Abstract

This study investigates the moderating role of independent directors on corporate boards in raising the ESG reporting for non-financial listed firms in Pakistan to strive for a greener revolution around the economy. A sample of 369 firms listed and operated on the Pakistan Stock Exchange (PSX) for a period covering 2012–2023 (both inclusive) have been taken out of a target population of 456 non-financial listed firms. The results are investigated using bivariate, multiple, and hierarchical regression analyses. This study has significant findings in the context of Pakistan and can be generalized to struggling economies around the globe. The interventional role of independent directors has significant findings for the full model. Findings from the Corporate Social Responsibility Strategy Score (CSRSS) are inconclusive irrespective of the measurement method used, i.e., environmental innovation score (EIS) or environmental pillar score (EPS). Environmental, Social, Governance Score (ESGS) has revealed a positive and significant impact when EIS is used as a performance variable, whereas when EPS is taken as a performance measure, the results are significant and negative. Under the lens of stakeholders’ theory, upper echelon theory, and agency theory, this study contributes to the corporate governance domain and the literature on environmental improvisation and ESG reporting. Researchers, statutory authorities, and academicians can benefit from it. The vital role of independent directors is the key to developing economies to strive for a sustained greener environment. This study is the first in the Asian and, specifically, Pakistani context to take on the interventional role of independent directors in promoting ESG reporting requirements for corporate greener revolution efforts.

1. Introduction

Pakistan is a country which has been surrounded by multiple crises since its inception, and with every day passing by, these troubles are aggravating at an accelerating pace [1]. These crises include an energy crisis [2], political instability [3], geo-political issues [4], ethnic and provincial problems [5], and environmental concerns [6]. Environmental concerns, including sustainability reporting on the part of firms, have been symbolic [7]. However, constant monitoring from the regulatory authorities has pushed firms to move from symbolic CSR and ESG activities to reality. At the global outset, corporate firms have started reporting the United Nations’ indicator for SDGs in their annual audited financial reports in compliance with sustainability practices. Sustainability reports serve multiple purposes to firms, winning the trust of the stakeholders [8] and improving the transparency and accountability of the business operations [9]. Sustainability reporting and compliance lead to a greener revolution, but less evidence is available in the context of Pakistan regarding fair sustainability reporting and its compliance [10]. On account of the low evidence available in the literature, the sustainability reports of firms fail to depict the true position related to CSR- and ESG-related activities compared to developed nations. The governance structure of non-financial listed firms in Pakistan is in its infancy compared to developed countries, so firms are facing many issues of compliance with sustainability [11].

Sustainability reporting comprises two pillars: CSR reporting and ESG reporting. CSR expands its boundary lines in the corporate culture setup involving environmental, social, and governance (ESG) theory. CSR and ESG scores are broadly accepted as indicators for measuring how socially responsible a firm is [12,13]. The reporting of CSR and its related activities has gotten significant attention in most advanced and developed countries like the USA, EU, China, and UK, where the disclosure regarding CSR has been made mandatory so as to have a transparent disclosure of information related to the environment [14]. Pakistan Securities and Exchange Commission of Pakistan (SECP)) has directed non-financial listed firms to disclose CSR-related activities, but this has yet to be made mandatory [15]. Results regarding CSR reporting and related financial and social outcomes are inconclusive [16,17,18]. Still, firms reporting and practicing CSR activities have significantly contributed to a greener society [19]. Also, to avoid pressure from external forces, including government regulatory authorities, shareholders, lenders, etc., CSR reporting acts as a tool to release the pressure on a firm.

In the most recent era, ESG reporting has played a decisive role in divulging corporate concerns and social, environmental, and governance practices [20]. Transparent disclosures ensure that firms can win the faith and trust of all primary, secondary, and connected stakeholders. This shows how much a company feels it has accountability to the community at large [21,22]. From the viewpoint of stakeholders, it becomes easier to assess the company’s role in making the environment greener and revitalizing it, keeping in view its ESG performance disclosures [23]. The ESG score of any company reflects its performance by considering its ESG issues [24]. A rising interest in the ESG requirements at the corporate outset explains firms’ concern towards the social well-being of society as a whole. The sustainability reports of the firms yield a crystal-clear view for all the stakeholders interested in knowing about the firms’ efforts towards environmental performance [25,26]. Through sustainability reports, one can find evidence about the information that cannot form a part of the financial statements, such as corporate governance practices, environmental effluences, and the rights of the people in general [27].

With the advent and evolution of greener practices involving financial reporting frameworks, corporate governance practices, and environmental issues, rating agencies have significant value where ESG ratings are accepted. The ESG ratings help to raise environmental performance standards with the aid provided by the external stakeholders, especially those who are directly held liable for environmental protection as in Pakistan, and to make the performance greener, like the stipulations of the Pakistan Environmental Protection Act 1997 (PEPA), Parks and Horticulture Authority (PHA), Pakistan Space and Upper Atmosphere Research Commission (SUPARCO), etc. [28,29,30]. The modernization of industry has worsened and even aggravated environmental damages like air pollution, water contamination, depletion of the ozone layer, deforestation, carbon emissions, and ocean acidification in Pakistan in the last few decades [31]. It has become necessary to make the masses aware of the complications arising from environmental hazards and the remedial measures for them. The existing literature lacks studies regarding ESG scores for greener environmental practices [32,33]. For instance, in the literature on ESG ratings’ role in corporate restructuring and advancement in underdeveloped countries [34], the literature findings stood as being significant for all stakeholders, including direct, indirect, and connected stakeholders.

Independent directors are hired on a board to ensure transparency and safeguard the stakeholders’ interests. Their presence on a board is always a relief for the stakeholders, who believe their stakes remain protected [35,36]. The role of independent directors is decisive in this case, as they are blessed with experiences and skills and with educational, professional, and technical backgrounds, which helps them understand what a stakeholder demands. In alliance with the rest of the board, the independent directors add value to the firm, contributing to a greener environment by making ESG reporting transparent and fair [37,38]. That is why the present study has included the moderating role of independent directors in ESG reporting and corporate greener revolution practices in Pakistan.

Regarding ‘Environmental practices’, this study examines waste management, pollution control, carbon emissions, and sustainability. The ‘Social aspects’ of ESG practices encompass compliance with labor laws, workplace safety, human rights, employee education and medical benefits (including outdoor work provisions), and healthy employee relations. Governance factors include ethical leadership, robust internal controls, equitable stakeholder rights, and transactional transparency [39]. Detailed frameworks for these dimensions are provided in Appendix A, Appendix B, Appendix C and Appendix D. Over time, firms in Pakistan have increasingly recognized their ESG responsibilities and adopted sustainable practices to align with financial goals and broader organizational objectives. Recently, the Principle of Responsible Investment (PRI) and the Enhanced Analytics Initiatives (EAI) have emerged as key drivers of ESG implementation in Pakistan [40]. However, as a low-income developing economy, Pakistan has been slow to adopt global ESG updates [41]. In 2009, the Securities and Exchange Commission of Pakistan (SECP) mandated all firms to disclose ESG practices and outcomes in their annual audited reports [42,43].

To measure the green revolution, various indicators are employed in the literature, the most common being the Environmental Innovation Score (EIS) [24,44] and Environmental Pillar Score (EPS) [45,46], both widely used in recent studies. Researchers, governments, and regulatory authorities consistently urge businesses to adopt responsibly and integrate eco-friendly technologies into their operations to foster a greener economy and mitigate the adverse effects of industrial processes. Similarly, environment-friendly is critical to achieving a green revolution [47]. The development of eco-friendly products and processes is closely tied to investments in R&D-related activities, directly impacting the firm’s revenue and profitability. Although the benefits may not be immediate when investing in green solutions from a strategic point of view, it is worth it in terms of the firm’s market share enhancement and value appraisal [48]. A significant body of literature shows positive results of a higher greener innovation ratio on the firm’s financial outcomes. A study of Chinese manufacturing companies investigated the positive impact on financial performance mediating the role of environmental performance [49]. Still, there are contrary arguments that challenge the win-win narrative. Some studies challenged it, and cited that it is quite challenging to prove that investment in environmental greenery may return financially [50]. Furthermore, greener innovation surely brings eco-friendly products and processes at the cost of environmental externalities. Once the market downturns during this high-earned period, the reward for greener innovation gets even lower than their investment [51,52].

Environmental innovation score is the result of finding the ratio of all eco-friendly innovations by firms to the total innovations in an industry, i.e.,

where

- EIS = environmental innovation score;

- m = total number of innovation activities or processes performed in an accounting period;

- n = total number of innovation activities noted in an industry in an accounting period.

The similar environmental pillar score (EPS) is calculated based on the weights assigned to the activities taken from CSR or ESG activities.

where

- EPS = environmental pillar score;

- m = total number of activities or processes performed by a firm in an accounting period;

- n = total number of activities noted in an industry in an accounting period.

The current study aims to examine the role of ESG practices of non-financial listed Pakistani firms in driving the green revolution in Pakistan with a focus on the moderating role of board independence. This research is the first to analyze the combined role of CSR assessment scores and ESG practices in Pakistan’s green revolution while accounting for board independence. The study’s second objective is to assess the impact of ESG reporting within the context of a developing economy like Pakistan on the transition toward a greener revolution. The third objective is determining whether ‘Board independence’ enhances corporate governance in this context. Methodologically, the study used the panel regression analysis technique alongside hierarchical regression to test the hypotheses. Empirical results demonstrate that ESG adoption is significantly and positively related to green practices. Similarly, board independence shows a significant positive association with ESG reporting and the green revolution [24,53]. Based on these findings, the following research questions need to be addressed in the current literature:

RQ1:

Does CSRSS impact the greener revolution (using EIS and EPS as performance measures) in the context of Pakistan?

RQ2:

Does ESGS impact the greener revolution (using EIS and EPS as performance measures) in the context of Pakistan?

RQ3:

Does the board independence moderate the relationship between CSRSS and the greener revolution (using EIS and EPS as performance measures) in the context of Pakistan?

RQ4:

Does the board independence moderate the relationship between ESGS and the greener revolution (using EIS and EPS as performance measures) in the context of Pakistan?

The study covers a 12-year sample period from 2012 to 2023 (inclusive). From a target population of 456 non-financial listed firms, we selected a sample of 369 firms. Our research identifies a significant gap in the context of Pakistan regarding ESG reporting and firms’ transition toward a green revolution while examining the moderating role of independent directors as a key element of board diversity. These findings open new avenues for academic researchers practitioners, and regulatory authorities in Pakistan. Moreover, the results may be generalized to other developing countries in Asia.

The paper is structured as follows: Section 2 presents the literature review, including the theoretical framework, hypothesis development, and conceptual framework. Section 3 describes data and methodology, detailing the econometric model and variable operationalization. Section 4 presents and interprets the results, while Section 5 provides concluding remarks.

2. Literature Review and Hypothesis Development

2.1. Theoretical Framework

Sustainability reporting strongly impacts corporate performance, where all the stakeholders are equally addressed. The study under consideration is multidimensional, including the stakeholders, the resources of the firm, and the corporate governance domain, where the moderating role of independent directors can be seen. Three-dimensional research is hard; it is hard to justify using one single theory that encompasses all the issues at a time. Therefore, theoretical support from three theories is taken: stakeholder theory, resource-based theory, and agency theory. Since the literature involves stakeholders of all types, i.e., direct, connected, and indirect stakeholders, ‘stakeholder theory’ seems most appropriate to deal with the social performance of the non-financial listed firms [54]. The literature is evidence of the use of stakeholder theory, where the concern is testing the role of ESG reporting in a greener environment [55,56]. Under this theory, corporations tend to design a network of people comprising social and local communities [57,58]. The second theory, which is evidenced by the literature, is resource-based. The rationale behind making the theory a basis for this study is that non-imitable resources like waste recycling techniques, unique efforts, or resource inputs to make the environment free of pollution have been a core competence and a resource of companies, which are difficult to replicate [59]. These techniques not only help save costs but also assist in winning the customer’s loyalty and growing the customer base. Since organizations are consistently working on developing internal processes and upgrading through Balancing, Modernization, and Replacement (BMR), ‘resource-based theory’ is a good fit for theoretical foundations [60]. Resource-based theory likely advocates for the green revolution, as it aims to mitigate the pollution and carbon emissions (CO2) produced by manufacturing [61,62]. That is why resource-based theory is added to strengthen the theoretical foundations. The moderation of the independent board directors raises the issue of conflict between the principal and agent, which is covered by the agency theory in most of the literature [63,64]. Hence, agency theory is added to mitigate the agency issues between the principal and agent. ESG reports comprise the decisions of board management relating to green revolutions.

The presence of independent directors on the board helps reduce agency conflicts, which serve the interest of all the stakeholders best. This parallels the resource-based and upper echelon theories [24,65]. Competitive advantage in terms of cost leadership or product pioneering is one of the firms’ aims to gain a competitive and sustainable edge in the market. The most important task is not the attainment of the resources but the effective and efficient utilization of those resources, keeping in view the minimal environmental retardations [66].

2.2. The Role of Corporate Social Responsibility in the Greener Revolution

In sustainability reporting, firms unveil their CSR and ESG information in their financial statements to inform the stakeholders of their contribution to society [12]. CSR and ESG reporting are discussed to determine their relative impact on a greener environment. With the advent of greener practices, the demand for CSR has kept rising in less developed economies like Pakistan. CSR has caught significant attention from stakeholders, including research analysts and board members. A handful of the literature supports an association between the firm’s CSR activities and the greener revolution [17,67]. The adoption and application of CSR practices by the industrial sector unanimously and by all the firms at the national level results in achieving ‘Go Greener’, helps maintain and sustain product quality, mitigates operational costs, and, above all, results in customer loyalty [68]. Eventually, there will be an expected gradual rise in profitability for the years to come, which results in common stockholders’ wealth maximization [69]. Organizations that are steering towards a greener environment are expected to follow pertinent CSR practices; without consistently following and applying CSR practices in business operations, ‘Go Greener’ turns out to be merely a slogan for nothing [70]. It is evident that, on account of pressure from stakeholders and regulatory authorities, and due to owing liability to society, firms are undertaking CSR activities seriously, which not only minimizes the burden on stakeholders but also boosts the earning potential of the firm. Likewise, firms practicing CSR activities lead to attaining and sustaining long-term strategic goals, including a greener environment [71,72].

These days, firms are making worthwhile investments in CSR-related activities. This has a multiplier effect on the return on investment of the firms [73,74]. In parallel, production units have started complying with global sustainable practices through greener practices, including removing obsolete production processes and replacing them with eco-friendly ones [75]. The urge to ‘Go Greener’ leads to compliance with CSR practices, which achieve financial stability, lessening the inverse outcomes of obsolete production processes and revealing a real-time greener environmental change. Additionally, the GI (greener innovation) enhances the productivity, efficiency, and enhancement of the customer network while retaining the existing one [76]. Pakistan is a struggling and developing economy where firms take CSR activities as a window dressing to manipulate their earnings quality. Still, a greener environment is a dream. However, based on global changes, listed firms in Pakistan have started taking CSR activities seriously and practicing them to have a ‘greener revolution’ in society [76,77].

The literature shows a positive association between CSR practices and GI (greener innovation). A study of 424 Chinese manufacturing firms using a linear regression model revealed a significant positive association between the firms’ CSR activities and greener process innovation [78]. Likewise, results are discovered from a study in Ghana where a cross-sectional sample of employees over six months revealed the positive impact of the CSR activities of the firm towards employees, which led to green innovations and raised the firm’s social performance [79]. Similar findings from the literature included a sample of 204 manufacturing firms from the Malaysian stock exchange which yielded a significant and positive association between CSR and green innovation [53]. This discussion, dealing with the CSR activities of firms, calls for the need to frame and test hypotheses concerning a greener environment using EIS and EPS in the context of Pakistani listed firms.

H1:

CSRSS has a positive and significant impact on the greener revolution as measured using EIS.

H2:

CSRSS has a positive and significant impact on the greener revolution as measured using EPS.

2.3. The Role of ESGS on the Greener Revolution

The second integral part of sustainability reporting is the role of ESG reporting and practice in shaping a greener environment. Without the inclusion of ESG reporting in their sustainability reporting, transparency cannot be attained, and neither can the trust of the stakeholders [80]. The ESG performance of the firms is rated based on investments and returns arising out of their greener projects [81]. The ESG ratings discuss the precious and worthy resources comprising a greener technological edge over others, social responsibilities towards communities, and a firm’s environmental concerns [82]. ESG is a 3D phenomenon, addressing the stakes of all stakeholders: suppliers, customers, and statutory authorities. ESG reporting encourages greener practices by incorporating a competitive edge for the firms who incorporate these practices over the others [83]. ESG practices help raise firms’ growth, improvisation, and BMR (Balancing, Modernization, and Replacement), initiating greener activities and establishing and maintaining strategic relations with all stakeholders. Not only has this occurred, but the significant growth of immovable assets has also resulted in a rise in firms’ value. This will help the potential stakeholders to make short-term or strategic decisions in favor of the firm, ultimately allowing firms to grow exponentially [84,85]. Another study suggests that firms’ significant ESG performance meets stakeholders’ demands, compromising cost-effectiveness by raising its value in return.

ESG practices drive greener innovation; contrary to that, firms that breach ESG standards or practices sooner end up with customer loyalty and reputational losses, losing their market value [86]. A practical ESG framework also reduces the cost of implementing a greener environment while transforming the traditional production process into a greener one. A sustainable and competitive greener environment is always challenging for firms as it involves huge capital outlay and many bottlenecks to the existing corporate governance framework [87]. ESG practices and their implementation are considered a ‘strength’ in the ‘SWOT’ matrix and a ‘weakness’ if not appropriately managed. ESG reflects the firm’s commitment and seriousness towards greener evolutions, which ensures the inflow of funds from the stakeholders and assists in the organization’s sustainability [88].

Most research investigates ESG reporting as being significantly and positively associated with the firm’s financial performance [81,89,90]. A panel data analysis using quantile regression from 37 countries investigated a significant positive association between ESG and greener innovation from 1990 to 2019 [91]. Another study produced similar results, where a sample of 223 Chinese firms produced significant results between ESG performance and green innovation moderating R&D role for a period covered 2015–2018 by using multiple regression analysis. Likewise, ESG practices are revolutionizing a greener environment as they embed a sense of responsibility in the stakeholders, whether direct, indirect, or connected, once communicated effectively at all hierarchical levels [92]. This discussion can be allied with the practical implementation of a greener revolution.

Pakistan is a struggling economy with stagflation, political disturbances, ethical issues, and, above all, ESG used as window dressing [39]. In the context of Pakistan, sustainability reporting is in its infancy; firms are treating ESG reporting as a cosmetic treatment because of the weak governance framework, and ESG reporting and practice remain symbolic [93]. Still, a good amount of the literature supports that listed firms have started following ESG regulatory requirements as an aggregate to make society greener and win stakeholders’ trust [43]. The literature demands that hypotheses for ESG and greener revolution in the context of Pakistan be framed using EIS and EPS as performance measures, which are as follows:

H3:

ESGS has a positive and significant impact on the greener revolution as measured using EIS.

H4:

ESGS has a positive and significant impact on the greener revolution as measured using EPS.

2.4. Board Independence as Moderator

Under upper echelon theory, independent directors are sometimes not a part of the firm’s management and are not influenced by the BOD. Still, they are supposed to bring with them exposure and valuable perspectives for the stakeholders as they are held liable to monitor the decisions taken by the corporate board closely [94]. In corporate governance frameworks, independent directors are an obstacle to the poor financial performance of the firm [95]. It is also contended that independent directors bring greater satisfaction for all the stakeholders, so a firm that has a good reputation in terms of ‘independent directors’ can gain the emotional favor of all the current and prospective stakeholders, whether they are direct, indirect, or connected stakeholders [96,97]. An independent director’s role is directly proportional to the environmental revolution and climatic change [98,99]. Independent directors are called ‘green directors’ and ‘eco-friendly directors’ because they emphasize making and revolutionizing a greener environment [98,100].

In the Pakistan corporate governance framework, the presence of independent directors and their significance from different viewpoints cannot be overlooked. Their role in real-time reporting practice, not remaining confined to cosmetic treatment, is second to none [101]. It is further contended that including independent directors on the board assists the management in converting CSR practices to a policy framework that strengthens the allied disclosure requirements in the context of Pakistani listed firms [35,102]. Additionally, from the viewpoint of managing earnings, manipulating financial statements, and having an accurate and fair view of financial statements, the role of an independent board of directors is quite crucial in Pakistan, keeping in view different scams, like the Taj company scandal, Mehran Gate scandal, and Pakistan Telecommunication Limited [103,104]. This push factor is a reason to add the role of independent directors as moderators in the current literature to investigate the results of the presence of independent directors on the board.

The following hypotheses are framed by considering independent directors’ roles in Pakistan’s greener revolution:

H5:

Board independence significantly moderates the association between CSRSS and the corporate greener revolution as measured using EIS.

H6:

Board independence significantly moderates the association between CSRSS and the corporate greener revolution as measured using EPS.

H7:

Board independence significantly moderates the association between ESGS and the corporate greener revolution as measured using EIS.

H8:

Board independence significantly moderates the association between ESGS and the corporate greener revolution as measured using EPS.

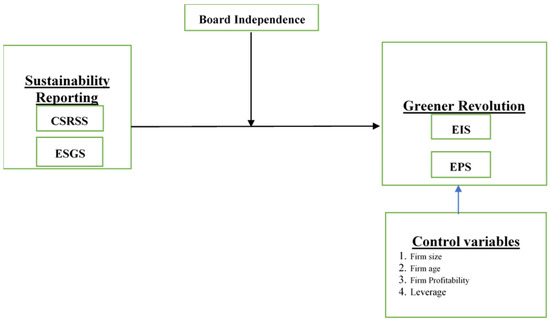

2.5. Conceptual Framework

Three variables are part of this research work. The greener revolution is the dependent variable of the study under consideration. EPS (environmental pillar score) and EIS (environmental innovation score) are used to measure the greener revolution. ESG reporting is considered an independent variable; ESG scores and CSR strategy scores are used to measure the independent variables. Additionally, board independence is taken as a moderating variable of the model. To measure the board independence, the ratio of the total number of independent board members to the total board members is taken. The conceptual framework is shown in Figure 1.

Figure 1.

Conceptual framework.

3. Data and Methodology

3.1. Data Collection and Sampling Technique

Using probability sampling, a sample of 369 non-financial listed firms is taken from a target population of 456 non-financial listed firms from PSX. Out of those 456 firms, 42 are found to be defaulters, and these are excluded from the targeted data. Probability sampling is applied to the rest of the 414 firms to arrive at the final sample of 369 firms. Multiple regression and hierarchal regression analyses are used to affirm the hypotheses. The firms are ordered as per their top market capitalization using ‘World Bank ESG data’, the ‘GRI’ database, and ‘PSX’ for the 12-year period covered, i.e., 2012 to 2023, inclusive of both. ‘Greener business revolution’ is the study’s dependent variable, whereas ESG reporting is an independent variable, taking ‘board independence’ as a moderator of this study. Firm size, firm age, firm profitability, and leverage ratio are the control variables of this study. The budget quota allotted to the greener revolution is associated with the sales revenue earned in a particular accounting period. A higher sales revenue in a specific accounting period refers to higher spending on the greener revolution by the business unit [105,106]. Likewise, higher revenues earned are related to firms spending more money on greener revolutions, reflecting the stakeholders’ interest and trust in the firms’ operations [107].

ESG reporting is measured using two variables. CSRSS is taken as an average score of all the indicators found in the annual audited reports, as mentioned in the previous literature [108]. For ESGS, the weighted average score of the indicators found in the annual audited reports of PSX is taken [109]. The greener revolution can be explained as an effort to reframe production processes using tools and techniques to lessen environmental hazards while lowering the rate of resource depletion [110]. In the research under discussion, environmental innovation and pillar score (EIS) is a proxy measure for the greener revolution that firms aim to achieve in Pakistan. EIS is the weighted average score of innovations, resource consumption, and overall emissions [111]. EPS is the weighted average of four indicators taken from the annual audited reports, including environmental management practices, resource usage efficiency, climate change strategies, biodiversity, and land use, as is evident in the literature [112].

To address multicollinearity, predictors were standardized after assessing bivariate correlations. The panel regression technique assesses the direct effect with fixed and random effects. In contrast, the hierarchical regression model predicts the moderating role of board independence. Pooled OLS deals with sample heterogeneity, whereas the fixed-effect model considers the time-invariant differences with varying intercepts due to historical business variations. Lastly, the random-effects model captured time-based variations within and across sections.

In Appendix A, Appendix B, Appendix C and Appendix D, indicators comprising all the factors relating to ESG reporting and the greener revolution taken from the annual audited reports of non-financial firms listed on PSX are shown.

3.2. Econometric Model

Eight variables are taken in the econometric model to test the hypotheses, including firm size, firm age, firm profitability, and leverage, which are the control variables of the firm. EIS and EPS are proxy measures for environmental innovation, whereas ESG reporting is covered using CSRSS and ESGS. Board independence is the moderator of the study. Equations (1) and (2) are used to assess , which assesses the direct effect of CSRSS and ESGS on the EIS and EPS. Equations (3) and (4) are used to estimate the moderating role of Bind on EIS and EPS to affirm .

The acronyms used in the four equations above stand for the following:

CSRSS = Corporate Social Responsibility Strategy Score, ESGS = Environmental, Social, Governance Score, EIS = environmental innovation score, EPS = environmental pillar score, Fs = firm size, Fage = firm age, FP = firm profitability, Lvg = leverage, Bind = board independence.

Table 1 comprises the operationalization of variables, explaining the ESG reporting, greener revolution, board independence, and control variables, and their proxies, measurement criteria, and references.

Table 1.

Operationalization of Variables.

4. Results and Interpretation

Table 2 presents the results of bivariate statistical analysis, including mean, standard deviation, and correlation coefficients for ESG reporting, the Greener Revolution, and the moderator Board independence (Bond). The analysis is based on a sample of 369 non-financial listed firms over 12 years (2012–2023), yielding 4,428 firm-year observations. Positive and significant findings are noted in ESGS, EIS, and EPS. Only ‘Bind’ yields a significant negative correlation. All these are positive indicators for a developing economy like Pakistan, where the firms aim at a greener revolution by taking drastic steps to better themselves and the nation.

Table 2.

Bivariate statistical analysis.

The results show that a positive association between board independence and EIS unveils the directors’ concern about adopting eco-friendly innovations. In contrast, a negative association with EPS shows that directors strive for short-term goals instead of having a longer strategic perspective. All correlation coefficients were below 0.80, confirming no multicollinearity issues in the dataset.

Table 3 represents the multiple regression analysis exclusive of the moderator, using two performance variables, EIS and EPS. The aim is to explore the association between ESG reporting and the environmental revolution.

Table 3.

Multiple regression model (excluding moderator ‘Bind’).

In Table 3, model 1 represents a multiple regression model without the moderator ‘Bind’, using EIS as the performance measure. The first column of Table 3 represents the Pooled OLS analysis, where a significant negative effect of CSRSS on EIS (β = −2.98, p < 1%) and a considerable positive impact of ESGS on EIS (β = 0.88, p < 5%) is investigated, whereas this significance is absent in random and fixed effects and the results are inconclusive. The significant findings of ESGS show that firms are striving for environmental greenery. The BP-LM test justifies using a random effect model over Pooled OLS as reflected by (chi2 = 2583.66, p < 1%). Due to the presence of fixed effects in the model, the Hausman test is conducted, demonstrating the use of the fixed effect over random effect model, as suggested by (chi2 = 19.87, p < 1%). When considering EIS, the Pooled OLS produces more significant results than the random and fixed effect model.

In Table 3, model 2 represents multiple regression analysis without the moderator ‘Bind’, using EPS as a performance measure. It is discovered that CSRSS is significantly positive under Pooled OLS regression (β = 0.39, p < 5%) and keeps on improving with the application of RE (β = 0.53. p < 5%) and FE (β = 0.71, p < 1%), as can be seen by their respective regression coefficients. This situation reflects that the non-financial listed firms of Pakistan are investing at higher levels in CSR-related activities, focusing on a greener revolution in the Pakistani environment, accepting . But with ESGS, a positive and significant association is cited with EPS using Pooled OLS, as (β = 0.29, p < 1%). This means that firms with a better ESGS (using Pooled OLS) are better at taking steps for environmental revolution. With the involvement of the RE and FE model, the situation is becoming worse, as results are negative, and even the FE model suggests that firms with a higher ESGS have a lower inclination towards a greener revolution, as reflected by (β = −0.28, p < 5%). Most funds keep investing in ESGS-related activities, compromising the greener revolution objective. The BP-LM test favors RE over Pooled OLS as (chi2 = 813.04, p < 1%); such a lower probability value prioritizes RE over Pooled OLS. The Hausman test suggests that the FE model is preferred over RE because of its lower p-value (chi2 = 22.81, p < 1%).

Table 4 represents a multiple regression model including the moderator ‘Board independence’ and its impacts on the greener revolution aims of non-financial listed firms from Pakistan. Model 1 represents the impact of CSRSS on the EIS of the firm. Pooled OLS shares a significant positive impact of CSRSS on the EIS of the firm, as reflected by its coefficient (β = 4.77, p < 1%), but moving the model from RE to FE, the results are cited as inconclusive, rejecting H1, as no significant findings are noted. In model 2, EPS is taken as a performance variable for CSRSS. Here, the results are indecisive too, rejecting H2 as being significant, and positive inferences are found to be absent.

Table 4.

Multiple regression model including the moderator.

In Table 4, the results of the hypothesis for ESGS investigated in terms of its positive impact for EIS, as shown by the respective coefficients in all three regression analyses, including POLS (β = 2.13, p < 5%), RE (β = 1.93, p < 1%), and FE (β = 1.84, p < 1%), accept H3 on account of the significant and positive findings. But when ESGS is tested for EPS, the results are found to be significant and negative for RE (β = −0.32, p < 10%) and FE (β = −0.46, p < 5%), rejecting H4.

Continuing with Table 4, the moderator ‘Bind’ yields significant positive results using RE with the regression coefficient (β = 8.97, p < 5%) and with FE (β = 9.50, p < 5%) when tested with EIS under model 1. But ‘Bind’ cites confused results when EPS is taken as a performance measure, though the results are significant and negative at Pooled OLS (β = −1.49, p < 1%) and at RE (β = −3.28, p < 1%) initially, at the decision point, the FE results are cited as insignificant.

Table 4 represents the inclusion of the moderator ‘Bind’, which shows a significant and positive association between CSRSSBind and EIS as a performance variable. The regression results are as follows: Pooled OLS is found to be inconclusive, whereas the RE (β = 6.82, p < 10%) and FE (β = 8.12, p < 5%) models, as explained by their respective regression coefficients, yield significant and positive results, accepting H5. In the table, similarly, when the performance variable is changed to EPS, the presence of moderator CSRSSBind yields significant positive results in all three models as expressed by their regression coefficients: Pooled OLS (β = 3.37, p < 1%), RE (β = 2.50, p < 1%), and FE (β = 1.82, p < 10%), respectively, accepting H6. When the other independent variable, ESGS, interacts with ‘Bind’, taking EIS as a performance variable, the results are quoted as being significant and negative, as is evident from their respective regression coefficients at RE (β = −5.17, p < 1%) and FE (β = −5.68, p < 1%), accepting H7. Likely, the replacement of the performance variable with EPS yields significant and positive findings, as can be seen through regression coefficients Pooled OLS (β = 1.74, p < 1%) and RE (β = 1.21, p < 5%), accepting H8.

The preferences of the model are evident from the BP-LM Test where p < 1%; being so small, the p-value random effect model is preferred over Pooled OLS. Similarly, the Hausman test reflects a chi2 value = 21.67 and p < 1%, again so small that the p-value fixed effect model is preferred over the random effect model.

BP-LM test affirms the use of the RE model over Pooled OLS because of the lowest p-value = 0.000. Likewise, the Hausman test suggests using the FE model over RE as (chi2 = 31.26, p = 0.003).

The hierarchical regression model is estimated in Table 5 to examine the study’s relationship. The base model for EIS and EPS have values as 0.017 and 0.029, respectively. The full model explains a statistically significant increase in explanatory power over the base model at 0.102 and 0.042, respectively. The F-test shows that both models were significant at 7.49 for EIS and 9.73 for EPS. The relative change from the ‘Base model’ to the ‘Full model’ is quite encouraging, from 1.7% to 10.2% with the inclusion of the moderator, i.e., Bind, suggesting that Pakistani non-financial firms listed on the PSX are actively contributing to the greener revolution, board independence (‘Bind’) plays a significant moderating role, the moderator in case EIS is the performance variable. As the T-test suggests, CSRSS, ESGS, and FS are significantly associated with the performance variables when the model is tested using EIS.

Table 5.

Hierarchical regression models.

Only ESGS is found statistically negatively significant when EPS is under consideration, based on the T-test, rejecting the hypothesis under consideration. The change in explanatory power from the ‘Base model’ to the ‘Full model’, it is found to be 0.029 to 0.042. However, the rate of variation is higher than before in the ‘Full model, and the T-test affirms the significance of the study, but the inclusion of the moderator, ‘Bind’, does not significantly drive this change, but may be other unobserved factors may contribute after the inclusion of moderator in the study. The indeterminate preference between RE and FE models for choosing either of the methods supports the robustness of the study.

4.1. Interaction Effect of Sustainability Reporting

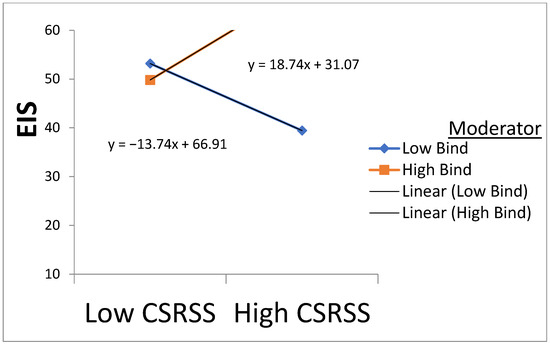

4.1.1. Interaction Effect of CSRSS with Bind, Using EIS as a Performance Variable

Figure 2 explains the relationship between CSRSS and the EIS moderating the role of board independence. The role of independent directors is considered vital and significant as they are free from the bias and pressure of the top management. They act independently and monitor and supervise the firm’s affairs to safeguard the stakeholders’ stakes. Pakistan is a country struggling economically, politically, and socially. Most firms use this and treat CSR as a paper exercise. Here comes the role of independent directors who serve as catalysts to pursue CSR activities as framed in the corporate governance framework. Firms with higher board independence are perceived as more transparent and trustworthy by stakeholders. In Pakistan, this role is even more crucial as more of the growing industrial sectors hold many independent directors on their boards for transparency and application of CSR activities in real life.

Figure 2.

Interaction effect of CSRSS with board independence using EIS.

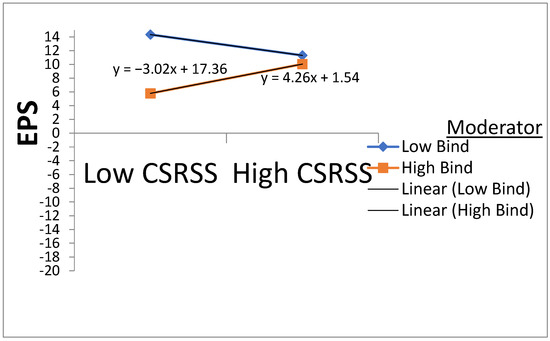

4.1.2. Interaction Effect of CSRSS with Bind, Using EPS as a Performance Variable

Figure 3 represents the effect of CSRSS and Bind using EPS as a performance measure. The results illustrate that firms with independent board directors can better demonstrate stronger alignment between CSR initiatives and environmental performance. This reflects a positive trend for Pakistan, where firms are realizing their responsibilities toward a greener environment through the active ‘Push’ role of independent directors is there. Independent directors ensure that CSR activities will not remain confined in black and white but to actual practice. The relationship is particularly important for non-financial listed firms dealing with energy, environmental risks, and safety. The independent directors are a catalytic factor, strengthening the relationship between CSR activities and elevated EPS.

Figure 3.

Interaction effect of CSRSS with board independence using EPS.

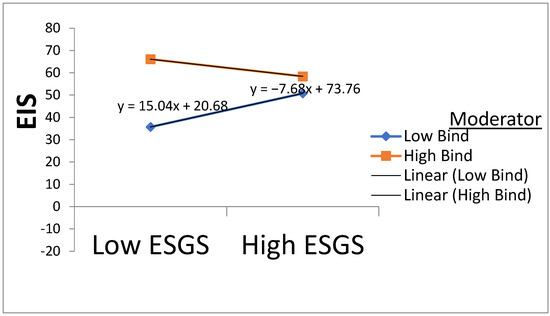

4.1.3. Interaction Effect of ESGS with Bind, Using EIS as a Performance Variable

Figure 4 represents a dampening effect of board independence between ESGS and EIS. This weakened association stems from most of the board of directors, having many independent directors, prioritizing short-term objectives, so they adopt risk-averse strategies and remain cost-conscious. Independent directors (independent directors) use this to justify their risk-averse behavior because of Pakistan’s volatile economic climate, where investors are concerned with short-term gains instead of ESG activities. Thus, even in firms with higher ESGS, the presence and behavior of independent directors weaken this relationship.

Figure 4.

Interaction effect of ESGS with board independence using EIS.

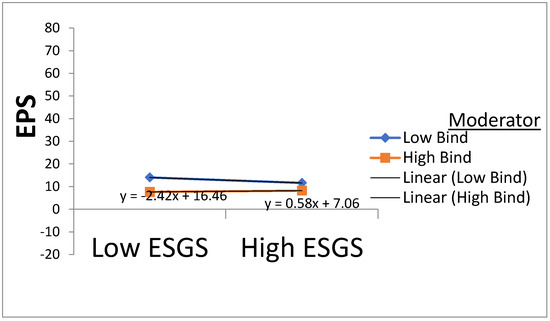

4.1.4. Interaction Effect of ESGS with Bind, Using EPS as a Performance Variable

Figure 5 represents the ESG and EPS negative relationship, meaning that firms emphasizing ESG disclosure may not show equally strong environmental performance due to regulatory compliance or symbolic ESG disclosure. However, the interventional role of independent directors dampens this relationship, as they are used to bridging the gap between disclosure and practice. Pakistan is a country where listed firms are mostly family-concentrated. The role of an independent board of directors is vital as they put pressure on the firms to align their ESG disclosure requirements with initiatives.

Figure 5.

Interaction effect of ESGS with board independence using EPS.

5. Discussion of Findings

Three theories, the stakeholder theory, resource-based theory, and agency theory, are taken in parallel to study the impact of ESG reporting on the greener revolution in the context of non-financial listed firms in Pakistan. The sample comprises 369 non-financial listed firms out of a target population of 456 non-financial listed firms for 12 years (2012–2023), inclusive of both. The data collection sources are PSX (annual audited reports), the State Bank of Pakistan (https://www.sbp.org.pk, accessed on 22 July 2024), and the GRI database. This research makes a significant contribution to developing economies like Pakistan and the corporate sector in framing policies and strategies to be in line with the yield of results.

Primarily, the study unveils the effect of ESG reporting and its impact on a greener revolution for Pakistani non-financial listed firms on PSX. The results for the CSRSS for EIS and EPS are inconclusive; though the magnitude is positive, no significant findings are noted. This shows that most firms engage in CSR activities as a formality for their personal image-building and regulatory compliance. This means that CSR activities are in black and white but not practiced at the firm level in Pakistan. The lack of stakeholder trust and availability of resources in time fail to support the stakeholder theory. Likewise, the failure of resource-based theory is attributed to the inconsistency in translating the CSR activities to environmental innovation outcomes; hence, both scores of EIS and EPS are compromised.

Taking ESGS as an independent variable for EIS, significant and positive results are noted, and the hypothesis is accepted. This shows that Pakistani firms have started realizing their responsibility towards a greener environment and have taken sustainability reporting seriously, especially regarding EIS. As stated, firms are integrating their ESG into their long-term strategic plans, ready to move to sustainable innovations, follow regulatory requirements, and shift from short-term to long-term value-driven approaches [24,134]. Considering the result, one can say environmental regulations are now being applied more than they are treated as a window dressing, and stakeholders are gradually becoming aware of their responsibilities. Pure support is from resource-based theory, and stakeholder theory is observed, as the results and hypotheses are supported by theory in the context of Pakistani non-financial listed firms.

Lastly, when ESGS is investigated and reveals significant negative results, the firm’s claim is restricted to slogans and statements only. Still, in practice, the environmental effect of ‘greening’ is only through word of mouth and is symbolic. The resource limitation and greater focus on profit realization fails the cause of a greener revolution. At the national level, regulatory requirements are missing, and normally, bribed money reports regarding sustainability and ESG are approved. In Pakistan’s ESG, ESG-related activities seem superficial, and EIS is not treated as a core competitive resource, so resource-based theory fails to support the results. The other ‘stakeholder’ theory also fails to support the results, which might be because firms are larger and more resourceful, and state and regulatory authorities failed to exert pressure on them. Also, the real greener revolution is compromised, and there seems to be more of a focus on reporting. That is the reason why results are not supported by theory.

In Table 5, under hierarchical regression, the results are also in line with the efforts by emerging economies to ‘Go Greener’ [135,136]. So, under the baseline model, i.e., in the absence of ‘Bind’, the CSRSS is cited as being significant and negative, and ESGS is investigated as being significant and positive. However, the role of independent board directors is an added edge, and CSRSS is positive and important and in line with the previous literature [137,138]. Also, the coefficient value of ESGS improves well. The role of an independent board of directors is found to be insignificant and positive, as it usually acts impartially with better monitoring capabilities and always keeps trying to improve environmentally sustainable practices towards a greener revolution, keeping in view fair CSR practices at the corporate board-level. This happens because Pakistan is a developing economy, and most of the manufacturing firms are leaving adverse environmental practices and introducing to eco-friendly processes, like the adoption of environmental practices from the global outset, use of solar power systems, adoption of environment-friendly processes in their production system to produce lower emissions, etc. [139,140]. The other critical factor is the role of politicians in Pakistan, who not only have developed but also enforced laws related to green practices at corporate levels through SECP, PEPA, PHA, and other allied statutory authorities, which results in a greener revolution, as evident by EIS for CSRSS and ESGS. The results align with the previous literature, having strong theoretical support for all three theories [24,141,142]. The results are not country-specific but can be generalized for developing economies.

Considering the EPS, the results for CSRSS and ESGS are inconclusive in the presence of ‘Bind’. The inclusion of independent directors does not signify the results for EPS because of their symbolic role only. It seems that in Pakistan, the role of an independent board of directors is just a regulatory requirement and nothing else, as the results state. The results are endorsed by the previous literature [32,143]. This result may be due to the independent director’s compromise of long-term strategic profits over short-term profits, lessening the focus toward CSR objectives that lead to greener environmental practices. The other reason is that CSR activities are just an act for nothing, with real deals for profit maximization having no or low concern with environmental betterment. Likewise, the poor economic conditions and volatility in political circumstances urge firms to consider profit maximization as their primary and secondary goal by just having so-called compliance with the statutory laws. All these factors produce inconclusive results. The negative role of both of these factors is, in fact, a big challenge for aligning the corporate environmental strategies with the actual performance results, keeping in view the regulatory requirement of what different statutory authorities are trying to embed at the corporate level from time to time.

To attain significant results, a strong coherence between CSRS and ESGS at the corporate and state levels is required, where the policies and strategies are not only in black and white but also properly implemented. The role of independent directors is to mitigate the adverse effects somehow. Still, in the case of EPS, the role of other factors like structural improvements, a sound corporate governance framework, and the interventional role of the state is required, where all the laws are implemented in their true spirits to achieve the aim of a greener revolution. This result aligns with the previous literature [91].

5.1. A Holistic Comparison of the Results with Those of Past Studies

Sustainability reporting has become a global phenomenon, keeping in view the environmental issues and the responsibility of the firms in this regard. Studies have used multiple theories to support their arguments, including stakeholder theory [144,145,146], legitimacy theory [147,148,149], institutional theory [146,150], agency theory [151,152], resource-based theory [59,153], and upper echelon theory [154,155]. The inclusion of three different theories, stakeholder theory, resource-based theory, and agency theory, is because by including stakeholders and the vital resources of the firm, the moderating role from corporate governance, i.e., the independent board of directors, is taken. Also, the results from the previous literature are inconclusive. The literature from the past is evidence of significant and positive results of sustainability reporting and a greener environment [156,157,158].

Contrary to that, the literature has found negative results between sustainability reporting and a greener environment [159,160]. Also, an inverted U-shape association was found between command and control regulation and the corporate green investment of Chinese listed firms for the period between 2008 and 2016 [161]. These inconclusive findings are a bigger push for this study in a Pakistani context, where the corporate governance framework is weak [147,148] and sustainability reporting at the firm level is symbolic and used for earnings quality management [162,163]. In addition, most of the studies have used traditional and conventional regression models. In contrast, this study has included hierarchical regression to test the incremental explanatory power of board independence to the CSRS and ESGS, which strengthens the results in a kind of emerging economy like Pakistan.

5.2. Theoretical Implications

The present study has found strong theoretical support, as is found to have a significant change in the full model, which is also affirmed by the t-test. A strong positive association is found between EIS, CSRSS, and ESGS, as non-financial listed firms aim for a greener revolution for Pakistan by remolding their production process to eco-friendly processes and removing practices that have adverse effects on environmental protection. This inference aligns with the stakeholder and upper echelon theories [164,165]. Contrary to that, keeping in view the case of developing economies, EPS yields significant and negative results, affirmed by agency theory, as most of results are attributed to the non-serious behavior of independent directors, which creates agency issues [166,167]. The findings for the moderator for two constructs of the performance variable are mixed, supporting agency theory and going against it simultaneously [168,169].

5.3. Policy Recommendation

This study deals with the significance of the role of ESG reporting on the greener evolution of Pakistani non-financial listed firms. The findings are more of concern and utility for all stakeholders, ranging from direct to indirect stakeholders. The stakeholders include ESG rating agencies, researchers, academicians, and statutory regulatory authorities at both federal and provincial levels. To achieve a greener revolution in society, firms must strive to find new products in their product lines, retransform their production processes to eco-friendly processes, and comply with all statutory regulatory requirements set by the state.

Primarily, the statutory authorities like SECP, PEPA, PHA, etc., should make themselves well versed in laws, policies, and strategies to design CSR policies that reduce environmental disasters. To achieve a revolution towards a greener environment, CSR and ESG practices must be redefined to follow global standards and meet and compete with international standards. Also, we must ensure that we do not keep the environmental standards in black and white but ensure firms put them into practice.

Independent directors are hired on the corporate boards to safeguard the stakeholders’ rights; they should be well aware of their monitoring and supervisory role, where they act effectively and efficiently to make the board members accountable for their greener practices, keeping in view CSR and ESG practices.

The results explore the inconsistencies and gaps in the application of CSR and ESG activities to achieve a greener revolution through non-financial listed firms, opening an avenue for the researchers to consider why the application of CSR and ESG failed to bring the desired results and what areas at the board level and state level need to be highlighted to bring the desired results, especially with a strong focus on improving governance, enhancing meaningful and impactful activities, and managing greenwashing. A researcher can bridge these gaps by suggesting actionable and doable strategies that work at the micro and macro levels.

5.4. Limitations of This Study

The sample comprises 369 non-financial firms listed and operated on PSX from 2012 to 2023. Data are not available immediately in the firms’ audited financial statements. Other sources, the State Bank of Pakistan and the GI databases, are also used. The biggest flaw is that data are scattered and unavailable at one click, like is the case in developed economies. Secondly, though the financial data are audited, the EPS and EISs might still be manipulated because of a lack of training in collecting the data, there being no properly trained enumerators available, and having few reports showing the source of international agencies. Regarding the reporting phenomenon, there are likely complications regarding the measurement of ESGS and CSRS data availability and the allocation of weights to their respective scores. Lastly, Pakistan is a struggling economy in the Asia region, burdened with debt and occupied with other sanctions from the monetary institutions; the results can be generalized to other similar kinds of countries struggling economically like Sri Lanka, Bangladesh, Afghanistan, Nepal, etc., where the corporate governance framework is in its infancy.

5.5. Avenues for Future Research and Recommendations

The study under consideration is confined to Pakistan’s non-financial listed firms. It can also introduce the financial sector, including the money market, capital market, and family-owned businesses. Also, other neighboring countries of the Asian region can be added to the study sample to make the results more generalizable, instead of remaining specific. Most of the control variables, when an interaction is taken, fail to be controlled, like Fs, FP, and Lvg; these variables, along with other board-related variables like institutional ownership, tenure diversity, educational diversity, and board size, can be taken as moderators of the study, or even the independent variables, in the future literature.

5.6. Concluding Remarks

In light of the above findings, this study shedded light on sustainability performance by investigating the role of CSRSS and ESGS in revamping the efforts towards society to create a greener one under the lens of ‘stakeholder theory’, ‘resource-based theory’, and ‘agency theory’. The results evidenced that CSRSS and ESGS produced significant positive results, showing that firms have strong intentions for society to ‘Go Greener’. Regarding EPS, the CSRSS yielded inconclusive results, and ESGS cited significant negative results in the presence of an independent board of directors. This happened due to the limited enforcement of regulatory standards and the low concern of the boards of firms about putting the slogan of ‘Go Greener’ into practice. This study’s results emphasize the significance of the CSR and ESGS frameworks in corporate governance structures for elevating environmental performance. Future researchers can explore sector-specific dynamics while incorporating qualitative aspects to better understand the complexities of board attributes on sustainable innovation in developing economies, including the geographical expansion in the region involving other struggling economies.

Author Contributions

All authors contributed equally to the realization of this article. Conceptualization, A.N. and R.H.; methodology, A.N. and R.H.; software, A.N. and R.H.; validation, C.F.; formal analysis, A.N. and R.H.; investigation, A.N., R.H. and V.M.A.; resources, C.F. and V.M.A.; data curation, A.N. and R.H.; writing—original draft preparation, A.N. and R.H.; writing—review and editing, A.N., R.H. and V.M.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be provided upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

List of indicators found from the annual audited reports from PSX relating to CSR score.

Table A1.

CSR activities.

Table A1.

CSR activities.

| S.r No | Title of Activities |

|---|---|

| 1 | Occupational health |

| 2 | Consumer protection measures |

| 3 | Contribution towards natural calamities |

| 4 | Policy of mutual respect at the workplace |

| 5 | Employees’ children policy |

| 6 | Rural development program |

| 7 | The on-job vocational training program |

| 8 | Pension and retirement plans |

| 9 | Interest-free loans to employees |

Appendix B

Table A2.

List of indicators found from annual audited reports from PSX relating to ESG score activities.

Table A2.

List of indicators found from annual audited reports from PSX relating to ESG score activities.

| Environment, Social, and Governance |

| Environment |

|

| Social |

|

| Governance |

|

Appendix C

Table A3.

List of indicators found from annual audited reports from PSX for the calculation of EIS.

Table A3.

List of indicators found from annual audited reports from PSX for the calculation of EIS.

| EIS | Weight Assigned | |

|---|---|---|

| Environmental Impact Reduction | 30% | |

| ||

| Innovation and New Product Development | 30% | |

| ||

| Technology Adoption and Process Efficiency | 40% | |

| ||

Appendix D

Table A4.

List of indicators found from annual audited reports from PSX for calculation of EPS.

Table A4.

List of indicators found from annual audited reports from PSX for calculation of EPS.

| EPS | |

|---|---|

| Environmental Management Practices | 40% |

| |

| Resource Usage Efficiency | 25% |

| |

| Climate Change Strategies | 25% |

| |

| Biodiversity and Land Use | 10% |

| |

References

- Shah, H.J.; Khan, A.J.S.S.; Open, H. Globalization and nation states–Challenges and opportunities for Pakistan. Soc. Sci. Humanit. Open 2023, 8, 100621. [Google Scholar] [CrossRef]

- Fazal, R.; Rehman, S.A.U.; Bhatti, M.I. Graph theoretic approach to expose the energy-induced crisis in Pakistan. Energy Policy 2022, 169, 113174. [Google Scholar] [CrossRef]

- Aksar, I.A.; Firdaus, A.; Gong, J.; Anwar Pasha, S. Examining the impacts of social media on the psychological well-being in a patriarchal culture: A study of women in Pakistan. Online Inf. Rev. 2024, 48, 294–313. [Google Scholar] [CrossRef]

- Khan, M.F.; Raza, A.; Naseer, N. Cyber security and challenges faced by Pakistan. Pak. J. Int. Aff. 2021, 4, 865–881. [Google Scholar]

- Sheikh, M.K.; Gillani, A.H. Ethnic issues and National Integration in Pakistan: A review. Pak. J. Humanit. Soc. Sci. 2023, 11, 187–195. [Google Scholar] [CrossRef]

- Hussain, M.; Butt, A.R.; Uzma, F.; Ahmed, R.; Irshad, S.; Rehman, A.; Yousaf, B. A comprehensive review of climate change impacts, adaptation, and mitigation on environmental and natural calamities in Pakistan. Environ. Monit. Assess. 2020, 192, 1–20. [Google Scholar] [CrossRef]

- Hamid, S.; Riaz, Z.; Azeem, S.M.W. Carroll’s dimensions and CSR disclosure: Empirical evidence from Pakistan. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 365–381. [Google Scholar] [CrossRef]

- Ahmad, N.; Mahmood, A.; Han, H.; Ariza-Montes, A.; Vega-Muñoz, A.; Din, M.u.; Iqbal Khan, G.; Ullah, Z.J.S. Sustainability as a “new normal” for modern businesses: Are smes of pakistan ready to adopt it? Sustainability 2021, 13, 1944. [Google Scholar] [CrossRef]

- Khan, I.; Fujimoto, Y.; Uddin, M.J.; Afridi, M.A. Evaluating sustainability reporting on GRI standards in developing countries: A case of Pakistan. Int. J. Law Manag. 2023, 65, 189–208. [Google Scholar] [CrossRef]

- Rahman, H.U.; Zahid, M.; Khan, P.A.; Al-Faryan, M.A.S.; Hussainey, K. Do corporate sustainability practices mitigate earnings management? The moderating role of firm size. Bus. Strategy Environ. 2024, 33, 5423–5444. [Google Scholar] [CrossRef]

- Shakri, I.H.; Yong, J.; Xiang, E.J. Corporate governance and firm performance: Evidence from political instability, political ideology, and corporate governance reforms in Pakistan. Econ. Politics 2024, 36, 1633–1663. [Google Scholar] [CrossRef]

- Kandpal, V.; Jaswal, A.; Santibanez Gonzalez, E.D.; Agarwal, N. Corporate social responsibility (CSR) and ESG reporting: Redefining business in the twenty-first century. In Sustainable Energy Transition: Circular Economy and Sustainable Financing for Environmental, Social and Governance (ESG) Practices; Springer: Berlin/Heidelberg, Germany, 2024; pp. 239–272. [Google Scholar]

- Nugroho, D.P.; Hsu, Y.; Hartauer, C.; Hartauer, A. Investigating the Interconnection between Environmental, Social, and Governance (ESG), and Corporate Social Responsibility (CSR) Strategies: An Examination of the Influence on Consumer Behavior. Sustainability 2024, 16, 614. [Google Scholar] [CrossRef]

- Ren, S.; Huang, M.; Liu, D.; Yan, J. Understanding the impact of mandatory CSR disclosure on green innovation: Evidence from Chinese listed firms. Br. J. Manag. 2023, 34, 576–594. [Google Scholar] [CrossRef]

- Faisal, F. Corporate Social Responsibility (CSR) Exploring Disclosure Quality in Australia and Pakistan: The Context of a Developed and Developing Country. Master’s Thesis, University of Tasmania, Hobart, Australia, 2021. [Google Scholar]

- Weihong, J.; Kuo, T.-H.; Wei, S.-Y.; Hossain, M.S.; Tongkachok, K.; Imran, A. Relationship between trade enhancement, firm characteristics and CSR: Key mediating role of green investment. Econ. Res. Istraz. 2022, 35, 3900–3916. [Google Scholar] [CrossRef]

- Avotra, A.A.R.N.; Chenyun, Y.; Yongmin, W.; Lijuan, Z.; Nawaz, A. Conceptualizing the state of the art of corporate social responsibility (CSR) in green construction and its nexus to sustainable development. Front. Environ. Sci. 2021, 9, 774822. [Google Scholar] [CrossRef]

- Gull, A.A.; Saeed, A.; Suleman, M.T.; Mushtaq, R. Revisiting the association between environmental performance and financial performance: Does the level of environmental orientation matter? Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1647–1662. [Google Scholar] [CrossRef]

- Xiong, D.; Liu, H.; Yang, M.; Duan, Y. Does corporate environmental responsibility make firms greener in innovation? The role of knowledge flows. J. Knowl. Manag. 2025, 29, 393–414. [Google Scholar] [CrossRef]

- Wasiuzzaman, S.; Subramaniam, V. Board gender diversity and environmental, social and governance (ESG) disclosure: Is it different for developed and developing nations? Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2145–2165. [Google Scholar] [CrossRef]

- Del Gesso, C.; Lodhi, R.N. Theories underlying environmental, social and governance (ESG) disclosure: A systematic review of accounting studies. J. Acc. Lit. 2024, 47, 433–461. [Google Scholar] [CrossRef]

- Liu, H.; Lyu, C. Can ESG ratings stimulate corporate green innovation? Evidence from China. Sustainability 2022, 14, 12516. [Google Scholar] [CrossRef]

- Arvidsson, S.; Dumay, J. Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? Bus. Strategy Environ. 2022, 31, 1091–1110. [Google Scholar] [CrossRef]

- Mohy-ud-Din, K. ESG reporting, corporate green innovation and interaction role of board diversity: A new insight from US. Innov. Green Dev. 2024, 3, 100161. [Google Scholar] [CrossRef]

- Di Vaio, A.; Syriopoulos, T.; Alvino, F.; Palladino, R. “Integrated thinking and reporting” towards sustainable business models: A concise bibliometric analysis. Meditari Account. Res. 2021, 29, 691–719. [Google Scholar] [CrossRef]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- Wagenhofer, A. Sustainability reporting: A financial reporting perspective. Account. Eur. 2024, 21, 1–13. [Google Scholar] [CrossRef]

- Mukhtar, Z. Environmental pollution and regulatory and non-regulatory environmental responsibility (reviewing Pakistan environmental protection act). Am. J. Ind. Bus. Manag. 2023, 13, 443–456. [Google Scholar] [CrossRef]

- Mumtaz, M. Green infrastructure as key tool for climate adaptation planning and policies to mitigate climate change: Evidence from a Pakistani City. Urban Clim. 2024, 56, 102074. [Google Scholar] [CrossRef]

- Hanif, A.; Shirazi, S.A.; Majid, A. Role of community for improvement of ecosystem services in urban parks. Pak. J. Agric. Sci. 2020, 57, 1591–1596. [Google Scholar]

- Nasar-u-Minallah, M.; Jabbar, M.; Zia, S.; Perveen, N. Assessing and anticipating environmental challenges in Lahore, Pakistan: Future implications of air pollution on sustainable development and environmental governance. Environ. Monit. Assess. 2024, 196, 865. [Google Scholar] [CrossRef]

- Morri, G.; Yang, F.; Colantoni, F. Green investments, green returns: Exploring the link between ESG factors and financial performance in real estate. J. Prop. Invest. Financ. 2024, 42, 435–452. [Google Scholar] [CrossRef]

- Baocheng, H.; Jamil, A.; Bellaoulah, M.; Mukhtar, A.; Clauvis, N.K. Impact of climate change on water scarcity in Pakistan. Implications for water management and policy. J. Water Clim. Change 2024, 15, 3602–3623. [Google Scholar] [CrossRef]

- Singhania, M.; Saini, N.; Shri, C.; Bhatia, S. Cross-country comparative trend analysis in ESG regulatory framework across developed and developing nations. Manag. Environ. Qual. Int. J. 2024, 35, 61–100. [Google Scholar] [CrossRef]

- Islam, R.; Ali, M.; French, E. Director independence and its influence on corporate social responsibility decisions and performance. Soc. Responsib. J. 2023, 19, 1917–1934. [Google Scholar] [CrossRef]

- Al Amosh, H. From home to boardroom: Marital status and its influence on ESG disclosure. Bus. Strategy Dev. 2024, 7, e402. [Google Scholar] [CrossRef]

- Yu, J.; Hwang, Y.-S. The Interaction Effects of Board Independence and Digital Transformation on Environmental, Social, and Governance Performance: Complementary or Substitutive? Sustainability 2024, 16, 9098. [Google Scholar] [CrossRef]

- Arif, M.; Sajjad, A.; Farooq, S.; Abrar, M.; Joyo, A.S. The impact of audit committee attributes on the quality and quantity of environmental, social and governance (ESG) disclosures. Corp. Gov. Int. J. Bus. Soc. 2021, 21, 497–514. [Google Scholar] [CrossRef]

- Awan, T.; Gul, A. Impact of environmental, social, and governance (ESG) performance on investment mix. New empirical evidence from non-financial firm in Pakistan. Int. Res. J. Manag. Soc. Sci. 2024, 5, 880–900. [Google Scholar]

- Lydenberg, S.; Sinclair, G. Mainstream or daydream? The future for responsible investing. In Landmarks in the History of Corporate Citizenship; Routledge: London, UK, 2024; pp. 47–68. [Google Scholar]

- Brohi, N.A.; Qureshi, M.A.; Shaikh, D.H.; Mahboob, F.; Asif, Z.; Brohi, A. Nexus Between Servant Leadership, Green Knowledge Sharing, Green Capacities, Green Service Innovation, and Green Competitive Advantage in the Hospitality Sector of Pakistan: An Sdg & Esg Stakeholder Compliance Framework. J. Mark. 2024, 6, 211–433. [Google Scholar]

- Hassan, S. The Impact of Environmental, Social and Governance on Firm Performance: Moderating Role of Financial Slacks and Research &Development Intensity. City Univ. Res. J. 2024, 14, 24–38. [Google Scholar]

- Jan, F.U.; Zahid, M. Environmental, Social, Governance (ESG) and Financial Performance of Firm in the Context of Corporate Governance Code 2019 in Pakistan. J. Bus. Manag. Res. 2024, 3, 973–1000. [Google Scholar]

- Albitar, K.; Borgi, H.; Khan, M.; Zahra, A. Business environmental innovation and CO2 emissions: The moderating role of environmental governance. Bus. Strategy Environ. 2023, 32, 1996–2007. [Google Scholar] [CrossRef]

- Senadheera, S.S.; Withana, P.A.; Dissanayake, P.D.; Sarkar, B.; Chopra, S.S.; Rhee, J.H.; Ok, Y.S. Scoring environment pillar in environmental, social, and governance (ESG) assessment. Sustain. Environ. 2021, 7, 1960097. [Google Scholar] [CrossRef]

- Omran, M.S.; Zaid, M.A.; Dwekat, A. The relationship between integrated reporting and corporate environmental performance: A green trial. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 427–445. [Google Scholar] [CrossRef]

- Mansoor, M.; Jam, F.A.; Khan, T.I. Fostering eco-friendly behaviors in hospitality: Engaging customers through green practices, social influence, and personal dynamics. Int. J. Contemp. Hosp. Manag. 2025. ahead-of-print. [Google Scholar] [CrossRef]

- Chi, Y.; Hu, N.; Lu, D.; Yang, Y. Green investment funds and corporate green innovation: From the logic of social value. Energy Econ. 2023, 119, 106532. [Google Scholar] [CrossRef]

- Aastvedt, T.M.; Behmiri, N.B.; Lu, L. Does green innovation damage financial performance of oil and gas companies? Resour. Policy 2021, 73, 102235. [Google Scholar] [CrossRef]

- Young-Ferris, A.; Roberts, J. ‘Looking for something that isn’t there’: A case study of an early attempt at ESG integration in investment decision making. Eur. Acc. Rev. 2023, 32, 717–744. [Google Scholar] [CrossRef]

- Raghunandan, A.; Rajgopal, S. Do ESG funds make stakeholder-friendly investments? Rev. Acc. Stud. 2022, 27, 822–863. [Google Scholar] [CrossRef]

- Xie, R.; Teo, T.S. Green technology innovation, environmental externality, and the cleaner upgrading of industrial structure in China—Considering the moderating effect of environmental regulation. Technol. Forecast. Soc. Change 2022, 184, 122020. [Google Scholar] [CrossRef]

- Mukhtar, B.; Shad, M.K.; Woon, L.F.; Haider, M.; Waqas, A. Integrating ESG disclosure into the relationship between CSR and green organizational culture toward green Innovation. Soc. Responsib. J. 2024, 20, 288–304. [Google Scholar] [CrossRef]

- Awa, H.O.; Etim, W.; Ogbonda, E. Stakeholders, stakeholder theory and corporate social responsibility (CSR). Int. J. Corp. Soc. Responsib. 2024, 9, 11. [Google Scholar] [CrossRef]

- Habib, A.; Oláh, J.; Khan, M.H.; Luboš, S. Does Integration of ESG Disclosure and Green Financing Improve Firm Performance: Practical Applications of Stakeholders Theory. Heliyon 2025, 11, e41996. [Google Scholar] [CrossRef]

- Treepongkaruna, S.; Au Yong, H.H.; Thomsen, S.; Kyaw, K. Greenwashing, carbon emission, and ESG. Bus. Strategy Environ. 2024, 33, 8526–8539. [Google Scholar] [CrossRef]

- Corazza, L.; Cottafava, D.; Torchia, D.; Dhir, A. Interpreting stakeholder ecosystems through relational stakeholder theory: The case of a highly contested megaproject. Bus. Strategy Environ. 2024, 33, 2384–2412. [Google Scholar] [CrossRef]

- del Águila, I.M.; del Sagrado, J. Salience-based stakeholder selection to maintain stakeholder coverage in solving the next release problem. Inf. Softw. Technol. 2023, 160, 107231. [Google Scholar] [CrossRef]

- Bhandari, K.R.; Ranta, M.; Salo, J. The resource-based view, stakeholder capitalism, ESG, and sustainable competitive advantage: The firm’s embeddedness into ecology, society, and governance. Bus. Strategy Environ. 2022, 31, 1525–1537. [Google Scholar] [CrossRef]

- Singh, S.; Verma, R.; Fatima, A.; Kumar, M. Building Brand Reputation and Fostering Customer Loyalty Through ESG Practices: A Strategic Imperative for Competitive Advantage. In ESG Frameworks for Sustainable Business Practices; IGI Global: Hershey, PA, USA, 2024; pp. 281–309. [Google Scholar]

- Cui, Y.; Li, L.; Lei, Y.; Wu, S. The performance and influencing factors of high-quality development of resource-based cities in the Yellow River basin under reducing pollution and carbon emissions constraints. Resour. Policy 2024, 88, 104488. [Google Scholar] [CrossRef]

- Farrukh, A.; Mathrani, S.; Sajjad, A. A comparative analysis of green-lean-six sigma enablers and environmental outcomes: A natural resource-based view. Int. J. Lean Six Sigma 2024, 15, 481–502. [Google Scholar] [CrossRef]

- Qaderi, S.A.; Ghaleb, B.A.A.; Hashed, A.A.; Chandren, S.; Abdullah, Z. Board characteristics and integrated reporting strategy: Does sustainability committee matter? Sustainability 2022, 14, 6092. [Google Scholar] [CrossRef]