Abstract

Existing research has focused chiefly on the impact of artificial intelligence (AI) on economic growth. This study developed an AI dictionary using machine learning methods. Based on data from 3646 Shanghai- and Shenzhen-listed A-share companies from 2011 to 2022 and a panel mediation effect model, the relationships between AI application, human capital structure adjustment, and corporate ESG performance were examined. Theoretical research suggests that when corporates adopt AI, demand for high-skilled labor will increase while some low-skilled positions will be replaced. This leads to optimization of the human capital structure, which in turn improves corporate ESG performance. The results of the mechanism examination show that enhancing corporate ESG performance through AI use is achieved by modifying the human capital structure. Analysis of heterogeneity finds that for non-state-owned, large-sized, and non-technology-intensive corporates, the impact of AI applications on corporate ESG performance is more pronounced. This research further deepens the understanding of AI’s role in the corporate governance process at the micro-corporate level and offers suggestions to promote the development of AI technology.

1. Introduction

With the rapid development of new-generation digital technologies such as big data, blockchain, and artificial intelligence (AI), the deep integration of AI with traditional industries is driving unprecedented economic changes. The term AI application refers to the practical process and results of combining machine learning, deep learning, natural language processing, computer vision, speech recognition, and other AI technologies with specific scenarios and industry needs, and achieving specific functional goals and solving practical problems through algorithm model development, system integration, or tool implementation. Undoubtedly, AI will bring profound changes to production methods and relations, mainly reflected in the adaptive adjustment of corporate human capital structure under the framework of labor relations. The iterative advancement of AI technology has made the need for collaboration between capital and highly skilled talent increasingly urgent. Therefore, the optimization path of corporate human capital structure is worth exploring in depth. The technological progress represented by AI and the widespread application of intelligent devices can directly replace many routine, repetitive tasks, thereby increasing the proportion of high-skilled labor within corporates. The rational adjustment of an corporate’s human capital structure helps it accumulate more high-skilled human capital. When the corporate human capital structure changes, its operational efficiency, environmental awareness, and governance capabilities can improve. Therefore, the indirect application of AI significantly impacts the corporate ESG (environmental, social, and corporate governance) performance. Based on this, relevant research focuses on whether AI will increase the demand for high-skilled labor in corporates and, through adjustments to the human capital structure, ultimately improve corporate ESG performance. AI technology’s large-scale penetration of corporates is a recent phenomenon. This study not only reveals the impact of AI on corporate ESG performance but also deeply analyzes the basic principles of optimizing the labor structure in the context of the rise of AI, as well as the specific role of this structural optimization in corporate ESG performance.

AI is a product that emerged with digital transformation. Digitization is the process of collecting and analyzing large amounts of data, converting information into digital formats, and utilizing digital technology to reshape and transform business processes for more efficient, intelligent, and innovative development. In the age of AI, greater demands are placed on human capital, and corporates also need to incorporate new AI technologies into employees’ work processes. Businesses need to transform and recalibrate due to AI, which upgrades production technology, leading to increased investments in corporate capital and skilled labor. For instance, to boost the application and growth of AI technology, companies will experience an increased demand for AI professionals. This will prompt them to raise salaries and perks to attract the best talent. At this stage, the AI employed by corporates enhances their human capital structure by eliminating certain types of unskilled labor, thus affecting their ESG performance. Consequently, an investigation has been carried out to understand how the application of AI has influenced the adjustment of the human capital structure and the ESG performance of corporates. Specifically, the theoretical connection between AI, the adjustment of human capital structure, and corporate ESG performance were initially analyzed by reviewing the current literature. Subsequently, panel data from 3646 Chinese A-share listed companies from 2011 to 2022 were matched to ensure consistency in research methodology. An empirical examination was then carried out to assess the influence of AI adoption on corporate ESG performance in terms of human capital structure modification. The findings indicate that the application of AI boosts the demand for highly skilled labor and reduces the need for some low-skilled labor, thus refining the human capital structure and enhancing ESG performance. The results of the mechanism test indicate that adjusting the human capital structure due to AI application leads to an elevation in corporate ESG performance. Analysis of heterogeneity indicates that for non-state-owned, large-sized, and non-technology-intensive corporates, the influence of AI adoption on ESG performance is more prominent.

The existing research related to this paper mainly involves two aspects: The influencing factors of corporate ESG performance and the economic consequences of AI application. Against the backdrop of the rapid development of AI in China, the requirements for sustainable development offer attractive prospects for investigating the impact of AI implementation on corporate ESG performance. Using text recognition, an index that comprehensively reflects the degree of AI utilization in Chinese listed companies is established. Subsequently, an exploration is carried out regarding the impact and underlying mechanism of AI on corporate ESG performance. Unlike the current research, this study makes three incremental contributions.

First, it expands the investigation of AI application at the corporate level. In the past, research endeavors mainly centered on investigating the effect of automation and the digital economy on economic development or technological innovation at the macro level of countries or industries (Arntz et al., 2016; Acemoglu and Restrepo, 2018; Myovella et al., 2020; Zhang et al., 2024; Gao et al., 2025) [1,2,3,4,5]. Nonetheless, the direct influence of AI on companies’ ESG performance at the micro level has not been explored. Unlike previous studies on corporate human capital structure, this research reveals the economic consequences of AI implementation at the micro level. Meanwhile, focusing on the informatization, automation, and intelligent features enabled by AI implementation, this study explores how AI upgrades the corporate human capital structure and enhances the impact of AI use and the optimization of the human capital structure on corporate ESG performance. These findings provide micro-level evidence for the changes in the employment structure of the corporate workforce in the context of AI implementation.

Second, this study provides new empirical evidence regarding the improvement of the corporate human capital structure. The adjustment of human capital structure is incorporated into the analytical framework for assessing how AI application impacts corporate ESG performance. At present, a large amount of research has explored the relationship between digital transformation and corporate ESG (e.g., Ren et al., 2023; Wang and Esperança, 2023; Ding et al., 2024) [6,7,8], technological innovation (Lin and Mao, 2023; Niu et al., 2023; Guo et al., 2023; Wang and He, 2024; Ding et al., 2024) [9,10,11,12,13], and economic performance (Li, 2022; Houston and Shan, 2022; Vu et al., 2024) [14,15,16]. Some investigations have also investigated the economic impacts of small-sized corporates’ utilization of digital technology by analyzing particular information technologies such asthe Internet, digital finance, network infrastructure, and AI (e.g., Goldfarb and Tucker, 2019; Kohtamäki et al., 2020; Wu and Huang, 2022; de Clercq et al., 2023; Afolabi, 2023; Alshareef, 2025) [17,18,19,20,21,22]. However, hardly any research has looked into the relationship between AI and corporate ESG performance. Moreover, an in-depth understanding of the way AI affects a firm’s ESG performance by means of modifying the human capital structure has yet to be established.

Furthermore, the results of this study are of practical significance to scholars, practitioners, and policymakers. Economic development is significantly propelled by factors such as human capital and technological innovation (Cinnirella and Streb, 2017; Fonseca et al., 2019) [23,24]. The alterations in the labor structure brought about by the development of the digital economy have drawn the combined attention of the government, industry, and academia. Unlike previous studies that investigated the impact of AI regarding human capital efficiency (Dou et al., 2023) [25], and human capital investment (Liu et al., 2023; He and Chen, 2024) [26,27], this research intends to elaborate on the “labor dividend” issue brought about by corporate AI from the perspective of optimizing human capital structure. This study reveals that AI has increased companies’ demands for highly proficient labor, and this impact varies depending on different corporate, industrial, and regional characteristics. These results provide fresh viewpoints for understanding and evaluating the ESG performance of AI in corporates.

The structure of this study is as follows. Section 2 presents the literature review and frames the hypotheses. Section 3 details the empirical method for hypothesis verification. This includes elements such as model construction, variable measurement, and descriptive statistical examination. Section 4 presents the outcomes of the baseline regression, accompanied by a thorough analysis. In Section 5, tests for robustness and endogeneity are conducted. Section 6 is dedicated to conducting ananalysis of heterogeneity. Finally, this study provides a conclusive review in Section 7.

2. Literature Review and Hypotheses

2.1. AI and Corporate ESG Performance

Over the past few years, scholars have shown increasing interest in matters related to AI technology. Previous studies have concentrated on the economic consequences of AI adoption, mainly regarding economic effects, technological progressions, and corporate performance. Numerous studies have typically confirmed a positive relationship between technological innovation and total factor productivity (TFP) from macro or industry perspectives (Czernich et al., 2011; Haller and Lyons, 2015; Erik and McElheran, 2016; Ford, 2018; Aldashev and Batkeyev, 2021; Mwananziche et al., 2023) [28,29,30,31,32,33]. After categorizing patents into invention and non-invention patents, Li et al. (2023) found that the influence of technological innovation is more prominent in promoting radical innovation [34]. Employing panel fixed-effects models and mediation analysis, the results shows that AI technological innovation has significantly improved the efficiency of production tools, and production tools have entered the Intelligent Era (Yang and Yang, 2025) [35]. Intelligent hardware collects the data through interconnection. At the same time, software carries out analysis and makes determinations in accordance with program directives, improving the overall efficiency of the corporate by reducing costs.

As stated by Cai et al. (2023), for businesses, AI technology acts as a vital path for discovering new production methods, cultivating new productive forces, and generating new economic models [36]. The pace of corporate digital transformation can be accelerated by making use of AI. Traditional manufacturing corporates can be converted into intelligent manufacturing ones by making use of emerging technologies such as AI, big data, cloud computing, and blockchain (Zhuo and Chen, 2023) [37]. Furthermore, the performance of ESG can be improved by drawing in highly proficient labor (Yu, 2024) [38]. AI provides new business models for corporates, effectively promoting the growth of corporate value (Zhang et al., 2023; Nguyen et al., 2023) [39,40]. Concurrently, Zhang and Yang (2024) argue that there is a significant positive link between the adoption of AI and corporate ESG performance [41]. AI improves ESG performance both directly and indirectly by enhancing firms’ ability to absorb and utilize sustainability knowledge. Based on the research results of Xu and Song (2025), the speed at which AI-driven innovations increase TFP is 40 times greater than that of ordinary patents [42].

Typically, the utilization of AI can accelerate the informatization process of businesses. Traditional manufacturing corporates can be converted into smart manufacturing entities by making use of information technologies such as big data, cloud computing, and the Internet. This could enhance their technological innovation and finally result in enhanced ESG performance. As a result, the following hypotheses are proposed:

H1:

AI application can effectively improve corporate ESG performance.

2.2. AI, Human Capital Structure Adjustment, and Corporate ESG Performance

In the age of AI, human resources have become the most competitive and unique assets for companies. Innovation and economic transformation are significantly propelled by AI. Through the combination of big data, cloud computing, blockchain, and other means, common technologies are transformed into specialized ones that are crucial for sustainable development. This leads to more rigorous requirements for the overall abilities of the workforce, covering knowledge reserves and professional skills. Several researchers have pointed out that AI acts as a key element in facilitating the adjustment of the corporate human capital structure (Alex et al., 2022) [43]. With the elevation of the human capital level in corporates, first-rate knowledge assets along with human resources will be integrated into the processes of product production and business operations. This combination leads to immediate technological diffusion effects and enhances corporates’ ability to innovate. Meanwhile, high-caliber human capital is characterized by greater innovation capabilities and superior ESG performance. This can significantly enhance the financial performance of corporates (Zaborovskaia, 2020; Ran et al., 2023; Zhang et al., 2024) [44,45,46].

While corporates are implementing AI, automated machinery and equipment are gradually taking over some repetitive tasks. It can be seen that companies have a reduced need for workers with lower skill levels, leading to a decrease in the number of people performing repetitive jobs. It is apparent that after the deployment of AI, a large part of the production workforce in corporates is replaced, and there is a corresponding increase in the specialization degree of labor elements. With the adoption of digital technology, there is a growing need for workers with a high level of education, thus indicating a more sophisticated human capital setup in companies. When looking at the growth happening in the complex value chain networks of corporates, an increase in the levels of labor specialization can also be seen. Examples show that due to the combination of various value chain connections, the enhancement of business operations, the decrease in production and transaction expenses, the refinement of investment decision-making procedures (Adeoye et al., 2024) [47], and the strengthened innovation capabilities of corporates are the outcomes of collaboration among highly skilled labor forces with expertise. This outcome leads to a reduction in production expenses and simultaneously enhances operational effectiveness (Troise et al., 2022; Li et al., 2022; Chen and Tian, 2022) [48,49,50].

Specifically, it is evident that the incorporation and implementation of AI reduce the costs related to meeting social obligations while enhancing the efficiency of performing these tasks; as a result, tangible incentives for improving ESG performance are provided. corporates make use of digital technologies including big data analytics, blockchain frameworks, and cloud-based computing services. Evidently, these technological facilitators contribute to enhancing the investment capabilities of companies and help improve the governance mechanisms within corporate setups, thus driving progress in corporate ESG metrics (Yin et al., 2023) [51]. As a result, businesses are driven to actively explore this specific area. After the application of AI, it can be seen that the percentage of technical staff within the organization increases (Li et al., 2023) [52]. Consequently, it is essential to promptly execute strategic realignment and regular enhancement of existing human resources to effectively navigate the intricacies and uncertainties brought about by digital transformation. An eagerness for qualitative enhancements emerges from this restructuring of human capital makeup; the effectiveness of resource distribution spreads across corporate arenas, strengthening the core competitive edge. Apparently, enhanced human capital enables better efficiency in the allocation of innovation resources within corporates. As businesses comprehensively enhance their human resource configurations and profit indicators and maintain stable financial states, they effectively demonstrate enhanced ESG performance. In light of this, it is necessary to introduce a mediation effect model to test the mechanism of AI application, human capital structure, and corporate ESG performance. The methodological principle of the mediation effect model comes from the research of Baron & Kenny (1986) [53]. Based on the above analysis, the following hypothesis is put forward for testing:

H2:

AI application positively affects corporate ESG performance via human capital structure adjustment.

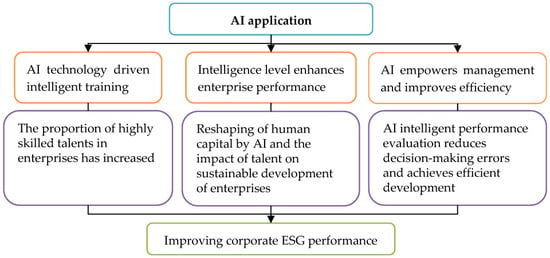

This paper summarizes the theoretical mechanisms by which AI application affects corporate ESG performance via human capital structure in Figure 1.

Figure 1.

Theoretical framework.

3. Methodology

3.1. Model Design

To verify the research hypothesis, we construct the following model:

In Equations (1) and (2), esgit represents corporate ESG performance in the t-th period; AIit represents corporate AI application in the t-th period; capitalit represents human capital structure adjustment in the t-th period. We also introduce a series of corporate characteristics as control variables into the model, which are represented as Xit. The controlled variables include corporate size (sizeit), corporate profitability (roait), corporate asset–liability ratio (debtit), Tobin’s Q (tobinit), corporate current ratio (currentit), corporate ownership concentration (ownershipit), corporate innovation (innovationit), corporate financial assets (financeit), and corporate age (ageit). Subscripts i and t denote individual and time; γi and δt are individual and time fixed effects; εit is the random error term.

In addition to the direct effects reflected in Equations (1) and (2), we also examine the mechanisms by which AI affects corporate ESG performance through human capital structure adjustment, then construct the following models:

In Equation (3), α1 and α2 are the regression coefficients; capitalit represents human capital structure adjustment in the t-th period. Other variables and symbols have the same meanings as Equations (1) and (2). In the empirical section, we will use Stata 16.0 for regression analysis.

3.2. Variables

3.2.1. Dependent Variables

Corporate ESG performance (esg). The ESG performance of an corporate represents a new evaluation system which focuses on the sustainable development of corporates based on three facets—the overall environment, social responsibility, and corporate governance. The ESG performance of the corporate was measured by selecting the ESG rating results of listed companies released by Huazheng. Shanghai Huazheng Index Information Service Co., Ltd. (Shanghai, China) (referred to as the “Huazheng Index”) is one of the main institutions for ESG rating in China. Its ESG rating data can be traced back to 2009, making it the longest traceable ESG rating system in the domestic market. Huazheng’s ESG index rating system arranges a three-level index system from top to bottom. More specifically, there are 3 main indicators, 14 sub-indicators, 26 tertiary indicators, and more than 130 underlying data indicators. ESG performance is evaluated through quarterly regular evaluations and dynamic tracking, with nine ratings ranging from “AAA” to “C” assigned from best to worst.

3.2.2. Independent Variables

AI (AI): We use machine learning methods to generate an AI dictionary and then construct corporate AI indicators based on annual reports and patent texts of listed companies. As we know, simply considering whether a corporation has implemented an AI strategy or utilized specific information technologies to describe AI may overlook a significant amount of information (Lei et al., 2025; Wang et al., 2025) [54,55]. This makes measuring a corporation’s AI usage challenging. Existing research mainly measures the application of artificial intelligence from the perspectives of industrial robot penetration, robot quantity, keyword frequency, and the number of artificial intelligence patent applications. Considering the high credibility and timeliness of textual information in corporate annual reports, it can comprehensively capture the technical application details and implementation effects in the production and operation scenarios of corporates. The AI of corporates has given rise to new business models, which require the help of technological progress and the widespread application of intelligent devices. Technological progress and the widespread application of intelligent devices will improve the ESG performance of corporate employees and enhance internal management efficiency. For this purpose, referring to the Chinese translation of AI-related terms provided by Chen and Srinivasan(2023) [56], the “Science and Technology Innovation Board Series—AI Industry Chain Panorama” published by Ping An Securities, the “2019 China AI Industry Market Outlook Research Report” compiled by the China Industry Research Institute, the “2019 AI Industry Status and Development Trends Report” published by Shenzhen Forward Industry Research Institute, and the AI vocabulary provided by the World Intellectual Property Organization (WIPO), 52 words were manually selected as seed words. Referring to Li et al. (2021) [57], the Word2Vec technique was used (Mikolov et al., 2013) [58], and Skip gram model was adopted to train words from annual reports and patent text materials as a corpus. Based on the cosine similarity between the seed words and the output words, we selected 10 words with the closest semantic degree to each seed word. Then, repeated words, words unrelated to AI, and words with a low frequency were removed, and a total of 73 words (e.g., AI, AI products, AI chips, machine translation, and machine learning) were obtained as the AI dictionary for this paper (see Table 1). On this basis, we used Python 3.12 to extract keywords from financial reports of listed companies.

Table 1.

Construction of AI application variable and keywords.

3.2.3. Mechanism Variables

Human capital structure adjustment (capital). The educational attainment of the workforce, which serves as an indicator of skill levels, can be used to measure this variable. The application of AI has a substitution effect on conventional and repetitive labor positions, thereby reducing the demand for conventional low-skilled labor in corporates and increasing the demand for non-conventional highly skilled labor to exert the productivity effect of AI. Generally, workers with a high educational background usually require more sophisticated skills for their jobs. On the contrary, individuals with a lower level of educational achievement generally undertake routine tasks that are highly substitutable. The skill level is measured by the educational attainment of corporate employees. To put it more accurately, the optimization of a company’s human capital composition is characterized by a higher proportion of employees with a bachelor’s degree or above among the total number of employees.

3.2.4. Control Variables

The control variables in this study include the following considerations. Corporate size (size) is measured by the total number of employees. Corporate profitability (roa) is measured by the ratio of corporate net profit to total assets. Corporate asset–liability ratio (debt) is measured by the ratio of corporate total liabilities to its total assets. Tobin’s Q (tobin) is measured by the ratio of shareholder equity to the corporate market value. Corporate current ratio (current) is measured by the ratio of current assets to total assets. Corporate ownership concentration (ownership) is measured by the sum of the shareholding ratios of the top 5 major shareholders (Unit: %). Corporate innovation (innovation) is measured by the R&D input (Unit: Yuan). To assess corporate financial assets (finance), we measure the sum of corporate monetary funds, held-to-maturity investments, trading financial assets, real estate investment, financial assets available for sale, long-term equity investments, dividends receivable, and interest receivable (Unit: Yuan). Corporate age (age) is calculated based on the year of the corporation’s establishment. Table 2 shows the definition of variables.

Table 2.

Definition of variables.

3.3. Data Description and Descriptive Statistics

This paper uses panel datasets of listed corporates on the Shenzhen and Shanghai Stock Exchanges in China. Considering data availability and comparability, the selection criteria are as follows. (1) Missing important statistical data are deleted. (2) We exclude four financial industries, including ST and PT listed corporates, banking, insurance, and securities. (3) We fill in partial missing data using linear interpolation. It should be noted that this study will exclude financial corporates(such as banks, securities, insurance, etc.) from the sample, which is a common practice in academia and industry. The core reason is that there are fundamental differences between financial and non-financial corporates in terms of business nature, financial structure, regulatory environment, etc. These differences will seriously interfere with the logic of empirical analysis, the accuracy of variable measurement, and the effectiveness of conclusions. Notably, this study’s data are manually collected and organized from the China Stock Market & Accounting Research (CSMAR) database, Wind database and listed corporates’ annual reports. The final sample contains 3646 listed corporates and 22,056 observations from 2011 to 2022. The descriptive statistics of variables are presented in Table 3.

Table 3.

Descriptive statistics.

We can see from Table 3 that the average ESG performance of corporates is 4.1992, ranging from 1 to 8, with a standard deviation of only 0.9557, indicating a relatively concentrated distribution of values. The average AI application is 4.4533, but the maximum value reaches 334 with a standard deviation of 14.0195, indicating that a small number of samples have extremely high AI levels. The average value of human capital structure adjustment is 28.1373, ranging from 0 to 100, with a standard deviation of 21.9153. From the perspective of controlling variables, the mean corporate size is 6972, with a minimum value of 28 and a maximum value of 570,060, and a standard deviation of 22,694.37, indicating a significant difference in sample size. The average debt level is 0.4108, with a maximum value of 31.4667, and a few samples have debt levels much higher than the average. The average shareholding ratio of shareholders is 54.0279 (equity ratio), ranging from 7.8073 to 99.23, with a standard deviation of 15.0099. The top five shareholders’ shareholding ratios are concentrated around 54%. The mean value of the corporate innovation variable is 291 million, with a minimum value of 1 and a maximum value of 738 million, and a standard deviation of 13.3 billion, indicating a significant difference in corporate innovation investment.

4. Empirical Results

4.1. Baseline Regression Analysis

First, Table 4 presents the baseline results regarding how the use of AI application impacts corporate ESG performance. The findings suggest that the implementation of AI can boost corporate ESG performance. After integrating all control variables, the data presented in Columns (1)–(4) show regression coefficients of 0.0138, 0.0132, 0.0133, and 0.0138, respectively, all of which reach significance at the 1% level. Viewed from an economic perspective, taking Column (1) as an example, a 1% increase in the utilization of AI will result in a 1.38% improvement in corporate ESG performance. Based on the above-mentioned theoretical exploration, the utilization of AI drives corporates to achieve automated and intelligent production. This enables them to collect and assess a large amount of production information, precisely forecast market requirements, and appraise production capacities and effectiveness. Through such actions, they are enabled to streamline inventory management, boost logistics effectiveness, and reduce procurement expenses, thus promoting the high-quality growth of corporates. With the progress of AI technology, the integration of corporates and AI has given rise to a new model of networked collaborative production. This has greatly reduced the costs associated with information search, contract execution, and product development. Furthermore, it has improved the effectiveness of resource utilization in businesses, thus greatly enhancing their ESG performance. As a result, H1 is initially validated.

Table 4.

Baseline results.

According to the regression results of controlling variables, company size, Tobin’s Q, corporate current ratio, technological innovation, and other factors have a positive promoting effect on corporate ESG performance. Meanwhile, the return on assets and age of the company have a negative impact on the performance. Overall, the regression results for controlling variables meet the expectations of this study.

4.2. Mechanism Test

Previously, it was directly demonstrated with evidence that the implementation of AI significantly enhances companies’ ESG performance. Following this, an exploration was carried out regarding how the adoption of corporate AI impacts corporate ESG performance via the modification of the human capital structure. The findings of the mechanism examination are presented in Table 5. Within these outcomes, it is evident from Column (1) that the impact of AI application on the optimization of the human capital structure is rather notable. The regression coefficient of AI application in Column (1) is 0.0237, which is significant at the 1% level. This discovery implies that the execution of AI applications propels companies towards greater intelligence and automation, thus leading to an increasing demand for highly skilled labor. As a result, corporates will make modifications to their human resource configuration and strengthen the recruitment and incorporation of employees with high educational backgrounds and abundant experience. Individuals with advanced qualifications possess a greater ability to rapidly understand novel technologies and tools and apply them in practice, thus improving ESG performance. Column (2) shows the impact of AI application on corporate ESG performance after considering the adjustment of human capital structure as an intermediary variable. Clearly, the use of AI has a significantly positive effect on companies’ ESG performance. In Column (2), the regression coefficient is 0.0137, which remains significant at the 1% level. In addition, the optimization of the human capital composition also has a remarkably positive impact on the ESG performance of the corporate. The regression coefficient in Column (2) is 0.0038, which remains significant at the 10% level. According to the principle of the mediation effect model, while both AI application and human capital structure adjustment have significant positive effects on corporate ESG performance, AI application can be considered to improve corporate ESG performance through human capital structure adjustment.The mechanism test indicates that the utilization of AI enhances corporate ESG performance by modifying the human capital structure. As a result, H2 has largely been validated.

Table 5.

Mechanism test: AI, human capital structure adjustment, and corporate ESG performance.

5. Robustness Test and Endogeneity Test

5.1. Robustness Test

5.1.1. Considering Measurement Errors of Core Variables

The previous study examined the relationship between AI application, human capital structure adjustment, and corporate ESG performance using the two-way FE panel model. To further demonstrate the reliability of our baseline results and mechanism testing, we conducted robustness tests by replacing core variables. Conducting robustness tests by replacing variables is one of the core steps, which essentially responds to the key question of whether research conclusions are reliable. The complexity of the economic system, limitations in data measurement, and subjectivity in model setting collectively determine the necessity of this testing method. Therefore, we conducted robustness testing by replacing core variables. Specifically, we constructed a new AI application variable (AI_new) from the perspective of the number of AI keywords in the MD&A section of the annual report of listed companies plus 1 to re-evaluate companies’ AI application, while the number of employees with bachelor’s degrees or higher was used as an explanatory variable for human capital structure adjustment (capital_pop). Furthermore, considering the possibility of self-selection bias in empirical samples, we selected panel data from Chinese companies listed on the ChiNext and Science and Technology Innovation Board from 2011 to 2022 for robustness testing. In addition, we also attempted to use new econometric methods for robustness testing, introducing a dynamic panel model based on the system generalized method of moments estimation (Sys-GMM) to verify the reliability of our research conclusions. The results of the robustness tests are presented in Table 6, Table 7 and Table 8.

Table 6.

Robustness test: core variables are replaced.

Table 7.

Robustness test: change the observation sample.

Table 8.

Robustness test: change econometric model.

As presented in Table 6, when the variables associated with AI application and the modification of human capital structure are substituted, it can be seen that AI application can promote the adjustment of the corporate human capital structure. In the first column, the regression coefficient is 0.0258, and it reaches significance at the 1% level. The application of AI has decreased the corporate need for low-end labor and increased the need for high-end talents in areas such as R&D design, logistics marketing, management consulting, and system integration. After the mediating variable of the adjustment of human capital structure was incorporated, the regression coefficients for AI application in Columns (2) remained positive, the regression coefficient is 0.0142, and were significant at either the 5% or 10% level. This indicates that the application of AI enhances corporate ESG performance through the adjustment of the human capital structure. Logically, the implementation of AI requires employees to master novel technologies and tools, motivating them to continuously learn and enhance their capabilities. At the same time, companies are offering training and recruiting individuals with digital knowledge to enhance employees’ digital capabilities and innovative skills, enabling them to better adapt to and manage the digital environment (Zhang et al., 2023) [59]. Because the enhancement of human capital allows employees to more clearly comprehend their work and the requirements for completing it, it ultimately helps companies make more effective use of AI technologies to promote innovation and ESG performance. These discoveries indicate that AI technology heightens the production efficiency of corporates through its substitution effect on traditional low-skilled labor and complementary effect on non-traditional high-skilled labor. This further validates the research results of this study.

5.1.2. Changing the Observation Sample

The previous study used data from 3646 listed companies in the Shanghai and Shenzhen A-share markets from 2011 to 2022 to explore the relationship between AI application, human capital structure adjustment, and corporate ESG performance. After that, a robustness test was conducted using data for Chinese corporates listed on the ChiNext and Science and Technology Innovation Board during the period from 2011 to 2022. The results of the robustness test when the sample was replaced are shown in Table 7, which shows that the use of AI application still has a significant impact on the adjustment of the human capital structure. In the first column, the regression coefficient of AI implementation is 0.0431, and it shows significance at the 1% level. Moreover, an interesting finding was obtained. Regarding the companies listed on the ChiNext and Science and Technology Innovation Board, the implementation of AI together with the modification of human capital structure continues to have a positive impact on ESG performance. The second column shows that the regression coefficients of the utilization of AI and the modification of human capital structure are 0.0135 and 0.0004, respectively.

5.1.3. Changing the Econometric Model for Mechanism Analysis

Unlike the mediation effect model, the moderation effect model places more emphasis on how the application of AI can change the human capital structure of corporates, thereby affecting their ESG performance. To obtain a more comprehensive research conclusions, this article further designs a moderation effect model to analyze the relationship between AI applications, human capital structure adjustments, and corporate ESG performance as follows:

In Equation (4), α1, α2, and α3 are the regression coefficients; AI × capital is the interaction term between AI applications and human capital structure adjustment. Other variables and symbols have the same meanings as Equations (1)–(3). From Table 8, it can be seen that after introducing the interaction term of AI application and human capital structure adjustment, the application of AI and human capital structure adjustment still have promoting effects on the ESG performance of corporates. However, the interaction between AI applications and human capital structure adjustment has not positively affected corporate ESG performance. That is, AI applications cannot improve corporate ESG performance by influencing the adjustment of human capital structure.

5.1.4. Replacing the Measurement Estimation Method

Finally, this study uses a dynamic panel model based on the system generalized method of moments estimation (Sys-GMM) for robustness testing. Meanwhile, we use residual sequence correlation testing to assess the effectiveness of model setting and estimation. Among them, the null hypothesis of the AR test is that “there is no sequence correlation in the residual term after differentiation”. If the test accepts the null hypothesis, it indicates that the model setting and estimation are effective. The detailed estimation results are shown in Table 9.

Table 9.

Robustness test: based on the Sys-GMM dynamic panel model.

From the estimation results in Columns (1)–(2), it can be seen that the selection of instrumental variables is effective, as the AR (1) and AR (2) tests show that the residual terms have first-order autocorrelation but no second-order autocorrelation. For example, in Column (1), AR (1) is −8.045 (Prob. = 0.001) and AR (2) is −1.310 (Prob. = 0.143), indicating that GMM estimation is valid. From the perspective of the impact of specific variables, Column (1) indicates that corporate AI application has a significant positive effect on human capital structure adjustment, with a regression coefficient of 0.0075, and this coefficient holds at a significance level of 5%. Column (2) represents the impact of AI application and human capital structure adjustment on corporate ESG performance when using different methods to measure corporate ESG performance. The regression coefficient for human capital structure adjustment is 0.0162 and holds significance at the 10% level. During the process of AI application, it is possible to more accurately grasp market demand and supply chain dynamicsby introducing intelligent manufacturing and automation technology to precisely control production costs, helping companies optimize production processes, and using intelligent manufacturing technology to reduce waste and losses in the production process. This makes it easier for them to accept and adapt to the new technologies and models brought about by AI application, thereby improving corporate ESG performance.

5.2. Endogeneity Test

Previously, it was confirmed that the utilization of AI could prompt the modification of corporates’ human capital composition, thus improving ESG performance. This empirical result was mainly obtained through the utilization of the two-way FE panel model. Although the two-way FE panel model can, to an extent, deal with the problem of the connection between individual and time effects and independent variables, it cannot deal with the endogeneity issue caused by the reciprocal causality between independent and dependent variables. Therefore, in this research, the instrumental variables two-stage least squares (IV-2SLS) is employed for the endogeneity analysis. The IV-2SLS is executed in two steps: First, ordinary least squares (OLS) regression is conducted. In this regression, the explanatory variables are regressed on the instrumental variables to isolate the exogenous part of the endogenous variables (the fitted values). After that, OLS regression is conducted using the explanatory variables with respect to the values derived from the first-stage regression. Notably, in the process of model estimation, instrumental variables are utilized as a way to replace the endogenous explanatory variables that were associated with the random disturbance terms in the model. The instrumental variables are highly correlated with the endogenous explanatory variables yet have no connection with the random disturbance term.

In this study, considering the significance of potential endogeneity issues, the number of urban mobile phone subscribers (phone) and the number of broadband subscribers (broadband) are utilized as instrumental variables (IVs). The reason is that the selection of instrumental variables needs to consider their correlation with the explanatory variable AI; that is, their correlation with the random disturbance term, but not with the explained variable corporate ESG performance. The number of urban mobile phone users reflects the information infrastructure of the region where the corporate is located, which is related to the adoption of AI by the corporate and thus meets the relevant standards. In addition, the main function of mobile phones is to provide communication services to the public and thus they will not directly affect the technology research and development decisions of corporates. Therefore, the ESG performance of corporates is not directly affected by the number of mobile phone users, thus meeting external requirements. In addition, the number of broadband users in the city where the company is located reflects the level of development of network infrastructure in the region, which will definitely affect the application of AI technology in production and operation processes. In addition, broadband, as a medium for information dissemination, has no direct impact on a company’s ESG performance. Therefore, the number of urban mobile phone users and the number of urban broadband users are appropriate instrumental variables. The results of the regression using the instrumental variable method are presented in Columns (1)–(4) of Table 10. Following this, a comprehensive analysis of the regression outcomes will be conducted.

Table 10.

Endogeneity test: IV-2SLS methods.

As presented in Column (1) of Table 10, the outcomes of the initial stage derived from the IV two-stage least squares (2SLS) for lnphone and lnbroadband exert a remarkable positive impact on the optimization of the human capital structure. The regression coefficients are 0.2553 and 0.0392, respectively, at a significance level of 1%. This indicates that a remarkable relationship exists between the number of urban mobile phone and urban broadband users and the modification of the human capital structure. Similarly, the results of the first-stage regression in Column (3) of Table 10 are the same and will not be repeated. Moreover, the Kleibergen–Paap rk LM statistics in Column (1) and Column (3) are 593.839 and 351.330, respectively. These have successfully passed the tests regarding unidentifiable and weak instrumental variables (IVs), thereby jointly validating the chosen IVs.

Furthermore, the results of the second-stage analysis in Column (2) using IV-2SLS suggest that the utilization of AI significantly positively impacts the optimization of corporate human capital structure. The second-stage results in Column (2) derived from IV-2SLS, with a regression coefficient of 0.0075, suggest that the utilization of AI can significantly promote the regulation of human capital structure. Concerning the mechanism examination, when the adjustment of human capital structure was incorporated, the second-stage results in Column (4) showed that the regression coefficients for the utilization of AI and the adjustment of human capital structure were both remarkably positive, being 0.0252 and 0.0033, respectively. In general, the impact of AI application on corporate ESG performance still conforms to the fundamental findings. Meanwhile, upon introducing the adjustment of human capital structure as an intermediate variable, the sign and direction of the coefficient of the impact of AI application on corporate ESG performance do not vary significantly. Therefore, the results of this study remain robust even after using IV-2SLS to address endogeneity issues.

6. Heterogeneity Analysis

6.1. Different Ownership

To explore the impact of AI adoption on the adjustment of corporates’ human capital structure and ESG performance under various ownership types, the sample is separated into state-owned corporates (SOEs) and non-state-owned corporates (non-SOEs), and estimation is conducted using Equation (3). The outcomes of the heterogeneity analysis are presented in Table 11, specifically in (1)–(2). The results suggest that, in Column (1), the impact of AI application on the optimization of the human capital structure and ESG performance of state-owned corporates is favorable. Moreover, the regression coefficients are statistically significant at a significance level of 10%. As shown by the regression results in Column (2), for non-state-owned corporates, the implementation of AI has a significantly positive impact on ESG performance. Therefore, the impact of AI adoption differs substantially according to the type of corporate ownership. More specifically, the impact of AI application on the ESG performance of corporates that are not state-owned is more conspicuous. In contrast to state-owned corporates, privately run corporates generally exhibit greater flexibility and innovation. In areas such as decision-making processes, resource allocation, and employee incentives, they possess greater autonomy. Non-SOEs can bring in new AI technologies and models at a quicker pace. This enables non-state-owned corporates to react and make decisions more swiftly when faced with the implementation of AI, thereby promoting the adjustment of the human capital structure and the enhancement of ESG performance. This finding is consistent with the research findings of Naveed et al. (2024), Zhao and Jin (2025), and Xiao and Xiao (2025) [60,61,62]. They generally believe that the impact of AI application on the ESG performance of corporates that are not state-owned is more conspicuous.

Table 11.

Heterogeneity analysis.

6.2. Different Scales

The impact of AI application on companies of different sizes is also considered in this study. In the context of the Chinese economy, significant differences exist between large corporates and small- and medium-sized ones in areas including resource acquisition, innovation drive, and ESG achievements. Therefore, companies are ranked according to their total asset size. corporates with total asset size in the top 50% are regarded as large corporates, whereas those in the bottom 50% are considered small- and medium-sized corporates. This can ensure the consistency of the sample’s statistical caliber. The results of the estimation are shown in Table 11.

Among them, the results in Columns (3)–(4) show that the utilization of AI has a positive impact on the ESG performance of large corporates, and the regression coefficient is significant at the 5% level. On the contrary, for small- and medium-sized enterprises, the impact of implementing AI on improving ESG performance is not as significant. The regression coefficient in Column (4) is 0.0102 and significant at the 1% level. This discovery indicates that large-sized corporates are more likely to make use of the positive impact of AI on ESG performance. The same applies to large corporates.

6.3. Different Industries

Finally, the differences in the intensity of industry factors are considered. In industries that are not technology-intensive, the promotional effect of AI application on highly skilled employees ought to be more prominent. This is because the production and business activities of firms in technology-intensive fields rely more on investments in capital elements such as technology and machinery, and their internal technological requirements are relatively high. According to the principle of complementarity, it can be inferred that the initial quantity of high-skilled labor reserves is relatively large in technology-intensive sector corporates. As a result, the effect of AI adoption on such corporates is relatively small. In light of this, an exploration is carried out regarding the varying effects of AI adoption on the modification of the human capital structure and the ESG performance of companies in different technology-intensive industries. According to the industry classification standard of the first level in the Industry Classification Guidelines for Listed Companies of 2012 issued by the China Securities Regulatory Commission, corporate samples are categorized into labor-intensive, capital-intensive, and technology-intensive types. Following this, an examination is carried out on the impact of AI implementation on the modification of the human capital structure and the ESG performance of companies in various industry types.

The results shown in Columns (5)–(7) of Table 11 indicate that there is significant variation in the impact of AI on the ESG performance of companies in different industries. When it comes to labor-intensive industries, the regression results of the application of AI are remarkable. The estimated coefficient value in Column (5) is 0.0178. In contrast to technology-intensive industries, non-technology-intensive industries are less complex technologically, and the results of R&D innovations regarding technological transformation are relatively simpler. The application of AI leads to changes in the production methods of non-technology-intensive industries. Given that non-technology-intensive industries have a relatively low technological threshold, it is more practical for these sectors to accept and adapt to the changes induced by the implementation of AI. As AI technology advances, the demands for human resources in non-technology-intensive industries are also undergoing changes. The utilization of AI has also prompted the optimization of resource allocation in non-technology-intensive fields. Traditional labor-intensive tasks are being gradually replaced by mechanized equipment, and there is an increasing demand for people with digital knowledge and innovative abilities. This has forced companies to adjust their human resource composition to satisfy the demands of AI implementation. With the enhancement of the ability to allocate high-level human resources within corporates, individuals with different knowledge can communicate and inspire each other. By making use of the knowledge diffusion effect, they are able to promote collaborative innovation, thereby boosting the ESG performance of the company.

It must be noted that for both capital-intensive and technology-intensive companies, the positive impact of AI implementation on corporate ESG performance is not significant. The regression coefficients in Columns (6) and (7) are 0.0201 and 0.0079, respectively. The possible causes for such an outcome are as follows. First, during the past few years, capital-intensive corporates have faced substantial pressure as a result of rising costs. Owing to the decline in the external economic situation, a great number of corporates have reduced their asset investments in an attempt to reduce costs and improve efficiency. As a result, corporates that rely heavily on capital should concentrate on accumulating intangible assets when implementing AI to improve their production and operational effectiveness. In addition, companies with a high level of technological sophistication have a relatively complex technological makeup. These corporates have already met the basic requirements for carrying out production, operation, and management activities using intelligent, automated, and information technologies. As a result, the effect of technological research and development and technological accumulation on ESG performance is more remarkable than that caused by the application of AI. This also results in the effect of AI application on the ESG performance of technology-intensive corporates being less conspicuous.

7. Conclusions and Policy Recommendations

In the context of deep integration between advanced information technology and sustainable development, the synergistic evolution of AI applications and corporate ESG performance has become a key driver of corporates’ core competitiveness. The deep penetration of AI not only reshapes corporates’ operational modes but also promotes the reallocation of human capital toward a higher-skilled orientation. Therefore, clarifying its inherent correlation can guide coordinated planning of AI technology investment and talent strategy within corporates, thereby achieving a win–win situation between ESG performance and operational efficiency and providing micro-level support for corporate high-quality development. This study shows that the application of AI significantly increases the proportion of employees with bachelor’s degrees or higher in companies, promotes the adjustment of human capital structure, and improves ESG performance. At the same time, the synergistic evolution of AI applications and the human capital structure profoundly affects corporate ESG performance. This article breaks through the traditional single analytical framework of “technology performance” in the interaction mechanism and constructs a complete logical chain of “technology application factor reconstruction value upgrading”, thereby enriching the theory of corporate sustainable development.

Currently, AI technology is moving from technical breakthroughs to large-scale applications, showing great potential in reshaping the value system of human capital and optimizing corporate ESG performance. To take advantage of the opportunities presented by the technological revolution and promote the deep integration of AI applications with human capital transformation and corporate ESG improvement, the following policy recommendations are proposed based on research findings. First, corporates should steadily promote the application of AI and actively explore the role of advanced technologies in environmental protection, social responsibility, and corporate governance; improve policy measures to encourage the development and application of AI; establish a sound AI governance system led by government and industry organizations, involving corporates and the public; ensure the healthy growth and safe application of AI; and provide real-time, comprehensive decision-making support for corporate management. Second, corporates should attach importance to the construction of executive cognitive abilities, support the implementation of the “AI+” initiative, strengthen the cultivation of executive digital and green cognitive skills, enhance executive understanding of technology through specialized training, build AI application scenarios, enhance computing power support for AI iteration and upgrading, and provide a solid external environment for AI applications. Third, they should continuously optimize the structure of skilled talents. In this article’s sample, employees with a college degree or higher are considered middle- to high-skilled human capital. Still, the labor force with vocational education and below, mainly composed of industrial workers, is also vital in creating social wealth. AI increases demand for medium- and high-skilled human capital and compresses low-skilled positions through a dual mechanism of substitution and creation. Therefore, corporates should focus on cultivating a large-scale, innovative talent team; strengthening digital skills training for the new generation of labor force; enhancing the application capabilities of cutting-edge technologies such as AI; and improving the competitiveness of corporate employees in the age of AI.

This study has the following limitations. First, the measurement methods for AI are limited. Due to the lack of a unified understanding and definition of AI applications, accurately quantifying this indicator with corporate data is difficult. Moreover, there is scope for further enhancing the mechanism. The impact mechanism of AI application on corporate ESG performance was explored from the perspective of altering the human capital structure. However, other mediating or moderating variables may influence the relationship between AI adoption and corporate ESG performance. In addition, more abundant research data could be required. This study explored the relationship between the use of AI, the adjustment of human capital composition, and the ESG performance of corporates in China. Future research endeavors could expand and strengthen this research domain by incorporating corporate data from diverse countries and regions, thereby providing more robust evidence.

In view of this, future research can expand the research boundary on the interaction among AI applications, human capital structure adjustment, and corporate ESG performance from multiple dimensions, thereby yielding deeper theoretical and practical insights. In terms of research content, we can focus on the dynamic nature of AI applications and the lag effect of human capital structure adjustment, explore the differentiated impact of different AI technologies (such as generative AI and industrial AI) on human capital skill demand, and how this difference manifests in ESG dimensions. At the same time, the interaction mechanism of the ESG dimension is worth exploring. This includes the reverse constraint of environmental performance improvement on the allocation of human capital training resources, or the guaranteed effect of governance mechanism improvement on the prevention and control of ethical risks in AI technology. From a research perspective, it is possible to break beyond the single-corporate level, incorporate the moderating effects of industry heterogeneity and the institutional environment, analyze differences in the paths of the relationship between manufacturing and service industries, or compare the strategic choice logic of corporates under different environmental policy intensities. In terms of research methods, a mixed research approach can be adopted, combining panel data models to quantify causal relationships, supplemented by case studies to reveal micro-operational mechanisms, and introducing machine learning techniques to improve the accuracy of variable measurement, thereby providing more targeted theoretical guidance for promoting the synergy between AI application, human capital upgrading, and sustainable development of corporates.

Author Contributions

Conceptualization, Y.Q.; Methodology, Y.Q.; Software, G.Y.; Validation, G.Y.; Formal analysis, Y.Q.; Investigation, Y.Q.; Resources, G.Y.; Data curation, G.Y.; Writing—original draft, Y.Q.; Supervision, G.Y.; Project administration, G.Y.; Funding acquisition, Y.Q. All authors have read and agreed to the published version of the manuscript.

Funding

This publication is supported by the Fundamental Research Funds for the Central Universities of Northwest Minzu University (No. 31920250131), and the Soft Science Special Project of Gansu Basic Research Plan (No. 24JRZA152).

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Arntz, M.; Gregory, T.; Zierahn, U. The Risk of Automation for Jobs in OECD Countries: A Comparative Analysis; OECD Social, Employment and Migration Working Papers 189; OECD Publishing: Paris, France, 2016. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. Artificial Intelligence, Automation and Work; NBER Working Paper, No. 24196; National Bureau of Economic Research: Cambridge, MA, USA, 2018. [Google Scholar] [CrossRef]

- Myovella, G.; Karacuka, M.; Haucap, J. Digitalization and economic growth: A comparative analysis of Sub-Saharan Africa and OECD economies. Telecommun. Policy 2020, 44, 101856. [Google Scholar] [CrossRef]

- Zhang, Q.; Wu, P.P.; Li, R.R.; Chen, A. Digital transformation and economic growth Efficiency improvement in the Digital media era: Digitalization of industry or Digital industrialization? Int. Rev. Econ. Financ. 2024, 92, 667–677. [Google Scholar] [CrossRef]

- Gao, Y.; Liu, S.Q.; Yang, L. Artificial intelligence and innovation capability: A dynamic capabilities perspective. Int. Rev. Econ. Financ. 2025, 98, 103923. [Google Scholar] [CrossRef]

- Ren, X.; Zeng, G.; Zhao, Y. Digital finance and corporate ESG performance: Empirical evidence from listed companies in China. Pac.-Basin Financ. J. 2023, 79, 102019. [Google Scholar] [CrossRef]

- Wang, S.F.; Esperança, J.P. Can digital transformation improve market and ESG performance? Evidence from Chinese SMEs, Journal of Cleaner Production. J. Clean. Prod. 2023, 419, 137980. [Google Scholar] [CrossRef]

- Ding, X.A.; Sheng, Z.L.; Appolloni, A.; Shahzad, M.; Han, S.J. Digital transformation, ESG practice, and total factor productivity. Bus. Strategy Environ. 2024, 33, 4547–4561. [Google Scholar] [CrossRef]

- Lin, J.B.; Mao, M.Y. How does digital transformation affect sustainable innovation performance? The pivotal roles of digital technology-business alignment and environmental uncertainty. Sustain. Dev. 2023, 32, 3163–3181. [Google Scholar] [CrossRef]

- Niu, Y.H.; Wen, W.; Wang, S.; Li, S.F. Breaking barriers to innovation: The power of digital transformation. Financ. Res. Lett. 2023, 51, 103457. [Google Scholar] [CrossRef]

- Guo, X.C.; Li, M.M.; Wang, Y.L.; Mardani, A. Does digital transformation improve the firm’s performance? From the perspective of digitalization paradox and managerial myopia. J. Bus. Res. 2023, 163, 113868. [Google Scholar] [CrossRef]

- Wang, Y.Z.; He, P.Z. Enterprise digital transformation, financial information disclosure and innovation efficiency. Financ. Res. Lett. 2024, 59, 104707. [Google Scholar] [CrossRef]

- Ding, Y.Y.; Shi, Z.Y.; Xi, R.C.; Diao, Y.X.; Hu, Y. Digital transformation, productive services agglomeration and innovation performance. Heliyon 2024, 10, e25534. [Google Scholar] [CrossRef]

- Li, L.X. Digital transformation and sustainable performance: The moderating role of market turbulence. Ind. Mark. Manag. 2022, 104, 28–37. [Google Scholar] [CrossRef]

- Houston, J.F.; Shan, H.Y. Corporate ESG profiles and banking relationships. Rev. Financ. Stud. 2022, 35, 3373–3417. [Google Scholar] [CrossRef]

- Vu, D.A.; Nguyen, T.V.; Nhu, Q.M.; Tran, T.Q. Does increased digital transformation promote a firm’s financial performance? New insights from the quantile approach. Financ. Res. Lett. 2024, 64, 105430. [Google Scholar] [CrossRef]

- Goldfarb, A.; Tucker, C. Digital economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef]

- Kohtamäki, M.; Parida, V.; Patel, P.C.; Gebauer, H. The relationship between digitalization and servitization: The role of servitization in capturing the financial potential of digitalization. Technol. Forecast. Soc. Change 2020, 151, 119804. [Google Scholar] [CrossRef]

- Wu, Y.L.; Huang, S.L. The effects of digital finance and financial constraint on financial performance: Firm-level evidence from China’s new energy enterprises. Energy Econ. 2022, 112, 106158. [Google Scholar] [CrossRef]

- de Clercq, M.; D’Haese, M.; Buysse, J. Economic growth and broadband access: The European urban-rural digital divide. Telecommun. Policy 2023, 47, 102579. [Google Scholar] [CrossRef]

- Afolabi, J.A. Advancing digital economy in Africa: The role of critical enablers. Technol. Soc. 2023, 75, 102367. [Google Scholar] [CrossRef]

- Alshareef, M.N. Artificial intelligence-enhanced environmental, social, and governance disclosure quality and financial performance nexus in Saudi listed companies under vision 2030. Sustainability 2025, 17, 7421. [Google Scholar] [CrossRef]

- Cinnirella, F.; Streb, J. The role of human capital and innovation in economic development: Evidence from post-Malthusian Prussia. J. Econ. Growth 2017, 22, 193–227. [Google Scholar] [CrossRef]

- Fonseca, T.; de Faria, P.; Lima, F. Human capital and innovation: The importance of the optimal organizational task structure. Res. Policy 2019, 3, 616–627. [Google Scholar] [CrossRef]

- Dou, B.; Guo, S.L.; Chang, X.C.; Wang, Y. Corporate digital transformation and labor structure upgrading. Int. Rev. Financ. Anal. 2023, 90, 102904. [Google Scholar] [CrossRef]

- Liu, S.; Wu, Y.T.; Yin, X.B.; Wu, B. Digital transformation and labour investment efficiency: Heterogeneity across the enterprise life cycle. Financ. Res. Lett. 2023, 58 Pt C, 104537. [Google Scholar] [CrossRef]

- He, X.W.; Chen, W. Digital transformation and environmental, social, and governance performance from a human capital perspective. Sustainability 2024, 16, 4737. [Google Scholar] [CrossRef]

- Czernich, N.; Falck, O.; Kretschmer, T.; Woessmann, L. Broadband infrastructure and economic growth. Econ. J. 2011, 121, 505–532. [Google Scholar] [CrossRef]

- Haller, S.A.; Lyons, S. Broadband adoption and firm productivity: Evidence from Irish manufacturing firms. Telecommun. Policy 2015, 39, 1–13. [Google Scholar] [CrossRef]

- Erik, B.; McElheran, K. The rapid adoption of data-driven decision-making. Am. Econ. Rev. 2016, 106, 133–139. [Google Scholar] [CrossRef]

- Ford, G.S. Is faster better? Quantifying the relationship between broadband speed and economic growth. Telecommun. Policy 2018, 42, 766–777. [Google Scholar] [CrossRef]

- Aldashev, A.; Batkeyev, B. Broadband infrastructure and economic growth in rural areas. Inf. Econ. Policy 2021, 57, 100936. [Google Scholar] [CrossRef]

- Mwananziche, J.; Myovella, G.; Karacuka, M.; Haucap, J.; Moshi, G. Is digitalization a booster for economic growth in Africa? Short run and long run evidence from Tanzania. Telecommun. Policy 2023, 47, 102679. [Google Scholar] [CrossRef]

- Li, Q.; Chen, H.M.; Chen, Y.; Xiao, T.; Wang, L. Digital economy, financing constraints, and corporate innovation. Pac.-Basin Financ. J. 2023, 80, 102081. [Google Scholar] [CrossRef]

- Yang, G.; Yang, X.D. AI adoption and ESG performance: Evidence from China. Int. Rev. Econ. Financ. 2025, 104, 104659. [Google Scholar] [CrossRef]

- Cai, C.; Tu, Y.Q.; Li, Z. Enterprise digital transformation and ESG performance. Financ. Res. Lett. 2023, 58 Pt D, 104692. [Google Scholar] [CrossRef]

- Zhuo, C.F.; Chen, J. Can digital transformation overcome the enterprise innovation dilemma: Effect, mechanism and effective boundary. Technol. Forecast. Soc. Change 2023, 190, 122378. [Google Scholar] [CrossRef]

- Yu, G.H. Digital transformation, human capital upgrading, and enterprise ESG performance: Evidence from Chinese listed enterprises. Oeconomia Copernic. 2024, 15, 1465–1508. [Google Scholar] [CrossRef]

- Zhang, H.; Dong, S. Digital transformation and firms’ total factor productivity: The role of internal control quality. Financ. Res. Lett. 2023, 57, 104231. [Google Scholar] [CrossRef]

- Nguyen, D.K.; Broekhuizen, T.; Dong, J.Q.; Verhoef, P.C. Leveraging synergy to drive digital transformation: A systems-theoretic perspective. Inf. Manag. 2023, 60, 103836. [Google Scholar] [CrossRef]

- Zhang, C.; Yang, J.H. Artificial intelligence and corporate ESG performance. Int. Rev. Econ. Financ. 2024, 96 Pt C, 103713. [Google Scholar] [CrossRef]

- Xu, R.F.; Song, F.M. Is AI a key driving force for Chinese total factor productivity growth? Mechanistic analysis of employment, supply chain, and information asymmetry. Econ. Model. 2025, 150, 107126. [Google Scholar] [CrossRef]

- Alex, O.A.; Eric, E.O.O.; Janet, D.; Nana, K.K. Enhancing human development in developing regions: Do ICT and transport infrastructure matter? Technol. Forecast. Soc. Change 2022, 180, 121725. [Google Scholar] [CrossRef]

- Zaborovskaia, O.; Nadezhina, O.; Avduevskaya, E. The impact of digitalization on the formation of human capital at the regional level. J. Open Innov. Technol. Mark. Complex. 2020, 6, 184. [Google Scholar] [CrossRef]

- Ran, R.; Wang, X.Y.; Wang, T.; Hua, L. The impact of the digital economy on the servitization of industrial structures: The moderating effect of human capital. Data Sci. Manag. 2023, 6, 174–182. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, B.; Yang, Y. Digital economy and urban innovation level: A quasi-natural experiment from the strategy of “Digital China”. Humanit. Soc. Sci. Commun. 2024, 11, 574. [Google Scholar] [CrossRef]

- Adeoye, O.B.; Okoye, C.C.; Ofodile, O.C.; Odeyemi, O.; Addy, W.A.; Ajayi-Nifise, A.O. Artificial Intelligence in ESG investing: Enhancing portfolio management and performance. Int. J. Sci. Res. Arch. 2024, 11, 2194–2205. [Google Scholar] [CrossRef]

- Troise, C.; Corvello, V.; Ghobadian, A.; O’Regan, N. How can SMEs successfully navigate VUCA environment: The role of agility in the digital transformation era. Technol. Forecast. Soc. Change 2022, 174, 121227. [Google Scholar] [CrossRef]

- Li, Y. Enterprise digital transformation and enterprise value. Adv. Appl. Math. 2022, 11, 5986–5993. [Google Scholar] [CrossRef]

- Chen, H.S.; Tian, Z. Environmental uncertainty, resource orchestration and digital transformation: A fuzzy-set QCA approach. J. Bus. Res. 2022, 139, 184–193. [Google Scholar] [CrossRef]

- Yin, X.N.; Li, J.P.; Su, C.W. How does ESG performance affect stock returns? Empirical evidence from listed companies in China. Heliyon 2023, 9, e16320. [Google Scholar] [CrossRef]

- Li, C.M.; Xu, Y.; Zheng, H.; Wang, Z.Y.; Han, H.T.; Zeng, L.E. Artificial intelligence, resource reallocation, and corporate innovation efficiency: Evidence from China’s listed companies. Resour. Policy 2023, 81, 103324. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Lei, L.Y.; Feng, H.; Ren, J.J. Artificial intelligence, human capital and firm-level total factor productivity. Financ. Res. Lett. 2025, 85 Pt A, 107897. [Google Scholar] [CrossRef]

- Wang, J.R.; Li, W.J.; Wang, B.; Wang, Z.Y. Digitalize and stabilize: Corporate digital transformation and performance volatility. Appl. Econ. 2025, 57, 9345–9359. [Google Scholar] [CrossRef]

- Chen, W.; Srinivasan, S. Going digital: Implications for firm value and performance. Rev Acc. Stud. 2024, 29, 1619–1665. [Google Scholar] [CrossRef]

- Li, K.; Mai, F.; Shen, R.; Yan, X.Y. Measuring corporate culture using machine learning. Rev. Financ. Stud. 2021, 34, 3265–3315. [Google Scholar] [CrossRef]

- Mikolov, T.; Sutskever, I.; Chen, K.; Corrado, G.S.; Dean, J. distributed representations of words and phrases and their compositionality. Adv. Neural Inf. Process. Syst. 2013, 26, 3111–3119. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Meng, Z.Z.; Song, Y. Digital transformation and metal enterprise value: Evidence from China. Resour. Policy 2023, 87 Pt B, 104326. [Google Scholar] [CrossRef]

- Naveed, K.; Farooq, M.B.; Zahir-Ul-Hassan, M.K.; Rauf, F. AI adoption, ESG disclosure quality and sustainability committee heterogeneity: Evidence from Chinese companies. Meditari Account. Res. 2025, 33, 708–732. [Google Scholar] [CrossRef]

- Zhao, K.; Jin, Z.Y. Impact of AI on corporate ESG performance: Evidence from China. Sustain. Futures 2025, 10, 101543. [Google Scholar] [CrossRef]

- Xiao, Y.P.; Xiao, L. The impact of artificial intelligence-driven ESG performance on sustainable development of central state-owned enterprises listed companies. Sci. Rep. 2025, 15, 8548. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).