Abstract

Amid China’s push for digital transformation, green technology innovation has become a vital pathway to achieving its carbon neutrality goals. Using panel data from Chinese A-share-listed companies between 2012 and 2023, sourced from the CNRDS and CSMAR databases, this study employs a two-way fixed effects model to examine how digital transformation affects green innovation. In this model, carbon information disclosure serves as a mediator and is measured through text analysis and entropy weighting, while media attention is included as a moderator. The results show that: (1) Digital transformation significantly promotes green technology innovation, with a one-unit increase in the digitalization index raising green patent applications by 4.45%; upon controlling for potential path dependence, the effect remains stable at 3.76%. (2) Carbon information disclosure plays a partial mediating role. (3) Media attention moderates both the direct effect of digital transformation and the first stage of the indirect effect through carbon information disclosure. (4) Heterogeneity analyses, supplemented by inter-group difference tests, reveal stronger effects in state-owned enterprises, firms in western China, and larger firms. The study concludes with practical recommendations for corporate practice and public policy.

1. Introduction

With the rapid development of the global economy and the continuous improvement in industrialization, environmental problems are becoming increasingly prominent. How to reduce carbon dioxide emissions and maintain sustainable economic development is a critical issue of global concern. After signing the Paris Agreement, China formally put forward its “dual carbon” goals at the 75th United Nations General Assembly in September 2020: “striving to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060”. In 2022, the Chinese government issued the “Implementation Plan for Further Improving the Market-Oriented Green Technology Innovation System (2023–2025)”, emphasizing the key role of green technology in low-carbon development and proposing to strengthen enterprises’ principal position in innovation and build a green technology innovation system. In 2025, the Chinese government issued the “Opinions on Promoting Voluntary Disclosure of Greenhouse Gas Information by Enterprises”, which also provides guidance on the carbon information disclosure of enterprises.

Green technology innovation, as a key engine of sustainable development, emphasizes the integration of environmental friendliness and development efficiency. It achieves ecological protection through reducing pollution, improving resource utilization, and has a positive driving force on economic and social development. On the one hand, from the perspective of enterprise development, green technology innovation enhances production efficiency, reduces costs, and enables companies to gain green premiums [1]. It also enhances enterprises’ market competitiveness [2] and improves their financial performance [3]. On the other hand, from an environmental protection perspective, green technology innovation not only improves urban carbon emission performance [4] but also significantly enhances industrial enterprises’ ESG ratings and social value. This broader impact is corroborated by studies on clean-energy technology pathways, including research on hydrogen production systems. For example, the green technology approach of integrating hydrogen energy at wind farms can convert unstable wind power into storable hydrogen energy, effectively resolving wind curtailment issues while significantly reducing carbon emissions and environmental pollution through clean energy substitution [5]. Additionally, emerging green technologies and end-of-pipe treatment technologies can help industrial enterprises reduce CO2 emissions [6].

In the era of rapid digital economy development, digital transformation has become the core driving force for enterprise growth. Existing research indicates that digital transformation significantly improves resource allocation efficiency [7,8]. It also enhances the competitive advantage of manufacturing enterprises [9], boosts operational performance by increasing firms’ efficiency and effectiveness [10], and exerts a significant positive impact on total factor productivity [11]. In 2023, the Chinese government released the “Overall Layout Plan for the Construction of Digital China”, emphasizing the digital transformation as a key driver for high-quality development. It advocates for the coordinated development and deep integration of industrial digitalization, intellectualization, and greening, aiming to leverage digital technologies to enable green transformation. Tang et al. (2023) [12] found that digital transformation enhances corporate green technology innovation through technological innovation effects, collaborative innovation networks, and the alleviation of financing constraints; similarly, Liu et al. (2025) [13] demonstrated that it fosters enterprise innovation capability by cultivating cooperative and innovative cultures. Meanwhile, Song et al. (2025) [14] revealed that digital transformation drives green transition by improving the quality of environmental information disclosure.

However, existing research also indicates that digital transformation can yield certain negative effects. For instance, Sang and Huang (2025) [15] suggested that while digital transformation enhances efficiency, it may simultaneously undermine operational flexibility. Furthermore, studies have identified a spatial spillover effect of digital transformation on green technology innovation. Specifically, Du et al. (2024) [16] found that regions with advanced digital development tend to attract enterprises from neighboring areas, thereby inhibiting green technology innovation in those neighboring regions. Given these complex implications, clarifying the impact and internal mechanisms of digital transformation on green innovation is crucial for advancing corporate sustainability and formulating effective environmental policies.

Since enterprises are the primary entities responsible for carbon emissions, their carbon information disclosure is not only a requirement for a green economy but also a social responsibility they must fulfill. Wang et al. (2024) [17] found that carbon information disclosure can promote green technology innovation through internal governance mechanisms such as reducing agency costs and enhancing human capital. Ma (2025) [18] pointed out that carbon information disclosure helps companies improve transparency and boost investor confidence, thereby lowering the financing costs of corporate green innovation. Furthermore, they also indicated that corporate green innovation can reduce pollution, improve resource utilization efficiency, and ultimately enhance corporate performance.

Meanwhile, the media, as a highly credible information intermediary, can leverage rich expressions to improve the transparency of environmental information and enhance stakeholders’ understanding, thereby reducing information asymmetry [19]. Research has found that media attention can help reduce financing costs, alleviate financing constraints, and change the situation of insufficient green investment in enterprises [20]. In addition, by thrusting companies into the public spotlight, media incentivizes them to build a green reputation and strengthen environmental protection efforts. This greater public visibility elevates the importance of green technology innovation, allowing firms to demonstrate their commitment to responsible and sustainable growth.

Current studies on how enterprise digital transformation affects green technology innovation leave critical gaps in explaining the underlying integrated mechanisms. First, the mediating role of carbon information disclosure remains underexplored, particularly within a broader causal chain. Previous studies have seldom positioned carbon disclosure as a critical transmission channel. In this mechanism, digital transformation enhances monitoring and management capabilities, which improves carbon transparency. This transparency, in turn, creates external incentives and regulatory pressure that foster green innovation. Second, the moderating effect of media attention has been largely overlooked, especially its potential to amplify existing mechanisms. In the digital era, media serves as both cognitive infrastructure and a meaning-making framework, significantly lowering the public’s costs for interpreting information. However, research has not systematically investigated how media attention might strengthen the relationship between digital transformation and green innovation. Third, the research on heterogeneity needs to be improved in terms of methodology. Most current heterogeneity studies primarily rely on grouped regression followed by a simple comparison of coefficient differences. However, they often lack formal tests for these differences across groups, thus leaving it uncertain whether the observed disparities are statistically significant [21].

In order to fill these research gaps, this paper constructs a joint framework of the mediating role of carbon information disclosure and the moderating effect of media attention, so as to better reveal the impact mechanism of enterprise digital transformation on green technology innovation. In this study, the inter-group difference test will also be carried out in the grouped regression on heterogeneity studies, so as to obtain statistically reliable conclusions. Our framework centered on “information” as the core nexus to systematically elucidate the intrinsic mechanisms among corporate digital transformation, carbon information disclosure, media attention, and green innovation. The framework’s logic unfolds as follows: digital transformation serves as the technological foundation, enhancing a firm’s information processing capacity to efficiently and accurately generate and account for carbon data, thereby enabling high-quality carbon information disclosure. Carbon information disclosure acts as a critical bridge, transforming internal information into external signals and managerial pressure. This, on one hand, compels management to address environmental costs through green innovation, and on the other hand, attracts external resource support, thereby driving green innovation. Throughout this process, media attention plays a pivotal contextual moderating role. By amplifying public scrutiny through agenda-setting, it not only strengthens the firm’s willingness to disclose carbon information but also ensures that disclosure commitments translate into substantive green innovation actions, preventing greenwashing.

In measuring carbon information disclosure, this study builds upon text analysis by introducing the entropy weight method to determine dimensional weights, aiming to provide a potential pathway for optimizing traditional carbon disclosure indicator construction through a data-driven, objective weighting approach. The framework reveals the transmission path from digital technology to information behavior and finally to green innovation. By simultaneously examining the mediating effect of carbon information disclosure and the moderating effect of media attention, it expands the research perspective from a singular technological determinism to a systemic level of technology-governance-environment interaction. This reveals the mechanisms through which digital transformation drives green innovation and deepens the understanding of how digital technology promotes green innovation by reshaping corporate information governance models and responding to external institutional pressures.

The potential contributions of this paper are as follows: First, this study verifies mediating role of carbon information disclosure on the relationship between enterprise digital transformation and green technology innovation. Digital transformation can reduce information asymmetry, thereby improve the carbon information disclosure, and then create a more complete resource allocation environment and innovation incentive mechanism for green technology innovation. Our study contributes to the mechanistic understanding of this topic. Second, this study confirms the moderating role of media attention, which strengthens both the direct effect of digital transformation on green technology innovation and its indirect effect through carbon information disclosure, thereby supporting its role as an important external governance force in corporate low-carbon development. Third, this study analyzes the heterogeneity from the perspectives of ownership, region, and enterprise size, and employs Fisher’s Permutation test method to assess the significance of inter-group differences. Chinese state-owned enterprises possess greater resources and stronger government connections due to their unique political status; and firms in western China often benefit from greater policy support; additionally, firm size also plays an important role in shaping a firm’s ability to control and utilize resources. Our research reveals statistically significant differences in all three aspects, thereby confirming prior findings.

The paper proceeds as follows. In Section 2, we review the literature on how digital transformation drives green technology innovation, as well as on carbon information disclosure and media attention; based on this, we develop the hypotheses for this paper. Section 3 is the research methodology, where we describe the data and variables and establish regression models. Section 4 is the empirical results, where we conduct heterogeneity analysis, and analyze the influence mechanism from the perspectives of mediating and moderating effects. Section 5 summarizes the analysis of this study, presents recommendations at the enterprise and government levels, and also addresses the research limitations and potential future research.

2. Literature Review and Hypotheses Development

2.1. Digital Transformation and Green Technology Innovation

Currently, research on the impact of digital transformation on green technology innovation has been carried out, and scholars have analyzed the impact mechanism and transmission path from different perspectives. In terms of technological enablement, studies highlight how digital capabilities directly empower innovation processes. Song et al. (2022) [22] observed that in heavily polluting industries, digital transformation strengthens information sharing and knowledge integration, thereby accelerating green technology development. Similarly, Guo et al. (2023) [23] demonstrated that digitalization achieves both scale expansion and quality improvement in green innovation by optimizing human capital allocation and deepening industry-university-research collaboration. Sun (2024) [24] further corroborated that digital transformation significantly enhances green technology innovation performance through improved knowledge sharing.

Regarding governance and incentive mechanisms, research emphasizes how digital transformation reshapes organizational behavior and external relationships. Xue et al. (2022) [25] identified that digital transformation alleviates financing constraints and helps attract government subsidies, creating favorable conditions for green innovation. Wang et al. (2024) [26] further confirmed that financing constraints play a partial mediating role in the relationship between digital transformation and green technology innovation, with economic policy uncertainty moderating this mediating effect. Li et al. (2023) [27] revealed that digital transformation creates an enabling environment for green innovation by reducing information asymmetry, strengthening market expectations, and improving corporate governance. From a social responsibility perspective, Zheng and Zhang (2023) [28] found that digital transformation promotes proactive fulfillment of corporate social responsibility, which in turn provides additional impetus for green technology innovation.

Enterprise digital transformation systematically drives green technology innovation through a triple mechanism of resource restructuring, operational efficiency enhancement, and market linkage. First, by leveraging big data and artificial intelligence, digital transformation enables the precise identification and efficient orchestration of internal and external green innovation resources, directly improving innovation efficiency and success rates. Second, it optimizes production and financial decision-making while expanding revenue streams, effectively alleviating financing constraints and consolidating the resource base to provide sustained and stable investment support for green R&D. Finally, digital transformation empowers enterprises to gain real-time insights into market demands and consumer preferences through digital channels, ensuring that green innovation activities accurately respond to market signals and complete the transition from technological value to commercial value.

This study argues that enterprise digital transformation influences green technology innovation through multiple channels. For example, in addition to what was mentioned earlier, this impact can also be achieved through the supply chain pathway; digitalization of enterprise can collect, integrate, and analyze data from various nodes of the supply chain, forming an information collaboration network between upstream and downstream links of the corporate supply chain [29]; this information sharing enhances the directionality of corporate green technology innovation, curbs resource and labor redundancies, and thereby boosts its overall efficiency. Additionally, as analyzed in the following of this article, digital transformation can also affect the carbon information disclosure and subsequently impact green technology innovation. Therefore, we propose Hypothesis 1:

H1.

Enterprise digital transformation can promote green technology innovation.

2.2. The Mediating Role of Carbon Information Disclosure

There are studies showing that the carbon information disclosure can affect enterprises’ green technology innovation. In terms of market incentive mechanisms, research demonstrates that disclosure systems create external pressures and alignment incentives that drive innovation. Li and Wang (2013) [30] identified that corporate carbon emission data and strategic plans enable investors to better assess carbon risks and potential returns, while well-established disclosure systems help standardize corporate operations and enhance incentive effectiveness, collectively motivating firms to pursue energy-saving and emission-reduction innovations. Regarding resource allocation effects, studies consistently show how disclosure improves financial accessibility for green innovation. Ji and Qian (2022) [31] found that carbon information disclosure alleviates corporate financing constraints, thereby stimulating green technology innovation activities. This finding is reinforced by Zheng et al. (2025) [32], who also demonstrated that accurate carbon data helps ease financing constraints and promotes green technology innovation.

Existing studies also demonstrate that digital transformation has impact on carbon information disclosure. From an internal governance perspective, research demonstrates that digital transformation strengthens organizational capacity for transparent reporting. Jian (2024) [33] established that digital transformation improves internal governance mechanisms by curbing irrational managerial behavior and ensuring both the quantity and quality of carbon information disclosure. This finding is corroborated by Chen et al. (2024) [34], who found that even early-stage digital transformation initiates improvements in carbon disclosure practices, suggesting that digital capabilities build foundational governance structures that support transparency. Regarding external monitoring mechanisms, studies highlight how digital transformation amplifies stakeholder scrutiny. Jian (2024) [33] further demonstrated that digital transformation attracts increased analyst coverage, creating external pressure that motivates management to enhance carbon disclosure. This external channel complements internal governance improvements by establishing a feedback loop where better disclosure attracts more monitoring, which in turn drives further disclosure improvements.

Beyond the established correlations discussed in prior literature, the intricate relationship between enterprise digital transformation and carbon information disclosure can be further elucidated by integrating two complementary theoretical lenses: disclosure theory and legitimacy theory. From the perspective of disclosure theory, digital transformation empowers firms with enhanced data capabilities, enabling them to send credible signals about their environmental stewardship to the market. Concurrently, legitimacy theory posits that the act of digital transformation itself elevates stakeholder expectations, pressuring firms to use carbon disclosure as a tool to maintain their social license to operate. Thus, digital transformation drives carbon disclosure both by enabling strategic signaling and by intensifying the need for legitimacy management.

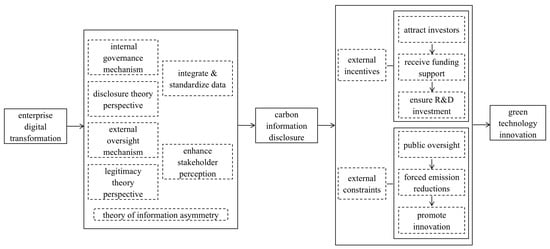

This study argues that digital transformation of enterprises can promote green innovation through enhancing carbon information disclosure. From the perspective of information asymmetry, when enterprises actively promote their own digital transformation, their ability to sort and integrate massive heterogeneous data from both internal and external sources is enhanced, therefore standardized data becomes more valuable and usable; the integration of digital technology and production and operation processes has also enhanced stakeholders’ ability to perceive and obtain information, thereby improving the quality of information disclosure and reducing information asymmetry. From the perspective of corporate governance, high-quality carbon information disclosure provides positive external incentives and constraints for green technology innovation. In terms of external incentives, when companies publicly and transparently disclose carbon information to the market, they can convey signals to investors that they are actively addressing climate change and committed to sustainable development; such companies are more likely to attract the attention and financial support of green investors, thereby ensuring investment in green technology research and development. In terms of external constraints, high-quality carbon information disclosure puts companies under stricter supervision from the public and relevant institutions, prompting them to actively explore and apply green technology innovation achievements to improve their carbon performance, attain carbon reduction goals, and promote sustainable social development. Therefore, we propose Hypothesis 2 (Figure 1 shows the mechanism of H2).

Figure 1.

The mediating mechanism of carbon information disclosure.

H2.

Enterprise digital transformation promotes green technology innovation by improving carbon information disclosure.

2.3. The Moderating Role of Media Attention

Based on agenda-setting theory, the media powerfully shape the cognitive priorities of both the public and corporate decision-makers by selectively highlighting specific issues. The extensive media coverage of climate change and China’s “dual carbon” goals has established green transformation as a core strategic agenda that enterprises must address. Furthermore, through attribute agenda-setting, the media define the essential characteristics of responsible corporate behavior: the necessary integration of transparent carbon information disclosure with substantive green technology innovation. Consequently, media attention not only amplifies the green innovation returns of digital transformation (moderating the direct effect) but, more crucially, generates substantial external pressure that significantly amplifies digital transformation’s impact on corporate carbon disclosure. This enhanced disclosure mechanism subsequently strengthens the mediating pathway to green innovation.

Due to media’s extensive information reachability and powerful diffusion effect, they have become important influencing variables for enterprise innovation. In terms of resource allocation enhancement, studies demonstrate that media coverage improves financial accessibility for innovation activities. Liu et al. (2024) [35] found that online media attention alleviates corporate financing constraints and promotes green technology innovation. Regarding innovation incentive amplification, research shows that media scrutiny creates external pressures that motivate innovative behavior. Liu and Li (2019) [36] established that online media attention enhances innovative behavior in publishing companies, while Guo and Lv (2023) [37] demonstrated that media attention promotes green technology innovation and facilitates sustainable corporate development. Concerning technological adoption moderation, emerging evidence suggests media attention strengthens the innovation impact of advanced technologies. Yao et al. (2025) [38] revealed that media attention significantly moderates the process of artificial intelligence-driven enterprise technological innovation, with higher media attention strengthening the positive impact of AI on innovation outcomes. This moderating effect is further supported by Liu et al. (2024) [35], who identified media’s moderating role in the relationship between investor attention and corporate green innovation.

This study posits that media attention plays a moderating role in the relationship between enterprise digital transformation and green technology innovation. Media attention, as an important mechanism for external governance of enterprises, is a crucial channel for external stakeholders to obtain corporate information. Its core function is to exert supervisory pressure on management through information dissemination and public opinion guidance, thereby achieving external governance of the enterprise. In the situation of high media attention, based on the motivation of reputation maintenance, corporate executives will pay more attention to the improvement of their own green technology innovation capabilities. The media’s coverage and supervision of corporate environmental pollution will encourage companies to enhance their sense of responsibility for environmental protection, optimize their decision-making processes in the field of environmental innovation, and promote green technology innovation [39]. In addition, media attention facilitates knowledge exchange between enterprises and external research institutions and industry experts. As a result, enterprises can obtain more potential opportunities for innovation cooperation, broaden their ideas and perspectives in green technology innovation, and accelerate the transformation and application of digital transformation investment in the field of green technology innovation. Based on the above analysis, Hypothesis 3 is proposed:

H3.

Media attention has a positive moderating effect on the impact of enterprise digital transformation on green technology innovation.

In addition, several studies also have shown that media attention can affect the quality of information disclosure of enterprises. In terms of external supervision, research demonstrates that media scrutiny creates a monitoring environment that compels disclosure compliance. Wang et al. (2022) [40] established that media’s supervisory capacity effectively improves corporate operational and management capabilities, motivating comprehensive environmental information disclosure. This external pressure mechanism is further reinforced by Ma et al. (2023) [41], who found that public pressure enhances board efficiency, thereby improving corporate carbon disclosure practices. Regarding internal governance improvement, studies indicate that media attention strengthens internal control mechanisms that support disclosure quality. Zhang (2018) [42] identified that media attention serves as a positive moderator, strengthening the linkage between media sentiment and accounting information quality. Concerning voluntary disclosure motivation, emerging evidence shows media exposure encourages proactive transparency. Du and Li (2025) [43] empirically demonstrated through a study of Chinese A-share market that increased media attention significantly boosts listed companies’ willingness to voluntarily disclose climate risk information.

This study examines the moderating effect of media attention on the relationship between enterprise digital transformation and carbon information disclosure. In the current era where low-carbon development has become a mainstream trend, media attention has triggered a social supervision effect driven by a wide range of stakeholders, compelling companies to proactively enhance carbon information disclosure in response to stakeholder demands [44]. As a “magnifying glass” for corporate information disclosure, media attention can transform a company’s carbon management capabilities into a public spotlight. On the one hand, in response to external pressure caused by media attention, enterprises will actively leverage the advantages of data collection, processing, and analysis brought about by digital transformation to disclose carbon information more rigorously, comprehensively, and timely. On the other hand, extensive media coverage enables companies to better appreciate the benefits of high-quality carbon information disclosure. By learning from industry peers, they can identify and implement strategies to refine their own carbon information disclosure, ultimately achieving its continuous improvement. Therefore, we propose the hypothesis 4:

H4.

Media attention plays a positive moderating role in the impact of enterprise digital transformation on carbon information disclosure.

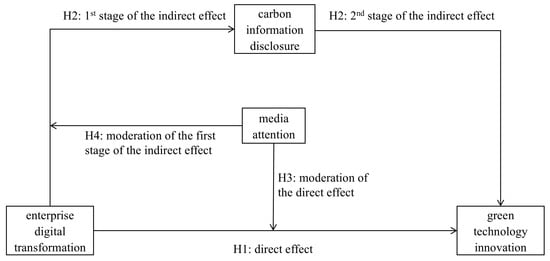

In summary, the overall research hypotheses of this paper are shown in Figure 2.

Figure 2.

Carbon information disclosure and media attention: mediation and moderation.

3. Research Methodology

3.1. Sample Selection and Data Sources

This study takes Chinese A-share listed companies as the research object and selects data from 2012 to 2023 as the initial research sample. The digital transformation indicator is constructed by employing textual analysis to conduct word frequency statistics on the content of annual reports of listed companies; the carbon information disclosure indicator is developed through word frequency statistics on annual report content combined with a weighting process using the entropy weight method. The indicators of green technology innovation, media attention, per capita GDP, and environmental regulatory intensity are sourced from the Chinese Research Data Services Platform (CNRDS). The remaining enterprise level control variable data are sourced from the China Stock Market & Accounting Research Database (CSMAR).

The data processing in this study follows these procedures: (1) exclusion of ST and ST* listed companies; (2) removal of financial sector observations; (3) elimination of samples with missing core variables or key financial data; (4) exclusion of observations lacking per capita GDP or environmental regulatory intensity data. Ultimately, 37,263 valid observations are obtained. The final sample used in this study constitutes an unbalanced panel data structure. This is primarily attributable to two reasons: First, observations with missing values in core variables were removed during data cleaning. Second, the varying listing times of the sample companies naturally result in differences in the length of observation periods across firms. To mitigate the impact of outliers, all continuous variables are winsorized at the 1st and 99th percentiles.

3.2. Selection and Measurement of Variables

3.2.1. Explained Variable

Green technology innovation (GTI). Following the approach of Hu and Xiong (2024) [45], the green technology innovation capability of enterprises is measured by the total number of green technology patent applications, which comprises both green invention patents and green utility model patents. Specifically, we take the natural logarithm of this count plus one to accommodate zero values.

3.2.2. Explanatory Variable

Enterprise digital transformation (DIG). Drawing on the research of Wu et al. (2021) [46], this study classifies digital transformation keywords and selects five dimensional indicators: artificial intelligence technology, big data technology, cloud computing technology, blockchain technology, and digital technology applications. The total word frequency of digital transformation keywords in the annual reports of listed companies is calculated, to which 1 is added before taking the natural logarithm.

The measurement of digital transformation based on the frequency of keywords in annual reports is a mainstream approach in current research. First, although this method is sensitive to corporate disclosure styles and may systematically overestimate the digitalization levels of firms with elaborate reporting practices, as Wang et al. (2024) [47] pointed out, corporate annual reports, as standardized information disclosure vehicles, effectively reflect firms’ strategic intentions and future development directions. Therefore, the keyword frequency-based measurement method can adequately capture the intensity of a firm’s commitment to advancing digital transformation. Second, Wang et al. (2024) [26] further emphasized that constructing a systematic and multidimensional digital keyword library significantly enhances the reliability and validity of the measurement indicators, making them particularly suitable for large-sample empirical research. Third, existing studies employing this measurement approach have also demonstrated that the digital transformation indicators derived from it exhibit significant explanatory power for both corporate R&D investment intensity [48] and financial performance [47].

3.2.3. Mediating Variable

Carbon information disclosure (CID). Drawing on the research of Song et al. (2019) [49], Zhou and Xiao (2024) [50], and Xu et al. (2024) [51], this study adopts an integrated approach combining textual analysis and the entropy weight method to measure carbon information disclosure level. First, the textual analysis method is employed to categorize carbon information keywords (See Appendix A) into three assessment dimensions: low-carbon development philosophy system, low-carbon technology management system, and low-carbon information accounting system. The selection of keywords for CID was based on major international frameworks and domestic standards, including the CDP questionnaire, the Climate Disclosure Standards Board (CDSB) Framework, as well as China’s 2015 “General Guidelines for Greenhouse Gas Emissions Accounting and Reporting by Industrial Enterprises”. The word frequencies of carbon-related keywords in annual reports are counted to obtain the respective word frequencies for each dimension. Subsequently, the entropy weight method is applied to determine the weight of each dimension. These weights are then multiplied by their respective word frequencies and summed to yield a composite measure. To enhance the clarity of the measurement data, following the approach of Liu and Ma (2024) [52], the composite measure is multiplied by 100 and incremented by 1, prior to taking the natural logarithm to obtain the standardized carbon information disclosure indicator.

The CID indicator constructed in this study is fundamentally based on counting relevant term frequencies in corporate annual reports, which primarily measures the quantity of information disclosure. However, the dimension of keywords related to the “low-carbon information accounting system” specifically focuses on disclosing concrete carbon emission data, which is also, to a certain extent, an indicator of the quality of the information disclosed.

This study employs the entropy weight method to determine the weights of various indicators, primarily for two reasons:

First, the entropy weight method is an objective weighting technique where the weights are derived solely from the degree of variation within the data itself, effectively avoiding the potential human bias associated with subjective weighting methods.

Second, grounded in information theory, the method posits that greater dispersion in an indicator’s values leads to a smaller entropy value, which in turn signifies a greater amount of information content. Consequently, such an indicator plays a more critical role in distinguishing between samples within the evaluation system and should therefore be assigned a higher weight. This provides a purely data-driven and objective evaluation pathway, particularly valuable in the absence of prior knowledge regarding the relative importance of the indicators.

The calculation process of the entropy weight method used in this paper is as follows: First, the term frequency data is standardized, yielding :

Here, m represents the number of observed samples, and n denotes the number of indicators (dimensionality).

Then, the entropy value of each indicator is calculated:

where is the normalization coefficient. Finally, the weight of the j-th indicator is obtained:

3.2.4. Moderating Variable

Media attention (Media). Following the approach of Wang et al. (2022) [53], this study measures media attention using the logarithm of the annual count of corporate media coverage plus one. To mitigate potential multicollinearity issues in moderation effect analysis, this variable will be mean-centered before constructing interaction terms.

3.2.5. Control Variables

Consistent with most existing studies, this paper selects several conventional variables that may influence corporate green technology innovation as control variables. These specifically include: firm size (Size), firm listing age (Age), total asset turnover ratio (ATO), financial leverage level (Lev), corporate growth (Growth), return on assets (ROA), and CEO duality (Dual). Additionally, we control for regional economic development and external environmental regulation using the logarithm of per capita GDP (PGDP) and the logarithm of the number of environmentally related sentences in municipal policy documents (Env), respectively, both measured at the city level where the firm is located.

The specific definitions of the variables in this paper are listed in Table 1.

Table 1.

Variable definitions.

3.3. Regression Models

3.3.1. Benchmark Regression Model

To evaluate the impact of enterprise digital transformation on green technology innovation (H1), this study constructs the following model for benchmark regression analysis:

In Model (1), i and t denote firm and year, respectively. GTIi,t measures firm i‘s green technology innovation in year t, while DIGi,t captures its digital transformation. The term Controls refers to a set of control variables. The model includes firm fixed effects , year fixed effects , and an idiosyncratic error term . The coefficient measures the total effect of DIG on GTI. A positive and statistically significant estimate of would support H1, indicating that digital transformation promotes green technology innovation.

3.3.2. Mediating Effect Model

To test H2, following the approach of Wen and Ye (2014) [54], we introduce the mediating variable, CID, into the analytical framework based on Model (1) to examine its mediating effect:

In Model (2), coefficient measures the effect of DIG on the mediator CID. In Model (3), and represent the direct effect of DIG on GTI and the effect of CID on GTI, respectively. If , , and are all positive and statistically significant, carbon information disclosure plays a partial mediating role between digital transformation and green innovation, supporting H2.

3.3.3. Moderating Effect Model

To further test the moderating effect of media attention (H3 and H4), and drawing on Wen and Ye’s (2014) [55] work on moderated mediation effects, we build the following models:

In Models (4) and (6), a positive and significant coefficient and indicates that media attention positively moderates the relationship between digital transformation and green technology innovation, supporting H3. Similarly, in Model (5), a positive and significant confirms the positive moderating role of media attention between digital transformation and carbon information disclosure, validating H4.

4. Empirical Results and Analysis

4.1. Descriptive Statistics

Descriptive statistics of key variables are presented in Table 2. The value of GTI is between 0 and 4.83, with a mean of 0.888 and a standard deviation of 1.182. The data range is large and the mean is small, indicating that there is a significant gap in the number of green patent applications between enterprises. Most enterprises have deficiencies in green research and development innovation activities, and green innovation among enterprises is in an unbalanced state. The value of DIG ranges from 0 to 5.20, with a mean of 1.582 and a standard deviation of 1.423. This indicates that although digitalization has developed rapidly in recent years and top enterprises have undergone significant digital transformation, most enterprises are still in the early stages of transformation. The value of CID ranges from 0 to 2.22, with a mean of 0.573 and a standard deviation of 0.580. The difference between the mean and extreme values shows that listed companies generally exhibit the characteristics of “low coverage and high differences”, which is in line with the current situation of China’s voluntary carbon information disclosure policy; and the level of carbon information disclosure needs to be improved by various companies. The value of Media ranges from 2.94 to 7.94, with a mean of 4.990 and a standard deviation of 0.963, indicating substantial variation in media coverage across firms. From the data of other control variables, it can also be seen that there are obvious differences among enterprises.

Table 2.

Descriptive statistics of variables.

To test for multicollinearity, this study employs Variance Inflation Factors (VIF). As presented in Table 3, all VIF values remain well below the critical threshold of 10, with a mean value of 1.33, which indicates the absence of severe multicollinearity issues in the model.

Table 3.

VIF test of variables.

4.2. Benchmark Regression Analysis

Table 4 reports the benchmark regression results of enterprise digital transformation on green technology innovation. To mitigate potential heteroscedasticity issues, robust standard errors clustered at the firm level are employed in the regressions. Column (1) presents the results without control variables and without controlling for fixed effects. Column (2) builds on Column (1) by incorporating control variables. In both cases, the coefficient for DIG is statistically significant at the 1% level and positive, indicating that digital transformation has a positive promoting effect on green technology innovation. Column (3) incorporates a two-way fixed effects specification, controlling for both firm- and year-level unobserved heterogeneity. The two-way fixed effects model effectively controls for time-invariant firm heterogeneity and aggregate time trends. Specifically, it captures common time shocks, such as those stemming from nationwide policies implemented simultaneously across all firms and regions. Although the model does not account for firm-specific linear trends, it fully absorbs the influence of all time-invariant firm characteristics on the outcomes. In this case, the coefficient of DIG is 0.0445, which is still significant at the 1% level. Since GTI is the logarithm of the number of patent applications, this result indicates that for every one-unit increase in DIG, the expected number of green patent applications increases by 4.45%. Overall, the regression results support the promotion effect of enterprise digital transformation on green technology innovation, and H1 is verified.

Table 4.

Results of benchmark regression model.

4.3. Robustness Tests

4.3.1. Lagged Explanatory Variable

Due to the long-term nature of green technology innovation, the impact of enterprise digital transformation on it may experience a lag. Therefore, following the approach of Du and Zhang (2020) [56], this study tests for lagged effects by incorporating the explanatory variable DIG with lags of one, two, and three periods into Model (1).

As a robustness check, this study separately examines the independent impact of DIG on green innovation at lags of one to three periods (t − 1, t − 2, t − 3). This specification is grounded, first and foremost, in the theory of the dynamic innovation process: the short-term effect of digital transformation (t − 1) primarily stems from its role in enhancing the efficiency of existing R&D processes (exploitative innovation), whereas its deeper impact in driving fundamental technological change (exploratory innovation) requires a longer cycle of knowledge absorption and recombination (t − 2, t − 3). In terms of empirical strategy, to avoid the multicollinearity problems that arise when multiple lagged terms are included simultaneously and to unbiasedly identify the independent effect at each lag, this paper follows standard practice in empirical research by estimating the lagged terms in separate models [57]. This approach is also consistent with the classic finding in the economics of innovation that the impact of R&D investment exhibits a lag of 1 to 3 years [58].

The results are shown in Table 5. Columns (1) to (3) report the estimated results of lagged periods one, two, and three, respectively, with coefficients of 0.0400, 0.0385, and 0.0212 for DIG. Among them, the coefficients of DIG in Columns (1) and (2) are significant at the 1% level, and that in Column (3) is significant at the 5% level. This indicates that even considering the cyclical delays in innovation activities, the enterprise digital transformation still has a significant positive impact on green technology innovation.

Table 5.

Robustness tests—lagged explanatory variable.

Together, the findings here lead to two key observations: first, compared to the baseline results in Column (3) of Table 4, the estimated coefficient of DIG here is significantly smaller; second, the promoting effect of corporate digital transformation on green innovation markedly weakens as the lag period increases. This finding confirms that the incentivizing effect of digital technology on green innovation is time-sensitive, with a more direct impact in the short term. The reason for this is that the initial dividends of digital transformation are quickly absorbed over time. Subsequent deeper levels of green innovation (such as the development of disruptive environmental technologies) often require substantially larger investments, longer cycles, and may encounter multiple obstacles including technological bottlenecks, financial constraints, and organizational inertia, thereby demonstrating a diminishing marginal effect of digital transformation.

4.3.2. Replace the Explained Variable

Drawing on the approach of Li and Xiao (2020) [59], this study uses the number of green patent authorizations as a proxy for green technology innovation. This variable (GTIchange) is measured as the natural logarithm of (1 + the total number of green patents granted to the enterprise in a given year). The regression results are shown in Column (1) of Table 6. The coefficient of DIG is 0.0142, which is significant at the 1% level. This indicates that the promotion effect of enterprise digital transformation on green technology innovation still holds true.

Table 6.

Robustness tests—replace the explained variable and exclude some city samples.

As shown in Table 6, the impact of DIG diminishes when patent grants are used as the dependent variable. This result suggests that enterprise digitalization plays divergent roles at different stages of the innovation process. The transition from patent applications to grants involves a rigorous screening mechanism. This indicates that digitalization may be more effective in expanding the pipeline of innovation (applications) than in enhancing the quality or compliance necessary for grant approval.

4.3.3. Exclude Some City Samples

According to the “Digitalization Evolution Index (2024)” [60], Shanghai, Hangzhou, Beijing, Shenzhen, and Chengdu rank among the top five. These cities have achieved significant results in digital development, with obvious geographic advantages and strong innovation capabilities. Enterprises located in these cities may face more complete environmental infrastructure, more active green technology trading markets, and stricter government environmental regulations. These factors may lead to a lack of representativeness of enterprises in these cities. Therefore, this article conducts regression analysis on the remaining enterprise samples from the five cities mentioned above. As shown in Column (2) of Table 6, the coefficient of DIG is 0.0365, which is significantly positive at the 1% level, and the conclusion of the benchmark regression remains unchanged.

A similar pattern is also evident from the results here, which shows that the impact of DIG on GTI diminishes in the subsample that excludes top-tier cities in terms of digital development. This reveals that the effect of enterprise digitalization is not isolated but deeply embedded within the broader external environment. The observed attenuation suggests a complementary relationship between firm-level digital transformation and the city-level digital ecosystem. When advanced urban digital infrastructures are absent, the efficacy of corporate digital initiatives in fostering green innovation is significantly reduced.

4.3.4. Negative Binomial Regression

Considering that green technology innovation data are count variables and may exhibit potential over-dispersion, this study further employs negative binomial regression for empirical analysis to more accurately capture the distribution characteristics of corporate green technology innovation activities and ensure the robustness of the research findings. The results are shown in Column (1) of Table 7. The estimated coefficient for DIG is 0.0388, statistically significant at the 1% level, reaffirming the positive relationship between digital transformation and green technology innovation established in the baseline analysis. The regression results show that the coefficient estimates from the negative binomial regression are smaller than those from the OLS regression. This difference primarily stems from the inherent characteristics of corporate green technology innovation data, which typically contain numerous zeros and exhibit a right-skewed distribution. By introducing a dispersion parameter, the negative binomial regression better captures the over-dispersed nature of the data. Compared to OLS regression, the negative binomial approach is less sensitive to extreme values, resulting in more conservative coefficient estimates.

Table 7.

Negative binomial regression and accounting for potential path dependence.

4.3.5. Accounting for Potential Path Dependence

We further examined the potential path dependence in enterprise green technology innovation by including its lagged term (LGTI) as a control variable in the model. The results are shown in Column (2) of Table 7. The empirical results demonstrate that even after accounting for this dynamic pattern, the estimated coefficient for DIG is 0.0376, statistically significant at the 1% level. The positive impact of digital transformation on green technology innovation remains statistically significant, though its magnitude shows a moderate decrease compared to the baseline model. This result indicates that for every one-unit increase in DIG, the expected number of green patent applications increases by 3.76%, after controlling for potential path dependence. It is reasonable to posit that the lagged term now accounts for some portion of the sustained innovation previously captured by the digital transformation variable in the static specification. This finding supports the robustness of our core conclusions from a dynamic perspective, confirming that the promoting effect of digital transformation on green innovation is persistent and stable, unaffected by accounting for the historical accumulation of innovation activities.

4.4. Endogeneity Test

To mitigate potential endogeneity concerns, this paper constructs an instrumental variable (IV) calculated as follows: first, we compute the annual average of the digitalization indicators of other firms within the same industry (i.e., excluding the firm itself), and then take the logarithm of this average value plus one. This instrumental variable effectively captures common industry trends that are exogenous to the firm. By excluding information specific to the firm itself, it significantly reduces the risk of correlation with unobserved firm-level characteristics in the error term, thereby providing a more reliable basis for accurately identifying the causal effect of digitalization on firm performance.

A two-stage least squares (2SLS) regression is then applied, and the results are shown in Table 8. In the first-stage regression results, the coefficient of the IV is 0.8688, which is statistically significant at the 1% level, indicating that the instrumental variable satisfies the relevance assumption; the underidentification test, the Kleibergen–Paap rk LM statistic is 118.92, significant at the 1% level, indicating no statistical issue of underidentification. In the weak instrument test, the Kleibergen–Paap Wald rk F statistic is 170.72, substantially exceeding the critical value of 16.38 at the 10% significance level based on the Stock–Yogo test, thus confirming the absence of a weak instrument problem. In the second-stage regression results, the coefficient of DIG is 0.1758, which is significantly positive at the 1% level. Therefore, the conclusion that enterprise digital transformation promotes green technology innovation remains unchanged.

Table 8.

The results of endogeneity test.

The significantly larger estimated coefficient from the instrumental variable (IV) approach compared to the OLS estimate suggests that conventional methods may have underestimated the true effect of digital transformation. This discrepancy can be largely attributed to a “resource crowding-out” effect arising from bidirectional causality: when firms channel substantial resources into green innovation projects, it may delay or crowd out investments in digital transformation. This reverse inhibitory effect introduces bias in OLS regression, diluting the observed positive correlation between digital transformation and green innovation and consequently leading to a downward bias in the estimated coefficient. In contrast, the IV method addresses this by constructing an exogenous shock, effectively isolating this interference and thereby uncovering a more genuine and pronounced promoting effect.

4.5. Heterogeneity Analysis

Recognizing that the impact of digital transformation on green technology innovation may vary by firm characteristics, this study examines heterogeneity across three dimensions: ownership, region, and firm size.

4.5.1. Ownership Heterogeneity Analysis

In China, state-owned enterprises possess a unique political status and distinct governance structures compared to non-state-owned enterprises. These inherent distinctions fundamentally shape their governance mechanisms, resource acquisition, business objectives, and risk tolerance. This study divides enterprises into two groups based on their ownership: state-owned enterprises and non-state-owned enterprises. The results of grouped regression are shown in Table 9.

Table 9.

The results of ownership heterogeneity analysis.

In both groups, the coefficients of DIG are significant at the 1% level, and the coefficient of the state-owned enterprises group (0.0743) is larger than that of the non-state-owned enterprises group (0.0304). To examine whether this difference is statistically significant, this study further employs Fisher’s Permutation test method to conduct an inter-group coefficient difference test. The results show that the p-value corresponding to the inter-group difference in the coefficient of DIG is 0.004, which is significant at the 1% level, confirming that the regression coefficients between these two groups indeed exhibit statistically significant difference. This indicates that the promoting effect of digital transformation on green technology innovation varies across companies with different ownership, with state-owned enterprises demonstrating a stronger promotional effect compared to non-state-owned enterprises.

The underlying mechanism for this divergence can be attributed to the fundamental differences in the “resource-institution” dual-driver logic between state-owned and non-state-owned enterprises. From the resource-based view, state-owned enterprises (SOEs), leveraging their political connections and institutional advantages, enjoy privileged access to specialized fiscal subsidies, low-cost policy loans, and critical data resources required for digital transformation. This not only alleviates financial constraints on technological innovation but also significantly reduces the uncertainties associated with long-term R&D, creating a unique resource buffer effect. From the perspective of institutional theory, their digitalization behaviors are often deeply embedded in national-level strategic initiatives (such as the “dual carbon” goals), generating strong institutional isomorphism pressures. Consequently, digital transformation is no longer merely an efficiency tool but evolves into a pursuit of legitimacy through fulfilling policy-driven social responsibilities, thereby giving rise to a targeted and resource-concentrated policy-induced green innovation pathway.

In contrast, non-state-owned enterprises are primarily driven by market competition and survival pressures. Facing severe financing constraints and disadvantages in accessing policy resources, their technological investments are often prioritized for short-term profitability and market responsiveness. As a result, their empowerment of green innovation tends to exhibit stronger characteristics of cost sensitivity and path dependency. Thus, the stronger promoting effect of digital transformation on green technology innovation in SOEs is essentially shaped by their unique institutional resource redundancy and policy-oriented objective function.

4.5.2. Regional Heterogeneity Analysis

China’s significant geographical disparities, coupled with varying levels of economic development and regional government macro-policies across different areas, may lead to divergent impacts of digital transformation on green technology innovation depending on enterprises’ regional locations. Following the economic zone classification criteria issued by the National Bureau of Statistics of China in 2021, this study categorizes 12 provincial-level regions—including Inner Mongolia, Guangxi, and Chongqing—as the western region, while classifying the remaining areas as the central-eastern region. The grouped regression results are presented in Table 10.

Table 10.

The results of regional heterogeneity analysis.

The coefficients of DIG in both regression groups are statistically significant at the 1% level, and the coefficient of the western region group (0.0766) is larger than that of the central-eastern region group (0.0398). To examine whether this difference is statistically significant, this study further employs Fisher’s Permutation test method to conduct an inter-group coefficient difference test. The results show that the p-value corresponding to the inter-group difference in the coefficient of DIG is 0.052, which is significant at the 10% level; this indicates a statistically significant difference between the regression coefficients of the two groups; the promoting effect of digital transformation on green technology innovation is more pronounced in the western region.

The underlying mechanism of this phenomenon stems from the unique developmental context in Western China, shaped by the interplay of resource endowment and policy orientation. At the resource-technology alignment level, the abundance of renewable energy sources such as wind and solar power, along with mineral resources in the region, provides distinctive application scenarios for digital transformation. Through digital technologies like the Internet of Things and big data, enterprises can deeply integrate these resource advantages with specific fields such as smart grid construction and green mining, achieving effective coupling between resource conditions and technological pathways. This high degree of alignment not only reduces the implementation barriers to green technology innovation but also significantly enhances the practical benefits of digital transformation at the regional level.

At the institution-resource synergy level, national policy support for Western development systematically complements the local resource structure. By employing policy instruments such as fiscal subsidies and tax incentives, the government alleviates the costs of corporate transformation while steering digital investments toward green industries that align with the region’s comparative advantages. Such institutional arrangements strengthen both the willingness and capability of enterprises to apply digital technologies in green innovation. Ultimately, the resource foundation and supporting policies in Western China form a synergistic force that collectively amplifies the driving effect of digital transformation on green technology innovation.

4.5.3. Firm Size Heterogeneity Analysis

Firm size reflects an enterprise’s resource allocation and market position in economic activities, serving as a critical indicator for evaluating its growth stage and economic strength. Based on the median firm size of sample enterprises each year, this study categorizes enterprises into groups, with the regression results presented in Table 11.

Table 11.

The results of firm-size heterogeneity analysis.

The coefficients of DIG in both regression groups are statistically significant at the 1% level, and the coefficient of large-size enterprises group (0.0602) is bigger than that of the small & medium-size enterprises group (0.0281). This study further employs Fisher’s Permutation test method to examine the inter-group coefficient difference. The p-value corresponding to the DIG coefficient difference between groups is 0.022, which is statistically significant at the 5% level, indicating a statistically significant difference between the coefficients of the two groups. Thus, the positive impact of digital transformation on green technology innovation varies with firm size, with the effect being stronger in large enterprises.

The differential impact of firm size on the green innovation effects of digital transformation may be attributed to the systemic advantages enjoyed by large enterprises. In terms of resources and financing, large firms’ substantial capital reserves, stable cash flows, and highly skilled workforce enable them to simultaneously support infrastructure investments for digital transformation and long-term research and development for green innovation. Their higher credit ratings facilitate access to low-cost financing, creating sustainable capital protection. At the organizational and market level, their mature governance structures, professional risk management, and extensive market networks not only enhance the efficiency and robustness of digital implementation but also accelerate the large-scale conversion of digital technologies into green products and services. This composite advantage, formed by resource redundancy, financing convenience, organizational resilience, and market integration, systematically strengthens large enterprises’ capacity to drive green technology innovation through digital transformation, resulting in a significantly more pronounced promoting effect compared to small and medium-sized enterprises, which face resource constraints and weaker risk resistance capabilities.

4.6. Mediating Effect Analysis

To examine the mediating effect of carbon information disclosure in the relationship between enterprise digital transformation and green technology innovation, this study draws on the approach of Wen and Ye (2014) [54] and conducts a stepwise regression analysis using Models (1), (2) and (3). In Table 12, Column (1) presents the benchmark regression results discussed earlier, where the coefficient of DIG reflects the total effect of digital transformation on green technology innovation. Column (2) examines the impact of enterprise digital transformation on carbon information disclosure. The results show that the coefficient of DIG is 0.0151, which is statistically significant at the 1% level, indicating that digital transformation has a statistically significant positive effect on carbon information disclosure. Column (3) presents the regression results with both digital transformation and carbon information disclosure included in Model (3). The results show that the coefficient of CID is 0.1144, statistically significant at the 1% level, indicating a positive impact of carbon information disclosure on green technology innovation. Based on the findings from Columns (2) and (3), it can be concluded that digital transformation influences green technology innovation through its effect on carbon information disclosure, meaning carbon information disclosure plays a mediating role. Thus, H2 is validated.

Table 12.

The results of mediating effect analysis.

In addition, the coefficient of DIG (0.0428) in Column (3) represents the direct effect of digital transformation on green technology innovation, which is significantly positive at the 1% level and smaller than that in Column (1); therefore, carbon information disclosure plays a partial mediating role between digital transformation and green technology innovation.

Following the preliminary analysis using the stepwise regression approach, this study subsequently applied Sobel test to further validate the statistical significance of the mediating effect. The results of the Sobel test are presented in Table 13. The test demonstrates a statistically significant mediating effect, with an indirect effect of 0.00173 (p < 0.001).

Table 13.

Sobel mediating effect test.

Furthermore, this study employed the Bootstrap sampling method for verification. Based on 5000 random samples, the results presented in Table 14 also shows an indirect effect of 0.00173 with a 95% confidence interval of [0.0010, 0.0025] excluding zero, while the direct effect remains significant. This finding aligns with the conclusions from both the stepwise regression method and Sobel test, collectively confirming that carbon information disclosure quality plays a significant partial mediating role between digital transformation and green technology innovation.

Table 14.

Bootstrap mediating effect test.

The relatively weaker mediating effect of CID, compared to the direct effect, merits a forward-looking interpretation. This “weakness” largely mirrors the early-stage development of carbon disclosure practices in China, where disclosure levels are generally low and its institutional power is not fully unleashed. We argue that this does not negate the substantive role of CID but rather highlights its untapped potential. As the regulatory environment evolves, potentially culminating in mandatory disclosure mandates, the informational and governance functions of CID will be significantly amplified. Consequently, what is currently a supplementary pathway could evolve into a central conduit through which digital transformation fuels green innovation. Acknowledging this pathway now is critical for a comprehensive understanding of corporate green transition dynamics.

4.7. Moderating Effect Analysis

Drawing on the testing approach for moderated mediation effects proposed by Wen and Ye (2014) [55], as shown in Models (4)–(6) (Equations in Section 3.3.3), this study verifies the presence of moderating effects by constructing interaction terms between the moderating variable Media and DIG. To mitigate the impact of multicollinearity on model estimation, we performed mean-centering on the moderating variable Media. Specifically, Media was transformed into deviation score form by subtracting its sample mean before constructing interaction terms. This approach effectively reduces multicollinearity among variables and enhances the stability of model estimation while preserving the substantive nature of the moderating effects between variables. The regression results are presented in Table 15.

Table 15.

The results of moderating effect analysis.

First, we examine the directly moderating effect between enterprise digital transformation and green technology innovation. In both Column (1) and Column (3), the coefficients of DIG show statistically significant positive coefficients at the 1% level, and the coefficients of DIG × Media are significantly positive at the and 1% and 5% level, respectively. This indicates that media attention plays a positive moderating role and amplifies the impact of enterprise digital transformation on green technology innovation. H3 is validated.

Then, we investigate the moderating effect on the pathway from digital transformation to carbon information disclosure. In Column (2), the coefficient of DIG is 0.0140, significant at the 1% level, and the coefficient of DIG × Media is 0.028, significant at the 1% level. This indicates that media attention positively moderates the relationship between digital transformation and carbon information disclosure. Specifically, under the pressure of media, digital transformation exerts a stronger effect on improving corporate carbon information disclosure, thus validating H4.

5. Research Conclusions and Recommendations

5.1. Research Conclusions

To achieve the “dual carbon” goal, China regards green technology innovation as a key engine for sustainable development and promotes the coordinated development of digital transformation and green innovation in enterprises. By introducing carbon information disclosure as a mediating variable and media attention as a moderating variable, this study explores the mechanism of the relationship between enterprise digital transformation and green technology innovation. In addition, to account for heterogeneity among firms, this study performs regressions on groups stratified by ownership, region, and firm size, with tests for inter-group coefficient differences across these groups. The main conclusions are as follows:

(1) Enterprise digital transformation significantly promotes green technology innovation. This conclusion remains robust after conducting a series of tests including using lagged explanatory variables, replacing the dependent variable, excluding specific city samples, estimation with a negative binomial regression, and addressing endogeneity through the 2SLS method. The results indicate that a one-unit increase in the digitalization index is associated with a 4.45% rise in green patent applications; after controlling for potential path dependence, this effect remains stable at 3.76%.

(2) Heterogeneity analysis reveals that the promoting effect of digital transformation on green technology innovation is more pronounced in state-owned enterprises, large firms, and enterprises located in western China. Fisher’s Permutation Test statistically confirms significant differences in this effect across enterprises with different ownership types, regional locations, and scales.

(3) Mediation effect tests demonstrate that carbon information disclosure plays a partial mediating role in the relationship between digital transformation and green technology innovation. Results from both the stepwise regression method and the Sobel test and the Bootstrap approach consistently indicate that digital transformation enhances green technology innovation capability by improving the level of corporate carbon information disclosure.

(4) Moderating effect analysis indicates that media attention positively moderates both the direct impact of digital transformation on green technology innovation and the pathway from digital transformation to carbon information disclosure. Enterprises with greater media exposure show a significantly stronger correlation between digital transformation and green innovation outcomes, as well as between digital transformation and carbon disclosure levels. These results demonstrate that media attention effectively amplifies the role of digital transformation in driving green technology innovation and enhancing carbon information disclosure.

5.2. Recommendations

5.2.1. Enterprise Level

(1) Enterprises should integrate digital transformation into their core strategic planning. The study robustly demonstrates that digital transformation significantly promotes green technology innovation, with particularly pronounced effects in state-owned enterprises, large firms, and those located in western China. Relevant enterprises should advance digital transformation according to their specific characteristics to build a technological foundation for green innovation.

(2) Enterprises should enhance carbon information disclosure mechanisms through digital tools. The mediation effect tests confirm that carbon information disclosure serves as a critical pathway through which digital transformation drives green technology innovation. Beyond basic data such as carbon emissions, companies should disclose substantive information including emission reduction technical pathways and green R&D investments to convey clear green innovation signals to the market.

(3) Enterprises should recognize the enabling role of media attention. The moderation analysis reveals that media attention strengthens both the direct impact of digital transformation on green technology innovation and its effect on carbon information disclosure. Companies can proactively disclose their progress in digital transformation and green innovation, thereby transforming media supervision into a driving force for green development.

5.2.2. Government Level

(1) Establish a targeted fiscal support system focusing on digital transformation and green innovation. Special funds should be created to subsidize digital technology R&D and green process upgrades, particularly for non-state-owned and small-to-medium enterprises where financial constraints are more binding. Tax incentives should be expanded, including super-deductions for innovation R&D expenses and tax reductions for enterprises that demonstrate high-quality carbon information disclosure, directly building on the finding that carbon disclosure mediates green innovation.

(2) Implement differentiated policies based on enterprise characteristics. Given the stronger effects observed in state-owned enterprises and western regions, policy should leverage state-owned and large enterprises as demonstration cases while providing targeted subsidies for digital equipment purchases to non-state-owned and small-to-medium enterprises. Regional collaboration platforms should be established to harness the western region’s clean energy resources and the advanced digital capabilities of central and eastern regions, addressing the identified regional disparities.

(3) Develop media-based monitoring mechanisms to amplify digital transformation effects. Building on the moderating role of media attention, government should create platforms regularly disclosing corporate digital transformation progress, carbon disclosure quality, and green innovation outcomes. Third-party verification and objective reporting of these metrics will enhance transparency, while public oversight mechanisms will help transform media scrutiny into sustained drivers for green development.

5.3. Policy Implications for Developing Economies

This study is situated within China’s specific institutional context, yet its core findings hold significant implications for other developing and transition economies. The transmission mechanism through which digital transformation promotes green technology innovation via carbon information disclosure, along with the amplifying effect of media attention on this process, remains applicable in economies facing similar challenges in digitalization and green development. The particularly strong effects observed in state-owned enterprises, large firms, and western regions demonstrate the universal need to account for enterprise heterogeneity and regional development disparities in policy formulation.

Countries can draw upon this study’s conclusions to adopt differentiated pathways in promoting the coordinated transition of digitalization and green development. By establishing synergistic mechanisms between digital technology and environmental information disclosure, effective progress in green transition can be achieved even during stages when carbon markets are not yet fully developed. Simultaneously, attention should be given to the role of media supervision in strengthening corporate environmental governance, constructing a multi-stakeholder oversight system. These measures provide actionable references for transition pathways across economies at different development stages.

5.4. Limitations

(1) This study focuses on Chinese A-share listed companies, excluding unlisted small and micro enterprises due to data constraints. As listed firms benefit from stronger governance, financing capacity, and regulatory oversight, the identified pathway from digital transformation to green innovation via carbon disclosure may represent an optimal scenario. In contrast, unlisted firms face greater resource constraints and typically prioritize basic operational efficiency in digitalization, making it difficult to replicate this innovation pathway. Consequently, these findings should be interpreted as an upper-bound effect primarily applicable to well-established firms, requiring downward adjustment when generalizing to the broader enterprise population.