1. Introduction

Financial choices are often associated with human behavior. If a person does not recognize or understand that they lack certain knowledge, they are likely to make poor decisions compared to someone who is aware of their low capacity and possibly seeks more information before making a financial choice. Financial literacy is just one of the factors that influence consumer decisions [

1,

2,

3,

4], since behavioral aspects have a greater impact than objective information on basic financial knowledge. During the decision-making process, most people rely on their intuition rather than reflective thinking, leading them to make decisions that are detrimental to their financial health [

5]. When observing these factors, it is necessary to conduct an analysis that considers factors such as financial literacy and behavior and also analyses the emotions of individuals, especially public school teachers, who are the target audience to be studied in this article. The results of the analyses in this study will serve as input for the formulation of public policies aimed at training education professionals to have a sufficient level of financial literacy, to mitigate the emotional and behavioral effects on financial decision-making [

6,

7].

The Organization for Economic Cooperation and Development (OECD) has been warning of the impact of a lack of financial literacy on nations, citing the North American subprime crisis and, more recently, the COVID-19 pandemic as examples. According to this organization, states need to start worrying about developing individuals who are able to take care of their finances autonomously, aware that, as financial agents, they are responsible for their own economic and social wellbeing but are also a fundamental part of local, national, and ultimately global economic development. In view of this recommendation, Brazil established the National Strategy for Financial Education (ENEF) in 2010, with the aim of implementing educational practices that would contribute to the development of people who are more competent to make financial decisions. The strategy was instrumental in changing the National Common Core Curriculum (BNCC), which made financial education a cross-curricular theme. In other words, it should permeate all areas of knowledge, providing a more comprehensive education that correlates with students’ daily lives.

Therefore, this research studies the correlation between financial literacy and financial wellbeing and behavior among public school teachers and whether this can be associated not only with the level of financial literacy but also with the latent behavioral attitudes proposed in this study. The literature shows that people with financial knowledge and skills also make surprisingly poor financial decisions. This is related to emotional states, as well as heuristics and biases, as reasons to overcome logic [

8]. Furthermore, other studies show a positive association between cognitive ability and financial literacy, demonstrating that individuals’ financial behavior is considerably improved by variables that include financial education, self-regulation in relation to money, and demographic factors, especially educational attainment and income level [

9,

10,

11,

12].

Considering the importance of a multifaceted analysis that involves not only financial literacy but also analyzes emotional and financial behavior, the practical contribution of this work is its ability to inform public policies on financial literacy for public school teachers, aligning with the Sustainable Development Goals (SDGs) of the 2030 Agenda [

13]. By measuring financial literacy gaps and identifying teachers’ sensitivities, we will provide input for the creation of continuing education programs that move beyond basic financial knowledge, addressing the emotional and behavioral challenges that public school teachers face.

Our article is based on the premise that financial literacy is one of the pillars of sustainable development. The financial literacy of elementary and secondary school teachers plays a strategic social role in investing in sustainability. We advocate promoting greater financial knowledge and well-being among these teachers, who play a key role in educating children and adolescents. This investment will help create the conditions for a more stable and sustainable future—not only for these teachers but also for the children in their care. Our research helps advance the Sustainable Development Goals, such as quality education—SDG 4 (teachers who are more financially stable and have greater well-being are more effective in educating children). It also promotes greater equity by demonstrating that public policies should address the gender gap (SDG 5). Finally, by linking financial literacy with financial well-being, a relationship is established between financial health and more sustainable social and financial outcomes.

The main contribution of this study lies in its focus on teachers and financial behavior. By examining the financial literacy and emotional and financial decisions of public school teachers, we directly support target 4.c of SDG 4 (Quality Education), which aims to significantly increase the supply of highly qualified teachers. Financial stress, coupled with decisions that are detrimental to teachers’ financial health, directly affects their professional performance, hindering progress toward achieving the SDG 4 goals. By providing input for the development of continuing education and training programs that take these factors into account, the study offers a unique contribution to improving the well-being and effectiveness of teachers, which is an innovative angle in financial literacy research linked to the SDGs.

The goals of this research are twofold. First, our interest is in determining the vital demographic and behavioral parameters that reflect the level of Financial Literacy (FL) possessed by public school teachers in Brazil. As a second aim, our role is to determine how much FL predicts their Financial Wellbeing and Behavior (FWB). This research and its results directly reflect the achievement of the SDG 4 (Quality Education) goals, since an education professional with an adequate level of financial literacy and emotional balance is a prerequisite for quality teaching. Investing in the financial education of education professionals is an indispensable strategy for high social impact, also contributing to gender equality (SDG 5) and a reduction in poverty and inequality (SDG 10).

Our work contributes to research in this field in three main ways. First, we combined different methods to analyze the data and gain more confidence in the results. We used both econometric analysis, which is more traditional, and machine learning. The idea was to determine whether both approaches arrived at the same answer, strengthening our conclusion. Second, we focused on the neglected, yet consequential, population of Brazilian public education workers. Lastly, we relate our findings to policy formation and the UN Sustainable Development Goals, providing policy-relevant recommendations for improved education and equitable economic prospects.

2. Theoretical Background

There is a vast literature that defines financial literacy. This concept is not only about basic knowledge of economics and finance but also concerns an individual’s ability to make good financial decisions. Good financial decisions refer to a set of actions that affect one’s finances and are capable of increasing economic wellbeing or protecting an individual from financial vulnerability [

14]. Having an adequate level of financial literacy is essential for the general population. However, attention to financial literacy should be even higher for specific groups such as educators. This is because cognitive development is directly associated with an individual’s ability to gain a good understanding of finance [

15]. Thus, when teachers are financially literate, they can help their students navigate financial issues with greater ease.

The literature shows that psychological traits, wherein the individual suffers from distress, anxiety, and impatience, creates a situation that can negatively influence assertive financial decision-making, which tends to be mitigated by the pursuit of financial education, since higher levels of financial literacy are associated with less anxiety about financial issues [

16]. More consolidated financial literacy is also associated with better financial decisions about financial investments, providing accumulation of wealth, thus minimizing uncertainties, making people less anxious, especially in old age [

17]. Studies still indicate that financial anxiety is more pronounced among women, which exacerbates the gender gap when we talk about finance [

16,

18].

Just like knowledge of technology and advanced teaching methods, financial literacy is an essential skill for teachers, since a financially literate teacher is better equipped to teach basic concepts about economics and finance during class, as well as being better able to guide students on managing a family budget while they are still in their teens [

19,

20]. Providing students with better financial instruction can reduce the susceptibility to and perpetuation of situations of stress and financial vulnerability, which contributes to the wellbeing and quality of life of these students.

In addition to the impact on student learning, the low financial literacy of teachers makes them more vulnerable to financial instability due to poor financial management. Financially vulnerable situations are the main causes of stress and emotional overload in adult life, which directly affect the motivation and wellbeing of teachers and can reduce their performance in the classroom [

21,

22].

Socio-emotional factors play a crucial role in the learning and teaching process, influencing the ability to process information effectively. Emotions influence how both teachers and students learn, both within and beyond the classroom setting, highlighting the importance of emotional regulation and, above all, the prevention of stressful situations [

23]. Confidence in one’s own ability to teach is a key factor in teachers’ professional growth and in improving student learning and performance [

20,

24,

25]. Control over personal finances strengthens individuals’ overall self-efficacy, which has a positive impact on their professional development.

Thus, financial literacy proves to be an indispensable factor in teacher training, especially for those who work in the public school system and, naturally, are responsible for teaching the most vulnerable populations. This is because an adequate level of financial literacy will directly impact the financial health of literate teachers, in addition to directly contributing to the development of knowledge and skills that can help break the cycle of poverty among vulnerable students [

26].

3. Methodology

3.1. Data Collection

An anonymous online survey was conducted through in-person or online interviews, with data collected in the encrypted Survey Monkey environment. The Human Research Ethics Committee of the Getulio Vargas Foundation (CEPH/FGV) approved this research (Protocol P.421.2023). Data collection began after ethical permission was obtained. All participants provided informed consent.

The purpose of the study, the participant’s autonomy, confidentiality, the voluntary nature of participation, and the freedom to withdraw at any time, as well as a guarantee of data anonymization to protect identity were included. The initial sample consisted of 329 participants in the survey; after removing samples with missing values, the final number of respondents was 286. We collected data through direct contact with schools in the Federal District and online surveys sent to teachers.

The analysis helps to identify determinants of financial inadequacy and financial instability in Brazil. However, the results should be interpreted in light of the specific characteristics of our sample, which was selected for convenience, although we made efforts to construct a diverse sample.

Data collection was performed on electronic devices using the Survey Monkey platform (version 4.5.7). Data storage occurred in the Survey Monkey cloud database, which ensures encryption in accordance with the SOC 2 standard.

3.2. FL and FWB Instruments

This study developed and validated a measurement instrument for Financial Literacy and Financial Wellbeing and Behavior and subsequently tested the structural relationship between these two latent constructs.

3.2.1. Financial Literacy

To assess financial literacy among university professors, we created a financial literacy assessment tool based on a battery of key questions (from the literature) (

Table 1). Each of the questions was explicitly chosen to test a unique fundamental economic principle, such as compound interest, actual rate of return adjusting for inflation, and the principle of risk diversification. By combining the answers into a single numeric indicator, this test tool produced a single standardized measure that accurately quantified the overall financial literacy of this particular academic population. To calculate financial literacy, each factor was measured using binary dummies, with 1 indicating correct answers and 0 indicating incorrect answers. Next, each respondent’s total number of correct answers was determined [

27,

28].

To ensure a more accurate measurement of financial literacy, we used the Item Response Theory (IRT). This method ensures a more accurate measurement of financial literacy, thus ensuring that the score obtained more reliably reflects the participants’ real knowledge. The IRT was applied using the mirt package, developed to estimate the parameters of exploratory and confirmatory models in multidimensional contexts, using maximum likelihood approaches [

29]. The IRT was applied using the mirt (Multidimensional Item Response Theory) package, developed to estimate the parameters of exploratory and confirmatory models in multidimensional contexts, using maximum likelihood approaches [

29]. After analyzing the instrument’s six questions related to financial literacy, we did not identify inconsistencies or items with inadequate performance according to IRT criteria. Therefore, we included six questions in the questionnaire (

Figure 1).

3.2.2. Financial Wellbeing and Behavior

To construct a comprehensive assessment of Financial Wellbeing (FWB), this study employs a multidimensional tool, such that each question investigates a unique facet of an individual’s financial situation (

Table 2). The tool works as follows: Item FWB1 explores the level of financial stress associated with debt obligations. Item FWB2 gauges financial insecurity by examining experiences related to liquidity constraints. Item FWB3 attempts to identify the adverse spillover effect of financial concerns on occupational productivity. The emotional reaction to one’s finances is assessed using Item FWB4, which relates to emotions evoked by bank statements. Items FWB5 and FWB6 together measure behavioral traits, with the former serving as an indicator of financial self-efficacy and the latter measuring financial avoidance/procrastination propensities. Item FWB7 is a behavioral indicator of past financial difficulty, made real by inquiring about instances of payment default. Lastly, Item FWB8 assesses constructive financial behaviors by gauging involvement with long-range planning and saving strategies. By methodically studying these unique dimensions, the tool provides a detailed and comprehensive measure of an individual’s Financial WellBeing [

28]. Respondents must answer each item according to a Likert scale, ranging from 1 (strongly disagree) to 5 (strongly agree).

3.3. Econometric Regressions

The econometric model used for the regressions was ordinary least squares (OLS) as a multiple linear regression [

30], in which Financial Wellbeing and Behavior is explained by Financial Literacy. We also controlled for various demographic factors in the econometric regressions in order to understand their impact on the financial literacy of education professionals. The definition of the multiple linear regression model explains the dependent variable y in terms of the independent variables (

), represented by the predictive variables of this study, where

represents the intercept, (

) are the slope parameters of the line, and

corresponds to the error term, as per the following equations:

The equations presented model the dependent variables and , which represents the financial literacy of individual i. For models (1) and (2), the dependent variables and are explained by the following independent variables:

FL (; variable for financial literacy measured by four observed indicators);

Children (; number of children of respondent);

Gender (; dummy for women);

Young age (; dummy for young individuals);

Old age (; dummy for older individuals);

Race—black (; dummy for black individuals);

Race—brown (; dummy for brown individuals);

Marital status—single (; dummy for single individuals);

Income bracket—low income (; dummy for low-income individuals);

Income bracket—high income (; dummy for high-income individuals);

Educational level—postgraduate (; dummyfor individuals with a postgraduate degrees).

We utilize CFA and demonstrate that the instruments possess valid psychometric properties. We also implement a Structural Equation Model to regress the latent factors on their explanatory variables, as in Rosseel [

31]. To address potential endogeneity, an Instrumental Variable (IV) analysis was conducted [

32]. We demonstrate that financial literacy is positively correlated with financial wellbeing. The results reinforce our empirical findings obtained using OLS and IV models (See

Appendix A and

Appendix B).

3.4. Machine Learning

As one of the main fields of artificial intelligence, machine learning (ML) focuses on optimizing the performance of algorithms based on data and previous experiences [

33,

34]. They can be classified into three main types: supervised, unsupervised, and reinforcement [

35]. In supervised learning, which was our approach for the study, the algorithm is trained with a dataset, where each input is associated with a correct output. In our case, we are predicting Financial Literacy and Financial Wellbeing, using the scores as variables.

Supervised learning algorithms are generally divided into two main categories: classification and regression. Classification models are designed to predict discrete outcomes. When the result can take two possible values, such as True or False, several algorithms can be applied to classification tasks, including logistic regression, decision tree classifier, K-Nearest Neighbors (KNN) classifier, Random Forest classifier, and neural networks [

36].

Regression algorithms are a type of supervised learning that learns from data to predict continuous values, such as financial literacy. As with classification, many algorithms can be used for regression tasks, including linear regression, decision trees, KNN, neural networks, random forests, and elastic nets, among others [

36].

The main reason for using machine learning (ML) algorithms to predict the variables that best explain Financial Literacy (FL) and Financial Wellbeing and Behavior (FWB) is their ability to create more effective predictive models in complex scenarios. Furthermore, these algorithms overcome common limitations of traditional econometric models, such as ordinary least squares (OLS) regression.

OLS models are based on the assumption of a strictly linear relationship between the predictors and the outcome variable, among other conditions. Here, the model structure is set a priori by the researcher, and the meaning of the coefficients, although straightforward, only holds if the pre-specified model structure accurately represents the reality of the data. Such factors that affect the FWB, however, seldom have strictly linear associations; instead, they are better defined by intricate interactions, non-linear relationships, and threshold effects.

In contrast, ML techniques operate in a functionally agnostic way. They are designed to learn patterns inductively and automatically from the characteristics provided, allowing the discovery of complex empirical relationships that would not be easily specified manually. Thus, the choice of ML in this study is based on its crucial advantages.

First, it helps elucidate intricate connections. The model demonstrates a better capacity to identify and represent higher-order associations and non-linear patterns of the FWB determinants. Secondly, it also helps to provide a new understanding of results that people without in-depth knowledge of machine learning are often unable to interpret. Although machine learning models have sometimes been dubbed “black boxes,” the development of new interpretability methods, including Shapley Additive exPlanations (Shap), makes it possible to discover the influence of each variable on predictions. Hence, to achieve the highest possible accuracy in FWB forecasting, the adaptability and computational ability inherent in ML algorithms constitute the most suitable methodological solution.

To identify the best model that fitted our data, we conducted a competitive evaluation between several supervised regressors, using the RMSE (root mean squared error) as a metric. Because it had an RMSE equal to or lower than that of the other methods when applied to our data, we considered the random forest method to be the one with the best predictive power, best explaining Financial Literacy (FL) and Financial Wellbeing (FWB). For modeling, we used the tidymodels framework for R Version 1.4.1 [

37].

Random forests are sets of decision trees, where each tree is created independently from randomly chosen data. The final result is obtained by voting among the trees. This method avoids overfitting, and the error tends to stabilize with more trees. In addition, random forests are resistant to noise and achieve high accuracy, even when using many weak or similar variables [

38].

4. Results

4.1. Social Demographics

In Brazil, there is a predominance of female teachers in basic education, which is reflected in our sample.

Figure 2 shows a predominance of 222 female professionals (77.6%), 62 male professionals (21.7%), and two professionals who identified with another gender. Regarding age, 204 professionals (71.3%) were between 18 and 44 years old. Regarding marital status, 138 were married (48.2%), 103 were single (35.51%), 33 were divorced (11.72%), and a small portion (4.2%) were widowed, legally separated, or identified with other categories.

In terms of parenthood, 107 professionals (37.4%) reported not having children, while 179 (63.09%) stated they had at least one child. Concerning self-declared race/color, 147 professionals identified as brown (51.4%), 91 as white (31.5%), 42 as black (14.7%), and a smaller percentage (3.1%) identified as indigenous or of Asian origin. Most professionals have specialized educational training (55.9%), although few hold a master’s or doctoral degree. The average income is around four minimum wages, making it one of the lowest among higher education professions.

4.1.1. Financial Literacy Results

The frequency distribution of the results obtained for financial literacy was in the range [0,1] inclusive. The average number of correct answers was approximately 0.72 points, with approximately 72% of teachers answering at least four questions correctly, proving that they have a good level of financial literacy.

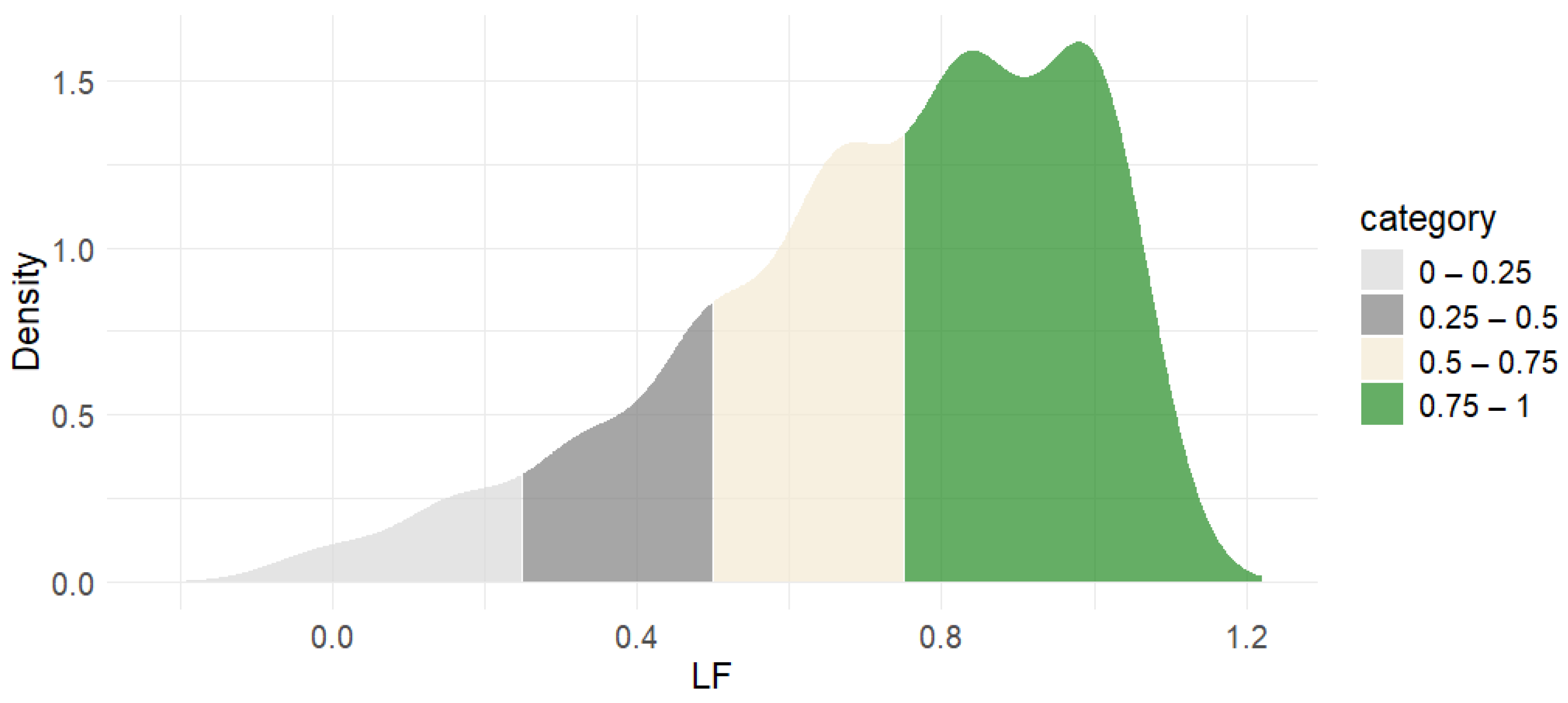

The result of the graph in

Figure 3 shows that the density of financial literacy corresponds to an asymmetrical distribution, divided by color into four distinct intervals of the same size, which show the good financial education of education professionals, as described below.

4.1.2. Financial Wellbeing and Behavior Results

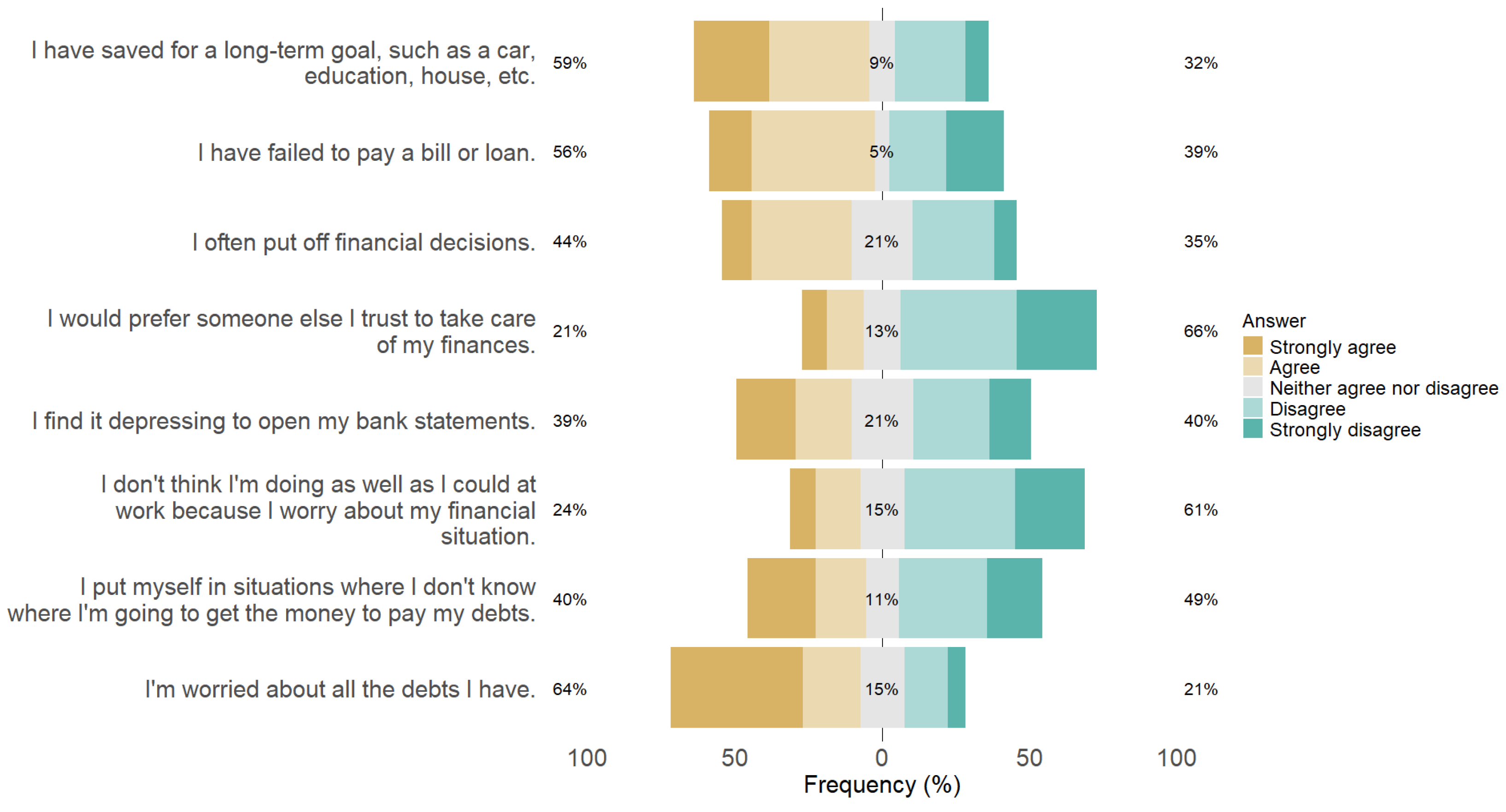

Figure 4 presents the distribution of FWB responses for each question and illustrates the descriptive results of the eight items that comprise the questionnaire. The results indicate the financial landscape among the educators surveyed, with significant financial problems offset by some planning strategies.

What stands out most in the data is the high level of financial instability and distress. A significant percentage of the sample, 64%, report feeling anxious, because they are worried about all the debts they have. This psychological stress is confirmed by behavior: 56% of respondents admit to having failed to pay a loan or bill. In addition, 40% reported feeling extremely uncertain about where they will get the money to pay off their financial commitments, which means they do not know how they will manage their debts. Finally, 39% show a negative emotional reaction to their finances, reporting feeling discouraged when looking at their bank statements.

The data show several important financial behaviors. Almost half of people 44% tend to postpone decisions about money. On the other hand, only 21% prefer to hand over money management to others, which indicates that most participants take care of this personally, despite some insecurity. Even with these difficulties, 59% of teachers say they save for large goals, such as buying a car, taking courses, or owning a home, which reflects financial planning for the future. In addition, only 24% said that money worries interfere with their work.

Many respondents delay financial decisions in their daily lives, particularly regarding debt and challenges in meeting financial obligations. However, they continue to implement strategies for long-term savings. This pattern indicates that, despite current financial challenges, participants engage in future-oriented financial planning.

4.2. Econometric Regression Results

In

Table 3, multiple econometric regression analysis was conducted based on the total number of correct answers for each respondent. Models were used to compare the average of various factors observed in the sample of 286 education professionals, with financial literacy and Financial Wellbeing and Behavior as the dependent variables, accounting for gender and additional explanatory variables.

In the financial literacy analysis, the regressions were significant at 1% for the female gender with a close negative correlation in all the models tested, suggesting that on average women have less financial literacy than men (coef. −0.149;

p < 0.01), which confirms the results of Kadoya and Khan [

39]. As for the other predictive variables, there was not enough statistical significance to have any impact on the financial literacy of education professionals. In other words, there is not sufficient evidence to reject the null hypothesis.

In the analysis of Financial Wellbeing and Behavior, Financial Literacy showed a significant positive relationship (coef. 1.024; p < 0.01), demonstrating that higher levels of financial knowledge directly affect the emotional state of an individual’s financial life and the practical management behaviors they adopt, improving positive behaviors, such as paying bills on time and saving for long-term goals. Individuals who have children have a lower level of financial wellbeing and behavior than individuals who do not (coef. −0.185; p < 0.01). Women have better levels of financial wellbeing and behavior than men (coef. 0.228; p < 0.1). Individuals who identify themselves as black (coef. −0.407; p < 0.01) or brown (coef. −0.210; p < 0.1) have lower levels of financial wellbeing and behavior. This demonstrates that race emerges as an important feature and that black and brown individuals are more financially susceptible. Our findings provide evidence that financial literacy directly affects financial wellbeing, and behavior plays an essential role in inducing improved financial habits.

4.3. Machine Learning Results

In this section, we present the results of the model in which random forest was applied to predict financial literacy. We ran a model to predict the importance of the variables Financial Literacy (FL) and Financial Wellbeing (FWB). To obtain a better-fitting model, we performed the following treatments on the database: removing variables with low variability, removing highly correlated variables, and removing variables with zero variance.

For a clearer understanding of the results, we used the SHAP (Shapley Additive explanations) technique, a common method in XAI (Explainable Artificial Intelligence). SHAP provides consistent and precise assignment values for the explanatory variables, based on game theory principles, which allows us to understand transparently how each characteristic contributes to the prediction of the model [

40].

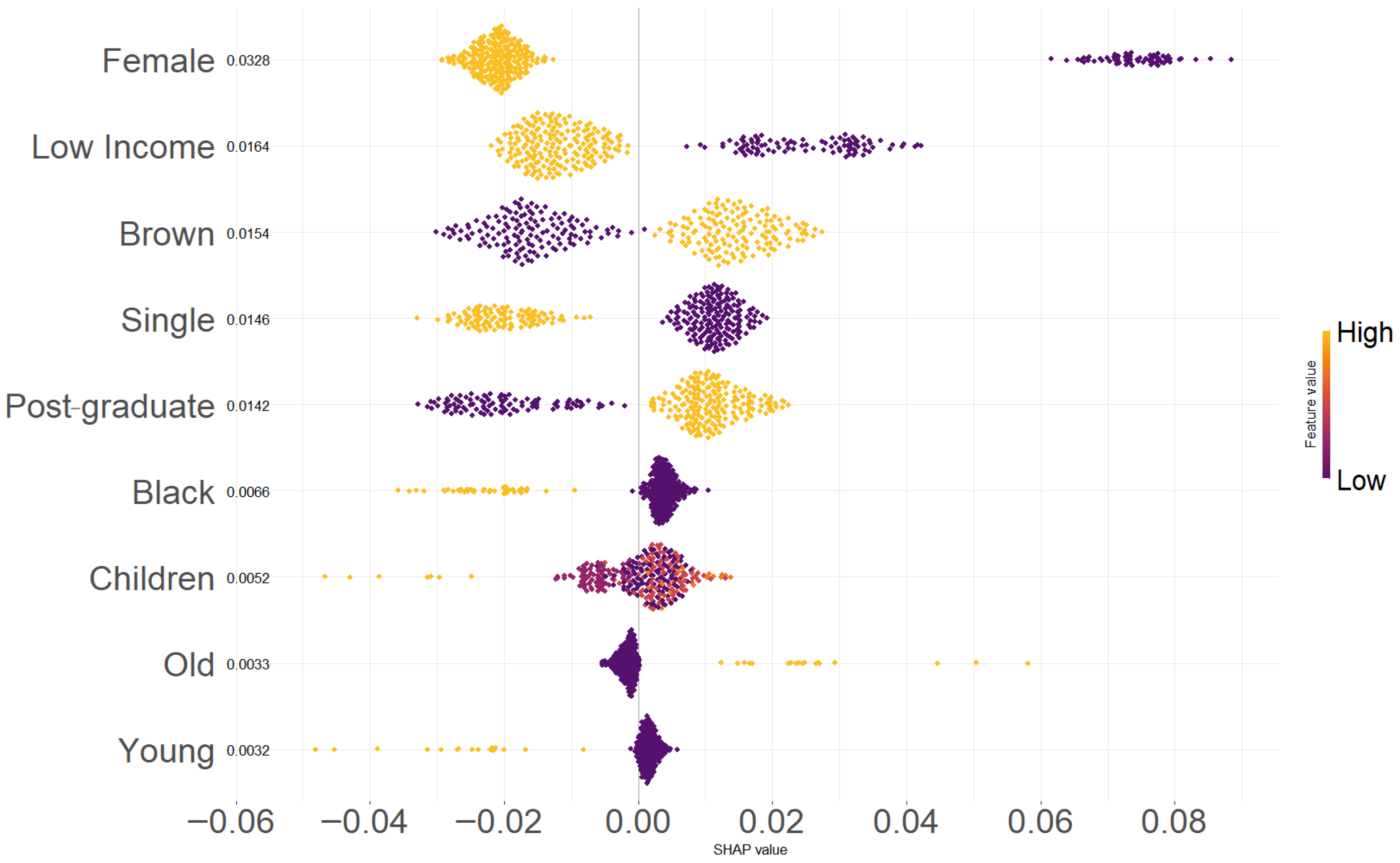

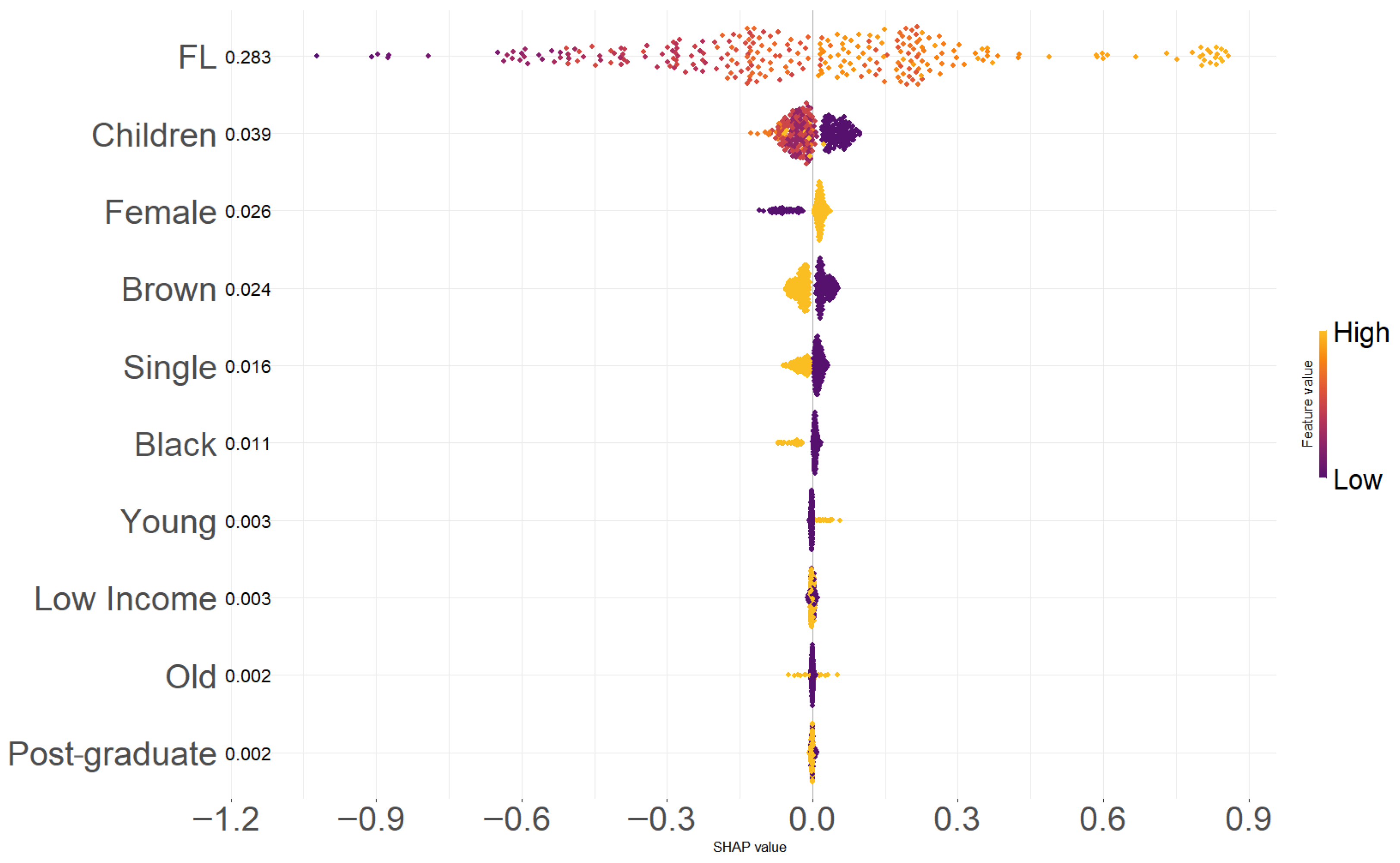

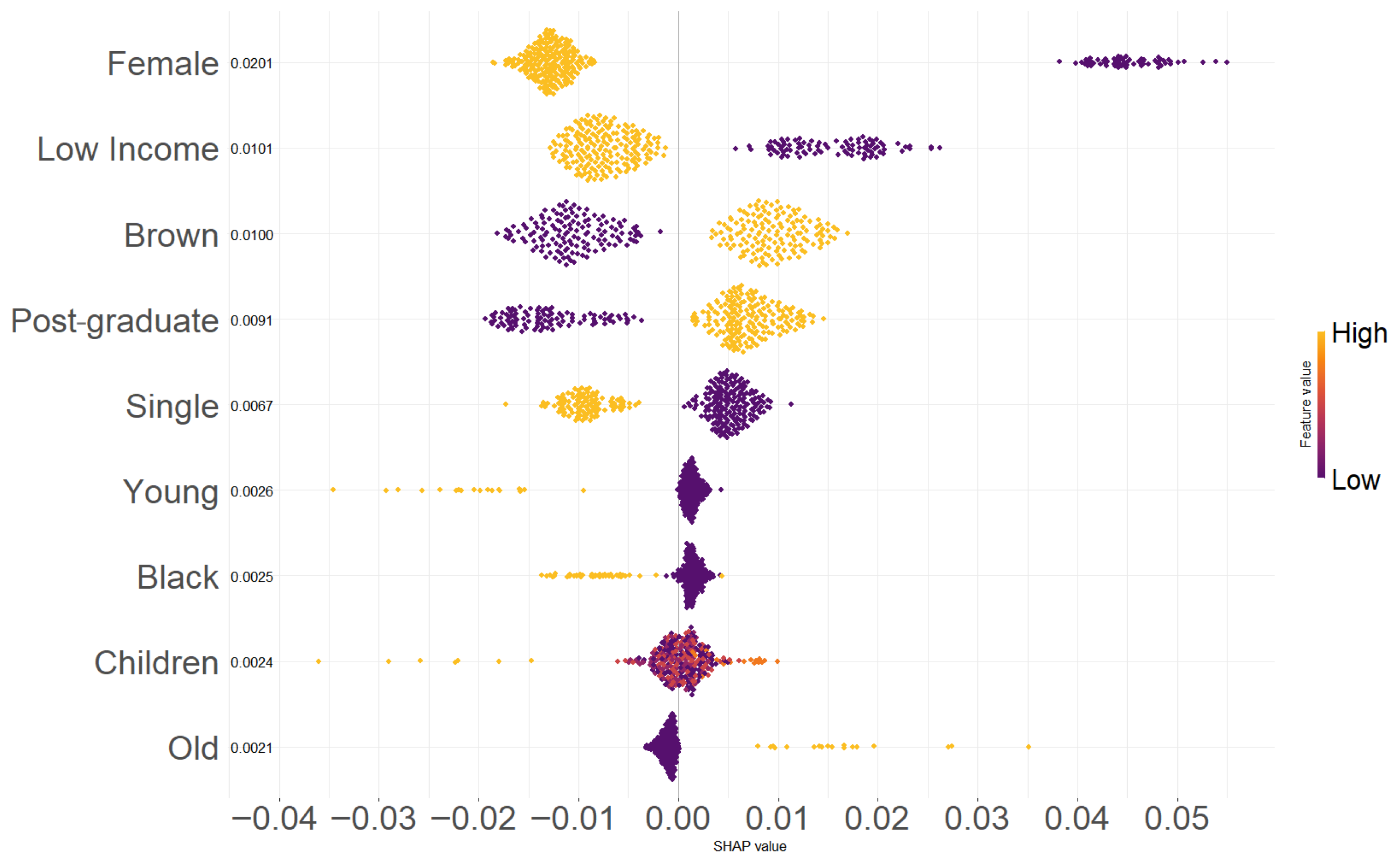

Figure 5 and

Figure 6 show the SHAP results for the beeswarm graph, with the dependent variables of Financial Literacy (LF) and Financial Wellbeing (FWB) In the graph, the horizontal axis shows the SHAP values, and the vertical axis shows the predictor variables. Positive values indicate that the variable increases the prediction of Financial Literacy (LF), while negative values indicate that it reduces the prediction. Each point on the graph represents a specific observation and shows how much that variable contributed to the prediction in that case.

In an analysis of Financial Literacy (LF), being a woman was the most relevant variable in the model, with the most significant impact on the forecasts for the dependent variables. We can also highlight the variables “Low Income”, “Brown”, “Single” and “Post-graduate”. Other characteristics in the model results were not significant. The variable “High Income” did not show results for any of the outcomes, because it represents only 2.10% of the samples. When cross validation was performed, it was divided between training and test samples, so these values ended up being distributed only in some sets, causing the model to discard the variable.

For Financial Wellbeing and Behavior prediction, Financial Literacy was the most relevant variable in the model, with the most significant impact on the forecasts for the three dependent variables, indicating that those with effective knowledge are correlated with better levels of wellbeing, such as controlling and projecting their finances. The “Children” variable is the second variable with a significant impact, similar to the “Single” variable. It has significant weight in the model’s results, ranking as the third variable with the greatest impact, considering the outcome for each dependent variable. Biological characteristics, such as whether the person is “Black” or “Mixed Race,” or whether the person is female, yield reasonable results for all three dependent variables. Characteristics such as “Old” or “Young”, as well as levels of education such as “Post-graduate” or whether the person has “Lower Income”, do not show significant results in terms of predictive scores. Their impact on the results is relatively low, and they do not stand out as relevant variables for the predictions.

When we examine the results of the SHAP methodology, they confirm the regression results, and they provide a ranking of the importance of each variable.

5. Final Considerations

Lusardi and Mitchell [

27] state that, although a substantial body of empirical and theoretical work on financial education exists, there has been relatively little focus on how individuals learn and apply financial education. However, in recent years, the demand for financial knowledge has increased substantially, motivating a more careful examination of whether education professionals follow this trend. This paper contributes to the examination of the financial lives of public school teachers in Brazilian public schools in two steps. In the first step, it identified relevant determinants of Financial Literacy, of which one such relevant determinant was found to be gender. In the second step, it demonstrated that high Financial Literacy significantly predicts high Financial Wellbeing and Behavior, both for econometric specifications and for machine learning specifications. Although financial education is a cross-cutting theme of the National Common Curriculum Base—BNCC, there is no concern to associate it with education in behavioral economics, i.e., the individual may have the mathematical knowledge to make better decisions. However, as they have not been conditioned to do so, they probably continue to make less assertive choices.

We highlight a limitation of our study, related to the participants. We started with 329 responses and removed incomplete ones. Ultimately, the analysis included 286 respondents. The group that completed the questionnaire may be different from the group that dropped out or left it blank. One possibility is that those who were more organized with their finances or more interested in the topic were the ones who had the patience to complete the entire questionnaire. Therefore, those who are more organized with their finances are more interested in completing the questionnaire; so, this group may not accurately represent all education professionals in Brazil. In a nutshell, our sample may be made up of more cautious people than average. Another relevant point would be to replicate this research in other professional classes to compare the results. In the future, further research would be beneficial to investigate how poor working conditions and low educational attainment relate to the mental health of education professionals. This might help understand why they sometimes have a less assertive stance. Our article also suggests that future studies should focus on global goals such as gender equality, quality education, and decent work, as well as understanding how all of this is connected to economic development.