Abstract

This study aims to examine the corporate values of IBEX35-listed companies and compare them with the sustainability governance information in their Non-Financial Statements (NFSs) to identify cultural patterns indicating high sustainability governance maturity (HSGM). The study uses the Cultural Fit Assessment Method (CFAM©) based on the Competing Values Framework (CVF) and six cultural archetypes (People, Goals, Digital, Innovation, Norms, ESG). It also incorporates sector-specific indicators related to sustainability governance from the IV Comparative Report of the NFS of IBEX35-listed companies published in 2021 by Ernst and Young (E&Y). A fuzzy-set qualitative comparative analysis (fsQCA) was conducted to identify patterns of corporate culture that explain the high maturity levels of sustainability governance. The results reveal two sector-level paths to HSGM in which Digital emerges as a core presence condition and ESG appears as a core absence condition (~ESG). ESG does not emerge as a necessary condition; instead, HSGM arises configurationally. The first combination encompasses the presence of people, goals, and digital cultures, coupled with the absence of innovation, norms, and ESG archetypes, resulting in an HSGM model. The other alternative to obtaining HSGM is through a cultural combination of the absence of people, goals, and ESG cultures alongside a strong emphasis on digital, innovation, and norms archetypes. This study offers a unique approach to assessing the maturity of sustainability governance based on corporate culture. Identifying patterns of corporate culture that indicate high maturity levels of sustainability governance offers practical guidance on how organizations can enhance their sustainability practices.

1. Introduction

In recent years, organizational or corporate culture has positioned itself as one of the most essential variables to be considered within the internal analysis framework of companies [1]. Corporate values and culture are crucial in shaping a company’s identity, behavior, and success [2].

Corporate culture can be defined as a set of values, beliefs, customs, and practices shared by a group of people who make up an organization [3]. The corporate culture drives how decisions are made, risks are managed, and ethical standards are upheld, all these being key elements of governance. A healthy corporate culture ensures that governance practices go beyond formal compliance to reflect the organization’s true commitment to ethical behaviour and accountability. Organizational culture has long been acknowledged as a significant driver of a company’s success. One of the greatest management gurus of all time, Peter Drucker, famously stated that “culture eats strategy for breakfast,” emphasizing the crucial role of culture in organizational performance. For instance, recent studies have demonstrated that innovation culture is significantly and positively related to employees’ Innovative Work Behavior [4].

Building on the literature on organizational values, it is important to acknowledge the distinction between disclosed and authentic culture. Disclosed culture refers to the values and principles that organizations publicly communicate to stakeholders, whereas authentic culture reflects the values and practices that genuinely guide internal behaviors. Recognizing and bridging the gap between disclosed and authentic culture is crucial for achieving alignment and fostering a positive and impactful organizational culture [5]. This study, however, focuses exclusively on disclosed values, as they constitute observable, comparable signals that are systematically available across firms. While differences between disclosed and authentic culture may generate tensions of consistency and trust, here they are treated as a boundary condition and further considered in the limitations section. By analyzing disclosed values, we capture the symbolic layer through which firms communicate priorities to external audiences, which is particularly relevant for understanding their governance and performance implications. Externally visible cultural signals are consequential for governance attention and sustainability action [6].

In addition, there has been a noticeable increase in the importance of sustainability and social responsibility within business communities, especially in Europe. Numerous non-governmental organizations and third-party institutions have advocated for the disclosure and evaluation of ESG information, while governments have started implementing laws, regulations, and policies related to ESG. For instance, in 2014, the European Union issued a directive on Non-Financial Information Statements (NFS), mandating that large companies include ESG issues in their external disclosure of non-financial information. Recent evidence also shows that boards respond decisively when ESG issues become salient, underscoring the governance relevance of ESG disclosures [7]. NFS is a key component of integrated reporting, which combines financial, environmental, social, and governance information to provide stakeholders with a comprehensive view of an organization’s performance, strategy, and value creation [8]. These policy shifts reinforce a configurational view of sustainability governance as bundles of interdependent practices [9].

The governance pillar plays a crucial role in promoting accountability, transparency, and efficiency in managing environmental and social issues. Board attributes systematically shape firms’ social responsibility engagement, informing our governance lens [10]. This ensures that organizations prioritize sustainability in their decision-making processes, allowing for the effective management of resources and equitable development [11]. By adopting sustainability governance practices and disclosing environmental information through an NFS, companies can demonstrate their commitment to sustainable development and align their operations with broader environmental and societal goals. Effective frameworks help organizations identify, assess, and manage risks and opportunities related to sustainability issues [12]. According to Atika and Simamora [13], a crucial factor influencing the effectiveness of sustainability governance is corporate culture. The relationship between corporate culture and sustainability governance has already been studied [14,15,16] but the field is still evolving, with notable gaps and areas for debate in the literature. The limitations include sample selection, differentiation between practical actions and perceptions, and the integration of the Triple Bottom Line (TBL). Research suggests that organizations with robust sustainability governance structures tend to outperform their peers in terms of financial performance, innovation, and stakeholder trust [17].

Other studies have examined the role of organizational culture in shaping sustainability behaviors and practices [18,19]. A more in-depth understanding is still needed, particularly regarding how various dimensions of corporate culture such as values, norms, and practices shape and influence sustainability governance. Sustainability governance integrates environmental, social, and governance considerations into a company’s operations and decision-making. These practices benefit stakeholders by enhancing trust through transparency and accountability, creating long-term value, and mitigating risks [20]. Stakeholders, including investors, employees, consumers, and communities, increasingly expect organizations to demonstrate their commitment to sustainability through transparent governance practices. Therefore, embedding sustainability governance can enhance a company’s reputation, attract investment, foster employee engagement, and build stronger stakeholder relationships [21].

Our study aims to shed some light on how the different corporate cultures have an impact on sustainability governance maturity. Specifically, this study addresses the following research question: What configurations of corporate culture lead to high sustainability governance maturity (HSGM)? Understanding this cultural arrangement within the sectors of the companies listed on the IBEX35 can provide an insight into which specific cultural configuration within each sector is the most effective in implementing sustainability governance policies. To address some of the previous literature gaps, we employ a comprehensive analysis approach using the Cultural Fit Assessment Method (CFAM©). This approach includes objective measures and integrates the TBL framework with cultural characteristics. By doing so, this paper contributes to a more holistic understanding of sustainability governance and cultural influences.

We chose the IBEX35-listed companies to create a sample that reflects the diversity of the Spanish business landscape, encompassing the most productive sectors. This approach allows us to derive results that can be reliably extrapolated. The research question is clarified by employing QCA, specifically fuzzy set qualitative comparative analysis (fsQCA) [22] which has been used in various fields including information systems [23], online business and marketing [24,25], consumer psychology [26], strategy and organizational research [27,28], education [29,30], data science [31], and learning analytics [32].

2. Theoretical Background

The cultural context within Spanish organizations plays a significant role in shaping sustainability governance practices. This is evident through the traditional acceptance of hierarchical structures, influenced by power distance, and the emphasis on collectivist values, prioritizing community needs [33,34]. Additionally, the prominence of relational capital underscores the importance of strong interpersonal relationships in business dealings, guiding Spanish companies in engaging with stakeholders for sustainable governance [35]. Furthermore, the adoption of socially integrated business models by Spanish companies prioritizes community well-being and social cohesiveness, aligning with traditional cultural values and influencing sustainable governance practices [36]. Moreover, exploring the broader context of sustainability practices among Spanish firms can shed light on the applicability of the study’s findings to other contexts. For instance, Spanish companies have been increasingly adopting sustainability strategies as a strategic imperative, aligning with global trends in corporate sustainability [37]. The emphasis on sustainability in Spanish firms, as evidenced by their engagement in sustainability reporting and certification programs, highlights a growing commitment to environmental and social responsibility. Investment decisions are increasingly based on a combination of financial and nonfinancial information. In Spain, a meaningful change occurred with the implementation of Law 11/2018 on NFS and diversity, which was built on RD 18/2017 and imposed specific obligations on public interest entities with over 500 employees or meeting specific criteria. This led to the creation of the Comparative Report on NFS by Ernst&Young (E&Y), which has now become a go-to document for Spanish companies on this issue.

ESG encompasses non-financial indicators beyond a company’s financial statements, including reputation, corporate culture, brand value, and risk management capabilities. It is commonly used as a framework to evaluate a company’s sustainability [38]. In recent years, organizations have increasingly focused on sustainability governance, as they recognize the need to align their practices with environmental, social, and economic sustainability objectives. Much of the existing research on this subject raises traditional questions about sustainability governance, so there are still many topics that could be explored in this field [39].

Finally, more recent studies [40,41,42,43,44] have focused on exploring the relationship between corporate ESG performance and corporate value, as well as contributing to the understanding of sustainability governance in different firms. These studies also exhibit limitations in sample selection, focusing narrowly on specific regions and relying heavily on subjective measures of sustainability. The literature review leads us to consider a positive relationship between corporate culture and high sustainability governance, but it is necessary to delve into how the interaction of different corporate cultures can give rise to this relationship.

This paper addresses these gaps by employing a comprehensive analysis approach using the Cultural Fit Assessment Method (CFAM©) and fsQCA analysis. It incorporates objective measures and integrates the TBL framework with cultural characteristics. By doing so, the paper contributes to a more holistic understanding of sustainability governance and the different combinations of cultural influences in IBEX35-listed companies, offering valuable insights for future research endeavors in the field.

This study also draws on multiple theoretical foundations to understand the impact of corporate culture on sustainability governance. Integrating institutional, stakeholder, and resource-based theories provides a solid theoretical framework for understanding this relationship. Institutional Theory emphasizes organizations’ pursuit of legitimacy by aligning themselves with prevailing norms, including sustainable practices, to gain acceptance. This theory is based on three essential pillars: coercive, normative, and mimetic pressures that arise from institutions [45]. Classic new institutionalism further explains these dynamics through coercive, mimetic, and normative isomorphism [46]. The adoption of Directive 2014/95/EU and Law 11/2018 in Spain on NFS can be framed as institutional pressure that requires companies to enhance transparency and accountability in their ESG practices. This Institutional Theory helps to explain companies’ compliance behaviors and their efforts to align with social and regulatory expectations. In addition to institutional pressure, the coercions from various shareholders to invest in ESG activities are beneficial for companies’ marketplace competitiveness [47]. Recent studies confirm the role played by institutional pressures for sustainability in explaining the involvement of organizations in economic, social, and environmental aspects [48].

The Stakeholder Theory underscores stakeholders’ interests and integrates sustainability into cultural values. The challenge of accounting for the generation of value not only for shareholders but also for other stakeholders [20] can be used to frame research on how corporate cultures that value sustainability and responsibility impact governance. This aligns with the study’s emphasis on integrating environmental, social, and governance (ESG) concerns into organizational decision-making. Meanwhile, the Resource-Based View (RBV) focuses on developing sustainable resources to attain a competitive advantage. A major premise of the RBV is that a competitive advantage is a function of a firm’s resources and capabilities [49,50,51]. When examining how the different dimensions of corporate culture (values, norms, practices) influence sustainability governance, this study can use this RBV to argue that a culture emphasizing sustainability is a valuable organizational resource that can drive superior ESG performance and maturity in sustainability governance. It is noteworthy to highlight that some authors have articulated that the RBV may not be regarded as a comprehensive theory, asserting that it is frequently portrayed more as a conceptual framework rather than a fully developed theory [52]. The selection of Institutional Theory, Stakeholder Theory, and RBV for the theoretical background of the study aligns well with the study’s focus on sustainability governance, organizational culture, and the integration of ESG considerations into decision-making processes. They provide theoretical frameworks that enhance the understanding of why and how organizations engage in sustainable practices and governance, making them valuable contributions to the literature review in the paper. Integrating these theories within organizational cultural values reflects a holistic approach to sustainability governance that addresses external pressures integrating holder interests and internal capabilities.

Table 1 presents some of the main findings in the literature on the relationship between corporate culture and sustainability governance. There is no evidence of studies examining how different combinations of corporate cultures affect ESG performance as a unit or sustainability governance performance.

Table 1.

Some studies on the relationship between corporate culture and sustainability governance. Source: own research.

The literature review collectively underscores the significance of internal governance mechanisms, such as board diversity and corporate culture, and the pivotal role of ESG factors in enhancing corporate value and innovation, as well as the interplay between knowledge management, sustainability and corporate culture in driving sustainable practices. While this paper focuses on identifying cultural patterns indicative of HSGM, the literature review concentrates on diverse aspects of governance, culture, and their impact on sustainability across different sectors and regions. Integrating these insights would yield a comprehensive understanding of how internal governance mechanisms and cultural dynamics intersect to drive sustainability practices and enhance business sustainability. Drawing on relevant theories, formulating propositions, and defining key variables, this study aims to contribute to the knowledge of sustainable practices within organizations and offers practical insights for companies seeking to improve their sustainability governance. As the impact of various corporate culture configurations on IBEX35-listed companies remains unclear, this study aims to address this gap. Therefore, we propose the following propositions:

- Proposition 1 (complexity): High Sustainability Governance Maturity (HSGM) results from the complex configurational interplay among the six CFAM© cultural archetypes.

- Proposition 2 (equifinality): Distinct configurations of corporate cultural conditions can equally lead to high levels of Sustainability Governance Maturity (HSGM), illustrating the principle of equifinality.

- Proposition 3 (asymmetry): Corporate cultural conditions exert differential and non-uniform influences on Sustainability Governance Maturity (HSGM), revealing the asymmetric nature of these relationships.

- Proposition 4 (causal asymmetry): Corporate cultural archetypes affect Sustainability Governance Maturity (HSGM) in non-reciprocal and directionally distinct ways, consistent with the principle of causal asymmetry in configurational analysis.

3. Research Objective, Methodology and Data

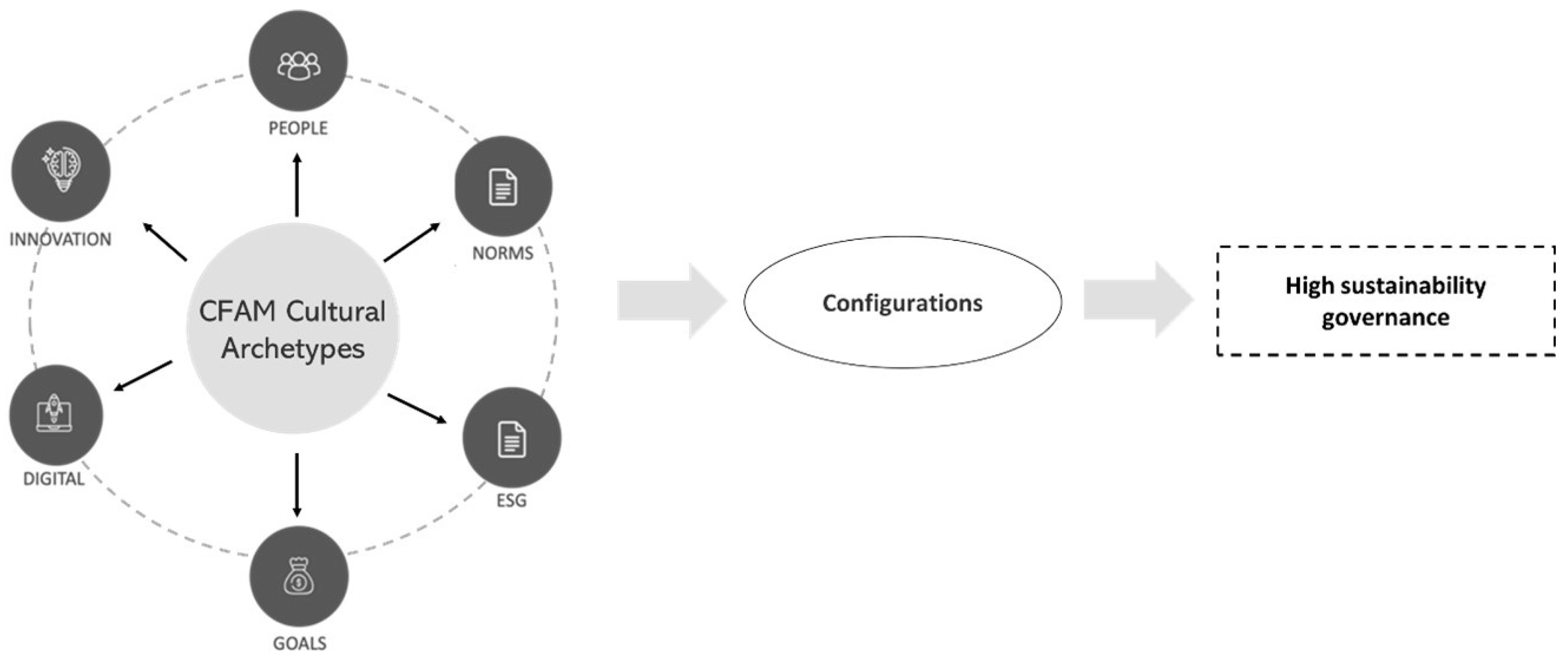

This study analyzes sectoral cultural configurations of IBEX35 firms and their association with sustainability governance maturity via fsQCA. Evidence of equifinal managerial paths to sustainability performance [54] motivates this design. See Figure 1 for the conceptual model.

Figure 1.

Conceptual model of the CFAM© cultural archetypes pillars’ configuration impacting high sustainability governance maturity. Source: own research.

3.1. Data Collection and Variables Measurement

The data employed in this study are publicly available and derived from open-access secondary sources. Specifically, the research uses non-confidential, aggregated information disclosed by IBEX35-listed companies published in the IV Comparative Report of Non-Financial Information Statements (NFS) by Ernst & Young (2021) [55], as well as publicly available corporate values obtained from official company websites.

- Initial Sample: The initial sample for this study comprises the 2021 IBEX35-listed companies (See Table A1 in Appendix A) and the sustainability governance maturity indicators from the IV Comparative Report of IBEX35-listed companies developed by E&Y (See Table A2 in Appendix A).

- Data Collection: Organizational values were extracted from the corporate websites of the IBEX35-listed companies. Up to 103 different organizational values were extracted (See Table A3 in Appendix A), with 409 total values. These values were searched for based on the disclosed corporate values of the IBEX35-listed companies.

- Categorization and coding procedure: Mapping each disclosed value to one of the six CFAM© archetypes followed a two-step protocol:

- Canonical lexicon. Values that exactly matched any of the 36 canonical CFAM© items (Table 2) were assigned directly to their archetype. This is a method developed by Leal-Rodríguez et al. [56] which incorporates six core cultural archetypes: People, Innovation, Goals, Norms, ESG, and Digital.

Table 2. CFAM© cultural values by archetype. Source: Own research.

Table 2. CFAM© cultural values by archetype. Source: Own research. - Dictionary-based, AI-assisted coding. For values not explicitly listed among the 36 items, we used a curated equivalence dictionary (synonyms/near-synonyms grounded in CFAM© definitions) supported by AI-based text analytics to propose the closest canonical term; this reduced researcher subjectivity and enhanced replicability.

Each of the CFAM© cultural archetypes is described below:

- People: Organizations managed as family-type corporations.

- Goals: Organizations based on a management-by-objectives model.

- Digital: Organizations with great openness to change and an analytical mindset.

- Innovation: Highly creative, dynamic, and innovative organizations.

- Norms: Organizations whose management model is based on the principles inherent in bureaucracy.

- ESG: Organizations are highly concerned about the well-being of their employees, society, and the environment.

These archetypes were selected based on their alignment with the foundational Competing Values Framework (CVF) by Quinn and Rohrbaugh [57] and expanded upon by Cameron and Quinn [58]. The six dimensions reflect critical aspects of modern organizational cultures, representing unique values and behaviors that support distinct organizational outcomes. By integrating these six archetypes, CFAM© provides a nuanced tool that captures the multifaceted nature of corporate culture in today’s diverse business landscape. The chosen dimensions have been validated through extensive empirical research and practical applications, ensuring their relevance in assessing cultural alignment within organizations. The 36 underlying values shaping the CFAM© are listed below.

Sector Allocation: These cultural archetypes were further classified and distributed across different sectors for analysis. All present values in the IBEX35-listed companies were divided into eight study cases (sectors) depending on the number of values found for each cultural archetype. (See Table A5 in Appendix A). Table 3. shows the disclosed cultural weight at the sector level, with these eight cases, we achieved a reasonable level of detail and analysis within the constraints of our study. This sample size balances depth and breadth, allowing for an in-depth exploration of each sector while offering a comprehensive view of the research question.

Table 3.

Weight of the disclosed culture of the IBEX35-listed companies at a sector level. Source: own research.

Finally, according to the sustainability governance maturity information extracted from the IV Comparative Report of IBEX35-listed companies, the aggregated score (from 0 to 5) was incorporated into Table 4, and the results were ordered by sector to determine the level of sustainability governance maturity based on the indicators.

Table 4.

Aggregated score of each indicator ordered by sector. Source: own research.

This classification was performed to compare the information on IBEX35 corporate cultures with the analysis conducted by E&Y. The rationale behind the choice of the sample period and the selected variables can be elucidated with theoretical and practical considerations. The selection of the sample period is grounded in the availability of data from a specific timeframe (2021) that aligns with the research context. The data selected correspond to the publication year of key reports. This period was selected to capture the most recent and comprehensive data related to ESG aspects, as mandated by the EU’s Directive on NFS. Additionally, the theoretical argument for the chosen variables stems from their alignment with established frameworks and measurement criteria (See Table A6 in Appendix A) that reflect a theoretical foundation in sustainability governance assessment. The questionnaire and results are shown in Table A7 Appendix A. The selection of these variables not only ensures practical measurability and data quality but also directly addresses the research goals of examining the impact of cultural archetypes on sustainability governance maturity, as illustrated in the CFAM© conceptual model. By linking the sample period and variable selection to theoretical frameworks, data availability, and research objectives, the study’s research design gains clarity and robustness, contributing to the reliability and validity of the study’s findings.

3.2. Methodology

3.2.1. Research Design

This study applies the fsQCA methodology, a data analysis technique developed by Charles Ragin. Adopting a configurational analysis perspective, the fsQCA method systematically examines the interactions between antecedent variables that cause the outcomes [59]. This technique has experienced significant growth in terms of interest and application within the academic field of business management [25,60,61]. Instead of focusing on the net effects of each factor, this study investigates how combinations of various causal conditions (cultural archetypes) positively influence the maturity of sustainability governance. The fsQCA is particularly well-suited for working with samples that have few cases due to its flexibility and analytical power. Unlike traditional methods that may struggle with small sample sizes, fsQCA can effectively handle limited cases, providing insightful results [25]. In the context of fsQCA, the analysis revolves around identifying patterns across cases without the need to individually interpret each case, making it ideal for our study since we want to analyze how the interaction of different cultures influences sustainability governance.

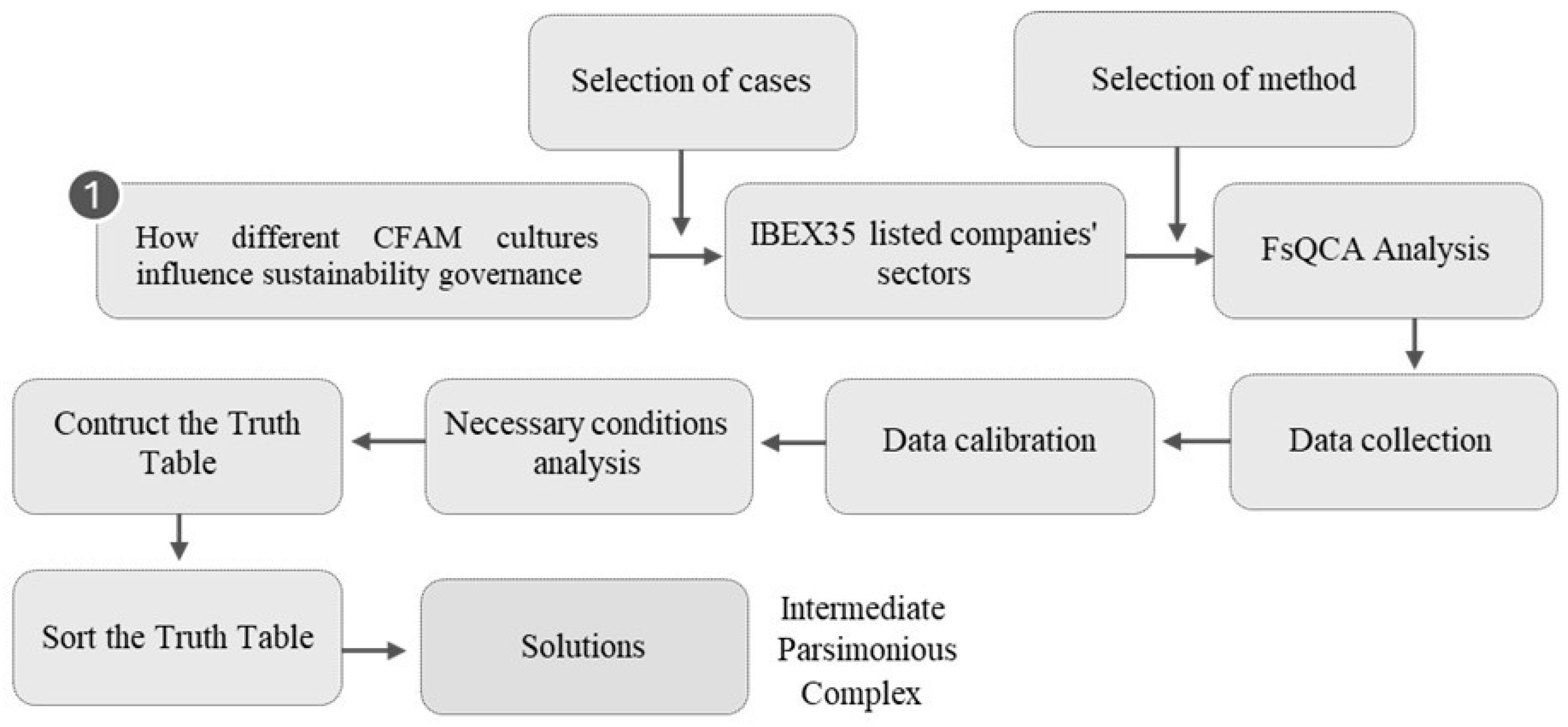

The main steps of fsQCA are illustrated in Figure 2, incorporating sustainability governance maturity as the outcome and CFAM© cultures as the variables across different sectors:

Figure 2.

Main steps of fsQCA analysis. Source: own research.

3.2.2. Calibration

Data Treatment and Fuzzy Sets

The most crucial step in fsQCA is the calibration of data, which transforms conditions and outcomes into fuzzy-set membership scores ranging from 0 (full non-membership) to 1 (full membership), with 0.5 representing the point of maximum ambiguity or crossover [62]. Unlike probabilities, these scores express the degree of set membership, meaning how strongly a case belongs to a given condition or outcome. In this way, a membership score close to 1 indicates strong alignment with the set, whereas scores near 0 signal clear exclusion.

The variable “sustainability governance maturity” has been coded as a “HSGM” condition. In our analysis, we examine the present condition of having HSGM. The negation of a condition is referred to in the literature as the absence of a condition, and the two terms have been used interchangeably based on how absence is computed [27,63,64]. We coded the remaining variables and computed the presence or absence of each condition.

Choosing Thresholds

The data calibration used was “direct calibration” which is more commonly recommended and utilized [25] and involves setting three thresholds. We have chosen the values 0.95 (full membership threshold), 0.50 (crossover point threshold), and 0.05 (full non-membership threshold), transforming the data into all values between 0 and 1. To determine which values in our dataset correspond to 0.95, 0.50, and 0.05 we use percentiles. A lower threshold (0.05) can help identify conditions that have a minor impact on the outcome of HSGM. This will allow for the consideration of even a slight influence of cultural archetypes on overall sustainability governance maturity. The mid-level threshold (0.5) signifies the conditions that moderately impact HSGM. Setting this threshold helps to identify cultural archetypes that significantly contribute to this outcome. The higher threshold (0.95) allows us to identify conditions that have a strong impact on achieving HSGM. Cultural archetypes that meet this threshold are critical for ensuring robust sustainability practices.

By incorporating these thresholds, we can effectively capture the diverse spectrum of influences from different cultural archetypes on the sustainability governance maturity of IBEX35-listed companies. This choice for data calibration in fsQCA has been supported by various authors due to its ability to effectively capture different levels of membership or non-membership in fuzzy sets, thereby accommodating the inherent nuances in qualitative data [25]. Table 5 reports the calibration thresholds (5th, 50th, and 95th percentiles) employed for each cultural archetype and for the outcome of sustainability governance maturity. This procedure ensures methodological transparency and provides the basis for transforming the raw sector-level data presented in Table 3 and Table 4 into calibrated values suitable for configurational analysis.

Table 5.

Calibration thresholds by cultural archetype and outcome. Source: own research.

Calibrating the Data in fsQCA Software 3.0

By calibrating the data, we ensured that the CFAM© cultural archetypes had meaningful and interpretable fuzzy membership scores concerning sustainability governance maturity. Once we have decided on the thresholds, we proceed to data calibration using fsQCA 3.0. Calibration was performed using the software’s “Calibrate” function, which inputs the variable to be calibrated and the three breakpoints (from the highest to the lowest values). Dataset after calibration is shown in Table 6 and presents calibrated membership scores. Values near 1 indicate high set membership given the p95/p50/p5 anchors and values near 0 indicate low membership.

Table 6.

The dataset after calibration. Source: own research.

4. Results and Discussion

4.1. Analysis of Necessary Conditions

A necessary condition is a factor or attribute that must be present for a particular outcome to occur. In fsQCA, a necessary condition is indispensable for the occurrence of the outcome of interest. If a necessary condition is absent, the outcome will not be manifested. This step precedes truth table analysis and is crucial for understanding the underlying conditions necessary for the outcome. Table 7 shows the results of the necessary condition analysis for the conditions tested in the context of high and low maturity of sustainability governance.

Table 7.

Analysis of necessary conditions. Source: own research.

It is important to note that the consistency values for HSGM range between 0.48 and 0.76, indicating that some conditions are more consistently related to sustainability governance maturity. A threshold of consistency greater than 0.9 is the core measure for determining whether a condition is necessary for the outcome [27]. In this case, each condition is below the threshold value of 0.9, indicating that no single cultural archetype is necessary for high or low maturity of sustainability governance. This implies that the sustainability governance maturity of the IBEX35 sectors may be influenced by the synergistic effects of the six cultures.

Coverage in this context reflects the extent to which a specific cultural archetype contributes to the overall explanation of sustainability governance maturity across cases in the dataset. A higher coverage value indicates a stronger and more consistent relationship between the archetype and the outcome, highlighting its importance in influencing sustainability governance practices. It signifies the degree to which the conditions or factors identified (cultural archetypes in this case) are effective in explaining the variability in sustainability governance maturity levels. In any case, coverage is only meaningful for the conditions necessary to pass the consistency test [65]. When analyzing fsQCA results, it is crucial to consider not only necessary conditions but also the nuanced interplay between necessary and sufficient conditions to gain a deeper understanding of the underlying causal mechanisms and relationships within the dataset. By elucidating these distinctions, researchers can effectively interpret the complexity of configurations identified through fsQCA and extract meaningful information from the data.

4.2. Sufficiency Analysis of Conditional Configuration

Based on the above findings, different combinations of corporate cultures influence the sustainability governance maturity of the IBEX35 sectors. To identify the specific combinations of corporate cultures that lead to high sustainability governance outcomes, we conducted a sufficiency analysis of the conditional configuration. A sufficient condition refers to a factor or combination of factors that, when present, are adequate to bring about the desired outcome.

This analysis provides three types of solutions. The complex solution is the most detailed solution generated by the fsQCA tool and encompasses all combinations of conditions and their relationships with the outcome of interest [25]. A parsimonious solution provides a concise and easily understandable explanation, but there is a risk of oversimplifying the complexity of causal relationships. Finally, the intermediate solution is obtained through a counterfactual analysis of complex and parsimonious solutions, incorporating only theoretically plausible counterfactuals [58].

To obtain these solutions, firstly, we have computed the presence of the outcome, and the fsQCA analysis extracts all the configurations that may occur, providing, in this case, 26 rows with every combination. Next, the truth table was sorted according to frequency and consistency [22]. The threshold was set to 1 and all the combinations with a frequency of 0 were removed. A higher frequency threshold means that each configuration refers to more cases in the sample, but, as a result, this will reduce the percentage (i.e., coverage) of the sample explained by the retained configurations. However, a lower frequency threshold increases the coverage of the sample, although each combination refers to fewer cases in the sample [22,27]. Once the configurations with zero frequency were removed, the truth table was sorted using raw consistency. We set the minimum recommended value of 0.75 [65].

Configurational Solutions for HSGM results are presented in Table 8. This style follows Fiss’s style [23] who emphasizes the distinction between core and peripheral conditions in configurational results. Furthermore, we have selected in this study the conditions for the intermediate solution. Complex and parsimonious solutions are presented in Appendix B Table A8. To enhance the presentation of the results, we transform the solutions obtained from the fsQCA output into a table. This distinction provides a more straightforward approach to effectively comprehend and convey the results. The presence of a condition is denoted by a black circle (●), while its absence is represented by a cross (X), and a blank space signifies a “do not care” condition [27]. We also used large and small icons to differentiate between the core and peripheral conditions highlighting the key factors influencing sustainability governance maturity.

Table 8.

Configurational Solutions for HSGM. Source: own research.

While core conditions are present in both the parsimonious and intermediate solutions underscoring their significance in attaining high maturity levels, the conditions eliminated from the parsimonious solution and appearing only in the intermediate solution are referred to as “peripheral conditions” [27]. Having two distinct solutions underscores the multifaceted nature of achieving high maturity in sustainability governance, recognizing the diverse pathways organizations can take to enhance their governance practices. Each solution offers unique combinations of conditions, emphasizing the dynamic interplay between different cultural archetypes and their influence on sustainability governance outcomes. In both configurations, digital is a core presence and ESG is a core absence (~ESG) only to sufficiency configurations; the remaining conditions act as peripheral elements within each recipe. Combining the presence of people, goals, and digital cultures with the absence of innovation, norms, and ESG cultures leads to HSGM (solution 1). The other solution to achieve HSGM would be the combination of the absence of people, goals, and ESG cultures with the presence of digital, innovation, and norms cultures (solution 2).

Table 8 also shows the study’s consistency and coverage. The table of solutions provides set-theoretic consistency values for each configuration and the overall solution, all exceeding the threshold value of 0.75, indicating high set-theoretic coherence between the configurations and the outcome. The solution exhibits high set-theoretic consistency (0.878) and moderate empirical coverage (0.563). In fsQCA, coverage is not variance explained, it indicates the share of the outcome set captured by the configurations, while consistency reflects set-theoretic accuracy [56,58].

Table 9 lists the cases covered by both configurations. Membership scores are reported as pairs: the first value refers to the degree of case membership in the configurational solution (term) and the second to the degree of membership in the outcome set (high maturity of sustainability governance). This distinction follows standard fsQCA practice, where term and outcome memberships are separately assessed to evaluate empirical relevance [62,64]. Both have membership greater than 0.5 in terms of antecedent and outcome membership. The technology, media, and telecommunications sector (0.75,0.57) in path number 1 has an antecedent membership of 0.75 and a membership of 0.57 on the HSGM outcome. On the other hand, in path number 2, the energy sector has a 0.61 antecedent membership and a 0.95 membership in the HSGM outcome.

Table 9.

Cases covered by high maturity of sustainability governance configurations. Source: own research.

4.3. Discussion

This study investigated the cultural configurations underlying high sustainability governance maturity (HSGM) among IBEX35-listed companies, applying the CFAM© framework and fsQCA methodology. The findings demonstrate that no single cultural archetype constitutes a necessary condition for achieving HSGM, which reinforces the argument that sustainability governance is inherently complex and shaped by interdependent cultural dynamics. Instead, two alternative configurations emerged, confirming the principle of equifinality: organizations may achieve HSGM through distinct but coherent cultural pathways. In line with Fiss’s approach [27], digital culture emerges as a core presence condition, whereas ESG appears as a core absence condition (~ESG) within the two sufficient configurations; thus, no single condition among ESG, digital, ~ESG, and ~digital is necessary for HSGM. By contrast, people, goals, innovation, and norms operate as peripheral conditions whose influence depends on the specific configuration. The first configuration combines strong people, goals, and digital-oriented cultures with the absence of innovation, norms, and ESG orientations. This pathway suggests that when organizations emphasize human-centered values, performance-driven logics, and digital openness—without overburdening themselves with bureaucratic rigidity or superficial ESG narratives—they can attain robust sustainability governance. Conversely, the second pathway is marked by the absence of people, goals, and ESG cultures but reinforced by digital, innovation, and norms orientations. Here, governance maturity stems from combining digital sophistication with procedural rigor and innovative dynamism, even in contexts where explicit ESG and stakeholder-oriented values are not prominently articulated.

These findings highlight the asymmetric role of ESG culture: while often presumed to be a direct driver of sustainability maturity, ESG culture can play both positive and negative roles depending on its configuration. This resonates with prior research emphasizing the dual nature of sustainability commitments, which can be either deeply embedded or merely symbolic. Similarly, the centrality of digital culture across both solutions underscores the transformative role of technological orientation in enhancing governance maturity, echoing arguments on the importance of digitalization in sustainability transitions.

Digital culture appears as a core presence in both configurations because the EY governance-maturity criteria rely on digitally enabled reporting, traceability, and risk-oversight routines (e.g., board-level monitoring, risk analysis frameworks, auditable processes), which are infrastructural to high maturity (Appendix A Table A7). By contrast, the peripheral bundle varies by industry context. In Energy (Path 2: Digital*Innovation*Norms with ~People~Goals~ESG), Innovation and Norms combine with Digital, reflecting a regulated, process-intensive field undergoing technological transition where standardized procedures and technological renewal jointly support governance maturity.

In TMT/Tech (Path 1: People*Goals*Digital with ~Innovation~Norms~ESG), People and Goals accompany Digital, consistent with agile, human-centered, purpose-driven coordination rather than procedural formalization. Across sectors, the causal role of ESG in our sample is consistent, it does not emerge as necessary and appears as a core absence (~ESG) within both sufficient configurations.

In line with earlier works on causal complexity in governance and [61], our results validate the suitability of fsQCA in identifying nonlinear and non-recursive pathways. The identified solutions capture the diversity of sectoral contexts within the IBEX35 and reinforce that sustainability governance cannot be explained through linear, one-dimensional approaches.

4.3.1. Theoretical Implications

This research advances the literature on organizational culture and sustainability governance in several ways.

First, by integrating the CFAM© model with fsQCA, the study contributes to configurational approaches that account for complexity, equifinality, and asymmetry. Previous studies have often focused on isolated cultural traits; our findings demonstrate that combinations of archetypes, rather than singular values, drive governance maturity.

Second, the results provide new insights for Institutional Theory. While coercive and normative pressures (e.g., Directive 2014/95/EU, Spanish Law 11/2018) create a framework for ESG disclosure, our findings reveal that firms’ internal cultural configurations determine how such pressures translate into governance maturity. This extends institutional explanations by showing how cultural archetypes mediate compliance and legitimacy-seeking behaviors.

Third, the study refines Stakeholder Theory [20] by illustrating that people and ESG-oriented cultures can, under certain configurations, either strengthen or weaken sustainability governance outcomes. This challenges the assumption that stakeholder-oriented values are universally positive, pointing to the importance of alignment with other cultural archetypes.

Finally, from the Resource-Based View (RBV) [50,51,52], the study highlights digital and innovation cultures as valuable and rare organizational resources that can foster governance maturity. By conceptualizing culture itself as a resource, our work adds depth to the RBV perspective on sustainability practices.

4.3.2. Practical Implications

The findings also carry important practical lessons for managers, policymakers, and stakeholders. For corporate managers, the results suggest that there is no single “ideal” cultural model for achieving sustainability governance maturity. Instead, firms should identify cultural configurations that best align with their sectoral context and strategic objectives. Emphasizing digital culture appears particularly critical, given its central role across both identified pathways. Leaders should therefore invest in digital skills, data-driven decision-making, and technological infrastructures to strengthen governance practices.

For policymakers and regulators, the asymmetric role of ESG culture highlights the need to move beyond compliance-based reporting frameworks. Regulations should encourage not only disclosure but also authentic integration of ESG principles within corporate culture. Otherwise, there is a risk that ESG remains a symbolic label that undermines rather than supports governance maturity.

For stakeholders such as investors and civil society, this study shows that the disclosed cultural values of firms are informative signals of sustainability governance capacity. However, stakeholders should be cautious when interpreting ESG narratives in isolation. A more reliable assessment requires analyzing cultural patterns holistically, considering how ESG interacts with other cultural orientations such as digital or innovation.

4.3.3. Significance and Originality

This study uniquely applies fsQCA, allowing for the examination of complex interactions between cultural archetypes and sustainability governance maturity across different sectors. The configurational insights generated by fsQCA stress distinct, sector-specific cultural combinations that drive HSGM, revealing nuances that traditional methods may overlook.

The incorporation of the CFAM© method provides a novel framework to measure and compare disclosed and authentic corporate values, adding theoretical and practical value. CFAM© facilitates insights into how well-stated values align with internal practices, offering a useful diagnostic for researchers and practitioners alike in assessing cultural impacts on sustainability governance.

4.3.4. Contribution to Theory Building

This study extends Stakeholder Theory and RBV by highlighting the role of specific cultural configurations in achieving robust sustainability governance. By demonstrating the influence of combined cultural resources, the findings contribute to a nuanced understanding of how companies can strategically manage their internal cultures to align with external ESG requirements. Additionally, the study bridges the gap between disclosed and authentic corporate culture, offering a framework for realigning corporate values with actual practices to improve the authenticity and effectiveness of sustainability governance.

5. Conclusions

The study’s exploration of sustainability governance maturity within IBEX35-listed companies revealed that achieving high maturity in this area is intricately linked to specific corporate cultural conditions. Particularly, the research identified a high Digital culture condition and the absence of ESG culture as pivotal factors in sufficiency analysis in attaining HSGM. Although this may seem counterintuitive, our fsQCA evidence shows that ESG is not a necessary condition and that ~ESG functions as a core absence within both sufficient configurations. This should not be read as a claim against ESG-oriented cultures per se. Rather, within our sector-level, disclosure-based measures, governance maturity arises through cultural combinations with a high Digital culture presence.

Through the application of the fsQCA approach, the study unraveled the complex relationships and interactions between different corporate cultural archetypes, providing insights into the multifaceted causality at play in real-world phenomena and their impact on sustainability governance maturity.

The confirmation of the proposed propositions stems from the rigorous analysis conducted utilizing the fsQCA approach, which effectively uncovered the complexities underlying the relationships between corporate cultural archetypes and sustainability governance maturity within IBEX35-listed companies (proposition 1). The identification of diverse configurations leading to HSGM supports the concept of equifinality, demonstrating that various combinations of cultural conditions can yield the desired outcome (proposition 2). Furthermore, the discovery of non-symmetrical causal relationships between specific cultural archetypes and maturity levels emphasizes the nuanced nature of these interactions, showcasing how different cultural conditions can have varying impacts on sustainability governance outcomes (proposition 3). The exploration of causal asymmetry further deepens the understanding of how specific cultural archetypes exert differing degrees of influence, highlighting the unequal and non-reciprocal nature of these effects on sustainability governance maturity (proposition 4). Overall, the confirmation of these propositions underlines the importance of considering the intricate dynamics of corporate culture in driving sustainable governance practices within large publicly listed companies.

Despite its contributions, this study has some limitations that should be acknowledged. This study investigates eight sector cases derived from the IBEX 35. As is typical for small-N fsQCA designs, truth-table limited diversity constrains the number of empirically observed combinations; accordingly, our claims are sector-level and context-bound to the IBEX35 setting and should be read as set-theoretic (analytic) generalizations, not population-level estimates. To assess external validity, future research should replicate and extend the analysis with larger and multi-index samples—for example, by incorporating the Euro Stoxx 50 (and other indices such as DAX 40 or CAC 40), combining sectors across countries, and examining temporal stability with multi-year panels. Additionally, this study focuses on six dimensions of corporate culture, leaving room for further exploration of other dimensions that might influence sustainability governance. Looking ahead, there are several promising avenues for further exploration in this field. Firstly, expanding the application of CFAM© and fsQCA to encompass different geographic contexts could provide valuable insights into how cultural variations across regions influence sustainability governance.

Furthermore, delving into industry-specific studies could offer tailored strategies for enhancing sustainability governance maturity. Longitudinal studies tracking changes in corporate culture and sustainability governance over time could provide a dynamic understanding of the evolving impacts of cultural shifts. Furthermore, investigating potential moderating variables, including company size or external stakeholder pressure, could refine our understanding of the complex relationship between culture and sustainability governance. Lastly, exploring the misalignment between authentic and disclosed corporate culture presents an intriguing avenue for future research, offering opportunities to realign organizational culture to drive more effective sustainability practices.

The study provides valuable empirical evidence of specific configurations that organizations can adopt to achieve HSGM and sheds light on the role of digitalization in sustainability efforts. Furthermore, it also identifies the absence of ESG culture as a core condition, emphasizing the probability of greenwashing occurring in different companies and sectors, as there is a significant controversy concerning this matter. This study serves as a valuable contribution to the understanding of how corporate cultural archetypes influence sustainability governance maturity, providing actionable insights for managers and implications for policymakers. By aligning corporate cultures with the demands of stakeholders and regulatory ESG requirements, companies can foster an environment that not only drives effective sustainability practices but also yields positive financial returns and enhances competitive advantage.

Author Contributions

Conceptualization: J.P.-T. and A.L.L.-R. Methodology: J.P.-T. Software: C.S.-P. Validation: A.L.L.-R., C.S.-P. and E.B. Formal análisis: J.P.-T. and C.S.-P. Investigation: J.P.-T. Resources: A.L.L.-R., C.S.-P. and E.B. Data curation: C.S.-P. and E.B. Writing—original draft preparation: J.P.-T. Writing—review and editing: J.P.-T. Visualization: C.S.-P. Supervision: C.S.-P. and A.L.L.-R. Project administration: A.L.L.-R. All authors have read and agreed to the published version of the manuscript.

Funding

This research has been funded by project SNEO-20231198 within the NEOTEC 2023 program, managed by the Center for Industrial Technological Development (CDTI) and part of the 2021–2023 Spanish State Plan for Scientific, Technical, and Innovation Research.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

IBEX35 (2021) listed companies. Source: own research.

Table A1.

IBEX35 (2021) listed companies. Source: own research.

| Acciona | Banco Sabadell | Enagás | Inditex | Pharmamar |

| Acerinox | Banco Santander | Endesa | Indra Sistemas | Red Eléctrica Corporación |

| Grupo ACS | Bankinter | Ferrovial | Inmobiliaria Colonial | Repsol |

| Aena | BBVA | Fluidra | Mapfre | Rovi |

| Almirall | Caixabank | Grifols | Meliá Hotels International | Siemens Gamesa Renewable energy |

| Amadeus Group | Cellnex Telecom | IAG | Merlin Properties | Solaria Energía |

| Arcelormittal | Cie Automotive | Iberdrola | Naturgy | Telefónica |

Table A2.

The 25 ESG indicators ordered according to their six thematic areas. Source: IV Comparative Report on Non-Financial Information Statements (EINF) of the IBEX-35.

Table A2.

The 25 ESG indicators ordered according to their six thematic areas. Source: IV Comparative Report on Non-Financial Information Statements (EINF) of the IBEX-35.

| Thematic Areas | Indicators |

|---|---|

| Environment | Biodiversity |

| Climate Change and Carbon Footprint | |

| Sustainable use of resources | |

| Contamination | |

| Circular economy | |

| Environmental impact and management | |

| Employees | Inclusivity and accessibility |

| Equality and Governing Bodies | |

| Formation | |

| Health & Safety | |

| Work–life balance, disconnection, and well-being | |

| Pay Gap and Equality | |

| Sustainability Governance * | Corporate Policies |

| Sustainability strategy | |

| Economic resources and sustainability | |

| Materiality | |

| ESG Risks | |

| Sustainability Responsibility | |

| Society | Corruption and bribery |

| Responsible taxation | |

| Impact on the local community | |

| Claims Systems—Customers | |

| Consumer Health and Safety | |

| Supply Chain | Responsible Supply Chain Management |

| Human rights | Human Rights Due Diligence |

* Thematic area under study.

Table A3.

The 103 values found in the IBEX35-listed companies ordered by CFAM© cultures. Source: own research.

Table A3.

The 103 values found in the IBEX35-listed companies ordered by CFAM© cultures. Source: own research.

| Closeness | Confidence | Simplicity | Proximity | Frankness |

| Commitment | Credibility | Honesty | Solidarity | Consensus |

| Generosity | Reliability | Pride | Hope | Sustainable development |

| Loyalty | Hospitality | Empathy | Determination | Equality |

| Teamwork | Participation | Employee engagement | Dialogue | Passion |

| Ambition | Business Orientation | Quality | Experience | Formation |

| Leadership | Professionalism | Solvency | Financial Strength | Flexibility |

| Pragmatism | Recognition | Resolution | Profitability | Adaptability |

| Results-oriented | Long-term vision | Specialization | Effort | Entrepreneurship |

| Excellence | Efficiency | Passion for Success | Performance | Value Creation |

| Customer Adaptation | Transformation | Share | Customer Service | Bravery |

| Cooperation | Digitalization | Agile | Collaboration | Integrity |

| Openness to change | Environment Adaptation | Anticipation | Preparation | Respect |

| Creativity | Enthusiasm | Talent | Proactivity | Welfare |

| Innovation | Speed | Challenges | Transformation | Diversity |

| Risk tolerance | Nonconformity | Progress | Audacity | Ethics |

| Agility | Self-criticism | Think Big | Originality | Inclusion |

| Inspiration | Intelligence | Discovery | Continuous Improvement | Equity |

| Efficiency | Confidentiality | Rigor | Compliance | Model Employer |

| Responsibility | Objectivity | Coherence | Concern for the environment | Multiculturalism |

| Sustainability | Transparency | Social Responsibility |

Note: Values were mapped to the six CFAM© archetypes following Section 3.1—exact matches to the 36 canonical items (Table 2), otherwise dictionary- and AI-assisted synonym matching with independent human validation; one archetype per value.

Table A4.

Number of values by company. Source: own research.

Table A4.

Number of values by company. Source: own research.

| People | Goals | Digital | Innovation | Norms | ESG | |

|---|---|---|---|---|---|---|

| ACCIONA | 2 | 4 | 2 | 1 | 0 | 10 |

| ACERINOX | 1 | 3 | 0 | 1 | 0 | 4 |

| AENA | 3 | 0 | 1 | 3 | 1 | 6 |

| ALMIRALL | 0 | 0 | 1 | 2 | 1 | 6 |

| AMADEUS IT GROUP | 2 | 2 | 4 | 1 | 1 | 4 |

| ARCELORMITTAL | 0 | 3 | 0 | 3 | 0 | 2 |

| BANCO SABADELL | 5 | 3 | 2 | 2 | 0 | 0 |

| BANCO SANTANDER | 4 | 1 | 3 | 1 | 1 | 5 |

| BANKIA | 2 | 3 | 0 | 2 | 0 | 4 |

| BANKINTER | 1 | 0 | 0 | 4 | 0 | 1 |

| BBVA | 4 | 1 | 2 | 4 | 1 | 5 |

| CAIXABANK | 2 | 4 | 1 | 1 | 2 | 4 |

| CELLNEX TELECOM | 4 | 4 | 5 | 3 | 0 | 1 |

| CIE AUTOMOTIVE | 4 | 2 | 3 | 3 | 2 | 8 |

| ENAGÁS | 1 | 0 | 0 | 1 | 1 | 4 |

| ENDESA | 1 | 0 | 2 | 3 | 1 | 4 |

| FERROVIAL | 2 | 2 | 3 | 4 | 2 | 4 |

| GRIFOLS | 3 | 2 | 0 | 2 | 0 | 2 |

| GRUPO ACS | 1 | 3 | 0 | 2 | 0 | 3 |

| IAG | 2 | 2 | 2 | 1 | 2 | 5 |

| IBERDROLA | 4 | 0 | 1 | 2 | 1 | 5 |

| INDITEX | 0 | 0 | 1 | 3 | 1 | 6 |

| INDRA SISTEMAS | 2 | 3 | 1 | 1 | 0 | 1 |

| INMOBILIARIA COLONIAL | 1 | 3 | 0 | 0 | 1 | 1 |

| MAPFRE | 1 | 2 | 1 | 1 | 0 | 6 |

| MELIÁ HOTELS INTERNATIONAL | 2 | 1 | 2 | 2 | 1 | 1 |

| MERLIN PROPERTIES | 0 | 1 | 0 | 0 | 2 | 5 |

| NATURGY | 3 | 2 | 2 | 3 | 1 | 3 |

| PHARMAMAR | 2 | 0 | 0 | 2 | 1 | 4 |

| RED ELÉCTRICA CORPORACIÓN | 0 | 2 | 4 | 1 | 0 | 3 |

| REPSOL | 0 | 2 | 2 | 3 | 2 | 2 |

| SIEMENS GAMESA RENEWABLE ENERGY | 1 | 2 | 1 | 1 | 1 | 2 |

| SOLARIA ENERGÍA Y MEDIO AMBIENTE | 1 | 2 | 1 | 3 | 0 | 3 |

| TELEFÓNICA | 4 | 0 | 2 | 2 | 0 | 2 |

| VISCOFAN | 3 | 4 | 1 | 3 | 1 | 4 |

Note: Numbers report the count of distinct disclosed values per company and per CFAM© archetype, computed via a presence–absence tally (value = 1 if found for that company; 0 otherwise). Each value is mapped to exactly one archetype; table totals are the sum of 1 s across values.

Table A5.

Number of values by sector. Source: own research.

Table A5.

Number of values by sector. Source: own research.

| Number of Values by Archetype | |||||||

|---|---|---|---|---|---|---|---|

| Sector | People | Goals | Digital | Innovation | Norms | ESG | Total |

| automotive | 5 | 2 | 3 | 4 | 3 | 11 | 28 |

| construction, infrastructure, and real estate | 7 | 15 | 6 | 8 | 6 | 24 | 66 |

| diversified industrial products | 5 | 8 | 3 | 7 | 2 | 14 | 39 |

| energy | 10 | 8 | 12 | 16 | 6 | 24 | 76 |

| financial services | 19 | 15 | 10 | 14 | 6 | 25 | 89 |

| healthcare | 5 | 2 | 1 | 6 | 2 | 12 | 28 |

| retail and consumer products | 5 | 5 | 4 | 8 | 3 | 11 | 36 |

| technology, media and telecommunications | 12 | 9 | 12 | 7 | 1 | 8 | 49 |

Table A6.

Evaluation criteria scores ranging from 0 to 5 based on the scale derived from the “EY Maturity Assessment Tool”. Source: IV Comparative Report on Non-Financial Information Statements (EINF) of the IBEX-35.

Table A6.

Evaluation criteria scores ranging from 0 to 5 based on the scale derived from the “EY Maturity Assessment Tool”. Source: IV Comparative Report on Non-Financial Information Statements (EINF) of the IBEX-35.

| Valuation | Status | Meaning |

|---|---|---|

| 5 | Leader | Disclosure and transparency are deep. Performance is outstanding. The state of maturity of management mechanisms is at the level of best possible practices. |

| 4 | Advanced | Disclosure and transparency are extensive. Performance is outstanding. The state of maturity of the management mechanisms is advanced, on the way to the best possible practices. |

| 3 | Established | Disclosure and transparency are adequate. Performance is acceptable. The state of maturity of management mechanisms covers all key elements. |

| 2 | In development | Disclosure and transparency are limited. Performance is not satisfactory. The state of maturity of management mechanisms comes close to covering all core elements. |

| 1 | First steps | Disclosure and transparency are very limited. Performance is not satisfactory. The state of maturity of management mechanisms is still basic and early. |

Table A7.

Questionnaire and results for the sustainability governance indicator. Source: IV Comparative Report on Non-Financial Information Statements (EINF) of the IBEX-35.

Table A7.

Questionnaire and results for the sustainability governance indicator. Source: IV Comparative Report on Non-Financial Information Statements (EINF) of the IBEX-35.

| Consideration of ESG risks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Responsibility in sustainability management |

|

|

|

|

|

|

|

| Materiality analysis |

|

|

|

|

|

|

|

| Sustainability strategy |

|

|

|

|

|

|

|

| Economic resources and sustainability |

|

|

|

|

|

|

|

| Corporate policies |

|

|

|

|

|

|

|

|

|

|

Appendix B

Table A8.

fsQCA complex and parsimonious solutions. Source: own research.

Table A8.

fsQCA complex and parsimonious solutions. Source: own research.

| --- Parsimonious Solution --- | |||

| frequency cutoff: 1 | |||

| consistency cutoff: 0.792 | |||

| raw coverage | unique coverage | consistency | |

| ~ESG | 0.670 | 0.048 | 0.721 |

| DIGITAL | 0.763 | 0.141 | 0.836 |

| Solution coverage: 0.812 | |||

| Solution consistency: 0.758 | |||

| --- Complex Solution --- | |||

| frequency cutoff: 1 | |||

| consistency cutoff: 0.792 | |||

| raw coverage | unique coverage | consistency | |

| PEOPLE*GOALS*DIGITAL*~INNOVATION*~NORMS~ESGc | 0.297 | 0.214 | 0.792 |

| ~PEOPLE*~GOALS*DIGITAL*INNOVATION*NORMS*~ESGc | 0.348 | 0.265 | 0.972 |

| Solution coverage: 0.563 | |||

| Solution consistency: 0.878 |

Note: In fsQCA, “*” indicates the conjunction (AND) of conditions, while “~” denotes the absence (negation) of a condition. Presence or absence of a condition contributes to explaining the outcome based on combinations.

References

- Naveed, R.T.; Alhaidan, H.; Halbusi, H.A.; Al-Swidi, A.K. Do organizations really evolve? The critical link between organizational culture and organizational innovation toward organizational effectiveness: Pivotal role of organizational resistance. J. Innov. Knowl. 2022, 7, 100178. [Google Scholar] [CrossRef]

- Schein, E.H. The role of the founder in creating organizational culture. Organ. Dyn. 1983, 12, 13–28. [Google Scholar] [CrossRef]

- Schein, E.H. Organizational Culture and Leadership, 4th ed.; Jossey-Bass: San Francisco, CA, USA, 2010. [Google Scholar]

- Ekmekcioglu, E.B.; Öner, K. Servant leadership, innovative work behavior and innovative organizational culture: The mediating role of perceived organizational support. Eur. J. Manag. Bus. Econ. 2023, 33, 272–288. [Google Scholar] [CrossRef]

- Lok, P.; Crawford, J. The effect of organisational culture and leadership style on job satisfaction and organisational commitment. J. Manag. Dev. 2004, 23, 321–338. [Google Scholar] [CrossRef]

- Parboteeah, K.P.; Weiss, M.; Hoegl, M. Ethical climates across national contexts: A meta-analytical investigation. J. Bus. Ethics 2023, 188, 573–590. [Google Scholar] [CrossRef]

- Burke, J.J. Do boards take environmental, social, and governance (ESG) issues seriously? CEO dismissal after negative ESG media coverage. J. Bus. Ethics 2022, 176, 647–671. [Google Scholar] [CrossRef]

- Eccles, R.G.; Krzus, M.P. One Report: Integrated Reporting for a Sustainable Strategy; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Delbridge, R.; Helfen, M.; Pekarek, A.; Schuessler, E.; Zietsma, C. Organizing sustainably: Introduction to the special issue. Organ. Stud. 2024, 45, 7–29. [Google Scholar] [CrossRef]

- Lee, H.H.; Liang, W.-L.; Tran, Q.N.; Truong, Q.-T. Do old board directors promote corporate social responsibility? J. Bus. Ethics 2024, 195, 67–93. [Google Scholar] [CrossRef]

- Kardos, M. The reflection of good governance in sustainable development strategies. Procedia Soc. Behav. Sci. 2012, 58, 1166–1173. [Google Scholar] [CrossRef]

- Biermann, F.; Hickmann, T.; Sénit, C.; Beisheim, M.; Bernstein, S.; Chasek, P.; Grob, L.; Kim, R.E.; Kotzé, L.J.; Nilsson, M.; et al. Scientific evidence on the political impact of the Sustainable Development Goals. Nat. Sustain. 2022, 5, 795–800. [Google Scholar] [CrossRef]

- Atika, A.; Simamora, A.J. The effect of corporate culture on sustainability report quality. J. Akunt. 2024, 28, 100–124. [Google Scholar] [CrossRef]

- Linnenluecke, M.K.; Griffiths, A. Corporate sustainability and organizational culture. J. World Bus. 2009, 45, 357–366. [Google Scholar] [CrossRef]

- Awan, U.; Kraslawski, A.; Huiskonen, J. Governing interfirm relationships for social sustainability: The relationship between governance mechanisms, sustainable collaboration, and cultural intelligence. Sustainability 2018, 10, 4473. [Google Scholar] [CrossRef]

- Bauer, M.; Niedlich, S.; Rieckmann, M.; Bormann, I.; Jaeger, L. Interdependencies of culture and functions of sustainability governance at higher education institutions. Sustainability 2020, 12, 2780. [Google Scholar] [CrossRef]

- Senadheera, S.S.; Gregory, R.; Rinklebe, J.; Farrukh, M.; Rhee, J.H.; Ok, Y.S. The development of research on environmental, social, and governance (ESG): A bibliometric analysis. Sustain. Environ. 2022, 8, 2125869. [Google Scholar] [CrossRef]

- Bansal, P. Evolving sustainably: A longitudinal study of corporate sustainable development. Strateg. Manag. J. 2004, 26, 218. [Google Scholar] [CrossRef]

- Sharma, S.; Henriques, I. Stakeholder influences on sustainability practices in the Canadian forest products industry. Strateg. Manag. J. 2004, 26, 159–180. [Google Scholar] [CrossRef]

- Freeman, R.E. Five challenges to stakeholder theory: A report on research in progress. In Stakeholder Management; Emerald Publishing Limited: Bradford, UK, 2017. [Google Scholar] [CrossRef]

- Naciti, V.; Cesaroni, F.; Pulejo, L. Corporate governance and sustainability: A review of the existing literature. J. Manag. Gov. 2021, 26, 55–74. [Google Scholar] [CrossRef]

- Ragin, C.C. Measurement versus calibration: A set-theoretic approach. In The Oxford Handbook of Political Methodology; Oxford University Press: Oxford, UK, 2009; pp. 174–198. [Google Scholar] [CrossRef]

- Fedorowicz, J.; Sawyer, S.; Tomasino, A. Governance configurations for inter-organizational coordination: A study of public safety networks. J. Inf. Technol. 2018, 33, 326–344. [Google Scholar] [CrossRef]

- Pappas, I.O.; Kourouthanassis, P.E.; Giannakos, M.N.; Chrissikopoulos, V. Explaining online shopping behavior with fsQCA: The role of cognitive and affective perceptions. J. Bus. Res. 2015, 69, 803. [Google Scholar] [CrossRef]

- Pappas, I.O.; Woodside, A.G. Fuzzy-set qualitative comparative analysis (fsQCA): Guidelines for research practice in Information Systems and marketing. Int. J. Inf. Manag. 2021, 58, 102310. [Google Scholar] [CrossRef]

- Schmitt, A.K.; Grawe, A.; Woodside, A.G. Illustrating the power of fsQCA in explaining paradoxical consumer environmental orientations. Psychol. Mark. 2017, 34, 323–334. [Google Scholar] [CrossRef]

- Fiss, P.C. Building better causal theories: A fuzzy set approach to typologies in organization research. Acad. Manag. J. 2011, 54, 393–420. [Google Scholar] [CrossRef]

- Greckhamer, T.; Furnari, S.; Fiss, P.C.; Aguilera, R.V. Studying configurations with qualitative comparative analysis: Best practices in strategy and organization research. Strateg. Organ. 2018, 16, 482–495. [Google Scholar] [CrossRef]

- Pappas, I.O.; Giannakos, M.N.; Jaccheri, L.; Sampson, D.G. Assessing student behavior in computer science education with an fsQCA approach. ACM Trans. Comput. Educ. 2017, 17, 1–23. [Google Scholar] [CrossRef]

- Plewa, C.; Ho, J.; Conduit, J.; Karpen, I.O. Reputation in higher education: A fuzzy set analysis of resource configurations. J. Bus. Res. 2016, 69, 3087–3095. [Google Scholar] [CrossRef]

- Vatrapu, R.; Mukkamala, R.R.; Hussain, A.; Flesch, B. Social set analysis: A set theoretic approach to big data analytics. IEEE Access 2016, 4, 2542–2571. [Google Scholar] [CrossRef]

- Sergis, S.; Sampson, D.G.; Giannakos, M.N. Supporting school leadership decision making with holistic school analytics: Bridging the qualitative-quantitative divide using fuzzy-set qualitative comparative analysis. Comput. Hum. Behav. 2018, 89, 355–366. [Google Scholar] [CrossRef]

- Hofstede, G. Culture’s Consequences: International Differences in Work Related Values (review). Organ. Stud. 1983, 4, 390–391. [Google Scholar] [CrossRef]

- Triandis, H.C. Individualism and Collectivism; Westview Press: Boulder, CO, USA, 1995. [Google Scholar]

- Rondinelli, D.A.; London, T. How corporations and environmental groups cooperate: Assessing cross-sector alliances and collaborations. Acad. Manag. Perspect. 2003, 17, 61–76. [Google Scholar] [CrossRef]

- Fernández-Kranz, D.; Santaló, J. When necessity becomes a virtue: The effect of product market competition on corporate social responsibility. J. Econ. Manag. Strategy 2010, 19, 453–487. [Google Scholar] [CrossRef]

- Gutiérrez-Ponce, H. Sustainability as a strategy base in Spanish firms: Sustainability reports and performance on the Sustainable Development Goals. Sustain. Dev. 2023, 31, 3008–3023. [Google Scholar] [CrossRef]

- De Silva Lokuwaduge, C.S.; Heenetigala, K. Integrating environmental, social and governance (ESG) disclosure for a sustainable development: An Australian study. Bus. Strategy Environ. 2016, 26, 438–450. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Aragón-Correa, J.A.; Marano, V.; Tashman, P.A. The corporate governance of environmental sustainability: A review and proposal for more integrated research. J. Manag. 2021, 47, 1468–1497. [Google Scholar] [CrossRef]

- Aleqedat, H.Q.H. The impact of the culture on corporate governance (board structure) in Jordan context. In Corporate Governance—Recent Advances and Perspectives; IntechOpen: London, UK, 2021. [Google Scholar] [CrossRef]

- Arduini, S.; Manzo, M.; Beck, T. Corporate reputation and culture: The link between knowledge management and sustainability. J. Knowl. Manag. 2023, 28, 1020–1041. [Google Scholar] [CrossRef]

- Jin, X.; Lei, X. A study on the mechanism of ESG’s impact on corporate value under the concept of sustainable development. Sustainability 2023, 15, 8442. [Google Scholar] [CrossRef]

- Deirmentzoglou, G.A.; Agoraki, K.K.; Patsoulis, P. The nexus between cultural values and perceptions of corporate sustainable development. Soc. Responsib. J. 2023, 20, 224–242. [Google Scholar] [CrossRef]

- Al Rawaf, R.A.; Alfalih, A.A. The role of governance in achieving sustainability in family-owned business: Do responsible innovation and entrepreneurial culture matter? Sustainability 2023, 15, 5647. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations; Sage: London, UK, 1995. [Google Scholar]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Agustia, D.; Supratiwi, W.; Jermias, J. High-quality integrated reporting based on concentrated versus dispersed ownership. J. Competitiveness 2023, 15, 3–18. [Google Scholar] [CrossRef]

- Pasamar, S.; Bornay-Barrachina, M.; Morales-Sánchez, R. Institutional pressures for sustainability: A triple bottom line approach. Eur. J. Manag. Bus. Econ. 2023. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Conner, K.R. A historical comparison of resource-based theory and five schools of thought within industrial organization economics: Do we have a new theory of the firm? J. Manag. 1991, 17, 121–154. [Google Scholar] [CrossRef]

- Peteraf, M.A. The cornerstones of competitive advantage: A resource-based view. Strateg. Manag. J. 1993, 14, 179–191. [Google Scholar] [CrossRef]

- Davis, G.F.; DeWitt, T. Organization theory and the resource-based view of the firm: The great divide. J. Manag. 2021, 47, 1684–1697. [Google Scholar] [CrossRef]

- Ludwig, P.; Sassen, R. Which internal corporate governance mechanisms drive corporate sustainability? J. Environ. Manag. 2022, 301, 113780. [Google Scholar] [CrossRef]

- Ren, S.; Fan, D.; Tang, S. Organizations’ management configurations towards environment and market performances. J. Bus. Ethics 2023, 188, 239–257. [Google Scholar] [CrossRef]

- Ernst; Young, S.L. Rethinking Sustainability. IV Estudio Comparativo De Los Estados De Información No Financiera Del IBEX 35 Resumen Ejecutivo. 2021, pp. 2–4. Available online: https://www.ey.com/es_es/insights/rethinking-sustainability/iv-informe-comparativo-del-estado-de-la-informacion-no-financiera (accessed on 22 October 2024).

- Leal-Rodríguez, A.L.; Sanchís-Pedregosa, C.; Moreno-Moreno, A.M.; Leal-Millán, A.G. Digitalization beyond technology: Proposing an explanatory and predictive model for digital culture in organizations. J. Innov. Knowl. 2023, 8, 100409. [Google Scholar] [CrossRef]

- Quinn, R.E.; Rohrbaugh, J. A competing values approach to organizational effectiveness. Public Prod. Rev. 1981, 5, 122. [Google Scholar] [CrossRef]

- Cameron, K.S.; Quinn, R.E. Diagnosing and Changing Organizational Culture, Based on the Competing Values Framework; Addison Wesley: Boston, MA, USA, 1999. [Google Scholar]

- Llopis-Albert, C.; Palacios-Marqués, D.; Simón-Moya, V. Fuzzy set qualitative comparative analysis (fsQCA) applied to the adaptation of the automobile industry to meet the emission standards of climate change policies via the deployment of electric vehicles (EVs). Technol. Forecast. Soc. Change 2021, 169, 120843. [Google Scholar] [CrossRef]

- López-Cabarcos, M.Á.; Vázquez-Rodríguez, P.; Piñeiro-Chousa, J.R. Combined antecedents of prison employees’ affective commitment using fsQCA. J. Bus. Res. 2016, 69, 5534–5539. [Google Scholar] [CrossRef]

- Misangyi, V.F.; Greckhamer, T.; Furnari, S.; Fiss, P.C.; Crilly, D.; Aguilera, R. Embracing causal complexity. J. Manag. 2016, 43, 255–282. [Google Scholar] [CrossRef]

- Schneider, C.Q.; Wagemann, C. Set-Theoretic Methods for the Social Sciences: A Guide to Qualitative Comparative Analysis; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Pappas, I.O. User experience in personalized online shopping: A fuzzy-set analysis. Eur. J. Mark. 2018, 52, 1679–1703. [Google Scholar] [CrossRef]

- Ragin, C.C. Redesigning Social Inquiry: Fuzzy Sets and Beyond; University of Chicago Press: Chicago, IL, USA, 2008; Volume 240. [Google Scholar] [CrossRef]

- Rihoux, B.; Ragin, C. Configurational Comparative Methods: Qualitative Comparative Analysis (QCA) and Related Techniques; SAGE Publications: Thousand Oaks, CA, USA, 2009. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).