Abstract

This study investigates the impact of Internet of Things (IoT) demand on Digital Economic Growth (DEG) in Saudi Arabia between 2015 and 2023, employing both linear regression and a panel Autoregressive Distributed Lag (ARDL) model. The results show a long-term, significant, and positive association between IoT adoption and DEG, supported by the Technology Organization Environment (TOE) framework, highlighting the relevance of technology readiness and organizational capacity. Moreover, Internet penetration is a significant driver of digital transformation, aligned with the Diffusion of Innovations (DOI) theory, which emphasizes the role of connectivity in facilitating the adoption of digital devices. IoT will have little or no impact in the short term, but in the long run, the benefits are clear. Furthermore, despite the long- and short-term benefits of 5G deployment indicated by the results, a divergence between 5G deployment and electricity consumption is signaled by the significance of the error-correction term, which may be attributed to infrastructure and deployment prerequisites. Additionally, as an extension of the Resource-Based View (RBV) paradigm, the ultimate drivers of DEG through innovation and strategic resources highlight the importance of Research and Development (R&D) investment and Foreign Direct Investment (FDI) in inducing its growth. In contrast, inflation has an adverse impact on DEG, confirming macroeconomic instability as an obstacle to digital advancement, which relates to the environmental pillar of TOE. Policymakers can maximize Saudi Arabia’s digital economic growth on a sustainable, stronger path by investing in IoT infrastructure, increasing internet access and adoption, enhancing R&D and institutional support, and addressing challenges related to macroeconomic stability and 5G deployment. This study adds to the extant research by empirically evaluating the short- and long-term effects of IoT adoption on Saudi Arabia’s digital economic development, thereby providing insights into the roles of innovation, infrastructure, and institutional support in driving digital transformation.

1. Introduction

The Internet of Things (IoT) has emerged as a critical driver of digital transformation, reshaping industries, economies, and societies worldwide. IoT refers to the network of interconnected devices that communicate and exchange data to optimize operations, enhance efficiency, and improve decision-making [1]. With the rise in smart technologies, IoT has been increasingly integrated across sectors such as healthcare, manufacturing, transportation, and finance, leading to significant economic benefits [2].

In the case of Saudi Arabia, the adoption of IoT technologies is central to the country’s Vision 2030 initiative, which aims to diversify the economy and foster a globally competitive digital infrastructure [3]. The Saudi government has prioritized investments in emerging technologies, allocating over $24.8 billion in digital infrastructure over the past six years [4]. These investments have significantly improved digital connectivity, with 99% internet penetration and one of the fastest mobile internet speeds globally, averaging 215 Mbps, nearly double the global average [4].

The Saudi IoT market is witnessing exponential growth. In 2022, the market was valued at approximately $2.7 billion, with projections indicating a surge to $6.9 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 12.5%. This growth is driven by rising IoT demand across various industries, including smart cities, logistics, healthcare, and energy. The Saudi smart city initiative, which includes projects such as NEOM, The Red Sea Project, and Qiddiya, has significantly accelerated the deployment of IoT solutions for urban development, sustainability, and infrastructure optimization [5].

Globally, IoT has been linked to significant economic contributions. Studies indicate that IoT adoption can enhance economic productivity by up to 25% and contribute over $11 trillion to the global economy by 2030 [5]. However, the extent to which IoT demand influences the digital economy in emerging markets such as Saudi Arabia remains an open question. Understanding this relationship is particularly crucial as the country shifts towards a knowledge-based, digitally driven economy.

Previous studies have analyzed the role of digital transformation and technology adoption in economic growth. For instance, ref. [6] remarked that productivity gains with IoT-based industrial automation are remarkable in developed countries. Similarly, ref. [7] showed that, through the integration of IoT, the quality and efficiency of public works will improve, and the economy will contribute to the building of environmentally friendly cities. However, limited empirical research has examined the direct economic effects of IoT demand in emerging economies such as Saudi Arabia.

In addition, current research conducted in Saudi Arabia addresses digital transformation in general [8] or examines the technological preparedness of firms [9] and does not further explore the quantitative demand for IoT in the context of economic growth and diversification. To policymakers and industry stakeholders alike, understanding the short- and long-term economic effects of IoT demand is important in light of the Kingdom’s ambitions for its digital agenda and investments in smart infrastructure, artificial intelligence, and IoT-driven solutions.

Under this premise, the investigation on how the demand generated by the IoT influences Saudi Arabia’s economy, along with its technological upgrade and diversification of the economy, as well as its effect on GDP. Previous studies have analyzed the effect of digital transformation on the economic performance, but few have explicitly focused on the influence of IoT demand in the Saudi Arabian economy. The purpose of this research is to examine the influence of IoT demand on Saudi Arabia’s digital economy using both linear regression and ARDL analysis. In particular, it aims to measure the short- and long-term impacts of IoT adoption on economic growth and diversification in the Kingdom.

In addition, this research fills an important gap in the literature by supplying empirical evidence regarding the association between IoT demand and the digital economy in Saudi Arabia. With the Kingdom steering its strategic focus towards digital transformation to realize economic diversification, the insights from this research can guide policy differentiation and direct investment objectives. They can also help identify developmental gaps in the Kingdom’s strategic efforts to integrate IoT.

Existing literature has examined the general implications of digitalization for economic growth; this study is unique in that it investigates the impact of the demand for IoT technologies on Saudi Arabia specifically. The study employs the Panel ARDL methodology, which accounts for both short- and long-term effects of IoT demand on the digital economy, providing a more holistic overview of the relationship between these technologies. Such methodological implementation is novel in the context of Saudi Arabia’s economic conditions.

The structure of this paper is as follows: Section 2 provides the theoretical review, and Section 3 examines the empirical literature. Section 4 formulates the research hypotheses, while Section 5 describes the methodology and data sources. Section 6 presents the empirical results, followed by the discussion in Section 7. Policy implications are introduced in Section 8, and the conclusion is offered in Section 9. Section 10 outlines the study’s limitations, and Section 11 proposes avenues for future research.

2. Background Theory

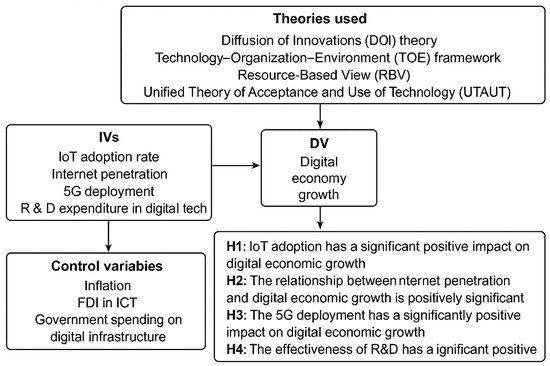

This study adopts an integrated theoretical approach to examine how demand for IoT technologies influences the development of Saudi Arabia’s digital economy. Rather than treating theoretical models as isolated concepts, this framework combines four complementary perspectives the Diffusion of Innovations (DOI) theory, the Technology–Organization–Environment (TOE) framework, the Resource-Based View (RBV), and the Unified Theory of Acceptance and Use of Technology (UTAUT) to provide a multi-level analysis of IoT adoption and its economic implications.

The Diffusion of Innovations (DOI) theory [10] offers the macro-level foundation by explaining how technological innovations spread within a social system. Its core attributes relative advantage, compatibility, complexity, trialability, and observability help explain why adoption rates differ across industries within Saudi Arabia’s digital transformation landscape. In a national context where Vision 2030 initiatives actively promote technological modernization, DOI helps clarify how institutional support, perceived benefits, and sectoral characteristics shape the pace and direction of IoT diffusion.

Building on this societal-level perspective, the Technology–Organization–Environment (TOE) framework [11] focuses on organizational decision-making. While DOI explains the broader diffusion process, TOE addresses the internal and external conditions that influence whether firms adopt IoT. Technological readiness, organizational capabilities, and environmental pressures such as competition, regulatory requirements, and governmental digitalization efforts are particularly pronounced in Saudi Arabia’s rapidly evolving ICT ecosystem. TOE therefore provides a structured lens for assessing cross-industry variation in IoT adoption, linking national digital policies with firm-level adoption behavior.

Whereas DOI and TOE explain adoption determinants, the Resource-Based View (RBV) [12] explains adoption outcomes. IoT technologies, when supported by complementary resources such as skilled human capital, data analytics infrastructure, and effective organizational processes, function as strategic assets that contribute to enhanced performance and competitiveness. In the context of Saudi Arabia, where digital economy development is a strategic national priority, RBV clarifies how IoT demand translates into firm-level advantages that cumulatively strengthen the digital economy.

Finally, the Unified Theory of Acceptance and Use of Technology (UTAUT) [13] adds a micro-level behavioral dimension. While DOI and TOE focus on societal and organizational determinants, UTAUT explains how perceptions at the user level performance expectancy, effort expectancy, social influence, and facilitating conditions influence actual acceptance and use of IoT technologies. This is particularly relevant in Saudi Arabia, where digital literacy, workforce capabilities, and organizational culture play crucial roles in translating IoT availability into effective utilization.

3. Empirical Review

Empirical studies on the link between IoT adoption and economic growth have reported a positive association. For instance, refs. [14,15] found that Total Factor Productivity (TFP) growth increases by 0.23% for an increase of 10% in inhabitants to IoT connections in an analysis of data from 82 countries in the period from 2010 to 2018. This finding underscores the IoT’s potential to increase productivity, a key driver of economic growth.

While the growth of internet access is generally regarded as a key driver of economic development, one that promotes the spread of information, the growth of markets, and innovation [16,17]. Many studies confirm that internet penetration had a positive effect on GDP growth [18]. According to a World Bank study, broadband penetration increased GDP per capita growth rate by between 0.9 and 1.5 percentage points for every 10% increase in coverage. Again, with an estimated 10-percentage-point increase, broadband access could add over 875,000 jobs and $186 billion in economic output over five years [19].

This effect is likely to decline as penetration rates become more saturated. Studies on the digital economy and urban-rural integration in China point out that the promotional effect of the digital economy on integration is nonlinear, presenting a declining trend, but does not reach an ‘inflection point’, when the effect of the digital economy switches from promotion to inhibition [20]. This suggests that (i) robust initial investments in internet infrastructure deliver outstanding economic returns, but that (ii) it appears likely that incremental returns will decline and reach zero or even negative levels when penetration rates are already very high.

Moreover, widespread implementation of 5G technology is expected to have large-scale economic repercussions, with estimates indicating that 5G may account for trillion-dollar contributions to global and national GDPs. For example, studies predict that 5G could contribute about $1.3 trillion to global gross domestic product (GDP) by 2030. In the United States, projections range from $1.4 trillion to $1.7 trillion by 2030, accompanied by the creation of millions of jobs.

Nevertheless, there are critical attitudes about the empirical validation of these optimistic projections. The actual economic impact of 5G deployment will depend on many factors, such as the effectiveness of implementation strategies considerations for spectrum allocation, and regulatory frameworks [21,22]. Additionally, the expected gains might not be uniformly shared across sectors and regions, as they are influenced by existing infrastructure and technological preparedness [23].

In addition, empirical research suggests a positive link between R&D spending and economic growth [24]. For example, a 1% increase in R&D spending is associated with a 0.039% increase in per capita GDP [25]. In similarities, research shows that R&D investment is highly correlated with economic growth in developing countries, allowing them to move towards the developed labor market. However, the extent to which R&D investments translate into economic growth varies across economies, often depending on technological readiness, institutional quality, and absorptive capacity [26]. For instance, high-tech industrial R&D expenditure positively affects GDP per capita, but this effect amplifies at higher levels of economic development. Moreover, research has shown that investments in public and private R&D are complementary, with the most significant economic returns arising from investments in both sectors [27].

There is existing literature that highlights the positive relationship (i.e., correlation) between digital technologies, including IoT adoption, internet penetration, 5G deployment, and Research and Development (R&D) investment in digital technologies and economic growth. For instance, ref. [28] found evidence from IoT, and [29] found strong evidence that increases in the per-inhabitant IoT connections were positively correlated with the growth of total factor productivity, especially in the early phase of IoT diffusion. Importantly, these studies are generalist, based on aggregate data and projections that neglect sectoral differences and the quality of technology implementation, and therefore should be taken with a pinch of salt. The economic benefits become nonlinear, so a country with high internet penetration may experience diminishing marginal returns as it approaches saturation, which future studies should account for [30].

Furthermore, while research and development investments generally correlate with economic growth, the quality of those investments can vary depending on factors such as technological readiness and institutional quality. Ref. [31] document that a 1% higher gov. Research and Development (R&D) spending is associated with a 0.025% higher productivity. These findings highlight the need for more research on the conditions that enable the efficiency of R&D investments. In the face of these deficiencies, the current research aims to address them by providing a granular understanding of sectoral saturation effects alongside internet saturation, an empirically grounded understanding of 5G rollout, and broader support for the determinants of R&D investment returns. Through this multidisciplinary approach, the research aims to shed light on the interplay between digitalization and economic growth, ultimately providing policymakers and decision-makers with actionable insights and tools to maximize the impact of digital technologies on long-term growth prospects.

4. Hypothesis Development

4.1. IoT Adoption and Digital Economic Growth

The rapid growth of the IoT in the aggregate is expected to be a significant source of productivity and economic growth. Technological change is widely regarded as a primary driver of productivity. Ref. [28] argue that Technological Change, Organizing, and the IoT have become central to the process of productivity augmentation. Based on data available until October 2021, empirically, a 10-percentage-point increase in the number of cellular IoT connections per head is linked to a 0.23-percentage-point rise in total factor productivity growth, representing USD 197 billion in contribution at the 2018 world GDP. This association is stronger in the early stage of IoT diffusion. The effect of IoT uptake on economic development, however, differs by sector: growth impacts depend on the quality of implementation, sector-specific characteristics, and existing technological infrastructure. Specific industries may accrue significant benefits from IoT integration depending on these variables, whereas others may be less affected. Therefore, a nuanced analysis is essential to understand the sector-specific effects of IoT adoption on economic performance. Based on this context, accordingly, the following hypothesis is formulated:

H1.

Increased IoT adoption leads to significant and positive growth in the digital economy.

4.2. Internet Penetration and Digital Economic Growth

Numerous studies affirm the positive impact of increased internet penetration on GDP growth [32,33]. For instance, a World Bank study reported that a 10% increase in broadband penetration could raise GDP per capita growth by 0.9 to 1.5 percentage points. Similarly, Deloitte’s analysis indicated that a 10-percentage-point increase in broadband access could result in over 875,000 additional jobs and $186 billion more to economic output over five years. However, the magnitude of this effect may diminish as penetration rates approach saturation levels. Research on China’s digital economy and urban–rural integration suggests a nonlinear relationship, in which the digital economy’s promotive effect on integration shows a marginal decline without yet reaching an ‘inflection point’ at which the effect shifts from promotion to inhibition [34]. Therefore, the following hypothesis is proposed:

H2.

The relationship between internet penetration and digital economic growth is positively significant.

4.3. Fifth-Generation Deployment and Economic Growth

Projections suggest that 5G could add approximately $1.3 trillion to global GDP by 2030. In the United States, estimates indicate that 5G will contribute over $1.5 trillion to GDP from 2021 to 2023, with significant impacts in states like California, New York, and Texas [35]. These projections underscore the transformative potential of 5G technology to enhance economic performance by improving mobile broadband, mission-critical services, and massive IoT applications. However, the actual economic impact of 5G deployment depends on several factors, including implementation strategies, spectrum allocation, regulatory frameworks, and existing infrastructure. Therefore, accordingly, the following hypothesis is formulated:

H3.

The deployment of 5G networks significantly promotes the advancement of the digital economy.

4.4. R&D Investment and Economic Growth

Investment in Research and Development (R&D) serves as a central engine of innovation and economic growth [36]. Research shows that a 1% increase in R&D spending results in a 0.039% increase in per capita GDP [37]. Analogously, results show a significant association between R&D investment and economic growth in emerging economies, helping them upgrade to developed economies [24]. However, the conversion of R&D investment to economic growth is not uniform, with technology readiness, institutional quality, and economies’ absorptive capacity affecting its efficacy. For instance, although the relationship between high-tech industrial R&D expenditure and GDP per capita is positive, it becomes stronger as economic development increases. So, the below hypotheses are offered:

H4.

The effectiveness of R&D has a significant positive impact on digital economic growth.

Figure 1 conceptual framework illustrates how four major theories Diffusion of Innovations (DOI), Technology–Organization–Environment (TOE), Resource-Based View (RBV), and the Unified Theory of Acceptance and Use of Technology (UTAUT) collectively explain the drivers of digital economy growth. The independent variables (IoT adoption, internet penetration, 5G deployment, and R&D expenditure in digital technologies) are positioned as key technological and organizational enablers that directly influence the dependent variable, digital economy growth.

Figure 1.

Conceptual Framework.

Control variables such as inflation, FDI in ICT, and government spending on digital infrastructure help isolate these effects by accounting for macroeconomic and policy-related influences. The hypotheses (H1–H4) articulate the expected positive relationships between each technological factor and digital economy growth, reinforcing the theoretical assumptions that technological readiness, innovation diffusion, organizational capabilities, and user acceptance all contribute to accelerating digital economic development.

5. Methodology and Data Source

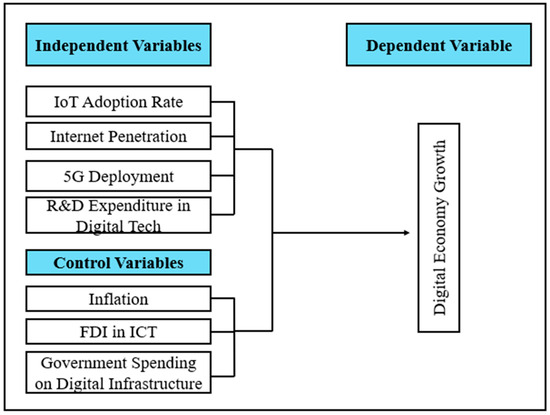

This study explores the influence of Internet of Things demand, internet penetration, 5G, and R&D from 2015 to 2023, utilizing linear regression analysis. To check the long and short-run impact further, the study has used panel ARDL [38]. The research framework of the study is shown in Figure 2.

Figure 2.

Research Framework.

For this study, data were collected from authoritative and standardized sources to ensure accuracy and reliability. The Digital Economy Growth data, measured in billion SAR, were obtained from the General Authority for Statistics (GASTAT), which provides comprehensive insights into the economic contributions of the digital sector. The IoT adoption rate percentages were taken from reports published by the Communications, Space, and Technology Commission (CST) that indicate the percentage of IoT adoption by industry. Data on Internet Penetration rates were also retrieved from CST, which reported a 99% penetration rate in Saudi Arabia in its 2023 report. Fifth-Generation Deployment percentage data were compiled from CST publications regarding the deployment and coverage of 5G throughout the country. GASTAT’s Consumer Price Index reports were used to obtain inflation rates. Data on Foreign Direct Investment (FDI) in the Information and Communications Technology (ICT) sector were collected from the Ministry of Investment and show the value of FDI in ICT in billion SAR. Lastly, Government Spending on Digital Infrastructure (in billion SAR) was obtained from GASTAT and illustrates the state’s financial investments in developing digital infrastructure.

5.1. Description of Variables

The dependent variable, Digital Economy Growth (DEG), measures the expansion of the digital sector within the economy, encompassing activities such as e-commerce, digital services, and information technology, and reflects the sector’s contribution to overall economic development [39]. The independent variables include the IoT adoption rate. The IoT refers to a network of interconnected physical devices such as sensors, machines, and digital systems that collect, transmit, and process data through the internet with minimal human intervention. IoT enables real-time monitoring, automation, and intelligent decision-making across industries [1,40]. In this study, IoT represents the percentage of IoT adoption across industries in Saudi Arabia, reflecting the extent to which organizations utilize IoT technologies to support digital transformation and economic development. Data for the IoT were collected from official reports published by the Communications, Space, and Technology Commission (CST) of Saudi Arabia. These reports provide annual IoT adoption rates by industry, expressed as percentages, which indicate the degree to which different sectors have implemented IoT technologies [41]. Internet Penetration, which denotes the proportion of the population with internet access [42], and has reached 99% in Saudi Arabia as of 2023; 5G Deployment, measuring the extent of 5G technology implementation within the region [43] and Research and Development (R&D) Expenditure in Digital Technology, indicating the financial resources allocated to digital technology research and development [44]. In order to account for other economic influences, the study utilizes additional controls including Inflation, Foreign Direct Investment (FDI) associated with Information and Communications Technology (ICT), i.e., the sum of the foreign investment in the ICT industry (which would include technology-oriented businesses, such as telecommunications providers); and Government Spending on Digital Infrastructure (to date, Saudi Arabia has invested a total of SAR 93.7 billion into building its digital infrastructure).

5.2. Model Specification and Analytical Techniques

In this study, linear regression is used to examine the relationship between the digital economy and economic growth [45]. Linear regression is a basic statistical analysis that finds the relationship between the dependent and independent variables and fits the best linear line over the observed data [46]. It was one of the most commonly used models in economic research, as it was simple, interpretable, and therefore practical for modeling outcomes and making predictions. By using linear regression, we can measure the degree and direction of the relationship between digital economy parameters and economic growth, thereby providing insight into how changes in digital infrastructure and adoption rates may affect aggregate economic activity. The structure of the linear regression model is:

where;

DEGi = α0 + α1IoTi + α2InPi + α35GDi + α4R&Di + α5INFi + α6FDIi + α7GSDI + μI

α0 is the intercept term, indicating the expected value of DEG when all independent variables are zero. μᵢ is the error term, accounting for unobserved factors and random noise affecting digital economy growth for entity i.

The panel Autoregressive Distributed Lag (ARDL) model is employed to investigate further the short- and long-run effects of the variables on the growth of the digital economy [47]. This panel ARDL approach allows variables to have mixed orders of integration, such as I(0) or I(1), making it appropriate for datasets with mixed orders of integration. Furthermore, the panel ARDL model can estimate short-run dynamics and long-run relationships simultaneously [38], making it more convenient for comprehensively examining the economic growth of the digital economy and the time effects of related factors. It is particularly beneficial for examining the effects of fast-moving variables on digital economic growth, as well as for exploring how these short-run effects persist over time, providing decision-makers and stakeholders with a rounded view of the pathway of digital-led economic growth. Drawing on the framework presented in Figure 1, the ARDL model employed to analyze the link between the digital economy and economic growth is formulated as follows:

DEGit = α0 + β1 IoTit + β2 InPit + β3 5GDit + β4 R&Dit + εit

The main motivation for employing panel data in this study is its capacity to capture effects at the population level rather than the individual level [48]. Panel data also offers advantages in addressing heteroscedasticity and is particularly valuable in situations where long-term time-series data are limited—a common challenge in developing countries and in datasets comprising repeated cross-sectional observations [49]. To estimate both short- and long-run dynamics, this study adopts a panel Autoregressive Distributed Lag (panel ARDL) model, an econometric technique well-suited for analyzing relationships across time and entities [50]. As highlighted by [51], the ARDL approach is especially relevant because it accommodates lagged values of both dependent and independent variables, consistent with the Granger causality inherent in economic relationships. This is particularly advantageous when examining persistent variables and their long-term outcomes. Moreover, the ARDL methodology is widely preferred in empirical economic research due to its flexibility in handling co-integration, dynamic interactions, endogeneity, and non-stationarity among variables [52].

The simplified ARDL (p, q, q, …, q) model is specified as:

Yit is the dependent variable, as (Xit) is a vector of r independent variables (Xit) where the vector should consist of (r = 0), (r = 1) process of [AR(0)] [AR(1)] and cointegration. Where δi is the coefficient of the lagged dependent variable, scalar. The coefficients βij correspond to the independent variable vector. The term ϕi captures unit-specific fixed effects, where i = 1, …, N is the cross-sectional dimension and t = 1, 2, 3, …, T is the time dimension. p and q indicate the optimal lag orders, and εit is the residual term, reflecting unobserved disturbances in the model.

The revised ARDL (p, q, q, q, …, q) error correction model is specified as

In the preceding equation, represents digital economic growth (DEG) as the dependent variable, incorporating both lagged and differenced terms to capture short- and long-run effects. Conversely, denotes the set of independent variables, which also include lagged and differenced values to account for dynamic interactions within the model.

6. Results and Analysis

The results of the linear regression presented in Table 1 show that the IoT has a positive effect on the DEG of Saudi Arabia. It indicates that with the growth and proliferation of IoT technology, the digital economy makes a prominent advancement. The result aligns with the studies by [53,54], which show that IoT delivers automation, data analytics, and real-time decision-making critical elements that are essential to propelling digital transformation and improving economic efficiency. For example, within Saudi Arabia, growing IoT adoption fuels smart city initiatives such as NEOM and Vision 2030, and encourages progress toward digital economic growth.

Table 1.

Linear regression.

The findings also suggest that internet penetration positively influences DEG in Saudi Arabia. This is in line with evidence from [55,56] that shows that while increasing internet penetration improves access to information and broadens participation in the digital economy, digital trade gets a boost. This finding in Saudi Arabia supports national initiatives during Vision 2030 to expand internet infrastructure and inclusion.

Moreover, it provides evidence that 5G development (5GD) has an adverse effect on Saudi Arabia’s DEG. This implies that, despite its promise, the present phase of 5G rollout may involve short-term challenges with negative results that exceed short-term economic gains. Although counterintuitive, this finding aligns with other studies [57,58] that suggest that during the early phases of 5G deployment, high infrastructure costs and low short-term returns may temporarily clash with some economic benefits. Regarding Saudi Arabia, it is believed that the negative influence on DEG can be attributed to the fact that 5G is still being rolled out in the country, and the costs investors incur outweigh the benefits.

Research and Development (R&D) also positively affects Saudi Arabia’s DEG. It means that higher investment in R&D activities will foster digital economy development through Measuring Investment in R&D activities. Such observation aligns with the literature, which concludes that R&D investment begets innovation, develops technological capabilities, and boosts productivity [59,60]. For instance, in Saudi Arabia, R&D contributes to the shift away from oil-based revenues toward knowledge-based economic activity.

Additionally, results show that inflation adversely affects Saudi Arabia’s DEG while FDI and government spending on digital infrastructure (GSDI) positively influence it. DEG negatively correlates with inflation, and high inflation may lower consumer purchasing power, increase the cost of doing business, and some also argue that this will depress investment in digital technologies. On the other hand, the positive nature of FDI indicates that foreign investment has a major influence on the development of the digital economy. Foreign Direct Investment (FDI) brings not only capital but also new technologies, expertise, and business practices that support the growth of digital sectors. Likewise, the positive effect of government spending on digital infrastructure highlights the importance of public investment in creating the foundational systems, such as broadband networks, data centers, and smart technologies, that enable digital services and innovation.

6.1. Diagnostic Tests

Table 2 presents the diagnostic tests. The Wooldridge test for autocorrelation reports an F-statistic of 1.94 with a p-value of 0.186, indicating that the null hypothesis of no first-order autocorrelation cannot be rejected. This suggests that the residuals are not serially correlated, and the dynamic structure of the panel ARDL model is appropriately specified. However, the Modified Wald test for groupwise heteroscedasticity yields a χ2 value of 27.58 with a p-value of 0.000, providing strong evidence of heteroscedasticity across the panel. This implies that the variance of the error terms differs across units or years, a common occurrence in macroeconomic and technological datasets. Additionally, the Pesaran cross-sectional dependence test produces a CD statistic of 3.21 and a p-value of 0.001, indicating significant cross-sectional dependence. This means that the variables across the panel units are interrelated and influenced by common shocks or shared national-level policies.

Table 2.

Diagnostic Tests.

6.2. Unit Root Test

Table 3 presents the results of the ADF and PP unit root tests for all variables under consideration. The results indicate that the variables InP and R&D are stationary at the level, as both the ADF and PP test statistics are significant at conventional levels. This implies that these variables are integrated of order zero, I(0). On the other hand, the variables DEG, IoT, and 5GD are non-stationary at the level but become stationary after first differencing. Both ADF and PP tests show statistically significant results at the first difference, confirming that these variables are integrated of order one, I(1).

Table 3.

Results of ADF and PP unit root tests.

The unit root test results suggest a mixed order of integration among the variables: InP and R&D are I(0), while DEG, IoT, and 5GD are I(1). This combination of integration orders is suitable for applying techniques such as the ARDL bounds testing approach to examine long-run relationships among the variables.

6.3. Cointegration

Table 4 reports the results of the panel cointegration tests, including both panel and group statistics, to assess whether the variables are co-integrated, indicating a stable long-run equilibrium relationship. The tests include the v-statistic, rho-statistic, t-statistic, and ADF-statistic, based on the Pedroni cointegration testing framework. The results show that the rho, t, and ADF statistics for both the panel and group dimensions are significantly negative, indicating the rejection of the null hypothesis of no cointegration. Although the panel v-statistic is negative and not significant, the remaining test statistics particularly the panel t-statistic (−7.102), group t-statistic (−8.215), panel ADF (−8.356), and group ADF (−9.124) all provide strong evidence in favor of cointegration.

Table 4.

Cointegration.

Therefore, the overall findings support the existence of a long-run cointegration relationship among the model’s variables. This justifies the use of further long-run estimation techniques, such as the Panel ARDL, to explore the dynamic relationships among the variables.

6.4. Post-Estimation Results for Short-Term and Long-Term

In Table 5, the results reveal that IoT has a positive, statistically significant impact on long-run DEG, indicating that increased adoption of IoT technologies contributes to sustained digital economic development. However, in the short run, IoT exhibits a negative and statistically insignificant effect on DEG, suggesting that short-term fluctuations in IoT implementation may not immediately translate into economic benefits, possibly due to initial adaptation costs or lagged effects. The ECT is negative and statistically significant at the 7% level, confirming an adjustment process. This means any short-run imbalance returns to the long-run path over time, and the system gradually reverts to it.

Table 5.

The Effect of IoT Adoption on Digital Economic Growth (DEG).

In addition, the positive impact of IoT on DEG aligns with the research in [61,62], which shows that IoT adoption positively influences productivity, innovation, and digital infrastructure, thereby promoting long-term economic development. On the contrary, these insignificant negative effect findings in the short run dispute the relatively optimistic perception of [63], who argue that IoT adoption has the potential to deliver immediate improvements in operational performance. It aligns with [64], which argues that high implementation costs and adaptation difficulties might delay near-term benefits. The negative error correction term also aligns with [65], suggesting a slow adjustment process that corrects short-term deviations from equilibrium while establishing a stable long-run equilibrium.

The results in Table 6 show that Internet penetration (InP) has a positive, statistically significant effect on the growth of DEG in both the short- and long-run. This means that the more immediate access and use of the internet are offered, the faster a digital economy builds, supporting digital transactions, communication, innovation, and access to digital services. The short-run effect suggests that the benefits of improvements to internet infrastructure can materialize quickly. In contrast, the long-run effect underscores the infrastructure’s significance for the continued digitalization and transformation of the economy. Furthermore, negative and statistically significant ECT at the 8% level suggests that deviations from the long-run equilibrium are being appropriately corrected over time.

Table 6.

Effect of Innovation Performance (InP) on Digital Economic Growth (DEG).

The finding that Internet penetration (InP) positively and statistically significantly affects DEG both in the long run and short run is consistent with the study of [66,67], which found that better internet access stimulates economic growth by building connectivity, information flow, and the adoption of digital services. Other recent works, however, support the idea that internet infrastructure brings immediate, and often sustainable, benefits to digital transformation and economic performance, particularly in developing and emerging economies, a phenomenon previously noted by [68,69]. In other words, the presence of the negative and significant error correction term is consistent with dynamic models [70], which postulate that short-run fluctuations in economies adjust to long-run equilibrium through this hysteretic adjustment, thereby strengthening the stability of the internet-DEG dynamics in the long run.

Moreover, the results in Table 7 suggest that the implementation of 5G positively and significantly affects the growth of the DEG in both the short and long run. It can be concluded that the introduction of 5G significantly improves digital economic activities immediately and in the long run. This suggests that investments in 5G infrastructure enhance connectivity, support advanced technologies, and improve digital services, thereby boosting the digital economy at all stages. The error correction term (ECT) is negative and statistically significant at the 6% level, which aligns with theoretical expectations for a stable long-run relationship. A negative and significant ECT indicates that any short-run deviations from the long-run equilibrium are gradually corrected over time. This implies that the system exhibits convergence toward its long-run path, and the adjustment mechanism works effectively to restore equilibrium following a shock.

Table 7.

Influence of 5G Deployment on Digital Economic Growth.

The finding aligns with the studies by [71,72], which emphasize that 5G technology enhances digital connectivity, drives innovation, and supports the adoption of advanced digital applications, all of which contribute directly to economic growth. These studies argue that 5G creates immediate efficiency gains (short-run effects) and lays the foundation for long-term digital transformation. Similarly, refs. [73,74] report highlight that early investments in 5G infrastructure lead to measurable improvements in digital productivity and economic competitiveness. Nonetheless, the observed negative and significant ECT is consistent with the standard behavior anticipated in dynamic models, where a negative ECT indicates convergence toward the long-run equilibrium. This finding suggests that deviations from the long run path are corrected over time, aligning with previous studies such as [70], who also reported stable and converging long-run relationships in similar models examining digital infrastructure.

Additionally, the results in Table 8 show a positive short- and long-run effect of research and development (R&D) on DEG, indicating that higher investment in R&D significantly contributes to economic growth, both in the short and long run. In addition, the error correction term (ECT) is negative and significant at the 8% threshold level, indicating a stable adjustment process in which short-term deviations from the long-run equilibrium are gradually corrected over time.

Table 8.

Impact of R&D on DEG.

This result is in line with [75] endogenous growth theory and [76] work on research and development, and it supports the investment in research and development, which leads to innovation and sustained long-term growth. Ultimately, OECD reports and Cohen and [77] show that R&D leads to better economic performance, increased innovation, and enhanced absorptive capacity. This view is also supported by the short-run and long-run positive effects observed in this study. Results differ from those of [78,79], who find R&D benefits concentrated in or conditioned by institutional and absorptive capacity in developed economies. Therefore, while the findings broadly support established theories linking R&D to economic growth, they may offer a contrasting view to studies that highlight regional or institutional limitations on R&D’s effectiveness.

7. Discussion

The results demonstrate a robust positive effect of IoT adoption on Saudi Arabia’s DEG, providing empirical support for the Technology–Organization–Environment (TOE) framework. From a technological perspective, IoT enables automation, real-time analytics, and intelligent decision-making [53,54], directly enhancing productivity and operational efficiency. Organizationally, the ability to integrate IoT depends on internal capabilities such as digital infrastructure, skilled workforce, and managerial support factors emphasized by TOE as critical for effective technology deployment. In Saudi Arabia, the Vision 2030 agenda acts as a macro-level facilitator, creating an institutional environment that mitigates adoption barriers and encourages alignment between organizational readiness and national digital objectives. Thus, the positive IoT effect is not only a reflection of technological capabilities but also of systemic coordination between policy, firms, and technology ecosystems.

Internet penetration similarly exhibits a significant positive impact on DEG, consistent with the Diffusion of Innovations (DOI) theory. Beyond simply increasing connectivity, greater Internet access reduces transaction costs, accelerates information flows, and enhances the visibility of digital solutions, effectively lowering the adoption threshold for both firms and consumers. This mechanism underlines a feedback loop: higher Internet access leads to broader digital engagement, which stimulates further technological diffusion and reinforces long-term digital economic expansion.

Conversely, early-stage adoption of technologies such as 5G demonstrates initial negative or limited short-run effects, consistent with DOI’s recognition that innovations initially face structural and economic constraints. Implementation barriers including high infrastructure costs, limited interoperability, and organizational unpreparedness [57,58] slow diffusion. Over time, however, as complementary technologies and skills mature, these constraints diminish, allowing 5G and IoT to jointly amplify productivity and digital service delivery. This dynamic highlights the importance of considering adoption as a phased process, where long-run benefits emerge after short-term integration challenges are overcome.

Empirical evidence also emphasizes the strategic role of internal resources. R&D investment consistently exhibits a positive effect on DEG, reflecting the Resource-Based View (RBV) perspective that innovation capabilities constitute key strategic assets. R&D enhances absorptive capacity, enabling firms to identify, assimilate, and leverage new technologies for competitive advantage [59]. Similarly, foreign direct investment (FDI) introduces advanced technologies, managerial expertise, and best practices, reinforcing RBV’s assertion that external knowledge inflows can complement internal resources to drive sustainable economic outcomes. These mechanisms suggest that Saudi Arabia’s digital growth is not only technology-driven but also knowledge-driven, where the generation, transfer, and effective utilization of knowledge form the core of economic transformation.

Macroeconomic conditions, however, can mediate these effects. Inflation negatively affects DEG, consistent with the environmental dimension of TOE. Higher prices increase uncertainty, raise operational costs, and reduce the expected return on technological investments, slowing adoption. This indicates that even with advanced technology and strong institutional support, environmental stability is crucial for translating adoption into measurable economic gains. In contrast, government expenditure on digital infrastructure exerts a positive effect, highlighting the role of public institutions in reducing technological friction, subsidizing network externalities, and enhancing the absorptive capacity of firms and consumers alike.

The ARDL analysis further provides nuanced insights into the temporal dynamics of these effects. While IoT’s short-run impact may be muted or even slightly negative due to integration costs and learning curves, the long-run effect is strongly positive, reflecting cumulative gains from efficiency, innovation, and digital infrastructure development. The negative and significant error correction term (ECT) confirms that deviations from the long-run equilibrium are gradually corrected, illustrating a self-stabilizing system where initial shocks or adoption delays do not derail long-term growth. This aligns with DOI theory’s diffusion logic, showing that technological systems eventually converge toward stability as adoption networks expand.

Furthermore, the long-run significance of Internet penetration and 5G demonstrates the reinforcing interaction between connectivity and technology adoption. Enhanced networks facilitate IoT deployment, while IoT applications create incentives for further network expansion, producing a virtuous cycle of technological and economic growth. This interaction highlights the nonlinear nature of digital economic transformation, where short-term disruptions coexist with structural forces that amplify long-term benefits.

Finally, the persistent positive effect of R&D emphasizes the centrality of knowledge creation and absorption, consistent with Romer (1990) and Cohen and Levinthal (1989) [75,77]. Saudi Arabia’s increasing institutional maturity, improved innovation policies, and human capital investments suggest that the country is progressively strengthening the mechanisms through which R&D and technology adoption translate into sustainable digital economic growth. While studies like [79] caution that institutional deficiencies can limit R&D effectiveness, the observed convergence dynamics and robust long-run effects indicate that Saudi Arabia’s digital innovation ecosystem is maturing and capable of sustaining growth.

8. Policy Implications

Based on the empirical findings and theoretical interpretations, several policy implications emerge to support and sustain Saudi Arabia’s DEG. First, the positive long-run impact of IoT suggests that policymakers should continue to prioritize investments in IoT infrastructure, particularly through initiatives like Vision 2030 and NEOM. However, to address the observed short-run inefficiencies, government and industry stakeholders must support businesses in overcoming initial adaptation barriers through financial incentives, technical training, and standardized integration frameworks. Similarly, the strong short- and long-run influence of internet penetration calls for continued expansion of high-speed internet access, particularly in rural and underserved areas. Policies should focus on affordability, digital literacy programs, and public–private partnerships to accelerate the diffusion of digital tools and ensure inclusive participation across all segments of society, as framed by the DOI theory.

Furthermore, in addition to demonstrating the co-integration between 5G and DEG, it is also revealed that the error correction term (ECT) behaves in an unusual manner, suggesting structural instability and underlying economic risk. Policymakers thus need to put in place policies to steer solutions to first-order challenges, such as 5G infrastructure roll-out subsidies, regional equitable distribution, and user readiness, thereby smoothing the transition to a 5G-enabled economy. The positive effect of R&D on DEG was consistent across models, suggesting significant room to improve innovation policy, such as by increasing public and private R&D investment, stimulating interaction between academia and business, and incentivizing entrepreneurship in knowledge-intensive industries. Alongside this, we must attract FDI into sectors conducive to technology transfer and innovation. Finally, the negative effect of inflation on DEG underscores the need to ensure macroeconomic stability. Policymakers must take proactive steps to put in place sound fiscal and monetary policies to insulate the digital economy from inflation, while continuing to invest in digital infrastructure. By employing the TOE framework and RBV theory to guide the implementation of government initiatives, the current research will contribute to strengthening the institutions of the economy, thereby fostering innovation capabilities and a resilient digital economy.

9. Conclusions

The primary objective of this study was to investigate the impact of IoT demand on Saudi Arabia’s digital economy. Using linear regression and panel ARDL, the empirical results highlight the role of digital technologies and innovation-related factors in driving Saudi Arabia’s DEG, underpinned by theoretical insights from the TOE framework, the DOI theory, and the Resource-Based View (RBV). The long-run positive impact of the IoT and internet penetration emphasizes the importance of technological readiness, organizational support, and widespread connectivity in fostering digital transformation. These findings reinforce the TOE and DOI perspectives, suggesting that institutional commitment, such as through national projects like Vision 2030, and increased access to digital infrastructure, create an enabling environment for economic growth. However, short-run limitations, such as the delayed impact of IoT and unexpected divergence in 5G adoption, signal that innovative outcomes are not always immediate and may face structural or transitional barriers, especially in the early stages of deployment. Moreover, the empirical finding of substantial and long-run contributions of R&D and FDI to DEG supports the RBV’s proposition that a competitive and resilient digital economy depends on the productivity of its internal capabilities and strategic resources. Simultaneously, the negative impacts of inflation highlight the fragility of digital transformation processes to context and macroeconomic volatility, which, in line with TOE’s environmental dimension, cannot be controlled at the organizational level. The differences in ECT results stemming from 5G adoption and related industries call for future research and consideration of their associated businesses, as the shock to 5G implementation in developing countries requires a better approach to infrastructure and organizational readiness for new technologies.

10. Limitations of the Study

Although this study provides important insights into the impact of IoT demand on the digital economy of Saudi Arabia by applying linear regression and panel ARDL models, a few limitations should be noted. While the methodology used captures both short- and long-run effects, it may not do justice to the complex, nonlinear interactions underlying digital technology adoption, especially for all-seeing technologies like 5G. The limitations of existing data will likely hinder the accuracy and extent of these results. Moreover, the study relies on macroeconomic indicators and does not address micro-level or firm-specific dynamics, which could yield valuable insights into organizational readiness and user adoption patterns.

11. Future: Research Directions

Future studies need to investigate sector-level effects of IoT adoption, use firm-level datasets to assess organizational readiness, and employ advanced modeling techniques to gain deeper insights. Studies can also integrate TOE, DOI, and RBV frameworks, investigate structural challenges to 5G adoption, and regional comparisons to position Saudi Arabia’s digital agenda within the GCC.

Author Contributions

S.M.S.: Formal Analysis; Conceptualization, Data curation, and Software Project Administration. M.A.A.: Writing—original draft. S.H.S.: Methodology and reviewing. All authors have read and agreed to the published version of the manuscript.

Funding

This study is supported via funding from Prince Sattam bin Abdulaziz University project number (PSAU/2025/02/33648).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used in preparing this manuscript are available from the corresponding author upon reasonable request.

Acknowledgments

The authors extend their appreciation to Prince Sattam bin Abdulaziz University for funding this research work through the project number (PSAU/2025/02/33648).

Conflicts of Interest

The authors declare that they do not have any conflicts of interest.

Correction Statement

This article has been republished with a minor correction to the Acknowledgments. This change does not affect the scientific content of the article.

References

- Atzori, L.; Iera, A.; Morabito, G. The Internet of Things: A survey. Comput. Netw. 2010, 54, 2787–2805. [Google Scholar] [CrossRef]

- Chataut, R.; Phoummalayvane, A.; Akl, R. Unleashing the power of IoT: A comprehensive review of IoT applications and future prospects in healthcare, agriculture, smart homes, smart cities, and industry 4.0. Sensors 2023, 23, 7194. [Google Scholar] [CrossRef]

- Saudi Vision. Vision 2030 Kingdom of Saudi Arabia. 2016. Available online: https://www.vision2030.gov.sa/ (accessed on 12 February 2025).

- International Trade Administration. Saudi Arabia—Information and Communications Technology (ICT); U.S. Department of Commerce: Washington, DC, USA, 2023. [Google Scholar]

- McKinsey Global Institute. The Internet of Things: Catching up to an Accelerating Opportunity; McKinsey & Company: New York, NY, USA, 2018. [Google Scholar]

- Cheng, G.; Zhang, W.; Zhao, Y. Unleashing the power of industrial robotics on firm productivity. J. Econ. Behav. Organ. 2024, 224, 500–520. [Google Scholar] [CrossRef]

- Brous, P.; Janssen, M.; Herder, P. The dual effects of the Internet of Things (IoT): A systematic review of the benefits and risks of IoT adoption by organizations. Int. J. Inf. Manag. 2020, 51, 101952. [Google Scholar] [CrossRef]

- Alhussain, T.; Drew, S. Employees’ perceptions of biometric technology adoption in e-government: An exploratory study in the Kingdom of Saudi Arabia. Int. J. Electron. Gov. Res. 2010, 6, 39–57. [Google Scholar] [CrossRef]

- Alsheibani, S.; Messom, C.; Cheung, Y. Re-thinking the competitive landscape of artificial intelligence. In Proceedings of the PACIS 2020: 24th Pacific Asia Conference on Information Systems (PACIS), Dubai, United Arab Emirates, 20–24 June 2020; Available online: https://www.researchgate.net/publication/339020229_Re-thinking_the_Competitive_Landscape_of_Artificial_Intelligence (accessed on 10 February 2025).

- Rogers, E.M.; Singhal, A.; Quinlan, M.M. Diffusion of innovations. In An Integrated Approach to Communication Theory and Research; Routledge: London, UK, 2014; pp. 432–448. [Google Scholar]

- Tornatzky, L.G.; Fleischer, M. The Processes of Technological Innovation; Lexington Books: Lexington, KY, USA, 1990. [Google Scholar]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Abubakr, A.A.M.; Khan, F.; Mohammed, A.A.A.; Abdalla, Y.A.; Mohammed, A.A.A.; Ahmad, Z. Impact of AI applications on corporate financial reporting quality: Evidence from UAE corporations. Qubahan Acad. J. 2024, 4, 782–792. [Google Scholar] [CrossRef]

- Edquist, H.; Goodridge, P.; Haskel, J. The Internet of Things and economic growth in a panel of countries. Econ. Innov. New Technol. 2021, 30, 262–283. [Google Scholar] [CrossRef]

- Lee, C.C.; He, Z.W.; Yuan, Z. A pathway to sustainable development: Digitization and green productivity. Energy Econ. 2023, 124, 106772. [Google Scholar] [CrossRef]

- Khan, A.A.; Hidthir, M.H.B.; Mansur, M.; Ahmad, Z. Role of financial inclusion in enhancing the effect of remittance on economic growth in developing countries. Cogent Econ. Financ. 2025, 13, 2476093. [Google Scholar] [CrossRef]

- Qiang, C.Z.W.; Rossotto, C.M.; Kimura, K. Economic impacts of broadband. In Information and Communications for Development 2009: Extending Reach and Increasing Impact; World Bank: Washington, DC, USA, 2009; pp. 35–50. [Google Scholar]

- Habibi, F.; Zabardast, M.A. Digitalization, education, and economic growth: A comparative analysis of Middle East and OECD countries. Technol. Soc. 2020, 63, 101370. [Google Scholar] [CrossRef]

- Deloitte. Broadband and Jobs: The Economic Benefits of Expanded Broadband Access; Deloitte: London, UK, 2014. [Google Scholar]

- bin Hidthiir, M.H.; Ahmad, Z.; Lun, L.K.; Mansur, M.; Abubakr, A.A.M.; Sahal, M.S.G. Determinants of Government Debt in ASEAN-5 Nations: An ARDL Analysis of Economic Factors. Qubahan Acad. J. 2024, 4, 250–267. [Google Scholar] [CrossRef]

- Bin Hidthir, M.H.; Khan, A.A.; Junoh, M.Z.M.; Yusof, M.F.B.; Ahmad, Z. Development of the Financial Composite Index for MENA Region: A Two-Staged Principal Components Analysis. SAGE Open 2025, 15, 21582440251320484. [Google Scholar] [CrossRef]

- Patwary, M.N.; Nawaz, S.J.; Rahman, M.A.; Sharma, S.K.; Rashid, M.M.; Barnes, S.J. The potential short- and long-term disruptions and transformative impacts of 5G and beyond wireless networks: Lessons learnt from the development of a 5G testbed environment. IEEE Access 2020, 8, 11352–11379. [Google Scholar] [CrossRef]

- Oughton, E.J.; Lehr, W. Surveying 5G techno-economic research to inform the evaluation of 6G wireless technologies. IEEE Access 2022, 10, 25237–25257. [Google Scholar] [CrossRef]

- Al-Amatullah, I.; Ahmad, Z.; Hidthiir, M.H.B.; Mansur, M.; Ali, M.A. Examining macroeconomic drivers of inflation: Evidence from panel ARDL and wavelet coherence approaches. Asian Econ. Financ. Rev. 2025, 15, 1978–1999. [Google Scholar]

- Herzer, D. The impact of domestic and foreign R&D on TFP in developing countries. World Dev. 2022, 151, 105754. [Google Scholar] [CrossRef]

- Lai, Y.L.; Lin, F.J.; Lin, Y.H. Factors affecting firm’s R&D investment decisions. J. Bus. Res. 2015, 68, 840–844. [Google Scholar]

- Becker, B. Public R&D policies and private R&D investment: A survey of the empirical evidence. J. Econ. Surv. 2015, 29, 917–942. [Google Scholar]

- Edquist, H.; Henrekson, M. Technological breakthroughs and productivity growth. In Research in Economic History; Emerald Group Publishing Limited: Bingley, UK, 2006; pp. 1–53. [Google Scholar]

- Hidthiir, M.H.B.; Ahmad, Z.; Junoh, M.Z.M.; Yusof, M.F.B. Dynamics of economic growth in ASEAN-5 countries: A panel ARDL approach. Discover Sustainability 2024, 5, 145. [Google Scholar] [CrossRef]

- Albiman, M.M.; Sulong, Z. The linear and non-linear impacts of ICT on the economic growth of disaggregate income groups within the SSA region. Telecommun. Policy 2017, 41, 555–572. [Google Scholar] [CrossRef]

- Coccia, M. Public and private R&D investments as complementary inputs for productivity growth. Int. J. Technol. Policy Manag. 2010, 10, 73–91. [Google Scholar] [CrossRef]

- Manyika, J.; Roxburgh, C. The great transformer: The impact of the Internet on economic growth and prosperity. McKinsey Glob. Inst. 2011, 1, 1–9. [Google Scholar]

- Isa, M.Y.; Bahaman, M.A.; Ahmad, Z.; Islamkulov, A.; Ahmed, M. Impact of global boycotts on Israeli goods: Evidence from Islamic and non-Islamic countries using an event study approach. Asian Econ. Financ. Rev. 2025, 15, 1111–1124. [Google Scholar] [CrossRef]

- Man, J.; Liu, J.; Cui, B.; Sun, Y.; Sriboonchitta, S. Coupling and coordination between the digital economy and urban-rural integration in China. Sustainability 2023, 15, 7299. [Google Scholar] [CrossRef]

- Kalenyuk, I.; Bohun, M.; Djakona, V. Investing in intelligent smart city technologies. Balt. J. Econ. Stud. 2023, 9, 41–48. [Google Scholar] [CrossRef]

- Karhan, G. Investing in research and development for technological innovation: A strategy for Turkey’s economic growth. J. Bus. Econ. Options 2019, 2, 152–158. [Google Scholar]

- Das, R.C.; Mukherjee, S. Does spending on R&D influence income? An enquiry on the world’s leading economies and groups. J. Knowl. Econ. 2020, 11, 1295–1315. [Google Scholar]

- Saleem, H.; Shabbir, M.S.; Bilal Khan, M. The short-run and long-run dynamics among FDI, trade openness, and economic growth: Using a bootstrap ARDL test for co-integration in selected South Asian countries. South Asian J. Bus. Stud. 2020, 9, 279–295. [Google Scholar] [CrossRef]

- Williams, L.D. Concepts of digital economy and Industry 4.0 in intelligent and information systems. Int. J. Intell. Netw. 2021, 2, 122–129. [Google Scholar] [CrossRef]

- Ashton, K. That ‘Internet of Things’ thing. RFID J. 2009, 22, 97–114. [Google Scholar]

- Communications, Space & Technology Commission. Internet of Things Indicators and Adoption Report; CST: Riyadh, Saudi Arabia, 2023. Available online: https://www.cst.gov.sa (accessed on 10 February 2025).

- Zhang, S.; Li, F.; Xiao, J.J. Internet penetration and consumption inequality in China. Int. J. Consum. Stud. 2020, 44, 407–422. [Google Scholar] [CrossRef]

- Pawlak, R.; Krawiec, P.; Żurek, J. On measuring electromagnetic fields in 5G technology. IEEE Access 2019, 7, 29826–29835. [Google Scholar] [CrossRef]

- Shirui, Z.; Mansur, M.; Hidthiir, M.H.B.; Ahmad, Z.; Abubakr, A.A.M. The impact of digital financial inclusion on household financial vulnerability in China: An empirical study based on CFPS. Asian Econ. Financ. Rev. 2025, 15, 1834–1853. [Google Scholar] [CrossRef]

- Li, R.; Gospodarik, C.G. The impact of digital economy on economic growth based on Pearson correlation test analysis. In International Conference on Cognitive-Based Information Processing and Applications (CIPA 2021); Springer: Singapore, 2021; Volume 2, pp. 19–27. [Google Scholar]

- Jäntschi, L.; Pruteanu, L.L.; Cozma, A.C.; Bolboacă, S.D. Inside of the linear relation between dependent and independent variables. Comput. Math. Methods Med. 2015, 2015, 360752. [Google Scholar] [CrossRef]

- Ogwuru, H.O.R.; Okolie, D.O.; Okolie, J.I. Economic openness, institutional quality and per capita income: Evidence from the Economic Community of West African States (ECOWAS). Res. Pap. Econ. Financ. 2022, 6, 50–67. [Google Scholar]

- Elliott, G.; Rothenberg, T.J.; Stock, J.H. Efficient tests for an autoregressive unit root. Econometrica 2008, 64, 813–836. [Google Scholar] [CrossRef]

- Karabiyik, L.; Agarwal, A.; Sen, T. Panel data econometrics in development research: The case for developing countries. J. Dev. Econ. Stat. 2019, 2, 44–59. [Google Scholar]

- Behera, S.R.; Dash, D.P.; Khamari, N.K. Revisiting the energy-growth nexus in BRICS nations: Evidence from the panel ARDL approach. Energy Rep. 2020, 6, 621–627. [Google Scholar] [CrossRef]

- Nkoro, E.; Uko, A.K. Autoregressive Distributed Lag (ARDL) cointegration technique: Application and interpretation. J. Stat. Econom. Methods 2016, 5, 63–91. [Google Scholar]

- Rahman, M.M.; Islam, M.R. Dynamic relationship between financial development and economic growth in Bangladesh: Evidence from ARDL and ECM approaches. Int. J. Econ. Financ. Issues 2020, 10, 210–216. [Google Scholar]

- Saliah, S.M.; Nadarajan, S.; Teong, L.K. The influencing factors of sustainable procurement category management process in the MSMEs in the state of Tamil Nadu, India: Using PRISMA and AHP. Int. J. Procure. Manag. 2024, 21, 302–323. [Google Scholar] [CrossRef]

- Al-Mansour, J.F.; Al-Ajlan, S.A.; Al-Khalifa, H.S. Adoption of Internet of Things (IoT) in Saudi Arabia: An empirical study. Int. J. Adv. Comput. Sci. Appl. 2022, 13, 452–460. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development. Digital Economy Report 2019: Value Creation and Capture—Implications for Developing Countries; UNCTAD: Geneva, Switzerland, 2019; Available online: https://unctad.org/publication/digital-economy-report-2019 (accessed on 12 February 2025).

- World Bank. World Development Report 2021: Data for Better Lives; World Bank Publications: Washington, DC, USA, 2020; Available online: https://www.worldbank.org/en/publication/wdr2021 (accessed on 9 February 2025).

- Hossain, M.S.; Kim, J. Impact of 5G technology on the digital economy: Early-stage challenges and future perspectives. J. Bus. Res. Technol. 2021, 12, 45–59. [Google Scholar]

- Lee, H.; Park, J.; Shin, Y. Short-term economic impact of 5G deployment: Evidence from early adopters. Telecommun. Policy 2020, 44, 102030. [Google Scholar]

- Organisation for Economic Co-operation and Development (OECD). Main Science and Technology Indicators; OECD Publishing: Paris, France, 2018; Available online: https://www.oecd.org/sti/msti.htm (accessed on 12 February 2025).

- Ghosh, S. R&D investment and its impact on digital economic growth in emerging markets. Int. J. Innov. Econ. 2020, 32, 211–225. [Google Scholar]

- Li, L.; Su, F.; Zhang, W.; Mao, J.Y. Digital transformation by SME entrepreneurs: A capability perspective. Inf. Syst. J. 2020, 30, 393–420. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Sharma, R. Modeling the internet of things adoption barriers in food retail supply chains. J. Retail. Consum. Serv. 2021, 58, 102303. [Google Scholar] [CrossRef]

- Zhou, Y.; Chong, A.Y.L. Understanding the impact of IoT adoption on operational performance: A process-oriented view. Ind. Manag. Data Syst. 2019, 119, 1846–1866. [Google Scholar]

- Saliah, S.M.; Nadarajan, S.; Teong, L.K. Procurement Category Management Process: Alignment to Industry 4.0. Seybold Rep. 2023, 18, 1628–1638. [Google Scholar]

- Yoo, S.; Park, J.; Kim, B. Economic impact of IoT diffusion: Error correction modeling from a cross-country panel data. Telecommun. Policy 2020, 44, 101968. [Google Scholar]

- Farrell, D. The Internet’s Contribution to U.S. Productivity Growth; McKinsey Global Institute: New York, NY, USA, 2007. [Google Scholar]

- Niebel, T. ICT and economic growth—Comparing developing, emerging, and developed countries. World Dev. 2018, 104, 197–211. [Google Scholar] [CrossRef]

- Vu, K.M. Internet infrastructure and economic development: A cross-country analysis. Telemat. Inform. 2020, 55, 101451. [Google Scholar] [CrossRef]

- Katz, R.; Callorda, F. How broadband services contribute to economic growth in Latin America. Telecommun. Policy 2021, 45, 102091. [Google Scholar] [CrossRef]

- Muthinja, M.M.; Chipeta, C. What drives financial innovation in Kenya’s commercial banks? Afr. J. Econ. Manag. Stud. 2018, 9, 287–307. [Google Scholar]

- Zhao, Z.; Li, Y.; Wang, S. The economic impact of 5G: A review of current evidence and future implications. Telecommun. Policy 2021, 45, 102166. [Google Scholar] [CrossRef]

- Chhetri, B.; Sharma, S.K.; Adhikari, R. 5G and digital innovation: Exploring the linkages in developing economies. Inf. Syst. Front. 2022, 9, 47–58. [Google Scholar]

- GSMA. The Mobile Economy 2020; GSM Association: London, UK, 2020; Available online: https://www.gsma.com/mobileeconomy/ (accessed on 9 February 2025).

- International Telecommunication Union (ITU). Economic impact of 5G Infrastructure Investment and Deployment; ITU Publications: Geneva, Switzerland, 2021; Available online: https://www.itu.int/en/publications (accessed on 12 February 2025).

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Griliches, Z. R&D and Productivity: The Econometric Evidence; University of Chicago Press: Chicago, IL, USA, 1998. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Innovation and learning: The two faces of R&D. Econ. J. 1989, 99, 569–596. [Google Scholar] [CrossRef]

- De Gregorio, J. Economic growth in Latin America. J. Dev. Econ. 1992, 39, 59–84. [Google Scholar] [CrossRef]

- Coe, D.T.; Helpman, E. International R&D spillovers. Eur. Econ. Rev. 1995, 39, 859–887. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).