How ICT and Green Technologies Shape the Nexus Between Financial Development and Carbon Footprint: Evidence from an N-Shaped EKC

Abstract

1. Introduction

2. Literature Review and Theoretical Underpinning

2.1. Economic Growth and Environmental Sustainability

2.2. Financial Development and Environmental Sustainability

2.3. Green Technology and Environmental Sustainability

2.4. ICT and Environmental Sustainability

2.5. Environmental Policy Stringency and Environmental Sustainability

2.6. Research Gap and Research Questions

- Q1:

- Is there an N-shaped connection between economic growth and carbon footprint?

- Q2:

- Does financial development increase carbon footprint?

- Q3:

- Do green technologies reduce carbon footprint?

- Q4:

- Do green technologies have a moderating role in the connection between financial development and environmental quality?

- Q5:

- Does ICT reduce carbon footprint?

- Q6:

- Does ICT moderate the connection between financial development and carbon footprint?

- Q7:

- Do strict environmental policies reduce carbon footprint?

3. Data Discussion, Model Construction, and Estimation Strategy

3.1. Data Discussion

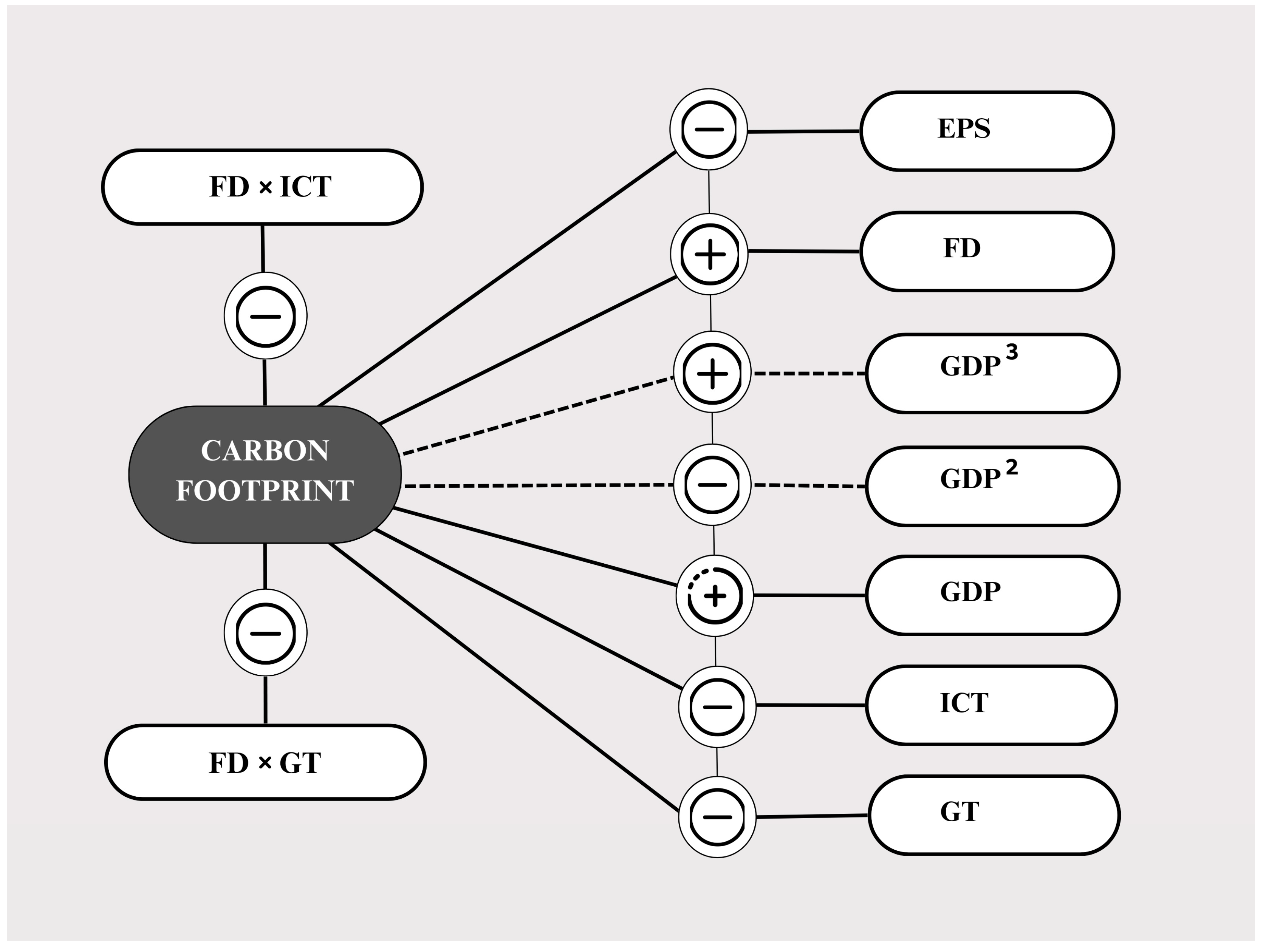

3.2. Model Construction

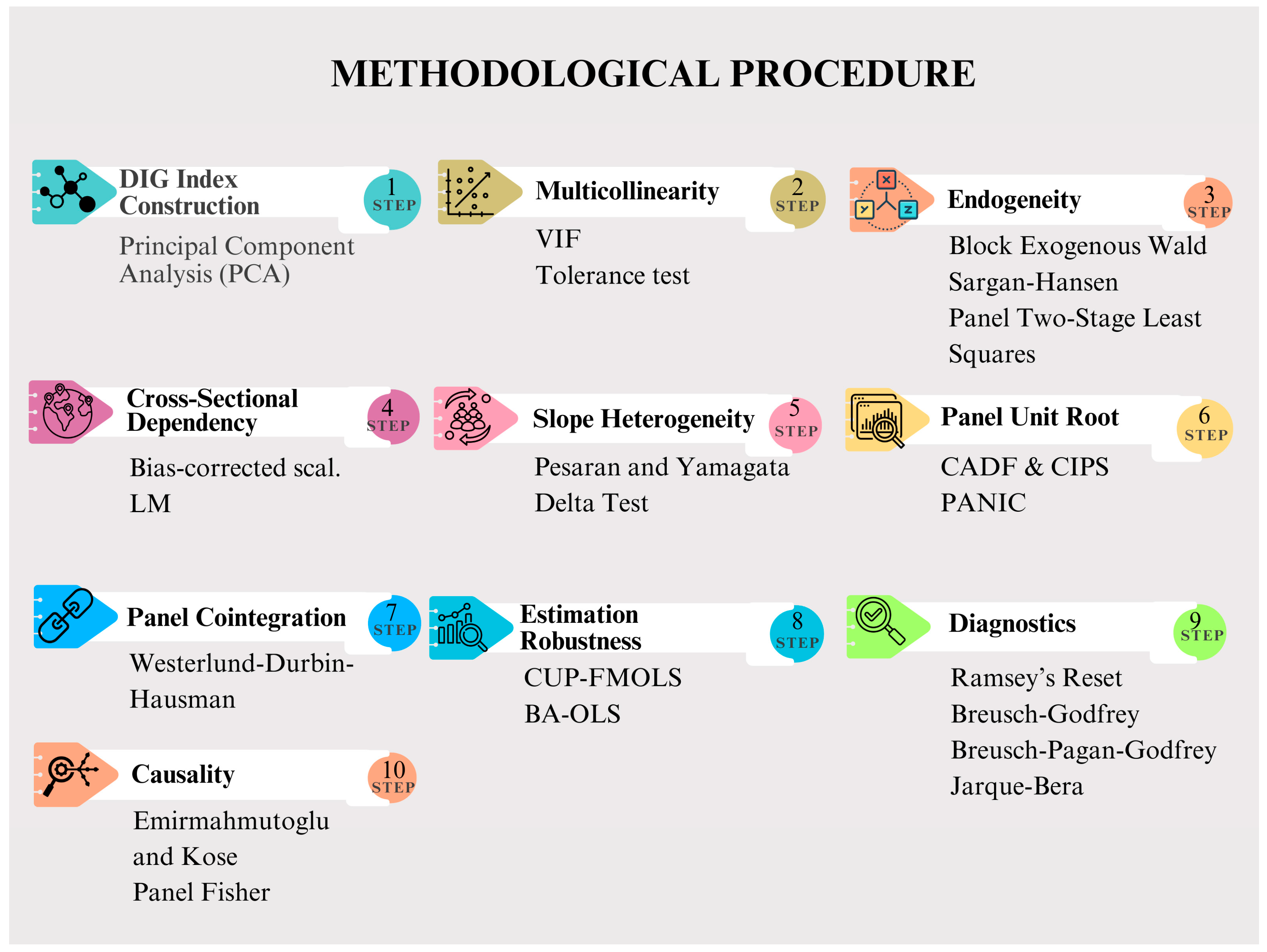

3.3. Estimation Strategy

4. Results

5. Conclusions

5.1. Policy Implications

5.2. Limitations and Directions for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Balibey, M. Relationships among CO2 emissions, economic growth and foreign direct investment and the EKC hypothesis in Turkey. Int. J. Energy Econ. Policy 2015, 5, 1042–1049. [Google Scholar]

- Dogan, E.; Inglesi-Lotz, R. The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: Evidence from European countries. Environ. Sci. Pollut. Res. 2020, 27, 12717–12724. [Google Scholar] [CrossRef]

- Tenaw, D.; Beyene, A.D. Environmental sustainability and economic development in sub-Saharan Africa: A modified EKC hypothesis. Renew. Sustain. Energy Rev. 2021, 143, 110897. [Google Scholar] [CrossRef]

- Kahuthu, A. Economic growth and environmental degradation in a global context. Environ. Dev. Sustain. 2006, 8, 55–68. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Nasir, M.A.; Canh, N.P.; Lan Le, T.N. Environmental degradation & role of financialisation, economic development, industrialisation and trade liberalisation. J. Environ. Manag. 2021, 277, 111471. [Google Scholar] [CrossRef]

- Jahanger, A.; Usman, M.; Murshed, M.; Mahmood, H.; Balsalobre-Lorente, D. The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: The moderating role of technological innovations. Resour. Pol. 2022, 76, 102569. [Google Scholar] [CrossRef]

- Luo, H.; Sun, Y. The Impact of Energy Efficiency on Ecological Footprint in the Presence of EKC: Evidence from G20 Countries. Energy 2024, 304, 132081. [Google Scholar] [CrossRef]

- Ozcan, B.; Tzeremes, P.G.; Tzeremes, N.G. Energy consumption, economic growth and environmental degradation in OECD countries. Econ. Model. 2020, 84, 203–213. [Google Scholar] [CrossRef]

- Hossain, M.R.; Rej, S.; Awan, A.; Bandyopadhyay, A.; Islam, M.S.; Das, N.; Hossain, M.E. Natural resource dependency and environmental sustainability under N-shaped EKC: The curious case of India. Resour. Policy 2023, 80, 103150. [Google Scholar] [CrossRef]

- Adams, S.; Klobodu, E.K.M. Financial development and environmental degradation: Does political regime matter? J. Clean. Prod. 2018, 197, 1472–1479. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Majeed, M.T.; Mazhar, M. Financial development and ecological footprint: A global panel data analysis. Pak. J. Commer. Soc. Sci. 2019, 13, 487–514. [Google Scholar]

- Kirikkaleli, D.; Sofuoğlu, E.; Ojekemi, O. Does patents on environmental technologies matter for the ecological footprint in the USA? Evidence from the novel Fourier ARDL approach. Geosci. Front. 2023, 14, 101564. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Nur, T.; Topaloglu, E.E.; Pilař, L. Do ICT and green technology matter in sustainable development goals? Sustain. Dev. 2024, 33, 1545–1574. [Google Scholar] [CrossRef]

- Borojo, D.G. The heterogeneous impacts of environmental technologies and research and development spending on green growth in emerging economies: The moderating role of financial globalization. Front. Environ. Sci. 2024, 12, 1351861. [Google Scholar] [CrossRef]

- Guo, M.; Nowakowska-Grunt, J.; Gorbanyov, V.; Egorova, M. Green technology and sustainable development: Assessment and green growth frameworks. Sustainability 2020, 12, 6571. [Google Scholar] [CrossRef]

- Tiwari, S. Impact of Fintech on natural resources management: How financial impacts shape the association? Resour. Pol. 2024, 90, 104752. [Google Scholar] [CrossRef]

- Feng, S.; Chong, Y.; Yu, H.; Ye, X.; Li, G. Digital financial development and ecological footprint: Evidence from green-biased technology innovation and environmental inclusion. J. Clean. Prod. 2022, 380, 135069. [Google Scholar] [CrossRef]

- Cheng, C.Y.; Chien, M.S.; Lee, C.C. ICT diffusion, financial development, and economic growth: An international cross-country analysis. Econ. Model. 2021, 94, 662–671. [Google Scholar] [CrossRef]

- Huang, Y.; Haseeb, M.; Usman, M.; Ozturk, I. Dynamic association between ICT, renewable energy, economic complexity and ecological footprint: Is there any difference between E-7 (developing) and G-7 (developed) countries? Technol. Soc. 2022, 68, 101853. [Google Scholar] [CrossRef]

- Ramzan, M.; Raza, S.A.; Usman, M.; Sharma, G.D.; Iqbal, H.A. Environmental cost of non-renewable energy and economic progress: Do ICT and financial development mitigate some burden? J. Clean. Prod. 2022, 333, 130066. [Google Scholar] [CrossRef]

- Zhou, Q.; Shi, M.; Huang, Q.; Shi, T. Do double-edged swords cut both ways? The role of technology innovation and resource consumption in environmental regulation and economic performance. Int. J. Environ. Res. Public Health 2021, 18, 13152. [Google Scholar] [CrossRef] [PubMed]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Asghari, M. The stringency of environmental regulations and technological change: A specific test of the porter Hypothesis. Iran. Econ. Rev. 2010, 15, 95–115. [Google Scholar]

- Yirong, Q. Does environmental policy stringency reduce CO2 emissions? Evidence from high-polluted economies. J. Clean. Prod. 2022, 341, 130648. [Google Scholar] [CrossRef]

- Europe Sustainable Development Report. 2025. Available online: https://eu-dashboards.sdgindex.org (accessed on 15 September 2025).

- Alola, A.A.; Bekun, F.V.; Sarkodie, S.A. Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci. Total Environ. 2019, 685, 702–709. [Google Scholar] [CrossRef]

- Tiwari, S.; Sharif, A.; Nuta, F.; Nuta, A.C.; Cutcu, I.; Eren, M.V. Sustainable pathways for attaining net-zero emissions in European emerging countries—The nexus between renewable energy sources and ecological footprint. Environ. Sci. Pollut. Res. 2023, 30, 105999–106014. [Google Scholar] [CrossRef]

- Abid, A.; Majeed, M.T.; Luni, T. Analyzing Ecological Footprint through the Lens of Globalization, Financial Development, Natural Resources, Human Capital and Urbanization. Pak. J. Commer. Soc. Sci. 2021, 15, 765–795. [Google Scholar]

- Adekoya, O.B.; Oliyide, J.A.; Fasanya, I.O. Renewable and non-renewable energy consumption–Ecological footprint nexus in net-oil exporting and net-oil importing countries: Policy implications for a sustainable environment. Renew. Energy 2022, 189, 524–534. [Google Scholar] [CrossRef]

- Satrovic, E.; Cetindas, A.; Akben, I.; Damrah, S. Do natural resource dependence, economic growth and transport energy consumption accelerate ecological footprint in the most innovative countries? The moderating role of technological innovation. Gondwana Res. 2024, 127, 116–130. [Google Scholar] [CrossRef]

- Shahbaz, M.; Bhattacharya, M.; Ahmed, K. CO2 emissions in Australia: Economic and non-economic drivers in the long-run. Appl. Econ. 2017, 49, 1273–1286. [Google Scholar] [CrossRef]

- Koc, S.; Bulus, G.C. Testing validity of the EKC hypothesis in Republic of Korea: Role of renewable energy and trade openness. Environ. Sci. Pollut. Res. 2020, 27, 29043–29054. [Google Scholar] [CrossRef] [PubMed]

- Saud, S.; Haseeb, A.; Zaidi, S.; Khan, I.; Li, H. Moving towards green growth? Harnessing natural resources and economic complexity for sustainable development through the lens of the N-shaped EKC framework for the European Union. Resour. Policy 2024, 91, 104804. [Google Scholar] [CrossRef]

- Nathaniel, S.P.; Ahmed, Z.; Shamansurova, Z.; Fakher, H.A. Linking clean energy consumption, globalization, and financial development to the ecological footprint in a developing country: Insights from the novel dynamic ARDL simulation techniques. Heliyon 2024, 10, e27095. [Google Scholar] [CrossRef] [PubMed]

- Raihan, A. Nexus between natural resources, financial development, economic growth, and ecological footprint in Malaysia. In Proceedings of the International Conference on Natural Resources and Sustainable Development, Medan, Indonesia, 4 September 2024. [Google Scholar]

- Raheem, I.D.; Tiwari, A.K.; Balsalobre-Lorente, D. The role of ICT and financial development in CO2 emissions and economic growth. Environ. Sci. Pollut. Res. 2020, 27, 1912–1922. [Google Scholar] [CrossRef] [PubMed]

- Zhang, C.; Liu, C. The impact of ICT industry on CO2 emissions: A regional analysis in China. Renew. Sustain. Energy Rev. 2015, 44, 12–19. [Google Scholar] [CrossRef]

- Batool, R.; Sharif, A.; Islam, T.; Zaman, K.; Shoukry, A.M.; Sharkawy, M.A.; Hishan, S.S. Green is clean: The role of ICT in resource management. Environ. Sci. Pollut. Res. 2019, 26, 25341–25358. [Google Scholar] [CrossRef] [PubMed]

- Zhang, X.; Yang, Y.; Wen, J. Are ICT and CO2 emissions always a win-win situation? Evidence from universal telecommunication service in China. J. Clean. Prod. 2023, 428, 139262. [Google Scholar] [CrossRef]

- Alvarado, R.; Toledo, E. Environmental degradation and economic growth: Evidence for a developing country. Environ. Dev. Sustain. 2017, 19, 1205–1218. [Google Scholar] [CrossRef]

- Dissanayake, H.; Perera, N.; Abeykoon, S.; Samson, D.; Jayathilaka, R.; Jayasinghe, M.; Yapa, S. Nexus between carbon emissions, energy consumption, and economic growth: Evidence from global economies. PLoS ONE 2023, 18, 287579. [Google Scholar] [CrossRef]

- Magazzino, C. Ecological footprint, electricity consumption, and economic growth in China: Geopolitical risk and natural resources governance. Empir. Econ. 2024, 66, 1–25. [Google Scholar] [CrossRef]

- Stern, D.I. Progress on the environmental Kuznets curve? Environ. Dev. Econ. 1998, 3, 173–196. [Google Scholar] [CrossRef]

- Stokey, N.L. Are There Limits to Growth? Int. Econ. Rev. 1998, 39, 1–31. [Google Scholar] [CrossRef]

- Rothman, D.S.; De Bruyn, S.M. Probing into the environmental Kuznets curve hypothesis. Ecol. Econ. 1998, 25, 143–145. [Google Scholar] [CrossRef]

- Isik, C.; Ongan, S.; Ozdemir, D. The economic growth/development and environmental degradation: Evidence from the US state-level EKC hypothesis. Environ. Sci. Pollut. Res. 2019, 26, 30772–30781. [Google Scholar] [CrossRef] [PubMed]

- Zhu, Z.; Jia, Q.; Xie, S.; Song, K.; Zhang, T.; Cai, R.; Wang, H. Estimating the impacts of economic globalization and natural resources on ecological footprints within the N-shaped EKC in the Next 11 economies. Sci. Rep. 2024, 14, 27465. [Google Scholar] [CrossRef]

- Shahbaz, M.; Dogan, M.; Akkus, H.T.; Gursoy, S. The effect of financial development and economic growth on ecological footprint: Evidence from top 10 emitter countries. Environ. Sci. Pollut. Res. 2023, 30, 73518–73533. [Google Scholar] [CrossRef] [PubMed]

- Saboori, B.; Sulaiman, J. Environmental degradation, economic growth and energy consumption: Evidence of the environmental Kuznets curve in Malaysia. Energy Policy 2013, 60, 892–905. [Google Scholar] [CrossRef]

- Fan, C.; Zheng, X. An Empirical Study of the Environmental Kuznets Curve in Sichuan Province, China. Environ. Pollut. 2013, 2, 107–115. [Google Scholar] [CrossRef]

- Shahbaz, M.; Mallick, H.; Mahalik, M.K.; Loganathan, N. Does globalization impede environmental quality in India? Ecol. Indic. 2015, 52, 379–393. [Google Scholar] [CrossRef]

- Javid, M.; Sharif, F. Environmental Kuznets curve and financial development in Pakistan. Renew. Sustain. Energy Rev. 2016, 54, 406–414. [Google Scholar] [CrossRef]

- Can, M.; Gozgor, G. The impact of economic complexity on carbon emissions: Evidence from France. Environ. Sci. Pollut. Res. 2017, 24, 16364–16370. [Google Scholar] [CrossRef] [PubMed]

- Numan, U.; Ma, B.; Meo, M.S.; Bedru, H.D. Revisiting the N-shaped environmental Kuznets curve for economic complexity and ecological footprint. J. Clean. Prod. 2022, 365, 132642. [Google Scholar] [CrossRef]

- Peráček, T. A few remarks on the (im)perfection of the term securities: A theoretical study. Trib. Jurid. 2021, 11, 135–149. [Google Scholar]

- Khezri, M.; Karimi, M.S.; Khan, Y.A.; Abbas, S.Z. The spillover of financial development on CO2 emission: A spatial econometric analysis of Asia-Pacific countries. Renew. Sustain. Energy Rev. 2021, 145, 111110. [Google Scholar] [CrossRef]

- Kashyap, A.K. Rethinking FinTech Regulation Under the Indian Data Protection Framework. Jur. Trib. 2024, 14, 363–383. [Google Scholar] [CrossRef]

- Hafeez, M.; Yuan, C.; Shahzad, K.; Aziz, B.; Iqbal, K.; Raza, S. An empirical evaluation of financial development-carbon footprint nexus in One Belt and Road region. Environ. Sci. Pollut. Res. 2019, 26, 25026–25036. [Google Scholar] [CrossRef] [PubMed]

- Baloch, M.A.; Zhang, J.; Iqbal, K.; Iqbal, Z. The effect of financial development on ecological footprint in BRI countries: Evidence from panel data estimation. Environ. Sci. Pollut. Res. 2019, 26, 6199–6208. [Google Scholar] [CrossRef]

- Sharma, R.; Sinha, A.; Kautish, P. Does financial development reinforce environmental footprints? Evidence from emerging Asian countries. Environ. Sci. Pollut. Res. 2021, 28, 9067–9083. [Google Scholar] [CrossRef]

- Shoaib, H.M.; Rafique, M.Z.; Nadeem, A.M.; Huang, S. Impact of financial development on CO2 emissions: A comparative analysis of developing countries (D8) and developed countries (G8). Environ. Sci. Pollut. Res. 2020, 27, 12461–12475. [Google Scholar] [CrossRef]

- Shahbaz, M.; Destek, M.A.; Dong, K.; Jiao, Z. Time-varying impact of financial development on carbon emissions in G-7 countries: Evidence from the long history. Technol. Forecast. Soc. Change 2021, 171, 120966. [Google Scholar] [CrossRef]

- Wen, Y.; Song, P.; Yang, D.; Gao, C. Does governance impact on the financial development-carbon dioxide emissions nexus in G20 countries. PLoS ONE 2022, 17, e0273546. [Google Scholar] [CrossRef] [PubMed]

- Ashraf, A.; Nguyen, C.P.; Doytch, N. The impact of financial development on ecological footprints of nations. J. Environ. Manag. 2022, 322, 116062. [Google Scholar] [CrossRef] [PubMed]

- Sun, Y.; Al-Tal, R.M.; Bakkar Siddik, A.; Khan, S.; Murshed, M.; Alvarado, R. The non-linearity between financial development and carbon footprints: The environmental roles of technological innovation, renewable energy, and foreign direct investment. Econ. Res.-Ekon. Istraz. 2023, 36, 2. [Google Scholar] [CrossRef]

- Uddin, I.; Ullah, A.; Saqib, N.; Kousar, R.; Usman, M. Heterogeneous role of energy utilization, financial development, and economic development in ecological footprint: How far away are developing economies from developed ones. Environ. Sci. Pollut. Res. 2023, 30, 58378–58398. [Google Scholar] [CrossRef] [PubMed]

- Saqib, N.; Usman, M.; Ozturk, I.; Sharif, A. Harnessing the synergistic impacts of environmental innovations, financial development, green growth, and ecological footprint through the lens of SDGs policies for countries exhibiting high ecological footprints. Energy Policy 2024, 184, 113863. [Google Scholar] [CrossRef]

- Uzar, U.; Eyuboglu, K. Testing the asymmetric impacts of income inequality, financial development and human development on ecological footprint in Türkiye: A NARDL approach. J. Clean. Prod. 2024, 461, 142652. [Google Scholar] [CrossRef]

- Horobet, A.; Radulescu, M.; Bouraoui, T.; Mnohoghitnei, I.; Balsalobre-Lorente, D.; Belascu, L. Financial development and environmental degradation: Insights from European countries. Appl. Econ. 2025, 57, 4679–4694. [Google Scholar] [CrossRef]

- Dogan, E.; Taspinar, N.; Gokmenoglu, K.K. Determinants of ecological footprint in MINT countries. Energy Environ. 2019, 30, 1065–1086. [Google Scholar] [CrossRef]

- Batala, L.K.; Qiao, J.; Regmi, K.; Weiwen, W.; Rehman, A. The implications of forest resources depletion, agricultural expansion, and financial development on energy demand and ecological footprint in BRI countries. Clean Technol. Environ. Policy 2023, 25, 2845–2861. [Google Scholar] [CrossRef]

- Jahanger, A.; Hossain, M.R.; Onwe, J.C.; Ogwu, S.O.; Awan, A.; Balsalobre-Lorente, D. Analyzing the N-shaped EKC among top nuclear energy generating nations: A novel dynamic common correlated effects approach. Gondwana Res. 2023, 116, 73–88. [Google Scholar] [CrossRef]

- Omoke, P.C.; Nwani, C.; Effiong, E.L.; Evbuomwan, O.O.; Emenekwe, C.C. The impact of financial development on carbon, non-carbon, and total ecological footprint in Nigeria: New evidence from asymmetric dynamic analysis. Environ. Sci. Pollut. Res. 2020, 27, 21628–21646. [Google Scholar] [CrossRef] [PubMed]

- Habiba, U.; Xinbang, C.; Anwar, A. Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renew. Energy 2022, 193, 1082–1093. [Google Scholar] [CrossRef]

- Bergougui, B. Investigating the relationships among green technologies, financial development and ecological footprint levels in Algeria: Evidence from a novel Fourier ARDL approach. Sustain. Cities Soc. 2024, 112, 105621. [Google Scholar] [CrossRef]

- Aydin, C.; Esen, O.; Çetintaş, Y. Nexus between environmental innovation and ecological footprint in OECD countries: Is there an environmental rebound effect? J. Environ. Stud. Sci. 2024, 15, 113–123. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. Green technology innovations, urban innovation environment and CO2 emission reduction in China: Fresh evidence from a partially linear functional-coefficient panel model. Technol. Forecast. Soc. Change 2022, 176, 121434. [Google Scholar] [CrossRef]

- Sharif, A.; Saqib, N.; Dong, K.; Khan, S.A.R. Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: The moderating role of social globalisation. Sustain. Dev. 2022, 30, 1934–1946. [Google Scholar] [CrossRef]

- Chang, K.; Liu, L.; Luo, D.; Xing, K. The impact of green technology innovation on carbon dioxide emissions: The role of local environmental regulations. J. Environ. Manag. 2023, 340, 117990. [Google Scholar] [CrossRef] [PubMed]

- Balsalobre-Lorente, D.; Nur, T.; Topaloglu, E.E.; Evcimen, C. Assessing the impact of the economic complexity on the ecological footprint in G7 countries: Fresh evidence under human development and energy innovation processes. Gondwana Res. 2024, 127, 226–245. [Google Scholar] [CrossRef]

- Nketiah, E.; Song, H.; Adjei, M.; Obuobi, B.; Adu-Gyamfi, G. Assessing the influence of research and development, environmental policies, and green technology on ecological footprint for achieving environmental sustainability. Renew. Sustain. Energy Rev. 2024, 199, 114508. [Google Scholar] [CrossRef]

- Lv, C.; Shao, C.; Lee, C.C. Green technology innovation and financial development: Do environmental regulation and innovation output matter? Energy Econ. 2021, 98, 105237. [Google Scholar] [CrossRef]

- Chen, K.; Zhang, S. Influence of energy efficient infrastructure, financial inclusion, and digitalization on ecological sustainability of ASEAN countries. Front. Environ. Sci. 2022, 10, 1019463. [Google Scholar] [CrossRef]

- Zulfiqar, M.; Tahir, S.H.; Ullah, M.R.; Ghafoor, S. Digitalized world and carbon footprints: Does digitalization really matter for sustainable environment? Environ. Sci. Pollut. Res. 2023, 30, 88789–88802. [Google Scholar] [CrossRef] [PubMed]

- Saqib, N.; Duran, I.A.; Ozturk, I. Unraveling the interrelationship of digitalization, renewable energy, and ecological footprints within the EKC framework: Empirical insights from the United States. Sustainability 2023, 15, 10663. [Google Scholar] [CrossRef]

- Khan, F.N.; Sana, A.; Arif, U. Information and communication technology (ICT) and environmental sustainability: A panel data analysis. Environ. Sci. Pollut. Res. 2020, 27, 36718–36731. [Google Scholar] [CrossRef]

- Shobande, O.A.; Asongu, S.A. Searching for sustainable footprints: Does ICT increase CO2 emissions? Environ. Model. Assess. 2023, 28, 133–143. [Google Scholar] [CrossRef]

- Yadou, B.A.; Ntang, P.B.; Baida, L.A. Remittances-ecological footprint nexus in Africa: Do ICTs matter? J. Clean. Prod. 2024, 434, 139866. [Google Scholar] [CrossRef]

- Le, V.L.T.; Pham, K.D. The Impact of financial inclusion and digitalization on CO2 emissions: A cross-country empirical analysis. Sustainability 2024, 16, 10491. [Google Scholar] [CrossRef]

- Adeshola, I.; Usman, O.; Agoyi, M.; Awosusi, A.A.; Adebayo, T.S. Digitalization and the environment: The role of information and communication technology and environmental taxes in European countries. Nat. Resour. Forum 2024, 48, 1088–1108. [Google Scholar] [CrossRef]

- Wen, Y.; Haseeb, M.; Safdar, N.; Yasmin, F.; Timsal, S.; Li, Z. Does degree of stringency matter? Revisiting the pollution haven hypothesis in BRICS countries. Front. Environ. Sci. 2022, 10, 949007. [Google Scholar] [CrossRef]

- Chu, L.K.; Tran, T.H. The nexus between environmental regulation and ecological footprint in OECD countries: Empirical evidence using panel quantile regression. Environ. Sci. Pollut. Res. 2022, 29, 49700–49723. [Google Scholar] [CrossRef] [PubMed]

- Sadik-Zada, E.R.; Ferrari, M. Environmental policy stringency, technical progress and pollution haven hypothesis. Sustainability 2020, 12, 3880. [Google Scholar] [CrossRef]

- Kongbuamai, N.; Bui, Q.; Nimsai, S. The effects of renewable and nonrenewable energy consumption on the ecological footprint: The role of environmental policy in BRICS countries. Environ. Sci. Pollut. Res. 2021, 28, 27885–27899. [Google Scholar] [CrossRef] [PubMed]

- Li, S.; Samour, A.; Irfan, M.; Ali, M. Role of renewable energy and fiscal policy on trade adjusted carbon emissions: Evaluating the role of environmental policy stringency. Renew. Energy 2023, 205, 156–165. [Google Scholar] [CrossRef]

- Dai, S.; Du, X. Discovering the role of trade diversification, natural resources, and environmental policy stringency on ecological sustainability in the BRICST region. Resour. Policy 2023, 85, 103868. [Google Scholar] [CrossRef]

- Sohag, K.; Husain, S.; Soytas, U. Environmental policy stringency and ecological footprint linkage: Mitigation measures of renewable energy and innovation. Energy Econ. 2024, 136, 107721. [Google Scholar] [CrossRef]

- Luo, H.; Sun, Y.; Zhang, L. Effects of macroprudential policies on ecological footprint: The moderating role of environmental policy stringency in the top 11 largest countries. Sci. Rep. 2024, 14, 7423. [Google Scholar] [CrossRef] [PubMed]

- Dmytrenko, D.; Prokop, V.; Zapletal, D. The impact of environmental policy stringency and environmental taxes on GHG emissions in Western and Central European countries. Energy Syst. 2024, 1–19. [Google Scholar] [CrossRef]

- Mazur, A.; Phutkaradze, Z.; Phutkaradze, J. Economic growth and environmental quality in the European Union countries–is there evidence for the environmental Kuznets curve? Int. J. Manag. Econ. 2015, 45, 108–126. [Google Scholar] [CrossRef]

- Aydin, M.; Degirmenci, T.; Gurdal, T.; Yavuz, H. The role of green innovation in achieving environmental sustainability in European Union countries: Testing the environmental Kuznets curve hypothesis. Gondwana Res. 2023, 118, 105–116. [Google Scholar] [CrossRef]

- Zia, Z.; Zhong, R.; Akbar, M.W. Analyzing the impact of fintech industry and green financing on energy poverty in the European countries. Heliyon 2024, 10, e27532. [Google Scholar] [CrossRef]

- Wiedmann, T.; Minx, J.A. Chapter 1: Definition of ‘Carbon Footprint’. In Ecological Economics Research Trends; Pertsova, C.C., Ed.; Nova Science Publishers: Hauppauge, NY, USA, 2008; pp. 1–11. [Google Scholar]

- OECD; Interagency Task Team (IATT). Science, Technology and İnnovation for the SDGs; Organisation for Economic Co-Operation and Development: Paris, France, 2018; pp. 1–5. [Google Scholar]

- Sun, H. What are the roles of green technology innovation and ICT employment in lowering carbon intensity in China? A city-level analysis of the spatial effects. Resour. Conserv. Recycl. 2022, 186, 106550. [Google Scholar] [CrossRef]

- Avom, D.; Nkengfack, H.; Fotio, H.K.; Totouom, A. ICT and environmental quality in Sub-Saharan Africa: Effects and transmission channels. Technol. Forecast. Soc. Change 2020, 155, 120028. [Google Scholar] [CrossRef]

- Danish. Effects of information and communication technology and real income on CO2 emissions: The experience of countries along Belt and Road. Telemat. Inform. 2020, 45, 101300. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Agyekum, E.B.; Altuntaş, M.; Khudoyqulov, S.; Zawbaa, H.M.; Kamel, S. Does information and communication technology impede environmental degradation? fresh insights from non-parametric approaches. Heliyon 2022, 8, e09108. [Google Scholar] [CrossRef] [PubMed]

- Añón Higón, D.; Gholami, R.; Shirazi, F. ICT and environmental sustainability: A global perspective. Telemat. Inform. 2017, 34, 85–95. [Google Scholar] [CrossRef]

- Nchofoung, T.N.; Asongu, S.A. ICT for sustainable development: Global comparative evidence of globalisation thresholds. Telecommun. Policy 2022, 46, 102296. [Google Scholar] [CrossRef]

- Dhahri, S.; Omri, A.; Mirza, N. Information technology and financial development for achieving sustainable development goals. Res. Int. Bus. Financ. 2024, 67, 102156. [Google Scholar] [CrossRef]

- Xia, A.; Liu, Q. Modelling the asymmetric impact of fintech, natural resources, and environmental regulations on ecological footprint in G7 countries. Resour. Pol. 2024, 89, 104552. [Google Scholar] [CrossRef]

- Bisset, T. N-shaped EKC in sub-Saharan Africa: The three-dimensional effects of governance indices and renewable energy consumption. Environ. Sci. Pollut. Res. 2023, 30, 3321–3334. [Google Scholar] [CrossRef]

- Patel, N.; Mehta, D. The asymmetry effect of industrialization, financial development and globalization on CO2 emissions in India. Int. J. Thermofluids 2023, 20, 100397. [Google Scholar] [CrossRef]

- Prempeh, K.B. The role of economic growth, financial development, globalization, renewable energy and industrialization in reducing environmental degradation in the economic community of West African States. Cogent Econ. Financ. 2024, 12, 2308675. [Google Scholar] [CrossRef]

- Farooq, A.; Anwar, A.; Ahad, M.; Shabbir, G.; Imran, Z.A. A validity of environmental Kuznets curve under the role of urbanization, financial development index and foreign direct investment in Pakistan. J. Econ. Admin. Sci. 2024, 40, 288–307. [Google Scholar] [CrossRef]

- Yao, W.; Liu, L.; Fujii, H.; Li, L. Digitalization and net-zero carbon: The role of industrial robots towards carbon dioxide emission reduction. J. Clean. Prod. 2024, 450, 141820. [Google Scholar] [CrossRef]

- Ullah, A.; Dogan, M.; Pervaiz, A.; Bukhari, A.A.A.; Akkus, H.T.; Dogan, H. The impact of digitalization, technological and financial innovation on environmental quality in OECD countries: Investigation of N-shaped EKC hypothesis. Technol. Soc. 2024, 77, 102484. [Google Scholar] [CrossRef]

- Li, S.; Hu, K.; Kang, X. Impact of financial technologies, digitalization, and natural resources on environmental degradation in G-20 countries: Does human resources matter? Resour. Pol. 2024, 93, 105041. [Google Scholar] [CrossRef]

- Kaika, D.; Zervas, E. The Environmental Kuznets Curve (EKC) theory—Part A: Concept, causes and the CO2 emissions case. Energy Policy 2013, 62, 1392–1402. [Google Scholar] [CrossRef]

- Nabi, A.A.; Ahmed, F.; Tunio, F.H.; Hafeez, M.; Haluza, D. Assessing the impact of green environmental policy stringency on eco-innovation and green finance in Pakistan: A Quantile Autoregressive Distributed Lag (QARDL) analysis for sustainability. Sustainability 2025, 17, 1021. [Google Scholar] [CrossRef]

- Sarafidis, V.; Yamagata, T.; Robertson, D. A test of cross-section dependence for a linear dynamic panel model with regressors. J. Econom. 2009, 148, 149–161. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Feng, Q.; Kao, C. A Lagrange Multiplier test for cross-sectional dependence in a fixed effects panel data model. J. Econom. 2012, 170, 164–177. [Google Scholar] [CrossRef]

- Swamy, P.A. Efficient inference in a random coefficient regression model. Econometrica 1970, 38, 311–323. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Bai, J.; Ng, S. A PANIC attack on unit roots and cointegration. Econometrica 2004, 72, 1127–1177. [Google Scholar] [CrossRef]

- Pesaran, M. A Simple Panel Unit Root Test in the Presence of Cross-Section Dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Bai, J.; Ng, S. Panel unit root tests with cross-section dependence: A further investigation. Econom. Theory 2010, 26, 1088–1114. [Google Scholar] [CrossRef]

- Westerlund, J. Panel cointegration tests of the Fisher effect. J. Appl. Econom. 2008, 23, 193–233. [Google Scholar] [CrossRef]

- Pedroni, P. Fully modified OLS for heterogeneous cointegrated panels. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels; Emerald Group Publishing Limited: Leeds, UK, 2001; pp. 93–130. [Google Scholar] [CrossRef]

- Bai, J.; Kao, C.; Ng, S. Panel cointegration with global stochastic trends. J. Econom. 2009, 149, 82–99. [Google Scholar] [CrossRef]

- Emirmahmutoglu, F.; Kose, N. Testing for Granger causality in heterogeneous mixed panels. Econ. Model. 2011, 28, 870–876. [Google Scholar] [CrossRef]

- Tabachnick, B.G.; Fidell, L.S. Using Multivariate Statistics; Allyand Bacon Pearson Education: London, UK, 2001. [Google Scholar]

- Wang, Q.; Ge, Y.; Li, R. Does improving economic efficiency reduce ecological footprint? The role of financial development, renewable energy, and industrialization. Energy Environ. 2025, 36, 729–755. [Google Scholar] [CrossRef]

| Variable | Symbol | Variable Definitions | Source |

|---|---|---|---|

| Carbon footprint | CF: log of CF | Carbon footprint (gha per person) | GFN |

| Information and communication technologies | ICT | The ICT index is constructed by principal component analysis based on three components: Mobile cellular subscriptions Fixed telephone subscriptions (per 100 people) Individuals using the Internet | WB |

| Environmental Policy Stringency Index | EPS: log of EPS | The index measures the stringency of 13 environmental policy tools, primarily related to climate change and air pollution | OECD |

| Financial development | FD: log of FD | Financial development index (Broad-based index of financial depth, access, and efficiency) | IMF |

| Green Technology | GT: log of GT | Patents in environment-related technologies | OECD |

| Gross domestic product | GDP: log of GDP | Per capita, constant 2015 US$ | WB |

| Gross domestic product | GDP2: log of GDP2 | Square per capita, constant 2015 US$ | WB |

| Gross domestic product | GDP3: log of GDP3 | Cube per capita, constant 2015 US$ | WB |

| Box Plots |  |  |  |  |  |  |

| CF | EPS | FD | ICT | GT | GDP | |

| Mean | 1.205 | 2.509 | 0.598 | 0.212 | 10.931 | 10.247 |

| Med. | 1.167 | 2.639 | 0.650 | 0.349 | 10.736 | 10.394 |

| Max. | 2.518 | 4.889 | 0.901 | 2.140 | 26.616 | 11.630 |

| Min. | 0.496 | 0.056 | 0.192 | −2.117 | 0.901 | 8.694 |

| Std. Dev. | 0.359 | 0.916 | 0.177 | 0.907 | 4.102 | 0.616 |

| Skew. | 1.402 | −0.376 | −0.554 | −0.120 | 0.755 | −0.133 |

| Kurt. | 6.151 | 2.743 | 2.181 | 2.451 | 4.252 | 2.596 |

| J-B | 400.162 *** | 14.214 *** | 42.740 *** | 8.088 *** | 86.545 *** | 5.266 * |

| Obs. | 540 | 540 | 540 | 540 | 540 | 540 |

| Scatters |  |  |  |  |  |

| 1/VIF | VIF | CF | 1.000 | −0.072 | 0.133 | 0.322 | −0.122 | 0.463 |

| 0.625 | 1.601 | EPS | −0.072 | 1.000 | 0.277 | 0.137 | 0.524 | 0.377 |

| 0.430 | 2.328 | FD | 0.133 | 0.277 | 1.000 | 0.576 | 0.056 | 0.649 |

| 0.587 | 1.703 | ICT | 0.322 | 0.137 | 0.576 | 1.000 | −0.082 | 0.541 |

| 0.717 | 1.395 | GT | −0.122 | 0.524 | 0.056 | −0.082 | 1.000 | 0.103 |

| 0.432 | 2.315 | GDP | 0.463 | 0.377 | 0.649 | 0.541 | 0.103 | 1.000 |

| Mean VIF | 1.868 | CF | EPS | FD | ICT | GT | GDP |

| Panel Two-Stage Least Squares | |||

|---|---|---|---|

| Variable | Coefficient | t-Statistic | Prob. |

| EPSRESID | −0.023 | −0.234 | 0.814 |

| FDRESID | 0.006 | 0.086 | 0.930 |

| ICTRESID | −0.015 | −0.858 | 0.391 |

| GTRESID | −0.002 | −0.609 | 0.542 |

| GDPRESID | 0.010 | 0.774 | 0.438 |

| Block exogenous Wald | |||

| Hypothesis—H0: Exogenous | X2(1) | Prob. | |

| EPS | FD | 1.340 | 0.247 |

| ICT | 0.536 | 0.464 | |

| GT | 0.488 | 0.484 | |

| GDP | 0.031 | 0.859 | |

| FD | EPS | 1.702 | 0.192 |

| ICT | 0.153 | 0.695 | |

| GT | 0.757 | 0.384 | |

| GDP | 0.562 | 0.453 | |

| ICT | EPS | 0.544 | 0.460 |

| FD | 0.033 | 0.855 | |

| GT | 0.023 | 0.878 | |

| GDP | 0.658 | 0.417 | |

| GT | EPS | 0.183 | 0.668 |

| FD | 0.004 | 0.948 | |

| ICT | 1.201 | 0.273 | |

| GDP | 0.017 | 0.896 | |

| GDP | EPS | 0.640 | 0.423 |

| FD | 0.379 | 0.537 | |

| ICT | 0.007 | 0.930 | |

| GT | 0.054 | 0.815 | |

| Sargan-Hansen Test for Exogeneity of Instruments | |||

| Instrument specification: | Instrument validity | Sargan–Hansen J statistic | Prob(J-statistic) |

| @DYN(CF, -2) EPS(-1) FD(-1) ICT(-1) GT(-1) GDP(-1) | Model A | 18.411 | 0.188 |

| @DYN(CF, -2) EPS(-1) FD(-1) ICT(-1) GT(-1) GDP(-1) FD × ICT(-1) | Model B | 16.576 | 0.219 |

| @DYN(CF, -2) EPS(-1) FD(-1) ICT(-1) GT(-1) GDP(-1) FD × GT(-1) | Model C | 18.054 | 0.659 |

| H0: The instruments used in this model are valid | |||

| Variable | Pesaran Bias-Corrected LM | Delta Tests | ||||

|---|---|---|---|---|---|---|

| Stat. | Prob. | Prob. | Prob. | |||

| CF | 136.414 | 0.000 | 2.575 | 0.005 | 2.731 | 0.003 |

| EPS | 206.467 | 0.000 | −1.465 | 0.929 | −1.554 | 0.940 |

| FD | 78.713 | 0.000 | 3.971 | 0.000 | 4.212 | 0.000 |

| ICT | 81.795 | 0.000 | −1.530 | 0.937 | −1.623 | 0.948 |

| GT | 71.592 | 0.000 | 2.606 | 0.005 | 2.764 | 0.003 |

| GDP | 115.260 | 0.000 | 4.879 | 0.000 | 5.175 | 0.000 |

| Model A | 9.353 | 0.000 | 10.903 | 0.000 | 13.235 | 0.000 |

| Model B | 10.948 | 0.000 | 10.735 | 0.000 | 13.389 | 0.000 |

| Model C | 13.608 | 0.000 | 9.551 | 0.000 | 11.913 | 0.000 |

| Intercept | ||||||

| Variables | CIPS | PANIC | ||||

| CIPS t-Stat. | Prob. | PCe Choi | Prob. | PCe MW | Prob. | |

| CF | −1.994 | ≥0.10 | −0.413 | 0.660 | 36.299 | 0.637 |

| ΔCF | −2.747 | <0.01 | 10.151 | 0.000 | 130.794 | 0.000 |

| EPS | −1.756 | ≥0.10 | 0.005 | 0.497 | 40.049 | 0.468 |

| ΔEPS | −2.591 | <0.01 | 11.167 | 0.000 | 139.885 | 0.000 |

| FD | −1.836 | ≥0.10 | −0.146 | 0.558 | 38.690 | 0.529 |

| ΔFD | −3.079 | <0.01 | 10.345 | 0.000 | 132.530 | 0.000 |

| ICT | −1.928 | ≥0.10 | 1.108 | 0.133 | 47.660 | 0.135 |

| ΔICT | −2.501 | <0.01 | 13.103 | 0.000 | 157.204 | 0.000 |

| GT | −1.933 | ≥0.10 | 0.770 | 0.220 | 46.889 | 0.210 |

| ΔGT | −3.607 | <0.01 | 12.799 | 0.000 | 154.480 | 0.000 |

| GDP | −1.132 | ≥0.10 | −2.188 | 0.985 | 20.429 | 0.995 |

| ΔGDP | −3.574 | <0.01 | 3.431 | 0.000 | 70.693 | 0.002 |

| Intercept and trend | ||||||

| Variables | CIPS | PANIC | ||||

| CIPS t-stat. | Prob. | PCe Choi | Prob. | PCe MW | Prob. | |

| CF | −2.181 | ≥0.10 | 0.557 | 0.288 | 44.984 | 0.271 |

| ΔCF | −3.963 | <0.01 | 9.950 | 0.000 | 128.999 | 0.000 |

| EPS | −1.748 | ≥0.10 | −1.350 | 0.911 | 27.924 | 0.925 |

| ΔEPS | −4.565 | <0.01 | 10.159 | 0.000 | 130.872 | 0.000 |

| FD | −1.992 | ≥0.10 | −1.307 | 0.904 | 28.303 | 0.917 |

| ΔFD | −4.496 | <0.01 | 8.105 | 0.000 | 112.499 | 0.000 |

| ICT | −1.960 | ≥0.10 | 0.916 | 0.179 | 45.988 | 0.175 |

| ΔICT | −3.803 | <0.01 | 13.416 | 0.000 | 160.001 | 0.000 |

| GT | −2.354 | ≥0.10 | −0.381 | 0.648 | 36.588 | 0.624 |

| ΔGT | −4.969 | <0.01 | 10.520 | 0.000 | 134.097 | 0.000 |

| GDP | −1.527 | ≥0.10 | −1.988 | 0.976 | 22.212 | 0.989 |

| ΔGDP | −4.148 | <0.01 | 2.694 | 0.003 | 64.099 | 0.009 |

| Model A | Value | Prob. | Model B | Value | Prob. | Model C | Value | Prob. | |||

| DHg | 3.181 | 0.001 | DHg | 2.662 | 0.004 | DHg | 3.107 | 0.001 | |||

| DHp | 2.264 | 0.012 | DHp | 2.614 | 0.004 | DHp | 4.347 | 0.001 |

| Robustness | Main Estimation | Post Estimation | |||||||

|---|---|---|---|---|---|---|---|---|---|

| FMOLS | Cup-FMOLS | ||||||||

| Model A Regressor | Coeff. | t-stat. | Prob. | Coeff. | t-stat. | Prob. | Test | F/t-stat. | Prob. |

| GDP | 0.011 | 8.584 | 0.000 | 0.017 | 4.607 | 0.000 | Jarque–Bera | 0.746 | 0.688 |

| GDP2 | −0.021 | −3.797 | 0.000 | −0.046 | −8.053 | 0.000 | Ramsey’s Reset | 0.130 | 0.896 |

| GDP3 | 0.009 | 9.479 | 0.000 | 0.012 | 5.226 | 0.000 | LM | 1.520 | 0.157 |

| FD | 0.406 | 12.985 | 0.000 | 0.219 | 2.150 | 0.032 | BPG | 0.688 | 0.682 |

| ICT | −0.125 | −22.558 | 0.000 | −0.115 | −8.053 | 0.000 | |||

| EPS | −0.135 | −18.113 | 0.000 | −0.116 | −3.391 | 0.001 | |||

| GT | −0.043 | −3.048 | 0.002 | −0.036 | −7.166 | 0.000 | |||

| Adj. R2 | 0.853 *** | ||||||||

| Model B Regressor | Coeff. | t-stat. | Prob. | Coeff. | t-stat. | Prob. | Test | F/t-stat. | Prob. |

| GDP | 0.008 | 8.010 | 0.000 | 0.016 | 3.236 | 0.002 | Jarque–Bera | 0.928 | 0.628 |

| GDP2 | −0.013 | −6.761 | 0.000 | −0.051 | −8.210 | 0.000 | Ramsey’s Reset | 0.118 | 0.905 |

| GDP3 | 0.006 | 14.417 | 0.000 | 0.013 | 5.792 | 0.000 | LM | 1.550 | 0.147 |

| FD | 0.431 | 17.158 | 0.000 | 0.228 | 2.057 | 0.040 | BPG | 0.672 | 0.716 |

| ICT | −0.246 | −9.727 | 0.000 | −0.216 | −6.626 | 0.000 | |||

| EPS | −0.133 | −18.221 | 0.000 | −0.076 | −10.598 | 0.000 | |||

| GT | −0.036 | −5.767 | 0.000 | −0.027 | −4.499 | 0.000 | |||

| FD × ICT | −0.208 | −5.609 | 0.000 | −0.104 | −6.325 | 0.000 | |||

| Adj. R2 | 0.855 *** | ||||||||

| Model C Regressor | Coeff. | t-stat. | Prob. | Coeff. | t-stat. | Prob. | Test | F/t-stat. | Prob. |

| GDP | 0.009 | 6.069 | 0.000 | 0.014 | 3.063 | 0.004 | Jarque–Bera | 0.942 | 0.624 |

| GDP2 | −0.011 | −5.355 | 0.000 | −0.047 | −8.557 | 0.000 | Ramsey’s Reset | 0.156 | 0.875 |

| GDP3 | 0.007 | 11.264 | 0.000 | 0.011 | 4.894 | 0.000 | LM | 1.512 | 0.160 |

| FD | 0.619 | 20.742 | 0.000 | 0.310 | 2.407 | 0.026 | BPG | 0.602 | 0.776 |

| ICT | −0.100 | −21.235 | 0.000 | −0.113 | −5.745 | 0.000 | |||

| EPS | −0.085 | −11.293 | 0.000 | −0.057 | −13.341 | 0.000 | |||

| GT | −0.205 | −13.089 | 0.000 | −0.103 | −3.418 | 0.001 | |||

| FD × GT | −0.033 | −16.332 | 0.000 | −0.021 | −5.781 | 0.000 | |||

| Adj. R2 | 0.864 *** | ||||||||

| Country | Shape | Coeff.GDP | Coeff.GDP2 | Coeff.GDP3 |

|---|---|---|---|---|

| Austria | N-shaped (final upward) | 0.001 | −0.036 | 0.186 |

| Belgium | N-shaped (final upward) | 0.001 | −0.036 | 0.222 |

| Czechia | N-shaped (final upward) | 0.001 | −0.053 | 0.624 |

| Denmark | Not N-shaped | 0.000 | 0.012 | −0.370 |

| Estonia | Not N-shaped | 0.001 | −0.025 | −0.188 |

| Finland | Not N-shaped | 0.001 | −0.009 | −0.329 |

| France | N-shaped (final upward) | 0.001 | −0.027 | 0.091 |

| Germany | Not N-shaped | 0.000 | 0.011 | −0.131 |

| Greece | N-shaped (final upward) | 0.005 | −0.162 | 0.925 |

| Hungary | N-shaped (final upward) | 0.002 | −0.065 | 0.460 |

| Ireland | Not N-shaped | −0.001 | 0.083 | −1.618 |

| Italy | N-shaped (final upward) | 0.002 | −0.053 | 0.229 |

| Luxembourg | N-shaped (final upward) | 0.001 | −0.039 | 0.140 |

| The Netherlands | Not N-shaped | 0.001 | −0.004 | −0.323 |

| Poland | Not N-shaped | 0.000 | 0.010 | −0.279 |

| Portugal | Not N-shaped | 0.001 | −0.004 | −0.453 |

| Slovakia | Not N-shaped | 0.001 | −0.031 | 0.302 |

| Slovenia | N-shaped (final upward) | 0.002 | −0.050 | 0.199 |

| Spain | N-shaped (final upward) | 0.002 | −0.070 | 0.342 |

| Sweden | N-shaped (final upward) | 0.001 | −0.028 | 0.150 |

| Causality | GDP ⟶ CF | FD ⟶ CF | ICT ⟶ CF | EPS ⟶ CF | GT ⟶ CF | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fisher/Wald | Prob. | Fisher/Wald | Prob. | Fisher/Wald | Prob. | Fisher/Wald | Prob. | Fisher/Wald | Prob. | |

| Panel | 140.987 | 0.020 | 133.240 | 0.000 | 114.502 | 0.000 | 108.193 | 0.000 | 114.323 | 0.000 |

| Austria | 14.768 | 0.002 | 0.885 | 0.347 | 0.012 | 0.912 | 4.103 | 0.129 | 2.793 | 0.095 |

| Belgium | 7.089 | 0.029 | 1.767 | 0.184 | 17.265 | 0.016 | 4.588 | 0.101 | 18.844 | 0.000 |

| Czechia | 4.707 | 0.030 | 7.188 | 0.066 | 15.642 | 0.029 | 3.313 | 0.346 | 0.359 | 0.549 |

| Denmark | 0.898 | 0.343 | 0.001 | 0.973 | 6.923 | 0.328 | 9.620 | 0.022 | 2.926 | 0.087 |

| Estonia | 6.085 | 0.014 | 6.639 | 0.036 | 7.730 | 0.357 | 0.877 | 0.831 | 0.447 | 0.504 |

| Finland | 3.233 | 0.072 | 11.247 | 0.010 | 3.429 | 0.843 | 9.507 | 0.009 | 10.177 | 0.001 |

| France | 13.311 | 0.001 | 1.542 | 0.214 | 0.637 | 0.425 | 6.474 | 0.039 | 2.760 | 0.097 |

| Germany | 9.414 | 0.002 | 14.802 | 0.001 | 7.381 | 0.194 | 3.683 | 0.298 | 1.716 | 0.424 |

| Greece | 4.916 | 0.086 | 3.213 | 0.073 | 8.014 | 0.331 | 11.250 | 0.004 | 0.929 | 0.335 |

| Hungary | 0.66 | 0.417 | 6.275 | 0.043 | 2.500 | 0.287 | 0.200 | 0.654 | 0.403 | 0.526 |

| Ireland | 4.06 | 0.131 | 9.915 | 0.007 | 0.153 | 0.695 | 2.717 | 0.099 | 7.565 | 0.006 |

| Italy | 11.638 | 0.003 | 7.521 | 0.057 | 1.434 | 0.231 | 14.323 | 0.001 | 7.405 | 0.007 |

| Luxembourg | 2.733 | 0.098 | 0.262 | 0.609 | 59.451 | 0.000 | 5.493 | 0.019 | 0.253 | 0.969 |

| The Netherlands | 7.931 | 0.019 | 36.977 | 0.000 | 12.527 | 0.085 | 1.059 | 0.304 | 13.442 | 0.001 |

| Poland | 1.151 | 0.765 | 0.023 | 0.880 | 9.915 | 0.042 | 0.024 | 0.876 | 1.188 | 0.276 |

| Portugal | 13.307 | 0.004 | 0.275 | 0.600 | 18.091 | 0.012 | 6.089 | 0.014 | 1.232 | 0.267 |

| Slovakia | 0.511 | 0.475 | 0.257 | 0.612 | 18.673 | 0.009 | 0.119 | 0.730 | 0.098 | 0.755 |

| Slovenia | 2.676 | 0.102 | 2.188 | 0.139 | 8.816 | 0.266 | 2.160 | 0.340 | 4.256 | 0.235 |

| Spain | 12.321 | 0.000 | 12.296 | 0.002 | 3.672 | 0.817 | 13.110 | 0.000 | 11.113 | 0.004 |

| Sweden | 2.959 | 0.085 | 0.209 | 0.648 | 10.391 | 0.167 | 2.803 | 0.423 | 6.728 | 0.035 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Topaloglu, E.E.; Nur, T.; Yilmaz Ozekenci, S.; Aydingulu Sakalsiz, S. How ICT and Green Technologies Shape the Nexus Between Financial Development and Carbon Footprint: Evidence from an N-Shaped EKC. Sustainability 2025, 17, 10191. https://doi.org/10.3390/su172210191

Topaloglu EE, Nur T, Yilmaz Ozekenci S, Aydingulu Sakalsiz S. How ICT and Green Technologies Shape the Nexus Between Financial Development and Carbon Footprint: Evidence from an N-Shaped EKC. Sustainability. 2025; 17(22):10191. https://doi.org/10.3390/su172210191

Chicago/Turabian StyleTopaloglu, Emre E., Tugba Nur, Sureyya Yilmaz Ozekenci, and Seren Aydingulu Sakalsiz. 2025. "How ICT and Green Technologies Shape the Nexus Between Financial Development and Carbon Footprint: Evidence from an N-Shaped EKC" Sustainability 17, no. 22: 10191. https://doi.org/10.3390/su172210191

APA StyleTopaloglu, E. E., Nur, T., Yilmaz Ozekenci, S., & Aydingulu Sakalsiz, S. (2025). How ICT and Green Technologies Shape the Nexus Between Financial Development and Carbon Footprint: Evidence from an N-Shaped EKC. Sustainability, 17(22), 10191. https://doi.org/10.3390/su172210191