Abstract

Macroprudential policy, as an important instrument for counter-cyclical regulation, plays a crucial role in enhancing urban economic resilience. Based on this, this paper empirically examines the influence of macroprudential policy on urban economic resilience and its optimization paths using data from 284 prefecture-level cities in China from 2011 to 2023. The research findings indicate that macroprudential policy significantly enhances urban economic resilience, and the conclusion still holds after various robustness tests. Further analysis reveals that the main transmission channels include stimulating digital finance development, promoting industrial structure upgrading, and deepening regional integration. Notably, this effect is particularly pronounced in smart cities, big data pilot zones, and cities with less fiscal pressure. Additionally, the test results of spatial spillover effects show that the direct effect of macroprudential policy on the economic resilience of cities is relatively significant, while the indirect effect is relatively weak. Finally, empirical tests have proved that the improvement of urban economic resilience can further drive regional innovation capability. This study provides empirical support and theoretical references for improving China’s “dual-pillar” regulatory framework and enhancing urban economic resilience.

1. Introduction

Since the in-depth development of financial globalization, the financial systems of various countries around the world have become increasingly interconnected, making them more sensitive to external environmental factors. In addition, geopolitical uncertainty is gradually increasing, global economic volatility is intensifying, and financial risks are becoming more frequent. Therefore, many scholars suspect that the existing financial regulatory framework is not enough to maintain the stability of the financial system, so they are exploring policy instruments to maintain financial stability [1,2,3,4]. In the aftermath of the global financial crisis in 2008, macroprudential policy, as the third pillar of the financial stabilization framework, formally emerged onto the historical stage. The report of the 20th National Congress of the Communist Party of China (hereinafter referred to as the 20th National Congress of the CPC) clearly states that it is necessary to “strengthen and improve modern financial regulation, enhance the financial stability guarantee system” and “hold the bottom line of not allowing systemic risks to occur”, emphasizing the importance of macroprudential policy. Macroprudential policy is a series of policy measures implemented by the government to mitigate systemic financial risks through financial regulation and policy instruments.

The core objective of macroprudential policy is to maintain the stability of the financial system, prevent the accumulation and outbreak of systemic risks [5,6], and lay a stable financial environment for the optimization of the economic structure and long-term growth. In addition, as a flexible instrument that can be dynamically adjusted, macroprudential policy can promote the high-quality development of the real economy through the rational allocation of economic resources, which plays an important role in urban planning and spatial layout. Therefore, macroprudential policy has regained favor in the post-crisis period [7]. According to the statistics of the International Monetary Fund [8], there are 12 major macroprudential policy instruments in the world, and more than 140 countries implemented macroprudential policy from 2000 to 2017. Monitoring data from the Bank for International Settlements (BIS) indicated that 78% of central banks worldwide incorporated macroprudential policy into their crisis response toolkit in 2020, marking 42% increase from 2008. The global experience demonstrates that macroprudential policy has a substantial capacity to mitigate systemic risks and stabilize economic cycles. However, its efficacy is contingent upon the precision of policy design, the flexibility of instrument combinations, and the effectiveness of international and domestic coordination mechanisms. To this end, the macroprudential policy framework should be continuously improved and its applicability to new risks such as digital finance and emerging industries should be explored.

In recent years, the global economic environment has undergone a period of heightened uncertainty. Consequently, the resilience of economic systems to risk has emerged as a pivotal concern for academic and policy communities. The urban economy, as the spatial carrier of the modern economy, exhibits both innovation-driven advantages and vulnerabilities due to its high degree of agglomeration and systemic complexity. These vulnerabilities have prompted widespread attention. The report of the 20th National Congress of the CPC underscored the significance of urban economic resilience for long-term city development, particularly in promoting industrial optimization and stable economic growth. This issue is particularly salient for developing countries grappling with global economic uncertainty.

Urban economic resilience is defined as the capacity of the urban economic system to withstand, mitigate, and recover from external shocks, reaching or surpassing its original level. Su (2015) asserted that economic resilience serves as a crucial indicator of a nation’s economic resilience to external shocks [9]. Economic resilience refers to the ability to achieve rapid recovery from external shocks, reallocate resources, adjust industrial structure, and continuously transform and upgrade after experiencing economic shocks, and it is an important indicator for evaluating a country’s economic ability to resist external shocks [9,10,11,12]. Urban economic resilience is not only related to the stable operation of the urban economy, but also directly affects the sustainable development of cities. Statistical evidence indicated that in 2020, 23% of the top 600 cities in terms of global GDP rankings were projected to encounter economic downturns that surpass the national average, largely attributable to a singular industrial structure or the buildup of financial risks [13]. This underscores the imperative for a comprehensive examination of the mechanisms that underpin urban economic resilience, particularly in the context of the myriad challenges posed by global financial cycle fluctuations, geopolitical conflicts, and climate change. The development of policy instruments to enhance the risk-resistant and resilient capacity of the urban economy has emerged as a pivotal issue in achieving sustainable development.

In the contemporary economic landscape, there has been a notable escalation in economic uncertainties, accompanied by a rise in market volatility and the emergence of novel challenges and features in economic development. Macroprudential policy, as a policy framework focusing on the overall stability of the macroeconomy, plays a pivotal role in stabilizing the financial market and ensuring the rational allocation of financial resources. Additionally, it fosters a conducive financial environment for the healthy development of the real economy, thereby promoting the urban economy to achieve high-quality and sustainable growth within the context of the new normal. Consequently, in the context of the new normal economy, it is of great practical significance and far-reaching strategic value to study the impact of macroprudential policy on urban economic resilience. This paper attempts to overcome the limitations of the prevailing theoretical framework by systematically elucidating the micro-mechanisms and spatial effects of macroprudential policy on urban economic resilience. To this end, a three-dimensional analytical model is constructed, encompassing “policy instruments, conduction path, and resilience performance”. The research findings contribute to the advancement of the theoretical framework of economic resilience by offering insights into the role of macroprudential policy in enhancing urban economic resilience. In addition, the study provides a valuable reference point for local governments in formulating customized risk prevention and control strategies. Specifically, the following aspects are examined.

Firstly, in the current research, the dynamic effect has not been fully explored, and the short-term inhibitory effect and the long-term structural optimization effect of macroprudential policy need to be further weighed. This paper deepens the static theory into a dynamic structural optimization effect through the three levels of industrial structure upgrading, which provides theoretical support for the dynamic adjustment of policy instruments.

Secondly, in the context of the new economic normal, finance has emerged as the predominant catalyst for urban economic development. This paper undertakes a comprehensive examination of the pivotal domains of urban economic development, delves into the impact of macroprudential policy on urban economy resilience, transcends the constraints imposed by a single disciplinary perspective, and fosters theoretical innovation through the integration of regional economics and behavioral finance.

Thirdly, the majority of extant research focuses on the national level. However, this paper delves deeper into the urban level of macroprudential policy and explores the policy mechanism through the channels of digital financial development, industrial structure upgrading, and regional integration.

By elucidating the role of macroprudential policy, this study provides a framework for decision-making that can enhance urban economic resilience from the perspective of implementation effects. This framework can more effectively guide the sustainable development of the urban economy and enhance its ability to withstand external shocks. The results of the study are expected to have an important reference value for improving the financial regulatory system under China’s new urbanization strategy.

2. Literature Review

2.1. Theoretical and Practical Evolution of Macroprudential Policy

The concept of macroprudential policy can be traced back to the 1970s, and its related theoretical exploration is mainly carried out from two dimensions: one is to enhance the ability of the financial system to resist external shocks [14,15], and the other is to improve the mechanism to prevent internal risks [16]. Based on this, after the establishment of the theoretical framework of macroprudential policy after the 2008 financial crisis [17], the research focus has gradually shifted from theoretical construction to extensive application discussion.

For the application of macroprudential policy, existing research focuses on two core dimensions: one is the study of the policy effects. From the perspective of credit cycle, De Schryder and Opitz (2021) concluded that tightening macroprudential instruments not only reduces household credit-to-GDP and bank credit-to-GDP ratios [18], but also suppresses the medium-term cyclical component of the ratios. From the perspective of international capital flows, as demonstrated by Beirne and Friedrich (2017) [19], macroprudential policy has been shown to mitigate international capital flows. The effectiveness of macroprudential policy is contingent upon the banking sector structure, as well as higher regulatory quality and credit-to-deposit ratios. Conversely, higher cost-to-income ratios have the opposite effect. From the perspective of bank risk, Ely et al. (2021) concluded that structurally based macroprudential instruments have a significant positive impact [20]. However, the impact of these measures varies depending on the characteristics of the banks and the market structure in which they are implemented. The findings underscore the context-dependent nature of policy implications. Nonetheless, macroprudential instruments can serve as effective instruments for policymakers to mitigate risks during the expansionary phase of the financial and economic cycle [21]. The other core dimension is the study of the construction and improvement of policy frameworks. The macroprudential policy framework should encompass a system of early warning indicators that signal increased vulnerability to financial stability and a suite of pertinent policy instruments that can address the heightened vulnerability at an early stage [22]. A growing body of research has highlighted the shortcomings of the prevailing framework in many jurisdictions, which emphasizes the autonomy and soundness of individual institutions. This framework has been shown to be ineffective in addressing systemic risks. Consequently, there is a growing recognition among scholars that the macroprudential or systemic orientation of the regulatory and supervisory framework should be strengthened [23].

At the same time, the rapid digital transformation of the financial industry is profoundly reshaping the way risk is managed. In order to cope with traditional challenges such as information asymmetry and low operational efficiency, the industry is actively promoting fintech business innovation based on big data and new algorithms [24]. However, digital finance not only improves efficiency, but also reconstructs the transmission mechanism of systemic risk and expands its potential impact. In this context, in recent years, a number of emerging economies have begun to actively explore and establish an effective macroprudential regulatory framework. Taking China as an example, under the guidance of macroprudential policy framework, macroprudential instruments can directly act on the procyclical characteristics of digital credit, so as to stabilize market liquidity at the source, restrain asset price bubbles, and achieve the ultimate goal of systemic risk control [25]. In Indonesia, the Financial Services Authority of Indonesia (OJK) tightened macroprudential policy on traditional consumer loans to manage systemic risk, which created a significant “crowding-out effect” and led to the rapid expansion of the fintech credit market [26]. To address potential risks, the OJK has proactively extended and integrated the scope of macroprudential supervision into the digital financial ecosystem, and through instruments such as regulatory sandbox and payment system blueprint, taken the initiative to create an environment that is both inclusive of innovation and risk control.

To sum up, digital finance not only endows macroprudential policy with new instruments and new perspectives, but also brings more complex risk transmission and regulatory challenges. This requires that the macroprudential framework must be forward-looking and adaptable to effectively integrate digital financial activities into regulation and seek a dynamic balance between risk prevention and financial development. As China’s urbanization accelerates, local financial systems are increasingly interconnected with real estate, municipal bonds and other sectors, making the city level the key to systemic risk prevention and control. Based on this, this paper will focus on the urban dimension and discuss in depth the influence mechanism and optimization path of macroprudential policy.

2.2. Theoretical Evolution of Urban Economic Resilience

The concept of urban resilience can be defined as the extent to which a city can withstand disruption before undergoing a process of reorganization around a new set of structures and processes [27]. In the economic realm, the capacity of the urban economy to withstand and recuperate from external shocks is denoted as urban economic resilience. This concept was pioneered in the domain of spatial economics by Fujita and Thisse (2002) and Reggiani et al. (2002) [28,29], among other scholars, and has progressively evolved into a pivotal notion within the field of economic geography. Martin et al. (2016) conceptualized economic resilience as the capacity of an economic system to withstand, recuperate, adjust, and renew itself when confronted with shocks [30]. The four dimensions of economic resilience can be utilized to more comprehensively assess the current status and trends of urban economic system development.

The formation mechanism of urban economic resilience is intricate and contingent on tangible factors such as infrastructure and industrial structure, yet it is influenced by intangible factors, including policy systems and social capital. Urban scholars have developed an analytical framework at the urban scale comprising three main levels: The first is industrial structure resilience. According to Zhang et al. (2021) [31], industrial diversification and agglomeration enhance the resilience of the urban economy during periods of shocks. The second is institutional resilience. Corodescu-Roșca et al. (2023) demonstrated that public management plays an important role in facilitating or hindering local economic development [32]. However, in the long run, public management may undermine the autonomous functioning of various forms of local institutions, thus reducing resilience. Third, technological innovation is important for urban resilience. Kong et al. (2022) reviewed the relationship between urban resilience and various functions and emphasized the importance of the ability to innovate in rapid recovery of the urban economy [33]. Li et al. (2019) believed that the degree of resistance is closely related to the long-term historical development path of the system [34], and resilience ensures that the system can quickly restore the original path or break the original path through the impact of adaptation changes such as industrial organization structure, technological innovation level and policy system to achieve “path breakthrough”. Therefore, this paper analyzes the impact of macroprudential policy on urban economic resilience through three paths: digital finance, industrial structure, and regional integration.

2.3. Limitations of Existing Research and Direction of Breakthrough

In recent years, scholars have begun to focus on the indirect role of financial regulatory policy on economic resilience. For instance, Ma (2020) examined the role of macroprudential policy on financial stability through capital flow and credit channels [35]. This research demonstrated that such a policy not only reduces the likelihood of crises, but also alleviates economic fluctuations, thereby fostering economic growth [36]. However, three significant theoretical gaps in extant research warrant further examination. Firstly, the mechanism of macroprudential policy’s impact on economic resilience remains controversial. While some scholars believe that, in the context of limited monetary policy space after the global financial crisis, macroprudential policy provides a key support for economic stability by reducing the tail risk of future output growth [37], some studies pointed out that strict macroprudential regulation in emerging market economies can improve financial stability, but it can also hurt growth [38]. Secondly, in the domain of urban economic resilience development research, numerous scholars are dedicated to constructing a measurement system that can accurately gauge the resistance and resilience of the urban economy in the face of various types of shocks. However, due to the substantial variations in economic structure, industrial layout, and resource endowment across different regions, a universally applicable and feasible indicator system has yet to be developed for the assessment of these regions. This limitation not only impedes the comprehensive promotion of urban economic resilience research but also deprives cities of a robust quantitative foundation for the formulation of targeted development strategies. Thirdly, macroprudential policy at the global level is mainly implemented by countries, and their core role is to proactively prevent the accumulation of systemic risks by enhancing the inherent resilience of the financial system, so as to lay a crucial foundation for the sustainable development of the world economy [39]. However, this policy system has not yet permeated the urban level deeply. Cities play a pivotal role in economic development, yet their unique financial activities, economic structures, and exposure to financial risks differ significantly from those of the country as a whole, resulting in a conspicuous gap in the implementation of macroprudential policy at the urban level. This is evident in the urban financing of infrastructure, the oversight of local financial institutions, and the management of municipal financial risks. The exploration of the urban implementation of macroprudential policy is relatively lagging and requires substantial promotion and enhancement.

3. Hypothesis Development

3.1. Macroprudential Policy and Urban Economic Resilience

Macroprudential policy can effectively reduce the volatility of economic and financial variables, enhance urban economic resilience to negative shocks, and thereby have a positive impact on economic recovery and growth. First, macroprudential policy mitigates economic fluctuations while reducing the risk interlinkages between urban industries, thereby enhancing the risk buffer capacity of urban economies. On the one hand, macroprudential policy can smooth out credit fluctuations in cyclical sectors, such as real estate, through counter-cyclical capital buffers and other instruments [40], in order to reduce its systemic risk impact on the urban economic system. On the other hand, macroprudential policy can effectively reduce the probability of risk contagion by monitoring the debt-to-asset ratio of key industries and establishing an early warning mechanism for cross-sector risk [41]. Second, macroprudential policy helps build resilient financial institutions by establishing regional financial stability funds and improving emergency response mechanisms for local government debt risk, thereby fortifying the core of the urban financial system [42]. Finally, macroprudential policy focuses on the overall risk of the financial system [43], which helps balance the relationship between economic security and structural upgrading, enhancing the transformation and development power of urban economies. This policy can not only build a macro risk monitoring framework covering emerging businesses, assess structural risks in digital finance and other fields, and prevent capital misallocation in the process of transformation, but it can also reduce the probability and cost of systemic financial crisis, build a safety barrier for long-term stable development, and thus improve the ability of urban economy to resist external shocks [43]. Based on this, we propose the following hypothesis:

H1:

Macroprudential policy can enhance urban economic resilience.

3.2. Transmission Mechanism of Macroprudential Policy on Urban Economic Resilience

3.2.1. Digital Finance Development

Macroprudential policy can enhance the urban economic resilience by stimulating digital finance development. This policy has been widely used to address financial stability, systemic risk, and procyclicality of the financial sector to enhance financial resilience [44,45]. Research findings indicate that, within the context of digital finance, macroprudential policy instruments possess the capacity to influence the procyclical characteristics of commercial bank leverage, thereby reducing the level of vulnerability and systemic risk within the financial system [25,46]. As a result, these instruments ultimately promote the development of digital finance, effectively transforming it into a “shock absorber” and “stabilizer” for urban economic development and ultimately fortifying urban economic resilience. The specific mechanism of this policy is outlined as follows.

Firstly, macroprudential policy optimizes the allocation of digital financial resources. Macroprudential policy inhibits excessive speculation by regulating asset prices and credit restrictions, enhances resource allocation agility, and guides financial resources to flow more efficiently into the demand side. This process would promote the high-quality development of the urban economy, which helps the urban economy to recover from the fluctuations of macroeconomic uncertainty. For instance, during periods of overheating in the real estate market, regulatory authorities can raise counter-cyclical capital buffer requirements to prompt banks to be more cautious in lending to the real estate sector and prevent excessive concentration of financial resources in this area. When facing the risk of economic recession, it must be ensured that there are sufficient financial resources that can flow efficiently to the real economy sectors that most need support.

Secondly, macroprudential policy enhances the resilience of the digital financial system. Macroprudential policy has been shown to do so by increasing regulatory standards for financial institutions in terms of capital adequacy, liquidity, and soundness [47], effectively improving financial adaptability. For instance, the Indian regulator stipulates that digital payment companies must maintain risk reserves at a specific percentage to mitigate potential transaction risks and financial losses. Consequently, India’s digital payment system can withstand immense transaction pressure when confronted with financial risks, ensuring the stable operation of the digital payment infrastructure, enhancing the robustness of the digital financial system within the payment chain, and fortifying the capacity of the urban economy to withstand adverse impacts.

Thirdly, macroprudential policy improves the digital financial risk detection system. Macroprudential policy fosters the establishment of robust digital financial risk detection systems, leveraging dynamic monitoring and intelligent analysis instruments to avert the accumulation of risks, thereby mitigating the deleterious effects of rapid digital financial development. For instance, the People’s Bank Of China has initiated the construction of a regulatory big data platform, intending to enhance the efficiency of risk identification and mitigation. Monitoring economic and financial conditions in real time provides dynamic support for urban economic resilience. Based on this, we propose the following hypothesis:

H2:

Macroprudential policy can enhance urban economic resilience by stimulating digital finance development.

3.2.2. Industrial Structure Upgrading

Macroprudential policy can enhance urban economic resilience by promoting industrial structure upgrading. By reshaping the logic of financial resource allocation, macroprudential policy establishes a conducive policy environment for the enhancement of industrial structures, facilitating financial institutions to extend greater credit support to high-efficiency, high-value-added, green, and emerging low-carbon industries. In this capacity, the industrial structure has been gradually transformed and upgraded, significantly improving the overall quality of the economy [48]. The specific mechanism of action underlying this phenomenon can be outlined as follows.

Firstly, macroprudential policy promotes the rationalization of industrial structure. Industrial structure rationalization is the foundation of industrial structure upgrading [48]. By limiting credit expansion in real estate and energy-intensive industries, differentiated credit support provided by macroprudential policy can effectively avoid excessive concentration of resources in inefficient areas [49]. This approach serves to reduce dependence on traditional, inefficient industries, optimize industrial layout, and promote synergistic development among industries. For instance, macroprudential policy has prompted financial institutions to allocate more financial resources to projects that foster collaboration between manufacturing and service industries in Chongqing province. This approach thereby reduces financing costs, fortifying inter-industry linkages and interactions. When the local industrial structure evolves in the direction of rationalization, it can effectively enhance the economic resilience of the region [50].

Secondly, macroprudential policy promotes the advancement of the industrial structure. By using counter-cyclical capital buffers and other tools, macroprudential policy effectively curbs excessive leverage and speculative financing, alleviates the problem of capital mismatch, and promotes the transformation and upgrading of traditional industries to high-value-added industries. A notable example is the substantial proliferation of science- and technology-based small and medium-sized enterprises in Zhongguancun of Beijing, which have secured financial support from financial institutions and achieved rapid development in fields such as artificial intelligence, biomedicine, and integrated circuits. This has led to the transformation of the local industrial structure towards high-end, intelligent, and innovative domains, enhancing the industry’s overall competitiveness and empowering the city’s transformational development, thereby enhancing urban economic resilience.

Thirdly, macroprudential policy promotes the ecologization of industrial structure. When macroprudential policy incorporates considerations of climate risk, central banks may be incentivized to reallocate their asset portfolios toward green sectors. Sectoral macroprudential policy can assume a more structural role in facilitating a seamless transition to net-zero emissions and fostering green capital and output [51], thereby promoting the ecologization of industrial structure and contributing to the urban economic ability to face external and endogenous shocks and increase its resilience. Based on this, we propose the following hypothesis:

H3:

Macroprudential policy can enhance urban economic resilience by promoting industrial structure upgrading.

3.2.3. Regional Integration

Macroprudential policy can enhance urban economic resilience by deepening regional integration. Macroprudential policy maintains regional economic stability through various mechanisms, including risk prevention and control, capital management, and support for synergistic regional development, leading to regional integration. A common assertion is that as a system becomes more tightly connected and integrated, its resilience increases [52]. This observation is confirmed in a study of the world’s megacities, where “highly integrated systems exhibit high levels of resilience” [53]. The process of regional integration has been demonstrated to effectively reduce circulation transaction costs, thereby promoting interconnections and sharing within the urban agglomerations and enhancing the possibility of other ways to compensate for the damage of the urban system, which is an important way to achieve high-quality economic development [54,55]. Consequently, it improves the economic resilience of cities. The specific mechanism of action underlying regional integration can be outlined as follows.

Firstly, macroprudential policy promotes infrastructure integration. Macroprudential policy implements regulations on the capital adequacy ratio, leverage ratio, and other indicators of financial institutions through the implementation of differentiated capital buffer requirements to break down the barriers to infrastructure construction caused by the uneven distribution of financial resources. Concurrently, macroprudential policy serves to mitigate the vulnerability of infrastructure projects to the accumulation of debt risks by monitoring the macro leverage ratio, curbing debt bubbles in the infrastructure sector, and promoting regional infrastructure integration. For instance, under the oversight of macroprudential policy, financial regulators have incentivized financial institutions to offer customized credit support for infrastructure projects in the Beijing–Tianjin–Hebei region. This has entailed the provision of substantial long-term loans for the development of transportation infrastructure, including high-speed railways and highways, connecting Beijing and Tianjin–Hebei, thereby facilitating the integration of infrastructure within the Beijing–Tianjin–Hebei region. It has promoted the coordination and connectivity of regional infrastructure, thus laying a solid foundation for enhancing the urban economic resilience. It can be seen that macroprudential policy can have a positive transmission effect on urban economic resilience by promoting infrastructure integration.

Secondly, macroprudential policy facilitates market integration. Under the framework of macroprudential policy, regulatory coordination among different regions and sectors can be strengthened, enabling the formulation of unified market rules and regulatory standards, eliminating market segmentation and arbitrage spaces caused by regulatory differences, and achieving efficient market operation. Market integration accelerates the flow of resource elements within the region, contributes to the optimization of resource allocation, and facilitates the formation of complementary advantages of intraregional resources [56]. This enhances the overall adaptive adjustment capacity of the urban economy, making it more resilient to external shocks and facilitating its recovery and development after experiencing such shocks.

Thirdly, macroprudential policy promotes industrial integration. Macroprudential policy, by preventing cross-industry and cross-market risk contagion, reduces the impact of fluctuations in the financial system on the real economy and provides a stable environment for the integrated and coordinated development of industries. At the same time, by limiting the scale of financial institutions’ inter-bank business and off-balance-sheet wealth management products, macroprudential policy effectively encourages more capital flow to the real economy, promotes the integrated development of industries, and generates positive spillover effects. Among them, the spillover of knowledge and technology helps to enhance the innovation ability of regional economies and enhance the ability of urban economies to adjust the economic operation mode and explore new development paths in response to risks [57]. Based on this, we propose the following hypothesis:

H4:

Macroprudential policy can enhance urban economic resilience by deepening regional integration.

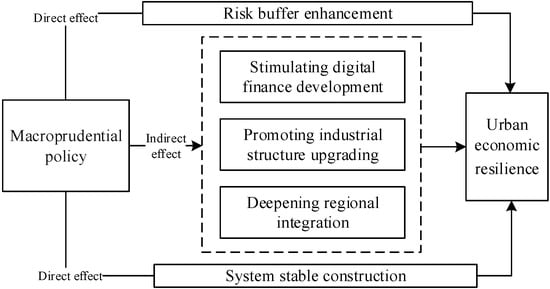

Based on the above analysis and hypotheses, we construct the influencing mechanism of macroprudential policy on urban economic resilience, as shown in Figure 1.

Figure 1.

Influence mechanism. This figure systematically shows the two-path model of macroprudential policy acting on urban economic resilience. The primary path is the direct effect, which is realized through “risk buffer capacity enhancement” and “system stable construction”. Secondly, the indirect effect is that macroprudential policy indirectly enhances economic resilience through three channels of “stimulating digital finance development”, “promoting industrial structure upgrading”, and “deepening regional integration”. The two types of effects together constitute a comprehensive mechanism for macroprudential policy to enhance urban economic resilience.

4. Sample and Research Design

4.1. Data

This paper selects data from 284 prefecture-level cities in China and establishes a panel dataset spanning the period from 2011 to 2023. Based on the availability and comparability of the data, and considering that some cities have been adjusted in administrative divisions during the sample period, Chaohu City in Anhui Province, Laiwu City in Shandong Province, Sansha City in Hainan Province, Simao City in Yunnan Province, Bijie City in Yunnan Province, Tongren City in Yunnan Province, Pu’er City in Yunnan Province, Turpan City in Xinjiang Uygur Autonomous Region, Hami City in Xinjiang Uygur Autonomous Region, and Haidong City in Qinghai Province were excluded. The data sources mainly include the statistical yearbooks of various cities, the National Bureau of Statistics, and CSMAR database, among others. The data on macroprudential policy is sourced from the iMaPP database, and a small amount of missing data is filled in through linear interpolation. The data on digital finance development is provided by Peking University Digital Inclusive Financial Index.

4.2. Variable Measurement

4.2.1. Explained Variable

Under the impact of uncertainty, the actual change in urban economic output is the most direct reflection of the regional response to risks [30]. Therefore, this paper uses the change in real economic output at the urban level to measure urban economic resilience. Referencing the research by Xu et al. (2024) [58], this paper introduces the concept of deviation shares to measure urban economic resilience. However, to avoid the endogeneity issue in the national average GDP growth rate and to prevent expected benchmarks from being contaminated by cyclical fluctuations that could weaken the identification of policy effects, we estimate the economic resilience index for each city during the sample period by calculating the degree of deviation between actual economic output and the benchmark value in 2008. This approach better separates changes in resilience before and after the implementation of the policy. The formula is as follows.

where i refers to the city; t − 1 refers to time lag item; Ei,2008 indicates the actual economic output of city i in 2008; and ECRi,t−1 indicates the economic resilience of city i in year t − 1. The larger the indicator, the higher the urban economic resilience, and the greater its ability to resist or recover from uncertain shocks.

4.2.2. Explanatory Variable

Considering the comprehensiveness, accuracy, and completeness of the indicators, this paper uses the iMaPP database of the International Monetary Fund (IMF) as the measurement benchmark. The database has a wide coverage and comprehensively includes the 17 macroprudential policy instruments of the IMF (See Table 1). The objectives and targets of China’s macroprudential policy are similar to the above content, and these policy instruments have been implemented to varying degrees in China. Therefore, this paper selects the 17 policy instruments in Table 1 to construct the China Macroprudential Policy Index (MPI). In this regard, drawing on the practice of Cerutti et al. (2017) [59], whether a certain macroprudential policy instrument was implemented in the current year is used as the assignment criterion; that is, if a certain macroprudential instrument is implemented in the current year, the value of the policy instrument is taken as 1, and otherwise as 0. After summarizing the results of the implementation of 17 prudential instruments in the MPI for the year, the higher the MPI value, the more significant the degree to which China implemented macroprudential policy in that year.

Table 1.

Definition of macroprudential policy instruments.

4.2.3. Mediating Variables

The mediating variables of this study are digital finance development (DIFI), industrial structure upgrading (STR), and regional integration (INTEGR). Among them, DIFI is measured by the digital inclusive financial index [60], which includes three specific dimensions: coverage breadth, usage depth, and digitalization degree [61]. It is an indicator system that can scientifically and comprehensively summarize the current situation of digital inclusive finance in China [62]. STR is measured by the ratio of the output value of the tertiary industry to that of the secondary industry, and INTEGR is measured by the market segmentation index derived from the relative price ratio [63].

4.2.4. Control Variables

To more accurately assess the influence of macroprudential policy on urban economic resilience and reduce estimation biases caused by ignoring key variables, this paper introduces the following control variables based on the research by Guo et al. (2024) and Man et al. (2021) [64,65]. Urban population density (RKM) is expressed as the ratio of urban population to urban area. The level of infrastructure construction (ROAD) is measured by the ratio of the area of urban roads to the total number of urban population. The level of financial development (DEV) is expressed as the ratio of loan balances of financial institutions to GDP. The level of resident income (INC) is equal to the logarithm of the average wage of employees. Research and Development Expenditure (UREX) is expressed as the logarithm of expenditure on scientific projects. Market size (RET) is the percentage of total retail sales in GDP. Human capital (CAPIT) is expressed as the ratio of the number of people with a college degree or above to the total number of people. Education level expenditure (EDU) refers to the proportion of education expenditure in the local general public budget expenditure. The details are shown in Table 2.

Table 2.

Data description.

4.3. Model Specification

4.3.1. Benchmark Regression

After the F-test and Hausman test, the p values obtained are less than 10%, so a double fixed effects model is constructed for empirical verification.

where i represents the city, t represents the year, ECRi,t represents the urban economic resilience of city i in year t, MPIi,t−1 represents the macroprudential policy index of city i in year t − 1, α represents the coefficient of relevant variables, CONTROLS represents a collection of control variables, λ represents the city fixed effect, μ represents the year fixed effect, and ε denotes the random disturbance term.

4.3.2. Mediating Tests

This paper adopts a three-step method to construct mediating models.

where Mi,t represents mediating variables, including DIFI, STR and INTEGR; CONTROLS represents a collection of control variables; β and ϕ represent the coefficients of relevant variables; λ represents city fixed effects; μ represents time fixed effects; and ε represents the random disturbance term.

5. Empirical Findings

5.1. Descriptive Statistics

Table 3 reports descriptive statistical results for the main variables. The data results reveal that the overall economic resilience of Chinese cities is at an acceptable level, with significant differences among cities. They possess certain resilience and post-disaster recovery capabilities in the face of external shocks. The relevant data characteristics of macroprudential policy also indicate that since 2011, the tightening intensity of macroprudential policy has continued to increase. There are significant differences in the implementation intensity of policies in different years, but the policy execution has strong continuity.

Table 3.

Summary statistics.

5.2. Correlation Checks

Table 4 shows the correlation coefficients among main variables. It can be seen that there is a significant positive correlation between MPI and ECR, which initially supports H1, and at the same time there is a certain correlation among most variables. It is worth noting that the correlation coefficients of most variables are all below 0.5, indicating that although there is a certain degree of correlation, the intensity of the correlation is relatively weak, thereby reducing, to a certain extent, the problems that may be caused by multicollinearity.

Table 4.

Correlation matrix.

5.3. Baseline Results

Table 5 reports the baseline regression results of the impact of macroprudential policy on urban economic resilience. Among them, Columns (1) and (2), respectively, present the regression results after only controlling for the uncontrolled variables and controlling for the fixed effects of cities and years. Column (3) presents the results including all control variables, while Column (4) further controls the fixed effects and variables on the basis of Column (3). Empirical analysis results indicate that macroprudential policy can significantly enhance urban economic resilience, and the conclusion remains consistent even after controlling for additional variables, demonstrating strong robustness. Therefore, H1 is verified. In all columns, the coefficient of MPI is always significantly positive. From Column (4), it can be seen that for every additional unit of macroprudential policy usage, the urban economic resilience index will increase by 3.7%. This result is completely in line with the theoretical expectation direction. It is shown that with the increase in the frequency of macroprudential policy used by government departments, urban finance can develop stably, and urban economic resilience would be enhanced.

Table 5.

Baseline results.

For control variables, we can see from Column (4) that an improvement in the sophistication of the financial system and an increase in R&D investment can effectively promote the growth of target economic variables. Although the impact of improving the quality of the labor force and optimizing educational resources is relatively limited, they still make positive contributions to development. It is worth noting that the negative impact of market size may stem from the congestion effect accompanying scale expansion, which indicates that under the current market structure, economic scale has not yet taken the dominant position.

5.4. Robustness Checks

Although the benchmark regression results support the core conclusion, in order to ensure the reliability of the empirical research results, this study further carries out robustness tests. We analyze how macroprudential policy affects urban economic resilience by replacing the explanatory variable, replacing the explained variable, and changing the sample interval and then conducting robustness tests.

5.4.1. Replace the Measurement of Explanatory Variable

Since economic resilience itself is a complex multi-dimensional concept that can be measured in different ways, the method of alternative explanatory variable is used to enhance the credibility of the conclusion. Referring to the research of Chao and Xue (2023) [66], the measurement of urban economic resilience is still used as above, and the deviation between the number of employees in each city and the data in 2008 (ECR1) is used as the surrogate variable for ECR, which is substituted into the original regression model. The results obtained are shown in Column (1) of Table 6. The regression coefficient of MPI is 0.011, which is significantly positive at the 1% level, confirming the reliability of the previous conclusion.

Table 6.

Results of robustness checks.

5.4.2. Replace the Measurement of Explained Variable

As a counter-cyclical adjustment tool, the impact of macroprudential policy tightening and easing on the credit cycle and even economic resilience may be asymmetric. Therefore, in terms of the construction of substitution variables for explanatory variables, this paper focuses on the implementation of policy, referring to the research method of Alam et al. (2019) [67]. The alternative variable for macroprudential policy (MPI1) is set as follows: tight policy has a value of 1, loose policy has a value of −1, and a value of 0 indicates there is no change. The annual value of MPI1 is finally derived by aggregating the implementation data of 17 macroprudential policy instruments. By introducing the direction dimension, this alternative method can more finely capture the dynamic changes in policy intensity and orientation, so as to more comprehensively reflect the real regulation intention of macroprudential policies. The regression results obtained are shown in Column (2) of Table 6, where the coefficient of MPI1 is 0.129, the coefficient symbol has not changed substantially, and the results are consistent with the baseline test.

5.4.3. Change in the Sample Interval

Due to the long sample interval in the baseline regression in this paper, China experienced the impact of a public health emergency in the sample period, which may interfere with the baseline regression results. Therefore, referring to the research of Cao and Zeng (2024) [68], the sample period is controlled to regress from 2011 to 2019. The regression results are shown in Column (3) of Table 6, and the estimated regression coefficient is 0.070, which is statistically significant at the level of 1%, further verifying the robustness of the conclusion.

5.5. Endogeneity Tests

5.5.1. Adding Missing Variables

To minimize the endogenous influence of potential missing variables on the results, this study also performed a test for adding more control variables. The selection of control variables is carried out by referring to the research of Cao and Zeng (2024) [68]. Firstly, considering that fiscal expenditure is a key instrument for local governments to regulate the economy, its scale, structure, and efficiency will directly affect the multiple dimensions of urban economic resilience. Therefore, in this study, government intervention (GOV) defined by the ratio of government intervention of fiscal expenditure to GDP is included in the model as a control variable. The higher the value, the greater the local government expenditure. On the contrary, it indicates that the local government fiscal expenditure is less. Secondly, as the core embodiment of the contradiction between revenue and expenditure of local governments, fiscal liquidity directly restricts their macroeconomic regulation ability and the level of public service supply, and the latter is an important constraint factor for building urban economic resilience. Therefore, this paper introduces fiscal liquidity (FP) as a control variable in the model and defines it as the ratio of the difference between local government general budget expenditure and revenue to GDP. The higher the value, the lower the fiscal liquidity of the local government. On the contrary, it indicates that the local fiscal liquidity is high. Finally, considering that the level of economic development is the core indicator to measure the level of regional economic development, it has a systemic impact on urban economic resilience through the paths of fiscal capacity, industrial structure, and innovation investment. Therefore, the logarithm of GDP per capita (LNPGDP) is introduced into the model as a control variable. The higher the value, the higher the level of urban economic development. On the contrary, a lower value means a relatively lower level of urban economic development.

Column (1) of Table 7 reports the regression results of the test, in which the coefficient of MPI is 0.030, which is significantly positive at the level of 1%, indicating that the basic conclusion of macroprudential policy to promote urban economic resilience is robust.

Table 7.

Endogeneity test results.

5.5.2. Two-Stage Least Squares Method

The level of urban economic resilience will significantly affect the formulation intensity and implementation effect of macroprudential policy through the risk feedback mechanism. In highly resilient cities, a diversified industrial structure, sound risk buffer mechanism, and mature financial intermediary system can effectively absorb the impact of financial fluctuations and reduce the exposure to systemic risks. Such an intrinsic stabilizer would send a positive signal to regulators, potentially reducing the frequency and intensity of contractionary prudential policy. On the contrary, cities with low resilience are more likely to trigger early warning indicators of financial risk. This structural vulnerability could force regulators to enact more stringent prudential measures. In view of the reverse causality problem, this section adopts the two-stage least squares method (2SLS) to alleviate the estimation bias caused by the endogeneity problem. Referring to the studies of Chen and Li (2022) [69], we choose the changing of national leaders as the instrumental variable (IV). First, the governing styles of leaders in different countries are different, and their governing styles directly affect the implementation of policies, which makes the changing of national leaders likely to have a certain impact on the formulation and implementation of macroprudential policy, which meets the requirements of the instrumental variable. On the other hand, the succession of national leadership has no direct relationship with urban economic resilience. Therefore, the instrumental variable meets the exogenous requirements. Based on this, the succession of national leaders is selected as the instrumental variable of China’s macroprudential policy (IV). The test values of weak instrumental variable (Cragg–Donald Wald F = 49.190) and unidentifiable variable (Kleibergen–Paap Wald rk F = 68.170) both exceed the critical value at the level of 10% (16.38), indicating that the null hypothesis of insufficient identification of instrumental variable and weak instrumental variable can be rejected. The results in Column (3) of Table 7 show that the regression coefficient of MPI is 0.892, which remains significantly positive at the significance level of 1%, which is consistent with the benchmark regression results. Based on the above results, the conclusions of this paper are still valid after dealing with the endogeneity problem.

5.5.3. Heckman Two-Step Model

The availability of sample data is not random, but closely related to the economic and social development level of the city. Cities with a high level of economic development and strong governance capacity usually have a more perfect statistical system and data disclosure mechanism, and are more likely to be included in the sample. Cities with a backward economy or insufficient administrative capacity are more likely to be excluded due to missing data, resulting in a systematic bias of samples towards cities with higher levels of economic development and stronger government effectiveness. Therefore, the sample used in this paper may be subject to the endogeneity problem of self-selection to a certain extent. In order to avoid the estimation bias that may be caused by this self-selection problem, we used Heckman’s two-step regression model for tests [70]. Referring to the method of Wang and Zhou (2024) [71], we used the political cycle, namely the dummy variable of the time of the National People’s Congress of the Communist Party of China and the National Financial Work Conference, as the instrumental variable (IV’). Specifically, the year when the National People’s Congress of the Communist Party of China and the National Financial Work Conference are held and the following year are set as 1, and the remaining years are set as 0. These two meetings, as exogenous political events in the banking system, can effectively encourage the financial regulatory authorities to strengthen macroprudential management and stability supervision, and its policy impact has obvious time lag and persistence. However, the convening of the conference itself does not directly affect the urban economic resilience, which meets the conditions of exogeneity and correlation of instrumental variables.

In the first step, Probit model is used to estimate the probability of macroprudential policy implementation (MPI’) and calculate the Inverse Mills Ratio for each sample city. Among them, when MPI is not less than the median, the value of MPI’ is 1; otherwise it is 0. The second stage is to add the Inverse Mills Ratio obtained in the first stage to the original regression equation, and then estimate the regression parameters. Columns (4) and (5) of Table 7 show the results of Heckman two-step model, and the coefficient of Inverse Mills Ratio is significant, indicating that there is a sample selection bias in this paper. However, the coefficient of MPI is significantly positive at the level of 5%, indicating that the research conclusion remains unchanged under the condition of controlling the sample selection bias.

6. Further Analysis

The above empirical tests sufficiently confirm the role of macroprudential policy in enhancing urban economic resilience, which is still valid after a series of robustness tests. To further analyze the internal mechanisms of macroprudential policy affecting urban economic resilience, this section conducts analysis from two dimensions: transmission pathways and heterogeneity characteristics. First, we focus on examining the mechanisms of potential transmission channels such as digital finance development, industrial structure upgrading, and regional integration. Second, the heterogeneity analysis is conducted based on the digital development level, financial pressure, and other dimensions to reveal the differentiated effect of macroprudential policy. The series of tests not only helps clarify the transmission pathways of macroprudential policy on urban economic resilience but also provides a scientific basis for differentiated policy formulation.

6.1. Channels

6.1.1. Digital Finance Development

Digital finance, with its inclusiveness, efficiency, and innovation, has become an important engine to promote the high-quality development of the urban economy, by providing broader financing support and technology empowerment for the real economy. Therefore, the mediating effect of digital finance was tested based on formulas (3) and (4). Column (1) in Table 8 shows that macroprudential policy can promote the development of digital finance. Column (2) in Table 8 shows the results of incorporating MPI and DIFI into the regression equation simultaneously. The regression coefficient of DIFI is significantly positive at the 1% significance level and is lower than 0.037 (Column (4) in Table 5), meaning that macroprudential policy stimulates digital finance development, reduces the vulnerability level and systemic risk of the financial system [35], and improves the ability of the urban economy to resist risks, thus enhancing the urban economic resilience. Therefore, H2 is verified.

Table 8.

Mediation tests’ results.

6.1.2. Industrial Structure Upgrading

As one of the key ways to enhance urban economic resilience, industrial structure upgrading can effectively reduce the transmission effect of economic fluctuations by increasing the proportion of modern service industries such as finance and information technology [72]. Based on the above assumptions in this paper, the mediating effect of industrial structure upgrading was studied. Column (3) in Table 8 shows that macroprudential policy can promote the upgrading of industrial structure. Column (4) in Table 8 shows that, in the regression equation, both MPI and STR are introduced. The coefficient of STR remains significantly positive at the 1% significance level and is less than 0.037 (Column (4) in Table 5), meaning that industrial structure upgrading has a mediating effect. The high-end evolution of the industrial structure has further improved the total factor productivity and the efficiency of resource allocation, so that the urban economy has a stronger buffer space, faster recovery speed, and better transformation path in the face of external shocks. Thus, H3 is supported.

6.1.3. Regional Integration

Regional integration, as an important strategy for modern economic development, can respond to shocks and make up for the insufficient governance capacity of individual cities by efficiently integrating resources, effectively reducing market fragmentation and institutional barriers [73]. Based on the aforementioned assumptions, this paper examines the mediating effect of regional integration. At present, there are two main ways to measure regional integration: one is to introduce the market segmentation index based on the relative price index [74], and the other is to express the process of regional integration by the implementation of national urban agglomeration policy [75]. In contrast, the market segmentation index has two significant advantages in measuring regional integration. First, its construction relies on the “glacier cost” model [76], and measures the degree of interregional market integration based on the “relative price method”, which reveals the internal economic logic of interregional price fluctuations and can directly reflect the actual transaction costs of cross-regional flow of commodities and factors, providing a clear micro mechanism support for empirical analysis. Second, the index is comparable and robust. The index is calculated based on the consumer price sub-indexes systematically published in local statistical yearbooks, which avoids common subjective setting errors in policy variables and can generate continuous and comparable annual panel data, which is conducive to accurately describing the dynamic evolution process of regional integration level. Therefore, although the policy variables of urban agglomeration are helpful to identify the institutional shock effect, the market segmentation index shows unique value in both theoretical connotation and data quality, and is more suitable as the core proxy variable of regional integration to accurately identify the transmission efficiency of macroprudential policy at the spatial level. Based on this, Column (5) in Table 8 shows that macroprudential policy can promote regional integration. According to the data in Column (6), when MPI and INTEGR are included in the regression equation at the same time, it can be observed that the regression coefficient of INTEGR is significantly negative at the 5% level, and the coefficient of MPI is 0.036, which is significantly positive at the 1% level and smaller than 0.037 (Column (4) in Table 5). The above results show that in the process of preventing systemic financial risks, macroprudential policy promotes regional integration. According to the growth pole theory, in the early stage of regional integration, labor, capital, technology, and other factors will gather to the city center or core cities [77], which is conducive to the centralized allocation of resources by the government and improves the efficiency of resource allocation. It enhances the risk resistance ability of the region when it defends and encounters shocks [78]. Therefore, H4 is proved.

6.2. Heterogeneity Tests

6.2.1. Heterogeneity of Smart Cities

By guiding the flow of financial resources and strengthening risk monitoring, macroprudential policy provides institutional guarantee for the steady development of digital finance, and ultimately improves urban economic resilience. Based on this logic, this paper argues that smart city pilot cities, with their better infrastructure, can effectively respond to macroprudential policy and enhance urban economic resilience. First of all, relying on digital infrastructure such as the Internet of Things and big data platforms, smart cities can realize high-precision monitoring and early warning of regional financial risks, industrial structure dynamics, and factor flows and provide accurate information basis and fast transmission channels for the implementation of macroprudential policy [79]. Secondly, the integration of transportation, information, and public services promoted by smart cities objectively promotes the connectivity with surrounding areas, enlarges the radiation scope and synergistic effect of digital finance [80], and thus further strengthens the risk resistance and recovery capacity of the economic system at the regional level. Therefore, through the heterogeneity test of the smart city pilot, it is tested whether the effect of macroprudential policy depends on an efficient “digital governance system”. Given this, referring to the research of Song et al. (2021) [81], this paper classifies the sample cities according to whether they are smart city pilot cities and studies the association between macroprudential policy and urban economic resilience. As shown in Columns (1) and (2) of Table 9, the regression coefficient of MPI in the smart-city group is significant at the 1% significance level, and the value was significantly higher than that of the non-smart-city group. It means that the smart city pilots have a high degree of digital economy development and can effectively cooperate with macroprudential policy to promote urban economic resilience. Therefore, compared with smart city pilot cities, non-pilot cities are limited by weak digital infrastructure and insufficient data integration ability. The implementation of macroprudential policy often faces problems such as information asymmetry and long transmission delay, which makes it difficult to give full play to the expected effects on urban economic resilience.

Table 9.

Heterogeneity tests’ results.

6.2.2. Heterogeneity of National Big Data Comprehensive Pilot Zone

Macroprudential policy can inhibit excessive leverage and speculative financing and promote the transformation and upgrading of traditional industries to the direction of high added value, thus promoting industrial structure upgrading and ultimately improving urban economic resilience. Based on this logic, this paper argues that the national big data comprehensive pilot zone (hereinafter referred to as the big data pilot zone) has significantly accelerated the deep integration of data elements and traditional industrial systems through institutional innovation and technology empowerment [82]. Specifically, by building a standardized data circulation market and unified data standards, the big data pilot zone breaks the “data island” in the industry, so that the credit and financial resources guided by macroprudential policy can be more accurately allocated to links and enterprises with potential [83]. This process can promote a deeper and wider range of industrial structure optimization, greatly enhance the adaptability and urban economic resilience to internal and external shocks, and make macroprudential policy play a more significant role in improving economic resilience in the test area. Therefore, through the heterogeneity test of the big data pilot zone, it can be determined whether the promoting effect of macroprudential policy on urban economic resilience is significantly dependent on the support of efficient data element ecology. Given this, this paper records the cities not included in the big data pilot zone as 0, and the cities in the experimental area as 1, and performs group regression to investigate the relationship between macroprudential policy and urban economic resilience. As shown in Columns (3) and (4) of Table 9, the regression coefficient of MPI in the group of the big data pilot zone is 0.040, which passes the significance test at the 1% level, while the coefficient of MPI in the non-big data pilot zone is −0.001. The results mean that compared with the non-big data pilot zone, the big data pilot zone has significant advantages in promoting the construction of new information infrastructure, laying a digital foundation for macroprudential policy and enhancing urban economic resilience.

6.2.3. Heterogeneity of Fiscal Pressure

The effectiveness of macroprudential policy is deeply dependent on the fiscal ecological environment of local governments. This paper argues that fiscal pressure restricts the effect of macroprudential policy on improving urban economic resilience mainly by distorting the behavior of local governments. On the one hand, high fiscal pressure will drive local governments to compete for local financial resources through urban investment platforms and other channels, leading to the contraction of credit supply of financial institutions in the field of supporting innovation and digitalization [84,85]. This not only weakens the function of macroprudential policy in optimizing the allocation of digital financial resources, but also reduces the overall utilization efficiency of financial resources, thus hindering the transmission path of macroprudential policy to enhance urban economic resilience with the development of digital finance. On the other hand, local governments facing high fiscal pressure often lack the motivation to promote regional coordinated development. Therefore, through the heterogeneity test of fiscal pressure, we can effectively identify the institutional constraints on the effects of macroprudential policy and clarify the internal mechanism of the differentiation of their effects in different fiscal ecological environments. Given this, referring to the research of Lin et al. (2022) [86], this paper measures fiscal pressure by calculating the difference between urban general public budget expenditure and revenue and the ratio of the region’s GDP. The samples are divided into a high-fiscal-pressure group and a low-financial-stress group according to the median value, and group regression was performed. As shown in Columns (5) and (6) of Table 9, the regression coefficient of MPI of the high-financial-pressure group is 0.008, which is not statistically significant, while that of the low-financial-pressure group is 0.068, which is significant at the level of 5%. This result shows that compared with cities with greater fiscal pressure, cities with less fiscal pressure play a more significant role in improving urban economic resilience. The reason may be that cities with less fiscal pressure can provide more suitable fiscal environment and institutional space, corresponding to stronger autonomy and sustainability of policy implementation.

6.3. Spatial Spillover Effects Analysis

The urban economic system is not isolated but is closely connected with neighboring cities through the flow of factors, industrial linkages, and financial networks. Macroprudential policy can generate spillover effects on neighboring cities through channels such as cross-regional credit transmission, risk contagion, or resource reallocation. Second, ignoring spatial dependence can lead to model specification errors, such as overestimating or underestimating the local policy effects. Through spatial econometric analysis, the differentiated impacts of policy on local and neighboring cities can be identified, thereby revealing the mechanisms of regional cooperation or competition. Additionally, this test can provide a basis for policy coordination, such as optimizing the differentiated combination of macroprudential instruments at the urban agglomeration level to avoid “beggar-thy-neighbor” or “free-riding” phenomena, ultimately enhancing the overall economic resilience of the region. Therefore, this section examines the spatial spillover effects of macroprudential policy on urban economic resilience.

6.3.1. Spatial Autocorrelation Test

The premise of constructing the spatial econometric model is to ensure that the explanatory variable has spatial correlation. Based on the spatial adjacency matrix (W), this paper analyzes the global Moran’s I indexes of urban economic resilience, and the results are shown in Table 10. The results show that, except for 2013, all indicators are significantly positive at the 1% level, indicating that urban economic resilience is not randomly distributed in space, but shows positive spatial dependence characteristics.

Table 10.

Global Moran’s I for 2011–2023.

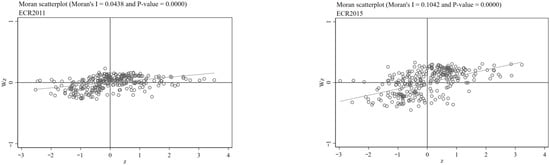

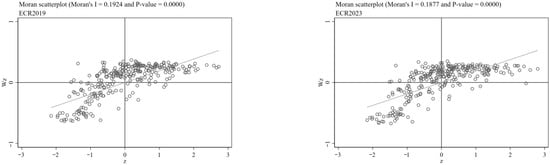

Global spatial autocorrelation solely reflects the general state of the spatial autocorrelation of urban economic resilience. If there is spatial heterogeneity, the accuracy of the test would decline. To further investigate the distributional properties of the variables in order to demonstrate their aggregation status, we conducted a local autocorrelation test and drew Moran’s I scatter plot [87]. There are four types of spatial linkages in the Moran’s I index scatter plot. The scatter plot of Moran’s I index shows four types of spatial correlation. The first type is the first quadrant (H-H type), which shows positive spatial correlation, that is, high-level cities and high-level cities are clustered in space. The second category is the second quadrant (L-H type), showing negative spatial correlation; that is, low-level cities and high-level cities are spatially adjacent. The third category is the third quadrant (L-L type), showing positive spatial correlation; that is, low-level cities and low-level cities are spatially adjacent. The fourth category is the fourth quadrant (H-L type), which shows negative spatial correlation; that is, high-level cities and low-level cities are spatially clustered adjacent to each other. The local spatial autocorrelation test results (Figure 2) show that the local Moran’s I index in representative years significantly exceeds 0, and most cities are located in the first and third quadrants of the region with positive spatial correlation, which further confirms the significant spatial agglomeration effect of urban economic resilience. This is consistent with the findings of Ai et al. [88].

Figure 2.

Local spatial autocorrelation test. Note: The horizontal axis shows the standardized urban economic resilience, and the vertical axis shows the spatial lag value of urban economic resilience, as shown in the figure below. Due to the limited space, this paper only reports the localized Moran index for four years (2011, 2015, 2019 and 2023) under the 100 km threshold weight matrix, and the remaining results are reserved for reference.

6.3.2. Spatial Effect Analysis

The model settings were determined through LM test, Hausman test and LR test, and the Spatial Durbin Model was used for bidirectional fixed effects. In order to further study the spatial effects of macroprudential policy on urban economic resilience, the regression results of the Spatial Durbin Model are decomposed into direct effects, indirect effects and total effects, and the results are shown in Table 11. Rho represents the spatial autocorrelation coefficient, which reflects the direction of the spatial spillover effect of the explanatory variable in the region. The results show that the Rho of the model is positive and passes the significance level test of 1%, indicating that macroprudential policy has a positive spatial spillover effect. Apart from the direct effect of macroprudential policy on urban economic resilience passing the significance test at the 5% level, neither the indirect effect nor the total effect of macroprudential policy on urban economic resilience passed the significance test, indicating that the total spatial effect of macroprudential policy on regional economic resilience is not significant. Therefore, macroprudential policy currently has a relatively limited impact on the resilience of local cities, and its radiation effect on other regions is also relatively weak. In order to verify the reliability of the conclusion, this paper converts the spatial adjacency matrix into the spatial distance matrix for re-estimation, and the results show that the signs of core variables are basically consistent with the benchmark regression, indicating that the model has good robustness.

Table 11.

Regression results of Spatial Durbin Model.

The preliminary analysis of spatial spillover effects shows that the test based on the traditional geographical distance weight matrix does not identify significant spatial spillover effects of macroprudential policy on urban economic resilience. Considering that the explanatory power of economic ties for regional interaction may go beyond geographical proximity, this study further establishes the inter-city investment network matrix as the spatial weight setting, so as to more accurately describe the substantive economic ties between regions and more reliably identify the possible spatial spillover effects of macroprudential policy. Even under the inter-city investment matrix that is more consistent with the logic of economic correlation, the model does not capture significant spatial spillover effects. This result prompts us to revisit the possibility that the externality of the policy may itself be weak and that its effects are theoretically overestimated.

This empirical finding may be due to the following reasons: firstly, macroprudential policy has a strong geographical targeting. Its original purpose is to defuse local financial risks, and policy instruments (such as real estate loan concentration management) mainly regulate financial institutions and market behaviors in a specific region. Secondly, although there are close economic and investment exchanges between cities, the territorial framework of financial regulation and the lack of policy coordination among local governments may hinder the effective spillover of risk signals and policy intentions, resulting in a significant attenuation of policy impact across administrative divisions. Therefore, the insignificant spatial spillover effect of macroprudential policy does not mean that regions are completely isolated, but more likely reflects that the scope of influence has a strong localized tendency, and the cross-regional coordination and linkage mechanism still needs to be further strengthened.

6.4. Follow-Up Research on the Improvement of Urban Economic Resilience

The improvement of urban economic resilience builds a stable development environment and a virtuous cycle mechanism for regional innovation capacity. On the one hand, resilient cities can better withstand external economic shocks and avoid the interruption of capital investment and R&D cycle necessary for innovation activities due to short-term fluctuations, which provides a basic guarantee for the development of regional innovation capacity. On the other hand, the improvement of urban economic resilience is often driven by a diversified industrial structure. Diverse regions are thought to have greater potential to promote new types of restructuring among local industries and open up new paths to growth, a phenomenon known as the Jacobs externality, named after the pioneering research of Jacobs (1969) [89]. Therefore, we believe that the improvement of urban economic resilience can promote regional innovation capacity by reducing innovation risk and optimizing innovation ecology. Therefore, according to the Evaluation Report on China’s Regional Innovation Capability from 2011 to 2023, the utility value of regional innovation capability of each province is sorted out to construct regional innovation capability (INNO1) for testing. As one of the important achievements of the national Innovation Survey system, the report includes an index system covering the five dimensions of innovation investment, output, environment, performance, and potential, comprehensively covering key areas such as R&D investment, number of R&D personnel, patent application and authorization, high-tech industry cultivation status, science and technology policy support, and achievement transformation efficiency. Through a series of steps such as data standardization processing, weight distribution and comprehensive evaluation model, this paper evaluates and analyzes the innovation capability of 31 regions (provinces, autonomous regions and municipalities directly under the Central Government) in China [90], so as to achieve an objective and comprehensive evaluation of the innovation capability and development level of all regions in China.

To further verify the above conjecture, the following formula is constructed.