Abstract

Given the global imperative for energy transition, vertical mergers and acquisitions (M&As) have become a strategic lever for renewable energy enterprises to enhance supply chain resilience. This study examines the performance of Chinese A-share listed renewable energy enterprises from 2011 to 2023. By constructing an evaluation index system for supply chain resilience, the study employs a multi-period difference-in-differences (DID) model to examine the impact of vertical M&As on supply chain resilience and the mediating effect of supplier concentration. The results demonstrate that the supply chain resilience of vertically merged renewable energy enterprises is generally stronger than that of non-M&A counterparts, with a significant upward trend observed in M&A enterprises during the study period. However, renewable energy enterprises demonstrate lower supply chain resilience compared to manufacturing firms. Vertical M&As in renewable energy enterprises enhance supply chain resilience, a conclusion that remains valid after a series of robustness tests. Vertical M&As mitigate supplier concentration and further enhance supply chain resilience in renewable energy enterprises. Heterogeneity analyses reveal that vertical M&A has a more pronounced effect on supply chain resilience in renewable energy enterprises that have low financing constraints and high growth potential. In the solar power, lithium and hydrogen energy industries, vertical M&As had a greater promoting effect on supply chain resilience. This study provides empirical evidence and decision-making guidelines for renewable energy enterprises to adopt vertical M&A strategies for enhancing supply chain resilience.

1. Introduction

Driven by the “carbon neutrality” goal, the development of traditional industries with high carbon emissions faces severe constraints. Zero-carbon and low-carbon industries are flourishing, and the renewable energy sector, centered around innovative technologies, has emerged as a new economic growth engine. As the world’s largest energy consumer, China is actively advancing the renewable energy industry. The government has issued policy documents such as the “Implementation Plan for Promoting High-Quality Development of Renewable Energy in the New Era” and the “14th Five-Year Plan for Renewable Energy Development”, which strongly support the sector’s growth. However, China’s renewable energy supply chain still faces challenges, including slow adoption of key technologies and weak competitiveness of core components. Yuan et al. (2024) emphasized that the unprecedented low-carbon energy transformation has raised global concerns over disruptions to critical metal raw material supplies [1]. Consequently, enhancing supply chain resilience has become pivotal for promoting the renewable energy industry. As key actors in this sector, renewable energy enterprises utilize vertical M&As to integrate upstream and downstream linkages within the industry chain, thereby strengthening supply chain resilience. This approach is essential for achieving strategic objectives such as modernizing the renewable energy industry and promoting its high-quality development.

As a globally recognized industry with one of the most promising development prospects, the renewable energy sector has attracted extensive scholarly attention. However, limited research has focused on vertical M&As within this specific domain. Under policy directives aimed at consolidating industrial chains, an increasing number of renewable energy enterprises are adopting vertical M&A strategies to extend their industrial reach. In order to ensure the stable supply of raw materials, BYD has increased the number of first-tier suppliers to more than 8 through vertical M&As, and reduced the proportion of key raw material suppliers to less than 20%, thereby integrating industrial chain linkages and enhancing supply chain resilience. According to Deloitte’s 2023 Renewable Energy Industry Report, vertical M&A activity within the power battery sector ranks highest in the renewable energy industry, with annual transaction counts rising from 151 (2020) to 277 (2023), demonstrating consistent year-on-year growth. By leveraging synergistic innovation and industrial upgrading, vertical M&As facilitate information sharing and production coordination between upstream suppliers and downstream clients, restructure supply chain frameworks, and ensure operational stability. Against this backdrop, investigating whether vertical M&As can enhance the stress tolerance thresholds in renewable energy supply chains holds significant practical implications.

This study analyzes data from A-share listed renewable energy enterprises (2011–2023) to systematically investigate the vertical M&As’ impact on supply chain resilience. The analysis evaluates the impact of vertical M&As through the lens of supplier concentration, while also investigating heterogeneity effects related to financing constraints, corporate growth, and different industries. The research contributions are threefold: “First, current literature predominantly explores supply chain resilience through factors spanning institutional environments and policy uncertainty [2], yet fails to address the role of vertical M&As. This study addresses this research gap by integrating vertical M&A behaviors of renewable energy enterprises, innovative resource consolidation, and supply chain resilience into a unified theoretical framework. Second, the incorporation of supplier concentration as a mediating variable elucidates its conditioning effect on the vertical M&A–supply chain resilience nexus, thereby identifying key combinatorial factors for enhancing resilience. Third, heterogeneity analysis across financing constraints and enterprise growth levels reveals context-specific impacts of vertical M&A strategies, providing actionable insights for renewable energy firms to optimize M&A decision-making under diverse operational scenarios”.

2. Literature Review

2.1. Research on Renewable Energy Enterprises

Renewable energy usually refers to zero-carbon and low-carbon renewable green energy. Through a review of relevant literature on renewable energy enterprises, scholars have primarily focused on the macro- and micro-level factors influencing the development of renewable energy enterprises. Existing macro-level analyses predominantly assess the effects of industrial policies on renewable energy enterprises and conduct comparisons of policy tools. Specifically, Dong et al. (2020) revealed the phased differences in policy effects through a dynamic perspective, highlighting that as the renewable energy industry transitions from government-led to market-driven, the marginal utility of traditional policy tools shows a decreasing trend [3]. Building on this foundation, Hsiao et al. (2023) employed a policy tool comparison framework to argue that government subsidies and long-term planning have a significantly greater promoting effect on industrial development than tax incentives and administrative directives, indicating that the choice of policy type directly impacts implementation effectiveness [4]. Furthermore, Qin et al. (2024) identified that distinguishing between subsidy-type and non-subsidy-type policies, such as market access mechanisms and dual credit systems, can more effectively stimulate innovation behaviors of renewable energy vehicle enterprises and have a structural impact on their long-term value creation compared to traditional fiscal subsidies [5].

Micro-level analyses systematically investigate how government subsidy-driven industrial policies induce heterogeneous responses in renewable energy firms’ economic behaviors. First, Shao et al. (2021), based on the resource constraint theory, pointed out that government subsidies significantly encourage innovation investment and drive total factor productivity growth by alleviating the R&D cost pressure on enterprises [6,7]. However, Wang et al. (2021) found through financial performance analysis that subsidy dependence may trigger a soft budget constraint effect, leading to a decline in operational efficiency and the accumulation of financial risks for enterprises [8]. Further research highlights that the subsidy phase-out mechanism exhibits a dual effect. Wang et al. (2024) verified through dynamic panel data analysis that while the subsidy phase-out increases operational pressure on firms in the short run [9], it simultaneously triggers a mechanism that encourages firms to enhance their R&D investment intensity [10], while diminishing symbolic innovation and fostering structural improvement in innovation quality [11]. These policy adjustments essentially redefine the trade-off path between enterprise innovation incentives and short-term economic performance.

2.2. Research on Vertical Mergers and Acquisitions of Enterprises

Vertical M&A refers to M&A between upstream and downstream distributors within an integrated supply chain. Existing literature predominantly investigates the driving factors and economic consequences of vertical M&As. Regarding the driving factors of vertical M&As, current academic circles suggest that the primary driving factors include institutional environment and industry characteristics. In terms of the institutional environment, Fan et al. (2017) argued that enterprises influenced by the industrial policy of becoming bigger and stronger will carry out more M&As [12], and the uncertainty of external economic policies and the instability of price fluctuations will increase enterprises’ transaction costs, thereby forcing them to conduct vertical M&As [13,14]. Institutional factors, such as accelerating financial deepening and improving trade liberalization, promote vertical M&As by reducing factor flow barriers [15,16]. At the industry level, the visibility of supply chain risks prompts enterprises to establish risk defense mechanisms through vertical M&As [17]. The degree of asset specificity positively influences firms’ propensity for vertical M&As, and the sunk costs resulting from specific investments drive firms to implement vertical M&As [18]. State-owned enterprises, leveraging their resource acquisition advantages and facing policy-oriented constraints, are more inclined to achieve industrial chain reconstruction through vertical M&As [19].

Research on vertical (M&A) predominantly analyzes the microeconomic effects of enterprises, covering many dimensions such as enterprise value, investment efficiency, resource allocation, and technological innovation. In terms of enterprise value, vertical M&As significantly bolster supply chain integration, promote corporate sustainability performance [20], and thus, enhance the stock value and business performance of enterprises [21]. In terms of investment efficiency, vertical M&As can help mitigate information asymmetry and reduce enterprise operational risks [22] and effectively reduce enterprise equity financing costs [23]. From the perspective of resource allocation, vertical M&As can strengthen cross-departmental coordination and communication, thus increasing internal resource allocation efficiency [24]. In the field of technological innovation, vertical M&As can improve the innovation speed and overall innovation capability of enterprises [25]; however, Liu et al. (2025) pointed out that the failure of M&As will reduce their innovation input and thus weaken the innovation capability [26].

2.3. Research on the Resilience of Enterprise Supply Chain

Supply chain resilience was first defined as the ability of the supply chain to recover to the original or even better state in the event of operational disruptions [27]. Specifically, the definition of supply chain resilience involves three levels: the ability to anticipate and address potential crises, the ability to rapidly respond to disruptions, and the ability to adapt and evolve post-crisis [28]. In terms of measurement, scholars tend to employ comprehensive indicators to assess supply chain resilience. Negri et al. (2021) divided supply chain resilience into two dimensions: resistance and resilience [29]. Zhang (2025) employed a comprehensive index to measure not only supply chain relaxation but also supply chain concentration and supply chain innovation quality [30]. As emerging technologies are increasingly integrated into supply chain management, Shoomal et al. (2024) incorporated the Internet of Things into the development of supply chain resilience indicators [31], leveraging existing resources such as “Quantifying IoT Security Parameters: Assessment Framework” to further enhance indicator construction [32].

Regarding the influencing factors of supply chain resilience, scholars have focused on institutional environments, digital technology, and supply chain relationships. From a macro perspective, considering the analysis of institutional environments and digital technology, an improved external institutional environment is essential for enhancing supply chain resilience. Therefore, scholars have investigated the impact of institutional environments on enterprise supply chain resilience. Government policies, such as tax credits and digital investments, facilitate the development of digital dynamic capabilities in enterprises, thereby enhancing supply chain resilience [33]. The adoption of digital technologies, including artificial intelligence, the Internet of Things, and Big Data, has emerged as a critical enabler for ensuring the resilient functioning of supply chains [34,35]. Additionally, digital transformation, supply chain digitization, blockchain technology, and data elements can optimize supply–demand matching, promote supply chain diversification, and foster supply chain information and knowledge spillover, thereby improving enterprise supply chain resilience [36,37,38]. From a micro perspective, this paper examines the relationships, innovation capabilities, and organizational governance within the supply chain. Cooperation among supply chain members can promote information and resource sharing, thereby enhancing supply chain resilience [39]. In the face of external uncertainties such as geopolitical conflicts, the COVID-19 pandemic, and climate-induced supply shocks, the development of enterprise intelligence effectively mitigates the negative impact of uncertainty, improves the supply chain efficiency, and thus, strengthens the supply chain resilience [40]. Enterprises with innovative human capital can facilitate information sharing, knowledge exchange, and technology dissemination with suppliers and customers. This enhances the flexibility and agility of enterprises in responding to external shocks, thereby reinforcing supply chain resilience [41].

2.4. Literature Summary

A review of relevant literature on renewable energy enterprises reveals that scholars’ research primarily examines the impact of industrial policies, such as government subsidies and tax incentives, on the development of renewable energy enterprises. Currently, the supply chain of renewable energy enterprises remains vulnerable to risks, including supply chain interruptions, the gradual evolution of key technologies, and the insufficient competitiveness of core components. Driven by industrial policies and industry characteristics, an increasing number of renewable energy enterprises are undertaking vertical M&As. The question of whether such vertical M&As can enhance supply chain resilience warrants further discussion. Based on this background, a further review of literature related to vertical M&As and supply chain resilience reveals that scholars primarily investigate the impact of vertical M&As on enterprise value, investment efficiency, resource allocation, and technological innovation. However, limited attention has been directed toward the influence of vertical M&As on enterprise supply chain resilience, with relevant studies being relatively scarce. Therefore, can vertical M&As of renewable energy companies enhance supply chain resilience? If so, what is the mechanism of action? Taking renewable energy enterprises as the research object, an in-depth exploration of the relationship between vertical M&As and enterprise supply chain resilience can more truly and comprehensively understand the microeconomic consequences of vertical M&As of renewable energy enterprises and the aspects of supply chain resilience.

3. Theoretical Analysis and Research Hypotheses

3.1. Vertical Mergers and Acquisitions and Supply Chain Resilience

Based on the relationship between the main body and the upstream and downstream of the supply chain, supply chain resilience can be categorized into risk resistance, chain resilience, and enterprise creativity. By applying transaction cost theory, resource integration theory, and synergy theory, the relationship between vertical M&As of renewable energy enterprises and supply chain resilience can be objectively analyzed. Through vertical M&As, renewable energy enterprises internalize the supply of upstream raw materials or downstream sales channels, thereby reducing dependence on external suppliers. This ensures the quantity and quality of raw materials, lowering enterprises’ transaction costs [42], stabilizing the cooperative relationship between enterprises and suppliers, and effectively mitigating the risk of supply chain disruption. Enhancing the supply chain’s resistance to risks is crucial. Based on the resource integration theory, vertical M&As (M&As) can bring in higher quality resources, optimize enterprise resource allocation efficiency [43], integrate the dependent and complementary products and resources from the upstream and downstream of the industrial chain, and improve the coordination between internal and external resources. This integration also helps reduce the communication costs of intermediate links and enables timely responses to market demand fluctuations. To ensure that enterprise production is not subject to drastic external shocks leading to production suspension and to enhance the resilience of the supply chain, it is essential to strengthen the chain’s ability to adapt to disruptions and maintain operational continuity. Based on the synergistic effect theory, enterprises acquire knowledge capital, such as advanced technology, knowledge, and human capital, through vertical M&As. This facilitates the formation of new knowledge combinations, enhances enterprises’ ability to absorb and apply knowledge capital, and ultimately leads to the formation of a knowledge synergy effect [44]. At the same time, the constructed division of labor and cooperation network is utilized to promote cooperation and communication among enterprises. This forms a collaborative innovation network [45], which improves the collaborative innovation capabilities of the industrial chain and supply chain resilience [46]. By focusing on breakthroughs in key core technologies and critical links of the industrial chain and supply chain, the creativity of enterprises is further enhanced.

Hypothesis 1.

Vertical mergers and acquisitions in renewable energy enterprises enhance supply chain resilience.

3.2. Vertical Mergers and Acquisitions, Supplier Concentration, and Supply Chain Resilience

Supplier concentration reflects the dependence of enterprises on suppliers in the procurement market. According to industrial competition theory and opportunity hypothesis theory, enterprises with high supplier concentration will lead to strong bargaining power of suppliers, which will bring risks to the production and operation of enterprises. In order to maintain the stability of raw material supply, renewable energy enterprises need to establish a good cooperative relationship with suppliers. However, in the process of bargaining, these enterprises are often at a disadvantage, which greatly increases the external transaction costs of enterprises and leads to the decline of product market competitiveness. Based on the theory of resource dependence, an enterprise with a high concentration of suppliers is highly reliant on a limited number of suppliers. This increases the risk exposure of the enterprise and, consequently, the risk of supply chain disruption. Furthermore, excessive concentration of suppliers negatively impacts the technological innovation capabilities of enterprises [47]. As high-tech enterprises, renewable energy companies exhibit strong product innovation capabilities and robust downstream demand. Therefore, high supplier concentration exacerbates the instability of supply chains, particularly in production and demand areas. Through vertical M&As, renewable energy enterprises can establish cooperative relations with suppliers, reduce their dependence on suppliers, weaken the suppliers’ bargaining power [48], and save procurement costs of raw materials, thereby avoiding supply chain disruptions and enhancing risk resistance capabilities. Furthermore, through vertical M&As, renewable energy enterprises can build a division of labor and a cooperation network to lower supplier concentration and achieve supply chain risk sharing. When the supply chain is subjected to strong external shocks, this enables the chain to quickly resume normal production and improve its recovery capacity. Moreover, renewable energy enterprises are in a stage of rapid development, and their technological innovation requires significant capital investment. Enterprises with a high concentration of suppliers are often regarded as potential risks by financial institutions, which requires more stringent loan approval conditions [49]. Vertical M&As can obtain more loans from financial institutions by reducing the concentration of suppliers, which ensures the capital investment of renewable energy enterprises to some extent. It enhances the innovative capacity of enterprises, thus strengthening the supply chain resilience of enterprises.

Hypothesis 2.

Vertical mergers and acquisitions mitigate supplier concentration and further enhance supply chain resilience in renewable energy enterprises.

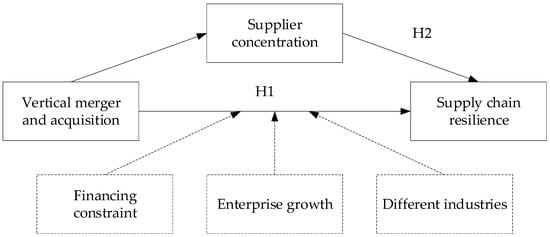

In conclusion, the analysis framework of the impact mechanism and heterogeneity of vertical M&As on supply chain resilience is seen in Figure 1.

Figure 1.

Theoretical analysis framework diagram.

4. Methodology

4.1. Data Source

Renewable energy enterprises refer to the manufacturing industry of renewable energy, including the acquisition, transmission, storage, and efficient utilization of renewable energy. However, there is currently no unified standard for the classification of renewable energy enterprises. In combination with guiding documents such as the “Guiding Opinions on Accelerating the Development of Renewable Energy Storage (Draft for Comments)” jointly issued by the National Development and Reform Commission and the Energy Administration, renewable energy enterprises are classified. Firstly, data for A-share listed companies were downloaded from the CSMAR database. Secondly, through text analysis, companies whose business scope or main business involved keywords such as new energy vehicles, photovoltaic equipment, and lithium batteries were identified as renewable energy enterprises. The initial research sample period was selected as A-share listed renewable energy enterprises from 2011 to 2023. Samples with ST, *ST, and severe missing main variables were excluded. A small amount of missing data were filled in using interpolation. Finally, 200 renewable energy enterprises were selected, yielding 2600 observation values. To mitigate the impact of extreme values, the main continuous variables were truncated by 1% on both the upper and lower ends. The relevant data were sourced from the CSMAR database and the Choice database.

4.2. Variable Definition and Descriptive Statistics

4.2.1. Explained Variable

Supply chain resilience (SCR). Supply chain resilience refers to the ability of the supply chain to adjust to a normal state or even a more ideal state in a timely manner when dealing with potential market risks and uncertain shocks [50]. The supply chain resilience of renewable energy enterprises is measured across three dimensions: risk resistance capacity, chain resilience, and enterprise innovation.

Supply chain resilience refers to the ability of renewable energy enterprises to maintain stable operations in the face of external shocks, risks, and uncertainties [51]. This resilience is composed of three key aspects: capital recovery ability, financial health, and supplier concentration. Capital recovery ability reflects an enterprise’s capacity to quickly recover and manage capital pressure, which directly impacts the efficiency and stability of supply chain operations. Financial health indicates the degree to which an enterprise’s asset–liability structure and profitability are sound, with a healthy financial status enhancing an enterprise’s ability to withstand risks and respond to emergencies. Supplier concentration refers to an enterprise’s reliance on suppliers, where optimizing the geographical distribution and quantity ratio of suppliers can effectively mitigate the risk of supply chain disruption.

Supply chain resilience refers to the ability of a supply chain to quickly adjust and restore its operations in the face of emergencies and unpredictable challenges [52]. The assessment of resilience can help enterprises identify potential bottlenecks and risks, formulate effective coping strategies, and enhance both supply chain resilience and the organization’s ability to manage disruptions. The recovery ability is measured through five secondary indexes: chain stability, inventory management efficiency, cash reserve level, expense management level, and enterprise profitability. Chain stability directly impacts the production and delivery capacity of the enterprise. Maintaining chain stability minimizes the loss caused by supply chain interruptions, ensuring smoother operations during crises. Efficient inventory management reduces capital occupation tied up in excess inventory and enhances the flexibility and responsiveness of enterprises. By optimizing inventory levels, companies can better adapt to sudden changes in demand or supply conditions. Sufficient cash reserves ensure that the company has adequate funds for daily operating expenses and strengthens partnerships through consistent financial stability. This financial buffer is essential for navigating unexpected challenges without compromising business continuity. The cost management level reflects the enterprise’s ability to control expenses and manage resources effectively. It also indicates the company’s financial health and its capacity to sustain operations during tough times. Enterprise profitability demonstrates the company’s ability to generate market value and support strategic program management. This is directly linked to the survival and long-term development of the enterprise, as profitability ensures the availability of resources for innovation and growth.

Supply chain creativity. Supply chain creativity refers to the ability of renewable energy enterprises to effectively manage supply chain processes, coordinate activities, and optimize resource allocation to create value by integrating internal and external resources [53]. Measuring supply chain creativity provides enterprises with a more comprehensive perspective on supply chain resilience management. This creativity is assessed through three secondary indexes: technical innovation ability, staff work efficiency, and talent quality level. Technical innovation ability enables enterprises to introduce new technologies, tools, and methods in supply chain management, thereby enhancing the efficiency and flexibility of supply chain operations. As a crucial component of supply chain operations, employees’ working efficiency directly impacts the overall effectiveness of the chain. Additionally, supply chain management requires specific professional knowledge and skills, and high-quality talents are essential for effectively planning, optimizing the supply chain process, and addressing risks and challenges. The specific indicators are measured as shown in Table 1.

Table 1.

Construction of enterprise supply chain resilience index system.

4.2.2. Explanatory Variable

Vertical mergers and acquisitions (Vma). The vertical M&A behavior of renewable energy enterprises for the first time is 1, otherwise 0. According to the description of the transaction overview in the M&A purpose in the M&A database of CSMAR, the M&A between the acquirer and the acquiree is identified as vertical M&A. When identifying the type of vertical M&A, the specific operations are as follows: If the keywords on vertical M&As such as “improve the industrial chain layout” and “upstream and downstream relationships” appear in the transaction overview, it is defined as vertical M&A. To ensure the accuracy of the data, furthermore, Python3.7 text mining was used to analyze the financial statements or industry reports of 200 renewable energy enterprises and cross-verify whether vertical mergers and acquisitions occurred in the enterprises to avoid potential misclassification or missing cases.

4.2.3. Mediating Variable

Supplier concentration (Sup). Following the approach of Guo et al. (2024), the ratio of the top five suppliers’ procurement amount to the total annual procurement amount is used for measurement [54]. The value range of this variable is between 0 and 1, and the higher the value, the higher the concentration of suppliers.

4.2.4. Control Variable

To address the endogeneity issue arising from omitted variables, the following control variables are employed. The total asset–liability ratio (Lev) is calculated by dividing total liabilities by total assets. Return on total assets (RTA) is determined by the sum of total profits and finance expenses divided by total assets. The administrative expense ratio (Cost) is obtained by dividing administrative expenses by operating income. Cash flow (Cash) is measured by dividing net cash flow from operating activities by total assets. Growth is calculated as the increase in operating revenue divided by the operating revenue. The fixed assets ratio (Fixed) is derived by dividing fixed assets by total assets. The proportion of skilled workers (Tech) is represented by the ratio of skilled workers.

The descriptive statistics of each variable are shown in Table 2.

Table 2.

Descriptive statistical analysis.

4.3. Model Construction

In order to examine the impact of vertical M&As of renewable energy enterprises on their supply chain resilience, a multi-temporal DID model is constructed as follows:

Among them, is the dependent variable and is the explanatory variable. If is positive, it indicates that vertical M&As of renewable energy enterprises have a positive effect on their supply chain resilience. is the control variable set, is the individual fixed effect, is the time fixed effect, and is the random error term.

In order to test the mediating effect of supplier concentration, a mediating effect model was constructed to verify Hypothesis 2. The model is as follows:

5. Empirical Results and Discussion

5.1. Basic Characteristics of Supply Chain Resilience in Renewable Energy Enterprises

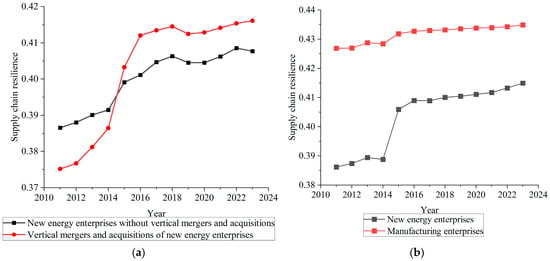

To empirically investigate the supply chain resilience of renewable energy enterprises, an analysis will be conducted to determine whether vertical M&As have occurred, as well as to compare the supply chain resilience of different types of enterprises. The specific findings are presented in Figure 2. From Figure 2a, it can be observed that the supply chain resilience trend of renewable energy enterprises that have not undergone vertical M&A remains relatively stable, while the supply chain resilience trend of renewable energy enterprises that have undergone vertical M&A shows continuous improvement. During 2011–2014, a few renewable energy enterprises engaged in vertical M&As. During this period, the supply chain resilience of renewable energy enterprises that underwent vertical M&A was lower than that of those that did not undergo vertical M&A. The possible reasons are that renewable energy enterprises are currently in their growth stage. Due to their high technology and high investment characteristics, financial institutions impose stricter approval conditions for bank loans, and the government’s subsidy and tax incentive systems have not yet been fully developed. In this situation, enterprises often face funding shortages. If vertical M&As are carried out, substantial cash outflows may occur, potentially leading to cash flow shortages for the enterprises. This could result in the enterprises being unable to meet their normal production supply and demand, thereby affecting the stability of the supply chain and leading to weaker supply chain resilience. In 2015, a large number of renewable energy enterprises underwent vertical M&A, and their supply chain resilience significantly increased, exceeding that of renewable energy enterprises that did not undergo vertical M&A. Subsequently, supply chain resilience showed a steady upward trend. The reason for this is that, under the guidance of industrial policies such as expanding and extending the industrial chain, more and more renewable energy enterprises are conducting vertical M&A to maintain their competitive advantage and enhance the resilience of their supply chains. From Figure 2b, it can be observed that the average supply chain resilience of renewable energy enterprises is 0.400, compared to 0.432 for manufacturing enterprises. Although the supply chain resilience of renewable energy enterprises continues to improve, it remains weaker than that of manufacturing enterprises. By describing the basic characteristics of supply chain resilience in renewable energy enterprises, it can be concluded that vertical M&As serve as a crucial mechanism for enhancing the resilience of renewable energy supply chains. Strengthening the resilience of renewable energy enterprise supply chains is particularly important for achieving their high-quality development.

Figure 2.

(a) Analysis of supply chain resilience of vertical mergers and acquisitions and (b) analysis of supply chain resilience of different types of enterprises.

5.2. Results of Baseline Regression

To examine the impact of vertical M&As on the supply chain resilience of renewable energy enterprises, regression analysis was conducted using model (1). The analysis initially focused on fixed effects, with results presented in columns (1)–(2) of Table 3. The regression coefficient of vertical M&As in renewable energy enterprises is significantly positive, suggesting that vertical M&As enhance supply chain resilience. When control variables are added to the basis of fixed effects, the results are shown in column (3) of Table 3. The coefficient for vertical M&As of renewable energy enterprises is 0.004, which is significantly positive at the 5% level, indicating a substantial positive impact of vertical M&As on supply chain resilience. Hypothesis 1 is therefore supported.

Table 3.

Regression results of the benchmark model and the mediating effect.

5.3. Mediating Effect Test

Considering that suppliers are an important component of the industrial chain and supply chain of renewable energy enterprises, supplier concentration degree, an important supply chain variable, is introduced on the basis of Model (1), and the intermediary effect of supplier concentration degree is tested through Models (2)–(3). From column (4) of Table 3, it can be observed that in the regression results of vertical M&A affecting the supplier concentration of renewable energy enterprises, the regression coefficient of vertical M&A is −0.024, which is significant at the 5% level. From column (5), it can be observed that the regression coefficient of supplier concentration is −0.015, which is significant at the 1% level. Moreover, the direct effect of vertical M&A on supply chain resilience is 0.004, which is significant at the 5% level, indicating that hypothesis H2 is valid. To ensure the robustness of the conclusion, a Sobel test with a Z-value of −2.048 was first conducted to verify the mediating effect of supplier concentration. Subsequently, a Bootstrap test was performed with 1000 replications. The results showed that the 95% confidence interval of the indirect effect did not include zero, further indicating the existence of mediating effects. Higher supplier concentration increases renewable energy enterprises’ dependence on upstream enterprises, which reduces resource allocation efficiency and negatively impacts supply chain resilience. Therefore, vertical M&As can reduce supplier concentration and improve the supply chain resilience of renewable energy enterprises.

5.4. Results of Robustness Test

5.4.1. Parallel Trend Test

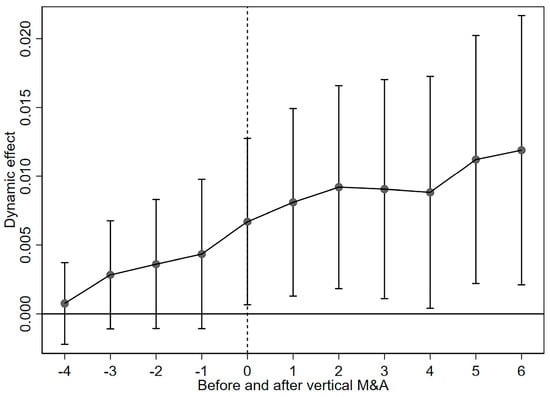

The validity of the DID estimation relies on the parallel trends assumption: Prior to renewable energy enterprises’ vertical M&A events [55], the supply chain resilience trends between the treatment group and the control group must be statistically indistinguishable. To empirically validate this, a regression model should be established that examines the supply chain resilience and time dummy variables of renewable energy enterprises. The results of the parallel trend test are shown in Figure 3. There was no significant difference in supply chain resilience between the treatment group and the control group samples before the vertical M&A; however, after the vertical M&A, the regression coefficient began to be positive and passed the significance test, thus satisfying the parallel trends hypothesis.

Figure 3.

Parallel trend test.

5.4.2. Placebo Test

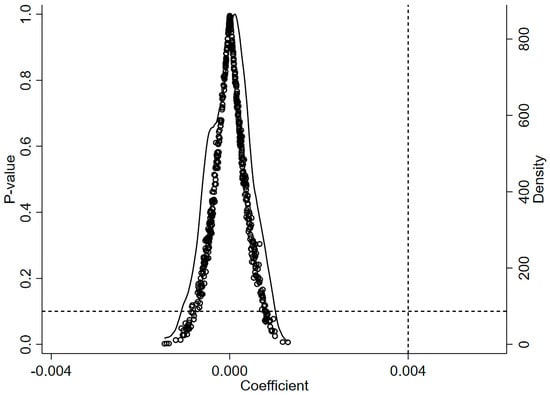

To strengthen the causal interpretation that vertical M&A enhances supply chain resilience in renewable energy enterprises, a placebo test was randomly selected from both treatment and control groups [56]. Specifically, 178 renewable energy enterprises were randomly selected from the full sample to serve as the false experimental group, while the remaining enterprises were designated as the false control group. False vertical merger dummy variables were randomly generated for the experimental group samples, and the estimated coefficients of their impact on supply chain resilience were obtained through regression analysis. This random sampling process was repeated 500 times, and the p-values and kernel density distributions of the 500 estimated coefficients were plotted, as illustrated in Figure 4. The results reveal that the estimated coefficients of Vma are centrally distributed around 0, and the corresponding p-values for most coefficients are greater than 0.1. The estimated coefficient of 0.004 obtained in the benchmark regression represents a rare occurrence in the random matching experiment. These findings indicate that the promotion effect of vertical mergers and acquisitions on supply chain resilience in renewable energy enterprises is not significantly influenced by unobservable factors.

Figure 4.

Placebo test.

5.4.3. PSM-DID Inspection

Furthermore, the PSM-DID method was employed to correct the selection bias of the sample of renewable energy enterprises. The 1:4 nearest neighbor matching and radius matching methods were used to rematch the data of renewable energy enterprises. After matching, the p-values for the mean differences between the treatment and control groups across variables were above the 10% significance level, suggesting that covariate balance was achieved. The regression results are presented in columns (1)–(2) of Table 4. The regression coefficients for vertical M&As of renewable energy enterprises are 0.006 and 0.004, respectively, which are statistically significant and positive at the 5% level. This indicates that the regression results of the benchmark model are robust under different matching methods.

Table 4.

Robustness test.

5.4.4. Other Robustness Tests

To exclude interference from other policies, the paper implements a two-way fixed effects model to control for macroeconomic confounding factors such as industrial policies. Given the government’s substantial policy incentives to actively promote the renewable energy sector, the joint fixed effects method is introduced to address potential confounders. On the basis of model (1), adding industry–time joint fixed effects can control for policy interference at the industry level. The regression results are shown in column (3) of Table 4, and the regression coefficients and significance of vertical M&As of renewable energy enterprises remain consistent, indicating the robustness of the core conclusion.

To replace the explanatory variables, principal component analysis (PCA) was employed to construct the index system of enterprise supply chain resilience. The regression results are presented in column (4) of Table 4. The regression coefficient of vertical M&A of renewable energy enterprises is 0.048, which is significantly positive at the 5% level, further indicating that hypothesis 1 is valid, and this conclusion is robust.

5.4.5. Endogeneity Test

To address potential endogeneity issues, such as two-way causality and omitted variables, the instrumental variable approach is employed to control for potential confounding factors. A two-stage least-squares regression is conducted for vertical mergers and acquisitions, with a one-stage lag serving as instrumental variables. The results of the first stage are presented in column (1) of Table 5. The coefficient for LVma is 0.533, which is significantly positive at the 1% level, indicating a strong correlation between the instrumental variables and the explanatory variables. The second stage results are shown in column (2). The coefficient for Vma is 0.006, which is statistically significant at the 5% level. This suggests that vertical mergers and acquisitions of renewable energy enterprises significantly enhance supply chain resilience. The Kleibergen–Paap rk LM statistic rejects the null hypothesis of under-recognition, and the Kleibergen–Paap rk Wald F statistic also rejects the null hypothesis of weak identification, demonstrating a robust positive influence effect.

Table 5.

Endogeneity test.

5.5. Test of Heterogeneity

5.5.1. Heterogeneity of Financing Constraints

Renewable energy enterprises are in a stage of rapid development and require additional financial resources to sustain their high-quality development. Consequently, different degrees of financing constraints may exert varying impacts on the supply chain resilience of enterprises. The KZ index is constructed based on factors such as cash flow, financial leverage, dividend payouts, cash holdings, and investment opportunities of enterprises and comprehensively reflects the financing constraints of enterprises. Renewable energy enterprises are in a stage of rapid development, and external financing is the key to supporting their growth. The KZ index is highly sensitive when enterprises rely on external financing. Therefore, it is used to measure the financing constraints of renewable energy enterprises. The sample enterprises are divided into two groups with high- and low-financing constraints, and the impact of vertical M&A on the supply chain resilience of renewable energy enterprises under different financing constraints is investigated. The analysis presents the regression results in columns (1)–(2) of Table 6. The promotion effect of vertical M&A on the supply chain resilience of renewable energy enterprises is more pronounced in those with low financing constraints, while the effect is not significant in enterprises with high financing constraints. Renewable energy enterprises generally face significant financing constraints. Enterprises with low financing constraints have greater access to funds to conduct vertical M&A to gain competitive advantages, collaborate with external resources in vertical M&A to reduce their external transaction costs and internal management costs, thereby enhancing their operating efficiency. While expanding their market share, these efforts also contribute to the safety and stability of the enterprise’s supply chain resilience.

Table 6.

Heterogeneous grouping regression results on financing constraints.

5.5.2. Heterogeneity of Enterprise Growth

As a strategic emerging industry, the growth of renewable energy enterprises reflects their capacity for continuous value addition and serves as a critical foundation for their sustainable development. Therefore, differential impacts of enterprise growth on supply chain resilience may exist, with the growth rate proxied by the growth rate of operating income. The sample enterprises are divided into two groups with high growth and low growth, and the influence of vertical M&A on the supply chain resilience of renewable energy enterprises under different growth characteristics is investigated. The regression results are shown in columns (3)–(4) of Table 6. Vertical M&A more significantly enhances the supply chain resilience of renewable energy enterprises with high growth, whereas it diminishes in those with lower growth. High-growth renewable energy enterprises have a stronger ability to absorb the innovation resources and advanced knowledge of external enterprises, while high-growth enterprises have higher vitality of technological innovation, forming complementary advantages and collaborative innovation with upstream and downstream enterprises. By continuously enhancing their own technological advantages, they strengthen the resilience of their supply chain.

5.5.3. Heterogeneity of Different Industries

Considering that the renewable energy industry covers a wide range, based on the main business of renewable energy enterprises, the sample is divided into renewable energy vehicles, solar power generation, wind power, lithium electricity, energy storage, and hydrogen energy industries. To further explore the heterogeneity of vertical M&A among different industry types, Table 7 is presented to show the regression results of vertical M&A on supply chain resilience in six major renewable energy sectors. In the solar power generation, lithium electricity, and hydrogen energy industries, the regression coefficient of vertical M&A on supply chain resilience is significantly positive, while it is not significant in other industries. The possible reasons include the fact that solar power, lithium, and hydrogen energy are more dependent on key raw materials or technologies. For instance, solar energy requires silicon materials, lithium electricity needs lithium ore, and hydrogen energy relies on electrolytic cells or hydrogen storage technology. Vertical M&As can help these companies gain control of key resources and reduce external dependence. However, the supply chain structures of renewable energy vehicles, wind power, and energy storage industries differ. While renewable energy vehicles involve numerous components, such as batteries, motors, and electrical controls, original equipment manufacturers (OEMs) may already have mature supply chain management systems. This can limit the benefits of vertical M&A or make integration more challenging, resulting in less noticeable supply chain resilience improvements. The wind energy sector depends on substantial infrastructure and global supply chains, making comprehensive vertical mergers and acquisitions (M&As) challenging due to the complexity of covering all links, high technical intricacies, and the fact that integration costs often negate the benefits. In contrast, the energy storage industry is still in a rapid growth phase, characterized by diverse technical pathways and limited standardization. Vertical M&As in this sector could introduce risks such as technology lock-in, potentially constraining flexibility. Secondly, the solar and lithium industries exhibit high market concentration, making vertical M&As more likely to yield economies of scale. Conversely, renewable energy vehicles and wind power markets are fragmented or highly vertically integrated, limiting M&A opportunities. Considering the industry life cycle, hydrogen energy is in its growth stage, allowing companies to swiftly establish complete industrial chains through M&As. Meanwhile, energy storage and wind power sectors are either in mature phases or facing technological shifts, resulting in less pronounced merger effects.

Table 7.

Heterogeneous grouping regression results for different industries.

6. Research Conclusions and Recommendations

Based on the data of A-share listed renewable energy companies from 2011 to 2023, this study examined the impact of vertical M&A on the resilience of supply chains in renewable energy enterprises. The analysis leads to the following conclusions: First, the supply chain resilience of vertically merged renewable energy enterprises is generally stronger than that of non-M&A counterparts, with a significant upward trend observed in M&A enterprises during the study period. However, renewable energy enterprises exhibit weaker supply chain resilience compared to manufacturing firms. Second, vertical M&As in renewable energy enterprises enhance supply chain resilience, a conclusion that remains valid after a series of robustness tests. Third, vertical M&As mitigate supplier concentration and further enhance supply chain resilience in renewable energy enterprises. Fourth, heterogeneity analysis reveals that vertical M&A has a more pronounced effect on supply chain resilience in renewable energy enterprises with low financing constraints and high growth potential. In solar power, lithium and hydrogen energy industries, vertical M&A had a more significant promoting effect on supply chain resilience.

Based on the findings presented above, the following policy recommendations are proposed: First, promote vertical M&A among renewable energy enterprises and optimize policy support; formulate policies such as tax incentives and discounted interest on M&A loans to mitigate the M&A costs for renewable energy enterprises, particularly for those with significant M&A effects, such as solar power generation; establish special funds for M&A to support enterprises in integrating upstream and downstream resources through M&A; simultaneously, build a technical exchange platform with manufacturing enterprises, learn from their mature experiences in supply chain redundancy design and risk diversification, and shorten the learning curve for renewable energy enterprises. Second, renewable energy enterprises should adopt vertical M&A as part of their strategic planning to disperse supply risks. They should prioritize M&A of upstream and downstream enterprises related to key raw materials and core technology links, reducing dependence on a limited number of suppliers and building a diversified supply network. After a successful merger, a dedicated supply chain management team should be established to optimize production processes, enhance information sharing, and improve inventory management. Third, support for renewable energy enterprises in conducting vertical M&A should be categorized based on their characteristics. This approach aims to maximize the supply chain resilience of renewable energy enterprises. Specifically, targeted financing support, such as green bonds and supply chain finance, should be provided to renewable energy enterprises with high growth potential and high financing constraints. Such measures will reduce their financing constraints, amplify the effects of M&A, and further enhance supply chain resilience.

Author Contributions

Conceptualization, Y.W. and Q.G.; software, Q.L.; validation, Y.W.; formal analysis, Q.G.; investigation, Q.G.; resources, Q.L.; data curation, Q.L.; writing—original draft preparation, Q.L.; writing—review and editing, Q.G.; visualization, Q.L.; supervision, Y.W.; project administration, Y.W.; funding acquisition, Y.W. and Q.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was financially supported by the Chinese National Social Science Foundation project (22XTJ001), the Jiangxi Provincial Think Tank Research Project (23ZK05), and the Jiangxi Postgraduate Innovation Special Fund Project (YC2024-S530).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Yuan, P.F.; Li, D.; Feng, K.S.; Wang, H.M.; Wang, P.; Li, J.S. Assessing the supply risks of critical metals in China’s low-carbon energy transition. Glob. Environ. Change-Hum. Policy Dimens. 2024, 86, 10. [Google Scholar] [CrossRef]

- Liu, K.; Luo, J.; Faridi, M.Z.; Nazar, R.; Ali, S. Green shoots in uncertain times: Decoding the asymmetric nexus between monetary policy uncertainty and renewable energy. Energy Environ. 2025. [Google Scholar] [CrossRef]

- Dong, F.; Liu, Y. Policy evolution and effect evaluation of new-energy vehicle industry in China. Resour. Policy 2020, 67, 101655. [Google Scholar] [CrossRef]

- Hsiao, C.Y.; Ling; Yang, R.; Zheng, X.; Chiu, Y. Evaluations of policy contagion for new energy vehicle industry in China. Energy Policy 2023, 173, 113402. [Google Scholar] [CrossRef]

- Qin, S.; Xiong, Y. Differences in the innovation effectiveness of China’s new energy vehicle industry policies: A comparison of subsidized and non-subsidized policies. Energy 2024, 304, 132151. [Google Scholar] [CrossRef]

- Lin, B.; Zhang, A. Government subsidies, market competition and the TFP of new energy enterprises. Renew. Energy 2023, 216, 119090. [Google Scholar] [CrossRef]

- Shao, W.; Yang, K.; Bai, X. Impact of financial subsidies on the R&D intensity of new energy vehicles: A case study of 88 listed enterprises in China. Energy Strategy Rev. 2021, 33, 100580. [Google Scholar]

- Wang, X.; Li, Z.; Shaikh, R.; Ranjha, A.R.; Batala, L.K. Do government subsidies promote financial performance? Fresh evidence from China’s new energy vehicle industry. Sustain. Prod. Consum. 2021, 28, 142–153. [Google Scholar] [CrossRef]

- Wang, F.; Han, H. How does progressive subsidy reduction affect the innovation and economic performance of new energy vehicle firms? Econ. Anal. Policy 2024, 84, 1621–1635. [Google Scholar] [CrossRef]

- Wu, Z.; Fan, X.; Zhu, B.; Xia, J.; Zhang, L.; Wang, P. Do government subsidies improve innovation investment for new energy firms: A quasi-natural experiment of China’s listed companies. Technol. Forecast. Soc. Change 2022, 175, 121418. [Google Scholar]

- Wang, Y.; Lu, T.; Qiao, Y. Visible hands: The impact of subsidy withdrawal on new energy vehicle enterprises’ innovation behaviors. Energy Policy 2025, 198, 114466. [Google Scholar]

- Fan, J.P.H.; Huang, J.; Morck, R.; Yeung, B. Institutional determinants of vertical integration in China. J. Corp. Financ. 2017, 44, 524–539. [Google Scholar]

- Alfaro, L.; Conconi, P.; Fadinger, H.; Newman, A.F. Do prices determine vertical integration? Rev. Econ. Stud. 2016, 83, 855–888. [Google Scholar]

- Yu, Z.; Li, Y.; Ouyang, Z. Economic policy uncertainty, hold-up risk and vertical integration: Evidence from China. Pac.-Basin Financ. J. 2021, 68, 101625. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S.; Mitton, T. Determinants of vertical integration: Financial development and contracting costs. J. Financ. 2009, 64, 1251–1290. [Google Scholar]

- Liu, Q.; Qiu, L.D.; Zhan, C. Trade liberalization and domestic vertical integration: Evidence from China. J. Int. Econ. 2019, 121, 103250. [Google Scholar]

- Ersahin, N.; Giannetti, M.; Huang, R. Supply chain risk: Changes in supplier composition and vertical integration. J. Int. Econ. 2024, 147, 103854. [Google Scholar]

- Gulbrandsen, B.; Sandvik, K.; Haugland, S.A. Antecedents of vertical integration: Transaction cost economics and resource-based explanations. J. Purch. Supply Manag. 2009, 15, 89–102. [Google Scholar]

- Barbieri, E.; Huang, M.; Pi, S.; Pollio, C.; Rubini, L. Investigating the linkages between industrial policies and M&A dynamics: Evidence from China. China Econ. Rev. 2021, 69, 101654. [Google Scholar]

- Chang, X.; Gao, H.; Li, W. Discontinuous distribution of test statistics around significance thresholds in empirical accounting studies. J. Account. Res. 2025, 63, 165–206. [Google Scholar]

- Pi, S.; Li, H. Vertical cooperation and coopetition of incumbents under the new energy substitute: Evidence from Chinese automobile industry. J. Clean. Prod. 2022, 359, 131964. [Google Scholar]

- Avinadav, T.; Shamir, N. Partial Vertical Ownership, Capacity Investment, and Information Exchange in a Supply Chain. Manag. Sci. 2023, 69, 6038–6056. [Google Scholar]

- Yu, H.; Cheng, X.; Sun, Q.; Shen, X. Does vertical integration reduce the cost of equity? Int. Rev. Financ. Anal. 2025, 97, 103811. [Google Scholar]

- Devos, E.; Li, H. Vertical integration to mitigate internal capital market inefficiencies. J. Corp. Financ. 2021, 69, 101994. [Google Scholar]

- Zhang, Y.; Tong, T.W. How vertical integration affects firm innovation: Quasi-experimental evidence. Organ. Sci. 2021, 32, 455–479. [Google Scholar]

- Liu, Y.; Wang, Y. Does the failure of corporate mergers and acquisitions affect innovation efficiency. Int. Rev. Financ. Anal. 2025, 97, 103821. [Google Scholar]

- Christopher, M.; Peck, H. Building the resilient supply chain. Int. J. Logist. Manag. 2004, 15, 1–13. [Google Scholar]

- Doetsch, S.; Huchzermeier, A. The intersection of supply chain resilience and sustainability from a theoretical and practical perspective: An integrated framework. J. Clean. Prod. 2024, 484, 144306. [Google Scholar]

- Negri, M.; Cagno, E.; Colicchia, C.; Sarkis, J. Integrating sustainability and resilience in the supply chain: A systematic literature review and a research agenda. Bus. Strategy Environ. 2021, 30, 2858–2886. [Google Scholar]

- Zhang, P. Cross-border e-commerce, foreign shareholding, and supply chain resilience. Int. Rev. Financ. Anal. 2025, 101, 103998. [Google Scholar]

- Shoomal, A.; Jahanbakht, M.; Componation, P.J.; Ozay, D. Enhancing supply chain resilience and efficiency through internet of things integration: Challenges and opportunities. Internet Things 2024, 27, 101324. [Google Scholar]

- Al-Talib, M.; Melhem, W.Y.; Anosike, A.I.; Garza Reyes, J.A.; Nadeem, S.P.; Kumar, A. Achieving resilience in the supply chain by applying IoT technology. Procedia CIRP 2020, 91, 752–757. [Google Scholar]

- Dubey, R.; Bryde, D.J.; Dwivedi, Y.K.; Graham, G.; Foropon, C.; Papadopoulos, T. Dynamic digital capabilities and supply chain resilience: The role of government effectiveness. Int. J. Prod. Econ. 2023, 258, 108790. [Google Scholar]

- Modgil, S.; Singh, R.K.; Hannibal, C. Artificial intelligence for supply chain resilience: Learning from COVID-19. Int. J. Logist. 2022, 33, 1246–1268. [Google Scholar]

- Tian, S.; Wu, L.; Pia Ciano, M.; Ardolino, M.; Pawar, K.S. Enhancing innovativeness and performance of the manufacturing supply chain through datafication: The role of resilience. Comput. Ind. Eng. 2024, 188, 109841. [Google Scholar]

- Liu, R.; Zheng, L.; Chen, Z.; Cheng, M.; Ren, Y. Digitalization through supply chains: Evidence from the customer concentration of Chinese listed companies. Econ. Model. 2024, 134, 106688. [Google Scholar]

- Pattanayak, S.; Ramkumar, M.; Goswami, M.; Rana, N.P. Blockchain technology and supply chain performance: The role of trust and relational capabilities. Int. J. Prod. Econ. 2024, 271, 109198. [Google Scholar]

- Zhang, J.; Miao, X.; Shang, T. Impact mechanism of digital transformation on supply chain resilience. Financ. Res. Lett. 2025, 76, 106993. [Google Scholar]

- Jia, L.; Li, J. How does digital collaboration impact supply chain resilience. Financ. Res. Lett. 2024, 66, 105684. [Google Scholar]

- Ma, L.; Wang, H.; He, C.; Sui, X. Can intelligent development improve manufacturing firms’ supply chain resilience? Int. Rev. Econ. Financ. 2025, 97, 103753. [Google Scholar]

- Zhou, L.; Tang, C.; Cao, Y. Innovative human capital, government support for science and technology policy, and supply chain resilience. Financ. Res. Lett. 2025, 74, 106741. [Google Scholar]

- Cao, C.; Ray, G.; Subramani, M.; Gupta, A. Enterprise systems and the likelihood of horizontal, vertical, and conglomerate mergers and acquisitions. MIS Q. 2022, 46, 1227–1242. [Google Scholar]

- Sang, B.; Md Noor, R.; Ghazali, E.M.; Aghamohammadi, N. How does supply chain collaboration improve innovation performance of SMEs? The roles of absorptive capacity and business environment. J. Innov. Knowl. 2024, 9, 100607. [Google Scholar]

- Zhu, L.; Shen, J.; Yeerken, A. Impact analysis of mergers and acquisitions on the performance of China’s new energy industries. Energy Econ. 2024, 129, 107189. [Google Scholar]

- Liu, Z.; Wang, Y.; Feng, J. Identifying supply chain R&D partners via multilayer institutional cooperation network and tailored link prediction. Comput. Ind. Eng. 2025, 201, 110887. [Google Scholar]

- Wang, S.; Wang, Y.; Li, Q. Impact of mergers and acquisitions on enterprise innovation efficiency: The mediating role of factor endowment. Financ. Res. Lett. 2024, 66, 105652. [Google Scholar]

- Lin, S.; Deng, J. Does supplier concentration impede firms’ digital innovation? A resource dependence perspective. Int. J. Prod. Econ. 2024, 273, 109276. [Google Scholar]

- Ahsan, T.; Mirza, S.S.; Gull, A.A.; Majeed, M.A. How to deal with customer and supplier concentration to attain sustainable financial growth? The role of business strategy. Bus. Strategy Environ. 2023, 32, 4600–4619. [Google Scholar]

- Zhang, X.; Zou, M.; Liu, W.; Zhang, Y. Does a firm’s supplier concentration affect its cash holding? Econ. Model. 2020, 90, 527–535. [Google Scholar]

- Gu, M.; Yang, L.; Huo, B. The impact of information technology usage on supply chain resilience and performance: An ambidexterous view. Int. J. Prod. Econ. 2021, 232, 107956. [Google Scholar]

- Zhang, S.; Gu, C.; Zhang, P.; Dong, X. Intelligent logistics empowers supply chain resilience: Theory and empirical evidence. China Soft Sci. 2023, 11, 54–65. [Google Scholar]

- Zhang, W.; Li, H.; Zhang, T. Measuring the Resilience of China’s Manufacturing Industry Chain and Its Spatial-temporal Differentiation. Econ. Geogr. 2023, 43, 134–143. [Google Scholar]

- Research Group of Institute of Industrial Economics of CASS; Institute of Industrial Economics; Chinese Academy of Social Sciences. The Connotation Characteristics, System Construction and Implementation Path of New Industrialization. China Ind. Econ. 2023, 3, 5–19. [Google Scholar]

- Guo, S.; Xie, X.; Chen, M.; Gong, Y. Supplier concentration and corporate carbon emissions. Econ. Anal. Policy 2024, 82, 571–585. [Google Scholar] [CrossRef]

- Jacobson, L.S.; LaLonde, R.J.; Sullivan, D.G. Earnings losses of displaced workers. Am. Econ. Rev. 1993, 83, 685–709. [Google Scholar]

- Li, P.; Lu, Y.; Wang, J. Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 2016, 123, 18–37. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).