Abstract

Prior studies suggest that investors have limited attention, which determines the speed with which information is incorporated into share prices and, in turn, affects the efficiency of the markets. Unlike other corporate events, the information contained in an acquisition announcement is generally less standard and more complicated to process. Therefore, investor inattention is less likely around this event. In this study we test the existence of investor inattention for a sample of all-cash acquisition announcements of listed and unlisted target firms released by listed Spanish firms from 1998 to 2018. Cash acquisitions allow us to control for the strategic behavior of overvalued companies engaged in stock-financed acquisitions. We perform a joint analysis of day of the week and time of trade from both a univariate and a multivariate perspective, after controlling for several factors that are related to the market reaction to acquisition announcements. Consistent with the notion that investors are less attentive to Friday announcements, we find a significant lower market reaction to acquisition announcements released during market trading hours both in terms of price and trading volume.

1. Introduction

Investors’ attention drives the decision-making process and the incorporation of new information into prices. Investors are exposed to a significant amount of information (market-specific, sector-specific, or firm-specific information) that needs to be processed and incorporated into trading which, eventually, is reflected in the stock prices. As investor attention is a scarce resource, a fundamental point in this process is the extent to which new information captures investors’ attention.

Previous research suggests that investors might pay less attention to information released on Friday than to similar information released on other days of the week. The reasoning is that investors and traders might get distracted by the weekend and thus pay less attention to corporate news on Friday, which would result in a market underreaction to the announcement. Research on the impact of limited investor attention on market reaction to news covers different types of corporate events. Initially, empirical evidence of the impact of limited investor attention was based on scheduled release of accounting information, such as earnings announcements [1,2,3]. Later, research analyzed whether investor inattention affects the market response to merger announcements [4,5,6,7]. Finally, some research has extended the focus to corporate news events other than earnings and merger announcements, including announcements of stock repurchases, seasoned equity offerings and dividend changes [8,9] as well as analyst recommendation changes [10].

We focused on acquisition announcements made by Spanish listed firms. The analysis of investor attention’s effect on value creation for the acquirer is of interest for two reasons. First, corporate acquisition is a strategic business decision with an uncertain result for the acquirer. Previous research has documented significant positive abnormal returns to acquirers around the acquisition of unlisted targets, whereas the results for returns to acquirers of listed companies are mixed, with significantly negative or no significant abnormal returns [11]. Second, a merger announcement is an event that implies an extensive analysis by investors on factors such as the target value, the potential synergies, the premium paid and the rest of conditions of the deal. Therefore, although investor inattention is less likely around this event, the level of inattention required to hamper the efficient processing of the merger information is also much lower than around less important events such as earnings announcements [4].

The aim of this study is to analyze whether investor inattention affects the information processing of an unanticipated and complex corporate event such as an acquisition announcement. We considered not only the day of the week but also the time of the day (prior to the moment the market opens, during trading, after the market closes) of the corporate acquisition announcement. This day-time combination analysis extends previous research on mergers announcements and contributes to the analysis of strategic timing of the announcement of corporate acquisitions.

We employed a final sample of 265 all-cash acquisition announcements of listed and unlisted target firms released by listed Spanish firms from 1998 to 2018. We used all-cash acquisition for three reasons. First, previous studies found that, on average, investors do not react significantly to announcements of cash offers involving publicly owned targets, but they react positively and significantly to those involving privately owned targets [12,13,14]. Targets’ private status is the single most important determinant of acquirers’ abnormal returns on cash acquisitions in the Spanish market [15,16,17]. Second, and related to the former reason, cash acquisitions allowed us to avoid the interferences of the strategic behavior of overvalued companies engaged in stock-financed acquisitions [5]. Third, the number of stock-financed acquisitions by listed Spanish firms was too small to consider the day-time combination in our analysis (37 stock or mixed financed acquisitions, as opposed to 268 all-cash acquisitions). We performed a joint analysis of day of the week and time of trade from both a univariate and a multivariate perspective, after controlling for several factors that were related to the market reaction to acquisition announcements. We found evidence consistent with the notion that investors are less attentive to Friday announcements than to non-Friday announcements, as we found a significant lower market reaction to acquisition announcements of unlisted target firms released during market trading hours in terms of both price and trading volume.

This study makes two important contributions to the literature related to both merger and acquisitions (M&A) and investor scrutiny. On the one hand, we show that the ample previous evidence that cash-financed acquisitions of unlisted firms are associated with wealth increases for bidders immediately after the announcement does not hold any longer when we introduce limited investor attention in the analysis. On the other hand, the combined analysis of the day and time the announcement is made introduces the notion of attention fluctuations along the trading day, thus enriching previous evidence on the inattention hypothesis around acquisition announcements. As far as we know, this is the first analysis of investor inattention taking into account the day of the week and time of the day combination of the corporate acquisition announcement.

The remainder of the article is structured as follows. Section 2 presents the literature review and the hypotheses under study. Section 3 describes the sample used and defines the variables. The methodology is presented in Section 4. The results from the univariate and multivariate analyses are discussed in Section 5 and Section 6, respectively. Finally, Section 7 presents the conclusions.

2. Literature Review and Hypotheses to Test

Investors’ attention plays an important role in the decision-making process and in the determination of asset prices. Traditional asset-pricing models imply that information revealed in the markets is analyzed by the investors and incorporated into prices through trading. The quantity or quality of information revealed, the knowledge of this information by all the investors, and the speed with which it is incorporated into prices determine the efficiency of the markets. In this regard, some anomalies have been detected together with investor behavioral bias that explain the incomplete or delayed responses of prices to new information.

The level of attention is a determinant factor in the incorporation of information into prices and in the decision-making process. Kahneman [18] claimed that attention is a limited cognitive resource. Therefore, individuals are unable to monitor all the available information sources and attention determines the choice. Thus, individual preferences will determine decision-making [19].

Previous psychology-based evidence on attention formed the basis for subsequent research on economics and finance [18,20]. As regards finance in particular, some authors have attempted to explain how investors’ attention affects the incorporation of information into prices. Peng and Xiong [21] and Peng, Xiong and Bollerslev [22] showed that limited attention affects the processing of information, since it leads investors to determine asset prices based more on market and industry information than on firm-specific information. Other authors have studied the impact of investors’ attention on trading. Thus, Barber and Odean [19] showed that individual investors, unlike institutional investors, buy attention-grabbing stocks. Reyes [23] observed a negative–positive attention asymmetry because retail investors are more attracted to negative stock market performance than to comparably positive performance. Kudryavtsev [24] analyzed the incorporation of analyst recommendation revisions on prices and confirmed the presence of investor inattention principally for low capitalization firms and more volatile stocks. Peres and Schmidt [25] showed that distracting news affects the limited attention of retail traders and determines their trading decision-making process.

One of the most significant developments in this area of research refers to the consequences of limited investor attention when new firm-specific information is released. The literature suggests that investors have a limited attention capacity and, consequently, underreact to corporate announcements. As a result, prices do not fully reflect all available public information. Nevertheless, Daniel et al. [26] suggested that the limited attention of the investor causes investor credulity in processing information about new stock issuances. Most of the empirical evidence is based on the Friday effect, that is, the lower attention of investors to releases on Friday due to weekend distraction, which lowers the quality of their decision-making [1].

Investor inattention due to the Friday effect has been investigated with regards to earnings and on mergers announcements. DellaVigna and Pollet [1] found evidence of market inattention on Friday earnings announcements. They observed that the immediate response to Friday earnings announcements is less pronounced and that the post-earnings announcement drift is greater due to the delayed incorporation of the new information into prices. Conversely, De Haan, Shevlin and Thornock [2] and Michaely, Rubin and Vedrashko [3] did not find such evidence on earnings announcements. De Haan et al. [2] did not find lower attention on Fridays. However, they observed that managers report bad earnings news after market hours, when market attention is expected to be lower. Michaely et al. [3] analyzed the timing of the earnings release considering day-time combinations and observed that Friday evening is the period with the most negative earnings announcements. However, they showed that bad earning announcements on Friday owe to managers’ strategic timing: They exploit the trading opportunity since Friday news is not fully incorporated into prices.

Regarding merger announcements, Louis and Sun [4] found evidence of the Friday effect. They found that, when the announcements are made on Fridays, the acquirers’ average abnormal return is less positive for stock finance acquisitions involving listed targets and less negative for those involving unlisted targets than on other days. They also observed a lower abnormal trading volume for Friday stock acquisitions than for non-Friday stock acquisitions. In this vein, trading volume is used as a measure of the investor’s degree of attention. Thus, Miller [27] suggested that high trading volume implies that investors pay more attention. Gervais et al. [28] argued that the increase in trading of a firm makes it more visible and exposes it to greater demand. Thus, the abnormal trading volume of announcements made on Fridays could be significantly lower than the abnormal trading volume of announcements made on the other days of the week.

Meanwhile, Michaely, Rubin and Vedrashko [8] extended the analysis of the Friday effect to corporate news events other than earnings and merger announcements and included announcements of stock repurchases, seasoned equity offerings and dividend changes. Surprisingly, they observed that the initial limited reaction to Friday announcements disappears when the firm-selection bias is considered. They concluded that the different market reaction is due to the type of announcing firms but not to limited investor attention to Friday announcements. As to merger announcements, Adra and Barbopoulus [5] showed that overvalued acquirers subject to limited attention are more likely to engage in stock acquisition of public firms and do not experience significant abnormal wealth losses. As a measure of investor attention, they employed the average daily percentage of the number of shares traded.

Following the idea that investor attention is low on Fridays and high on Mondays, Siganos [7] observed that target firms experience a greater positive abnormal return on mergers announced on Mondays than on those announced on other days of the week, and that investors overreact to merger announcements on Mondays after daylight saving times. Glasner [29] suggested that on Mondays, investors pay more attention to the market than on the other days.

Autore and Jiang [9] analyzed whether investors are less attentive to preholiday announcements. They showed that limited attention to preholiday announcements does not drive the market reaction to the corporate events. Instead, they found that the effect of holiday mood, the optimism, is what drives investors to underreact to negative information and overreact to positive firm news. Likewise, Hood and Lesseig [30] confirmed that investors are distracted around stock market holidays.

Reyes [6] studied the relationship between investor attention and the merger performance of acquirers of public companies. The author found an increase in the level of investor attention around merger announcements. High attention of retail investors leads to an overvaluation of the acquirer’s stocks and to higher announcement returns. In contrast, high attention of sophisticated investors leads to a more precise market response to the merger announcement, resulting in a less marked overvaluation of the acquirer’s stocks and lower announcements returns. Reyes [6] employed Google’s internet search volume index as a measure of level of attention. Google’s search index has also been employed in the study of the level of attention around earnings announcements. Ben-Rephael, Da and Israelsen [10] found that high institutional attention facilitates the incorporation of information into prices on the announcement day, thus reducing the subsequent drift. In addition, using Google’s search index, Padungsaksawasdi, Treepongkaruna and Brooks [31] found evidence of the importance of investor attention in asset pricing.

Based on the above evidence, we analyzed the existence of the Friday effect in the Spanish market resulting from the fact that investors get distracted by the weekend and pay less attention to merger announcements on that day. We included the timing of the announcement to perform a day-time analysis and considered three times of the day (before, during, and after trading hours). We analyzed the different market responses to Friday and non-Friday all-cash announcements. As we have pointed out above, we used all-cash acquisitions because ample prior evidence has shown that, on average, investors do not react significantly to announcements of cash offers involving publicly owned targets, but they react positively and significantly to those involving privately owned targets [12,13,14]. In addition, cash acquisitions allowed us to avoid the interferences of the strategic behavior of overvalued companies engaged in stock-financed acquisitions [5]. Therefore, the differential acquirers’ abnormal returns upon the announcements of cash acquisitions involving publicly owned and privately owned targets offered a natural setting to test whether the inattention hypothesis holds for acquisition announcements.

In the context of the above reasoning, the following hypotheses were formulated:

Hypothesis 1 (H1).

Investors’ limited attention leads to lower abnormal returns and lower abnormal trading-volume activity for acquisition announcements made after the market closes.

Hypothesis 2 (H2).

If the Friday effect applies and investors’ attention is limited on Friday, we expect lower abnormal returns and lower abnormal trading-volume activity for acquisition announcements made on Friday than for those made on non-Friday days.

3. Sample

3.1. Sample Selection

Information on acquisitions (announcement date, identity of bidders and targets, payment method, etc.) performed by Spanish listed firms was manually collected from the Spanish Security Exchange Commission (Comisión Nacional del Mercado de Valores, hereafter CNMV) web page. Once the official date was identified for each acquisition, we searched the financial press in the Factiva database for any previous rumor or leak in order to price the market information arrival. Given the Spanish Equity Market Law, the CNMV orders a firm trading halt when it considers that a relevant piece of information could affect a firm’s market price. Therefore, we only considered a rumor about an acquisition if the CNMV halted the acquirer’s trading.

Given our goal, we needed to define the day of the acquisition announcement and the event day (t0). The announcement day is the calendar day on which the CNMV publishes the official acquisition communication, regardless of the time of the day at which it is released. The event day (t0) is the trading day when the first closing price is available after the official acquisition communication to the CNMV. This distinction is important because of the computing of the price and trading activity reaction to acquisitions announced after the closing of the market.

The necessary economic and financial information for this research came from Sociedad de Bolsas S.A., Banco de España (Spanish Central Bank) web page and SABI, Amadeus and Orbis databases. Following Chang [12] and others, the sample comprised “completed control acquisitions” exclusively. We defined a completed control acquisition as one in which the buyer has increased its ownership position to over 50%, regardless of the amount of the target firm’s stake previously owned by the buyer. Therefore, our initial sample consisted of all acquisitions conducted by listed firms in the Spanish market (Sistema de Interconexión Bursátil Español, hereafter SIBE) over the period 1991–2018, that is, 365 acquisitions announcements. For an acquisition announcement to remain in the final sample, it needed to meet the following criteria:

- The exact time of the official acquisition announcement must appear on the CNMV website.

- No other overlapping acquisition announcement must exist by the same firm during the 120 trading days prior to the event day (t0).

- No other contaminating event must exist in the five days prior to and after the event day that may affect the target firm’s price, such as dividend payments, profit announcements or stock splits.

- The selected acquirers are those for which data on the method of payment and the listing status of the target firm were available.

After the application of the former criteria, we obtained a sample that comprised 305 acquisition announcements from 1998 to 2018 that satisfied these selection criteria.

Table 1 shows the comparative descriptive statistics for acquisitions involving private and public companies. In line with previous studies on other markets, the number of unlisted target firm announcements in our sample greatly exceeded that for listed companies, and cash was employed as the method of payment in most cases for both listed and unlisted target acquisitions. As discussed in Section 2, we focused on acquisition announcements for which cash was the method of payment. Therefore, our sample consisted of 268 acquisition announcements.

Table 1.

Number of acquisition announcements by listing status of target.

3.2. Sample Characteristics

Table 2 presents the daily distribution of the all-cash acquisition announcements. As trading in the SIBE starts at 09:00 and ends at 17:30, we defined three time slots: pre-market, during-trading and post-market. The distribution of the acquisition announcements in the three time slots was as follows: pre-market was the period from midnight (00:00) to 09:00; during-trading was the period during which the market was open, from 09:00 to 17:30; and post-market was the period from 17:30 to midnight (00:00).

Table 2.

Calendar daily distribution of cash acquisition announcements.

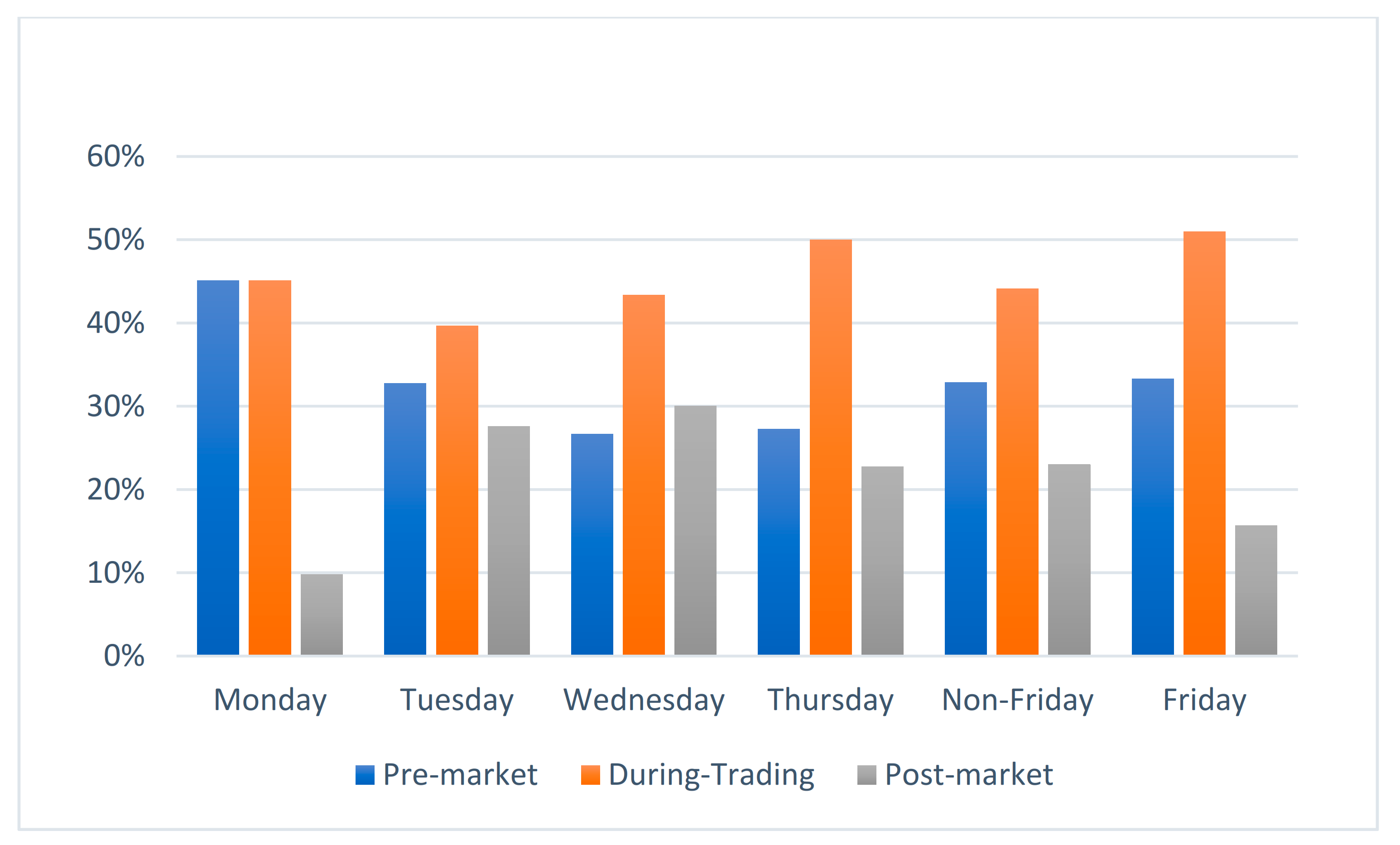

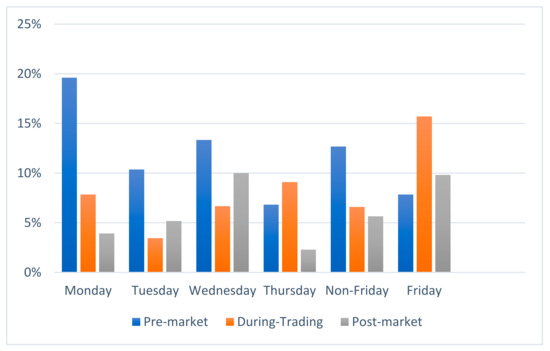

The data sample is presented in Figure 1. The number of pre-market announcements for the full sample declined during the week, with 45.10% of the announcements being made on Monday and 33.33% on Friday. Similarly, during-trading announcements showed an increase if we compared Monday and Friday, with a percentage of 45.10% and 50.98%, respectively. However, for the rest of the days of the week, there was a decrease in announcements on Tuesday, but an increase on Wednesday and on Thursday, with values of 39.66%, 43.33%, and 50.00%, respectively. Regarding the post-market period, the number of announcements on Monday was lower than on Friday, with 9.80% and 15.69%, respectively. One announcement was made in the post-market period of a pre-holiday Thursday. Therefore, the event day associated was on Monday. We reclassified this announcement as taking place in the post-market period of Friday. The rest of the days of the week presented a similar behavior, and four announcements at the weekend were considered to be Friday’s post-market announcements.

Figure 1.

Daily distribution of the full sample.

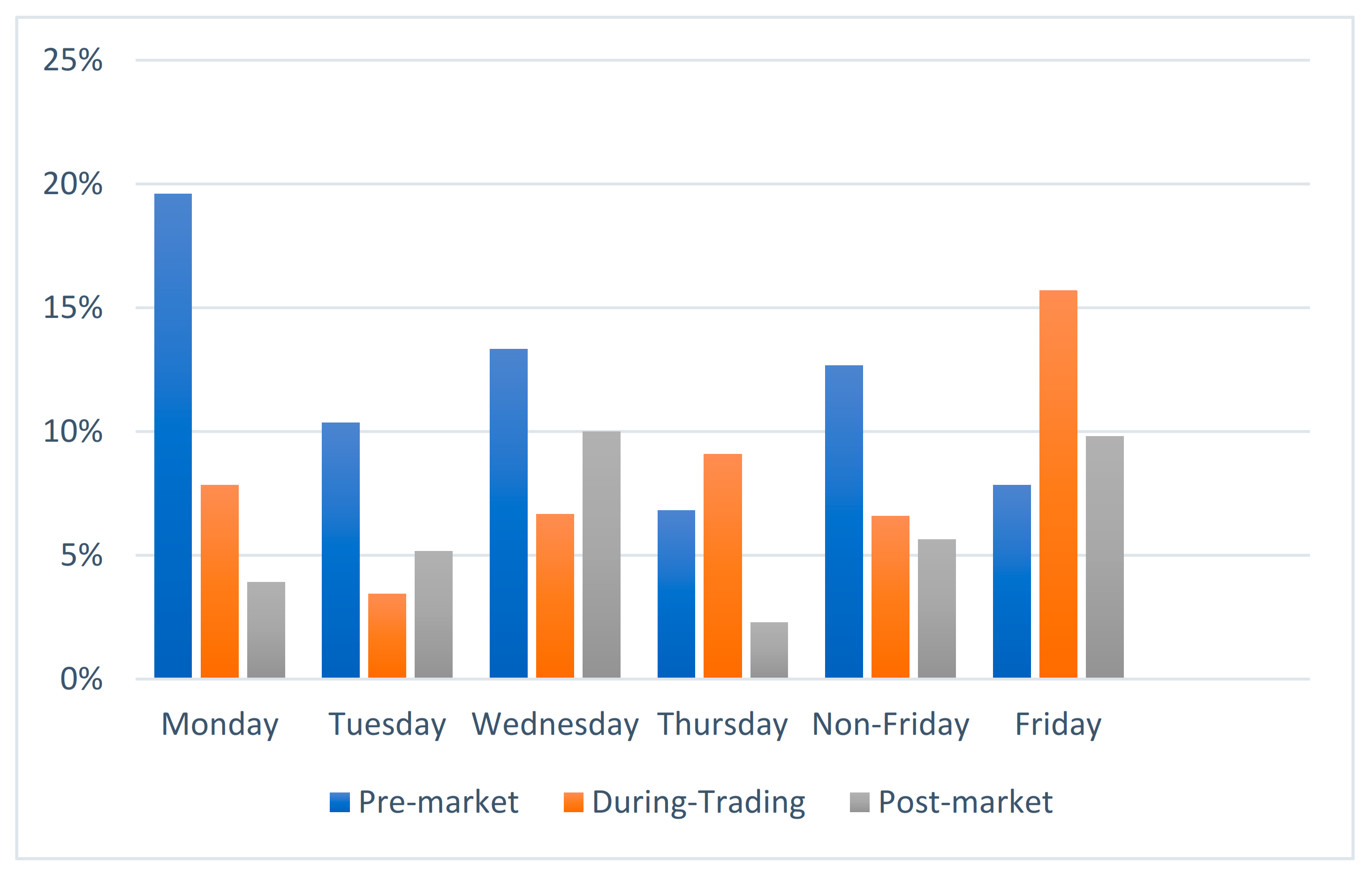

Figure 2 shows the daily distribution of acquisition announcements of listed target firms. The number of announcements declined during the week in the pre-market period, with 19.61% of the announcements made on Monday and 7.84% on Friday. In this line, the percentages for the other days represented decreases and increases, compared to Friday. They were 10.34%, 13.33% and 6.82% on Tuesday, on Wednesday, and on Thursday, respectively. However, in the during-trading period there was an increase if we compared Monday and Friday, with a percentage of 7.84% and 15.69%, respectively. For the rest of the days of the week, there was a decrease in announcements on Tuesday and on Wednesday and an increase in announcements on Thursday, with values of 3.45%, 6.67% and 9.09%, respectively. Regarding the post-market period, the number of announcements with which the week began was lower than on Friday, with 3.92% of the announcements made on Monday and 9.80% on Friday. The rest of the days of the week presented a similar behavior, and three announcements at the weekend were considered to belong to Friday’s post-market period.

Figure 2.

Daily distribution of the listed target firms.

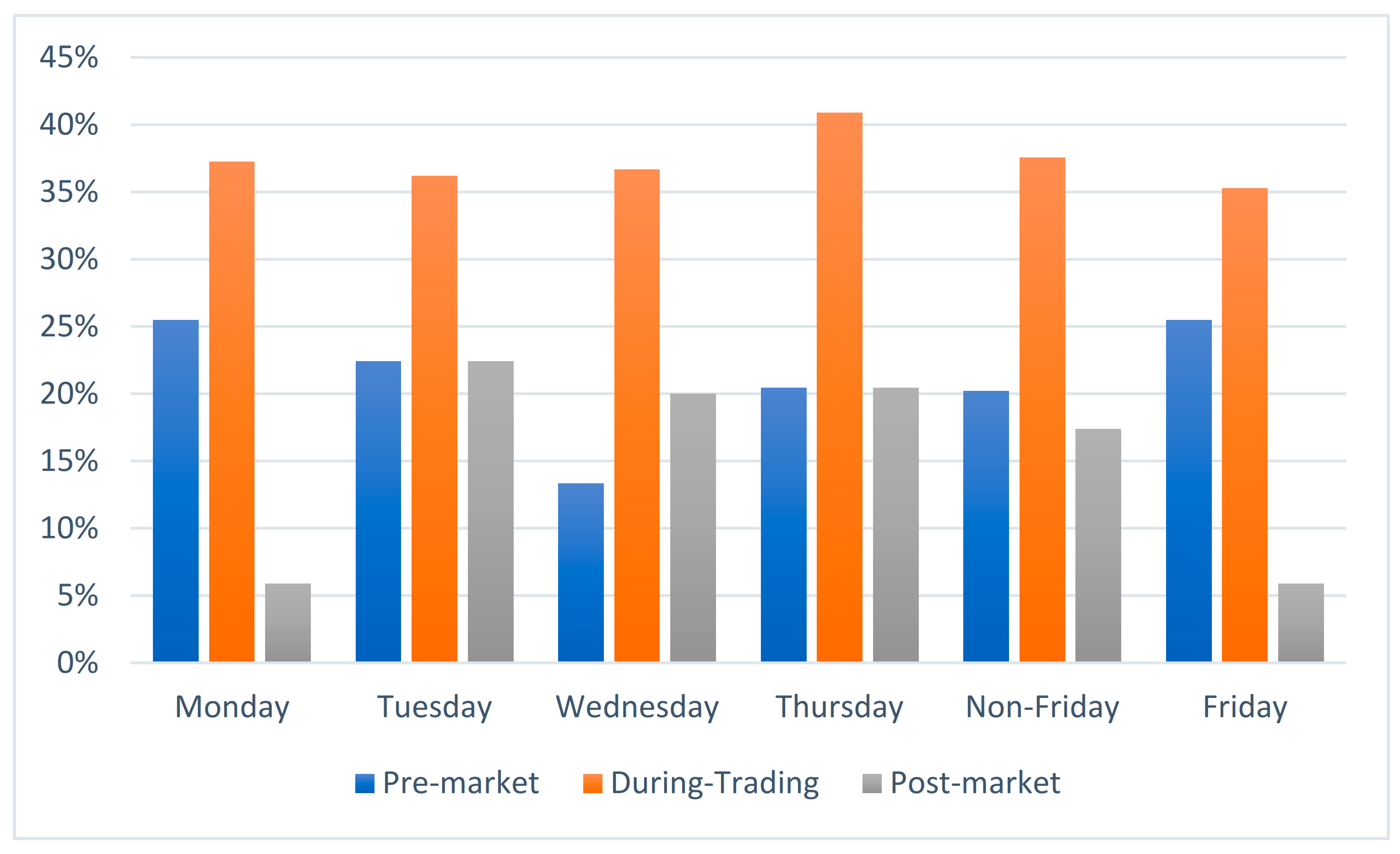

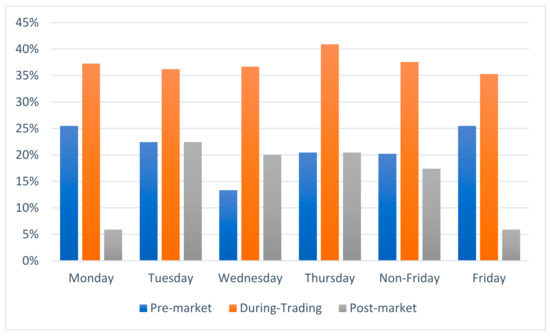

In the case of unlisted target firms (see Figure 3), we observed that the number of announcements for the daily distribution of the sample was higher than for the listed firms. The number of announcements declined during the week in the pre-market period, except for Fridays.

Figure 3.

Daily distribution of the unlisted target firms.

However, in the during-trading period there was a decrease if we compared Monday and Friday, with a percentage of 37.25% and 35.29%, respectively. For the rest of the days of the week, the number of announcements was higher. Regarding the post-market period, the number of announcements on Mondays and on Fridays was similar, both at 5.88%. As to the rest of the days of the week, there was an increase in the number of announcements on Tuesday, which decreased on Wednesday and Thursday. Nevertheless, the number of announcements made on these three days was higher than on Friday. The number of observations for these three days of the week was 22.41%, 20.00% and 20.45%, respectively. Finally, there was one announcement at the weekend, which was considered to be a Friday post-market announcement.

Drawing from Capron and Shen [32], Feito-Ruiz et al. [33], Farinós et al. [15], and others, we reported in Table 3 the average of the following characteristics of the sample (acquirer, target firm and deal characteristics) and tested for differences between non-Friday and Friday announcers:

Table 3.

Average characteristics of Friday vs. non-Friday announcements.

- −

- Acquirer market value: This variable is defined as the market value of the acquirer’s common stock 20 trading days prior to the acquisition announcement date (in millions of euros).

- −

- Acquirer total assets: The acquirer’s total assets in the most recent December prior to the acquisition announcement date (in millions of euros).

- −

- Acquirer return on assets ratio (ROA): The acquirer’s ROA is defined as the Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) divided by the acquiring firm’s total assets at the end of the year prior to the acquisition announcement date.

- −

- Acquirer market-to-book ratio (MTB): The market-to-book ratio is defined as the market value of the acquirer’s common stock 20 trading days prior to the acquisition announcement date divided by the book value of the acquirer’s common stock at the end of the year prior to the acquisition announcement date.

- −

- Target total assets: The target firm’s total assets in the most recent December prior to the acquisition announcement date (in millions of euros).

- −

- Relative size of the target: This variable is computed as the target’s total assets divided by the acquirer’s total assets in the most recent December prior to the acquisition announcement date.

- −

- Public: This is a binary variable taking the value one if the target firm is a listed company and zero otherwise.

- −

- Diversified acquisition: This is a binary variable taking the value one if the two merging partners are in the same two-digit CNAE code (Spanish SIC codes) and zero otherwise.

- −

- Cross-border acquisition: This is a binary variable taking the value one if the target firm is foreign and zero otherwise.

Panel A of Table 3 reports the average characteristics for the full sample of acquisition announcements, whereas Panels B and C show the mean characteristics conditional on the listing status of the target. It is worthy to note that only one of the characteristics showed a significant difference between non-Friday announcements and Friday announcements. Specifically, we found that acquirers of listed targets had a significant lower market-to-book ratio when the bid announcement was made on Friday. For the rest of the characteristics, we did not find significant differences, regardless of whether the announcer belonged to the full sample or to the acquisition of a listed/unlisted target. This evidence is relevant as it suggests that our results would not be conditioned by the characteristics of the deal, the bidder or the target firm.

4. Methodology

In this section, we describe the methodology used to analyze the market reaction in terms of prices and trading activity to an acquisition announcement conditional on the day of the week and time of the day.

4.1. Abnormal Return Estimation

In order to compute the abnormal returns on the event day (t0), we employed conventional event study methodology. The event window was defined as an 11-day window centered on the day of the announcement (t0 − 5, t0 + 5), and the estimation window (“uncontaminated” interval) was defined as a 115-day window (t0 − 6, t0 − 120). We estimated “uncontaminated” risk factors from the Capital Asset-Pricing Model (CAPM) as we show in Expression (1).

where Rit is the simple daily return of the acquiring firm i on day t, Rft is the daily return on Letras del Tesoro (Spanish Treasury Bill) and Rmt is the return on a value-weighted market index (specifically, the Madrid Stock Exchange Index–IGBM). Extreme abnormal returns (outliers) were identified as those that exceeded three times the standard deviation of the abnormal returns.

We tested the significance of the average abnormal returns with the conventional heteroskedasticity-robust t-test. The t-tests for the mean differences assumed unequal variances.

4.2. Abnormal Trading Activity Estimation

Regarding trading activity, Padungsaksawasdi et al. [31] showed evidence that reinforces prior literature that used trading volume as a proxy of investor attention. Therefore, we employed the abnormal trading volume to analyze the market’s reaction to acquisition announcements conditional on the day of the week and time of the day. To measure abnormal trading volume, we followed DellaVigna and Pollet [1], Hirshleifer et al. [34] and Louis and Sun [4]. First, we took the log transformation of the market value of the shares traded (log_V). Then, we estimated the abnormal trading volume as the difference between log_V at the acquisition announcement and log_V over the premerger announcement period. In order to remove the effect of normal trading-volume variations across the days of the week and capture the effect of the acquisition announcements on the trading volume, we matched the event day (t0) with the same day of the week over the previous four weeks. Specifically, for each acquisition announcement, we computed the acquirer’s abnormal trading volume for day t0 as the difference between the log_V for day t0 and the average log_V for days −7, −14, −21, and −28. This process allowed us to match the acquisition announcement days with their corresponding pre-acquisition announcement days. As we required days −7, −14, −21, and −28 to have trading-activity data, some acquisitions announcements were discarded.

We tested the significance of the average abnormal trading with the conventional heteroskedasticity-robust t-test. The t-tests for the mean differences assumed unequal variances.

4.3. Multivariate Analysis of the Differential Market Reaction to Friday Announcements

Prior literature has identified various factors that are related to the market reaction to acquisition announcements. We did not have any ex ante reason to expect these factors to vary with the day of the week. Statistics in Table 3 reinforced this intuition, as we did not find significant differences in these factors across Friday and non-Friday announcements. Nevertheless, to ensure that our inferences were not due to omission of correlated variables, we extended our univariate analysis to a multivariate setting. We modeled the market reaction in Expression (2).

where MR is either the abnormal return or the abnormal trading activity on the event day (t0); FRIDAY is a binary variable taking the value one if an acquisition is announced on a Friday and zero otherwise; PRIVATE is a binary variable taking the value one if the target is an unlisted firm and zero if it is a listed one, and LSIZE is the natural log of the acquirer’s market value 20 trading days prior to the acquisition announcement date (in millions of euros). ROA and MTB stand for acquirer’s ROA and market-to-book ratio, respectively, as defined in Section 3.2. DIVER and CROSS stand for diversified acquisition and cross-border acquisition, respectively, as defined in Section 3.2. Due to the great number of missed observations, we did not include the relative size of the target variable in Expression (2). Heteroskedasticity was corrected using White’s methodology.

According to the inattention hypothesis, we expect γ1 to be negative regardless of the listing status of the target when the dependent variable in Expression (2) is the abnormal trading volume. Nevertheless, the association between the variable FRIDAY and the abnormal return depends on the listing status of the target, as previous literature has shown. In any case, for completeness, we performed both joined and separate analyses for acquisitions of privately owned targets and acquisitions of publicly owned targets for both dependent variables.

5. Univariate Results

5.1. Abnormal Returns

The acquirers’ average all-cash acquisition announcement’s abnormal returns are reported in Table 4. In computing the abnormal returns, we detected and removed from the final sample three outliers (one acquisition announcement of a listed target made on Friday and two acquisition announcements of unlisted targets made on Thursday and on Friday, respectively). Therefore, the final sample consisted of 265 acquisition announcements, where 72 of the targets were listed firms and 193 were unlisted firms. We employed this sample in the following analyses.

Table 4.

Acquirers’ average abnormal returns around Friday vs. non-Friday all-cash acquisition announcements conditional on the listing status of the target.

Consistent with previous studies about the Spanish market [15,16,17,35] and other international markets [33,36,37,38], Table 4 shows that, on average, acquirers earned significant abnormal returns when buying unlisted target firms and insignificant average abnormal returns when the target firm was a listed one.

When we computed the average abnormal return by day of the week, we found that it was non-significant for acquisitions of listed targets, regardless of the day of the week. However, and consistent with the inattention hypothesis, Table 4 shows that, for acquisitions of privately owned targets, the average abnormal return was statistically significant for all the business days except for Fridays. In fact, for acquisitions of privately owned targets, the average abnormal return was 1.01% for non-Friday announcers, but only 0.20% for Friday announcers. The Friday differential return of −0.81% for acquisitions involving privately owned targets was both statistically and economically significant. This is a relevant result. As far as we know, previous literature on M&As unanimously found that cash-financed acquisitions of unlisted firms were associated with immediate wealth increases for acquirers at the time of the bidding announcement. However, our results showed that this behavior does not hold any longer when we introduce the Friday effect in the analysis.

Table 5 shows the abnormal return of acquisition announcements for listed and unlisted target firms conditional on the day of the week (Friday vs. non-Friday) and time of the day (pre-market, during-trading and post-market). Following the inattention hypothesis, we expected lower abnormal returns for those announcements made after the market closes, being the lowest for those acquisitions that were officially announced to the CNMV once the market had closed on Friday. Note that the computation of the abnormal return in this last case implied the use of the closing price on the following Monday relative to the closing price on Friday. As in Table 4, we did not find any significant abnormal return in the case of listed target-firm acquisitions. When we computed abnormal return differences, none of them was significantly different from zero, either.

Table 5.

Acquirers’ average abnormal returns for all-cash acquisition announcements conditional on the public status of the target, day of the week and time of the day of the acquisition announcement.

For acquisitions of privately owned targets (Panel B from Table 5), we found significant abnormal returns any time of the day for announcements made on a non-Friday. Interestingly, we found a significantly higher market reaction to announcements made before the market opens. This result may indicate that these sorts of announcements made at the beginning of the day capture the investors’ attention better than those made later that day (either during- or post-market times).

Unlike non-Friday announcements, abnormal return differences between intra-day periods were not statistically significant for acquisition announcements made on Friday. Not even pre-market acquisition announcements seemed to awaken the interest of investors. This result suggests that investor inattention holds all day Friday, no matter if the acquisition announcement is made in the pre-market, during-trading or post-market periods on Friday. Interestingly, when we compared Friday and non-Friday intra-day periods we found that both pre-market and during-trading announcements were significantly lower on Friday than on non-Friday days (−1.34% and −0.76%, respectively), but not in the case of post-market announcements. In that case, the abnormal return difference between Friday and non-Friday post-market announcements was not significantly different. Nevertheless, the small size of the sample for post-market announcements on Friday led us to be cautious in the interpretation of the results.

5.2. Market Trading Volume by Day of the Week

Prior to performing the analysis of the trading-volume reaction to the day of the week and time of the day of acquisition announcements, we explored the trading-volume behaviour of the Spanish market (SIBE and BME Growth) by day of the week. This analysis was needed to properly adjust the volume traded at the acquisition announcement and, therefore, to remove the effect of normal trading-volume variations across the days of the week.

Table 6 shows mean differences of euro trading volume (in thousands) from November 1998 to December 2018. To mitigate the possible effect of extreme values, truncation threshold of 1% was employed in the trading-volume weekday series. Contrary to Meneu and Pardo’s [39] findings for the Spanish market, we found that trading activity on Monday and Tuesday was significantly lower than on the other business days. When we compared non-Friday and Friday trading volume, we found a significantly higher trading activity on Friday than on non-Friday days. These results are relevant because (i) they confirm that we needed to remove the effect of normal trading-volume variations across the days of the week when computing the abnormal trading activity at the acquisition announcement, and (ii) they are contrary to the notion that investors’ attention declines on Fridays.

Table 6.

Differences in mean of daily euro trading volume (in thousands) in the Spanish stock market (SIBE and the Alternative Stock Market–MAB) from November 1998 to December 2018.

5.3. Abnormal Trading Volume

The acquirers’ abnormal trading volumes are reported in Table 7. As expected, we found that announcers experience a significantly higher average trading volume on the day of the acquisition announcement. When we split the sample by the announcement day, unlike Louis and Sun [4] but consistent with the inattention hypothesis, we found that the abnormal trading volume was significantly greater than zero for all the weekdays and for both listed and unlisted target firms, except for acquisition announcements made on Friday. Interestingly, this Friday effect was observed for acquisition announcements of both public and private target firms and was consistent with the absence of significantly abnormal returns on Friday (Table 4). However, Table 7 shows that, on average, the abnormal trading volume for the Friday announcers was not significantly different from the abnormal trading volume for the non-Friday announcers, for neither listed nor unlisted target firms.

Table 7.

Acquirers’ average abnormal trading volume: Friday vs. non-Friday all-cash acquisition announcements.

Table 8 shows the abnormal trading volume on acquisition announcement days for listed and unlisted target firms conditional on day of the week (Friday vs. non-Friday) and time of the day (pre-market, during-trading and post-market). When we split the abnormal trading volume for announcements of public target firms (Panel A in Table 8) into our two vectors of interest (day of the week and time of the day), we found that the statistically higher abnormal trading volume on all non-Fridays shown in Table 7 concentrated in those announcements made in the pre- and post-market periods, not in the during-trading period. From the inattention theory perspective, this result suggests that investors perceive all these out-of-the-market announcements to be of special interest, although this interest did not eventually result in statistically higher abnormal returns (see Panel A in Table 8). This pattern did not hold for Friday announcements. Nevertheless, the interpretation of our results was conditioned by the small size of the samples.

Table 8.

Acquirers’ average abnormal trading volume around Friday vs. non-Friday all-cash acquisition announcements conditional on the public status of the target and time of the day of the acquisition announcement.

Regarding the abnormal trading volume for acquirers of private target firms (Panel B from Table 8), we found that the statistically positive abnormal trading volume on all non-Fridays shown in Table 7 remained, regardless of the time of the day the announcement was made. Furthermore, none of the differences in average abnormal trading volume was statistically significant when we compared the different periods under study.

Nevertheless, a compelling feature arose in Panel B of Table 8 when we decomposed Friday announcements: only the acquisition announcements of unlisted target firms made before the market opened (pre-market period) showed a significantly higher abnormal trading volume. After that moment (the market opening), announcers showed a non-significant abnormal trading volume. In fact, the difference in average abnormal trading between the pre-market and during-trading periods of 0.297 was statistically significant with a p-value of 0.007. This behavior also held when we compared the abnormal trading between the post-market and during-trading periods, as the difference of 0.208 was statistically significant with a p-value of 0.048. In fact, the abnormal trading volume of the during-trading period for the Friday announcers was significantly lower than the abnormal trading volume of the during-trading period for the non-Friday announcers. Put together, these results from Panel B of Table 8 and the results from Panel B of Table 5 suggest that inattention affects investors’ information processing in the context of one of the largest and most important corporate events, that is, the acquisition of a firm.

Therefore, our evidence from the univariate analysis does not support our first hypothesis (H1), as we did not find a significantly lower market response to announcements after the market closed, but our results suggest that investors pay limited attention on Friday, thus supporting our second hypothesis (H2).

6. Differential Market Reaction to Friday Announcements: Multivariate Analysis

6.1. Abnormal Return Multivariate Analysis

Table 9 presents the regression results of model (2) using the acquirers’ merger-announcement abnormal return as the dependent variable. After controlling for several key factors, and consistent with previous research, we found that the acquisition of privately owned targets was both economically and statistically significant, as the coefficient of the PRIVATE dummy variable showed an announcement abnormal return increment of 1% for acquisitions of unlisted firms (full sample column of Table 9). Regarding the market response to Friday acquisition announcements, the results from Table 9 were consistent with those from Table 4: the coefficient on FRIDAY under the unlisted targets column was negative (−0.0081), with a p-value of 0.021, which is consistent with the notion that the market responds less to Friday merger announcements. This evidence was different from that of Louis and Sun (2010), whose coefficient on the FRIDAY dummy variable was negative for those stock swap acquisitions involving privately owned targets and positive for those involving publicly owned targets. Our results show that both types of acquisitions are affected by the Friday effect.

Table 9.

Multivariate analysis of acquirers’ abnormal return at the all-cash acquisition announcements (Friday vs. non-Friday) conditional on the listing status of the target.

Table 10 presents results from the estimation of model (2) using the acquirers’ merger-announcement abnormal return as the dependent variable but now conditional on the time of the day of the acquisition announcement. Interestingly, Table 10 suggests that the abnormal return increment on an announcement found in Table 4 when the target is an unlisted firm concentrates around pre-market announcers, as we found that the dummy variable PRIVATE showed a coefficient of 0.013 (1.3%) with a p-value of 0.014 (Panel A from Table 10). In the during-trading and post-market periods (Panels B and C, respectively), this variable showed non-significant coefficients.

Table 10.

Multivariate analysis of acquirers’ abnormal return on all-cash acquisition announcements (Friday vs. non-Friday), conditional on the listing status of the target and time of the day of the acquisition announcement.

Regarding the Friday effect, the results from Table 10 reinforced those shown in Table 5, as we found that the FRIDAY coefficient was negative and statistically significant only for those acquisitions involving privately owned targets in the pre-market and during-trading periods (Panels A and B, respectively). As in Table 5, this evidence suggests investor’s constant inattention for announcements made all trading day on Friday.

6.2. Abnormal Trading-Volume Multivariate Analysis

Table 11 presents the regression results of model (2) using the acquirers’ merger-announcement abnormal trading volumes as the dependent variable. As reported under the full sample column of the table, the coefficient on FRIDAY was negative (−0.0910), with a p-value of 0.043, which was consistent with the notion that the market responds less to Friday acquisition announcements. When we split the sample into acquisition announcements of listed and unlisted target firms, we found that this differential behavior between Friday and non-Friday owed to the behavior of acquirers of listed targets, as the coefficient on FRIDAY was negative (−0.1457), with a p-value of 0.038; on the other hand, the coefficient of acquisitions of unlisted target firms was non-significant. This result did not support evidence from Table 7, where we did not find the abnormal trading volume for the Friday announcers to be significantly different from the abnormal trading volume for the non-Friday announcers, regardless of the listed status of the target firms.

Table 11.

Multivariate analysis of acquirers’ abnormal trading volume on all-cash acquisition announcement days (Friday vs. non-Friday), conditional on the listing status of the target.

Table 12 presents the results of the estimation of model (2) using the acquirers’ merger-announcement abnormal trading as the dependent variable, conditional on the time of the day of the acquisition announcement. In general, evidence from Table 12 was consistent with the results in Table 8. Specifically, we found that differential abnormal trading volume between Friday and non-Friday announcers was significant for announcers of listed targets in the post-market period (Panel C of Table 12) and for announcers of unlisted targets in the during-trading period (Panel B of Table 12). Nevertheless, and as in the univariate analysis (Panel A of Table 8), we must be cautious with the result for acquirers of listed targets, as the negative coefficient on FRIDAY had a p-value of 0.100 (Panel C of Table 12). Regarding acquirers of private targets, evidence from Table 8 and Table 12 supports the notion of investors being distracted on Friday.

Table 12.

Multivariate analysis of acquirers’ abnormal trading volume on all-cash acquisition announcement days (Friday vs. Non-Friday), conditional on the listing status of the target and time of the day of the acquisition announcement.

As a whole, the results from the multivariate analysis were consistent with the evidence from the univariate analysis and supported our second hypothesis (H2). That is, the market responds less to Friday acquisition announcements of unlisted firms in terms of returns and trading volume when the announcements are made during the trading hours.

7. Conclusions

Overwhelming previous evidence in the M&A literature has supported the idea that cash-financed acquisitions of unlisted firms are associated with wealth increases for bidders immediately after the announcement. As far as we know, this is the first study that shows that this result does not hold any longer when the limited investor attention on Friday is introduced in the analysis. Furthermore, the combined analysis of the day and time the announcement is made introduces the notion of attention fluctuations along the trading day.

Our empirical evidence of the existence of investors’ inattention to acquisition announcements came from a final sample of 265 all-cash acquisition announcements of listed and unlisted target firms released by Spanish listed firms over the period 1998–2018. We performed a joint analysis of day of the week and trading period from both univariate and multivariate perspectives. In focusing on cash-financed acquisitions, we avoided the interferences of the strategic behavior of overvalued companies in stock-financed acquisitions.

Consistent with the inattention hypothesis, we found that the acquirers’ average abnormal return for acquisitions of privately owned targets is positive and statistically significant any time of the day on all business days except on Fridays. As we pointed out before, this is a relevant result as it challenged the widespread belief based on previous evidence that bidders of cash-financed acquisitions of unlisted firms make gains irrespective of the characteristics of the deal, the bidder or the target firm. We showed that a key factor was missing from the former equation: equity investors being distracted by their weekend plans.

Furthermore, we found that the average abnormal trading volume during trading hours is significantly lower for Friday announcers than for non-Friday announcers. Interestingly, acquisition announcements of unlisted target firms made on Friday before the market opens (pre-market period) showed a significant abnormal trading volume, indicating that the announcements made before the market opens capture the investor’s attention better than those made during the rest of the day.

Consistent with the notion that investors are less attentive to Friday news, we found that acquirers’ abnormal trading volume of publicly owned targets was higher for all non-Friday announcements than for Friday announcements. This higher abnormal trading volume was concentrated in those announcements made before and after the trading hours, suggesting that investors perceive this sort of announcements to be of special interest. Therefore, our results suggest an attention fluctuation along the trading day. Nevertheless, the small size of these subsamples calls for caution in interpreting these results.

Our findings have several implications. First, they provide evidence of investors’ inattention around cash acquisition announcements of unlisted target firms released on Friday. From the company perspective, this result may be employed in order to hide acquisitions motivated not by value creation but by opportunistic or managerial reasons. Second, from the investor’s perspective, our results show the relevance of considering the day-time combination when making an announcement, due to the fluctuations in investor attention along the day.

Given the salience of our results, future research should address key questions like the sophistication of the investor. That is, we will explore from a market microstructure view whether this differential behavior we found is associated with changes in the balance between liquidity (retail) traders and sophisticated (institutional) traders.

Author Contributions

J.E.F. contributed to all aspects of the study and has read and agreed to the published version of the manuscript; B.H. contributed to all aspects of the study and has read and agreed to the published version of the manuscript; and M.Á.L. contributed to all aspects of the study and has read and agreed to the published version of the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Conselleria d’Innovació, Universitats, Ciència i Societat Digital (Generalitat Valenciana) project GV/2020/151.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

The authors appreciate the useful comments and suggestions from participants in the XIX International Meeting AECA (Guarda, 2020), where an earlier draft of this paper was presented. We acknowledge the valuable comments and suggestions from three anonymous referees of the review.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- DellaVigna, S.; Pollet, J.M. Investor inattention and Friday earnings announcements. J. Financ. 2009, 64, 709–749. [Google Scholar] [CrossRef]

- DeHaan, E.; Shevlin, T.; Thornock, J. Market (in) attention and the strategic scheduling and timing of earnings announcements. J. Account. Econ. 2015, 60, 36–55. [Google Scholar] [CrossRef]

- Michaely, R.; Rubin, A.; Vedrashko, A. Further evidence on the strategic timing of earnings news: Joint analysis of weekdays and times of day. J. Account. Econ. 2016, 62, 24–45. [Google Scholar] [CrossRef]

- Louis, H.; Sun, A. Investor inattention and the market reaction to merger announcements. Manag. Sci. 2010, 56, 1781–1793. [Google Scholar] [CrossRef]

- Adra, S.; Barbopoulos, L.G. The valuation effects of investor attention in stock-financed acquisitions. J. Empir. Financ. 2018, 45, 108–125. [Google Scholar] [CrossRef]

- Reyes, T. Limited attention and M&A announcements. J. Empir. Financ. 2018, 49, 201–222. [Google Scholar]

- Siganos, A. The daylight saving time anomaly in relation to firms targeted for mergers. J. Bank. Financ. 2019, 105, 36–43. [Google Scholar] [CrossRef]

- Michaely, R.; Rubin, A.; Vedrashko, A. Are Friday announcements special? Overcoming selection bias. J. Financ. Econ. 2016, 122, 65–85. [Google Scholar] [CrossRef]

- Autore, D.; Jiang, D. The preholiday corporate announcement effect. J. Financ. Mark. 2019, 45, 61–82. [Google Scholar] [CrossRef]

- Ben-Rephael, A.; Da, Z.; Israelsen, R.D. It depends on where you search: Institutional investor attention and underreaction to news. Rev. Financ. Stud. 2017, 30, 3009–3047. [Google Scholar] [CrossRef]

- Martynova, M.; Renneboog, L. A century of corporate takeovers: What have we learned and where do we stand? J. Bank. Financ. 2008, 32, 2148–2177. [Google Scholar] [CrossRef]

- Chang, S. Takeovers of privately held targets, methods of payment, and bidder returns. J. Financ. 1998, 53, 773–784. [Google Scholar] [CrossRef]

- Fuller, K.; Netter, J.; Stegemoller, M. What do returns to acquiring firms tell us? Evidence from firms that make many acquisitions. J. Financ. 2002, 57, 1763–1793. [Google Scholar] [CrossRef]

- Moeller, S.; Schlingemann, F.; Stulz, R. Firm size and the gains from acquisitions. J. Financ. Econ. 2004, 73, 201–228. [Google Scholar] [CrossRef]

- Farinós Viñas, J.E.; Herrero, B.; Latorre Guillem, M.A. The Decision to Acquire Listed vs. Unlisted Firms: Determinants and Value Effects in the Spanish Stock Market. Rev. Econ. Apl. 2017, 73, 55–94. [Google Scholar]

- Farinós, J.E.; Herrero, B.; Latorre, M.A. Self-selection bias and the listing status of target firms: Value effects in the Spanish market. Czech J. Econ. Financ. 2017, 67, 423–438. [Google Scholar]

- Farinós, J.E.; Herrero, B.; Latorre, M.A. Market valuation and acquiring firm performance in the short and long term: Out-of-sample evidence from Spain. Bus. Res. Q. 2020, 23, 1–14. [Google Scholar] [CrossRef]

- Kahneman, D. Attention and Effort; Prentice-Hall: Englewood Cliffs, NJ, USA, 1973; Volume 1063. [Google Scholar]

- Barber, B.M.; Odean, T. All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. Rev. Financ. Stud. 2008, 21, 785–818. [Google Scholar] [CrossRef]

- Pashler, H.E. The Psychology of Attention; MIT Press: Cambridge, MA, USA, 1999. [Google Scholar]

- Peng, L.; Xiong, W. Investor attention, overconfidence and category learning. J. Financ. Econ. 2006, 80, 563–602. [Google Scholar] [CrossRef]

- Peng, L.; Xiong, W.; Bollerslev, T. Investor attention and time-varying comovements. Eur. Financ. Manag. 2007, 13, 394–422. [Google Scholar] [CrossRef]

- Reyes, T. Negativity bias in attention allocation: Retail investors’ reaction to stock returns. Int. Rev. Financ. 2019, 19, 155–189. [Google Scholar] [CrossRef]

- Kudryavtsev, A. Effect of investor inattention on price drifts following analyst recommendation revisions. Int. J. Financ. Econ. 2019, 24, 348–360. [Google Scholar] [CrossRef]

- Peress, J.; Schmidt, D. Glued to the TV Distracted Noise Traders and Stock Market Liquidity. J. Financ. 2020, 75, 1083–1133. [Google Scholar] [CrossRef]

- Daniel, K.; Hirshleifer, D.; Teoh, S.H. Investor psychology in capital markets: Evidence and policy implications. J. Monet. Econ. 2002, 49, 139–209. [Google Scholar] [CrossRef]

- Miller, E.M. Risk, uncertainty, and divergence of opinion. J. Financ. 1977, 32, 1151–1168. [Google Scholar] [CrossRef]

- Gervais, S.; Kaniel, R.; Mingelgrin, D.H. The high-volume return premium. J. Financ. 2001, 56, 877–919. [Google Scholar] [CrossRef]

- Glasner, J. And now, for those other deals. Wired. 2000. Available online: https://www.wired.com/2000/01/and-now-for-those-other-deals/ (accessed on 22 May 2020).

- Hood, M.; Lesseig, V. Investor inattention around stock market holidays. Financ. Res. Lett. 2017, 23, 217–222. [Google Scholar] [CrossRef]

- Padungsaksawasdi, C.; Treepongkaruna, S.; Brooks, R. Investor attention and stock market activities: New evidence from panel data. Int. J. Financ. Stud. 2019, 7, 30. [Google Scholar] [CrossRef]

- Capron, L.; Shen, J.C. Acquisitions of private vs. public firms: Private information, target selection, and acquirer returns. Strat. Manag. J. 2007, 28, 891–911. [Google Scholar] [CrossRef]

- Feito-Ruiz, I.; Fernández, A.I.; Menéndez-Requejo, S. Determinants of the acquisition of listed versus unlisted firms in different legal and institutional environments. Appl. Econ. 2014, 46, 2814–2832. [Google Scholar] [CrossRef]

- Hirshleifer, D.; Lim, S.S.; Teoh, S.H. Driven to distraction: Extraneous events and underreaction to earnings news. J. Financ. 2009, 64, 2289–2325. [Google Scholar] [CrossRef]

- Latorre, M.A.; Herrero, B.; Farinós, J.E. Do acquirers’ stock prices fully react to the acquisition announcement of listed versus unlisted target firms? Out-of-sample evidence from Spain. Appl. Econ. Lett. 2014, 21, 1075–1078. [Google Scholar] [CrossRef]

- Draper, P.; Paudyal, K. Acquisitions: Private versus public. Eur. Financ. Manag. 2006, 12, 57–80. [Google Scholar] [CrossRef]

- Petmezas, D. What drives acquisitions? Market valuations and bidder performance. J. Multinatl. Financ. Manag. 2009, 19, 54–74. [Google Scholar] [CrossRef]

- Martynova, M.; Renneboog, L. The performance of the European market for corporate control: Evidence from the fifth takeover wave. Eur. Financ. Manag. 2011, 17, 208–259. [Google Scholar] [CrossRef]

- Meneu, V.; Pardo, A. Pre-holiday effect, large trades and small investor behaviour. J. Empir. Financ. 2004, 11, 231–246. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).