Abstract

Led by the UN’s International Maritime Organization (IMO) and the EU, the shipping industry struggles to reduce its greenhouse gas (GHG) emissions to align with the Paris Agreement. Clean Cargo, the leading voluntary buyer–supplier forum for sustainability in the cargo shipping industry, developed some years ago a methodology to calculate and report the GHG emissions from containerships. The recently introduced carbon emission requirements by the IMO and EU have reinforced the members’ interest in a new Clean Cargo reporting mechanism that enables a more effective and efficient monitoring of the decarbonization progress. A better understanding of the user needs accompanied by due consideration to the regulatory environment and the technological advances are key to build this new framework. This paper builds on the case of the Clean Cargo initiative to (1) identify the stakeholders’ expectations and motivations for voluntary disclosure of environmental information, and (2) discuss the governance challenges of voluntary initiatives. A questionnaire was designed and deployed to investigate the current uses of Clean Cargo data and the information sharing among different stakeholders. Voluntary schemes can speed up the decarbonization process by proposing standards accepted by all actors of the global value chain. Clean Cargo members envision reporting on absolute GHG emissions per shipment as the way forward.

1. Introduction

According to the Fourth Greenhouse Gas (GHG) study of the International Maritime Organization (IMO) [1], the maritime industry generated 2.89% of the global anthropogenic CO emissions in 2018. Although this proportion has been relatively stable over the last decade, the CO emissions from international shipping have increased by more than 5% since 2012. To align with the Paris Agreement targets, the IMO launched in 2018 its ‘Initial IMO strategy on reduction of GHG emissions from ships’. The strategy sets the ambition of reducing total annual GHG emissions of international shipping by at least 50% by 2050 compared to 2008. It also stipulates a reduction of carbon intensity, defined as CO emissions per transport work, by at least 40% by 2030 (and towards 70% by 2050) compared to 2008 levels [2]. Given that the transport demand is expected to increase by 4.5% annually [3], these targets become even more ambitious requiring significant and immediate mitigation measures.

At global level, the first regulatory measures on shipping emissions were introduced by IMO in 2011 with the adoption of the Energy Efficiency Design Index (EEDI) and the Ship Energy Efficiency Management Plan (SEEMP) [4]. In addition, as of 2019, ships have to report their fuel consumption and distance travelled under the IMO Data Collection System (DCS) [5]. At regional level, since 2018, ships travelling from, to and within EU ports have been required to report their fuel consumption, CO emissions and transport work under the European Union Monitoring Reporting and Verification (EU MRV) regulation [6]. While the EU MRV regulation is a bit older and more comprehensive than IMO DCS, its regional nature unavoidably limits the achievable coverage. However, both IMO DCS and EU MRV schemes are very recent and the retrospective analysis of their impact is not sufficiently studied yet [7].

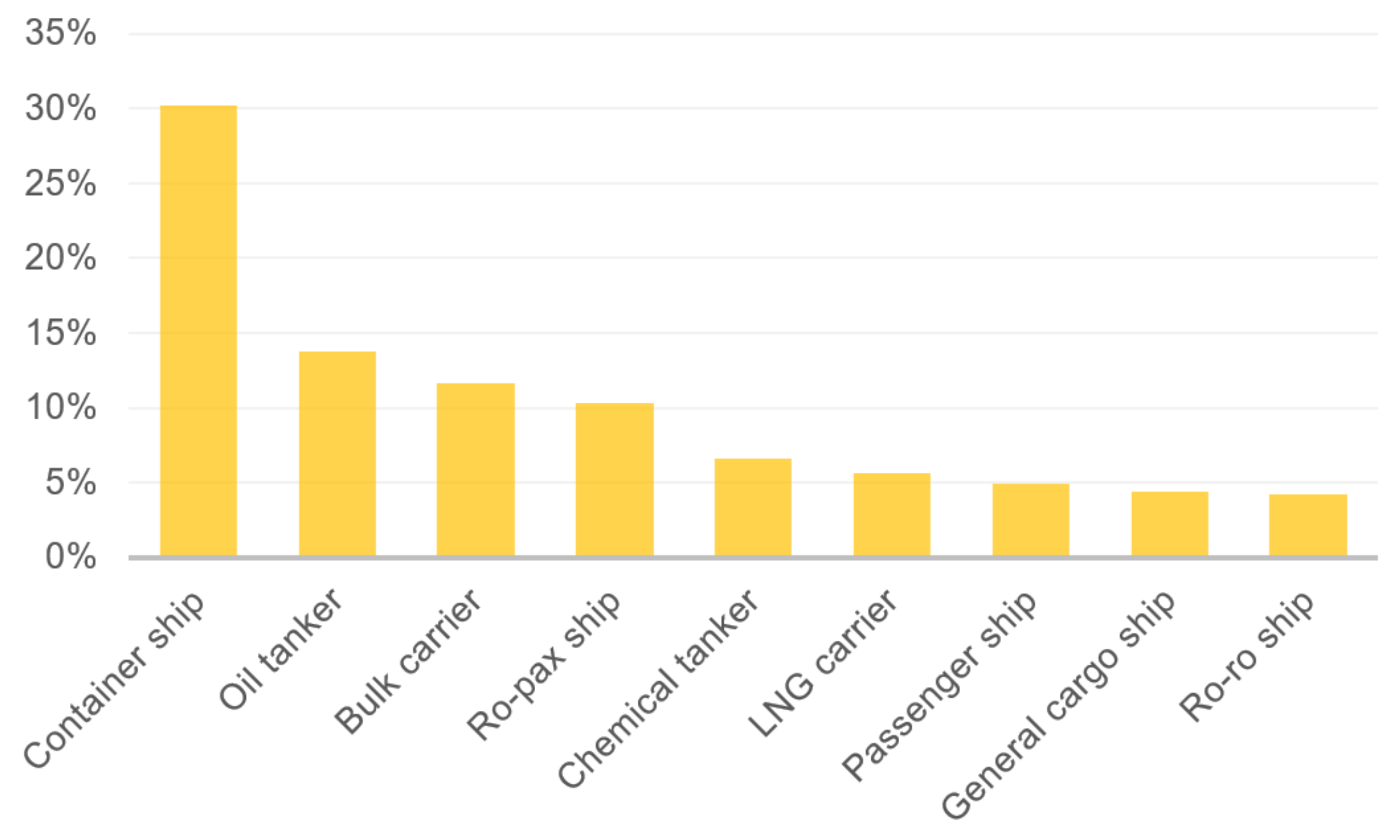

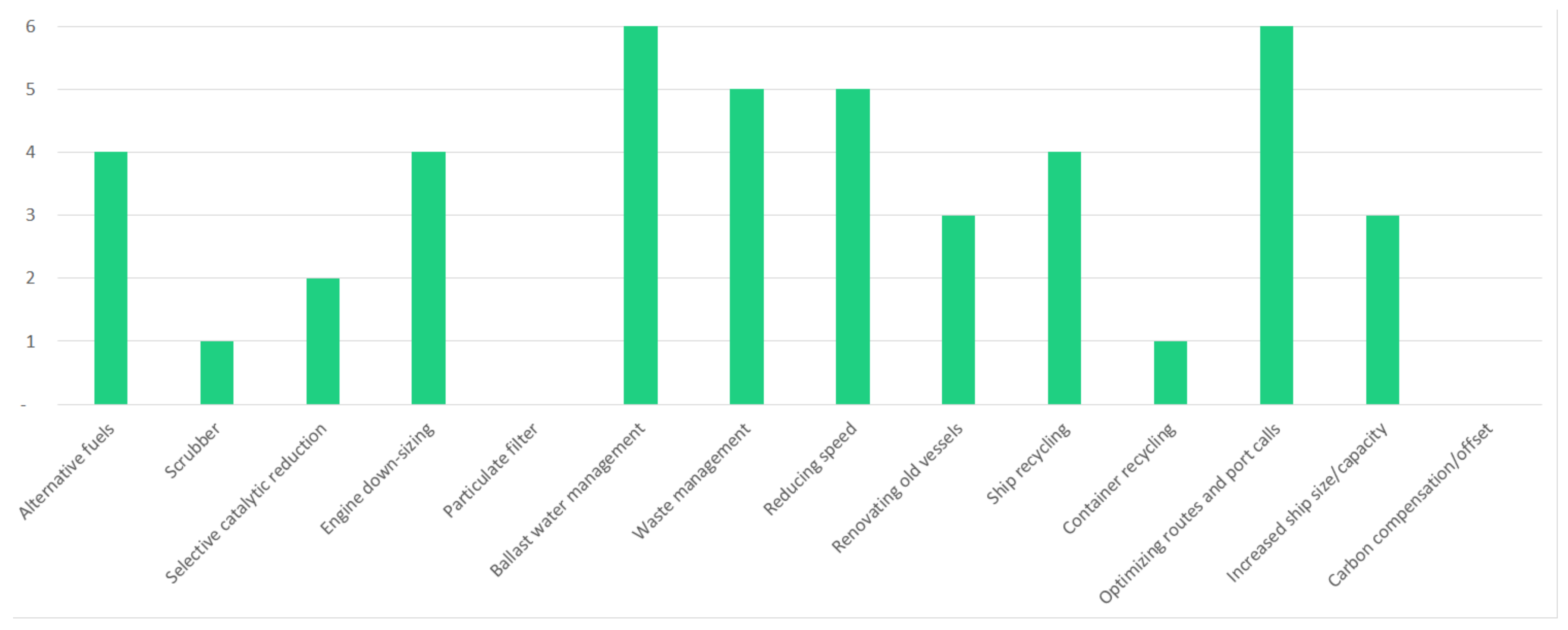

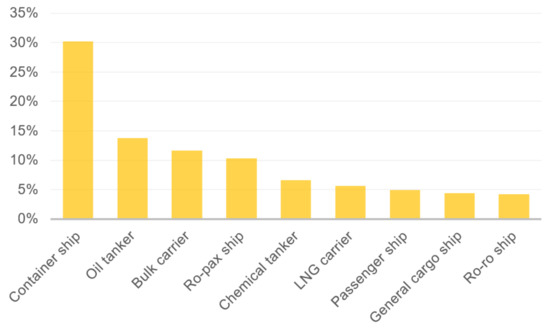

Containerships alongside bulk carriers and oil tankers constitute the three largest emitters within the maritime sector, both globally [1] and regionally [8] (refer to Figure 1). Among these segments, container shipping happens to be the closest one to the end users as it mainly carries consumable goods in break bulk form. As such, it is more susceptible to pressures for better environmental performance coming from cargo owners. The continuously increasing concern of cargo owners can be an important potential driver for environmental upgrading in maritime transport and more specifically in the containership operations [9,10,11,12].

Figure 1.

Share of different ship types in total CO emissions reported under EU MRV for 2019. Source: 2019 CO Emission Report [8].

Several private initiatives have emerged over the years to address sustainability issues in shipping, motivated by a need for more transparency and the corresponding exchange of information between different stakeholders. Section 2.1 presents a number of such initiatives. Among them, the present article focuses on Clean Cargo, previously known as the Clean Cargo Working Group (CCWG). It is a business-to-business leadership initiative dedicated to promoting responsible shipping and reducing the environmental impact of global freight transport. It was launched in the early 2000s by BSR, an organization of sustainable business experts that works with its global network of leading companies to build a just and sustainable world. Clean Cargo involves more than 80 major cargo carriers, shippers and freight forwarders, and represents about 80% of world container cargo capacity [13]. In the 2010s, Clean Cargo established among others a standard for the calculation of CO emissions generated by ocean container transportation, based on operational data reported by carriers. Shippers and freight forwarders use the calculated emissions to assess the footprint of their sea freight as part of their procurement decisions.

With the recent introduction of the above-mentioned emission reporting schemes of IMO and the EU, the initial aim of some private initiatives concerning disclosure of environmental information becomes redundant. Should private initiatives wish to maintain their role of pulling shipping companies towards decarbonization and laying the foundations for future regulations in this direction, they need to evolve with the industry and the regulatory framework and move the decarbonization frontier forward to include new grounds.

Against this background, members of Clean Cargo expressed an interest in defining a new emission reporting framework to be applied in the next decade. To address this need, a dual objective has been set for the present paper: (i) identify the stakeholder expectations and motivations for voluntary disclosure of environmental information, and (ii) discuss the governance challenges of voluntary initiatives.

More specifically, the paper summarizes the results of a questionnaire-based study that was undertaken to map the expectations and needs of the different stakeholders, as well as their willingness to contribute and share information, supporting the definition of the Clean Cargo future reporting framework. Furthermore, the findings of the survey contribute to the on-going dialogue on the transformational power of information with aspects such as the use of information in transport procurement negotiations, and the capacity of the relevant stakeholders (carriers, shippers and freight forwarders) to promote the reduction of carbon emissions in this segment of maritime transport. External parameters, such as international regulation and market-based measures, are integrated in the analysis for this purpose. While several articles have focused on the advantages and weaknesses of private governance initiatives in international shipping [14,15,16,17], the present work investigates the operational and technical aspects of the Clean Cargo initiative, alongside its governance features in view of the above-mentioned external pressures.

Section 2 describes the concept of private initiatives, the common characteristics of initiatives similar to Clean Cargo, and their potential for environmental upgrading together with their limitations. Following this broad review, the Clean Cargo current reporting framework is explained in more detail. Section 3 highlights the context and methodology adopted for this study and Section 4 presents the results of the questionnaire. Section 5 discusses the main findings of this work, while Section 6 concludes the article.

2. Reporting Frameworks

2.1. Literature Search

A great number of private initiatives have emerged since the late 1990s, with a noticeable acceleration in the past decade, to meet the environmental challenges of shipping and fill the gap created by the lack of regulation. Named ‘private standards’ by Scott et al., these initiatives can be of a different nature [17]. This paper focuses on the ‘independent performance indicators’ category in the taxonomy of Gibson et al., also defined as ‘ship rating schemes’ by Scott et al. or ‘eco-rating schemes’ by Poulsen et al. Their aim is to provide an indication of the environmental performance of ships, independently of any regulatory organization or state actor.

Gibson et al. distinguish 12 initiatives in the category ‘performance indicators’ with a public level of transparency, out of the 85 initiatives identified in the literature [17]. Scott et al. highlighted six prominent examples of ship rating schemes and Poulsen et al. based their analysis on six eco-rating schemes, listed on the Sustainable Shipping Initiative (SSI) website [18]. Table 1 summarizes the characteristics of five ship rating initiatives, which are the most frequently cited by the industry [15] and in the literature [9,14,15,16,17,19,20,21,22,23,24].

Table 1.

Most frequently cited ship rating schemes governing CO emissions.

Private stakeholders have been motivated to join these initiatives for three main reasons: social pressures with the goal of establishing a public green image that offers competitive advantages, regulatory pressures concerning both existing and possible future regulations, and financial motivations through the identification of efficiency gains [10,19]. It has been found that the interest in private standards can even be increased by unsuccessful discussions on new regulations [14]. The potential and limitations of these initiatives are analyzed below. The subject is approached through five common perspectives: scope, stakeholder engagement, level of ambition, transparency, methodology and data reliability.

The sustainability issues concerning international shipping are broad and challenging. While the initiatives that constitute the focal point of this paper mostly relate to fuel consumption and air emissions, some also include emissions to water [15,17]. Some schemes specialize in a specific shipping segment, as is the case with Clean Cargo which basically concerns the container industry, while others cover the entire commercial fleet, always with a global ambition and a benchmarking perspective. The scopes of the standards cited in Table 1 overlap due to the objectives and interests of the different stakeholders who are, thus, partly forced to choose among the available schemes. In this respect, the lack of universality of the schemes reduces their potential for environmental benefits [15]. On the other hand, the development of Corporate Social Responsibility (CSR) practices within the shipping industry can both boost participation in such private standards as part of the company CSR strategy, and simultaneously compete with them by creating or suggesting new norms and standards [19].

A key determinant of the success of the private initiatives is “their ability to persuade an adequate number of target actors to make use of the standard” [14]. Clean Cargo is the most successful one in this sense, as it covers more than 80% of global ocean container capacity by deadweight [14,15]. In addition, major cargo owners, who constitute a key stakeholder in the shipping industry, participate actively in the group, thus contributing critically to the scheme’s environmental effectiveness [15]. Such wide acceptance leads to the institutionalization of private standards, which are then observed as becoming ‘obligatory’ without being ‘legally binding’, solely as a result of the industry’s self-regulatory mechanisms and peer pressure [25]. Nonetheless, most of these standards are developed by and for the industry, which results in neglecting important stakeholders, such as financial actors and NGOs. This omission is likely to reduce their legitimacy, and consequently their environmental effectiveness [14,15]. For example, Wuisan et al. emphasized the limited participation of cargo owners in the Clean Shipping Project (CSP), formed mostly by Swedish companies with a limited purchasing power. Other factors weakening the entrenched capability of private initiatives include that the standards require time and financial investments from the different stakeholders, as well as that both engagement in the schemes and willingness to invest in sustainable shipping can be tied to economic results [26].

Another much-criticized element in the literature is the limited level of ambition of the rating schemes. While Wuisan et al. stressed the greater ambition potential and faster implementation of private standards compared to international regulation, Scott et al. argued that in order to avoid discouraging information sharing and participation, the schemes set no absolute criteria. Instead, the schemes evaluate performance against industry averages, making the higher-rated levels easier to reach. A gain in the energy efficiency of ships, correlated with money savings, is often sought and this does not prevent the rise of absolute emissions due to transport demand growth [14]. Even if several rating schemes are considered to go ‘beyond regulatory requirements’, Gibson et al. note that they are unlikely to produce reduction of emissions below the levels set by IMO. As the main reference point for international shipping, IMO standards and methods are usually integrated in the private standards [26]. Besides, scoring mechanisms are often based on vessel design characteristics rather than operational criteria, which does not provide the necessary economic incentives for companies to perform better [17]. Furthermore, no compliance mechanism exists to impose the use of the data produced by the scheme or guide stakeholders in this direction [26]. Finally, certain environmental issues of shipping are neglected from these schemes, such as accidental challenges (invasive species, oil spills, etc.) and the end-of-life problems (recycling) [15].

While there is no doubt that private schemes make information available [14,26], limitations in terms of transparency are pointed out in the literature. For instance, when a vessel benchmarking is available, this is often reserved to the members of the initiative under certain restrictions (membership fee, confidentiality agreement, etc.) [14,15]. The lack of transparency raises two main issues. Firstly, it is not possible to compare the schemes and how a ship or a company is performing within the different schemes. Secondly, the assessment of the environmental improvements driven by these initiatives is complicated and poorly communicated publicly in terms of concrete examples and quantitative evidence [14,15,17]. Limited transparency also characterizes the use of information by the different stakeholders [26].

Lastly, the methodology followed by the rating schemes is another subject of criticism despite the general acknowledgement that the schemes have the potential for improving the internal mechanisms of a company for measuring and mitigating CO emissions [14]. For instance, the schemes often cover different environmental features (CO emissions, air pollutants, discharge to water, etc.) that are combined through weighting factors, which not only vary greatly across schemes but are assigned on the basis of very limited documentation [17]. The data reliability and quality are also questioned: companies often report directly to the schemes, and in the absence of any independent verification, the credibility of the outcomes is jeopardized [15]. Even though a number of initiatives have included third-party verification in their methodology, “established procedures for routinised, ongoing, scrutiny of the standards and their implementation” are nowhere to be seen [14].

In addition to the overlaps in scope and targets previously mentioned, changes in the regulatory framework can affect the potential of private standards with regard to environmental upgrading. The introduction of the EU MRV and IMO DCS has increased overlapping, especially in terms of accountability and, in the case of EU MRV, the public access to CO reporting [14]. On the other hand, new regulations can “play a role in galvanising and shaping private standards”, which can intend to fill the gaps not covered by the new laws [14]. An alignment of eco-rating schemes to regulations on environmental disclosure is thus encouraged in order to gain effectiveness and avoid conflict and confusion among the different stakeholders [11,16,26]. To catalyze the efforts made by the actors involved, IMO can play a critical role in orchestrating these different initiatives [16]. For instance, Lister et al. suggested IMO to grant consultative status to the private standards as a way to enhance their legitimacy and allow greater alignment of the initiatives. Reciprocal benefits between private initiatives and regulatory bodies is also suggested by Gibson et al. for both the implementation of regulations and the uptake of the private initiatives.

2.2. The Clean Cargo Initiative and Its Reporting Framework

The Clean Cargo emission reporting framework was developed in the early 2000s and, apart from small fixes and improvements, it has not changed over the years. Based on data reported by carriers, emission factors are calculated for each carrier and each trade lane, alongside a scoring system including also other environmental attributes.

The current methodology for CO emissions is defined in a document from 2015, available on the Clean Cargo website [21]. On a yearly basis, the carriers of the group (around 20 in number) report data for each one of their vessels, both owned and chartered, operated during the year. For 2019, 17 carriers reported data on approximately 3500 vessels, which collectively represent around 85 percent of ocean container capacity worldwide [27].

For every vessel of their fleet operated for more than 90 days, carriers report the following data further analyzed under the Clean Cargo framework:

- Vessel characteristics: IMO number, year built, nominal capacity (TEU), vessel ownership (owned/chartered), number of reefer plugs;

- Service characteristics: time frame of data (days), trade lane, distance sailed (km);

- Fuel consumed (tonnes): HFO, MDO/MGO, LFO, propane LPG, butane LPG, LNG, methanol, ethanol, hybrid fuels;

- Average sulfur content by weight (%): HFO, MDO/MGO, LFO, hybrid fuels;

- NO performance: main and auxiliary engines NO performance (g/kWh) and rated engine speed (rpm);

- Certification under ISO 14001 or other equivalent environmental management system.

In addition, an environmental performance assessment is carried out concerning the company’s environmental goals and policies, performance management and public reporting.

Based on the data collected, different outputs are produced both on a carrier- and a trade-lane-level. Each carrier receives a yearly scorecard, including the following elements:

- The carrier scores for CO, SO, NO, Environmental Management System (EMS) and transparency: The CO and SO scores are calculated in relation to the Clean Cargo averages for these emissions. The NO emission score is calculated in relation to the IMO curve defined in the resolution MEPC.251(66) of the MARPOL protocol [28]. The EMS score is defined as a percentage over the certified fleet. Finally, the transparency score is based on the corporate-level public reporting. Note that in order to account for the energy consumed by the refrigerated containers (also called reefers), a separate score (CO Reefer) is calculated for this part of energy demand, while the remaining energy consumption is reflected in the CO Dry score [21].

- The carrier emissions of CO Dry, CO Reefer and SO expressed in g/TEUkm per trade lane and carrier. A trade lane describes the major route on which a vessel is deployed. There are global trade lanes, such as ‘Asia to-from North Europe’, and intra-regional trade lanes, such as ‘Intra North Europe’.

- The year-over-year performance for the carrier emissions of CO Dry, CO Reefer and SO per trade lane and carrier, for tracking potential improvements from one year to the next.

3. Methodology

One of the objectives of this paper is to identify the needs and expectations of different stakeholders for environmental information, as well as their willingness to contribute and share information. We designed a questionnaire to interrogate directly the members of the group on the definition of Clean Cargo’s future reporting framework. The members were able to access the questionnaire for three weeks in May 2020. This section describes the objectives, content and development process of the questionnaire.

3.1. Preliminary Expectations about the Future Reporting Framework

Developed in the early 2000s, the Clean Cargo reporting framework based its methodology and data collection process on member expectations. At that time, companies did not have reliable IT systems in place and data processing was costly. Clean Cargo succeeded over the years in developing comparable data and a recognized methodology across the container sector.

Since the establishment of the methodology, several improvements have been implemented. A recent example is the shift of CO emissions being initially calculated on a Tank-To-Wheel (TTW) basis to a Well-To-Wheel (WTW) approach in 2020, in order to align with the Global Logistics Emissions Council (GLEC) recommendations [29]. At the same time, the Clean Cargo initiative scaled the emission factors from CO to CO, following the recommendations of the GLEC framework. The shift from CO to CO (CO = 101–102% of CO) accounts for the emissions of other GHG (methane, nitrous oxide, sulphur hexafluoride, nitrogen fluoride, hydrofluorocarbons, perfluorocarbons) [29]. In summary, Clean Cargo shifted from CO TTW emission factors to CO WTW emission factors in 2020, as explained in Clean Cargo annual report “2019 Global Container Shipping Trade Lane Emissions Factors” [27]. Consequently, while the Clean Cargo methodology mentions CO scores and emission factors, from this point onward we refer to GHG scores and emission factors, to emphasize this recent shift.

With the impressive advent of digital solutions and the increased societal expectations for more transparency, members across segments have expressed their desire to further develop the existing reporting framework. In response, BSR formed the ‘Future of Reporting’ working group within Clean Cargo, to draw the new reporting framework with a 10-year horizon. The main objective is to obtain more accurate data in an easier manner. The potential introduction of carbon pricing measures and other new regulations are issues that also need to be considered.

3.2. Questionnaire

The identification of the wishes of the Clean Cargo members in relation to the future reporting framework, as well as the corresponding implications constitute the key objective of this research work. A purposely built questionnaire was chosen as the method for capturing the diversity of opinions across members. The research questions addressed and the corresponding hypotheses are those that enter the questionnaire directly and there is no need for them to be repeated here. For the sake of completion, it is mentioned that the usual deductive (for the formulation of hypotheses) and inductive (for revising the initial theory/assumptions) theory of social research is silently applied [30].

Questionnaires are a common method for collecting data from a target group, particularly in social sciences. We used a self-completion questionnaire, meaning that respondents answer the questionnaire themselves. As a method, the self-completion questionnaire offers the advantage of being quick to administer and convenient for the respondents, while it avoids biases introduced by the interviewer [30]. The method’s weakness, namely the inability of the researcher to ensure completion of the entire questionnaire or collect additional data, was perceived by the authors as the price we had to pay in exchange for securing a sufficient sample for the analysis.

The design of the questionnaire involved the close cooperation and exchange of views between the authors and the BSR staff in charge of the Clean Cargo initiative. The expertise of the BSR staff in relation to the evolution of the initiative and its framework was a key asset. With the assistance of the BSR staff, the authors refined the questionnaire to serve the research purpose, and customized it to the Clean Cargo segments (carriers, shippers and freight forwarders). In addition, we conducted a pilot run for verifying the questions involving one Clean Cargo member from each segment. These pilots provided useful comments improving the quality of the questionnaire, which reflects both the industrial practices and the Clean Cargo experiences of the members. Table 2 provides an overview of the questionnaire structure.

Table 2.

Structure and content of the questionnaire.

Three major challenges arose when designing the questionnaire. First, the members of Clean Cargo consist of both data providers (carriers) and users (shippers and freight forwarders). These two groups of users have different needs and use the data reporting mechanism differently, resulting in two versions of the questionnaire: one for data providers and a separate one for data users, with small differentiation between shippers and freight forwarders. Three different versions of the questionnaire were finally produced, one for each segment, with similar questions for shippers and freight forwarders.

A related issue concerned the desired level of detail of the output, and consequently, input of the system. The users of the system prefer a higher level of detail in the information produced. However, this requires a much greater effort in data collection and manipulation from the side of the data providers. A balance is, therefore, necessary to meet the information requirements at minimum cost.

Second, the design of a future reporting system has to accommodate both the present and the anticipated future needs of the users. In turn, future needs are shaped by the aspirations of the users themselves and by the requirements imposed externally, such as the regulatory environment. Thus, the questionnaire provided the respondents with the opportunity to discuss their environmental strategy and their vision for Clean Cargo, as well as possible effects from the ever-changing regulatory framework and business environment.

Third, we kept the questionnaire reasonably short (less than 30 min to fill in), to avoid the risk of a very low response rate. This was achieved through a mix of closed- and open-ended questions, enabling respondents to describe in detail their views if they so wished. The questionnaire could be filled in anonymously and individual answers were confidential.

Due to the relatively small size of the sample, we decided to enhance the reliability of our results by conducting interviews for validating our findings. We interviewed one shipper, one freight forwarder and one carrier. We found a good convergence between the information collected from the questionnaire and the interviews. The following section presents the results produced by both the questionnaire and the interviews.

4. Results

4.1. The Sample

The main challenge of every survey lies in obtaining a good-sized representative sample that can provide a broad picture of the target population, in this case the Clean Cargo membership. As of 6 May 2020, the Clean Cargo membership comprised of 80 companies. Among them, our questionnaire targeted a total number of 68 companies, representing all three segments (carriers, shippers and freight forwarders). The 12 remaining companies—car carriers, subsidiaries of carrier companies not reporting to Clean Cargo, or ‘Less than Container Load’ freight forwarders which have limited access to the Clean Cargo data—do not use the reporting framework. Consequently, they were excluded from the present study.

We collected 34 responses, representing 50% of the targeted companies. Nine carriers, 13 shippers and 12 freight forwarders answered. All answers entered the analysis although some of them were incomplete. Table 3 shows the composition of complete responses by segment. The resulting sample of complete responses (19 out of 68) is more than adequate, as is the representation of the segments where complete responses correspond to 41%, 23% and 24% of the carriers, shippers and forwarders respectively. Sample composition in terms of total responses is more balanced with response rates of 53%, 50% and 48%, respectively.

Table 3.

Number of responses to the questionnaire by segment and level of completeness.

Table 4 shows the respondent profiles within their affiliated companies. Most respondents work for the Sustainability department of their organization, followed by the Logistics department in the case of shippers. However, the second most popular origin for freight forwarders is the Procurement department, indicating perhaps the prominent use of the Clean Cargo data in procuring transport services.

Table 4.

Profiles of respondents (33 responses).

The following two subsections present the responses to the questionnaire. The first one concerns the current reporting mechanism and investigates the motivation of the companies for participating in the Clean Cargo scheme, the data used, and the effort required by the carriers to produce these data. The second subsection deals with future reporting needs and concentrates on requirements imposed either by emission tracking or by external forces.

4.2. Current Clean Cargo Reporting Framework

4.2.1. Reasons for Using a Private Reporting Framework

Carriers identify shippers and freight forwarders as the main audience of their emission reporting, and expect them to use the reports for informing their own clientele and for selecting service providers. They also use the produced output internally for evaluating their own performance and for supporting their policy deliberations. About half of the responding carriers use Clean Cargo data to fulfill regulatory reporting obligations and to support rebate applications with port authorities and terminal operators. Less frequently, carriers also communicate Clean Cargo data to investors and suppliers. Most carriers (5 out of 7) perceive their environmental performance (especially in terms of GHG emission abatement) as an important contributor to their competitiveness and, thus, as a strategic objective. Consequently, Clean Cargo reporting is viewed as a useful tool.

This result is in line with the responses from the shippers and freight forwarders, who mainly use Clean Cargo data to estimate their own emissions and to reach transport procurement decisions. Internally, shippers mainly use the carriers’ emissions to monitor their progress towards decarbonization, to reduce their Scope 3 (the GHG Protocol categorizes GHG emissions in three scopes: Scope 1 covers direct emissions from owned or controlled sources, Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating and cooling consumed by the reporting company, and Scope 3 includes all other indirect emissions that occur in a company’s value chain [31]) emissions, and to help set up their own strategy (only one shipper does not report their Scope 3 emissions). Freight forwarders also use Clean Cargo data to provide carbon reports to their customers, namely the shippers. The audience of the shippers’ and forwarders’ emission reporting is mainly internal stakeholders, end customers and investors.

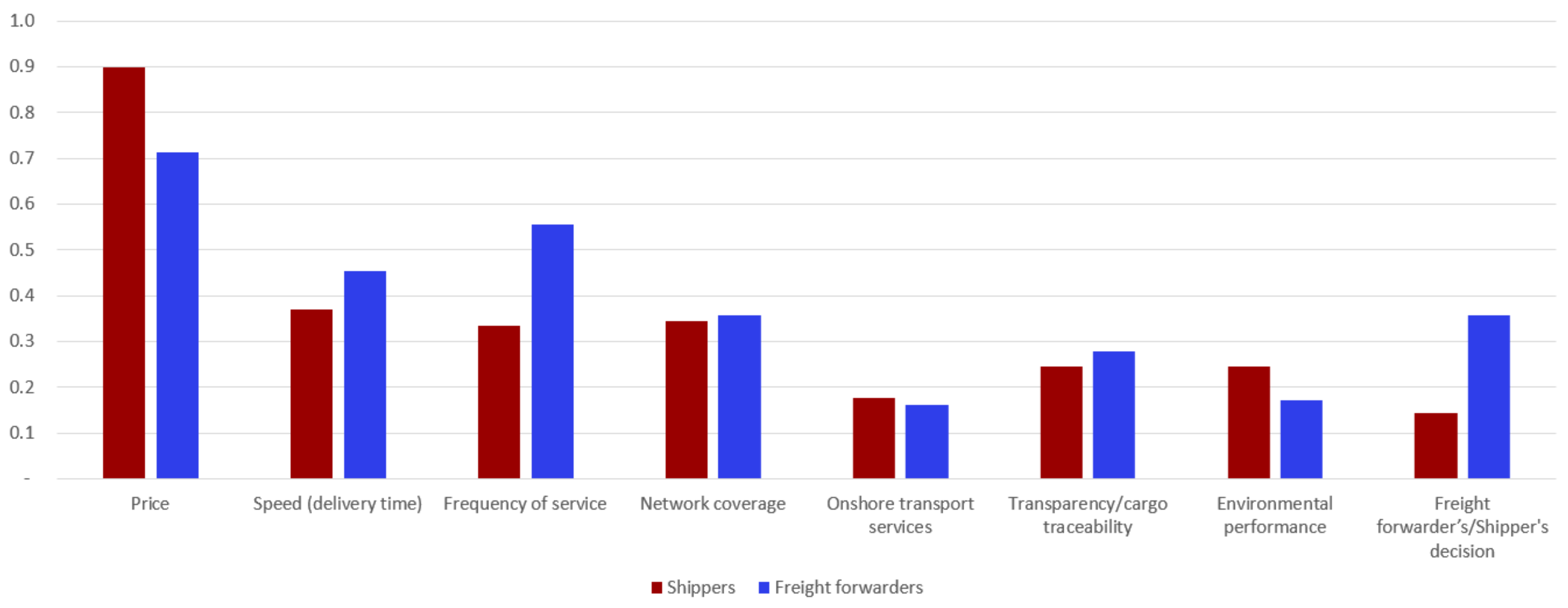

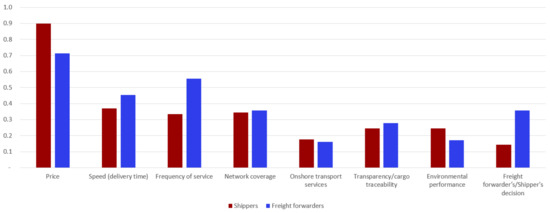

Although carriers’ emissions are often stated as an input in procurement decisions, Figure 2 shows that environmental performance is not a priority when selecting carriers (the vertical scale of the graph reflects the inverted average rank of each criterion with 1 being the first priority and 8 the last one). Price remains by far the main driver for selecting the service provider. The second most important criterion is delivery time for the shippers and frequency of service for the freight forwarders. It is worth noting that freight forwarders do not often make the call themselves as the carrier is selected directly by the shipper.

Figure 2.

Carrier selection criteria.

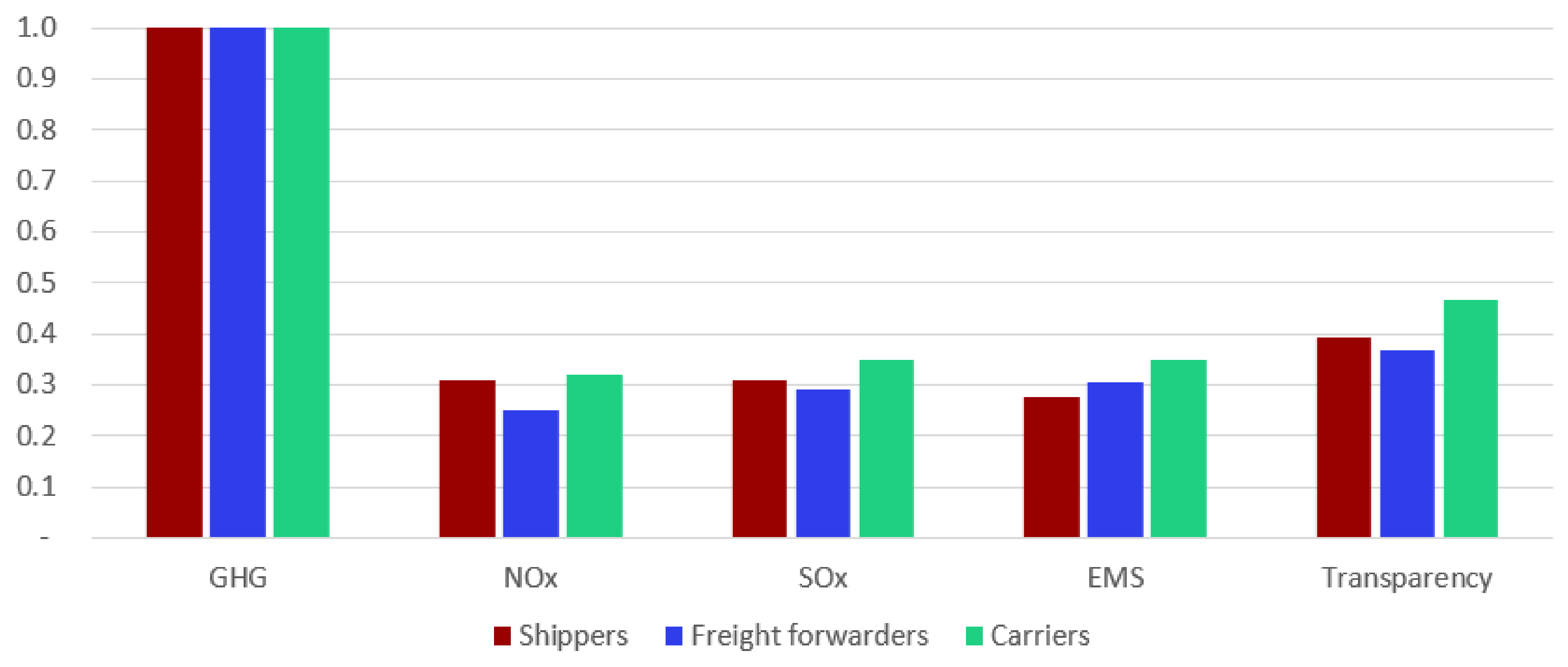

4.2.2. Type of Data Used by Different Stakeholder Groups

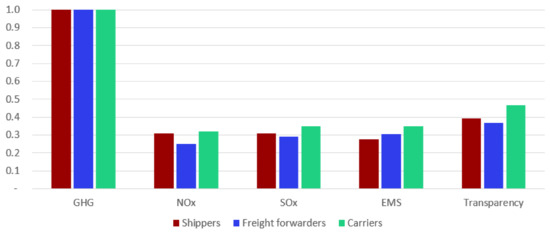

The questions regarding which Clean Cargo data and outputs the different stakeholders use were divided in two categories: the environmental attributes (GHG, SO, NO, EMS, transparency) and the outputs, which include the carrier scores, their trade lane and fleet emissions and their year-over-year performance. Regarding the first category, as shown in Figure 3, the most important element for all stakeholders is GHG emissions. The second most important element identified by all stakeholders is transparency, reflecting the corresponding demand of the society. Carriers ranked NO as the least important attribute, after SO and EMS. It should be noted that NO emissions [28], and, since 2020, SO emissions [2] are regulated, representing a reduced strategic challenge for carriers. Similarly, the least importance was given to NO and SO emissions and EMS by shippers and freight forwarders.

Figure 3.

Clean Cargo environmental attributes within members’ environmental strategy.

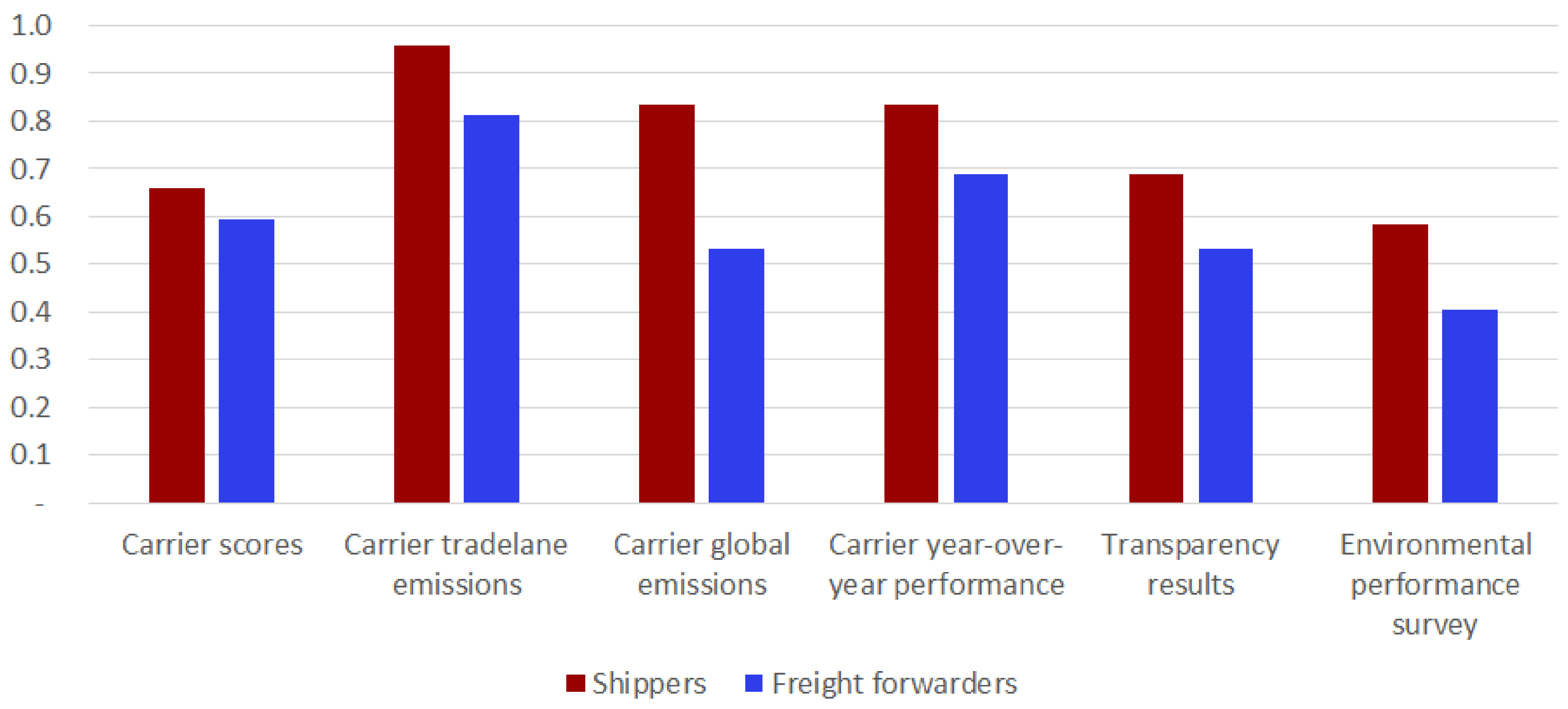

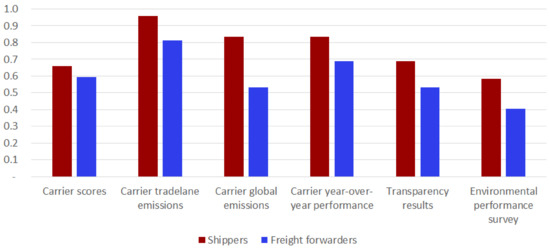

In terms of outputs, both shippers and freight forwarders consider the carrier trade lane emissions to be the most useful information (refer to Figure 4, where usefulness is measured on a Likert scale from 0 (never use it) to 1 (very useful)). This was expected, as most of them use Clean Cargo data to estimate their own emissions. For the same reason, both these stakeholder groups consider the year-over-year performance as the second most useful output. Shippers view the carrier fleet emissions as equally useful, ahead of carrier scores, transparency and the environmental performance survey.

Figure 4.

Usefulness of Clean Cargo outputs for shippers and freight forwarders.

The most useful output for the carriers are the GHG Dry emissions at both the fleet and trade lane levels, followed by GHG Reefer emissions, year-over-year performance and SO emissions. More than half of the carriers use Clean Cargo scores, while none of the respondents use NO and EMS results.

4.2.3. Reporting Effort of Carriers

The data collection process can be time- and resource-consuming for both carriers and BSR staff. Nevertheless, most carriers of the sample state that their environmental reporting generally goes beyond the requirements imposed by the Clean Cargo reporting framework. This is due to internal reporting needs and requirements related to regulations and other voluntary schemes.

4.3. Future Reporting Framework

4.3.1. Emission Tracking

It is generally acknowledged that the metrics currently used for tracking emissions are insufficient to address the challenges generated by the ever increasing societal pressure for decarbonization. However, no consensus on the metric to be used internally by the carriers emerged from the questionnaire. Most carriers agree that the actual emissions per transport work is what is mainly needed for their communication with customers (shippers and forwarders).

Indeed, in order to improve their internal reporting of maritime emissions, shippers expressed a need for GHG (CO equivalent) absolute emissions on a WTW basis, more comprehensive data on trade lane and vessel level, and also information on air pollutant emissions (SO and NO). Freight forwarders expressed similar needs, with a great interest in GHG emissions by shipment (). Requests have also been reported for emissions per transport work () on a per vessel, per ship type, per port pair, and on a per alliance basis.

4.3.2. External Environment

While shippers assess the impact of the maritime regulatory framework on their business as being moderate, freight forwarders state that the regulatory framework can affect their everyday business significantly. Consequently, freight forwarders follow developments in the regulatory environment closely, as opportunities for introducing new services to their clientele might emerge. Approximately half of both shippers and freight forwarders include the IMO targets in their environmental strategy. Some shippers declare having more ambitious targets at company level than those of IMO 2050.

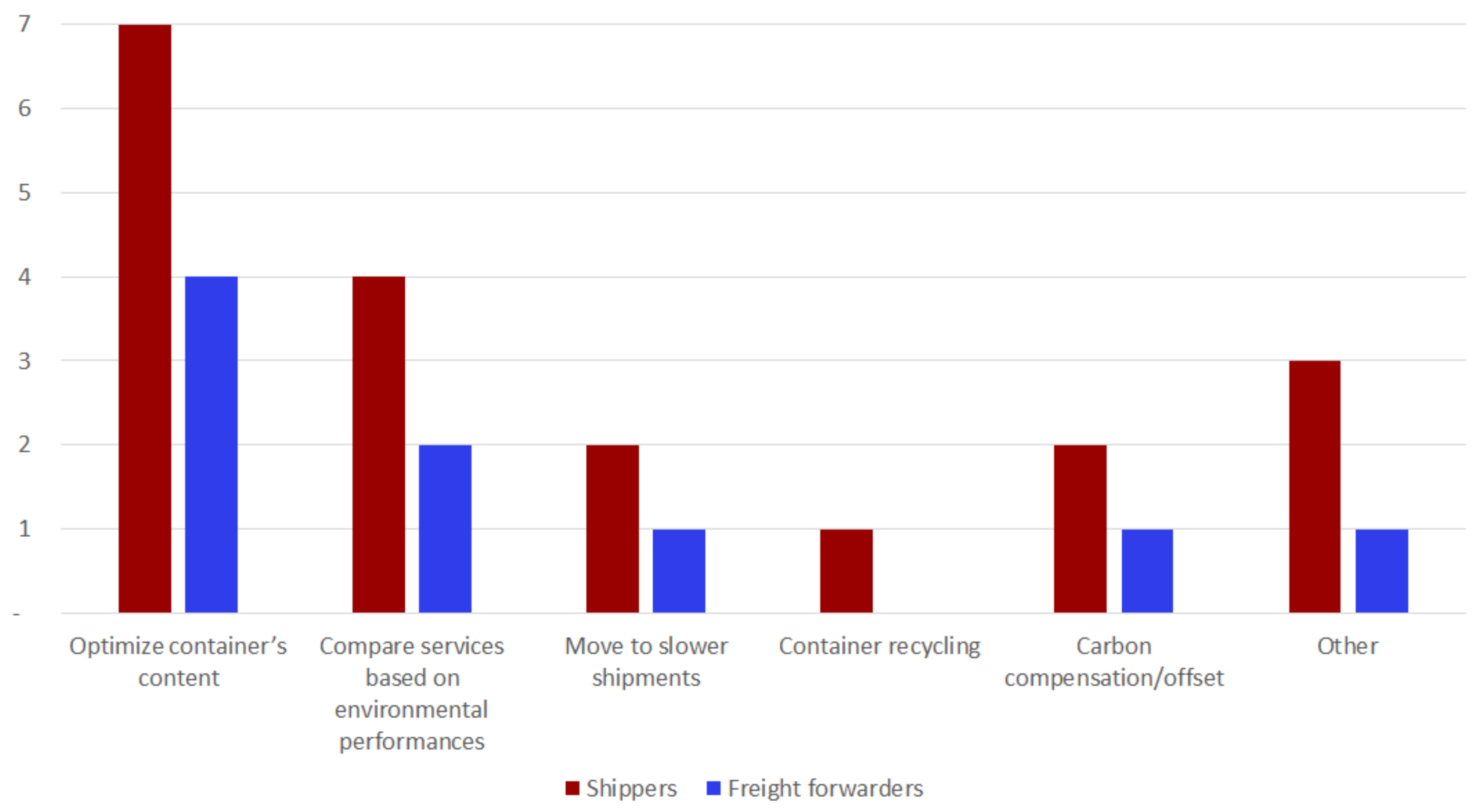

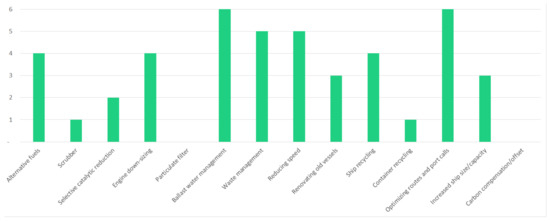

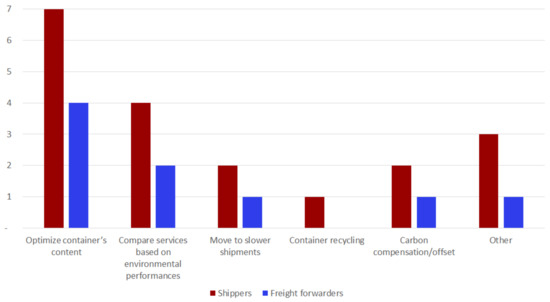

Figure 5 and Figure 6 present the popularity of measures that carriers and shippers/forwarders, respectively, implement to reduce their environmental impacts (the vertical axis indicates the number of respondents who have selected each measure). Optimization of routes and port calls by the carriers, and optimization of container content by the shippers/forwarders are the most popular measures, as they also have a bearing on the financial profitability of the companies involved. More than half of the responding carriers implement slow steaming, engine downsizing and alternative fuels, including LNG and biofuels, in relation to carbon emission reduction. Ballast water management, waste management and ship recycling are also high in the carriers’ agenda. The limited popularity of lower speeds among the shippers/forwarders in contrast to the views of the carriers is worth noting.

Figure 5.

Measures implemented by carriers to reduce their maritime environmental impacts.

Figure 6.

Measures implemented by shippers and freight forwarders to reduce their maritime environmental impacts.

5. Main Findings

The analysis of the responses received and the subsequent interviews with Clean Cargo members led to the following main findings:

- GHG emissions are at the core of the members’ interests across all segments;

- Absolute GHG emissions per shipment constitutes a main request of shippers and freight forwarders;

- The way data are used by shippers and freight forwarders is not always harmonized and can lead to discrepancies;

- The reporting effort of carriers is quite substantial and needs to be considered when modifying the reporting framework;

- Several members are investing in alternative fuels to decarbonize their transport operations, posing a number of questions in relation to the Clean Cargo reporting;

- Although many shippers and freight forwarders have set Scope 3 targets, very few have a specific maritime reduction target.

5.1. Improving Clean Cargo Data and Its Use

GHG emissions are by far, and across all segments, the main concern of Clean Cargo members in terms of environmental impact. This aligns with the IMO 2050 targets on CO emissions reduction and the need for decarbonizing the sector. Tang and Gekara analyzed the CSR report of 15 carriers and also concluded that the CO emissions, along with the energy and fuel efficiency, were the top priorities for these companies [32]. Other environmental impacts, such as SO and NO emissions or waste, water and chemicals management, generally garner less interest. Carriers do not use NO and EMS, which are also of lower priority for the shippers and freight forwarders. These matters are handled more effectively by the IMO and are, thus, of a less strategic nature for the members.

Shippers, and thereby freight forwarders, often need to obtain the absolute emissions per ship to improve the granularity and accuracy of their maritime emissions reporting. Indeed, several of them would like to have the absolute emissions per shipment, expressed in , in order to be compatible with reporting emissions from other sources and transport modes.

Data use by shippers and freight forwarders needs to be harmonized. Weaknesses exist within the calculation of own maritime emissions by the shippers/forwarders which uses the carriers’ trade lane emissions as input. For example, the distance calculated by the users varies depending on the system used, and does not always reflect the real distance sailed by carriers. A 15% distance detour factor is currently recommended by Clean Cargo to fix this problem.

Carriers spend hours to collect their vessels’ data and report it under the Clean Cargo framework, involving several persons in their company, including crew members. Some data points are more challenging to collect, such as the sulfur content of fuels and the characteristics and operational data of the chartered vessels. These challenges need to be reconsidered in view of the recent changes in reporting requirements imposed by the regulatory framework and industry standards.

5.2. Driving Container Ship Decarbonization across the Membership

Several members are already investing in alternative fuels, such as LNG and biofuels. This raises questions concerning the integration of alternative fuels into Clean Cargo reporting, particularly in relation to upstream emissions and the applicability of the life cycle approach. The varying emission factors of the literature create further compatibility problems when integrated in the Clean Cargo reporting system. In fact, the matter has not been resolved scientifically and it is still being discussed at IMO.

Shippers appear as the segment that set the most ambitious decarbonization targets through their Scope 3 emissions. In fact, some shippers even consider the IMO targets to be very modest and have established their own more ambitious targets. This is not surprising since they comprise consumer-facing companies with relatively high reputation risks, while the decarbonization effort mainly has to be undertaken by a third party (carriers or ship owners). It is worth noting that the Clean Cargo initiative is dedicated to the environmental performance improvement of the marine container transport segment specifically, leaving little room for measurement, evaluation, and reporting of out-of-segment emissions.

The question that remains to be answered is whether the shippers and forwarders are in a position to incentivize reduction of air emissions from containerships. Poulsen et al. argue that the power relations between actors in the global value chains have a decisive impact on the environmental footprint of shipping [33]. In relation to the tanker shipping that they studied, they suggest directing attention to the powerful cargo owners. Unlike the tanker industry, however, the clientele of container shipping is much more dispersed as this part of the industry carries mainly semi-finished and finished products in break bulk form. Carriers constitute the most powerful actor here as the 10 largest companies control 84.5% of the world fleet [34]. As shown in Figure 2, the environmental performance of the carriers plays a rather secondary role in the procurement decisions of shippers and forwarders, which are still driven by price and reliability [10,11,26]. The dominant role of carriers in reducing emissions is also confirmed by their active involvement in all major regulatory fora, including IMO and the EU.

Furthermore, it is worth noting that carriers already offer specialized emission calculators to their customers. Although this development addresses a real market need, the lack of standardization impedes compatibility and hinders benchmarking. A private initiative, such as Clean Cargo, can harmonize the methods deployed and allow shippers to select the most attractive service.

6. Discussion

6.1. Recommendations Based on the Main Findings

Several recommendations can be made based on the findings presented earlier. Although these recommendations are focused on the Clean Cargo framework, they can be adapted to serve other voluntary initiatives as well.

Firstly, carriers have recently started reporting fuel consumption and CO emissions under the existing regulatory frameworks (EU MRV and IMO DCS). Differences exist between Clean Cargo and these schemes in terms of both aims and responsibilities. Clean Cargo aims to make GHG emissions transparent to shippers and freight forwarders. IMO DCS enables IMO to monitor progress on CO savings, while EU MRV serves as the basis for the Emission Trading Scheme of the European Commission. In terms of responsibilities, the ship operator (carrier) undertakes reporting for the Clean Cargo framework, while responsibility goes to the ship owner for the EU MRV and the DOC (Document of Compliance) holder for the IMO DCS. As such, a charter vessel owner will focus on the regulatory schemes but have no interest in private standards, while a pure operator, who does not own any vessels, concentrates on private standards and has no formal legal obligations to report emissions.

Several data items collected by these schemes are identical. An alignment of the data format required by the Clean Cargo reporting framework to IMO DCS and EU MRV could facilitate and harmonize reporting. As Poulsen et al. argue, “environmental upgrading in shipping is not likely to materialize without clear and enforceable global regulation and stronger alignment between regulation and voluntary sustainability initiatives” [11]. For the metrics other than CO that are less popular, new considerations should be made to investigate how members, especially shippers and freight forwarders, consider these environmental impacts in view of the regulations in force. Decisions can then be made after comparing costs with benefits.

Secondly, the absolute emissions of GHG per shipment should be examined as a new metric, in line with the requests put forward by several shippers and freight forwarders. In addition to the complications created by the nature of the cargo (volume- or weight-intensive), this would require to report the exact weight of the cargo and work out a detailed emission allocation mechanism that takes into consideration the repositioning of containers. Such a scheme would be the equivalent of the recently published Sea Cargo Charter for the dry and liquid bulk sector [35]. Of course, such a scheme would be very demanding on the side of the carriers and the group should assess the benefits of more accurate reporting against the costs of producing these reports. In case that this suggestion proves too ambitious, carriers could report emissions per voyage along with the request of some members who have already been pushing for adopting service-level reporting.

The final recommendation relates to the potential role of voluntary initiatives in driving the demand for greener services. While ambitious regulation for GHG emission abatement can take years to be negotiated and adopted, voluntary schemes such as Clean Cargo have the potential to speed up the decarbonization process by proposing standards accepted by all actors of the global value chain.

6.2. Limitations and Further Research

The presented work is not without limitations:

- The response rate for the questionnaire was about 50%, and some of these responses were only partially complete;

- The questionnaire was designed to raise a broad scope of issues concerning the environmental reporting of Clean Cargo and a relatively large number of questions were asked. To reduce the time required for answering these questions, many of the questions were designed in a multiple choice format. Although the possibility of commenting on an answer was offered, the risk that the answers are not fully described cannot be ruled out;

- The responses received from freight forwarders were generally less elaborated than the rest, making some results difficult to interpret.

Although an effort was made to tackle these limitations by interviewing selected members following the survey, this research could benefit from having the feedback of all members, maybe in a more formalized setting. Furthermore, decisions on the metrics used by the future reporting framework can be greatly supported by assessing the benefits to be generated against the costs of production for various possible levels of detail and accuracy. The matter requires a great deal of coordination among members as it is a clear split incentive case; the party receiving the benefits (shippers/forwarders) is not the one bearing the costs (carriers).

7. Conclusions

The paper identifies and discusses the expectations and needs of the industrial stakeholders that participate in the Clean Cargo initiative in relation to the voluntary disclosure of environmental information. A questionnaire, supported by interviews, gathered the perspectives of Clean Cargo members on the design and integration of the future reporting framework. GHG emissions constitute the primary interest of the members, with the absolute GHG emissions per shipment being the ultimate desire of shippers and freight forwarders. Voluntary schemes such as Clean Cargo have the potential to speed up the decarbonization process by proposing standards accepted by all actors of the global value chain. Alternative fuels entering the market need to be integrated in the reporting framework, following a comprehensive analysis of their emission factors and their role in the decarbonization pathway.

The integration of these elements would greatly improve the added value of the future Clean Cargo reporting framework, particularly following the introduction of the mandatory reporting schemes of IMO and the EU. The level of ambition of this future framework depends on the balance reached between the demands of the shippers/forwarders and the required efforts by the carriers to collect and process the necessary data. In this respect, the reporting of emissions per service rather than per shipment can be a compromise worth considering. We hope that our findings and recommendations will contribute to strengthening the role of the voluntary schemes in meeting the IMO 2050 targets.

Author Contributions

Conceptualization, A.G.; methodology, A.G., G.P. and M.B.B.; validation, A.G., G.P. and M.B.B.; formal analysis, A.G.; investigation, A.G.; resources, A.G., G.P. and M.B.B.; data curation, A.G.; writing—original draft preparation, A.G.; writing—review and editing, G.P. and M.B.B.; visualization, A.G.; supervision, M.B.B. and G.P.; project administration, M.B.B.; funding acquisition, G.P. and M.B.B. The paper is founded on the M.Sc. thesis of A.G. [36]. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Danish Maritime Fund under the NICE project, grant number 2020-024.

Data Availability Statement

Restrictions apply to the availability of the data used in the analysis. These data are retained by BSR and can be availed by the corresponding author only with the permission of BSR.

Acknowledgments

The authors express their gratitude to Victor Gancel, Clean Cargo manager, for his precious advice during the whole process of this study, and to all the respondents of the survey for their time and insights. The authors are also thankful to the four Sustainability reviewers, who provided constructive comments on two earlier versions of this manuscript.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

Abbreviations

The following abbreviations are used in this manuscript:

| CCWG | Clean Cargo Working Group |

| CO | carbon dioxide |

| CSI | Clean Shipping Index |

| CSP | Clean Shipping Project |

| CSR | Corporate Social Responsibility |

| DCS | Data Collection System |

| DOC | Document Of Compliance |

| EEDI | Energy Efficiency Design Index |

| EMS | Environmental Management System |

| ESI | Environmental Ship Index |

| EU | European Union |

| EVDI | Existing Vessel Design Index |

| GHG | greenhouse gas |

| GLEC | Global Logistics Emissions Council |

| HFO | Heavy Oil Fuel |

| IMO | International Maritime Organization |

| LFO | Light Oil Fuel |

| LNG | Liquefied Natural Gas |

| LPG | Liquefied Petroleum Gas |

| MDO | Marine Diesel Oil |

| MEPC | Marine Environment Protection Committee (of the IMO) |

| MGO | Marine Gas Oil |

| MRV | Monitoring, Reporting and Verification (of CO emissions) |

| NO | nitrogen oxides |

| PM | particulate matter |

| SEEMP | Ship Energy Efficiency Management Plan |

| SO | sulfur oxides |

| SSI | Sustainable Shipping Initiative |

| TEU | Twenty-Foot Equivalent Unit |

| TTW | Tank-To-Wheel |

| WTW | Well-To-Wheel |

References

- Faber, J.; Hanayam, S.; Zhang, S.; Pereda, P.; Comer, B.; Hauerhof, E.; Schim van der Loeff, W.; Smith, T.; Zhang, Y.; Kosaka, H.; et al. Fourth IMO Greenhouse Gas Study 2020; Technical Report; International Maritime Organization (IMO): London, UK, 2020. [Google Scholar]

- IMO. Initial IMO Strategy on Reduction of GHG Emissions from Ships; MEPC.304(72); International Maritime Organization (IMO): London, UK, 2018. [Google Scholar]

- UNCTAD. Review of Maritime Transport 2019; Technical Report October; United Nations Conference on Trade and Development: Geneva, Switzerland, 2019. [Google Scholar]

- IMO. Inclusion of Regulations on Energy Efficiency for Ships in MARPOL Annex VI; MEPC.203(62); International Maritime Organization (IMO): London, UK, 2011. [Google Scholar]

- IMO. Data Collection System for Fuel Oil Consumption of Ships; MEPC.278(70); International Maritime Organization (IMO): London, UK, 2016. [Google Scholar]

- Council of the European Union; European Parliament. Monitoring, Reporting and Verification of Carbon Dioxide Emissions from Maritime Transport; Regulation (EU) 2015/757; European Union: Brussels, Belgium, 2015.

- Panagakos, G.; Pessôa, T.d.S.; Dessypris, N.; Barfod, M.B.; Psaraftis, H.N. Monitoring the carbon footprint of dry bulk shipping in the EU: An early assessment of the MRV regulation. Sustainability 2019, 11, 5133. [Google Scholar] [CrossRef]

- EU MRV. 2019 CO2 Emission Report; Technical Report; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Lister, J. Green Shipping: Governing Sustainable Maritime Transport. Glob. Policy 2015, 6, 118–129. [Google Scholar] [CrossRef]

- Linder, A. Explaining shipping company participation in voluntary vessel emission reduction programs. Transp. Res. Part D Transp. Environ. 2018, 61, 234–245. [Google Scholar] [CrossRef]

- Poulsen, R.T.; Ponte, S.; Lister, J. Buyer-driven greening? Cargo-owners and environmental upgrading in maritime shipping. Geoforum 2016, 68, 57–68. [Google Scholar] [CrossRef]

- Kopela, S. Making ships cleaner: Reducing air pollution from international shipping. Rev. Eur. Comp. Int. Environ. 2017, 26, 231–242. [Google Scholar] [CrossRef]

- BSR. Clean Cargo. Available online: https://www.clean-cargo.org/ (accessed on 23 September 2020).

- Scott, J.; Smith, T.; Rehmatulla, N.; Milligan, B. The promise and limits of private standards in reducing greenhouse gas emissions from shipping. J. Environ. Law 2017, 29, 231–262. [Google Scholar] [CrossRef][Green Version]

- Poulsen, R.T.; Hermann, R.R.; Smink, C.K. Do eco-rating schemes improve the environmental performance of ships? Mar. Policy 2018, 87, 94–103. [Google Scholar] [CrossRef]

- Lister, J.; Poulsen, R.T.; Ponte, S. Orchestrating transnational environmental governance in maritime shipping. Glob. Environ. Chang. 2015, 34, 185–195. [Google Scholar] [CrossRef]

- Gibson, M.; Murphy, A.J.; Pazouki, K. Evaluation of environmental performance indices for ships. Transp. Res. Part D Transp. Environ. 2019, 73, 152–161. [Google Scholar] [CrossRef]

- Sustainable Shipping Initiative. Ratings and Schemes. 2020. Available online: https://ssi.brenock.com/Scheme/Search (accessed on 23 September 2020).

- Parviainen, T.; Lehikoinen, A.; Kuikka, S.; Haapasaari, P. How can stakeholders promote environmental and social responsibility in the shipping industry? WMU J. Marit. Aff. 2018, 17, 49–70. [Google Scholar] [CrossRef]

- Clean Shipping Index. Methodology and Reporting Guidelines 2020; Technical Report; Clean Shipping Index: Gothenburg, Sweden, 2020. [Google Scholar]

- BSR. Clean Cargo Working Group Carbon Emissions Accounting Methodology; Technical Report June; Clean Cargo: Paris, France, 2015. [Google Scholar]

- Environmental Ship Index. General Information. 2020. Available online: https://www.environmentalshipindex.org/info (accessed on 23 September 2020).

- RightShip. About RightShip. 2020. Available online: https://www.rightship.com/about-rightship/ (accessed on 23 September 2020).

- Green Award. Green Award. 2020. Available online: https://www.greenaward.org/ (accessed on 23 September 2020).

- Yliskylä-Peuralahti, J.; Gritsenko, D. Binding rules or voluntary actions? A conceptual framework for CSR in shipping. WMU J. Marit. Aff. 2014, 13, 251–268. [Google Scholar] [CrossRef]

- Wuisan, L.; van Leeuwen, J.; van Koppen, C.S. Greening international shipping through private governance: A case study of the Clean Shipping Project. Mar. Policy 2012, 36, 165–173. [Google Scholar] [CrossRef]

- BSR. 2019 Global Container Shipping Trade Lane Emissions Factors; Technical Report July; Clean Cargo: Paris, France, 2020. [Google Scholar]

- IMO. Amendments to Regulations 2, 13, 19, 20 and 21 and the Supplement to the IAPP Certificate under MARPOL Annex VI and Certification of Dual-Fuel Engines under the NOX Technical Code 2008; MEPC.251(66); International Maritime Organization (IMO): London, UK, 2014. [Google Scholar]

- Greene, S.; Lewis, A. Global Logistics Emissions Council Framework for Logistics Emissions Accounting and Reporting; Technical Report; Smart Freight Centre: Amsterdam, The Netherlands, 2019. [Google Scholar]

- Bryman, A. Social Research Methods; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Carbon Trust. Available online: https://www.carbontrust.com/ (accessed on 22 June 2020).

- Tang, L.; Gekara, V. The Importance of Customer Expectations: An Analysis of CSR in Container Shipping. J. Bus. Ethics 2020, 165, 383–393. [Google Scholar] [CrossRef]

- Poulsen, R.T.; Ponte, S.; van Leeuwen, J.; Rehmatulla, N. The Potential and Limits of Environmental Disclosure Regulation: A Global Value Chain Perspective Applied to Tanker Shipping. Glob. Environ. Politics 2021, 21, 99–120. [Google Scholar] [CrossRef]

- Alphaliner. Top 100. 2021. Available online: https://alphaliner.axsmarine.com/PublicTop100/ (accessed on 13 July 2021).

- Sea Cargo Charter. 2020. Available online: https://www.seacargocharter.org/ (accessed on 28 October 2020).

- Godet, A. Tracking Progress towards IMO2050: Proposals for a Holistic and Integrated Reporting Framework for Container Cargo. Master’s Thesis, Danmarks Tekniske Universitet, Kongens Lyngby, Denmark, 2020. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).