Abstract

In the context of the growing prominence of socially responsible investment, the debate over whether sustainable corporate practices translate into sustained shareholder value has intensified. As a key tool for aligning their investment portfolios with responsible/sustainable corporate practices, investors rely on listed companies’ Environmental, Social, and Governance (ESG) ratings. This study aims to investigate the long-term impact of ESG practices on the stock performance of listed companies. We perform a Q1 2000–Q1 2025 backtest to analyse the comparative performance of a Best-in-Class ESG portfolio, constructed by the top 30 listed companies with market capitalisations above USD 2 billion ranked by Morningstar Sustainalytics’ ESG Risk Ratings as of 31 March 2025 against the S&P 500 Total Return index. We found that ESG leaders exhibited superior risk-adjusted performance, outperforming the S&P 500 Total Return Index. The BiC portfolios achieved a substantially higher CAGR and Sharpe ratio, while maintaining maximum drawdowns that remained comparable to the benchmark S&P 500 Total Return index. We also found that ESG advantages were more pronounced in market downturns, with the Best-in-Class ESG portfolio showing better CAGR and Sortino ratios. The findings of this study demonstrate that responsible governance and management create benefits for all stakeholders, including investors, society and nature, in the broadest sense of these terms.

1. Introduction

In recent years, sustainability concerns have attained heightened significance across diverse domains of public life and the economy. Environmental, Social, and Governance (ESG) principles have been established as a critical factor for evaluating corporate governance, strongly influencing companies’ sustainable development and operations, risk exposure, and long-term value creation [1,2,3,4,5], regardless of size or (un)profitability scope of the company [6,7,8]. This shift reflects an extensive transformation on a global economic plane, where regulators, investors, and stakeholders are increasingly demanding greater accountability, transparency, integrity and ethical conduct from companies [9,10,11,12].

The focus on sustainability has attracted the interest of investors, with a greater amount of assets being directed towards sustainable investing. A growing number of investors are taking into consideration the United Nations’ Sustainable Development Goals (SDGs) when constructing their portfolios, with a particular emphasis on Climate Action (SDG 13) and Affordable and Clean Energy (SDG 7), thus recognizing that addressing global challenges can create long-term value while also contributing to societal welfare [13,14,15]. As a key tool for aligning their investment portfolios with responsible governance, strategies, and practices, investors rely on ESG ratings [3]. It is evident that all investors, including those who prioritise sustainability, seek to achieve a favourable return on their investments. Thus, the relationship between ESG ratings and corporate financial performance has become increasingly central to both investment practice and academic research.

As the global value of ESG assets is rising, and as the tendency for incorporating sustainability considerations into the financial decision-making process is increasing, it is becoming ever more essential to understand the role of ESG ratings in corporate financial results and their implications for policymakers, investors, and corporate directors/managers [16,17]. The present study aims to investigate the long-term impact of Environmental, Social, and Governance (ESG) practices on the stock performance of listed companies. To address this, we pose the following research question: Do cumulative ESG practices of listed companies affect their stock market valuations over the 2000–2025 period? We analyse the comparative performance of a Best-in-Class (BiC) ESG portfolio, constructed by the top 30 listed companies ranked by their Morningstar Sustainalytics’ ESG Risk Ratings as of 31 March 2025, against the S&P 500 Total Return index. We design a robust framework to examine the long-term association between ESG leadership and market valuation to perform a Q1 2000–Q1 2025 backtest.

Despite the extensive literature on the link between ESG practices and financial performance, research is mostly based on time-dynamic, rolling ESG scores that change from year to year, meaning they measure short- to medium-term effects. Studies typically analyse how changes in ESG ratings are reflected in future returns, volatility or cost of capital (e.g., [16,18,19]). However, very little research focuses on the question of whether companies that become ESG leaders in the long run show a persistence advantage even in the periods before they were recognised as leaders. Even rarer research employs a methodology that analyses the retrospective trajectory of these companies through several full business cycles, identifying ESG leaders only at the endpoint (2025) and then examining their long-term market story. The lack of such analyses represents a key research gap: we do not know whether ESG excellence is the result of recent changes or the result of long-term, cumulative practice that markets have rewarded. This study fills this gap by using a 25-year backtest that measures the long-term market behaviour of companies that ultimately emerged as ESG leaders, rather than just those that received high scores in a given year.

This article finds that long-term, responsible, and sustainable corporate governance, which incorporates ESG principles, can simultaneously serve the interests of shareholders who seek to enhance the value of their invested capital through high-level corporate performance, while ensuring social and environmental fairness for all stakeholders. By analysing the performance of the 30 ESG leading companies over 25 years, this study shows that these companies not only avoided valuation penalties but consistently outperformed the S&P 500 Total Return Index on a risk-adjusted basis. This study aims to establish whether companies that emerge as ESG leaders demonstrate consistent long-term market outperformance, rather than performing a backtest of investment strategy for the 2000–2025 period from an investor’s perspective. Our results confirm that while ESG excellence may represent a short-term cost, it enhances a company’s reputation, strengthens resilience to operational and global disruptions, and generates high added value over the long term. The analysis of five-year subperiods confirms that ESG leadership offers stable advantages, which are rewarded by markets, especially during downturns. As a result of this research, we can claim that investing in ESG-aligned companies is becoming a foundation for sustainable growth and a mechanism for driving structural change, directing capital toward solutions to global challenges. This highlights the urgent need for globally standardised ESG taxonomies to ensure comparability across companies and markets.

In Section 2 of this article, the authors present the theoretical background, including the Environmental, Social, and Governance (ESG) concept, ESG ratings, sustainable investment, the relationship between ESG ratings and corporate financial performance, and formulate two hypotheses. Section 3 delineates the methodological framework employed in the study, including data and asset universe, portfolio construction, evaluation periods, performance metrics, and robustness check. The main findings are presented and discussed in detail in Section 4, followed by Section 5, where conclusions and research recommendations are outlined.

2. Theoretical Background

Environmental, Social, and Governance (ESG) is a holistic framework that measures corporate ethical and sustainability standards beyond financial indicators [20,21]. First introduced by the United Nations Global Compact in 2004, ESG has become a central pillar of corporate governance, strategies, business practice and investment decision-making. It aims to guide organisations to operate responsibly across three key domains: environmental responsibility, social equity via social responsibility, and governance integrity for financial stability. Thus, ESG comprises three interdependent pillars that assess organisational stakeholder and environmental contributions together [11,22,23]. The roots of ESG lie in broader societal expectations and ethical imperatives [1,24,25]. Companies can pursue the ESG principles through socially responsible and sustainable governance, along with the corresponding strategies and operations [2,6,7,8,26].

From a theoretical standpoint, ESG can be best understood through several complementary theories. The stakeholder theory posits that, in order to maintain legitimacy and long-term success, companies must consider the interests of all their various stakeholders, rather than only those of their shareholders [11,27,28,29,30,31]. This standpoint supports the prevailing principles of ESG by highlighting the interdependence between corporate actions and their societal outcomes. The legitimacy theory posits that ESG practices can assist organisations in aligning with societal norms and expectations, thereby acquiring social permission to operate [5,32]. The agency theory offers a financial perspective, positing that ESG disclosures can reduce information asymmetry and diminish agency conflicts between managers and investors [2,33].

The primary instruments utilised by professionals to assess corporate sustainability performance are ESG ratings, which measure and quantify a company’s exposure to environmental, social, and governance risks, as well as its ability to manage those risks effectively. In the context of financial decision-making, investors apply ESG ratings to complement traditional financial metrics and gain insights into long-term resilience and ethical alignment. Major ESG ratings providers include MSCI, Morningstar Sustainalytics, S&P Global, LSEG, Moody’s ESG, ISS ESG, Bloomberg, and CDP [3,4,19]. The methodologies employed by these rating agencies are distinctive in nature with regard to the assessment of environmental, social, and governance dimensions [34,35,36]. MSCI utilises industry-relative performance assessments on a scale from AAA to CCC, evaluating companies’ exposure to and management of ESG risks compared to sector peers [37,38]. Morningstar Sustainalytics adopts an absolute risk-based approach, assigning ESG Risk Ratings, whereby lower scores indicate reduced financial risk from ESG factors [16,39]. S&P Global employs percentile rankings within industry classifications, integrating ESG factors with traditional credit analysis [40,41].

ESG ratings can be examined through the prism of the information asymmetry theory. In markets where sustainability data is non-transparent or fragmented, ratings help reduce uncertainty by providing investors with credible information [4]. However, whether the transmission of information would be efficient would be contingent upon the transparency and rigour of the rating methodology. Critics argue that the lack of transparency of ESG rating models can unintentionally enable greenwashing, where companies receive favourable ratings despite engaging in questionable practices. Regulators are becoming increasingly engaged in addressing these challenges. For example, to foster trust and consistency across the market, the European Commission has proposed measures to increase transparency and oversight of ESG rating providers [42]. These developments reflect a broader shift towards accountability and standardisation in the ESG landscape.

Sustainable investment signifies a considerable transformation in the way investors evaluate prospects, transcending conventional financial metrics to encompass a more comprehensive evaluation of societal and environmental ramifications within the framework of decision-making processes. Sustainable investment involves a variety of investment approaches that integrate ESG factors alongside traditional financial analysis in portfolio selection and management [43,44,45]. Various terms are used interchangeably to refer to sustainable investment, including socially responsible investing, ethical investing, responsible investing, impact investing, and ESG investing [41,46].

The foundation of sustainable investment is inherently holistic. For instance, an investor’s portfolio, which has traditionally focused on optimising risk and return, has been extended to incorporate ESG factors as non-financial risks that can affect portfolio performance [10,12]. Socially responsible investing introduces a normative dimension, emphasising ethical considerations and stakeholder welfare, i.e., investors focus on the benefits to society and the environment while rejecting investments in companies that engage in environmentally or socially harmful practices or produce harmful goods [11,47,48]. In addition to financial return, it primarily takes into account ethical, social and environmental goals. Institutional theory [49,50] can help to explain how norms, regulations and cultural expectations shape investor behaviour, thereby promoting the integration of sustainable practices into mainstream policy-making and corporate governance, resulting in effective strategies and practices.

The launch of the Domini 400 Social Index (subsequently MSCI KLD 400) in 1990 provided the first comprehensive benchmark for socially responsible equity performance, thus marking a crucial step towards mainstreaming sustainable investment [51]. In the following years, sustainable investment evolved into a mainstream investment approach, with a significant turning point in 2006 by the launch of the United Nations Principles for Responsible Investment, which provided a globally recognised framework for incorporating ESG factors into investment processes. As of March 2024, the organisation had 5345 signatories (comprising 4827 investors and 518 service providers) representing approximately USD 128.4 trillion in assets under management [52].

Sustainable investment acknowledges the significance of ESG issues as material factors with the potential to influence long-term portfolio performance [52], and it has been shown to exhibit a favourable correlation between the generation of financial returns and the contribution to positive societal outcomes [14,39]. A number of studies have documented the finding that green companies generate lower returns than brown companies, consistent with equilibrium models that predict lower returns for high-ESG assets due to investor preferences [40,53,54,55]. Other research supports that ESG integration can enhance long-term financial performance through various channels, including improved innovation capacity, enhanced employee retention and motivation, increased resilience during crises, and lower cost of capital [16,38,39]. A study of ESG-based investments across 23 developed markets from 2004 to 2022 reveals that while the relationship between ESG ratings and expected returns is generally weak, during periods of heightened sustainability focus, high ESG-rated stocks tend to gain advantages, particularly companies with strong management practices [56]. Recent research has provided strong empirical evidence that investors exhibit preferences for ESG investments and that their actions can generate positive social impact through corporate engagement [41].

A substantial body of research has been conducted on the correlation between ESG ratings and corporate financial performance [57]. A significant positive correlation was found between ESG performance and Return on Equity (ROE), Return on Assets (ROA), and market valuations in an extensive study of Shanghai and Shenzhen A-share listed companies from 2011 to 2020 [58]. A 1% increase in ESG ratings has been found to improve the productivity level of manufacturing companies by 0.124%, providing empirical evidence that ESG is financially material [59]. A comprehensive review of 3332 listed companies over the 2011–2020 period has also revealed positive correlations between ESG scores and company performance across various industries [60]. A mediation analysis reveals that ESG ratings improve company performance by mitigating financing constraints [61].

Research has also been conducted on the impact of ESG ratings on stock market performance. Galema & Gerritsen [62] conducted an analysis of MSCI ESG rating changes, the results of which indicated that stock prices adjust over prolonged periods, with complete reflection of rating modifications taking multiple months. Empirical evidence reveals asymmetric effects of rating changes. Shanaev & Ghimire [63] found that ESG rating downgrades consistently exert a detrimental effect on stock performance, resulting in statistically and economically significant negative returns, while upgrades generate relatively modest positive effects. These findings are more pronounced for ESG leaders and remain robust across various asset-pricing model specifications [64,65].

The construction of sustainable investment portfolios is a matter of some complexity, and recent evidence provides nuanced guidance on the matter. ESG screening approaches—negative screening excluding controversial industries versus positive screening selecting ESG leaders—generate different risk-return profiles [66,67]. ESG integration strategies incorporating ESG factors into traditional financial analysis appear most promising for balancing sustainability objectives with financial returns [56]. When making investment decisions, volatility considerations are important. Negative correlations between ESG ratings and stock volatility have been found, with relationships strengthening during periods of high market volatility, suggesting ESG serves as portfolio stabiliser during turbulent periods [9,10,68,69].

As Atz et al. [9] discovered, ESG investing provides asymmetric benefits, particularly during social or economic crises. Furthermore, Broadstock et al. [70] found that ESG performance mitigates financial risk during a financial crisis. Corporate governance mechanisms and transparency also play a vital role in this context [71]. Risk-adjusted return analyses reveal that the correlation between ESG ratings and Sharpe ratios turned significantly positive in recent years, particularly when removing the lowest-rated stocks, indicating that excluding ESG laggards improves risk-adjusted performance [16,72]. Dynamic portfolio strategies responding to ESG rating changes rather than static ESG levels may enhance performance [3,19]. Given the asymmetric effects of rating changes—downgrades generating significant negative returns while upgrades produce modest positive effects—investors should prioritise avoiding downgrades over chasing upgrades [18,73].

In accordance with the research question stipulated in the Introduction section (Section 1) and the theoretical framework delineated in this section, the authors have formulated the following two hypotheses:

H1:

Listed companies with best ESG ratings do not underperform the S&P 500 Total Return benchmark in long-run risk-adjusted returns.

Theoretical premises show that stable, long-term ESG practices often correspond to improved organisational performance, lower information asymmetry and better governance mechanisms that reduce operational and regulatory risks [4,38]. According to stakeholder theory [28], companies that strategically invest in relationships with key stakeholders build long-term legitimacy and resilience, which is reflected in more stable cash flows and lower risk for equity investors. From the perspective of agency theory, transparency and stricter control mechanisms reduce opportunistic behaviour and lower the cost of capital [2]. Empirical meta-analyses [16] confirm that ESG leaders achieve, on average, positive or neutral effects on financial performance. On this basis, it is expected that companies with the best ESG ratings will not lag behind market indicators in the long term, but will show at least comparable, and often improved, risk-adjusted returns. H1 thus directly relies on theoretical arguments that ESG excellence reduces risks, improves governance and creates conditions for better long-term market value.

H2:

ESG advantages are more pronounced in market downturns.

Legitimacy theory posits that companies that maintain high standards of environmental and social responsibility are more likely to retain the support of key stakeholders during times of crisis [32]. In times of crisis, risks related to operational disruptions, regulatory scrutiny, social pressure and access to capital increase, so the stability of ESG practices plays a more important role. Empirical research indicates that ESG leaders exhibit lower downside risks, lower volatility, and faster recovery from shocks, a finding also confirmed by studies on financial crises [9,70]. The effects are also consistent with models that treat ESG as a non-diversifiable, systemic risk factor [10]. ESG leaders generally implement tighter management systems, more robust supply chains and more transparent reporting, which reduces liquidity and information risks in times of crisis. Therefore, theory and empirics support the expectation that the impact of ESG will be even more pronounced in bear markets, which directly substantiates H2.

The attainment of a high ESG rating is a long-term process that necessitates a considerable investment of time and financial resources on the part of the company. Consequently, it can be assumed that companies with high ESG ratings as of 31 March 2025 have invested in ESG over the years. This study is intentionally designed as a retrospective test anchored in 2025. First, we identify the ESG leaders as of 31 March 2025, and then we trace their market performance back to 1 January 2000. We do not seek to simulate an investor’s ex ante decisions as made in 2000; rather, we examine whether companies that ultimately emerge as ESG leaders exhibit a pattern of superior market performance over the long term. Thus, we test the persistence and market recognisability of ESG leadership rather than the historical tradability of ESG signals.

3. Materials and Methods

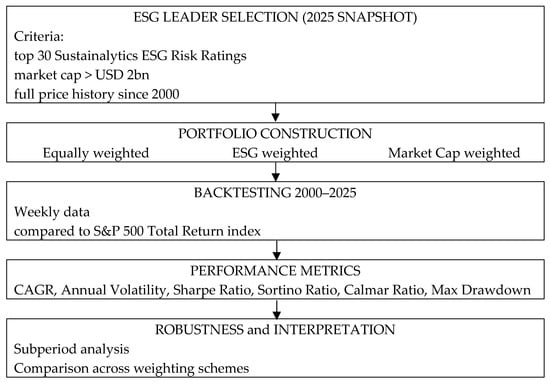

This research is structured as a backward-looking analysis based in 2025. The methodology employed in this study begins with the identification of ESG frontrunners as of 31 March 2025, followed by a retrospective evaluation of their market performance starting from 1 January 2000 onwards. The objective is not to replicate an investor’s forward-looking choices from 2000 but rather to ascertain whether companies that eventually emerge as ESG leaders demonstrate consistent outperformance in the market over the long term. We assess the durability and market acknowledgement of ESG leadership, as opposed to the past practicality of ESG indicators for investment purposes. A diagram of the methodological process is shown in Figure 1.

Figure 1.

The methodological process.

3.1. Data and Asset Universe

In this study, we backtest a Best-in-Class (BiC) ESG portfolio, constructed from the top 30 companies ranked by their Morningstar Sustainalytics’ ESG Risk Ratings as of 31 March 2025 (Table 1), and we compare its performance to the S&P 500 Total Return index (SPX_TR). As our analysis focuses on top ESG performance, we excluded companies that performed poorly, changed their profile or did not survive the entire backtest period. We choose the S&P 500 Total Return Index as the benchmark because it accounts for both capital gains and dividends, providing a comprehensive measure of market performance.

Table 1.

Top 30 companies by Morningstar Sustainalytics’ ESG Risk Ratings as of 31 March 2025.

The asset universe covers publicly traded companies with Morningstar Sustainalytics’ ESG Risk Ratings and market capitalisations above USD 2 billion as of 31 March 2025, to emphasise liquidity and data quality while minimising small-cap biases. Additionally, we restrict the selection to companies with stock price history starting no later than 1 January 2000, as verified through adjusted close prices from Yahoo Finance. This ensures comprehensive coverage of the backtest period and mitigates survivorship issues from subsequent listings. Historical ESG scores and market capitalisation data are retrieved from Yahoo Finance via Python 3.13.2 scripts utilising yfinance and pandas libraries. We use weekly returns for the calculation of the portfolio metrics, derived by aggregating daily adjusted Friday’s closes. We consider the weekly time frame to be most suitable, as it provides sufficient data points for statistical reliability while reducing the daily noise that could hide long-term ESG-driven performance trends.

3.2. Portfolio Construction

The BiC portfolio consists of the fixed top 30 constituents, ranked by Morningstar Sustainalytics’ ESG Risk Ratings as of 31 March 2025, with the base case being an Equally Weighted (EW) portfolio, allocating wi = 1/N to each (approximately 3.33%), where N is the number of companies in the portfolio (N = 30). This straightforward method [74] serves as our primary perspective, emphasising the ESG selection without introducing size or score-based biases.

The following symbols are used in the formulas throughout this paper:

V0—Initial value of the portfolio or benchmark at the start of the test period;

VT—Final value of the portfolio or benchmark at the end of the test period;

T—Length of the test period, measured in years;

rt—Returns of the portfolio or asset. Weekly returns in this study;

mean(rt)—The mean (average) of the returns (typically weekly returns, in this study) over the test period;

sd(rt)—Standard deviation of returns (weekly returns in this study), used to calculate Annualised Volatility (AnnVol);

sddown(t)—Downside Deviation, representing the standard deviation of negative returns only;

peakt—the running peak (high-water mark) of the portfolio equity V up to time t.

For a robustness check, we incorporate two variants into our analysis:

- ESG-Weighted (ESG_W), where wi = , to further emphasise the effect of the higher-rated companies and test the effects of sustained ESG integration driving performance;

- Market Cap-Weighted (MCAP_W), where wi = , to assess size-related influences similar to those in broad market indices like the S&P 500 Total Return Index (SPX_TR) and ensure the ESG-driven returns are not solely due to equal weighting.

Weights for the BiC portfolio, derived from Morningstar Sustainalytics’ ESG Risk Ratings and market capitalisation data as of 31 March 2025, remain static across all variants—Equally Weighted (EW), ESG-Weighted (ESG W), and Market Cap-Weighted (MCAP W). Weekly return calculations, based on adjusted Friday closing prices retrieved from Yahoo Finance and processed via yfinance and pandas, are renormalised to sum to one to account for any data gaps, ensuring consistency across the portfolio. We exclude transaction costs, presenting gross returns, as our focus is on the intrinsic ESG signal rather than strategy implementation constraints.

For constructing our BiC ESG portfolios, we use Morningstar Sustainalytics’ ESG Risk Ratings as of 31 March 2025 because we assume that ESG ratings reflect the aggregated, long-term impact of a company’s environmental, social, and governance practices. Our research focuses on the above-mentioned aggregate effect of ESG practices on corporate market performance rather than on particular factors, such as company sector and market size. Unlike financial metrics, which can change significantly over time, ESG initiatives usually require years to translate into financial performance or market valuation [75,76]. By selecting the top 30 companies based on their 2025 ESG scores, we argue that the consistent implementation of their ESG policies over the years has not had a negative effect on their market valuation but has actually contributed to better historical stock returns. Unlike traditional backtesting practices, which rely on real-time ESG data, this approach offers a new perspective on analysing the sustained financial benefits of ESG integration, such as enhanced risk-adjusted returns. We further propose that companies identified as top ESG performers by Q1 2025 are likely to have thoroughly integrated these principles into their operational frameworks, which could contribute to superior stock performance under varying market scenarios.

3.3. Evaluation Periods

The backtest period covers the span from1 January 2000 to 31 March 2025, using weekly data obtained from Yahoo Finance adjusted Friday closing prices. We use the yfinance and pandas libraries to evaluate the full period and non-overlapping five-year subperiods (2000–2004, 2005–2009, 2010–2014, 2015–2019, 2020–2024), plus a partial 2025 segment (January–March). These timeframes, selected to reflect critical market regimes such as the dot-com crash of 2000–2002, the 2008 global financial crisis, the post-crisis recovery from 2010 to 2014, the low-interest-rate growth phase of 2015–2019, and the COVID-19 pandemic with its subsequent recovery from 2020 to 2024, provide a robust framework for assessing ESG performance resilience across diverse economic conditions. The 2025 segment incorporates the most recent data to align with the static weighting derived from Morningstar Sustainalytics’ ESG Risk Ratings as of 31 March 2025. This time period structure enables a comprehensive comparison with the S&P 500 Total Return Index (SPX_TR) across these periods, testing the notion that top ESG performers identified in 2025 have deeply integrated these principles, potentially yielding superior risk-adjusted returns over time as outlined in the research methodology.

The construction of our Best-in-Class (BiC) ESG portfolio is based on the modern portfolio theory [77,78] and is consistent with meta-analytic evidence of positive links between ESG and financial performance [16]. We extend modern portfolio theory by incorporating ESG factors as a non-diversifiable risk that influences long-term financial performance and cost of capital. The selection of the top 30 ESG leaders via a single 2025 Morningstar Sustainalytics’ ESG ratings snapshot applies a positive screening filter that is aligned with the quality premium in factor investing [79]. This is predicated on the assumption that persistent ESG excellence signals superior governance and resilience, compounding into higher risk-adjusted returns over decades [38,39]. The process of backtesting adheres to standard asset-pricing protocols using static weights and weekly total returns [80]. This approach is employed to isolate the impact of selection alpha, thereby eliminating the influence of rebalancing bias. Annualization via the square root of 52 adheres to conventional risk scaling under the assumption of independent and identically distributed data [81].

3.4. Performance Metrics

For each portfolio and time window within the backtest spanning 1 January 2000 to 31 March 2025, standard return and risk measures are computed from weekly returns, with annualization applied using a factor of √52, reflecting the typical number of trading weeks in a year:

- Compound Annual Growth Rate (CAGR) serves as a key metric, representing the geometric average growth of capital over the sample period, assuming full reinvestment (Merton, 1980 [81]). It converts the total period return into an equivalent per-year % rate and is path-independent:where V0, VT are initial and final values of the portfolios and the benchmark, and T is the length of the test period in years.CAGR = (VT/V0)1/T − 1

- Annualised Volatility (AnnVol) quantifies total return variability and is calculated as the standard deviation of returns, scaled to an annual frequency [82]. Higher values imply a wider dispersion and typically larger interim losses. With weekly returns, the standard deviation sd(rt) is annualized by √52:

- Sharpe Ratio [83] calculates the excess return earned per unit of volatility. In our implementation, the risk-free rate is set to zero, so it reduces to the annualised mean divided by annualised volatility:

- Maximum Drawdown (MaxDD) represents the largest drop from a peak to a trough in the equity curve of an asset or portfolio, reflecting the capital impairment risk that keeps investors on edge [84]. It is a path dependent measure and complements the dispersion-based metrics, such as volatility, to provide explanation of how sustainable those returns might be over the long run. What makes it particularly useful is capturing the order of gains and losses, proving its worth when evaluating how well strategies, like the ESG portfolios, hold up through those rough market phases:MaxDD = maxt∈[0,T] (1 − Vt/peakt)

- Sortino Ratio [85] improves the Sharpe Ratio by substituting total volatility with downside deviation focusing exclusively on negative return variations to better capture risk from losses. It is often more informative than Sharpe for portfolios exhibiting positively skewed returns, such as those influenced by ESG rebalancing or sector tilts, as it provides a more accurate assessment of downside risk:

- Calmar Ratio [86] connects long-run growth to the worst realised loss, offering a measure of how effectively a strategy converts drawdown risk into compounded returns over time. Higher values are generally preferred, though it is worth noting that the denominator represents a single extreme drawdown, which can skew the metric if that event is unusually severe. However, this is a valuable indicator, especially for risk averse investors:Calmar = CAGR/MaxDD

We use this set of portfolio performance metrics because it balances long-run performance with risk. CAGR captures the geometric growth of capital, while the remaining measures explain the risk taken to achieve this return. Annualized volatility summarizes overall dispersion. That is why we add the Sharpe ratio, which converts return into a risk-adjusted efficiency score under symmetric risk, and the Sortino ratio that takes into account only downside moves. This is particularly relevant for ESG portfolios that can show positive skew after rebalances or sector tilts. Path risk matters to investors, so we complement dispersion metrics with Maximum Drawdown and Calmar ratio that links growth to that worst loss, indicating whether higher CAGR was achieved without unacceptable drawdowns. Taken together, the six metrics enable us to compare Best-in-Class ESG portfolios with a traditional benchmark in terms of growth, variability, downside sensitivity, and capital preservation.

3.5. Robustness Check

The Equally Weighted (EW) is our base case and it is the cornerstone of our BiC ESG portfolio analysis. To test the robustness of the analysis results, we construct two alternative weighting schemes: ESG-Weighted (ESG_W) and Market Cap-Weighted (MCAP_W). This approach enables us to probe the stability of the ESG selection process, testing whether the superior performance of the ESG portfolio is a result of the inherent quality of the top 30 companies (ranked by Morningstar Sustainalytics’ ESG Risk Ratings as of 31 March 2025) or the specific weighting mechanics applied. By comparing performance metrics, such as CAGR, AnnVol, Sharpe Ratio, Sortino Ratio, MaxDD, and Calmar Ratio across these three portfolio variants, we aim to identify persistent patterns that support the notion that ESG integration drives returns, regardless of whether weights are distributed equally, based on ESG scores or market capitalisation. The reporting of these metrics for the full backtest period (1 January 2000 to 31 March 2025) and its five-year subperiods ensures consistency, while the inclusion of ESG_W shows the impact of prioritising higher-rated companies. The MCAP_W portfolio is constructed in the same as the broad market benchmarks (e.g., S&P 500 Total Return Index) and provides additional arguments to validate our findings. This multi-faceted evaluation not only strengthens the credibility of our conclusions but also provides additional information on how weighting choices might influence the effectiveness of ESG strategies in diverse market conditions.

4. Results and Discussion

We examine the market performance of a Best-in-Class (BiC) ESG portfolio selected by Morningstar Sustainalytics’ ESG Risk Ratings as of 31 March 2025 relative to a traditional market benchmark (S&P 500 Total Return Index), using weekly data from Q1 2000 to Q1 2025. The methodological choices are deliberate: (i) a static 2025 ESG snapshot to proxy long-horizon ESG leadership, (ii) an S&P 500 total-return benchmark to ensure dividends are captured, and (iii) robustness via two additional portfolio weighting schemes (ESG-weighted, and market-cap-weighted). The backtest results demonstrate that the BiC ESG portfolios, constructed from the top 30 Morningstar Sustainalytics’ ESG Risk Ratings companies with price history from 2000, consistently outperform the S&P 500 Total Return benchmark for the full backtest period (Table 2) and for most subperiods (Table 3) based on weekly returns data.

Table 2.

Full-Period (Q1 2000–Q1 2025) Portfolio Performance Metrics (Weekly Frequency).

Table 3.

Portfolio Performance Metrics by Subperiod (Weekly Frequency).

Survivorship bias represents a methodological challenge in analyses of long-term portfolio returns, as it can lead to overestimated performance estimates when only companies that survived the entire observation period are present in the sample. In our approach, this bias arises from the fact that only issuers classified as ESG leaders in 2025, with a continuous data history from 2000 onwards, are included in the portfolio. Such a selection implicitly excludes companies that have failed in previous years, were excluded from markets or suffered serious financial or operational shocks that could also affect their ESG results. As a result, a portfolio may exhibit a higher degree of robustness than would an entire population of companies with different trajectories of success or failure. It is therefore important to interpret the results in light of the limitation that the analysis measures the long-term persistence of companies that have proven to be sustainable leaders, rather than the entire number of companies that have faced heterogeneous ESG trajectories and development outcomes.

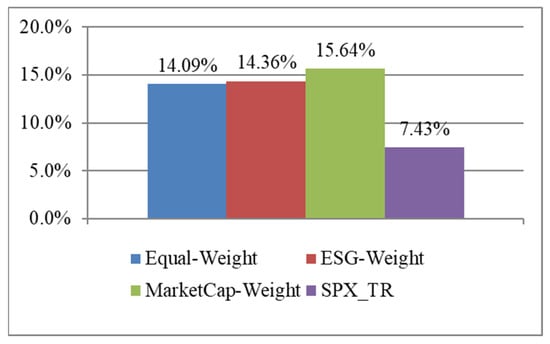

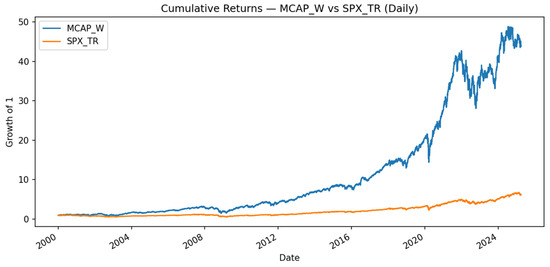

The base case Equally Weighted (EW) portfolio has a full-period CAGR of 14.09%, substantially exceeding the benchmark’s 7.43% (Figure 2), with modestly higher volatility (20.53% vs. 17.74%). Robustness checks through the ESG-Weighted (ESG_W) and Market Cap-Weighted (MCAP_W) variants confirm these findings, with CAGRs of 14.36% and 15.64%, respectively. When expressed as differences in CAGR, the ESG portfolios outperform SPX_TR by +6.66 pp (EW), +6.93 pp (ESG_W), and +8.21 pp (MCAP_W). Within the ESG portfolio variants, MCAP_W leads, exceeding ESG_W by +1.28 pp and EW by +1.55 pp (with ESG_W ahead of EW by +0.27 pp). Risk-adjusted metrics further underscore this advantage as the Sharpe Ratio ranges from 0.75 to 0.76 for the ESG portfolios, well above the S&P 500 Total Return benchmark’s 0.49, while the Sortino Ratio, reflecting downside risk, spans from 1.00 to 1.07 versus 0.63 for SPX_TR, confirming the enhanced efficiency. Maximum drawdowns remain comparable (−52.69% to −54.32% vs. −54.71%), and the related Sortino ratios ((0.26–0.30) vs. 0.14) support the notion that ESG portfolios exhibit superior risk-adjusted performance during times of market turbulence, where the ESG strategies demonstrate resilience.

Figure 2.

CAGR full period (Q1 2000–Q 2025) portfolio variants.

Sub-period analysis (Table 3) reveals that the performance of ESG portfolios depends on the market regime. They performed better in the volatile early periods but have shown mixed results in recent bull markets. Table 3 summarises portfolio metrics for the base case Equally Weighted (EW) portfolio and the robustness variants (ESG_W and MCAP_W), alongside the S&P 500 Total Return Index (SPX_TR) benchmark, highlighting consistent relative outperformance in most intervals despite changing market dynamics.

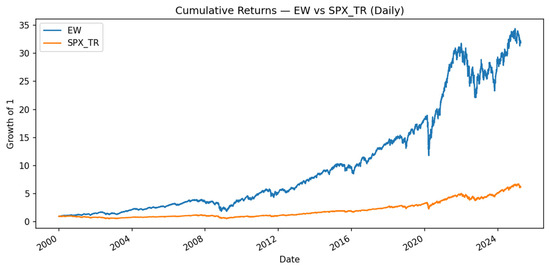

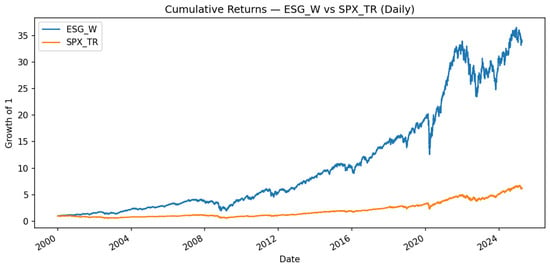

The cumulative returns for the full period and subperiods are presented in Figure 3 (EW vs. SPX_TR), Figure 4 (ESG_W vs. SPX_TR), and Figure 5 (MCAP_W vs. SPX_TR).

Figure 3.

Full period (Q1 2000–Q 2025) cumulative returns for EW vs. SPX_TR.

Figure 4.

Full period (Q1 2000–Q 2025) for ESG_W vs. SPX_TR.

Figure 5.

Full period (Q1 2000–Q 2025) for MCAP_W vs. SPX_TR.

In the turbulent 2000–2004 dot-com bust period, the EW and ESG_W portfolios posted impressive CAGRs of 19.62% and 20.62%, far surpassing the benchmark’s −2.10% and even the MCAP_W’s 11.87%, underscoring ESG’s defensive edge in downturns. Their Sharpe ratios, ranging from 0.54 to 1.1 vs. −0.02 for the benchmark index, confirm this observation. The 2005–2009 period, marked by the 2008 World Financial Crisis, shows continued outperformance of the ESG portfolios, with EW at 8.56% and ESG_W at 8.70% against the benchmark’s near-flat 0.61%, while MCAP_W edged ahead at 11.39% due to the resilience of larger companies. During the same period, the maximum drawdowns reached their highest levels across the entire backtest (−54.3% to −52.7% for the ESG portfolios vs. −54.7% for the benchmark), underscoring market turbulence, yet the ESG portfolios posted superior Calmar ratios (0.16–0.21) relative to the benchmark (0.01), highlighting their ability to translate such deep losses into more efficient long-term compounded returns. Recovery years (2010–2014) showed balanced gains, with ESG variants nearly matching or slightly exceeding the benchmark (15.49%), and MCAP_W leading at 21.08%. The 2015–2019 bull market highlighted MCAP_W’s dominance at 19.13%, while EW (13.36%) and ESG_W (13.68%) still outperformed SPX_TR’s 11.40%. In the period 2020–2024, amid COVID-19 pandemic volatility and recovery, MCAP_W (16.12%) and the benchmark (14.75%) scored higher returns, while the EW and ESG_W portfolios held steady around 11.6–11.7%. The brief 2025 segment reflected broad market declines during Q1, with ESG variants (−9.19% to −9.34%) faring better than the benchmark’s −22.66%. These patterns of portfolio returns and risk confirm the value of ESG in volatile regimes while noting market-cap advantages in sustained bull markets, with robustness checks ensuring that weighting choices do not drive the core outperformance.

The results obtained from this study offer a compelling basis for interpreting performance as a function of persistent ESG leadership rather than as tactical ranking or rebalancing mechanics. The main implication of this retrospective analysis is that our findings are to be interpreted as evidence that today’s ESG leaders have been long-term market winners, rather than as a proof that the same real-life investment returns could have been achieved. This distinction is important because it suggests that ESG leadership is a slow-moving, path-dependent corporate attribute that has been rewarded by markets over multiple cycles.

H1 posited that listed companies with best ESG ratings in 2025 do not underperform the S&P 500 Total Return benchmark in long-run risk-adjusted returns. Across the three portfolio variants (EW, ESG_W, and MCAP_W), the BiC approach exhibits higher efficiency (return per unit of total and downside risk) and stronger compounding relative to the benchmark over the complete sample. The results of the equal-weight base case portfolio test are of particular importance because they demonstrate the isolated effect of ESG leadership, unaffected by company size (market capitalisation) or the magnitude of ESG ratings. This indicates that the results of this study are influenced by the selection of companies, regardless of their respective portfolio weights. By allocating capital to the best-rated companies without compromising portfolio performance, the ESG-weighted portfolio metrics validate the strength of ESG as a performance driver. Nevertheless, the market-cap-weighted portfolio performance metrics illustrate that the ESG selection set can still exploit the growth dynamics that are typical for broad equity market. These patterns strongly support our hypothesis that selecting companies with strong ESG leadership when constructing a portfolio not only aligns with but even drives better long-term market performance in comparison with the broad market benchmarks on risk-adjusted basis.

H2 posited that companies with strong ESG practices perform better during challenging market periods, such as the .com bubble burst (subperiod 2000–2004), world financial crisis (subperiod 2005–2009), or the volatility caused by the COVID-19 pandemic (subperiod 2020–2024). The findings of this study corroborate H2, particularly in the context of periods of heightened stress and during the early stages of recovery. However, in circumstances where market dynamics are characterised by a bull trend marked by robust momentum and liquidity, the relationship between ESG portfolios and market performance becomes more complex. During periods of broad risk-off behaviour and earnings pressure, the BiC portfolios tend to offer enhanced protection to investors’ capital, facilitating the conversion of early recoveries into stronger, risk-balanced gains. Conversely, during extended risk-on phases driven by a small number of mega-cap companies the market-capitalisation-weighted ESG portfolio has been shown to capture upside most effectively [87]. In contrast, we found that both the equal-weighted and the ESG-weighted portfolio variants underperformed the broader market, nevertheless they continued to perform efficiently. We can conclude that ESG leadership is most beneficial during periods of significant uncertainty and during transition periods. However, the BiC portfolio edge in strong uptrending markets depends on how closely the portfolio aligns with the prevailing dominant market leaders and with the most popular sectors.

This pattern is consistent with a “resilience-first, beta-second” approach. It has been demonstrated that companies with robust ESG practices are better equipped to limit significant losses and to manage operational challenges more effectively [60,88]. This results in greater stability of their stock prices during periods of market turbulence. However, when financial markets are characterised by the predominance of a small number of major players and long-term growth trends, the advantages of this stability can be superseded by more significant surges in the market. In such cases, a market-cap-weighted ESG portfolio has been shown to align more closely with the prevailing market trends, thereby facilitating the portfolio’s ability to maintain pace with the most successful performers.

This study’s robustness design, which maintains the same group of ESG-selected companies but changes their weights in the portfolio, reveals at least three key takeaways. Firstly, the most effective method of testing the efficacy of ESG leadership selection is to assign equal weight to all companies in the portfolio, thus ensuring that larger corporations do not dominate the results. The consistent outperformance of this portfolio in comparison to a standard benchmark serves to demonstrate that ESG leadership itself is a robust choice. Secondly, the allocation of a greater weight to the better-rated ESG companies enhances their impact, confirming that focusing on top ESG performers pays off without significantly increasing losses during downturns. Thirdly, the utilisation of company size (market capitalisation) as a weighting metric proves the capacity of ESG selections to still demonstrate efficacy in markets driven by large, fast-growing firms. This ensures that investors are not disadvantaged when the market favours mega-cap companies. Taken together, these findings demonstrate the versatility and efficacy of the “Best-in-Class” (BiC) approach across a range of configurations. This development is of particular significance to investors who are required to comply with specific regulations or who prefer to closely align their portfolios with established market indexes.

For long-term investors, the results of this study support integrating BiC ESG strategies as a strategic structural allocation rather than a tactical overlay. The equal-weighted variants are indicative of the efficacy of the selection process and serve to mitigate concentration risk. ESG-weighted variants allow investors with strong sustainability convictions to allocate more funds to ESG leaders. Market-cap-weighted variants maintain benchmark adjacency and minimize tracking-error concerns in growth-led cycles. The fundamental conclusion drawn from this analysis of the various portfolio variants is that ESG leadership and strong financial performance are not, in fact, incompatible. Long-term ESG practices clearly appear to operationalise the same attributes—discipline, transparency, resiliency—that modern risk-aware portfolio construction seeks to achieve.

5. Conclusions

This paper aimed at investigating the long-term effect of Environmental, Social, and Governance (ESG) practices on listed companies’ stock performance. We explored whether long-term, responsible and sustainable corporate governance, encompassing the ESG principles, can be aligned with the interests of investors/shareholders by maintaining or even increasing the value of their investment in the company, as measured by stock market performance. We constructed a BiC portfolio from the top Morningstar Sustainalytics rated companies as of 31 March 2025 and backtested on weekly data for 1 January 2000–31 March 2025. We incorporated ESG factors as a non-diversifiable risk influencing long-term financial performance and the cost of capital. Our selection of the top 30 ESG leaders via a single 2025 Morningstar Sustainalytics’ ESG rating snapshot applied positive screening, based on the assumption that consistent ESG excellence indicates superior governance and resilience, resulting in higher risk-adjusted returns over time. Our results indicate that ESG leaders did not experience a market valuation penalty; in fact, they achieved higher risk-adjusted performance than the S&P 500 Total Return Index. Over the full 25-year-period, the ESG portfolios achieved materially higher CAGR and Sharpe ratios, while maintaining drawdowns that were comparable to the benchmark.

The research findings of this study corroborated our two working hypotheses to a strong degree. First, we proved that listed companies with the best ESG ratings in 2025 did not underperform on the S&P 500 Total Return benchmark in long-run risk-adjusted returns (H1). Over the period of the backtest, companies that ultimately ranked as ESG leaders (as of 31 March 2025) did not suffer a valuation penalty; rather, they achieved superior risk-adjusted performance in comparison to the S&P 500 Total Return Index. In the full period, the BiC portfolios achieved a substantially higher Compound Annual Growth Rate (CAGR) and Sharpe ratio, while maintaining maximum drawdowns that remained comparable to the benchmark S&P 500 TR. It has been established that the EW ESG portfolio outperforms SPXTR by +6.66 pp (EW), while CAGR of ESG_W and MCAP_W were +6.93 pp and +8.21 pp higher than that of the market benchmark, respectively. These findings provide evidence that sustained Environmental, Social, and Governance (ESG) leadership has been rewarded by financial markets over multiple cycles. We suggest that the combination of good corporate governance, appropriate disclosure, reduced controversy risk and favourable stakeholder relations has been discounted in the stock prices positively over the studied 25-year period.

Second, the hypothesis that ESG advantages were more pronounced in downturns was also validated, with the Best-in-Class ESG portfolio showing better CAGR and Sortino ratios (H2). The evidence suggests that the ESG advantage is most significant in environments of market stress and during the early stages of recovery. (e.g., 2000–2004 and 2005–2009), where the ESG portfolios exhibited better downside control and faster compounding. During the post-dot-com period and the Global Financial Crisis, the ESG portfolios preserved capital more effectively and recovered faster than the benchmark. In extended, narrow bull markets characterised by mega-cap dominance, the disparity in performance narrows, and the cap-weighted ESG strategy exhibits a greater ability to capitalise on market uptrends. The findings of this study demonstrate that the evidence can be interpreted as persistence and market recognition of ESG leadership, rather than as an ex ante tradable signal in 2000. This is due to the study’s retrospective, point-in-time 2025 design. We found that the BiC portfolios generally deliver stronger risk-adjusted efficiency and robust long-run growth than the benchmark over the full backtest period. This outperformance is, however, dependent on the market regime, the portfolio weighting choices and the market structure (e.g., the dominance of mega-cap growth in certain phases).

This paper aimed at assessing the long-term market consequences of sustained ESG practices. By fixing the ESG leadership portfolio at a single point in time (Q1 2025) and examining its behaviour over an extended period (Q1 2000–Q1 2025), we demonstrate that publicly listed companies that emerge as ESG leaders in 2025 are rewarded by the markets across multiple cycles.

The approach of this study is based on a static ESG cross-section (snapshot 2025), which means that we measure the persistence of ESG excellence over 25 years, rather than analysing short-term changes in ratings. This perspective is practically unaddressed in the literature. Additionally, the research with this approach enables verification of whether ESG leaders exhibit long-term market characteristics, such as lower sensitivity to crisis shocks and faster recovery dynamics, even before they are formally recognised as ESG excellent. The use of three portfolio constructions (EW, ESG_W, MCAP_W) enables the verification of whether the effect of ESG selection is independent of weighting, thereby strengthening the robustness of the results and adding value compared to most studies that employ only one approach.

The findings of this study have several implications. The manuscript highlights that ESG quality is associated with financial stability, more efficient compounding, and lower downside risk, reinforcing the case for integrating ESG factors into long-term investment strategies. For policymakers and regulators, the results support efforts to standardise ESG disclosure and rating methodologies, so that ex ante ESG portfolio construction becomes feasible and comparable. For investors and asset managers, the results show that pressure for better ESG performance is not necessarily in conflict with long-term shareholder value. Hence, ESG can credibly be regarded as a credible strategic, long-term investment allocation approach, with equal- or ESG-weighted portfolio variants being favoured in volatile market regimes and market-cap-weighted versions being used when proximity to a broad market benchmark is important. For corporate managers, the findings indicate that consistent, long-term, transparent implementation of ESG principles is rewarded by markets over time.

The methodological approach adopted in this paper is subject to several limitations. In this study, we focused on the overall performance of the portfolios, not on specific factors like portfolios’ size, growth, or structure. Exploring these factors further in future studies would help figure out if ESG leadership is the primary driver or merely follows other market patterns. This would enhance the robustness of the results and render them more useful for different markets. Furthermore, our portfolios do not change much in terms of company or weight allocation, and we only show gross results. Adding realistic costs and assessing the practicality of these portfolios for large-scale investment would make them more relevant for major investors. We used just one source (Morningstar Sustainalytics) as ESG ratings provider. In order to ascertain whether the ESG portfolio outperformance is attributable to ESG in general or to Morningstar Sustainalytics’ approach for ESG ratings calculation, it would be advisable to consider other ESG rating providers, such as MSCI or LSEG. As our study measured persistence, and not tradability, it focused on top ESG performance; therefore, companies that performed poorly, changed their profile or did not survive the entire time period (2000–2025) were excluded from its scope. Furthermore, breaking down environmental, social, and governance scores separately would allow for a deeper understanding of the separate ESG components influence on the portfolio performance. Future research should build on this analysis by using point-in-time ESG ratings from multiple providers, investigating the effect of controversies on the reliability of ESG ratings, creating factor-neutral portfolios, and accounting for explicit transaction costs.

Author Contributions

Conceptualisation, S.M., P.D. and T.Š.; methodology, S.M. and P.D.; formal analysis, S.M. and P.D.; validation, S.M., P.D. and T.Š.; project management, T.Š.; writing—original draft preparation, S.M., P.D. and T.Š.; writing—review and editing, P.D. and T.Š.; visualisation, S.M.; supervision, P.D. All authors have read and agreed to the published version of the manuscript.

Funding

The corresponding author reports financial support from the Slovenian Research Agency (research core funding No. P5–0023 “Entrepreneurship for Innovative Society” and research core funding No. BI-BA/24-25-001 “Sustainable development goals for the sustainable development of the company”).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All information in this research is based on publicly available data. More information about the data analysed in this research is available from the first author.

Acknowledgments

The authors would like to extend their sincere gratitude to the journal editors and anonymous reviewers.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Bamford, C.E.; Hoffman, A.N.; Wheelen, T.L.; Hunger, J.D. Strategic Management and Business Policy: Globalization, Innovation and Sustainability, 16th ed.; Pearson: London, UK, 2024. [Google Scholar]

- Bani-Khaled, S.; Azevedo, G.; Oliveira, J. Environmental, social, and governance (ESG) factors and firm value: A systematic literature review of theories and empirical evidence. AMS Rev. 2025, 15, 228–260. [Google Scholar] [CrossRef]

- Berg, F.; Kölbel, J.F.; Rigobon, R. Aggregate confusion: The divergence of ESG ratings. Rev. Financ. 2022, 26, 1315–1344. [Google Scholar] [CrossRef]

- Christensen, D.M.; Serafeim, G.; Sikochi, A. Why is corporate virtue in the eye of the beholder? The case of ESG ratings. Account. Rev. 2022, 97, 147–175. [Google Scholar] [CrossRef]

- Del Gesso, C.; Lodhi, R.N. Theories underlying environmental, social and governance (ESG) disclosure: A systematic review of accounting studies. J. Account. Lit. 2025, 47, 433–461. [Google Scholar] [CrossRef]

- Štrukelj, T.; Dankova, P. Ethical leadership and management of small- and medium-sized enterprises: The role of AI in decision making. Adm. Sci. 2025, 15, 274. [Google Scholar] [CrossRef]

- Štrukelj, T.; Nikolić, J.; Zlatanović, D.; Sternad Zabukovšek, S. A Strategic Model for Sustainable Business Policy Development. Sustainability 2020, 12, 526. [Google Scholar] [CrossRef]

- Štrukelj, T.; Dankova, P.; Hrast, N. Strategic Transition to Sustainability: A Cybernetic Model. Sustainability 2023, 15, 15948. [Google Scholar] [CrossRef]

- Atz, U.; Van Holt, T.; Liu, Z.Z.; Bruno, C.C. Does sustainability generate better financial performance? Review, meta-analysis, and propositions. J. Sustain. Financ. Invest. 2022, 13, 802–825. [Google Scholar] [CrossRef]

- Pedersen, L.H.; Fitzgibbons, S.; Pomorski, L. Responsible investing: The ESG-efficient frontier. J. Financ. Econ. 2021, 142, 572–597. [Google Scholar] [CrossRef]

- Weiss, J.W. Business Ethics: A Stakeholder and Issues Management Approach, 7th ed.; Berrett-Koehler Publishers: Oakland, CA, USA, 2021. [Google Scholar]

- Zdolšek, D.; Jagrič, V.; Štrukelj, T.; Taškar Beloglavec, S. The path towards international non-financial reporting framework. In Managing Risk and Decision Making in Times of Economic Distress, Part B; Contemporary studies in economics and financial analysis; Grima, S., Özen, E., Romānova, I., Eds.; Emerald: Bingley, UK, 2022; Volume 108, pp. 37–60. [Google Scholar] [CrossRef]

- Arora, R.U.; Sarker, T. Financing for Sustainable Development Goals (SDGs) in the Era of COVID-19 and beyond. Eur. J. Dev. Res. 2023, 35, 1–19. [Google Scholar] [CrossRef] [PubMed]

- Bekaert, G.; Rothenberg, R.; Noguer, M. Sustainable investment—Exploring the linkage between alpha, ESG, and SDGs. Sustain. Dev. 2023, 31, 3831–3842. [Google Scholar] [CrossRef]

- US SRI. US Forum for Sustainable and Responsible Investment. US Sustainable Investing Trends 2024/2025. 2024. Available online: https://www.ussif.org/research/trends-reports/us-sustainable-investing-trends-2024-2025-executive-summary (accessed on 5 November 2025).

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Nian, H.; Said, F.F. The impact of ESG on firm risk and financial performance: A systematic literature review. J. Scientometr. Res. 2025, 13, s144–s155. [Google Scholar] [CrossRef]

- Serafeim, G.; Yoon, A. Stock price reactions to ESG news: The role of ESG ratings and disagreement. Rev. Account. Stud. 2023, 28, 1500–1530. [Google Scholar] [CrossRef]

- Gibson, R.; Krueger, P.; Schmidt, P.S. ESG rating disagreement and stock returns. Financ. Anal. J. 2021, 77, 104–127. [Google Scholar] [CrossRef]

- Li, T.T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Linnenluecke, M.K. Environmental, social and governance (ESG) performance in the context of multinational business research. Multinatl. Bus. Rev. 2022, 30, 1–16. [Google Scholar] [CrossRef]

- Schueth, S. Socially responsible investing in the United States. J. Bus. Ethics 2003, 43, 189–194. [Google Scholar] [CrossRef]

- Yang, O.-S.; Han, J.-H. Assessing the effect of corporate ESG management on corporate financial & market performance and export. Sustainability 2023, 15, 2316. [Google Scholar] [CrossRef]

- Robertson, C.J. An analysis of 10 years of business ethics research in strategic management journal: 1996–2005. J. Bus. Ethics 2008, 80, 745–753. [Google Scholar] [CrossRef]

- Robertson, C.J.; Blevins, D.P.; Duffy, T. A five-year review, update, and assessment of ethics and governance in strategic management journal. J. Bus. Ethics 2013, 117, 85–91. [Google Scholar] [CrossRef]

- Malik, F. Navigating into the Unknown: A New Way for Management, Governance and Leadership; Campus Verlag: Frankfurt, Germany; New York, NY, USA, 2016. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman Publishing: Boston, MA, USA, 1984. [Google Scholar]

- Freeman, R.E.; Harrison, J.S.; Wicks, A.C.; Parmar, B.L.; De Colle, S. Stakeholder Theory: The State of the Art; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Bottenberg, K.; Tuschke, A.; Flickinger, M. Corporate governance between shareholder and stakeholder orientation: Lessons from Germany. J. Manag. Inq. 2017, 26, 165–180. [Google Scholar] [CrossRef]

- Carroll, A.B.; Brown, J. Business and Society: Ethics, Sustainability, and Stakeholder Management, 11th ed.; Cengage Learning: Boston, MA, USA, 2022. [Google Scholar]

- Civera, C.; Cortese, D.; Dmytriyev, S.; Freeman, R.E. Letters to stakeholders: An emerging phenomenon of multi-stakeholder engagement. Bus. Ethics Environ. Responsib. 2023, 34, 246–259. [Google Scholar] [CrossRef]

- O’Donovan, G. Environmental disclosures in the annual report: Extending the applicability and predictive power of legitimacy theory. Account. Audit. Account. J. 2002, 15, 344–371. [Google Scholar] [CrossRef]

- Rau, P.R.; Yu, T. A survey on ESG: Investors, institutions and firms. China Financ. Rev. Int. 2024, 14, 3–33. [Google Scholar] [CrossRef]

- Avramov, D.; Cheng, S.; Lioui, A.; Tarelli, A. Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 2022, 145, 642–664. [Google Scholar] [CrossRef]

- Billio, M.; Costola, M.; Hristova, I.; Latino, C.; Pelizzon, L. Inside the ESG ratings: (Dis)agreement and performance. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1426–1445. [Google Scholar] [CrossRef]

- Chatterji, A.K.; Durand, R.; Levine, D.I.; Touboul, S. Do ratings of firms converge? Implications for managers, investors and strategy researchers. Strateg. Manag. J. 2016, 37, 1597–1614. [Google Scholar] [CrossRef]

- Clementino, E.; Perkins, R. How do companies respond to environmental, social and governance (ESG) ratings? Evidence from Italy. J. Bus. Ethics 2021, 171, 379–397. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Flammer, C. Corporate green bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar] [CrossRef]

- Hsu, P.H.; Li, K.; Tsou, C.Y. The pollution premium. J. Financ. 2023, 78, 1343–1392. [Google Scholar] [CrossRef]

- Kräussl, R.; Ruenzi, S.; Weigert, F. A review on ESG investing: Investors’ expectations, beliefs and perceptions. J. Econ. Surv. 2024, 38, 476–502. [Google Scholar] [CrossRef]

- European Commission. Proposal for a Regulation of the European Parliament and of the Council on the Transparency and Integrity of Environmental, Social and Governance (ESG) Rating Activities; European Union: COM/2023/314 final; European Commission: Brussels, Belgium, 2023; Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:52023PC0314 (accessed on 17 October 2025).

- Berry, T.C.; Junkus, J.C. Socially Responsible Investing: An Investor Perspective. J. Bus. Ethics 2013, 112, 707–720. [Google Scholar] [CrossRef]

- Camilleri, M.A. The market for socially responsible investing: A review of the developments. Soc. Responsib. J. 2021, 17, 412–428. [Google Scholar] [CrossRef]

- Global Sustainable Investment Alliance. Global Sustainable Investment Review. 2022. Available online: https://www.gsi-alliance.org/members-resources/gsir2022/ (accessed on 30 September 2025).

- Capelle-Blancard, G.; Monjon, S. Trends in the literature on socially responsible investment: Looking for the keys under the lamppost. Bus. Ethics Eur. Rev. 2021, 21, 239–250. [Google Scholar] [CrossRef]

- Martini, A. Socially responsible investing: From the ethical origins to the sustainable development framework of the European Union. Environ. Dev. Sustain. 2021, 23, 16874–16890. [Google Scholar] [CrossRef]

- Oehmke, M.; Opp, M.M. A Theory of Socially Responsible Investment. Rev. Econ. Stud. 2025, 92, 1193–1225. [Google Scholar] [CrossRef]

- Cooper, D.; Ezzamel, M.; Willmott, H. Examining ‘Institutionalization’: A Critical Theoretic Perspective; Greenwood, R., Oliver, C., Suddaby, R., Eds.; SAGE Publications: Thousand Oaks, CA, USA, 2008; pp. 673–701. [Google Scholar] [CrossRef]

- Lok, J. Why (and How) Institutional Theory Can Be Critical: Addressing the Challenge to Institutional Theory’s Critical Turn. J. Manag. Inq. 2019, 28, 335–349. [Google Scholar] [CrossRef]

- Kurtz, L. Answers to Four Questions. J. Invest. 2005, 14, 125–140. Available online: https://www.pm-research.com/content/iijinvest/14/3/125 (accessed on 17 October 2025). [CrossRef]

- UNPRI. United Nations Principles for Responsible Investment. Annual Report. 2024. Available online: https://dwtyzx6upklss.cloudfront.net/Uploads/v/y/x/annualreport2024_final_98918.pdf (accessed on 16 September 2025).

- Baker, M.; Bergstresser, D.; Serafeim, G.; Wurgler, J. The pricing and ownership of US green bonds. Annu. Rev. Financ. Econ. 2022, 14, 415–437. [Google Scholar] [CrossRef]

- Bolton, P.; Kacperczyk, M.D. Investors care about carbon risk? J. Financ. Econ. 2021, 142, 517–549. [Google Scholar] [CrossRef]

- Zerbib, O.D. A Sustainable Capital Asset Pricing Model (S-CAPM): Evidence from Environmental Integration and Sin Stock Exclusion [Asset pricing with liquidity risk]. Rev. Financ. 2020, 26, 1345–1388. [Google Scholar] [CrossRef]

- Vu, T.N.; Lehkonen, H.; Junttila, J.P.; Lucey, B. ESG investment performance and global attention to sustainability. N. Am. J. Econ. Financ. 2025, 75, 102287. [Google Scholar] [CrossRef]

- Sun, Y.; Zhao, Z. Responsible investment: Institutional shareholders and ESG performance. Pac.-Basin Financ. J. 2024, 85, 102357. [Google Scholar] [CrossRef]

- Zhang, L.-S. The impact of ESG performance on the financial performance of companies: Evidence from China’s Shanghai and Shenzhen A-share listed companies. Front. Environ. Sci. 2025, 13, 1507151. [Google Scholar] [CrossRef]

- Ding, H.; Lee, W. ESG and Financial Performance of China Firms: The Mediating Role of Export Share and Moderating Role of Carbon Intensity. Sustainability 2024, 16, 5042. [Google Scholar] [CrossRef]

- Chen, S.; Song, Y.; Gao, P. Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef]

- Gong, Q.; Gu, J.; Kong, Z.; Shen, S.; Dong, X.; Li, Y.; Li, C. The Impact of ESG Ratings on Corporate Sustainability: Evidence from Chinese Listed Firms. Sustainability 2025, 17, 5942. [Google Scholar] [CrossRef]

- Galema, R.; Gerritsen, D. ESG rating changes and stock returns. J. Int. Money Financ. 2025, 154, 103309. [Google Scholar] [CrossRef]

- Shanaev, S.; Ghimire, B. When ESG meets AAA: The effect of ESG rating changes on stock returns. Financ. Res. Lett. 2021, 46, 102302. [Google Scholar] [CrossRef]

- Asteriou, D.; Pilbeam, K.; Pouliot, W. ESG ratings and investment returns at the country level: Does higher mean better? Int. J. Financ. Econ. 2025, 30, 123–145. [Google Scholar] [CrossRef]

- Belghitar, Y.; Clark, E.; Deshmukh, N. Does it pay to be ethical? Evidence from the FTSE4Good. J. Bank. Financ. 2014, 47, 54–62. [Google Scholar] [CrossRef]

- Bennani, L.; Le Guenedal, T.; Lepetit, F.; Ly, L.; Mortier, V.; Roncalli, T.; Sekine, T. How ESG Investing Has Impacted the Asset Pricing in the Equity Market. SSRN Electron. J. 2018. Available online: https://ssrn.com/abstract=3316862 (accessed on 17 October 2025). [CrossRef]

- Cornell, B. ESG preferences, risk and return. Eur. Financ. Manag. 2021, 27, 12–19. [Google Scholar] [CrossRef]

- Madhavan, V.; Tarun, S.; Kashiramka, S. The sustainability imperative: Evaluating the effect of ESG on corporate financial performance before and after the pandemic. Discov. Sustain. 2025, 6, 28. [Google Scholar] [CrossRef]

- Sciarelli, M.; Cosimato, S.; Landi, G.; Iandolo, F. Socially responsible investment strategies for the transition towards sustainable development: The importance of integrating and communicating ESG. TQM J. 2021, 33, 39–56. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Chan, K.; Cheng, L.T.; Wang, X. The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Financ. Res. Lett. 2020, 38, 101716. [Google Scholar] [CrossRef] [PubMed]

- Li, C.; Wu, M.; Chen, X.; Huang, W. Environmental, social and governance performance, corporate transparency, and credit rating: Some evidence from Chinese A-share listed companies. Pac.-Basin Financ. J. 2022, 76, 101806. [Google Scholar] [CrossRef]

- Liang, H.; Renneboog, L. The global sustainability footprint of sovereign wealth funds. Oxf. Rev. Econ. Policy 2020, 36, 380–426. [Google Scholar] [CrossRef]

- Murata, R.; Hamori, S. ESG Disclosures and Stock Price Crash Risk. J. Risk Financ. Manag. 2021, 14, 70. [Google Scholar] [CrossRef]

- DeMiguel, V.; Garlappi, L.; Uppal, R. Optimal versus naive diversification: How inefficient is the 1/N portfolio strategy? Rev. Financ. Stud. 2009, 22, 1915–1953. [Google Scholar] [CrossRef]

- Whelan, T.; Atz, U.; Holt, T.V.; Clark, C. ESG and Financial Performance: Uncovering the Relationship by Aggregating Evidence from 1000 Plus Studies Published Between 2015–2020; NYU Stern Center for Sustainable Business, Rockefeller Asset Management: New York, NY, USA, 2021. [Google Scholar]

- Zhou, Y.; Bu, W. When Environmental, Social, and Governance (ESG) Meets Shareholder Value: Unpacking the Long-Term Effects with a Multi-Period Difference-in-Differences (DID) Approach. Systems 2025, 13, 315. [Google Scholar] [CrossRef]

- Elton, E.J.; Gruber, M.J. Modern Portfolio Theory and Investment Analysis; John Wiley and Sons Inc.: New York, NY, USA, 1995. [Google Scholar]

- Markowitz, H.M. Portfolio Selection: Efficient Diversification of Investments; Yale University Press: New Haven, CT, USA, 1959; Available online: https://www.jstor.org/stable/j.ctt1bh4c8h (accessed on 8 October 2025).

- Asness, C.S.; Frazzini, A.; Pedersen, L.H. Quality minus junk. Rev. Account. Stud. 2019, 24, 34–112. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Lo, A.W.; MacKinlay, A.C. The Econometrics of Financial Markets; Princeton University Press: Princeton, NJ, USA, 1997. [Google Scholar] [CrossRef]

- Merton, R.C. On estimating the expected return on the market: An exploratory investigation. J. Financ. Econ. 1980, 8, 323–361. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar] [CrossRef]

- Sharpe, W.F. Mutual Fund Performance. J. Bus. 1966, 1, 119–138. [Google Scholar] [CrossRef]

- Magdon-Ismail, M.; Atiya, A.F. Maximum Drawdown. Risk Mag. 2004, 17, 99–102. [Google Scholar]

- Sortino, F.A.; van der Meer, R. Downside risk: Capturing what’s at stake in investment situations. J. Portf. Manag. 1991, 17, 27–31. [Google Scholar] [CrossRef]

- Young, T.W. Calmar ratio: A smoother tool. Futures 1991, 20, 40–41. [Google Scholar]

- Shapiro, R.; Zheng, F. Recent Large-Cap Stock Outperformance and Its Impact on US Equities. J. Invest. 2021, 30, 95–106. [Google Scholar] [CrossRef]

- Oyetade, J.A.; Igbalawole, O.; Johnson-Rokosu, S.F. From Shareholder Value to Stakeholder Impact: Integrating ESG Considerations into Financial Decisions. Int. J. Res. Innov. Soc. Sci. 2025, 9, 239–255. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).