Abstract

This paper presents a theoretical and empirical analysis of how banks apply artificial intelligence (AI) in digital and mobile banking to implement and communicate ESG (Environmental, Social, and Governance) strategies, with particular emphasis on environmental dimensions of sustainable finance. The study adopts a mixed methodological approach combining desk research, encompassing a synthesis of academic studies, industry reports, and European regulatory frameworks on AI and ESG, and case study analysis of selected banks implementing AI-based sustainability solutions. The findings reveal that AI supports ESG strategy implementation primarily through green investment recommendations, carbon footprint analytics, automated sustainability reporting, and ethical communication with clients. AI-driven tools enhance the operational efficiency, transparency, and customer engagement of financial institutions while simultaneously fostering low-carbon financial behaviors. However, the study also highlights ethical and governance challenges related to algorithmic transparency, data bias, and responsible AI oversight. The paper contributes to the growing body of literature on AI-driven digital transformation and sustainable finance by identifying research gaps and outlining future directions for exploring the role of AI in accelerating the transition of the banking sector.

1. Introduction

The dynamic development of digital technologies, combined with increasing regulatory and societal pressure, has positioned the banking sector as an active participant in achieving the goals of sustainable development and the energy transition. In particular, the implementation of the ESG (Environmental, Social, and Governance) concept has become one of the core objectives of many financial institutions [1,2]. At the same time, the ongoing digitalization of banking services, including the rise in mobile banking and AI-based tools, creates new opportunities for implementing ESG principles and engaging users in pro-environmental and pro-energy behaviors [3,4]. The literature emphasizes that AI constitutes a key component of modern banking systems, supporting process automation, big data analytics, risk assessment, service personalization, and operational efficiency optimization [3,4]. An increasing number of studies indicate that AI can play a crucial role in achieving environmental objectives by facilitating customer carbon footprint monitoring, identifying green investments, analyzing ESG indicators, and automating non-financial reporting [5,6]. Mobile applications, in particular, serve as an attractive channel for integrating AI functions with tools that encourage environmentally friendly behavior, enabling personalized communication, ecological education, and the promotion of pro-sustainability attitudes that support the energy transition [2]. At the same time, scholars and practitioners highlight challenges and risks associated with AI use in the ESG context, such as the lack of data standardization, ethical concerns, algorithmic accountability, decision-model biases, and the risk of “technological greenwashing” [7,8]. Consequently, there is a growing need to develop frameworks for Responsible AI and Explainable AI that ensure transparency, auditability, and user trust in the digital finance environment [7]. Despite the growing number of publications addressing digital transformation in the financial sector and AI applications, a research gap persists regarding the integration of these technologies with ESG strategy implementation, particularly in mobile banking and its role in shaping pro-environmental behaviors and the perceived credibility of banks among young users [1,5].

Theoretical Framework

The theoretical framework of this study integrates perspectives from environmental economics, energy economics, and innovation theory, focusing on the asymmetric relationships between competitive industrial performance, industrialization, renewable energy use, and the carbon footprint. Central to the analysis is the role of artificial intelligence (AI), circular economy–related technologies, and energy intensity in achieving Sustainable Development Goal 13 (Climate Action) [9,10].

From the perspective of environmental economics, increasing competitive industrial performance and advancing industrialization are key drivers of energy consumption and CO2 emissions. However, these relationships are neither linear nor symmetric: positive production shocks may generate disproportionately higher carbon footprints, whereas economic slowdowns do not necessarily lead to equivalent emission reductions. This asymmetry underscores the need to identify mechanisms capable of mitigating the environmental costs of industrial growth [10,11].

The literature highlights renewable energy deployment and energy intensity as critical moderating factors in the industry–environment nexus. An increasing share of renewable energy and improvements in energy efficiency can weaken the emission pressures associated with industrialization, although the magnitude of these effects depends on the technological structure of the economy and its stage of development, further reinforcing the asymmetric nature of these relationships [12,13,14].

Within this context, artificial intelligence is conceptualized as a general-purpose technology with the potential to reshape the relationship between industrial competitiveness and environmental outcomes. AI enables energy optimization, intelligent production management, and the integration of renewable energy sources, thereby contributing to carbon footprint reduction [10,15]. At the same time, its environmental impact is not unidirectional: under conditions of high energy intensity, the initial expansion of AI applications may increase energy demand, while in the long term it tends to enhance efficiency and reduce emissions [12,14].

This perspective is complemented by the concept of the circular economy in which digital technologies—particularly AI—support resource efficiency, waste reduction, and lower energy intensity. The integration of AI, circular economy models, and renewable energy creates synergistic effects that facilitate climate mitigation while sustaining industrial competitiveness [16,17,18].

In relation to SDG 13, the theoretical framework assumes that the interactions among industrialization, energy systems, technology, and carbon footprint are asymmetric and context-dependent. Artificial intelligence, circular economy-related technologies, and energy efficiency improvements are therefore viewed as key enablers of “green competitiveness,” allowing industrial performance to improve without proportional increases in emissions [15,19,20]. These theoretical considerations provide the foundation for the subsequent empirical analysis of AI’s role in environmental sustainability.

This article aims to analyze the role of AI in implementing the ESG concept in digital banking, with particular emphasis on applications in mobile banking that support the energy transition. The study is based on a systematic review of literature published between 2015 and 2025 and contributes to the interdisciplinary discourse linking sustainable finance, digital technology, and algorithmic ethics.

2. Methodology

The study adopts a qualitative research approach that combines two complementary methods: secondary data analysis (desk research) and a structured case study analysis. The desk research method involved a systematic review of academic literature, industry reports, and institutional publications concerning the use of artificial intelligence in the context of ESG strategies within the banking sector. The analysis encompassed both academic sources indexed in databases such as Scopus, Web of Science, and SSRN, as well as reports published by financial institutions and regulators (e.g., EBA, ECB, MAS, SEC), international organizations (e.g., UNEP FI, WEF, OECD), and consulting firms (e.g., Deloitte, PwC, Accenture). The objective of this stage was to identify key areas of AI application in banking with respect to the three ESG dimensions: environmental (E), social (S), and governance (G).governance (G).

2.1. ESG—AI Maturity Assessment Framework for Banks

To ensure methodological transparency and replicability of the case study analysis, the study introduces a structured ESG—AI maturity assessment framework specifically designed for the banking sector. The framework serves as the analytical backbone of the empirical part of the study and enables a systematic comparison of AI-driven ESG practices across banks operating in different regulatory and market environments.

The framework is based on a multi-dimensional evaluation model covering strategic, data-related, technological, governance, and reporting aspects of ESG—AI integration. In total, twelve assessment dimensions were defined, including (i) integration of AI into ESG and sustainability strategy, (ii) use of AI in ESG and climate risk assessment, (iii) application of ESG—AI in credit and investment decision-making, (iv) scope and integration of ESG data (including Scope 1–3 emissions), (v) level of data automation, (vi) AI techniques applied (ML, NLP, generative AI), (vii) model explainability, (viii) AI governance mechanisms, (ix) regulatory alignment, (x) automation of ESG reporting, and (xi) value creation for sustainable finance.

Each dimension is assessed using a five-point ordinal scale (0–4), where higher values indicate a more advanced level of ESG—AI maturity. The detailed scoring logic, criteria, and maturity thresholds are presented in Table 1, enabling transparency, consistency, and replicability of the assessment. Based on the total score, banks are classified into five maturity levels: Initial, Emerging, Operational, Integrated, and Transformational.

Table 1.

ESG—AI Maturity Assessment Framework for Banks.

2.2. Case Study Design and Scoring Procedure

The second stage of the research is based on the case study method, applied to conduct an in-depth analysis of selected AI implementations in banks representing different regions of the world and diverse business models. Within a comparative research design, twenty case studies were developed, covering financial institutions from Europe, Asia, and North America. The cases were selected to reflect diversity in regulatory environments, technological capabilities, and strategic approaches to ESG and AI adoption.

Each case was evaluated by applying the ESG—AI maturity assessment framework described in Section 2.1. The scoring was based exclusively on publicly available information, including ESG reports, annual reports, sustainability strategies, regulatory disclosures, and official descriptions of AI-based tools. This procedure ensured comparability across cases and reduced subjectivity in the evaluation process. The results of the assessment are summarized in a comparative case table (Table 2), which highlights similarities, differences, and best practices in AI-enabled ESG management across regions.

Table 2.

ESG—AI Maturity Scores by Bank.

2.3. Research Scope and Conceptual Model

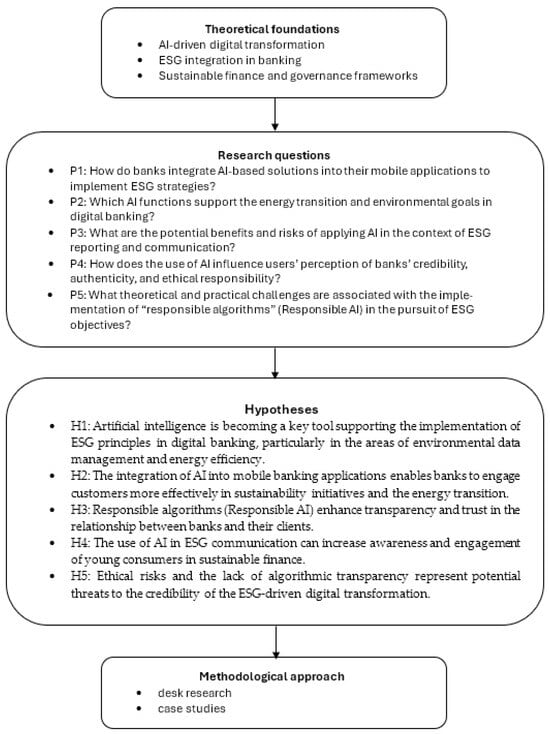

The aim of the study is to provide a conceptual analysis of the role of AI in implementing the ESG concept within the digital banking sector, with particular emphasis on how banks use AI-based solutions, including mobile applications, to implement, monitor, and communicate pro-energy and pro-environmental initiatives. The research adopts a conceptual and review-based character, aiming to deepen the understanding of the technological dimension of sustainable finance transformation. The conceptual research model is presented in Figure 1.

Figure 1.

The conceptual research model. Source: own research.

In formulating these research questions, it is assumed that AI has become one of the key drivers of the banking sector’s transformation toward sustainable development.

Methodological Contribution

In summary, the adopted methodology enables not only the systematic identification of AI applications supporting ESG objectives but also a structured and replicable comparison of banking practices across regions and levels of ESG–AI maturity. By combining desk research, a formalized maturity assessment framework, and comparative case analysis, the study addresses an identified research gap at the intersection of artificial intelligence, ESG management, and sustainable finance in banking.

3. Desk Research

3.1. ESG and Sustainable Finance in the Banking Sector

The growing importance of sustainable development in the financial sector stems from global climate challenges, increasing regulatory pressure, and evolving societal expectations regarding the role of financial institutions in the economy. Banks play a pivotal role in financing the energy transition and supporting the low-carbon economy, acting both as capital intermediaries and as institutions influencing investor and retail client behavior [1,2]. In response to tightening environmental requirements and heightened climate-related risks, financial institutions are required to implement comprehensive ESG frameworks encompassing credit policies, transparency, technological innovation, and risk management practices [21,22].

The literature identifies banks as key catalysts of sustainable investment, particularly in renewable energy, energy efficiency, and low-carbon infrastructure [3,4]. As sustainable finance becomes an integral component of financial sector strategies, banks increasingly develop tools to assess the environmental impact of lending activities and to facilitate capital allocation to green and transitional projects [23,24].

Global regulatory and reporting frameworks significantly shape ESG implementation in banking. Key initiatives include the United Nations Sustainable Development Goals (SDGs), the UN Principles for Responsible Banking (PRB), disclosure standards issued by the International Sustainability Standards Board (ISSB), and the Task Force on Climate-Related Financial Disclosures (TCFD) [24,25]. In parallel, the Basel Committee on Banking Supervision has incorporated climate risk management into financial stability guidelines [22]. Studies indicate that banks aligning with these frameworks are better equipped to assess climate-related risks within their portfolios and to improve capital allocation efficiency [1,7].

At the same time, the digitalization of banking services has gained importance as an enabler of sustainable finance at both operational and communication levels. Mobile banking has become the primary channel of interaction between clients and financial institutions, while digital technologies, including artificial intelligence (AI), support ESG indicator monitoring, user behavior analysis, and the deployment of solutions promoting environmentally responsible actions [2,5]. Increasingly, digital technologies are recognized not only as drivers of operational efficiency but also as instruments of pro-environmental transformation within the financial system [6,8].

Overall, the banking sector operates at the intersection of two major megatrends: the energy transition and the digitalization of finance. Financial institutions are therefore expected not only to comply with ESG regulations but also to actively support the transformation of consumption and investment patterns toward sustainability. In this context, the integration of advanced technologies such as artificial intelligence into ESG management systems is becoming a critical factor in enhancing resilience, competitiveness, and social trust in the financial sector.

3.2. Artificial Intelligence in Digital Banking

The progressive digitalization of the financial sector over the past decade has positioned artificial intelligence (AI) as a key tool supporting the transformation of banking operational models, risk management, and customer experience [3,4]. AI-based solutions are widely applied in credit scoring, transaction monitoring for anti-money laundering (AML) purposes, back-office process automation, and the personalization of financial products and communication [5,8]. Through behavioral data analysis and machine learning techniques, banks are able to identify customer behavior patterns, predict needs, and develop more tailored products and services [4].

The academic literature emphasizes that the application of AI in mobile banking represents one of the most dynamically developing areas of digital finance [2]. Mobile banking applications increasingly rely on algorithms to analyze transaction histories, predict consumer behavior, and support personal financial management, including automated expense categorization, budget planning, and personalized financial recommendations [3,6]. Moreover, the deployment of intelligent voice assistants, chatbots, and tools based on large language models (LLMs) enhances service accessibility and improves bank–client communication by enabling continuous, personalized support [8].

Regulatory frameworks and reporting standards significantly shape the development of ESG practices in the banking sector. Key initiatives include the United Nations Sustainable Development Goals (SDGs), the UN Principles for Responsible Banking (PRB), disclosure standards issued by the International Sustainability Standards Board (ISSB), and the Task Force on Climate-Related Financial Disclosures (TCFD) [24,25]. At the supervisory level, the Basel Committee on Banking Supervision has incorporated climate risk management into financial stability guidelines [22]. The literature indicates that banks aligning with these frameworks are better equipped to assess climate-related risks in their asset portfolios and to improve the effectiveness of capital allocation [1,7].

Beyond process automation and efficiency gains, AI contributes to innovation in customer relationship management and value creation, supporting the transformation of banking business models [1]. The growing importance of digital channels, together with the preferences of younger user cohorts, reinforces the need to integrate advanced AI-based solutions into mobile banking, which has become the dominant platform for client interaction [2]. Consequently, AI plays a central role in reshaping banking operations, strategies, and interactions with the broader socio-economic environment.

In summary, the development of AI in digital banking underpins the ongoing transformation of the financial sector by enabling automation, efficiency improvements, service personalization, and enhanced operational security. In the context of the subsequent analysis focused on AI–ESG integration, it is important to emphasize that AI-based tools in banking support not only economic performance but also environmental and social processes, thereby constituting a core component of sustainable finance.

3.3. Integration of Artificial Intelligence with ESG Goal Implementation in Banking

The integration of artificial intelligence (AI) into ESG implementation in the banking sector constitutes a key direction in the development of contemporary sustainable finance. The literature indicates that AI enables effective monitoring of environmental indicators, optimization of ESG-related processes, and automation of non-financial reporting, thereby supporting regulatory compliance and the creation of competitive advantage [2,26]. Banks increasingly apply AI algorithms to analyze customer carbon footprint data, identify areas of high environmental impact, and design financial products promoting low-emission and sustainable investments [27,28].

Within the environmental (E) dimension, AI applications include CO2 emission modeling, climate risk assessment, forecasting the effects of the energy transition on credit portfolios, and evaluating green investment projects [22,29]. Many financial institutions have implemented AI-based tools in mobile banking applications to monitor sustainable consumer behavior, such as expenditure-related carbon footprint calculators and environmentally oriented financial recommendations derived from behavioral data [1,30]. Empirical studies confirm that AI-driven personalization enhances customer engagement and increases the effectiveness of green “nudging” mechanisms [6,31].

In the social (S) dimension, AI contributes to financial inclusion by improving credit scoring accuracy and mitigating biases associated with traditional risk assessment approaches [21,32]. Machine learning models facilitate the analysis of microtransactions and behavioral data, enabling access to financial services for individuals with limited credit histories and supporting the development of products tailored to groups at risk of financial exclusion [26,28]. At the same time, the literature emphasizes the need for algorithmic transparency and auditability to prevent discriminatory outcomes and ensure fairness in automated decision-making processes [7,33].

Within the governance (G) dimension, AI supports the automation of due diligence procedures, assessment of operational and regulatory risks, and detection of greenwashing practices [34,35]. AI-based auditing tools improve the quality and consistency of ESG data, identify irregularities, and enhance corporate transparency [5,36]. The European Banking Authority (EBA) highlights AI as a key mechanism for enabling digital ESG supervision and ensuring compliance with sustainability reporting requirements [27].

Despite these benefits, the integration of AI with ESG also presents significant challenges. The literature identifies risks related to data bias, limited interoperability of reporting standards, technological greenwashing, and the high costs of implementing advanced AI systems [21,26,34]. Addressing these challenges requires coherent frameworks for responsible AI governance, robust auditing mechanisms, and the development of digital competencies among managerial staff [7,35].

Overall, the integration of AI with ESG in the banking sector fundamentally reshapes the measurement of environmental impact, the design of financial products, client communication practices, and institutional accountability for social responsibility. AI thus functions both as a catalyst for more effective ESG implementation and as an area requiring strengthened ethical, regulatory, and supervisory oversight.

3.4. Ethics, Trust, and Responsible Artificial Intelligence Governance in Banking

The development of artificial intelligence (AI) in the banking sector generates new ethical and regulatory challenges that are critical for maintaining public trust, institutional credibility, and financial market stability [7,21]. The literature emphasizes that the responsible deployment of AI requires robust governance frameworks ensuring algorithmic transparency, auditability, bias mitigation, and data privacy protection [26,33].

Concepts such as Responsible AI, Explainable AI (XAI), and Trustworthy AI define key principles for the ethical and fair design of algorithmic systems [37,38,39]. In banking, these principles are particularly relevant, as credit scoring models, fraud detection systems, and recommendation algorithms directly influence the financial outcomes of individuals and firms [2,40]. Biases embedded in training data may result in discriminatory decisions, thereby reinforcing financial exclusion [32,37].

Algorithmic transparency has therefore become a central issue, as users increasingly expect explanations of AI-driven financial recommendations and decisions. Empirical evidence indicates that transparency enhances user trust and increases willingness to adopt digital financial services [31,36]. In response, regulators have introduced oversight mechanisms for AI systems, including the European AI Act [33], the OECD Guidelines on Responsible AI, and the NIST AI Risk Management Framework in the United States [21,41].

Responsible AI governance also encompasses data protection, cybersecurity, and operational resilience. Banks are required to comply with data protection regulations (e.g., GDPR, CCPA) while investing in safeguards against data misuse and cyber threats [28,34]. Mechanisms such as AI audit trails and real-time model monitoring are increasingly adopted to detect undesirable algorithmic behavior and mitigate reputational and operational risks [24,27,35].

An additional challenge concerns the risk of technological greenwashing, whereby ESG narratives are supported by opaque algorithms without delivering measurable environmental outcomes, often compounded by fragmented reporting standards [26,34]. Consequently, institutions such as the ISSB, the European Banking Authority (EBA), and the UN Principles for Responsible Investment (PRI) advocate mandatory data validation procedures, ESG audits, and the establishment of ethical AI oversight structures [23,42].

In summary, responsible AI governance in banking requires an integrated approach combining technological capabilities, regulatory compliance, and ethical principles. Its core pillars include (1) transparency and explainability, (2) bias mitigation, (3) data protection and security, (4) auditability and supervisory oversight, and (5) trust building. The effective implementation of these principles determines not only regulatory compliance but also the long-term credibility and legitimacy of the banking sector in the digital economy.

3.5. Empirical Research Gaps in the Context of AI and ESG

Despite the growing interest in applying artificial intelligence (AI) to achieve ESG objectives in the financial sector, the literature identifies a substantial shortage of empirical evidence confirming the actual impact of AI technologies on ESG outcomes in banking [26,32,40]. Existing research is dominated by conceptual studies, review articles, and industry reports, while quantitatively grounded analyses and behavioral experiments remain scarce [2,28]. In particular, limited empirical evidence exists on the effectiveness of AI-driven mobile algorithms in promoting pro-environmental user behaviors, such as conscious consumption choices or preferences for low-emission financial products [30,31].

Scholars also point to the lack of longitudinal studies examining the effects of AI and ESG integration on credit portfolios, climate-related risks, and overall financial stability [22,29]. Although theoretical models addressing climate risk in banking portfolios have been developed, empirical validation remains constrained by limited data availability, the absence of standardized ESG metrics, confidentiality concerns, and fragmented data sources [21,24]. Consequently, banks often rely on predictive models whose effectiveness and objectivity have not been sufficiently tested under real market conditions [34,36].

A further research gap concerns the role of AI in advancing financial inclusion and reducing social inequalities. While prior studies suggest that algorithmic analysis of alternative data may lower credit barriers, empirical findings remain inconclusive and are frequently based on small or non-representative samples [21,32]. This highlights the need for robust empirical research examining when AI applications effectively mitigate bias and expand access to financial services, and when they may instead reinforce existing inequalities [7,33].

In addition, qualitative research on customer perceptions of AI in the ESG context remains limited, particularly with respect to young mobile banking users. The influence of AI-based personalization on environmentally conscious decision-making has not yet been sufficiently explored [1,6]. Empirical assessments are also needed to evaluate the effectiveness of tools such as carbon footprint calculators, green investment recommendation systems, and applications employing environmental “nudging” mechanisms [30,31]. A summary of the key research gaps identified in this study is presented in Table 3.

Table 3.

The main research gaps in the application of AI to the implementation of ESG-oriented sustainable development strategies in the banking sector.

3.6. Models of AI and ESG Integration

Three dominant models of AI integration into banks’ ESG processes can be identified:

- Analytical model—AI is applied as a data processing and interpretation tool, supporting climate risk measurement, portfolio analysis, stress testing, and compliance with sustainability reporting standards (ISSB/TCFD) [4,24,29]. Predictive models enable climate scenario simulations, allowing institutions to anticipate regulatory and market developments [21,53].

- Operational model—AI functions as an optimization and automation mechanism that streamlines internal processes, enhances IT system efficiency, and reduces the energy footprint of digital infrastructure, for example, through intelligent data center and cloud management [3,28]. This approach aligns with the concept of green cloud banking discussed in sectoral and consulting literature [31].

- Relational model—AI supports customer communication and interaction through chatbots, language assistants, and behavioral modules that enable ESG-related education, personalization, and the shaping of consumer behavior [2,30]. Empirical studies indicate that personalized recommendations significantly increase the effectiveness of pro-environmental actions [54,55].

The literature indicates a clear evolution from AI as a regulatory compliance tool (“compliance tech”) toward AI as a driver of social and environmental impact (“impact tech”). AI accelerates the energy transition by enabling emission modeling, climate risk assessment, and more efficient green financing mechanisms [1,29]. Algorithmic solutions allow banks to assess investment energy efficiency, identify physical and transition risks, and allocate capital to renewable energy projects with greater precision than traditional financial methods [53,56].

At the retail level, mobile banking applications incorporating carbon footprint tracking and green financial incentives increasingly serve educational and motivational functions [30]. Research on sustainable behavior design confirms that algorithmic micro-interventions can support attitude change and promote more sustainable consumption patterns [31,54]. At the same time, scholars caution that AI systems trained on historical data may perpetuate inefficient investment behaviors if such data fail to reflect the dynamics of the ongoing energy transition and emerging climate risk profiles [54,57].

3.7. Limitations and Risks of AI–ESG Integration: Standardization Gaps, Ethical Concerns, and Over-Automation

Despite the significant potential of integrating AI algorithms into energy and financial systems, this process involves multiple limitations and risks that require deliberate governance. A key challenge concerns the lack of standardization in methodologies and implementation protocols. The diversity of applied solutions and the absence of unified standards for data quality, system interoperability, and model validation reduce effectiveness and hinder technological scalability [58]. Insufficient standardization also limits the comparability of empirical findings and industrial applications, thereby slowing the diffusion of innovation [31].

Another critical issue relates to algorithmic ethics, including transparency of decision-making processes, accountability for algorithmic outcomes, and the risk of unintended bias arising from training data quality and structure [59]. In the context of energy infrastructure, AI-supported decisions may directly affect energy security, consumer protection, and sustainable development, necessitating enhanced oversight, explainability, and auditability of algorithmic systems [60].

The increasing automation of energy-related processes further raises concerns regarding excessive reliance on autonomous systems. While automation improves efficiency and reduces human error, overdependence on AI may erode operational competencies and weaken the capacity to respond effectively in crisis situations [61]. In addition, algorithmic failures and cyber threats pose potential risks to network stability and the continuity of energy supply [62].

Accordingly, the further development of AI-based systems in the energy sector should be accompanied by coherent ethical, regulatory, and operational frameworks that ensure their safe and responsible deployment. In the financial sector, AI constitutes a core element of digital transformation by enabling process automation, enhanced risk assessment, and the development of sustainable business models. However, the growing reliance on algorithmic decision-making—particularly in credit assessment, risk management, and ESG reporting—requires robust governance mechanisms to sustain trust in financial institutions and their sustainability commitments [21,35].

Responsible AI governance in the ESG context encompasses mechanisms ensuring model transparency, continuous risk monitoring, auditability, and regulatory compliance [22,41]. In practice, this involves the adoption of data quality standards, bias mitigation techniques, and model validation procedures grounded in ethical and environmental criteria [7,34]. The implementation of these principles directly affects the credibility of ESG reporting, particularly with regard to emission measurement, climate risk assessment, and the environmental impact of financed activities [62,63].

Moreover, the adoption of responsible AI governance strengthens stakeholder trust, including that of investors and financial institution clients. Greater algorithmic transparency and accountability improve data quality, reduce the risk of technological greenwashing, and support the development of fair and sustainable financial markets [36,39,64]. Consequently, institutions aligning AI governance frameworks with international standards and principles of technological ethics may gain reputational and operational advantages, which is particularly relevant in an increasingly dynamic regulatory environment [26,31].

Overall, responsible AI governance constitutes a critical pillar for building ESG credibility in the financial sector. Integrating ethical principles, compliance mechanisms, and technological oversight into decision-making processes enhances transparency, strengthens market trust, and supports the long-term stability and sustainability of financial systems.

The literature further indicates that AI is no longer perceived solely as a tool for process automation within ESG strategies but is increasingly embedded in banks’ business models as a catalyst for the green transformation of finance [1,2]. AI enables more advanced ESG analytics and transforms complex data into actionable insights, thereby reinforcing both regulatory compliance and competitive advantage [21,24].

In practice, banks deploy intelligent systems to monitor transaction-level carbon footprints, assess project alignment with green taxonomies, and classify credit and investment-related emissions [27,29]. From the end-user perspective, AI supports the personalization of environmental incentives, ranging from CO2 calculators in mobile banking applications to algorithms promoting environmentally conscious financial decisions, as observed in initiatives implemented by ING and Santander [30,65]. At the same time, AI increasingly functions as a digital sustainability assurance tool by automating ESG data evaluation and reducing the risk of human error [34,36]. This analytical precision enhances the quality of disclosed information and strengthens investor and customer trust [32]. Nevertheless, as highlighted in the literature, the actual impact of AI on ESG transformation remains partly declarative and insufficiently supported by robust empirical evidence [7,53].

4. Applications of AI Within ESG Strategies in the Banking Sector—A Case Study

The ongoing digitalization of finance and rising sustainability requirements place banking at the intersection of AI and ESG. ESG implementation extends beyond non-financial reporting toward systemic changes in decision-making, portfolio management, and stakeholder relations, with AI enabling large-scale data processing, automated risk assessment, and the operationalization of sustainable finance objectives. AI–ESG integration is driven by regulatory pressure and societal expectations. The EU Taxonomy Regulation (2020/852), CSRD, SFDR, and the EBA Sustainable Finance Roadmap 2022–2025 require systematic disclosure of environmental and social impacts, while the AI Act (2024) sets principles for responsible AI use, including transparency, risk management, and ethical compliance. Together, these regimes define a trajectory where AI supports both operational efficiency and social responsibility.

Across ESG pillars, AI supports (E) climate risk assessment, financed emissions monitoring, portfolio carbon footprint analysis, and EU Taxonomy alignment, increasingly enhanced through satellite and IoT data for impact verification; (S) financial inclusion via alternative-data credit assessment, bias detection and mitigation, and sentiment analysis for monitoring perceptions of social responsibility; and (G) fraud detection, compliance monitoring, explainability, and transparency in AML, CFT, and internal auditing through behavioral and network analysis. While benefits include improved risk management, portfolio optimization, cost reductions, and stronger trust, key challenges involve data quality, explainability, privacy, and Responsible AI compliance. The case study approach is therefore suitable for examining how banks operationalize AI-driven ESG strategies, differentiate maturity levels, identify best practices, and assess Responsible AI implementation alongside barriers and opportunities.

Case study 1. United Overseas Bank (UOB) & GreenFi (Singapur): automation of asset emission analysis using AI

The UOB–GreenFi partnership demonstrates AI-driven ESG analytics enabling automated analysis and reporting of financed GHG emissions [66,67,68]. Implemented within the UOB FinLab GreenTech Accelerator 2024 as a sustainability control tower, the platform automates data aggregation, deduplication, and consistency improvements, replacing fragmented spreadsheet-based processes [67,68]. GreenFi uses XAI and deep learning to process heterogeneous sources (ESG disclosures, certificates, energy/water use, emission records, climatic and geolocation data) within a lakehouse, generating Scope 1–3 indicators and detecting gaps/anomalies [47,69,70]. No-code dashboards align reporting with CSRD, SFDR, and the EU Taxonomy, linking outputs to the GHG Protocol and PCAF to support decarbonization scenario modeling [66,68]. The platform flags inconsistencies, identifies climate hotspots, and supports low-carbon transition decisions; literature cites it as an example of AI-driven ESG risk management, while emphasizing Responsible AI practices (validation, auditing, human-in-the-loop) to mitigate misclassification and bias risks [68,69,70,71,72,73]. Overall, it strengthens (E) financed emission measurement and (G) data governance, auditability, and compliance, illustrating a shift from reactive reporting to proactive climate risk management [66,67,68].

Case study 2. Mitsubishi UFJ Financial Group (MUFG)(Japonia): integration of AI and ESG management in a large global bank

MUFG integrates ambitious climate goals (net zero by 2050; emissions reductions by 2030; expanded sustainable finance) with data/AI infrastructure positioning it as an AI-native organization [47,70]. Its Portfolio ESG Reporting Solution (2021) maps ESG data to portfolios, generates aggregated ratings, identifies best/worst assets, and enables cross-sector analysis [47,70]; it relies on RepRisk, combining AI/ML and expert analysis to detect ESG risks at company/project level [74]. In 2025, MUFG Bank selected Databricks as a next-generation data and AI platform to unify model development and accelerate ML and generative AI deployments across risk, fraud, automation, and personalization [47,69,70]. Operationally, AI supports (G) through fraud detection and continuous monitoring (e.g., Mitsubishi UFJ NICOS behavioral profiling and risk scoring) and strengthens AML/CFT controls and customer protection [47,70]. MUFG also formalized Responsible AI governance via an AI Transparency and Responsible Use Policy and, in 2025, a Group-level MUFG AI Policy emphasizing fairness, transparency, data protection, accountability, and human oversight while restricting fully automated decisions with legal/equivalent effects [71,72,73]. In (E), MUFG’s climate risk framework incorporates physical/transition scenarios, sector targets by 2030, and credit policy alignment with decarbonization pathways, supported by data/AI partnerships and platforms for automated climate-risk and financed emissions monitoring [47,69,70,75,76]. Overall, MUFG exemplifies integrated AI–ESG across (E), (S) (controversy monitoring via external data/tools), and (G) (formal AI governance reported to top supervisory bodies) [47,69,70,71,72,73].

Case study 3. BNP Paribas (France): artificial intelligence in the service of sustainable finance and responsible governance

BNP Paribas integrates AI into its Positive Banking strategy, using analytics, reporting automation, and AI governance to deliver climate and social objectives [77,78,79]. In (E), the AI for Climate Risk Analytics platform (with IBM Environmental Intelligence Suite) combines satellite, meteorological, and financial data to assess physical risks (floods, droughts, heatwaves) affecting collateral and portfolios; ML computes exposure indicators integrated with credit risk models [77,78]. ESG data lake solutions consolidate emissions, energy, and sustainable finance data across the Group [52]. In (S), ML pilots in France and Africa use alternative data to assess creditworthiness of underbanked clients, while emphasizing Responsible AI compliance [71,72,73,79]. In (G), BNP Paribas’ AI Governance Charter (2023) defines requirements for explainability, ethical/social risk assessment, audits, and human-in-the-loop oversight, supervised by an AI Ethics Committee alongside the Group ESG Committee [78,79]. Under Data4ESG, NLP extracts ESG indicators from corporate disclosures aligned with EU Taxonomy and CSRD, improving accuracy and reducing reporting time; in 2025 the Group piloted generative AI for summarizing climate reports and scenarios with safeguards and expert oversight [79]. Overall, BNP Paribas illustrates AI-enabled transition from reactive reporting to integrated risk and value management across ESG pillars [77,78,79].

Czase study 4. ING Group (Netherlands): AI in assessing climate transition pathways and managing ESG risk

ING’s Terra approach aligns carbon-intensive portfolio segments with Paris-consistent pathways and net zero by 2050, based on financed emissions measurement and benchmarking against science-based scenarios [80,81,82]. In 2024, ING launched ESG.X to assess the credibility of clients’ transition plans by automatically collecting public climate data (emissions, targets, plans, governance) and generating a transition score embedded in risk assessment and transaction approvals, initially applied to ~2000 large high-emission clients [81,82]. ING’s ML-based Early Warning System analyzes financial and non-financial (market/media) data and uses sentiment analysis to flag early credit-risk deterioration, with capacity to incorporate ESG-related controversy indicators [74,83,84]. In 2024, ING outlined an AI framework with multi-stage evaluation covering model, ethical, data, and cybersecurity risks and emphasizing transparency, explainability, and human oversight [71,72,73,81]. The case is complemented by ING Bank Śląski, whose ESG Strategy 2022–2024 integrates ESG with processes, digital transformation, and risk management, including AI use in security, KYC/AML, and digital services aligned with environmental and social priorities [81,82]. Overall, ING demonstrates AI-enabled portfolio decarbonization and transition-risk assessment (E), potential inclusion effects under bias controls (S), and structured AI/data governance integrated into risk management (G) [71,73,80,81,82].

Case study 5. Raiffeisen Bank International (RBI) (Austria): artificial intelligence and semantic analysis in ESG and reputation risk assessment

RBI’s ESG & Data-Driven Banking strategy uses AI and NLP for sustainability risk assessment and market perception monitoring across CEE [85,86]. Its ESG Data Solution applies ML, data mining, and NLP to analyze corporate reports, media, financial/regulatory sources, and social media, using multilingual transformer models (BERT, XLM-RoBERTa) across CEE languages [86]. The system assigns ESG risk scores (E/S/G) integrated with credit and financial indicators to support scalable, continuous monitoring in the credit process [85,86,87]. A sentiment and topic-modeling module generates an ESG Sentiment Index monitored in real time to manage reputational risks (e.g., greenwashing allegations) and support CSRD/SFDR reporting [87]. RBI also piloted NLP-based ESG data extraction from PDFs (with SAS/IBM/Raiffeisen Digital), reducing analysis time from days to hours and lowering interpretation errors [85,86,87]. Governance is supported by a Responsible AI & Data Ethics framework (EU Trustworthy AI), operationalized through an AI & Ethics Committee overseeing models in risk, ESG, and communications [71,72,73]. Overall, RBI links AI-driven analytics with ethical oversight to strengthen transparency and trust under rising EU requirements [85,86,87].

Case study 6. PKO Bank Polski (Poland): artificial intelligence in ESG risk management and KYC/AML systems

PKO BP integrates AI into compliance, risk analytics, and sustainable finance under PKO Bank of the Future 2023–2025 and ESG Strategy 2024–2027 [88,89]. Its AML AI Engine (with NCBR and PKO Data Science) uses anomaly detection, network and graph AI to process hundreds of millions of transactions daily, reducing false positives by up to 30% and shortening analyst response times; models are continuously trained and validated with human-in-the-loop oversight [71,72,73]. In KYC, AI document verification and facial biometrics support remote onboarding (FaceID-AI with OPI PIB and EU providers), with an Ethical AI Use Policy (2023) and an AI Governance Team for audits and compliance [88,89]. Since 2022, PKO BP has implemented an ESG risk management system integrating internal data with external sources (e.g., National Emissions Register, GUS, Eurostat, commercial ESG databases), using AI for portfolio segmentation by climate risk, stress-test scenarios, and ESG-based pricing/rating adjustments aligned with EU Taxonomy, CSRD, and Fit for 55 [88,89,90]. NLP/text mining supports analysis of client disclosures to detect reputational risks, non-compliance, and greenwashing and to improve CSRD reporting quality [90]. As a UN PRB signatory and participant in the Polish Sectoral Agreement for Sustainable Finance, PKO BP illustrates how CEE banks can combine AI governance with ESG risk management and compliance [88,89,90].

Case study 7. Deutsche Bank (Germany): artificial intelligence in ESG report analysis and predictive modeling of investment decisions

Deutsche Bank’s AI@DB program and Sustainable Finance 2030 strategy integrate AI into ESG report processing and predictive modeling [83,84]. In 2023, Deutsche Bank Research and the Data Innovation Lab analyzed >1000 ESG reports using NLP (multilingual BERT/RoBERTa) to assess disclosure quality and compliance with EU Taxonomy, CSRD, and GRI, producing an AI-Based ESG Disclosure Quality Index used in aggregated ESG risk profiles for investment/credit/internal ratings [74,83,84]. The bank reports reducing analysis time from ~4 h to ~20 min per company, while improving consistency. Predictive models (nonlinear regression, decision trees, MLP neural networks) link ESG disclosure quality with financial variables (volatility, ROE, credit risk) to produce an ESG-Driven Investment Scoring Model combining financial and contextual data (satellite imagery, news analytics, registries) and supporting sustainable portfolios and green bond decisions [74]. Governance is reinforced via an AI Governance Framework and an AI Ethics Board (2024) aligned with AI Act/CSRD requirements, including ethical audits and reporting to supervisory bodies; Responsible AI principles apply to ESG and investment models [71,72,73,74,83]. Overall, Deutsche Bank provides an integrated AI–ESG ecosystem enabling scalable disclosure assessment, forward-looking risk analysis, and strengthened accountability [71,72,73,74,83,84].

Case study 8. Bank of America (USA): artificial intelligence in ESG analysis and monitoring and in the development of sustainable development strategies

Bank of America deploys AI/ML/NLP for ESG data analysis, climate monitoring, and sustainable product design within its Responsible Growth strategy, aligned with SEC, SASB, TCFD, and IFRS S1/S2 requirements [91,92,93]. Its AI-ESG Data Intelligence platform (2023) continuously collects and updates ESG data from disclosures, databases, filings, rating agencies, and registries for ~15,000 issuers, detecting gaps and inconsistencies (e.g., missing Scope 3) and issuing alerts for analysts [92,93]. The ESG Predictive Analytics Model integrates financial and non-financial data to forecast impacts of ESG performance changes on returns, credit ratings, and financing costs; BoA reports ~25% improved ESG risk forecast accuracy versus traditional approaches [92]. In 2024, the Climate Metrics Engine aggregates financed emissions, energy use, and sustainable portfolios to generate scenario projections aligned with IEA/NGFS pathways and support TCFD/IFRS S2 reporting. Advisory is supported by GreenAdvisor AI (2024), which analyzes portfolio footprints and proposes decarbonization pathways (green bonds, thematic funds, ESG-linked lending) with outputs compliant with SEC/SASB [93]. Responsible AI governance (2023) includes audits, bias testing, explainability, and an AI Ethics Council, with human-in-the-loop decision-making and collaborations with MIT AI Policy Lab and Harvard Berkman Klein Center on audit standards [68,69,70]. Overall, BoA illustrates systemic AI integration across (E), (S), and (G) [91,92,93].

Case study 9. Japan Post Bank (Japan): generative artificial intelligence as an element of ESG strategy and value creation

JPB positions AI, including generative AI, as a core enabler in its Sustainability Report 2024, Integrated Report 2024, and Medium-Term Management Plan 2024–2026, linking technological innovation with social well-being and environmental stability [94,95,96]. AI supports (E) and (G) through automation of ESG reporting, emissions analysis, and predictive energy management in administrative processes, reducing operational footprint and resource use [94,95,96]. In (S), JPB deploys generative AI and Japanese-language chatbots to improve accessibility for elderly and rural customers, reducing communication barriers and risks of digital exclusion while supporting financial education [97]. In (G), JPB develops AI governance, ethical data-use policies, and audit frameworks for traditional and generative AI, emphasizing human-in-the-loop, personal data protection, and transparency; it references compliance with Japanese supervisory guidelines and international standards (TCFD, ISSB) [94,95,96,98]. Although some initiatives remain early-stage, the case demonstrates a strategic AI–ESG approach focused on long-term value creation [94,95,96,97,98].

Case study 10. Bank of Korea (South Korea): artificial intelligence and digital governance in the public sector

BoK’s Digital Transformation Strategy 2024–2026 includes the AI chatbot Voxyli (2024), supporting internal operations through automated data retrieval and preparation of reports and analyses related to monetary policy and financial regulation [99,100]. Voxyli uses a Korean LLM developed with KAIST and the National Supercomputing Center, targeting dedicated processing of economic documents and macroeconomic analysis in Korean [101]. The strategy emphasizes “AI for Governance” to improve efficiency, transparency, and communication; from an ESG perspective, it primarily strengthens (G) via streamlined processes and information flows, and supports (S) by enhancing public access to information and education on policy and sustainable finance [99,100,101]. This aligns with perspectives from the World Bank and BIS on AI for public value creation in finance [102].

Case study 11. China Construction Bank (China): artificial intelligence in support of the “dual-carbon” policy and green finance

CCB integrates AI and big data with green transformation. With Carbonstop, it launched individual carbon accounts linking behavioral environmental data (energy, transport, e-commerce, mobility) with AI-based footprint estimation and incentives promoting low-carbon behavior [103,104,105]. The Carbon Digital Loan targets SMEs and uses AI/big data to calculate footprints, inventory emissions, assess sustainability across supply chains, and support transition planning while accelerating credit approval [105,106]. CCB also received recognition for its AI/ML Model Management Platform Initiative, supporting model quality control, risk reduction, and governance compliance through centralized model management (including LLMs, NLP, AutoML) [107]. Overall, CCB shows how AI can be a strategic pillar of sustainable finance ecosystems aligned with national “dual-carbon” objectives [104,105,106,107].

Case study 12. Industrial and Commercial Bank of China (China): the use of AI for greenwashing detection and the integration of ESG with digital transformation

ICBC is cited as applying AI/big-data text classification to assess consistency between clients’ environmental claims and actual emissions/ecological performance, supporting greenwashing detection and ESG data credibility, despite limited public technical disclosure [108]. These tools help identify risks of financing “pseudo-green” projects and support compliance with reporting standards (CSRC, ISSB, IFRS S2) [108]. Embedded in broader green finance action efforts and climate risk model development, the case illustrates AI not only for process optimization but also for ethical oversight and transparency in green finance, strengthening (G) competencies in the Asian financial sector [108].

Case study 13. KB Kookmin Bank (South Korea): integration of AI and ESG within the digital transformation of the financial sector

KB Bank established a Financial AI Center to automate processes, conduct data analysis, and support ESG reporting [76,109]. Under the KB Green Wave Tool, AI supports ESG risk identification and mitigation planning across value chains (including suppliers/SMEs), combining big data and ESG classification for responsible finance [110]. Collaboration with DeepBrain AI created an AI Experience Zone featuring an AI-Banker kiosk; while not directly ESG-related, it reflects advanced digital maturity and openness to AI adoption [111]. Benefits include higher efficiency enabling more sustainable resource use, strengthened support for SMEs via ESG monitoring tools, and cultural embedding of ESG-oriented innovation [76,109,110,111].

Case study 14. Mizuho Bank (Japan): integration of artificial intelligence with ESG analysis and digital transformation

Mizuho integrates AI into ESG data analysis for climate reporting, client document analysis, and environmental risk assessment to accelerate processing and improve precision [112,113]. Partnerships support tools for monitoring corporate emissions and transition plans, automating document verification and ESG extraction, and enabling reporting compliant with TCFD, ISSB, and Japanese FSA guidelines [98,113]. Outcomes include shorter reporting cycles, improved environmental data quality, and stronger integration of ESG into credit and investment decisions, reflected in growth of green instruments (e.g., green bonds, sustainability-linked loans) [113]. The case represents systematic back-end digitalization supporting organizational transparency rather than front-end AI applications.

Case study 15. DBS Bank (Singapore): the use of AI in climate risk analysis and ESG assessment

DBS applies AI-based analytical systems for climate risk assessment and ESG monitoring under its Responsible Banking policy [114,115]. A multi-source module integrates environmental and financial data to evaluate alignment with Paris goals and model long-term decarbonization pathways. DBS pilots generative AI for automated analysis of non-financial reports, climate documentation, and Scope 3 data, supporting inconsistency detection and evaluation of transition strategies, alongside greenwashing detection models [115,116]. Reported outcomes include faster assessment, improved data consistency, and expanded transition finance (green loans, sustainability-linked instruments). Governance aligns with MAS FEAT principles under the Veritas Initiative, strengthening credibility and auditability [114,115,116].

Case study 16. Maybank (Malaysia): the use of AI for emission estimation and climate risk management

Under the M25+ Sustainability Blueprint, Maybank developed a multi-module AI platform integrating emissions, energy efficiency, and customer behavior data [117,118]. The “estimated carbon scoring” model uses ML to estimate corporate emissions when data are incomplete, increasing inclusiveness and credibility of ESG assessment [117]. An NLP-based ESG reporting system analyzes corporate reports, regulatory documents, industry news, and social media to track risks and regulatory change and assess compliance with ISSB (S1/S2) and ASEAN Taxonomy Version 2 [118]. Pilot work includes physical risk scenario modeling (floods, droughts, supply disruptions). Outcomes include improved ESG/credit assessment accuracy, stronger ISSB/ASEAN-aligned reporting, and increased transparency and reputation in sustainable finance [117,118,119].

Case study 17. Bank Rakyat Indonesia (BRI): artificial intelligence in the service of green finance and social inclusion

BRI implemented an AI-based credit scoring system integrating environmental, social, and financial data under its Sustainable Finance Framework to support SMEs aligned with ESG [120,121,122]. AI embeds sustainability factors (e.g., energy efficiency, waste management, social impact) into credit risk analysis, enabling more effective financing allocation to green and socially beneficial entities. ML also supports climate risk monitoring in vulnerable sectors (agriculture, logistics, food) by assessing portfolio exposure to droughts and floods [121,122]. Reported effects include expanded access to green financing for SMEs, increased portfolio resilience via climate risk analytics, and support for socio-economic transition toward low-carbon growth.

Case study 18. Royal Bank of Canada (RBC): artificial intelligence in climate risk analysis and ESG data validation

RBC develops AI platforms for modeling climate risk of corporate clients, especially in energy-intensive sectors [123,124]. Models integrate meteorological data, climate models, and geoinformatics to assess exposure to physical risks (floods, wildfires, extreme temperatures) and produce dynamic risk maps supporting credit and strategic decisions. RBC also applies ML to monitor CO2 emissions in financed infrastructure projects and validate client ESG reporting consistency with standards such as TCFD, ISSB, and CSRD [125]. Reported outcomes include higher data reliability, enhanced sustainability-linked rating models, and support for Net-Zero 2050 by integrating emissions and climate projections into risk assessment.

Case study 19. Skandinaviska Enskilda Banken (SEB) (Sweden): AI in support of EU Taxonomy compliance and ESG transparency

SEB’s Green Digital Finance program uses AI to automate assessment of financed projects’ EU Taxonomy compliance and Net-Zero alignment across corporate banking and asset management [126,127,128]. ML tools accelerate classification and improve accuracy by analyzing ESG documents and reports; the bank also develops emission monitoring linked to credit assessment and ESG ratings for real-time tracking of alignment with climate and taxonomy goals. In asset management, prototype ML tools assess ESG risk in fund portfolios, detect anomalies, and relate environmental data to financial performance. Outcomes include faster taxonomy classification, accelerated sustainable investment assessment, and improved transparency and credibility of ESG funds [126,127,128].

Case study 20. NatWest Group (United Kingdom): artificial intelligence in green retail banking

With Cogo, NatWest developed the Carbon Tracker app, using AI and consumer behavior analytics to translate transaction data into carbon footprints and provide personalized recommendations (e.g., consumption changes, provider switching) to reduce emissions [129,130]. NatWest also applies AI to analyze corporate ESG reports to identify reputational, environmental, and social risks and support compliance with TCFD and CSRD reporting [43,129,130]. Outcomes include encouraging pro-environmental consumer behavior, improving ESG data quality and reputational risk detection, and strengthening NatWest’s position in green financial innovation.

Summary of Case Studies. The cases show regional differences shaped by regulation, technological maturity, and risk culture, yet converge on a common pattern: AI is becoming a strategic instrument accelerating banking’s transition to sustainable and responsible finance. Asian institutions emphasize (E) through emissions analytics, footprint estimation, energy management, and reporting automation, alongside regional Responsible AI standards (e.g., MAS FEAT and Veritas) and growing focus on AI governance in Japan and South Korea [80,81,82]. European banks apply a holistic ESG approach, integrating AI with credit, investment, and reputational risk management, advancing EU-aligned Responsible AI frameworks consistent with CSRD, the EU Taxonomy, and the EU AI Act [81,82]. North American banks emphasize systemic climate risk integration and governance, combining predictive analytics with long-term sustainability strategies [91,92,93,123,124,125].

Three comparative conclusions emerge: (1) AI is becoming part of sustainable finance infrastructure, integrating dispersed ESG data into decision processes; (2) AI governance is evolving globally, combining ethics, transparency, and regulatory compliance—from MAS FEAT to the EU AI Act and U.S. SEC Sustainability Disclosure Rules; and (3) ESG data quality and standardization remain critical for credible modeling, climate reporting, and reliable risk assessment. Overall, AI’s role is shifting from operational support to a strategic component of governance that advances climate, social, and ethical objectives; strengthens trust; and supports long-term financial stability during green transformation. Taken together, the presented cases (Table 4) confirm that AI increasingly combines data precision, transparency, and efficiency with ethics, trust, and long-term social value creation, reinforcing sustainable finance infrastructure that supports global climate and social goals.

Table 4.

Summary of all case study examples.

Consequently, it can be concluded that the role of AI in the banking sector is evolving from an operational tool to a strategic component of corporate governance, supporting the achievement of climate, social, and ethical objectives. An integrated approach to AI and ESG is becoming not only a source of competitive advantage but also a foundation for building public trust and ensuring the long-term stability of the financial system in the era of green transformation.

Taken together, the presented cases (Table 4) demonstrate that artificial intelligence is becoming a key tool in transforming the financial sector toward sustainable and responsible development—combining data precision, decision-making transparency, and operational efficiency with the principles of ethics, trust, and long-term social value creation. They also indicate the growing role of AI as a component of sustainable finance infrastructure, supporting the achievement of global climate and social goals.

5. Results and Discussion

The results of the literature review and case study analysis allow for a comprehensive assessment of how banks integrate AI-based solutions into the implementation of their ESG strategies, directly addressing the defined research problems and hypotheses. The collected evidence confirms that AI is becoming not only a technological tool but also a strategic element supporting the long-term goals of sustainable development, transparency, and ethical governance within the financial sector.

With regard to research problem 1 (P1)—concerning the integration of AI solutions into banking applications and systems in the context of implementing ESG strategies—the analysis confirms hypothesis H1, indicating that AI plays a key role in managing environmental data, energy efficiency, and non-financial reporting. In many cases (e.g., UOB, Maybank, CCB, ING, SEB), these technologies enable the automation of climate data and GHG emissions analysis, supporting net-zero goals and the development of sustainable finance infrastructure.

In the context of research problem 2 (P2), concerning the role of AI functions in the energy transition and the achievement of environmental objectives, the findings confirm hypothesis H2. The use of AI in digital banking—such as in analyzing customers’ carbon footprints (NatWest Carbon Tracker, CCB Carbon Account) or optimizing credit processes for green investments (DBS, ING)—contributes to greater effectiveness of pro-environmental actions and increased customer engagement in sustainable financial decisions.

Regarding research problem 3 (P3), which examines the potential benefits and risks of using AI in ESG reporting and communication, the observations reveal a dual nature of effects. On one hand, data automation and analytics (e.g., BNP Paribas, Deutsche Bank, PKO Bank Polski) improve the consistency and transparency of ESG reports, thus supporting the achievement of sustainability goals. On the other hand, part of hypothesis H5 is confirmed, highlighting ethical risks and a lack of full model transparency. The “black box” issue and the challenges in algorithm validation may undermine the credibility of reporting and increase reputational risk, particularly in the context of greenwashing detection.

Research problem 4 (P4), addressing the impact of AI use on users’ perception of banks’ credibility and ethical conduct, partially confirms hypotheses H3 and H4. The inclusion of responsible AI elements—such as model explainability (XAI), ethical oversight, and algorithmic compliance with ESG principles—strengthens trust in financial institutions and positively affects their image as socially responsible entities. At the same time, the use of AI in mobile applications (e.g., NatWest, PKO BP, MUFG) supports user education and awareness, particularly engaging younger generations in environmentally and socially responsible financial behaviors.

With regard to research problem 5 (P5)—concerning the theoretical and practical challenges associated with the implementation of responsible algorithms (Responsible AI)—the study reveals that the main barrier remains data quality and the lack of standardization. Uneven access to ESG data, their limited comparability across regions, and the low interpretability of AI models hinder the full implementation of Responsible AI principles. Consequently, hypothesis H5 is fully confirmed: ethical risks and the lack of model transparency may weaken public trust in the digital transformation of the financial sector.

In summary, the analysis allows for the formulation of three general conclusions:

- AI constitutes a key component of the sustainable finance architecture, enabling the effective use of ESG data in banks’ decision-making processes.

- The integration of AI and ESG in mobile applications increases consumer engagement in sustainable finance, particularly among young digital banking users, confirming the importance of the behavioral dimension in research on sustainable transformation.

- Responsible algorithms (Responsible AI) are becoming an essential element of corporate governance and digital trust; however, they require further standardization, data interoperability, and clear ethical principles to avoid the risk of undermining the sector’s credibility.

As a result, the conducted study confirms that the role of AI in banking is evolving from operational applications to a strategic component of ESG and corporate governance, supporting not only energy efficiency but also the long-term social and reputational value of financial institutions.

6. Conclusions and Future Work

The banking sector is entering a critical phase of transformation in which digitalization and sustainability have evolved into interdependent pillars of a new operating model. Artificial intelligence (AI) plays a catalytic role in this process by enabling more precise, transparent, and data-driven implementation, monitoring, and reporting of ESG strategies. The analyses conducted and the case studies presented confirm that AI is becoming a core instrument supporting the achievement of ESG objectives in financial institutions.

In the Environmental (E) dimension, AI-based solutions enable banks to measure and reduce greenhouse gas emissions, analyze climate-related data, identify environmental risks, and support clients in their energy transition. These technologies facilitate dynamic modeling of decarbonization pathways, verification of emissions within credit portfolios, and the mitigation of greenwashing practices. Consequently, AI contributes to higher data quality, improved reporting reliability, and increased effectiveness of green finance mechanisms.

In the Social (S) dimension, AI supports the development of inclusive financial products and services that expand access to finance and promote sustainable consumer behavior. Machine learning algorithms enable behavioral analysis, personalization of environmentally oriented offerings, and the shaping of socially responsible attitudes. In selected cases, AI also performs an educational function, linking retail banking services with broader social and climate objectives.

Within the Governance (G) dimension, AI implementation enhances process transparency, automates auditing functions, and strengthens risk-control mechanisms. AI systems support non-financial reporting, assess compliance with ESG taxonomies, and improve oversight of data quality. At the same time, the growing relevance of Responsible AI—encompassing algorithmic ethics, model explainability, auditability, and compliance with regulatory frameworks such as the EU AI Act, OECD, and NIST guidelines—highlights the necessity of integrating AI governance principles with ESG policies to maintain public trust and institutional credibility.

The comparative analysis of case studies reveals regional differences in AI–ESG applications. European banks primarily emphasize AI solutions supporting regulatory compliance and sustainability reporting (e.g., ING, SEB), Asian institutions focus on environmental risk assessment and green finance mechanisms (e.g., China Construction Bank, DBS Bank), while North American banks prioritize predictive analytics and automation of ESG risk management processes (e.g., Bank of America, RBC). Across all regions, a common pattern emerges: the increasing importance of high-quality data, predictive analytics, and generative AI in building credible, measurable, and scalable sustainability strategies.

Overall, the integration of AI into ESG strategy implementation should be understood not merely as a technological advancement, but as a strategic component of the future banking model. AI enables financial institutions to reconcile economic efficiency with social and environmental responsibility, functioning both as an optimization tool and as a mechanism for social value creation. However, further empirical research is required to assess the real-world effectiveness and consequences of AI-driven ESG solutions. Key gaps in the existing literature concern

- The impact of AI on actual ESG performance indicators in financial institutions;

- The effectiveness of mobile and digital applications in shaping pro-environmental behavior;

- The empirical validation of AI-based climate risk models;

- The manifestation and mitigation of algorithmic bias in practice;

- Customer perceptions and trust formation in AI-enabled ESG systems.

Addressing these gaps requires interdisciplinary empirical research integrating economics, fintech, behavioral science, data analytics, and sustainability studies. Only by combining technological innovation with ethical governance and transparency can AI become a durable pillar of sustainable development in the banking sector.

Author Contributions

Conceptualization, P.P., K.S., A.W. and B.W.; methodology, P.P., K.S., A.W. and B.W.; formal analysis, P.P., K.S., A.W. and B.W.; investigation, P.P., K.S., A.W. and B.W.; resources, P.P., K.S., A.W. and B.W.; writing—original draft preparation, P.P., K.S., A.W. and B.W.; writing—review and editing, P.P., K.S., A.W. and B.W.; funding acquisition, P.P., K.S., A.W. and B.W. All authors have read and agreed to the published version of the manuscript.

Funding

The article is co-financed by the Minister of Science under the “Regional Initiative of Excellence”.

Data Availability Statement

All data comes from reports and other materials that are listed in the references.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Xiang, S.; Deng, L.; Zhou, Z.; Zhang, Z. Digital Finance, ESG Performance, and Financial Performance in Chinese Firm Levels: The Pathway to Sustainability. Sustainability 2024, 16, 7976. [Google Scholar] [CrossRef]

- Lim, T. Environmental, Social, and Governance (ESG) and Artificial Intelligence in Finance: State-of-the-Art and Research Takeaways. Artif. Intell. Rev. 2024, 57, 76. [Google Scholar] [CrossRef]

- Kalyani, S.; Gupta, N. Is Artificial Intelligence and Machine Learning Changing the Ways of Banking: A Systematic Literature Review and Meta-Analysis. Discov. Artif. Intell. 2023, 3, 41. [Google Scholar] [CrossRef]

- Fares, O.H.; Butt, I.; Lee, S.H.M. Utilization of Artificial Intelligence in the Banking Sector: A Systematic Literature Review. J. Financ. Serv. Mark. 2023, 28, 835–852. [Google Scholar] [CrossRef]

- Zhang, C.; Yang, J. Artificial Intelligence and Corporate ESG Performance. Int. Rev. Econ. Financ. 2024, 96, 103713. [Google Scholar] [CrossRef]

- Xu, J. AI in ESG for Financial Institutions: An Industrial Survey. arXiv 2024, arXiv:2403.05541. [Google Scholar] [CrossRef]

- Batool, A.; Zowghi, D.; Bano, M. Responsible AI Governance: A Systematic Literature Review. arXiv 2023, arXiv:2401.10896. [Google Scholar] [CrossRef]

- Abdulsalam, T.A.; Tajudeen, R.B. Artificial Intelligence (AI) in the Banking Industry: A Review of Service Areas and Customer Service Journeys in Emerging Economies. Bus. Manag. Compass 2024, 68, 19–43. Available online: https://bi.ue-varna.bg/ojs/index.php/bmc/article/view/66 (accessed on 20 November 2025). [CrossRef]

- Rasheed, M.; Yuhuan, Z.; Haseeb, A.; Ahmed, Z.; Saud, S. Asymmetric relationship between competitive industrial performance, renewable energy, industrialization, and carbon footprint: Does artificial intelligence matter for environmental sustainability? Appl. Energy 2024, 367, 123346. [Google Scholar] [CrossRef]

- Dou, J.; Chen, D.; Zhang, Y. Towards energy transition: Accessing the significance of artificial intelligence in ESG performance. Energy Econ. 2025, 146, 108515. [Google Scholar] [CrossRef]

- Tissaoui, K.; Zaghdoudi, T. Against a background of energy uncertainty and climate change, is there a substitution effect between fossil fuels in OECD countries? Energy 2025, 320, 135271. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F.; Li, R.; Sun, J. Does artificial intelligence promote energy transition and curb carbon emissions? The role of trade openness. J. Clean. Prod. 2024, 447, 141298. [Google Scholar] [CrossRef]

- Hallioui, A.; Herrou, B.; Santos, R.; Katina, P.; Egbue, O. Systems-based approach to contemporary business management: An enabler of business sustainability in a context of industry 4.0, circular economy, competitiveness and diverse stakeholders. J. Clean. Prod. 2022, 373, 133819. [Google Scholar] [CrossRef]

- Chen, Y.; Huang, X.; Liu, C. Can AI computing power promote the green transformation of energy enterprises? Evidence from the nonlinear moderating effect of public environmental awareness. J. Environ. Manag. 2025, 391, 126455. [Google Scholar] [CrossRef]

- Gupta, S.; Langhans, S.; Domisch, S.; Fuso-Nerini, F.; Felländer, A.; Battaglini, M.; Tegmark, M.; Vinuesa, R. Assessing whether artificial intelligence is an enabler or an inhibitor of sustainability at indicator level. Transp. Eng. 2021, 4, 100064. [Google Scholar] [CrossRef]

- Garcés-Marín, R.; Arias-Pérez, J.; Restrepo-Estrada, C. The interplay of data-driven insights and AI anxiety in shaping the impact of AI capabilities on circular economy capability. J. Ind. Inf. Integr. 2026, 49, 101019. [Google Scholar] [CrossRef]

- Platon, V.; Pavelescu, F.; Antonescu, D.; Constantinescu, A.; Frone, S.; Surugiu, M.; Mazilescu, R.; Popa, F. New evidence about artificial intelligence and eco-investment as boosters of the circular economy. Environ. Technol. Innov. 2024, 35, 103685. [Google Scholar] [CrossRef]

- Khan, M.; Rahman, A.; Mahmud, F.; Bishnu, K.; Ahmed, M.; Mridha, M.; Aung, Z. A systematic review of AI-driven business models for advancing Sustainable Development Goals. Array 2025, 28, 100539. [Google Scholar] [CrossRef]

- Platania, F.; Toscano Hernandez, C.; El Ouadghiri, I.; Peillex, J. Bridging AI innovation and sustainable Development: The effect of AI technological progress on SDG investment performance. Technovation 2025, 146, 103279. [Google Scholar] [CrossRef]

- Năstasă, A.; Dumitra, T.; Grigorescu, A. Artificial intelligence and sustainable development during the pandemic: An overview of the scientific debates. Heliyon 2024, 10, e30412. [Google Scholar] [CrossRef]