Abstract

In this article, a new modification of the Weibull model with three parameters, the new exponential Weibull distribution (E-WD), is defined. The new model has many statistical advantages, the heavy-tailed behavior and the regular variation property were offered. Many of the important statistical functions of the modified model are presented in closed forms. The flexibility of E-WD has been improved. The proposed model can be used to fit data with different shapes, it can be right-skewed, left-skewed, decreasing, curved and symmetric. Some distribution properties of the proposed model, including moment generating function, characteristic function, moment, quantile and identifiability property, have been derived. In addition to the information generating function, the Shannon entropy and information energy are also discussed. The maximum likelihood approach and Bayesian estimation are used to estimate the distribution parameters. In the Bayesian method, three different loss functions are used. The calculations show the biases and estimated risks to obtain the best estimator. The bootstrap confidence intervals, the asymptotic confidence intervals and the observed variance-covariance matrix are obtained. Metropolis Hastings’ MCMC procedure is used for the calculations. We apply the composite distribution to stock data for four variables. The goodness-of-fit results show that the model performs well compared to its competitors. The proposed model can be used for forecasting and decision making.

1. Introduction

In this article, we present a new statistical distribution with three parameters that has some desirable properties. There are many previous studies and researches on the topic of composite distributions and the study of their properties, as well as methods for estimating the parameters and the reliability function. Here are some related researches and studies on this topic. Nadarajah and KOT [1] introduced a composite probability model, as he derived some of the characteristics of the proposed model represented by the probability distribution function, moments, mode, median, and the study of property measures of dispersion such as variance, average deviation, torsion, and flattening, and the parameters of the proposed model and the reliability function were estimated. Lingji et al. [2] develop a new composite statistical model Beta-Gamma, investigated the model properties, estimated the parameters and the risk function in different ways, and applied the model to real data in the health field. Akinsete et al. [3] discussed construction of a new composite statistical model for the Beta-Pareto distribution with four parameters and the study of the properties of the model, such as the arithmetic mean, mode, median, standard deviation, variance, skewness, and flatness, as well as the parameters and reliability of the model. Barreto et al. [4] discussed the study of a complex statistical model Beta-Generalised Exponential in terms of its mathematical properties and the derivation of rth degree moments.

A study on the complex distribution beta-Burr XII was published, in which the characteristics were derived by Paranaiba et al. [5]. A study on the construction of a composite statistical model for the Beta-Half Cauchy distribution was presented by Cardeior and Lemonts [6], such as the arithmetic mean and mode, and some properties of the dispersion measures. ALkadim and Boshi [7] published a paper that combined the exponential-Pareto distribution with two independent distributions, the Exponential and the Pareto distribution. The properties of the new distribution were studied in terms of the probability density function, the reliability function, the cumulative function, the risk function, and the use of the method of greatest likelihood to estimate the parameters. Gupta and Kundu [8] proposed the generalized exponential distribution and Nasiri [9] estimated the parameters via using different method in person of outlier.

Many literatures researched the issue of new statistical models based on the Weibull distribution. For example, Martinez et al. [10] developed the generalized modified Weibull distribution. Lee et al. [11] developed a beta Weibull model. Tahir et al. [12] developed a new Weibull-Pareto distribution. Emam developed the generalised Weibull-Weibull distribution [13]. Emam and Tashkandy [14] developed the generalised Arcsine-Kumaraswamy-X family of distributions by incorporating a trigonometric function, the Weibull claim model [15] using a class of claim distributions, the modified alpha-power Weibull-Weibull model [16], the generalised modified Weibull model [17] and the Khalil generalized Weibull distribution based on ranked set samples [18]. The exponential probability density function is:

Here is the inverse scale parameter. The exponential is:

Next, the Weibull cumulative distribution function with two parameters takes the following form:

where , is the scale parameter and is the shape parameter.

2. The E-WD

In this section we introduce a new combined statistical model and study its behavior. It is the E-WD with three agency parameters, which also consists of an exponential family and a Weibull distribution. The proposed model is superior to many previous distributions and proves its efficiency in modeling stock movement data in the stock market. The cumulative distribution function (CDF) of the new combined statistical model is as follows:

The probability density function (PDF) of the complex statistical model gives as follows:

and , the function in the aforementioned Equation (5) , but

The function in Equation (5) is a non-probability PDF because its integral is not equal to one, so the appropriate method to convert it into a probability density function is to multiply it by the reciprocal of integration. The PDF of the proposed E-WD is:

The corresponding CDF gives as follows:

The CDF of E-WD is

Furthermore, the survival function, hazard function, cumulative hazard function, and reverse hazard function of E-WD are given, respectively, by

The importance and main motivation for the proposed modification E-WD:

- (i)

- To improve the flexibility and distribution properties of Weibull model.

- (ii)

- The proposed model can take several forms: a right-skewed form, a left-skewed form, a decreasing form, a curved form, and a symmetric form.

- (iii)

- A simple way to add an additional parameter that gives an extended distribution with “heavy tail” properties and is very useful in modeling stock movement data and financial data.

- (iv)

- The important statistical functions of the modified E-WD are presented in closed forms.

- (v)

- The new version has many special statistical features. Now we present the visual representation of the PDF of the E-WD.

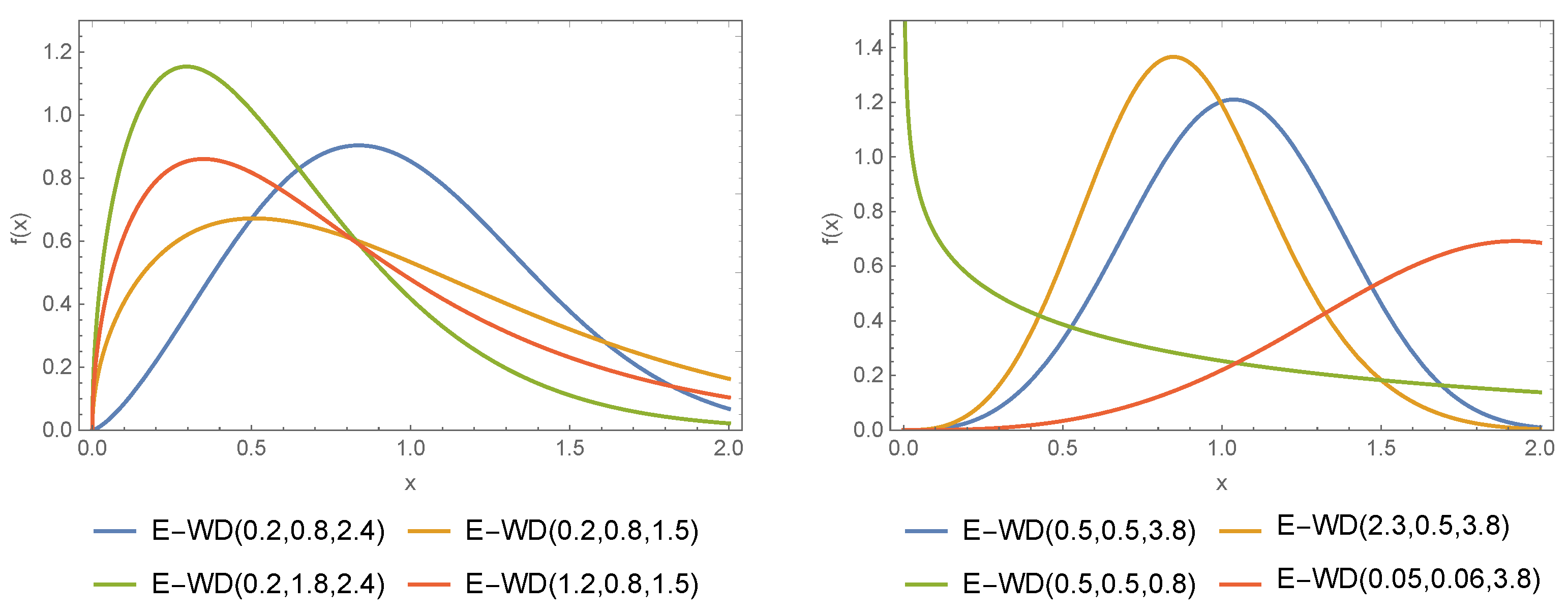

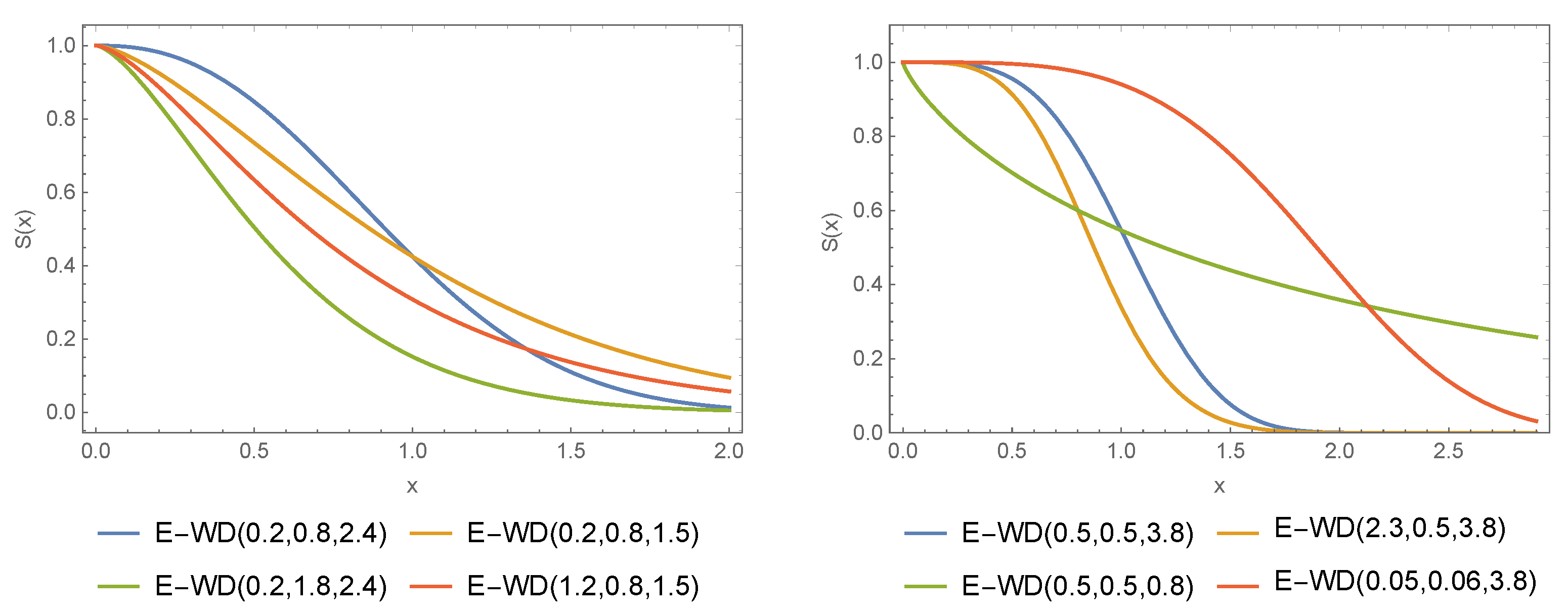

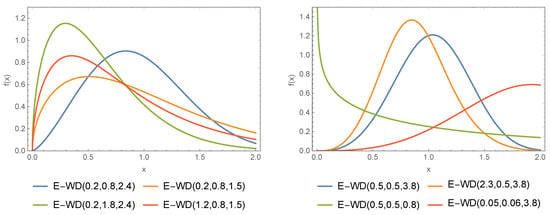

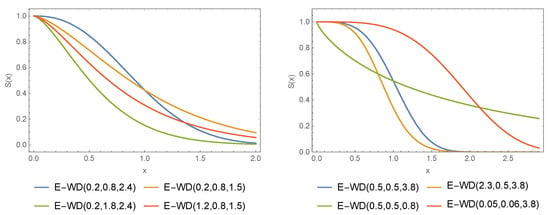

Various visual representations of the E-WD PDF are shown in Figure 1. The representations of f(x) are obtained for and for; (i) (blue-line), (ii) (green-line), (iii) (orange-line), (vi) (red-line). In Figure 1, the representations of f(x) are obtained for and for; (i) (blue-line), (ii) (green-line), (iii) (orange-line), (vi) (red-line). In left banal of Figure 1 we can observe the different shapes of the PDF of the E-WD. These include a right-skewed shape (green line), a decreasing shape (orange line), a curved shape (red line), zero skewness and a symmetrical shape (blue line). In right banal of Figure 1 we can observe the different shapes of the PDF of the E-WD. These include a left-skewed shape (red line), a decreasing shape (green line), and a symmetrical shape (blue line and orange line). From Figure 1, we can see that the E-WD PDF is very flexible and therefore can be used to cover datasets with indicated, decreasing, right-skewed, left-skewed or symmetric behaviour. Figure 2 presents the CDF of the corresponding casses of Figure 1.

Figure 1.

Different PDF for the E-WD.

Figure 2.

Different CDF for the E-WD.

3. The Heavy-Tailed Characteristic

This section offers the heavy-tailed behavior and regular variational results of the E-WD. Probability distributions that are right-skewed and possess heavy-tailed behavior are very useful in providing the best description of the biomedical data sets. A probability model is called a heavy tailed distribution, if it satisfies for every p

Theorem 1.

, the probability distribution that given in Equation (5) is heavy tailed distribution as .

Proof.

Based on Equation (10), we can write that

□

An important property of the heavy-tailed probability distributions is called the regular variational property. This property implies that the tail of the distribution decays in a power-law fashion, with an exponent that determines how fast it decays. The larger the value of , the slower the decay of the tail. The regular variational property has important implications for many areas of science and engineering, including finance, telecommunications, and network science. It allows us to model extreme events and rare occurrences more accurately and to estimate their probabilities more reliably. Here, we derive the regular variational property of the E-WD. According to Karamata’s theorem (see, Seneta [19]), the E-WD in terms of SF is regularly varying, if it satisfies for every p

where represents an index of regular variation.

Theorem 2.

, non-zero and finite, the probability distribution that given in Equation (5) is regularly varying model.

4. Distributional Properties

Here we derive some distribution properties of the E-WD. These distribution properties include the quantile function, the rth moment, the moment generating function (MG-F), the characteristic function (C-F), and the identifiability property (I-P).

4.1. The Quantile Function

By inverting Equation (9), we get the form of the quantile function of the E-WD expressed as

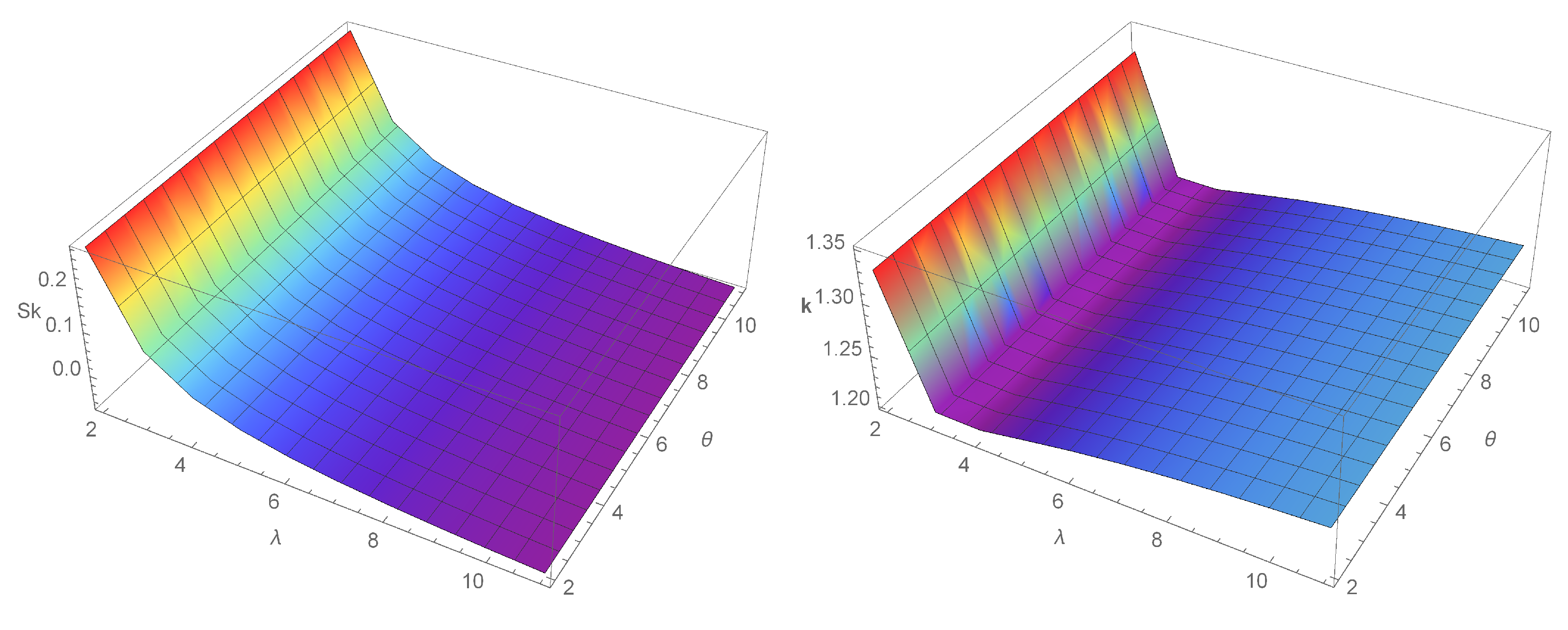

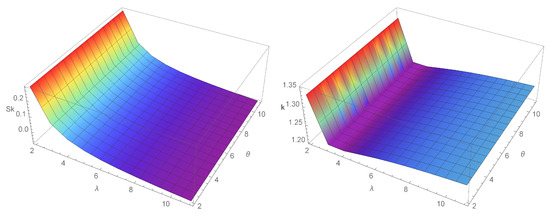

where . These quartiles can be used to derive further properties of the E-WD such as (i) skewness (see Bowley [20]) and (ii) kurtosis (See, Moor [21]). Figure 3 plots the skewness and kurtosis of the model . The skewness and kurtosis formulas are, respectively, given by

and,

Figure 3.

Plots for the skewness and kurtosis of E-WD.

4.2. The rth Moment

Suppose is a random vaiable follows the E-WD, then, its rth moment is obtained as

By using Maclaurin series expansion for , we can write

where

4.3. The MG-F

The MG-F of the E-WD is derived as

And by expanding , we can write

where is a gamma constant.

4.4. The C-F

The C-F is another useful approach for obtaining the basic moments of a probability model. Here, we can write

The C-F of the E-WD can take the form

4.5. The I-P

This subsection offers proof of the I-P of the E-WD for the parameters.

4.5.1. The I-P Using

Here, we provide complete proof of the IP of the E-WD for . Suppose and be the parameters of the E-WD with CDFs

respectively. The parameter of the E-WD is called identifiable, if . To prove the I-P of the E-WD for , we start with

4.5.2. The I-P Using

Let and be the parameters of the E-WD with CDFs

respectively. The parameter of the E-WD is called identifiable, if . To prove the I-P of the E-WD for a1, we start with

4.5.3. The IP Using

Let and be the parameters of the E-WD with CDFs

respectively. The parameter of the E-WD is called identifiable, if . To prove the I-P of the E-WD for a1, we start with

5. The Information Generating Measure

In addition to the moment generating function, information generating functions (IGF) have also been used in information theory, to generate some well-known information measures such as Shannon entropy and Kullback–Leibler divergence. For more details about the IGF and its extensions one may see López-Ruiz et al. [22].

5.1. The Information Generating Function

Let X∼, the information generating function , for any (see, Golomb [23]), is defined as

5.2. The Shannon Entropy (H)

The Shannon entropy, or Information entropy was introduced by Claude Shannon [24], and is defined as

H can obtain from as

5.3. The Informational Energy (IE)

The IE for any X∼, is given by

In particular, is simply IE when , and is given by

For some discussions on the usefulness and applications of the IE, see, Cataron and Andonie [25].

6. Maximum Likelihood Estimation (MLE)

Let are observed values of that is an ordered random sample from the E-WD. The E-WD likelihood is

and the corresponding log-likelihood function is

Taking the first partial derivatives of log-likelihood (39) with respect to and equating each to zero.

Solving Equation (42) for , we have

Solving Equations (40) and (41) after substituting Equation (43), we get the maximum likelihood estimators of the parameters.

The asymptotic confidence intervals of the parameters , and . Then is the observed variance covariance matrix, such that

A two-sided approximate confidence intervals for the parameters , and are then given by

and

respectively, where and are the estimated variances of , , and , which are given by the diagonal elements of , and is the upper percentile of the standard normal distribution.

Next, obtain the bootstrap confidence intervals for boot-p for the unknown parameters ), we apply the following algorithms

- 1.

- Generate sample of size n from the and estimate a .

- 2.

- Generate another sample of size n using . Then estimate .

- 3.

- Repeat step 2 B times.

- 4.

- Via , that is, the CDF of , the C.I. of is given bywhere and x is prefixed.

For more details about the bootstrap confidence intervals, one may refer to Kundu and Joarder [26].

7. Bayesian Estimation

Bayesian inference is a convenient method to be used with the complete samples from . We assume that , , and are random variables that follow the prior PDFs Gamma, Gamma, and Gamma, respectively, are given by

and

Then, the posterior density of and the data is given by

where J is the normalizing constant.

MCMC Method

We use Metropolis Hastings procedure as:

- Set start values , , and . Then, simulate sample of size n from E-WD , next set .

- Simulate and . using the proposal distributions , , and .

- Calculate .

- Simulate U from Uniform(0, 1).

- If , then .If , then .

- Set .

- Iterate Steps 2–6, M repetitions, and get and for .

Suppose the squared error loss function, given by By using the generated random samples from the M-H technique and for N is the nburn. Then, the Bayes estimator of against the squared error loss function, is given by

Next, suppose the LINEX () loss function, given by

The approximate Bayes estimate of under loss function, is given by

Finally, suppose the general entropy () loss function, given by

The approximate Bayes estimate of the parameters, given by

MCMC HPD credible interval Algorithm:

- Arrange and in rising values.

- The lower bounds of and is in the rank .

- The Upper bounds of and is in the rank .

- Iterate the previous steps M times. Get the average value of the lower and upper bounds of and .

8. Simulation Study

In this section, we show the usefulness of the theatrical findings in this paper by conducting series of simulation experiments. The simulations show the bias and estimated risk of bayesian and the maximum likelihood estimates. The biases and ERs are given, respectively, by

and

Coverage probabilities (CPs) are also calculated at the 95% and 90% HPD credible intervals. Point and Interval estimation of the parameters , , and for n = 25, 50, and 100 are presented in Table 1. Table 2 represents the simulation results for the parameters , and , respectively for n = 200, 300, and 400. The bayesian estimate are calculated based on GE, LINEX and SE loss functions. In addition, 95% and 90% the confidence, Bootstrap and HPD credible intervals are calculated with the corresponding width. The simulation experiments can be explained though the following steps:

Table 1.

Point and Interval estimation of the parameters , , and for n = 25, 50 and 100.

Table 2.

Point and Interval estimation of the parameters and for n = 200, 300 and 400.

- We generate sample of sizes n = 25, 50, 100, 200, 300, 400 from the via initial parameter values are and .

- Again use each of the cases in step (1) for calculating the Bayesian estimates for both cases of GE, LINEX and SE loss functions. The parameter in LINEX is chosen as −3 and 7. The parameter in general entropy is chosen as 0.5.

- For the Bayesian analysis, we take random values for the hyper-parameters as ∼.

- The steeps (1)–(3) are repeated M = 10,000 times, then the estimate, bias and estimated risk (ER) in each cases are calculated in Table 1 for n = 25, 50, and 100 and in Table 2 for n = 200, 300, and 400. Obtain the point Estimation of the parameter and using MLE and MCMC methods (with 10,000 repetitions and zero burns).

- The and approximate confidence, bootstrap HPD credible intervals with their width are calculated.

- The bais and ER shows that the Bayesian approach gives better estimates. Also, in most cases the Bayesain estimate based Linex with positive shows good performance.

- In most cases the estimation of and in over estimated, while in some cases it is under estimated.

- In most cases the estimation of in under estimated, while in some cases it is over estimated.

- The interval length increases as the confidence level increases as expected.

9. Application of the E-WD to the Stock Price Data

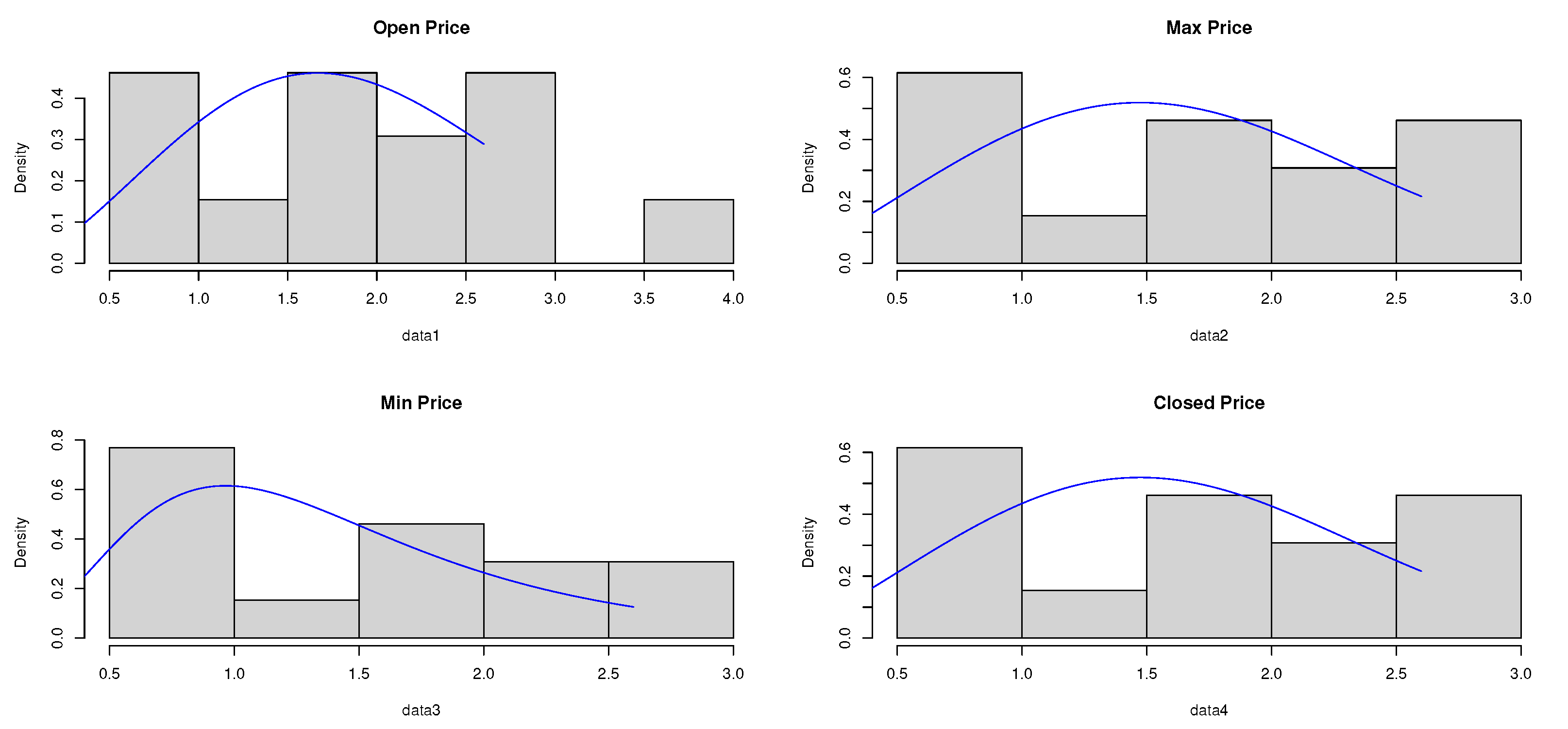

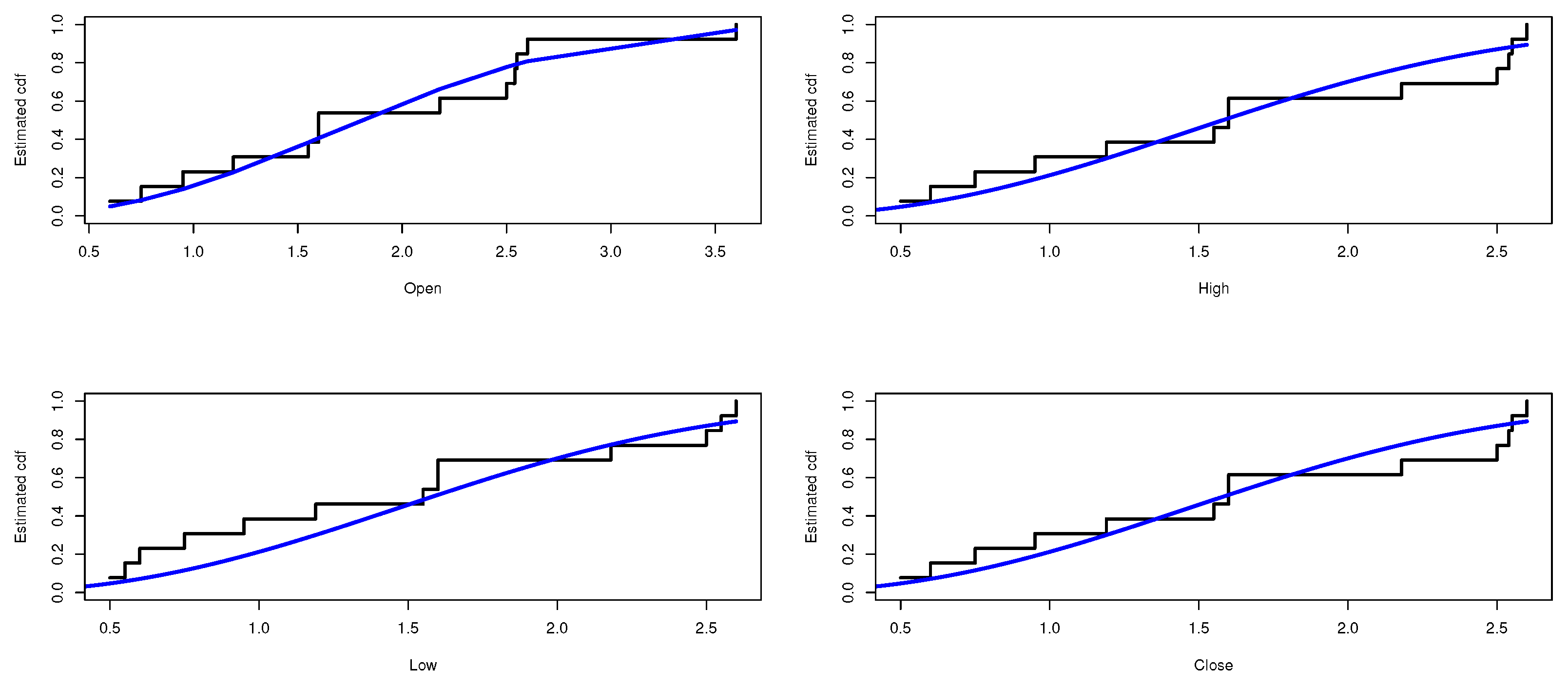

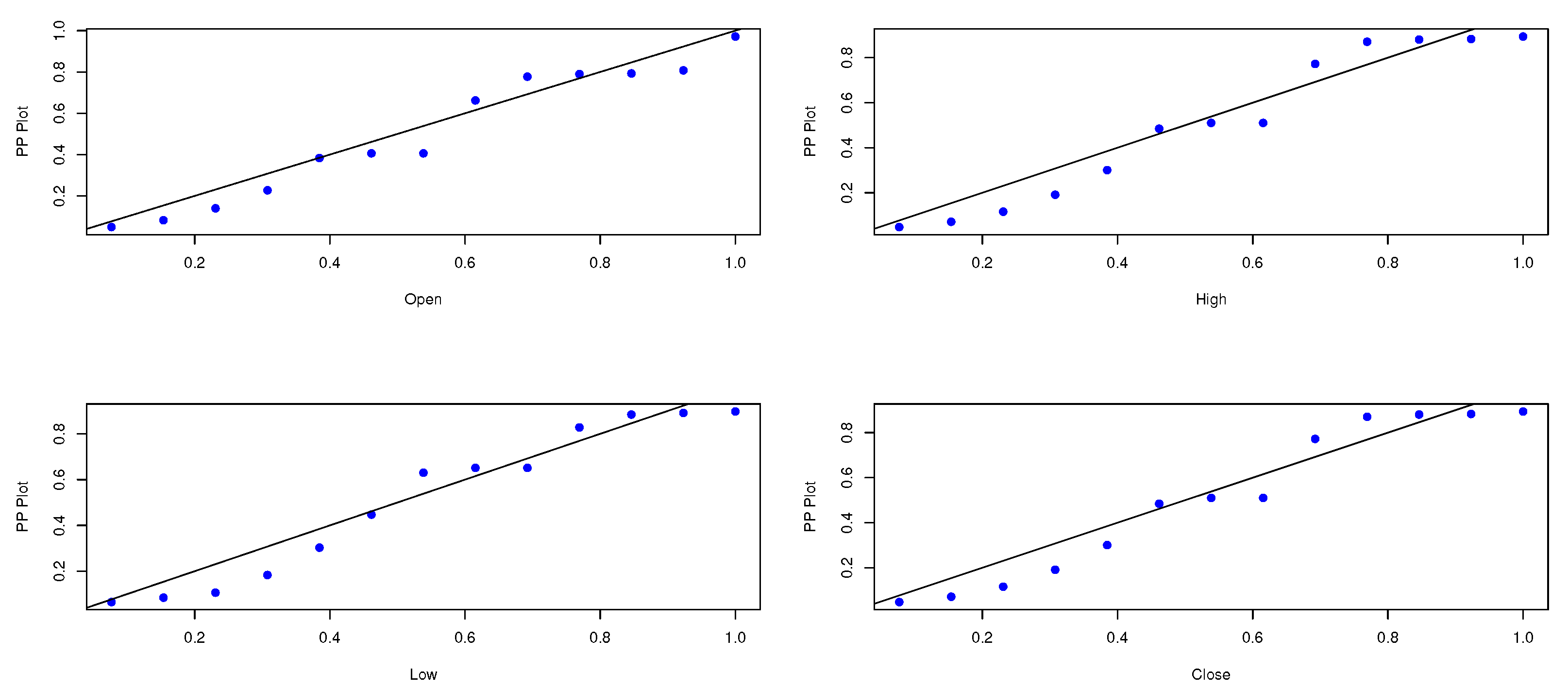

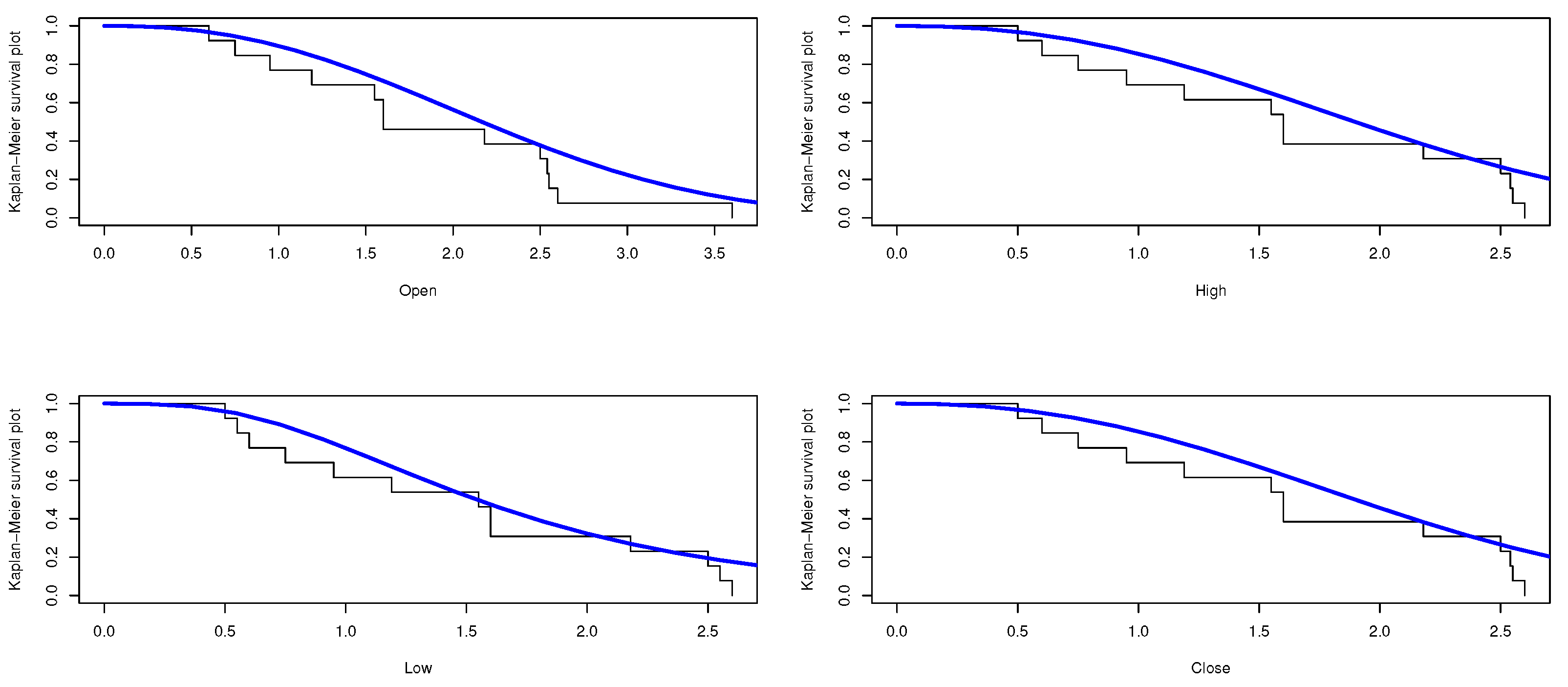

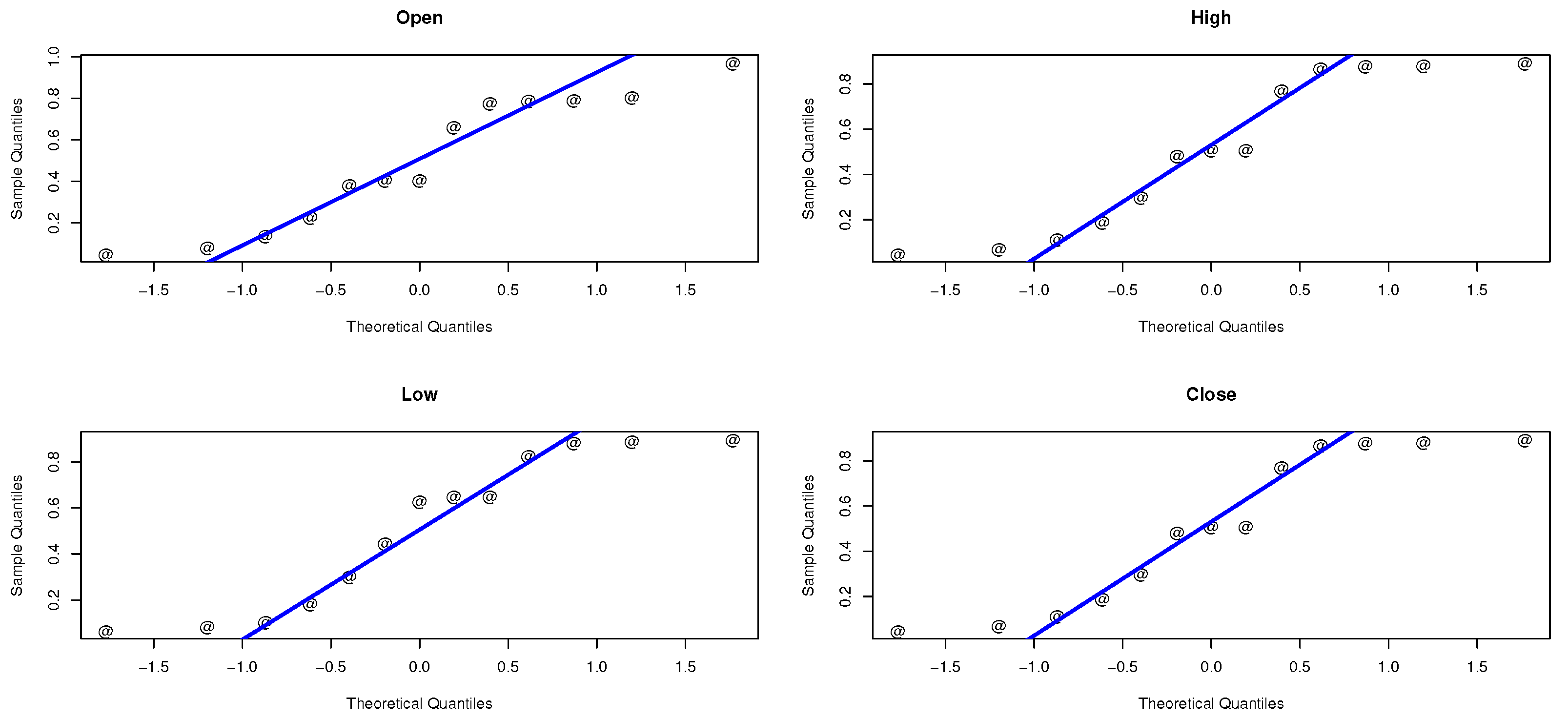

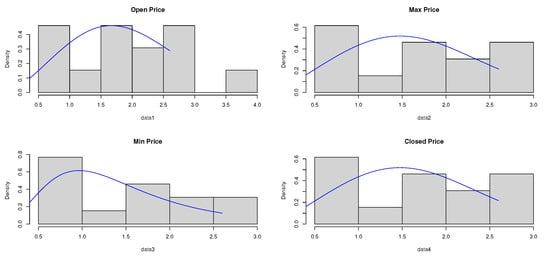

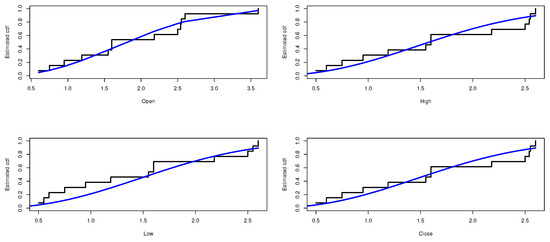

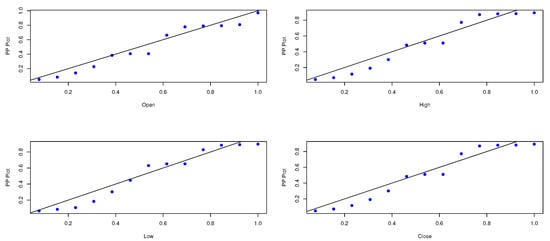

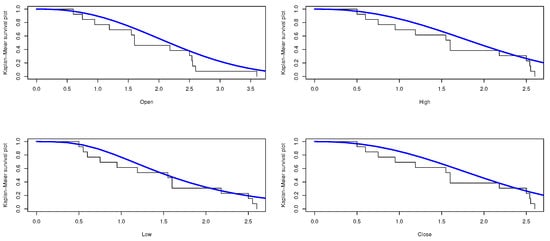

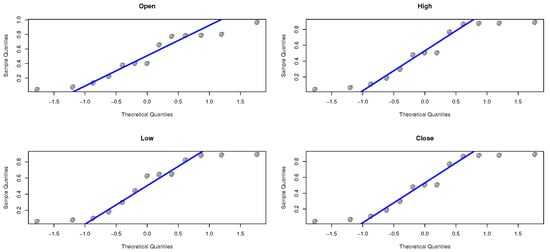

In this section, we apply the composite distribution E-WD to Sarhad stock exchange market transactions data for four variables especially: the open price, the high price, the low price, and the close price. Table 3 shows the descriptive statistics of the proposed stock price data. The data is analyzed and the maximum likelihood and the bayesian estimate results for the parameters and , respectively, are obtained. Table 4, Table 5, Table 6 and Table 7 represent the estimate result for the opening price, the high price, the low price, and the Closing price, respectively. The stimated PDF and stimated PDF of the proposed data based on E-WD are ploted in Figure 4 and Figure 5, respectively. The PP plot are shown in Figure 6. The Kaplan–Meier survival function the Q-Q normality plot are shown in Figure 7 and Figure 8, respectively.

Table 3.

Descriptive statistics of the stock data.

Table 4.

The estimation of the parameters , , and for the open price.

Table 5.

The estimation of the parameters , , and for the high price.

Table 6.

The estimation of the parameters , , and for the low price.

Table 7.

The estimation of the parameters , , and for the close price.

Figure 4.

The estimated PDF of E-WD for the stock data.

Figure 5.

The estimated CDF of E-WD for the stock data.

Figure 6.

The PP plot of the E-WD.

Figure 7.

The Kaplan–Meier survival function of the E-WD.

Figure 8.

The Q-Q normality plot of the E-WD.

The goodness-of-fit results of the E-WD model are compared with some other models, including the Mudholkar exponintiated Weibull distribution [27] (MEWD), the generalized Weibull Modified Weibull distribution (GWMWD), the generalized Weibull-Rayleigh distribution (GWRD), the exponentiated distribution (EXP-CD). The CDF of the competing probability models are, respectively, given by

and

Table 8 compare the E-WD via some recognition criterion, such as The: Akaike information criterion (AIC), Bayesian information criterion (BIC), Hannan–Quinn information criterion (HQIC) and consistent Akaike information Criterion (CAIC). Table 9 compares the E-WD based on one-sample Kolmogorov-Smirnov test.

Table 8.

Relative quality of the E-WD vs. competing models.

Table 9.

One-sample Kolmogorov-Smirnov test for the E-WD and the competing models.

10. Conclusions

Financial markets play basic role through financial operations, from issuing securities and offering them to investors to making them available for trading. The name of a share is derived from the concept of participation, because the share represents a certain part, a share or a piece of the capital of a listed company, and its owner is considered a shareholder of this company. Shares, for example—These are usually tradable through the trading methods prescribed in the money market regulations. In this study, we introduce a new three-parameter modification of the Weibull model, called the exponentiated Weibull distribution. We proofed that, the new model has many statistical advantages, the flexibility, the heavy-tailed behavior and the regular variation property were offered. We presented many of the important statistical functions including the quantile function, rth-moment, moment generating function, characteristic function, identifiability property, the information generating function, the Shannon entropy and the information energy have been derived in closed forms. The distribution parameters are estimated using the maximum likelihood approach and Bayesian estimation. The squared error loss function, the LINEX loss function, and the general entropy loss function are used for the Bayesian procedure. The simulation result shows that the Bayesian approach gives better estimates and specially Linex loss function with positive constant shows good performance. and interval estimate of each parameter and the corresponding width are obtained. The interval length increases as the confidence level increases as expected. We apply the new composite exponentiated Weibull distribution to the real stock exchange transaction data over four variables, the opening price, the high price, the low price, and the closing price. The goodness of fit results are compared with some other models. The comparisons are made using the Kolmogorov-Smirnov test for one sample and some recognition criterion, such as, the Akaike information criterion, Bayesian information criterion, Hannan-Quinn information criterion and consistent Akaike information criterion. The results indicate that the proposed model provides better fits than other competing models and could be chosen as an adequate model.

Author Contributions

Data curation, W.E.; Funding acquisition, Y.T.; Investigation, W.E.; Methodology, W.E.; Resources, W.E.; Supervision, W.E.; Writing—review & editing, Y.T. All authors have read and agreed to the published version of the manuscript.

Funding

The study was funded by Researchers Supporting Project number (RSP2023R488), King Saud University, Riyadh, Saudi Arabia.

Data Availability Statement

Data available on request.

Conflicts of Interest

The authors declare that they have no conflict of interest.

References

- Nadarajah, S.; Kot, S. The beta Gumbel distribution. Math. Probab. Eng. 2002, 10, 323–332. [Google Scholar] [CrossRef]

- Lingji, K.; Catl, L.; Sepanski, J.H. On the Properties of beta–gamma Distribution. J. Mod. Appl. Stat. Methods 2007, 6, 187–211. [Google Scholar]

- Akinsete, A.; Famoy, F.; Lee, C. The beta–pareto distribution. Statistics 2009, 42, 547–563. [Google Scholar] [CrossRef]

- Barreto-Souza, W.; Santos, A.H.S.; Cordeiro, G.M. The beta generalized exponential distribution. Statistics 2009, 42, 547–563. [Google Scholar] [CrossRef]

- Paranaiba, P.F.; Ortega, M.M.E.; Cordeiro, G.M.; Pescim, R.R. The beta Burr XII distribution with application to lifetime data. Comput. Stat. Data Anal. 2010, 55, 1118–1136. [Google Scholar] [CrossRef]

- Cordeiro, G.M.; Lemonte, A.J. The beta-half-Cauchy Distribution. J. Probab. Stat. 2011, 2011, 904705. [Google Scholar] [CrossRef]

- AL-Kadim, k.A.; Boshi, M.A. Exponential-Pareto Distribution. Math. Theory Model. 2013, 3, 135–146. [Google Scholar]

- Gupta, R.D.; Kundu, D. Generalized Exponential Distribution: Different method of estimation. J. Stat. Simul. 2000, 30, 315–338. [Google Scholar] [CrossRef]

- Nasiri, P. Estimation of Parameters of Generalized Exponential Distribution in Person of Outlier. 2006. Available online: http://www.m-hikari.com/ams/ams-2010/ams-45-48-2010/nasiriAMS45-48-2010.pdf (accessed on 13 March 2023).

- Martinez, E.Z.; Achcar, J.A.; Jacome, A.A.A.; Santos, J.S. Mixture and non-mixture cure fraction models based on the generalized modified Weibull distribution with an application to gastric cancer data. Comput. Methods Programs Biomed. 2013, 112, 343–355. [Google Scholar] [CrossRef]

- Carl, L.; Felix, F.; Olugbenga, O. Beta-Weibull Distribution: Some Properties and Applications to Censored Data. J. Mod. Appl. Stat. Methods 2007, 6, 173–186. [Google Scholar]

- Tahir, H.; Cordeiro, G.M.; Ayman, A.; Mansoor, M.; Zubair, M. A New Weibull–Pareto Distribution: Properties and Applications. Commun. Stat. Simul. Comput. 2011, 45, 3548–3567. [Google Scholar] [CrossRef]

- Emam, W. On Statistical Modeling Using a New Version of the Flexible Weibull Model: Bayesian, Maximum Likelihood Estimates, and Distributional Properties with Applications in the Actuarial and Engineering Fields. Symmetry 2023, 15, 560. [Google Scholar] [CrossRef]

- Emam, W.; Tashkandy, Y. The Arcsine Kumaraswamy-Generalized Family: MLE and Classical Estimates and Application. Symmetry 2022, 14, 2311. [Google Scholar] [CrossRef]

- Emam, W.; Tashkandy, Y. The Weibull Claim Model: Bivariate Extension, Bayesian, and Maximum Likelihood Estimations. Math. Probl. Eng. 2022, 2022, 8729529. [Google Scholar] [CrossRef]

- Emam, W.; Tashkandy, Y. Modeling the Amount of Carbon Dioxide Emissions Application: New Modified Alpha Power Weibull-X Family of Distributions. Symmetry 2023, 15, 366. [Google Scholar] [CrossRef]

- Emam, W.; Tashkandy, Y. A New Generalized Modified Weibull Model: Simulating and Modeling the Dynamics of the COVID-19 Pandemic in Saudi Arabia and Egypt. Math. Probl. Eng. 2022, 2022, 1947098. [Google Scholar] [CrossRef]

- Emam, W.; Tashkandy, Y. Khalil New Generalized Weibull Distribution Based on Ranked Samples: Estimation, Mathematical Properties, and Application to COVID-19 Data. Symmetry 2022, 14, 853. [Google Scholar] [CrossRef]

- Seneta, E. Karamata’s characterization theorem, feller and regular variation in probability theory. Publ. Inst. Math. 2002, 71, 79–89. [Google Scholar] [CrossRef]

- Bowley, A.L. Elements of Statistics, 4th ed.; Charles Scribner’s Sons: New York, NY, USA, 1920. [Google Scholar]

- Moors, J.J.A. The meaning of kurtosis: Darlington re-examined. Am. Stat. 1986, 40, 283–284. [Google Scholar]

- López-Ruiz, R.; Mancini, H.L.; Calbet, X. A statistical measure of complexity. Phys. Lett. 1995, 209, 321–326. [Google Scholar] [CrossRef]

- Golomb, S. The IGF of a probability distribution. IEEE Trans. Inf. Theory 1966, 12, 75–77. [Google Scholar] [CrossRef]

- Shannon, C. A Mathematical Theory of Communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Cataron, A.; Andonie, R. How To Infer The Informational Energy from Small Datasets. In Proceedings of the 2012 13th International Conference on Optimization of Electrical and Electronic Equipment (OPTIM), Brasov, Romania, 24–26 May 2012; IEEE: Piscatawaj, NJ, USA, 2012; pp. 1065–1070. [Google Scholar]

- Kundu, D.; Joarder, A. Analysis of Type-II progressively hybrid censored data. Comput. Stat. Data Anal. 2006, 50, 2509–2528. [Google Scholar] [CrossRef]

- Mudholkar, G.S.; Srivastava, D.K. Exponentiated Weibull family for analyzing bathtub failure-rate data. IEEE Trans. Reliab. 1993, 42, 299–302. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).