Abstract

Industrial Organization, the Resource-Based View, and the Relational View are some classical, well-established, and widely accepted theories in the strategic management domain regarding the understanding, explanation, and prediction of competitive advantage of firms and above-average firm performance. Recent evidence of economic geography and regional economics added to this stream of research new perspectives like cluster theory and microeconomic competitiveness. Despite the high enthusiasm with which companies and policymakers embraced the new advancements, there is some contradictory evidence regarding the positive effect of local conditions on firm performance. Thus, in this paper, we aim to empirically test some aspects of a modern regional development theory, proposed mainly by Michael Porter and collaborators, and the impact of these aspects on firm performance. External determinants considered at three levels of analysis (local economy, local clusters, and industry) will be investigated in relation to firm performance. We will analyze empirical data through detailed correlational analyses and by building multilinear regression models. After the statistical analysis of the answers provided directly by 67 medium and large manufacturing companies operating in Romania, we will provide empirical support for some external determinants, while for other determinants, we will show that the data rejected the proposed associations. The main conclusion derived from this study is that different combinations of external determinants, considered at all three levels of analysis, have a positive and significant effect on different measures of firm performance. The findings in our paper are important for both regional economics and the strategic management literature, suggesting the importance of creating local or urban conditions depending on the type of performance that the firms in the local economy are underperforming.

1. Introduction

Sociology, public administration, organizational studies, economics, and business administration are academic fields in which the relationship among various aspects internal or external to organizations, nationally or internationally considered, and the implications for firm performance have been investigated. In relation to the existing theories, there is a shared understanding in the existing management, international business, marketing, or strategic management literature that both internal and external determinants drive firm performance [1,2,3,4]. In the management field, for instance, management scholars addressed the external or internal determinants in relation to firm performance using classical theories such as Industrial Organization [5,6], the Resource-Based View [7,8], or the more recent Relational View of inter-organizational relations [9]. Other perspectives from regional and urban economics contributed to the discussion regarding the implications of external determinants for firm performance. For instance, a topic that recently received increased attention is the study of regional clusters, the participation of companies in regional clusters, and the implications of agglomeration of economic-related activity for firm performance [10,11,12,13,14].

Over time, scholars from different academic fields, adhering to different research methodological traditions, investigated various aspects of firm or organizational performance at the firm level, the dyad level, the business unit level, the industry level, and more [3]. Considering this variety of scholars from a wide range of academic fields, currently, in academia, there is not a consensus among scholars about what might be called ‘firm performance’ and how researchers measure firm performance [1,15]. Thus, as recent studies suggest, scholars obtain different results depending on what they consider firm performance. This variation in measuring firm performance could largely explain why scholars reported different results while investigating the same phenomena [16].

It might seem that in the existing literature, the influence of external determinants on firm performance has already been investigated in previous studies. Thus, one question that might arise is: why conduct another study? As far as we know, there are some gaps in the existing literature that we will address in this study. First, classical and neo-classical, as well as modern regional and local economic development theories, focus mainly on top-down regional economic development and local business environment regulation [17,18]. The existing studies are usually concerned with investigating aspects like the localization of industries and firms, the explanation and prediction of regional differences in terms of income, employment, or quality of life, or addressing the assurance of regional equilibrium. Many local economy studies also include a variable to measure local performance. For instance, the gross domestic product growth per capita [19].

In this paper, we adopt a modern regional and urban development theory for theoretical discussion and empirical analysis, which suggests that a location or city is competitive only in the case that the companies operating in the location can compete successfully in the national or international markets [20,21]. Thus, we will place the firms as the main focus of our further discussion. Moreover, we will center our attention not on all firms but on the companies and firms operating in the traded/exporting economy. Then, we will discuss the external determinants for superior performance in relation to this theoretical position. Ref. [22] proposed a model for understanding the local economies and local business environment conceptualized as “the diamond model”. As we will discuss later, the dimensions of the diamond model are different depending on whether researchers consider the local or exporting economy. In short, in our research, we will analyze the specific external determinants of firm performance within the four dimensions of the “refined” diamond model.

Second, there is a shared understanding among business, management, international business, and marketing academia that both external factors as well as internal factors contribute to a firm’s superior performance and its competitive advantage [1,3]. To our knowledge, what is missing from the existing literature is empirical evidence and observations regarding how much external determinants contribute to firm success compared to internal factors. However, one exception exists. Ref. [2] found that organizational factors contributed twice as much as economic factors to firm performance. Thus, relying on the theoretical position presented above, first, we will analyze the specific external determinants and their effect on specific measures of firm performance. Then, we will analyze to what extent the external determinants (considered at the local economy, local cluster, and industry levels) explain the variation among companies in the same industry depending on firm performance.

Third, to our knowledge, most studies in the existing literature investigated various external determinants and their influence on firm performance by relying on secondary data analysis or through the analysis of statistical reports. For instance, ref. [23] investigated 471 listed EU companies. Ref. [24] considered a database containing data reported by 314 Taiwanese manufacturing firms. The same observation is true regarding the presence and development of regional, local, or city clusters and the implications for firm performance. Almost all studies rely on secondary data or archived data analysis. See, for example, refs. [12,14,25,26,27,28,29], to name just a few studies. Given the fact that in the existing literature, the evidence provided from inside the firm is quite scarce [3], we will investigate the external factors in relation to firm performance, importantly, considering evidence reported directly by business managers in economic practice.

Fourth, the existing studies in regional or urban economics investigated various aspects or dimensions of the local economy and associated them with various performances at the regional and local levels [21,30,31]. Instead, we will focus our attention on the relationship between local economy determinants and firm performance rather than regional or urban performance. In short, we will investigate whether companies derive real benefits from the existence of appropriate local conditions in their regional or local economy.

Considering the gaps discussed above, in this paper, we will analyze the external determinants in relation to firm performance in the context of a modern local economic development theory that is built on the following four main assumptions: (1) the regulation of the local business environment according to the company needs to be competitive in the national or international markets; (2) the development of local or urban policies through a highly collaborative process between public and private sector; (3) support for the industries and firms operating in the traded/exporting economy; and (4) the related diversification of local economies and smart specialization on industries in the traded/exporting economy [19,21,32].

Therefore, we aim to provide answers to the following questions: Do the companies derive real economic benefits by operating in more favorable local business environments? What external factors in the local economy, local clusters, and industry levels have a positive and significant effect on firm performance? What specific measures of firm performance are influenced by external conditions in the local economy? Why do some companies obtain superior performances in comparison with other companies in the same industry? To what extent is the superior performance reported by companies explained by the external determinants in the local economy, local clusters, or industry levels? We will provide an answer to these questions using a statistical analysis of empirical data provided from inside firms directly by business managers of 67 medium and large companies operating in Romania. We will analyze the empirical data using detailed correlational analyses and by building various multilinear regression models.

The findings in our paper may be valuable both for regional economics and for strategic management theory and practice. For regional economics, our results may enrich the existing literature by providing empirical evidence regarding the specific dimensions of local economies that positively impact firm performance. The strategy literature may also benefit from the contributions of our paper. Our research provides empirical evidence regarding how much the external factors contribute to firm performance in the local economy and local clusters, as well as the industry in which the firm operates. Our paper also highlights the importance of firm participation in building local or urban competitiveness. On the other hand, in this paper, public administration practitioners may find the specific dimensions—scientifically grounded—of their local or urban economy that they need to improve in order for companies in their location or city to compete successfully in the national or international markets.

The remainder of this paper is structured as follows. We start with a short review of the existing literature in relation to external determinants and firm performance. Then, we present the Research Methodology Section. The empirical data are analyzed next, followed by an interpretation of the results. From these results, we develop some practical implications for local and urban economies, as well as for companies. This paper ends with the main conclusions.

2. Literature Review

2.1. External Determinants and Firm Performance

There are numerous factors in the external environment of companies that might influence firm performance. The shared understanding in the management, marketing, international business, and strategic management literature is that in addition to the internal factors (e.g., an improvement in labor productivity might result in superior performance) the external factors also contribute to increasing firm performance and its competitiveness on the market [2,4]. Over time, various aspects have been studied in relation to firm performance. For example, ref. [24] investigated the impact of corporate and family investors on the innovative performance of firms. The authors reported a positive relationship between the presence of corporate investors and innovative performance. Ref. [1] found a negative relationship between the existence of informal competition sectors in the local economy and firm performance. Moreover, the strategic partnerships developed by firms in their supply chain were positively associated with firm performance [33]. In addition, the involvement of the firm in the local economy through CSR initiatives [34] and the implementation of eco-innovation practices [35] were also associated with superior firm performance. Recently, ref. [23] found that the inclusion of political actors in the boardroom of companies was negatively associated with firm performance. However, there are also some contextual conditions (e.g., highly regulated industries) under which companies with political directors reported superior performances.

The relationship between external factors and firm performance might have been studied in other academic disciplines. We will focus our attention on the following two main academic disciplines that have direct connections with the activities of firms: regional economics and strategic management. In both academic disciplines, external determinants have been considered, and the implications for firm performance, to some extent, have been discussed. In the next sections, we will briefly review the existent theories in these fields in relation to firm performance.

2.2. Regional and Urban Economics Perspective

Regional economics is a discipline that belongs to regional science. In a broader sense, since the formal establishment of regional science in 1954 by the American economist Walter Isard [36], regional scholars have been concerned with the following two main problems: (1) the localization of industries and firms and (2) understanding, explaining, and predicting regional differences in terms of income, employment, or quality of life [37,38,39,40,41]. Although there are differences between regional and urban economics, mainly depending on the unit of analysis, for the purpose of this paper, we will use regional, local, and urban economics as interchangeable concepts.

From an evolutionary perspective, the existent theories in the regional economics literature can be broadly classified into the following three categories [42]: (1) classical regional development theories, e.g., ref. [43] or ref. [44] on classical location theory; (2) neoclassical regional development theories, e.g., the demand-driving theory or the Keynesian model of economic growth of ref. [45]; and (3) modern or recent regional development theories, e.g., the New Economic Geography of ref. [39].

In general terms, regional and urban economics and their constituent subdisciplines (e.g., urban development and planning, regional development, local and urban competitiveness) aim to provide an answer to the specific question: Why do some regions develop better and faster and obtain a better quality of life for their citizens in comparison with other regions [46]? Most regional or urban development theories also include a variable to measure performance, such as an output for their proposed causality, for example, the gross domestic product growth per capita [30,47], the regions’ resistance to shocks [48], or the regional productivity growth [13].

Considering the classic emphasis of regional economic development theories on industrial location or factors of production migration, recently, regional economists started to approach modern subjects like regional resilience [48,49,50], regional development and competitiveness [46,51], urban safety and security [52], or the dynamics between the innovation happening within firms and the regional innovation system [47]. However, even now, the location strategies of companies and industries continue to drive the attention of scholars, as evidenced by the recent works of [53,54].

As far as we know, most theories in the regional and urban economics literature discuss and analyze various aspects of regional or local economies and associate these aspects only with regional or local performances. There are a few exceptions. For instance, recently, ref. [55] associated various regional factors like existing regional knowledge stock, agglomeration economies, urbanization economies, and regional openness with innovative capacity building in start-ups, respectively, incumbent firms. The authors reported a positive relationship between regional factors and innovation capacity development. On the other hand, ref. [56] investigated the relationship between external innovation spillovers and firm performance and found no significant effect between these variables.

Recent studies suggest that location also matters for firm and firm performance [20,57]. A group of scholars even argue that competitive advantage and firm performance are determined outside the company, even outside its industry. It depends on the existing conditions in the local economy and the appropriateness of the local business context for improving firm productivity and innovation [58]. Accordingly, in the next sections, we will analyze the external determinants of the local economies and the implications for firm performance. For example, do the companies that encounter more favorable conditions for innovation in their local business environment also report superior innovative performances? Therefore, we propose the following hypotheses for statistical testing:

H1a:

Firms operating in more favorable local business environments for productivity will obtain superior productivity-related performances.

H1b:

Firms operating in more favorable local business environments for innovation will obtain superior innovation-related performances.

2.3. Strategic Management and Firm Performance

From another perspective, strategy scholars are also concerned with external factors mainly for competitive reasons. Almost all strategy or management textbooks underline the importance of the external environment for firm performance. For example, classical theories such as Industrial Organization (IO) consider the factors outside a company as industry-related for developing a competitive advantage. According to IO theory, a company might obtain a competitive advantage in a situation in which it operates in an industry with above-average potential for profitability [5,6]. Other industry-related factors [59], industries’ five competitive forces [60], the participation of firms in strategic groups [61,62], or macroeconomic level factors [2,63] are some examples of the classical external determinants considered in the explanations of superior firm profitability provided by scholars.

Beyond the emphasis of strategy scholars on classical external determinants, recent topics regarding external factors and their impact on firm performance have also received attention. For example, customers’ expectations [4] or the development of Demand-Related Business Models [64] represent modern external determinants associated with superior firm performance. At the same time, the involvement of firms in local communities through eco-innovation practices [35] or CSR initiatives [34], the development of strategic partnerships in their supply chain [33], or the inclusion of corporate investors among the firm’s shareholders [24] were also found to be positively associated with firm performance. On the other side of the coin, ref. [23] found a negative relationship between the inclusion of political actors in the boardroom of companies and firm performance. In the same vein, ref. [24] reported a negative relationship between the presence of family investors among a firm’s shareholders and firm performance.

Regarding the external determinants and their influence on firm performance, a particular topic has recently received increased attention in the strategic management literature. Namely, the emphasis on the participation of firms in local clusters. Local clusters, imagined as new spatial organization forms [58], represent a specific form of collaboration similar to any other strategic alliance, strategic partnership, or strategic network. The main difference is the consideration of geographical location [13,65]. Thus, a local cluster reflects a geographically bounded collaboration developed among various firms, organizations, and public institutions pertaining to different industries, both vertically and horizontally connected and closely collaborating in specific product or service segments in a specific region. A local cluster might include suppliers, manufacturers, distributors, and complementors such as universities or financial institutions, and it might even involve collaboration with local authorities [10,14,19,39,58,65,66].

Researchers in the strategic management domain have investigated various aspects with respect to the phenomenon of the clustering of companies or the agglomeration of economic-related activity. For instance, ref. [67] investigated new entrants in local clusters and the survival of existing firms depending on the industry life cycle. Researchers found that local clusters attracted new firms only in the industry growth stage. In the maturity stage, the participation of firms in the local clusters increased their chances of survival. At the same time, ref. [68] found a positive relationship between cluster size and alliance governance. Scholars reported that alliance governance moderated the influence of local clusters on a firm’s innovation-related performances. In the same vein, recently, ref. [54] reported that MNEs, when internationalized, are located in local or urban economies with clusters of firms in the same industry to reduce adverse or hostile institutional environments.

In addition, local clusters were also associated with many dimensions and aspects of performance, in one form or another, whether we consider the macroeconomic, mesoeconomic, or microeconomic levels. From a macroeconomic perspective, clusters are regarded as useful tools that governments and public authorities might use to accelerate economic growth and development. Clusters can also enhance local or regional competitiveness [13,19,25,28]. From another perspective, the participation of firms in regional or local clusters is positively associated with various firm-level outcomes such as the development of new innovations, productivity growth, or simply cost reduction. This happens since the firms participating in the local cluster encounter already specialized suppliers in their local economy, so they can reduce their production costs [10,53,54,69].

Despite the rising interest in studying local clusters and the high enthusiasm with which business managers and local authorities embraced these new advancements, there is also some contradictory evidence regarding the positive effect of local clusters on firm performance. For instance, while some studies reported a positive and strong effect of local clusters on firm performance [10,68,70], other researchers found only a weak intensity effect for the same relationship [12,29]. Other studies even reported contradictory evidence [14]. For example, ref. [14] found a strong relationship between local clusters and innovation-related performance but reported no relationship with financial performance. On the other hand, it is also important to mention that most studies investigated the clustering phenomenon and the implications for firm performance relying on archived data and analysis of statistical reports.

Thus, on the one hand, considering the increase in the contradictory evidence regarding the positive effect of local clusters on firm performance and, on the other hand, considering the limited evidence provided from inside the firm, in this paper, we will analyze if the presence of related industries and complementors in the local economy influences firm performance. Importantly, we will investigate this relationship using evidence provided directly from inside the firm by experienced managers. In addition, we will also aim to investigate what specific aspects regarding the participation of firms in local clusters influence specific measures of firm performance. For example, do the companies that have developed close collaborations with local partners also report superior firm performances? Thus, we hypothesize the following:

H2a:

Firms that encounter related industries and complementors in their local economies will obtain superior productivity-related performances.

H2b:

Firms that encounter related industries and complementors in their local economies will obtain superior innovation-related performances.

2.4. Local and Urban Economic Development through Microeconomic Competitiveness Building

A relatively new model for regional economic development has been proposed by Michael Porter and collaborators at Harvard Business School. This model centers on productivity and improving the productivity of firms operating in a location. In addition, the focus of this economic development model is on promoting local exports and supporting the companies and industries that operate in the traded economy. For a region or location to improve its performance, the firms operating in the location need to be productive. It is impossible to achieve, for instance, higher salaries or higher levels of employment in the case where the firms cannot compete successfully in the national or international markets. Thus, this model for local or urban development centers on microeconomic competitiveness building for above-average local or urban performances [27]. The model is built on four main assumptions.

First, the local or urban economies are composed of the following two main components: (1) the local economy and (2) the traded or exporting economy [71]. (We will discuss this modality to classify the local economies in the next pages). While the local economy is quite important, the focus of the local authorities in regulating their local business environment should be placed on the traded economy. Specifically, it should be placed on developing and supporting the firms and industries that produce and sell their products in national or international markets. While the more prosperous local or urban economies are active in more and different sectors than in less advanced locations, the modern paradigm centers on accelerating the companies and industries that produce and sell products for export [21].

Second, this theory suggests that local or urban development should be based on what the regional scholars conceptualized as “related diversification” [32,72]. Accordingly, local economies develop a competitive advantage in activities related to the activities that are already present in the local economy. At the same time, entrepreneurial opportunities and the creation of new companies will also take place within the areas of local or city specialization [70]. In this contemporary paradigm, each local or urban economy should be different and should design its own strategy, relying on its strengths and uniqueness, to obtain and sustain a locational competitive advantage [21].

Third, local economic development through microeconomic competitiveness building should prioritize economic development mainly through a bottom-up approach, implying a close collaboration between the public and private sectors [19,73]. Accordingly, companies should actively involve themselves in shaping their local business environment. Through active involvement in shaping their local economy, companies might contribute to the regulation of the local economy to facilitate firm competitiveness for national or international competition.

Fourth, local economic development through microeconomic competitiveness building centers on firms and companies. As mentioned above, a local or urban economy cannot improve the quality of life of the median citizen if the companies in the local economy cannot compete successfully in the national or international markets [21].

The Competitive Advantage of Nations [22] developed a model for understanding the local business environment and the dynamics among various aspects present in the local economies from a competition perspective. Although the model was initially developed at the national level, the same model can be applied to understand local or urban economies. The model is composed of the following four main dimensions: (1) the factor (input) conditions; (2) the demand conditions; (3) the presence of related industries and complementors in the local economy; and (4) the context of firm strategy and rivalry. This model, developed for understanding the local economy, has been conceptualized as “the diamond model”. According to the theory of local economic development through microeconomic competitiveness building, the four dimensions in the diamond model should fit with the assumptions discussed above and with the following four main concepts of modern local economic development: (1) emphasis on the traded or exporting economy; (2) the related diversification of locations; (3) bottom-up local or urban economic growth and regulation; and (4) company-centric local or urban economic development.

In each of the four dimensions of the diamond model, there are specific elements, which we will call external determinants, that might influence firm performance. These external determinants within the four dimensions of the diamond model are at the heart of our discussion and statistical analysis. In the empirical section, we will investigate the external determinants within the four dimensions of the diamond model in relation to firm performance.

2.5. Local vs. Traded Economy in Local and Urban Development

Existing firms operating in the local economy might produce and sell their goods and services on the local market or they might address their products to serving the national or international markets. Thus, the firms that produce and sell their products in the local economy are called “local economy firms”, while the companies that produce goods and services for the national and international markets are called “traded economy firms” [25,71]. This methodology for classifying local economies is not new per se, however. Scholars in the regional and urban economics literature proposed, some decades ago, the growth of regional economies by accelerating regional exports [19,38,74]. Local economy firms are quite important as they provide the necessary support and resources for the companies operating in the national or international competition. According to a recent study conducted in the U.S. [71], two-thirds of the jobs created in the U.S. economy in the last decades were generated in the local economy. The problem is that the local economy does not generate above-average local performance. In the theory of local economic development through microeconomic competitiveness building, the competitive advantage of a location is generated when firms active in the location identify a need that can be served globally, develop a product, and manufacture and sell the product on national or international markets [21].

2.6. Limitations of the Diamond Model for Traded Economy-Based Urban Development

Considering the theories, models, and theoretical frameworks reviewed above, we argue that there are some limitations in the existing literature. First, this theory or model of local economic development places firms operating in the trade economy at the center of attention for above-average locational performance. A local or urban economy is competitive in a situation where the firms operating in the location can compete successfully in the national or international competition [27]. Accordingly, proponents suggest that the companies need to encounter continuously high pressure from local customers in their local economy to improve their products offered on the market. The problem is that the companies operating in the traded economy produce their goods locally and sell them nationally or internationally. Consequently, their customers are located outside the local economy where these companies might have operations or where they might have operating manufacturing plants. Thus, the demand dimension in the diamond model is not determined locally in the case we consider for discussing the traded economy. Accordingly, for statistical analysis, we will consider the demand dimension in the diamond model at the industry level. In the light of the above, the following hypotheses are formulated:

H3a:

Firms facing high pressure from their customers for continuous improvement in the firms’ goods and services will obtain superior productivity-related performances.

H3b:

Firms facing high pressure from their customers for continuous improvement in the firms’ goods and services will obtain better innovation-related performances.

Second, the same assumption might be true for the local competition dimension in the diamond model. The companies operating in the location need to encounter vigorous and intense local competition to improve the quality of their products and their performances. If the companies do not need to compete in the local economy, they will not improve their performances [27]. Again, since in the traded economy, the companies produce locally but sell their products nationally or globally, most firms have no direct competitors in their local economy where they might have operations or manufacturing plants. This aspect might be particularly true in the manufacturing sector, which we will present evidence for in this paper. In most cases, there are no competitors in the local economy for manufacturing companies. Thus, the competition dimension in the diamond model also needs to be considered at the industry level for theoretical discussion and statistical analysis. Therefore, we propose the following hypotheses for statistical testing:

H4a:

Firms facing intense competition in their industry will obtain superior productivity-related performances.

H4b:

Firms facing intense competition in their industry will obtain superior innovation-related performances.

H5a:

There is no relationship between local competition and productivity-related performances.

H5b:

There is no relationship between local competition and innovation-related performances.

Therefore, in the situation we consider for discussing the traded economy, the competitiveness of a location (local or urban economy) and the performance of companies are determined at multiple levels of analysis. The factor (input) conditions are a local-economy variable, the presence of related industries and complementors in the local economy is a cluster-level variable, while the demand conditions for regional products and the context for the firm strategy and rivalry dimension are industry-level variables.

Third, as far as we know, the existing theories of regional development as well as the competitiveness framework reviewed above have not been tested with empirical data provided from inside the firm, that is, data provided directly by company managers. Most of the existing theories and models proposed for economic development rely only on data collected from statistical reports or existing archives. For example, ref. [57] used a database of 17 OECD countries over a period of 20 years, ranging from 1973 to 1996. Ref. [27] used a database covering 130 countries over the 2001–2008 period. In this paper, we aim to investigate how the managers of companies actually see their local business environment in relation to firm performance.

Fourth, most regional development theories as well as the competitiveness framework investigated various aspects of the regional economy in relation to regional and/or local performance. While it seems clear that the local business environment, the presence and development of local clusters, and the existence of performing firms drive regional or local performance [21,25,27,66], a subject that has received less attention is the influence of these dimensions on firm performance. For example, do firms extract real value from the existence of proper factor (input) conditions in the local economy? Do firms extract real value from the presence of related industries and complementors in the local economy? Consequently, next, we will investigate if there is an association between the dimensions of the local business environment proposed in the refined diamond model and firm performance.

2.7. Why Take a Firm Perspective?

Thus far, considering the main limitations of this model for local economic development, the following related question might be derived from the aspects discussed above: why take a company perspective? There are at least four reasons why evaluating the local business environment from a company perspective by company managers is important. First, it is important to understand the relationship between local business conditions and firm performance for competitive reasons. While a strength in the local business environment might amplify or improve firm performance, a weakness can stifle it. For example, the strategic collaborations developed by companies with local partners might contribute to increasing firm innovativeness, but the local regulatory policies might hamper the development of new innovative products and services. This phenomenon happened already in France. A strong infrastructure supporting scientific education and technical training was present, but the national regulatory policies toward pharmaceuticals seriously limited innovation in the French pharmaceutical clusters throughout the 1970s and 1980s [57]. It is important to consider business managers’ perspective since, unless the critical drivers of competitiveness are present at home, companies will not be able to sustain their competitive advantage in the long run [22]. Thus, local policymakers should consider involving companies in the local economic development for long-term local economic development [19,66]. In the case that the companies cannot sustain their competitive advantage in the long run, the local economies and the quality of life of the average citizen might deteriorate. As mentioned earlier, the quality of life of the average citizen in the location directly depends on the existence of successful companies in the national or international markets.

Second, it is quite difficult to obtain data regarding the collaborations, strategic alliances, and networks developed by local firms, respectively, and the quality of these relationships developed between companies and local partners. This type of data, to an important extent, can be obtained only from inside the firm. For example, ref. [57] measured the common innovation structure objectively using available data but faced various challenges in finding the data for evaluating the cluster-specific environment for innovation and productivity. Researchers faced the same challenge in evaluating the quality of the linkages between the common innovation structure and innovation in local clusters.

Third, according to the literature reviewed above, in both regional economics as well as in the strategic management field, there is a need for supplementary bottom-up data and industry-specific analysis to better understand, explain, and predict endogenous local economic growth and development [19,47,52,73]. As ref. [52] argued: “Urban development policy cannot be based on speculative insights but needs to be anchored in empirical evidence […]. Providing urban policymakers with solid information for good governance and access to reliable and up to date information is a sine qua non (p. 592)”.

Modern theories of local economic development call for a close collaboration between the public and private sectors, rather than imposing legal conditions and regulations for businesses from top to bottom [19,52]. Modern local or urban competitiveness supposes a close collaboration for regulating the local business environment in order for the companies to have access to the proper conditions for their operations and to be competitive in the national or international markets. Therefore, it is important for the local authorities to understand how the companies see their local business environment for better regulation of their local economy.

Fourth, considering the company perspective by consulting company managers might help to identify the elements in the local economy that are barriers to productivity and/or innovation. It is quite important for the local authorities to identify and eliminate the existing barriers in their local economy to improve their local or urban microeconomic competitiveness. According to ref. [27], microeconomic competitiveness factors are those factors that have a direct impact on company productivity and innovation. Therefore, the local authorities need to understand how the companies view their local economy and what resources they need to be competitive in the national or international economy. Consequently, we hypothesize the following:

H6a:

Firms operating in local business environments that are better regulated by local authorities will obtain better productivity-related performances.

H6b:

Firms operating in local business environments that are better regulated by local authorities will obtain better innovation-related performances.

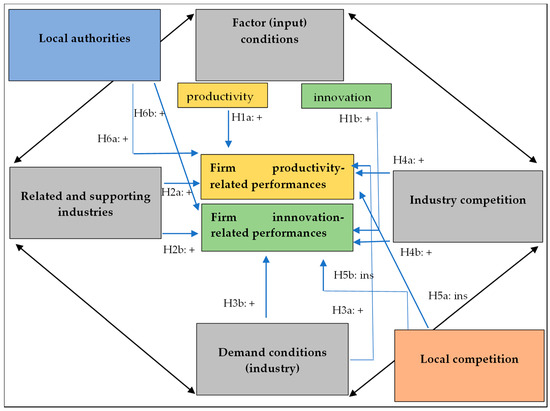

In Figure 1, we depict a conceptual model in which readers can visualize all the relationships among the variables considered in our study.

Figure 1.

A conceptual model of the relationships between the refined diamond model for traded economy urban development and firm performance.

In addition to the aspects discussed above, this paper is important and useful for both the theory and practice of urban economics because the aspects discussed in this paper will complement the existing theories. For instance, the diamond model proposed in The Competitive Advantage of Nations [22] has not been tested in a systematic way with quantitative data nor in the developing Eastern European economies. In addition, while other dimensions in the diamond model might not influence innovation or productivity differently, the factor (input) conditions in the diamond model (e.g., local infrastructure) are quite different for the different measures of firm performance [20]. As far as we know, this facet of the local economies has not been tested for innovation or productivity separately. Moreover, the four dimensions of the diamond model have not been tested in a systematic way for the traded economy in comparison with the local economy, which we perform in this paper. Finally, the four dimensions of the diamond model have not been investigated in relation to firm performance using different measures of firm performance.

Considering all the aspects discussed above, next, we aim to investigate if the four dimensions in the diamond model, which are refined and adopted for local economic development through microeconomic competitiveness building, influence firm performance. Specifically, we aim to investigate which elements in each of the diamond model’s dimensions influence a specific measure of firm performance. In addition, we aim to investigate to what extent the various external determinants within the diamond model’s dimensions can explain the differences among companies in terms of their performances.

3. Research Methodology

3.1. Research Strategy

To find the answers to our research questions, we employed a research strategy based on conducting a social survey with explanatory and predictive purposes. For data collection, we developed a research questionnaire that we administered to companies at a national level. Compared with other research methods, such as the analysis of secondary data, conducting a social survey allowed us to investigate managers’ perspectives on their local business environment [75]. We collected empirical data in three waves, between 15 April and 15 September 2023. We contacted 1025 medium and large firms in the manufacturing industry. We contacted each firm by email at least three times, accompanied by a letter of intent and the research questionnaire. After five months of data collection activities, we received 67 questionnaires completed by managers. In our study, 52 medium-sized companies and 15 large companies participated, resulting in a participation rate of 6.53%. The 67 participating companies operate in 17 industries, respectively, and in 29 industry segments, all operating in Section C—manufacturing sector. Of the 67 participating companies, 19 companies are listed/public companies and 48 are Limited Liability Companies (LLC).

Most managers in our study are quite experienced managers. The average managerial experience reported by managers in our study is 16 years (minimum 2 years and maximum 40 years). We analyzed the answers provided by 36 top managers/executives (e.g., business owners, administrators, CEOs, general managers), 19 middle managers (e.g., marketing directors, production directors), 7 operations managers (e.g., team leaders, chief accountants), and of 3 non-managerial personnel (e.g., engineers, accountants). Furthermore, we analyzed the answers provided by 41 Romanian companies and 26 subsidiaries of international companies in Romania.

In the National Economic Activity Classification [76], there are 21 sections, with a total of 614 four-digit CAEN codes. The focus of our research is on the exporting economy. Therefore, we focused our effort on Section C—Manufacturing, for the following reasons. The backward industries such as those in Section A (Agriculture, Forestry, and Fishing) are, in many cases, supplier industries of raw materials and components for the manufacturing companies. Then, industries in Section B (Mining and Quarrying) extensively use natural resources for their operations, while many other sections contain industries and firms that operate in the local economy. In Section C, there are in total 23 industries, each one with its own industry segments. We analyzed each industry segment individually and we extracted from each segment the total number of firms and companies to identify the industries and industry segments without intense economic activity. Based on our theoretical position, local or urban economies develop a competitive advantage in activities related to the activities that are already present in the region. In the regional and urban economics literature, this concept is called related diversification [32] or smart specialization [42]. Entrepreneurial opportunities and the creation of new companies will also take place within the areas of local specialization, and the development of new products for export will be related to those already present in the local economy [32,70].

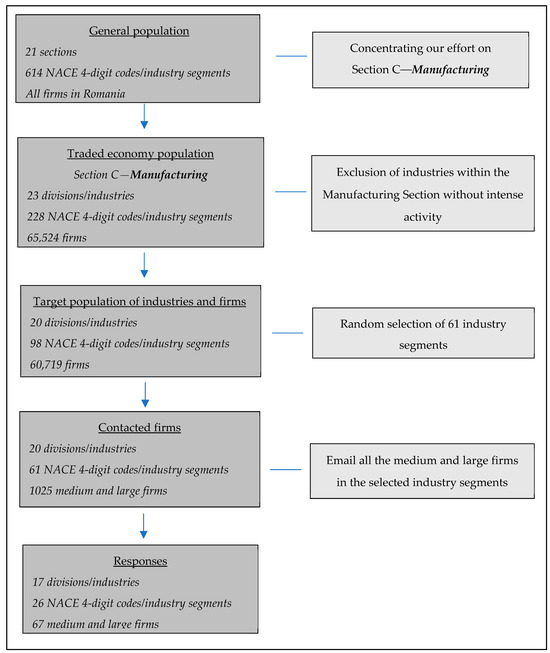

Thus, in Section C and its constituent 23 industries, there are 228 industry segments within which 65,524 firms operate [76]. Following our analysis, we excluded 3 industries/NACE 4-digit codes, summing a total of 130 industry segments but only 4805 firms. We kept for further analysis 20 industries and 98 industry segments, summing a total of 60,719 manufacturing firms. Next, we randomly chose wave by wave the industry segments, and we contacted by email all the medium and large companies in each segment for which we obtained a valid email address. We stopped collecting data when we obtained a representative number of questionnaires to allow us to generalize the specific population or at least extract some valid conclusions from the point of view of statistics. The sampling procedure is depicted in Figure 2.

Figure 2.

Sampling procedure.

In this context, it is also important to mention that although there are differences, sometimes huge differences, between the industries and industry segments we considered for empirical analysis, the main objective of this paper is to identify the common factors from the external environment of firms that impact firm performance, regardless of the industry in which the firm activates. In more specific terms, we looked for common patterns that could be generalized across industries. For example, although there are huge differences between the operations of firms in the public alimentation and energy sector, the presence of related industries and complementors in the local economy will positively impact the performance of firms in both industries. We controlled industry differences through the design of the research questionnaire, with managers reporting their perspective only in relation to other firms in their industry.

3.2. Variables

The empirical analysis consists of two main parts. First, at the general level, we aim to investigate the relationship between the external determinants at the local economy level, cluster level, and industry level and firm performance. Thus, the independent variables considered at the local economy level are “local business environment for productivity” (LBE_PROD), “local business environment for innovation” (LBE_INNOV), “local competition” (LOC_COMPE), and “local business environment regulation by local authorities” (LOC_AUTR). At the cluster level, the independent variable is “the presence of related industries and complementors in the local economy” (CLUSTER). At the industry level, we consider the following independent variables: “industry competition” (IND_COMPE) and “customer high pressure for continuous product improvement” (IND_CLIENT). (See also Table 1).

Table 1.

Variable measurement I.

Next, at the detailed level, we created more specific independent variables of external determinants. For example, initially, we used six items to measure the independent variable LBE_PROD. For the detailed analysis, we created two new independent variables including INFRA_PROD (four items) and HR_PROD (two items). The results of our methodological approach can be observed in Table 2. We measured all the independent variables on a 7-point Likert scale ranging from 1 to 7 with the following meanings: “1 = Total/strong disagreement and 7 = Total/strong agreement”. We kindly asked the managers to appreciate the extent to which the statement in the questionnaire fits the situation in their company, according to the scale mentioned above.

Table 2.

Variable measurement II.

On the other hand, we considered the following dependent variables. For the general-level analysis, we considered “productivity-related performances” (PRPs) and “innovation-related performances” (IRPs), while for the detailed analysis, we considered “firm traditional performance” (FTP), “profits” (Pr), “labor productivity” (Wl), “organizational growth” (ORG_GROWTH) and, respectively, “pure innovation” (INNOV), “diversification” (DIVERSIF), and “expansion” (EXPANSION). We kindly asked the managers to appreciate the competitive position of their company, for the various measures of firm performance, compared to other (1) national firms and (2) international firms (from Central and Eastern Europe) in the same industry on a 7-point Likert scale ranging from 1 to 7 with the following meanings “1 = Strong competitive disadvantage to 7 = Strong competitive advantage”.

To implement the analysis depicted above, first, we analyzed the empirical data at a correlational level to identify the significant associations among our variables of interest. In this context, the Pearson coefficient is quite appropriate for our methodological approach since we used scales with a different number of items in each one. According to ref. [77], this coefficient transforms values into z-scores and establishes the relationships between two variables that contain z-scores. Thus, after we conduct the correlational analysis, we can make predictions, but these results will not explain the causality beyond the significant association [75]. For example, companies operating in local economies in which the local infrastructure facilitates productivity might also report better scores for productivity-related performances. However, this initial relationship does not provide information on why some companies obtain superior productivity-related performances. To be able to provide an explanation regarding the differences among the companies depending on their performances, our analysis required us to consider developing multilinear regression models. Similar to any hierarchical regression, our regression supposes the comparison between the explanatory power of at least two hierarchical models. In the case that the differences between the two equations are high enough, we can affirm that the differences between the performances of companies are due to our considered external factors [77].

4. Data Analysis and Results

We start the data analysis section by providing descriptive statistics (see Table 3) and correlational results for our variables of interest (see Table 4). One can observe that a few external determinants from the local economy level, local cluster level, and industry level have a positive and significant effect on firm performance. First, regarding the productivity-related performances (PRP_RO), one can observe that only LBE_PROD (r = 0.237, p < 0.05), CLUSTER (r = 0.248, p < 0.05), and IND_CLIENT (r = 0.465, p < 0.01) have a positive and significant effect on PRP_RO. Importantly, one should notice that the relationships are relatively weak in intensity but are still significant. On the other hand, according to the evidence reported directly by business managers, it seems that only the continuous pressure exerted by customers to improve a firm’s goods and services (IND_CLIENT) has a significant and positive effect on innovation-related performances (IRP_RO) (r = 0.284, p < 0.05). One can observe that neither the local competition (LOC_COMPE) nor the regulation of the local business environment by local authorities (LOC_AUTR) has a significant effect on achieving superior productivity or innovation-related performances. Therefore, the empirical data support hypotheses H1a, H2a, H3a, H3b, H5a, and H5b and reject hypotheses H1b, H2b, H6a, and H6b. Regarding the variable that measures industry competition (IND_COMPE), we found a positive effect of industry competition on firm performance, but since we obtained a low score for the reliability analysis, we excluded this variable from our discussion.

Table 3.

Descriptive statistics.

Table 4.

Correlation matrix.

Compared to other companies in the same industry, but operating in Central and Eastern Europe, according to the evidence provided by managers, the results are mostly similar. There exists only one exception: LBE_PROD does not have a significant effect on PRP_UE. The other significant relationships obtained for Romania also received empirical support when investigated in comparison with other companies operating in Central and Eastern Europe.

These results provide relatively weak support for the impact of factor (input) conditions regarding the presence of local clusters on achieving superior productivity-related performances. At the same time, it seems that local competition and the regulation of the local business environment by local authorities do not influence productivity-related performance. In addition, our initial results strongly support the industry-related variables and the refined theoretical framework presented above. The same is true regarding local competition. There is no relationship between the intensity or nature of local competition and firm performance when we consider the traded economy for local economic development. From the external determinants, the industry-related variables have the strongest, positive, and most significant effect on superior productivity performance.

On the other hand, perhaps these initial results provide some contradicting evidence regarding the positive effect of external determinants on superior innovation performance, as suggested by the existing literature. According to the data provided directly by managers, only the pressure exerted by the firm’s customers for continuous improvement has a positive and significant effect on achieving superior innovation performance. Neither the existing factor (input) conditions in the local economy, the presence of related industries and complementors in the local economy, nor industry competition have a significant effect on superior innovation performances, in comparison with other companies in the same industry in Romania and in Central and Eastern Europe.

From another perspective, our initial results provide support for company-centric business development and firm performance. In more specific terms, a firm’s superior performance, whether regarding productivity or innovation, depends mainly on what the firm does, its strategy, its organic growth, and so on. According to our data, some companies reported superior performances in comparison with other companies in the same industry even if they did not encounter adequate conditions in their local business environment. Thus, our results provide support for the existing studies, e.g., [2,3], which found that achieving superior performances is mainly due to firm characteristics and also depends on appropriate positioning within a strategic group and its industry.

Based on these general-level results, we next aimed to investigate in detail the specificity of the proposed relationships. We did so since we observed that some items might influence the different measures of firm performance differently. For example, both variables INFRA_PROD and HR_PROD measure the same initial variable Local Business Environment for Productivity (LBE_PROD). As one can observe in Table 5, these variables have different patterns of influence depending on the specific dependent variable. INFRA_PROD, for example, does not influence organizational growth (ORG_GROW) nor pure innovation (INNOV), but HR_PROD does influence the same variables. Therefore, next, we conducted a detailed correlational analysis to identify the significant specific patterns in the interactions for further analysis. The results of our investigation are shown in Table 5. The relevance and pertinence of this methodological approach are supported by the increased number of significant associations identified and perhaps the increase in the intensity of the significant relationships as well.

Table 5.

Specific local economy, cluster, and industry determinants and their impact on specific measures of firm performance.

We can notice in Table 5 that a different set or mix of local, cluster, and industry conditions have a positive and significant effect on different specific measures of firm performance. Therefore, we grouped all the statistically significant external determinants from all three levels of the analysis depending on the dependent variable they influence. Next, we analyzed in detail which specific local conditions significantly impacted a specific type of firm performance.

Firstly, firm traditional performance (FTP), in the sense of revenue growth, productivity growth, customer satisfaction growth, etc., is positively and significantly impacted by the existence of an adequate local infrastructure (e.g., administrative, logistical) and by the existence of highly qualified human resources in the location or city. On the cluster side, it seems that only the close strategic collaborations developed by firms with local partners influence this type of performance. Neither the access to specialized factors of production in the local economy nor the support of local partners influence FTP. On the industry side, all the specific industry-related indicators have a positive and significant effect on FTP. The most significant effect on FTP is exerted by the NPD driven by the existing customers (e.g., initial signals regarding new customer needs, such as the first customers requiring a new product) and the development of products that can be sold on international markets. In addition, no variable referring to the local authorities has a positive impact on FTP. Finally, in contrast to the existent studies, e.g., [21], local competition significantly but negatively influences this type of performance. The higher the scores reported by firms for local competition, the lower the performances reported by business managers.

Secondly, in contrast to the discussion above, no variable related to the local business environment nor the cluster conditions impact firm profitability (Pr). The data in our study suggest that only the existence of highly qualified personnel in the local economy positively and significantly impacts firm profitability. On the other hand, business managers reported better profitability when all the industry-related conditions were present (e.g., the firm’s customer-driven NPD, serving international and ethical customers, activating in industries or industry segments that can be served globally). Interestingly, the exception is the presence of international customers in the firm’s portfolio. It seems that this variable does not influence firm profitability. This result might be simple to explain if we consider that one firm might efficiently serve international customers but have quite high production costs at home. Regarding local competition, the local competitive conditions negatively and significantly influence firm profitability. No variable measuring the local authorities’ regulation of the local business environment influences this type of performance.

Thirdly, regarding labor productivity (WL), firms reported superior productivity growth when they encountered both adequate local infrastructure conditions and highly qualified personnel in the local economy. In addition, compared with the other types of performance, firms increased their labor productivity when they encountered specialized factors of production in the local economy. On the other hand, the close strategic alliances and partnerships developed with local partners as well as the support devoted to the growth of local partners do not impact productivity growth. One firm might have well-developed partnerships but if within the company, the employees do not follow the rules or if the machinery is outdated, well-developed partnerships cannot result in productivity growth. Regarding the industry-related variables, except for customers’ pressure for continuous improvement, all the industry-related factors positively and significantly influence productivity growth. On the competition side, compared with the performance types discussed above, firms reported superior productivity growth when they activate in local economies that are properly regulated and when the local authorities regulate the local economies specialized for the development of export industries.

Fourthly, for the variable measuring organizational growth (ORG_GROW) in the sense of hiring new employees as well as the growth of the median salary, we observed that this type of performance was not influenced by the existence of an adequate local infrastructure but by the existence of highly qualified human resources in the local economy. The higher the scores reported for the existence of qualified personnel in the location or city, the better the scores reported for hiring new employees or the growth in the median salary. On the cluster side, in contrast to the other types of firm performance, all cluster-related variables (access to specialized factors of production, close collaborations, and support for the growth of local partners) positively and significantly impacted a firm’s growth. Regarding the industry-related variables, except for the presence of international customers, all the industry-related variables positively and significantly impacted a firm’s growth. Regarding the local competition dimension, as well as the regulation of the local business environment by local authorities, no variable influences the growth in the median salary or the hiring of new employees.

Fifthly, “pure” innovative performance (INNOV), in the sense of new or improved goods and services or organizational processes, was positively and significantly impacted only by the existence of highly qualified personnel in the local economy. No external factors from the existing local business environment determine the superior incremental or radical innovations of firms. On the cluster side, superior innovative performance was influenced only by the close strategic alliances and partnerships developed by firms with local partners. The higher the scores reported by managers for the development of strategic alliances in the local economy, the better the innovative performance. It seems that the other cluster-related factors did not impact the pure innovative performance. Regarding the industry-related factors, better innovations were reported by business managers of companies facing high pressure from their customers for continuous improvement, firms developing customer-driven new products, and firms developing a portfolio of products with potential for scaling. In addition, no variable measuring local competition or the regulation of the local business environment by local authorities impacted this type of performance.

Sixthly, firms reported superior diversification (DIVERSIF) with new business lines only when they developed close strategic alliances and partnerships with local partners. No other variable measuring the local business environment or cluster conditions impacted this type of performance. On the industry side, only the potential for scaling and selling the product on international markets and the participation in industries with potential for real benefits positively and significantly impacted the addition of new business lines. In this context, it is interesting to mention that for this type of performance, all the variables measuring the regulation of the local business environment by local authorities positively and significantly influenced the addition of new business lines by firms. These variables only influenced this type of performance. The same is true regarding the existence of incentives for productivity and innovation in the local economy. This variable only influenced the diversification with new business lines. Firms reported higher diversification when there were incentives for productivity and innovation in the local economy.

Seventhly, regarding national or international expansion (EXPANSION), the firms reported higher scores for expansion when they served international customers and when they operated in industries and industrial segments with potential for scaling. It seems that no other variable influenced the national or international expansion of the firms.

As one can observe from the detailed analysis above, it is neither useful nor sufficient to approach the local economies only at a general level of analysis since different aspects of the local economy influence different types of firm performance. We needed this granular view to understand the complex relationship between the local economy factors and firm performance.

Next, we aimed to understand not only which specific set of local, cluster, and industry determinants influence a specific measure of firm performance but also how much of the dispersion/variation in firm performance can be explained by the set of independent variables. In more specific terms, we aimed to investigate why some companies obtain better performances compared with other companies in the same industry. To do so, we designed and implemented various multilinear regression models. For example, in Table 5, we can notice that INFRA_PROD, HR_PROD, INFRA_INNOV, HR_INNOV, COLLABORATION, CLIENT_PRES_INNOV, CLIENT_NPD, CLIENT_INT, CLIENT_ETICHS, SCALING, and BENEFITS positively and statistically significant impact superior firm traditional performance (FTP). In Table 6, we present how much of the variation in the dependent variable (FTP) can be explained by this set or mix of local economy, local cluster, and industry determinants identified, proposed, and tested by us in our research.

Table 6.

Regression analysis (FTP).

In Table 6, one can observe that Model 1 (the control model) is not statistically significant and explains only 1.3% of the differences depending on firm traditional performance (R2 = 0.013; Sig. > 0.1). Then, in Model 2, after adding our significant variables of interest (INFRA_PROD, HR_PROD, INFRA_INNOV, HR_INNOV, COLLABORATION, CLIENT_PRES_INNOV, CLIENT_NPD, CLIENT_INT, CLIENT_ETICHS, SCALING, and BENEFITS), we can observe that the model is statistically significant, where all the variables explain no less than 37.2% of the dispersion in the dependent variable (FTP) (R2 = 0.372; Sig. < 0.05). The growth in the explanatory power of Model 2, compared with Model 1, is given by the difference in the R2 values. Thus, we observe that no less than 35.9% (∆R2 = 35.9) of the dispersion in the FTP is explained exclusively by the set or mix of external determinants from the local, cluster, and industry contexts. In other words, if we want to explain why some companies obtain better FTP compared with other companies in the same industry, no less than 35.9% of the differences are explained by the external determinants considered in our model (INFRA_PROD, HR_PROD, INFRA_INNOV, HR_INNOV, COLLABORATION, CLIENT_PRES_INNOV, CLIENT_NPD, CLIENT_INT, CLIENT_ETICHS, SCALING, and BENEFITS). The differences regarding FTP from 35.9% to 100% are due to other factors we did not consider in our investigation. For instance, the differences might be attributed to internal factors such as team leadership, organizational culture, firm strategies, etc. In this context, it is also important to mention that 35.9% is quite significant in social sciences, where variation typically ranges from 10% to 50% [77]. We conducted the same analysis for all the regression models. Due to editorial constraints, and lack of space, we do not report a detailed analysis for all the models. However, we present the synthesized results in Table 7.

Table 7.

Results of regression analysis.

Finally, we conclude that we conducted this analysis only for the dependent variables measuring the firm performance of manufacturing companies in Romania. As mentioned above, the results are largely similar for performance measurement in comparison to other companies in the same industry in Central and Eastern Europe. It is also important to mention that Romania is a developing country, and the results might be influenced by the specific set of local conditions. As ref. [58] explicitly stated, the current stage of economic development of a country also matters for understanding the local business environment and the implications of local conditions for firm performance. Industrial traded clusters are more likely to develop in more advanced economies compared with developing economies. In developing countries, even if there are operating exporting industries and firms in the local economy, they will be rather isolated, and related industries and complementors will be scattered across regions. Therefore, the generalizability of the results presented above might be limited to local economies like those encountered in Central and Eastern Europe. On the other hand, our results might not apply to the situation of more advanced local economies such as Silicon Valley or Greater Pittsburgh in the U.S.

5. Discussion and Policy Implications

The findings from our paper have several implications for the regional or local economies and for the companies operating in the local economy. First, we found that firm performance is determined by existing conditions outside a company, in addition to internal factors. This fact, however, is not new per se. For decades, scholars have understood that firm performance is determined by both internal and external factors. Our current data supporting the stream of research focusing on external factors brings to the attention of managers the important role the company plays in building modern local or urban competitiveness. The involvement of the company in the development of the local economy is not only good but necessary for its competitiveness in terms of national and international competition. Thus, the data supporting the stream of research that focuses on external determinants has some direct implications for the public administration domain and for local authorities.

The new local or urban development theory—which centers on microeconomic competitiveness building—should involve a close collaboration between public authorities and private companies. Consequently, local or urban economic development should prioritize a bottom-up approach, with the local authorities regulating the local business environment according to the companies’ needs for national or international competition. Local policymakers should develop regulations that facilitate building and developing the competitiveness of companies operating in the location for national or international competition. Local policymakers should understand that their local economies cannot function well and achieve above-average performances in terms of the quality of life of their citizens in the case that the companies operating in the location or city cannot compete successfully in national or international markets [27,78].

According to this emerging need to regulate the local business environment according to the companies’ needs for national or international competition, the contribution of our paper is quite important. The main implication for the local or urban economic practice is that the local authorities may understand that the performance and competitiveness of companies operating in the traded/exporting economy are determined by a different set or mix of local conditions, pertaining to the local business environment, local clusters, and industries that are present in the local economy. More importantly, local authorities should understand that they need to create proper conditions depending on the type of performance the companies operating in the location are underperforming, in comparison with other companies in the same industry from other locations.

For example, in the case where the companies are underperforming regarding innovation, perhaps the problem might be with the regulation of the local economy. This phenomenon already happened in other countries (e.g., France) as mentioned earlier. The data in our study support these practical implications. As an example, the companies in our sample reported superior diversification when they encountered the presence of incentives in the local economy that encouraged innovation and when they anticipated obtaining real benefits after introducing innovation. These two determinants are outside of firm control and mainly have to do with the existing conditions in the local economy.

The existing theories of local and urban economic development suggest that local authorities need to improve the local business environment overall. Typically, local authorities develop different aspects of their local economy depending on the determinants that generate success in other regions. For example, creating industrial parks, attracting new companies and foreign direct investments, reducing the cost of doing business, and so on [78]. What the results from our research suggest is that improving the local business environment overall is a necessary but not sufficient condition. The existing literature in the economic development field suggests that improving the local business environment overall will lead to “table stakes” or to a “zero-sum competition” in which no location or city can develop a competitive advantage [78]. We argue that a threshold improvement in the local economies overall should take place in each location, but the local authorities should prioritize regulating the local economy according to the needs of the companies to be competitive in the national or international markets. Along this line of thinking, the data in our study suggest that the performances of traded-economy companies are determined by different external factors and conditions present in each local economy. Local authorities should increase their attention devoted to improving the specific aspects of their local economy depending on the type of performance the traded-economy firms are underperforming.

Second, from a company perspective, companies and firms need to understand that their performance is determined by external factors, in addition to internal factors. We have seen that different determinants from the external environment (local economy, local cluster, or industry) impact different measures of firm performance. Thus, companies could monitor external factors depending on the type of performance they are underperforming. The main idea or the main implication derived from this study is that companies should be actively involved in local economies to create a local economy to support their superior performances and improve their competitiveness in the national and international markets. The active involvement of companies in the development of the local business environment is not only good for the company’s competitiveness but also necessary. The new local or urban economic development theory places in the center the firms operating in the traded or exporting economy. It implies a close collaboration between the public and private sectors. If the companies are not involved in building the competitiveness of their local economy, they will leave the entire local economy to be regulated at national, regional, or local levels and according to what the local authorities think is good and effective without considering the company’s perspective.

6. Limitations and Future Avenues for Research

There are also some limitations of this paper, both methodological and theoretical. First, from the methodology point of view, the most important limitation is that we analyzed the empirical data provided by 67 medium and large companies operating in Romania. The sample size may seem relatively small, but it is important to consider that we obtained empirical data from inside the firm directly from business managers. For this reason, our sample is, perhaps, smaller than in other studies. Executives and business managers are quite busy social actors. Therefore, we argue that obtaining empirical evidence from inside the firm is more difficult than analyzing already-collected data. At this point, the readers may consider that although our conclusions are well supported by empirical evidence our results might not be representative of the entire population of medium and large companies.