Abstract

China’s collective forestland tenure reform has dramatically affected the business environment of domestic forest product firms. This study examines the impact of the said reform on the expected values of these firms, via the reaction of investors (as seen on the stock markets) towards the issuance of related policies. Based on signaling theory and the assumption that the Chinese stock markets are efficient in terms of work form, this study adopts an event study method and examines five policies during the 2003–2009 period. The numbers of forest product firms used in the examinations herein differ among the policies and range from 21 to 29. This study found that the policies have differentially affected the expected values of forest product firms and that the impact on firms lacking forestland holdings is generally more significant than that on firms that hold forestland. The findings of this study enhance our understanding of the effect of collective forestland tenure reform on the value of forest product firms; they also have implications on forest product firms as they work to adapt to the reform.

1. Introduction

The majority of China’s forestland is collectively owned [1]. The legal owners of the collective forestland are administrative villages that consist of a number of natural villages or villager families [2]. China has sought to devolve the collectives’ forestland management responsibilities to individual households to improve the performance of the collective forestland [3]. Particularly, the collective forestland tenure reform initiated in 2003 is considered successful, as it clarifies the ownership of forestland, regulates the transfer of forestland ownership, and improves the forest timber logging management system, inter alia [2,4].

Among the actions being taken on account of the tenure reform initiated in 2003, clarifying forestland ownership, which includes the issuance of forestland ownership certificates, tends to be one of the primary tasks [5]. When that ownership is clarified, forestland-use rights can be reallocated by means of transferring or leasing to forest product firms or other forestland users, to improve the performance of the collective forestland [6]. The area of land involved in transferred collective forestland has been increasing over the years, ever since the initial launch of the collective forestland tenure reform in 2003; as of the end of 2015, that area was at 283 million mu (18.87 million ha) [7].

Such flexible forestland management under the tenure reform is likely to affect the business environment of the forest product industry, whose business activities, such as paper-making, timber-processing, and furniture-manufacturing, which rely on the provision of forest resources [8,9,10]. The collective forestland tenure reform would affect both the quantity and quality of forest resources [11,12], which would, in turn, impact the forest product industry. In addition, forest product firms that own forestland enjoy strategic and competitive advantages; in particular, it has long been recognized that owning timberland is critical to a forest product firm’s profitability and positive valuation [13,14]. This is because timberland ownership improves these firms’ return on assets and earnings stabilization, and their ability to respond to uncertainty and mitigate risk [15].

However, there is a lack of empirical research on the impact of China’s collective forestland tenure reform on the value of financial forest product firms. Additionally, few studies differentiate firms that already hold forestland from those that do not. Since these policies affect the holding of forestland by allowing ownership transfers, firms that do not hold forestland might respond differently from those that do. It would also be interesting to compare the impact of these policies between firms with and without forestland holdings.

This study adopted an event study method to assess the effects of the collective forestland tenure reform policies on forest product firm value. Studies within the literature adopt this method to analyze the effects of forestland policies and related events on the value of forest product firms. For example, Niquidet used event study techniques to analyze the impact of announcements pertaining to the Forestry Revitalization Plan, which touches upon the reallocation of forestland tenure, as implemented by the government of British Columbia, Canada, on the value of publicly traded forest product firms [16].

The current study thus looks to examine how policies relating to China’s collective forestland tenure reform have affected the value of forest product firms, as reflected in stock market prices. It is important to understand the impact of collective forestland tenure reform policies on forest product firms in China. First, it would help to gather empirical evidence regarding the effects of tenure reform on forest product firms; this evidence would be particularly helpful for policy-makers as they craft policy vis-à-vis the development of the forest product industry sector, such as that which accompanies the reform and promotes that industry’s development. Second, findings from the current study may shed light on the effects of the reform on the development of the forest product industry and thus inform forest product firms as they adapt to the changing environment.

The remainder of this paper is structured as follows. Section 2 presents the background and theoretical foundations of this study. Section 3 outlines this study’s research methodology, including that pertaining to data collection and analysis; this is followed in Section 4, with the presentation and discussion of the analytical results. Finally, Section 5 presents the current study’s contributions to the literature, the policy implications of its findings, and the study’s limitations, and offers future research directions.

2. Background and Theoretical Development

2.1. The Collective Forestland Tenure Reform and Its Effect

Chinese forestland is owned either by the state or by village collectives. Approximately 60% of China’s forestland is collectively owned [17]. During the 1980s, most of the collective forestland was contracted to individual households through the implementation in rural areas of the “Household Responsible System.” However, the collective forestland tenure reform at that time was incomplete and still insecure, and this resulted in the marginalization of both individual-level rights and the interests of collective forestland tenure [18]. In such circumstances, households and collective villages lack incentives to manage collective forestland [9].

Before 1998, forestland owned by the state that mainly comprised natural forestland represented a large proportion of China’s domestic timber supply. Following the 1998 flash floods from the Yangtze and other waterways, the National Forest Protection Program (NFPP)––which is in essence a logging ban on natural forestland––was implemented. Timber harvests from state-owned natural forestland dropped dramatically, and this stimulated a shift of domestic timber production from state-owned natural forestland to collective forestland [19].

To boost the productivity of collective forestland, the Chinese government initiated in 2003 the collective forestland tenure reform, as part of the “Decision of the Central Committee of the Communist Party of China on accelerating the development of forestry.” This round of reforms was designed to give individual farmers some secure and transferable rights to use, lease, or mortgage forestland for 70 years; these rights are protected by a legal contract and through the issuance of forestland tenure certificates. Such a decentralization strategy is likely to lead this round of tenure reform to success [20]. In 2008, the Chinese government announced “The State Council’s decision on promoting the collective forestland tenure reform,” which officially launched nationwide reform processes for privately owned collective forestland. This decision authorized unprecedented local autonomy for the reallocation and management of collective forestland; it also formally permitted land transfers, together with a goal to develop land transfer markets to complement the tenure reform [17]. Meanwhile, a series of supporting policies supplement the two aforementioned milestone policies [21].

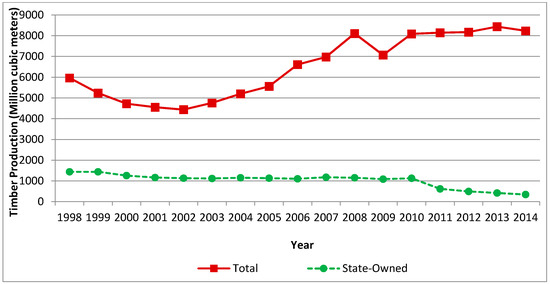

The ultimate goal of the collective forestland tenure reform is to increase domestic timber supply by enhancing forestland quality and productivity and providing an incentive to invest in forestland by claiming a secure forestland tenure [5,22,23]. Indeed, the collective forestland tenure reform has been found to encourage investment among farmer households in forestland [24,25]. Additionally, the collective forestland tenure reform has boosted collective forestland’s contribution to China’s domestic timber production. The collective forestland has, in the recent past, been the source of 46% of China’s domestic wood supply [26]. With the initial implementation of the NFPP in 1998, timber production from state-owned forest gradually decreased, while that from collective forestland has gradually increased [27]. Such trends are especially obvious in the policy’s second phase, which started in 2010 (Figure 1). One should note that, since 2003, the Chinese government has been slowly phasing out the annual cutting allowance, which has, in turn, helped gradually increase total timber production [27]. However, it did not seem to lead to any obvious increase in timber production from state-owned forestland. One could, therefore argue, to some extent, that the contribution of collective forestland to timber production has grown over the years.

Figure 1.

China’s total domestic timber production and the contribution of state-owned forestland. Notes: (1) Data sources: China Forestry Statistical Yearbook, 1998–2014; state-owned forestland timber production data are drawn from data on 135 key state-owned timber harvesting firms and 20 key state-owned forestland management bureaus. (2) Given the impact of the freezing rain and snow disaster and earthquakes, timber production in 2008 increased dramatically and returned to normal levels in 2009 [27].

Evidence from academia shows similar results. Yin and Xu found that timber harvests have increased in those provinces where the collective forestland tenure reform has been implemented [11]. Specifically, based on Zhang and Buongiorno’s [28] assessment, it appears that this reform increased China’s timber supply by 18% wherever it was implemented. It was also found that with the implementation of the collective forestland tenure reform, timber prices have been in decline; this can be partially explained by the increase in timber supply that stemmed from the reform [29].

The tenure reform has also boosted the transfer or lease of forestland, making it possible for forest product firms to have control over collective forestland by means of leasing, contracting, cutting rights arrangements, and cooperation [4]. Forestland transfers are essential to long-term investment and the preservation of tropical hardwood trees [30]. Whenever the operation rights of collective forestland are transferred or leased to outside enterprises, these firms may pursue more intensive levels of forestland use—levels that had not been previously possible for local households [6].

2.2. Structure-Conduct-Performance Model

The structure-conduct-performance (SCP) model is one of the main analytical approaches used by industry organizations, and it can be applied to industry-wide and specific sectors alike. The SCP model argues that a sector’s structure affects its performance, either directly or through conduct [15,31]. A sector’s structure includes the number and size of sellers and buyers, the cost structure, the degree of vertical integration, barriers to entry, and the degree of product differentiation. Here, “conduct” refers to investments, price-setting, research and development, and the like. Performance manifests in various efficiency measures (e.g., prices and profit distribution) [15,31].

Inherent in the SCP model is the argument that factors, such as governance arrangements and regulations are key determining factors of market structure, conduct, and performance [15,32]. The underlying thinking here is that firms can achieve competitive advantages by responding to the composition and dynamics of their own sector [33]. For example, Owubah et al. applied the SCP model to forestland ownership and found that in Ghana, there is a direct relationship between tenure structure and performance in terms of sustainable forestry practices [30]. Additionally, the results of Zhang and Binkley’s [34] study show that forestland policy changes in British Columbia have not had any significant economic impact on the forest product firms there; on the other hand, another study by Binkley and Zhang found that a timber-fee increase policy had a general and negative impact on forest product firms in British Columbia [35].

Likewise, it could be argued that government policies relating to forestland tenure are likely to affect forest product firms’ financial performance. Niquidet found that the announcement of the Forestry Revitalization Plan by the British Columbia government was found to have a significant adverse effect on forest product firms there, owing to the loss of forestland tenure and the difficulties associated with translating property rights into forest resources in Canada [16].

2.3. Raw Material Supply and Forestland Ownership

Access to and control over raw production materials are especially important and serve as competitive advantages among firms in the natural resource sector, to which forest product firms belong [36]. Lähtinen et al. assessed the relative importance of various resources in the forest product industry, using sawmills as an example; they found that, among all the resources that a sawmill requires, raw materials are ranked as most important [14]. Likewise, a lack of raw materials, problems in acquiring raw materials, and increases in raw material prices are among the key causes of firm failure in the forestry sector [37]. In particular, it is critical that wood industry firms secure raw material if they are to produce higher-priced commodities and tailored services [38].

For all these reasons, forest product firms tend to gain control of the raw material supplies derived from stable timber supply production. They do so to obtain competitive advantages, including returns on timberland, earnings stabilization, risk reduction, and supply assurance, among other benefits [14,15,39]. Having its own raw material supply as a backup helps a firm increase its price negotiation power in timber markets and reduce the risk of a raw material price increase [36]. When timber prices are high, firms can use more of their own timber, and, conversely, firms can buy timber on open markets [15].

In situations where a forest product firm reports forestland as an asset or otherwise under its control (e.g., through leasing, contracting, cutting rights arrangements, and cooperation), that firm is said to have “forestland ownership” [36,39]. Owning timberland is critical to a forest product firm’s profitability and valuation, as it provides the firm with raw production materials and the ability to respond more effectively to market fluctuations [13,38]. Moreover, holding industrial timberland can improve management’s ability to make decisions that enhance the firm’s long-term financial success by reducing dependence on raw material sources on the open market [13,15]. As a result, holding forestland is likely to affect the financial performance of forest product firms. Li and Zhang empirically examined how holding timberland relate to the financial performance of US forest product firms; they found that timberland ownership improves these firms’ profitability (in terms of return on assets and price-earnings ratio) and their ability to respond to uncertainty [15].

It should be noted, however, that holding forestland may have a negative effect on a firm’s financial performance because timber production is capital-intensive and large amounts of capital can be tied to timberland [39]. Besides, forest product firms tend to feature high asset specificity and a lack of flexibility [36,39], which means that the value of production facilities would diminish if production were suspended on account of a lack of available wood and related raw materials [13]. In addition, internal organization costs may increase when industrial timberland holdings are large [15].

In summary, the primary objective of this study is to examine the effect of collective forestland tenure reform policies on the financial performance of forest product firms in China. Given the notion that the acquisition, integration, and deployment of resources as determined by forestland ownership might explain variance in firm performance [36], this research further examines whether the effect differs between firms that do and do not hold forestland.

2.4. Event Study Method

Financial economists use the event study method to assess the effect of a specific event on a firm’s financial performance, and on its firm value as reflected in stock price variations. The event study method was developed on the basis of signaling theory [40] and the efficient market hypothesis [41]. Signaling theory holds that in the absence of complete and accurate information, decision-makers will interpret observable factors or a signal revealed by a sender, and adjust their purchasing behavior accordingly [40]. The efficient market hypothesis implies that the revelation of information about a specific event would trigger an instant fluctuation in the stock price [41]; in other words, the stock market response represents the value derived from the delivered signal [42]. Relating the influence of the signal sent by an event to the reaction of the stock market allows one to determine whether the event provides stock market participants with valuable information [43]. The current market value of a firm reflects investor perception of the present value of all future benefits to the firm, in both the long and short term. Therefore, the effect of an event on a firm’s stock price can be determined by the difference between the actual and predicted returns, which is often called the “abnormal return” [42].

The event study method is appropriate for the current study, given its power to explore linkages between events and firm values; additionally, it is a powerful means by which to examine how stock market participants assess the informativeness of an event [42,44]. Studies within the literature have analyzed the effect of forestland policies and related events on the financial performance of forest product firms by adopting an event study methodology. Prior research in the forestry economics field that leveraged the event study method is summarized in the Appendix A.

As shown in Table A1 and Table A2 in the Appendix A, these studies mainly examined stock markets in North America, which are mostly considered mature markets and where the efficient market hypothesis applies [45,46]. Chinese stock markets can also be considered efficient, although that efficiency is in a somewhat weak form [47,48,49]. As an emerging economy, China has attempted to advance its stock markets via a series of regulatory transformations, and this has led over the years to efficiency improvements in its stock markets [50,51,52,53]. Thus, to some extent, the event study method is suitable for investigating the Chinese stock market’s reaction to various events, such as environmental policies [54], corporate social responsibility initiatives [55], and environmental violation events [56]. Therefore, the event study method can be used to analyze the effects of announcements pertaining to the collective forestland tenure reform and related policies in China on the forest product firm values of interest in this study.

Consistent with other studies that have examined the stock market reaction to forestland-related policies, this study follows a standard event study method. Events of interest, event windows, and selected forest product firms were first identified, followed by the measurement of abnormal returns and their aggregations across time and firms.

3. Methodology

3.1. Defining the Event

The events of interest in this study are the release of policies relating to the collective forestland tenure reform in China that directly affect either collective forestland tenure or timber supply. According to the Center for the Collective Forestland Tenure Reform of the State Forestry Administration, there were five policies relating to collective forestland tenure reform on forestland ownership and timber supply between 2003 and 2009 [21]. Each policy was treated as an event, with the date of release used as the event date. The selected policies and their key terms are described below.

Policy I: Decision of the Central Committee of the Communist Party of China on accelerating the development of forestry (date: 25 June 2003)

- Encourage the development of collective forestland

- Improve the forestland tenure system

- Accelerate the promotion of upgrades to the structure of the forestry industry, and encourage the development of the timber production base

- Enhance the guidance and control of forestry industry development, and promote management schemes (such as firms working with the timber production base, and the timber production base working with farmers)

Policy II: Notice of the State Forestry Administration on further strengthening and standardizing the management of forestland rights registration and certification (date: 8 February 2007)

- Enhance the registration process and the issuance of forestland certificates

Policy III: Opinions of the Central Committee of the Communist Party of China on promoting the collective forestland tenure reform (date: 8 June 2008)

- Clarify forestland property rights and reaffirm forestland ownership to individual households, with official licenses issued to individual households

- Issue forestland certificates

- Clarify forestland ownership

- Reallocate and manage collective forestland, and also formally permit land transfers

- Regulate the transfer of forestland and timber, and the development of land transfer markets

- Improve the forest-wood logging management system

Policy IV: Opinions of the State Forestry Administration on the reform and improvement of collective forestland logging management (date: 17 July 2009)

- Simplify the processes of forest-wood logging management

- Improve management of the logging cut allowance

Policy V: Opinions of the State Forestry Administration on strengthening the management of collective forestland rights transfer (date: 15 October 2009)

- Build a regulated and ordered mechanism for the transfer of collective forestland rights

- Build an efficient platform by which to transfer collective forestland rights

3.2. Determining the Event Window

This study uses a three-day event window consisting of the day of the announcement, the preceding trading day, and the trading day following the announcement day. This window was chosen because it is likely to lead to reliable results: when the event window is increased beyond three days, the power of the estimation model decreases [57,58]. Moreover, with a longer-term event window, there might be confounding events within the same period that could also affect a firm’s market value. Choosing a shorter event window can help reduce the likelihood of stock price data from the event window being contaminated by confounding events such as those pertaining to dividends, earnings, mergers/acquisitions, and changes in top management [57,58].

The current study uses a 250-day estimation period, starting 252 days before and ending two days before the date of the announcement. (Roughly speaking, 250 days is the number of trading days in one calendar year.) Using such a relatively long estimation period can reduce the influence of possible seasonal stock price movements [59]. Additionally, a shorter estimation period may have too few observations for estimating the parameters, which are discussed below [60].

3.3. Calculating Abnormal Returns

The event study method measures abnormal returns observed when an event announcement is made public with regard to normal returns expected in the absence of the event. An abnormal return measured over the event window is the cumulative abnormal return (CAR). To measure the aforementioned change in a firm’s financial performance, as triggered by collective forestland tenure reform policy events, the normal rate of returns was estimated via the approach of Brown and Warner [61]. The stock return of firm i on day (i.e., ), and the stock return of the market portfolio on day t (i.e., are first calculated using Equations (1) and (2), respectively, where is the stock price of firm i on day t and is the stock market price index on day t.

Then, according to the efficient market hypothesis [41], the return of a specific stock can be presented as a function of the market portfolio, as in Equation (3), where represents the return of stock i on day t; is the return of the market portfolio on day t; and are the intercept and slope parameters, respectively, of firm i; and is the disturbance term for stock i on day t. These parameters are estimated using stock price data observations over the 250-day period that ends two business days before the events (i.e., day (–2)). Then, a regression is run for on (as shown in Equation (3)) to derive , and (in Equation (4)). Finally, the normal rate of return of firm i on day t (i.e., ) is calculated by Equation (4).

The abnormal rate of return for firm i on day t within the event window (T1:T2) is derived using Equation (5). Then, the CAR for stock i over the event window is calculated as per Equation (6), while for a sample of n stocks the average CAR over the event window is represented by Equation (7), where N is the number of firms included in the sample or subsample. Furthermore, to examine whether the overall return is abnormal for each day of the event window, the stock price reaction can be tested for significance, by using Equation (8).

3.4. Data Description

Given that forest product firms are exposed to the impact of policies relating to forest product industries at large, a thorough search was required to identify any suspicious policy announcements released during the five-event windows defined in this study. Confounding policies might relate to tariffs on forest products and related commodities, forestland certification, and the like. The search for confounding policies was conducted on major websites relating to the forest product industry, including the National Forestry Administration (http://www.forestry.gov.cn/), the Chinese Forestry Industry Association (http://www.chinalycy.org/), and the China National Forest Products Industry Association (http://www.cnfpia.org/). In addition, the production of forest resources is vulnerable to major natural disasters, which would affect the supply of raw materials for the forest product industry. The records of natural disasters in the China Forestry Yearbook (2004, 2008–2010) were closely examined for any occurrence of natural disasters during the event windows, such as freezing rain, snow, and earthquakes. No confounding policy or major natural disaster was found, and so this study retained the five events and their time windows for further analysis.

According to the China Securities Regulatory Commission’s industry classification guidelines for publicly traded firms, the forest product industry comprises timber product manufacturing, bamboo and grass production, furniture production, and the making of paper and paper products. This study used the Wind Terminal database to identify the industry category of each firm by following the Wind Industry Classification Standard. This standard is based on the Global Industry Classification Standard, with minor amendments to accommodate the characteristics of publicly traded firms in China [62]. The Global Industry Classification Standard has been widely used in stock market research and is considered a better choice for financial analysts and investors than other industry classifications [63,64]. Therefore, it is reasonable to believe that the use of the Wind Industry Classification Standard aligns well with this study objective (i.e., understanding investors’ behavior in the stock market). In this sense, it can be argued that findings from this study are likely to be comparable to those of studies conducted in stock markets in other countries. Additionally, this study excluded from the sample those firms who are listed in the forest product industry but whose income in forest product-related fields accounted for less than 35% of their total income in the year when a policy was released.

For the purposes of testing whether there were any differences between firms with and without forestland holdings, this study analyzed the annual reports of publicly traded firms under these categories for the years in which the aforementioned policies were released. If a forest product firm had reported holding forestland—as either an asset or otherwise under its control (e.g., by leasing contract)—the firm was classified as one with forestland; otherwise, it was classified as one without. These firms were then classified into two further categories, based on their primary operating revenues in a particular year: (1) timber products manufacturing and (2) furniture production and paper-making and paper products. For example, when the primary operating revenue of a firm derives mainly from timber processing, that firm was classified as being in timber products manufacturing.

As a proxy for stock market returns, this study used the daily return of the Shanghai Stock Comprehensive Index and of the Shenzhen Stock Index; this study considered any firm traded on either of these stock exchanges. The daily stock returns of the individual firms were retrieved from the Wind Finance database. Of the firms being identified, this study included only those whose stock price information was continuously listed over the three-day event period and the 250-day estimation period.

This study excluded firms listed as ST or ST* (i.e., firms under special treatment who suffer from continuous loss for two years or three years, respectively) during the aforementioned period, to eliminate extreme values and the data contamination they can incur. This study additionally excluded firms with potentially confounding announcements (e.g., dividends, earnings, mergers/acquisitions, and changes in top management) during the three-day event window. Presented below are the numbers of firms identified by following these sampling criteria for each policy, together with the analytical results. Table 1 shows the number of firms identified at each stage of the sampling process.

Table 1.

Data-screening process.

4. Results

Table 2, Table 3, Table 4, Table 5 and Table 6 present the average CARs by policy obtained over the three-day event window. Each table shows the results of testing the impact of a particular policy on firm value, where firms are classified in terms of whether or not they hold any forestland and whether the firm is in timber products manufacturing, or in furniture production/paper-making and paper products. Positive signs on the average CARs indicate that the presence of corresponding events increased the stock price of these firms, while negative signs suggest the opposite. When only one firm is in a certain situation, the direction of the impact is discussed without considering its level of significance.

Table 2.

Results of testing policy I.

Table 3.

Results of testing policy II.

Table 4.

Results of testing policy III.

Table 5.

Results of testing policy IV.

Table 6.

Results of testing policy V.

As Table 2 shows, when firms with or without forestland overall are considered, the CARs are positive and statistically significant for timber products manufacturing firms, but negative for furniture production/paper-making and paper product firms. The CARs are also positive for timber-processing firms that hold forestland but negative for furniture production/paper-making and paper product firms that do not hold forestland. When examining firms across all categories, only the CARs of firms that do not hold forestland are positive and statistically significant.

For policy II, the CARs of firms in all situations are positive and statistically significant, with the CARs of firms that do not hold forestland demonstrating stronger magnitudes than those of firms that hold forestland (Table 3).

Table 4 shows that, for policy III, the CARs in all situations are negative and statistically significant save for those of firms without forestland and which fall into the furniture production/paper-making and paper products category, which were positive.

For policy IV, when considering firms that do and do not hold forestland as a single group, the CARs of firms in both the timber products manufacturing category and the furniture production/paper-making and paper products category are statically significant, with the former being negative and the latter being positive (Table 5). The same pattern is seen for firms that hold forestland. For firms that do not hold forestland, the CARs are negative in all cases.

For policy V (Table 6), the CARs of firms that do not hold forestland are positive and statistically significant, particularly for firms in the furniture production/paper-making and paper products category.

5. Discussion

In this section, the discussion of the findings with respect to each of the five policies examined is presented.

5.1. Policy I: Accelerating the Development of Forestry, 2003

There is a possible explanation for the positive impacts of policy I on firms that hold forestland and are in the timber products manufacturing category and firms in all categories that do not hold forestland. Following the reform, these firms would have been more readily able to acquire from the domestic timber market the raw materials needed for production, as the policy encourages the development of forestland and possibly boosts domestic timber supply. Additionally, under the new collective forestland tenure reform, it is possible for forest product firms to possess forestland on their own, by securing long-term timber supply agreements (i.e., by trading certain rights to the collective forestland with farmers). Holding their own forestland enables firms to cope with incomplete information and uncertainty [15]. In addition, policy I encourages firms to develop their timber production base in order to increase the domestic timber supply. It is expected that forestland product firms will secure raw material production supplies in the future; this is especially true for timber product manufacturing firms in particular, and firms that do not hold forestland in general. However, it might be difficult for those firms that do not hold forestland and are in the furniture production/paper-making and paper products category to develop their own raw material supply base: they did not possess forestland on their own, and this could explain the negative impact of policy I on this type of firm.

5.2. Policy II: Strengthening and Standardizing the Management of Forestland Rights Registration and Certification, 2007

The positive impacts of policy II in all the situations might stem from the fact that holding forestland can generally enhance a firm’s benefits. It is possible to reduce not only those production costs that stem from direct costs incurred during the physical production process, but also transaction costs that relate to negotiating, monitoring, enforcing, and possibly bonding to the terms of arrangements [65].

Additionally, having an abundant timber supply on the future timber market could possibly preclude unreasonable timber-price increases, and thus reduce forest product firms’ production costs. Because farmers tend to invest more in forestland plots where the tenure security is considered high [66], the forestland rights registration and certification policy, which gives individual farmers some secure rights over currently collective forestland, would allow farmers to invest in new means of production [5,24]. Thus, the domestic timber supply derived from collective forestland is expected to increase in the future, as Zhang and Buongiorno speculate [28]. Hence, it is possible that said policy will push stock market investors to remain positive vis-à-vis future firm values.

5.3. Policy III: Promoting the Collective Forestland Tenure Reform, 2008

As policy III emphasizes collective forestland rights—particularly their assurance and transfer—it makes it possible for firms to hold forestland on their own in the future, by means of forestland transfer. Hence, this policy is likely to affect investor perception regarding the value of firms that do not hold forestland.

In considering all the firms as a group and only the firms with forestland holdings, the finding that policy III has had negative impacts aligns with that of Niquidet [16], namely, that the Forestry Revitalization Plan in British Columbia, in which forestland tenure was reallocated, had a negative impact on several forest product firms. Niquidet noted that one characteristic of these affected firms was that they were operating almost exclusively with fiber derived from public land; as such, the negative impact might have derived from the loss of forestland tenure and the difficulties in Canada associated with converting property rights into forest resources [16]. Likewise, Niquidet’s findings may have stemmed from uncertainties vis-à-vis the future state of forestland ownership management. For one thing, it could take a long time for the reform to be effectively implemented nationwide, even as the various forms of forestland ownership may still be subject to reform developments. For another, timber production is capital-intensive, which means that large amounts of capital can be tied to forestland [39]; under such circumstances, internal firm costs may increase in cases where a firm’s timberland holdings are large [15]. In addition, because forestland and forest production are two different businesses, conflicts may arise when firms decide to use their forestland as a supply base for their forest production or manage them as profit centers [39].

Another possible reason for such results might be the freezing rain and snow disaster in Southern China, which had a “great impact on the collective forest tenure reform” [67]. The disaster caused enormous damage in the 19 provinces that constitute the primary areas of collective forestland tenure reform. Among those 19 provinces, the collective forestland in 13 provinces, in which the collective forestland tenure reform had been fully implemented, accounts for 65% of all collective forestland across China [67]. As a consequence, in the wake of this natural disaster, investors might have been pessimistic regarding the value of forest product firms that hold forestland.

5.4. Policy IV: The Reform and Improvement of Collective Forestland Logging Management, 2009

This study found that policy IV had a negative impact on firms that do not hold forestland; this finding aligns with that of an event study conducted by Boardman, et al. [68], who found that, compared to firms that own forestland, those that do not have worse financial performance when logging restrictions were implemented in the 1990s in the United States. One possible explanation for the negative impact in the Chinese context could be that timber production is still restricted to some extent by the production quota for a certain period [28]. As indicated by policy IV, associated reforms to the timber production quota policy should be accomplished within five years; this new policy will replace the existing harvesting quota system with a record-keeping system [7]. Timber product manufacturing levels might be constrained on account of the timber harvesting quota, as it limits domestic timber supplies; this may explain the negative impact of the policy on the value of this type of firm. However, if firms in the furniture production/paper-making and paper products category have their own pulpwood forestland bases, then harvesting for pulpwood will be separate from the timber harvesting quota [69]. This might, in turn, explain the divergent reactions of this type of firm, and firms in timber product manufacturing.

5.5. Policy V: Strengthening the Management of Collective Forestland Rights Transfer, 2009

The finding that this policy has had a positive effect on firms that do not hold forestland—especially those in the furniture production/paper-making and paper products category—might be explained by the fact that, after the reform, it may have been easier for these firms to obtain raw production materials from the domestic timber market. Another possible explanation is that policy V also formally permitted forestland transfers, and this would imply the opportunity for firms that do not hold forestland to do so through leasing, contracting, and the like. Under the new collective forestland tenure reform, forest product firms can acquire forestland and secure long-term timber supply agreements by trading with farmers certain rights to the collective forestland. It is expected that such an action would allow firms to deal with incomplete information and uncertainty if they were to hold forestland [15].

6. Conclusions

This study employed an event study method to assess the effects of China’s collective forestland tenure reform policies on forest product firm values. To that end, this study examined five policies enacted between 2003 and 2009. This study used as events the official announcements of these policies, and for each policy, abnormal returns were calculated for these firms. The results of this study suggest that the impact of collective forestland tenure reform policies on forest product firm values varies from policy to policy. Generally, firms that do not hold forestland react more strongly to policies that promote forestland security and forestland transfers than do firms that hold forestland. Additionally, the effects on timber product manufacturing firms differ from those on furniture production/paper-making and paper product firms.

The findings of this study contribute significantly to the literature. First, while most studies have investigated the effects of reforms from the farmers perspective, the current study contributes to the literature by elucidating the effect of the collective forestland tenure reform in China, while taking the perspective of forest product firms. Since forest product firms are essential entities in the forest product industry, to fully understand the impact of the reform on that industry, it is essential to examine this issue from the viewpoint of these firms.

Second, this study responds to the call to investigate the relationship between structure and financial performance at the firm level in the forest product industry, under the structure-conduct-performance (SCP) paradigm [70]. In so doing, the current study validates the SCP paradigm, in the sense that tenure reform policy is found to affect a forest product firm’s financial performance as measured by changes in stock prices.

Third, this study provides valuable empirical evidence of the effects of collective forestland tenure reform on the value of forest product firms with and without forestland holdings, and firms that undertake timber products manufacturing and furniture production/paper-making and paper product manufacturing. The outcomes of this study reveal that, from the market investor perspective, collective forestland tenure reform policies have had very real impacts on the financial performance forest product firms that have forestland holdings. The responses of capital markets to different policies that relate to the collective forestland tenure reform suggest that for forest product firms that hold forestland assets, being in possession of forestland certificates could play an important strategic role. Hence, it is suggested that the collective forestland tenure reform should be accompanied by policies on how to enhance the management of forestland certificates, especially among forest product firms that hold forestland assets.

Finally, related studies have been mostly conducted in North American and European countries (e.g., Finland [14]). Although active increases in timberland holdings among Asian forest product firms suggest a predominantly resource-seeking motive among firms in this region, few studies have investigated the impact of such changes in timberland holdings on Asian firms’ financial performance [36]. The current study contributes to the literature in this respect, to show how forestland ownership affects Asian forest product firms’ financial performance and while using Chinese forest product firms as examples. Additionally, by using changes in stock prices as measures of change in firm values, the current study also shows the feasibility of using an event study in forestry economics research in the Chinese context.

The findings of this study bear important policy implications for future policy-making in terms of the management of forestland tenure in China. For one, since forestland holdings and forestland ownership certification have been found to play strategic roles in the anticipated value of forest product firms, the collective forestland tenure reform should be accompanied by policies on how to enhance the management of forestland ownership. In addition, to boost the domestic timber supplies of forest product firms via collective forestland tenure reform, policy-makers should consider introducing policies by which to establish a favorable and specific forest-wood logging management mechanism and encourage collective forestland owners to increase timber production. For another, the suggested relationship between forestland holdings and financial performance can be used to derive suggestions on how to help Chinese forest product firms adapt to the collective forestland tenure reform. For example, forest product firms that do not currently have forestland holdings may consider acquiring some.

Some study limitations, as well as some possible directions for future research are noted here. Although the results of the current study indicate that with the release of most collective forestland tenure reform policies, the stock market has become more favorable to forest product firms that have no timberland holdings, further research is needed to confirm the underlying reasons for this. Additionally, there is an ongoing debate regarding the efficiency of the Chinese stock markets, which throws into question the trustworthiness of applying the efficient market hypothesis [71]. Further research should be conducted to strengthen the viability of using the stock value to represent the firm value in China and support the reliability of the results herein. Moreover, forest product firms that are not listed on the stock market may need to interpret the results of this study with caution, as an event study allows only for the investigation of firms for which stock prices are available. Hence, further research may wish to take different approaches in examining the impact of the collective forestland tenure reform on the financial performance of forest product firms not publicly traded on the stock market, especially small or medium-sized firms. For example, future research may consider testing the relationship by using the actual financial benefits of forestland ownership on production, whenever it can be observed.

Author Contributions

Conceptualization, T.Z. and S.Y.; methodology, T.Z.; formal analysis, T.Z.; resources, J.Y.; data curation, Z.L.; writing—original draft preparation, T.Z.; writing—review and editing, A.A.H.; supervision, S.Y.; funding acquisition, Z.L., S.Y. and A.A.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China, grant number 71603126 and 71911530164; the Special Fund for Forest Scientific Research in the Public Welfare, grant number 201504424 and the Swedish Foundation for International Cooperation in Research and Higher Education (STINT), grant number CH2018-7762.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Summary of event studies in forest economics and related fields.

Table A1.

Summary of event studies in forest economics and related fields.

| Authors | Topic | Region | Estimation Method | Sample Size | Event Window | Estimation Window | Major Findings |

|---|---|---|---|---|---|---|---|

| Sun and Zhang [72] | Industrial timberland sales | U.S. | 1. Standard event analysis 2. Capitalization analysis 3. Risk analysis | 32 events; 11 firms | (0, 3) | (−80, −1) for estimation and capitalization analysis (4103) and (4153) for risk analysis | 1. Positive abnormal rates of returns is associated with timberland sales 2. Change in capitalization is related to firms’ total asset and sales |

| Sun, et al. [73] | Industrial timberland ownership | U.S. | 1. Standard Event analysis 2. Event analysis with GARCH modeling 3. Event-induced volatility | 24 events; 24 firms | (−15, 15) | (−265, −16) | 1. Negative impact for timberland sales by forest firms and acquisitions by Real estate investment trusts (REITs) 2. Positive impact for conversions to REITs |

| Bouslah, et al. [74] | Forest certification | Canada and U.S. | 1. Standard event analysis 2. Buy-and-hold abnormal return (BHAR) approach | 151 events; 42 firms | (−1, +1) (−10, 10) | 1. 36 months before the certification announcements month for stand event analysis 2. 36 months following the certifications announcements month for the BHAR approach | 1. No significant impact on firms’ financial performance in the short run 2. Negative impact on firms’ financial performance in the long run. |

| Zhang and Binkley [34] | Forest policy change on harvesting rights | Canada | 1. Standard event analysis 2. Multiple regression analysis | three events; 11 firms | (−8, 14) | 147 days ending two weeks prior to the announcement date | 1. Negative, but not statistically significant impact on all firms 2. Small but statistically insignificant negative impact on medium-sized firms that own little private land and operate mainly locally 3. No impact on large local firms and non−local firms |

| Binkley and Zhang [35] | Timber−fee increase | Canada | Standard event study | 1 event; 12 firms | (−27, 5) | 218 days | 1. Negative impact |

Table A2.

Summary of event studies in forest economics and related fields (continued).

Table A2.

Summary of event studies in forest economics and related fields (continued).

| Authors | Topic | Region | Estimation Method | Sample Size | Event Window | Estimation Window | Major Findings |

|---|---|---|---|---|---|---|---|

| Niquidet [16] | Forest Revitalization Plan | Canada | Standard event study | one event; 13 firms | (0) | 448 trading days | Negative impact on several firms |

| Ho, et al. [75] | Bankruptcy | North America | Standard event study | Four events; four firms | (−20, 5) | (−250, −50) | 1. Negative market reaction to a bankruptcy announcement for pulp and paper firms. |

| Mei and Sun [76] | Merger and acquisitions (M&A) | U.S. | 1. Standard event study 2. Risk analysis | 1. 70 events; 90 firms for standard event study 2. 14 events; 90 firms for risk analysis | (−7, 7) (−5, 5) (−3, 3) (−1, 1) | 1. 200 days before selected event window for standard event study 2. 50,100, and 150 days after the event window for risk analysis | 1. Positive impact over the 15-day event windows and the 3-day event window |

| Sun and Liao [44] | Litigation under the Endangered Species Act (ESA) on forest products firms | U.S. | 1. Standard event study 2. Risk analysis | six events; 14 firms | (−2, 2) (−3, 3) (−4, 4) (−5, 5) (−6, 6) (−7, 7) | 1. 250 days before selected event window for standard event study 2. 50,100, and 150 days before and after the event window for risk analysis | 1. Four cases generated either positive or negative impacts. |

| Mendell, et al. [77] | Timberlands structured as real estate investment trusts (REIT) | U.S. | Standard event analysis | four events; four firms | (−5, 5) | (−105, −6) | 1. Positive impact on stock prices |

| Malhotra and Gulati [78] | The 1996 U.S.-Canada Softwood Lumber Agreement | U.S. | Standard event analysis | one event; 37 firms | (−1, 1) (−2, 2) (−3, 3) (−5, 5) | (−369, −31) (365 days) | 1. Negative impacts on the stock prices |

References

- State Forestry Administration. China Forestry Statistical Yearbook; China Forestry Publishing House: Beijing, China, 2014. [Google Scholar]

- Xu, J.; Hyde, W.F. Collective forest tenure reform in China. In Forest Tenure Reform in Asia and Africa: Local Control for Improved Livelihoods, Forest Management, and Carbon Sequestration; Bluffstone, R., Robinson, E.J.Z., Eds.; Routledge: London, UK, 2014. [Google Scholar]

- Hyde, W.F. Whereabouts devolution and collective forest management? For. Policy Econ. 2016, 72, 85–91. [Google Scholar] [CrossRef]

- Zhang, Y.; Shen, Y.; Wen, Y.; Xie, Y.; Wang, S. China’s forest land tenure reforms: Redefining and recontracting the bundle of rights. In Handbook of Forest Resource Economics; Kant, S., Alavalapati, J., Eds.; Routledge: London, UK, 2014; pp. 417–429. [Google Scholar]

- Luo, Y.; Liu, J.; Zhang, D.; Dong, J. Actor, customary regulation and case study of collective forest tenure reform intervention in China. Small-Scale For. 2015, 14, 155–169. [Google Scholar] [CrossRef]

- Yang, B.; Busch, J.; Zhang, L.; Ran, J.; Gu, X.; Zhang, W.; Du, B.; Xu, Y.; Mittermeier, R.A. China’s collective forest tenure reform and the future of the giant panda. Conv. Lett. 2015, 8, 251–261. [Google Scholar] [CrossRef]

- State Forestry Administration. China Forestry Statistical Yearbook; China Forestry Publishing House: Beijing, China, 2016. [Google Scholar]

- Bonsi, R.; Gnyawali, D.R.; Hammett, A.L. Achieving sustained competitive advantage in the forest products firm: The importance of the resource-based view (RBV). J. For. Prod. Bus. Res. 2008, 5, 1–4. [Google Scholar]

- Ke, S.; Qiao, D.; Zhang, X.; Feng, Q. Changes of China’s forestry and forest products industry over the past 40 years and challenges lying ahead. For. Policy Econ. 2019, 106, 1. [Google Scholar] [CrossRef]

- Zhang, T.; Lan, J.; Yu, J.; Liu, Z.; Yao, S. Assessment of forest restoration projects in different regions using multicriteria decision analysis methods. J. For. Res. 2020, 25, 12–20. [Google Scholar] [CrossRef]

- Yin, H.; Xu, J. Empirical analysis of the influence of collective forest tenure reform on timber supply. For. Econ. 2010, 4, 27–30. [Google Scholar]

- Liu, X. Empirical analysis on the influence of collective forest tenure reform on the forest resources. For. Econ. 2010, 6, 40–45. [Google Scholar]

- Yin, R.; Harris, T.G.; Izlar, B. Why forest products companies may need to hold timberland. For. Prod. J. 2000, 50, 39. [Google Scholar]

- Lähtinen, K.; Haara, A.; Leskinen, P.; Toppinen, A. Assessing the relative importance of tangible and intangible resources: Empirical results from the forest industry. For. Sci. 2008, 54, 607–616. [Google Scholar]

- Li, Y.; Zhang, D. Industrial timberland ownership and financial performance of US forest products companies. For. Sci. 2014, 60, 569–578. [Google Scholar] [CrossRef]

- Niquidet, K. Revitalized? An event study of forest policy reform in British Columbia. J. For. Econ. 2008, 14, 227–241. [Google Scholar] [CrossRef]

- Hyde, W.F.; Yin, R. 40 years of China’s forest reforms: Summary and outlook. For. Policy Econ. 2019, 98, 90–95. [Google Scholar] [CrossRef]

- Zhang, H.; Zhang, M. Collective forest arrangement and villagers’ action attitude—Case study in the Yefang village in Fujian Province. Chin. Rural Econ. 2005, 38–43. [Google Scholar]

- Sun, X.; Wang, L.; Gu, Z. A brief overview of China’s timber market system. Int. For. Rev. 2004, 6, 221–226. [Google Scholar] [CrossRef]

- He, J.; Sikor, T. Looking beyond tenure in China’s collective forest tenure reform: Insights from Yunnan Province, Southwest China. Int. For. Rev. 2017, 19, 29–41. [Google Scholar] [CrossRef]

- Collective Forest Right System Reform Leading Group Office. Compilation of Important Documents and Policies and Regulations for the Collective Forest Right System Reform; China Forestry Publishing House: Beijing, China, 2010. [Google Scholar]

- Yin, R. Empirical linkages between devolved tenure systems and forest conditions: An introduction to the literature review. For. Policy Econ. 2016, 73, 271–276. [Google Scholar] [CrossRef]

- Yang, Y.; Li, H.; Liu, Z.; Cheng, L.; Abu Hatab, A.; Lan, J. Effect of forestland property rights and village off-farm environment on off-Farm employment in Southern China. Sustainability 2020, 12, 2605. [Google Scholar] [CrossRef]

- Yi, Y.; Köhlin, G.; Xu, J. Property rights, tenure security and forest investment incentives: Evidence from China’s Collective Forest Tenure Reform. Environ. Dev. Econ. 2014, 19, 48–73. [Google Scholar] [CrossRef]

- Yang, Y.; Li, H.; Liu, Z.; Hatab, A.A.; Ha, J. Effect of forestland tenure security on rural household forest management and protection in southern China. Glob. Ecol. Conserv. 2020, 22, e00952. [Google Scholar] [CrossRef]

- Miao, G.; West, R. Chinese collective forestlands: Contributions and constraints. Int. For. Rev. 2004, 6, 282–298. [Google Scholar] [CrossRef]

- State Forestry Administration. China Forestry Development Report; House, C.F.P., Ed.; State Forestry Administration: Beijing, China, 2011, 2018, 2010.

- Zhang, H.; Buongiorno, J. Markets, government policy, and China’s timber supply. Silva Fenn. 2012, 46, 595–608. [Google Scholar] [CrossRef]

- Shi, L.; Zhang, S.; Wang, S. Empirical research on timber price fluctuation mechanism under the condition of forestry tenure reform. For. Econ. 2014, 9, 59–64. [Google Scholar]

- Owubah, C.E.; Le Master, D.C.; Bowker, J.M.; Lee, J.G. Forest tenure systems and sustainable forest management: The case of Ghana. For. Ecol. Manag. 2001, 149, 253–264. [Google Scholar] [CrossRef]

- Thees, O.; Olschewski, R. Physical soil protection in forests-insights from production-, industrial-and institutional economics. For. Policy Econ. 2017, 80, 99–106. [Google Scholar] [CrossRef]

- Sundstrom, L.M.; Henry, L.A. Private rorest governance, public policy impacts: The forest stewardship council in Russia and Brazil. Forests 2017, 8, 445. [Google Scholar] [CrossRef]

- Ralston, P.M.; Blackhurst, J.; Cantor, D.E.; Crum, M.R. A structure–conduct–performance perspective of how strategic supply chain integration affects firm performance. J. Supply Chain Manag. 2015, 51, 47–64. [Google Scholar] [CrossRef]

- Zhang, D.; Binkley, C.S. The economic effect of forest policy changes in British Columbia: An event study of stock-market returns. Can. J. For. Res. 1995, 25, 978–986. [Google Scholar] [CrossRef]

- Binkley, C.S.; Zhang, D. Impact of timber-fee increases on British Columbia forest products companies: An economic and policy analysis. Can. J. For. Res. 1998, 28, 617–625. [Google Scholar] [CrossRef]

- Korhonen, J.; Zhang, Y.; Toppinen, A. Examining timberland ownership and control strategies in the global forest sector. For. Policy Econ. 2016, 70, 39–46. [Google Scholar] [CrossRef]

- Lukason, O.; Lukason, T.; Varblane, U. Firm failure causes in the forest sector: An analysis of bankrupted Estonian firms. Balt. For. 2016, 22, 175–180. [Google Scholar]

- Korhonen, S. A Capability-Based View of Organisational Renewal: Combining Opportunity-and Advantage-Seeking Growth in Large, Established European and North American Wood-Industry Companies; Finnish Society of Forest Science: Helsinki, Finland, 2006. [Google Scholar]

- Yin, R.; Caulfield, J.P.; Aronow, M.E.; Harris, T.G., Jr. Industrial timberland: Current situation, holding rationale, and future development. For. Prod. J. 1998, 48, 43. [Google Scholar]

- Spence, M. Job market signaling. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Fama, E.F.; Fisher, L.; Jensen, M.C.; Roll, R. The adjustment of stock prices to new information. Int. Econ. Rev. 1969, 10, 1–21. [Google Scholar] [CrossRef]

- Konchitchki, Y.; O’Leary, D.E. Event study methodologies in information systems research. Int. J. Acc. Inf. Syst. 2011, 12, 99–115. [Google Scholar] [CrossRef]

- Eastman, J.K.; Iyer, R.; Wiggenhorn, J.M. The short-term impact of Super Bowl advertising on stock prices: An exploratory event study. J. Appl. Bus. Res. 2010, 26, 69. [Google Scholar] [CrossRef][Green Version]

- Sun, C.; Liao, X. Effects of litigation under the Endangered Species Act on forest firm values. J. For. Econ. 2011, 17, 388–398. [Google Scholar] [CrossRef]

- Kohers, T.; Pandey, V.; Kohers, G. Using nonlinear dynamics to test for market efficiency among the major U.S. stock exchanges. Q. Rev. Econ. Financ. 1997, 37, 523–545. [Google Scholar] [CrossRef]

- Chan, K.C.; Gup, B.E.; Pan, M.S. International stock market efficiency and integration: A study of eighteen nations. J. Bus. Financ. Acounting 1997, 24, 803–813. [Google Scholar] [CrossRef]

- Lima, E.J.A.; Tabak, B.M. Tests of the random walk hypothesis for equity markets: Evidence from China, Hong Kong and Singapore. Appl. Econ. Lett. 2004, 11, 255–258. [Google Scholar] [CrossRef]

- Feng, K. An empirical study on the Chinese stock market efficiency. Bus. China 2009, 10, 33–34. [Google Scholar]

- Liu, X. Investigation on the Chinese stock market efficiency. Econ. Forum 2015, 10, 45–48. [Google Scholar]

- Hung, J.-C. Deregulation and liberalization of the Chinese stock market and the improvement of market efficiency. Q. Rev. Econ. Financ. 2009, 49, 843–857. [Google Scholar] [CrossRef]

- Chong, T.T.-L.; Lam, T.-H.; Yan, I.K.-M. Is the Chinese stock market really inefficient? China Econ. Rev. 2012, 23, 122–137. [Google Scholar] [CrossRef]

- Balsara, N.J.; Chen, G.; Zheng, L. The Chinese stock market: An examination of the random walk model and technical trading rules. Q. J. Bus. Econ. 2007, 46, 43–63. [Google Scholar]

- Beltratti, A.; Bortolotti, B.; Caccavaio, M. Stock market efficiency in China: Evidence from the split-share reform. Q. Rev. Econ. Financ. 2016, 60, 125–137. [Google Scholar] [CrossRef]

- Kong, D.; Liu, S.; Dai, Y. Environmental policy, company environment protection, and stock market performance: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2014, 21, 100–112. [Google Scholar] [CrossRef]

- Wang, M.; Qiu, C.; Kong, D. Corporate social responsibility, investor behaviors, and stock market returns: Evidence from a natural experiment in China. J. Bus. Ethics 2011, 101, 127–141. [Google Scholar] [CrossRef]

- Xu, X.D.; Zeng, S.X.; Tam, C.M. Stock market’s reaction to disclosure of environmental violations: Evidence from China. J. Bus. Ethics 2012, 107, 227–237. [Google Scholar] [CrossRef]

- Lin, J.-S.C.; Jang, W.-Y.; Chen, K.-J. Assessing the market valuation of e-service initiatives. Int. J. Serv. Ind. Manag. 2007, 18, 224–245. [Google Scholar] [CrossRef]

- Jacobs, B.W.; Singhal, V.R.; Subramanian, R. An empirical investigation of environmental performance and the market value of the firm. J. Oper. Manag. 2010, 28, 430–441. [Google Scholar] [CrossRef]

- Corrado, C.J. Event studies: A methodology review. Account. Financ. 2011, 51, 207–234. [Google Scholar] [CrossRef]

- Dobija, D.; Klimczak, K.M.; Roztocki, N.; Weistroffer, H.R. Information technology investment announcements and market value in transition economies: Evidence from Warsaw Stock Exchange. J. Strat. Inf. Syst. 2012, 21, 308–319. [Google Scholar] [CrossRef]

- Brown, S.J.; Warner, J.B. Using daily stock returns: The case of event studies. J. Financ. Econ. 1985, 14, 3–31. [Google Scholar] [CrossRef]

- Zhao, D. Listed companies industry classification standard (2012 revision). Stock Mark. Trend Anal. Wkly. 2012, 26, 13. [Google Scholar]

- Bhojraj, S.; Lee, C.; Oler, D.K. What’s my line? A comparison of industry classification schemes for capital market research. J. Account. Res. 2003, 41, 745–774. [Google Scholar] [CrossRef]

- Hrazdil, K.; Trottier, K.; Zhang, R. A comparison of industry classification schemes: A large sample study. Econ. Lett. 2013, 118, 77–80. [Google Scholar] [CrossRef]

- Collis, D.J.; Montgomery, C.A. Corporate Strategy: Resources and the Scope of the Firm; McGraw-Hill Ecuation: Irwin, IL, USA, 1997. [Google Scholar]

- Qin, P.; Xu, J. Forest land rights, tenure types, and farmers’ investment incentives in China: An empirical study of Fujian Province. China Agric. Econ. Rev. 2013, 5, 154–170. [Google Scholar] [CrossRef]

- Yuan, Y. The freezing rain and snow disaster cannot hold the way forward for the collective forest tenure reform. Economics 2008, 4, 114–115. [Google Scholar]

- Boardman, A.; Vertinsky, I.; Whistler, D. Using information diffusion models to estimate the impacts of regulatory events on publicly traded firms. J. Public Econ. 1997, 63, 283–300. [Google Scholar] [CrossRef]

- State Planning Commission; Ministry of Finance; State Forestry Administration. Opinion on Speeding up the Construction of the Paper Industry Raw Material Forest Base; State Planning Commission, Ministry of Finance, State Forestry Administration: Beijing, China, 2001. [Google Scholar]

- Schauerte, T.; Lindblad, F.; Johansson, J. Industry structure and risk positions for wooden single-family house firms in Sweden: Evaluating their potential to enter the multi-family house segment. In Proceedings of the Forest Products Society and World Conference on Timber Engineering Joint Proceedings, Québec City, QC, Canada, 10–14 August 2014. [Google Scholar]

- Chen, M.; Hong, Y. Has Chinese stock market become efficient? Evidence from a new approach. In Computational Science—ICCS 2003; Sloot, P.M.A., Abramson, D., Bogdanov, A.V., Gorbachev, Y.E., Dongarra, J.J., Zomaya, A.Y., Eds.; Springer: Berlin/Heidelberg, Germany, 2003; pp. 90–98. [Google Scholar]

- Sun, X.; Zhang, D. An event analysis of industrial timberland sales on shareholder values of major US forest products firms. For. Policy Econ. 2011, 13, 396–401. [Google Scholar] [CrossRef]

- Sun, C.; Rahman, M.M.; Munn, I.A. Adjustment of stock prices and volatility to changes in industrial timberland ownership. For. Policy Econ. 2013, 26, 91–101. [Google Scholar] [CrossRef]

- Bouslah, K.; M’Zali, B.; Turcotte, M.-F.; Kooli, M. The impact of forest certification on firm financial performance in Canada and the US. J. Bus. Ethics 2010, 96, 551–572. [Google Scholar] [CrossRef]

- Ho, C.-Y.; McCarthy, P.; Yang, Y.; Ye, X. Bankruptcy in the pulp and paper industry: Market’s reaction and prediction. Empir. Econ. 2013, 45, 1205–1232. [Google Scholar] [CrossRef]

- Mei, B.; Sun, C. Event analysis of the impact of mergers and acquisitions on the financial performance of the US forest products industry. For. Policy Econ. 2008, 10, 286–294. [Google Scholar] [CrossRef]

- Mendell, B.C.; Mishra, N.; Sydor, T. Investor responses to timberlands structured as real estate investment trusts. J. For. 2008, 106, 277–280. [Google Scholar]

- Malhotra, N.; Gulati, S. The effects of the 1996 US-Canada softwood lumber agreement on the industrial users of lumber: An event study. Contemp. Econ. Policy 2010, 28, 275–287. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).