Abstract

In the era of digital transformation, transaction-intensive e-business applications—such as high-frequency trading (HFT), e-monetary services and decentralized marketplaces—require infrastructures that are not only fast and secure but also sustainable. Current solutions often prioritize short-term performance over long-term resilience, leading to inefficiencies in energy use and system reliability. This paper introduces a conceptual framework for sustainable transaction processing, leveraging energy-efficient hardware accelerators, real-time communication protocols inspired by industrial automation and lightweight authentication mechanisms. By integrating associative memory-based matching engines and optimized network architectures, the proposed approach ensures predictable latency, robust security and scalability without compromising sustainability. The framework aligns with the United Nations Sustainable Development Goal 9 (Industry, Innovation, and Infrastructure) by reducing resource consumption, enhancing operational resilience and supporting future-ready digital ecosystems.

Keywords:

sustainable digital infrastructure; high-frequency trading (HFT); real-time transaction processing; knowledge-based processors (KBP); energy-efficient computing; lightweight authentication; digital resilience; blockchain and smart contracts; B2B e-marketplaces; UN SDG 9—industry, innovation, and infrastructure 1. Introduction

Digital trading platforms already dominate the top 10 of the world’s most valuable firms. According to [1], measured by market value, seven businesses among the ten largest companies worldwide were operators of electronic platforms. These results confirm the fact that digital platforms are the promotors of the digital transformation. The progress of e-marketplaces is associated with digital innovations, which have brought much disruption in the field of digital platforms [2]. A prominent example thereof is the introduction of High Frequency Trading (HFT). It refers to a class of algorithmic trading strategies that involve executing a large number of orders at extremely high speeds, often within microseconds or milliseconds. It relies on sophisticated information technology, low-latency networks and real-time data processing to gain a competitive advantage in financial markets [3].

One may argue that timeliness of transactions in e-commerce is not as important as correctness. However, there are applications where timeliness is critical. E-monetary transactions, which need to be performed within certain time frames to be valid, are a good example thereof. But this is not the only case where transaction time matters. A prominent example of high-speed or low-latency trading is HFT at stock markets, where success is determined by the number of transactions performed in a certain time frame [4]. Moreover, as with e-monetary transactions between banks, the transaction time frames are a subject of agreement between the stock markets and their customers and are even considered more important than order fulfillment. Hence, we may claim that timeliness in e-commerce is just as important as correctness.

According to a common classification, e-marketplaces mainly differ on their type and organization [5]. Material goods are mainly traded on business-to-business (B2B) platforms which may handle horizontal as well as vertical supply chain connections. While horizontal supply chains support cross-industry partnerships, vertical ones support businesses along the value chain of a certain line of industry. To better support supply chain management of the contributing firms, the latter have been upgraded to supply chain operating networks. They may be centralized or decentralized depending on the organization of order input and trading policy [6].

In e-business goods can be handled on the principles of an auction or a stock market, with the time, marked by when the buyer and seller disclose their identities to close the deal, being the main distinguishing characteristic. A similar situation appears in HFT markets where the traders’ identities are only disclosed to the stock market while their orders are anonymized at input.

Safety and security in e-business are generally assured by applying electronic certificates to identify trading partners and strong encryption to secure transaction data while being transferred on the Internet [7]. Both processes add some delay to the input/processing of buy/sell orders. Since the mentioned application areas belong to rapidly developing markets, the problems with their guaranteed real-time ability as well as transaction safety and security are becoming increasingly stringent.

In the past few years, e-business applications based on high-frequency, distributed digital systems, especially HFT and cryptocurrency transactions, have gained importance. The increasing numbers of their transactions impact their real-time ability, which is considered one of their most important characteristics. In contemporary e-marketplaces, this problem is already being addressed by organizational as well as technical means, usually at the cost of their safety and security. However, by addressing the consequences rather than the problem itself, these measures do not solve the problem. Hence, the challenge of timely, safe and secure transaction processing in e-commerce persists.

The proposed digital framework for high-frequency, distributed digital systems aims to solve these problems by introducing mechanisms to provide on-the-fly safe and secure transaction processing and hereby assure the sustainability of transaction intensive e-commerce applications in the long run.

The idea behind the proposed solution is the following. Since timeliness plays a crucial role in HFT and e-monetary transactions and both applications are e-trading large volumes of financial instruments, they may also have a common solution. Furthermore, since, due to production diversification, micro-order’s share in e-commerce is increasing, this solution may also be applied to B2B e-marketplaces in the future, to provide the same level of timeliness, safety and security in agile decentralized e-marketplaces, such as Distributed Autonomous Organizations (DAO) [8]. The proposed framework aims to solve the aforementioned bulk processing and latency problems by reducing the processing load through optimization of the network architectures, hardware accelerated pre-processing of orders and the reduced complexity of the algorithms employed to ensure a manageable workload of distributed digital systems, thereby assuring the sustainability of the corresponding e-commerce platforms in the long run.

The structure of this contribution is as follows. After a review of the literature identifying the gap induced by the increasing transactions volumes within e-marketplaces in general, and HFT markets in particular, the state of technology is investigated. Here, their digital infrastructure as well as processes and information flows are analyzed from the viewpoints of timeliness, safety and security. After that, the proposed solution is laid out and analyzed from the relevant SDG perspectives to ensure that the principles of pragmatic sustainability are met. Following a discussion on the perspectives of the new e-marketplace framework, a conclusion on its applicability is drawn.

2. Literature Review

HFT in the international stock exchange markets is a method of trading financial instruments that uses complex algorithms to analyze multiple markets and swiftly execute orders based on market conditions [9]. Since they are harvesting even small variations in stock prices to produce profits, HFT e-marketplaces are considered market-promotors. To be successful they need to handle increasingly large amounts of orders. Considering their increasing numbers, even by the use of HPC platforms, used in co-location for their swift processing, they would eventually fail to process them in real-time. Hence, due to the nature of its transactions, HFT is considered an application with strict real-time constraints. With the advent of electronic currencies, the same situation arose with the processing of e-monetary transactions.

In modern e-business environments individual transactions are allotted strict time frames for their processing. Due to their increasing volumes, this has been identified as a problem being addressed by time-sharing and high-performance computing (HPC) platforms [10]. Since these measures only address the consequences of the increasing volumes, they do not represent a solution to the overall problem of timely transaction processing, let alone its safety or security.

High-Frequency Trading (HFT) and B2B e-marketplaces share some key characteristics, particularly in automation, real-time decision-making and algorithmic price optimization [11]. As presented in Table 1, both operate in dynamic, data-driven environments where speed, liquidity and competitive pricing play crucial roles [12].

Table 1.

Similarities between HFT and B2B e-marketplaces.

There are several ways in which HFT influences B2B e-marketplaces. Considering algorithmic pricing and dynamic quoting, HFT relies on real-time price adjustments based on order book dynamics, whereas B2B marketplaces use algorithmic pricing models to adjust prices dynamically based on supply/demand and competitor pricing, to implement real-time discounting for bulk orders and to use automated contract negotiation for large-scale procurement. For example, Amazon Business and Alibaba use AI-powered dynamic pricing similar to HFT order book models.

With respect to arbitrage and cross-market optimization in HFT, arbitrage traders exploit price discrepancies between exchanges. In B2B marketplaces, similar strategies apply—global sourcing arbitrage, which refers to buying products in low-cost regions and selling in high-demand markets, as well as supply chain optimization, which identifies inefficiencies in procurement costs. For example, Alibaba’s AI-driven sourcing platform detects pricing inefficiencies across global suppliers.

From the viewpoint of order matching and liquidity management, HFT provides instant order matching, ensuring liquidity in stock markets, while B2B platforms use AI-driven matching. Hereby they connect buyers and suppliers dynamically, reduce market inefficiencies via real-time procurement recommendations and predict inventory needs to avoid supply shortages. For example, SAP Ariba and Oracle Procurement Cloud use predictive AI to optimize bulk order execution.

In the future the combined use of AI and HFT mechanisms in B2B e-marketplaces shall affect various aspects of e-commerce [13]:

- AI-driven automated procurement where, similarly to HFT bots, AI will fully automate supplier–buyer interactions.

- Blockchain-based smart contracts where decentralized transaction validation is used for secure, real-time contract execution.

- Quantum computing for next-generation supply chain pricing optimization using quantum algorithms.

In effect, HFT and B2B e-marketplaces are expected to share core principles of automation, algorithmic pricing and real-time order matching. AI, predictive analytics and smart contracts are expected to bridge the gap between high-speed trading and B2B procurement. The future of B2B e-commerce will likely incorporate HFT-inspired ultra-low-latency decision-making for supply chain optimization. Since by their nature, supply chains are distributed and dynamic, future e-business applications will involve processing DAO smart-contracts and transactions.

3. Materials and Methods

In the following section, the key aspects of HFT [4] are outlined, followed by a discourse on the appropriate regulatory and risk management strategies. As with other types of e-business, HFT strategy development requires a balance between real-time execution, risk management and cybersecurity. A well-designed HFT strategy must not only capitalize on speed advantages but also ensure system robustness and compliance with market regulations. Key components of HFT strategy development are as follows: low-latency trading [11], risk management and safety controls [9], security and cyber-risk mitigation [4] and real-time adaptation [14].

Latency is a critical factor in HFT, where even nanosecond-level improvements can translate to significant financial gains. Reducing latency involves optimizing hardware, software, networking and execution strategies.

In co-location and proximity hosting [15] HFT servers in data centers are placed in physical proximity to exchange servers to minimize transmission delays. Co-location reduces network latency from milliseconds to microseconds. Prominent stock exchanges like Eurex, NASDAQ, NYSE and CME all offer co-location services.

Optimized networking (ultra-low-latency networks) [10] makes use of optical fiber and microwave networks for high-speed data transmission. Microwave networks provide faster transmission rates than fiber optics due to the speed of over-the-air transmissions being faster than via fiber-optic connections. However, high-speed wireless transmissions usually require line-of-sight. To improve their performance, emerging technologies such as millimeter-wave and laser-based communications are being explored. On the other hand, fiber optics provide higher bandwidth and are not prone to atmospheric disturbances.

Using hardware acceleration (FPGA and GPU Computing) [16] Field Programmable Gate Arrays (FPGAs) can implement trading algorithms at the hardware level, bypassing software-induced delays. Furthermore, Graphics Processing Units (GPUs) can be used for parallel processing of large-scale financial data, as in cryptocurrencies.

Low-latency programming is achieved using C/C++ and assembly language instead of high-level languages like Python or Java [17]. In addition, the use of kernel bypass techniques such as Data Plane Development Kit (DPDK) and Remote Direct Memory Access (RDMA) can be introduced to avoid delays caused by operating system (OS)-induced interruptions across trading computers.

Smart order routing (SOR) and direct market access (DMA) [18] techniques use intelligent routing algorithms to dynamically select the best exchange for execution based on real-time market conditions. Direct Market Access (DMA) eliminates intermediary brokers, reducing transaction time. Furthermore, predictive order execution and latency arbitrage [19] methods use predictive analytics models to anticipate market movements and preemptively position trades.

Latency arbitrage exploits time delays between exchanges to capture price differentials. Latency reduction is a multi-faceted challenge in HFT, involving innovations in networking, hardware, software and execution algorithms. As trading speeds approach physical and technological limits, firms continue to explore quantum computing, AI-driven predictive execution and alternative data transmission methods.

Since HFT operates at high speeds, automated risk controls are crucial to prevent excessive losses, errant trades, or system failures, e.g., fat-finger error detection to block unintended large trades, kill-switch mechanisms to halt trading if anomalies occur, dynamic position limits to prevent excessive exposure, post-trade risk analysis and compliance based on results of real-time trade monitoring using AI-based analytics and regulatory compliance checks (MiFID II, SEC Rule 15c3-5 for risk management). In HFT systems real-time adaptation is an important part of HFT strategy and includes market-making strategies to provide liquidity by simultaneously placing buy and sell orders, statistical arbitrage to identify mispriced security risks using quantitative models and latency arbitrage to exploit price differentials across exchanges using ultra-low-latency networking (e.g., microwave links).

HFT systems are prime targets for cyberattacks such as DDoS attacks, data breaches and latency arbitrage exploits. Hence, multiple security measures should be applied:

- Secure trading protocols (e.g., FIX and ITCH with encryption),

- Firewall and Intrusion Detection Systems (IDS) for unauthorized access prevention in network security,

- Obfuscation of trading logic to prevent reverse engineering and randomized execution patterns to prevent adversarial exploitation in trading algorithms security,

- Georedundant data centers for system resilience and automated rollback mechanisms to restore previous states in case of failure, providing backup safety.

A secure HFT infrastructure requires continuous network monitoring, algorithm protection, fraud detection, disaster recovery and regulatory compliance. For long-term safety and security, firms must evolve their security measures alongside advancements in quantum computing, AI-driven cyberattacks and real-time data exploitation. Since HFT security is not just a technical challenge but also a regulatory requirement, key HFT security regulations should be considered:

- U.S. SEC Rule 15c3-5 (Market Access Rule) requires pre-trade risk controls to prevent system failures.

- EU MiFID II mandates HFT firms to register, monitor and audit trading algorithms.

- CFTC Regulation Automated Trading (Reg AT) requires kill switches and automated risk controls.

In summary, a successful HFT strategy must integrate real-time processing, risk safeguards and cybersecurity to ensure performance and resilience. As markets evolve, firms continuously optimize execution models and reinforce security frameworks to maintain a competitive edge.

3.1. State of Technology

Initially, the mainframe computing platform was used for stock exchange information systems. Nowadays, smaller and more cost- and energy-efficient solutions are utilized [20]. Contemporary HPC platforms, used in HFT by NASDAQ OMX Matching Engines, Eurex Enhanced Order Book Engines and Eurex Market Data Interfaces, are based on Intel Xeon Processor E5 family processors, Intel Solid-State Drives and high-speed communication interfaces (e.g., Thesys technologies [21]). Due to their reliability, availability and backwards compatibility, however, financial institutions still use mainframes to manage clients and their accounts, micro-payments as well as their clearing and settlement jobs.

According to recent statistics, due to increasing computing power, the rate of performing HFT orders in the German Xetra market has increased substantially. The number of daily Xetra transactions has grown from the initial 3.8 million to 136.0 million in June 2016. While the processing of a single transaction took 21 ms in 2006, the same transaction in 2016 could be performed in only 0.25 ms. This could only be achieved by the introduction of HPC platforms at the stock markets and high-speed network connections between trading firms [22].

To achieve a high transfer rate of data between different stock markets, diverse network technologies are being used. For example, there is a wireless microwave link between Chicago and New York, 1.150 km apart, whose guaranteed latency is 14.31 ms [23]. To connect US (e.g., New York) and European (e.g., Frankfurt) markets, a fiber-optic cable, whose guaranteed latency is 40 ms, was laid out across the Atlantic Ocean. To transmit data between the German stock market in Frankfurt and British stock market in London a Milliwave wireless connection with 4.6 ms latency across repeaters every 50 km is being utilized.

While wireless connections are typically quicker, they are prone to atmospheric disturbances (e.g., rain, snow, solar activity). Wired connections, on the other hand, often cannot take the shortest route, but they are in general more reliable. Better yet is the co-location-service as offered by the German stock exchange. In co-location there are two fiber-optics connections from the HFT computers to the Matching Engine of the German stock exchange. The communications are performed across the TCP/IP protocol and can reach transmission speeds of up to 10 Gbit/s. The clocks of the stock exchange computers in co-location are synchronized over a parallel network running the Precision Time (PTPv2) and Network Time Protocols (NTP) with reference to the UTC obtained from the Global Positioning System (GPS) [24].

The HFT computers at the Frankfurt stock exchange form a star network-topology providing minimum latency and maximum reliability. Since the transaction handling computer systems share the same room or building, safety and security here are not an issue. Hereby, one can achieve maximum transmission and processing rates [22]. Thus, only stock exchange markets with co-location can participate in HFT.

The computers of the German stock exchange are interconnected via InfiniBand high performance network infrastructure utilized in high-performance computing [25]. The HFT buy and sell orders are collected on a middleware level by a messaging service. By TCP/IP 64-bit messages they are input into the system in 51.2 ns. The matching process combines buy and sell orders into executable transactions that are worked off in the order of their arrival. A typical order-cycle in co-location takes from 0.2 ms to 0.35 ms per customer and is guaranteed by the German stock exchange [3].

3.1.1. Trading Model

The procedure of handling HFT transactions encompasses the following:

- Order input,

- Order processing and

- Order confirmation.

The matching algorithm [26] traverses the order book to find buy/sell orders that can form executable transactions (according to their ISIN, Price and Quantity). The limitations on buy/sell prices concern their minimum/maximum values. If prices are within the thresholds and the quantities do not match, the quantity provided is used and the rest is retained for subsequent transactions. If the whole quantity of a sell order is used, the order is erased from the order book. Otherwise, it is sustained for as long as its time frame is valid. The orders whose time frames have expired are considered void and are hence erased from the order book. The time frame in which orders persist in the market typically comprises a working day (approx. 8 h). Different stock markets have foreseen diverse opening hours (morning, evening or midday) to handle HFT orders. On each day in the market all order book entries are processed.

The HFT data structures being used on the German stock market in Frankfurt are elaborately described in [27]. As outlined in Table 2, each order is characterized by its trading attributes. ISIN represents the unique stock identifier of any financial instrument handled by the stock markets. The timestamps of each order and buy/sell transaction are defined in micro-seconds. Buyers and sellers are treated anonymously. All HFT transactions are executed by the stock market, which is treated as a contractual party by both sides.

Table 2.

HFT order book entry structure.

The following actions are performed on every incoming order [25]:

- Dealer anonymization,

- Order arrival timestamp,

- Order book entry.

During trading the following matching engine actions are performed on all current orders:

- Storing the orders in a transaction database and central order book.

- Confirmation of order inputs by dealer.

- Sorting the orders according to their type (buy or sell orders), price and quantity.

- Matching of buy and sell orders in the order book:

- ○

- Execution of matching transactions while timestamping executed transactions.

- ○

- Execution confirmation to the buyer *.

- ○

- Execution confirmation to the seller *.

- ○

- Transaction logging to the transaction database *.

- Removal of completed orders from the order book.

* These actions are not part of the matching engine; however, they are performed while processing transactions.

The transaction database of the stock market comprises datasets of the same structure, as presented in Table 3.

Table 3.

HFT transaction book entry structure.

3.1.2. Evaluation of the Current State

Despite all the listed organizational, infrastructural as well as software engineering measures, in the long run these may not be sufficient to provide real-time ability for HFT systems. Even considering the high data transmission rates on fiber-optics and the vast computing power of the HPC platforms employed in the stock markets, this fact remains valid, since they are all optimized for performance utilizing commercial ICT infrastructures.

Since neither software nor hardware accelerators are used, commercial HFT systems lack the following:

- Real-time ability in terms of guaranteed response times,

- Transaction safety in terms of preventing message loss,

- ICT safety and security, since they are considered too inefficient.

Traditionally, the safety of HFT transactions is neglected, since it is not as cost-effective as revoking lost orders. During HFT market hours, synchronization between stock markets even within a single market (e.g., Xetra in Germany) is not taking place. Apart from this, no technical safety measures are foreseen, since they would increase transaction latency and are therefore considered inappropriate. This arrangement is considered part of the stock markets policy and agreement between the stock markets and their customers. Apart from this, all co-location activities are monitored.

3.2. Hardware Accelerators

Considering the above description of HFT data structures and algorithms, the main processing load of the matching engine originates from traversing the main order book to find matching buy/sell orders by their ISIN identifiers. Hence, the software implementation of the search algorithms should be replaced by a hardware accelerated one [28]. It shall be based on the concept of associative memory or Content Addressable Memory (CAM), implemented in the form of content processors, also known as Knowledge-Based Processors (KBP). In particular, ternary KBPs should be used to be able to exclude parts of order book records that are not relevant in buy/sell order comparison.

KBPs shall automatically scan the incoming message headers to match with the existing orders’ identifiers. Hence, by their introduction, the need for the software implementation of the order book search and match procedures would be eliminated. Since the incoming order message’s datagrams are transported sequentially, the comparison register of the corresponding associative memory may be used for bit-wise comparison, thus processing incoming orders “on the fly”. Hereby, the complexity of the matching algorithm would be reduced to O(1).

Matching Engine

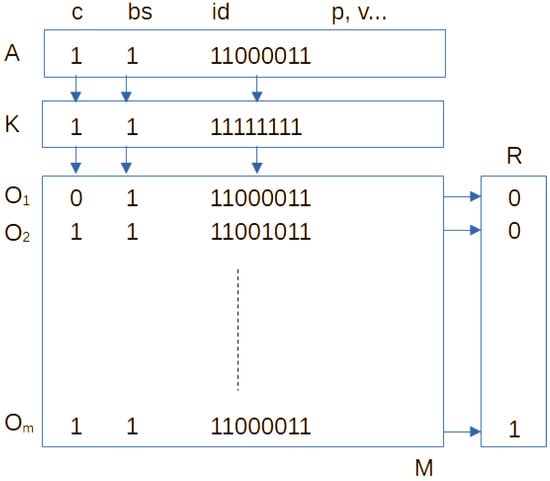

The structure of the matching engine is depicted in Figure 1. Here, vector A represents a new incoming order, K the input mask filtering out relevant bits for comparison, O the stored orders in memory M representing the order book and R the resulting mask, indicating executable transactions. The first (c) bit of every order in the order book represents the validity of the storage entry, meaning that it should or should not be considered in the matching process. The second bit (bs) represents the type (buy/sell) of the order based on which matching orders are detected. The id bits represent the ISIN, followed by volume, price and other information. As matching buy/sell orders for a specific ISIN are identified, the corresponding bits in the comparison register (R) are set, to indicate matching buy/sell entries, which are joined into executable transactions.

Figure 1.

Matching engine implementation with associative memory.

The matching engine’s internal logic shall be realized by the concept of CAM, also referred to as Hetero Associative Memory (HAM), forming a single-layer neural network. The architecture of HAM has n input “training” vectors and m output “target” vectors. The mathematical model of the HAM can hence be expressed as where M is the size of .

Its mapping function can then be expressed as

Namely,

where the matching of corresponding buy (b) and sell (s) orders yield

And the state of M also changes to M′ in the mapping process

where the M changes, updating residual buy/sales volumes to match

and possibly change the status of the order. If after matching buy and sales orders , there is a surplus of the sell volume, so only this value is changed. If the sell volume has been exhausted and the corresponding entry is invalidated . If the sell volume is insufficient () the original sales entry changes to buy ( inversion) with the price conditions of the buy order and the residual order quantity.

The listed search and match operations from (1) to (5) are executed in one step on each incoming order.

4. Results

The presented state of technology reveals obvious weaknesses and only partly fulfills the aforementioned requirements of future HFT and B2B e-marketplaces. Hence, methods and artifacts from industrial automation, currently not part of the mainstream HFT platforms, should be introduced.

To fulfill the real-time requirements of HFT, dedicated hardware components and real-time communication protocols should be used in conjunction with the trading algorithms. According to industrial experience, appropriate system architectures should be devised from application requirements and holistically designed with the main goal of achieving ICT safety, security and real-time ability.

The increase in transaction and ICT safety and security can be achieved by appropriate redundancy and hardware implementation of firewalls [29] as well as physically separated program and data-storage areas of the computers involved [30]. The combination of certificate-based user authorization and one-time pad (OTP) mechanisms as a lightweight means of order authentication and transaction authorization is considered equally efficient and sufficient to ensure transaction security.

Although the execution of application-specific HFT software components (e.g., matching engine) may currently fulfill the low-latency requirements, to achieve temporal predictability their functionalities should be transferred to dedicated hardware-accelerators to the highest possible degree.

Since Xetra computers are interconnected by InfiniBand, typical real-time communication restrictions according to HFT requirements [31], namely, maximum latency, minimum variations in latency, guaranteed bandwidth and meeting message transmission deadlines, can be fulfilled within the German stock exchange network. The same can be claimed for dealer computers in co-locations, connected via fiber optics. Although here standard TCP/IP connections are used, these point-to-point connections do not allow other participants to interfere in their message interchange and hence cannot introduce non-deterministic behavior. At this point, however, all other TCP/IP communications, especially buy and sell order messages, may clash and (over)fill input buffers. Hence, to avoid message loss and temporally unpredictable response times, appropriate network protocols from industrial automation, especially fieldbuses, should be introduced.

In the following section, the proposed digital framework for transaction-intensive e-business applications is presented. Its description comprises the optimized system’s architecture, transaction processing flow, mechanisms for ensuring its robustness, safety and security, as well as energy efficiency. As a proof of concept and feasibility study, its use-case is analyzed in the context of an HFT application.

4.1. System Architecture

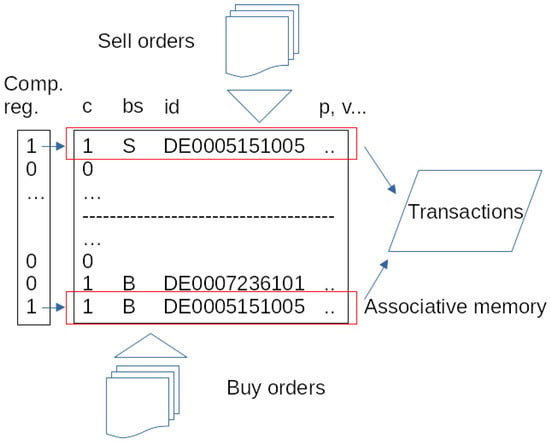

The main idea of the HAM-based matching engine (Figure 2) is to replace buyer and seller books with a common order book, where matching orders are processed immediately, while the rest are stored, based on their time of arrival, to be processed on subsequent orders.

Figure 2.

Single KBP HFT Implementation. Single KBP HFT implementation, showing how matching buy/sell orders are joined to form executable transactions.

Within a single KBP implementation the order volumes can be managed by high/low water principles with varying amounts of storage spaces for buy (b) and sell orders (s). Depending on the type of the incoming transaction, the associative memory compares buy orders against sell orders and vice versa. The capacity of associative memories, representing the order book, should be sufficient to cover daily traffic.

The processing of incoming orders is performed by a corresponding hardware-accelerator in relation to the current content of the HAM to form transactions. This may occur without even entering them into the order book.

The orders, which cannot be processed immediately, are stored according to their increasing timestamps. This way the orders which came first are also handled first. The search for executable buy/sell transactions is performed in a single step with respect to the provided type, ISIN, price and volume of incoming orders. When a match is found, the corresponding volumes are subtracted from the original orders to form buy/sell transactions. Possible overheads are retained for further processing. The identified executable transactions are fed into a queue for processing by the HFT system.

After an order’s volume has been exhausted, it is not physically erased from the order book—it is merely deactivated (marked void by resetting the validity indicator c back to 0) to disregard it in future comparisons. After market closure, all orders whose time frames have been exceeded are deactivated. The remaining orders may be transferred to a secondary storage from where they are reloaded to the associative memory before market opening on the next day, in the order of their arrival, to continue with their processing. This is necessary to retain active orders and to reduce associative memory segmentation, which may have a negative impact on its performance.

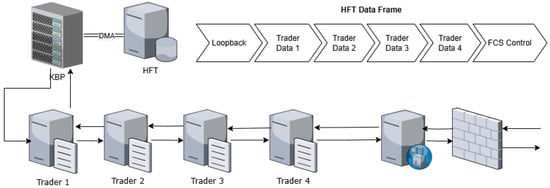

4.2. Network Architecture

For HFT communications between KBP and trading computers, the TCP/IP protocol should be replaced by a summation frame telegram protocol [32] in which the real-time data of multiple participants may be joined in a common datagram (Figure 3). This protocol is used in fieldbuses, where control systems, as well as all the sensors and actuators of an enterprise control system, form a ring network topology. The data flow from one participant to another is conducted in one direction throughout the entire ring. Every data block encapsulates current messages from all participants, with added loop-back and control data and a checksum for the entire block, to be processed in a single cycle. This ensures predictable message transfer speeds as well as prevents message loss on the inputs/outputs of the matching engine.

Figure 3.

HFT communication network topology.

During the initial phase, buyers and sellers are registered within the HFT system using their e-business credentials (e.g., digital certificates) secured through TLS encryption. Following registration, user identities are anonymized and each participant is assigned a sequence of OTP keys for consecutive order submissions, tailored to their profile and operational requirements. At the point of order entry, all buy and sell transactions undergo authentication via a hardware-accelerated OTP encryption mechanism prior to admission into the HFT system, thereby preventing unauthorized or improperly authenticated requests. Although complete mitigation of distributed denial-of-service (DDoS) attacks is infeasible, the integration of a hardware firewall in conjunction with hardware-accelerated security protocols ensures minimal latency during order processing. Once admitted, orders are considered secure and their timely execution is guaranteed through the application of the summation frame protocol, which enforces processing within the predefined time constraints.

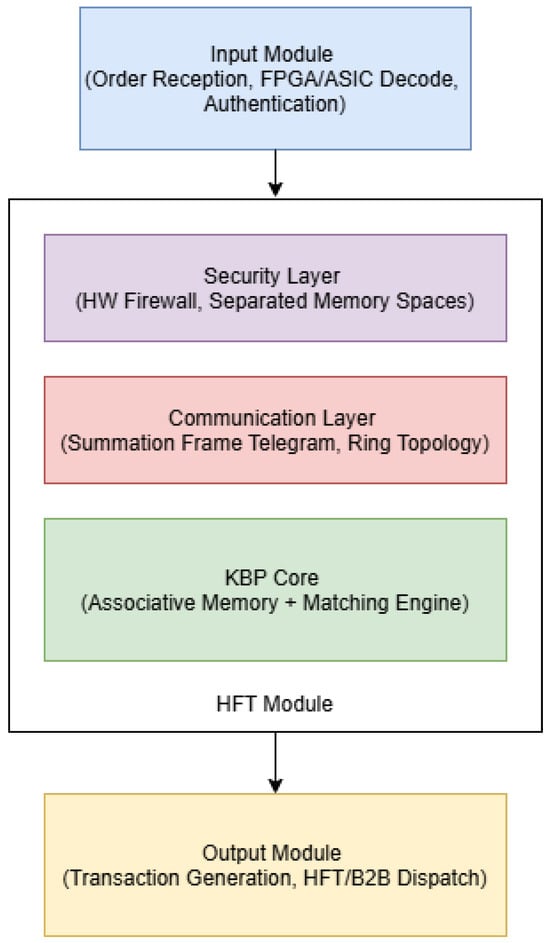

4.3. Architecture Optimization

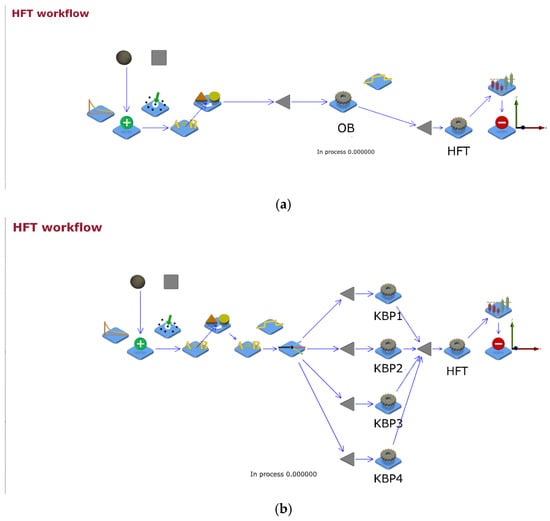

As indicated above, order (pre-)processing as well as parallel order processing are introduced by the new KBP-based HFT architecture (Figure 4) to ensure timely execution, safety and security of incoming orders and handle their increasing volumes. To provide for the scalability of the proposed solution, further improvements of the proposed HFT architecture are achievable by the following:

- Decoding incoming buy and sell order messages by FPGA/ASIC-based processors [33] for added efficiency and security of incoming order processing.

- Parallel processing of orders by multiple KBPs for load balancing.

- The realization of high-performance interfaces (e.g., Direct Memory Access (DMA)) between KBPs and the HFT computers for swift transaction processing.

Figure 4.

KBP-based HFT Architecture.

4.4. Use-Case

Let us consider a realistic working scenario of an HFT service system. In Figure 5a an algorithmic solution with a single matching processor over a common order book (OB) for buy and sell orders is shown. In contrast, in Figure 5b a KBP-based solution is outlined with four KBPs sharing the incoming load of 1.0951872 × 107 evenly distributed buy and sell transactions during an 8 h shift as opposed to an algorithmic one. Suppose they are arriving on an exponential distribution with the mean inter-arrival time of 3 ms from a (0,10) ms interval.

Figure 5.

(a) HFT service system with algorithmic matching as a JaamSim [34] simulation model. (b) HFT service system using KBP matching as a JaamSim [34] simulation model.

The simulation of the service system in the JaamSim discrete event simulation environment [35] rendered the results summarized in Table 4, taking into account the typical service time of 1.3889 × 10−7 ms for the Broadcom’s BCM15000 KBPs [34], where each can process 2048 K entries and with an HFT transaction processing time of 0.25 ms.

Table 4.

HFT algorithmic vs. KBP matching results.

Apart from the evident underutilization of the HFT processor, the main findings of this experiment concern the queue lengths, which represent the input buffers and the order service times. In the case of KBP-based matching, these service times are unaffected by order frequency or by the number of buy and sell orders in the order book(s). In contrast, the algorithmic implementation exhibits a noticeable delay, suggesting a potential issue as the workload increases.

5. Discussion

In terms of SDG 9 [36] and related goals (e.g., SDG 8 [37] on sustainable economic growth and SDG 12 [38] on sustainable consumption and production), the sustainability analysis of the benefits of the proposed framework reveals significant improvements considering the state of technology. The analysis reveals the clear benefits of using KBP’s associative memory in comparison with existing purely algorithmic solutions. There are, however, still some limitations to be overcome in terms of further technology transfers. They are presented in the outlook in the form of opportunities for further development to support the principles of pragmatic sustainability [39].

5.1. Analysis

High-Frequency Trading (HFT) algorithms and associative memory are both critical to optimizing real-time decision-making in financial markets. While HFT algorithms are designed for ultra-fast trade execution based on quantitative models, associative memory improves pattern recognition, trade optimization and low-latency decision-making (Table 5).

Table 5.

A comparison of HFT algorithms and associative memory.

HFT algorithms are designed to execute trades in microseconds using pre-defined strategies. These algorithms rely on low-latency data processing, statistical models and machine learning. The key features of HFT algorithms are as follows [4]:

- Ultra-low-latency, using hardware acceleration (FPGAs, GPUs) for rapid computation.

- Market microstructure analysis, identifying bid-ask spreads, order book depth and liquidity.

- Event-driven trading, to be able to react to news feeds, economic data and earnings reports in real-time.

- Machine learning-based forecasting, to predict price movements using AI.

Since they emerged in 1955, the main potential of using associative memory in HFT is predicted in the following [40]:

- Fast Market Pattern Recognition: Identifies repeating trade sequences and market conditions.

- Anomaly Detection: Detects spoofing, layering and quote stuffing.

- Low-Latency Decision Making: Reduces search time in large datasets by instantly matching new inputs with stored patterns.

- Neural Network Integration: Memory-augmented AI systems use historical data to optimize real-time trades.

As in the presented solution, the use of associative memory in HFT mainly enables pattern recognition by storing and retrieving data based on similarity, rather than explicit lookup. In addition to the proposed CAM-based solution, neural associative memory AI-driven models can be used for non-linear pattern detection for added safety and security of HFT. The proposed CAM-based neural solution is best supported by current technology.

While HFT algorithms excel at fast trade execution, associative memory enhances market pattern recognition. Combining them can reduce latency, improve accuracy and optimize trading models. Future advancements in AI, quantum computing and neuromorphic hardware will further integrate associative memory into next-generation trading systems. In the future, further combinations of HFT algorithms and associative memory are expected in terms of [41]: (a) AI-driven HFT models driven by neural networks with memory-augmented architectures for improved predictions, (b) quantum associative trading to enable ultra-fast decision-making using quantum computing and (c) hybrid trading systems combining predictive HFT models with real-time pattern recall from associative memory.

By introducing the presented HFT solution the following improvements have been achieved:

- Reduction in space requirements to perform transactions and improved scalability.

- Reduction in time requirements to perform transactions achieving linear O(1) complexity.

- Self-organizing lossless order books that are easier to maintain.

- Real-time ability by design due to reduced complexity of the matching process.

- Safety and security by design due to the lossless nature of transaction processing and lightweight yet secure security mechanisms, introduced by the HW-accelerated (pre-) processing of orders.

The greatest benefit of the presented architecture is its scalability, which is achievable by introducing an appropriate number of KBPs with respect to the expected volume of incoming orders, without sacrificing timeliness. Hereby, appropriate load management can be achieved in terms of space requirements as well as in terms of the service times achievable.

Considering the results of the analysis, the presented solution may be considered positive from all relevant aspects of real-time applications—timeliness, availability, reliability, as well as safety and security. While timeliness involves predictable transaction processing times, being assured by design, availability and reliability mainly address the system’s robustness. The system’s 24/7 availability can only be achieved by total automation being enabled by the current solution. The question remains whether this is the desired behavior in all transaction intensive applications, since they are subject to different regulatory requirements. Its reliability could only be compromised by a coordinated cyber-attack by (a group of) “trusted” users (probably resulting from themselves being attacked) not being prevented upfront by the provided safety and security mechanisms. Hence, to the best of our knowledge we may conclude that the new HFT framework fulfills all the mentioned criteria.

By addressing a pressing issue of high-volume/frequency digital transaction processing in the globally interconnected world in a holistic manner, this solution conforms with the principles of pragmatic sustainability. It is energy efficient, solvable by current technology and accessible to anyone participating in the e-commerce market.

5.2. Outlook

The presented solution may be extended to B2B e-marketplaces, where B2B transactions on buy/sell orders are handled in pretty much the same way, with the exception of not trading stocks identified by ISIN or e-currencies but goods identified by EAN codes. The differences in length between these identifiers may be overcome by appropriate organization of associative memory storage. Current KBP store arrays of associated user data, as lines of configurable lengths, viz. 32/64/128/256 bits (e.g., Broadcom’s Knowledge-Based Processor BCM15000 [34]).

With respect to the centralized vs. decentralized implementations of B2B e-marketplaces different trading rules and real-time restrictions may apply. In centralized e-marketplaces the situation is very much similar to the elaborated HFT case. With decentralized e-marketplaces, however, the situation is more similar to trading e-currencies. Here, the DAO marketplaces viz their yellow-page services [6] should provide for appropriate load balancing and seamless synchronization among remote HFT sites.

Due to an increased number of transactions, one may wish to strengthen their security, which can be achieved by introducing yet another hardware/software accelerator at the input of trading orders. The usual security mechanisms, already being employed with credit/debit card payments, can be used to perform adequate transaction authorization. For example, the implementation of OTP keys would increase transaction security both on the traders’ side, enhancing the customers electronic wallets security and on the customers’ side, augmenting user authentication at his/her trading app.

E-monetary transactions also share great similarity with HFT:

- They both handle financial instruments according to the “buy- and sell-principle”.

- Both handle large numbers of transactions.

- Synchronization of instrument data must occur after each market day.

Hence, cryptocurrencies can be handled by the same principle in the processes of their acquisition and selling. Since e-monetary transactions can be performed in different cryptocurrencies, their courses should be maintained by the (stock) markets in order to provide for appropriate conversions. As long as hard currencies are still in use, this shall involve a two-stage process—buying a certain amount of e-currency through the stock market and using it to pay for goods or services received. When using e-currencies as a payment method, they are not traded, they merely switch ownership. Hence, it is only a matter of adding or subtracting a certain amount to or from a user’s account.

When trading e-currencies at the stock market, due to a large number of additional trading accounts by e-currency users, the stock markets may provide simplified HFT profiles for end-users. Alternatively, there may be a possibility to trade currencies through their banks, in which case they would maintain their traditional role and no additional trading accounts would need to be established at the stock markets. To maintain transparency and prevent fraud, a single authority (stock market or bank) should be authorized to perform e-monetary transactions.

6. Conclusions

In this paper, the real-time ability and sustainability of e-commerce platforms has been discussed and a solution to provide for timeliness, safety and security in transaction intensive e-marketplaces has been presented. Real-time system’s quality of service criteria have been applied to analyze the proposed solution. Since they typically negatively influence their timeliness, safety and security mechanisms have also been taken into consideration. The goal was to provide a solution that would include them by design to minimize their impact on the entire system.

High frequency trading (HFT) markets have been chosen as an example, since they are handling increasingly large volumes of stocks. At the same time, due to their nature, their main constraints concern the timeliness, as well as safety and security of business transactions. Hence, by addressing real-time ability in HFT, a universal solution was investigated. Since it sensibly combines the properties of financial instruments traded at stock markets with e-monetary and DAO smart contracts, the proposed solution may be applied to all transaction-intensive e-marketplaces. It shall provide for the timeliness, correctness, availability, reliability, safety and security of e-commerce applications in the long run, regardless of their type.

By the presented solution, the introduction of AI mechanisms, like neural networks, occurs naturally and by design does not introduce execution delays. As in the case of HFT knowledge-based processors, they even present themselves as enablers of target application’s real-time ability. The added safety and security mechanisms do not negatively influence the performance of the proposed HFT solution since they are included by design. By doing so, their regulatory requirements can be fulfilled upfront with regular audits in the form of regular maintenance.

In summary, the goal of assuring the sustainability of e-commerce platforms is achievable by appropriate technology transfers from real-time systems, high-performance computing, as well as industrial automation and communications. In the future, one can expect multiple such solutions to appear in various application scenarios. As always, their interoperability will be sought for, and in this case the broad applicability and scalability of the presented solution shall present itself as a comparative advantage.

In this paper, we presented a conceptual framework for sustainable transaction processing in high-frequency e-business applications, based on energy-efficient components, secure communication protocols and lightweight authentication mechanisms. The proposed approach addresses key challenges of modern digital systems, such as reliability, security and responsiveness, without compromising long-term sustainability. By focusing on reducing resource consumption, increasing operational resilience and supporting innovative digital solutions, our framework contributes to achieving the UN Sustainable Development Goal 9 (Industry, Innovation, and Infrastructure).

Since the solution has not yet been deployed in a real e-business environment, its attack-robustness analysis remains outstanding and will be addressed during the planned implementation phase. The proposed HFT model will be empirically validated in a decentralized supply-chain setting incorporating distributed autonomous organizations and Physical Internet concepts.

Author Contributions

Conceptualization, W.H. and R.G.; methodology, R.G.; software, R.G.; validation, R.G., W.H. and T.K.; formal analysis, T.K.; investigation, R.G.; resources, T.K.; data curation, W.H.; writing—original draft preparation, R.G.; writing—review and editing, T.K.; visualization, R.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is available upon request from R.G.

Acknowledgments

During the preparation of this manuscript/study, the author(s) used publicly available data from Deutsche Börse, London Stock Exchange for the purposes of state of technology analysis and JaamSim simulation environment, version 2023 for the purpose of creating a use-case. The authors have reviewed and edited the output and take full responsibility for the content of this publication.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Alt, R. Evolution and perspectives of electronic markets. Electron. Mark. 2020, 30, 1–13. [Google Scholar] [CrossRef]

- Wiesböck, F.; Hess, T. Digital innovations. Electron. Mark. 2020, 30, 75–86. [Google Scholar] [CrossRef]

- Deutsche Bundesbank. Bedeutung und Wirkung des Hochfrequenzhandels am Deutschen Kapitalmarkt; Deutsche Bundesbank: Frankfurt am Main, Germany, 2016. [Google Scholar]

- Cartea, Á.; Jaimungal, S.; Penalva, J. Algorithmic and High-Frequency Trading, 1st ed.; Cambridge University Press: Cambridge, UK; Volume 2015, 2015. [Google Scholar]

- Rashad, W.; Gumzej, R. The Information Technology in Supply Chain Integration: Case Study of Reda Chemicals with Elemica. Int. J Supply Chain Manag. 2014, 3, 62–69. [Google Scholar]

- Milić, B.; Rosi, B.; Gumzej, R. An Approach to E-marketplace Automation. Tech. Gaz. 2019, 26, 639–649. [Google Scholar] [CrossRef]

- Gumzej, R. Engineering Safe and Secure Cyber-Physical Systems: The Specification PEARL Approach; Springer International Publishing: Berlin/Heidelberg, Germany, 2016. [Google Scholar] [CrossRef]

- Hassan, S.; De Filippi, P. Decentralized Autonomous Organization. Internet Policy Rev. 2021, 10. [Google Scholar] [CrossRef]

- Aldridge, I. High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems, 2nd ed.; Wiley: Hoboken, NJ, USA, 2013; Available online: https://www.wiley.com/en-us/High-Frequency+Trading%3A+A+Practical+Guide+to+Algorithmic+Strategies+and+Trading+Systems%2C+2nd+Edition-p-9781118343500 (accessed on 26 February 2020).

- Ait-Sahalia, Y.; Saglam, M. High Frequency Market Making: The Role of Speed (SSRN Scholarly Paper No. 2331613). Social Science Research Network; SSRN: Rochester, NY, USA, 2017. [Google Scholar] [CrossRef]

- Hasbrouck, J.; Saar, G. Low-latency trading. J. Financ. Mark. 2013, 16, 646–679. [Google Scholar] [CrossRef]

- Turban, E.; Outland, J.; King, D.; Lee, J.K.; Liang, T.-P.; Turban, D.C. Electronic Commerce 2018: A Managerial and Social Networks Perspective; Springer International Publishing: Berlin/Heidelberg, Germany, 2018. [Google Scholar] [CrossRef]

- Agrawal, A.; Gans, J.; Goldfarb, A. Prediction Machines: The Simple Economics of Artificial Intelligence; Harvard Business Review Press: Cambridge, MA, USA, 2018. [Google Scholar]

- Kirilenko, A.A.; Lo, A.W. Moore’s Law versus Murphy’s Law: Algorithmic Trading and Its Discontents. J. Econ. Perspect. 2013, 27, 51–72. [Google Scholar] [CrossRef]

- Laughlin, G.; Aguirre, A.; Grundfest, J. Information Transmission Between Financial Markets in Chicago and New York (SSRN Scholarly Paper No. 2227519). Social Science Research Network; SSRN: Rochester, NY, USA, 2012. [Google Scholar] [CrossRef]

- Gupta, D.; Purohit, A.; Naresh, R. FPGA for High-Frequency Trading: Reducing Latency in Financial Systems. In Proceedings of the 2024 3rd International Conference on Automation, Computing and Renewable Systems (ICACRS), Pudukkottai, India, 4–6 December 2024; pp. 19–25. [Google Scholar] [CrossRef]

- Rizzo, L. Netmap: A novel framework for fast packet I/O. In Proceedings of the 2012 USENIX Conference on Annual Technical Conference, Boston, MA, USA, 13–15 June 2012; p. 9. [Google Scholar]

- Biais, B.; Foucault, T.; Moinas, S. Equilibrium Fast Trading (SSRN Scholarly Paper No. 2024360). Social Science Research Network; SSRN: Rochester, NY, USA, 2014. [Google Scholar] [CrossRef]

- Budish, E.; Cramton, P.; Shim, J. The High-Frequency Trading Arms Race: Frequent Batch Auctions as a Market Design Response. Q. J. Econ. 2015, 130, 1547–1621. [Google Scholar] [CrossRef]

- Ebbers, M.; Byrne, F.; Gonzalez Adrados, P.; Martin, R.; Veilleux, J. Introduction to the New Mainframe: Large-Scale Commercial Computing. 2006. Available online: https://www.redbooks.ibm.com/abstracts/www.redbooks.ibm.com/abstracts/sg247175.html (accessed on 25 April 2024).

- Beller, C.S.M. Thesys Technologies: Creating a Microsecond Matching Engine|Connected Social Media. 2014. Available online: https://connectedsocialmedia.com/11676/thesys-technologies-creating-a-microsecond-matching-engine/ (accessed on 25 April 2024).

- Donner, A. Ultra-Low-Latency-Routen im Hochfrequenzhandel. IP-Insider. 2012. Available online: https://www.ip-insider.de/ultra-low-latency-routen-im-hochfrequenzhandel-a-369853/ (accessed on 3 July 2021).

- Petrou, V. How to Achieve Ultra-Low Latency in Your Trading Network. 2024. Available online: https://www.bso.co/all-insights/ultra-low-latency-trading-network (accessed on 25 April 2024).

- IEEE Std 1588-2019 (Revision of IEEE Std 1588-2008); IEEE Standard for a Precision Clock Synchronization Protocol for Networked Measurement and Control Systems. IEEE: Washington, DC, USA, 2020; pp. 1–499. [CrossRef]

- Börse, D. Deutsche Börse Cash Market—High-Frequency Trading. 2013. Available online: https://www.deutsche-boerse-cash-market.com/dbcm-en/newsroom/current-regulatory-topics/high-frequency-trading (accessed on 26 February 2020).

- Makrides, D.; Makarenko, V. Quadcode—Matching Engine: What is It and How Does It Work? Quadcode. 2024. Available online: https://quadcode.com/blog/matching-engine-what-is-it-and-how-does-it-work (accessed on 30 May 2024).

- Börse, D. Deutsche Börse Xetra—Order Types. 2025. Available online: https://www.xetra.com/xetra-en/trading/order-types (accessed on 22 January 2025).

- Halang, W.A.; Gumzej, R. Zuordnungsgerät Für Handelsaufträge. Patent No. DE102022000391A1, 3 August 2023. [Google Scholar]

- Halang, W.A.; Sukjit, P.; Komkhao, M.; Sodsee, S. An Insurmountable and Fail-Secure Network Interface. In Recent Advances in Information and Communication Technology; Meesad, P., Boonkrong, S., Unger, H., Eds.; Springer International Publishing: Berlin/Heidelberg, Germany, 2016; pp. 217–222. [Google Scholar]

- Halang, W.A.; Komkhao, M.; Sodsee, S. Secure Cloud Computing. In Recent Advances in Information and Communication Technology; Boonkrong, S., Unger, H., Meesad, P., Eds.; Springer International Publishing: Berlin/Heidelberg, Germany, 2014; pp. 305–314. [Google Scholar]

- Jäger, E. Industrial Ethernet: Funktionsweise, Implementierung und Programmierung von Feldgeräten Mit NetX. Hüthig. 2009. Available online: https://bib-pubdb1.desy.de/record/441537 (accessed on 26 February 2020).

- Sercos. Protokolleffizienz. 2020. Available online: https://www.sercos.de/technologie/warum-ethernetechtzeit-ethernet/protokolleffizienz/ (accessed on 26 February 2020).

- Leber, C.; Geib, B.; Litz, H. High Frequency Trading Acceleration Using FPGAs. In Proceedings of the 21st International Conference on Field Programmable Logic and Applications 2011, FPL 2011, Chania, Greece, 5–7 September 2011; pp. 317–322. [Google Scholar] [CrossRef]

- Broadcom. BCM15000 Knowledge-Based Processor; Broadcom Inc.: Palo Alto, CA, USA, 2016. [Google Scholar]

- JaamSim Development Team. JaamSim: Discrete-Event Simulation Software, version 2023-06; JaamSim Development Team: Vancouver, BC, Canada, 2023. Available online: http://jaamsim.com (accessed on 1 June 2023).

- United Nations—Department of Economic and Social Affairs. Sustainable Development Goal—9 Build Resilient Infrastructure, Promote Inclusive and Sustainable Industrialization and Foster Innovation. 2025. Available online: https://sdgs.un.org/goals/goal9 (accessed on 26 February 2020).

- United Nations—Department of Economic and Social Affairs. Sustainable Development Goal—8 Promote Sustained, Inclusive and Sustainable Economic Growth, Full and Productive Employment and Decent Work for All. 2025. Available online: https://sdgs.un.org/goals/goal8 (accessed on 26 February 2020).

- United Nations—Department of Economic and Social Affairs. Sustainable Development Goal—12 Ensure Sustainable Consumption and Production Patterns. 2025. Available online: https://sdgs.un.org/goals/goal12 (accessed on 26 February 2020).

- D’Adamo, I.; Gastaldi, M.; Nallapaneni, M.K. Europe Moves toward Pragmatic Sustainability: A More Human and Fraternal Approach. Sustainability 2024, 16, 6161. [Google Scholar] [CrossRef]

- Hopfield, J.J. Neural networks and physical systems with emergent collective computational abilities. Proc. Natl. Acad. Sci. USA 1982, 79, 2554–2558. [Google Scholar] [CrossRef] [PubMed]

- Bengio, Y. Learning Deep Architectures for AI (Vol. 2009). Now Foundations and Trends. 2009. Available online: https://ieeexplore.ieee.org/document/8187120 (accessed on 26 February 2020).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.