Abstract

By analyzing all types of risks in the investment process of a municipal railroad construction project, 16 investment risk factors are extracted, and a network of investment risk factors and a comprehensive impact matrix of the project are constructed by comprehensively applying social network analysis (SNA) and the decision-making test and evaluation laboratory (DEMATEL) method. By analyzing the point centrality, proximity centrality and intermediate centrality of the SNA network, core risk factors such as insufficient operation and management level (degree centrality: 51.111) and cost overruns (in-closeness centrality: 93.75) are identified; through the correlation strength analysis of risk factors via the DEMATEL method, “policy–approval–schedule–cost” is clearly identified. Moreover, through the DEMATEL method, correlation intensity analysis between risk factors was clarified, and six key risk transmission paths were identified, such as “policy–approval–duration–cost”, “market–cost–operation”, etc., among which the cumulative impact coefficient of the “market–cost–operation” path reached 0.664. According to the results of the analysis of core risk factors and key risk transmission paths, targeted investment risk response proposals for municipal railroad construction projects are put forward with regard to four aspects: strengthening the control of core driving factors, curbing the deterioration of key results factors, blocking the risk of intermediate conduction factors, and resisting the impact of marginal risk factors.

1. Introductory

As a key component of urban transportation systems, municipal railroads are greatly significant in promoting urban development. In the “on the promotion of municipal (suburban) railroad development of the guiding opinions” and other policies, measures have been implemented to increase construction efforts. However, the scale of city railroad construction investment is huge, often costing billions or even tens of billions of yuan, and construction has a long investment cycle, with the process from planning to completion of the operation taking several years or sometimes more than ten years. For a municipal railroad project with a total cost of 15 billion yuan, the construction cycle takes up to 8 years. Such a large-scale and long investment project faces many risk factors.

At the policy level, changes in national and local policies have a significant impact on investment in municipal railroad construction. Changes in policy orientation may cause project planning to be readjusted, thereby delaying the construction process and increasing investment costs. At the same time, the complexity and uncertainty of the approval process may lead to the extension of both the project’s pre-preparation time and the capital recovery cycle. At the economic level, fluctuations in the macroeconomic environment, such as changes in interest rates and exchange rates, will directly affect the cost of project financing. When interest rates rise, interest-related expenses on loans increase, and the financial pressure on the project increases. In addition, the instability of raw material prices, such as sharp fluctuations in the prices of steel and cement, can make it difficult to effectively control construction costs.

There are also many risk factors at the social level. In the process of land acquisition and relocation, it is difficult to coordinate the interests of the residents, and disputes over compensation standards and the resettlement of residents may cause social conflicts and hinder the project. Moreover, the noise, dust, and other environmental pollution problems generated during the construction of a project, if not handled properly, can easily lead to dissatisfaction among surrounding residents, obstructing construction. Furthermore, the construction of municipal railroads has high technical requirements, and if technical problems encountered during the construction process, such as construction technical problems caused by complex geological conditions, cannot be overcome in time, they will not only delay the construction period but also increase the cost of additional technical research and development and processing.

Globally, different countries have optimized their municipal railway systems through differentiated development strategies, providing valuable references for China. Japan has established a full-life-cycle risk pre-control mechanism for high-speed railway construction, integrating geological risk assessment and environmental impact evaluation into the early project planning stage; by accurately identifying risks such as earthquakes and geological subsidence, targeted prevention and control measures have been developed, and the risk management experience of its Shinkansen projects has been promoted in multiple cities []. Germany has adopted a “Public–Private Partnership (PPP) + Regional Coordination” model to balance investment and operational efficiency; through joint participation of the government and social capital in project design, construction, and operation, risk-sharing ratios are clearly defined, effectively reducing the risk of cost overruns, and the Berlin–Hamburg suburban railway project achieved a 12% increase in investment return rate through this model []. The United States has built a dynamic cost risk supervision system, relying on big data platforms to monitor real-time price fluctuations of key materials (e.g., steel, cement) and dynamically adjust project budgets in conjunction with federal and state policy changes, and the New York Metropolitan Railway Expansion Project controlled cost deviations within 5% using this system [].

China’s railway development process runs through the country’s modernization drive, and its evolutionary trajectory highlights the core value of municipal railroads in urban development. In 1881, China’s first independently constructed railway, the Tangshan–Xugezhuang Railway, was opened to traffic, marking the beginning of the exploration of railway transportation []; after the founding of the People’s Republic of China, the “First Five-Year Plan” focused on promoting railway construction, with the completion of trunk lines such as the Yingtan–Xiamen Railway and the Baoji–Chengdu Railway, laying the foundation for the national railway network []. Since the reform and opening-up, railway construction has entered a period of acceleration. In 1994, the Guangzhou–Shenzhen Railway took the lead in realizing quasi-high-speed operation with a speed of 160 km/h, and the opening of the Beijing–Tianjin Intercity Railway in 2008 marked China’s entry into the high-speed rail era [].

Entering the 21st century, municipal railroads (municipal/suburban railroads) have become a key driver for urban transportation upgrading: following the issuance of the Guiding Opinions on Promoting the Development of Municipal (Suburban) Railroads in 2017, cities such as Beijing, Shanghai, and Guangzhou took the lead in layout, and projects including the Beijing Daxing Airport Line and the Shanghai Jiamin Line were successively completed, effectively alleviating the commuting pressure between central urban areas and suburbs []. By 2024, the total length of completed municipal railroads nationwide has exceeded 2000 km, with the planned mileage exceeding 5000 km [].

The significance of this development process lies in: municipal railroads are not only transportation infrastructure but also the core link driving “metropolitan area integration”—by shortening the spatial-temporal distance, they promote the redistribution of population and industries to the suburbs, while driving economic development in areas along the routes []. However, with the expansion of construction scale, investment risks have become increasingly prominent (for example, a municipal railroad project in Beijing experienced a 23% cost overrun due to geological risks, and a project in Shanghai encountered an 18-month delay in the construction period due to approval delays) [,], which further confirms the necessity and practical value of conducting risk analysis in this study.

The main objective of this study is to construct a systematic investment risk analysis framework for municipal railway construction projects based on an improved SNA-DEMATEL integrated methodology, clarify the hierarchical structure and transmission logic of risk factors, and provide comprehensive scientific support for refined risk management. The specific objectives include four aspects: first, to systematically screen and confirm 16 key investment risk factors covering policy, market, construction, operation, and environmental dimensions through literature research and expert validation; second, to quantify the centrality indicators (degree centrality, closeness centrality, betweenness centrality) of each risk factor and classify them into four categories: core driving factors, intermediate transmission factors, key outcome factors, and marginal factors; third, to explore the key risk transmission paths and their impact intensities, and clarify the cumulative impact coefficients of the core paths; fourth, to propose targeted and operable risk response strategies based on the identified core factors and key paths to provide practical guidance for project risk management practice.

2. Literature Review

2.1. Analysis of Municipal Railway Construction

Huang W proposed an integrated model for train schedule and vehicle turnover planning for suburban railroads based on the Periodic Event Scheduling Problem (PESP), which significantly improved operational efficiency and passenger satisfaction by considering overtaking possibilities and flexible vehicle connections []. Li F suggested integrating urban space, promoting resource circulation and industrial differentiation through the construction of municipal (suburban) railroads to solve the spatial synergy problems faced by Beijing during non-capital function dissolution and quantity reduction and quality enhancement, safeguarding the city’s sustained and rapid development and providing a model for other cities []. Tong C emphasized that the differences between urban railroad and urban rail transit train control systems are a key factor affecting their smooth integration, so selecting an appropriate urban railroad train control system is important to ensure interconnection with the rail transit system []. Zhou Q emphasizes that the “love-hate” attitude of the residents along a line towards the station setting and environmental pollution in the process of urban railroad construction makes project implementation face complex social risks, putting forward targeted preventive solutions to promote the project’s smooth advancement []. Yang Y suggests that the zonal train operation mode based on “many-to-many” stops can effectively meet the demand of commuters for long-distance and concentrated trips, but the high passenger flow will cause the number of zones to be limited by the maximum capacity of the railroad line, resulting in a relative decline in operational efficiency [].

Wang H et al. constructed a “express-local trains + cross-line” combined operation mode for municipal railways and verified through model solution that the optimal scheme can reduce the total travel time of all passengers by 5.2% []. This study complements the deficiency of single operation mode research in existing literature, and its core advantage lies in balancing the efficiency of long-distance passengers and the accessibility of short-distance passengers. Compared with the zonal operation mode proposed by Yang Y, which is limited by line capacity, the combined mode has stronger adaptability to complex passenger flow structures, especially suitable for municipal railways with mixed commuting and intercity travel demands []. Xu X et al. took channel resource sharing as the core, constructed an operation scheme optimization model with the lowest passenger travel time cost and enterprise cost as dual objectives, and verified its feasibility through case analysis []. This research expands the optimization dimension of municipal railway network operation, and its emphasis on the balance between passenger and enterprise interests supplements the research perspective of Wang H et al., which focuses more on passenger travel efficiency, providing a more comprehensive decision-making basis for networked operation of multi-level rail transit []. Zhang K et al. proposed a tunnel structure crack detection method based on supervised learning, which realizes accurate extraction of crack edges by constructing geometric feature vectors of edge targets []. Compared with traditional manual inspection and simple image processing methods, this technology significantly improves the detection accuracy and efficiency, and its application in municipal railway tunnels effectively makes up for the technical gap in real-time safety monitoring of tunnel structures, providing technical support for the safe operation of municipal railways. Minqing Z et al. developed a TBM construction information monitoring system for railway tunnels, which integrates business, data, and technical architectures, and adds key functions such as risk early warning and data analysis that are lacking in traditional monitoring systems []. Taking the Gaoligong Mountain Tunnel as an example, the system has been verified to effectively reduce construction risks and improve the efficiency of information transmission, which is of great significance for solving the problems of complex structure and harsh working environment of TBM in municipal railway construction. Zhou F et al. aimed at the uncertainty and complexity of municipal railway tunnel construction risk factors, proposed a risk assessment method combining intelligent optimization algorithm and machine learning algorithm []. This method overcomes the limitation that traditional risk assessment methods are difficult to accurately quantify complex risks, and its effectiveness has been verified through Hangzhou tunnel projects, which provides a new technical path for improving the accuracy of tunnel construction risk evaluation. Li J et al. established an energy consumption and carbon emission analysis model for railway construction through a “top-down” approach and found that tunnel construction accounts for about 80% of the total energy consumption and carbon emissions in railway construction []. This research clarifies the key links of energy conservation and emission reduction in municipal railway construction, and its proposed strategies such as improving the efficiency of electrical equipment and reducing the use of diesel equipment provide important practical guidance for the green development of the industry.

2.2. PPP Project Investment Risk Analysis

Sun H proposed that based on the construction and validation of the Bayesian network model, the key risk sources of PPP projects are identified as project factors and government factors, among which the risk of underutilization and the risk of construction costs over-running significantly impact the investment return, thus providing an effective analytical tool for the risk management of PPP projects []. Song P proposed that constructing a multi-attribute group decision-making model by introducing a risk aversion strategy could effectively incorporate the risk aversion behaviors of decision makers in venture capital groups, thus providing a scientific and robust decision-making machine for selecting venture capital projects []. Wu Y proposed that by constructing a hierarchical model of risk factors and a risk derivation model during the decision-making stage of large-scale government projects, key risks can be identified and risk control principles based on feedback characteristics can be formulated, thus providing theoretical support to help managers to reasonably prevent and control risks []. Zhu C. proposed that by establishing an investment decision model for a comprehensive pipeline corridor PPP project and using Monte Carlo simulation, the significant impacts of key risk factors on the internal rate of return of a project were revealed, thus providing a scientific basis for social capitalists to make investment decisions under different risk conditions []. Biancardi M proposed that the mathematical model established by combining game theory and the real option method can effectively assess the risk posed by public/private partnership (PPP) projects and provide theoretical support to help managers to reasonably prevent risks []. A mathematical model can effectively assess the risk-sharing mechanism for public/private partnership (PPP) projects, thus reducing opportunistic behaviors triggered by mechanisms such as guaranteed minimum return or return cap. In the investment risk model constructed through the system dynamics approach revealed that the government subsidy risk subsystem has the most significant impact on the investment risk of social capital (IRSC), whereas the design risk and contract risk are the key boundary risks for preventing and controlling the IRSC, and this finding helps social capitalists to effectively reduce investment risk, thus attracting more social capital into urban rail transit projects and promoting the sustainable development of urban infrastructure [].

Weiwei H constructed a PPP project risk evaluation model using the fuzzy analytic hierarchy process (FAHP) with the help of the Delphi method and took the Mengcheng County Domestic Waste Incineration Power Plant as an example to build a multi-level risk evaluation system []. This study enriches the application scenarios of FAHP in PPP project risk assessment, and its emphasis on expert opinion integration provides a reference for solving the problem of subjective bias in risk factor weighting. Weng X et al. identified key risk factors of transportation infrastructure PPP projects through empirical research and expert interviews and established a risk assessment indicator system optimized by PCA and CRITIC-EWM methods []. Compared with the traditional indicator system construction method, this study improves the scientificity and operability of the system through quantitative analysis, and its verification results based on structural equation modeling provides a reliable tool for risk assessment of transportation infrastructure PPP projects. Li X took the Hangzhou–Taizhou High-speed Railway PPP project as a case, analyzed the limitations of single financial indicators in investment decision-making, and proposed a comprehensive multi-indicator collaborative analysis method []. This research fills the gap of case studies on railway PPP project investment decision-making, and its research results provide practical experience for private investors to participate in large-scale railway PPP projects. Kumar L et al. applied the NPV-at-risk model supported by Monte Carlo simulation to Indian highway PPP projects, identified critical financial risks such as traffic flow and project cost, and proposed corresponding mitigation strategies []. This study provides a standard risk analysis framework for infrastructure PPP projects in developing countries, and its research perspective on financial risk assessment complements the research on risk factors of domestic PPP projects, providing a reference for cross-regional risk management. Zhai Y et al. proposed a PPP project investment risk assessment method based on QPSO-LSSVM, which optimizes the parameters of the least squares support vector machine through quantum-behaved particle swarm optimization. Compared with traditional PSO-SVM and backpropagation neural network methods [], this method has higher assessment accuracy and efficiency, and its verification through 40 PPP projects in Hubei and Zhejiang provinces proves its applicability in practical scenarios, providing a new technical means for improving the precision of PPP project risk assessment. Geng L et al. constructed a continuous real option model to explore the impact of completion risk and project profitability on the investment decisions of the private sector in PPP projects. The study found that debt capital can reduce the investment boundary of the private sector, and the optimal debt level is related to tax rate and default loss rate []. This research deepens the understanding of the impact mechanism of financial factors on private sector investment decisions, and its conclusions provide important policy implications for the government to attract social capital participation in PPP projects.

2.3. Review of the Study

This study has achieved some success in municipal railroad construction and PPP project investment risk analysis. In studying municipal railroad construction, it covers many key aspects of project construction. Some scholars focus on technical convergence and operational management issues, which provide ideas for improving the operational efficiency and service quality of municipal railroads, while others pay attention to social impact and risk prevention, which help to promote the smooth implementation of a project. For the investment risk analysis of PPP projects, there are various research methods, including the Bayesian network model, the multi-attribute group decision-making model, etc., which identify key risk factors from different perspectives and provide effective approaches for risk management and decision-making.

However, some problems with existing research remain. Existing studies have achieved certain results in municipal railway construction and PPP project investment risk analysis, but limitations remain: In terms of research on the construction of municipal railroads, although macro roles, technology, and operation have been explored, there is a lack of systematic integration, with the studies failing to form a comprehensive and unified theoretical framework. Research on municipal railway construction lacks systematic integration and has not formed a unified theoretical framework. Insufficient research on the commonalities and differences between different cities in the construction of municipal railroads has limited the universality of the research results. Insufficient research on the commonalities and differences in construction across different cities limits the universality of results []. In terms of the investment risk analysis of PPP projects, most studies focus on individual projects or specific industries, and they lack systematic comparison and comprehensive analysis of the risks of different types of PPP projects. Investment risk analysis of PPP projects mostly focuses on single projects or specific industries, lacking systematic comparison of risks across different types of projects. Moreover, the existing studies are mainly based on static analysis, and there are fewer studies assessing the dynamic changes in risks across the whole life cycle of a project, making it difficult to meet the dynamic needs of actual international project risk management. Most studies adopt static analysis, with few studies on dynamic risk assessment throughout the project life cycle []. Future research should consider strengthening the systematicity and universality of research on the construction of municipal railroads, as well as deepening the dynamic analysis of the investment risk of PPP projects to better serve the actual projects.

Traditional risk analysis methods have certain limitations in dealing with the investment risk of municipal railroad construction projects. Traditional risk analysis methods have limitations: Although the Bayesian network model can determine the impacts of individual risk factors on the project, it is difficult to comprehensively consider the interaction of multiple factors; Bayesian network models struggle to comprehensively consider the interaction of multiple factors, although the multi-attribute group decision-making model can simulate random changes in multiple risk factors, it has high data requirements and complex model construction. While multi-attribute group decision-making models have high data requirements and complex construction []. Social network analysis (SNA) has a unique advantage in studying the relationship between elements in complex systems, as it can visualize the correlation structure between risk factors. Although SNA has unique advantages in studying relationships between elements in complex systems. However, when dealing with the investment risk of municipal railroad construction projects, traditional SNA has problems such as not reflecting the dynamic changes in risk factors in a timely manner and the network structure metrics not being comprehensive enough. Traditional SNA has shortcomings in municipal railway investment risk analysis, such as delayed reflection of dynamic risk changes and incomplete network structure indicators []. Therefore, it is necessary to improve SNA to reflect the dynamic changes in risk factors in a timelier manner and improve the network structure metrics to analyze the investment risks of urban railroad construction projects more accurately and efficiently, as well as to provide more powerful support for project decision-making and risk management. Therefore, this study improves the SNA method by optimizing centrality calculation indicators to enhance the ability to capture dynamic risk changes and combining it with the DEMATEL method to improve the accuracy of risk analysis.

3. Methods

3.1. Data Sources and Processing

Data were collected using literature research and expert questionnaires.

3.1.1. Literature Research

By reviewing 10 highly cited studies, 20 initial risk factors were identified, and 16 core factors with an occurrence frequency > 3 were selected to construct the indicator system.

3.1.2. Expert Questionnaire

A 0–4 scoring scale was adopted (0 = no impact, 1 = minimal impact, 2 = moderate impact, 3 = significant impact, 4 = strong impact). Forty experts with ≥10 years of experience in municipal railway projects (covering university scholars, enterprise practitioners, and research institution staff) were invited to participate. A total of 35 valid questionnaires were recovered, with an effective recovery rate of 87.5%.

3.2. Research Tools and Methods

3.2.1. Statistical Tools

SPSS 26.0: Used for questionnaire reliability test (Cronbach’s α = 0.87) and consistency test (Kendall’s W = 0.76).

Ucinet 6.0: Applied for SNA network construction, visualization, and centrality indicator calculation.

MATLAB R2023a: Utilized for DEMATEL matrix normalization and impact coefficient analysis.

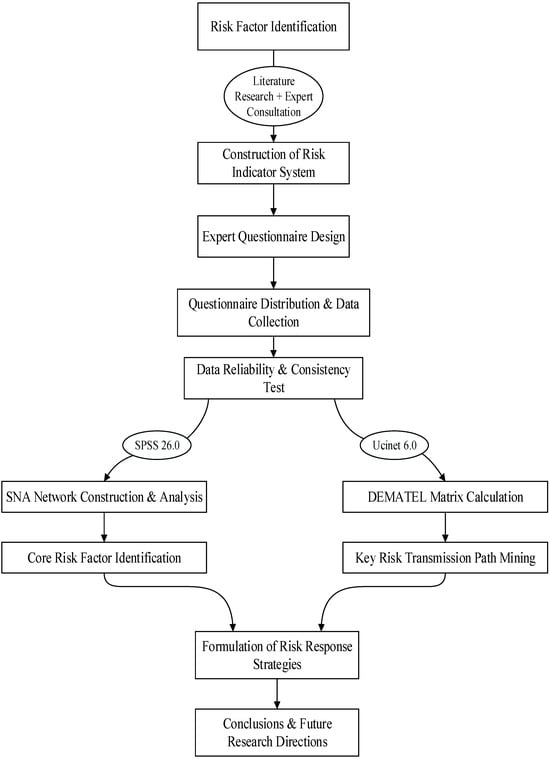

The research technical roadmap is shown in Figure 1.

Figure 1.

Research technical roadmap.

3.2.2. Improved SNA Method

On the basis of traditional degree centrality and closeness centrality, a weighted betweenness centrality indicator was added, and risk impact intensity weights were introduced to optimize the identification accuracy of core risk factors.

3.2.3. DEMATEL Method

By constructing a direct impact matrix, normalized matrix, and comprehensive impact matrix, the influence degree, influenced degree, centrality, and causality of each risk factor were calculated to identify risk transmission paths.

4. Importance Analysis of Investment Risk in Municipal Railroad Construction Based on SNA

4.1. SNA-Based Calculations

4.1.1. Calculation of the Direct Impact Matrix

This chapter adopts five levels to rate the degree of influence of each influencing factor, where 0 represents no influence, 1 represents very little influence, 2 represents medium influence, 3 represents large influence, and 4 represents strong influence. Since the research object of this study is the performance evaluation of the operation phase of urban underground comprehensive pipeline corridor projects, the performance evaluation indices in the operation period must be constructed according to the needs and characteristics of different types of projects. Therefore, this section combines the needs and characteristics of urban underground comprehensive pipeline corridor projects, relying on the government to issue relevant documents; analyzes studies with high relevance; and combines them with the extracted data to take the arithmetic mean as the data needed for this study, constituting the direct impact matrix A:

where aij represents the magnitude of influence of the influences on the horizontal coordinate relative to the influences on the vertical coordinate, where aij = 0 when i = j.

4.1.2. Establishment of a Normative Impact Matrix

Normalizing the processing matrix A with maximum value normalization yields the normalized impact matrix B:

where n is the dimension of the matrix and aij is an element in matrix A.

4.1.3. Construction of an Integrated Impact Matrix

Considering the direct and indirect impacts between the influencing factors, the method for determining cumulative direct and indirect impacts is used to calculate the comprehensive impact matrix N according to the following formula:

where I is the unit matrix.

4.1.4. Constructing Visual Network Diagrams and Calculating Centrality Metrics

The NetDraw module in Ucinet6 software is used to classify and construct a visual network diagram of the relationship structure of the influencing factors. To clarify the key influencing factors and their interconnections, quantitative centrality indices are used to analyze the influencing factors, and centrality indices are divided into point centrality and proximity centrality:

- (1)

- Point Degree Centrality is mainly used to assess the direct connectivity status of a node with other nodes in a network. For an undirected network, it is equivalent to the number of connections of a node, and this value reflects the number of factors directly related to the node and then reflects the position of the node in the network. The higher the centrality of a node’s point degree, the more central it is in the local network structure, with a strong direct connection to other influencing factors and stronger direct control over information or resources, indicating that it is closer to the center of the network.

- (2)

- Proximity centrality mainly describes the degree of closeness between nodes, which reflects the speed with which nodes propagate information in the network. When a node’s proximity centrality is greater, the shortest path from the node to other nodes in the network is shorter, the closeness between the nodes is higher, and the node tends to be closer to the center of the network. Nodes with high proximity centrality can quickly interact with other nodes in the network without relying on too many intermediate nodes.

4.2. Literature Data Collection

The municipal railroad PPP project can be divided into the construction period and the operation period, and as the project construction time is long, the implementation process is affected by varied factors, and there is a large degree of uncertainty and risk, we mainly focus on the investment risk in the construction phase of the municipal railroad. The method used for carrying out risk factor identification is optional, and the common qualitative research methods are the expert survey method, the literature analysis method, the risk checklist method, rooted theory, etc., while the quantitative research methods are the Delphi method, the brainstorming method, and the WBS-RBS method. The investment risk factors affecting municipal railroad PPP project construction share both the common risk of PPP projects and the individual risk of municipal railroad project construction, so we decided to use the literature research method to analyze the investment risk of the project. By combing and analyzing 10 highly cited studies, a list of construction investment risks was initially identified from the perspectives of the political risk, market risk, and construction risk of the project, as shown in Table 1.

Table 1.

A list of risk factors identified for investment in the construction of municipal railroad PPP projects.

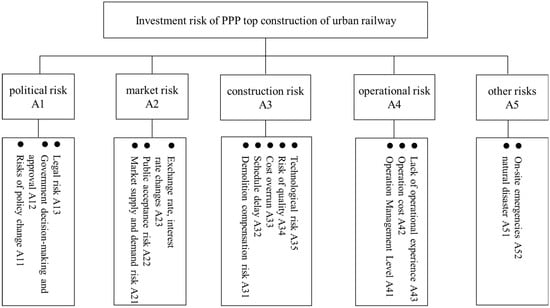

Based on the list of construction investment risks for the municipal railroad PPP project identified in the literature, the preliminary identified risks are approximated, and the municipal railroad construction investment risk indicator system shown in Figure 2 is finally formed.

Figure 2.

Municipal railroad PPP project construction investment risk indicator system.

5. Critical Analysis of Investment Risk in Municipal Railroad Construction Based on DEMADEL

5.1. DEMADEL-Based Calculations

This analysis involved the following steps:

(1) We determined the influencing factor set A. According to the influencing factors for the sustainable development of an urban underground comprehensive pipeline corridor identified by rooting theory, the influence factor set was established as , , …, .

(2) We established the direct influence matrix X. Based on the influencing factor system determined in the previous section, experts engaged in the work related to urban underground comprehensive pipeline corridor were invited to score the influencing factors, and the scoring stage adopted the scoring method ranked from 0 to 4, in which 0 stands for no influence, 1 stands for weak influence, 2 stands for medium influence, 3 stands for large influence, and 4 stands for strong influence. Based on the results of the published questionnaire, the direct impact matrix X is derived as shown in Equation (4):

where n is the number of influencing factors, with n = 13 in this study, while Aij represents the degree of influence of factors i on factors j.

(3) We calculated the normalized impact matrix V. Based on Equation (5), the direct influence matrix V was normalized to obtain the normalized influence matrix V:

(4) We calculated the integrated impact matrix H, and the formula is shown in Equation (6):

(5) We calculated the degree of influence F, degree of influence S, degree of centeredness C, and degree of cause R for each element of the composite influence matrix H.

Here, the impact degree F is calculated as shown in Equation (7):

The degree of being influenced S is calculated as shown in Equation (8):

For centrality C, the calculation formula is shown in Equation (9):

For reason degree R, the calculation formula is shown in Equation (10):

5.2. Research Questionnaire Design and Survey

5.2.1. Questionnaire Design

Based on the above analysis performed to obtain the risk indicator system, this section designs an expert scoring questionnaire to further utilize the DEMATEL method for subjective factor analysis. Referring to the hierarchical structure of risk indicators shown in Figure 2, a direct scoring scale is established. Because the previous research factors have 20 factors, two by two comparison will produce 380 pairs of comparative relationships, which cannot be easily filled out by the respondents, so we select the above frequency greater than 3 indicators to analyze 16 factors, and the specific contents of the factors and coding are shown in Table 2. Using the 0–4 scoring method, the degree of influence between the factors is divided into five levels: “0—no impact, 1—low impact, 2—general impact, 3—high impact, 4—great impact”. To ensure the reliability of the questionnaire results, we finalize the questionnaire and obtain relevant data as follows: first, the researchers in the field of municipal railroad construction are carefully selected; second, the requirements and related expressions are carefully explained before participants fill in the questionnaire; third, the data of individuals are corrected through filling in the form via multiple channels and visiting afterward, improving the accuracy of the measurement data and ensuring that the questionnaire content meets the norms of academic research. The definitions and explanations are shown in Table 2.

Table 2.

Explanations and definitions of risk indicators.

5.2.2. Questionnaire Data Processing

During the correlation analysis of DEMATEL’s influencing factors, to enrich the data source, scholars, experts, and executives with experience in the environmental protection research, as mentioned above, are selected to fill in the scoring questionnaire, including 40 respondents from higher education institutions, scientific research institutes, businesses, and other working fields. The questionnaires were distributed by mail and in the field. A total of 40 questionnaires were distributed and 35 valid questionnaires were ultimately returned, accounting for 87.5% of the recovered questionnaires. Among the valid questionnaires, according to the statistics, the number of university scholars was 18, accounting for 51.4% of respondents; the number of business practitioners of enterprises was 10, accounting for 28.6% of respondents; and the number of research institute practitioners was 7, accounting for 20% of respondents.

After effective data collection and organization, the relevant data need to be further analyzed due to the use of the two-by-two paired method of expert scoring and receipt of 35 valid questionnaires. Considering the questionnaire’s purpose and the number of considerations is not necessary to carry out questionnaire assessment and analysis, so the data on pre-processing performed before the DEMATEL analysis are excluded. According to the questionnaire recovery method, we integrated each investigator’s questionnaire data and used the averaging method formula to integrate them with the direct impact matrix. The partially filled scoring data are shown in Table 3.

Table 3.

Scoring data table.

6. Empirical Analysis

6.1. Project Overview

A new municipal railroad PPP project, using BOT operation mode (Build–Operate–Transfer, Build–Operate–Transfer), has a cooperation period of 30 years, which included the 4-year construction period and the 26-year the operation period. The total investment cost of the project is estimated to be 21,666.205 million yuan, of which construction investment is estimated to make up 20,242.958 million yuan and the interest paid during the construction period is estimated to make up 1423.2468 million yuan. The capital fund of the project accounts for 40% of the total investment, of which the government side accounts for 20% of the equity, the social capital side accounts for 80% of the equity, and the bank loan accounts for 60% of the total investment; the company responsible for the project and the bank will sign a loan agreement. The return mechanism includes a feasibility gap subsidy, which consists of a user fee and a government subsidy, with the user fee including passenger revenue and non-passenger revenue; non-passenger revenue is estimated at 10% of the current ticket revenue. The government subsidy consists of the availability fee and the operation and maintenance performance fee and deducts the current operation income, taking into account the construction and operation costs and reasonable profit, and the reasonable profit margin is estimated at 6%.

6.2. Network Structure Analysis of Investment Risk in Municipal Railroad Construction

6.2.1. Risk Network Construction

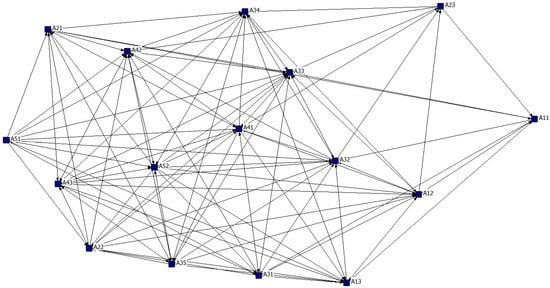

After identifying risk factors, the adjacency matrix of the influence relationship between coal mine safety production risk factors is constructed. Using the NetDraw tool in Ucinet 6.0 software to visualize the network of investment risk factors for the municipal railroad construction project, the investment risk network of the municipal railroad construction project is shown in Figure 3.

Figure 3.

Investment risk network diagram.

Each node in the graph represents an investment risk factor, and the number next to the node corresponds to a specific risk indicator, with the specific meaning being provided. The connecting lines between the nodes indicate a correlation between the risk factors. The more numerous and complex the lines, the more extensive the interactions and influences between the risk factors.

Some of these risk factors are located close to the center of the network, such as the policy change risk (A11), schedule delays (A32), and cost overruns (A33). These risk factors exhibit extensive linkages with numerous other risk factors. This suggests that they have a strong influence on the overall investment risk network and a significant effect on other risk factors.

6.2.2. Individual Network Calculation and Analysis

- (1)

- Point Centrality Analysis

Point Degree Centrality measures the degree to which a node is directly connected to other nodes in the network, reflecting the node’s own trading ability, which is calculated via OutDegree, InDegree, NrmOutDeg, and NrmInDeg, and the results are shown in Table 4.

Table 4.

Point centrality table.

Risk factors such as operation and management level (A41), cost overrun (A33), operation cost (A42), and schedule delay (A32) have outstanding out-degree and in-degree performance. They are the key risk factors in the investment risk network for municipal railroad construction projects and play a pivotal role in the risk transmission and diffusion process. These factors are highly active and vulnerable to the influence of other factors, so they must be monitored and strictly managed.

Relatively speaking, risk factors such as exchange rates, interest rate changes (A23), and natural disasters (A51) have relatively low values for both out-degree and in-degree, indicating that they have relatively limited influence on the risk network and are relatively minor risk factors. However, this does not mean that they can be completely ignored. Despite their weak influence, they may still have a potential impact on the overall project risk project under certain conditions.

- (2)

- Proximity Centrality Analysis

Proximity centrality measures the ability of a node in a network to be free from the control of other nodes, mainly represented by the metrics inFarness, outFarness, inCloseness, and outCloseness in our analysis. The larger the value, the less likely the node is to be controlled by other nodes in the network and the more independent it is; the smaller the value, the more likely it is to be affected by other nodes. The calculation results are shown in Table 5.

Table 5.

Calculation table for proximity centering.

Among these risk factors, cost overrun (A33) has a high value for in-proximity centrality, indicating a low degree of control and independence in terms of receiving influence from other nodes; although out-proximity centrality is relatively low, the overall ability not to be controlled by other nodes is still strong. Operation cost (A42), operation management level (A41), and schedule delay (A32) also have some autonomy in the network, although their ability to not be controlled is slightly weaker compared to cost overrun (A33). In contrast, factors such as demolition compensation risk (A31) and public acceptance risk (A22) have a balanced position in the network, with a medium ability not to be controlled by other nodes.

Technological risk (A35), site emergencies (A52), and other factors are lower in proximity to the center and are relatively easy to control when receiving the influence of other nodes. The impacts of exchange rate and interest rate changes (A23), policy change risk (A11), natural disasters (A51), and other factors on the proximity of centrality are even lower, as the network is more susceptible to the influence of other factors, so the ability to not be controlled is relatively weak. Taken together, cost overrun (A33) has the highest independence in the risk network; factors such as exchange rate and interest rate changes (A23) have a weaker ability to not be controlled by other factors. In risk management and control, factors with high near-centrality should be reasonably guided, and factors with low near-centrality must be subject to monitoring and management to reduce risks.

- (3)

- Intermediate Centrality Analysis

Betweenness centrality examines the ability of a node in the investment risk network of a municipal railroad construction project to control the exchange of information between other nodes. In the given data, this control ability is measured by the two indices of Betweenness and nBetweenness: the higher the value, the higher the frequency of the node appearing on the information transmission path, as well as the stronger the control ability during the exchange of information between the other nodes. The results of the calculation are shown in Table 6.

Table 6.

Calculation of intermediate centrality.

In the investment risk network for the municipal railroad construction project, the level of operation management (A41) has the strongest control over the exchange of information between other risk factors, and it is the key factor affecting the structure of the risk network and the flow of information; in contrast, factors such as exchange rates, interest rate changes (A23), and natural disasters (A51) have a weaker control ability. When conducting risk analysis and management, focus should be placed on risk factors with high intermediate centrality, as they have a greater impact on the entire risk network and, once changed, may trigger a series of chain reactions, affecting the relationship between other risk factors and the overall risk profile of the project.

6.2.3. Comprehensive Risk Network Analysis

Taken together, the degree of operations management (A41) and cost overruns (A33) occupies a central position in the entire risk network. These factors not only have a wide range and deep influence on other risk factors but are also strongly independent and have an outstanding ability to control the exchange of risk information. Legal risks (A13), a lack of operational experience (A43), and schedule delays (A32), although slightly less influential, also play an important role in the risk network. Factors such as exchange rate and interest rate changes (A23) and natural disasters (A51) are relatively minor.

Based on the results of these analyses, during the project risk management process, operation management level (A41) and cost overrun (A33) should be taken as the key monitoring objects, and a comprehensive and perfect risk warning and response mechanism should be established. For example, the likelihood of other risks arising from the operation management level (A41) can be reduced by optimizing the operation management process and improving the scientific nature of management decisions; the occurrence and spread of cost overrun (A33) can be effectively avoided by paying close attention to cost changes through strict budget control and using a cost monitoring system. For legal risks (A13), a lack of operational experience (A43), schedule delays (A32), and other influential risk factors, it is also necessary to strengthen prevention and control. Legal risk (A13) can be reduced by improving the contract terms, the operation team’s ability can be improved through training and experience accumulation to cope with the problem of a lack of operation experience (A43), and the risk of delay (A32) can be reduced through rationally planning the construction schedule and strengthening construction management. As for relatively minor risk factors, such as exchange rate and interest rate changes (A23) and natural disasters (A51), although their influence on the risk network is relatively small, they may still trigger a chain reaction under certain circumstances, so it is also necessary to formulate a corresponding contingency plan and make preparations in advance to minimize the losses that they may cause. In addition, due to the interconnection of risk factors, each factor cannot be viewed in isolation during the management process, instead needing to be considered comprehensively from the perspective of the overall network and the interactions between the factors to formulate a systematic and global risk management strategy, thus guaranteeing the smooth progress of the municipal railroad construction project.

6.3. Empirical Findings on the Investment Risk of Municipal Railroad Construction

6.3.1. Calculating the Normalized Impact Matrix

According to the synthesized data matrix, i.e., the direct influence relationship matrix before normalization, the normalization of the direct influence matrix is carried out using the relevant formula, and the normalized influence matrix is obtained, as shown in Table 7.

Table 7.

Normalization impact matrix.

The risk factors of municipal railroad construction projects constitute a highly coupled and complex network. The core risk factors represented by cost overrun and operation management level affect the whole situation through direct or indirect conduction paths; environmental factors such as policies and laws act as intermediate variables, amplifying or weakening the risk effect; and external factors such as natural disasters and exchange rate fluctuations, although their influence scope is relatively limited, may still trigger chain reactions under specific circumstances. In risk management practice, it is necessary to build a dynamic monitoring system, focusing on the prevention and control of core risk factors, but at the same time, it is necessary to pay attention to the potential transformation of medium-influencing factors and achieve overall control of the risk network by establishing cross-departmental coordination mechanisms and improving contingency plans, safeguarding the stability of the project’s construction and operation.

6.3.2. Calculation of the Integrated Impact Matrix

Based on the normalized direct impact relationship matrix, the integrated relationship impact matrix is obtained, as shown in Table 8, by further using the relevant equation.

Table 8.

Integrated impact matrix.

The comprehensive impact matrix presents the strength of association between 16 risk factors for a municipal railroad construction project in quantitative form, revealing the risk linkage law more intuitively compared with the normalized impact matrix. Through the in-depth mining of matrix data, a number of representative risk conduction paths can be identified, providing a precise direction for project risk management.

First, “policy–approval–duration–cost” constitutes a significant risk transmission chain. Policy change risk (A11) has an impact value of 0.151 for government decision- making and approval delays (A12), and policy adjustments tend to complicate and lengthen the approval process. In turn, government decision-making and approval delays (A12) act on schedule delays (A32) with an impact value of 0.163, directly slowing down project construction progress. Schedule delays (A32) further lead to cost overrun (A33) with an impact value of 0.155, forming a complete chain reaction from policy change to cost escalation. In actual projects, a tightened land policy may then lead to difficulties in land approval, meaning that construction cannot be carried out in time, in turn triggering an increase in labor and equipment rental costs.

Secondly, “market–cost–operation” forms a close linkage path. The impact of market supply and demand risk (A21) on cost overrun (A33) can be as high as 0.210, and the imbalance between market supply and demand directly affects the project cost. The impact value of cost overrun (A33) on operation cost (A42) is 0.201, significantly increasing the financial pressure during the operation stage. The impact value of operation cost (A42) on the operation management level (A41) is 0.253, and excessive cost pressure will reduce the efficiency and quality of operation management. For example, when the price of raw materials rises sharply, the construction cost will increase, and investment in equipment maintenance may be reduced at the operation stage to save money, ultimately affecting the overall operation management level.

Furthermore, there is a feedback loop mechanism linking “management–experience–cost”. The influence of the operation management level (A41) on the lack of operation experience (A43) is 0.229, meaning that the lack of management will make it difficult to accumulate operation experience effectively. The impact value of a lack of operational experience (A43) on cost overrun (A33) is 0.152. A lack of experience can easily lead to decision-making mistakes and the waste of resources, thus increasing costs. The cost overrun (A33) in turn affects the operation management level (A41) with an impact value of 0.194, forming a vicious cycle. If the operation team lacks experience in municipal railroad operation, it may not be able to reasonably dispatch resources when responding to sudden changes in passenger flow, increasing operating costs and further restricting management optimization.

In addition, there are unique indirect transmission paths for external risk factors. Natural disasters (A51) have an impact value of 0.144 for schedule delays (A32), and in the event of a natural disaster, the construction schedule will be directly disrupted. Schedule delays (A32) then transmit the impact of the natural disaster to the cost area through its effect (0.155) on cost overrun (A33). Changes in exchange rates and interest rates (A23), although limited in direct impact, have an impact value of 0.132 for cost overrun (A33). For projects with foreign financing or loans, fluctuations in exchange rates and interest rates will increase the cost of capital, lead to a risk of cost overruns, and then spread the impact to the entire risk network through the correlation between cost overruns and other factors.

6.3.3. Analysis of Impact Level Results

We aim to understand the intrinsic interactions between factors based on the calculated combined impact matrix. For the direct and indirect relationships of an influencing factor with another influencing factor in the integrated influence matrix, the degree of influence is represented by the row sum of the factor, while the degree of received influence is represented by the column sum of the factor. In addition, the degrees of influence and received influence, centeredness, and cause of each factor were calculated, as shown in Table 9.

Table 9.

Calculation of impact level results.

From the calculation results, it can be seen that after analyzing the investment risk factors of the municipal railroad construction project, the order of importance of each risk factor is A41 > A43 > A33 > A42 > A32 > A12 > A35 > A34 > A22 > A13 > A31 > A52 > A21 > A11 > A51 > A23. This ranking result supports the conclusion regarding the correlation strength of risk factors obtained through the normalized impact matrix and comprehensive impact matrix analysis, further verifying the scientific nature of the research method and the reliability of the conclusions and providing a solid basis for the subsequent development of targeted risk management strategies.

Among them, the center degree of operation management level (A41) is the highest, reaching 3.98318, while the cause degree is 0.37286, belonging to the cause factor with a weight proportion of 0.10828, ranking first. This shows that the operation management level is in the core driving position in the whole risk network, and its changes will directly or indirectly trigger changes in other risk factors; this key factor must be the primary focus of attention for the investment risk management of a municipal railroad construction project. During the project implementation process, enterprises should focus on improving operation management to reduce systemic risk.

In addition, cost overrun (A33) has a centrality of 3.88068, which is an outcome factor, but it ranks second because it has an influence of 2.75004, a cause of −1.6194, and a weight of 0.1055. This shows that cost overrun is the result of many risk factors, and it further triggers other risks, playing a “pivotal” role in the risk network. On the other hand, the centrality of exchange rate and interest rate changes (A23) is only 1.01158, with a causality of 0.14756 and a weight of 0.0275, ranking the lowest, indicating that its influence on other risk factors is low and that it is at the periphery of the risk network.

By combining the analysis of center degree, cause degree and weight, and other indicators, it can be seen that cause factors such as operation management level (A41), lack of operation experience (A43), etc., are often the source of risk generation and diffusion and result factors such as cost overruns (A33), schedule delays (A32), etc., are more the final performance of risk conduction. In risk management, it is necessary to focus on the prevention and control of cause factors to cut off the source of risk generation and, at the same time, pay attention to the result factors to avoid further expansion of risk, achieving effective control of investment risk in municipal railroad construction projects.

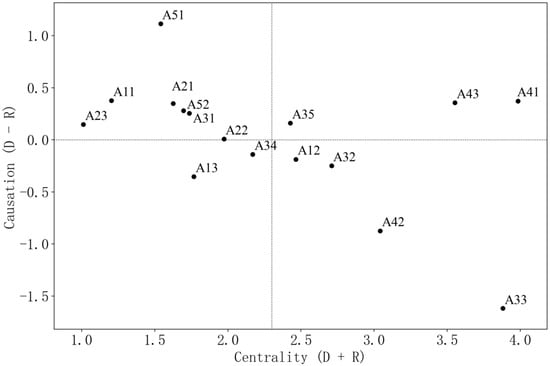

In Figure 4, it can be seen that A13, A22, A34, A12, A32, A42, and A33 are located below the horizontal coordinate with a cause degree less than 0, while the rest of them are located in the upper position with a cause degree greater than 0. This means that in the investment risk system of the municipal railroad construction project, legal risk (A13), risk of public acceptance (A22), risk of quality (A34), governmental decision-making and approval delays (A12), construction delays (A32), operation cost (A42), and cost overrun (A33) are more susceptible to other factors and can be regarded as outcome factors.

Figure 4.

The distribution of impact visualizations.

Comparatively speaking, natural disasters (A51), policy change risk (A11), market supply and demand risk (A21), site emergencies (A52), construction safety risk (A31), lack of operational experience (A43), operation management level (A41), demolition and relocation progress risk (A35), and exchange rate and interest rate changes (A23) are located at the top, and their influences are more powerful and, to some extent, determine the other influencing factors, belonging to the cause factors.

Specifically, the level of operations management (A41) and cost overrun (A33) are shown in the upper right and lower right corners of Figure 4, respectively. The level of operations management (A41), with high centrality and causality, is the core driver in the risk network and significantly impacts other risk factors; cost overrun (A33), with high centrality but negative causality, is a key outcome factor influenced by many risk factors, and it can further trigger other risks. It is a key outcome factor for many risk factors and will further trigger other risks. Exchange rate and interest rate changes (A23) are shown in the upper left corner, with relatively low centrality and low causality, indicating that they have a weak influence on the risk network and are located in a marginal position.

6.4. Investment Risk Response

6.4.1. Enhanced Control of Core Drivers

First, we carefully set up an operation management team composed of professionals in various fields such as transportation engineering, operation management, economics, and information technology to ensure that our team has a comprehensive knowledge system and professional skills and can effectively manage the operation of the municipal railroad from multiple dimensions. We construct a scientific operation management system covering equipment maintenance, ticketing management, personnel services, etc.; clarify the work standards and processes of each position; and achieve the standardization and standardization of operation management. Then, we actively introduce big data, the Internet of Things, artificial intelligence, and other advanced technologies to build an intelligent operation and management platform. The platform collects and analyzes passenger flow data, equipment operation status data, energy consumption data, and other information in real time to provide a scientific basis for operation decision-making; identify and solve problems in the operation process in a timely manner; and improve the timeliness and accuracy of management.

6.4.2. Curbing the Deterioration of Key Outcome Factors

In the pre-planning stage of the project, professional cost engineers and technical experts are organized to perform a comprehensive, detailed, and accurate estimation of the construction and operation costs of a project. They must fully consider the costs that may be incurred for various aspects such as land acquisition, material and equipment procurement, labor costs, later maintenance, etc., and reasonably set aside a certain percentage of risk reserve to cope with possible cost increases in light of both the market situation and actual situation of the project. During the project construction and operation process, the informationized cost management system is used to conduct real-time dynamic monitoring of cost expenditure. We regularly compare and analyze the actual cost relative to the budgeted cost, and once any deviation is found, we quickly organize relevant personnel to analyze the reasons in depth and formulate and implement targeted corrective measures. Then, we strictly standardize the change management process to account for increased costs due to design changes, changes in construction conditions, and other factors, though strict approval must be given and scientific proof obtained before this process begins. From the perspective of technical feasibility, economic rationality, etc., we must assess the necessity of change and the specific impact on costs to avoid unnecessary cost increases.

6.4.3. Risk of Blocking Intermediate Transmission Factors

In-depth market research is carried out, and a professional market research team is organized to comprehensively and systematically investigate and analyze the market supply and demand situation for steel, cement, equipment, and other major materials required for constructing and operating a municipal railroad. A detailed market information database is established by collecting historical data, analyzing the current market situation and predicting future market trends. We then establish a long-term and stable cooperative relationship with major material suppliers and clarify the quality standard, price mechanism, delivery time, and other key terms of material supply by signing a framework cooperative agreement and long-term supply contract. According to the market supply and demand situation and the actual needs of the project, the material procurement plan is reasonably arranged to avoid a shortage of materials or substantial price increase due to fluctuations in market supply and demand. At the same time, we optimize the material reserve management mode, using scientific inventory management methods, such as ABC classification method, to determine the appropriate amount of reserve material. Under the premise of guaranteeing the security of material supply, this process reduces the inventory cost and improves the efficiency of capital utilization.

6.4.4. Resilience to Marginal Risk Factor Shocks

At the project site selection and planning and design stages, full consideration is given to local geological and meteorological conditions and other factors. Professional geological survey and meteorological research institutions are commissioned to carry out detailed surveys and analyses of the project site, avoiding natural disaster-prone areas such as seismic fracture zones, flood-prone areas, and landslide-hazardous areas. If avoiding such areas is not possible, corresponding engineering measures will be taken at the design stage to improve the project’s disaster prevention and resilience, such as strengthening the foundation treatment and improving the seismic grade of building structures. We then formulate a perfect emergency plan for natural disasters, specifying the evacuation routes of personnel, equipment protection measures, and rescue and relief processes in the event of a disaster. We regularly organize relevant personnel to carry out emergency plan drills to ensure that emergency disposal work can be carried out in a rapid and orderly manner when disasters occur, reducing casualties and property losses. We also strengthen cooperation with meteorological and geological departments to establish a disaster early-warning mechanism. By accessing the real-time meteorological data of a meteorological department and the geological disaster monitoring data of a geological department, we can obtain disaster early-warning information in a timely manner. Before disasters occur, we can make various precautions in advance, such as reinforcing equipment and facilities and stockpiling emergency supplies, minimizing the impact of natural disasters on the project.

7. Results

7.1. Centrality Analysis of Risk Factors

Degree Centrality: Operation and management level (A41) ranked first with a degree centrality of 51.111, indicating it has the most direct connections with other factors.

Closeness Centrality: Cost overruns (A33) had the highest in-closeness centrality (93.75), making it a key outcome factor easily affected by other risks.

Betweenness Centrality: Operation and management level (A41) also ranked first with a betweenness centrality of 13.807, showing it has the strongest ability to control information transmission between other factors.

Relatively, marginal risk factors such as exchange rate and interest rate changes (A23) and natural disasters (A51) had low centrality indicators.

7.2. Analysis of Risk Transmission Paths

Based on the DEMATEL comprehensive impact matrix (Table 8), 6 key risk transmission paths were identified:

Policy change (A11) → Approval delay (A12) → Construction period delay (A32) → Cost overrun (A33) (cumulative impact coefficient: 0.469).

Market supply and demand (A21) → Cost overrun (A33) → Operation cost (A42) → Operation and management level (A41) (cumulative impact coefficient: 0.664, the highest among all paths).

Operation and management level (A41) → Lack of operational experience (A43) → Cost overrun (A33) → Operation and management level (A41) (forming a feedback loop with an impact coefficient of 0.575).

7.3. Classification of Risk Factors

According to the analysis of centrality, causality, and weight (Table 9), risk factors were classified into four categories:

Core Driving Factors: Operation and management level (A41), lack of operational experience (A43).

Key Outcome Factors: Cost overruns (A33), construction period delays (A32).

Intermediate Transmission Factors: Policy change (A11), legal risk (A13), etc.

Marginal Risk Factors: Exchange rate and interest rate changes (A23), natural disasters (A51).

8. Discussion

8.1. Comparison of Research Results with Existing Literature

The core risk factors identified in this study, such as insufficient operation and management level (degree centrality: 51.111) and cost overruns (in-closeness centrality: 93.75), are consistent with the findings of Sun et al. [] in their research on urban rail transit PPP projects. Sun et al. confirmed that operation management and cost control are critical risk dimensions affecting project investment returns, but their research only focused on the independent impact of individual factors and lacked in-depth exploration of the interaction between risk factors. In contrast, this study improved the SNA method by introducing a weighted betweenness centrality indicator. It not only identified core risk factors but also clarified their network positions (e.g., the operation and management level ranks first in both degree centrality and betweenness centrality) and revealed the multi-path transmission mechanism between factors (e.g., the feedback loop of “operation and management level → lack of operational experience → cost overrun → operation and management level”), effectively making up for the deficiency of insufficient analysis of risk interaction mechanisms in existing studies.

Compared with the risk research on comprehensive pipeline corridor PPP projects by Zhu et al. [], both studies adopt the SNA-DEMATEL integrated method to analyze investment risks, but there are obvious differences in research focus due to industry characteristics. Zhu et al.’s research emphasizes the risk transmission path of “design risk → construction risk → operation risk” in pipeline corridor projects, which is closely related to the technical complexity of pipeline corridor construction. Focusing on the industry characteristics of municipal railway construction (long approval cycle, strong policy dependence, and close connection with urban commuting), this study identified a unique risk transmission chain of “policy change (A11) → approval delay (A12) → construction period delay (A32) → cost overrun (A33)” (cumulative impact coefficient: 0.469). This transmission chain reflects the particularity of municipal railway projects being affected by policy and approval links, providing more targeted and accurate references for risk management in the municipal railway industry.

In addition, compared with the research of Liu et al. [], which only constructed an investment risk evaluation index system for municipal railways, this study further quantified the interaction intensity between risk factors through the comprehensive impact matrix. For example, the impact value of market supply and demand risk (A21) on cost overrun (A33) reaches 0.210, clarifying the key nodes of risk transmission and making the research results more operable.

8.2. Innovation and Limitations of Research Methods

8.2.1. Innovation

First, in terms of method improvement, the traditional SNA method mainly relies on degree centrality and closeness centrality for analysis, which is difficult to fully reflect the control ability of risk factors in the network. This study added a weighted betweenness centrality indicator and introduced risk impact intensity weights (calculated based on expert scoring data and matrix normalization results), which improved the accuracy of identifying core transmission nodes (e.g., legal risk (A13) with a betweenness centrality of 5.43 was identified as an important intermediate transmission factor).

Second, in terms of method integration, the organic combination of the improved SNA and DEMATEL method realized the complementarity of advantages: SNA was used to construct a visual risk network to clarify the connection structure of 16 risk factors, and DEMATEL was used to calculate the comprehensive impact matrix to quantify the interaction intensity between factors (e.g., the cumulative impact coefficient of the “market-cost-operation” path is 0.664). This integration solves the problem that traditional SNA is difficult to quantify the impact degree and DEMATEL is insufficient in network structure visualization, enhancing the systematicity and accuracy of risk analysis.

Third, in terms of research perspective, this study constructed a risk analysis framework covering the whole process of municipal railway construction (policy, market, construction, operation, environment) and quantitatively revealed the interaction intensity of each factor through the comprehensive impact matrix (e.g., the impact value of operation management level (A41) on cost overrun (A33) is 0.307), providing a new analytical perspective for in-depth understanding of the risk mechanism of municipal railway projects.

8.2.2. Limitations

First, in terms of sample coverage, although 35 valid questionnaires were collected from experts in universities, enterprises, and research institutions, the selected experts are mainly from Central China (Wuhan and surrounding areas), and no cases of municipal railway projects in western regions, northeastern old industrial bases, or small and medium-sized cities were included. Due to differences in economic development level, policy environment, and geological conditions in different regions, the types and impact degrees of investment risks may vary. For example, municipal railway projects in western regions may face more prominent geological risks, while those in eastern coastal areas may be more affected by market supply and demand fluctuations. This limits the universality of the research results to a certain extent.

Second, in terms of analysis dimension, the current risk assessment mainly adopts static analysis, which is based on cross-sectional data of expert scoring and fails to fully consider the dynamic evolution of risks throughout the project life cycle. In the actual project process, the impact degree of risk factors will change with the advancement of the project stage: for example, policy risks are more prominent in the planning and approval stage, construction risks are the main risks in the construction stage, and operation risks become the focus in the operation stage. The lack of dynamic tracking and analysis of risks makes it difficult to reflect on the time-varying characteristics of risks, which affects the timeliness of risk management suggestions.

Third, in terms of model optimization, machine learning methods (such as random forest and neural network) were not introduced to optimize the risk prediction model. The current identification of core risk factors and transmission paths mainly relies on the SNA-DEMATEL method, which is affected by subjective factors such as expert scoring to a certain extent. Machine learning methods can mine the potential laws of risk data through large-sample training and improve the accuracy of risk prediction. The lack of this part of content makes the research model need further optimization.

8.3. Practical Implications

8.3.1. Core Driving Factors: Precise Control Based on Intelligent Management

The operation and management level (A41) is the core driving factor of municipal railway investment risks, with a weight of 0.10828 ranking first in the risk network. To reduce risks, first, an operation management team should be established, including professionals in transportation engineering, operation management, economics, and information technology. A standardized management system covering equipment maintenance, ticketing management, and personnel services should be constructed to clarify the work processes and responsibility boundaries of each position. Second, big data and IoT technologies should be introduced to build an intelligent operation platform, which can collect and analyze real-time data such as passenger flow (peak passenger flow during morning and evening rush hours), equipment operation status (failure rate of key equipment), and energy consumption. For example, through the analysis of passenger flow data, the train operation schedule can be dynamically adjusted to improve operational efficiency; through the monitoring of equipment operation status, predictive maintenance can be carried out to reduce the impact of equipment failures on operation.

8.3.2. Key Outcome Factors: Whole-Process Control of Cost and Construction Period

Cost overruns (A33) and construction period delays (A32) are key outcome factors, with centrality values of 3.88068 and 2.7093, respectively. For cost control, first, in the early stage of the project, a professional team should be organized to conduct accurate cost estimation, fully considering factors such as land acquisition costs, raw material price fluctuations, and design changes, and a 10–15% risk reserve should be reasonably reserved. Second, during the construction process, an information-based cost management system should be used to dynamically monitor expenditures, compare the actual cost with the budget cost monthly, and analyze the causes of deviations in a timely manner. For example, if the price of steel rises, leading to an increase in material costs, measures such as signing long-term supply contracts with suppliers or adjusting the construction plan can be taken to control costs. For the control of construction period delays, the construction schedule should be reasonably planned, key construction paths should be identified, and the progress of each link should be monitored in real time. At the same time, the approval process should be optimized, and a cross-departmental coordination mechanism should be established to reduce the impact of approval delays on the construction period.

8.3.3. Intermediate Transmission Factors: Blocking Transmission Through System and Contract Design

Intermediate transmission factors such as policy change risk (A11) and legal risk (A13) play a linking role in the risk diffusion process. To block the risk transmission path, first, a policy tracking and early warning mechanism should be established in response to policy risks to closely monitor changes in national and local policies related to municipal railways and adjust the project plan in a timely manner according to policy adjustments. For example, if the government adjusts the subsidy policy for municipal railway projects, the profit model of the project should be re-evaluated to ensure the sustainability of the project. Second, in response to legal risks, contract terms should be improved to clearly define the rights and obligations of all parties involved in the project (government, social capital, and construction units) and standardize the dispute resolution mechanism. At the same time, a cross-departmental coordination mechanism (covering departments such as development and reform, transportation, and law) should be established to promptly solve legal and policy issues encountered during the project implementation process and block the risk transmission path from the source.

8.3.4. Marginal Risk Factors: Enhancing Resistance Capacity Through Contingency Plans

Marginal risk factors such as exchange rate and interest rate changes (A23) and natural disasters (A51) have limited direct impact but may trigger chain reactions under specific circumstances. For natural disasters, first, in the project site selection stage, detailed geological and meteorological surveys should be conducted to avoid disaster-prone areas such as seismic fault zones and flood-prone areas. If avoidance is not possible, engineering measures such as strengthening foundation treatment and improving the seismic grade of structures should be adopted in the design stage. Second, a complete natural disaster contingency plan should be formulated, including personnel evacuation routes, equipment protection measures, and emergency rescue procedures, and regular drills should be conducted to improve emergency response capabilities. For exchange rate and interest rate changes, especially for projects involving foreign capital or loans, financial derivatives (such as forward exchange contracts) can be used to hedge risks, and the loan term and interest rate adjustment mechanism should be reasonably designed in the loan agreement to reduce the impact of exchange rate and interest rate fluctuations on the project’s financial status.

9. Conclusions and Recommendations