Abstract

The attitude–behavior gap is an important issue in the consumer behavior theories. It is widely recognized that what people say is a little different from what they do in green consumption. This gap brings a great challenge for manufacturers to make sales and pricing strategies. Current studies on the attitude–behavior gap mainly focus on the explanation from the perspective of psychology and social behaviors. Few studies have considered quantitatively modeling the producing and pricing strategies of manufacturers under the attitude–behavior gap. This paper fills this gap by proposing a novel equilibrium analysis framework to model optimal strategies in both monopoly and duopoly scenarios. Our findings show that behavior-based strategies consistently outperform attitude-based strategies in both market structures. Furthermore, given the distribution of consumer attitudes towards the green products, we introduce an iterative algorithm to solve the equilibrium pricing strategy. In cases where the distribution is unknown, we demonstrate that manufacturers can obtain valuable insights through social surveys and empirical distributions. Numerical simulations validate our theoretical results, highlighting the practical implications of our model for manufacturers seeking to navigate the attitude-behavior gap.

1. Introduction

With the growing awareness of environmental protection, consumers increasingly advocate the use of green and sustainable products, such as new energy vehicles, organic foods, and recyclable packaging materials [1,2]. However, despite this growing environmental consciousness, the market shares of green products have not risen as expected. This discrepancy between consumers’ pro-environmental attitudes and their actual purchasing behaviors is widely known as the attitude–behavior gap or intention–behavior gap [3,4]. In other words, what consumers claim they would do for the environment often differs from what they actually do in practice.

In green consumption contexts, many consumers express positive attitudes toward environmentally friendly products and report a willingness to purchase them [5]. Yet, empirical evidence consistently shows that only a small fraction are willing to pay a higher price for such products, even when they strongly support environmental protection [6,7]. This inconsistency has profound implications for firms producing and marketing green products, as it complicates the formulation of effective production, pricing, and communication strategies.

Prior research has extensively explored the attitude–behavior gap from behavioral and psychological perspectives, emphasizing values, beliefs, motivations, and social norms as the core drivers of consumer decision-making [8]. While such studies enrich our understanding of the psychological underpinnings of green behavior, they provide limited insights into how firms can quantitatively model and respond to this gap in their operational and pricing strategies. In other words, the existing work largely explains why the gap exists, but not how businesses should act upon it.

This study differs from prior behavioral and psychological research by developing a quantitative decision-making framework that explicitly incorporates consumers’ attitude–behavior inconsistencies into firms’ production and pricing strategies. Rather than focusing solely on the formation of green attitudes, we examine how these mismatched preferences affect market equilibria under different competitive structures. The proposed model allows manufacturers to identify optimal strategies under both monopoly and duopoly settings, bridging the gap between behavioral theory and managerial decision-making.

Specifically, this paper addresses the following research questions:

1. How can manufacturers optimally determine production and pricing strategies when consumers exhibit an attitude–behavior gap in green consumption?

2. How do these strategies differ between monopoly and duopoly markets?

3. What are the equilibrium outcomes when consumer attitude distributions are known versus when they must be empirically estimated?

To answer these questions, we establish an equilibrium analysis framework that links consumer attitude distributions to actual purchasing behaviors, and further to firms’ pricing and production decisions. The logical structure of our model can be summarized in a conceptual diagram (Figure 1).

Figure 1.

Conceptual framework of the model: the relationship between consumer attitudes, behavioral transformation, and firms’ optimal decisions.

The main contributions of this study are threefold. First, it introduces a novel analytical framework that quantitatively captures the impact of the attitude–behavior gap on firms’ strategic decisions. Second, it provides comparative analyses under monopoly and duopoly settings, revealing that behavior-based strategies consistently outperform attitude-based ones. Third, it develops an iterative algorithm that enables manufacturers to approximate equilibrium prices even when the underlying consumer attitude distribution is unknown, thereby offering a practical tool for real-world decision-making.

The remainder of the paper is organized as follows. Section 2 reviews the existing literature on the attitude–behavior gap and green consumption, highlighting key theoretical and empirical insights. Section 3 presents the proposed modeling framework and derives optimal strategies under monopoly and duopoly markets. Section 4 extends the analysis to cases where consumer attitude distributions are unknown and must be empirically estimated. Section 5 concludes with managerial implications and future research directions.

2. Literature Review

2.1. Psychological and Behavioral Foundations of the Attitude–Behavior Gap

The attitude–behavior gap in green consumption has been widely examined through psychological and behavioral lenses. Early studies emphasized that individual environmental attitudes do not always translate into consistent pro-environmental actions, leading scholars to explore the underlying motivational and cognitive mechanisms [9].

A dominant theoretical approach involves values–beliefs–attitudes (VBA) models, which argue that stable personal values shape beliefs, which in turn influence environmental attitudes and behaviors [10]. Value-based theories posit that altruistic and biospheric values strengthen pro-environmental intentions, while egoistic values weaken them [11,12]. For instance, individuals who emphasize universalism and altruism are more likely to purchase eco-friendly products, whereas those guided by self-interest tend to avoid them [13].

Building on this foundation, the value–belief–norm (VBN) theory provides a causal chain linking personal values to environmental norms and actions. Beliefs serve as mediators that explain how moral obligations and social expectations shape environmental attitudes among diverse consumer groups [14,15]. Empirical studies support this perspective: Nguyen et al. (2017) [16] investigated the energy efficient household appliances in emerging markets, and found that altruistic values facilitate consumers’ purchase behaviour by enhancing their attitudes towards environmental protection. Prakash et al. (2019) [17] discussed the influence of altruistic and egoistic values of customers on their attitudes towards eco-friendly packaged products. In general, VBA theories may partially explain the reasons why most consumers prefer green products when other factors are the same.

While these theories help explain why consumers express positive attitudes toward green products, they fall short in predicting actual purchase behaviors. Numerous studies have observed that positive attitudes do not necessarily lead to consistent purchase decisions, revealing that the attitude-behavior gap remains substantial across markets and product categories [18]. For instance, an empirical study by Berberyan et al. (2025) [19] involving 1000 German consumers revealed that positive attitudes toward ethical fashion often do not translate into corresponding behaviors. The authors highlighted perceived social norms and insufficient personal benefit as major drivers of this attitude–behavior gap.

2.2. Economic and Contextual Factors Influencing the Attitude–Behavior Gap

Beyond psychological determinants, several contextual and economic factors further widen the gap between consumer attitudes and behaviors. The price premium of green products has been repeatedly identified as a critical barrier. Consumers often perceive eco-friendly goods as expensive, even when they acknowledge their environmental benefits [20]. For example, in the Danish organic food market, high prices were found to be the dominant reason for consumers’ reluctance to purchase green alternatives—particularly among young consumers [21].

Moreover, information asymmetry and perceived quality uncertainty exacerbate the gap. Many consumers lack reliable information to evaluate environmental claims, leading to skepticism toward green advertising and labeling [22]. Some studies suggest that consumers associate higher prices with higher quality, which complicates their decision-making process [23]. Kaiser et al. (2010) [24] emphasized that ignoring the behavioral cost—the effort and time associated with green behavior—can distort the interpretation of the attitude-behavior gap. Bray et al. (2011) further [25] identified factors such as limited experience, lack of trust, and perceived behavioral costs that intervene between intention and action. Recently, Margariti et al. (2024) [26] found that the conditional indirect effect of consumers’ attitudes toward green purchases on green purchase behavior through their purchase intentions that are moderated by greenwashing concerns.

In summary, previous research has established that both internal factors (values, beliefs, attitudes) and external factors (price, quality perception, and information access) jointly shape consumers’ actual purchasing decisions. However, most of these studies are descriptive or correlational, providing limited guidance on how producers and retailers can strategically respond to the attitude-behavior gap.

2.3. Quantitative and Managerial Approaches to Green Consumption

In contrast to the behavioral literature, a smaller but growing body of research has begun to explore green consumption from an economic and operational perspective. Actually, green production manufacturers require different marketing and pricing strategies than non-green products and services [27]. Consumers’ attitudes, beliefs and behaviors towards green consumption promote enterprises to update technology, use green materials and produce more environmentally friendly products [28]. Swami and Shah (2013) [29] found that the greening efforts by the manufacturer and retailer resulted in demand expansion at the retail end. However, current researches on the attitude–behavior gap mainly focus on the social investigation and explain this gap from the perspective of psychology and behavioral theories [30,31]. Few researches consider to model the attitude–behavior gap quantitatively in the pricing and marketing strategies of manufacturers.

This paper proposes the optimal producing and pricing strategies of manufacturers under the attitude-behavior gap in green consumption. A quantitative framework is established to characterize the decision-making process of consumers and explain the intrinsic mechanism of attitude–behavior gap in green consumption. The optimal pricing strategies are derived under both monopoly and duopoly markets. We show that the strategies based on consumer behaviors are always better than that based on consumer attitudes. In addition, an iterative algorithm is proposed to solve the equilibrium when two entities compete with each other. In most practical scenarios, the underlying distribution of consumer attitudes towards green products is unknown. We demonstrate the manufacturers may approximate to the true underlying distribution by the empirical distribution with finite samples, which can be obtained by investigation or questionnaire survey. Numerical simulations are implemented to illustrate that the optima in the empirical distribution would converge to that in the true underlying distribution.

3. Consumer Behaviors

In this paper, we consider two types of products are substitutes: green products M and ordinary products N. Here green products have similar functions and usages with ordinary products, except that green products are more environmentally friendly and sustainable. Manufacturers produce green products and ordinary products with costs and , respectively. It can be assumed that , which conforms to the reality in most instances. Then the product will provide a basic utility to consumers,

where is a coefficient to denote the value-added rate.

According to the VBA theories, consumers often prefer green products when other factors are the same [5]. It means green products can bring an extra utility to consumers. This extra utility, named as the green utility, depends on the consumer attitude towards green products. People who have higher pro-environmental awareness will gain more utility from green products. Assume the consumer attitude towards green products is a continuous random variable X, which is defined on with a cumulative distribution function . Then the green utility to consumers can be written as , where denotes a conversion coefficient between attitudes and utilities. Thus, considering the prices consumers have to pay, green products and ordinary products have different excess utilities to consumers as follows [32]:

where and are the prices of green products and ordinary products respectively. Here we assume that for to avoid negative utilities. Actually, consumers will not consider purchasing products when excess utilities are negative.

According to Equation (2), consumers will choose green products if , i.e.,

where and ; otherwise, they will purchase ordinary products. Let be a critical value between two types of products. This framework characterizes the attitude-behavior gap efficiently: Firstly, the pro-environmental attitudes do not necessarily lead to green purchase behaviors. Consumers often behave to maximize their utilities after taking prices into consideration. In addition, consumers with higher pro-environmental attitudes are more likely to purchase green products, since they may gain more green utilities from green products.

Note that X is a continuous random variable with a cumulative distribution function . The probability that consumers choose green products can be written as . Similarly, the probability that consumers purchase ordinary products is . Let D be the whole capacity of the demand market, which is assumed to be a constant independent of prices. Thus, the demand market for green products is and the demand market for ordinary products is . Since X is a random variable defined on the interval , we have if and if . They are two special cases that consumers will concentrate on one market and abandon the other. In the following analysis, we focus on the general cases that .

4. Business Strategies

4.1. Monopoly

First, we consider the scenario that one manufacturer or an industry group monopolizes the market. The enterprise is capable to produce both green products and ordinary products. It needs to determine the quantity of each type of products to maximize its profit. There exists two main ideas of business strategies: strategies based on consumer attitudes and strategies based on consumer behaviors.

In attitude-based strategies, the manufacturer determines the quantities based on consumer attitudes. Since the consumer attitude towards green products X is defined on [0,1], the manufacturer may consider consumers with higher green attitudes that to be green consumers, and expect them to purchase green products. Other consumers with lower green attitudes that are considered as ordinary consumers, who are expected to purchase ordinary products. Thus, the manufacturer would produce green products and ordinary products, respectively, where and are the quantities of two types of products in attitude-based strategies. Note that the quantities of supply and demand may not be equal. The actual sales should be the lower one between supply and demand. Thus, the manufacturer maximize its profit by setting optimal prices of products as follows:

where denotes the manufacturer’s profit when it makes decisions based on consumer attitudes.

According to the framework in Section 3, the manufacturer can predict consumer behaviors based on attitudes. Consumers will prefer green products when , while purchase ordinary products when , where is a critical value depending on the difference of prices and utilities of products. Thus, the manufacturer would produce green products and ordinary products, respectively, where and are the quantities of two types of products in behavior-based strategies. Note that the quantities of products in behavior-based strategies are equal to the demands of the market. It can attain an optimal equilibrium called market clearing. Then, the manufacturer maximize its profit by setting optimal prices of products as follows:

where denotes the manufacturer’s profit when it makes decisions based on consumer behaviors.

Here we draw several propositions as follows:

Proposition 1.

The behavior-based strategies are always better than the attitude-based strategies, i.e., , regardless of the underlying distribution of green attitudes X.

Proof.

If , then

If , then

So, it holds that . Similarly, we have . Thus,

Proven. □

Proposition 1 shows that the behavior-based strategies are always better than the attitude-based strategies. So the manufacturer will prefer to predict the consumer behaviors based on attitudes first and then make decisions.

Proposition 2.

In the monopoly case, the manufacturer’s profit with behavior-based strategies attains the maxima when and . Then, the maximal profit is equal to .

Proof.

Since , we have

The equality holds when and . At this point, according to Equation (3), we have . Then, and . It implies that consumers would concentrate on green products. Proven. □

Proposition 2 demonstrates that, to maximize its profit, the monopoly manufacturer can guide consumers to purchase green products by adjusting the difference of prices between two products. It is an ideal market for the monopoly manufacturer since green products have a higher gross margin than ordinary products. It captures the whole market and obtains the maximal profit by pricing the products as high as possible.

The propositions offer several implications for sustainability marketing and firm strategy. First, since behavior-based strategies consistently outperform attitude-based strategies, firms should focus on observable consumer behaviors rather than stated attitudes when designing marketing campaigns. Second, pricing serves as a key lever to promote green products, as aligning prices with consumers’ perceived utility can maximize profit while encouraging sustainable purchases. Finally, because green products often yield higher margins, combining behavior-based strategies with strategic pricing allows firms to achieve both financial and environmental objectives.

4.2. Duopoly

In the monopoly scenario, consumers do not have other choices. They must purchase either green or ordinary products from the monopoly manufacturer. Thus, the manufacturer can maximize its profit by pricing the products as high as possible. However, if there exist other competitive manufacturers, the sales and pricing strategies will be quite different.

In this section, we consider the duopoly scenario, i.e., two manufacturers compete with each other. The scenario with more competitors can be generalized directly from the duopoly scenario. Assume that there is no difference of products produced by different manufacturers except for the prices. If both manufacturers are capable to produce both types of products, the two competitors will continue to mark down both types of products until the constraints of costs, i.e., and . Either manufacturer who attempts to raise the prices will lose the whole market and can not gain any benefits. Thus, it is an equilibrium that and if both manufacturers are capable to produce both types of products.

Then we consider the case that each manufacturer can only produce one type of products. Without loss of generality, assume that the first manufacturer produces green products and the second manufacturer produces ordinary products, respectively. According to Proposition 1, the behavior-based strategies are always better than the attitude-based strategies. So the quantities of products will be determined by the demand market, i.e., and . Thus, the profit of the first manufacturer is expressed as follows:

where is the critical attitude of ordinary consumers and green consumers. Similarly, the profit of the second manufacturer is expressed as follows:

As shown in Section 4.1, one manufacturer can guide consumers to purchase green products by adjusting the difference of prices between two products in the monopoly scenario. However, in the duopoly scenario, two manufacturers can only price their own products. It means one can lower its price and attract consumers from the rival. Although the margin profit is reduced with the lower price, the market share is increased and thus the manufacturer may gain more benefits.

From the perspective of the first manufacturer, given the price of ordinary products , it maximizes its profit in Equation (6) by taking derivative of the price of green products ,

Since , then . So, we have , where denotes the probability density function of random variable X. Thus, given , the optimal price of green products should satisfy the last equality in Equation (8), denoted as , or located at the boundary of support set .

Similarly, given , the second manufacturer maximizes its profit in Equation (7) by taking derivative of ,

Since , then . Thus, we have . Thus, given , the optimal price of ordinary products should satisfy the last equality in Equation (9), denoted as , or located at the boundary of support set .

Unlike the monopoly scenario, Equations (8) and (9) show that the optimal strategies in the duopoly setting depend on the distribution of green attitudes X. The solution obtained by simultaneously solving these equations represents the manufacturers’ optimal equilibrium, where each firm’s pricing strategy is mutually consistent and no unilateral deviation is profitable. When the underlying distribution of X is known, both manufacturers can reach their optimal strategies through iterative games based on Equations (8) and (9). In this process, each manufacturer continuously adjusts its product price in response to the competitor’s decisions until the prices converge to an equilibrium. However, when the distribution of X is complex or general, deriving the equilibrium analytically becomes difficult. In such cases, Algorithm 1 provides an iterative numerical method to approximate the equilibrium.

| Algorithm 1 Iterative Algorithm |

|

In Algorithm 1, and denote the prices of green products and ordinary products in t-th iteration, respectively. After obtaining the equilibrium price and , we can calculate the critical value of green attitudes , and the market shares and maximal profits of each manufacturer, respectively.

4.3. Numerical Illustrations

This section presents several numerical simulations to illustrate the performance of Algorithm 1. Let the whole capacity of the demand market . The costs of green products and ordinary products are set as and to satisfy the constraint . Let the value-added rate and attitude-utility conversion coefficient . Here, we consider the attitude towards green products X following the Beta distribution with parameters and , i.e., . The density function is expressed as follows:

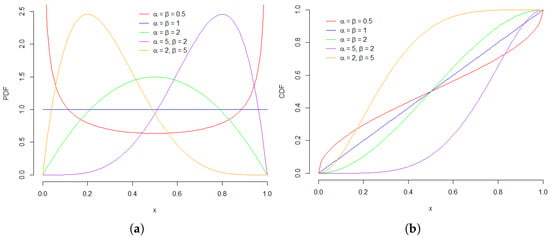

where and is the Beta function, which is a normalization constant to ensure that the total probability is 1. The Beta distribution is more flexible than other distributions defined on , such as the uniform distribution. Actually, the Beta distribution reduces to the uniform distribution when . With different combinations of and , Beta distributions can characterize various scenarios of green attitudes. Figure 2 presents the probability density functions and cumulative density functions with different and . For example of density functions, characterizes a symmetric and convex curve, while characterizes a symmetric and concave curve. In addition, and presents a curve skewed to the left, while and presents a curve skewed to the right. Specially, means the Beta distribution reduces to the uniform distribution with a level curve. They demonstrate that Beta distributions are flexible to adapt to more general cases.

Figure 2.

Beta distributions with various combinations of and : (a) Probability density functions. (b) Cumulative distribution functions.

Here, we consider the setting that and since the density function should be bounded in the distribution of real attitudes. Table 1 presents the optimal equilibrium under different and . The corresponding market shares (MS) and maximal profits are also reported. It demonstrates that the optimal solutions depending on the distribution of X, and our Algorithm 1 can attain the optima.

Table 1.

The equilibrium prices, market shares, and profits of green products and ordinary products under Beta distributions with different and .

Table 1 shows that the optimal equilibrium outcomes are sensitive to the underlying distribution of consumer green attitudes. Firms should tailor pricing and marketing strategies to the attitude profile of their target market to maximize adoption and profitability. In markets skewed toward highly pro-environmental consumers, green products can achieve high market penetration with moderate pricing, whereas broader distributions may require strategic price adjustments. These findings emphasize the value of data-driven insights for guiding sustainable product offerings and marketing, enabling firms to effectively promote green products while aligning commercial objectives with environmental goals.

4.4. Sensitivity Analysis

To further examine the robustness of the proposed model and the stability of the equilibrium solutions, we conduct a sensitivity analysis on two key parameters: the value-added rate and the attitude–utility conversion coefficient . These parameters capture the manufacturer’s efficiency in converting production cost into perceived value and the consumers’ responsiveness in translating their green attitudes into purchasing utility, respectively. Variations in these parameters directly influence both demand structures and equilibrium outcomes. Empirically, and can be estimated using consumer survey data.

The value-added rate reflects the additional perceived utility that consumers obtain from a product beyond its production cost. It represents the manufacturer’s capacity to enhance product value through technological innovation, quality improvement, branding, or green attributes. To investigate its effect, we vary within the range , while holding other parameters constant and assuming that consumer attitudes toward green products follow the distribution .

As shown in Table 2, increasing leads to a steady rise in the equilibrium price of the green product () and a slight decline in the price of the ordinary product (). The threshold attitude level () gradually decreases as increases, indicating that consumers with lower pro-environmental attitudes begin to purchase green products when the manufacturer achieves higher value-added efficiency. Consequently, the market share of the green product () expands, while that of the ordinary product () contracts. Furthermore, the green manufacturer’s profit () grows substantially—from 110.8 to 231.05—as increases, whereas the ordinary product’s profit () consistently declines.

Table 2.

Equilibrium outcomes under different values of the value-added rate .

Overall, these results demonstrate that improving the value-added rate significantly enhances both the competitiveness and profitability of green products. However, the marginal gain in market share becomes smaller at higher levels, suggesting that excessive investment in value-added enhancement may yield diminishing returns.

The attitude–utility conversion coefficient represents the strength of consumers’ green preference in shaping their purchasing decisions. A higher implies that consumers with pro-environmental attitudes are more likely to derive higher utility from green products. To examine its effect, we vary within the range , while keeping all other parameters constant and assuming that consumer attitudes toward green products follow the distribution .

Table 3 illustrates the effect of the attitude–utility conversion coefficient on equilibrium outcomes. As increases, the green product price rises steadily, while the ordinary product price shows only a slight increase. The threshold attitude level increases, indicating that consumers with moderate pro-environmental attitudes are more likely to purchase green products. Consequently, the green product’s market share gradually declines, whereas the ordinary product’s share expands. The green manufacturer’s profit grows substantially with higher , while the ordinary product’s profit remains limited.

Table 3.

Equilibrium outcomes under different values of the attitude–utility conversion coefficient .

5. Estimation of Attitude Distributions

Section 4 shows that the optimal strategies are independent of the distribution of green attitudes in the monopoly scenario. In the duopoly competition, we present an iterative algorithm to solve the optimal strategies if the distribution of green attitudes is given. However, in practice, manufacturers have no enough prior knowledge to determine the underlying distribution of green attitudes, especially when they are promoting a new type of products. To estimate the underlying distribution of green attitudes, manufacturers may implement social investigation or questionnaire survey. According to the sampled data, they may approximate to the true distribution of green attitudes by the empirical distribution.

Assume that the manufacturers sample n consumers randomly to investigate their green attitudes. Let be the observed data. Then, the empirical distribution is defined as

where denotes the indicator function. As , according to the Central Limit Theorem [33], the empirical distribution converges in distribution to the underlying distribution,

where denotes the convergence in distribution. It means manufacturers can obtain the true distribution of green attitudes as long as the number of investigated consumers is large enough.

Here, we present two specific examples to illustrate the convergence numerically. Let parameters D, , , , and follow the same setting in Section 4.3. First, we consider the true distribution of X is , i.e., the uniform distribution. Then, we generate n random samples from . Based on the generated random samples, the empirical distribution is calculated according to Equation (11). Through Algorithm 1, we can obtain the optimal pricing strategies in finite samples by replacing with . Table 4 presents the optimal prices of green and ordinary products under different samples n.

Table 4.

The optimal prices of green and ordinary products under different samples n when .

The column “True” means the optimal prices if the true distribution is known. Table 4 demonstrates that the optimal prices of green and ordinary products and converge to the equilibrium when true distribution is known as .

Similarly, we consider the true distribution is . Table 5 presents the results and draws similar conclusions.

Table 5.

The optimal prices of green and ordinary products under different samples n when .

6. Conclusions

6.1. Theoretical Implications

This study contributes to the theoretical understanding of the attitude–behavior gap in green consumption by providing a quantitative modeling framework. While prior research has largely examined the attitude–behavior gap from sociological and psychological perspectives, few studies have explored it through analytical or mathematical modeling. By introducing a consumer behavior model that explicitly incorporates the gap between environmental attitude and actual purchasing behavior, this paper advances the literature on green marketing and behavioral economics. The model reveals that behavior-based strategies consistently outperform attitude-based strategies, offering a formal mechanism to explain why consumer intentions may not fully translate into actions. Furthermore, the comparative analysis between monopoly and duopoly settings highlights how market competition interacts with behavioral heterogeneity, enriching the theoretical foundation for future research on sustainable consumption dynamics.

6.2. Practical Implications

From a managerial perspective, our results provide actionable insights for manufacturers and policymakers seeking to promote green products. In a monopoly market, the findings suggest that firms can effectively guide all consumers toward green products through strategic price control, thereby internalizing the attitude–behavior gap within pricing decisions. In contrast, under duopoly competition, optimal strategies depend critically on the distribution of consumers’ green willingness. When such information is unavailable, companies may rely on empirical data collected through surveys or social investigations to approximate consumer preference distributions. Our simulation results demonstrate that strategies based on empirical distributions can achieve near-optimal performance as sample size increases, implying that data-driven decision-making can bridge the gap between behavioral insights and operational strategy. These findings may assist firms in designing more efficient pricing, product positioning, and market segmentation strategies to encourage sustainable purchasing.

6.3. Future Research

Although the present study establishes a quantitative framework for analyzing the attitude–behavior gap, several avenues remain open for future exploration. First, future research could extend the model to incorporate dynamic consumer learning and temporal evolution of attitudes, providing a more realistic reflection of market adaptation over time. Second, the integration of heterogeneous information environments, such as social influence, advertising, and green certification effects, could deepen the behavioral realism of the model. Third, empirical validation using real-world consumption data would enhance the robustness and practical relevance of the theoretical findings. Finally, applying this modeling framework to other sustainability-related domains—such as renewable energy adoption or circular product markets—could further broaden its applicability and contribute to the understanding of sustainable consumer behavior at large.

Funding

This research was funded by the National Natural Science Foundation of China [12401391] and the Natural Science Research Project of Jiangsu Higher Education Institutions [23KJB520003].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be made available on request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Mohd Suki, N.; Majeed, A.; Mohd Suki, N. Impact of consumption values on consumers’ purchase of organic food and green environmental concerns. Soc. Responsib. J. 2022, 18, 1128–1141. [Google Scholar] [CrossRef]

- Mehmood, K.; Iftikhar, Y.; Jabeen, F.; Khan, A.N.; Rehman, H. Energizing ethical recycling intention through information publicity: Insights from an emerging market economy. J. Bus. Ethics 2024, 191, 837–863. [Google Scholar] [CrossRef]

- Park, H.J.; Lin, L.M. Exploring attitude–behavior gap in sustainable consumption: Comparison of recycled and upcycled fashion products. J. Bus. Res. 2020, 117, 623–628. [Google Scholar] [CrossRef]

- Frank, P.; Brock, C. Bridging the intention–behavior gap among organic grocery customers: The crucial role of point-of-sale information. Psychol. Mark. 2018, 35, 586–602. [Google Scholar] [CrossRef]

- Bhattacharya, C.B.; Sen, S. Doing better at doing good: When, why, and how consumers respond to corporate social initiatives. Calif. Manag. Rev. 2004, 47, 9–24. [Google Scholar] [CrossRef]

- Orsato, R.J. Competitive environmental strategies: When does it pay to be green? Calif. Manag. Rev. 2006, 48, 127–143. [Google Scholar] [CrossRef]

- Ramayah, T.; Lee, J.W.C.; Mohamad, O. Green product purchase intention: Some insights from a developing country. Resour. Conserv. Recycl. 2010, 54, 1419–1427. [Google Scholar] [CrossRef]

- Groening, C.; Sarkis, J.; Zhu, Q. Green marketing consumer-level theory review: A compendium of applied theories and further research directions. J. Clean. Prod. 2018, 172, 1848–1866. [Google Scholar] [CrossRef]

- Cleveland, M.; Kalamas, M.; Laroche, M. Shades of green: Linking environmental locus of control and pro-environmental behaviors. J. Consum. Mark. 2005, 22, 198–212. [Google Scholar] [CrossRef]

- Nash, N.; Lewis, A. Overcoming obstacles to ecological citizenship: The dominant social paradigm and local environmentalism. In Environmental Citizenship; MIT Press: Cambridge, MA, USA, 2006; pp. 153–184. [Google Scholar]

- Stern, P.C.; Dietz, T. The value basis of environmental concern. J. Soc. Issues 1994, 50, 65–84. [Google Scholar] [CrossRef]

- Karp, D.G. Values and their effect on pro-environmental behavior. Environ. Behav. 1996, 28, 111–133. [Google Scholar] [CrossRef]

- Yulianti, F.; Zulfikar, R. The Altruistic Connection: Unraveling How Altruism Drives Eco-Friendly Consumer Behavior in Green Marketing (Literature Review). Int. J. Prof. Bus. Rev. 2023, 8, 19. [Google Scholar] [CrossRef]

- Stern, P.C.; Dietz, T.; Guagnano, G.A. The new ecological paradigm in social-psychological context. Environ. Behav. 1995, 27, 723–743. [Google Scholar] [CrossRef]

- Stern, P.C.; Kalof, L.; Dietz, T.; Guagnano, G.A. Values, beliefs, and proenvironmental action: Attitude formation toward emergent attitude objects 1. J. Appl. Soc. Psychol. 1995, 25, 1611–1636. [Google Scholar] [CrossRef]

- Nguyen, T.N.; Lobo, A.; Greenland, S. Energy efficient household appliances in emerging markets: The influence of consumers’ values and knowledge on their attitudes and purchase behaviour. Int. J. Consum. Stud. 2017, 41, 167–177. [Google Scholar] [CrossRef]

- Prakash, G.; Choudhary, S.; Kumar, A.; Garza-Reyes, J.A.; Khan, S.A.R.; Panda, T.K. Do altruistic and egoistic values influence consumers’ attitudes and purchase intentions towards eco-friendly packaged products? An empirical investigation. J. Retail. Consum. Serv. 2019, 50, 163–169. [Google Scholar] [CrossRef]

- Summers, C.A.; Smith, R.W.; Reczek, R.W. An audience of one: Behaviorally targeted ads as implied social labels. J. Consum. Res. 2016, 43, 156–178. [Google Scholar] [CrossRef]

- Berberyan, Z.; Jastram, S.M.; Heuer, M.; Schnittka, O.; Rosenkranz, J. Attitude Without Action-What Really Hinders Ethical Consumption. J. Bus. Ethics 2025, 1–19. [Google Scholar] [CrossRef]

- Terlau, W.; Hirsch, D. Sustainable consumption and the attitude-behaviour-gap phenomenon-causes and measurements towards a sustainable development. Int. J. Food Syst. Dyn. 2015, 6, 159–174. [Google Scholar] [CrossRef]

- Aschemann-Witzel, J.; Niebuhr Aagaard, E.M. Elaborating on the attitude–behaviour gap regarding organic products: Young D anish consumers and in-store food choice. Int. J. Consum. Stud. 2014, 38, 550–558. [Google Scholar] [CrossRef]

- Pham, T.H.; Nguyen, T.N.; Phan, T.T.H.; Nguyen, N.T. Evaluating the purchase behaviour of organic food by young consumers in an emerging market economy. J. Strateg. Mark. 2019, 27, 540–556. [Google Scholar] [CrossRef]

- Palma, D.; de Dios Ortúzar, J.; Rizzi, L.I.; Guevara, C.A.; Casaubon, G.; Ma, H. Modelling choice when price is a cue for quality: A case study with Chinese consumers. J. Choice Model. 2016, 19, 24–39. [Google Scholar] [CrossRef]

- Kaiser, F.G.; Byrka, K.; Hartig, T. Reviving Campbell’ s paradigm for attitude research. Personal. Soc. Psychol. Rev. 2010, 14, 351–367. [Google Scholar] [CrossRef] [PubMed]

- Bray, J.; Johns, N.; Kilburn, D. An exploratory study into the factors impeding ethical consumption. J. Bus. Ethics 2011, 98, 597–608. [Google Scholar] [CrossRef]

- Margariti, K.; Hatzithomas, L.; Boutsouki, C. Elucidating the gap between green attitudes, intentions, and behavior through the prism of greenwashing concerns. Sustainability 2024, 16, 5108. [Google Scholar] [CrossRef]

- Ginsberg, J.M.; Bloom, P.N. Choosing the right green marketing strategy. MIT Sloan Manag. Rev. 2004, 46, 79–84. [Google Scholar]

- Rundle-Thiele, S.; Paladino, A.; Apostol, S.A.G., Jr. Lessons learned from renewable electricity marketing attempts: A case study. Bus. Horizons 2008, 51, 181–190. [Google Scholar] [CrossRef]

- Swami, S.; Shah, J. Channel coordination in green supply chain management. J. Oper. Res. Soc. 2013, 64, 336–351. [Google Scholar] [CrossRef]

- Yamoah, F.A.; Acquaye, A. Unravelling the attitude-behaviour gap paradox for sustainable food consumption: Insight from the UK apple market. J. Clean. Prod. 2019, 217, 172–184. [Google Scholar] [CrossRef]

- Beatson, A.; Gottlieb, U.; Pleming, K. Green consumption practices for sustainability: An exploration through social practice theory. J. Soc. Mark. 2020, 10, 197–213. [Google Scholar] [CrossRef]

- Farshbaf-Geranmayeh, A.; Zaccour, G. Pricing and Advertising in a Supply Chain in the Presence of Strategic Consumers. Omega 2020, 101, 102239. [Google Scholar] [CrossRef]

- Van der Vaart, A.W. Asymptotic Statistics; Cambridge University Press: Cambridge, UK, 2000; Volume 3. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).