1. Introduction

Given the “dual carbon” goal and broader agenda of sustainable development, enterprises are increasingly recognizing the significance of environmental protection and placing greater emphasis on Environmental, Social, and Governance (ESG) performance. At the same time, the rapid growth of the digital economy presents new opportunities for firms undergoing digital transformation, fostering innovation and accelerating growth. Although China’s manufacturing sector has achieved substantial progress as a key driver of economic development, it continues to face persisting challenges related to pollution, emissions, and energy consumption [

1,

2]. These challenges highlight the need to examine whether and how ESG performance can promote digital transformation in manufacturing enterprises.

Understanding the link between ESG performance and digital transformation sheds light on how corporate sustainability aligns with tech advancement—helping identify new paths for high-quality development in manufacturing—and may also reveal effective strategies to balance economic growth and environmental protection for long-term sustainability. This study’s main goal is to systematically explore how enterprise ESG performance (including E, S, and G dimensions) impacts digital transformation and how firm characteristics, industry types, and ownership structures moderate this relationship. To do this, it uses the causal forest algorithm to estimate heterogeneous treatment effects, plus OLS, quantile, and Poisson regressions for robustness tests—an approach that captures nonlinear relationships and subgroup differences overlooked by traditional linear models [

3,

4].

While research on the overlap between ESG and enterprise digital transformation is growing, most of the focus is on how digital transformation affects ESG performance, with far fewer studies exploring the reverse. A large body of the literature confirms that digital transformation boosts firms’ ESG outcomes; for instance, studies show that digitalization improves corporate environmental performance by driving green tech innovation and optimizing production structures. Similarly, the research in refs. [

5,

6,

7] indicates that digital transformation improves corporate social responsibility (CSR) engagement by increasing information transparency and reducing internal information asymmetry [

8,

9]. This mainstream view, which treats digital technologies as a catalyst for improving ESG ratings, is well documented [

10,

11]. In contrast, the potential for a firm’s strong ESG performance to itself be a driver of digital transformation remains a less explored avenue of research, representing a critical gap that this study aims to address.

The environmental dimension (E) may promote the adoption of digital technologies by encouraging pollution reduction initiatives. The social dimension (S) can facilitate the development of digital platforms through improved stakeholder and community engagement [

12,

13]. The governance dimension (G) can enhance decision-making efficiency, which may indirectly impact digital transformation.

To investigate these dynamics, this study employs the causal forest algorithm, which constructs numerous decision trees to estimate heterogeneous treatment effects. Compared to traditional regression analysis, the causal forest algorithm is better equipped to handle high-dimensional data and capture nonlinear relationships.

This study offers several contributions. First, by examining ESG performance as a driver rather than an outcome of digital transformation, it provides a reverse causal direction that contributes to a more comprehensive understanding of their interconnection. Second, it analyzes how enterprise-level characteristics moderate the impact of ESG performance on digital transformation, thereby enhancing our understanding of the interplay between sustainable development strategies and technological innovation. Third, by incorporating industry classification and enterprise heterogeneity, this study provides a more comprehensive assessment of how ESG performance influences digital transformation, offering practical implications for firms seeking to integrate sustainability with digital advancement. Specifically, this study addresses a notable gap in the literature, which has yet to systematically investigate the causal effect of ESG on digital transformation while accounting for the complex, heterogeneous conditions that shape this relationship.

2. Literature Review

Against the backdrop of global sustainable development and the rapid rise of the digital economy, exploring the interaction mechanism between environmental, social, and governance (ESG) performance and corporate digital transformation has become a key issue in academic and practical circles. However, existing research has not yet formed a systematic framework for this relationship, especially in emerging economies represented by China, where the theoretical and empirical foundations remain weak. This section combs through the relevant literature from the perspectives of ESG research, digital transformation research, and their intersection, clarifying theoretical gaps and the innovative contributions of this study.

Early ESG research was mainly rooted in stakeholder theory and focused on verifying its impact on financial performance. Freeman’s foundational work emphasized that enterprises fulfilling ESG responsibilities can reduce conflicts with stakeholders and thus improve financial returns, but this framework did not further explore the spillover effects of ESG on non-financial fields such as technological innovation [

2,

14,

15,

16]. With the deepening of research, scholars gradually realized that ESG performance is not only a “performance driver” but also a “resource enabler” that shapes corporate strategic choices. Ref. [

16] conducted an in-depth analysis of Chinese energy-listed companies and found that high-quality ESG disclosure can significantly improve financial performance by reducing information asymmetry between enterprises and stakeholders. Their study identified two key mechanisms: first, standardized ESG disclosure boosts investor confidence and cuts financing costs, helping enterprises accumulate “resource slack” for investing in digital infrastructure and talent training; second, active ESG practices gain institutional recognition and policy support, creating “institutional legitimacy” that reduces external resistance to digital transformation.

Research on digital transformation has achieved rich results in exploring its economic and social effects. Existing studies have confirmed that digital transformation can optimize production processes [

17], improve market response speed [

18], and even promote green technology innovation [

19]. However, there is an obvious “causal asymmetry” in the theoretical construction of this field: most studies focus on the impact of digital transformation on ESG performance, while ignoring the reverse impact of ESG on digital transformation. Specifically, scholars generally believe that digital technology is an important tool to improve ESG performance. For example, ref. [

10] found that digital transformation can promote enterprises to reduce environmental pollution and fulfill social responsibilities through data-driven management; ref. [

10] constructed a “capability-motivation” dual framework and proved that digital transformation enhances ESG performance by improving innovation capability and reducing agency costs; ref. [

20] further pointed out that digital transformation can alleviate financing constraints for green projects, thereby strengthening the implementation of ESG strategies. These studies laid a solid theoretical foundation for how digital transformation influences ESG performance, but they fail to answer a key question: as a comprehensive reflection of corporate sustainable development capabilities, can ESG performance in turn affect the decision making and depth of digital transformation? This theoretical gap is the research starting point of this study.

In recent years, scholars have begun to explore the interaction between ESG and digital transformation, but relevant research is still in its infancy, especially in emerging markets. From the perspective of the resource-based view, ref. [

12] found that corporate social responsibility (a core component of the S dimension) can promote digital transformation by accumulating relational resources such as stakeholder trust and organizational capabilities such as cross-departmental collaboration. This study preliminarily confirmed the enabling role of ESG in digital transformation but did not further decompose the heterogeneous effects of different ESG dimensions. Ref. [

13] supplemented this deficiency to a certain extent. They found that social responsibility can strengthen the positive impact of digital transformation on green technology innovation, indicating that the S dimension may play a “moderating role” in the process of digital transformation. Cross-border comparative studies also support this conclusion: ref. [

20] took Korean subsidiaries in emerging markets as samples and found that ESG level positively moderates the relationship between digital transformation capability and financial performance, suggesting that ESG and digital technology have a “complementary effect”; ref. [

21] pointed out in the research on sustainable artificial intelligence in the financial field that ESG factors are becoming a key variable affecting the direction and efficiency of digital technology deployment.

Despite all this progress, three core limitations still exist in the existing literature. First, the causal relationship is not balanced. Most studies focus on the “digital-driven ESG” pathway, while the “ESG-driven digital transformation” mechanism has not been systematically verified. Although ref. [

16] implied that ESG can provide resource support for strategic transformation, there is a lack of direct empirical evidence. Second, the dimension heterogeneity is not clarified. Existing studies mostly treat ESG as an overall variable, but ref. [

20] suggested that environmental, social, and governance dimensions may have different impacts on technological innovation. How E, S, and G dimensions affect digital transformation, respectively, remains an unsolved theoretical problem. Third, the methodological adaptability is insufficient. Most studies rely on traditional linear regression models [

20], which have difficulty capturing the nonlinear relationships and subgroup differences between ESG and digital transformation. For example, ref. [

22] used fixed-effect models to study the relationship between digital transformation and ESG but failed to identify the threshold effect of enterprise scale on this relationship.

Against this backdrop, this study aims to make three marginal contributions. First, it addresses the “causal asymmetry” in existing research: taking ESG performance as the independent variable, it systematically examines its impact on digital transformation, thereby enriching the theoretical connotation of the “ESG-digital transformation” relationship. It decomposes ESG into E, S, and G dimensions, clarifies their different influence paths on digital transformation, and responds to the call of [

23] for “dimension-specific research” [

20]. It adopts the causal forest algorithm, which can identify nonlinear relationships and subgroup heterogeneity more flexibly than traditional regression methods, providing more accurate empirical evidence for the complex relationship between ESG and digital transformation in emerging markets.

3. Research Hypothesis

Digital transformation, as a strategic overhaul involving technological upgrading, organizational restructuring, and resource reallocation, is shaped by a complex interplay of internal capabilities and external pressures. ESG performance, through its environmental (E), social (S), and governance (G) dimensions, exerts heterogeneous impacts on this transformation process by influencing resource availability, stakeholder dynamics, and decision-making mechanisms. This section develops hypotheses for each dimension based on resource-based theory, stakeholder theory, and agency theory, while clarifying the theoretical rationale for potential differential effects and their links to subsequent empirical analysis.

The environmental dimension of ESG reflects firms’ commitment to pollution control, energy efficiency, and ecological compliance. From the resource-based view, high environmental performance signals a firm’s ability to allocate resources toward long-term sustainability goals, which inherently aligns with the resource demands of digital transformation. Digital technologies such as IoT-enabled monitoring systems, big-data-driven emission tracking, and AI-optimized green production processes are critical for improving environmental management efficiency [

16]. Firms prioritizing environmental responsibilities face stronger pressure to adopt such technologies to meet regulatory requirements and market expectations for green development [

24]. Additionally, ref. [

16] demonstrated that high-quality environmental disclosure enhances investor confidence and reduces financing costs, generating “resource slack” that can be channeled into digital infrastructure investment. This resource support, coupled with the operational necessity of digital tools for environmental management, creates a positive link between E performance and digital transformation.

H1a: Higher environmental performance (E) is positively associated with greater levels of digital transformation in Chinese listed companies.

The social dimension of ESG emphasizes firms’ responsibilities to stakeholders such as employees, communities, and supply chain partners, focusing on relationship building and collaborative value creation. Stakeholder theory posits that strong social performance fosters trust and cooperation, which are foundational for digital transformation—an initiative that relies heavily on stakeholder engagement [

25]. Ref. [

26] found that firms with robust social responsibility practices attract greater stakeholder support for innovation, amplifying the effectiveness of digital tools in optimizing resource allocation. Moreover, high social performance enhances institutional legitimacy, reducing resistance to digital transformation from regulators or the public and facilitating access to policy support for technological upgrading. This alignment between social responsibility and digital collaboration mechanisms drives a positive relationship between S performance and transformation depth.

H1b: Higher social performance (S) is positively associated with greater levels of digital transformation in Chinese listed companies.

The governance dimension of ESG encompasses internal mechanisms such as board structure, ownership concentration, and agency cost control, which shape decision-making efficiency and risk tolerance [

27]. While effective governance theoretically mitigates principal–agent conflicts and promotes long-term investment, its impact on digital transformation may be more nuanced due to two countervailing mechanisms. On one hand, strong governance could facilitate digital transformation by ensuring strategic consistency and reducing short-termism in resource allocation. On the other hand, digital transformation involves high uncertainty and experimental investment, which may conflict with governance mechanisms designed to minimize risk [

28]. Additionally, in the Chinese context, many listed firms already maintain baseline governance standards, reducing the marginal contribution of G performance to transformation initiatives. Empirical precedents, such as [

29], also suggest that governance may exert weaker or nonlinear effects on technological innovation compared to E and S dimensions. This theoretical tension leads to the expectation that G performance may not exhibit a significant positive impact on digital transformation.

H1c: Governance performance (G) has no significant positive association with digital transformation in Chinese listed companies.

4. Methodology and Data

4.1. Data

This study selects Chinese A-share listed companies from 2009 to 2022 as the research sample. To ensure the reliability and comparability of the data, the sample is screened as follows: excluding ST and *ST companies with abnormal operating conditions, excluding financial and insurance industry firms due to their unique accounting standards and business models, and excluding samples with missing key variables such as ESG performance and digital transformation indicators. After these screening procedures, the final sample consists of 11,109 valid observations. All continuous variables in the dataset are winsorized at the 1% and 99% levels to mitigate the impact of extreme values on the empirical results.

Core research data are obtained from the Wind and CSMAR databases, which are widely recognized as authoritative sources for Chinese corporate financial and non-financial data in academic research. For measuring corporate digital transformation, this study adopts two text-based proxy variables, DIGA and DIGB, following the existing literature. Digital transformation is defined as a multidimensional strategic process, covering the adoption of technologies like AI, big data and cloud computing, innovation of Internet-based business models and platform ecosystems, production optimization through intelligent manufacturing and digital process re-engineering, and upgrading of modern information systems and data management architectures [

30,

31,

32,

33,

34].

Specifically, DIGA is constructed based on the methodology of [

35], using a dictionary of 76 keywords covering five dimensions: artificial intelligence, big data technology, cloud computing, blockchain technology, and digital technology application. The keyword selection for DIGA is validated by aligning with the China Digital Economy Development White Paper and Wind’s digital industry classification standards, cross-checking with annual report texts to ensure relevance to corporate digital practices. DIGB, referencing [

36], is measured using a dictionary of 99 keywords across four dimensions: digital technology application, Internet business models, intelligent manufacturing, and modern information systems, with reliability confirmed via consistent frequency trends with Ministry of Industry and Information Technology reports.

The main explanatory variable, ESG performance, is measured using the CSI ESG rating, which categorizes firms into nine levels from AAA to C, coded numerically from 9 to 1, with higher values indicating better ESG performance [

37,

38,

39]. Control variables include firm size (logarithm of total assets), operating income growth rate [

40], current ratio [

41], financial leverage, basic earnings per share, board size [

42], largest shareholder ownership percentage [

43], price-to-book ratio, and Tobin’s Q, following prevailing research practices [

44].

To contextualize the digitalization levels of sample firms, industry benchmark data from China’s Ministry of Industry and Information Technology and Wind’s industry classification reports are incorporated, providing sector-specific digitalization references for cross-industry comparison. Descriptive statistics for all variables are presented in

Table 1 to reflect the distribution characteristics of the sample data.

4.2. Causal Forest

The causal forest algorithm is employed to capture heterogeneous treatment effects, which is particularly suited to analyze the complex relationships between ESG performance and digital transformation across different industries and firm characteristics, aligning with the need to examine cross-sector disparities in digitalization levels [

23]. As an extension of the random forest framework, causal forests are specifically designed for estimating heterogeneous treatment effects (HTEs). Unlike traditional random forests that aim to optimize prediction accuracy, causal forests aim to partition the data in a way that maximizes the difference in disposition effects at different leaf nodes while minimizing the difference in disposition effects at the same leaf node.

Given a set of individual characteristics x, the conditional average treatment effect (CATE) is equivalent to the heterogeneous treatment effect (HTE) and is given by the following expression:

where

and

denote the potential outcomes of individuals not receiving treatment and receiving treatment, respectively. In observational data, only one of these potential outcomes is observable per individual, presenting the fundamental problem of causal inference.

When

represents the given individual characteristics, the expected value represents the average effect. Under the conditional non-confounding assumption and the local linear regression framework [

12], it is assumed that the individual’s propensity score for receiving treatment (m(x)) and the estimate of the explained variable (e(x)) can be obtained. Assuming that the treatment effect τ(x) is constant, a consistent estimate of the treatment effect can be derived as follows:

In Equation (2),

,

,

and

represent estimated values,

and

denote out-of-bag estimates, and

refers to the observed values not used to estimate

. If the heterogeneous treatment effect is considered, “R-learner” and used “R-learner” are employed to stimulate the estimated value of the conditional treatment effect (CATE):

The causal forest is constructed by growing an ensemble composed of B causal trees using sample fitting. Each tree partitions the covariate space such that within-leaf treatment effect variation is minimized. The resulting estimator aggregates predictions across trees using a data-driven weighting scheme:

where

is the leaf node in tree b containing x;

is the sub-sample used for tree b;

is the random forest in the given predicted value formed when the feature vector is determined.

According to Athey and Wager,

represents the probability that a given observation shares the same leaf node as the training sample within a causal tree [

23]. The weight

derived from the causal forest algorithm functions as a kernel that determines each sample’s contribution to the estimation of the conditional mean treatment effect, similar to nearest neighbor matching in traditional non-parametric methods. Therefore, the causal forest can be regarded as an adaptive kernel method that tailors local weights to account for feature similarity and treatment effect heterogeneity. The conditional average disposition effect estimate of individual

is given by the following expression:

The causal forest algorithm is implemented in two stages. In the first stage, two independent random forest models are trained to estimate the propensity score and the outcome variable , with out-of-bag predictions generated to mitigate overfitting and enhance robustness. In the second stage, an adaptive kernel function is used to derive sample-specific weights by optimizing the R-learner objective function. These data-driven weights are then incorporated into a locally weighted regression framework to estimate the conditional average treatment effects, allowing the model to capture individual-level heterogeneity and complex nonlinear relationships.

5. Analysis of Empirical Results

A key feature of the sample data, which lays the groundwork for subsequent empirical analysis, is the distribution characteristics of corporate digital transformation levels. Specifically, the digital transformation proxies DIGA and DIGB both exhibit a right-skewed distribution across the sample. This pattern means that most firms are in the early to middle stages of digital transformation, while only a small number of leading enterprises have achieved high-level digitalization—a phenomenon consistent with the staged development reality of China’s corporate digital transformation. Such distribution characteristics not only reflect the uneven progress of digitalization among Chinese listed companies but also highlight the need to further explore the drivers of digital transformation (such as ESG performance) and their heterogeneous effects across different firm groups, which will be detailed in the following sections.

5.1. Basic Causal Relationship Identification

The results of causal forest regression in

Table 2 provide clear empirical evidence for the relationship between ESG performance and digital transformation. Specifically, the total ESG performance exhibits a statistically significant positive effect on enterprise digital transformation, with a treatment effect coefficient of 2.559, indicating that stronger ESG performance is associated with higher levels of digital transformation.

To further decompose the heterogeneous effects of ESG dimensions, the model separately incorporates the environmental (E), social (S), and governance (G) components. The results show that the environmental dimension (E) exerts a prominent positive impact on digital transformation, with a coefficient of 2.79*** (standard error = 0.98), supporting Hypothesis H1a.

The social dimension (S) also demonstrates a significant positive effect, with a coefficient of 1.86, validating Hypothesis H1b.

In contrast, the governance dimension (G) shows no statistically significant influence on digital transformation, with a coefficient of −0.224 (standard error = 0.30), which supports Hypothesis H1c. This insignificance may stem from the dual nature of governance mechanisms: while effective governance can enhance decision-making efficiency, it may also impose risk-aversion constraints that limit investment in high-uncertainty digital initiatives, as suggested by the discussion in [

20] of governance’s nuanced role in technological innovation.

These results collectively indicate that companies tend to prioritize environmental and social responsibilities more prominently in their digital strategies, while the governance dimension exerts a comparatively weaker influence. Another plausible explanation is that many firms in the sample already maintain baseline governance standards, reducing the marginal role of governance in further advancing digital transformation. The findings underscore the importance of environmental and social responsibility in enhancing competitiveness and advancing sustainable development.

5.2. Corporate Regulatory Effect

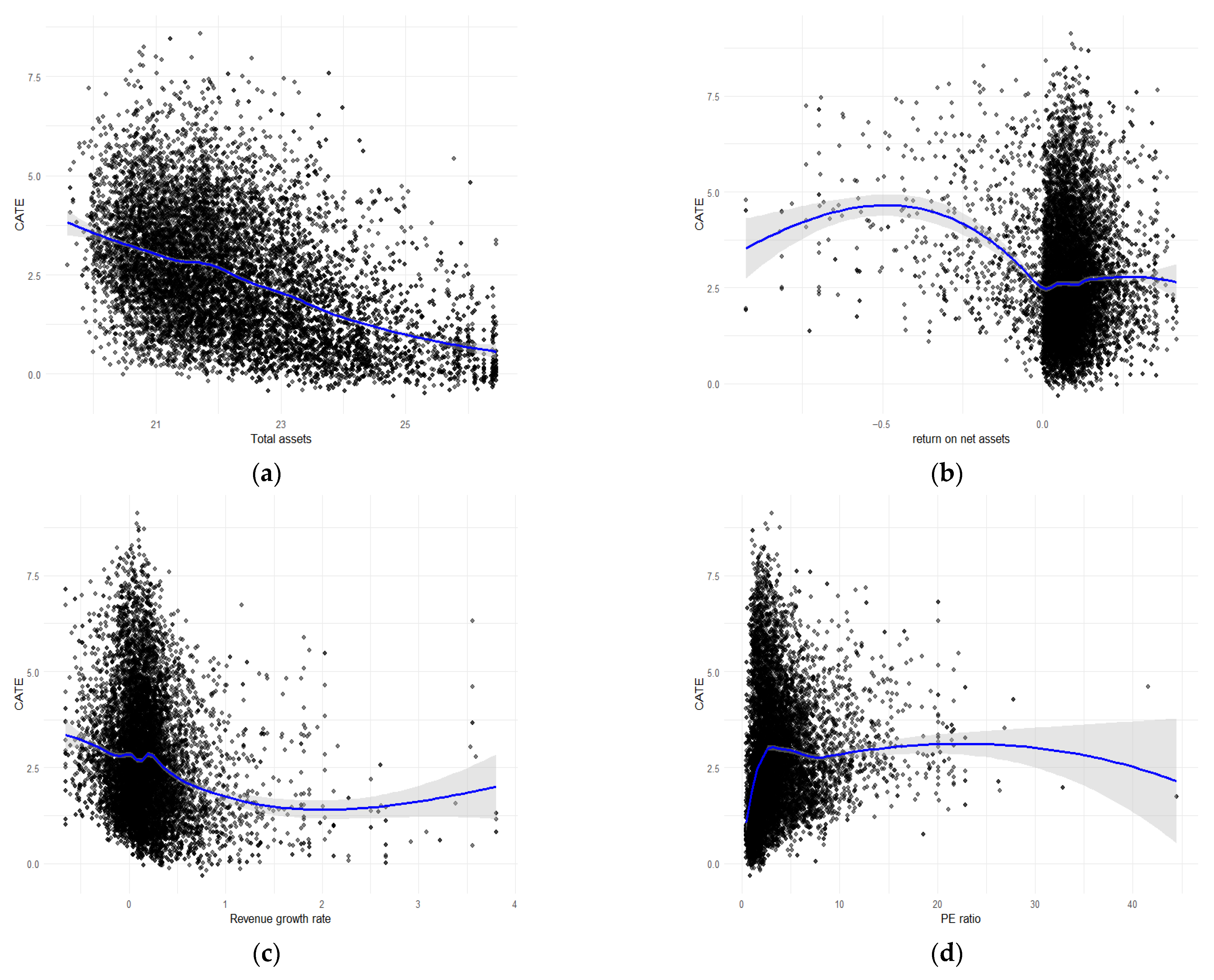

A more detailed analysis of corporate regulatory factors, as illustrated in

Figure 1, exhibits distinct trends in how ESG influences digital transformation across different firm characteristics. As total asset size grows, ESG’s impact on digital transformation becomes significantly negative. This relationship follows an inverted U-shape when return on equity is negative and remains stable when return on assets is positive. The growth rate of operating revenue generally displays a U-shaped trajectory, while price-to-earnings ratio heterogeneity initially intensifies before eventually stabilizing.

One possible explanation is that large enterprises, despite having abundant resources, often prioritize economies of scale and cost control over ESG initiatives, which may diminish the link between ESG and digital transformation. For firms with a negative return on equity, financial losses limit the ability to invest in both ESG and digital transformation. In such cases, while ESG may initially promote digital transformation, its marginal utility diminishes as firms shift focus toward financial recovery. In comparison, firms with a positive return on assets have greater financial flexibility, enabling mutually reinforcing development between ESG and digital transformation. At low P/E ratios, ESG efforts may enhance perceived enterprise value and investor confidence. However, as the P/E ratio increases, the synergistic effect between ESG and digitalization may saturate, slowing further growth in valuation.

5.3. Robustness Testing

5.3.1. Orthogonalization Discussion

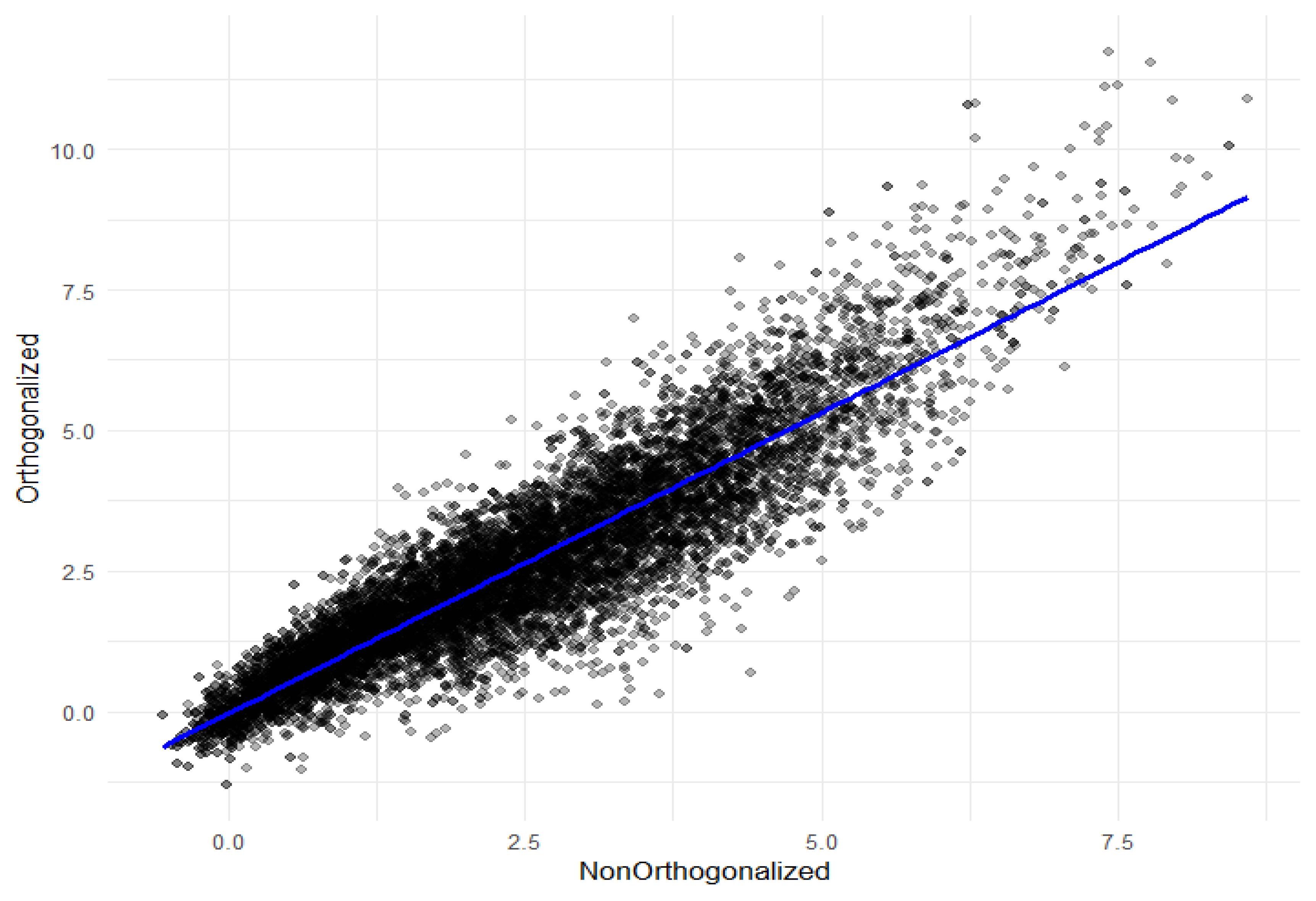

As previous studies suggest, orthogonalization is conceptually similar to propensity score matching in traditional econometrics [

45]. If a causal forest model is trained without estimating individual propensity scores, or it relies solely on the mean propensity score, it may result in non-orthogonalized estimates of average treatment effects. A substantial disparity between the results of orthogonalized and non-orthogonalized methods would indicate a failure in addressing endogeneity. The minimal variation in treatment effects observed here aligns with the consistency later confirmed by OLS, quantile, and Poisson regressions, reinforcing that our core findings are not driven by endogeneity biases.

Figure 2 presents the findings of the orthogonalization analysis. The findings show minimal variation in treatment effects regardless of whether orthogonalization is applied. This result reflects the balanced contribution of control variables in the prediction process, suggesting that non-orthogonalized estimates reliably reflect the average treatment effect. Overall, this supports the effectiveness of the forest-based causal identification approach in attaining sufficient matching and passing the endogeneity robustness test.

5.3.2. Variable Substitution

To ensure our findings are not dependent on a single measure of digital transformation, we conducted a robustness test by substituting our primary proxy (DIGA) with an alternative measure (DIGB). The re-estimated results, presented in

Table 3, confirm the stability of our main conclusions. The overall ESG performance continues to show a strong positive and significant effect on digital transformation, yielding a coefficient of 5.414 that is significant at the 1% level. More importantly, the distinct pattern of influence from the individual ESG dimensions is perfectly preserved. The environmental (E) dimension shows a coefficient of 5.07 and the social (S) dimension a coefficient of 4.09, with both remaining statistically significant at the 5% level. Consistent with our primary findings, the governance (G) dimension remains statistically insignificant. This consistency across different proxy variables strongly reinforces the reliability of our core conclusion: that ESG performance, driven primarily by its environmental and social components, is a robust driver of enterprise digital transformation.

5.3.3. OLS Regression Results

To further validate the reliability of the causal forest findings, this study also utilized traditional ordinary least squares (OLS) regression, with the results summarized in

Table 4. The OLS estimates are broadly consistent with those derived from the causal forest method, showing only minimal differences in the magnitude of coefficients and their significance levels. This consistency reinforces the robustness of the main results: OLS regression confirms the positive effect of ESG performance on digital transformation, with the environmental and social dimensions also exerting significant promotional effects, while the governance dimension remains statistically insignificant. Such alignment across different estimation techniques, causal forest and OLS, strengthens confidence in the conclusion that ESG performance, particularly its environmental and social components, drives corporate digital transformation.

5.3.4. Quantile Regression Results

Quantile regression is utilized to assess the heterogeneity in the effect of ESG across different levels of digital transformation. By analyzing three key quantile points of the conditional distribution, this method captures how ESG influences firms with varying degrees of digital transformation progress. The

Table 5 indicate that ESG performance does not significantly impact digital transformation at lower quantiles but shows pronounced positive effects at higher quantiles. This pattern complements the average effects observed in OLS and Poisson regressions, revealing that while ESG generally promotes digital transformation, its impact strengthens as firms advance in their digital maturity—consistent with the idea that resource-rich, digitally advanced firms better leverage ESG initiatives.

5.3.5. Poisson’s Multidimensional Fixed-Effects Test

This study utilizes a multidimensional fixed-effects pseudo-Poisson estimation method for robustness testing. This approach is particularly suitable as the digital transformation variable is non-negative count data, which often exhibits overdispersion where the variance significantly exceeds the mean. The pseudo-Poisson model is robust to this issue and provides consistent estimates even if the underlying data do not strictly follow a Poisson distribution, thereby ensuring the reliability of the results. The results are explained using semi-elasticity, which quantifies the percentage change in the outcome variable associated with changes in ESG performance.

Table 6 presents the Poisson regression results, demonstrating that ESG performance exerts a significant positive effect on digital transformation. The environmental dimension shows a strong positive impact, and the social dimension also exhibits a significant promotional effect, while the governance dimension remains insignificant.

These findings align closely with the results from OLS and quantile regressions. Poisson regression confirms the environmental and social dimensions as key drivers of digital transformation, mirroring the significance patterns observed in OLS regression where both dimensions showed statistically significant positive effects. Though significance levels vary slightly across methods, the core conclusion of ESG’s positive effect through environmental and social dimensions remains consistent. From the data perspective, the sample size of 11,109 listed companies ensures sufficient statistical power, and the consistency of results across different estimation frameworks further validates the stability of the core conclusion that the positive relationship between ESG performance and digital transformation holds across diverse data structures.

5.4. Heterogeneity Discussion

5.4.1. Industry Classification

The

Table 7 explores industry-level heterogeneity and finds that ESG’s impact on digital transformation is particularly pronounced in high-tech and technology-intensive sectors, which are widely recognized for their innovation capabilities. These industries benefit more from ESG-driven digital transformation due to their strong orientation toward innovation and advanced technologies. In contrast, the effect of ESG on digital transformation in traditional sectors remains limited.

From a theoretical perspective, this finding aligns with the resource-based view, which emphasizes that firms’ strategic outcomes depend on their resource endowments and dynamic capabilities. High-tech and technology-intensive industries inherently possess core resources such as technological expertise, R&D capacity, and innovation-oriented organizational cultures [

46]. These resources enable them to effectively convert ESG performance into digital transformation momentum: for example, environmental initiatives (E dimension) drive investment in IoT-based pollution monitoring systems, while social responsibility (S dimension) fosters cross-stakeholder collaboration platforms—both of which rely on existing technological capabilities to scale [

47]. In contrast, traditional industries (e.g., labor-intensive or high-pollution sectors) often lack such innovation resources, limiting their ability to integrate ESG practices with digital tools. As noted by [

12], relational resources from ESG require matching organizational capabilities to realize their value in digital transformation, which traditional industries often lack.

One plausible explanation lies in the inherent characteristics of high-tech industries. In these sectors, digital transformation is not merely a tool for enhancing efficiency or reducing costs but also a means to develop new business models and create innovative products. Their emphasis on environmental sustainability and their capacity to adopt digital technologies position them to gain significantly from ESG-driven initiatives.

Conversely, conventional industries often follow established business practices and lack strong incentives for digital transformation. While these industries implement basic ESG practices, these are not necessarily integrated into broader strategic goals, nor are they regarded as key drivers of technological change. As a result, the impact of ESG on digital transformation in these industries remains comparatively limited.

These findings imply that policy support for ESG-driven digital transformation should be differentiated across industries. High-tech and technology-intensive sectors may benefit more from general incentive policies, while traditional industries require targeted interventions to overcome inertia in integrating ESG and digital initiatives.

5.4.2. Nature of Business

The

Table 8 indicates that the effect of ESG performance on digital transformation varies with ownership structure. Among state-owned enterprises, ESG performance shows a limited influence on digital transformation, with only the environmental component exhibiting a modest positive effect. In contrast, private enterprises demonstrate a significant positive relationship, particularly driven by both environmental and social dimensions.

This divergence can be explained through the lens of institutional theory and stakeholder theory. From an institutional perspective, state-owned enterprises (SOEs) operate within a complex institutional environment shaped by government mandates, multi-stakeholder expectations, and bureaucratic norms [

48]. These institutional constraints prioritize stability, social obligations, and administrative goals over market-oriented innovation, reducing the incentive to align ESG with digital transformation. As noted, SOEs’ resource allocation is often directed toward fulfilling policy targets rather than investing in ESG-driven digital tools, even when resources are abundant.

In contrast, private enterprises face fewer institutional shackles and are more responsive to market and stakeholder demands, which aligns with stakeholder theory. They rely on stakeholder trust for legitimacy and resource access, making ESG performance a critical strategic tool [

49]. Strong social performance enhances stakeholder collaboration, facilitating adoption of digital platforms for employee training or supply chain coordination, while environmental initiatives drive investment in digital monitoring systems to meet market expectations for sustainability [

50]. This alignment of ESG with stakeholder demands creates stronger incentives for private enterprises to integrate sustainability with digital transformation.

This divergence may stem from the institutional characteristics of state-owned enterprises, which typically follow government-led objectives and prioritize social and economic responsibilities over environmental innovation. These firms tend to focus on administrative goals over ESG or digitalization initiatives, possibly due to complex government structures and political constraints. While they typically have sufficient resources, these are often directed toward maintaining operational stability and social obligations rather than investing in ESG activities or technological advancement.

On their part, private enterprises benefit from greater flexibility in strategic planning and resource allocation. With fewer institutional constraints, they tend to align implementation with strategic objectives, such as enhancing market competitiveness and improving operational efficiency. This allows them to integrate ESG into their digital transformation strategies more actively, especially in addressing environmental challenges through digital technologies.

The divergence between state-owned enterprises and private enterprises highlights the need for ownership-specific policies. Policies for state-owned enterprises should focus on institutional adjustments—such as reforming performance evaluation systems—to unlock ESG–digital synergies, while those for private enterprises could emphasize scaling successful integration models.

6. Conclusions

This study employs the causal forest algorithm to assess the relationship between enterprise ESG performance and digital transformation, with particular emphasis on the moderating role of firm-specific characteristics and the heterogeneity of industry and ownership types. The results indicate that stronger ESG performance significantly promotes digital transformation. In particular, the environmental and social components contribute positively to transformation outcomes, while the governance component does not exert a statistically significant effect on digital transformation.

Governance appears to have a more limited role in promoting digital transformation when compared to environmental and social components. While environmental and social initiatives often require the integration of new technologies and broader stakeholder engagement, governance primarily focuses on internal controls and compliance. As a result, firms tend to prioritize the environmental and social aspects of ESG, which more visibly support innovation and external accountability. In addition, firms with effective governance structures may already be well positioned to implement digital strategies, reducing the marginal impact of governance on transformation outcomes.

The analysis also highlights the role of firm-level characteristics in shaping the relationship between corporate ESG performance and digital transformation. As total assets increase, the positive impact of ESG on digital progress diminishes, suggesting that larger firms may prioritize economies of scale or operational stability over ESG-driven innovation. This relationship takes an inverted U-shape when the return on equity is negative. In contrast, a positive return on assets corresponds with stable and positive ESG impact. The operating revenue growth rate exhibits a U-shaped pattern, and the influence of the P/E ratio varies, initially intensifying and later stabilizing.

The findings further demonstrate heterogeneity across industries and ownership types. High-tech and technology-intensive industries benefit the most from ESG-driven digital transformation, likely due to their focus on innovation and their stronger capacity to integrate environmental and social considerations into strategic initiatives. In comparison, traditional industries exhibit a weaker relationship between ESG performance and digital transformation, possibly due to more established operational routines and less pressure to innovate. Ownership differences are also evident. State-owned enterprises (SOEs), often directed by governmental objectives and constrained by diverse stakeholder interests, show limited ESG influence on digital transformation, concentrating mainly on fulfilling economic targets. Private enterprises, with greater strategic flexibility and market orientation, demonstrate stronger positive effects of ESG, particularly in the environmental and social dimensions.

Policymakers are encouraged to promote environmental and social responsibility by offering targeted tax incentives and supportive regulatory policies. Enterprises should actively adopt digital technologies to improve environmental management practices and enhance transparency through comprehensive social responsibility reporting, thereby strengthening public trust and long-term stakeholder engagement.

For traditional industries, where ESG has limited impact on digital transformation, policymakers could offer industry-specific guidance to connect ESG and digital initiatives—such as subsidizing digital tools for pollution monitoring (like waste gas and water tracking systems for high-pollution sectors) or stakeholder engagement platforms (like employee training portals for labor-intensive industries)—along with sector-tailored training programs to build digital capability in sustainability integration.

For state-owned enterprises, where ESG-driven digital transformation is constrained by institutional factors, adjustments should focus on integrating ESG and digital goals into performance evaluations, establishing cross-functional teams to streamline implementation, and encouraging collaboration with tech-oriented firms to adopt flexible integration models, thereby unlocking the synergies between environmental and social practices and digital advancement.

While this study offers valuable insights, it has limitations that point to future research directions. First, digital transformation is measured via annual report text analysis; though widely used, this may not fully capture a firm’s digital activities and could be biased by corporate disclosure strategies. Future studies could add metrics like actual digital investment or patent data for a fuller view. Second, the sample only includes Chinese listed companies: China’s unique institutional and market environment may shape the results, so replicating this study in other contexts (e.g., Western developed markets) could test generalizability. Additionally, this study ignores China’s regional heterogeneity; given the gaps in economic development, institutions, and industries across eastern, central, and western regions, future research should explore how these regional factors moderate the ESG–digital transformation relationship to offer more targeted geographic policy advice.