Exploring the Determinants of FinTech Adoption Among University Students: A Second-Order Construct Analysis

Abstract

1. Introduction

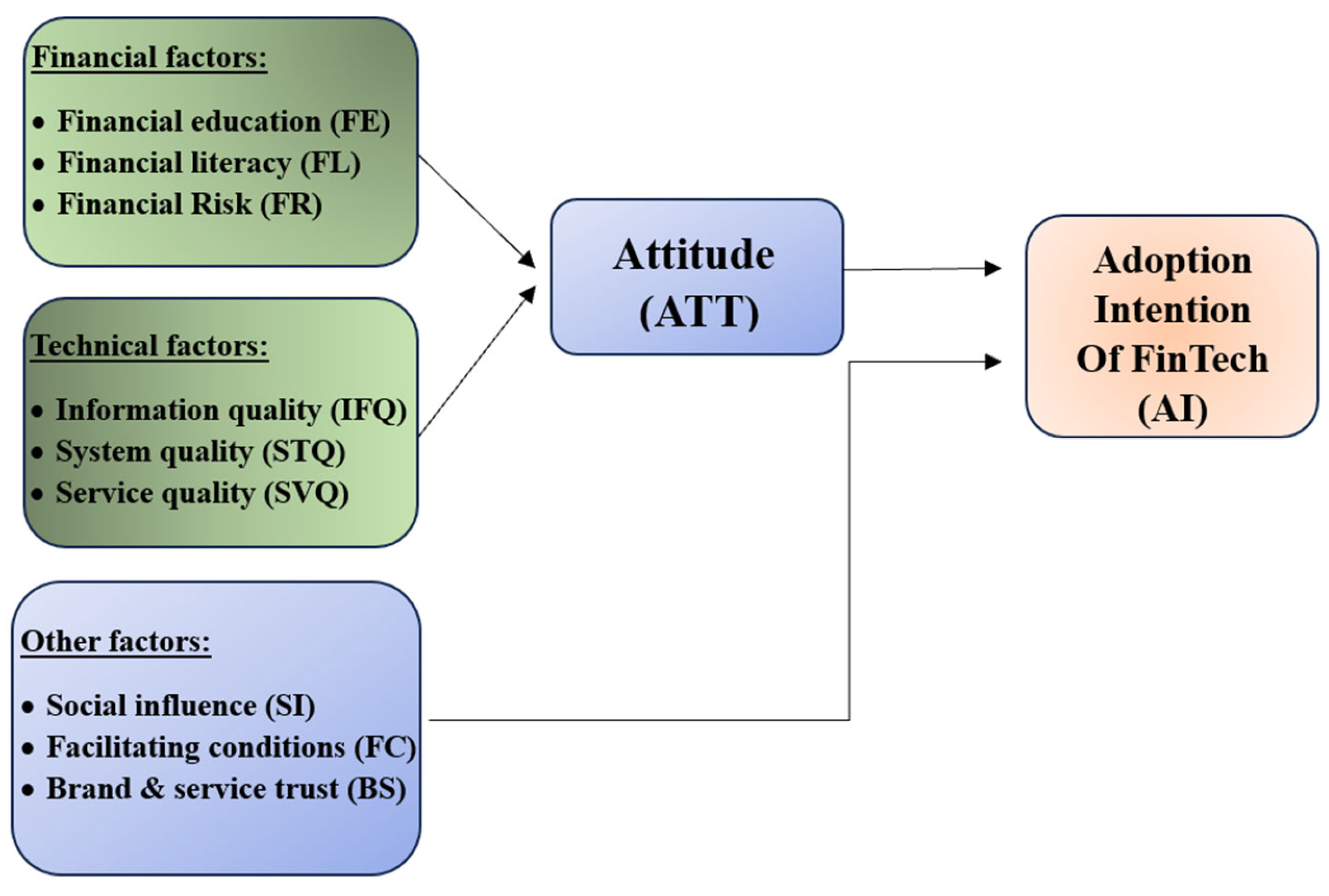

- Evaluate the roles of financial elements, such as financial understanding, fiscal teaching, and fiscal risk, in deciding how and when to utilize different FinTech products.

- Understand components of technical factors such as information quality, system quality, and service quality, and how these factors affect adoption intentions.

- Examine the influence of social factors, facilitating conditions, and brand trust on the attitude of users to the FinTech services.

- Apply Second-Order Construct in (SEM) to provide a deeper and more intensive, more appropriate approach than previous research to study Fintech adoption.

2. Literature Review

2.1. Determinants of FinTech Adoption

2.1.1. Financial Factors in FinTech Adoption

2.1.2. Technical Factors: System, Information, and Service Quality

2.1.3. Other Factors: Social Influence and Trust in FinTech

2.1.4. Cultural and Regulatory Factors in Saudi Arabia’s FinTech Adoption

2.2. Second-Order Constructs in FinTech Research

2.3. DeLone and McLean’s Information Systems (IS) Success Model

3. Theoretical Framework and Hypotheses Development

3.1. Theoretical Framework

3.1.1. DeLone and McLean IS Success Model

- System Quality: The usability, reliability, adaptability, and response time.

- Information Quality: The accuracy, relevance, and timeliness of financial information.

- Service Quality: The care given to the clients, staff, and the extent to which the system attends to its clientele promptly.

3.1.2. The Role of Second-Order Constructs

- Financial Factors include three factors: financial literacy, financial education, and financial risk.

- Technical factors have three factors, namely information quality, system quality, and service quality.

- Other factors include social influence, facilitating conditions, and brand and service trust.

3.2. Hypotheses Development

3.2.1. Technical Factors as a Second-Order Factor

3.2.2. Financial Factors as a Second-Order Factor

3.2.3. Other Factors as a Second-Order Factor

3.2.4. Financial Factors and Users’ Attitude

3.2.5. Technical Factors and Users’ Attitude

3.2.6. Other Factors and FinTech Adoption Intention

3.2.7. Attitude and FinTech Adoption Intention

4. Research Methodology

4.1. Measures

4.2. Sample

4.3. Data Collection

5. Results

5.1. Reliability and Validity Tests

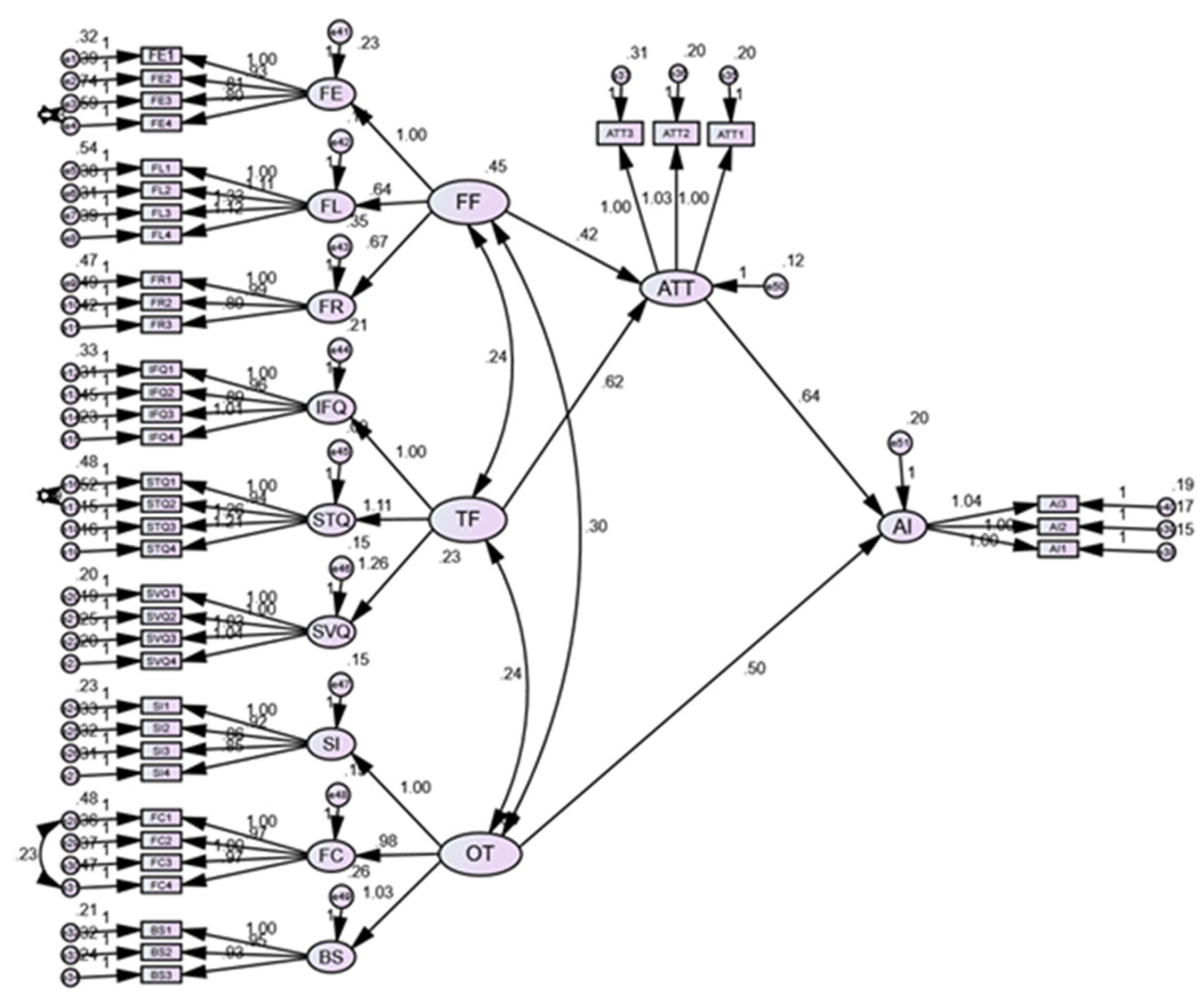

5.2. Second Order Factor Analysis (SOFA)

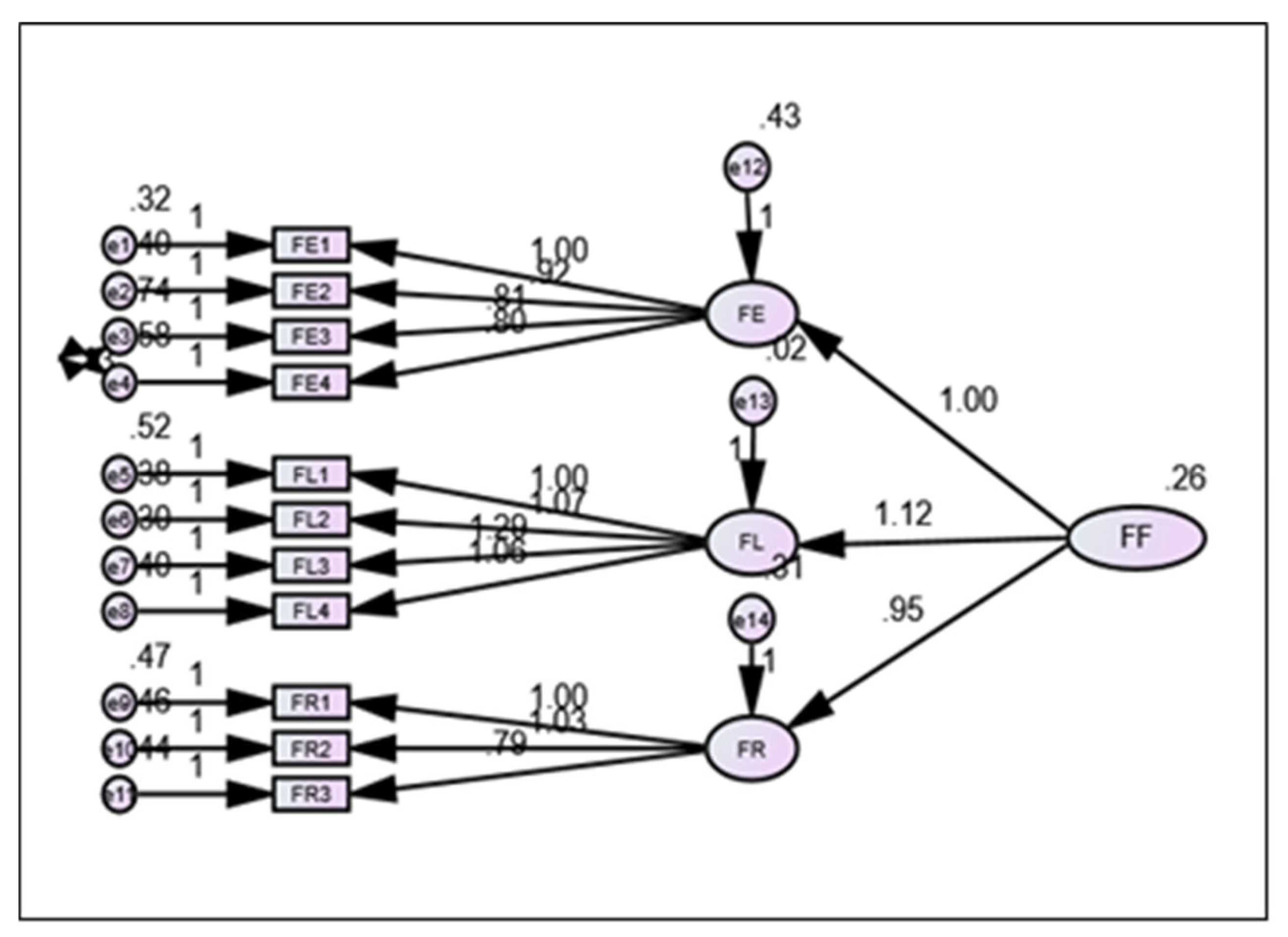

5.2.1. Financial Factor (FF)/(SOFA)

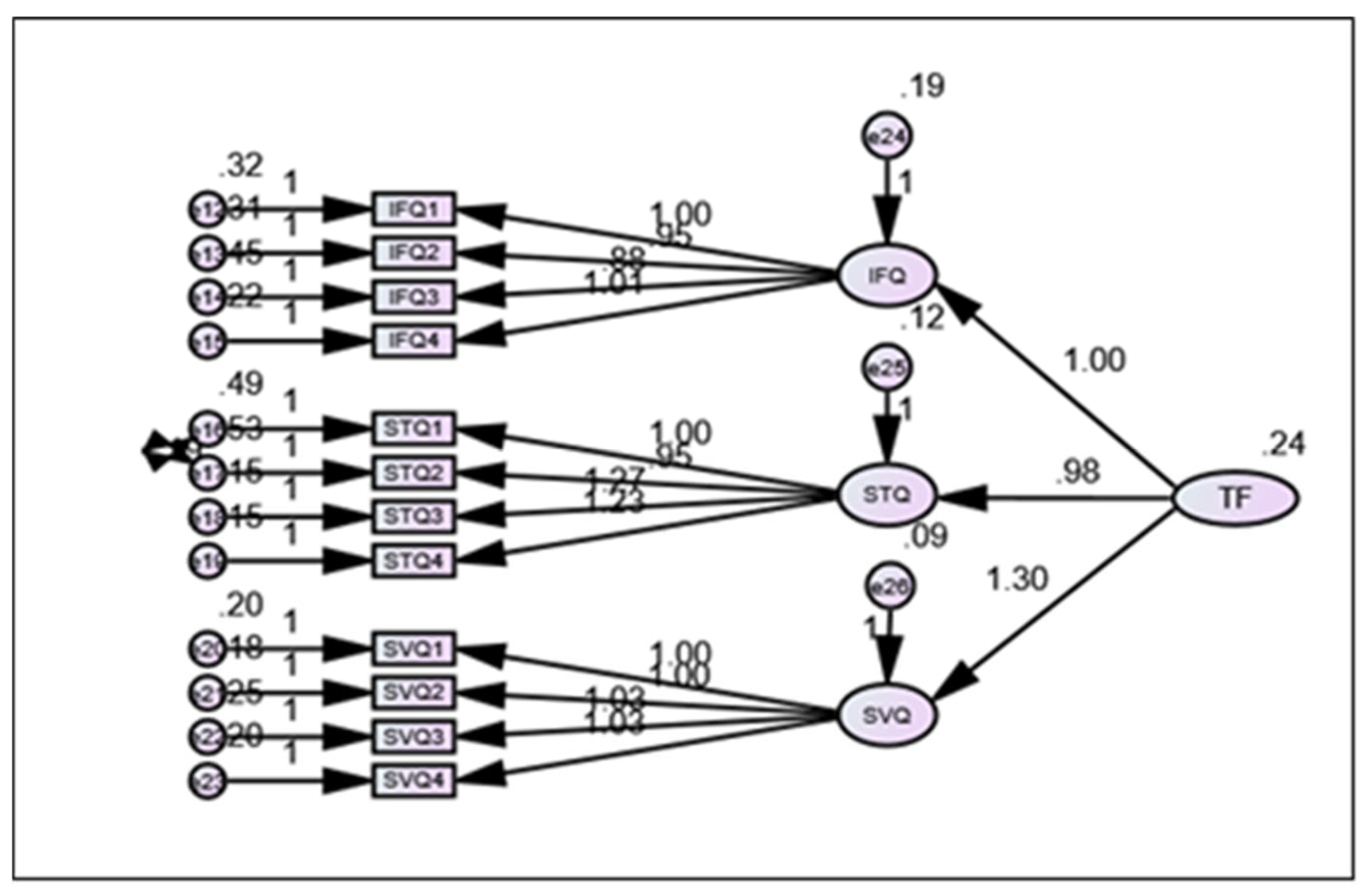

5.2.2. Technical Factor (TF)/(SOFA)

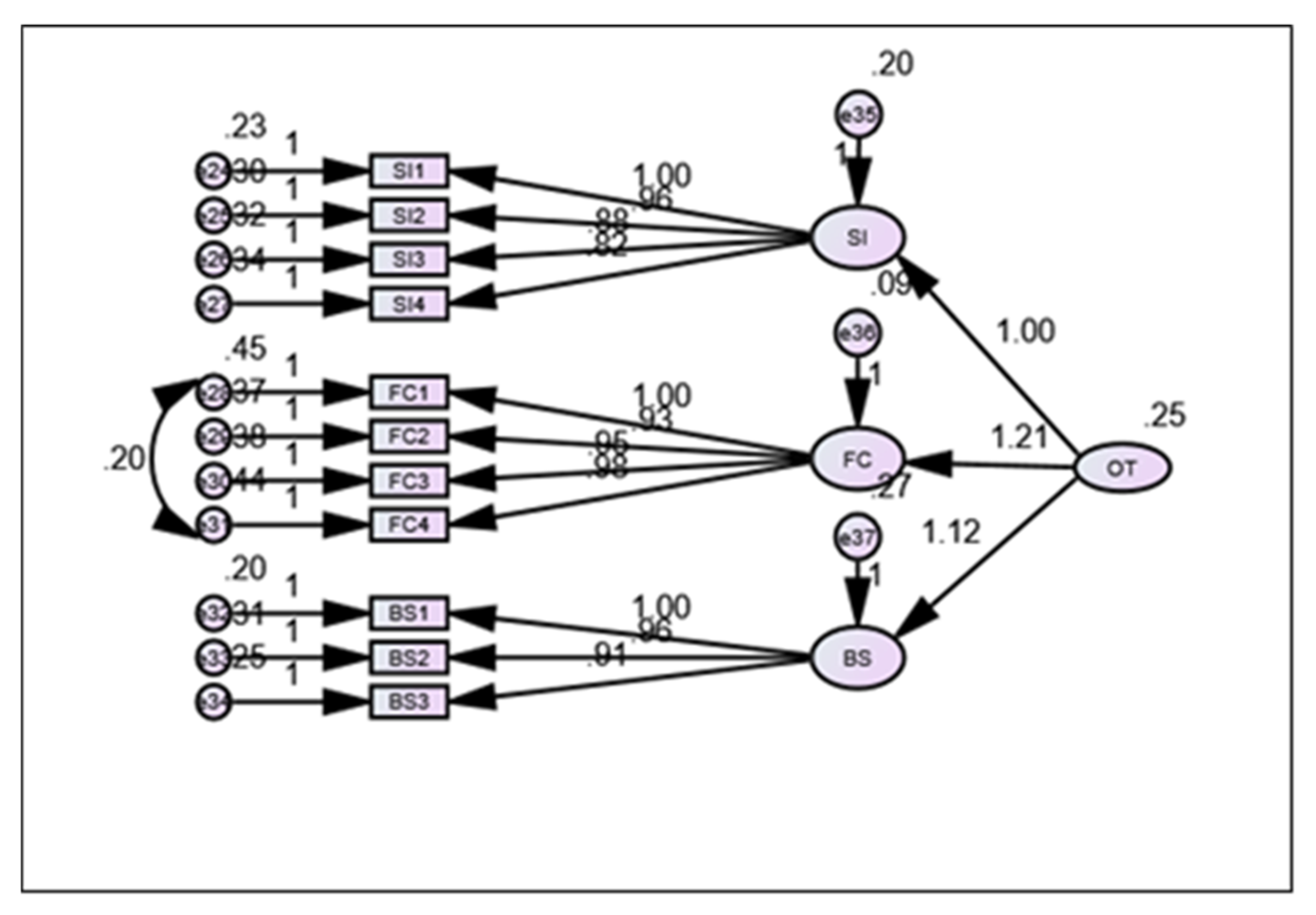

5.2.3. Other Factor (OT)/(SOFA)

5.3. Structural Equation Model (Path Analysis)

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| SEM | Structural Equation Modeling |

| TAM | Technology Acceptance Model |

| UTAUT | Unified Theory of Acceptance and Use of Technology |

| SOFA | Second Order Factor Analysis |

| SAMA | Saudi Central Bank |

| CMA | Capital Market Authority |

Appendix A

| Factors | ID | Items |

|---|---|---|

| Financial education (FE) | FE1 | Financial education influences the decision to use Fintech for managing your finances. |

| FE2 | Financial consumers have the appropriate financial knowledge to use Fintech. | |

| FE3 | Feel that limited financial education leads to less growth in the personal economy. | |

| FE4 | The lack of advice from banking entities is the main flaw in financial education. | |

| Financial literacy (FL) | FL1 | I have basic or near-zero knowledge of key financial concepts. |

| FL2 | I have the knowledge necessary to use Fintech services. | |

| FL3 | I intend to learn more about personal finance in the future. | |

| FL4 | I make appropriate decisions about personal finance on my own. | |

| Financial Risk (FR) | FR1 | Financial losses are likely when I use Fintech. |

| FR2 | Financial fraud or payment fraud is likely when I use Fintech. | |

| FR3 | Financial losses due to the lack of interoperability with other services are likely when I use Fintech. | |

| Information quality (IFQ) | IFQ1 | Information provided by Fintech systems is accurate. |

| IFQ2 | Information provided by Fintech systems is up to date. | |

| IFQ3 | Information provided by Fintech systems is easy to understand. | |

| IFQ4 | Information provided by Fintech systems meets my needs. | |

| System quality (STQ) | STQ1 | Fintech systems are easy to use. |

| STQ2 | Fintech systems can be accessed immediately. | |

| STQ3 | Fintech systems enable me to accomplish my financial transactions. | |

| STQ4 | Fintech systems provide helpful functions for my financial transactions. | |

| Service quality (SVQ) | SVQ1 | Fintech service quickly responds to my needs. |

| SVQ2 | Fintech service has the knowledge to answer my questions. | |

| SVQ3 | Fintech service understands my specific needs. | |

| SVQ4 | Fintech service is always willing to help me. | |

| Social Influence (SI) | SI1 | My peers and close friends support the idea of me using FinTech services. |

| SI2 | Most people I admire and I am influenced by are using FinTech services. | |

| SI3 | People who are important to me could assist me in the use of FinTech services. | |

| SI4 | Using FinTech services makes me look intelligent and modern. | |

| Facilitating conditions (FC) | FC1 | I have the knowledge and capability to use FinTech services. |

| FC2 | FinTech Services is compatible with all of my computing devices, mobile and gadgets. | |

| FC3 | I can always get help when facing any difficulties using or dealing with FinTech product. | |

| FC4 | I have sufficient experience to comfortably use FinTech. | |

| Brand & service trust (BS) | BS1 | I have confidence in Fintech Service provided by enterprises. |

| BS2 | I believe the transaction process and results of Fintech Service are correct. | |

| BS3 | I believe the transaction system of Fintech Service is secure. | |

| Attitude (ATT) | ATT1 | I believe using Fintech services is a good idea. |

| ATT2 | Using Fintech services is a pleasant experience. | |

| ATT3 | I am interested in Fintech services. | |

| Adoption intention (AI) | AI1 | I intend to adopt Fintech in the future. |

| AI2 | I expect to use Fintech regularly in the future. | |

| AI3 | I will strongly advise others to use Fintech. |

References

- Zavolokina, L.; Dolata, M.; Schwabe, G. The FinTech phenomenon: Antecedents of financial innovation perceived by the popular press. Financ. Innov. 2016, 2, 16. [Google Scholar] [CrossRef]

- Gomber, P.; Koch, J.-A.; Siering, M. Digital Finance and FinTech: Current research and future research directions. J. Bus. Econ. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Anagnostopoulos, I. FinTech and RegTech: Impact on regulators and banks. J. Econ. Bus. 2018, 100, 7–25. [Google Scholar] [CrossRef]

- Asem, A.; Mohammad, A.A.; Ziyad, I.A. Navigating digital transformation in alignment with Vision 2030: A review of organizational strategies, innovations, and implications in Saudi Arabia. J. Knowl. Learn. Sci. Technol. 2024, 3, 21–29. [Google Scholar] [CrossRef]

- Alsayari, A.M. Saudi Central Bank. Annual FinTech Report 2022; Saudi Central Bank: Riyadh, Saudi Arabia, 2022. Available online: https://www.sama.gov.sa/en-US/Documents/AFR22_en.pdf (accessed on 12 September 2025).

- Al-Obaidi, S. The Young Demographic Structure and Investment Opportunities. Al Riyadh. 2024. Available online: https://alriyadh.com/2092204 (accessed on 12 September 2025).

- Sulistyowati, A.; Rianto, M.R.; Sari, R.K.S.; Narpati, B.N.G. Indonesian millennial generation: Impact of internal factors and external factors on the intention to use financial technology (mobile payment applications) in Jakarta, Indonesia. Psychol. Educ. 2020, 57, 1525–1530. [Google Scholar]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 1989, 27, 425–478. [Google Scholar] [CrossRef]

- Singh, S.; Sahni, M.M.; Kovid, R.K. What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Manag. Decis. 2020, 58, 1675–1697. [Google Scholar] [CrossRef]

- Aggarwal, M.; Nayak, K.M.; Bhatt, V. Examining the factors influencing fintech adoption behaviour of Gen Y in India. Cogent. Econ. Financ. 2023, 11, 2197699. [Google Scholar] [CrossRef]

- Vasishta, P.; Singla, A.; Deep, S. Unveiling the FinTech revolution: Pioneering models and theories shaping FinTech adoption research. Manag. Rev. Q. 2024, 1–30. [Google Scholar] [CrossRef]

- Al-Okaily, M. So what about the post-COVID-19 era?: Do users still adopt FinTech products? Int. J. Hum.-Comput. Interact. 2025, 41, 876–890. [Google Scholar] [CrossRef]

- Setiawan, B.; Nugraha, D.P.; Irawan, A.; Nathan, R.J.; Zoltan, Z. User innovativeness and fintech adoption in Indonesia. J. Open Innov. Technol. Mark. Complex. 2021, 7, 188. [Google Scholar] [CrossRef]

- Bermeo-Giraldo, M.C.; Valencia-Arias, A.; Palacios-Moya, L.; Valencia, J. Adoption of fintech services in young students: Empirical approach from a developing country. Economies 2023, 11, 226. [Google Scholar] [CrossRef]

- Ryu, H.S. What makes users willing or hesitant to use Fintech?: The moderating effect of user type. Ind. Manag. Data Syst. 2018, 118, 541–569. [Google Scholar] [CrossRef]

- Makki, A.A.; Alqahtani, A.Y. Modeling the enablers to FinTech innovation in Saudi Arabia: A hybrid approach using ism and anp. Systems 2022, 10, 181. [Google Scholar] [CrossRef]

- Frare, A.B.; Fernandes, C.M.G.; Santos, M.C.D.; Quintana, A.C. Determinants of intention to use FinTechs services by accounting students: A mixed methods approach. Braz. Bus. Rev. 2023, 20, 580–599. [Google Scholar] [CrossRef]

- Hassan, M.S.; Islam, M.A.; Sobhani, F.A.; Hassan, M.M.; Hassan, M.A. Patients’ intention to adopt FinTech services: A study on Bangladesh healthcare sector. Int. J. Environ. Res. Public Health 2022, 19, 15302. [Google Scholar] [CrossRef] [PubMed]

- Odoom, R.; Kosiba, J.P. Mobile money usage and continuance intention among micro enterprises in an emerging market—The mediating role of agent credibility. J. Syst. Inf. Technol. 2020, 22, 97–117. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D. Managing user trust in B2C e-services. e-Service 2003, 2, 7–24. [Google Scholar] [CrossRef]

- Pavlou, P.A. Consumer acceptance of electronic commerce: Integrating trust and risk with the technology acceptance model. Int. J. Electron. Commer. 2003, 7, 101–134. [Google Scholar] [CrossRef]

- Alamoodi, M.A.A.; Selamat, Z. Determinants of FinTech products and services adoption in Kingdom of Saudi Arabia (KSA). J. Int. Bus. Econ. Entrep. 2021, 6, 1–8. [Google Scholar] [CrossRef]

- Al-Qudah, A.A.; Al-Okaily, M.; Yadav, M.P.P. The growth of FinTech and blockchain technology in developing countries: UAE’s evidence. Int. J. Account. Inf. Manag. 2025, 33, 383–406. [Google Scholar] [CrossRef]

- Bouheni, F.B. FinTech Landscape and Sustainable Economy in the GCC Region. In Green Growth Opportunities and Sustainable Finance in the Gulf Cooperation Council Region: Strengthening the Response to Global Shocks; Springer Nature: Singapore, 2025; p. 217. [Google Scholar] [CrossRef]

- Cao, T. The study of factors on small and medium enterprises’ adoption of mobile payment: Implications for the COVID-19 era. Front. Public Health 2021, 9, 646592. [Google Scholar] [CrossRef]

- Al-Sharafi, M.A.; Muhammed, I.; Alzaeemi, S.; Albashrawi, M.A.; Chae, I.; Dwivedi, Y.K. Factors shaping FinTech adoption: A systematic review, key determinants, theoretical insights, conceptual framework and future research directions. Inf. Discov. Deliv. 2025. [Google Scholar] [CrossRef]

- Zhou, T. An empirical examination of continuance intention of mobile payment services. Decis. Support Syst. 2013, 54, 1085–1091. [Google Scholar] [CrossRef]

- Ryu, H.S.; Ko, K.S. Sustainable development of Fintech: Focused on uncertainty and perceived quality issues. Sustainability 2020, 12, 7669. [Google Scholar] [CrossRef]

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption intention of FinTech services for bank users: An empirical examination with an extended technology acceptance model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef]

- Yan, C.; Siddik, A.B.; Akter, N.; Dong, Q. Factors influencing the adoption intention of using mobile financial service during the COVID-19 pandemic: The role of FinTech. Environ. Sci. Pollut. Res. 2023, 30, 61271–61289. [Google Scholar] [CrossRef]

- AlSuwaidi, R.A.; Mertzanis, C. Financial literacy and FinTech market growth around the world. Int. Rev. Financ. Anal. 2024, 95, 103481. [Google Scholar] [CrossRef]

- Kumar, J.; Rani, V. Financial innovation and gender dynamics: A comparative study of male and female FinTech adoption in emerging economies. Int. J. Account. Inf. Manag. 2025, 33, 334–353. [Google Scholar] [CrossRef]

- DeLone, W.H.; McLean, E.R. Information systems success: The quest for the dependent variable. Inf. Syst. Res. 1992, 3, 60–95. [Google Scholar] [CrossRef]

- Roh, T.; Yang, Y.S.; Xiao, S.; Park, B.I. What makes consumers trust and adopt FinTech? An empirical investigation in China. Electron. Commer. Res. 2024, 24, 3–35. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 4th ed.; Guilford Publications: New York, NY, USA, 2015. [Google Scholar]

- Sharma, S.K.; Sharma, M. Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. Int. J. Inf. Manag. 2019, 44, 65–75. [Google Scholar] [CrossRef]

- Hasan, R.; Ashfaq, M.; Shao, L. Evaluating drivers of FinTech adoption in the Netherlands. Glob. Bus. Rev. 2024, 25, 1576–1589. [Google Scholar] [CrossRef]

- Jamieson, S. Likert scales: How to (ab)use them? Med. Educ. 2004, 38, 1217–1218. [Google Scholar] [CrossRef] [PubMed]

- Collis, J.; Hussey, R. Writing up the research. In Business Research; Springer: London, UK, 2014; pp. 297–330. [Google Scholar]

- Thomas, B.; Subhashree, P. Factors that influence the financial literacy among engineering students. Procedia Comput. Sci. 2020, 172, 480–487. [Google Scholar] [CrossRef]

- Alkhwaldi, A.F.; Alharasis, E.E.; Shehadeh, M.; Abu-AlSondos, I.A.; Oudat, M.S.; Bani Atta, A.A. Towards an understanding of FinTech users’ adoption: Intention and e-loyalty post-COVID-19 from a developing country perspective. Sustainability 2022, 14, 12616. [Google Scholar] [CrossRef]

- Forsythe, S.; Liu, C.; Shannon, D.; Gardner, L.C. Development of a scale to measure the perceived benefits and risks of online shopping. J. Interact. Mark. 2006, 20, 55–75. [Google Scholar] [CrossRef]

- Wang, W.-T.; Wang, Y.-S.; Liu, E.-R. The stickiness intention of group-buying websites: The integration of the commitment–trust theory and e-commerce success model. Inf. Manag. 2016, 53, 625–642. [Google Scholar] [CrossRef]

- Singh, J.; Sirdeshmukh, D. Agency and trust mechanisms in consumer satisfaction and loyalty judgments. J. Acad. Mark. Sci. 2000, 28, 150–167. [Google Scholar] [CrossRef]

- Hu, L.T.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis; Pearson: Harlow, UK, 2014. [Google Scholar]

- Arner, D.W.; Buckley, R.P.; Zetzsche, D.A.; Veidt, R. Sustainability, FinTech and financial inclusion. Eur. Bus. Organ. Law Rev. 2020, 21, 7–35. [Google Scholar] [CrossRef]

- Chueca Vergara, C.; Ferruz Agudo, L. FinTech and sustainability: Do they affect each other? Sustainability 2021, 13, 7012. [Google Scholar] [CrossRef]

- Wang, Q.; Niu, G.; Zhou, Y.; Gan, X. Education and FinTech adoption: Evidence from China. China Financ. Rev. Int. 2025, 15, 140–165. [Google Scholar] [CrossRef]

- Alqirem, R.; Al-Smadi, R.W. Enhancing sustainable FinTech education: Investigating the role of smartphones in empowering economic development in Jordan. Discov. Sustain. 2025, 6, 509. [Google Scholar] [CrossRef]

| Variables | ID | Items Description | References |

|---|---|---|---|

| Financial factors: | |||

| Financial education | (FE) | It is essential for university students, as the ability to manage and utilize financial resources is crucial for the effective operation of any organization, and students are seen as future entrepreneurs. | [41] |

| Financial literacy | (FL) | Can be described as “measuring how well an individual can understand and use personal finance-related information” to make a decision. | [42] |

| Financial Risk | (FR) | It refers to the potential financial loss in the financial transactions of Fintech. | [43] |

| Technical factors: | |||

| Information quality | (IFQ) | It pertains to an individual’s assessment of service providers’ capacity to fulfill the user’s requirements. | [37] |

| System quality | (STQ) | It pertains to impressions formed by the whole operation of IT systems. | [37] |

| Service quality | (SVQ) | It is characterized as an individual’s assessment of the extent of assistance provided by an Information Systems department and its IT support framework. | [44] |

| Other factors: | |||

| Social influence | (SI) | The effect of a person’s family and friends on their decision to employ a specific system is what this term alludes to “the degree to which individuals recognize the need to use a system, since they notice that other relevant people are already using it”. | [19,20] |

| Facilitating conditions | (FC) | The available resources a person has to perform any particular behavior. “the degree to which an individual notices that a system can be easily controlled if supported by the organization and its technical infrastructure”. | [19,20] |

| Brand and service trust | (BS) | “The degree of effect on consumer trust toward enterprises that provide Fintech Service by brand and system security”. | [21,22,45] |

| Attitude | (ATT) | Attitude refers to the user’s subjective judgments and personal tendencies related to something. | [46] |

| Construct | CR | AVE |

|---|---|---|

| Financial Education (FE) | 0.808 | 0.517 |

| Financial Literacy (FL) | 0.803 | 0.507 |

| Financial Risk (FR) | 0.757 | 0.510 |

| Information Quality (IFQ) | 0.834 | 0.558 |

| System Quality (STQ) | 0.851 | 0.594 |

| Service Quality (SVQ) | 0.910 | 0.716 |

| Social Influence (SI) | 0.834 | 0.558 |

| Facilitation Conditions (FC) | 0.805 | 0.508 |

| Brand and Service Trust (BS) | 0.863 | 0.678 |

| Attitude (ATT) | 0.843 | 0.643 |

| Adoption Intention of FinTech (AI) | 0.920 | 0.793 |

| Title 1 | FE | FL | FR | IFQ | STQ | SVQ | SI | FC | BS | ATT | AI |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FE | 0.719 | ||||||||||

| FL | 0.602 | 0.712 | |||||||||

| FR | 0.400 | 0.638 | 0.714 | ||||||||

| IFQ | 0.450 | 0.333 | 0.284 | 0.747 | |||||||

| STQ | 0.630 | 0.503 | 0.420 | 0.605 | 0.771 | ||||||

| SVQ | 0.548 | 0.451 | 0.368 | 0.678 | 0.735 | 0.846 | |||||

| SI | 0.570 | 0.446 | 0.401 | 0.551 | 0.683 | 0.604 | 0.747 | ||||

| FC | 0.525 | 0.419 | 0.393 | 0.608 | 0.618 | 0.597 | 0.668 | 0.713 | |||

| BS | 0.508 | 0.392 | 0.274 | 0.560 | 0.536 | 0.628 | 0.556 | 0.657 | 0.823 | ||

| ATT | 0.645 | 0.584 | 0.446 | 0.456 | 0.720 | 0.642 | 0.720 | 0.689 | 0.640 | 0.802 | |

| AI | 0.620 | 0.489 | 0.331 | 0.439 | 0.686 | 0.597 | 0.647 | 0.602 | 0.602 | 0.800 | 0.891 |

| Estimate | S.E. | C.R. | p | |||

|---|---|---|---|---|---|---|

| FE | ← | FF | 1.000 | |||

| FL | ← | FF | 1.119 | 0.150 | 7.450 | *** |

| FR | ← | FF | 0.951 | 0.107 | 8.882 | *** |

| FE1 | ← | FE | 1.000 | |||

| FE2 | ← | FE | 0.925 | 0.054 | 17.007 | *** |

| FE3 | ← | FE | 0.806 | 0.060 | 13.390 | *** |

| FE4 | ← | FE | 0.797 | 0.055 | 14.387 | *** |

| FL1 | ← | FL | 1.000 | |||

| FL2 | ← | FL | 1.067 | 0.082 | 13.000 | *** |

| FL3 | ← | FL | 1.291 | 0.092 | 14.040 | *** |

| FL4 | ← | FL | 1.059 | 0.082 | 12.836 | *** |

| FR1 | ← | FR | 1.000 | |||

| FR2 | ← | FR | 1.026 | 0.076 | 13.566 | *** |

| FR3 | ← | FR | 0.786 | 0.062 | 12.705 | *** |

| CMIN/DF | 3.000 | Excellent |

| CFI | 0.963 | Excellent |

| SRMR | 0.048 | Excellent |

| RMSEA | 0.061 | Acceptable |

| PClose | 0.075 | Excellent |

| Estimate | S.E. | C.R. | p | |||

|---|---|---|---|---|---|---|

| IFQ | ← | TF | 1.000 | |||

| STQ | ← | TF | 0.981 | 0.090 | 10.869 | *** |

| SVQ | ← | TF | 1.299 | 0.105 | 12.381 | *** |

| IFQ1 | ← | IFQ | 1.000 | |||

| IFQ2 | ← | IFQ | 0.955 | 0.057 | 16.769 | *** |

| IFQ3 | ← | IFQ | 0.876 | 0.060 | 14.477 | *** |

| IFQ4 | ← | IFQ | 1.006 | 0.056 | 17.999 | *** |

| STQ1 | ← | STQ | 1.000 | |||

| STQ2 | ← | STQ | 0.950 | 0.059 | 16.111 | *** |

| STQ3 | ← | STQ | 1.274 | 0.076 | 16.754 | *** |

| STQ4 | ← | STQ | 1.234 | 0.074 | 16.708 | *** |

| SVQ1 | ← | SVQ | 1.000 | |||

| SVQ2 | ← | SVQ | 1.000 | 0.040 | 24.808 | *** |

| SVQ3 | ← | SVQ | 1.029 | 0.044 | 23.529 | *** |

| SVQ4 | ← | SVQ | 1.034 | 0.042 | 24.783 | *** |

| CMIN/DF | 4.587 | Acceptable |

| CFI | 0.956 | Excellent |

| SRMR | 0.051 | Excellent |

| RMSEA | 0.061 | Acceptable |

| PClose | 0.046 | Acceptable |

| Estimate | S.E. | C.R. | p | |||

|---|---|---|---|---|---|---|

| SI | ← | OT | 1.000 | |||

| FC | ← | OT | 1.207 | 0.117 | 10.334 | *** |

| BS | ← | OT | 1.115 | 0.099 | 11.222 | *** |

| SI1 | ← | SI | 1.000 | |||

| SI2 | ← | SI | 0.956 | 0.053 | 17.881 | *** |

| SI3 | ← | SI | 0.875 | 0.052 | 16.951 | *** |

| SI4 | ← | SI | 0.821 | 0.051 | 16.075 | *** |

| FC1 | ← | FC | 1.000 | |||

| FC2 | ← | FC | 0.931 | 0.066 | 14.063 | *** |

| FC3 | ← | FC | 0.953 | 0.067 | 14.116 | *** |

| FC4 | ← | FC | 0.982 | 0.050 | 19.564 | *** |

| BS1 | ← | BS | 1.000 | |||

| BS2 | ← | BS | 0.956 | 0.046 | 20.588 | *** |

| BS3 | ← | BS | 0.910 | 0.043 | 21.004 | *** |

| CMIN/DF | 3.764 | Acceptable |

| CFI | 0.962 | Excellent |

| SRMR | 0.041 | Excellent |

| RMSEA | 0.071 | Acceptable |

| Path | Estimate | S.E. | C.R. | p | Null Hypothesis | Decision | Conclusion |

|---|---|---|---|---|---|---|---|

| ATT ← FF | 0.425 | 0.081 | 5.238 | *** | No impact of FF on ATT | Reject | Financial Factors positively impact Attitude towards FinTech. Improving FF enhances ATT. |

| ATT ← TF | 0.617 | 0.110 | 5.620 | *** | No impact of TF on ATT | Reject | Technical Factors positively impact Attitude towards FinTech. Improving TF enhances ATT. |

| AI ← ATT | 0.639 | 0.086 | 7.438 | *** | No impact of ATT on AI | Reject | Attitude significantly impacts Adoption Intention of FinTech. Improving ATT increases AI. |

| AI ← OT | 0.503 | 0.100 | 5.034 | *** | No impact of OT on AI | Reject | Other Factors positively impact Adoption Intention of FinTech. Identifying OT factors enhances AI. |

| CMIN/DF | 2.421 | Excellent |

| CFI | 0.922 | Acceptable |

| SRMR | 0.052 | Excellent |

| RMSEA | 0.051 | Excellent |

| PClose | 0.263 | Excellent |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Felimban, R.H.; Alzahrani, L.S. Exploring the Determinants of FinTech Adoption Among University Students: A Second-Order Construct Analysis. Sustainability 2025, 17, 10215. https://doi.org/10.3390/su172210215

Felimban RH, Alzahrani LS. Exploring the Determinants of FinTech Adoption Among University Students: A Second-Order Construct Analysis. Sustainability. 2025; 17(22):10215. https://doi.org/10.3390/su172210215

Chicago/Turabian StyleFelimban, Razaz Houssien, and Latifa Saad Alzahrani. 2025. "Exploring the Determinants of FinTech Adoption Among University Students: A Second-Order Construct Analysis" Sustainability 17, no. 22: 10215. https://doi.org/10.3390/su172210215

APA StyleFelimban, R. H., & Alzahrani, L. S. (2025). Exploring the Determinants of FinTech Adoption Among University Students: A Second-Order Construct Analysis. Sustainability, 17(22), 10215. https://doi.org/10.3390/su172210215