Abstract

As a core driver of high-quality and sustainable economic development, the deep integration of the digital economy with foreign trade has emerged as a critical pathway to enhance the resilience of China’s foreign trade while advancing Sustainable Development Goals (SDGs)—particularly those related to decent work and economic growth, industry, innovation and infrastructure, and partnerships. This study employs panel data from 30 Chinese provinces spanning 2012–2021, combined with a two-way fixed effects model, mediating effect model, and threshold panel model, to empirically explore how the digital economy shapes foreign trade resilience and its implications for sustainable development. The findings demonstrate that the digital economy significantly empowers the enhancement of foreign trade resilience, with industrial structure advancement serving as a key mediating channel. This mechanism aligns with sustainable development principles by promoting resource allocation efficiency, reducing environmental footprints through optimized trade processes, and fostering inclusive industrial upgrading. To advance sustainable foreign trade development, policy implications include strengthening digital infrastructure, promoting the integration of digital economy and green industries, and optimizing institutional frameworks for inclusive digital trade.

1. Introduction

The report of the 20th National Congress of the Communist Party of China emphasized developing digital trade, accelerating the building of a strong trading nation, and focusing on enhancing the resilience and security of industrial and supply chains—all of which are closely linked to the United Nations Sustainable Development Goals. Fostering resilient and sustainable trade systems is critical to addressing global challenges such as economic volatility, environmental degradation, and unequal development. The global spread of the 2008 financial crisis, the escalating Sino–US trade disputes, Brexit, frequent Russia–Ukraine conflicts, and particularly the outbreak of the COVID-19 pandemic have severely impacted the global economy, intensified deglobalization trends, raised protectionism, and led many countries to enact various trade bans and restrictive measures to protect domestic enterprises and mitigate economic shocks from frequent global market fluctuations. In 2020, global merchandise imports and exports were USD 17.81 billion and USD 17.58 billion, respectively, both falling by over 7% year-on-year. Foreign trade is a vital driver of China’s economic development and a primary channel for participating in the international division of labor and exchanging experiences and technologies. Consequently, exploring how to maintain the stability of China’s foreign trade, enhance its resilience, and resist the impact of external uncertainties has become increasingly important. Simultaneously, China’s digital economy has achieved new progress, with its scale expanding rapidly. In 2022, it grew by 22.7% year-on-year, reaching RMB 50.2 trillion, accounting for 41.5% of GDP. As a new engine of national economic growth, the digital economy demonstrates strong potential, which is mainly reflected in three aspects in the context of foreign trade. Firstly, it breaks the information asymmetry in cross-border trade through digital technologies such as cloud computing and 5G, promoting the matching efficiency of supply and demand sides in international trade. Secondly, it optimizes the traditional trade model, reduces transportation costs and procedural costs, and promotes the paperless and efficient development of cross-border e-commerce. Finally, it spawns new industries and business forms such as digital inclusive finance and smart logistics, and promotes the digital transformation of traditional foreign trade industries, thus injecting sustained momentum into the growth of foreign trade.

2. Literature Review

2.1. Research on the Connotation, Measurement, and Benefits of the Digital Economy

As a crucial engine for high-quality economic development, the digital economy has attracted scholarly attention due to its remarkable vitality and dynamism. Current research on the digital economy primarily focuses on the following aspects. First, research on the connotations of the digital economy. Tapscott (1996) first proposed the ‘Digital Economy’ in his book ‘The Digital Economy: Promise and Peril in the Age of Networked Intelligence,’ where he posited that digital information and knowledge serve as the theoretical foundation for the evaluation indicator system developed in this study, with its depiction of e-commerce as a new form directly informing the ‘E-commerce Sales’ metric under the digital industry development dimension [1]. Cohen et al. (2000) regarded the digital economy as essentially an information technology-oriented system, covering data communication and data processing technologies, as well as a full set of technical tools dedicated to digital information manipulation, systematic organization, efficient transmission, and secure storage [2]. Carlsson (2004) conceptualized the digital economy as an integrated system formed by the convergence of information digitization and Internet technology, and he further labeled this emerging economic form the ‘New Economy,’ suggesting that what is truly new is the diffusion of Internet usage [3]. Li Changjiang (2017) systematically reviewed the origin and development of the digital economy, viewing it as a socio-economic form for value creation through digital technological means and also a time-sensitive concept [4]. Wei Zhonglong (2021) conducted a multi-dimensional analysis of the digital economy’s intrinsic characteristics, arguing that robust digital infrastructure constitutes the primary prerequisite for its development [5]. He further emphasized that digital technology, as a general-purpose technology capable of empowering multiple industries, serves as the core driving force behind the evolution and expansion of the digital economy. Ouyang Rihui (2023) argued that the essence of the digital economy is the transformation of economic paradigms and the enhancement of value creation capacity triggered by the digital technology revolution [6]. Second, research on measuring the digital economy. Deng Xiaohua et al. (2023) used the entropy method to construct an indicator system from aspects such as digital infrastructure construction, the popularity of the digital economy, the development level of digital industries, and the level of digital technological innovation, calculating a final composite score through weighted averaging [7]. Wang Weiguo et al. (2023) adopted principal component analysis as the research method to establish an indicator system, which covers three core dimensions: digital industry development, digital innovation capability, and digital application level [8]. Li Shunyong et al. (2022) conducted a multi-dimensional analysis of the digital economy’s development level, with the research perspectives covering digital terminal facilities, network resources, digital industry scale, technological innovation investment, the sustainable development of the digital economy, and the development level of digital finance [9]. Third, research on the benefits of the digital economy. Many scholars have previously studied the relationship between digital technology and economic growth. Zhong Qunying et al. (2023) found an “inverted U-shaped” relationship between the digital economy and foreign trade [10]. Chi Mingyuan et al. (2022) found that the digital economy can revolutionize traditional industries, promote industrial structure upgrading, and facilitate industrial optimization from perspectives such as production methods, operational methods, and circulation methods [11].

2.2. Research on the Connotation, Measurement, and Influencing Factors of Foreign Trade Resilience

First, studies focusing on the connotation of resilience. Reggiani et al. (2002) extended the concept of resilience, which originated from ecological science, to the research context of spatial economic systems [12]. They argued that resilience could serve as a potentially effective analytical tool for exploring the evolutionary trajectories of complex spatial systems, and defined it as the capacity of a system to absorb external shocks without triggering catastrophic changes to its core functional structure. Regarding economic resilience, the foreign scholars Hill et al. (2008) applied the concept of resilience to economic research, defining regional resilience as a region’s capability to successfully recover after encountering economic shocks—shocks that have caused or may cause the region to deviate from its original growth trajectory [13]. Martin et al. (2015) positioned resilience as an integral part of the geographically unbalanced process of economic evolution and development, describing it as a dynamic system consisting of four interrelated dimensions: vulnerability, resistance, robustness, and recoverability [14]. Second, research on measuring foreign trade resilience. Shi Kuiran et al. (2023) measured trade resilience under external shocks by calculating the deviation of trade volume from the trade volume impacted by the 2008 global financial crisis [15]. Sun Yuting et al. (2023) built a foreign trade resilience evaluation framework by selecting indicators across four dimensions: resistance capacity, recovery capacity, reorganization capacity, and innovation capacity [16]. They first determined the weights of these indicators using the Mahalanobis–Taguchi System, then adopted a catastrophe progression model to calculate the specific measurement value of trade resilience. Wang Ying et al. (2022) selected indicators from dimensions such as resistance capacity, recovery capacity, and restructuring capacity, using the entropy method to calculate a comprehensive score for foreign trade resilience [17]. Third, research on factors influencing foreign trade resilience. He Canfei et al. (2019) studied the impact of relatedly diversified export product structures on industrial export resilience from the demand-side dimension, suggesting that industries with high levels of related diversification suffer more direct and indirect external demand shocks [18]. Yuan Feng et al. (2023) proposed that diversification, related diversification, and innovation capacity do not significantly function in the initial stage of resisting a crisis but aid regional economic recovery after the crisis [19]. He Kunwen et al. (2023) analyzed factors affecting export trade resilience from both domestic and international trade perspectives, finding that factors enhancing export trade resilience at the domestic macro level include the strength of epidemic prevention policies and medical level, while at the international trade level, they include the number of export trade partners and the severity of the pandemic in the largest exporting country [20].

2.3. Research on the Impact of the Digital Economy on Foreign Trade Resilience

Ma Jianfeng et al. (2023) verified that the digital economy can significantly positively promote the enhancement of foreign trade resilience and studied the spatial effects between the digital economy and foreign trade resilience, finding significant spatial correlation and positive spatial spillover effects [21]. Zhang Pengyang et al. (2023) used a difference-in-differences model for research, finding that digitally transformed enterprises can withstand external shocks represented by anti-dumping trade friction [22]. Su Hang et al. (2023) believed that the digital economy can effectively promote the enhancement of urban export resilience by reducing urban trade costs, enhancing urban innovation capacity, and strengthening urban entrepreneurial vitality [23]. Chen Qun et al. (2023) argued that the impact of the digital economy on export resilience involves a mediating effect achieved through innovation and industrial diversification, and there is a spatial spillover effect [24].

Although existing studies have confirmed the positive impact of the digital economy on foreign trade resilience and explored spatial spillover effects and enterprise-level mechanisms, there are still obvious research gaps. First, most studies ignore the dual mediating role of industrial structure rationalization and advancement, failing to deeply analyze the internal transmission path of the digital economy affecting foreign trade resilience from the perspective of industrial structure optimization. Second, the nonlinear relationship between the digital economy and foreign trade resilience has not been fully discussed, especially the regulatory effect of key macroeconomic variables such as openness and tax burden has not been quantitatively verified. Third, regional heterogeneity analysis in existing studies is relatively simplistic, lacking a comparative study covering the eastern, central, western, and northeastern regions of China.

Based on the above literature review, this study takes 30 provinces in China from 2012 to 2021 as the research sample, adopts a two-way fixed effects model, mediating effect model and threshold panel model, and focuses on solving three core research objectives: verifying the direct effect of digital economy on foreign trade resilience, exploring the mediating mechanism of industrial structure, and clarifying the nonlinear threshold characteristics, so as to make up for the deficiencies of existing research.

3. Theoretical Analysis and Research Hypotheses

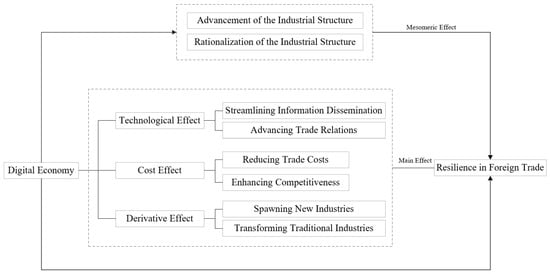

Combining the ‘Technology Effect—Cost Effect—Derivative Effect’ theoretical model constructed in this paper (Figure 1), the empowering paths of the digital economy on China’s foreign trade resilience can be refined into three major dimensions, all of which are supported by empirical data. Firstly, before establishing trade contracts, international trade buyers and sellers engage in information searches to find suitable trading partners. Due to differences in culture and laws among countries and information asymmetry, it is difficult for supply and demand parties to match. The digital economy can promote information exchange and transmission between different industries and economic entities through digital methods such as cloud computing and 5G communication, enhancing economic operational efficiency, improving information accessibility and transparency, and facilitating the establishment of trade relationships [25]. Secondly, relying on information networks and information communication technology, the digital economy can effectively mitigate the shortcomings of traditional trade, such as high transportation costs and lengthy trade processes, weaken geographical constraints, transform trade models, further leverage the advantages of cross-border e-commerce transactions, make trade processes trend towards paperless, effectively reduce trade costs, allowing economic entities to have more ample funds to invest in product innovation and production, enhance product international competitiveness, promote supply-side innovation, and strengthen trade resilience. Finally, as an emerging economic form, the digital economy has driven the development of a batch of derivative emerging industries, promoting the diversification of China’s industries. The digital economy not only spawns new business models like the sharing economy but also promotes the digital transformation of traditional industries, such as digital inclusive finance and smart logistics. Industrial diversification enhances China’s ability to withstand external economic shocks. Based on this, this paper proposes Hypothesis 1:

Figure 1.

Theoretical model of the digital economy empowering foreign trade resilience based on dual mediating and threshold effects.

H1.

The digital economy can significantly empower the enhancement of foreign trade resilience.

Industrial structure optimization can be analyzed from two core dimensions: industrial structure rationalization and industrial structure advancement. Industrial structure rationalization specifically refers to the promotion of rational allocation of production factor inputs and efficient distribution of resources throughout the production process. The digital economy plays a positive role in driving industrial structure rationalization. By leveraging digital and information technologies, and applying tools such as cloud computing and the Internet of Things to integrate key production-related information—including order demands, inventory levels, capacity planning, production schedules, and personnel arrangements—enterprises can optimize resource allocation, enhance operational efficiency, cut production costs, and thereby advance the rationalization of the industrial structure [26]. A rational industrial structure facilitates the full realization of the combinatorial effects of different production factors, promotes the transfer of production factors and resources from low-efficiency sectors to high-efficiency sectors, and effectively enhances trade resilience. Industrial structure advancement refers to the transition of the main industries gradually from the primary industry to the secondary and tertiary industries. The digital economy can promote the transformation of the industrial structure towards advancement. The digital economy has a technology spillover effect, promoting technological innovation, breaking the time and space constraints of commodity transactions, and deriving new consumption forms. Consumers on the demand side increase their quality requirements for products and services. To ensure leading enterprise status and market share, producers will increase investment in R&D and innovation, innovate production processes and flows, and enhance product added value. Based on this, Hypothesis 2 is proposed:

H2.

The digital economy can enhance foreign trade resilience by promoting industrial structure rationalization and advancement.

According to the previous theoretical analysis, the digital economy has a significant positive impact on foreign trade resilience, but there may be certain thresholds. Since data elements can be exchanged and used among different economic entities at low cost, weakening the boundaries of innovation activities such as information and technology, the acquisition of resources shows a trend of decreasing marginal cost [27], possessing a technology spillover effect. Digital technology has been extensively applied in the development of cross-border e-commerce, which not only fuels the booming growth of cross-border e-commerce transactions but also contributes to enhancing the added value of China’s export products in the global trade landscape. On one side, classical economists including Adam Smith and David Ricardo advocated for the expansion of openness and the development of free trade. They put forward the theory of absolute advantage and the theory of comparative advantage, respectively, advocating that countries should actively engage in the international division of labor. This proposition is conducive to improving the overall efficiency of international trade. However, as the degree of openness further expands, China’s connection with the world market becomes closer, increasing the possibility of being impacted through foreign trade channels, and the degree of impact also increases correspondingly with the degree of participation in the international division of labor. Simultaneously, German economist Friedrich List proposed that the expansion of openness would lead to the destruction of China’s infant industries by mature foreign industries, worsening China’s industrial structure and industrial development, thereby reducing China’s foreign trade resilience. On the other hand, an increase in the tax burden level can increase fiscal revenue. With fiscal revenue surpluses, the government can have sufficient funds to support technological innovation. Improved technological innovation levels subsequently enhance production and trade efficiency. However, excessively high tax burden levels increase enterprise costs and reduce enterprise profit margins. Enterprises do not bear the tax pressure alone but subtly transfer the tax pressure to consumers by increasing product prices. Excessively high product prices cause enterprises to lose competitiveness in the world market, leading to unsold goods [28]. Based on this, Hypothesis 3 is proposed:

H3.

The impact of the digital economy on foreign trade resilience is nonlinear.

This study identifies new pathways for enhancing foreign trade resilience through a three-dimensional theoretical framework: directly empowering foreign trade resilience through the digital economy’s own advantages, indirectly promoting it through the dual channels of industrial structure rationalization and advancement, and clarifying the nonlinear adjustment effect based on openness and tax burden thresholds, which enriches the practical path for improving foreign trade resilience.

4. Indicator Selection and Model Construction

4.1. Sample Selection and Data Sources

This paper analyzes relevant data from 2012 to 2021, covering 30 provinces in China (excluding Tibet). The raw data are sourced from the China Statistical Yearbook and provincial-level statistical yearbooks. For the missing data, linear interpolation and cubic spline interpolation are used for filling. The specific interpolation equations are as follows:

Linear interpolation equation: For missing data points , if the adjacent data points and are known, then

Cubic spline interpolation equation: Let the interpolation nodes on the interval be . The cubic spline function satisfies , and it is a cubic polynomial on each sub-interval , and has a second-order continuous derivative on .

4.2. Indicator Selection

4.2.1. Explained Variable

This paper builds an indicator system for foreign trade resilience, incorporating four dimensions: resistance capability, recovery capability, restructuring capability, and innovation capability. Details of the indicator system are presented in Table 1. The weights of each factor are determined by the entropy method. By calculating the information entropy of each indicator, the indicator weights are determined according to the size of the entropy value. The smaller the entropy value, the greater the indicator weight.

Table 1.

Foreign trade resilience evaluation indicator system.

4.2.2. Core Explanatory Variable

In line with the principles of conciseness, scientificity, and data availability for indicator selection, this paper establishes an evaluation indicator system to assess the digital economy’s development level, covering three dimensions: digital infrastructure, digital industry growth, and digital economic environment. The specifics of this indicator system are presented in Table 2, and the entropy method is additionally adopted to quantify the digital economy’s development level.

Table 2.

Digital economy evaluation indicator system.

4.2.3. Mediating Variables

This study identifies industrial structure advancement and industrial structure rationalization as mediating variables. For industrial structure advancement (AIS), its measurement method refers to the analytical framework proposed by Xu Min and Jiang Yong (2015) [29], and the specific calculation approach is defined as follows:

where is the province, is the year, and is the industrial sectors. is the “level of industrial structure advancement”, is the “regional Gross Domestic Product”, is “the added value of the j-th industry in the t-th year of the i-th province”. A larger value indicates a higher level of industrial structure advancement.

Industrial structure rationalization draws on the approach of Yu Binbin (2015) [30], measured using the reciprocal of the Theil index:

where is the province, is the year, is the industrial sectors. is the level of industrial structure rationalization, and is the Theil index. is the regional Gross Domestic Product, is the value-added of the industry, is the total employment, and is the employment in the industry. A smaller value indicates a larger value, signifying a higher level of industrial structure rationalization.

4.2.4. Threshold Variables

Therefore, the degree of openness (OPEN) and the tax burden level (TAX) are selected as threshold variables. Among them, the calculation formula for the degree of openness is as follows:

where is the total volume of goods trade in Province i in Year t; is the exchange rate of the US dollar against the Chinese yuan in Year t; and is the regional GDP of Province i in Year t.

The calculation formula for the tax burden level (TAX) is:

where is the tax revenue of Province i in year t; is the regional Gross Domestic Product of Province i in year t.

4.2.5. Control Variables

Human capital (EDU) is measured by the ratio of the number of higher education institution students to the total population, with this ratio further processed by taking the logarithm. The corresponding calculation formula is as follows:

where is the number of enrolled students in higher education institutions in Province i in Year t; is the total population of Province i in Year t.

R&D innovation (INNOV) is represented by the logarithm of the number of invention patent applications accepted. The calculation formula is as follows:

where is the number of invention patent applications accepted in the t-th year in the i-th province.

Transportation infrastructure construction (TRA) is measured by the logarithm of highway mileage. The calculation formula is as follows:

where is the highway mileage accepted for handling in the i-th province in the t-th year.

4.3. Model Construction

4.3.1. Benchmark Regression Model

The time effect is verified through the F-test. If the p-value of the F-statistic is less than 0.05, the null hypothesis is rejected, indicating the existence of a time effect. The individual effect is verified through the Hausman test. The null hypothesis H0 is that the individual effect is independent of the explanatory variables. If the p-value of the Hausman statistic is less than 0.05, the null hypothesis is rejected, and the fixed effects model is adopted. In this paper, the Hausman overidentification test shows that Prob > chi2 = 0.0000. Combining the results of the F-test, it is determined that the model has both time and individual effects. Therefore, a two-way fixed effects model is adopted.

4.3.2. Mediating Effect Model

To investigate whether the digital economy exerts its effect on enhancing foreign trade resilience through the dual pathways of driving industrial structure rationalization and advancing industrial structure, this study incorporates industrial structure rationalization and industrial structure advancement as mediating variables into the analytical framework.

In Equations (4)–(6), A, B, and D are the constant terms, is the sum of the products of the control variables and their respective regression coefficients, and stands for the mediating variable; all other variables retain the same definitions as in Model (3). Here, and are the individual fixed effects and time fixed effects, respectively, and is the random disturbance term.

4.3.3. Threshold Panel Model

To further explore whether there is a nonlinear impact of the digital economy on foreign trade resilience and the threshold conditions, a panel threshold model is constructed to study whether the effect of the digital economy on foreign trade resilience is influenced by the degree of openness and the tax burden level.

where is the threshold-dependent variable, namely the core explanatory variable, the digital economy; is the indicator function; is the threshold variable; and is the threshold value.

where is the threshold-dependent variable, namely the core explanatory variable, the digital economy; is the indicator function; is the threshold variable, and , are the threshold values.

5. Empirical Results Analysis

5.1. Descriptive Statistical Analysis

Table 3 presents the descriptive statistics of the variables in the benchmark regression. The maximum value of the foreign trade resilience index is 0.85, the minimum value is only 0.01, and the mean is 0.1481. The significant gap between the maximum, minimum, and mean values indicates an imbalance in foreign trade resilience among regions. The maximum value of the digital economy index is 0.74, and the minimum value is 0.01, with a large gap between them, indicating that the development of the digital economy may be slow in some regions and favorable in others, showing uncoordinated development across different regions.

Table 3.

Descriptive statistical analysis results.

5.2. Benchmark Regression Analysis

Tests revealed that the benchmark model has both time effects and individual effects. Additionally, the Hausman overidentification test showed Prob > chi2 = 0.0000. Based on this, this paper uses a two-way fixed effects model to explore the impact of the digital economy on foreign trade resilience.

This study performed stepwise regression analysis using Stata 17.0, and the results are presented in Table 4. In model (1), the analysis focuses solely on the impact of the digital economy on foreign trade resilience, without incorporating any control variables. The coefficient of the digital economy is 0.5953, positive and significant at the 1% level, which preliminarily suggests that the digital economy exerts a significant positive effect on foreign trade resilience. When control variables are gradually introduced in models (2) to (5), the positive sign and significance of the digital economy coefficient remain unchanged, all passing the 1% significance level test. In model (5), the coefficient of the digital economy on trade resilience is 0.6712, significant at the 1% level. This implies that, under the condition of holding other control variables constant, a 1-unit increase in the digital economy is associated with a 0.6712-unit increase in foreign trade resilience. Thus, the digital economy can significantly empower the enhancement of foreign trade resilience, validating Hypothesis 1. Human capital and the tax burden level pass the 1% significance test, while transportation infrastructure construction passes the 10% significance test, and their regression coefficients are all positive. Among them, the regression coefficient for human capital is 4.0979, indicating that for every 1-unit increase in human capital, foreign trade resilience increases by 4.0979 units. A possible reason is that a labor force with advanced knowledge and skills can enhance enterprises’ independent innovation capability, increase their scientific and technological innovation output, and help form unique core competitiveness. Simultaneously, high-level human capital can accelerate talent agglomeration, and the talent agglomeration effect is conducive to improving innovation output and efficiency, promoting industrial structure transformation, and enhancing product technological complexity and added value, thereby strengthening foreign trade resilience. The regression coefficient for the tax burden level is 0.5816, indicating that for every 1-unit increase in the tax burden level, foreign trade resilience increases by 0.5816 units. A possible reason is that levying a certain tax burden can increase fiscal revenue. With sufficient fiscal revenue, the government can better support strategic industries and technological development, play a guiding role, and rationally allocate resources. The regression coefficient for transportation infrastructure construction is 0.0539, indicating that for every 1-unit increase in transportation infrastructure construction, foreign trade resilience increases by 0.0539 units. A possible reason is that sound transportation infrastructure helps build an efficient and convenient road network system, greatly enhances the convenience of foreign trade, effectively reduces transportation costs, avoids market fragmentation, accelerates the flow speed and allocation efficiency of goods and production factors, and promotes the refinement of the international division of labor. Furthermore, convenient transportation facilities are conducive to industrial agglomeration, exerting economies of scale, promoting foreign trade development, and enhancing foreign trade resilience. R&D innovation did not pass the significance test, indicating that its effect on foreign trade resilience is not significant. A possible reason is that although the number of patents granted in China increases annually, it is difficult to transform scientific research achievements into practical applications. Additionally, technological innovation catalyzes the transformation of traditional industries, impacting traditional industries and leading to issues such as rising unemployment rates and declining labor compensation.

Table 4.

Benchmark regression results.

5.3. Robustness Tests and Endogeneity Discussion

5.3.1. Robustness Tests

To ensure the robustness of the above benchmark regression results, this study adopts multiple approaches for robustness testing.

First, given that the digital economy’s development is a cyclical process, its impact on foreign trade resilience may exhibit a lag effect; thus, the core explanatory variable (digital economy) is lagged by one period for regression analysis.

Second, to eliminate the interference of extreme values on empirical outcomes, the sample data is subjected to 1% bilateral winsorization.

Third, the sample period is adjusted: considering that China’s digital economy entered a phase of rapid growth after 2015, the study sets 2015 as the starting year and retains data from 2015 to 2021 for empirical estimation.

As presented in Table 5, the empirical results of these robustness tests are consistent with the earlier findings.

Table 5.

Robustness test results.

5.3.2. Endogeneity Discussion

While the robustness test methods employed can mitigate endogeneity issues to a certain degree, additional measures to address endogeneity remain essential. To reduce the bias arising from endogeneity, this study uses the one-period lag of the digital economy as an instrumental variable. The rationale for this selection is twofold: first, the digital economy’s development level in the prior period maintains a strong correlation with its current development, satisfying the relevance criterion for instrumental variables; second, the lagged digital economy development level is not associated with the current foreign trade resilience, thus meeting the exogeneity requirement of being uncorrelated with the error term. The results of this instrumental variable regression are presented in column (5) of Table 5. After accounting for endogeneity, the digital economy’s impact on foreign trade still remains significant at the 1% level, with a regression coefficient of 0.7762. Further validation through a weak instrument test shows that the K-Paap rk Wald F-statistic is 166.482, which exceeds the 10% level critical value of 16.38 specified in the Stock–Yogo weak identification test—this confirms that the chosen instrumental variable does not suffer from weak correlation. In the under-identification test, the K-Paap rk LM statistic yields a p-value of 0.000, which allows for the significant rejection of the null hypothesis that the instrumental variable is under-identified.

5.4. Heterogeneity Analysis

Regional Heterogeneity Analysis

China spans a vast geographical area, and distinct geographical regions exhibit unique characteristics due to variations in natural and human environments. This also leads to differences in the development and construction of the digital economy across regions. To further investigate the regional heterogeneity in the impact of the digital economy on foreign trade resilience, this study, drawing on the regional division method in the China Statistical Yearbook, categorizes the 30 provinces into four regional groups—eastern, central, western, and northeastern—for subgroup regression analysis. The results of this heterogeneity regression are presented in Table 6.

Table 6.

Heterogeneity analysis results.

The results reveal notable disparities in the digital economy’s capacity to empower foreign trade resilience across China’s eastern, central, western, and northeastern regions. As shown in Columns (1)–(3), the digital economy—acting as the core explanatory variable—passes the 1% significance test in the eastern, central, and western regions, yet its regression coefficients exhibit a gradual downward trend, registering 0.8090, 0.6305, and 0.6235, respectively. In contrast, Column (4) indicates that the digital economy in the northeastern region only meets the 5% significance level (lower than the other three regions) with a regression coefficient of 0.7132, suggesting its impact on local foreign trade resilience is slightly weaker. On the whole, the eastern region benefits most from the digital economy’s promotional effect on foreign trade resilience. This phenomenon can be attributed to the eastern region’s concentration of economically developed provinces, which boast relatively complete digital infrastructure, high digital penetration rates, and mature digital technology development. These hardware and software advantages allow the eastern region to fully tap into the digital economy’s potential, leverage its development dividends, and thereby strengthen foreign trade resilience more effectively. The enhancing effect of the digital economy on foreign trade resilience decreases in the central and western regions. Possible reasons are as follows: the central and western regions are relatively underdeveloped in terms of economic development and ecological environment construction, have less investment in the digital economy, lack sound infrastructure, and find it difficult to leverage the dividend effect of the digital economy. In the northeastern region, the digital foundation is weak, industrial digital transformation lags, the digital industry development severely falls behind, and the digital divide between regions has not been effectively bridged. Simultaneously, the remote geographical location, cold climate, harsh natural environment, and imperfect supporting talent policies make it difficult to attract talents proficient in digital technology to develop there, the digital divide shows a trend of expansion, thus failing to significantly enhance foreign trade resilience.

6. Mechanism Analysis

6.1. Mediating Effect

To further validate the mechanism underlying the digital economy’s impact on foreign trade resilience, this study selects industrial structure rationalization and industrial structure advancement as mediating variables, and employs the traditional three-step method to examine whether the digital economy enhances foreign trade resilience through these two channels. The test results of this method are presented in Table 7.

Table 7.

Three-step mediating effect test results.

When industrial structure rationalization serves as the mediating variable, the findings are as displayed in Columns (1)–(3). Column (1) reports the regression results without incorporating industrial structure rationalization: the digital economy is significant at the 1% level and exerts a positive promotional effect on foreign trade resilience, corresponding to a total effect of 0.6712. Column (2) analyzes the digital economy’s influence on industrial structure rationalization, with a regression coefficient of 66.12 (also significant at 1%), confirming that the digital economy can drive industrial structure rationalization. Column (3) shows the regression outcomes after adding industrial structure rationalization to the benchmark model: the digital economy still maintains a significant positive impact on foreign trade resilience (regression coefficient = 0.6448, i.e., the direct effect), which is smaller than the total effect. Additionally, the regression coefficient of industrial structure rationalization is 0.0004 (significant at 5%), preliminarily confirming the existence of a mediating effect.

When the mediating variable is replaced with industrial structure advancement, the test results are as shown in Columns (4)–(5) (Column (1) remains the regression without the mediating variable). Column (4) reveals the digital economy’s impact on industrial structure advancement: with a regression coefficient of 0.0832 (significant at 5%), it indicates the digital economy has a significant positive effect on industrial structure advancement. Column (5) presents the regression results after including industrial structure advancement in the benchmark model: the digital economy’s regression coefficient is 0.6535 (significant at 1%), verifying its ability to significantly empower foreign trade resilience enhancement; meanwhile, industrial structure advancement has a regression coefficient of 0.2123 (also significant at 1%), suggesting it can promote foreign trade resilience. The direct effect (0.6535) is smaller than the total effect, further preliminarily confirming the existence of a mediating effect.

6.2. Threshold Effect

To test Hypothesis 3, this study constructs a panel threshold model for regression analysis, adopting the bootstrap method with 1000 repeated samplings. The outcomes of the test and regression are presented in Table 8 and Table 9.

Table 8.

Threshold effect test results.

Table 9.

Threshold panel regression results.

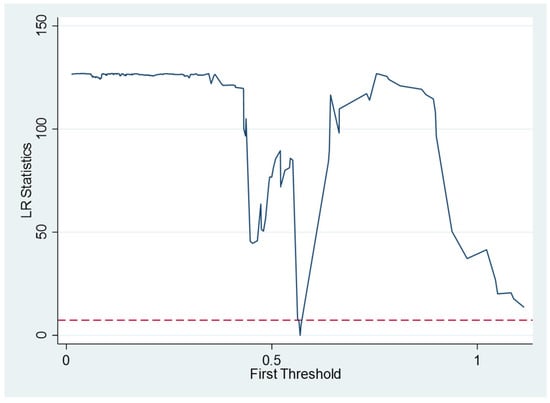

Column (1) of Table 9 displays the regression results when the degree of openness is taken as the threshold variable. When the degree of openness is lower than the threshold value of 0.5689, the regression coefficient of the digital economy on foreign trade resilience is 0.921, which is significantly positive at the 1% level. When the degree of openness exceeds the threshold value of 0.5689, the coefficient of the digital economy’s impact on foreign trade resilience is 0.566, which also passes the 1% significance test. Nevertheless, in comparison to the scenario where the degree of openness is below 0.5689, the regression coefficient has decreased notably (Figure 2). This indicates that the promotional effect of the digital economy on foreign trade resilience weakens as the degree of openness expands. Uncontrolled and blind expansion of openness will increase China’s dependence on foreign technologies, services, and products, which not only hinders the development of the country’s core pillar industries and advanced technologies but also elevates the risk of being affected by external economic and political volatility.

Figure 2.

LR graph with degree of openness as threshold variable.

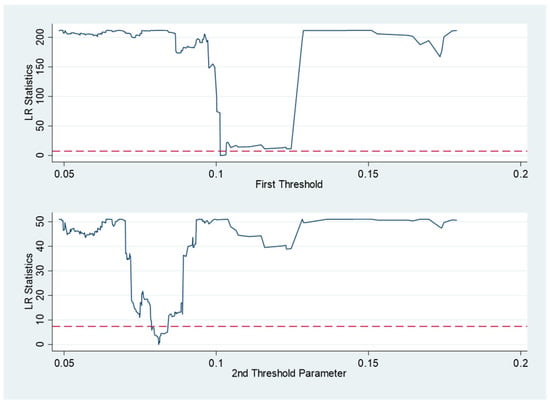

Column (2) of Table 9 presents the regression results with the tax burden level as the threshold variable. When the tax burden level is below the first threshold of 0.0811, the impact coefficient of the digital economy on foreign trade resilience is 0.792, significant at the 1% level. When the tax burden level lies between the first threshold of 0.0811 and the second threshold of 0.1013, the impact coefficient of the digital economy on foreign trade resilience is 0.635, still passing the 1% significance test. However, when the tax burden level surpasses the second threshold of 0.1013, the regression coefficient of the digital economy loses statistical significance. It is obvious that the continuous rise of the tax burden level leads to a significant decline in the promotional effect of the digital economy on foreign trade resilience (Figure 3). Excessively high tax burdens squeeze enterprises’ profit margins, forcing enterprises to shift tax pressures to consumers by raising product prices. Such excessive price hikes make enterprises lose their comparative advantage in the global market. Moreover, enterprises overwhelmed by heavy taxes lack the financial capacity to invest in the innovation of production technologies and processes, making it hard for them to build core competitive advantages in the long run.

Figure 3.

LR graph with tax burden level as threshold variable.

7. Research Conclusions and Policy Recommendations

7.1. Research Conclusions

As digital technology and Internet information technology advance rapidly, the digital economy—an emerging economic form—has permeated all facets of production and daily life. Beyond serving as a new engine for real economic growth, it also provides Chinese enterprises with a broad platform and opportunities for innovative development. This study conducts empirical tests using panel data from 30 Chinese provincial-level administrative regions spanning 2012 to 2021, employing a two-way fixed effects model, a mediating effect model, and a threshold panel model to explore the mechanism through which the digital economy impacts foreign trade resilience. The key conclusions are as follows:

First, the digital economy can significantly empower the enhancement of foreign trade resilience, emerging as a core driver for boosting China’s foreign trade resilience in the new era. Second, heterogeneity tests reveal that the digital economy exerts a significant positive promotional effect on China’s foreign trade resilience, with the strongest empowerment observed in the eastern region and a slightly weaker effect in the northeastern region. Third, the digital economy can significantly enhance foreign trade resilience through industrial structure advancement; however, the mediating role of industrial structure rationalization in the digital economy’s impact on foreign trade resilience failed to pass robustness tests. Fourth, the relationship between the digital economy and foreign trade resilience is nonlinear, meaning their interaction does not follow a simple linear pattern.

7.2. Policy Recommendations

First, enhance the speed and quality of digital economy development. Continuously enrich the theoretical system of the digital economy, explore the development laws of the digital economy, establish and improve the digital economy governance system, perfect corresponding digital economy laws and regulations, and provide theoretical and regulatory guarantees for the high-quality development of the digital economy. Increase support for the basic equipment and facilities, information service platforms, and technological innovation environment required for the development of the digital economy, integrate existing advantageous resources, establish a nationwide unified foreign trade information sharing platform, break down regional information barriers, and strengthen the efficiency of supply–demand matching between the digital economy and the real economy. Focus on cultivating interdisciplinary, application-oriented, innovative high-level talents required for the development of the digital economy, add corresponding majors around key digital industries, successfully introduce high-level talents proficient in artificial intelligence, 5G technology, blockchain, and other digital technologies, increase funding subsidies for relevant scientific research teams, and build a favorable talent environment for the development of the digital economy. Promote the deep integration of the digital economy and the real economy, achieving the supply–demand matching between digital economy development and real industry development.

Second, jointly promote industrial structure advancement. The mediating effect test results indicate that the digital economy can enhance foreign trade resilience by promoting industrial structure advancement. On the one hand, the industrial structure determines the trade structure to a certain extent. Increase the guiding role and support of fiscal expenditure for enterprise technological innovation and breakthroughs, leverage the high permeability and wide coverage of technological progress, assist the transformation of traditional industries into high-tech industries, promote the gradual shift in export products from low-tech, high-energy-consuming resource-intensive products to high-tech, low-energy-consuming technology-intensive products, promote the advancement of the trade structure, and enhance foreign trade resilience. On the other hand, increase the proportion of the secondary and tertiary industries, and extend the industrial chain. Vigorously develop the secondary and tertiary industries, promote enterprises in various regions to explore their own resources and utilize energy advantages, enhance enterprises’ independent innovation capability, deepen the degree of product processing, support and develop emerging industries, extend the industrial chain of advantageous products, enhance the added value of trade products, and strengthen foreign trade resilience.

Third, promote high-quality opening up and advance tax reduction and fee reduction. Opening up is a fundamental national policy of China and an inevitable path for modernization construction. Maintaining high-quality opening up requires maintaining certain limits and boundaries, and cannot completely rely on foreign technology and services, or attract investment without restrictions. We should adhere to independent innovation, develop national industries, independently master core technologies, and reduce import dependence to cope with the increasingly fierce international competition and technological blockades by Western countries against China. Simultaneously, establish a risk prevention and control mechanism. The government should formulate targeted risk monitoring and early warning systems for various industries and fields regarding opening up, and take timely measures for imported projects that involve harming China’s domestic industries. Promoting tax reduction and fee reduction can alleviate the financial burden on enterprises, enabling them to have ample funds for new rounds of investment and innovation R&D, promoting economic growth, and enhancing independent innovation capability. Meanwhile, reduced enterprise operating costs lead to lower product prices, conducive to forming price competitive advantages and enhancing foreign trade resilience.

Author Contributions

Conceptualization, J.Y. and Y.Z.; methodology, Y.Z.; software, J.Y.; validation, J.Y., Y.Z. and H.C.; formal analysis, J.Y. and Y.Z.; investigation, Y.Z.; resources, H.C.; data curation, J.Y.; writing—original draft preparation, J.Y.; writing—review and editing, J.Y.; visualization, Y.Z.; supervision, H.C.; project administration, H.C.; funding acquisition, H.C. All authors have read and agreed to the published version of the manuscript.

Funding

The article is supported by the National Social Science Foundation of China [National Office of Philosophy and Social Sciences, 19BTJ039].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be made available at the request of the authors.

Acknowledgments

The authors express their gratitude to all scholars who have supported this paper.

Conflicts of Interest

The authors declare no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Abbreviations

The following abbreviations are used in this manuscript:

| TFE | Time Fixed Effects |

| IFE | Individual Fixed Effects |

| ASP | Adjusted Sample Period |

| ET | Endogeneity Test |

| ISR | Industrial Structure Rationalization |

| ISA | Industrial Structure Advancement |

| MEC | Mediating Effect Coefficient |

| DEC | Direct Effect Coefficient |

| TEC | Total Effect Coefficient |

| MEP | Mediating Effect Proportion |

References

- Tapscott, D. The Digital Economy: Promise and Peril in the Age of Net worked Intelligence; Barnett, M., Ed.; Mc Graw Hill: New York, NY, USA, 1996; pp. 13–42. [Google Scholar]

- Cohen, S.S.; Zysman, J.; DeLong, B.J. Tools for Thought: What is New and Important About the “E-Conomy”? Berkeley Roundtable on the International Economy: Berkeley, CA, USA, 2000. [Google Scholar]

- Carlsson, B. The Digital Economy: What is new and what is not? J. Struct. Change Econ. Dyn. 2004, 15, 245–264. [Google Scholar] [CrossRef]

- Li, C.-J. A preliminary study on the connotation of digital economy. E-Government 2017, 9, 84–92. [Google Scholar]

- Wei, Z.-L. Research on the connotation and characteristics of digital economy. J. Beijing Econ. Manag. 2021, 36, 3–10. [Google Scholar]

- Ouyang, R.-H. Theoretical Evolution, Connotation Characteristics, and Development Law of Digital Economy. Guangdong Soc. Sci. 2023, 1, 25–35+286. [Google Scholar]

- Deng, X.-H.; Ci, L.-L. Digital economy promoting high-quality development of foreign trade: Mechanism and empirical study. J. Tianjin Univ. Commer. 2023, 43, 50–57. [Google Scholar]

- Wang, W.-G.; Wang, W.G.; Wang, Y.L.; Fan, D. Effects and mechanisms of the digital economy for carbon emission reduction. China Environ. Sci. 2023, 43, 4437–4448. [Google Scholar]

- Li, S.-Y.; Zhang, R.-X.; Zhang, J.-X.; Zhao, G.-J. A Study on Measuring the Level of Digital Economy Development in Chinese Provinces. J. Product. Res. 2022, 365, 38–42+90. [Google Scholar]

- Zhong, Q.-Y.; Cao, Y. Impact of digital economy development on regional carbon emissions and its mechanism: Based on panel data of 30 provinces in China. Jiangxi Soc. Sci. 2023, 43, 185–195. [Google Scholar]

- Chi, M.-Y.; Shi, Y.-N. The Influence Mechanism and Countermeasures of Digital Economy to Promote the Optimization and Upgrading of Industrial Structure. Econ. Rev. 2022, 4, 122–128. [Google Scholar]

- Reggiani, A.; De Graaff, T.; Nijkamp, P. Resilience: An evolutionary approach to spatial economic systems. Netw. Spat. Econ. 2002, 2, 211–229. [Google Scholar] [CrossRef]

- Hill, E.; Wial, H.; Wolman, H. Exploring Regional Economic Resilience; Working Paper; University of California, Institute of Urban and Regional Development (IURD): Berkeley, CA, USA, 2008. [Google Scholar]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2015, 15, 1–42. [Google Scholar] [CrossRef]

- Shi, K.-R.; Li, K.-Y.; Sun, Y. The Impact of Financial Agglomeration of Yangtze River Delta Economic Zone on Trade Resilience. Ind. Technol. Econ. 2023, 42, 3–11. [Google Scholar]

- Sun, Y.-T.; Chang, Z.-P. The Comprehensive Evaluation and Spatio-Temporal Evolution of Trade Resilience in Yangtze River Delta Urban Agglomeration. J. Change Univ. Sci. Technol. 2023, 36, 90–99. [Google Scholar]

- Wang, Y.; Li, S.-T. Measurement and Influencing Factors of China’s Foreign Trade Resilience. J. North Minzu Univ. 2022, 16, 3338. [Google Scholar]

- He, C.-F.; Chen, T. External Demand Shocks, Related Variety and Resilience of Export. China Ind. Econ. 2019, 7, 61–80. [Google Scholar]

- Yuan, F.; Xiong, X.; Ziteng, X.U.; Linghui, Y.U. Spatial differentiation and driving factors of economic resilience in the Yangtze River Economic Belt, China. Prog. Geogr. 2023, 42, 249–259. [Google Scholar] [CrossRef]

- He, K.-W.; Zhao, J.-F.; Wang, C.-M. Research on Spatial-temporal Characteristics and Driving Factors of China’s Export Resilience. Int. Econ. Trade Res. 2023, 39, 68–88. [Google Scholar]

- Ma, J.-F.; Liu, B.; Li, K.-J. Research on the impact of digital economy on China’s regional export resilience and its spatial spillover effect. Prices Mon. 2023, 32–42. [Google Scholar]

- Zhang, P.Y.; Liu, W.-G.; Tang, Y.-H. Enterprises’ Export Resilience under Trade Frictions: The Role of Digital Transformation. China Ind. Econ. 2023, 5, 155–173. [Google Scholar]

- Su, H.; Lu, X.-T. Does the Development of Digital Economy Improve the Export Resilience of Cities. Technol. Econ. 2023, 42, 67–82. [Google Scholar]

- Xu, H.; Zhang, Y.-L.; Cao, Y.-J. Digital Economy, Technology Spillover and Dynamic Coopetition Policy. Manag. World 2020, 36, 63–84. [Google Scholar]

- Li, P.-L.; Liu, W.-J. Research on the impact of platform economy on the rationalization development of industrial structure: Also on the mediating effect of green technology innovation. Commer. Econ. Res. 2023, 163–166. [Google Scholar]

- Chen, Q. A Study on The Effect of the Digital Economy on Theresilience of China’s Export Trade. Master’s Thesis, Hubei University, Wuhan, China, 2023. [Google Scholar]

- Proeger, T.; Runst, P. Digitization and knowledge spillover effectiveness—Evidence from the “German Mittelstand”. J. Knowl. Econ. 2020, 11, 1509–1528. [Google Scholar] [CrossRef]

- Li, R.; Zhang, K.-Q. The Macroeconomic Impact of Tax Change: An Empirical Analysis Based on Narrative Record. J. Knowl. Econ. 2023, 43, 32–46. [Google Scholar]

- Xu, M.; Jiang, Y. Can the China’s Industrial Structure Upgrading Narrow the Gap between Urban and Rural Consumption? J. Quant. Technol. Econ. 2015, 32, 3–21. [Google Scholar]

- Yu, B.-B. The economic growth effect of industrial structure adjustment and productivity improvement: Analysis based on a dynamic spatial panel model of Chinese cities. China Ind. Econ. 2015, 12, 83–98. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).