this momentum, noting increased interest in AI-powered advisory services and outlining policy initiatives in line with Vision 2030’s digital finance objectives [40]. Similarly, Riyadh Valley Company (2023) forecasts strong adoption driven by digital infrastructure, consumer demand, and the strategic push for Sharia-compliant innovation in robo-advisory services [41]. The FinTech and robo-advisory landscape in Saudi Arabia is on an upward trajectory, supported by robust regulatory frameworks, strategic national vision, and a receptive consumer base [21].

Despite the promising growth trajectory, the adoption of robo-advisors remains in its early stages, with challenges linked to user trust, risk, digital literacy, and regulatory clarity [3,21]. However, consumers’ openness to new financial technologies is increasing, driven by demographic trends, widespread smartphone usage, and evolving consumer preferences [42]. Empirical evidence further underscores the positive perception of FinTech in enhancing financial accessibility and efficiency in Saudi Arabia’s e-commerce and retail sectors [22]. Nonetheless, scholarly attention to robo-advisory adoption in the Kingdom remains limited, particularly in terms of user Behaviour, decision-making mechanisms, and trust-building strategies tailored to local cultural and regulatory settings [15,21]. Most existing studies focus broadly on FinTech or financial inclusion without isolating the unique characteristics and challenges of algorithm-driven advisory platforms. This gap signals the need for further empirical and theoretical investigations to better understand how Saudi investors perceive, evaluate, and adopt robo-advisory systems [25,30]. The study by [31] also recommends that future research should apply and empirically validate AI-based FinTech integration frameworks within specific financial institutions in Saudi Arabia to assess their effectiveness in enhancing operational efficiency and strategic decision-making.

As FinTech adoption accelerates across Saudi Arabia and the GCC, understanding robo-advisory adoption is vital for designing inclusive and culturally aligned digital investment solutions. These platforms are reshaping investor Behaviour and decision-making. Context-specific insights are crucial for designing inclusive, transparent, and effective digital investment solutions aligned with local cultural expectations, regulatory goals, and the Kingdom’s broader financial transformation agenda.

2.2. Robo-Advisory Services: Global Trends and Characteristics

Robo-advisors are automated digital platforms leveraging artificial intelligence (AI) to deliver personalized financial advice and investment management with minimal or no direct human intervention [2]. These platforms typically use sophisticated algorithm-based models to construct investment portfolios, execute transactions, and provide regular portfolio rebalancing, aiming to mitigate human biases, enhance investment accuracy, and deliver consistent advisory services [4]. By automating traditionally manual advisory processes, robo-advisors significantly reduce the costs associated with human financial advisors, thereby offering more affordable options for retail investors [5]. This affordability has facilitated the democratization of financial advice, extending sophisticated financial services to wider audiences, including individuals with limited financial literacy or lower investment capital [3]. Additionally, robo-advisors often provide user-friendly interfaces and intuitive dashboards, enhancing ease of use and making complex financial decisions more approachable for average investors [6].

Despite these notable advantages, robo-advisors encounter several significant barriers and challenges that impede widespread adoption. Trust constitutes a primary concern, as investors frequently express reservations about relying exclusively on AI-generated recommendations without the possibility of human interaction, particularly for high-stakes financial decisions [23]. The lack of human touchpoints often amplifies investor anxiety, as they question the system’s ability to empathize with individual financial circumstances and personal preferences [6]. Moreover, investor risk aversion creates skepticism regarding robo-advisors’ proficiency in navigating unpredictable market conditions and effectively managing portfolios during periods of high volatility [23]. Data privacy and security issues also pose substantial challenges, with users expressing apprehension about disclosing sensitive financial information to automated digital platforms. Concerns over potential cybersecurity threats and misuse of personal data further inhibit consumer willingness to fully embrace robo-advisory services [4].

Globally, the adoption of robo-advisory services continues to grow, driven by rapid advancements in AI technology, evolving consumer attitudes toward digital financial solutions, and industry-wide trends favoring digitization and automation [7]. In developed markets, robo-advisors are increasingly integrated into mainstream financial services, attracting young, tech-savvy investors who prefer convenience and digital interaction over traditional, face-to-face advisory relationships [5]. Meanwhile, in emerging markets, these services offer potential solutions for enhancing financial inclusion and increasing participation in formal investment channels among previously underserved demographics [3]. Continuous improvements in platform transparency, enhanced interpretability of AI algorithms, and user-centric design enhancements are imperative to overcome existing adoption barriers and attract diverse investor segments [6,43]. Therefore, comprehending the factors driving robo-advisor acceptance and the ongoing challenges remains crucial for financial institutions seeking sustainable innovation and competitive differentiation in an increasingly dynamic FinTech landscape.

2.3. Investor Behaviour and FinTech Adoption in Saudi Arabia

Investor Behaviour in Saudi Arabia demonstrates specific characteristics that influence FinTech adoption, notably including risk aversion and religious preferences [21]. Risk aversion significantly shapes investor decisions, as Saudi investors tend to prefer safer, more predictable financial instruments over high-risk opportunities, even when these involve innovative technologies such as FinTech [34]. Additionally, Islamic principles profoundly impact financial behaviors, compelling investors to seek Shariah-compliant FinTech products, reflecting a unique intersection between faith and finance within the Saudi context [15].

Recent trends highlight a growing retail investor engagement with FinTech services driven by Saudi Arabia’s ambitious Vision 2030 objectives, which prioritize digital transformation and financial sector modernization [18]. The Saudi financial landscape has seen a rapid increase in active FinTech companies, significantly exceeding initial growth targets, thereby indicating robust retail investor interest and confidence in technology-driven financial solutions [15]. This engagement is supported by proactive regulatory frameworks designed to foster innovation and safeguard consumer interests, enhancing retail investor confidence in adopting digital financial products [31].

Digital literacy and trust play crucial roles in the adoption of FinTech solutions in Saudi Arabia. High digital literacy levels empower investors to navigate and effectively utilize advanced financial technologies, thereby boosting overall adoption rates [22]. Trust remains a decisive factor, where concerns about cybersecurity and privacy often influence consumer willingness to engage with FinTech platforms. Ensuring robust security frameworks and transparent communication about data handling practices have become vital for building and maintaining consumer trust [33]. Thus, addressing behavioral traits, promoting digital literacy, and establishing trust are critical for fostering sustainable FinTech adoption among Saudi investors.

2.4. Green FinTech and Green Perceived Value (GPV)

The emergence of ESG criteria has significantly reshaped investment behaviors, giving rise to green investing, where financial decisions are aligned with sustainability goals [44]. Green investing prioritizes environmental protection, social responsibility, and good governance, thereby integrating ethical considerations into financial returns [45]. Robo-advisory platforms have begun incorporating ESG considerations, allowing investors to seamlessly align their portfolios with sustainability objectives through automated, algorithm-driven processes [46,47]. Reference [8] has stated that younger generations of investors are generally more environmentally conscious, showing a growing preference for sustainable products as a response to the immediate challenges posed by climate change.

GPV, as applied to green or organic products, represents a multidimensional construct that includes functional, conditional, social, and emotional benefits consumers associate with environmentally friendly offerings [28]. In the context of this study, GPV refers to an investor’s overall evaluation of the environmental, emotional, social, and situational benefits associated with using eco-friendly and sustainable digital financial platforms. It reflects the belief that such services reduce environmental impact, support paperless processes, align with personal environmental values, and contribute to the broader goal of sustainable financial practices. Recent studies suggest that a higher perception of green value enhances users’ attitudes toward sustainable technologies and significantly increases their intention to adopt such solutions [28]. In digital finance, GPV has been identified as a key determinant influencing trust and behavioral intention, especially among environmentally conscious consumers [29].

As Green FinTech continues to evolve, perceived green value becomes increasingly relevant in understanding user engagement with sustainable digital financial services [26,48,49]. Investors are not only evaluating these platforms based on their financial performance but also on their contribution to environmental well-being and alignment with personal sustainability goals [50,51]. When FinTech solutions such as robo-advisors incorporate features like ESG filters, carbon tracking, or paperless transactions, they enhance users’ perception of ecological responsibility [52]. This perception strengthens their trust and willingness to adopt such technologies, reinforcing the role of GPV as a key driver in the broader landscape of sustainable financial innovation. The digitalization of finance is pivotal for advancing environmental, social, and governance objectives, but its success hinges on effectively implementing emerging technologies and accurately assessing their sustainability impact [53].

2.5. Summary of Gaps and Research Motivation

Numerous studies have examined the adoption of robo-advisory services by focusing on constructs such as PU, ease of use, and RA. For instance, one study explored the role of trust and PEOU but overlooked platform-specific features such as interface quality [24]. Another investigation assessed investor intention using traditional models but failed to consider sustainability dimensions like GPV [12]. While some research highlighted the importance of algorithmic transparency and digital convenience, they did not account for users’ prior knowledge or environmental expectations [21].

The construct of GPV, although gaining traction in consumer goods research, remains largely underrepresented in the domain of digital financial services and robo-advisory platforms [26]. Similarly, KRA, which could play a foundational role in shaping perceptions of innovation, has not been systematically explored as a driver of trust or perceived value [25]. Moreover, despite evidence that user interface quality enhances digital adoption, especially among younger investors, this dimension is rarely integrated with green or value-based constructs in FinTech research [5,7].

Furthermore, although trust has been widely acknowledged as a significant determinant of FinTech adoption, prior studies have predominantly examined it as a direct antecedent rather than a moderating construct. This leaves a gap in understanding how trust may strengthen or weaken the influence of other predictors such as PIQ, green value, or user knowledge in robo-advisory adoption.

This gap is particularly relevant in the context of Saudi Arabia, where a young, digitally aware population is emerging alongside policy initiatives promoting FinTech and sustainability under Vision 2030 [22,30]. The market is ripe for models that go beyond classical technology acceptance and integrate environmental consciousness with usability and trust.

Accordingly, this study develops a holistic model by drawing on the DOI, TAM, VAM, and Trust Model. It introduces and tests underexplored constructs such as GPV, KRA, and PIQ, thereby offering a timely and contextually relevant contribution to sustainable FinTech adoption research.

2.6. Theoretical Background

2.6.1. Diffusion of Innovation (DOI)

The DOI theory, originally proposed by Everett M. Rogers in 1962 [54], explains how innovations spread within a social system over time through communication channels. DOI identifies key innovation attributes such as RA, compatibility, complexity, trialability, and observability that influence adoption Behaviour. It has been widely applied in technology acceptance research to understand how individuals and organizations evaluate and adopt new technological solutions [55]. In the context of digital finance, DOI has provided valuable insights into user acceptance of mobile banking, blockchain, and robo-advisory platforms. Studies have particularly highlighted the significance of RA and user knowledge in predicting adoption [33,56,57].

The innovation adoption process developed by [54] posits that actual adoption Behaviour is influenced by multiple motivations emerging from different branches of a decision-making process. This theoretical view aligns with the structure of the present study, which investigates how investors’ KRA, their perceptions of PIQ, and the GPV of robo-advisory systems converge to shape their adoption intentions. By drawing on DOI, this study captures the multi-path nature of innovation adoption, offering a socio-technical perspective that reflects the interplay of sustainability, usability, and technological trust in shaping investor Behaviour.

2.6.2. Technology Acceptance Model (TAM)

The TAM, developed by [58], is widely recognized for explaining user adoption of technology. Originating from the Theory of Reasoned Action (TRA), TAM primarily highlights two central constructs: PU and PEOU. PU reflects users’ belief that technology enhances their performance, while PEOU addresses their perception of the required effort. These factors collectively influence user attitudes and subsequent behavioral intentions towards adopting technological innovations.

Prior research extensively applied the TAM to investigate user adoption of innovative financial technologies such as robo-advisory services. For instance, studies examining robo-advisor adoption integrated TAM with trust, perceived risk, social influence, and demographic moderators, identifying trust and PU as significant predictors of user adoption attitudes and intentions [23]. Similarly, research focusing on investor Behaviour towards robo-advisors utilized TAM alongside performance expectancy, anxiety, and preference for human advisors, emphasizing trust and performance expectancy as critical to investor acceptance [5]. Further extending TAM, recent studies incorporated additional factors such as fiduciary responsibility, human–computer interaction, and corporate reputation, finding that these significantly impact perceived value and trust, subsequently influencing adoption intentions [12,59]. Collectively, these studies affirm TAM’s flexibility and relevance in examining FinTech adoption, especially when augmented by context-specific variables.

In alignment with the TAM, this study incorporates PU and PEOU as core determinants influencing user acceptance of robo-advisory services. Additionally, PIQ is introduced as an external antecedent enhancing users’ ease of use perceptions, thereby positively affecting their overall adoption intention.

2.6.3. Value-Based Adoption Model (VAM)

Originating from the work of Kim, Chan, and [60], the VAM conceptualizes technology adoption as a rational evaluation of trade-offs between perceived benefits and sacrifices. Benefits typically include PU and enjoyment, while sacrifices involve perceived technicality and monetary cost. This perceived value, arising from the benefit–sacrifice assessment, serves as the key determinant of users’ adoption intentions. VAM extends beyond traditional acceptance models like TAM by focusing on users’ overall value judgment, making it especially relevant for emerging digital technologies.

Recent FinTech studies have applied VAM to examine adoption of mobile banking, digital finance platforms, and robo-advisory services. For example, researchers exploring mobile finance in Indonesia found that enjoyment, usefulness, accessibility, perceived risk, and sacrifice significantly influence value perception and adoption intention [61]. Other work integrates VAM with UTAUT2, demonstrating that perceived value, shaped by trust, service quality, and digital literacy, drives FinTech adoption [62]. Reference [63] asserts that customers’ intention to adopt FinTech services depends significantly on the value they perceive from using such technologies.

Since GPV and PIQ directly influence users’ evaluation of robo-advisors, this study adopts the VAM to capture how users weigh benefits and sacrifices in their adoption decisions. Other factors, such as KRA, RA, PU, and PEOU, influence adoption intention independently and represent complementary dimensions of value perception. While these constructs do not shape green value directly, they contribute to users’ broader appraisal of the platform. Recent studies have also employed VAM to examine FinTech adoption [27], supporting its relevance here.

In this study, GPV is integrated as a sustainability-specific benefit dimension within the VAM framework. It is linked directly to users’ IURA, reflecting the belief that environmentally conscious financial technologies enhance service value. Through VAM’s benefit–sacrifice lens, the model demonstrates how green and usability-driven features jointly encourage adoption of sustainable robo-advisory services.

2.6.4. Perceived Trust

Building on the previously discussed theories, this study also considers PT as a key contextual factor, particularly due to its relevance in digital financial decision-making. While existing studies have primarily treated trust as a direct antecedent of adoption, its moderating role remains underexplored in the context of robo-advisors. Trust reduces perceived risk and increases confidence in automated investment systems, especially in environments where algorithmic decision-making lacks human oversight. For example, [25] highlights that PT significantly influences the adoption of AI-driven financial services among Saudi Gen Z users. Similarly, [21] underscores trust as a vital factor shaping robo-advisor adoption intentions in Saudi Arabia, yet considers it solely as an independent variable. In the study conducted by [27], trust was confirmed as a strong determinant of FinTech usage, but again without examining its interaction with other variables. By integrating PT as a moderator, this study addresses a notable gap by investigating how trust can amplify or attenuate the effects of constructs such as PIQ, green perceived value, and user knowledge on the intention to adopt robo-advisory services. This perspective offers a more nuanced understanding of investor Behaviour in a socio-technical context.

2.6.5. Theoretical Integration Supporting the Proposed Model

The proposed model synthesizes constructs from DOI, TAM, VAM, and the Trust perspective to explain investors’ intention to use robo-advisory services in a green digital finance context. Each theory supports specific variables and hypothesized relationships, forming a cohesive and testable framework.

DOI explains how innovation characteristics like RA and user knowledge influence technology adoption decisions. In this study, DOI underpins the role of KRA and RA as critical precursors to adoption intention, capturing how innovative green advisory services spread through investor communities.

While RA and PU may appear similar, they assess different levels of user evaluation. RA (from DOI) reflects an innovation’s superiority over current alternatives—viewed from a comparative or market-level perspective [64,65]. PU (from TAM), in contrast, captures the individual’s performance expectancy—specifically the belief that using a system enhances task efficiency and decision quality [58,66]. Prior research confirms these are related yet distinct constructs, emphasizing that RA speaks to relative improvement over existing solutions, while PU conveys personal utility and task-level benefits [67]. Retaining both constructs allows our model to incorporate both the broader innovation adoption perspective (RA) and the more individualized productivity orientation (PU), offering richer theoretical depth.

TAM supports the inclusion of PU and PEOU as central factors shaping user attitudes. PIQ is modelled as an antecedent that enhances usability perceptions, aligning with TAM’s structure and expanding it for digital finance. VAM informs the model by framing adoption because of value appraisal. Green Perceived Value, reflecting ecological benefits of robo-advisors, is conceptualized as a key “benefit” construct, while usability and knowledge dimensions represent supporting value drivers. Finally, PT is integrated as a moderator, not as a direct predictor, to investigate its conditional influence on the relationships between value perceptions (e.g., green value, usefulness) and intention. This approach builds on prior research treating trust as a determinant but extends it by examining its interactive role, offering a nuanced understanding of investor adoption in a socio-technical and sustainability-driven context.

This theoretical integration enables a multidimensional view of investor Behaviour and supports a novel contribution to the intersection of FinTech, sustainability, and user psychology. The following section presents the hypotheses developed from this framework.

2.7. Hypothesis Formulation

Knowledge about Robo-Advisors (KRA) includes financial literacy and an individual’s understanding of algorithmic decision-making, risk evaluation, and personalized investment features offered by automated digital advisory platforms [68]. KRA involves awareness of their operational features, benefits, and investment strategies, which enhances users’ trust and intention to adopt these automated platforms [21]. In this study, KRA refers to individuals’ financial literacy and their awareness of how robo-advisory platforms operate, specifically their algorithmic decision-making, risk-handling capabilities, and personalized investment strategies. This knowledge enhances user confidence, trust, and intention to adopt such platforms by enabling informed evaluation of their benefits and functionalities [69]. Within the FinTech domain, such knowledge is a critical precursor to adoption [70]. Prior knowledge enhances consumers’ ability to understand, evaluate, and trust digital investment platforms. The study by [12] showed that customer education significantly increased perceived value and trust, which in turn positively impacted robo-advisor adoption. Similarly, [71] found knowledge of AI technology had a direct and significant positive effect on adoption intention in the banking sector. Reference [72] further supports this by demonstrating that users’ awareness of algorithms shapes their trust in algorithmic processes and influences how they assess privacy concerns and self-disclosure decisions. In [21], investors with greater knowledge showed higher intention to adopt, recognizing the strategic benefits and reduced uncertainty. Reference [73] and [69] also confirmed that higher level of financial knowledge has positive impact on investors’ adoption of robo-advisors. This aligns with the DOI theory, which identifies knowledge as a foundational driver in the innovation adoption process, especially in evaluating RA and reducing uncertainty. Thus, knowledge fosters familiarity, reduces perceived complexity, and enhances users’ cognitive readiness to engage with robo-advisors, ultimately boosting intention to use these services.

GPV, as applied to green or organic products, represents a multidimensional construct encompassing functional, emotional, social, and conditional benefits that consumers associate with environmentally friendly offerings [28]. In the context of robo-advisory services, GPV captures users’ belief that these platforms can promote environmental sustainability while simultaneously delivering tangible investment value. As framed by the VAM, GPV reflects a critical “benefit” component that shapes users’ value judgments and adoption intentions in sustainability-driven financial technologies. Several studies provide indirect and direct support for the role of GPV in shaping user Behaviour toward digital financial services. Study [46] investigates the role of perceived value and sustainability orientation in green investing Behaviour. It finds that individuals with a strong orientation toward environmental sustainability are more likely to engage with green investment platforms. These users perceive greater value in platforms that align with their ethical and environmental values, reinforcing the importance of green positioning in attracting eco-conscious investors. In [26], GPV is confirmed to significantly influence brand trust, brand attitude, and purchase intention, particularly within green luxury consumption. The moderating role of digital customer engagement further underscores how eco-aligned perceptions can be amplified by interactive digital experiences. Similarly, [28] reveals that GPV positively affects attitude and behavioral intention when shaped by social consensus and informational cues, highlighting its relevance in socially influenced digital contexts. Moreover, [12] supports the relevance of perceived value, driven by performance efficacy, user education, and brand strength, as a predictor of robo-advisor adoption, reinforcing the functional and emotional pathways analogous to GPV. Finally, [29] confirms that GPV strongly influences sustainable consumption intentions, affirming that green attributes are integral to behavioral motivation.

Taken together, these findings suggest that GPV is a vital determinant in promoting the adoption of robo-advisory services, especially those positioned as environmentally responsible. Furthermore, KRA plays a foundational role in shaping this green value perception, thereby facilitating more informed and sustainability-oriented adoption decisions.

RA refers to the degree to which individuals perceive a new FinTech, such as robo-advisors, as offering superior benefits over traditional alternatives. In [74], RA is identified as a pivotal determinant influencing users’ adoption intention when they perceive digital investment tools as more convenient, cost-effective, and personalized. The study highlights that user perception of these advantages strongly correlates with behavioral intention to adopt such innovations. Reference [75] further strengthens this position by linking RA to perceived investment value; users are more likely to switch to FinTech platforms like crowd-lending when they recognize emotional and economic advantages over conventional banking services. Meanwhile, [76] supports the notion that knowledge about the platform enhances awareness of its distinctive benefits, thus increasing its perceived RA. In [77], however, RA’s impact on behavioral intention was found insignificant for some user groups, suggesting that contextual and demographic variables may moderate this relationship. Finally, [78] reiterates that when users are well-informed about robo-advisory functionalities, their perception of RA increases, reinforcing trust and adoption intention.

Aligned with the DOI theory, RA reflects one of the core innovation attributes that directly influences how individuals evaluate and adopt new technologies, particularly when the innovation offers observable and substantial improvements over prior solutions.

Collectively, the evidence indicates that RA plays a central role in FinTech adoption by influencing how users assess the innovation’s comparative advantages. This perception is shaped by users’ knowledge about robo-advisory platforms, as familiarity helps them recognize features that enhance convenience, efficiency, and overall value, thereby strengthening their adoption intentions.

PU refers to the degree to which individuals believe that using robo-advisory platforms will improve their financial decision-making efficiency and investment outcomes. In [23], PU is identified as a key determinant of both user attitudes and behavioral intentions. Users perceive robo-advisors as beneficial for offering secure, accurate, and personalized investment services, particularly when integrated with artificial intelligence, which enhances portfolio management and reduces decision fatigue. Reference [30] further supports PU’s central role by demonstrating that it significantly influences investors’ behavioral intention to adopt AI-enabled robo-advisors, particularly for sustainable investment decisions. The study confirms that features such as usability, trust, and lower perceived risks, when aligned with PU, positively shape investor intentions. Notably, knowledge and awareness of sustainable investing increase PU, making it an important mediator in guiding investor Behaviour. In [74], PU is again highlighted as a foundational element in the TAM. The study shows that when investors perceive robo-advisors to be more efficient, cost-effective, and accurate than traditional methods, their intention to adopt these platforms strengthens. PU not only affects attitude directly but also mediates the link between platform knowledge and intention to adopt. Similarly, [74] shows that PU plays a significant role in explaining users’ adoption Behaviour, particularly when paired with PEOU and performance expectancy. Reference [78] identifies PU as a robust predictor of intention, and the study emphasizes the role of knowledge and digital literacy in shaping PU perceptions.

Aligned with the TAM, PU captures how users evaluate technology based on expected performance outcomes, reinforcing its role as a rational determinant of behavioral intention in digital finance.

Across all the five mentioned studies, PU consistently enhances users’ confidence in robo-advisory platforms. It serves as a bridge between prior knowledge and behavioral intention by translating understanding into perceived benefits. Users who possess adequate KRA, including technical compatibility, operational readiness, and the availability of support systems, are more likely to recognize their practical advantages. This familiarity reduces uncertainty and strengthens perceptions of usefulness, reinforcing their intention to adopt. Thus, PU is not only a direct driver of intention but also a mediating mechanism through which KRA leads to greater adoption.

PEOU refers to the extent to which users believe that engaging with a new system, such as robo-advisory platforms, is free of effort. Across the literature, PEOU has been shown to significantly influence either the intention to adopt or the attitude towards such technologies, which in turn affects adoption Behaviour. In [23], while PEOU did not significantly influence users’ attitudes, it still exhibited a significant direct impact on adoption intention, implying that users are more inclined to adopt robo-advisory services when these platforms are user-friendly and simple to navigate. This aligns with the TAM, which posits that systems perceived as easier to use are more likely to be adopted due to lower cognitive demands and enhanced usability perceptions. Similarly, [77] confirms that the more intuitive and accessible a robo-advisory platform is, the more likely users are to develop a favorable perception toward using it. Notably, this paper also suggests that PEOU facilitates PU by reducing the cognitive and operational effort required to understand and operate the system, which enhances the perceived utility of the service. Reference [78] reinforces this perspective, showing that PEOU not only enhances user satisfaction but also acts as a critical antecedent to PU, thereby indirectly supporting adoption intention through improved usefulness perception. Finally, [12] finds that PEOU contributes positively to Perceived Value, which indirectly supports adoption intention. This complements the VAM perspective, where ease of use enhances users’ benefit evaluation and overall value perception in AI-driven financial platforms.

Thus, PEOU exerts a dual direct impact: it positively influences users’ intention to adopt robo-advisory services and enhances their perception of the platform’s usefulness. When users find the system intuitive and easy to interact with, they are more likely to perceive it as beneficial and be motivated to use it. This ease minimizes cognitive effort, reduces resistance to technology, and reinforces users’ confidence in achieving desired financial outcomes. Therefore, PEOU plays a pivotal role in shaping both PU and behavioral intention in the adoption of robo-advisory services. In this context, PU is also expected to mediate the relationship between PEOU and intention, translating usability into perceived value that drives adoption.

PIQ refers to users’ perceptions of the visual design, clarity of information, responsiveness, and eco-friendly features of a robo-advisory platform. It encompasses aspects such as professional aesthetics, easy navigation, device responsiveness, and understandable summaries that facilitate informed financial decisions. According to [79], interface design elements such as layout, typography, and interactivity play a crucial role in shaping user engagement and satisfaction. Reference [14] further asserts that the platform interface is a central touchpoint in the overall service experience, influencing how customers interact with and perceive digital financial services. However, studies such as [80,81,82] highlight current deficiencies in information disclosure on robo-advisor platforms. This shortcoming can be addressed by integrating explainability into interface design, as noted by [83,84], who found that explainable AI fosters user trust only when the disclosed information is comprehensible. Additionally, [21] recommends ongoing improvements in interface design through user feedback and iterative testing. The findings in [85] confirm that visually appealing and easy-to-navigate platforms enhance PT and usability, which in turn positively affect users’ confidence and decision-making.

Collectively, these studies indicate that high PIQ enhances PEOU by simplifying navigation, improving visual structure, and ensuring smooth functionality across devices. A well-designed interface enhances PU by improving the accessibility, clarity, and alignment of system features with users’ informational needs. Moreover, an intuitive and professional platform fosters trust and satisfaction, thereby directly shaping users’ IURA. Importantly, PIQ can serve as a precursor to PU, suggesting that users’ perception of usefulness may partially stem from the quality of their interface experience. Likewise, as PEOU increases through better interface design, PIQ may act as a conduit translating ease of use into behavioral intention. These interrelationships justify exploring the mediating role of PU between PIQ and Intention, as well as the mediating role of PIQ between PEOU and Intention.

Trust plays a foundational role in shaping investor Behaviour and is widely recognized as a pivotal factor in the adoption of FinTech innovations [56]. Across various FinTech contexts, trust has consistently emerged as a critical driver of user confidence, satisfaction, and intention to adopt. For instance, the FinTech-focused study [86] highlights trust as a key determinant of customer loyalty and digital banking adoption, enhancing perceived service value and satisfaction. Similarly, in the Saudi Arabian FinTech context, [25] confirms that trust is a vital antecedent to user satisfaction and reduces perceived risk, which is especially important in technology-driven financial interactions.

Trust is equally essential in the more specific domain of robo-advisory services. Study [21] identifies trust as a significant predictor of behavioral intention to adopt robo-advisors, particularly due to its influence on risk perception and system reliability. Likewise, [5] reinforces trust’s impact on reducing resistance to adopting digital banking solutions, demonstrating its applicability across multiple FinTech verticals. In [12] trust not only directly shapes adoption intention but also moderates the relationship between platform features and user confidence, suggesting a dual role of trust. Further, [23] supports trust as both a direct and moderating influence, particularly in enhancing the PU and quality of AI-powered robo-advisory platforms. Moreover, [68] affirms trust’s foundational role in AI-driven FinTech tools, highlighting its mediating influence between digital literacy and intention, especially in sustainable finance.

While previous studies have primarily examined trust as an independent variable, its potential moderating role in the robo-advisory context remains underexplored. Trust may not only influence users directly but also condition the strength of other key predictors of intention, such as knowledge and interface quality. For example, even well-informed users or those experiencing high-quality interfaces may hesitate to adopt robo-advisors if trust in the underlying system is low. Conversely, high PT could enhance the effectiveness of these antecedents by reducing perceived risk and reinforcing confidence in automated financial decisions. To address this gap, the current study investigates whether PT amplifies or attenuates the effects of platform knowledge and interface quality on user intention.

Based on the foregoing discussion of knowledge, green perceived value, RA, PU, PEOU, PIQ, and trust, the following set of hypotheses is proposed to capture the direct, mediating, and moderating relationships within the research model.

Direct Effects

H1.

KRA has a direct positive impact on IURA.

H2.

PIQ has a direct positive impact on IURA.

Mediating Effects

H3a.

GPV mediates the relationship between KRA and IURA.

H3b.

RA mediates the relationship between KRA and IURA.

H3c.

PU mediates the relationship between KRA and IURA.

H4a.

PU mediates the relationship between PIQ and IURA.

H4b.

PEOU and PU sequentially mediate the relationship between Perceived Interface Quality and IURA.

H4c.

PEOU mediates the relationship between PIQ and IURA.

Moderating Effects

H5a.

PT moderates the relationship between KRA and IURA.

H5b.

PT moderates the relationship between Perceived Interface Quality and IURA.

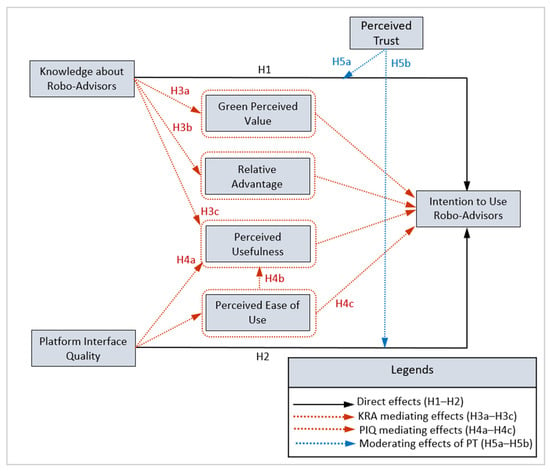

Figure 1 presents the proposed research model, developed in alignment with the above hypotheses and their supporting rationale.

Figure 1.

Proposed Framework.

3. Materials and Methods

3.1. Measurement Scale Design

This study employed a survey-based approach to collect data from respondents within Saudi Arabia. The target population comprised all adult individuals residing in the country, with a particular focus on those likely to engage in financial or investment decision-making. The survey items were primarily adapted from prior relevant literature. Specifically, six items measuring KRA were adapted from [21] and [68]. Four items assessing RA were sourced from the work of [87], while four items for PU were adopted from [21]. Similarly, four items measuring PEOU were adopted from [88], and four items for PT were drawn from [21]. The construct of IURA was measured using three items adapted from [88].

As no suitable existing measures were identified for PIQ and GPV within the robo-advisory and green finance context, the study developed five items for PIQ and four items for GPV. The development of PIQ items was grounded in the literature emphasizing visual design, information clarity, responsiveness, and eco-friendly features of digital financial platforms. Prior research highlights the importance of professional aesthetics, easy navigation, and interactivity in shaping user engagement and satisfaction [14,79]. Studies have also pointed to deficiencies in information disclosure on robo-advisor platforms [80,81,82], which can be addressed by incorporating explainability into interface design [83,84]. Additionally, iterative improvements based on user feedback have been recommended [21].

The GPV items were developed from literature linking green consumption values to functional, emotional, and social benefits of eco-friendly services. GPV captures user perceptions that robo-advisors support environmental sustainability while delivering investment value. Prior studies emphasize that GPV is a multidimensional construct reflecting functional, emotional, and ethical benefits associated with green-oriented offerings [28]. These insights guided the development of four GPV items reflecting paperless processes, environmental contribution, and alignment with personal values.

To ensure the instrument’s validity and reliability, a rigorous validation process was undertaken. Initially, the newly developed PIQ and GPV items, along with the adapted scales, were reviewed by three academic experts (specializing in information systems and financial technologies) and by two practitioners in digital financial services. Their constructive feedback was incorporated to refine clarity, wording, and relevance. A pre-test followed, aimed at assessing item clarity and functionality, during which a group of experienced respondents completed the survey and provided feedback. Based on this, a pilot study was conducted with 99 respondents to evaluate the clarity, reliability, and suitability of the measurement instrument. The sample size met the requirements of the 10-times rule [89] and G*Power analysis (Version 3.1.9.7) [90], ensuring adequate statistical power. Reliability indices were satisfactory, with Cronbach’s α ranging from 0.78 to 0.91 and composite reliability values between 0.80 and 0.93, all above recommended thresholds. No clarity issues were reported and, as a result, no revisions to the instrument were required. These outcomes provided confidence in the measurement instrument and justified proceeding with full-scale data collection for the final analysis.

To assess the psychometric properties of the newly developed and adapted scales, Exploratory Factor Analysis (EFA) was conducted using the ‘Maximum Likelihood’ extraction method with ‘Promax’ rotation. Coefficients below an absolute value of 0.3 were suppressed to enhance interpretability. All outcomes were found to be satisfactory. The communalities table indicated that all items had extraction values exceeding 0.4, suggesting that each item contributed meaningfully to the underlying factor structure and retained a substantial portion of explained variance. The Kaiser-Meyer-Olkin (KMO) measure of 0.926 indicated excellent sampling adequacy, while Bartlett’s Test of Sphericity was highly significant (p < 0.001), confirming the suitability of the data for factor analysis. The “Total Variance Explained” table revealed that the first eight components jointly accounted for 68.501% of the total variance, with strong initial eigenvalues and rotation enhancing the clarity of the factor structure. The results of the Pattern Matrix were deemed satisfactory, with all items loading robustly onto their respective components and no significant cross-loadings observed. These findings affirm the distinctiveness of the extracted factors. Overall, the EFA results support the construct validity and reliability of the measurement scales, confirming a well-structured factor solution with sound item loadings and an adequate explanation of variance. The measurement items of the study are listed in Appendix A.1.

3.2. Sampling and Data Collection Process

This study employed a purposive sampling technique to recruit potential users of Robo-Advisory services in Saudi Arabia. The target population comprised adult individuals residing in the Kingdom, with a particular focus on those likely to make financial or investment decisions. Purposive sampling was deemed appropriate as it allowed the researchers to select participants with relevant experience or interest in Robo-Advisory platforms, ensuring alignment with the study objectives. This approach also facilitated the inclusion of individuals who could provide meaningful insights into user perceptions and adoption behaviors.

The survey consisted of two sections: the first captured demographic information and the second assessed user perceptions based on constructs included in the proposed model. A screening question was placed at the beginning of the survey to present the informed consent and confirm participants’ willingness to respond. Only those who voluntarily agreed by selecting “Yes” proceeded with the survey. No identifiable personal data were collected, ensuring full confidentiality. The survey was administered both online and in person, with physical distribution limited to major cities, and data collection was conducted between March and June 2025. Strict protocols were followed throughout to maintain data security and respondent privacy.

As evident from the demographic profile in Table 1, the study included respondents from both urban and rural populations to promote diversity. This is particularly important in the Saudi context, where consumer preferences for financial services may vary across regions due to differing economic conditions, access to digital infrastructure, and cultural factors. Nonetheless, the sample is not fully representative of the entire Saudi investor population, as urban participants were more prominent due to higher digital access.

Table 1.

Demographic Information of the Sample.

To further define the study boundary, participants represented a mix of socio-economic and demographic groups. Table 1 illustrates the distribution by income, education, employment status, and region. The sample therefore reflects a cross-section of Saudi adults with varying investment capacities (ranging from less than SAR 50,000 to above SAR 200,000), education levels, and regional representation. While this approach enhances diversity, the purposive design and urban concentration mean that findings should be interpreted as indicative rather than fully generalizable to the entire Saudi investor population.

According to [91] sample size table, a minimum of 384 responses is recommended for a population exceeding 10,000. Following [92] guidelines, we initially targeted 384 responses. Out of the 418 responses collected, 31 were excluded due to incomplete data, yielding a final sample of 387 valid cases. This careful screening process enhanced data quality and ensured a reliable basis for analyzing the relationships among the study’s key variables.

3.3. Analysis of Data

For analysis, Partial Least Squares Structural Equation Modelling (PLS-SEM) was conducted using SmartPLS 4.0. PLS-SEM was selected over Covariance-based Structural Equation Modelling (CB-SEM) due to the model’s complexity, need for flexibility, and suitability for non-normal or indicator-rich data structures [93,94]. Preliminary diagnostics, including linearity and common method bias, were assessed using SPSS 26.0. Further data analysis details are provided in Section 3.3.1, Section 3.3.2, Section 3.3.3 and Section 3.3.4.

3.3.1. Common Method Bias

Given that this study utilized a survey-based design, the potential for common method bias (CMB) exists, as data for both independent and dependent variables were gathered from the same set of respondents. CMB may result in artificially inflated associations between variables, thereby compromising the validity of the results. As noted by [95], the presence of CMB can be inferred when a substantial portion of the total variance is explained by a single factor. To evaluate this, Harman’s single-factor test was conducted. The analysis revealed that a single factor accounted for only 35.84% of the total variance, which is significantly below the commonly accepted threshold of 50%, suggesting that CMB is unlikely to pose a serious issue.

In addition, a full collinearity assessment was performed. The variance inflation factor (VIF) values for all constructs were below 3.3 as recommended by [94], except for PT, which showed a slightly elevated value but remained under 5. According to [89], VIF values less than or equal to 5.0 are not indicative of problematic collinearity. Thus, as per their guidance, the VIF results further confirm that CMB is not a concern in this study.

3.3.2. Evaluation of the Measurement (Outer) Model

The measurement model was assessed using the Partial Least Squares (PLS) algorithm with default settings. In line with the recommendations of [89], tests for reliability and validity were conducted. The analysis indicated strong performance of the constructs across multiple assessment criteria. Cronbach’s alpha coefficients exceeded 0.6 for all constructs, indicating satisfactory internal consistency and confirming that the constructs reliably measure their respective latent variables. Composite reliability values were also above the accepted threshold of 0.7, reinforcing the reliability of the constructs. Convergent validity was confirmed, as each construct’s Average Variance Extracted (AVE) exceeded 0.5, demonstrating that the items adequately represent their intended constructs. Furthermore, indicator reliability was established, with all items recording values of 0.7 or higher. These findings collectively confirm the robustness and validity of the measurement model. Detailed statistics are presented in Table 2 for reference.

Table 2.

Reliability & Convergent Validity Results.

Discriminant validity was assessed using both the Heterotrait-Monotrait (HTMT) ratio and the Fornell-Larcker criterion. Following the guidance of [96], all HTMT values were found to be below the conservative threshold of 0.85, thereby confirming discriminant validity. Likewise, the Fornell-Larcker criterion results indicate that the square root of each construct’s AVE (diagonal values) exceeds its correlations with other constructs. These findings collectively affirm that the constructs are empirically distinct, supporting the robustness of the measurement model. Evidence for discriminant validity, based on both the HTMT and Fornell-Larcker assessments, is presented in Table 3 and Table 4, respectively.

Table 3.

HTMT Ratios.

Table 4.

Evaluation of Fornell-Larcker Measure.

3.3.3. Evaluation of the Structural (Inner) Model

The structural (inner) model was evaluated using several key indicators, including R2, effect size (f2), collinearity (VIF), and predictive relevance (Q2), in accordance with the recommendations of [89].

The R2 values indicate that the model explains a substantial portion of variance in IURA, with an R2 of 0.646, classified as substantial [89]. PU also demonstrated a moderate level of explained variance (R2 = 0.209), whereas RA, PEOU, and GPV showed weaker explanatory power, with R2 values of 0.112, 0.099, and 0.076, respectively. Table 5 displays the R2 values.

Table 5.

R2 Values of the Structural (Inner) Model.

The f2 values reveal that Knowledge of Robo-Advisors (KRA) has a medium effect on GPV (f2 = 0.082), IURA (f2 = 0.146), and RA (f2 = 0.126), and a weak effect on PEOU (f2 = 0.024). PEOU exerts a weak-to-medium influence on PU (f2 = 0.099) and IURA (f2 = 0.056). The contributions of PIQ to IURA (f2 = 0.109), PU (f2 = 0.027), and GPV (f2 = 0.035) are also within the weak-to-moderate range. The remaining constructs, including PU and PT, demonstrate weak effects across the dependent variables, suggesting limited individual contributions. The f2 values are reported in Table 6.

Table 6.

Effect Size (f2) of Exogenous Variables.

All Variance Inflation Factor (VIF) values remained below the threshold of 5.0, indicating no multi-collinearity concerns [89]. The highest VIF was observed for PT at 3.932, which, although elevated, still falls within the acceptable range. All other constructs showed acceptable VIF levels, suggesting the predictors are not excessively correlated. The VIF values are shown in Table 7.

Table 7.

Collinearity (Inner VIF) Values.

The predictive relevance of the model was assessed using the Q2 values obtained through the blindfolding procedure. In line with [89], a Q2 value greater than zero indicates that the exogenous constructs have predictive relevance for the corresponding endogenous variables. The Q2 value for IURA is 0.423, indicating strong predictive relevance. PU, RA, PEOU, and GPV also show acceptable predictive relevance, with Q2 values of 0.108, 0.102, 0.083, and 0.066, respectively. Additionally, the predictive accuracy of the model was further supported by the Root Mean Square Error (RMSE) and Mean Absolute Error (MAE) metrics. Lower values of RMSE and MAE signify better predictive performance [97]. IURA exhibited the lowest RMSE (0.763) and MAE (0.588), further affirming its strong predictive power. In comparison, GPV recorded relatively higher RMSE (0.972) and MAE (0.822), suggesting comparatively lower predictive accuracy. The values for PEOU (RMSE = 0.970, MAE = 0.733), PU (RMSE = 0.951, MAE = 0.780), and RA (RMSE = 0.953, MAE = 0.757) fall within acceptable ranges, confirming that the model demonstrates reasonable predictive accuracy across all endogenous constructs. Table 8 illustrates the Q2 values.

Table 8.

Predictive Relevance (Q2) and Predictive Accuracy (RMSE and MAE) of the Structural Model.

These results collectively highlight the robustness and practical applicability of the model in forecasting outcomes related to the adoption of robo-advisory services.

3.3.4. Structural Model–Hypotheses Testing

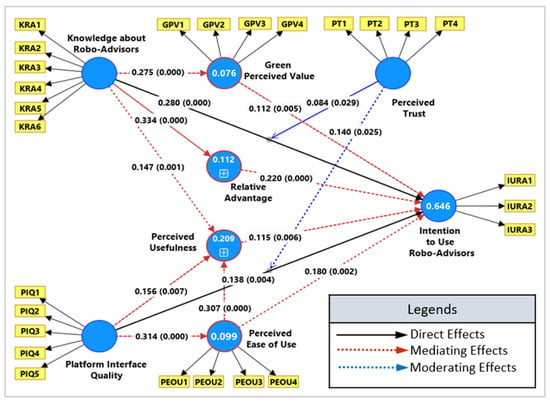

The bootstrapping technique was applied using the percentile bootstrap confidence interval approach with 10,000 subsamples, adopting a significance level of 0.05 (two-tailed) and enabling parallel processing for computational efficiency. Figure 2 visually presents the bootstrapped model results, while Table 9 summarizes the hypothesis testing outcomes.

Figure 2.

Bootstrapping Results (Structural Model shows path coefficients and p values).

Table 9.

Structural Relationship Analysis.

The results provide strong empirical support for H1, confirming that KRA has a direct and significant influence on IURA, with a path coefficient β = 0.280, t = 6.406, and p = 0.000. This underscores the foundational role of user awareness and understanding in driving the intention to engage with robo-advisory platforms.

The results for H2 (PIQ → IURA) indicate a direct and statistically significant impact with β = 0.138, t = 2.847, and p = 0.004, confirming the importance of interface quality in influencing usage intentions.

H3a is supported with β = 0.031, t = 2.266, and p = 0.023, confirming that GPV partially mediates the relationship between KRA and IURA. As per Table 9, both the direct path KRA → IURA and indirect paths (KRA → GPV and GPV → IURA) are significant, indicating complementary partial mediation. H3b is also confirmed, with β = 0.074, t = 3.291, and p = 0.001. Here, RA acts as a mediator between KRA and IURA. The direct and indirect paths are significant (KRA → RA: β = 0.334, RA → IURA: β = 0.220), suggesting another case of complementary partial mediation. H3c demonstrates a marginal mediation effect, with β = 0.017, t = 1.950, and p = 0.051, which does not reach statistical significance at the 95% confidence level. However, both underlying paths (KRA → PU and PU → IURA) are significant, while the direct effect (KRA → IURA) also remains significant. This pattern indicates the possibility of complementary partial mediation, but with only weak statistical support for the indirect effect. H4a, which examines the mediating role of PU between PIQ and IURA, yields β = 0.018, t = 1.830, and p = 0.067. Although the indirect path is marginally non-significant, the direct effects (PIQ → PU and PU → IURA) remain significant, supporting the interpretation of partial mediation with weaker support.

H4b explores a sequential mediation via PEOU and PU, yielding β = 0.011, t = 2.220, and p = 0.026. As all individual paths (PIQ → PEOU, PEOU → PU, PU → IURA) are significant, this confirms complementary partial mediation through a dual mediator structure. H4c is also validated, with a direct indirect path PIQ → PEOU → IURA showing β = 0.057, t = 2.374, and p = 0.018. As both PIQ → PEOU and PEOU → IURA are significant, this again supports complementary partial mediation.

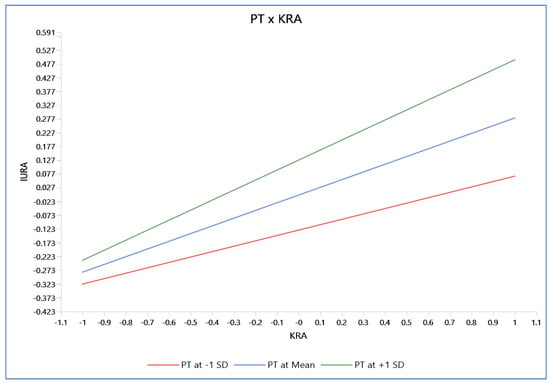

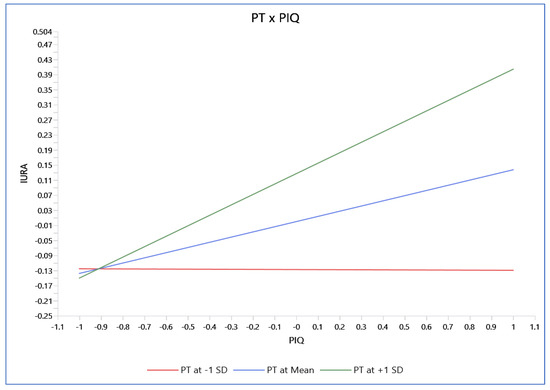

H5a is confirmed, demonstrating that PT moderates the relationship between KRA and IURA (β = 0.084, t = 2.187, p = 0.029). The interaction term is significant, and as illustrated in Figure 3, the effect of KRA on IURA strengthens with higher levels of PT. The positive slope indicates that individuals with greater trust in the system are more responsive to knowledge-based influences on usage intentions. H5b is also supported, with PT moderating the effect of PIQ on IURA (β = 0.140, t = 2.238, p = 0.025). As shown in Figure 4, the positive interaction confirms that PT enhances the influence of PIQ on intention. The steepness of the green line (PT at +1 SD) compared to the flat red line (PT at –1 SD) highlights the amplifying role of trust in this relationship.

Figure 3.

Simple Slope Analysis: PT x KRA → IURA.

Figure 4.

Simple Slope Analysis: PT x PIQ → IURA.

In summary, the bootstrapping results lend strong empirical validation to the proposed conceptual model. The findings confirm that KRA and PIQ significantly influence IURA both directly and through multiple mediating variables (GPV, RA, PU, and PEOU). Moreover, PT serves as a critical boundary condition that intensifies the impact of KRA and PIQ on IURA. These insights advance our understanding of the socio-technical drivers shaping investor engagement with digital robo-advisory platforms.

3.3.5. Assessing Group Heterogeneity

The dataset reflects diversity across age, gender, and other characteristics, which can potentially shape the structural relationships among constructs. Overlooking such heterogeneity during PLS-SEM evaluation may compromise the accuracy and validity of findings [89]. To capture these variations, group comparisons were undertaken using multi-group analysis (MGA) and moderation approaches [98]. Specifically, the sample was divided into two age categories: Younger Investors (≤40 years, 209 cases) and Older Investors (>40 years, 178 cases). Education-based groups were also created: Undergraduate Investors (211 cases) and Postgraduate Investors (176 cases). In addition, two categories of investment levels were established: Low-Investment Group (≤ SAR 100,000, 183 cases) and High-Investment Group (> SAR 100,000, 204 cases).

Each subgroup satisfied the minimum sample size requirement for PLS-SEM. As the most complex construct in the model has eight incoming paths, a minimum of 60 observations was required [89]. Since all groups exceeded this threshold, sample size adequacy was not an issue. Moderation effects were evaluated in line with [99], applying two decision rules: (1) when the path coefficient (β) is statistically significant in one group but not in the other, or (2) when both groups yield significant coefficients but in opposite directions. These guidelines provided a rigorous basis for testing moderation. The outcomes are summarized in Table 10 (age-based groups), Table 11 (education-based groups), and Table 12 (investment-level groups).

Table 10.

Younger & Older Investors Group Specific Characteristics.

Table 11.

Undergraduate & Postgraduate Investors Group Specific Characteristics.

Table 12.

Low & High Investment Level Group Specific Characteristics.

The MGA results (Table 10) highlight clear heterogeneity between Older Investors and Younger Investors. In the direct effects, KRA → IURA is significant for both groups, but the impact is stronger among Older Investors, while PIQ → IURA is significant for Older Investors and only marginal for Younger Investors. Indirect effects such as KRA → GPV → IURA and KRA → RA → IURA are more pronounced among Younger Investors, indicating a stronger reliance on perceived green value and relative advantage. Moreover, moderation is evident in PIQ → PEOU → IURA, PT × KRA → IURA, and PT × PIQ → IURA, suggesting that trust-based interactions differ across age groups in Saudi investors’ engagement with robo-advisory platforms.

The MGA results (Table 11) indicate variations between Postgraduate Investors and Undergraduate Investors. For both groups, KRA → IURA is significant, with a stronger effect among Undergraduate Investors, while PIQ → IURA is significant only for Undergraduate Investors, indicating heterogeneity. Similarly, KRA → RA → IURA shows a stronger effect for Postgraduate Investors, highlighting reliance on relative advantage in this group. In contrast, PIQ → PEOU → IURA is significant for Undergraduate Investors, suggesting that ease of use perceptions play a greater role for them. Moreover, moderation is evident in PT × KRA → IURA, showing that trust strengthens the KRA effect only for Undergraduate Investors. Overall, the results confirm that education level shapes investor interaction with robo-advisory systems in Saudi Arabia.

The MGA results (Table 12) reveal heterogeneity between High Investment and Low Investment groups. The direct path KRA → IURA is significant for both groups, with a stronger effect among High Investment investors, while PIQ → IURA is not significant in either group. Differences are evident in KRA → GPV → IURA and KRA → RA → IURA, which are stronger among Low Investment investors, suggesting they rely more on green value and relative advantage. Furthermore, significant moderation appears in PIQ → PEOU → IURA, PT × KRA → IURA, and PT × PIQ → IURA, where trust-based mechanisms play a greater role in shaping adoption among High Investment investors. These findings confirm that investment level conditions investor interaction with robo-advisory systems in Saudi Arabia.

4. Discussion

The present study validates a robust socio-technical framework to explain investor engagement with robo-advisory services in Saudi Arabia. Through empirical testing, the findings provide support for integrating constructs from knowledge, interface design, sustainability perception, and trust into a cohesive model.

The first major finding confirms that KRA significantly influences IURA. This result is aligned with the broader FinTech literature, where prior knowledge is consistently identified as a key driver of technology acceptance [21,73]. Reference [12] also highlight how customer education enhances trust and adoption. Reference [72] further support that algorithm awareness improves trust and reduces uncertainty. This empirical validation confirms that well-informed investors are better positioned to recognize the value and reliability of robo-advisors. Policy efforts should also support financial literacy initiatives specifically tailored for underserved or first-time investors. Many current platforms assume a baseline understanding of finance. However, making robo-advisors more intuitive and supportive of users with low financial knowledge could promote broader participation in the digital financial ecosystem.

The mediation analysis provides further insights. GPV significantly mediates the relationship between KRA and IURA, reflecting that sustainability perceptions are shaped by user awareness. This supports findings by [26,28,46], who observed that green-aligned digital services enhance trust and behavioral intention. The positive role of GPV also affirms its emerging status as a key determinant in FinTech adoption when platforms visibly align with environmental values. Green-themed investment portfolios, when presented with clear environmental impact indicators, can increase engagement. Aligning with your result on Green Perceived Value, Saudi robo-advisors could display carbon footprint metrics or sustainability scores to differentiate green products, fostering value alignment with environmentally conscious investors.

Similarly, the mediation via RA is significant. This resonates with findings by [74,75,76], all of whom confirm that when users perceive digital platforms to offer clear advantages over traditional options such as cost savings or personalization, adoption intention strengthens. The current study affirms this by showing that knowledge heightens users’ recognition of such advantages, which in turn increases adoption.