Abstract

Numerous organizational researchers have acknowledged that COVID-19 reduced the profit in the tourism industry. Some tourism firms decreased the cost by reducing the investment of CSR in order to increase the profit. However, the relevant literature remains scarce. The main purpose of this study is to explore the effect of COVID-19 on CSR investment in the tourism industry. This study fills the gap between stakeholder and cost stickiness theories. Based on a quasi-experiment of listed Chinese tourism companies from 2017 to 2021, the study finds that COVID-19 caused tourism firms to increase strategic CSR and decrease a responsive one. In addition, tourism firms that adopted cost leadership strategies trimmed responsive CSR more than strategic CSR. Tourism firms with differentiation leadership strategies increased strategic and decreased responsive CSR. Tourism firms with higher levels of political connections increased responsive CSR, while tourism firms with higher organizational resilience increased strategic CSR. At the theoretical level, this study reveals the theoretical mechanism of COVID-19 on tourism firms’ adjustment of CSR from the perspective of cost stickiness. On a practical level, it helps inform tourism firms’ decision-making regarding CSR adjustments for sustainable development when they face widespread crisis scenarios.

1. Introduction

Tourism relies on the mobility of tourists, with their consumption behavior typically occurring at their destination rather than their place of residence. Consequently, the tourism industry reacts strongly to crisis events and is very sensitive to changes in the external environment [1]. According to the “2021 Literature and Tourism Industry Dynamic Report”, China’s civil aviation passenger traffic experienced a significant decline, plummeting by 84.3% year-on-year in February 2020, primarily due to travel restrictions and other policies implemented following the outbreak of the COVID-19 epidemic in December 2019 [2].

Corporate social responsibility (CSR) is a costly investment for companies. Does COVID-19 have a negative impact on travel companies’ CSR investments? The answer is not clear. CSR activities involve diverse corporate stakeholders, including environmental, legal, economic, and human resources [3]. According to relevant crisis management theories, long-term CSR investment has both cumulative and insurance effects, which improve enterprises’ reputations and anti-risk abilities [4]. Compared to other industries, tourism presents higher risks, greater costs, and increased competition while typically offering lower profit margins [5]. Existing studies have shown that, from the perspective of corporate strategy, investing in CSR enhances a company’s goodwill, brand image, proportion of intangible assets, resource sustainability, and sustainable operation [6,7]. In contrast, other previous studies based on over-investment theory have shown that investing in CSR can be seen as showboating behavior, resulting in a serious waste of resources [8,9]. Since tourism behavior is not a human imperative, it is unlikely that certain investments by tourism firms, such as CSR, will yield sufficient returns [5]. Previous research has demonstrated that, unlike other industries, the adjustment costs—referred to as stickiness—of various categories of CSRs in the tourism industry vary widely [10].

The main purpose of this study is to investigate how tourism companies adjusted their CSR practices in response to the impact of the COVID-19 epidemic. It compares Chinese listed companies in the tourism sector with those in other industries from 2017 to 2021, utilizing stakeholder and cost stickiness theories. Furthermore, it systematically analyzes the moderating effects of the COVID-19 epidemic shock on CSR in the tourism industry, considering various corporate strategies, including differentiation leadership, cost leadership, political connections, and organizational resilience. The findings of the study are as follows: First, the COVID-19 shock led to an increase in strategic CSR activities among tourism firms, while responsive CSR activities decreased. Second, tourism firms that adopted cost leadership strategies exhibited a greater reduction in responsive CSR compared to strategic CSR. Those implementing differentiation strategies saw an increase in strategic CSR and a decrease in responsive CSR. Third, tourism firms with higher political connections tended to increase their responsive CSR activities. Lastly, tourism companies with higher organizational resilience tended to increase their strategic CSR activities.

Compared with previous studies, this study makes several significant contributions. First, by employing a quasi-experiment in China, it elucidates the theoretical mechanism by which CSR investments of listed tourism companies were adjusted amidst the COVID-19. Second, to account for the variance in cost stickiness levels among different types of CSR, the study categorizes CSR into strategic and responsive CSR. It demonstrates that strategic CSR exhibits a higher degree of cost stickiness than responsive CSR, providing a more nuanced understanding of the CSR adjustment preferences of tourism companies. Third, the study delves into the moderating effects of various strategic orientations on adjustments in CSR investments in tourism enterprises. It systematically analyzes the impact of corporate strategies (cost leadership strategy vs. differentiation leadership strategy) on the CSR adjustments of tourism enterprises. Fourth, this study investigates the moderating role of political connections in adjustments to responsive CSR investment among tourism enterprises. It scientifically examines the impact of political connections on the CSR adjustments of tourism enterprises. Finally, the study explores the moderating role of organizational resilience in the strategic CSR investment adjustments of tourism firms, methodically analyzing how organizational resilience influences the strategic CSR investment adjustments of tourism companies.

The findings of the study will assist policymakers in tailoring policies for tourism enterprises amidst the COVID-19 pandemic or other crisis events, aligning with tourism development principles and aiding tourism enterprises in weathering challenging times. Simultaneously, it offers a decision-making framework for tourism firm managers to adapt their CSR investments for sustainable development during crises.

2. Theoretical Analysis and Hypotheses Development

2.1. Strategic vs. Responsive CSR

According to institutional theory, tourism firms need to align their CSR behaviors with institutional pressures, ensuring compliance with laws, industry regulations, and stakeholder expectations in order to establish legitimacy and secure resource support [11]. Moreover, according to strategy theory, CSR initiatives must align with a firm’s strategic objectives to maintain competitive advantage by leveraging valuable, scarce, and unique resources [12].

Given the impact of COVID-19, did tourism companies reduce or maintain their CSR investments? The answer requires more specificity than what current research offers. According to Porter and Kramer’s social responsibility decision-making framework (2006), CSRs are categorized into two types: responsive and strategic CSR. Responsive CSR aims to enhance short-term relationships with stakeholders [13] and has often been regarded as a superficial impression management activity or a short-term investment distinct from an organization’s core business [14,15]. Strategic CSR, on the contrary, constitutes a long-term investment with limited short-term returns [16,17]. It necessitates long-term planning, substantial resource allocation, and significant adjustments to an organization’s structure [14]. Therefore, in the face of COVID-19, firms must evaluate the costs associated with adjusting responsive and strategic CSR, encompassing economic losses and intangible, difficult-to-directly-observe costs, such as social relationship, contractual, psychological, and reputational costs [16,18].

2.2. CSR Adjustments Based on Cost Stickiness

The cost stickiness theory posits that certain costs exhibit asymmetric behavior in response to changes in activity [18,19]. When a company’s business volume improves, sticky costs increase much more than they decrease when business volume declines [18,19]. From a cost stickiness perspective, the cost stickiness of strategic and responsive CSR differs significantly [16]. Strategic CSR focuses more on the convergence of corporate and social interests, integrating social responsibility into corporate strategy, resources, capabilities, processes, business models, and interactions with stakeholders [20]. In particular, strategic CSR, such as product and employee responsibility, requires long-term strategic planning, a significant investment of resources, and substantial organizational restructuring [14]. Consequently, the costs of strategic CSR tend to be stickier. If firms respond to the impact of COVID-19 by reducing strategic CSR, they face serious simultaneous losses, including diminished stakeholder confidence, economic setbacks, strained social relationships, contractual risks, and reputational damage [16,18]. In other words, making strategic adjustments to cope with the impact of COVID-19 by reducing strategic CSR investments does not yield favorable outcomes.

Responsive CSR aims to enhance relationships with certain stakeholders, fulfill immediate stakeholder requirements, and adhere to laws, industry regulations, and principles to establish legitimacy and secure resource support. It is characterized as a symbolic and ostentatious management activity, representing a short-term investment divergent from the organization’s core business [14,15]. Responsive CSR initiatives, such as community involvement (charitable donations) and environmental responsibility (investment in environmental protection), serve as fundamental strategies utilized to navigate the institutional environment, gain legitimacy, comply with governmental expectations, or address economic crises [21]. Moreover, based on agency theory’s over-investment hypothesis, CSR is considered an agency behavior reflecting management’s self-interest; CEOs tend to over-invest in CSR at the expense of shareholders, negatively impacting firm value and potentially becoming a substantial cost constraining firm development [8,9]. In comparison to strategic CSR, responsive CSR represents a short-term, reversible investment requiring fewer resources and lower adjustment costs and exhibiting a lower level of cost stickiness.

Based on this analysis, we propose the following hypothesis:

H1a.

Due to its high level of cost stickiness, tourism firms increase strategic CSR in the face of the COVID-19 shock.

H1b.

Due to its low level of cost stickiness, tourism firms decrease responsive CSR in the face of the COVID-19 shock.

2.3. The Moderating Role of Cost or Differentiation Leadership Strategies

Moderating role of cost leadership strategy: Companies implementing cost leadership strategies strive to minimize costs in order to offer the most competitively priced products and services. For instance, they optimize production processes for efficiency, scale up operations, adopt new technologies alongside production activities, and minimize expenses related to research and development, advertising, marketing, and services [22]. Implementing cost leadership strategies often leads to superior financial performance compared to other leadership strategies, leveraging comparative advantages from lower labor and production costs [23]. Lower prices are particularly appealing to consumers with limited disposable income [23]. Enterprises employing cost leadership strategies typically maintain lower adjustment costs and possess more adaptable cost structures [24,25]. CSR initiatives of firms following cost leadership strategies exhibit lower levels of cost stickiness, enabling them to swiftly adjust their CSR efforts in response to external shocks [26].

Moderating role of differentiation leadership strategy: Previous research suggests that CSR can serve as a tool for differentiation strategy. For example, Flammer’s (2015) study shows that, in the face of increasing import competition, US firms will choose to invest in social responsibility to differentiate themselves from competing foreign firms [27]. Companies implementing differentiation leadership strategies tend to prioritize cultivating positive relationships with core stakeholders, thereby accessing strategic resources, such as reputation or moral capital [28]. Additionally, the CSR costs of firms employing differentiation leadership strategies exhibit higher levels of cost stickiness; such firms prefer to sustain strategic CSR while reducing responsive CSR in the face of shocks [29,30].

Based on this analysis, we propose the following hypothesis:

H2a.

Tourism companies that implement cost leadership strategies decrease strategic or responsive CSR.

H2b.

Tourism companies that implement differentiated leadership strategies decrease responsive CSR and increase strategic CSR.

2.4. The Moderating Role of Political Connections on Responsive CSR

In a transition economy, governments play a crucial role in developing and implementing institutions, policies, and norms, serving as a vital source of resources and legitimacy. The relationship between businesses and governments is pivotal for business survival and growth [31]. Fehrler and Przepiorka argue that responsive social CSR signals firms’ pursuit of external legitimacy, suggesting that firms should strategically manage legitimacy costs when balancing legitimacy and profitability in response to external evaluations [32].

Political connections are generally understood as special informal relationships between businesses and governments, where ties are established between the business and governmental departments or individuals. These connections may involve top management (CEOs, chairpersons), may involve significant shareholders with government service experience, or may be made through public service and the cultivation of networks and government relationships [33,34]. However, it is important to note that political connections differ from political bribery, as they are legal [35]. Individuals with government experience possess unique insights into governmental operations, making them more likely to establish links with government officials, potentially leading to increased government support for businesses [33].

Political connections serve as a signal of legitimacy to stakeholders, including governments, fostering support and close ties with governmental entities and other stakeholders [35]. This diminishes the reversibility of responsive CSR, thereby increasing the level of cost stickiness associated with responsive CSR initiatives [36,37]. Therefore, when confronted with the shock of COVID-19, firms with more political connections may mitigate reductions in responsive CSR activities.

Based on this analysis, we propose the following hypothesis:

H3.

Higher political connections mitigate tourism firm reductions in responsive CSR.

2.5. The Moderating Role of Organizational Resilience on Strategic CSR

Existing studies have demonstrated that organizational resilience encompasses several processes through which organizations resist impacts, absorb adverse effects, and achieve rapid recovery [38,39]. When engaging in strategic CSR activities, tourism firms strengthen their interactions with strategic stakeholders to gain a competitive advantage and foster sustainable development [13].

Investment in strategic CSR fosters a stronger connection between tourism firms and strategic stakeholders, enabling them to acquire scarce resources closely aligned with their core business. This, in turn, supports their defense mechanisms in the face of crisis events and enhances their stability and absorptive capacity [38,40,41]. According to signal theory, firms can communicate positive information about their stable and favorable state to stakeholders through CSR investments, thereby enhancing stakeholders’ support and investment confidence and bolstering their ability to withstand changes in the external environment [38,42,43].

Based on this analysis, we propose the following hypothesis:

H4.

High organizational resilience enhances tourism firms’ increase in strategic CSR.

3. Data and Methodology

3.1. Sample Selection and Data Source

In this paper, listed companies in mainland China from 2017 to 2021 were selected to test the impact of COVID-19 epidemic shocks on the CSR of tourism companies. The sample size of this study was 13,747 after excluding samples with outliers and missing values. CSR data were obtained from the social responsibility data disclosed by Hexun.com (www.hexun.com. accessed on 31 December 2021). The financial data of control variables were from the China Stock Market Accounting Research (CSMAR) database. To reduce the influence of outliers, all continuous variables were winsorized at the 1% and 99% levels.

3.2. Measures

The independent variable in this study was the impact of the COVID-19 outbreak on tourism businesses (DID) [44]. The COVID-19 outbreak occurred in December 2019, so this paper assigned a value of 1 to the 41 listed tourism companies in mainland China in 2019 and after and 0 to the rest of the samples, noting this variable as DID. It should be noted that although the outbreaks recurred in various places after 2019, the recurrence of the subsequent episodes does not have the exact mechanism as that of the initial attacks. Initial seizures are more sudden and crisis-oriented than subsequent outbreaks, which is more in line with the assumptions of the double-difference model.

The dependent variables of this study were strategic CSR (SCSR) and responsive CSR (RCSR). Drawing on the methodology of previous researchers, strategic CSR is the sum of employee responsibility and product responsibility, and responsive CSR is the sum of environmental responsibility and community responsibility, which is derived from the social responsibility data of listed companies disclosed by Hexun.com [13,45].

The moderating variables: cost leadership VS differentiation leadership strategies. The measurement of cost leadership (Cost_leadership) and differentiation leadership (Diff_leadership) strategies in this paper drew on the research design of Gao et al. (2010) and Duanmu et al. (2018) [22,23], where cost leadership strategies are measured by the ratio of the difference between sales and production costs to sales, with larger values indicating that a firm’s cost leadership is more pronounced. The differentiation strategy is measured using the firm’s advertising costs ratio to total sales. The data in this section came from the CSMAR database.

The moderating variable: political connections. The political connection and ownership data in this paper came from the manual collation of the CSMAR database [46]. A firm’s degree of political connection was denoted as GOV_level. Suppose the chairman or general manager of the firm has or currently holds posts in the government, the Party Committee (Commission for Discipline Inspection), the standing organs of the National People’s Congress or CPPCC, the procuratorate, and the court. In that case, the political association GOV_level is assigned to four levels. To be specific, the political connection level of section-level cadres is set as 1, the political connection level of section-level cadres is set as 2, the political connection level of department-level cadres is set as 3, the political connection level of ministerial-level and national-level cadres is set as 4, and the political connection level of no political connection is set as 0. Suppose the chairman or general manager of the firm used to or currently served as a party representative, a representative of the National People’s Congress, or a member of the CPPCC. In that case, the political connection GOV_level is also assigned to four levels. Specifically, the GOV_level of the political connection at the county level and below is 1, the GOV_level of the political connection at the municipal level is 2, the GOV_level of the political connection at the provincial level is 3, the GOV_level of the political connection at the national level is 4, and the GOV_level of the political connection without the political connection is 0. Suppose there are data for both political connection GOV_level and political connection GOV_level definitions. In that case, the maximum value of the two is taken as the value of the political connection level of the firm.

The moderating variable: organizational resilience. In this paper, organizational resilience was considered a two-dimensional structural variable with high-performance growth (Revenue_Growth) and low financial volatility (Finance_Volatility), referring to the methodology proposed by Ortiz to measure these two dependent variables [47]. The indicator used in this paper to measure high-performance growth was the amount of cumulative sales revenue growth over three years, as incremental growth was more indicative of the long term than year-to-year growth, and consistent with the research of many scholars, three years was chosen as the period to measure the long-term growth of a firm. In this paper, financial volatility was measured by the volatility of stock returns, measured as the standard deviation of stock returns for each month of the year. In particular, the lower the value of Finance_Volatility, the lower the financial volatility and the more resilient the organization.

In order to control the influence of other factors, this paper started from the firm level and drew on previous studies to select firm size (Size), firm growth capacity (Growth), leverage level (Leverage), and cash flow (Cashflow) as the control variables [48,49].

3.3. Hypotheses and Proofs

This study proposed the following six hypotheses: (1) H1a. Due to its high level of cost stickiness, tourism firms increase strategic CSR in the face of the COVID-19 shock. (2) H1b. Due to its low level of cost stickiness, tourism firms decrease responsive CSR in the face of the COVID-19 shock. (3) H2a. Tourism companies that implement cost leadership strategies decrease strategic or responsive CSR. (4) H2b. Tourism companies that implement differentiated leadership strategies decrease responsive CSR and increase strategic CSR. (5) H3. Higher political connections mitigate tourism firm reductions in responsive CSR. (6) H4. High organizational resilience enhances tourism firms’ increase in strategic CSR.

Referring to previous studies [44], this study used a double difference model for regression analysis, as shown in Equations (1) and (2). If is significantly positive in Equation (1), then H1a is confirmed. If is significantly negative in Equation (2), then H1b is confirmed.

In the moderated effects test in further research, H2a is confirmed if the coefficient of Cost_leadership × DID is significantly negative in models with either SCSR or RCSR as the dependent variable. H2b is confirmed if the coefficient of Diff_leadership × DID is significantly negative in the model with SCSR as the dependent variable, and at the same time, the coefficient of Diff_leadership × DID is significantly positive in the modesl with RCSR as the dependent variable. If the coefficient of GOV_Level × DID is significantly positive, then H3 is confirmed. If the coefficient of Revenue_Growth × DID is significantly positive and the coefficient of Finance_Volatility × DID is significantly negative, then H4 is confirmed.

4. Results

4.1. Descriptive Statistics and Correlation Analysis

Table 1 showed descriptive statistics of variables.

Table 1.

Descriptive statistics.

In order to test whether there is a strong correlation between the variables, we report and observe the matrix of correlation coefficients between two-by-two variables. It is easy to find that, in Table 2, the absolute value of correlation coefficients between the variables is less than 0.7, so a strong correlation between the variables is excluded, indicating that there is no serious correlation between the variables [50].

Table 2.

Correlation coefficient matrix.

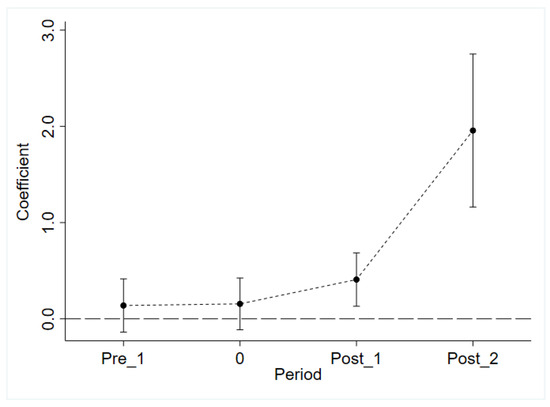

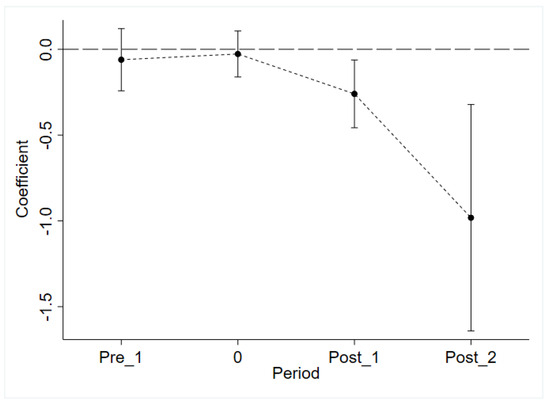

4.2. Parallel Trend Tests

Before carrying out the regression of the difference-in-difference (DID) model, this study needs to verify the parallel trend of the double difference model, as shown in Table 3. In the test results given in Table 3, strategic CSR is the dependent variable, and the regression coefficients for period one before the epidemic shock ~ period zero are not significant, indicating that there is a parallel trend in the strategic CSR investment between the control group and the treatment group [51]. With the responsive CSR as the dependent variable, the regression coefficients for period one before the epidemic shock ~ period zero are not significant, indicating that there is a parallel trend in the responsive CSR between the control group and the treatment group [51]. More intuitive results of this study are shown in Figure 1 and Figure 2.

Table 3.

Parallel trend tests.

Figure 1.

Parallel trend of strategic CSR.

Figure 2.

Parallel trend of responsive CSR.

4.3. Impact of the COVID-19 Epidemic on CSR in the Tourism Industry

The effects of the COVID-19 epidemic shock on strategic and responsive CSR are given in Table 4, where this study controls for firm-fixed effects, time-fixed effects, and control variables affecting CSR investment in the test. Model (1) and model (2) both use panel regression. In model (1), with strategic CSR as the dependent variable, the regression coefficient of DID is significantly positive, which indicates that the COVID-19 epidemic shock makes tourism enterprises increase investment in strategic CSR; H1a is proven. In model (2), with responsive CSR as the dependent variable, the regression coefficient of DID is significantly negative, which indicates that, under the COVID-19 epidemic shock, tourism enterprises reduce the investment in responsive CSR, and H1b is proven.

Table 4.

Effect of COVID-19 on socially responsible investment in tourism firms.

4.4. Robustness Tests

4.4.1. Tests of DID with a One-Period Lag

In this study, to verify the longer-term impact of the COVID-19 epidemic shock on tourism firms’ investment in CSR, a robustness test was conducted using strategic and responsive CSR measures of socially responsible investment with a lag of one year, and the results of the test are shown in Table 5 [52]. The results in column (1) show that, although one period of strategic CSR investment lags, the COVID-19 shock still positively contributes to it. Similarly, the column (2) results show that, although responsive CSR has faded by one period, it is still negatively weakened by the COVID-19 shock. In the above regressions, the positive and negative coefficients of DID are consistent with the benchmark regression, and H1a and H1b are confirmed, which proves that the results we obtain are robust.

Table 5.

Robustness tests using one year lag DID.

4.4.2. Tests for Changing the Timing of COVID-19

To further test the robustness of the results, this study conducts a counterfactual test by varying the timing of the dummy epidemic shocks, which excludes the effects of policy or stochastic factors other than the epidemic [53]. By advancing the timing of the epidemic shock by one year, if the regression coefficients of the variables representing the effect of the epidemic shock are not significant at this point, the additional impact of other policy factors can be excluded. As shown in Table 6, the results of the counterfactual test indicate that, if the epidemic shock is assumed to have occurred one year earlier, neither strategic nor responsive CSR is significantly affected, which suggests that other factors do not cause the adjustments in strategic and responsive CSR but instead come from the COVID-19 epidemic shock.

Table 6.

Counterfactual tests for changing the timing of COVID-19.

5. Further Research

5.1. Moderating Effects of Corporate Strategies on CSR

As shown in Table 7, firms implementing cost leadership strategies decrease both strategic and responsive CSR; H2a is confirmed. Firms implementing differentiation strategies increase strategic CSR and decrease responsive CSR; H2b is confirmed.

Table 7.

The moderating roles of corporate strategies.

5.2. Moderating Effects of Political Connections on Responsive CSR

As shown in Table 8, tourism with a higher degree of political affiliation mitigated the reduction in responsive CSR; H3 is confirmed.

Table 8.

The moderating roles of political connection on responsive CSR.

5.3. Moderating Effect of Organizational Resilience on Strategic CSR

As shown in Table 9, both high levels of performance growth and low levels of financial volatility reinforce the increase in strategic CSR of tourism firms; H4 is confirmed.

Table 9.

The moderating roles of organizational resilience on strategic CSR.

6. Conclusions and Discussion

6.1. Main Conclusions

The main findings of this study are outlined as follows. First, leveraging the quasi-experiment of COVID-19, we contrast the responses of the tourism industry with those of other sectors. Our analysis reveals that the shock of COVID-19 leads tourism firms to markedly increase strategic CSR while significantly decreasing responsive CSR. Second, we observe that tourism firms adopting cost leadership strategies reduce both strategic and responsive CSR, albeit with a greater reduction in responsive CSR. Conversely, tourism firms implementing differentiation leadership strategies witness an increase in strategic CSR coupled with a decrease in responsive CSR. Furthermore, we find that tourism firms with higher levels of political connection tend to mitigate reductions in responsive CSR. Lastly, our study highlights that tourism firms exhibiting higher organizational resilience reinforce an increase in strategic CSR.

6.2. Theoretical Contributions

First, this study introduces the cost stickiness theory as a framework for understanding how tourism firms adjust their strategic and responsive CSR investments, thereby enriching the application scenarios of cost stickiness theory. Conforming to the system and maintaining strategy are two critical theoretical perspectives in the literature on corporate strategy and firm behavior. However, the existing literature has explored fewer motivations for why firms adapt their strategies, particularly CSR strategies. This study draws upon the social responsibility decision-making framework developed by Porter and Kramer (2006), which categorizes CSR into responsive and strategic CSR [13]. Previous studies have indicated that the cost stickiness theory suggests certain costs are sticky, and these costs increase more asymmetrically when a firm’s business volume rises than they decrease when business volume falls [18,19]. The findings of this study validate the differentiation hypothesis of cost stickiness concerning different dimensions of social responsibility. This study demonstrates that when confronted with COVID-19 shocks, tourism firms maintain or even increase strategic CSR investments due to high-cost stickiness. Conversely, due to low-cost stickiness, tourism firms tend to reduce responsive CSR investments. The findings of this study contribute to a clearer understanding of the controversy surrounding the motivation of Chinese tourism firms to fulfill their social responsibility from the perspective of cost stickiness.

Second, this study integrates corporate strategy into a model of the impact of COVID-19 on the CSR of tourism firms, thereby further elucidating the boundary mechanisms of the effects of COVID-19 on the CSR of tourism firms. Similar to previous studies on corporate strategy [23,27], this study analyzes the moderating mechanisms of cost leadership and differentiation leadership strategies on the relationship between COVID-19 and tourism CSR. Previous studies have demonstrated that firms implementing a differentiation leadership strategy exhibit higher competitiveness because they concentrate on developing their core competencies and investing in long-term strategic resources [29,30]. Conversely, firms implementing cost leadership strategies tend to be short-sighted and primarily focus on cost reduction for profit maximization. This tendency makes them hesitant to invest in long-term resources and prompts them to resort to austerity policies to preserve profits at the first sign of a shock [24,25]. Consistent with prior research, this study reveals that firms implementing differentiated leadership strategies tend to promote strategic CSR, while firms employing cost leadership strategies tend to reduce either strategic or responsive CSR. Our findings provide further insights into the moderating mechanisms by which tourism firms adjust their social responsibility in the context of the COVID-19.

Third, by incorporating political connections into the model of the relationship between COVID-19 and tourism CSR, we further unveil the moderating mechanism of this relationship. Previous studies have defined political connections as the closeness of a firm’s relationship with the government [37]. While previous research on political connections has primarily focused on areas such as firm performance and behavior [36,37], there has been limited exploration of political connections in relation to CSR, especially responsive CSR. Given that political connections somewhat alter the stickiness of CSR costs, it becomes imperative to investigate their moderating role. Similar to previous studies on political connection [36,37], this paper finds that political connections make it challenging to reduce responsive CSR, thereby increasing the cost stickiness of responsive CSR. Consequently, we observe that a high level of political connection enhances the responsive CSR of tourism firms. Hence, this study further enriches and broadens the explanatory scope of cost stickiness theory from the perspective of political connections.

Finally, organizational resilience is integrated into the model of the relationship between COVID-19 and tourism CSR, thereby shedding further light on the regulatory mechanism of this relationship. Previous research has defined organizational resilience as the nature and resources of an organization, which is typically examined as an outcome variable [47]. Diverging from prior studies on organizational resilience [47], this study employs a firm’s level of organizational resilience as a differentiating factor to analyze the moderating mechanism of organizational resilience on the relationship between COVID-19 and tourism CSR. This study reveals that because organizational resilience is intricately linked to the core business of tourism enterprises, establishing organizational resilience necessitates long-term investment. Tourism firms with higher levels of organizational resilience exhibit greater cost stickiness, leading to an increase in strategic CSR. Therefore, this study further enriches and broadens the explanatory scope of cost stickiness theory from the perspective of organizational resilience.

7. Limitations and Future Studies

There are several limitations in the process and theory of this study, which include the following: First, regarding the measurement of CSR, this paper relies solely on one data source: the Hexun database. While this database is known for its high quality and widespread use among researchers, it may overlook the innovative aspects of CSR measurement. Second, due to constraints related to research experience and the time frame of the COVID-19 epidemic, the sample period covered in this study may not be extensive enough, and the data collected may be relatively limited. Third, this study focuses on A-share listed companies in the tourism sector for an empirical analysis. While using data from listed companies ensures completeness, the sample selection may still be somewhat biased. Currently, due to the unique nature of tourism enterprises, research on CSR in the tourism sector is still in its exploratory stages. There remains a significant amount of work to be explored and investigated deeply in the future, presenting ample research opportunities.

Future research could expand upon this study in the following ways: First, in addition to relying on secondary data for an empirical analysis, future research could establish independent measurements for CSR and utilize methods such as data mining or surveys. This approach would continuously update the measurement methods of research variables, enhancing the objectivity and scientific rigor of the research. Second, future research could incorporate case studies to gather firsthand information through interviews. Analyzing case companies would allow for a deeper examination of the evolution of CSR investment in tourism enterprises. Third, by expanding the research scope to include samples such as small- and medium-sized tourism enterprises and private tourism enterprises, theoretical extensions could be synthesized from a broader research perspective. Such conclusions would be more universally applicable and hold greater practical value.

Author Contributions

H.W.: conceptualization, methodology, literature analysis, theoretical analysis, data organization and analysis, writing. T.Z.: conceptualization, thematic guidance, literature analysis, theoretical analysis, financial support. X.W.: validation, data investigation, writing—review and editing. J.Z.: conceptualization, literature analysis, data analysis, theoretical analysis, editing and writing. Y.Z.: conceptualization, literature analysis, theoretical analysis, editing. R.C.: literature analysis, theoretical analysis, editing. X.L.: literature analysis, editing. Q.J.: literature analysis, theoretical analysis. Z.Z.: conceptualization, theoretical analysis. X.J.: conceptualization, editing. All authors have read and agreed to the published version of the manuscript.

Funding

This study is supported by the Research Project of Macao Polytechnic University (RP/ESCHS-04/2020).

Data Availability Statement

The data that support the findings of this study are available from Hexun Evaluation of Corporate Social Responsibility Reports of A-share Listed Companies, China Stock Market & Accounting Research database (CSMAR), but restrictions apply to the availability of data, which were used under license for the current study and so are not publicly available. Data are, however, available from the authors upon reasonable request and with permission of Beijing Hexun Online Information Consulting Service Company Limited (Hexun Evaluation of Corporate Social Responsibility Reports of A-share Listed Companies), Shenzhen CSMAR Data Technology Company Limited (CSMAR).

Acknowledgments

The authors are grateful to all research staff that contributed to the data collection required for this study.

Conflicts of Interest

We have no conflicts of interest to disclose. We confirm that this work is original and has not been published elsewhere, nor is it currently under consideration for publication elsewhere. We have no conflicts of interest to disclose. We confirm that all authors have approved the manuscript for submission.

References

- Tsao, C.-Y.; Ni, C.-C. Vulnerability, resilience, and the adaptive cycle in a crisis-prone tourism community. Tour. Geogr. 2016, 18, 80–105. [Google Scholar] [CrossRef]

- Beh, L.-S.; Lin, W.L. Impact of COVID-19 on ASEAN tourism industry. J. Asian Public Policy 2022, 15, 300–320. [Google Scholar] [CrossRef]

- Holder-Webb, L.; Cohen, J.R.; Nath, L.; Wood, D. The supply of corporate social responsibility disclosures among U.S. firms. J. Bus. Ethics 2009, 84, 497–527. [Google Scholar] [CrossRef]

- Tao, W.; Song, B. The interplay between post-crisis response strategy and pre-crisis corporate associations in the context of CSR crises. Public Relat. Rev. 2020, 46, 101883. [Google Scholar] [CrossRef]

- Li, T.; Liu, J.; Zhu, H.; Zhang, S. Business characteristics and efficiency of rural tourism enterprises: An empirical study from China. Asia Pac. J. Tour. Res. 2018, 23, 549–559. [Google Scholar] [CrossRef]

- Henderson, J.C. Corporate social responsibility and tourism: Hotel companies in Phuket, Thailand, after the Indian Ocean tsunami. Int. J. Hosp. Manag. 2007, 26, 228–239. [Google Scholar] [CrossRef]

- Sang, Y.; Han, E. A win-win way for corporate and stakeholders to achieve sustainable development: Corporate social responsibility value co-creation scale development and validation. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1177–1190. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate Social Responsibility as a Conflict Between Shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Friedman, M. The Social Responsibility of Business Is to Increase Its Profits. New York Time Magazine, 19 November 2017. pp. 355–359.

- Inoue, Y.; Lee, S. Effects of different dimensions of corporate social responsibility on corporate financial performance in tourism-related industries. Tour. Manag. 2011, 32, 790–804. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy and society: The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92+163. [Google Scholar]

- Bansal, P.; Jiang, G.F.; Jung, J.C. Managing Responsibly in Tough Economic Times: Strategic and Tactical CSR During the 2008–2009 Global Recession. Long Range Plan. 2015, 48, 69–79. [Google Scholar] [CrossRef]

- Muller, A.; Kräussl, R. Doing good deeds in times of need: A strategic perspective on corporate disaster donations. Strateg. Manag. J. 2011, 32, 911–929. [Google Scholar] [CrossRef]

- Habib, A.; Hasan, M.M. Auditor-provided tax services and stock price crash risk. Account. Bus. Res. 2016, 46, 51–82. [Google Scholar] [CrossRef]

- Kang, J. Labor market evaluation versus legacy conservation: What factors determine retiring CEOs’ decisions about long-term investment? Strateg. Manag. J. 2016, 37, 389–405. [Google Scholar] [CrossRef]

- Venieris, G.; Naoum, V.C.; Vlismas, O. Organisation capital and sticky behaviour of selling, general and administrative expenses. Manag. Account. Res. 2015, 26, 54–82. [Google Scholar] [CrossRef]

- Anderson, M.C.; Banker, R.D.; Janakiraman, S.N. Are Selling, General, and Administrative Costs “Sticky”? J. Account. Res. 2003, 41, 47–63. [Google Scholar] [CrossRef]

- Owen, J.R.; Kemp, D. A return to responsibility: A critique of the single actor strategic model of CSR. J. Environ. Manag. 2023, 341, 118024. [Google Scholar] [CrossRef]

- Cunha, F.A.F.d.S.; Meira, E.; Orsato, R.J. Sustainable finance and investment: Review and research agenda. Bus. Strategy Environ. 2021, 30, 3821–3838. [Google Scholar] [CrossRef]

- Gao, Q.-X.; Feng, Q.-Q. Research on the organizational model and human resource management based on advanced manufacturing technology. In Proceedings of the 2010 IEEE 17Th International Conference on Industrial Engineering and Engineering Management, Xiamen, China, 29–31 October 2010; pp. 577–581. [Google Scholar]

- Duanmu, J.; Bu, M.; Pittman, R. Does market competition dampen environmental performance? Evidence from China. Strateg. Manag. J. 2018, 39, 3006–3030. [Google Scholar] [CrossRef]

- Datta, Y. A critique of Porter’s cost leadership and differentiation strategies. Chin. Bus. Rev. 2010, 9, 37. [Google Scholar]

- Haque, M.G.; Munawaroh, M.; Sunarsi, D.; Baharuddin, A. Competitive Advantage in Cost Leadership and Differentiation of SMEs “Bakoel Zee” Marketing Strategy in BSD. PINISI Discret. Rev. 2021, 4, 277–284. [Google Scholar] [CrossRef]

- Li, J.; Luo, Z. Product market competition and cost stickiness: Evidence from China. Manag. Decis. Econ. 2021, 42, 1808–1821. [Google Scholar] [CrossRef]

- Flammer, C. Corporate Social Responsibility and the Allocation of Procurement Contracts: Evidence from a Natural Experiment. 2015. Available online: https://extranet.sioe.org/uploads/isnie2015/flammer.pdf (accessed on 31 December 2023).

- Restuti, M.D.; Gani, L.; Shauki, E.R.; Leo, L. Cost stickiness behavior and environmental uncertainty in different strategies: Evidence from Southeast Asia. Bus. Strategy Dev. 2023, 6, 972–985. [Google Scholar] [CrossRef]

- Kost, D.; Fieseler, C.; Wong, S.I. Boundaryless careers in the gig economy: An oxymoron? Hum. Resour. Manag. J. 2020, 30, 100–113. [Google Scholar] [CrossRef]

- Salas-Vallina, A.; Alegre, J.; López-Cabrales, Á. The challenge of increasing employees’ well-being and performance: How human resource management practices and engaging leadership work together toward reaching this goal. Hum. Resour. Manag. 2021, 60, 333–347. [Google Scholar] [CrossRef]

- Zhang, J.; Luo, X.R. Dared to care: Organizational vulnerability, institutional logics, and MNCs’ social responsiveness in emerging markets. Organ. Sci. 2013, 24, 1742–1764. [Google Scholar] [CrossRef]

- Fehrler, S.; Przepiorka, W. Charitable giving as a signal of trustworthiness: Disentangling the signaling benefits of altruistic acts. Evol. Hum. Behav. 2013, 34, 139–145. [Google Scholar] [CrossRef]

- Hillman, A.J. Politicians on the board of directors: Do connections affect the bottom line? J. Manag. 2005, 31, 464–481. [Google Scholar] [CrossRef]

- Hillman, A.J.; Hitt, M.A. Corporate political strategy formulation: A model of approach, participation, and strategy decisions. Acad. Manag. Rev. 1999, 24, 825–842. [Google Scholar] [CrossRef]

- Bergh, D.D.; Connelly, B.L.; Ketchen, D.J., Jr.; Shannon, L.M. Signalling theory and equilibrium in strategic man-agement research: An assessment and a research agenda. J. Manag. Stud. 2014, 51, 1334–1360. [Google Scholar] [CrossRef]

- Balakrishnan, R.; Gruca, T.S. Cost stickiness and core competency: A note. Contemp. Account. Res. 2008, 25, 993–1006. [Google Scholar] [CrossRef]

- Habib, A.; Hasan, M.M. Corporate Social Responsibility and Cost Stickiness. Bus. Soc. 2016, 58, 453–492. [Google Scholar] [CrossRef]

- DesJardine, M.; Bansal, P.; Yang, Y. Bouncing back: Building resilience through social and environmental practices in the context of the 2008 global financial crisis. J. Manag. 2019, 45, 1434–1460. [Google Scholar] [CrossRef]

- Jiang, Y.; Ritchie, B.W.; Verreynne, M. Building tourism organizational resilience to crises and disasters: A dynamic capabilities view. Int. J. Tour. Res. 2019, 21, 882–900. [Google Scholar] [CrossRef]

- Sajko, M.; Boone, C.; Buyl, T. CEO greed, corporate social responsibility, and organizational resilience to systemic shocks. J. Manag. 2021, 47, 957–992. [Google Scholar] [CrossRef]

- Wieczorek-Kosmala, M. A study of the tourism industry’s cash-driven resilience capabilities for responding to the COVID-19 shock. Tour. Manag. 2022, 88, 104396. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Fried, J.M. Executive compensation as an agency problem. J. Econ. Perspect. 2003, 17, 71–92. [Google Scholar] [CrossRef]

- Fama, E.F. Agency problems and the theory of the firm. J. Political Econ. 1980, 88, 288–307. [Google Scholar] [CrossRef]

- Kosfeld, R.; Mitze, T.; Rode, J.; Wälde, K. The COVID-19 containment effects of public health measures: A spatial difference-in-differences approach. J. Reg. Sci. 2021, 61, 799–825. [Google Scholar] [CrossRef]

- Flammer, C.; Ioannou, I. Strategic management during the financial crisis: How firms adjust their strategic investments in response to credit market disruptions. Strateg. Manag. J. 2021, 42, 1275–1298. [Google Scholar] [CrossRef]

- Fan, J.P.; Wong, T.J.; Zhang, T. Politically connected CEOs, corporate governance, and Post-IPO performance of China’s newly partially privatized firms. J. Financ. Econ. 2007, 84, 330–357. [Google Scholar] [CrossRef]

- Ortiz-De-Mandojana, N.; Bansal, P. The long-term benefits of organizational resilience through sustainable business practices. Strateg. Manag. J. 2016, 37, 1615–1631. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, H.; Zhou, X. Dare to be different? Conformity versus differentiation in corporate social activities of Chinese firms and market responses. Acad. Manag. J. 2020, 63, 717–742. [Google Scholar] [CrossRef]

- Zhao, E.Y.; Fisher, G.; Lounsbury, M.; Miller, D. Optimal distinctiveness: Broadening the interface between institutional theory and strategic management. Strateg. Manag. J. 2017, 38, 93–113. [Google Scholar] [CrossRef]

- Ali, N.; Jusof, K.; Ali, S.; Mokhtar, N.; Salamat, A.S.A. The Factors Influencing Students’ Performance at Universiti Teknologi Mara Kedah, Malaysia. Manag. Sci. Eng. 2009, 3, 81–90. [Google Scholar]

- Marcus, M.; Sant’Anna, P.H. The role of parallel trends in event study settings: An application to environmental economics. J. Assoc. Environ. Resour. Econ. 2021, 8, 235–275. [Google Scholar] [CrossRef]

- Guo, Q.; Zhong, J. The effect of urban innovation performance of smart city construction policies: Evaluate by using a multiple period difference-in-differences model. Technol. Forecast. Soc. Chang. 2022, 184, 122003. [Google Scholar] [CrossRef]

- Hong, Y.; Ma, F.; Wang, L.; Liang, C. How does the COVID-19 outbreak affect the causality between gold and the stock market? New evidence from the extreme Granger causality test. Resour. Policy 2022, 78, 102859. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).